Exhibit 99.2

January 2025 Presentation

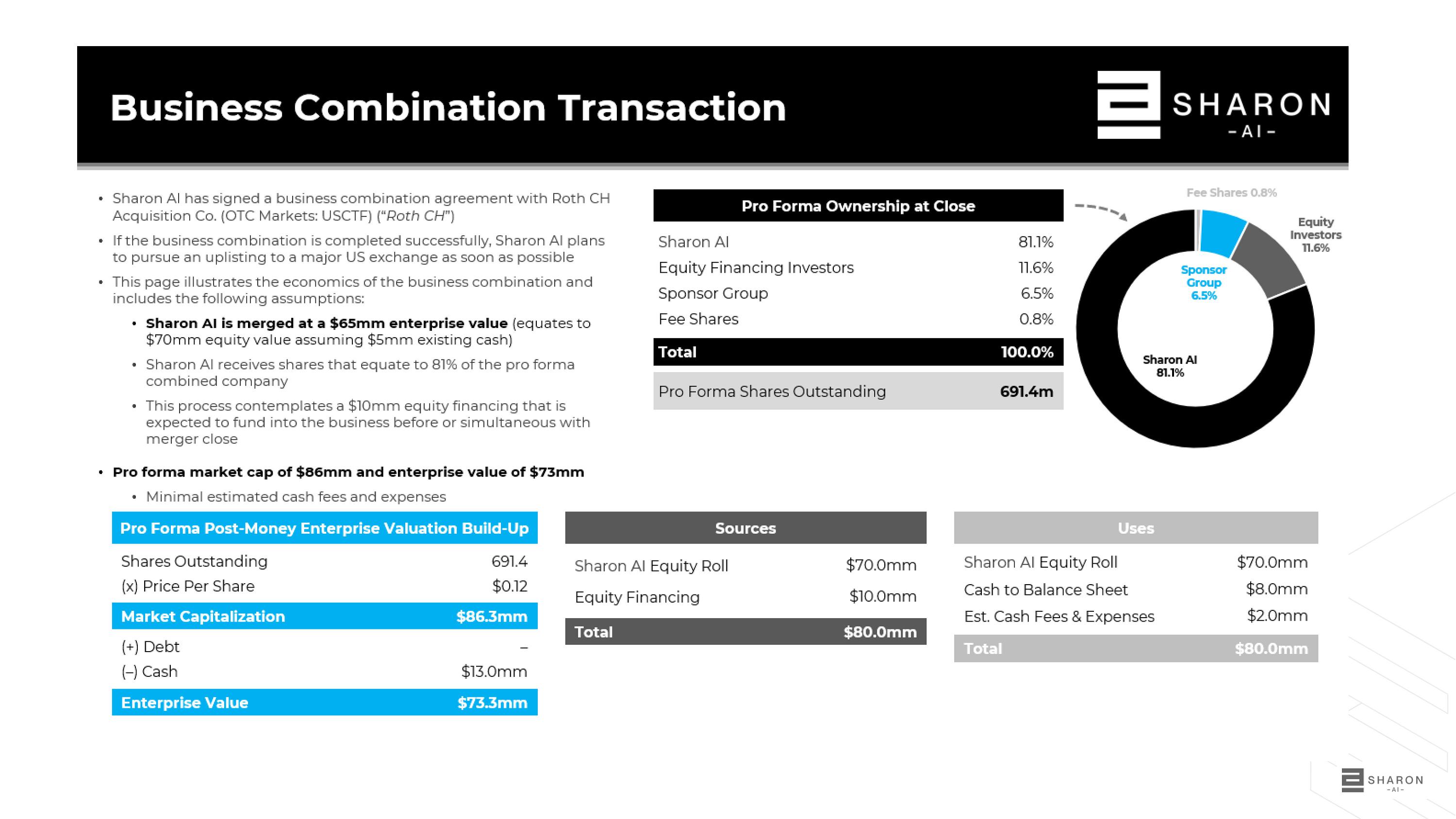

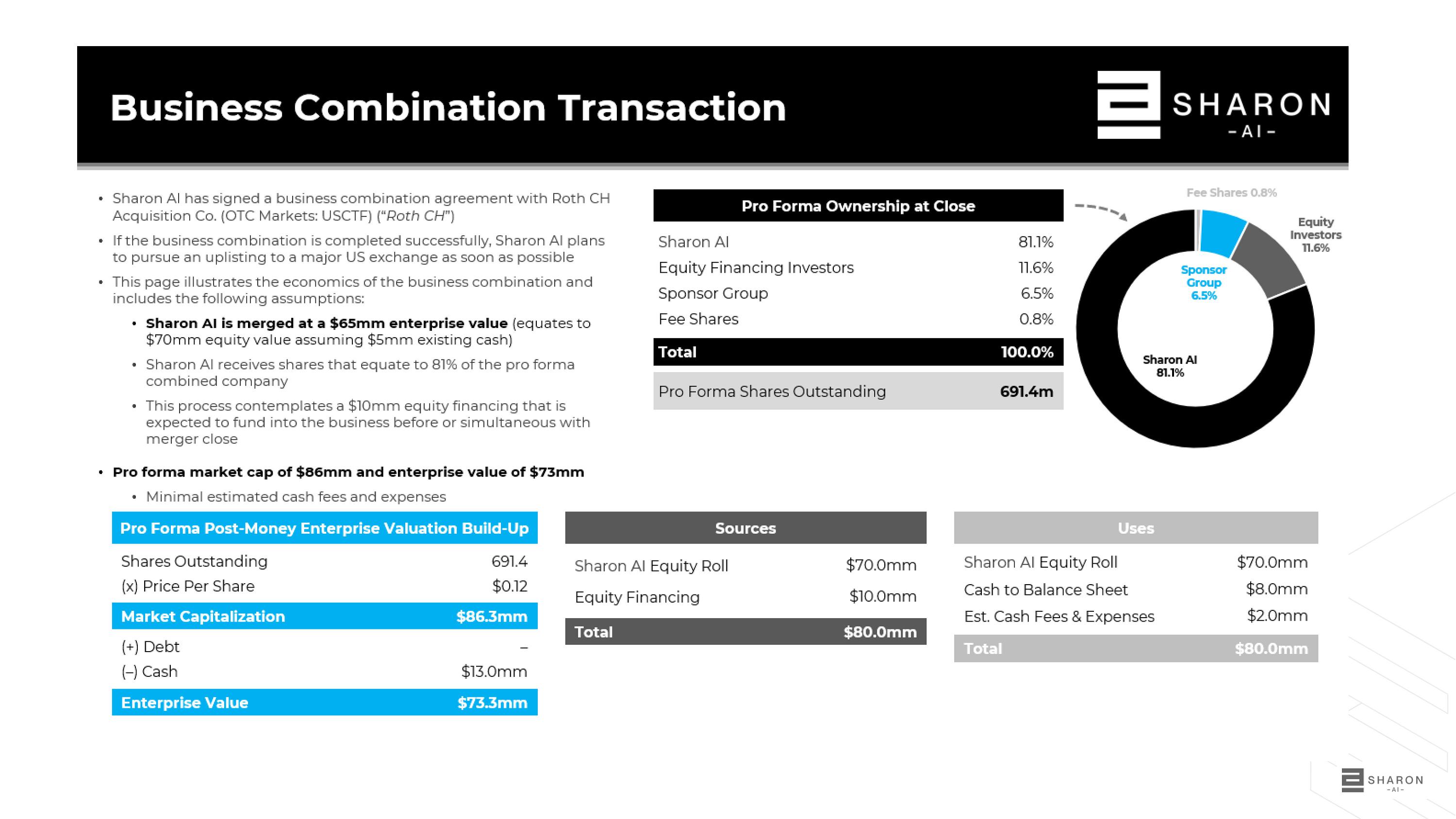

DISCLAIMERS This presentation (this “Presentation”) is provided solely for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity or debt . It has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Sharon AI Inc . , a Delaware corporation (“Sharon”) and Roth CH Acquisition Co . , a Cayman Islands exempted company (“ROTH CH” and related transactions (the “Proposed Business Combination”) and for no other purpose . On January 28 , 2025 , ROTH CH and Sharon entered into a Business Combination Agreement as it may be further amended, supplemented or otherwise modified from time to time, the “Merger Agreement”) . The information contained herein does not purport to be all - inclusive . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Any data on past performance or modeling contained herein is not an indication as to future performance . Sharon and ROTH CH assume no obligation to update the information in this Presentation, except as required by law . No Representation or Warranties All information is provided “AS IS” and no representations or warranties, of any kind, express or implied are given in, or in respect of, this Presentation . To the fullest extent permitted by law in no circumstances will Sharon , ROTH CH or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither Sharon nor ROTH CH has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness . This data is subject to change . In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Sharon or the Proposed Business Combination . Viewers of this Presentation should each make their own evaluation of the company and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . Industry and Market Data In this Presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which Sharon competes and other industry data . We obtained this information and statistics from third - party sources, including reports by market research firms and company filings . Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but Sharon will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Financial Information ; Non - GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus or registration statement to be filed by ROTH CH with the SEC, and such differences may be material. In particular, all Sharon projected financial information included herein is preliminary and subject to risks and uncertainties. Any variation between Sharon’s actual results and the projected financial information included herein may be material. This Presentation also contains non - GAAP financial measures and key metrics relating to the combined company’s projected future performance. A reconciliation of these non - GAAP financial measures to the corresponding GAAP measures on a forward - looking basis is not available because the various reconciling items are difficult to predict and subject to constant change. Use of Projections This Presentation contains projected financial information with respect to Sharon and ROTH CH . Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . See “Forward - Looking Statements” below . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved .

Any financial projections in this Presentation are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Sharon’s and ROTH CH’s control . While all projections are necessarily speculative, Sharon and ROTH CH believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation . The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections . The inclusion of projections in this Presentation should not be regarded as an indication that Sharon and ROTH CH, or their representatives, considered or consider the projections to be a reliable prediction of future events . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . The foregoing list of factors is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in ROTH CH and is not intended to form the basis of an investment decision in ROTH CH . Readers should carefully review the foregoing factors and other risks and uncertainties described in the “Risk Factors” section of the reports, which ROTH CH has filed or will file from time to time with the SEC . There may be additional risks that neither Sharon nor ROTH CH presently know, or that Sharon and ROTH CH currently believe are immaterial, that could cause actual results to differ from those contained in forward looking statements . For these reasons, among others, investors and other interested persons are cautioned not to place undue reliance upon any forward - looking statements in this Presentation . All