UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23661

Harbor ETF Trust

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302

(Address of principal executive offices) (Zip code)

Charles F. McCain, Esq. HARBOR ETF TRUST 111 South Wacker Drive, 34th Floor Chicago, Illinois 60606-4302 | Christopher P. Harvey, Esq. DECHERT LLP One International Place – 40th Floor 100 Oliver Street Boston, MA 02110-2605 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 443-4400

Date of fiscal year end: April 30

Date of reporting period: April 30, 2023

ITEM 1 – REPORTS TO STOCKHOLDERS

The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1):

Semi-Annual Report

HARBOR ETF TRUST

April 30, 2023

Harbor Commodity All-Weather Strategy ETF (formerly, Harbor All-Weather Inflation Focus ETF) (Consolidated)

Harbor Corporate Culture ETF

Harbor Corporate Culture Leaders ETF

Harbor Corporate Culture Small Cap ETF

Harbor Disruptive Innovation ETF

Harbor Dividend Growth Leaders ETF

Harbor Energy Transition Strategy ETF (Consolidated)

Harbor Health Care ETF

Harbor International Compounders ETF

Harbor Long-Term Growers ETF

Harbor Scientific Alpha High-Yield ETF

Harbor Scientific Alpha Income ETF

Harbor Small Cap Explorer ETF

Table of Contents

This material is intended for the Funds’ shareholders. It may be distributed to prospective investors only if it is preceded or accompanied by the current prospectus. Prospective investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor ETF before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Foreside Fund Services, LLC is the Distributor of the Harbor ETF Trust.

Harbor Commodity All-Weather Strategy ETF

CONSOLIDATED PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Subadvisor: Quantix Commodities LP

|

|

RISK ALLOCATION* (% of Net Assets) - Unaudited |

| | | | | | |

| Asset Class | | Sector | |

COMMODITIES | | | | | | |

| | |

| | Petroleum | | | 33.7 | % |

| | |

| | Precious Metals | | | 31.3 | % |

| | |

| | Base Metals | | | 15.8 | % |

| | |

| | Grains and Soybean Products | | | 14.7 | % |

| | |

| | Softs | | | 4.5 | % |

*Based on notional value and represents the sector allocation of the Quantix Commodity Index.

Principal Amounts, Value and Cost in Thousands

| | | | | | | | |

|

| | SHORT-TERM INVESTMENTS—88.2% | |

| | |

Principal Amount | | | | | Value | |

| U.S. TREASURY BILLS—88.2% | |

| | | | U.S. Treasury Bills | | | | |

| | $ 36,623 | | | 4.549%—05/16/2023† | | $ | 36,559 | |

| | 26,043 | | | 4.550%—06/27/2023† | | | 25,842 | |

| | 4,858 | | | 4.673%—07/11/2023† | | | 4,812 | |

| | | | | | | | |

|

| | TOTAL SHORT-TERM INVESTMENTS | |

| | (Cost $67,222) | | | 67,213 | |

| | | | | | | | |

|

| | TOTAL INVESTMENTS—88.2% | |

| | (Cost $67,222) | | | 67,213 | |

| | | | | | | | |

| CASH AND OTHER ASSETS, LESS

LIABILITIES—11.8% | | | 9,004 | |

| | | | | | | | |

| | TOTAL NET ASSETS—100% | | $ | 76,217 | |

| | | | | | | | |

OVER-THE-COUNTER (OTC) EXCESS RETURN SWAPS ON INDICES

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Fixed

Rate | | Pay/Receive

Fixed Rate | | Reference Index1 | | Expiration

Date | | Payment

Frequency | | Notional

Amount

(000s) | | Value

(000s) | | Upfront

Premiums

(Received)/

Paid

(000s) | | Unrealized

Appreciation/

(Depreciation)

(000s) |

Macquarie Bank Limited | | 0.110% | | Pay | | Quantix Commodity Index | | 05/31/2023 | | Monthly | | $76,202 | | $— | | $— | | | | $— | | |

| | | | | | | | | | | | | | | | | | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments and Swap Agreements schedule) were classified as Level 2.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

The accompanying notes are an integral part of the Financial Statements.

2

Harbor Commodity All-Weather Strategy ETF

CONSOLIDATED PORTFOLIO OF INVESTMENTS—Continued

| † | Coupon represents yield to maturity |

| 1 | The reference index components are published daily on Harbor Capital’s website at harborcapital.com. The index is comprised of publicly traded futures contracts on physical commodities. The table below represents the reference index components as of the period ended April 30, 2023. |

| | |

Commodity | | Weight |

Gold | | 31.3% |

Brent Crude Oil | | 13.7 |

RBOB Gasoline | | 10.1 |

Heating Oil | | 6.2 |

Aluminum | | 4.6 |

Copper | | 4.2 |

GasOil | | 3.7 |

Nickel | | 3.6 |

Corn | | 3.5 |

Zinc | | 3.4 |

Soybeans | | 3.3 |

Sugar | | 2.5 |

Soybean Oil | | 2.4 |

Cotton | | 2.0 |

Soymeal | | 1.9 |

KC Wheat | | 1.8 |

Wheat | | 1.8 |

The accompanying notes are an integral part of the Financial Statements.

3

Harbor Corporate Culture ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Adviser: Harbor Capital Advisors, Inc.

|

|

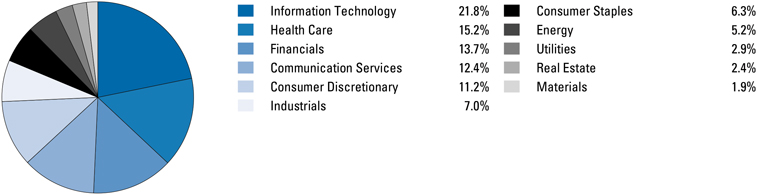

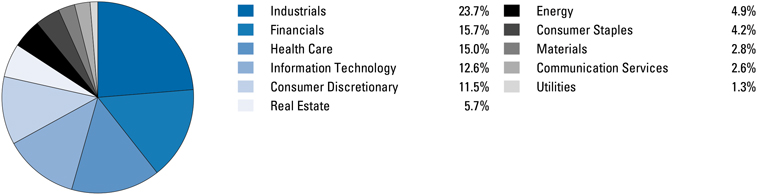

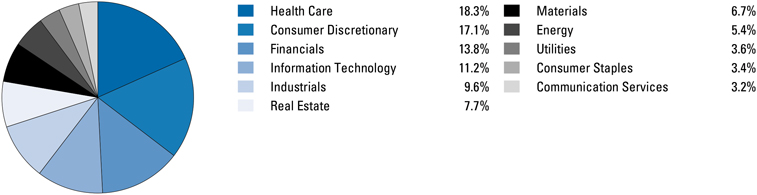

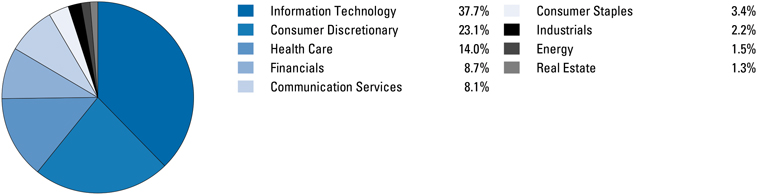

SECTOR ALLOCATION (% of investments) |

Value and Cost in Thousands

| | | | | | | | |

|

| | COMMON STOCKS—91.9% | |

| | |

| Shares | | | | | Value | |

| AEROSPACE & DEFENSE—1.8% | |

| | 6,149 | | | Lockheed Martin Corp. | | $ | 2,856 | |

| | 3,235 | | | Northrop Grumman Corp. | | | 1,492 | |

| | | | | | | | |

| | | | | | | 4,348 | |

| | | | | | | | |

|

| | AIR FREIGHT & LOGISTICS—1.3% | |

| | 17,466 | | | United Parcel Service, Inc. Class B | | | 3,141 | |

| | | | | | | | |

|

| | AIRLINES—0.5% | |

| | 15,416 | | | Delta Air Lines, Inc. * | | | 529 | |

| | 14,319 | | | Southwest Airlines Co. | | | 434 | |

| | 7,733 | | | United Airlines Holdings, Inc. * | | | 338 | |

| | | | | | | | |

| | | | | | | 1,301 | |

| | | | | | | | |

|

| | AUTOMOBILES—0.3% | |

| | 65,534 | | | Ford Motor Co. | | | 779 | |

| | | | | | | | |

|

| | BANKS—1.3% | |

| | 109,799 | | | Bank of America Corp. | | | 3,215 | |

| | 2,986 | | | First Republic Bank | | | 10 | |

| | | | | | | | |

| | | | | | | 3,225 | |

| | | | | | | | |

|

| | BEVERAGES—0.4% | |

| | 780 | | | Brown-Forman Corp. Class A | | | 51 | |

| | 4,893 | | | Brown-Forman Corp. Class B | | | 319 | |

| | 2,341 | | | Constellation Brands, Inc. Class A | | | 537 | |

| | | | | | | | |

| | | | | | | 907 | |

| | | | | | | | |

|

| | BIOTECHNOLOGY—2.7% | |

| | 2,098 | | | Alnylam Pharmaceuticals, Inc. * | | | 418 | |

| | 9,635 | | | Amgen, Inc. | | | 2,310 | |

| | 3,358 | | | BioMarin Pharmaceutical, Inc. * | | | 323 | |

| | 3,401 | | | Incyte Corp. * | | | 253 | |

| | 1,805 | | | Regeneron Pharmaceuticals, Inc. * | | | 1,447 | |

| | 4,810 | | | Vertex Pharmaceuticals, Inc. * | | | 1,639 | |

| | | | | | | | |

| | | | | | | 6,390 | |

| | | | | | | | |

|

| | CAPITAL MARKETS—4.3% | |

| | 2,369 | | | Ares Management Corp. Class A | | | 208 | |

| | 2,288 | | | BlackRock, Inc. | | | 1,536 | |

| | 22,887 | | | Charles Schwab Corp. | | | 1,196 | |

| | 452 | | | FactSet Research Systems, Inc. | | | 186 | |

| | 4,400 | | | Franklin Resources, Inc. | | | 118 | |

| | | | | | | | |

|

| | COMMON STOCKS—Continued | |

| | |

| Shares | | | | | Value | |

| CAPITAL MARKETS—Continued | |

| | 5,246 | | | Goldman Sachs Group, Inc. | | $ | 1,802 | |

| | 10,805 | | | KKR & Co., Inc. | | | 573 | |

| | 20,162 | | | Morgan Stanley | | | 1,814 | |

| | 904 | | | MSCI, Inc. | | | 436 | |

| | 5,459 | | | Nasdaq, Inc. | | | 302 | |

| | 5,369 | | | S&P Global, Inc. | | | 1,947 | |

| | 1,651 | | | Tradeweb Markets, Inc. Class A | | | 116 | |

| | | | | | | | |

| | | | | | | 10,234 | |

| | | | | | | | |

|

| | CHEMICALS—1.1% | |

| | 17,353 | | | Corteva, Inc. | | | 1,061 | |

| | 16,564 | | | Dow, Inc. | | | 901 | |

| | 10,332 | | | DuPont de Nemours, Inc. | | | 720 | |

| | | | | | | | |

| | | | | | | 2,682 | |

| | | | | | | | |

|

| | COMMUNICATIONS EQUIPMENT—0.2% | |

| | 2,544 | | | Arista Networks, Inc. * | | | 407 | |

| | | | | | | | |

|

| | CONSTRUCTION & ENGINEERING—0.2% | |

| | 3,344 | | | Quanta Services, Inc. | | | 567 | |

| | | | | | | | |

|

| | CONSUMER FINANCE—0.7% | |

| | 8,391 | | | American Express Co. | | | 1,354 | |

| | 7,615 | | | Synchrony Financial | | | 225 | |

| | | | | | | | |

| | | | | | | 1,579 | |

| | | | | | | | |

|

| | ELECTRIC UTILITIES—2.1% | |

| | 10,724 | | | American Electric Power Co., Inc. | | | 991 | |

| | 7,860 | | | Edison International | | | 578 | |

| | 19,696 | | | Exelon Corp. | | | 836 | |

| | 32,721 | | | PG&E Corp. * | | | 560 | |

| | 15,046 | | | PPL Corp. | | | 432 | |

| | 21,640 | | | The Southern Co. | | | 1,592 | |

| | | | | | | | |

| | | | | | | 4,989 | |

| | | | | | | | |

|

| | ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS—0.1% | |

| | 3,141 | | | Trimble, Inc. * | | | 148 | |

| | | | | | | | |

|

| | ENERGY EQUIPMENT & SERVICES—0.7% | |

| | 34,909 | | | Schlumberger NV | | | 1,723 | |

4

Harbor Corporate Culture ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | | | |

