0001860434 harbor:C000234331Member 2022-02-23 0001860434 harbor:C000228888Member 2022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23661

Harbor ETF Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302

(Address of principal executive offices) (Zip code)

Charles F. McCain, Esq.

HARBOR ETF TRUST

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302 | Christopher P. Harvey, Esq.

DECHERT LLP

One International Place – 40th Floor

100 Oliver Street

Boston, MA 02110-2605 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 443-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

ITEM 1 – REPORTS TO STOCKHOLDERS

The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1):

Harbor Active Small Cap ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Active Small Cap ETF ("Fund") for the period of August 28, 2024 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor Active Small Cap ETF | $14 | 0.80% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

| Total Net Assets (in thousands) | $8,572 |

| Number of Investments | 47 |

| Total Net Advisory Fees Paid (in thousands) | $11 |

| Portfolio Turnover Rate | 12% |

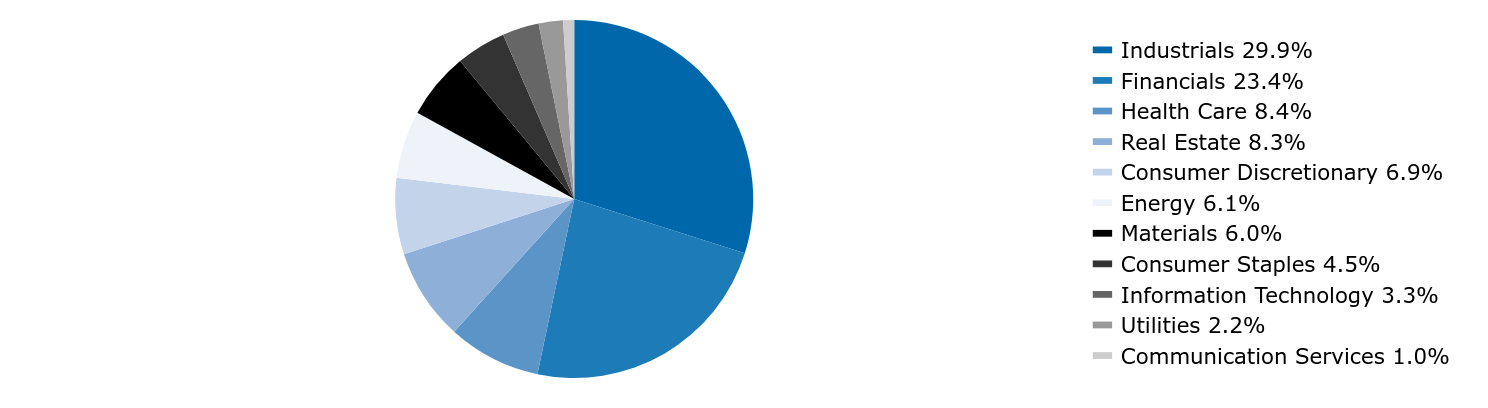

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Industrials | 29.9% |

| Financials | 23.4% |

| Health Care | 8.4% |

| Real Estate | 8.3% |

| Consumer Discretionary | 6.9% |

| Energy | 6.1% |

| Materials | 6.0% |

| Consumer Staples | 4.5% |

| Information Technology | 3.3% |

| Utilities | 2.2% |

| Communication Services | 1.0% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor AlphaEdge™ Large Cap Value ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor AlphaEdge™ Large Cap Value ETF ("Fund") for the period of September 4, 2024 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor AlphaEdge™ Large Cap Value ETF | $4 | 0.25% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

| Total Net Assets (in thousands) | $2,062 |

| Number of Investments | 75 |

| Total Net Advisory Fees Paid (in thousands) | $1 |

| Portfolio Turnover Rate | 12% |

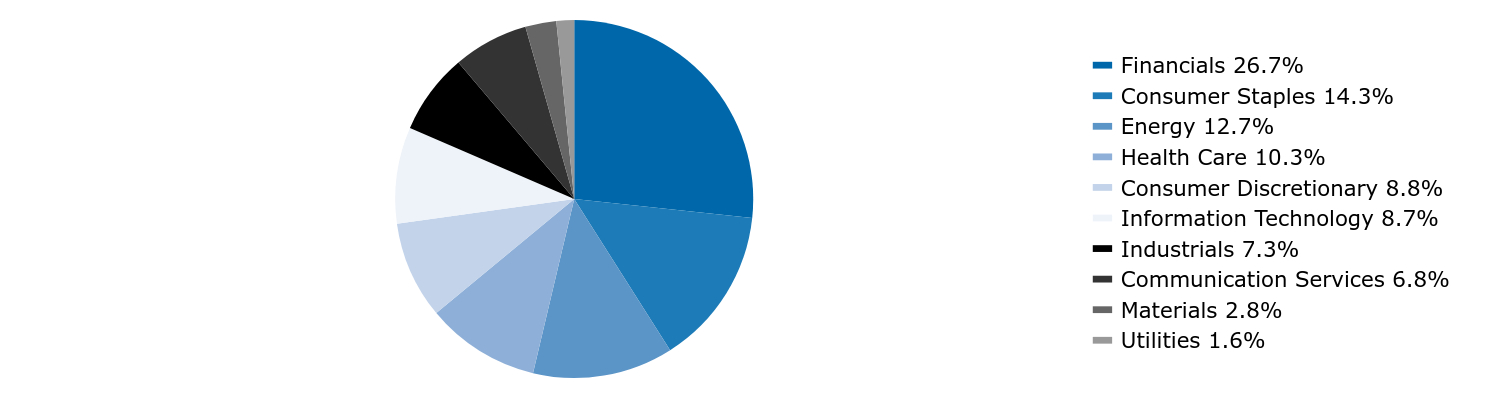

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Financials | 26.7% |

| Consumer Staples | 14.3% |

| Energy | 12.7% |

| Health Care | 10.3% |

| Consumer Discretionary | 8.8% |

| Information Technology | 8.7% |

| Industrials | 7.3% |

| Communication Services | 6.8% |

| Materials | 2.8% |

| Utilities | 1.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor AlphaEdge™ Next Generation REITs ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor AlphaEdge™ Next Generation REITs ETF ("Fund") for the period of September 4, 2024 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor AlphaEdge™ Next Generation REITs ETF | $8 | 0.50% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

| Total Net Assets (in thousands) | $2,005 |

| Number of Investments | 35 |

| Total Net Advisory Fees Paid (in thousands) | $1 |

| Portfolio Turnover Rate | 8% |

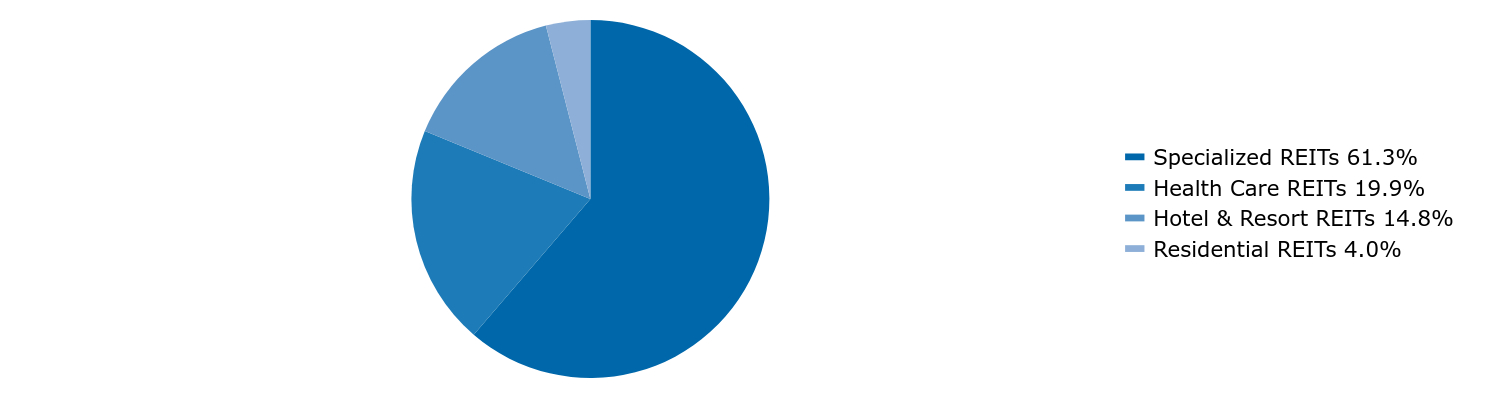

Industry Allocation (% of Investments)

| Value | Value |

|---|

| Specialized REITs | 61.3% |

| Health Care REITs | 19.9% |

| Hotel & Resort REITs | 14.8% |

| Residential REITs | 4.0% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor AlphaEdge™ Small Cap Earners ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor AlphaEdge™ Small Cap Earners ETF ("Fund") for the period of July 9, 2024 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor AlphaEdge™ Small Cap Earners ETF | $10 | 0.29% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

| Total Net Assets (in thousands) | $6,515 |

| Number of Investments | 695 |

| Total Net Advisory Fees Paid (in thousands) | $5 |

| Portfolio Turnover Rate | 17% |

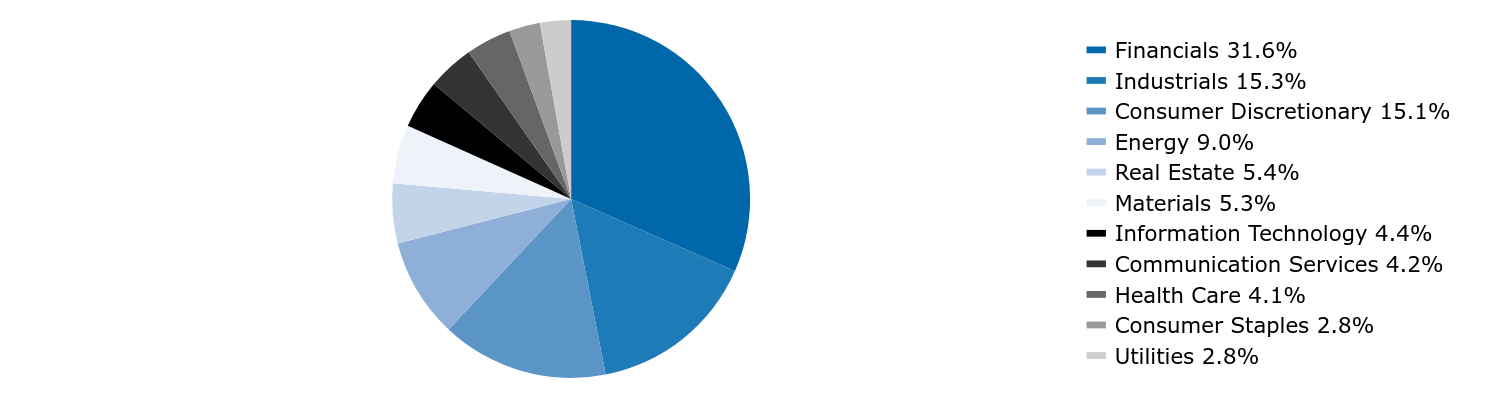

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Financials | 31.6% |

| Industrials | 15.3% |

| Consumer Discretionary | 15.1% |

| Energy | 9.0% |

| Real Estate | 5.4% |

| Materials | 5.3% |

| Information Technology | 4.4% |

| Communication Services | 4.2% |

| Health Care | 4.1% |

| Consumer Staples | 2.8% |

| Utilities | 2.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Commodity All-Weather Strategy ETF (Consolidated)

Principal U.S. Market: NYSE

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Commodity All-Weather Strategy ETF (Consolidated) ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Commodity All-Weather Strategy ETF | $70 | 0.68% |

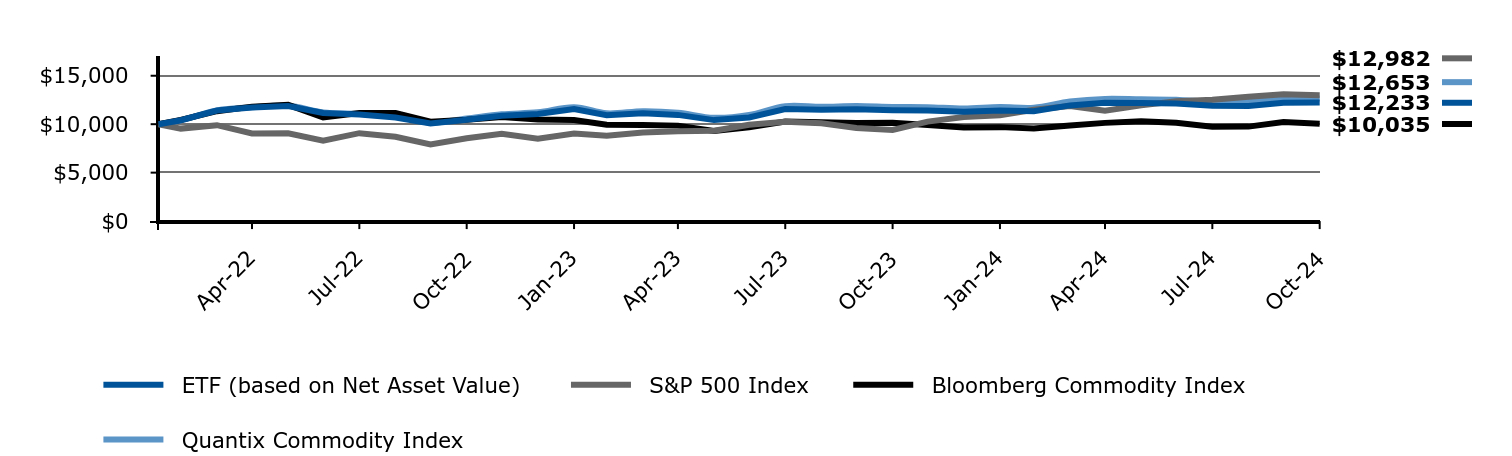

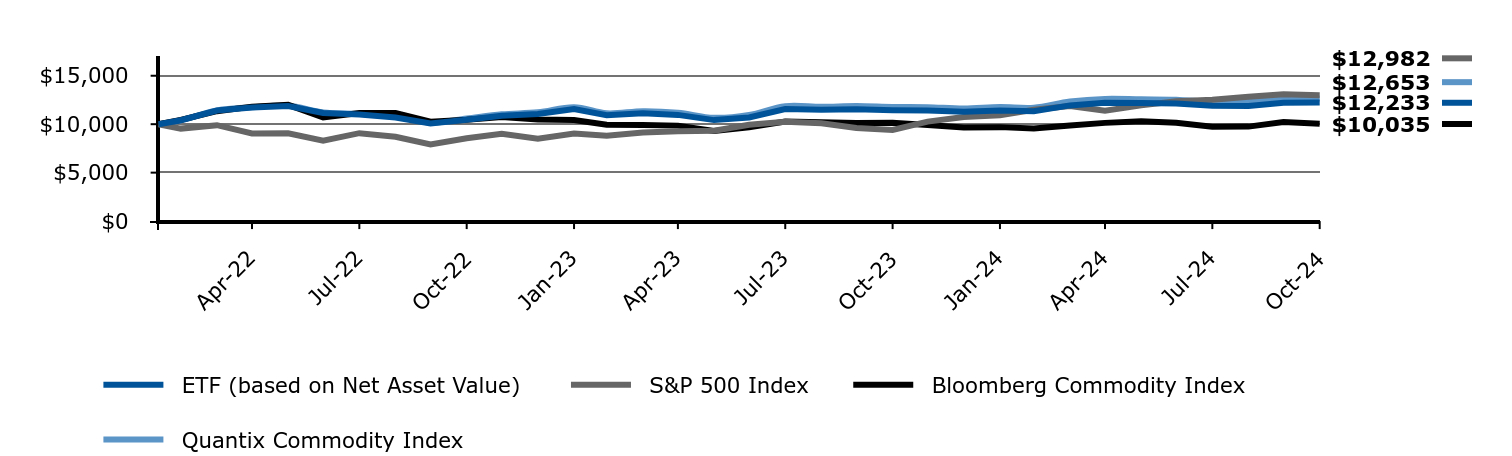

Management's Discussion of Fund Performance

Subadvisor: Quantix Commodities LP

Performance Summary

The Fund returned 6.90% for the year ended October 31, 2024. The Fund seeks to track the performance of the Quantix Commodity Index (the “Index”), which returned 7.44% during the same period.

Top contributors to performance included:

• The Precious Metals sector, which was the biggest positive contributor due to Gold, which is the largest individual commodity weight in the Index.

