Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY – SUBJECT TO COMPLETION, DATED MAY 9, 2024

PRELIMINARY PROXY STATEMENT FOR SPECIAL MEETING OF

THE STOCKHOLDERS OF NORTHVIEW ACQUISITION CORPORATION

(A DELAWARE CORPORATION)

PROSPECTUS FOR 16,875,000 SHARES OF COMMON STOCK OF NORTHVIEW ACQUISITION

CORPORATION, WHICH WILL BE RENAMED “PROFUSA, INC.”

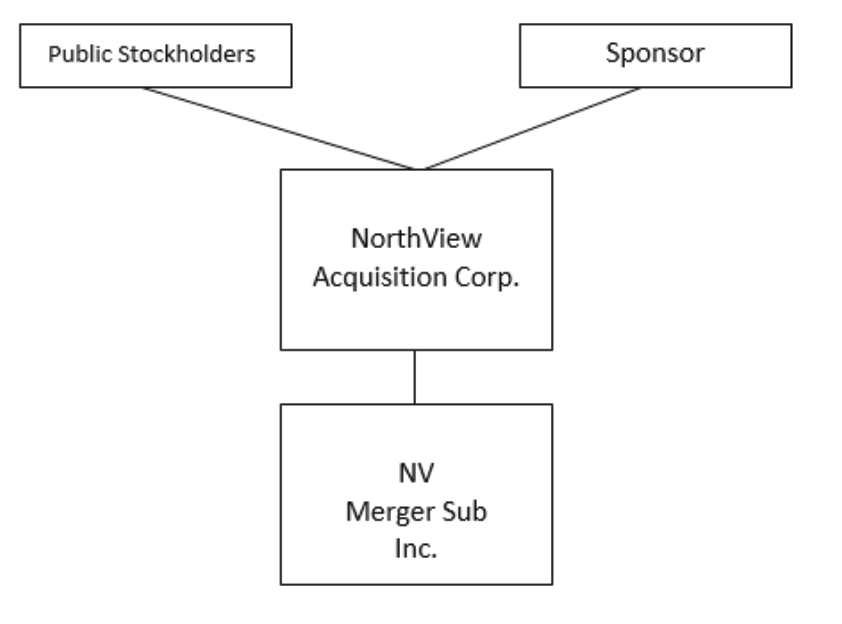

The board of directors of NorthView Acquisition Corporation, a Delaware corporation (“NorthView”, “we” or “our”), has unanimously approved (1) the merger of NV Profusa Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of NorthView (“Merger Sub”), with and into Profusa, Inc. (“Profusa”), a California corporation (the “Merger”), with Profusa surviving the Merger as a wholly owned subsidiary of NorthView (the time that the Merger becomes effective being referred to as the “Effective Time”), pursuant to the terms of the Merger Agreement and Plan of Reorganization, dated as of November 7, 2022, by and among NorthView, Merger Sub and Profusa, attached to this proxy statement/prospectus as Annex A (the “Merger Agreement”), as more fully described elsewhere in this proxy statement/prospectus and (2) the other transactions contemplated by the Merger Agreement and documents related thereto (collectively, the “Business Combination”). As used in this proxy statement/prospectus, “New Profusa” refers to NorthView after giving effect to the Business Combination.