|

| | COMMON STOCKS—Continued | |

| | |

| Shares | | | | | Value | |

| ENTERTAINMENT—1.1% | |

| | 3,874 | | | Electronic Arts, Inc. | | $ | 493 | |

| | 5,297 | | | Netflix, Inc. * | | | 1,748 | |

| | 3,466 | | | ROBLOX Corp. Class A* | | | 123 | |

| | 1,279 | | | Spotify Technology SA * | | | 171 | |

| | | | | | | | |

| | | | | | | 2,535 | |

| | | | | | | | |

|

| | EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS)—2.0% | |

| | 5,472 | | | Digital Realty Trust, Inc. | | | 542 | |

| | 1,734 | | | Equinix, Inc. | | | 1,256 | |

| | 1,142 | | | Essex Property Trust, Inc. | | | 251 | |

| | 17,474 | | | ProLogis, Inc. | | | 2,189 | |

| | 2,067 | | | SBA Communications Corp. | | | 539 | |

| | | | | | | | |

| | | | | | | 4,777 | |

| | | | | | | | |

| |

| | FINANCIAL SERVICES—6.1% | | | | |

| | 20,437 | | | Berkshire Hathaway, Inc. Class B* | | | 6,715 | |

| | 20,663 | | | Mastercard, Inc. Class A | | | 7,852 | |

| | | | | | | | |

| | | | | | | 14,567 | |

| | | | | | | | |

| |

| | FOOD PRODUCTS—1.0% | | | | |

| | 9,683 | | | General Mills, Inc. | | | 858 | |

| | 21,404 | | | Mondelez International, Inc. Class A | | | 1,642 | |

| | | | | | | | |

| | | | | | | 2,500 | |

| | | | | | | | |

| |

| | GAS UTILITIES—0.1% | | | | |

| | 2,858 | | | Atmos Energy Corp. | | | 326 | |

| | | | | | | | |

| |

| | HEALTH CARE EQUIPMENT & SUPPLIES—2.4% | | | | |

| | 1,008 | | | Align Technology, Inc. * | | | 328 | |

| | 47,228 | | | Boston Scientific Corp. * | | | 2,462 | |

| | 5,952 | | | GE Healthcare, Inc * | | | 484 | |

| | 6,168 | | | Intuitive Surgical, Inc. * | | | 1,858 | |

| | 2,644 | | | ResMed, Inc. | | | 637 | |

| | | | | | | | |

| | | | | | | 5,769 | |

| | | | | | | | |

| |

| | HEALTH CARE TECHNOLOGY—0.1% | | | | |

| | 1,687 | | | Veeva Systems, Inc. Class A* | | | 302 | |

| | | | | | | | |

| |

| | HOTELS, RESTAURANTS & LEISURE—2.8% | | | | |

| | 9,986 | | | Airbnb, Inc. Class A* | | | 1,195 | |

| | 1,301 | | | Booking Holdings, Inc. * | | | 3,495 | |

| | 5,015 | | | Expedia Group, Inc. * | | | 471 | |

| | 9,324 | | | Marriott International, Inc. Class A | | | 1,579 | |

| | | | | | | | |

| | | | | | | 6,740 | |

| | | | | | | | |

| |

| | HOUSEHOLD PRODUCTS—3.3% | | | | |

| | 13,381 | | | Colgate-Palmolive Co. | | | 1,068 | |

| | 5,379 | | | Kimberly-Clark Corp. | | | 779 | |

| | 38,320 | | | Procter & Gamble Co. | | | 5,993 | |

| | | | | | | | |

| | | | | | | 7,840 | |

| | | | | | | | |

|

| | INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS—0.1% | |

| | 13,699 | | | AES Corp. | | | 324 | |

| | | | | | | | |

| |

| | INDUSTRIAL CONGLOMERATES—1.4% | | | | |

| | 16,860 | | | Honeywell International, Inc. | | | 3,369 | |

| | | | | | | | |

| |

| | INDUSTRIAL REITS—0.1% | | | | |

| | 2,009 | | | Camden Property Trust | | | 221 | |

| | | | | | | | |

| |

| | INSURANCE—1.3% | | | | |

| | 5,304 | | | Arch Capital Group Ltd. * | | | 398 | |

| | 2,179 | | | Cincinnati Financial Corp. | | | 232 | |

| | | | | | | | |

|

| | COMMON STOCKS—Continued | |

| | |

| Shares | | | | | Value | |

| INSURANCE—Continued | |

| | 5,039 | | | Hartford Financial Services Group, Inc. | | $ | 358 | |

| | 3,923 | | | Principal Financial Group, Inc. | | | 293 | |

| | 8,815 | | | Progressive Corp. | | | 1,202 | |

| | 3,835 | | | Travelers Cos., Inc. | | | 695 | |

| | | | | | | | |

| | | | | | | 3,178 | |

| | | | | | | | |

| |

| | INTERACTIVE MEDIA & SERVICES—9.0% | | | | |

| | 75,090 | | | Alphabet, Inc. Class A* | | | 8,060 | |

| | 67,988 | | | Alphabet, Inc. Class C* | | | 7,358 | |

| | 4,142 | | | Match Group, Inc. * | | | 153 | |

| | 23,486 | | | Meta Platforms, Inc. Class A* | | | 5,644 | |

| | 7,408 | | | Pinterest, Inc. Class A* | | | 170 | |

| | 13,241 | | | Snap, Inc. Class A* | | | 115 | |

| | 3,597 | | | ZoomInfo Technologies, Inc. * | | | 79 | |

| | | | | | | | |

| | | | | | | 21,579 | |

| | | | | | | | |

| |

| | INTERNET & DIRECT MARKETING RETAIL—0.5% | | | | |

| | 18,632 | | | eBay, Inc. | | | 865 | |

| | 4,163 | | | Etsy, Inc. * | | | 421 | |

| | | | | | | | |

| | | | | | | 1,286 | |

| | | | | | | | |

| |

| | IT SERVICES—0.9% | | | | |

| | 624 | | | EPAM Systems, Inc. * | | | 176 | |

| | 10,994 | | | IBM Corp. | | | 1,390 | |

| | 744 | | | MongoDB, Inc. * | | | 178 | |

| | 2,965 | | | Snowflake, Inc. Class A* | | | 439 | |

| | 1,974 | | | Twilio, Inc. Class A* | | | 104 | |

| | | | | | | | |

| | | | | | | 2,287 | |

| | | | | | | | |

| |

| | LIFE SCIENCES TOOLS & SERVICES—0.8% | | | | |

| | 5,097 | | | Agilent Technologies, Inc. | | | 690 | |

| | 2,694 | | | Illumina, Inc. * | | | 554 | |

| | 3,164 | | | IQVIA Holdings, Inc. * | | | 596 | |

| | | | | | | | |

| | | | | | | 1,840 | |

| | | | | | | | |

| |

| | MACHINERY—1.4% | | | | |

| | 3,345 | | | Cummins, Inc. | | | 786 | |

| | 6,849 | | | Deere & Co. | | | 2,589 | |

| | | | | | | | |

| | | | | | | 3,375 | |

| | | | | | | | |

| |

| | MEDIA—0.3% | | | | |

| | 4,540 | | | Omnicom Group, Inc. | | | 411 | |

| | 4,235 | | | Trade Desk, Inc. Class A* | | | 273 | |

| | | | | | | | |

| | | | | | | 684 | |

| | | | | | | | |

| |

| | METALS & MINING—0.8% | | | | |

| | 21,003 | | | Newmont Corp. | | | 996 | |

| | 6,035 | | | Nucor Corp. | | | 894 | |

| | | | | | | | |

| | | | | | | 1,890 | |

| | | | | | | | |

| |

| | MULTI-UTILITIES—0.5% | | | | |

| | 7,496 | | | Consolidated Edison, Inc. | | | 738 | |

| | 3,965 | | | DTE Energy Co. | | | 446 | |

| | | | | | | | |

| | | | | | | 1,184 | |

| | | | | | | | |

| |

| | OIL, GAS & CONSUMABLE FUELS—4.5% | | | | |

| | 34,888 | | | Chevron Corp. | | | 5,881 | |

| | 24,615 | | | ConocoPhillips | | | 2,533 | |

| | 6,357 | | | EQT Corp. | | | 221 | |

| | 5,138 | | | Hess Corp. | | | 745 | |

| | 7,731 | | | ONEOK, Inc. | | | 506 | |

5

Harbor Corporate Culture ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | | | |

| |

| | COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | | Value | |

| OIL, GAS & CONSUMABLE FUELS—Continued | | | | |

| | 4,127 | | | Pioneer Natural Resources Co. | | $ | 898 | |

| | | | | | | | |

| | | | | | | 10,784 | |

| | | | | | | | |

| |

| | PHARMACEUTICALS—9.2% | | | | |

| | 14,704 | | | Eli Lilly & Co. | | | 5,821 | |

| | 45,835 | | | Johnson & Johnson | | | 7,503 | |

| | 42,791 | | | Merck & Co., Inc. | | | 4,941 | |

| | 97,660 | | | Pfizer, Inc. | | | 3,798 | |

| | | | | | | | |

| | | | | | | 22,063 | |

| | | | | | | | |

| |

| | PROFESSIONAL SERVICES—0.2% | | | | |

| | 3,054 | | | Jacobs Solutions, Inc. | | | 353 | |

| | 3,014 | | | TransUnion | | | 207 | |

| | | | | | | | |

| | | | | | | 560 | |

| | | | | | | | |

|

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—4.5% | |

| | 17,560 | | | Advanced Micro Devices, Inc. * | | | 1,569 | |

| | 49,718 | | | Intel Corp. | | | 1,544 | |

| | 9,759 | | | Marvell Technology, Inc. | | | 385 | |

| | 25,325 | | | NVIDIA Corp. | | | 7,028 | |

| | 1,804 | | | Teradyne, Inc. | | | 165 | |

| | | | | | | | |

| | | | | | | 10,691 | |

| | | | | | | | |

| |

| | SOFTWARE—10.5% | | | | |

| | 5,584 | | | Adobe, Inc. * | | | 2,108 | |

| | 1,032 | | | ANSYS, Inc. * | | | 324 | |

| | 1,540 | | | Atlassian Corp. PLC Class A* | | | 227 | |

| | 2,502 | | | Autodesk, Inc. * | | | 487 | |

| | 3,028 | | | Cadence Design Systems, Inc. * | | | 634 | |

| | 2,310 | | | CrowdStrike Holdings, Inc. Class A* | | | 277 | |

| | 6,927 | | | Fortinet, Inc. * | | | 437 | |

| | 3,374 | | | Intuit, Inc. | | | 1,498 | |

| | 43,578 | | | Microsoft Corp. | | | 13,390 | |

| | 16,361 | | | Palantir Technologies, Inc. Class A* | | | 127 | |

| | 3,257 | | | Palo Alto Networks, Inc. * | | | 594 | |

| | 11,787 | | | Salesforce, Inc. * | | | 2,338 | |

| | 2,446 | | | ServiceNow, Inc. * | | | 1,124 | |

| | 1,753 | | | Synopsys, Inc. * | | | 651 | |

| | 2,146 | | | Unity Software, Inc. * | | | 58 | |

| | 2,891 | | | VMware, Inc. Class A* | | | 361 | |

| | 2,325 | | | Workday, Inc. Class A* | | | 433 | |

| | 2,551 | | | Zoom Video Communications, Inc. Class A* | | | 157 | |

| | 918 | | | Zscaler, Inc. * | | | 83 | |

| | | | | | | | |

| | | | | | | 25,308 | |

| | | | | | | | |

| | | | | | | | |

| |

| | COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | | Value | |

| SPECIALIZED REITS—0.4% | | | | |

| | 2,890 | | | Public Storage | | $ | 852 | |

| | | | | | | | |

|

| | TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS—5.6% | |

| | 75,223 | | | Apple, Inc. | | | 12,764 | |

| | 15,331 | | | Hewlett Packard Enterprise Co. | | | 220 | |

| | 11,817 | | | HP, Inc. | | | 351 | |

| | | | | | | | |

| | | | | | | 13,335 | |

| | | | | | | | |

| |

| | TEXTILES, APPAREL & LUXURY GOODS—1.7% | | | | |

| | 3,918 | | | Lululemon Athletica, Inc. * | | | 1,489 | |

| | 19,581 | | | NIKE, Inc. Class B | | | 2,481 | |

| | 6,103 | | | VF Corp. | | | 143 | |

| | | | | | | | |

| | | | | | | 4,113 | |

| | | | | | | | |

| |

| | TOBACCO—1.6% | | | | |

| | 26,645 | | | Altria Group, Inc. | | | 1,266 | |

| | 25,017 | | | Philip Morris International, Inc. | | | 2,501 | |

| | | | | | | | |

| | | | | | | 3,767 | |

| | | | | | | | |

|

| | TOTAL COMMON STOCKS | |

| | (Cost $202,707) | | | 220,466 | |

| | | | | | | | |

| | | | | | | | |

|

| | EXCHANGE-TRADED FUNDS—7.8% | |

| |

| | CAPITAL MARKETS—7.8% | | | | |

| | 80,798 | | | Communication Services Select Sector SPDR Fund | | | 4,840 | |

| | 94,304 | | | Consumer Discretionary Select Sector SPDR Fund | | | 13,943 | |

|

| | TOTAL CAPITAL MARKETS | |

| | (Cost $18,213) | | | 18,783 | |

|

| | TOTAL INVESTMENTS—99.7% | |

| | (Cost $220,920) | | | 239,249 | |

| | | | | | | | |

| | CASH AND OTHER ASSETS, LESS LIABILITIES—0.3% | | | 839 | |

| | | | | | | | |

| | TOTAL NET ASSETS—100% | | $ | 240,088 | |

| | | | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| * | Non-income producing security. |

The accompanying notes are an integral part of the Financial Statements.

6

Harbor Corporate Culture Leaders ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Adviser: Harbor Capital Advisors, Inc.

|

|

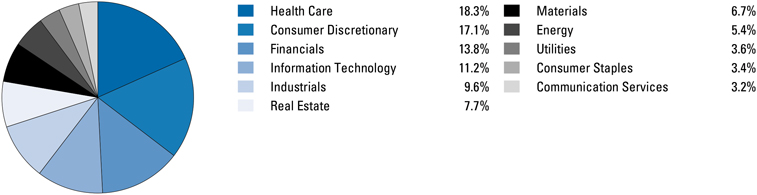

SECTOR ALLOCATION (% of investments) |

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—99.9% | | | | |

| | |

| Shares | | | | Value | |

AIRLINES—1.2% | | | | |

3,668 | | Delta Air Lines, Inc. * | | $ | 126 | |

| | | | | | |

| |

BANKS—1.0% | | | | |

1,063 | | First Republic Bank | | | 4 | |

1,802 | | Pinnacle Financial Partners, Inc. | | | 98 | |

| | | | | | |

| | | | | 102 | |

| | | | | | |

BIOTECHNOLOGY—4.0% | | | | |

640 | | Alnylam Pharmaceuticals, Inc. * | | | 127 | |

3,555 | | Intellia Therapeutics, Inc. * | | | 134 | |

1,194 | | Sarepta Therapeutics, Inc. * | | | 147 | |

| | | | | | |

| | | | | 408 | |

| | | | | | |

CAPITAL MARKETS—8.9% | | | | |

334 | | FactSet Research Systems, Inc. | | | 138 | |

2,458 | | KKR & Co., Inc. | | | 130 | |

607 | | Morningstar, Inc. | | | 108 | |

256 | | MSCI, Inc. | | | 124 | |

394 | | S&P Global, Inc. | | | 143 | |

4,392 | | TPG, Inc. | | | 127 | |

1,933 | | Tradeweb Markets, Inc. Class A | | | 136 | |

| | | | | | |

| | | | | 906 | |

| | | | | | |

CONSUMER FINANCE—2.6% | | | | |

295 | | Credit Acceptance Corp. * | | | 144 | |

3,955 | | Synchrony Financial | | | 117 | |

| | | | | | |

| | | | | 261 | |

| | | | | | |

ELECTRIC UTILITIES—1.4% | | | | |

5,031 | | PPL Corp. | | | 145 | |

| | | | | | |

| |

ENTERTAINMENT—5.6% | | | | |

400 | | Netflix, Inc. * | | | 132 | |

4,030 | | ROBLOX Corp. Class A* | | | 143 | |

2,539 | | Roku, Inc. * | | | 143 | |

1,138 | | Spotify Technology SA * | | | 152 | |

| | | | | | |

| | | | | 570 | |

| | | | | | |

|

EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS)—2.7% | |

1,125 | | ProLogis, Inc. | | | 141 | |

502 | | SBA Communications Corp. | | | 131 | |

| | | | | | |

| | | | | 272 | |

| | | | | | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

FINANCIAL SERVICES—1.4% | | | | |

389 | | Mastercard, Inc. Class A | | $ | 148 | |

| | | | | | |

| |

HEALTH CARE EQUIPMENT & SUPPLIES—4.9% | | | | |

3,038 | | Boston Scientific Corp. * | | | 158 | |

1,979 | | GE Healthcare, Inc * | | | 161 | |

597 | | Intuitive Surgical, Inc. * | | | 180 | |

| | | | | | |

| | | | | 499 | |

| | | | | | |

HEALTH CARE PROVIDERS & SERVICES—1.5% | | | | |

6,195 | | agilon health, Inc. * | | | 150 | |

| | | | | | |

| |

HEALTH CARE TECHNOLOGY—1.5% | | | | |

4,309 | | Doximity, Inc. * | | | 158 | |

| | | | | | |

| |

HOTELS, RESTAURANTS & LEISURE—1.4% | | | | |

1,192 | | Airbnb, Inc. Class A* | | | 143 | |

| | | | | | |

| |

HOUSEHOLD PRODUCTS—3.1% | | | | |

1,959 | | Colgate-Palmolive Co. | | | 156 | |

1,030 | | Procter & Gamble Co. | | | 161 | |

| | | | | | |

| | | | | 317 | |

| | | | | | |

|

INDEPENDENT POWER AND RENEWABLE ELECTRICITY

PRODUCERS—1.3% | |

5,466 | | AES Corp. | | | 129 | |

| | | | | | |

| |

INSURANCE—2.8% | | | | |

2,349 | | First American Financial Corp. | | | 135 | |

1,101 | | RLI Corp. | | | 153 | |

| | | | | | |

| | | | | 288 | |

| | | | | | |

INTERACTIVE MEDIA & SERVICES—5.8% | | | | |

760 | | Alphabet, Inc. Class A* | | | 82 | |

758 | | Alphabet, Inc. Class C* | | | 82 | |

802 | | Meta Platforms, Inc. Class A* | | | 193 | |

1,631 | | Ziff Davis, Inc. * | | | 119 | |

5,350 | | ZoomInfo Technologies, Inc. * | | | 117 | |

| | | | | | |

| | | | | 593 | |

| | | | | | |

INTERNET & DIRECT MARKETING RETAIL—1.1% | | | | |

1,078 | | Etsy, Inc. * | | | 109 | |

| | | | | | |

| | | | | | |

| |

IT SERVICES—6.0% | | | | |

398 | | EPAM Systems, Inc. * | | | 113 | |

7

Harbor Corporate Culture Leaders ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

IT SERVICES—Continued | | | | |

894 | | Globant SA * | | $ | 140 | |

629 | | MongoDB, Inc. * | | | 151 | |

13,830 | | Thoughtworks Holding, Inc. * | | | 86 | |

2,322 | | Twilio, Inc. Class A* | | | 122 | |

| | | | | | |

| | | | | 612 | |

| | | | | | |

LIFE SCIENCES TOOLS & SERVICES—1.2% | | | | |

940 | | Agilent Technologies, Inc. | | | 127 | |

| | | | | | |

| |

MEDIA—1.8% | | | | |

2,898 | | Trade Desk, Inc. Class A* | | | 187 | |

| | | | | | |

| |

METALS & MINING—2.3% | | | | |

2,534 | | Commercial Metals Co. | | | 119 | |

1,138 | | Steel Dynamics, Inc. | | | 118 | |

| | | | | | |

| | | | | 237 | |

| | | | | | |

MULTI-UTILITIES—1.5% | | | | |

1,576 | | Consolidated Edison, Inc. | | | 155 | |

| | | | | | |

| |

OIL, GAS & CONSUMABLE FUELS—2.6% | | | | |

1,266 | | ConocoPhillips | | | 130 | |

614 | | Pioneer Natural Resources Co. | | | 134 | |

| | | | | | |

| | | | | 264 | |

| | | | | | |

PHARMACEUTICALS—1.4% | | | | |

885 | | Johnson & Johnson | | | 145 | |

| | | | | | |

| |

PROFESSIONAL SERVICES—2.5% | | | | |

1,574 | | ASGN, Inc. * | | | 113 | |

2,111 | | TransUnion | | | 145 | |

| | | | | | |

| | | | | 258 | |

| | | | | | |

| |

RETAIL REITS—1.2% | | | | |

3,308 | | Spirit Realty Capital, Inc. | | | 127 | |

| | | | | | |

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—5.4% | |

5,016 | | Intel Corp. | | | 156 | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—Continued | |

627 | | NVIDIA Corp. | | $ | 174 | |

746 | | Silicon Laboratories, Inc. * | | | 104 | |

1,330 | | Teradyne, Inc. | | | 121 | |

| | | | | | |

| | | | | 555 | |

| | | | | | |

SOFTWARE—20.1% | |

380 | | Adobe, Inc. * | | | 143 | |

792 | | Atlassian Corp. PLC Class A* | | | 117 | |

722 | | Cadence Design Systems, Inc. * | | | 151 | |

5,983 | | Dropbox, Inc. * | | | 122 | |

3,064 | | Gitlab, Inc. * | | | 93 | |

1,911 | | Guidewire Software, Inc. * | | | 146 | |

341 | | Intuit, Inc. | | | 151 | |

528 | | Microsoft Corp. | | | 162 | |

876 | | Monday.com Ltd. * | | | 107 | |

845 | | Salesforce, Inc. * | | | 168 | |

9,089 | | Samsara, Inc. Class A* | | | 164 | |

8,624 | | SentinelOne, Inc. * | | | 139 | |

312 | | ServiceNow, Inc. * | | | 143 | |

1,225 | | VMware, Inc. Class A* | | | 153 | |

1,055 | | Zscaler, Inc. * | | | 95 | |

| | | | | | |

| | | | | 2,054 | |

| | | | | | |

TEXTILES, APPAREL & LUXURY GOODS—1.7% | | | | |

449 | | Lululemon Athletica, Inc. * | | | 171 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $10,793) | | | 10,216 | |

| | | | | | |

| |

TOTAL INVESTMENTS—99.9% | | | | |

(Cost $10,793) | | | 10,216 | |

| | | | | | |

CASH AND OTHER ASSETS, LESS LIABILITIES—0.1% | | | 15 | |

| | | | | | |

TOTAL NET ASSETS—100%. | | $ | 10,231 | |

| | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

* Non-income producing security.