• The Industrial Metals sector, with gains coming from Copper as Chinese stimulus package hopes supported demand expectations.

Top detractors from performance included:

• The Petroleum sector, particularly Heating Oil, Gasoil and Gasoline, detracted due to relatively subdued demand during peak driving season, along with an unexpectedly calm hurricane season.

• The Grains sector, notably Corn and Soybeans, detracted likely due to healthy global stocks-to-use ratios (a measure of supply and demand) and favorable weather patterns in the key producing regions.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Change in a $10,000 Investment

For the period 02/09/2022 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Bloomberg Commodity Index | Quantix Commodity Index |

|---|

| Feb-22 | $10,000 | $10,000 | $10,000 | $10,000 |

| Feb-22 | $10,405 | $9,545 | $10,440 | $10,410 |

| Mar-22 | $11,415 | $9,900 | $11,343 | $11,427 |

| Apr-22 | $11,720 | $9,037 | $11,813 | $11,746 |

| May-22 | $11,875 | $9,053 | $11,993 | $11,918 |

| Jun-22 | $11,160 | $8,306 | $10,701 | $11,218 |

| Jul-22 | $10,995 | $9,072 | $11,157 | $11,072 |

| Aug-22 | $10,685 | $8,702 | $11,167 | $10,780 |

| Sep-22 | $10,065 | $7,900 | $10,261 | $10,167 |

| Oct-22 | $10,460 | $8,540 | $10,466 | $10,594 |

| Nov-22 | $10,865 | $9,017 | $10,752 | $11,021 |

| Dec-22 | $11,056 | $8,498 | $10,489 | $11,222 |

| Jan-23 | $11,559 | $9,032 | $10,438 | $11,756 |

| Feb-23 | $10,920 | $8,811 | $9,947 | $11,121 |

| Mar-23 | $11,132 | $9,135 | $9,927 | $11,347 |

| Apr-23 | $10,960 | $9,277 | $9,852 | $11,187 |

| May-23 | $10,422 | $9,318 | $9,297 | $10,658 |

| Jun-23 | $10,699 | $9,933 | $9,672 | $10,952 |

| Jul-23 | $11,559 | $10,252 | $10,277 | $11,856 |

| Aug-23 | $11,484 | $10,089 | $10,199 | $11,792 |

| Sep-23 | $11,549 | $9,608 | $10,128 | $11,870 |

| Oct-23 | $11,444 | $9,406 | $10,155 | $11,776 |

| Nov-23 | $11,413 | $10,265 | $9,926 | $11,754 |

| Dec-23 | $11,275 | $10,732 | $9,659 | $11,617 |

| Jan-24 | $11,415 | $10,912 | $9,697 | $11,774 |

| Feb-24 | $11,328 | $11,494 | $9,555 | $11,699 |

| Mar-24 | $11,938 | $11,864 | $9,871 | $12,335 |

| Apr-24 | $12,219 | $11,380 | $10,136 | $12,610 |

| May-24 | $12,192 | $11,944 | $10,314 | $12,565 |

| Jun-24 | $12,143 | $12,373 | $10,156 | $12,529 |

| Jul-24 | $11,911 | $12,523 | $9,746 | $12,305 |

| Aug-24 | $11,884 | $12,827 | $9,751 | $12,279 |

| Sep-24 | $12,203 | $13,101 | $10,225 | $12,612 |

| Oct-24 | $12,233 | $12,982 | $10,035 | $12,653 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Bloomberg Commodity Index and Quantix Commodity Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 02/09/2022 |

|---|

| Harbor Commodity All-Weather Strategy ETF (Based on Net Asset Value) | 6.90% | - | 7.67% |

| S&P 500 Index | 38.02% | - | 10.04% |

| Bloomberg Commodity Index | -1.18% | - | 0.13% |

| Quantix Commodity Index | 7.44% | - | 9.01% |

The “Life of Fund” return as shown reflects the period 02/09/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $245,352 |

| Number of Investments | 8 |

| Total Net Advisory Fees Paid (in thousands) | $1,072 |

| Portfolio Turnover Rate (not applicable due to Fund's investments) | -% |

Fund Investments (excludes short-term investments)

Risk AllocationFootnote Reference* (% of Net Assets)

Commodities Sector

| Petroleum | 34.7% |

| Precious Metals | 31.5% |

| Grains and Soybean Products | 15.4% |

| Softs | 10.4% |

| Industrial Metals | 8.0% |

| Footnote | Description |

Footnote* | Based on notional value and represents the sector allocation of the Quantix Commodity Index. |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Disciplined Bond ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Disciplined Bond ETF ("Fund") for the period of May 1, 2024 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor Disciplined Bond ETF | $18 | 0.35% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

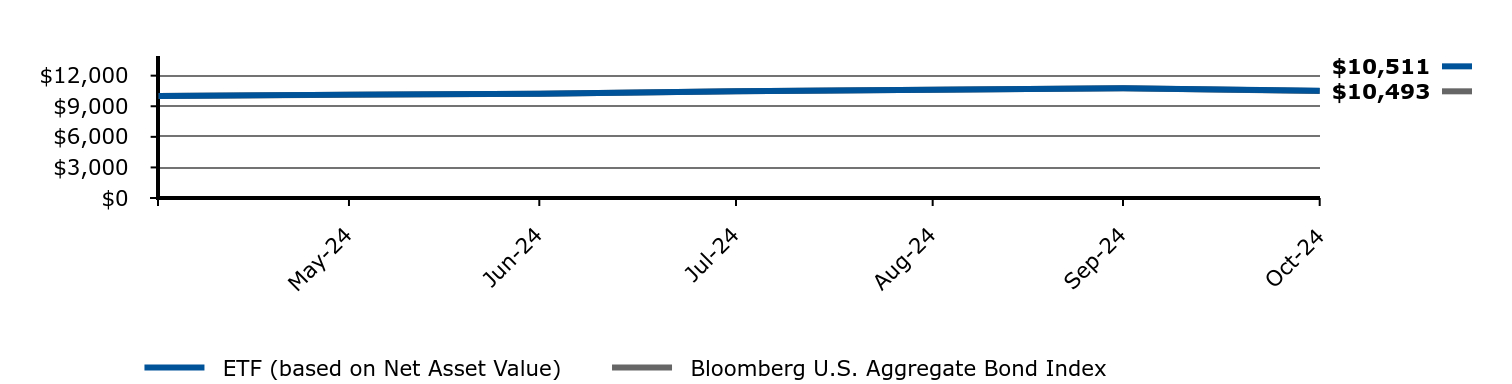

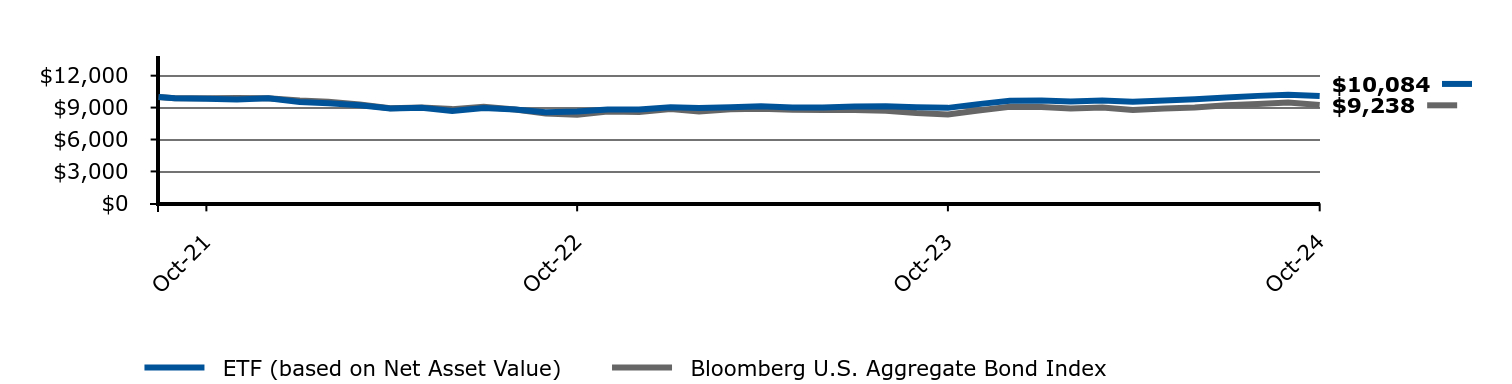

Management's Discussion of Fund Performance

Subadvisor: Income Research + Management

Performance Summary

The Fund returned 5.11% since inception on May 1, 2024 through the period ended October 31, 2024, while the Bloomberg U.S. Aggregate Bond Index returned 4.93% during the same period.

Top contributors to relative performance included:

• Security selection within the Financials and Industrial sectors and overweight in Financials.

• Security selection in primarily BBB- and BB-rated bonds which outperformed their A-rated counterparts as spreads broadly tightened during the period.

• Overweight to risk assets and underweight to U.S. Treasuries as corporate and securitized bonds broadly outperformed U.S. Treasury bonds.

• Within securitized products, overweight to Asset-Backed Securities and Commercial Mortgage-Backed Securities (CMBS).

Top detractors from relative performance included:

• Security selection within CMBS.

• Overweight to Agency Residential Mortgage-Back Securities (RMBS) and underweight to Utilities.

• Out-of-index position allocation to Small Business Administration securitizations and non-Agency RMBS.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Change in a $10,000 Investment

For the period 05/01/2024 through 10/31/2024

| ETF (based on Net Asset Value) | Bloomberg U.S. Aggregate Bond Index |

|---|

| May-24 | $10,000 | $10,000 |

| May-24 | $10,140 | $10,132 |

| Jun-24 | $10,238 | $10,228 |

| Jul-24 | $10,474 | $10,467 |

| Aug-24 | $10,623 | $10,617 |

| Sep-24 | $10,764 | $10,759 |

| Oct-24 | $10,511 | $10,493 |

The graph compares a $10,000 initial investment in the Fund with the performance of the Bloomberg U.S. Aggregate Bond Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 05/01/2024 |

|---|

| Harbor Disciplined Bond ETF (Based on Net Asset Value) | - | - | 5.11% |

| Bloomberg U.S. Aggregate Bond Index | - | - | 4.93% |

The “Life of Fund” return as shown reflects the period 05/01/2024 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $26,843 |

| Number of Investments | 182 |

| Total Net Advisory Fees Paid (in thousands) | $47 |

| Portfolio Turnover Rate | 41% |

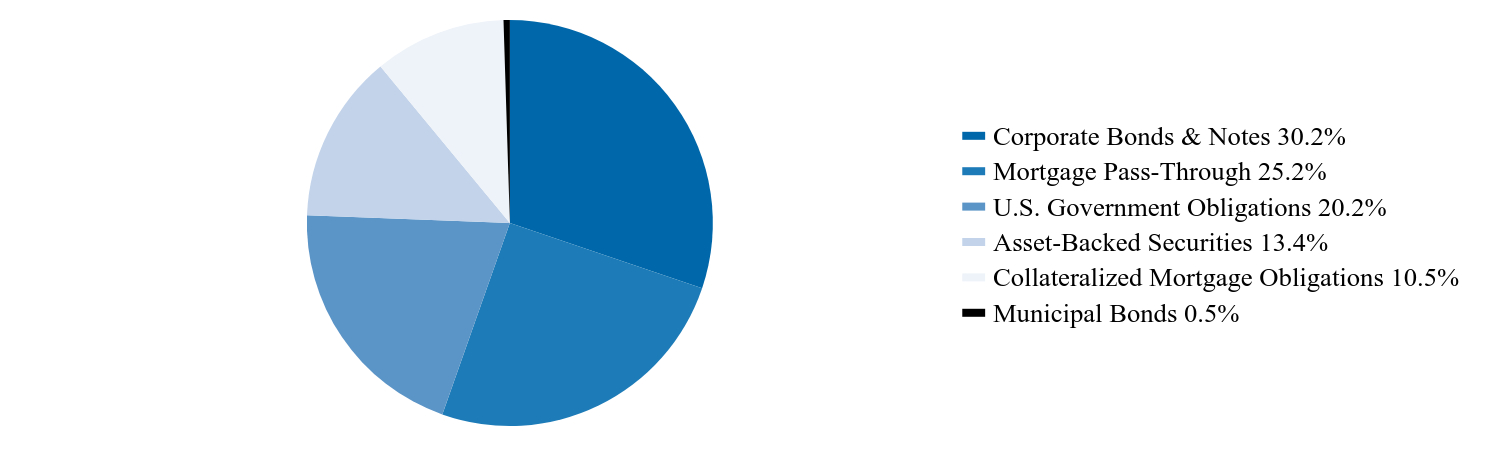

Investment Allocation (% of Investments)

| Value | Value |

|---|

| Corporate Bonds & Notes | 30.2% |

| Mortgage Pass-Through | 25.2% |

| U.S. Government Obligations | 20.2% |

| Asset-Backed Securities | 13.4% |

| Collateralized Mortgage Obligations | 10.5% |

| Municipal Bonds | 0.5% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

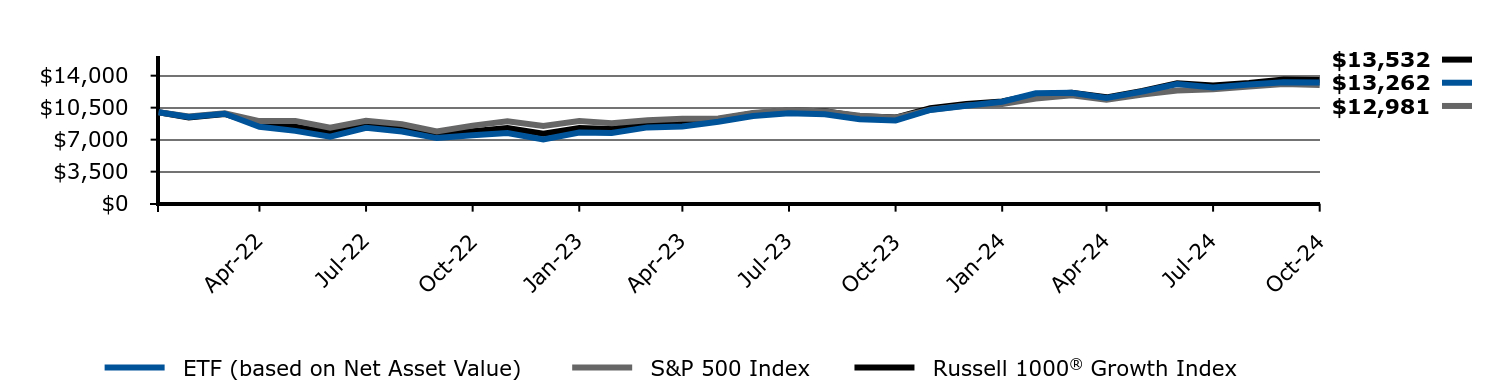

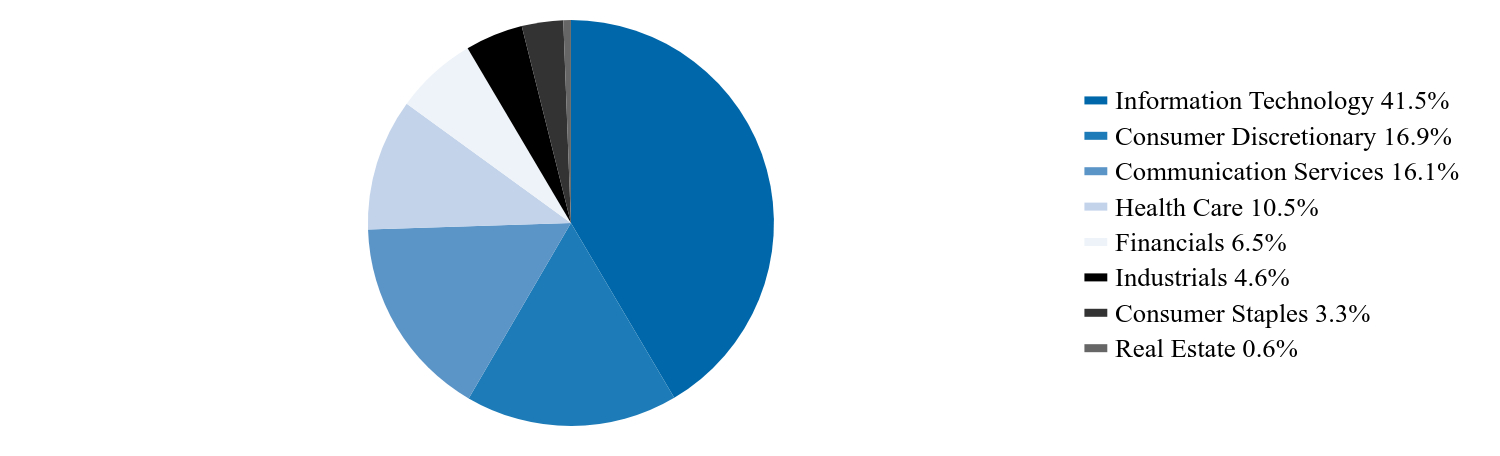

Harbor Disruptive Innovation ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Disruptive Innovation ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Disruptive Innovation ETF | $89 | 0.75% |

Management's Discussion of Fund Performance

Performance Summary

The Fund returned 36.66% for the year ended October 31, 2024, while the S&P 500 Index returned 38.02% during the same period.