subsequent written and oral forward - looking statements concerning Sharon and ROTH CH, the Proposed Business Combination or other matters and attributable to Sharon and ROTH CH or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above . No Offer or Solicitation This Presentation does not constitute a proxy statement or solicitation of a proxy, consent, vote or authorization with respect to any securities or in respect of the Proposed Business Combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange any securities, nor shall there be any sale, issuance or transfer of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Important Information About the Proposed Business Combination and Where to Find It In connection with the Proposed Business Combination, Roth CH Holdings, Inc . , a Delaware corporation and a wholly - owned subsidiary of ROTH CH (“Holdings”) will file with the SEC a registration statement on Form S - 4 , which includes a definitive proxy statement of ROTH CH and a prospectus of Holdings for the registration of Holdings securities (as amended from time to time, the “Registration Statement”) . A full description of the terms of the Proposed Business Combination will be provided in the Registration Statement . ROTH CH urges investors, stockholders and other interested persons to read the Registration Statement and the definitive proxy statement/prospectus, as well as other documents filed with the SEC because these documents will contain important information about Sharon, ROTH CH, Holdings and the Proposed Business Combination . After the Registration Statement has been declared effective by the SEC, the definitive proxy statement/prospectus and other relevant documents will be mailed to stockholders of ROTH CH as of a record date established for voting on the Proposed Business Combination . Stockholders and other interested persons will also be able to obtain a copy of the proxy statement, without charge, by directing a request to : Roth CH Acquisition Co . , 888 San Clemente Drive, Suite 400 , Newport Beach, CA 92660 . The definitive proxy statement/prospectus, can also be obtained, without charge, at the SEC's website ( www . sec . gov ) . The information contained on, or that may be accessed through, the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Presentation .