The accompanying notes are an integral part of the Financial Statements.

8

Harbor Corporate Culture Small Cap ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Adviser: Harbor Capital Advisors, Inc.

| | | | |

| |

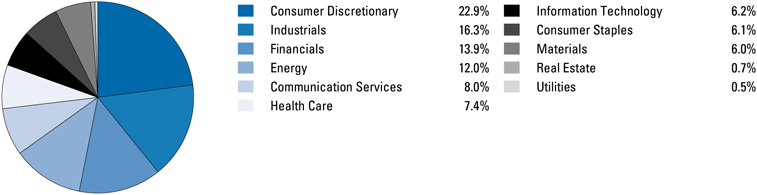

SECTOR ALLOCATION (% of investments) | | |

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—99.4% | | | | |

| | |

| Shares | | | | Value | |

| |

AEROSPACE & DEFENSE—0.7% | | | | |

10,256 | | Maxar Technologies, Inc. | | $ | 541 | |

| | | | | | |

| |

AUTOMOBILE COMPONENTS—1.4% | | | | |

15,049 | | Gentherm, Inc. * | | | 898 | |

11,396 | | Stoneridge, Inc. * | | | 214 | |

| | | | | | |

| | | | | 1,112 | |

| | | | | | |

AUTOMOBILES—0.6% | | | | |

29,920 | | Fisker, Inc. * | | | 193 | |

4,430 | | Winnebago Industries, Inc. | | | 257 | |

| | | | | | |

| | | | | 450 | |

| | | | | | |

BANKS—3.1% | | | | |

9,439 | | Bridgewater Bancshares, Inc. * | | | 94 | |

6,177 | | City Holding Co. | | | 563 | |

14,642 | | Live Oak Bancshares, Inc. | | | 345 | |

12,728 | | Origin Bancorp, Inc. | | | 375 | |

33,116 | | Seacoast Banking Corp. of Florida | | | 735 | |

24,482 | | Veritex Holdings, Inc. | | | 421 | |

| | | | | | |

| | | | | 2,533 | |

| | | | | | |

BIOTECHNOLOGY—8.7% | | | | |

30,639 | | Atara Biotherapeutics, Inc. * | | | 83 | |

21,493 | | Beam Therapeutics, Inc. * | | | 660 | |

18,396 | | Biohaven Ltd. * | | | 241 | |

18,611 | | Blueprint Medicines Corp. * | | | 950 | |

9,822 | | Cullinan Oncology, Inc. * | | | 96 | |

29,900 | | Denali Therapeutics, Inc. * | | | 743 | |

12,612 | | Kymera Therapeutics, Inc. * | | | 398 | |

27,625 | | Mersana Therapeutics, Inc. * | | | 121 | |

22,495 | | PTC Therapeutics, Inc. * | | | 1,240 | |

12,743 | | REGENXBIO, Inc. * | | | 247 | |

31,205 | | Relay Therapeutics, Inc. * | | | 355 | |

15,709 | | Sage Therapeutics, Inc. * | | | 767 | |

19,912 | | Twist Bioscience Corp. * | | | 248 | |

20,722 | | Ultragenyx Pharmaceutical, Inc. * | | | 905 | |

| | | | | | |

| | | | | 7,054 | |

| | | | | | |

BUILDING PRODUCTS—0.8% | | | | |

24,363 | | PGT Innovations, Inc. * | | | 625 | |

| | | | | | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

CAPITAL MARKETS—4.5% | | | | |

13,119 | | Evercore, Inc. Class A | | $ | 1,496 | |

14,815 | | Perella Weinberg Partners | | | 117 | |

10,362 | | PJT Partners, Inc. Class A | | | 713 | |

24,108 | | StepStone Group, Inc. Class A | | | 531 | |

27,603 | | TPG, Inc. | | | 800 | |

| | | | | | |

| | | | | 3,657 | |

| | | | | | |

CHEMICALS—4.5% | | | | |

98,725 | | Amyris, Inc. * | | | 81 | |

22,788 | | HB Fuller Co. | | | 1,508 | |

8,892 | | Koppers Holdings, Inc. | | | 292 | |

27,507 | | Rayonier Advanced Materials, Inc. * | | | 150 | |

9,450 | | Stepan Co. | | | 871 | |

53,435 | | Tronox Holdings PLC | | | 731 | |

| | | | | | |

| | | | | 3,633 | |

| | | | | | |

COMMERCIAL SERVICES & SUPPLIES—0.9% | | | | |

58,043 | | Aurora Innovation, Inc. * | | | 83 | |

6,399 | | Cimpress PLC (Ireland)* | | | 332 | |

39,681 | | Steelcase, Inc. Class A | | | 318 | |

| | | | | | |

| | | | | 733 | |

| | | | | | |

COMMUNICATIONS EQUIPMENT—1.8% | | | | |

8,269 | | Calix, Inc. * | | | 378 | |

17,691 | | Extreme Networks, Inc. * | | | 314 | |

14,680 | | Harmonic, Inc. * | | | 207 | |

28,385 | | Infinera Corp. * | | | 180 | |

11,019 | | Viasat, Inc. * | | | 386 | |

| | | | | | |

| | | | | 1,465 | |

| | | | | | |

CONSUMER FINANCE—0.2% | | | | |

23,733 | | EZCORP, Inc. Class A* | | | 204 | |

| | | | | | |

| |

CONSUMER STAPLES DISTRIBUTION & RETAIL—1.5% | | | | |

11,279 | | PriceSmart, Inc. | | | 831 | |

15,684 | | SpartanNash Co. | | | 385 | |

| | | | | | |

| | | | | 1,216 | |

| | | | | | |

DIVERSIFIED CONSUMER SERVICES—4.6% | | | | |

65,941 | | Chegg, Inc. * | | | 1,186 | |

15,567 | | Coursera, Inc. * | | | 194 | |

3,794 | | Duolingo, Inc. * | | | 517 | |

9

Harbor Corporate Culture Small Cap ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

DIVERSIFIED CONSUMER SERVICES—Continued | | | | |

55,396 | | Laureate Education, Inc. | | $ | 686 | |

59,864 | | Rover Group, Inc. * | | | 271 | |

17,662 | | Stride, Inc. * | | | 759 | |

8,627 | | Udemy, Inc. * | | | 78 | |

| | | | | | |

| | | | | 3,691 | |

| | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES—0.2% | | | | |

2,898 | | Bandwidth, Inc. Class A* | | | 35 | |

16,134 | | Liberty Latin America Ltd. Class A (Puerto Rico)* | | | 143 | |

| | | | | | |

| | | | | 178 | |

| | | | | | |

ELECTRIC UTILITIES—0.9% | | | | |

18,639 | | Hawaiian Electric Industries, Inc. | | | 731 | |

| | | | | | |

|

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS—0.1% | |

10,834 | | Arlo Technologies, Inc. * | | | 70 | |

| | | | | | |

| |

ENERGY EQUIPMENT & SERVICES—3.0% | | | | |

68,652 | | Archrock, Inc. | | | 706 | |

10,619 | | Bristow Group, Inc. * | | | 237 | |

4,078 | | Nabors Industries Ltd. * | | | 407 | |

99,002 | | Patterson-UTI Energy, Inc. | | | 1,108 | |

| | | | | | |

| | | | | 2,458 | |

| | | | | | |

FINANCIAL SERVICES—2.9% | | | | |

36,448 | | Affirm Holdings, Inc. * | | | 360 | |

12,315 | | Flywire Corp. * | | | 359 | |

6,934 | | Paymentus Holdings, Inc. Class A* | | | 57 | |

117,579 | | Payoneer Global, Inc. * | | | 642 | |

13,775 | | Walker & Dunlop, Inc. | | | 927 | |

| | | | | | |

| | | | | 2,345 | |

| | | | | | |

FOOD PRODUCTS—0.2% | | | | |

12,598 | | Vital Farms, Inc. * | | | 162 | |

| | | | | | |

| |

GAS UTILITIES—0.9% | | | | |

9,039 | | ONE Gas, Inc. | | | 696 | |

| | | | | | |

| |

HEALTH CARE EQUIPMENT & SUPPLIES—3.0% | | | | |

14,048 | | AtriCure, Inc. * | | | 618 | |

10,857 | | Axogen, Inc. * | | | 98 | |

13,637 | | Glaukos Corp. * | | | 648 | |

15,347 | | Outset Medical, Inc. * | | | 276 | |

19,262 | | Tandem Diabetes Care, Inc. * | | | 762 | |

| | | | | | |

| | | | | 2,402 | |

| | | | | | |

HEALTH CARE PROVIDERS & SERVICES—2.7% | | | | |

77,123 | | 23andMe Holding Co. Class A* | | | 152 | |

30,405 | | AdaptHealth Corp. * | | | 361 | |

7,591 | | Castle Biosciences, Inc. * | | | 172 | |

24,268 | | DocGo, Inc. * | | | 206 | |

14,046 | | Hims & Hers Health, Inc. * | | | 163 | |

34,557 | | Progyny, Inc. * | | | 1,149 | |

| | | | | | |

| | | | | 2,203 | |

| | | | | | |

HEALTH CARE REITS—1.9% | | | | |

103,963 | | Physicians Realty Trust | | | 1,499 | |

| | | | | | |

| |

HEALTH CARE TECHNOLOGY—3.2% | | | | |

4,579 | | Definitive Healthcare Corp. * | | | 49 | |

14,804 | | Doximity, Inc. * | | | 544 | |

39,397 | | Evolent Health, Inc. Class A* | | | 1,434 | |

11,921 | | GoodRx Holdings, Inc. Class A* | | | 56 | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