Top contributors to relative performance included:

• Security selection in the Financials, Industrials, and Communication Services sectors.

• Positions in Avidity Biosciences, Inc., Block, Inc., and United Rentals, Inc.

Top detractors from relative performance included:

• Security selection in the Information Technology, Consumer Staples, and Consumer Discretionary sectors.

• Positions in Farfetch Ltd., Dada Nexus Ltd. ADR, and an underweight in NVIDIA Corp.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

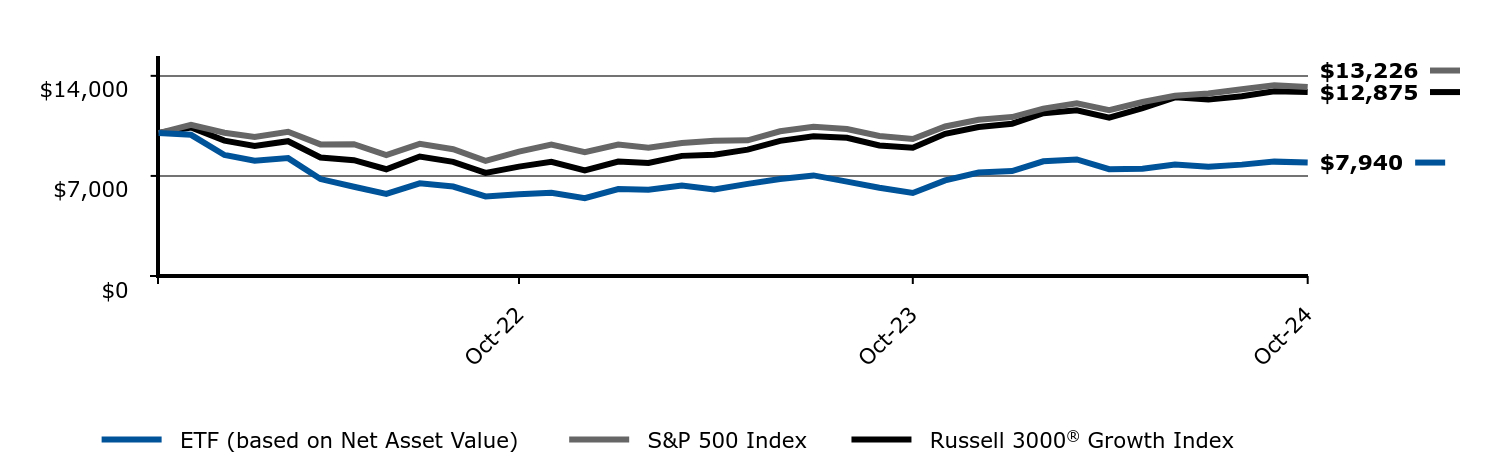

Change in a $10,000 Investment

For the period 12/01/2021 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Russell 3000® Growth Index |

|---|

| Dec-21 | $10,000 | $10,000 | $10,000 |

| Dec-21 | $9,875 | $10,572 | $10,391 |

| Jan-22 | $8,465 | $10,025 | $9,470 |

| Feb-22 | $8,065 | $9,725 | $9,092 |

| Mar-22 | $8,245 | $10,086 | $9,429 |

| Apr-22 | $6,780 | $9,206 | $8,290 |

| May-22 | $6,240 | $9,223 | $8,099 |

| Jun-22 | $5,745 | $8,462 | $7,466 |

| Jul-22 | $6,480 | $9,242 | $8,358 |

| Aug-22 | $6,255 | $8,865 | $7,987 |

| Sep-22 | $5,565 | $8,049 | $7,214 |

| Oct-22 | $5,715 | $8,701 | $7,652 |

| Nov-22 | $5,825 | $9,187 | $7,986 |

| Dec-22 | $5,440 | $8,657 | $7,381 |

| Jan-23 | $6,085 | $9,201 | $8,004 |

| Feb-23 | $6,030 | $8,977 | $7,909 |

| Mar-23 | $6,320 | $9,307 | $8,403 |

| Apr-23 | $6,055 | $9,452 | $8,476 |

| May-23 | $6,445 | $9,493 | $8,840 |

| Jun-23 | $6,790 | $10,120 | $9,452 |

| Jul-23 | $7,035 | $10,445 | $9,776 |

| Aug-23 | $6,600 | $10,279 | $9,667 |

| Sep-23 | $6,170 | $9,789 | $9,135 |

| Oct-23 | $5,810 | $9,583 | $8,977 |

| Nov-23 | $6,685 | $10,458 | $9,948 |

| Dec-23 | $7,240 | $10,933 | $10,423 |

| Jan-24 | $7,345 | $11,117 | $10,653 |

| Feb-24 | $8,025 | $11,711 | $11,387 |

| Mar-24 | $8,150 | $12,087 | $11,593 |

| Apr-24 | $7,475 | $11,594 | $11,082 |

| May-24 | $7,505 | $12,169 | $11,742 |

| Jun-24 | $7,790 | $12,605 | $12,497 |

| Jul-24 | $7,650 | $12,759 | $12,338 |

| Aug-24 | $7,790 | $13,068 | $12,576 |

| Sep-24 | $8,000 | $13,347 | $12,924 |

| Oct-24 | $7,940 | $13,226 | $12,875 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Russell 3000® Growth Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 12/01/2021 |

|---|

| Harbor Disruptive Innovation ETF (Based on Net Asset Value) | 36.66% | - | -7.60% |

| S&P 500 Index | 38.02% | - | 10.06% |

Russell 3000® Growth Index | 43.42% | - | 9.05% |

The “Life of Fund” return as shown reflects the period 12/01/2021 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $3,573 |

| Number of Investments | 74 |

| Total Net Advisory Fees Paid (in thousands) | $227 |

| Portfolio Turnover Rate | 66% |

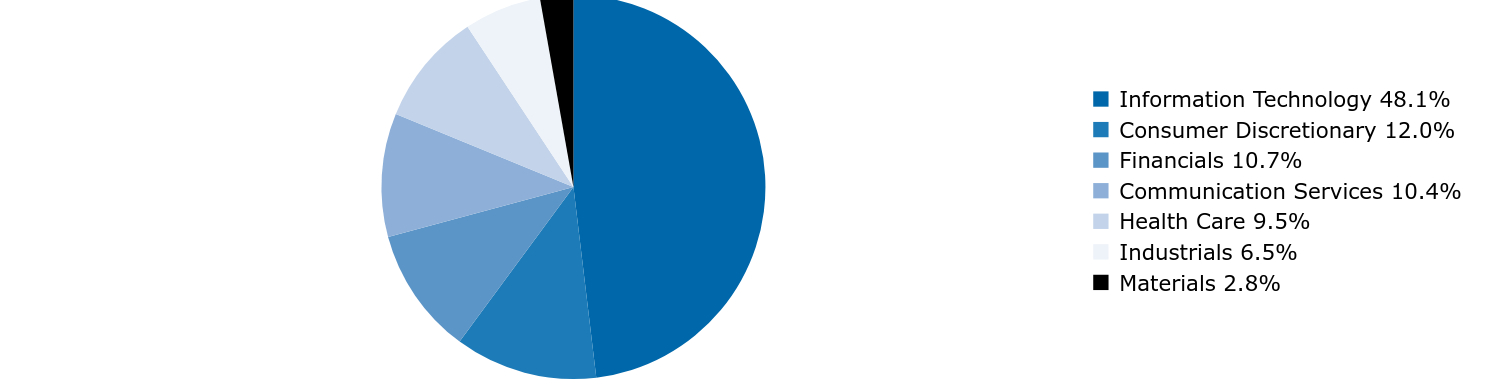

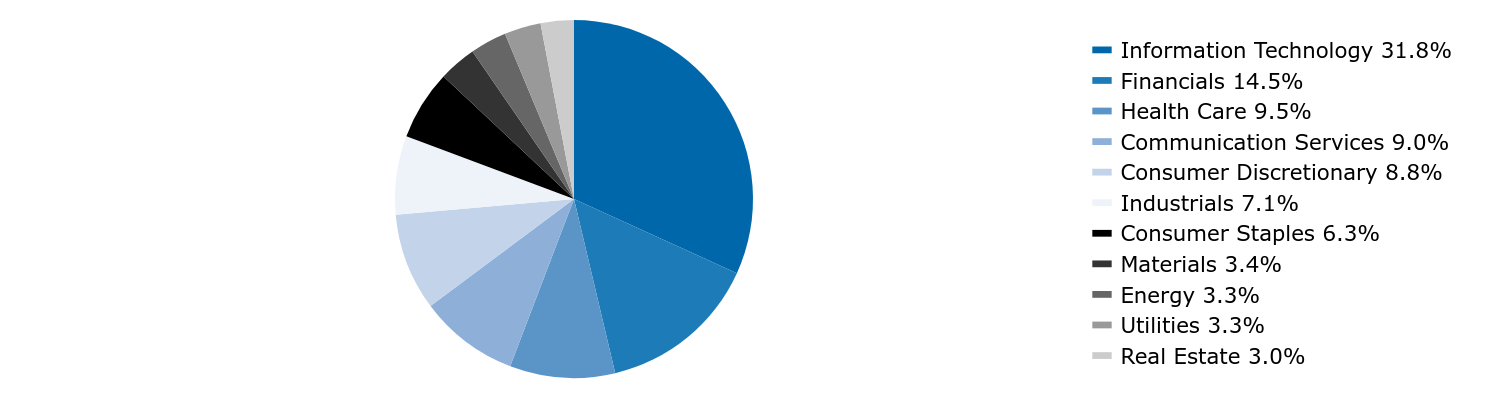

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 48.1% |

| Consumer Discretionary | 12.0% |

| Financials | 10.7% |

| Communication Services | 10.4% |

| Health Care | 9.5% |

| Industrials | 6.5% |

| Materials | 2.8% |

This is a summary of certain changes to the Fund since November 1, 2023.

Effective July 11, 2024, and May 23, 2024, 4BIO Partners LLP (“4BIO Capital”) and Tekne Capital Management, LLC (“Tekne”), respectively, were removed as subadvisors to Fund. The Fund employs a multi-manager approach to achieve its investment objective. The portion of the Fund’s assets that were allocated to 4BIO Capital and Tekne were reallocated by Harbor Capital Advisors, Inc., the Fund’s investment advisor, to the remaining subadvisors in the Fund.

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Dividend Growth Leaders ETF

Principal U.S. Market: NYSE

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Dividend Growth Leaders ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Dividend Growth Leaders ETF | $57 | 0.50% |

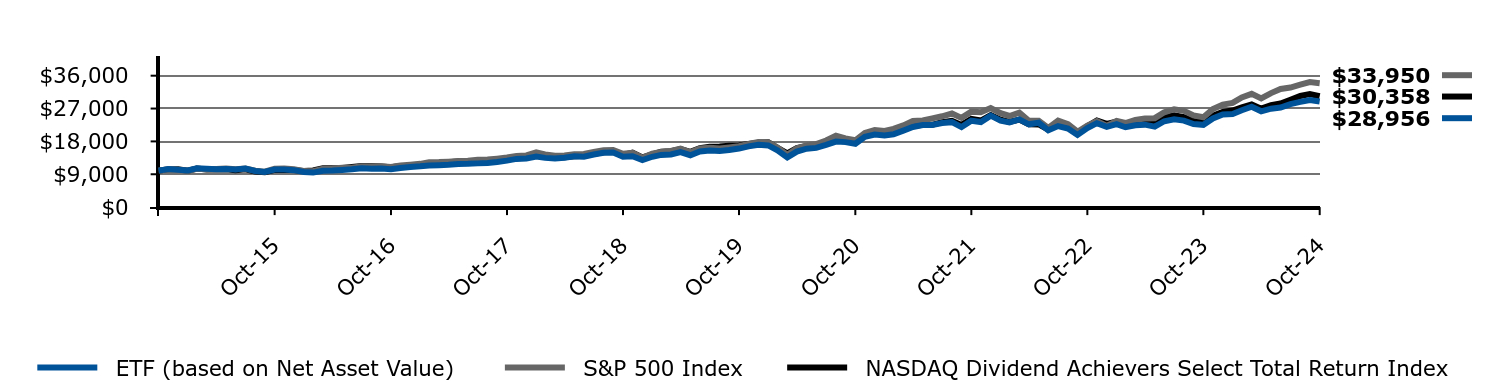

Management's Discussion of Fund Performance

Subadvisor: Westfield Capital Management, L.P.

Performance Summary

The Fund returned 28.47% for the year ended October 31, 2024, while the NASDAQ Dividend Achievers Select Total Return Index and S&P 500 Index returned 30.28% and 38.02%, respectively, during the same period.

Top contributors to relative performance included:

• Security selection in the Health Care and Consumer Discretionary sectors.

• Positions in pharmaceutical company, Eli Lilly & Co., and a consumer retail company, Williams-Sonoma, Inc.

Top detractors from relative performance included:

• Security selection in the Information Technology and Financials sectors.

• Positions in a developer of networking solutions and products, Cisco Systems, Inc. and a wealth management firm, Flagstar Financial, Inc.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

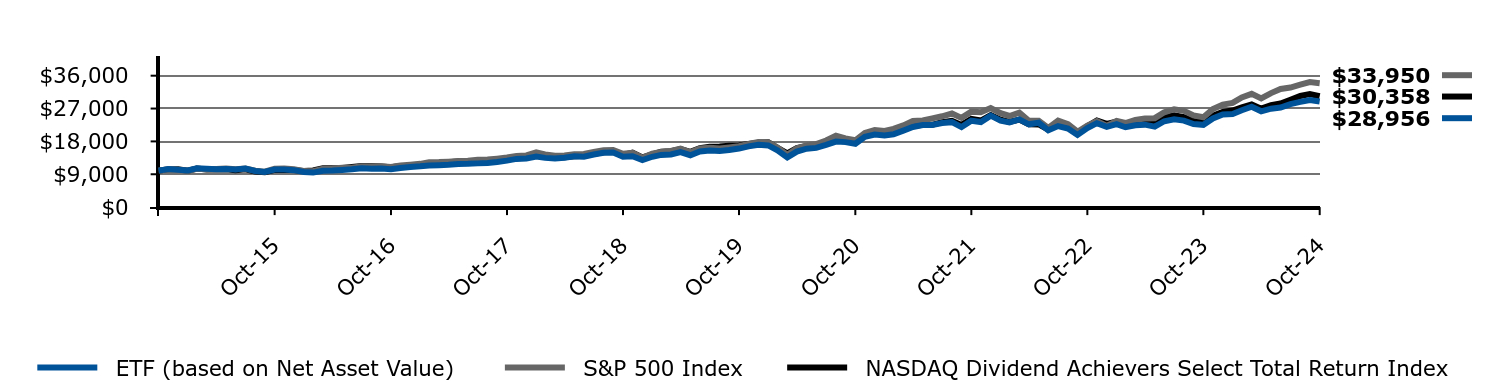

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | NASDAQ Dividend Achievers Select Total Return Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,404 | $10,269 | $10,316 |