Participants in the Solicitation Sharon, ROTH CH and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the Proposed Business Combination described herein under the rules of the SEC . Information about such persons and a description of their interests will be contained in the Registration Statement when it is filed with the SEC . These documents can be obtained free of charge from the sources indicated above . Cautionary Statements Regarding Forward Looking Statements This Presentation contains forward - looking statements including, but not limited to, Sharon’s and ROTH CH’s expectations or predictions of future financial or business performance or conditions . Forward - looking statements are inherently subject to risks, uncertainties and assumptions . Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward - looking statements . These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions . Such forward - looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements . Certain of these risks are identified and discussed in ROTH CH’s final prospectus for its initial public offering, dated October 26 , 2021 , under the heading “Risk Factors . ” These risk factors will be important to consider in determining future results and should be reviewed in their entirety . These forward - looking statements are expressed in good faith, and ROTH CH and Sharon believe there is a reasonable basis for them . However, there can be no assurance that the events, results or trends identified in these forward - looking statements will occur or be achieved . Forward - looking statements speak only as of the date they are made, and neither ROTH CH nor Sharon is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by law . In addition to factors previously disclosed in ROTH CH’s reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results to differ materially from forward - looking statements or historical performance : (i) expectations regarding Sharon’s strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and Sharon’s ability to invest in growth initiatives and pursue acquisition opportunities ; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement ; (iii) the outcome of any legal proceedings that may be instituted against Sharon or ROTH CH following announcement of the Proposed Business Combination and the transactions contemplated thereby ; (iv) the inability to complete the Proposed Business Combination due to, among other things, the failure to obtain ROTH CH stockholder approval on the expected terms and schedule, as well as the risk that regulatory approvals required for the Proposed Business Combination are not obtained or are obtained subject to conditions that are not anticipated ; (v) the failure to complete the planned PIPE financing ; (vi) the risk that the announcement and consummation of the Proposed Business Combination disrupts Sharon’s current operations and future plans ; (vii) the ability to recognize the anticipated benefits of the Proposed Business Combination ; (viii) unexpected costs related to the Proposed Business Combination ; (ix) limited liquidity and trading of ROTH CH’s securities ; (x) geopolitical risk and changes in applicable laws or regulations ; (xiv) the possibility that ROTH CH and/or Sharon may be adversely affected by other economic, business, and/or competitive factors ; (xi) operational risk ; (xii) risk that the COVID - 19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on our business operations, as well as our financial condition and results of operations ; and (xiii) the risks that the consummation of the Proposed Business Combination is substantially delayed or does not occur .

AWS acquires 960MW nuclear campus in Pennsylvania https://iee.ucsb.edu/index.php/news - events/news/aws - acquires - nuclear - powered - data - center - campus - pa How Wall Street Lenders Are Betting Big on the AI Boom https://www.wsj.com/tech/ai/how - wall - street - lenders - are - betting - big - on - the - ai - boom - 25b38259 AI Startup CoreWeave Nearly Triples Valuation to $19 Billion in Five Months https://www.wsj.com/tech/ai/ai - cloud - computing - startup - coreweave - valued - at - 19 - billion - in - new - funding - round - dfdb47cd Macquarie Leads $500 Million Loan for AI Infrastructure Company Lambda https://www.wsj.com/articles/macquarie - leads - 500 - million - loan - for - ai - infrastructure - company - lambda - 9ff6e517 Blackstone to buy Australia's AirTrunk in $16 billion deal https://www.reuters.com/markets/deals/blackstone - buy - australias - airtrunk - 16 - billion - deal - 2024 - 09 - 04/ Broadcom says it will sell $ 12 billion in AI parts and custom chips this year https://www.cnbc.com/amp/2024/09/05/broadcom - avgo - earnings - report - q3 - 2024.html Microsoft, BlackRock to launch $30 billion fund for AI infrastructure https://www.reuters.com/technology/artificial - intelligence/microsoft - blackrock - plan - 30 - bln - fund - invest - ai - infrastructure - ft - reports - 2024 - 09 - 17/ Meta to open $800m data center in Rosemount, Minnesota https://www.cbsnews.com/minnesota/news /meta - to - build - 800m - data - center - in - rosemount - minnesota/ Microsoft and OpenAI plan $100 billion data - center project https://www.reuters.com/technology/microsoft - openai - planning - 100 - billion - data - center - project - information - reports - 2024 - 03 - 29/ AI In The Media