HEALTH CARE TECHNOLOGY—Continued | | | | |

7,468 | | Health Catalyst, Inc. * | | $ | 94 | |

3,400 | | HealthStream, Inc. | | | 84 | |

8,102 | | Schrodinger, Inc. * | | | 239 | |

41,702 | | Sharecare, Inc. * | | | 64 | |

| | | | | | |

| | | | | 2,564 | |

| | | | | | |

HOTEL & RESORT REITS—1.7% | | | | |

93,368 | | Apple Hospitality REIT, Inc. | | | 1,390 | |

| | | | | | |

| |

HOTELS, RESTAURANTS & LEISURE—1.7% | | | | |

5,236 | | Bluegreen Vacations Holding Corp. | | | 151 | |

17,941 | | Brinker International, Inc. * | | | 716 | |

5,117 | | Dutch Bros, Inc. Class A* | | | 159 | |

1,319 | | NeoGames SA (Israel)* | | | 18 | |

12,295 | | PlayAGS, Inc. * | | | 65 | |

7,431 | | Xponential Fitness, Inc. Class A* | | | 246 | |

| | | | | | |

| | | | | 1,355 | |

| | | | | | |

HOUSEHOLD DURABLES—4.7% | | | | |

4,885 | | Beazer Homes USA, Inc. * | | | 104 | |

21,332 | | GoPro, Inc. Class A* | | | 91 | |

3,779 | | Helen of Troy Ltd. * | | | 379 | |

4,437 | | iRobot Corp. * | | | 175 | |

12,032 | | KB Home | | | 527 | |

6,536 | | La-Z-Boy, Inc. | | | 188 | |

3,037 | | LGI Homes, Inc. * | | | 361 | |

4,206 | | M/I Homes, Inc. * | | | 284 | |

5,217 | | Meritage Homes Corp. | | | 668 | |

15,823 | | Sonos, Inc. * | | | 335 | |

15,832 | | Taylor Morrison Home Corp. * | | | 682 | |

| | | | | | |

| | | | | 3,794 | |

| | | | | | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS—0.4% | |

18,845 | | Sunnova Energy International, Inc. * | | | 338 | |

| | | | | | |

| |

INSURANCE—2.8% | | | | |

13,497 | | Argo Group International Holdings Ltd. | | | 397 | |

29,478 | | Brighthouse Financial, Inc. * | | | 1,303 | |

11,418 | | Palomar Holdings, Inc. * | | | 574 | |

| | | | | | |

| | | | | 2,274 | |

| | | | | | |

INTERACTIVE MEDIA & SERVICES—1.2% | | | | |

14,558 | | Cargurus, Inc. * | | | 239 | |

9,021 | | Cars.com, Inc. * | | | 177 | |

12,076 | | Eventbrite, Inc. Class A* | | | 88 | |

17,780 | | Nextdoor Holdings, Inc. * | | | 38 | |

20,028 | | QuinStreet, Inc. * | | | 222 | |

22,266 | | Taboola.com Ltd. (Israel)* | | | 51 | |

20,834 | | Vimeo, Inc. * | | | 69 | |

5,223 | | ZipRecruiter, Inc. Class A* | | | 88 | |

| | | | | | |

| | | | | 972 | |

| | | | | | |

IT SERVICES—1.0% | | | | |

6,953 | | DigitalOcean Holdings, Inc. * | | | 219 | |

20,208 | | Edgio, Inc. * | | | 13 | |

12,481 | | Fastly, Inc. Class A* | | | 185 | |

7,431 | | Grid Dynamics Holdings, Inc. * | | | 81 | |

39,226 | | Thoughtworks Holding, Inc. * | | | 244 | |

1,306 | | Tucows, Inc. Class A* | | | 29 | |

| | | | | | |

| | | | | 771 | |

| | | | | | |

10

Harbor Corporate Culture Small Cap ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

MEDIA—1.3% | | | | |

18,863 | | John Wiley & Sons, Inc. Class A | | $ | 728 | |

18,727 | | Magnite, Inc. * | | | 176 | |

4,592 | | TechTarget, Inc. * | | | 156 | |

| | | | | | |

| | | | | 1,060 | |

| | | | | | |

| |

METALS & MINING—2.2% | | | | |

7,759 | | Piedmont Lithium, Inc. * | | | 446 | |

9,179 | | Ryerson Holding Corp. | | | 347 | |

23,725 | | SunCoke Energy, Inc. | | | 185 | |

13,643 | | Worthington Industries, Inc. | | | 810 | |

| | | | | | |

| | | | | 1,788 | |

| | | | | | |

| |

MULTI-UTILITIES—1.0% | | | | |

12,317 | | Black Hills Corp. | | | 804 | |

| | | | | | |

| |

OIL, GAS & CONSUMABLE FUELS—2.4% | | | | |

131,451 | | Kosmos Energy Ltd. (Ghana)* | | | 841 | |

52,058 | | Permian Resources Corp. | | | 544 | |

4,203 | | SilverBow Resources, Inc. * | | | 100 | |

20,686 | | Talos Energy, Inc. * | | | 282 | |

28,918 | | Teekay Corp. (Bermuda)* | | | 164 | |

| | | | | | |

| | | | | 1,931 | |

| | | | | | |

| |

PERSONAL CARE PRODUCTS—1.7% | | | | |

7,738 | | Edgewell Personal Care Co. | | | 338 | |

6,027 | | elf Beauty, Inc. * | | | 559 | |

7,457 | | Nu Skin Enterprises, Inc. Class A | | | 294 | |

3,298 | | USANA Health Sciences, Inc. * | | | 219 | |

| | | | | | |

| | | | | 1,410 | |

| | | | | | |

| |

PHARMACEUTICALS—1.1% | | | | |

54,763 | | Nektar Therapeutics * | | | 41 | |

25,962 | | Revance Therapeutics, Inc. * | | | 827 | |

| | | | | | |

| | | | | 868 | |

| | | | | | |

| |

PROFESSIONAL SERVICES—4.9% | | | | |

2,975 | | CRA International, Inc. | | | 313 | |

4,455 | | CSG Systems International, Inc. | | | 235 | |

5,646 | | Forrester Research, Inc. * | | | 175 | |

8,656 | | Huron Consulting Group, Inc. * | | | 734 | |

14,447 | | Insperity, Inc. | | | 1,769 | |

8,153 | | Kforce, Inc. | | | 482 | |

29,888 | | Planet Labs PBC * | | | 122 | |

17,695 | | Upwork, Inc. * | | | 169 | |

| | | | | | |

| | | | | 3,999 | |

| | | | | | |

| |

REAL ESTATE MANAGEMENT & DEVELOPMENT—0.8% | | | | |

35,538 | | eXp World Holdings, Inc. | | | 416 | |

7,056 | | RE/MAX Holdings, Inc. Class A | | | 136 | |

147,777 | | WeWork, Inc. Class A* | | | 62 | |

| | | | | | |

| | | | | 614 | |

| | | | | | |

| |

RETAIL REITS—3.4% | | | | |

19,892 | | Getty Realty Corp. | | | 663 | |

30,237 | | InvenTrust Properties Corp. | | | 682 | |

38,217 | | RPT Realty | | | 355 | |

82,969 | | SITE Centers Corp. | | | 1,024 | |

| | | | | | |

| | | | | 2,724 | |

| | | | | | |

| |

SOFTWARE—8.0% | | | | |

10,229 | | A10 Networks, Inc. | | | 145 | |

6,975 | | Altair Engineering, Inc. Class A* | | | 482 | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

SOFTWARE—Continued | | | | |

6,177 | | Amplitude, Inc. Class A* | | $ | 70 | |

2,365 | | Appfolio, Inc. Class A* | | | 330 | |

7,880 | | Asana, Inc. Class A* | | | 127 | |

18,504 | | AvePoint, Inc. * | | | 80 | |

19,115 | | Box, Inc. Class A* | | | 506 | |

4,996 | | Braze, Inc. Class A* | | | 147 | |

14,143 | | Confluent, Inc. Class A* | | | 311 | |

2,973 | | Couchbase, Inc. * | | | 46 | |

4,603 | | Domo, Inc. Class B* | | | 73 | |

9,941 | | DoubleVerify Holdings, Inc. * | | | 292 | |

6,278 | | Expensify, Inc. Class A* | | | 48 | |

21,974 | | Freshworks, Inc. Class A* | | | 294 | |

1,703 | | Intapp, Inc. * | | | 69 | |

9,692 | | Jamf Holding Corp. * | | | 183 | |

9,417 | | N-able, Inc. * | | | 120 | |

10,725 | | nCino, Inc. * | | | 265 | |

11,768 | | PagerDuty, Inc. * | | | 354 | |

5,741 | | Progress Software Corp. | | | 315 | |

8,649 | | Rapid7, Inc. * | | | 420 | |

12,544 | | Samsara, Inc. Class A* | | | 226 | |

4,441 | | Semrush Holdings, Inc. Class A* | | | 43 | |

6,804 | | Sprout Social, Inc. Class A* | | | 335 | |

14,142 | | Sumo Logic, Inc. * | | | 170 | |

15,312 | | Varonis Systems, Inc. * | | | 355 | |

6,689 | | Workiva, Inc. * | | | 625 | |

| | | | | | |

| | | | | 6,431 | |

| | | | | | |

| |

SPECIALTY RETAIL—3.1% | | | | |

2,472 | | America’s Car-Mart, Inc. * | | | 199 | |

7,710 | | Asbury Automotive Group, Inc. * | | | 1,491 | |

65,484 | | BARK, Inc. * | | | 72 | |

183,365 | | Farfetch Ltd. Class A (United Kingdom)* | | | 739 | |

| | | | | | |

| | | | | 2,501 | |

| | | | | | |

| |

TEXTILES, APPAREL & LUXURY GOODS—0.6% | | | | |

8,664 | | Fossil Group, Inc. * | | | 29 | |

13,861 | | Levi Strauss & Co. Class A | | | 200 | |

2,361 | | Oxford Industries, Inc. | | | 244 | |

3,544 | | Vera Bradley, Inc. * | | | 19 | |

| | | | | | |

| | | | | 492 | |

| | | | | | |

| |

TRADING COMPANIES & DISTRIBUTORS—2.3% | | | | |

30,282 | | Core & Main, Inc. Class A* | | | 789 | |

18,085 | | GMS, Inc. * | | | 1,050 | |

| | | | | | |

| | | | | 1,839 | |

| | | | | | |

| |

WATER UTILITIES—0.4% | | | | |

4,600 | | SJW Group | | | 349 | |

| | | | | | |

| |

WIRELESS TELECOMMUNICATION SERVICES—0.4% | | | | |

27,122 | | Gogo, Inc. * | | | 364 | |

| | | | | | |

|

TOTAL COMMON STOCKS | |

(Cost $80,294) | | | 80,290 | |

| | | | | | |

| | | | | | |

| |

EXCHANGE-TRADED FUNDS—0.6% | | | | |

| |

CAPITAL MARKETS—0.6% | | | | |

4,443 | | Invesco S&P SmallCap Consumer Discretionary ETF | | | 393 | |

11

Harbor Corporate Culture Small Cap ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

CAPITAL MARKETS—Continued | | | | |

| 2,756 | | Invesco S&P SmallCap Financials ETF | | $ | 116 | |

| | | | | | |

| |

TOTAL CAPITAL MARKETS | | | | |

(Cost $504) | | | 509 | |

| | | | | | |

| |

TOTAL INVESTMENTS—100.0% | | | | |

(Cost $80,798) | | | 80,799 | |

| | | | | | |

CASH AND OTHER ASSETS, LESS LIABILITIES—0.0% | | | 7 | |

| | | | | | |

| |

TOTAL NET ASSETS—100% | | $ | 80,806 | |

| | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

* Non-income producing security.

The accompanying notes are an integral part of the Financial Statements.