| Dec-14 | $10,252 | $10,243 | $10,337 |

| Jan-15 | $10,040 | $9,936 | $9,986 |

| Feb-15 | $10,629 | $10,507 | $10,546 |

| Mar-15 | $10,523 | $10,340 | $10,330 |

| Apr-15 | $10,339 | $10,440 | $10,279 |

| May-15 | $10,465 | $10,574 | $10,380 |

| Jun-15 | $10,310 | $10,369 | $10,121 |

| Jul-15 | $10,562 | $10,586 | $10,339 |

| Aug-15 | $9,914 | $9,948 | $9,732 |

| Sep-15 | $9,644 | $9,702 | $9,557 |

| Oct-15 | $10,310 | $10,520 | $10,197 |

| Nov-15 | $10,330 | $10,551 | $10,226 |

| Dec-15 | $10,128 | $10,385 | $10,142 |

| Jan-16 | $9,629 | $9,869 | $9,909 |

| Feb-16 | $9,456 | $9,856 | $10,026 |

| Mar-16 | $9,955 | $10,525 | $10,650 |

| Apr-16 | $10,026 | $10,566 | $10,624 |

| May-16 | $10,189 | $10,755 | $10,726 |

| Jun-16 | $10,383 | $10,783 | $10,979 |

| Jul-16 | $10,647 | $11,181 | $11,232 |

| Aug-16 | $10,535 | $11,196 | $11,230 |

| Sep-16 | $10,566 | $11,199 | $11,119 |

| Oct-16 | $10,403 | $10,994 | $10,904 |

| Nov-16 | $10,739 | $11,401 | $11,230 |

| Dec-16 | $10,970 | $11,627 | $11,352 |

| Jan-17 | $11,168 | $11,847 | $11,561 |

| Feb-17 | $11,408 | $12,318 | $12,066 |

| Mar-17 | $11,491 | $12,332 | $12,054 |

| Apr-17 | $11,616 | $12,459 | $12,263 |

| May-17 | $11,814 | $12,634 | $12,461 |

| Jun-17 | $11,856 | $12,713 | $12,488 |

| Jul-17 | $11,981 | $12,974 | $12,586 |

| Aug-17 | $12,075 | $13,014 | $12,546 |

| Sep-17 | $12,346 | $13,283 | $12,841 |

| Oct-17 | $12,732 | $13,593 | $13,107 |

| Nov-17 | $13,201 | $14,009 | $13,696 |

| Dec-17 | $13,330 | $14,165 | $13,883 |

| Jan-18 | $13,872 | $14,976 | $14,588 |

| Feb-18 | $13,483 | $14,424 | $14,009 |

| Mar-18 | $13,306 | $14,058 | $13,818 |

| Apr-18 | $13,542 | $14,112 | $13,690 |

| May-18 | $13,931 | $14,451 | $13,931 |

| Jun-18 | $13,813 | $14,540 | $13,991 |

| Jul-18 | $14,403 | $15,081 | $14,630 |

| Aug-18 | $14,863 | $15,573 | $15,046 |

| Sep-18 | $14,934 | $15,662 | $15,295 |

| Oct-18 | $13,790 | $14,591 | $14,322 |

| Nov-18 | $13,919 | $14,888 | $14,928 |

| Dec-18 | $12,864 | $13,544 | $13,608 |

| Jan-19 | $13,788 | $14,629 | $14,467 |

| Feb-19 | $14,295 | $15,099 | $15,138 |

| Mar-19 | $14,425 | $15,393 | $15,311 |

| Apr-19 | $15,075 | $16,016 | $15,884 |

| May-19 | $14,217 | $14,998 | $15,143 |

| Jun-19 | $15,218 | $16,055 | $16,164 |

| Jul-19 | $15,479 | $16,286 | $16,510 |

| Aug-19 | $15,361 | $16,028 | $16,618 |

| Sep-19 | $15,622 | $16,328 | $16,839 |

| Oct-19 | $16,038 | $16,681 | $16,853 |

| Nov-19 | $16,636 | $17,287 | $17,266 |

| Dec-19 | $17,074 | $17,809 | $17,656 |

| Jan-20 | $16,889 | $17,802 | $17,755 |

| Feb-20 | $15,567 | $16,336 | $16,267 |

| Mar-20 | $13,622 | $14,319 | $14,702 |

| Apr-20 | $15,210 | $16,154 | $16,168 |

| May-20 | $16,003 | $16,923 | $16,756 |

| Jun-20 | $16,228 | $17,260 | $16,763 |

| Jul-20 | $17,048 | $18,233 | $17,614 |

| Aug-20 | $17,947 | $19,544 | $18,712 |

| Sep-20 | $17,802 | $18,801 | $18,506 |

| Oct-20 | $17,365 | $18,301 | $18,072 |

| Nov-20 | $19,270 | $20,305 | $19,899 |

| Dec-20 | $19,867 | $21,085 | $20,414 |

| Jan-21 | $19,609 | $20,872 | $19,813 |

| Feb-21 | $19,939 | $21,448 | $20,118 |

| Mar-21 | $20,958 | $22,387 | $21,316 |

| Apr-21 | $21,947 | $23,582 | $22,179 |

| May-21 | $22,478 | $23,747 | $22,573 |

| Jun-21 | $22,493 | $24,301 | $22,549 |

| Jul-21 | $23,052 | $24,878 | $23,265 |

| Aug-21 | $23,267 | $25,635 | $23,664 |

| Sep-21 | $21,919 | $24,443 | $22,513 |

| Oct-21 | $23,669 | $26,155 | $24,142 |

| Nov-21 | $23,310 | $25,974 | $23,704 |

| Dec-21 | $25,050 | $27,138 | $25,216 |

| Jan-22 | $23,681 | $25,734 | $23,942 |

| Feb-22 | $23,207 | $24,963 | $23,314 |

| Mar-22 | $24,015 | $25,890 | $23,975 |

| Apr-22 | $22,680 | $23,632 | $22,725 |

| May-22 | $23,102 | $23,676 | $22,654 |

| Jun-22 | $21,030 | $21,721 | $21,229 |

| Jul-22 | $22,206 | $23,724 | $22,708 |

| Aug-22 | $21,539 | $22,757 | $21,924 |

| Sep-22 | $19,784 | $20,661 | $20,108 |

| Oct-22 | $21,662 | $22,334 | $22,147 |

| Nov-22 | $22,996 | $23,582 | $23,691 |

| Dec-22 | $22,002 | $22,223 | $22,815 |

| Jan-23 | $22,708 | $23,619 | $23,448 |

| Feb-23 | $21,872 | $23,043 | $22,781 |

| Mar-23 | $22,411 | $23,889 | $23,196 |

| Apr-23 | $22,586 | $24,262 | $23,698 |

| May-23 | $22,045 | $24,367 | $23,107 |

| Jun-23 | $23,520 | $25,977 | $24,598 |

| Jul-23 | $24,043 | $26,812 | $25,132 |

| Aug-23 | $23,706 | $26,385 | $24,664 |

| Sep-23 | $22,769 | $25,127 | $23,588 |

| Oct-23 | $22,540 | $24,599 | $23,303 |

| Nov-23 | $24,289 | $26,845 | $25,049 |

| Dec-23 | $25,392 | $28,065 | $26,049 |

| Jan-24 | $25,505 | $28,536 | $26,450 |

| Feb-24 | $26,526 | $30,060 | $27,339 |

| Mar-24 | $27,491 | $31,027 | $28,100 |

| Apr-24 | $26,242 | $29,760 | $26,960 |

| May-24 | $26,963 | $31,236 | $27,901 |

| Jun-24 | $27,285 | $32,356 | $28,369 |

| Jul-24 | $28,206 | $32,750 | $29,419 |

| Aug-24 | $28,815 | $33,545 | $30,444 |

| Sep-24 | $29,348 | $34,261 | $30,954 |

| Oct-24 | $28,956 | $33,950 | $30,358 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and NASDAQ Dividend Achievers Select Total Return Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Harbor Dividend Growth Leaders ETF (Based on Net Asset Value) | 28.47% | 12.54% | 11.22% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

| NASDAQ Dividend Achievers Select Total Return Index | 30.28% | 12.49% | 11.74% |

The Fund acquired the assets and assumed the then existing known liabilities of the predecessor fund on May 20, 2022 (the “Reorganization Date”). The Fund is the performance successor of the reorganization. This means that the predecessor fund’s performance and financial history are used by the Fund going forward from the Reorganization Date. Accordingly, the performance of the Fund for periods prior to the reorganization is the performance of the predecessor fund. The performance of the predecessor fund has not been restated to reflect the annual operating expenses of the Fund, which are lower than those of the predecessor fund. Because the Fund has different fees and expenses than the predecessor fund, the Fund would also have had different performance results. Please refer to the Fund’s prospectus for further details.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $278,272 |

| Number of Investments | 45 |

| Total Net Advisory Fees Paid (in thousands) | $1,303 |

| Portfolio Turnover Rate | 58% |

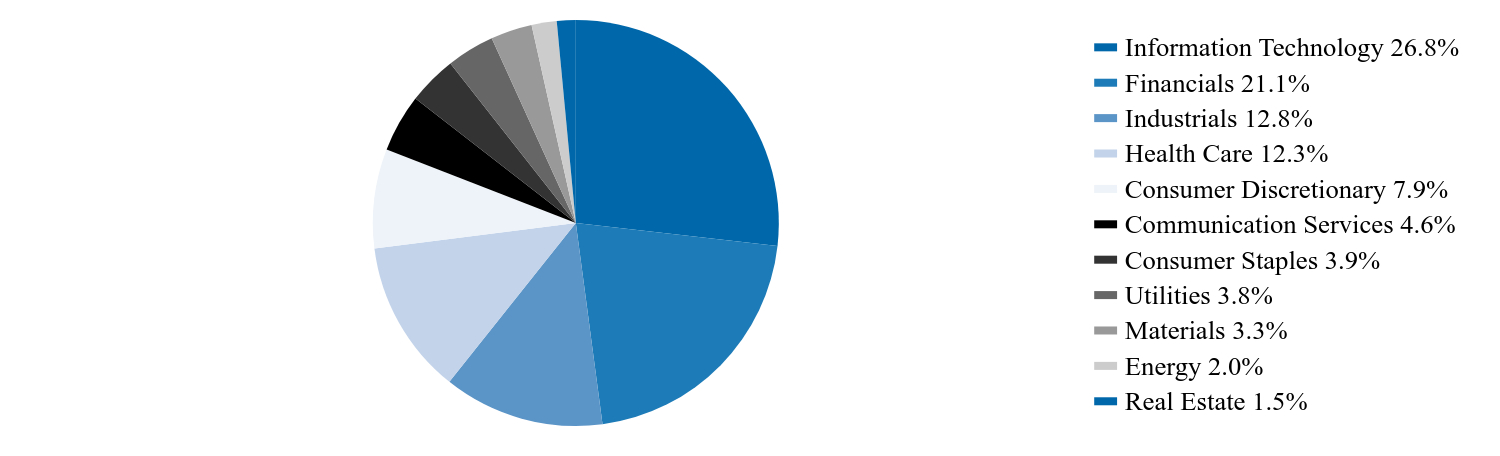

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 26.8% |

| Financials | 21.1% |

| Industrials | 12.8% |

| Health Care | 12.3% |

| Consumer Discretionary | 7.9% |

| Communication Services | 4.6% |

| Consumer Staples | 3.9% |

| Utilities | 3.8% |

| Materials | 3.3% |

| Energy | 2.0% |

| Real Estate | 1.5% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Energy Transition Strategy ETF (Consolidated)

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Energy Transition Strategy ETF (Consolidated) ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Energy Transition Strategy ETF | $77 | 0.80% |

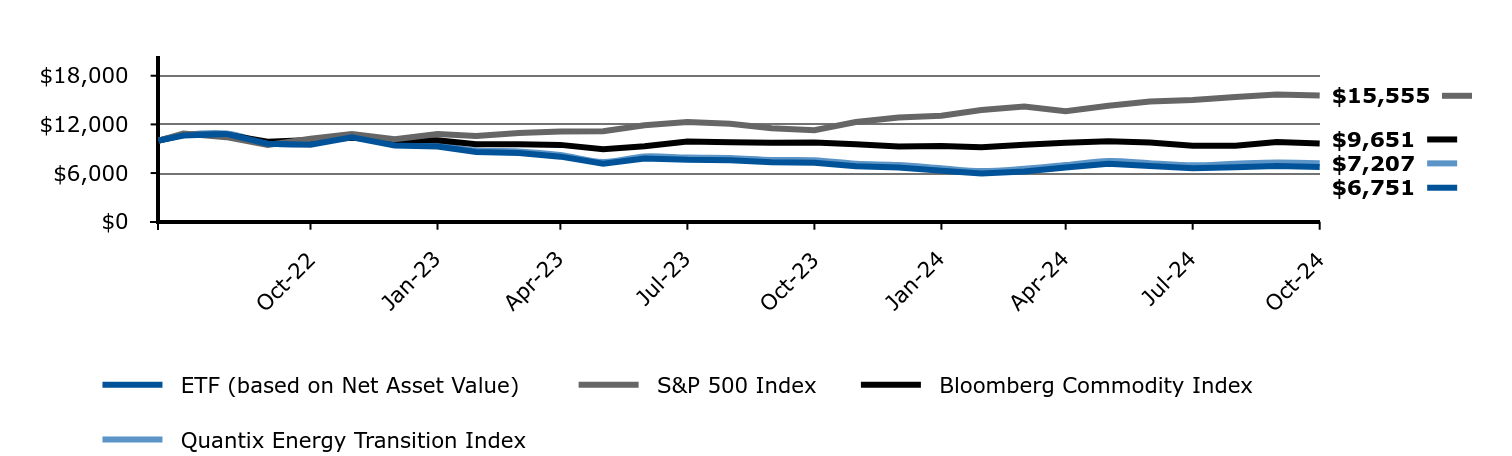

Management's Discussion of Fund Performance

Subadvisor: Quantix Commodities LP

Performance Summary

The Fund returned -7.07% for the year ended October 31, 2024. The Fund seeks to track the performance of the Quantix Energy Transition Index, which returned -4.96% during the same period.

Top contributors to performance included:

• Silver, which benefitted from a combination of the performance of Gold (arising from Central Bank diversification) as well as industrial demand in what is potentially a deficit market.

Top detractors from performance included:

• European Natural Gas (TTF) returns, which were negatively impacted by roll yield, a practice of moving from an expiring futures contract to one further out the curve to maintain exposure to the commodity.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

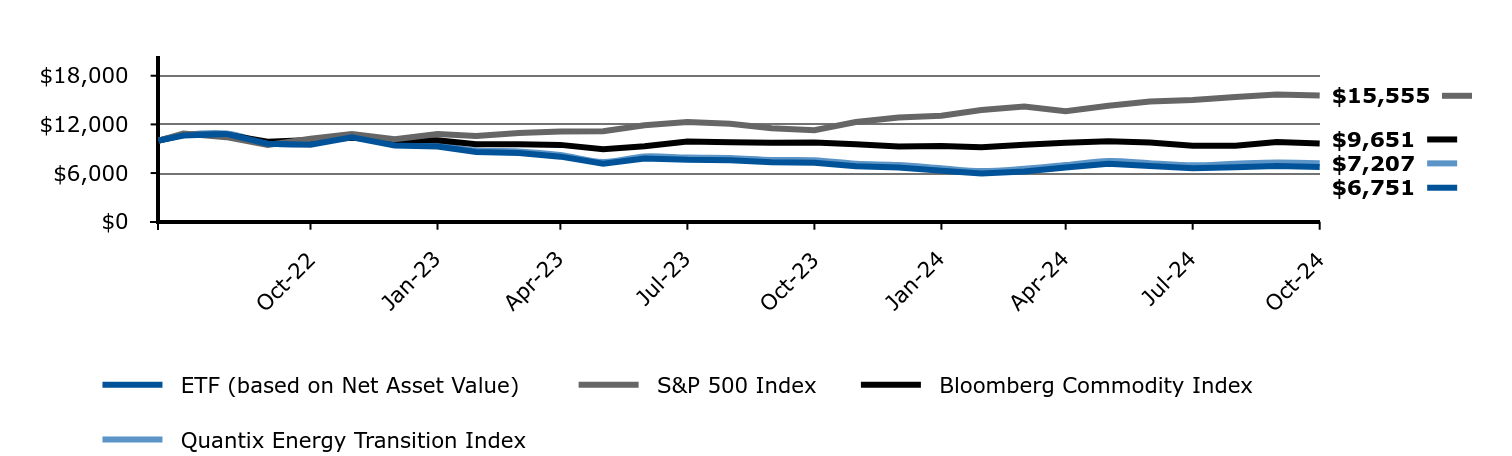

Change in a $10,000 Investment

For the period 07/13/2022 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Bloomberg Commodity Index | Quantix Energy Transition Index |