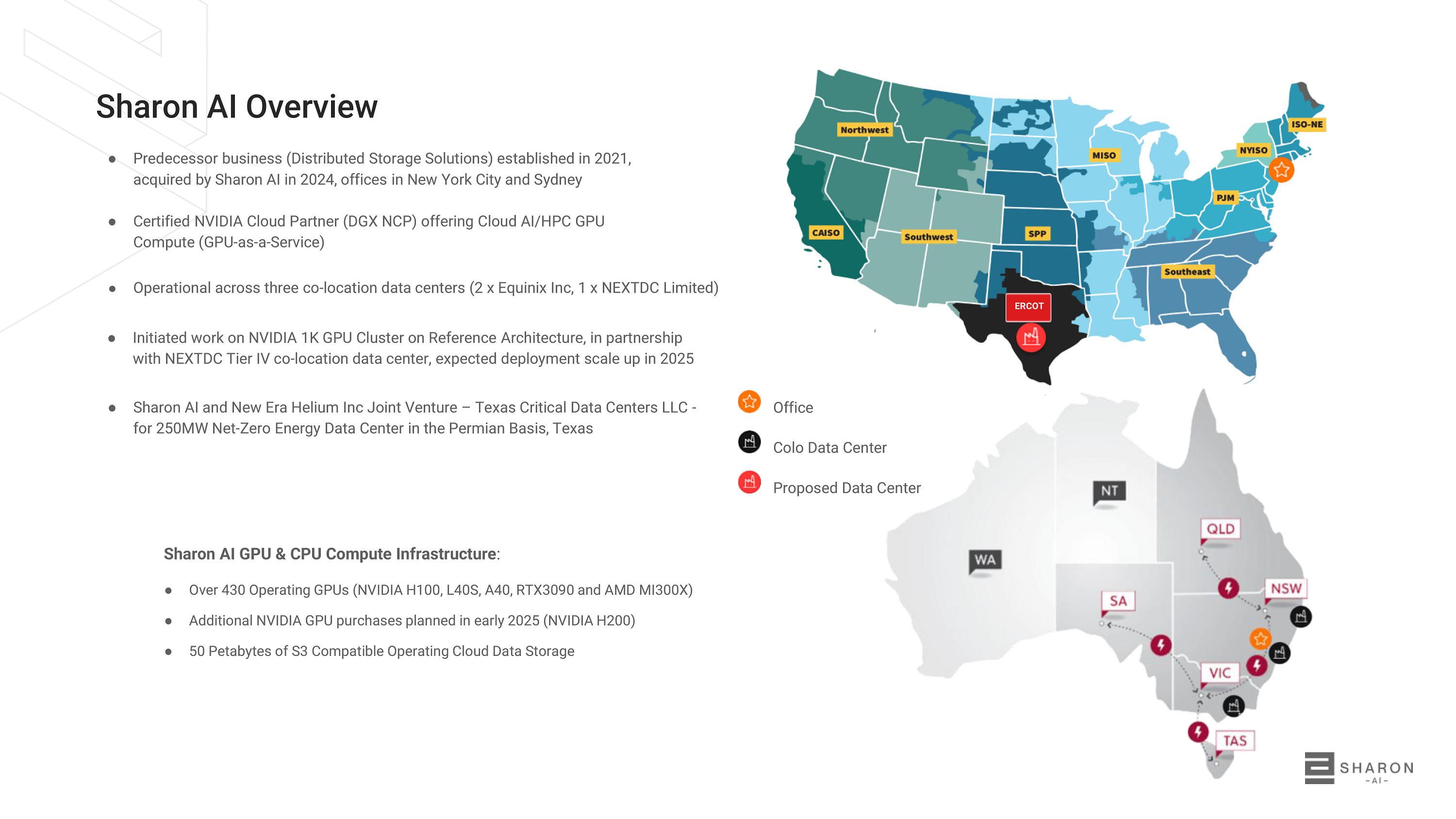

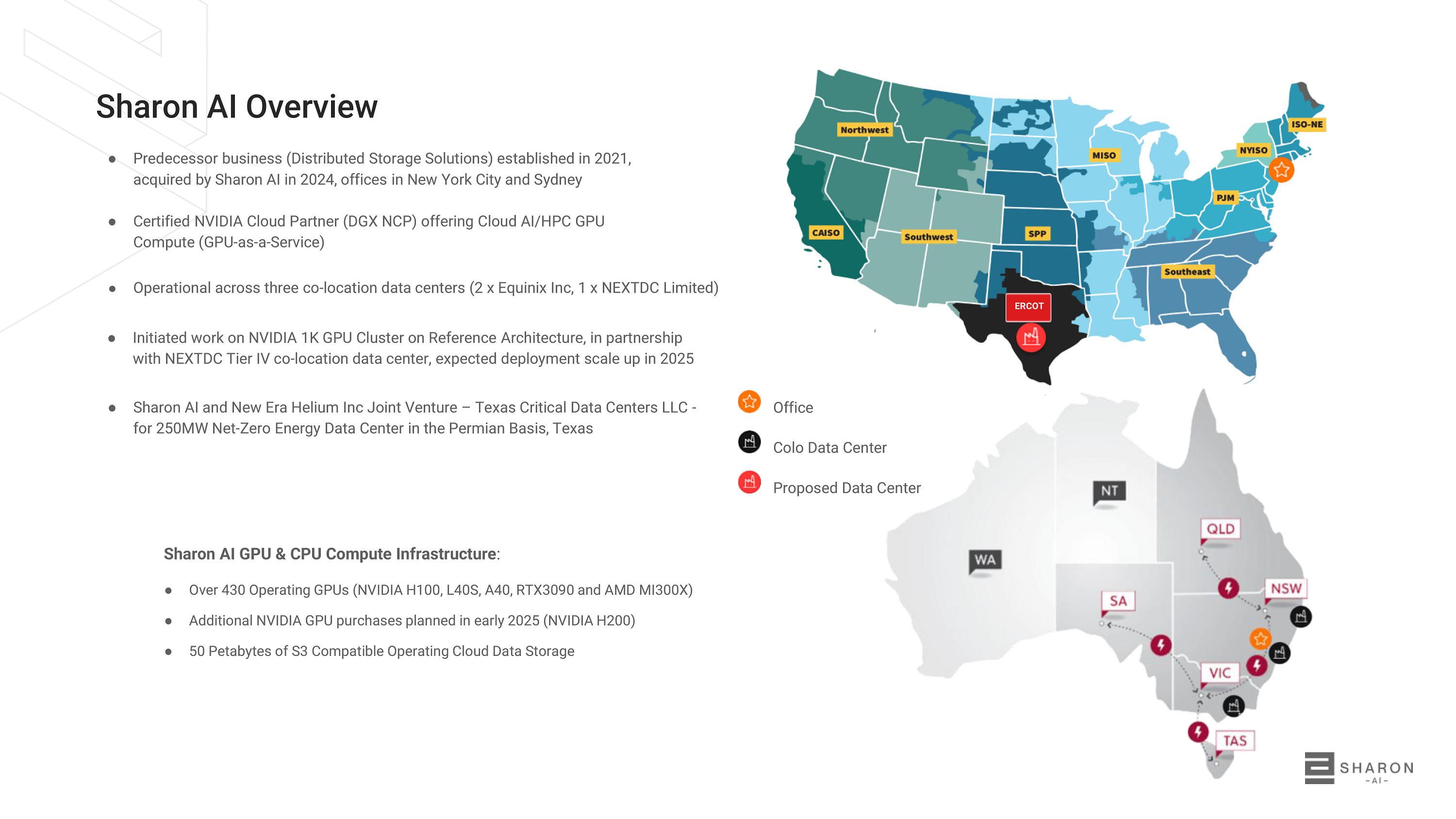

Sharon AI Overview Sharon AI GPU & CPU Compute Infrastructure : ● Over 430 Operating GPUs (NVIDIA H100, L40S, A40, RTX3090 and AMD MI300X) ● Additional NVIDIA GPU purchases planned in early 2025 (NVIDIA H200) ● 50 Petabytes of S3 Compatible Operating Cloud Data Storage ● Predecessor business (Distributed Storage Solutions) established in 2021, acquired by Sharon AI in 2024, offices in New York City and Sydney ● Certified NVIDIA Cloud Partner (DGX NCP) offering Cloud AI/HPC GPU Compute (GPU - as - a - Service) ● Operational across three co - location data centers (2 x Equinix Inc, 1 x NEXTDC Limited) ● Initiated work on NVIDIA 1K GPU Cluster on Reference Architecture, in partnership with NEXTDC Tier IV co - location data center, expected deployment scale up in 2025 ● Sharon AI and New Era Helium Inc Joint Venture – Texas Critical Data Centers LLC - for 250MW Net - Zero Energy Data Center in the Permian Basis, Texas Office Colo Data Center Proposed Data Center ERCOT

Our primary customers are businesses at the forefront of AI and HPC, including startups, SME’s and large enterprises looking to leverage AI for innovation and growth. Startups SMEs Enterprises Universities Research Institutes What we sell GPU Compute as a Service (GPUaaS) 01 Cloud Data Storage Solutions (CPUaaS) 02 Custom Orchestration Software Platform 03 04 Software (LLM’s, SaaS) + Hardware (GPUaaS) Our Customers