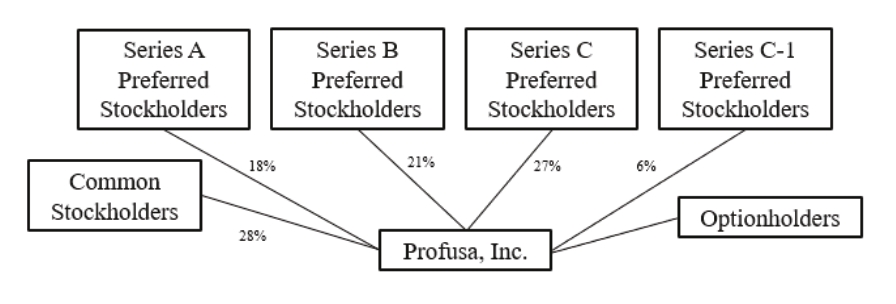

Pursuant to the Merger Agreement, immediately prior to the Effective Time (as defined in this proxy statement/prospectus), each share of issued and outstanding Profusa preferred stock, par value $0.01, shall be converted into a number of shares of Profusa common stock, par value $0.01 (“Profusa Common Stock”). At the effective time of the Merger, (i) each share of issued and outstanding Profusa Common Stock shall be converted into a number of shares of NorthView common stock, par value $0.0001 (“NorthView Common Stock”), based on the Exchange Ratio described below, (ii) each option to purchase Profusa Common Stock shall be converted into an option to purchase NorthView Common Stock at the Exchange Ratio, and (iii) each warrant to purchase Profusa Common Stock shall be converted into a warrant to purchase NorthView Common Stock at the Warrant Ratio (defined the Merger Agreement). Following the entry into Amendment No. 3 to the Merger Agreement (as defined below), the aggregate consideration to be received by the Profusa shareholders is based on the sum of (a) the pre-transaction equity value of $155,000,000, plus (b) the Private Placement Value (which is expected to be $25,000,000 for purposes of this proxy statement/prospectus and as contemplated by the Vellar Transactions described herein), and the Exchange Ratio will be equal to the value of a share of Profusa Common Stock, based on an equity valuation of Profusa of $155,000,000 (as adjusted for the Private Placement Value), divided by an assumed value of NorthView Common Stock of $10.00 per share. As of [ ], the Exchange Ratio and the Per Share Merger Consideration are estimated to be [ ] and [ ], respectively, at the time of Closing. Following the Effective Time, NorthView will change its name to “Profusa, Inc.”

This prospectus covers 16,875,000 shares of New Profusa Common Stock issued to holders of Profusa Common Stock in exchange for shares of Profusa Common Stock outstanding at Closing, based on the Exchange Ratio (as defined below). The number of shares of New Profusa Common Stock that this prospectus covers represents the maximum number of shares that may be issued to holders of shares, warrants and equity awards of Profusa in connection with the Business Combination. This offering is contingent upon final approval of The Nasdaq Stock Market LLC (“Nasdaq”) of our listing. Certain shares being issued as Merger Consideration to be received by certain holders of Profusa Common Stock will not be registered on this proxy statement/prospectus.

The NorthView stockholders previously elected to redeem 18,000,868 public shares of NorthView Common Stock in connection with a shareholder meeting on March 10, 2023, related to the extension of NorthView’s business combination period monthly, for up to nine months, from March 22, 2023, ultimately until as late as December 22, 2023. Separately, the NorthView stockholders previously elected to redeem 140,663 public shares of NorthView Common Stock in connection with a shareholder meeting on December 21, 2023, related to the extension of NorthView’s business combination period monthly, for up to three months, from December 22, 2023, ultimately until as late as March 22, 2024. Additionally, the NorthView stockholders elected to redeem 95,394 public shares of NorthView Common Stock in connection with a shareholder meeting on March 21, 2024, related to the extension of NorthView’s business combination period monthly, for up to six months, from March 22, 2024, ultimately until as late as September 22, 2024 (together with the previous extensions, the “Extension”). The aggregate of 18,236,925 public shares redeemed in connection with the Extension represented approximately 75.5% of the total NorthView shares of common stock outstanding following NorthView’s IPO and approximately 96.1% of the public shares previously outstanding.