|---|

| Jul-22 | $10,000 | $10,000 | $10,000 | $10,000 |

| Jul-22 | $10,630 | $10,870 | $10,729 | $10,651 |

| Aug-22 | $10,825 | $10,427 | $10,739 | $10,874 |

| Sep-22 | $9,610 | $9,466 | $9,868 | $9,694 |

| Oct-22 | $9,490 | $10,233 | $10,064 | $9,600 |

| Nov-22 | $10,395 | $10,805 | $10,340 | $10,539 |

| Dec-22 | $9,393 | $10,182 | $10,087 | $9,535 |

| Jan-23 | $9,272 | $10,822 | $10,038 | $9,434 |

| Feb-23 | $8,603 | $10,558 | $9,566 | $8,775 |

| Mar-23 | $8,487 | $10,945 | $9,546 | $8,671 |

| Apr-23 | $8,024 | $11,116 | $9,474 | $8,215 |

| May-23 | $7,153 | $11,165 | $8,940 | $7,361 |

| Jun-23 | $7,803 | $11,902 | $9,302 | $8,054 |

| Jul-23 | $7,626 | $12,285 | $9,883 | $7,903 |

| Aug-23 | $7,581 | $12,089 | $9,808 | $7,869 |

| Sep-23 | $7,324 | $11,513 | $9,740 | $7,625 |

| Oct-23 | $7,264 | $11,271 | $9,766 | $7,583 |

| Nov-23 | $6,831 | $12,300 | $9,546 | $7,137 |

| Dec-23 | $6,678 | $12,859 | $9,289 | $6,987 |

| Jan-24 | $6,277 | $13,075 | $9,326 | $6,587 |

| Feb-24 | $5,938 | $13,773 | $9,189 | $6,242 |

| Mar-24 | $6,204 | $14,216 | $9,493 | $6,533 |

| Apr-24 | $6,675 | $13,635 | $9,748 | $6,990 |

| May-24 | $7,141 | $14,312 | $9,919 | $7,498 |

| Jun-24 | $6,870 | $14,825 | $9,767 | $7,224 |

| Jul-24 | $6,605 | $15,006 | $9,372 | $6,953 |

| Aug-24 | $6,714 | $15,370 | $9,377 | $7,152 |

| Sep-24 | $6,881 | $15,698 | $9,833 | $7,300 |

| Oct-24 | $6,751 | $15,555 | $9,651 | $7,207 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Bloomberg Commodity Index and Quantix Energy Transition Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 07/13/2022 |

|---|

| Harbor Energy Transition Strategy ETF (Based on Net Asset Value) | -7.07% | - | -15.68% |

| S&P 500 Index | 38.02% | - | 21.15% |

| Bloomberg Commodity Index | -1.18% | - | -1.53% |

| Quantix Energy Transition Index | -4.96% | - | -13.26% |

The “Life of Fund” return as shown reflects the period 07/13/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $11,662 |

| Number of Investments (includes derivatives) | 16 |

| Total Net Advisory Fees Paid (in thousands) | $157 |

| Portfolio Turnover Rate (not applicable due to Fund's investments) | -% |

Fund Investments (excludes short-term investments)

Risk AllocationFootnote Reference* (% of Notional Value)

Commodities Sector

| Industrial Metals | 38.1% |

| Natural Gas | 26.4% |

| Emissions | 14.9% |

| Precious Metals | 13.7% |

| Oil Seeds | 6.9% |

| Footnote | Description |

Footnote* | Based on net notional value and represents the sector allocation of the Quantix Energy Transition Index. |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Health Care ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Health Care ETF | $91 | 0.80% |

Management's Discussion of Fund Performance

Subadvisor: Westfield Capital Management Company, L.P.

Performance Summary

The Fund returned 27.16% for the year ended October 31, 2024, while the Russell 3000® Growth Health Care Index returned 25.11% during the same period.

Top contributors to relative performance included:

• Security selection in the Pharmaceuticals and Health Care Equipment & Supplies sectors.

• Positions in a pharmaceutical company, Merck & Co., Inc. and a medical technology company, Lantheus Holdings, Inc.

Top detractors from relative performance included:

• Security selection in the Health Care Providers & Services and Health Care Technology sectors.

• Positions in Option Care Health, Inc., a provider of home care solutions, and a health care technology company, Veradigm Inc.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

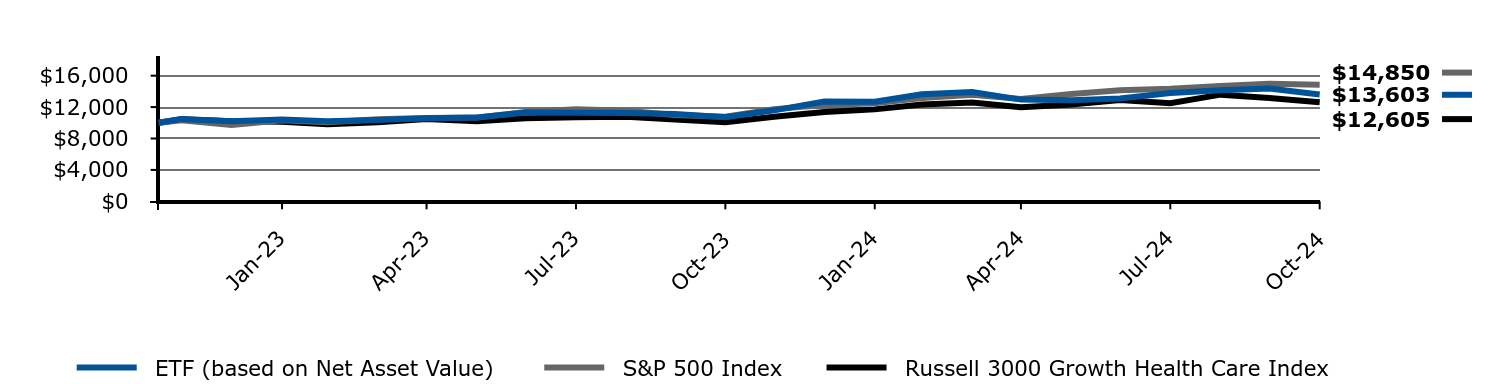

Change in a $10,000 Investment

For the period 11/16/2022 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Russell 3000 Growth Health Care Index |

|---|

| Nov-22 | $10,000 | $10,000 | $10,000 |

| Nov-22 | $10,473 | $10,315 | $10,461 |

| Dec-22 | $10,191 | $9,721 | $10,190 |

| Jan-23 | $10,423 | $10,331 | $10,126 |

| Feb-23 | $10,206 | $10,079 | $9,807 |

| Mar-23 | $10,358 | $10,449 | $10,054 |

| Apr-23 | $10,564 | $10,612 | $10,487 |

| May-23 | $10,675 | $10,659 | $10,181 |

| Jun-23 | $11,319 | $11,363 | $10,585 |

| Jul-23 | $11,279 | $11,728 | $10,720 |

| Aug-23 | $11,239 | $11,541 | $10,764 |

| Sep-23 | $11,123 | $10,991 | $10,412 |

| Oct-23 | $10,697 | $10,760 | $10,076 |

| Nov-23 | $11,586 | $11,742 | $10,763 |

| Dec-23 | $12,720 | $12,276 | $11,379 |

| Jan-24 | $12,669 | $12,482 | $11,708 |

| Feb-24 | $13,628 | $13,149 | $12,320 |

| Mar-24 | $13,931 | $13,572 | $12,582 |

| Apr-24 | $12,953 | $13,017 | $11,966 |

| May-24 | $12,869 | $13,663 | $12,325 |

| Jun-24 | $13,095 | $14,153 | $12,895 |

| Jul-24 | $13,793 | $14,325 | $12,491 |

| Aug-24 | $14,131 | $14,673 | $13,584 |

| Sep-24 | $14,352 | $14,986 | $13,158 |

| Oct-24 | $13,603 | $14,850 | $12,605 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Russell 3000 Growth Health Care Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 11/16/2022 |

|---|

| Harbor Health Care ETF (Based on Net Asset Value) | 27.16% | - | 17.01% |

| S&P 500 Index | 38.02% | - | 22.37% |

| Russell 3000 Growth Health Care Index | 25.11% | - | 12.55% |

The “Life of Fund” return as shown reflects the period 11/16/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $17,229 |

| Number of Investments | 35 |

| Total Net Advisory Fees Paid (in thousands) | $94 |

| Portfolio Turnover Rate | 146% |

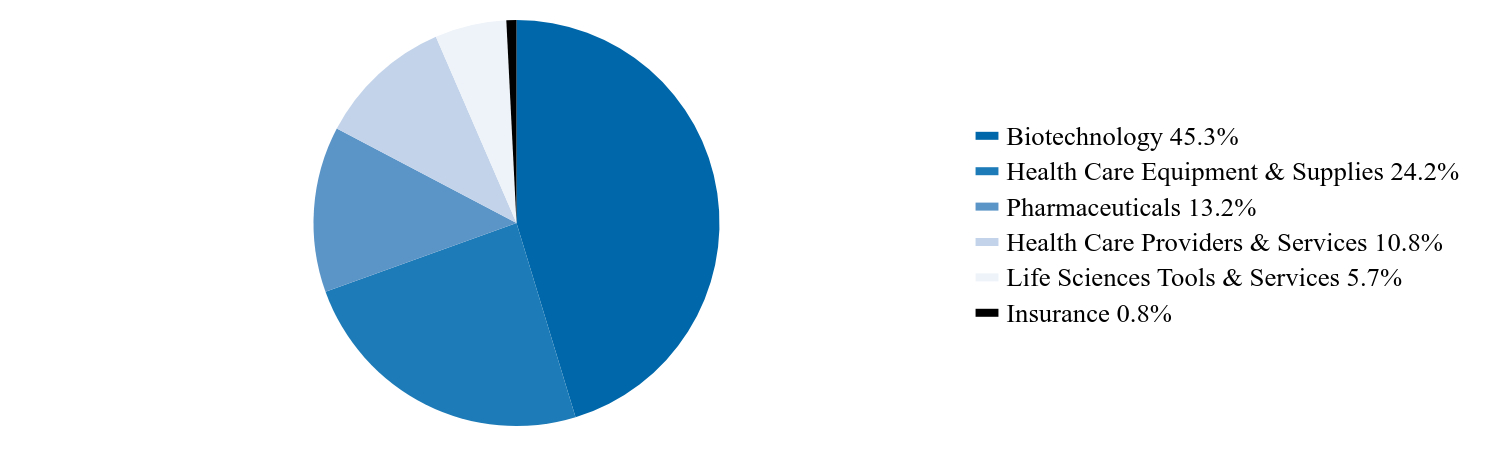

Industry Allocation (% of Investments)

| Value | Value |

|---|

| Biotechnology | 45.3% |

| Health Care Equipment & Supplies | 24.2% |

| Pharmaceuticals | 13.2% |

| Health Care Providers & Services | 10.8% |

| Life Sciences Tools & Services | 5.7% |

| Insurance | 0.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Human Capital Factor Unconstrained ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Human Capital Factor Unconstrained ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Human Capital Factor Unconstrained ETF | $59 | 0.50% |

Management's Discussion of Fund Performance

Performance Summary

The Fund returned 37.85% for the year ended October 31, 2024, while the Human Capital Factor Unconstrained Index returned 38.64% during the same period.

Top contributors to performance included:

• Security selection in the Financials, Health Care and Industrials sectors.

• Positions in Gentex Corporation, Genuine Parts, and Gilead Sciences.

Top detractors from performance included:

• Security selection in the Information Technology, Energy, and Consumer Discretionary sectors.

• Positions in Zoom Video Communications Inc., Zoetis Inc., and an underweight in NVIDIA Corp.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

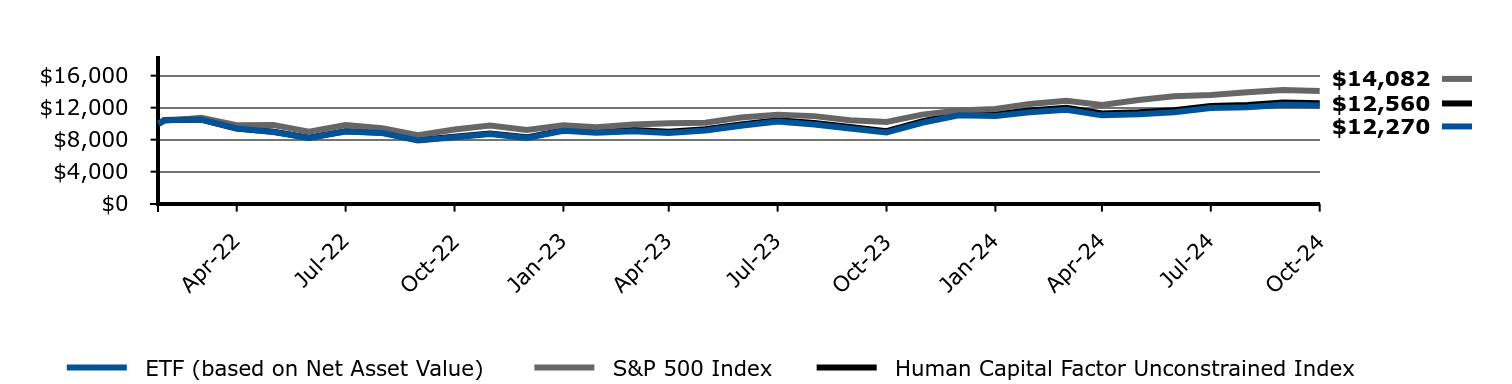

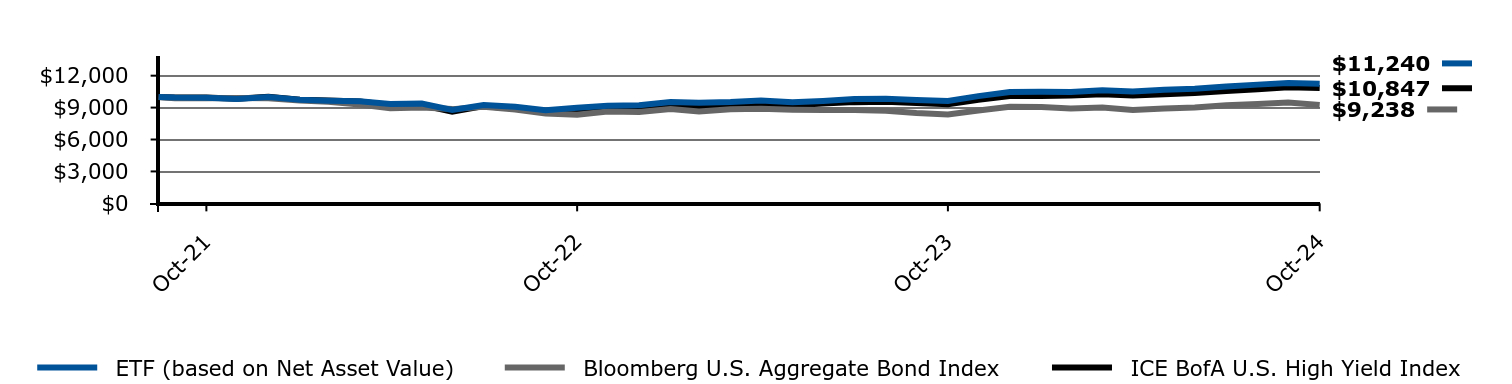

Change in a $10,000 Investment

For the period 02/23/2022 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Human Capital Factor Unconstrained Index |

|---|

| Feb-22 | $10,000 | $10,000 | $10,000 |

| Feb-22 | $10,461 | $10,354 | $10,468 |

| Mar-22 | $10,513 | $10,739 | $10,514 |

| Apr-22 | $9,394 | $9,802 | $9,389 |

| May-22 | $8,959 | $9,820 | $8,984 |

| Jun-22 | $8,229 | $9,010 | $8,253 |

| Jul-22 | $9,026 | $9,841 | $9,065 |

| Aug-22 | $8,824 | $9,439 | $8,879 |

| Sep-22 | $7,892 | $8,570 | $7,948 |

| Oct-22 | $8,296 | $9,264 | $8,354 |

| Nov-22 | $8,695 | $9,781 | $8,761 |

| Dec-22 | $8,226 | $9,218 | $8,292 |

| Jan-23 | $9,108 | $9,797 | $9,187 |

| Feb-23 | $8,875 | $9,558 | $9,014 |

| Mar-23 | $9,067 | $9,909 | $9,212 |

| Apr-23 | $8,844 | $10,064 | $8,990 |

| May-23 | $9,155 | $10,107 | $9,303 |

| Jun-23 | $9,741 | $10,775 | $9,900 |

| Jul-23 | $10,265 | $11,121 | $10,438 |

| Aug-23 | $9,907 | $10,944 | $10,077 |

| Sep-23 | $9,409 | $10,422 | $9,573 |

| Oct-23 | $8,901 | $10,203 | $9,060 |

| Nov-23 | $10,109 | $11,135 | $10,293 |

| Dec-23 | $11,041 | $11,641 | $11,245 |

| Jan-24 | $10,958 | $11,837 | $11,170 |

| Feb-24 | $11,421 | $12,469 | $11,647 |

| Mar-24 | $11,749 | $12,870 | $11,993 |

| Apr-24 | $11,041 | $12,344 | $11,271 |

| May-24 | $11,177 | $12,956 | $11,413 |

| Jun-24 | $11,432 | $13,421 | $11,681 |

| Jul-24 | $11,947 | $13,584 | $12,212 |

| Aug-24 | $12,067 | $13,914 | $12,340 |

| Sep-24 | $12,353 | $14,211 | $12,639 |

| Oct-24 | $12,270 | $14,082 | $12,560 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Human Capital Factor Unconstrained Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 02/23/2022 |