12

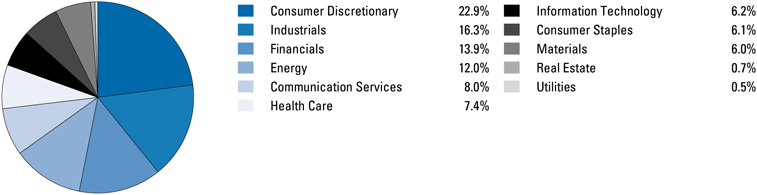

Harbor Disruptive Innovation ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Adviser: Harbor Capital Advisors, Inc.

|

|

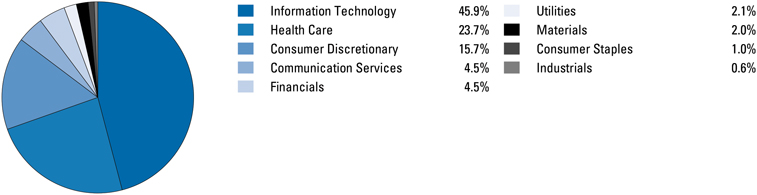

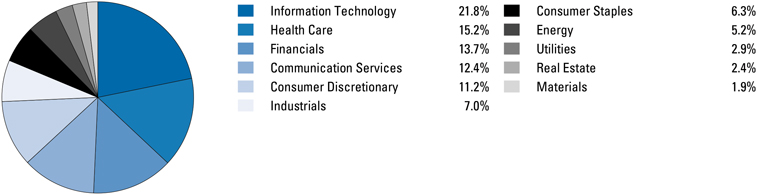

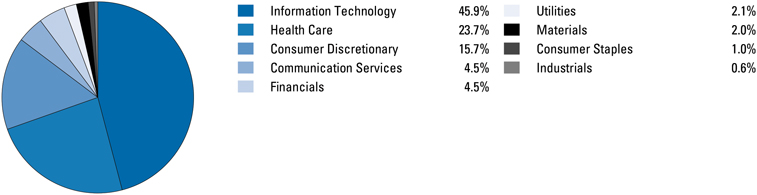

SECTOR ALLOCATION (% of investments) |

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—97.9% | | | | |

| | |

| Shares | | | | Value | |

| |

AUTOMOBILES—1.2% | | | | |

2,016 | | Tesla, Inc. * | | $ | 331 | |

| | | | | | |

| |

BIOTECHNOLOGY—11.2% | | | | |

1,825 | | 89bio, Inc. * | | | 29 | |

10,757 | | Alkermes PLC * | | | 307 | |

17,240 | | Allogene Therapeutics, Inc. * | | | 94 | |

1,232 | | Apellis Pharmaceuticals, Inc. * | | | 103 | |

5,125 | | Arrowhead Pharmaceuticals, Inc. * | | | 181 | |

3,448 | | Ascendis Pharma AS ADR (Denmark)*,1 | | | 241 | |

72,628 | | Autolus Therapeutics PLC ADR (United Kingdom)*,1 | | | 131 | |

7,458 | | Avidity Biosciences, Inc. * | | | 92 | |

6,250 | | Bicycle Therapeutics PLC ADR (United Kingdom)*,1 | | | 123 | |

17,418 | | C4 Therapeutics, Inc. * | | | 53 | |

3,602 | | Fate Therapeutics, Inc. * | | | 22 | |

37,021 | | Freeline Therapeutics Holdings PLC ADR (United Kingdom)*,1 | | | 13 | |

3,280 | | Intellia Therapeutics, Inc. * | | | 124 | |

16,733 | | Iovance Biotherapeutics, Inc. * | | | 94 | |

2,079 | | Krystal Biotech, Inc. * | | | 175 | |

3,705 | | Kymera Therapeutics, Inc. * | | | 117 | |

49,733 | | Magenta Therapeutics, Inc. * | | | 39 | |

33,076 | | Precision BioSciences, Inc. * | | | 28 | |

587 | | Prometheus Biosciences, Inc. * | | | 114 | |

7,936 | | REGENXBIO, Inc. * | | | 154 | |

10,984 | | Repare Therapeutics, Inc. (Canada)* | | | 98 | |

7,654 | | Replimune Group, Inc. * | | | 128 | |

16,111 | | Rocket Pharmaceuticals, Inc. * | | | 289 | |

823 | | Sarepta Therapeutics, Inc. * | | | 101 | |

86,308 | | Synlogic, Inc. * | | | 46 | |

22,104 | | TCR² Therapeutics, Inc. * | | | 39 | |

6,428 | | UniQure NV (Netherlands)* | | | 125 | |

| | | | | | |

| | | | | 3,060 | |

| | | | | | |

CONSUMER STAPLES DISTRIBUTION & RETAIL—0.9% | | | | |

42,246 | | Dada Nexus Ltd. ADR (China)*,1 | | | 256 | |

| | | | | | |

| |

CONTAINERS & PACKAGING—2.0% | | | | |

10,211 | | Ball Corp. | | | 543 | |

| | | | | | |

| |

ELECTRIC UTILITIES—2.1% | | | | |

7,321 | | NextEra Energy, Inc. | | | 561 | |

| | | | | | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

ENTERTAINMENT—0.7% | | | | |

2,382 | | Sea Ltd. ADR (Singapore)*,1 | | $ | 181 | |

| | | | | | |

| |

FINANCIAL SERVICES—3.3% | | | | |

473 | | Adyen NV (Netherlands)*,2 | | | 757 | |

8,019 | | Toast, Inc. Class A* | | | 146 | |

| | | | | | |

| | | | | 903 | |

| | | | | | |

HEALTH CARE EQUIPMENT & SUPPLIES—4.5% | | | | |

3,978 | | Dexcom, Inc. * | | | 483 | |

293 | | IDEXX Laboratories, Inc. * | | | 144 | |

363 | | Inspire Medical Systems, Inc. * | | | 97 | |

645 | | Insulet Corp. * | | | 205 | |

1,736 | | Lantheus Holdings, Inc. * | | | 148 | |

374 | | The Cooper Companies, Inc. | | | 143 | |

| | | | | | |

| | | | | 1,220 | |

| | | | | | |

HEALTH CARE PROVIDERS & SERVICES—0.9% | | | | |

53,757 | | Invitae Corp. * | | | 73 | |

345 | | UnitedHealth Group, Inc. | | | 170 | |

| | | | | | |

| | | | | 243 | |

| | | | | | |

HOTELS, RESTAURANTS & LEISURE—2.5% | | | | |

2,439 | | Airbnb, Inc. Class A* | | | 292 | |

185 | | Chipotle Mexican Grill, Inc. * | | | 382 | |

| | | | | | |

| | | | | 674 | |

| | | | | | |

INSURANCE—1.1% | | | | |

2,119 | | Progressive Corp. | | | 289 | |

| | | | | | |

| |

INTERACTIVE MEDIA & SERVICES—1.8% | | | | |

4,553 | | Alphabet, Inc. Class A* | | | 489 | |

| | | | | | |

| |

INTERNET & DIRECT MARKETING RETAIL—9.7% | | | | |

11,322 | | Amazon.com, Inc. * | | | 1,194 | |

329,482 | | Deliveroo PLC (United Kingdom)*,2 | | | 453 | |

2,105 | | DoorDash, Inc. Class A* | | | 129 | |

691 | | MercadoLibre, Inc. (Brazil)* | | | 882 | |

| | | | | | |

| | | | | 2,658 | |

| | | | | | |

IT SERVICES—8.8% | | | | |

7,645 | | Block, Inc. * | | | 465 | |

5,729 | | Cloudflare, Inc. Class A* | | | 270 | |

13

Harbor Disruptive Innovation ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

|

IT SERVICES—Continued | |

3,671 | | Fiserv, Inc. * | | $ | 448 | |

915 | | MongoDB, Inc. * | | | 220 | |

6,477 | | Okta, Inc. * | | | 444 | |

3,963 | | Shopify, Inc. Class A (Canada)* | | | 192 | |

2,448 | | Snowflake, Inc. Class A* | | | 362 | |

| | | | | | |

| | | 2,401 | |

| | | | | | |

|

LEISURE PRODUCTS—0.8% | |

23,288 | | Peloton Interactive, Inc. Class A* | | | 207 | |

| | | | | | |

|

LIFE SCIENCES TOOLS & SERVICES—4.9% | |

351 | | Bio-Rad Laboratories, Inc. Class A* | | | 158 | |

1,872 | | Danaher Corp. | | | 443 | |

1,986 | | ICON PLC * | | | 383 | |

311 | | Lonza Group AG (Switzerland) | | | 193 | |

313 | | Thermo Fisher Scientific, Inc. | | | 174 | |

| | | | | | |

| | | 1,351 | |

| | | | | | |

|

MACHINERY—0.6% | |

1,195 | | Chart Industries, Inc. * | | | 159 | |

| | | | | | |

|

PHARMACEUTICALS—1.6% | |

4,299 | | Arvinas, Inc. * | | | 113 | |

2,545 | | Catalent, Inc. * | | | 127 | |

530 | | Eli Lilly & Co. | | | 210 | |

| | | | | | |

| | | 450 | |

| | | | | | |

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—12.0% | |

2,193 | | Advanced Micro Devices, Inc. * | | | 196 | |

2,256 | | Applied Materials, Inc. | | | 255 | |

640 | | ASML Holding NV (Netherlands) | | | 405 | |

1,446 | | Lam Research Corp. | | | 758 | |

8,711 | | Microchip Technology, Inc. | | | 636 | |

1,164 | | NVIDIA Corp. | | | 323 | |

3,166 | | Texas Instruments, Inc. | | | 529 | |

3,720 | | Wolfspeed, Inc. * | | | 173 | |

| | | | | | |

| | | | | 3,275 | |

| | | | | | |

| | | | | | |

| |

COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | Value | |

| |

SOFTWARE—24.1% | | | | |

104,007 | | Agora, Inc. ADR (China)*,1 | | $ | 349 | |

3,151 | | Atlassian Corp. PLC Class A* | | | 465 | |

3,252 | | Cadence Design Systems, Inc. * | | | 681 | |

2,112 | | Datadog, Inc. * | | | 142 | |

3,027 | | Dynatrace, Inc. * | | | 128 | |

4,656 | | Fortinet, Inc. * | | | 294 | |

731 | | HubSpot, Inc. * | | | 308 | |

3,454 | | Microsoft Corp. | | | 1,061 | |

1,042 | | Palo Alto Networks, Inc. * | | | 190 | |

2,245 | | Salesforce, Inc. * | | | 445 | |

21,126 | | Samsara, Inc. Class A* | | | 381 | |

1,684 | | ServiceNow, Inc. * | | | 774 | |

5,514 | | Smartsheet, Inc. Class A* | | | 225 | |

2,246 | | Splunk, Inc. * | | | 194 | |

4,980 | | Workday, Inc. Class A* | | | 927 | |

| | | | | | |

| | | | | 6,564 | |

| | | | | | |

| |

SPECIALTY RETAIL—1.2% | | | | |

79,403 | | Farfetch Ltd. Class A (United Kingdom)* | | | 320 | |

| | | | | | |

| |

WIRELESS TELECOMMUNICATION SERVICES—2.0% | | | | |

3,781 | | T-Mobile US, Inc. * | | | 544 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

| (Cost $27,017) | | | 26,679 | |

| | | | | | |

| |

TOTAL INVESTMENTS—97.9% | | | | |

| (Cost $27,017) | | | 26,679 | |

| | | | | | |

CASH AND OTHER ASSETS, LESS LIABILITIES—2.1% | | | 568 | |

| | | | | | |

TOTAL NET ASSETS—100%. | | $ | 27,247 | |

| | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| * | Non-income producing security. |

| 1 | Depositary receipts such as American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs) and other country specific depositary receipts are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the U.S. or elsewhere. |

| 2 | Securities purchased in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. The Fund has no right to demand registration of these securities. As of April 30, 2023, the aggregate value of these securities was $1,210 or 4% of net assets. |

The accompanying notes are an integral part of the Financial Statements.