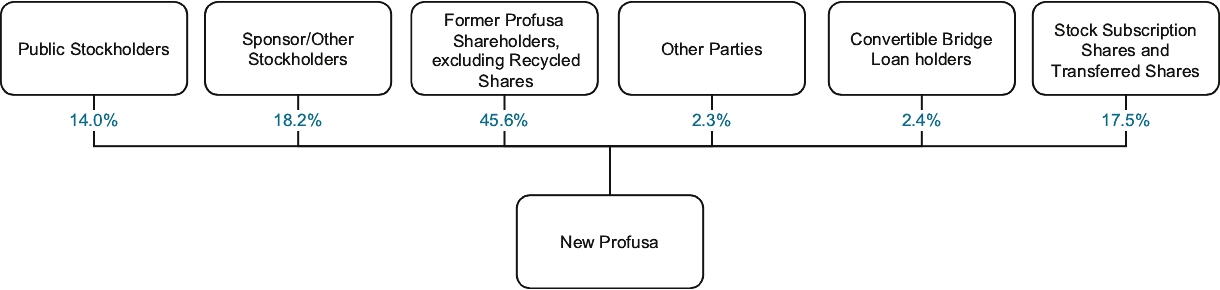

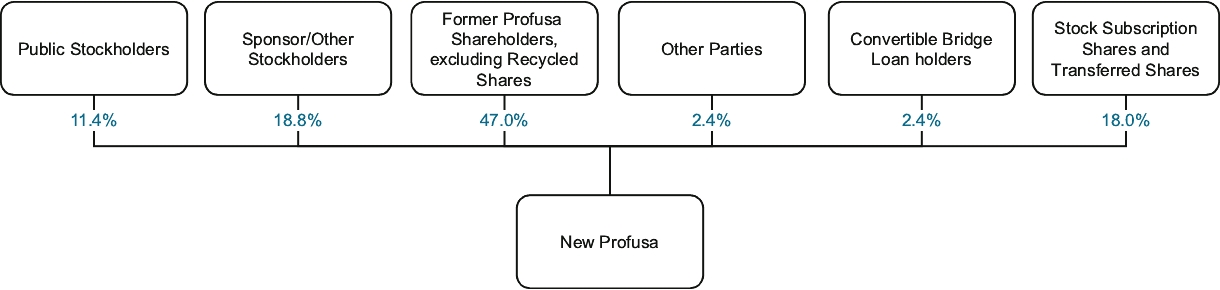

Immediately after the Closing, assuming no holder of Public Shares exercises its redemption rights, (i) Profusa shareholders (other than the Stock Subscription investors) will own, collectively, approximately 45.6% of the outstanding New Profusa Common Stock; (ii) NorthView’s public stockholders will retain an ownership interest of approximately 14.0% of the outstanding New Profusa Common Stock; (iii) the Sponsor (and its affiliates) will own approximately 18.2% of the outstanding New Profusa Common Stock, (iv) the Profusa shareholders who will have Profusa shares converted into Stock Subscription Shares and Transferred Shares will own, collectively, approximately 17.5% of the outstanding New Profusa Common Stock and (v) other stockholders will own approximately 4.7% of the outstanding New Profusa Common Stock, in each case, on a fully diluted net exercise basis. These indicative levels of ownership interest would amount to approximately 47.0%, 11.4%, 18.8%, 18.0% and 4.8% respectively, assuming the maximum redemption scenario. If the actual facts are different than these assumptions, the ownership percentages in New Profusa will be different.

NorthView is, and New Profusa will be, an “emerging growth company” as defined under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. New Profusa may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies.

NorthView Common Stock, NorthView rights, and NorthView warrants are currently listed and traded on the Nasdaq under the symbols “NVAC,” “NVACR,” and “NVACW”, respectively. NorthView intends to apply for listing, effective at the time of the Closing, of New Profusa Common Stock and New Profusa Warrants on the Nasdaq under the symbols “PFSA” and ‘‘PFSAW”, respectively. The NorthView rights will convert to shares of NorthView Common Stock at the Closing, and will cease to be outstanding.

This proxy statement/prospectus provides stockholders of NorthView with detailed information about the proposed Business Combination and other matters to be considered at the Special Meeting of NorthView. We encourage you to read this entire document, including the Annexes and other documents referred to herein, carefully and in their entirety. You should also carefully consider the risk factors described in the section entitled “Risk Factors” beginning on page 22 of this proxy statement/prospectus.NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY U.S. STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated [•], 2024 and is first being mailed to the stockholders of NorthView on or about that date.