|---|

| Harbor Human Capital Factor Unconstrained ETF (Based on Net Asset Value) | 37.85% | - | 7.91% |

| S&P 500 Index | 38.02% | - | 13.58% |

| Human Capital Factor Unconstrained Index | 38.64% | - | 8.85% |

The “Life of Fund” return as shown reflects the period 02/23/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $13,552 |

| Number of Investments | 75 |

| Total Net Advisory Fees Paid (in thousands) | $63 |

| Portfolio Turnover Rate | 74% |

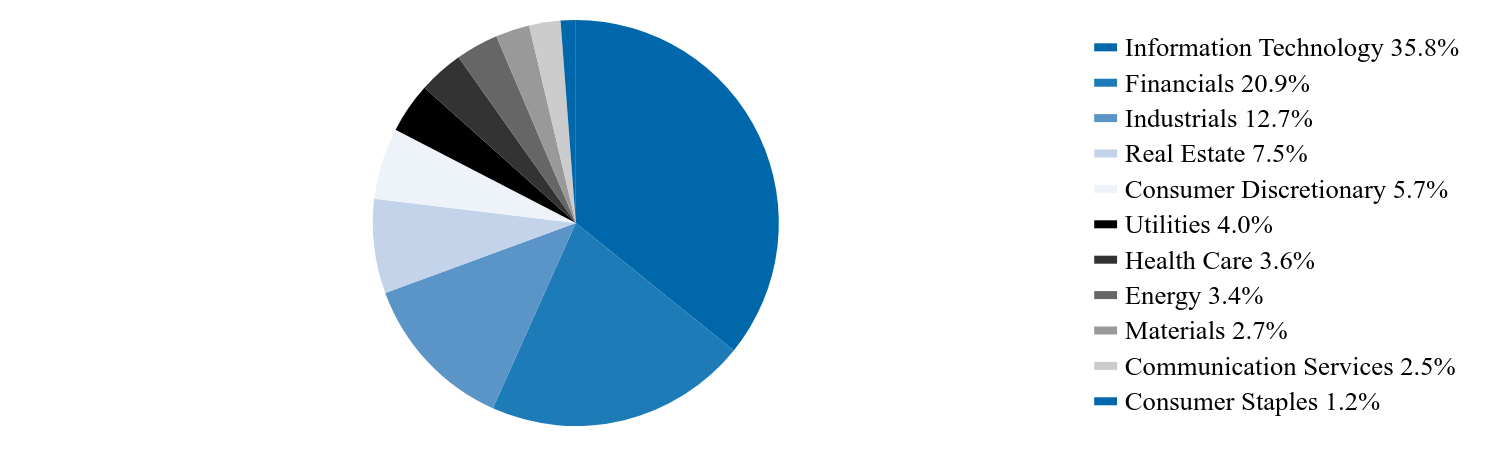

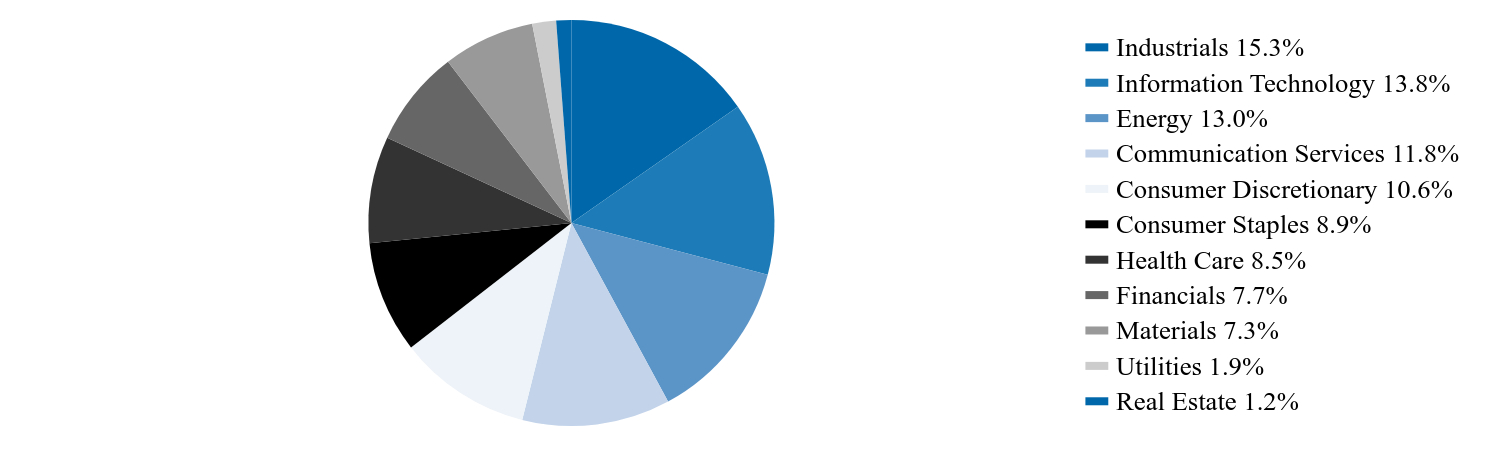

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 35.8% |

| Financials | 20.9% |

| Industrials | 12.7% |

| Real Estate | 7.5% |

| Consumer Discretionary | 5.7% |

| Utilities | 4.0% |

| Health Care | 3.6% |

| Energy | 3.4% |

| Materials | 2.7% |

| Communication Services | 2.5% |

| Consumer Staples | 1.2% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Human Capital Factor US Large Cap ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Human Capital Factor US Large Cap ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Human Capital Factor US Large Cap ETF | $42 | 0.35% |

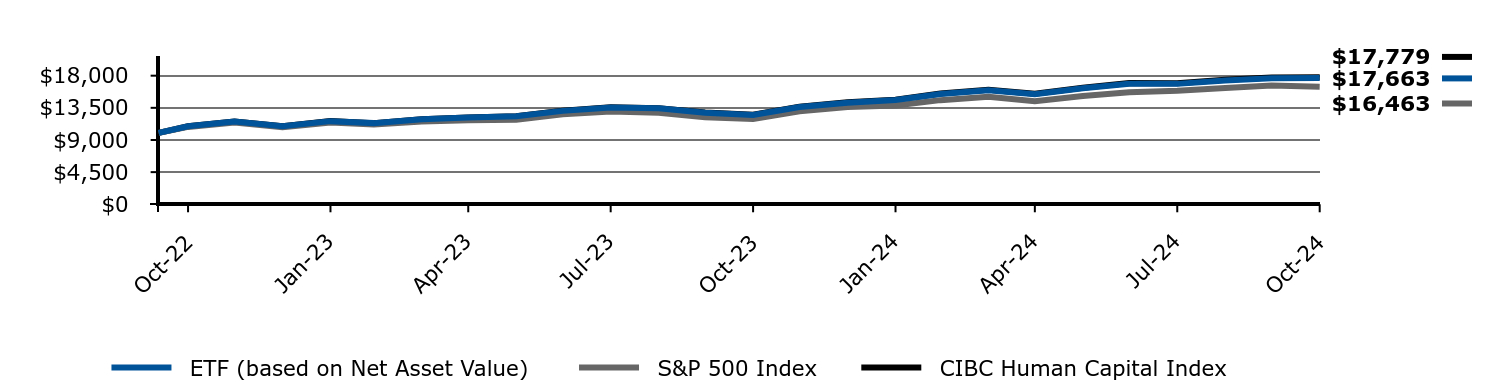

Management's Discussion of Fund Performance

Performance Summary

The Fund returned 41.23% for the year ended October 31, 2024, while the CIBC Human Capital Index returned 41.90% during the same period.

Top contributors to performance included:

• Security selection in the Healthcare, Information Technology, and Financials sectors.

• Positions in Technology Select Sector SPDR Fund, Consumer Discretionary Select Sector SPDR Fund, and Meta Platforms, Inc.

Top detractors from performance included:

• Security selection in the Consumer Staples, Energy, Utilities sectors.

• Positions in Zions Bancorp NA, Zimmer Biomet Holdings, Inc. and Amazon.com, Inc.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Change in a $10,000 Investment

For the period 10/12/2022 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | CIBC Human Capital Index |

|---|

| Oct-22 | $10,000 | $10,000 | $10,000 |

| Oct-22 | $10,912 | $10,830 | $10,914 |

| Nov-22 | $11,583 | $11,435 | $11,588 |

| Dec-22 | $10,913 | $10,776 | $10,923 |

| Jan-23 | $11,637 | $11,453 | $11,653 |

| Feb-23 | $11,360 | $11,174 | $11,358 |

| Mar-23 | $11,898 | $11,584 | $11,903 |

| Apr-23 | $12,154 | $11,765 | $12,161 |

| May-23 | $12,310 | $11,816 | $12,324 |

| Jun-23 | $13,074 | $12,597 | $13,094 |

| Jul-23 | $13,536 | $13,002 | $13,566 |

| Aug-23 | $13,426 | $12,795 | $13,456 |

| Sep-23 | $12,828 | $12,185 | $12,852 |

| Oct-23 | $12,506 | $11,928 | $12,530 |

| Nov-23 | $13,621 | $13,018 | $13,665 |

| Dec-23 | $14,220 | $13,609 | $14,272 |

| Jan-24 | $14,586 | $13,838 | $14,642 |

| Feb-24 | $15,435 | $14,577 | $15,498 |

| Mar-24 | $15,974 | $15,046 | $16,044 |

| Apr-24 | $15,389 | $14,431 | $15,459 |

| May-24 | $16,229 | $15,147 | $16,307 |

| Jun-24 | $16,874 | $15,690 | $16,962 |

| Jul-24 | $16,854 | $15,881 | $16,946 |

| Aug-24 | $17,322 | $16,266 | $17,424 |

| Sep-24 | $17,648 | $16,614 | $17,758 |

| Oct-24 | $17,663 | $16,463 | $17,779 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and CIBC Human Capital Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 10/12/2022 |

|---|

| Harbor Human Capital Factor US Large Cap ETF (Based on Net Asset Value) | 41.23% | - | 31.90% |

| S&P 500 Index | 38.02% | - | 27.46% |

| CIBC Human Capital Index | 41.90% | - | 32.32% |

The “Life of Fund” return as shown reflects the period 10/12/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $352,558 |

| Number of Investments | 152 |

| Total Net Advisory Fees Paid (in thousands) | $1,100 |

| Portfolio Turnover Rate | 41% |

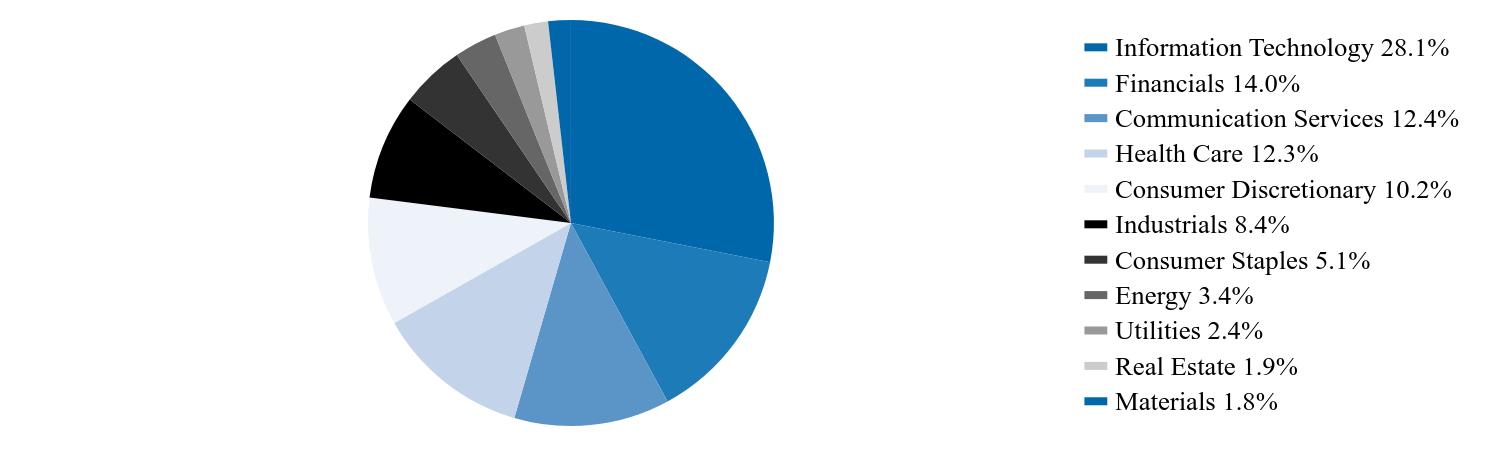

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 28.1% |

| Financials | 14.0% |

| Communication Services | 12.4% |

| Health Care | 12.3% |

| Consumer Discretionary | 10.2% |

| Industrials | 8.4% |

| Consumer Staples | 5.1% |

| Energy | 3.4% |

| Utilities | 2.4% |

| Real Estate | 1.9% |

| Materials | 1.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Human Capital Factor US Small Cap ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Human Capital Factor US Small Cap ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor Human Capital Factor US Small Cap ETF | $68 | 0.60% |

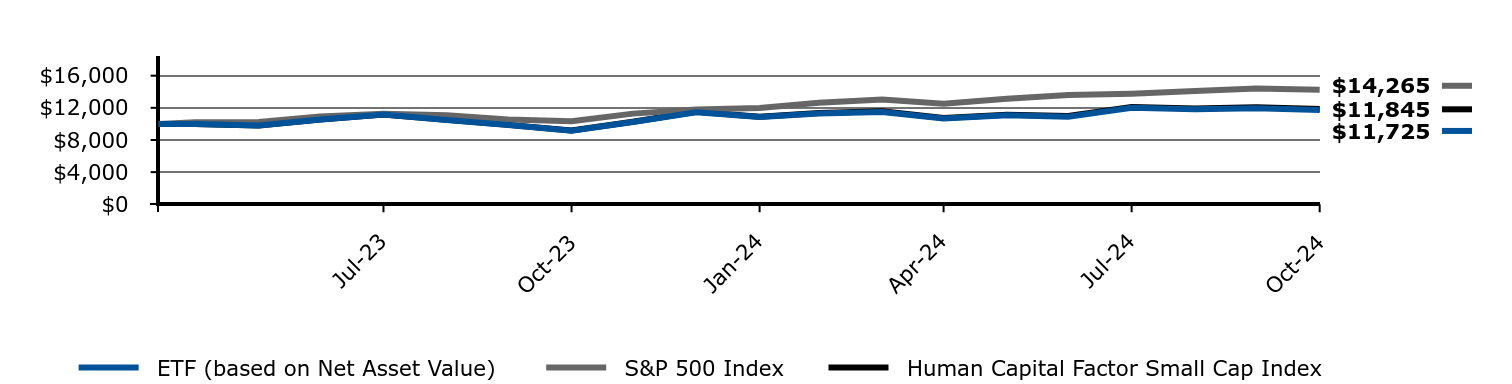

Management's Discussion of Fund Performance

Performance Summary

The Fund returned 28.09% for the year ended October 31, 2024, while the Human Capital Factor Small Cap Index returned 29.03% during the same period.

Top contributors to performance included:

• Security selection in the Financials, Materials, and Utilities sectors.

• Positions in Affirm Holdings, Inc., Brinker International, Inc. and TPG, Inc.

Top detractors from performance included:

• Security selection in the Information Technology, Consumer Discretionary, and Real Estate sectors.