14

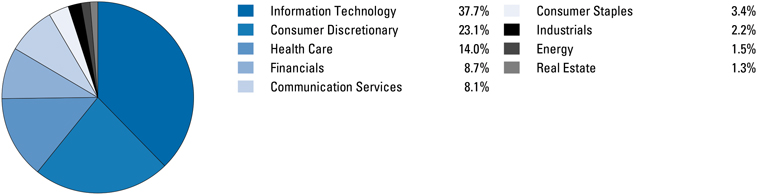

Harbor Dividend Growth Leaders ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Subadvisor: Westfield Capital Management Company, L.P.

|

|

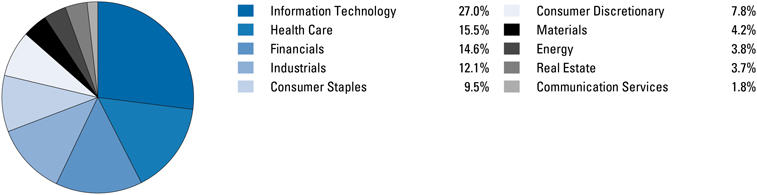

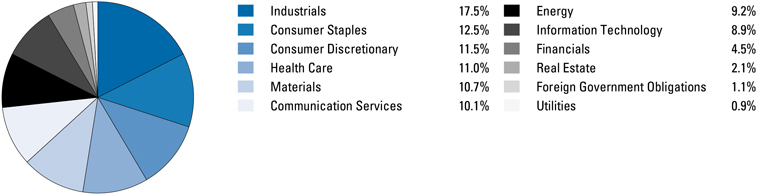

SECTOR ALLOCATION (% of investments) |

Value and Cost in Thousands

| | | | | | | | |

| |

| | COMMON STOCKS—96.9% | | | | |

| | |

| Shares | | | | | Value | |

| |

| | AIR FREIGHT & LOGISTICS—1.7% | | | | |

| | 15,610 | | | United Parcel Service, Inc. Class B | | $ | 2,807 | |

| | | | | | | | |

| |

| | BANKS—1.7% | | | | |

| | 99,688 | | | Bank of America Corp. | | | 2,919 | |

| | | | | | | | |

| |

| | BEVERAGES—7.2% | | | | |

| | 69,845 | | | Coca-Cola Co. | | | 4,481 | |

| | 13,899 | | | Diageo PLC ADR (United Kingdom)1 | | | 2,578 | |

| | 26,038 | | | PepsiCo, Inc. | | | 4,970 | |

| | | | | | | | |

| | | | | | | 12,029 | |

| | | | | | | | |

| |

| | BIOTECHNOLOGY—4.1% | | | | |

| | 20,300 | | | AbbVie, Inc. | | | 3,068 | |

| | 46,925 | | | Gilead Sciences, Inc. | | | 3,857 | |

| | | | | | | | |

| | | | | | | 6,925 | |

| | | | | | | | |

| |

| | BUILDING PRODUCTS—2.2% | | | | |

| | 19,783 | | | Trane Technologies PLC | | | 3,676 | |

| | | | | | | | |

| |

| | CAPITAL MARKETS—3.3% | | | | |

| | 8,396 | | | Ameriprise Financial, Inc. | | | 2,562 | |

| | 4,409 | | | BlackRock, Inc. | | | 2,959 | |

| | | | | | | | |

| | | | | | | 5,521 | |

| | | | | | | | |

| |

| | CHEMICALS—1.9% | | | | |

| | 30,755 | | | Celanese Corp. | | | 3,267 | |

| | | | | | | | |

| |

| | COMMERCIAL SERVICES & SUPPLIES—1.4% | | | | |

| | 5,261 | | | Cintas Corp. | | | 2,398 | |

| | | | | | | | |

| |

| | COMMUNICATIONS EQUIPMENT—2.4% | | | | |

| | 84,702 | | | Cisco Systems, Inc. | | | 4,002 | |

| | | | | | | | |

|

| | CONSUMER STAPLES DISTRIBUTION & RETAIL—2.3% | |

| | 24,391 | | | Target Corp. | | | 3,848 | |

| | | | | | | | |

| |

| | CONTAINERS & PACKAGING—0.9% | | | | |

| | 31,058 | | | Silgan Holdings, Inc. | | | 1,530 | |

| | | | | | | | |

|

| | DIVERSIFIED TELECOMMUNICATION SERVICES—1.7% | |

| | 41,024 | | | Cogent Communications Holdings, Inc. | | | 2,832 | |

| | | | | | | | |

|

| | ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS—1.6% | |

| | 15,580 | | | CDW Corp. | | | 2,642 | |

| | | | | | | | |

| | | | | | | | |

| |

| | COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | | Value | |

| |

| | FOOD PRODUCTS—2.0% | | | | |

| | 12,602 | | | Hershey Co. | | $ | 3,441 | |

| | | | | | | | |

| |

| | HEALTH CARE PROVIDERS & SERVICES—3.9% | | | | |

| | 13,225 | | | UnitedHealth Group, Inc. | | | 6,508 | |

| | | | | | | | |

| |

| | HOTELS, RESTAURANTS & LEISURE—2.9% | | | | |

| | 8,747 | | | McDonald’s Corp. | | | 2,587 | |

| | 19,910 | | | Texas Roadhouse, Inc. | | | 2,202 | |

| | | | | | | | |

| | | | | | | 4,789 | |

| | | | | | | | |

| |

| | INDUSTRIAL REITS—3.6% | | | | |

| | 42,447 | | | Equity LifeStyle Properties, Inc. | | | 2,925 | |

| | 22,054 | | | Sun Communities, Inc. | | | 3,064 | |

| | | | | | | | |

| | | | | | | 5,989 | |

| | | | | | | | |

| |

| | INSURANCE—9.1% | | | | |

| | 31,747 | | | American Financial Group, Inc. | | | 3,897 | |

| | 43,630 | | | American International Group, Inc. | | | 2,314 | |

| | 26,646 | | | Arthur J. Gallagher & Co. | | | 5,544 | |

| | 19,780 | | | Primerica, Inc. | | | 3,610 | |

| | | | | | | | |

| | | | | | | 15,365 | |

| | | | | | | | |

| |

| | IT SERVICES—3.1% | | | | |

| | 41,231 | | | IBM Corp. | | | 5,212 | |

| | | | | | | | |

| |

| | MACHINERY—4.8% | | | | |

| | 12,169 | | | Cummins, Inc. | | | 2,860 | |

| | 18,504 | | | IDEX Corp. | | | 3,818 | |

| | 19,681 | | | Mueller Industries, Inc. | | | 1,414 | |

| | | | | | | | |

| | | | | | | 8,092 | |

| | | | | | | | |

| |

| | METALS & MINING—1.2% | | | | |

| | 35,265 | | | BHP Group Ltd. ADR (Australia)1 | | | 2,082 | |

| | | | | | | | |

| |

| | OIL, GAS & CONSUMABLE FUELS—3.7% | | | | |

| | 13,562 | | | Chevron Corp. | | | 2,287 | |

| | 71,987 | | | Devon Energy Corp. | | | 3,846 | |

| | | | | | | | |

| | | | | | | 6,133 | |

| | | | | | | | |

| |

| | PHARMACEUTICALS—7.1% | | | | |

| | 18,040 | | | Eli Lilly & Co. | | | 7,141 | |

15

Harbor Dividend Growth Leaders ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | | | |

| |

| | COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | | Value | |

| |

| | PHARMACEUTICALS—Continued | | | | |

| | 40,735 | | | Merck & Co., Inc. | | $ | 4,704 | |

| | | | | | | | |

| | | | | | | 11,845 | |

| | | | | | | | |

|

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—8.4% | |

| | 12,806 | | | Analog Devices, Inc. | | | 2,303 | |

| | 6,524 | | | Broadcom, Inc. | | | 4,087 | |

| | 56,538 | | | Microchip Technology, Inc. | | | 4,127 | |

| | 31,315 | | | QUALCOMM, Inc. | | | 3,658 | |

| | | | | | | | |

| | | | | | | 14,175 | |

| | | | | | | | |

| |

| | SOFTWARE—5.2% | | | | |

| | 28,452 | | | Microsoft Corp. | | | 8,742 | |

| | | | | | | | |

|

| | TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS—5.5% | |

| | 54,170 | | | Apple, Inc. | | | 9,192 | |

| | | | | | | | |

| | | | | | | | |

| |

| | COMMON STOCKS—Continued | | | | |

| | |

| Shares | | | | | Value | |

|

| | TEXTILES, APPAREL & LUXURY GOODS—2.4% | |

| | 31,411 | | | NIKE, Inc. Class B | | $ | 3,980 | |

| | | | | | | | |

|

| | TRADING COMPANIES & DISTRIBUTORS—1.6% | |

| | 7,932 | | | Watsco, Inc. | | | 2,748 | |

| | | | | | | | |

|

| | TOTAL COMMON STOCKS | |

| | (Cost $144,260) | | | 162,689 | |

| | | | | | | | |

| |

| | TOTAL INVESTMENTS—96.9% | | | | |

| | (Cost $144,260) | | | 162,689 | |

| | | | | | | | |

| | CASH AND OTHER ASSETS, LESS LIABILITIES—3.1% | | | 5,280 | |

| | | | | | | | |

| | TOTAL NET ASSETS—100%. | | $ | 167,969 | |

| | | | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| 1 | Depositary receipts such as American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs) and other country specific depositary receipts are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the U.S. or elsewhere. |

The accompanying notes are an integral part of the Financial Statements.

16

Harbor Energy Transition Strategy ETF

CONSOLIDATED PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Subadvisor: Quantix Commodities LP

|

|

RISK ALLOCATION* (% of Net Assets) - Unaudited |

| | | | | | |

| Asset Class | | Sector | |

COMMODITIES | | | | | | |

| | |

| | Industrial Metals | | | 36.0 | % |

| | |

| | Natural Gas | | | 23.9 | % |

| | |

| | Emissions | | | 17.6 | % |

| | |

| | Precious Metals | | | 12.6 | % |

| | |

| | Oilseeds | | | 9.9 | % |

*Based on notional value and represents the sector allocation of the Quantix Energy Transition Index.

Principal Amounts, Value and Cost in Thousands

| | | | | | | | |

|

| | SHORT-TERM INVESTMENTS—73.3% | |

| | |

Principal

Amount | | | | | Value | |

| U.S. TREASURY BILLS—73.3% | |

| | | | U.S. Treasury Bills | | | | |

| | $ 7,590 | | | 4.549%—05/16/2023† | | $ | 7,577 | |

| | 8,259 | | | 4.799%—06/27/2023† | | | 8,195 | |

| | | | | | | | |

|

| | TOTAL SHORT-TERM INVESTMENTS | |

| | (Cost $15,771) | | | 15,772 | |

| | | | | | | | |

|

| | TOTAL INVESTMENTS—73.3% | |

| | (Cost $15,771) | | | 15,772 | |

| | | | | | | | |

| | CASH AND OTHER ASSETS, LESS LIABILITIES—26.7% | | | 5,741 | |

| | | | | | | | |

| | TOTAL NET ASSETS—100% | | $ | 21,513 | |

| | | | | | | | |

OVER-THE-COUNTER (OTC) EXCESS RETURN SWAPS ON INDICES

| | | | | | | | | | | | | | | | | | |

Counterparty | | Fixed

Rate | | Pay/Receive

Fixed Rate | | Reference Index1 | | Expiration

Date | | Payment

Frequency | | Notional

Amount

(000s) | | Value

(000s) | | Upfront

Premiums

(Received)/

Paid

(000s) | | Unrealized

Appreciation/

(Depreciation)

(000s) |

Goldman Sachs International | | 0.750% | | Pay | | Quantix Energy Transition Index | | 05/31/2023 | | Monthly | | $21,512 | | $— | | $— | | $— |

| | | | | | | | | | | | | | | | | | |

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments and Swap Agreements schedule) were classified as Level 2.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

The accompanying notes are an integral part of the Financial Statements.

17

Harbor Energy Transition Strategy ETF

CONSOLIDATED PORTFOLIO OF INVESTMENTS—Continued

| † | Coupon represents yield to maturity |

| 1 | The reference index components are published daily on Harbor Capital’s website at harborcapital.com. The index is comprised of publicly traded futures contracts on physical commodities. The table below represents the reference index components as of the period ended April 30, 2023. |

| | | | |

Commodity | | Weight | |

Emissions (Europe) | | | 14.9% | |

Aluminum | | | 12.3 | |

Natural Gas (United States) | | | 10.2 | |

Natural Gas (Europe) | | | 9.3 | |

Nickel | | | 8.3 | |

Copper | | | 8.0 | |

Soybean Oil | | | 7.2 | |

Silver | | | 7.0 | |

Zinc | | | 4.8 | |

Natural Gas (United Kingdom) | | | 4.4 | |

Platinum | | | 2.9 | |

Ethanol | | | 2.7 | |

Emissions (California) | | | 2.7 | |

Palladium | | | 2.7 | |

Lead | | | 2.6 | |

The accompanying notes are an integral part of the Financial Statements.