• Positions in Kosmos Energy Ltd., Super Micro Computer Inc., and Insperity, Inc.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Change in a $10,000 Investment

For the period 04/12/2023 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | Human Capital Factor Small Cap Index |

|---|

| Apr-23 | $10,000 | $10,000 | $10,000 |

| Apr-23 | $9,988 | $10,194 | $9,991 |

| May-23 | $9,789 | $10,239 | $9,796 |

| Jun-23 | $10,547 | $10,915 | $10,556 |

| Jul-23 | $11,166 | $11,266 | $11,183 |

| Aug-23 | $10,482 | $11,086 | $10,505 |

| Sep-23 | $9,854 | $10,558 | $9,879 |

| Oct-23 | $9,154 | $10,336 | $9,180 |

| Nov-23 | $10,239 | $11,280 | $10,279 |

| Dec-23 | $11,457 | $11,792 | $11,508 |

| Jan-24 | $10,851 | $11,990 | $10,903 |

| Feb-24 | $11,290 | $12,631 | $11,360 |

| Mar-24 | $11,490 | $13,037 | $11,567 |

| Apr-24 | $10,668 | $12,505 | $10,744 |

| May-24 | $11,063 | $13,125 | $11,150 |

| Jun-24 | $10,892 | $13,596 | $10,983 |

| Jul-24 | $12,002 | $13,761 | $12,105 |

| Aug-24 | $11,823 | $14,095 | $11,930 |

| Sep-24 | $11,945 | $14,396 | $12,059 |

| Oct-24 | $11,725 | $14,265 | $11,845 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and Human Capital Factor Small Cap Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 04/12/2023 |

|---|

| Harbor Human Capital Factor US Small Cap ETF (Based on Net Asset Value) | 28.09% | - | 10.78% |

| S&P 500 Index | 38.02% | - | 25.67% |

| Human Capital Factor Small Cap Index | 29.03% | - | 11.51% |

The “Life of Fund” return as shown reflects the period 04/12/2023 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $131,237 |

| Number of Investments | 184 |

| Total Net Advisory Fees Paid (in thousands) | $749 |

| Portfolio Turnover Rate | 96% |

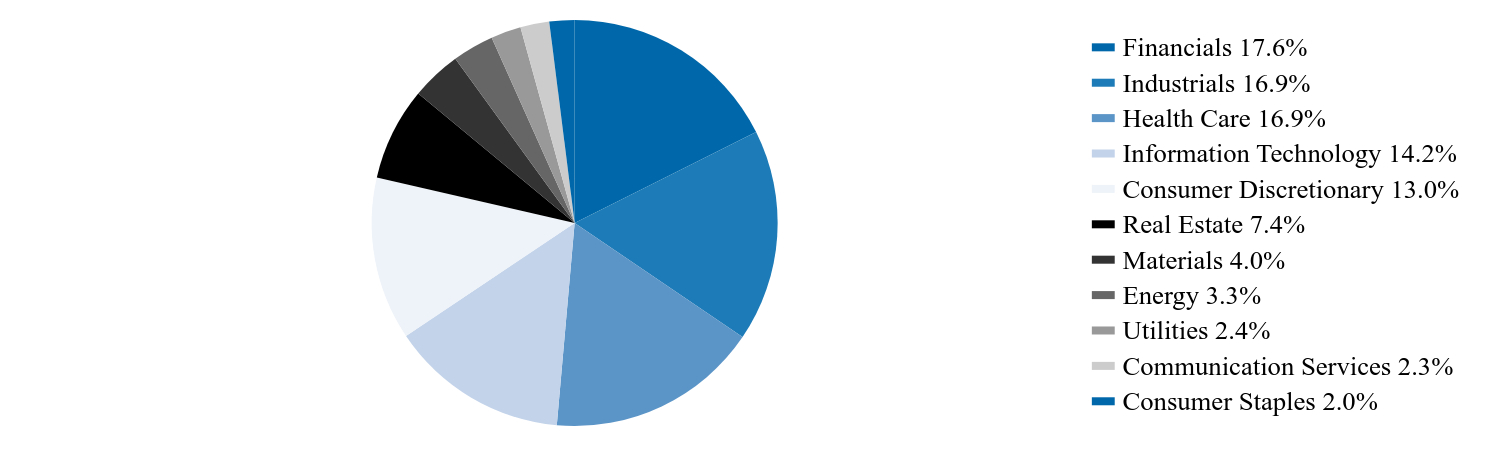

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Financials | 17.6% |

| Industrials | 16.9% |

| Health Care | 16.9% |

| Information Technology | 14.2% |

| Consumer Discretionary | 13.0% |

| Real Estate | 7.4% |

| Materials | 4.0% |

| Energy | 3.3% |

| Utilities | 2.4% |

| Communication Services | 2.3% |

| Consumer Staples | 2.0% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

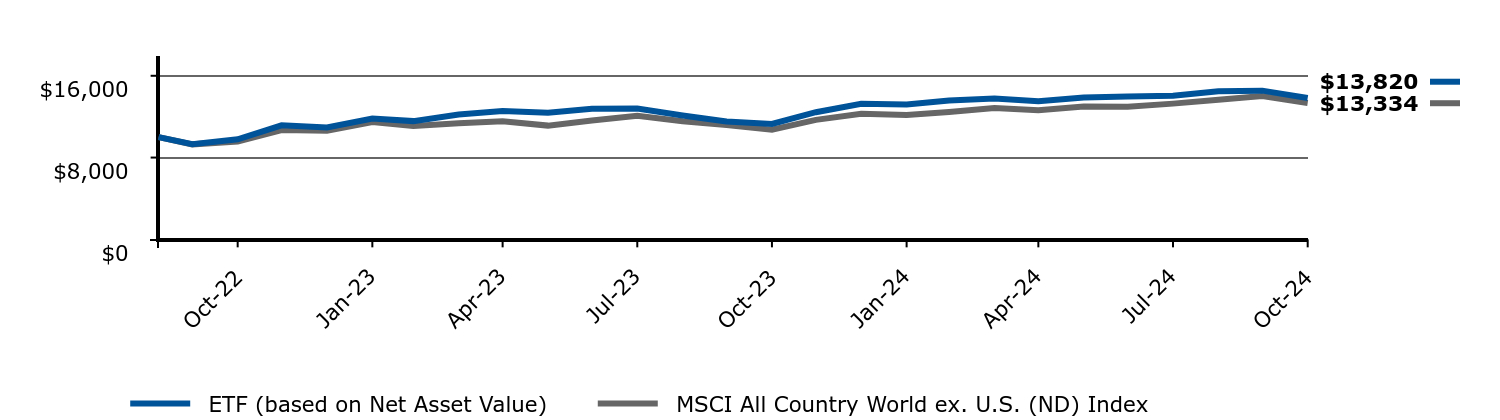

Harbor International Compounders ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor International Compounders ETF ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Harbor International Compounders ETF | $61 | 0.55% |

Management's Discussion of Fund Performance

Subadvisor: C WorldWide Asset Management

Performance Summary

The Fund returned 22.37 % in the year ended October 31, 2024, while the MSCI All Country World ex. U.S. (ND) Index returned 24.33% during the same period.

Top contributors to relative performance included:

• Security selection within Information Technology, Healthcare along with an underweight to Energy.

• Positions in SAP SE, Taiwan Semiconductor Manufacturing Co. Ltd. ADR, and Siemens AG.

Top detractors from relative performance included:

• Security selection within Financials, Consumer Staples, and Consumer Discretionary.

• Positions in L’Oreal SA, Daikin Industries Ltd., and Diageo PLC.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Change in a $10,000 Investment

For the period 09/07/2022 through 10/31/2024

| ETF (based on Net Asset Value) | MSCI All Country World ex. U.S. (ND) Index |

|---|

| Sep-22 | $10,000 | $10,000 |

| Sep-22 | $9,311 | $9,292 |

| Oct-22 | $9,784 | $9,570 |

| Nov-22 | $11,156 | $10,699 |

| Dec-22 | $10,947 | $10,619 |

| Jan-23 | $11,818 | $11,480 |

| Feb-23 | $11,566 | $11,077 |

| Mar-23 | $12,205 | $11,348 |

| Apr-23 | $12,557 | $11,545 |

| May-23 | $12,396 | $11,126 |

| Jun-23 | $12,779 | $11,625 |

| Jul-23 | $12,804 | $12,097 |

| Aug-23 | $12,119 | $11,551 |

| Sep-23 | $11,531 | $11,186 |

| Oct-23 | $11,294 | $10,725 |

| Nov-23 | $12,437 | $11,690 |

| Dec-23 | $13,253 | $12,277 |

| Jan-24 | $13,182 | $12,155 |

| Feb-24 | $13,587 | $12,463 |

| Mar-24 | $13,775 | $12,853 |

| Apr-24 | $13,501 | $12,622 |

| May-24 | $13,886 | $12,988 |

| Jun-24 | $13,972 | $12,976 |

| Jul-24 | $14,038 | $13,277 |

| Aug-24 | $14,484 | $13,655 |

| Sep-24 | $14,545 | $14,022 |

| Oct-24 | $13,820 | $13,334 |

The graph compares a $10,000 initial investment in the Fund with the performance of the MSCI All Country World ex. U.S. (ND) Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 09/07/2022 |

|---|

| Harbor International Compounders ETF (Based on Net Asset Value) | 22.37% | - | 16.24% |

| MSCI All Country World ex. U.S. (ND) Index | 24.33% | - | 14.32% |

The “Life of Fund” return as shown reflects the period 09/07/2022 (commencement of operations) through 10/31/2024.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $234,642 |

| Number of Investments | 29 |

| Total Net Advisory Fees Paid (in thousands) | $649 |

| Portfolio Turnover Rate | 3% |

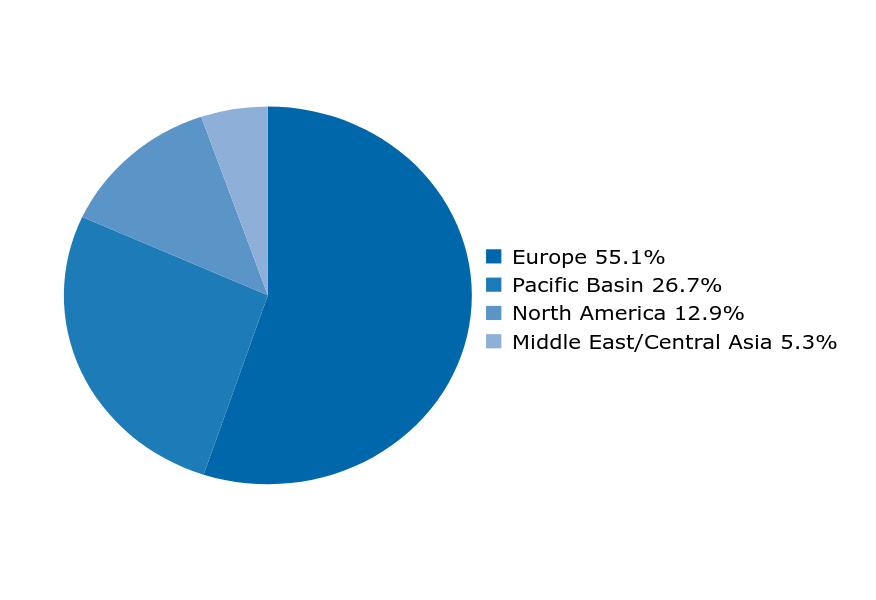

Region Breakdown (% of Investments)

| Value | Value |

|---|

| Europe | 55.1% |

| Pacific Basin | 26.7% |

| North America | 12.9% |

| Middle East/Central Asia | 5.3% |

Country Breakdown (% of Investments)

| United Kingdom | 15.4% |

| Japan | 15.3% |

| United States | 12.9% |

| Germany | 12.0% |

| France | 11.4% |

| Sweden | 8.2% |

| Denmark | 5.5% |

| India | 5.3% |

| Taiwan | 4.9% |

| Hong Kong | 3.4% |

| Indonesia | 3.1% |

| Netherlands | 2.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

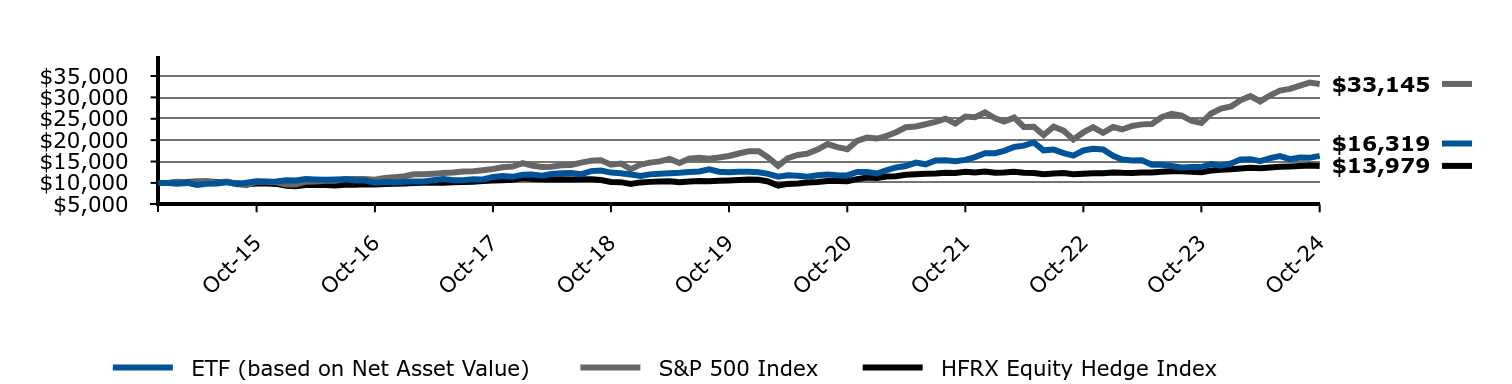

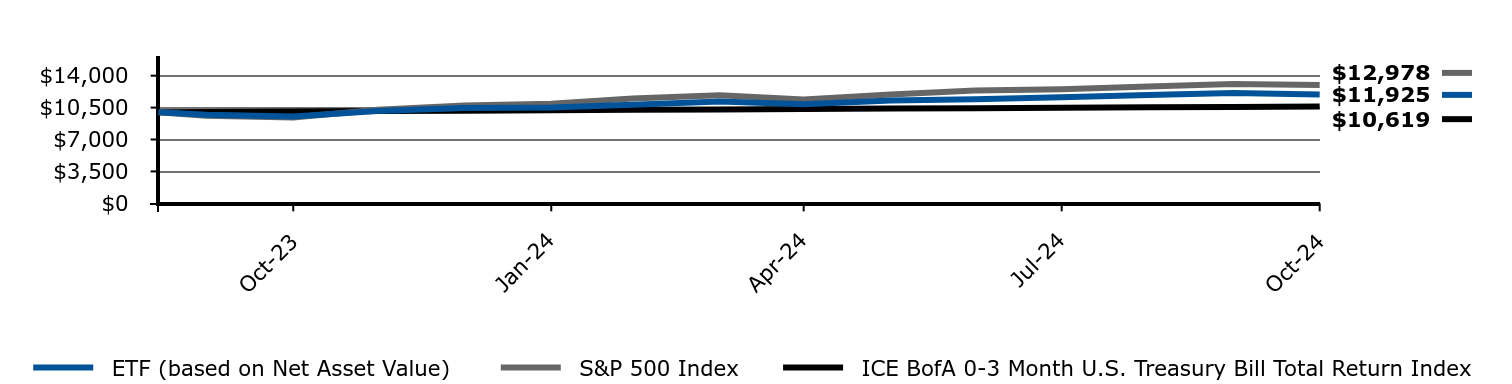

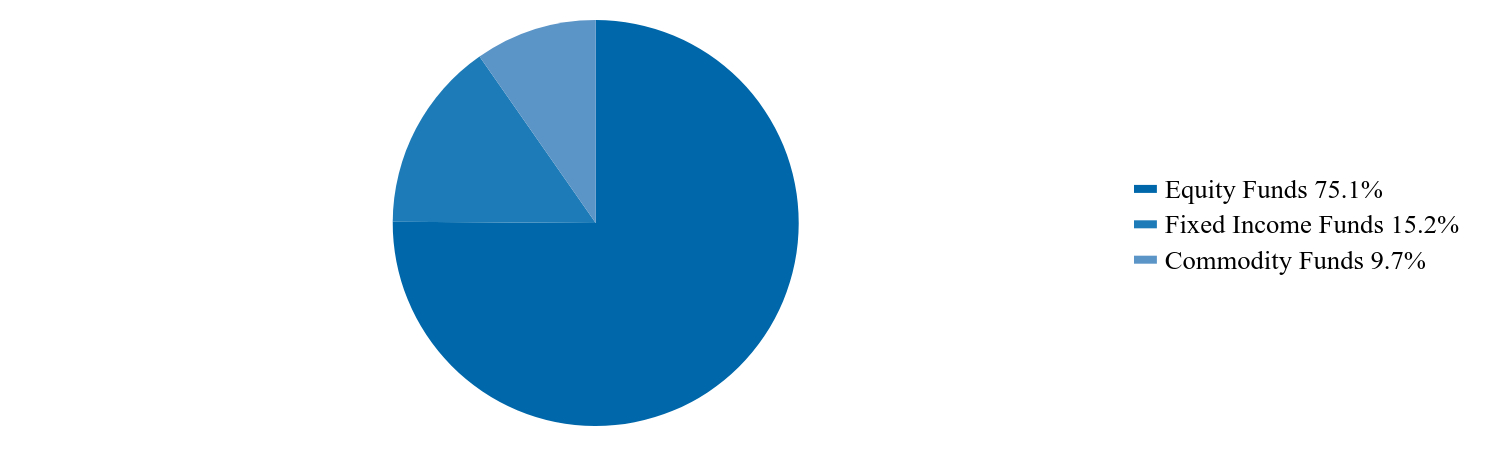

Harbor Long-Short Equity ETF

Principal U.S. Market: NYSE Arca, Inc.