18

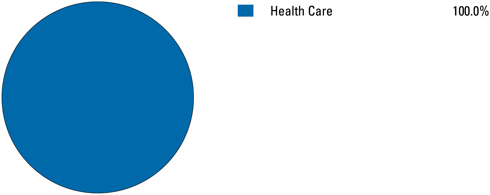

Harbor Health Care ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Subadvisor: Westfield Capital Management Company, L.P.

|

|

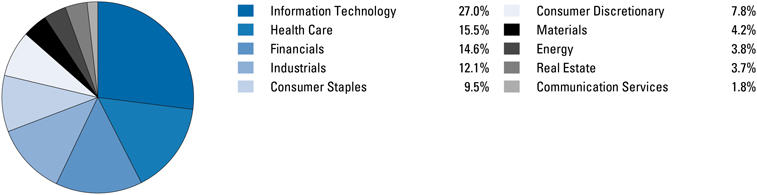

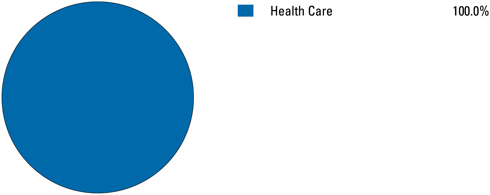

SECTOR ALLOCATION (% of investments) |

Value and Cost in Thousands

| | | | | | |

|

COMMON STOCKS—99.8% | |

| | |

| Shares | | | | Value | |

| |

|

BIOTECHNOLOGY—21.7% | |

1,542 | | 89bio, Inc. * | | $ | 25 | |

7,541 | | Alkermes PLC * | | | 215 | |

722 | | Apellis Pharmaceuticals, Inc. * | | | 60 | |

3,865 | | Ascendis Pharma AS ADR (Denmark)*,1 | | | 271 | |

731 | | Cerevel Therapeutics Holdings, Inc. * | | | 21 | |

1,354 | | IVERIC bio, Inc. * | | | 45 | |

405 | | Neurocrine Biosciences, Inc. * | | | 41 | |

495 | | Prometheus Biosciences, Inc. * | | | 96 | |

2,584 | | Rocket Pharmaceuticals, Inc. * | | | 46 | |

760 | | Sarepta Therapeutics, Inc. * | | | 93 | |

| | | | | | |

| | | | | 913 | |

| | | | | | |

| |

HEALTH CARE EQUIPMENT & SUPPLIES—19.0% | | | | |

1,415 | | Dexcom, Inc. * | | | 172 | |

262 | | Haemonetics Corp. * | | | 22 | |

105 | | IDEXX Laboratories, Inc. * | | | 52 | |

319 | | Inspire Medical Systems, Inc. * | | | 85 | |

344 | | Insulet Corp. * | | | 109 | |

327 | | Intuitive Surgical, Inc. * | | | 98 | |

1,220 | | Lantheus Holdings, Inc. * | | | 104 | |

438 | | Masimo Corp. * | | | 83 | |

191 | | The Cooper Companies, Inc. | | | 73 | |

| | | | | | |

| | | | | 798 | |

| | | | | | |

| |

HEALTH CARE PROVIDERS & SERVICES—21.3% | | | | |

1,223 | | Amedisys, Inc. * | | | 98 | |

168 | | Humana, Inc. | | | 89 | |

1,597 | | Option Care Health, Inc. * | | | 52 | |

138 | | Quest Diagnostics, Inc. | | | 19 | |

1,293 | | UnitedHealth Group, Inc. | | | 636 | |

| | | | | | |

| | | | | 894 | |

| | | | | | |

| | | | | | |

|

COMMON STOCKS—Continued | |

| | |

| Shares | | | | Value | |

| |

| |

HEALTH CARE TECHNOLOGY—1.8% | | | | |

5,969 | | Veradigm, Inc. * | | $ | 75 | |

| | | | | | |

|

LIFE SCIENCES TOOLS & SERVICES—15.6% | |

4,266 | | Avantor, Inc. * | | | 83 | |

1,495 | | Azenta, Inc. * | | | 65 | |

376 | | Bio-Rad Laboratories, Inc. Class A* | | | 170 | |

904 | | ICON PLC * | | | 174 | |

133 | | Repligen Corp. * | | | 20 | |

254 | | Thermo Fisher Scientific, Inc. | | | 141 | |

| | | | | | |

| | | | | 653 | |

| | | | | | |

| |

PHARMACEUTICALS—20.4% | | | | |

1,819 | | Catalent, Inc. * | | | 91 | |

1,562 | | Eli Lilly & Co. | | | 618 | |

757 | | Innoviva, Inc. * | | | 9 | |

1,184 | | Merck & Co., Inc. | | | 137 | |

| | | | | | |

| | |

| | | | | 855 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $4,052) | | | 4,188 | |

| | | | | | |

| |

TOTAL INVESTMENTS—99.8% | | | | |

(Cost $4,052) | | | 4,188 | |

| | | | | | |

CASH AND OTHER ASSETS, LESS

LIABILITIES—0.2% | | | 8 | |

| | | | | | |

TOTAL NET ASSETS—100% | | $ | 4,196 | |

| | | | | | |

19

Harbor Health Care ETF

PORTFOLIO OF INVESTMENTS—Continued

All investments as of April 30, 2023 (as disclosed in the preceding Portfolio of Investments) were classified as Level 1.

For more information on valuation inputs and their aggregation into the levels identified above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| * | Non-income producing security. |

| 1 | Depositary receipts such as American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs) and other country specific depositary receipts are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the U.S. or elsewhere. |

The accompanying notes are an integral part of the Financial Statements.

20

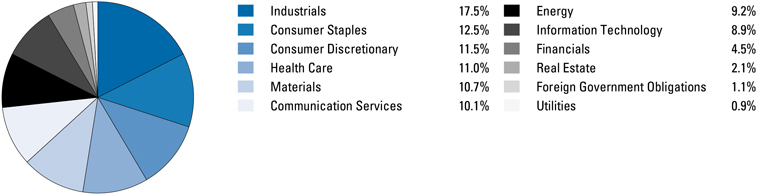

Harbor International Compounders ETF

PORTFOLIO OF INVESTMENTS—April 30, 2023 (Unaudited)

Subadvisor: C WorldWide Asset Management

|

|

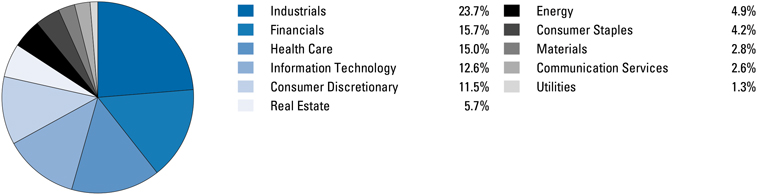

REGION BREAKDOWN (% of investments) |

The Fund’s Portfolio of Investments include investments denominated in foreign currencies. As of April 30, 2023, 35.2% of the Fund’s investments were denominated in Euro. No other foreign currency denomination comprised more than 25% of the Fund’s net assets.

Value and Cost in Thousands

| | | | | | |

|

COMMON STOCKS—98.8% | |

| | |

| Shares | | | | Value | |

| |

| |

BANKS—9.5% | | | | |

12,647 | | HDFC Bank Ltd. ADR (India)1 | | $ | 883 | |

686,400 | | PT Bank Central Asia Tbk (Indonesia) | | | 423 | |

| | | | | | |

| | | | | 1,306 | |

| | | | | | |

| |

BEVERAGES—3.0% | | | | |

8,956 | | Diageo PLC (United Kingdom) | | | 408 | |

| | | | | | |

|

BUILDING PRODUCTS—5.6% | |

15,532 | | Assa Abloy AB Class B (Sweden) | | | 369 | |

2,200 | | Daikin Industries Ltd. (Japan) | | | 398 | |

| | | | | | |

| | | | | 767 | |

| | | | | | |

| |

CAPITAL MARKETS—2.9% | | | | |

2,068 | | Deutsche Boerse AG (Germany) | | | 394 | |

| | | | | | |

| |

CHEMICALS—4.4% | | | | |

3,351 | | Air Liquide SA (France) | | | 603 | |

| | | | | | |

|

CONSTRUCTION & ENGINEERING—2.2% | |

2,464 | | Vinci SA (France) | | | 305 | |

| | | | | | |

| |

ELECTRIC UTILITIES—4.8% | | | | |

20,681 | | Iberdrola SA (Spain) | | | 268 | |

17,138 | | SSE PLC (United Kingdom) | | | 396 | |

| | | | | | |

| | | | | 664 | |

| | | | | | |

|

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS—2.3% | |

700 | | Keyence Corp. (Japan) | | | 314 | |

| | | | | | |

|

FOOD PRODUCTS—4.5% | |

4,774 | | Nestle SA | | | 612 | |

| | | | | | |

| |

HEALTH CARE EQUIPMENT & SUPPLIES—3.3% | | | | |

4,400 | | Hoya Corp. (Japan) | | | 459 | |

| | | | | | |

| |

HOUSEHOLD DURABLES—4.5% | | | | |

6,600 | | Sony Group Corp. (Japan) | | | 621 | |

| | | | | | |

| |

INDUSTRIAL CONGLOMERATES—4.0% | | | | |

3,344 | | Siemens AG (Germany) | | | 549 | |

| | | | | | |

| | | | | | |

|

COMMON STOCKS—Continued | |

| | |

| Shares | | | | Value | |

| |

| |

INSURANCE—3.1% | | | | |

39,600 | | AIA Group Ltd. (Hong Kong) | | $ | 429 | |

| | | | | | |

| |

IT SERVICES—1.6% | | | | |

137 | | Adyen NV (Netherlands)*,2 | | | 219 | |

| | | | | | |

| |

MACHINERY—3.9% | | | | |

25,828 | | Atlas Copco AB Class A (Sweden) | | | 373 | |

8,320 | | Epiroc AB Class A (Sweden) | | | 166 | |

| | | | | | |

| | | | | 539 | |

| | | | | | |

| |

PERSONAL CARE PRODUCTS—3.7% | | | | |

1,062 | | L’Oreal SA (France) | | | 506 | |

| | | | | | |

| |

PHARMACEUTICALS—11.4% | | | | |

3,916 | | AstraZeneca PLC (United Kingdom) | | | 578 | |

5,942 | | Novo Nordisk AS Class B (Denmark) | | | 988 | |

| | | | | | |

| | | | | 1,566 | |

| | | | | | |

|

REAL ESTATE MANAGEMENT & DEVELOPMENT—1.3% | |

8,206 | | Vonovia SE (Germany) | | | 177 | |

| | | | | | |

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—7.9% | |

1,122 | | ASML Holding NV (Netherlands) | | | 709 | |

4,400 | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Taiwan)1 | | | 371 | |

| | | | | | |

| | | | | 1,080 | |

| | | | | | |

| |

SOFTWARE—3.4% | | | | |

3,432 | | SAP SE (Germany) | | | 465 | |

| | | | | | |

|

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS—2.8% | |

308 | | Samsung Electronics Co. Ltd. GDR (South Korea)1 | | | 380 | |

| | | | | | |

|

TEXTILES, APPAREL & LUXURY GOODS—4.6% | |

660 | | LVMH Moet Hennessy Louis Vuitton SE (France) | | | 633 | |

| | | | | | |

21

Harbor International Compounders ETF

PORTFOLIO OF INVESTMENTS—Continued

Value and Cost in Thousands

| | | | | | |

|

COMMON STOCKS—Continued | |

| | |

| Shares | | | | Value | |

| |

| |

TRADING COMPANIES & DISTRIBUTORS—4.1% | | | | |

4,048 | | Ferguson PLC | | $ | 569 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $11,884) | | | 13,565 | |

| | | | | | |

| |

TOTAL INVESTMENTS—98.8% | | | | |

(Cost $11,884) | | | 13,565 | |

| | | | | | |

CASH AND OTHER ASSETS, LESS

LIABILITIES—1.2% | | | 159 | |

| | | | | | |

TOTAL NET ASSETS—100% | | $ | 13,724 | |

| | | | | | |