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Long-Short Equity ETF ("Fund") for the period of December 4, 2023 (commencement of operations) to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Harbor Long-Short Equity ETF | $185 | 1.98% |

| Footnote | Description |

Footnote* | The Fund has less than one year of operations. Expenses would be higher if the Fund operated for a full year. |

Footnote† | Annualized |

Management's Discussion of Fund Performance

Subadvisor: Disciplined Alpha LLC

Performance Summary

The Fund returned 19.19% for the year ended October 31, 2024, while the HFRX Equity Hedge Index returned 11.67% during the same period.

Top contributors to performance included:

• Security selection within Information Technology, Consumer Discretionary, and Consumer Staples.

• Long positions in the Fund including Applovin Corp. Class A, Vistra Corp., and Palantir Technologies, Inc.

Top detractors from performance included:

• Security selection within Industrials, Communication Services, and Materials.

• Long position in Sage Therapeutics, Inc.

• Short positions in the Fund including DocuSign, Inc. and MP Materials Corp.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

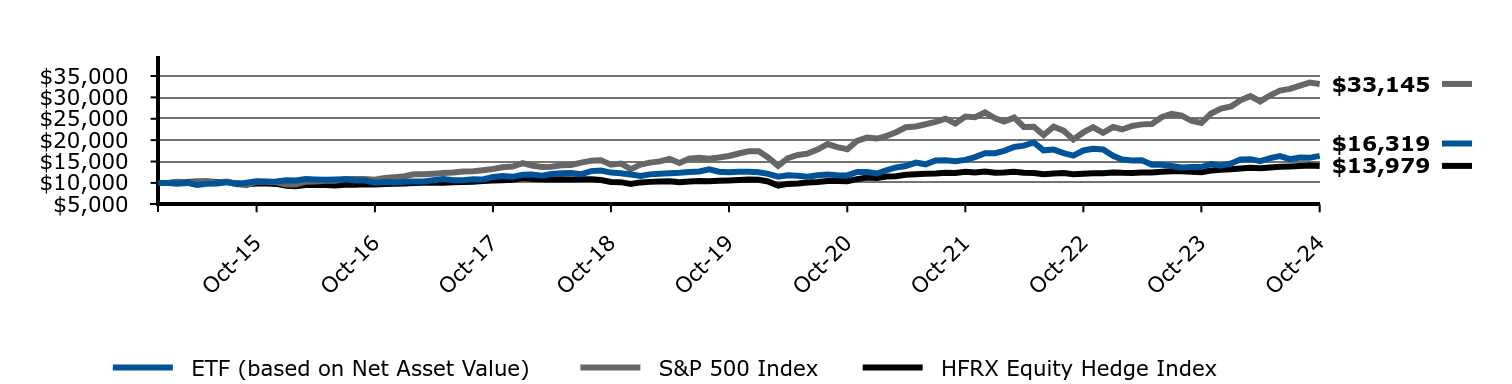

Change in a $10,000 Investment

For the period 01/01/2015 through 10/31/2024

| ETF (based on Net Asset Value) | S&P 500 Index | HFRX Equity Hedge Index |

|---|

| Jan-15 | $10,000 | $10,000 | $10,000 |

| Jan-15 | $10,000 | $10,000 | $10,000 |

| Feb-15 | $9,793 | $10,257 | $10,159 |

| Mar-15 | $10,002 | $10,095 | $10,220 |

| Apr-15 | $9,500 | $10,192 | $10,342 |

| May-15 | $9,788 | $10,323 | $10,324 |

| Jun-15 | $9,867 | $10,123 | $10,237 |

| Jul-15 | $10,171 | $10,335 | $10,207 |

| Aug-15 | $9,668 | $9,712 | $9,893 |

| Sep-15 | $10,033 | $9,471 | $9,687 |

| Oct-15 | $10,395 | $10,270 | $9,872 |

| Nov-15 | $10,295 | $10,301 | $9,876 |

| Dec-15 | $10,339 | $10,138 | $9,767 |

| Jan-16 | $10,596 | $9,635 | $9,328 |

| Feb-16 | $10,561 | $9,622 | $9,223 |

| Mar-16 | $10,899 | $10,275 | $9,480 |

| Apr-16 | $10,785 | $10,315 | $9,483 |

| May-16 | $10,711 | $10,500 | $9,524 |

| Jun-16 | $10,798 | $10,527 | $9,384 |

| Jul-16 | $10,876 | $10,915 | $9,571 |

| Aug-16 | $10,586 | $10,931 | $9,554 |

| Sep-16 | $10,553 | $10,933 | $9,700 |

| Oct-16 | $10,016 | $10,733 | $9,618 |

| Nov-16 | $10,218 | $11,131 | $9,759 |

| Dec-16 | $10,094 | $11,351 | $9,776 |

| Jan-17 | $10,251 | $11,566 | $9,859 |

| Feb-17 | $10,337 | $12,025 | $9,974 |

| Mar-17 | $10,311 | $12,039 | $10,040 |

| Apr-17 | $10,600 | $12,163 | $10,112 |

| May-17 | $10,886 | $12,334 | $10,055 |

| Jun-17 | $10,628 | $12,411 | $10,141 |

| Jul-17 | $10,620 | $12,666 | $10,230 |

| Aug-17 | $10,873 | $12,705 | $10,280 |

| Sep-17 | $10,809 | $12,967 | $10,467 |

| Oct-17 | $11,393 | $13,270 | $10,550 |

| Nov-17 | $11,611 | $13,677 | $10,642 |

| Dec-17 | $11,420 | $13,829 | $10,752 |

| Jan-18 | $11,899 | $14,621 | $11,119 |

| Feb-18 | $11,984 | $14,082 | $10,953 |

| Mar-18 | $11,687 | $13,724 | $10,878 |

| Apr-18 | $12,084 | $13,777 | $10,818 |

| May-18 | $12,273 | $14,108 | $10,850 |

| Jun-18 | $12,329 | $14,195 | $10,778 |

| Jul-18 | $12,052 | $14,724 | $10,856 |

| Aug-18 | $12,753 | $15,203 | $10,831 |

| Sep-18 | $12,908 | $15,290 | $10,655 |

| Oct-18 | $12,411 | $14,245 | $10,234 |

| Nov-18 | $12,261 | $14,535 | $10,170 |

| Dec-18 | $11,979 | $13,223 | $9,739 |

| Jan-19 | $11,634 | $14,282 | $10,121 |

| Feb-19 | $11,995 | $14,741 | $10,239 |

| Mar-19 | $12,126 | $15,027 | $10,319 |

| Apr-19 | $12,273 | $15,636 | $10,389 |

| May-19 | $12,360 | $14,642 | $10,180 |

| Jun-19 | $12,523 | $15,674 | $10,321 |

| Jul-19 | $12,689 | $15,899 | $10,431 |

| Aug-19 | $13,184 | $15,648 | $10,414 |

| Sep-19 | $12,611 | $15,940 | $10,506 |

| Oct-19 | $12,499 | $16,286 | $10,560 |

| Nov-19 | $12,600 | $16,877 | $10,653 |

| Dec-19 | $12,594 | $17,386 | $10,783 |

| Jan-20 | $12,489 | $17,379 | $10,747 |

| Feb-20 | $12,101 | $15,949 | $10,336 |

| Mar-20 | $11,469 | $13,979 | $9,346 |

| Apr-20 | $11,800 | $15,771 | $9,765 |

| May-20 | $11,655 | $16,522 | $9,885 |

| Jun-20 | $11,430 | $16,850 | $10,103 |

| Jul-20 | $11,780 | $17,801 | $10,187 |

| Aug-20 | $11,934 | $19,080 | $10,463 |

| Sep-20 | $11,810 | $18,355 | $10,465 |

| Oct-20 | $11,746 | $17,867 | $10,408 |

| Nov-20 | $12,567 | $19,823 | $10,886 |

| Dec-20 | $12,542 | $20,585 | $11,278 |

| Jan-21 | $12,200 | $20,377 | $11,161 |

| Feb-21 | $12,953 | $20,939 | $11,478 |

| Mar-21 | $13,605 | $21,856 | $11,578 |

| Apr-21 | $13,952 | $23,022 | $11,924 |

| May-21 | $14,752 | $23,183 | $12,025 |

| Jun-21 | $14,351 | $23,724 | $12,165 |

| Jul-21 | $15,227 | $24,288 | $12,221 |

| Aug-21 | $15,296 | $25,026 | $12,385 |

| Sep-21 | $15,082 | $23,863 | $12,321 |

| Oct-21 | $15,376 | $25,534 | $12,587 |

| Nov-21 | $16,021 | $25,357 | $12,436 |

| Dec-21 | $16,936 | $26,494 | $12,648 |

| Jan-22 | $16,945 | $25,123 | $12,380 |

| Feb-22 | $17,497 | $24,371 | $12,422 |

| Mar-22 | $18,390 | $25,276 | $12,610 |

| Apr-22 | $18,719 | $23,071 | $12,390 |

| May-22 | $19,450 | $23,114 | $12,298 |

| Jun-22 | $17,618 | $21,206 | $12,051 |

| Jul-22 | $17,784 | $23,161 | $12,196 |

| Aug-22 | $16,975 | $22,217 | $12,288 |

| Sep-22 | $16,367 | $20,170 | $12,041 |

| Oct-22 | $17,580 | $21,804 | $12,165 |

| Nov-22 | $17,964 | $23,022 | $12,254 |

| Dec-22 | $17,830 | $21,696 | $12,245 |

| Jan-23 | $16,334 | $23,059 | $12,436 |

| Feb-23 | $15,460 | $22,496 | $12,360 |

| Mar-23 | $15,244 | $23,322 | $12,343 |

| Apr-23 | $15,277 | $23,686 | $12,418 |

| May-23 | $14,250 | $23,789 | $12,450 |

| Jun-23 | $14,234 | $25,361 | $12,607 |

| Jul-23 | $13,952 | $26,176 | $12,696 |

| Aug-23 | $13,582 | $25,759 | $12,731 |

| Sep-23 | $13,734 | $24,531 | $12,634 |

| Oct-23 | $13,692 | $24,015 | $12,518 |

| Nov-23 | $14,392 | $26,208 | $12,884 |

| Dec-23 | $14,006 | $27,399 | $13,090 |

| Jan-24 | $14,549 | $27,859 | $13,176 |

| Feb-24 | $15,455 | $29,347 | $13,354 |

| Mar-24 | $15,548 | $30,291 | $13,535 |

| Apr-24 | $15,081 | $29,054 | $13,427 |

| May-24 | $15,787 | $30,494 | $13,594 |

| Jun-24 | $16,278 | $31,589 | $13,758 |

| Jul-24 | $15,542 | $31,973 | $13,855 |

| Aug-24 | $15,957 | $32,749 | $13,963 |

| Sep-24 | $15,863 | $33,448 | $14,068 |

| Oct-24 | $16,319 | $33,145 | $13,979 |

The graph compares a $10,000 initial investment in the Fund with the performance of the S&P 500 Index and HFRX Equity Hedge Index. The Fund performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | Life of Fund 01/01/2015 |

|---|

| Harbor Long-Short Equity ETF (Based on Net Asset Value) | 19.19% | 5.48% | 5.11% |

| S&P 500 Index | 38.02% | 15.27% | 12.96% |

| HFRX Equity Hedge Index | 11.67% | 5.77% | 3.47% |

The Fund was reorganized and commenced operations on December 4, 2023. The performance shown for the periods prior to December 4, 2023 is that of another investment vehicle, the Disciplined Alpha Onshore Fund LP, a Delaware limited partnership (the “Predecessor Fund”), and reflects all fees and expenses, including a performance fee, incurred by the Predecessor Fund. Prior to December 4, 2023, Disciplined Alpha served as the general partner and investment manager to the Predecessor Fund, which commenced operations on January 1, 2015, and implemented its investment strategy indirectly through its investment in a master fund, which had the same general partner, investment manager, investment policies, objectives, guidelines and restrictions as the Predecessor Fund. Regardless of whether the Predecessor Fund operated as a stand-alone fund or invested indirectly through a master fund, Disciplined Alpha managed the Predecessor Fund assets using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. However, the Predecessor Fund was not a registered fund and so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower. Please refer to the Fund’s prospectus for further details.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $22,355 |

| Number of Investments | 159 |

| Total Net Advisory Fees Paid (in thousands) | $186 |

| Portfolio Turnover Rate | 194% |

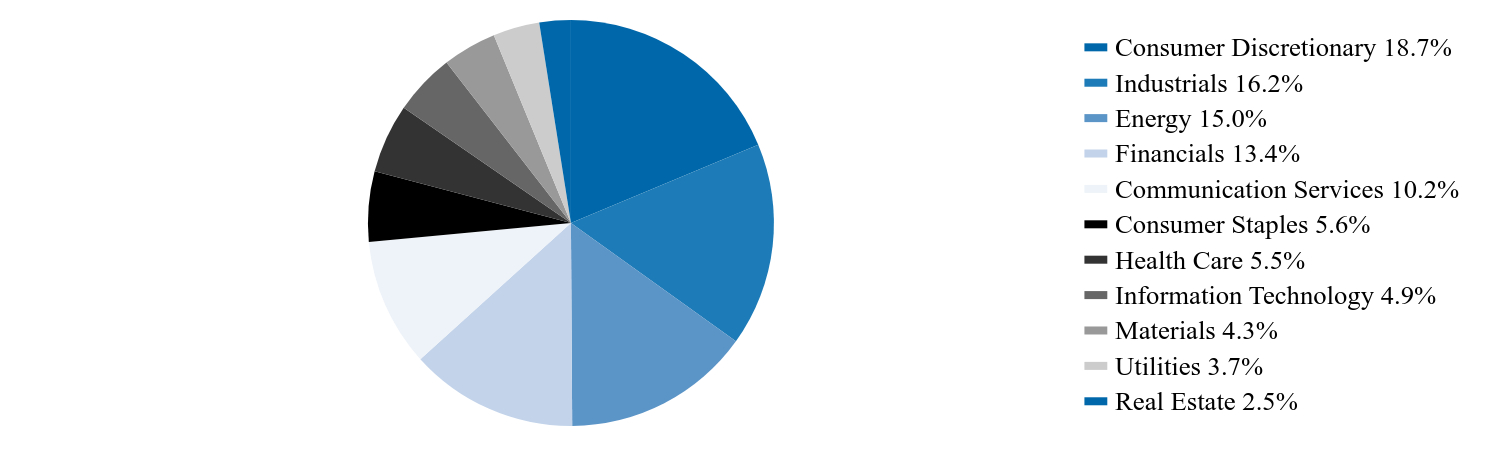

Sector Allocation (% of Investments)

| Consumer Discretionary | 21.0% |

| Information Technology | 20.7% |

| Health Care | 19.4% |

| Materials | 10.6% |

| Communication Services | 9.0% |

| Consumer Staples | 6.5% |

| Energy | 5.4% |

| Industrials | 4.8% |

| Utilities | 2.6% |

Sector Allocation (% of Investments Sold Short)

| Information Technology | 24.9% |

| Energy | 23.1% |