● LENOVO : Sharon AI has an existing commercial relationship with Lenovo for the supply of GPU/Servers. ● NVIDIA: Sharon AI is a certified NVIDIA Cloud Partner (NCP). ● NEXTDC : Sharon AI has an existing commercial relationship and GPU deployments with NEXTDC. Planned 1K GPU Cluster on NVIDIA Reference Architecture, in partnership with NEXTDC’s Tier IV co - location data center, target deployment scale up in 2025. AI/High Performance Computing Ecosystem

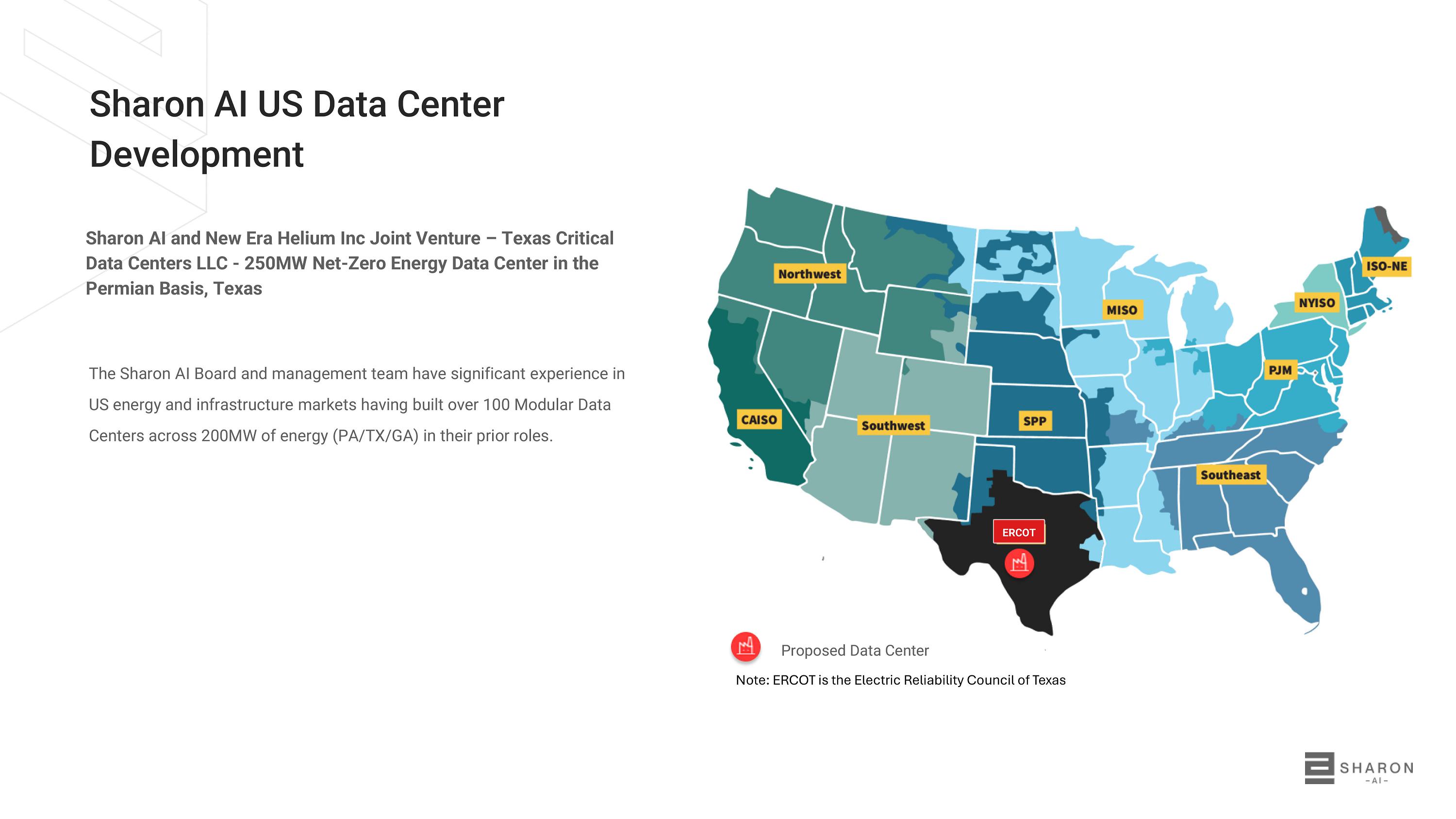

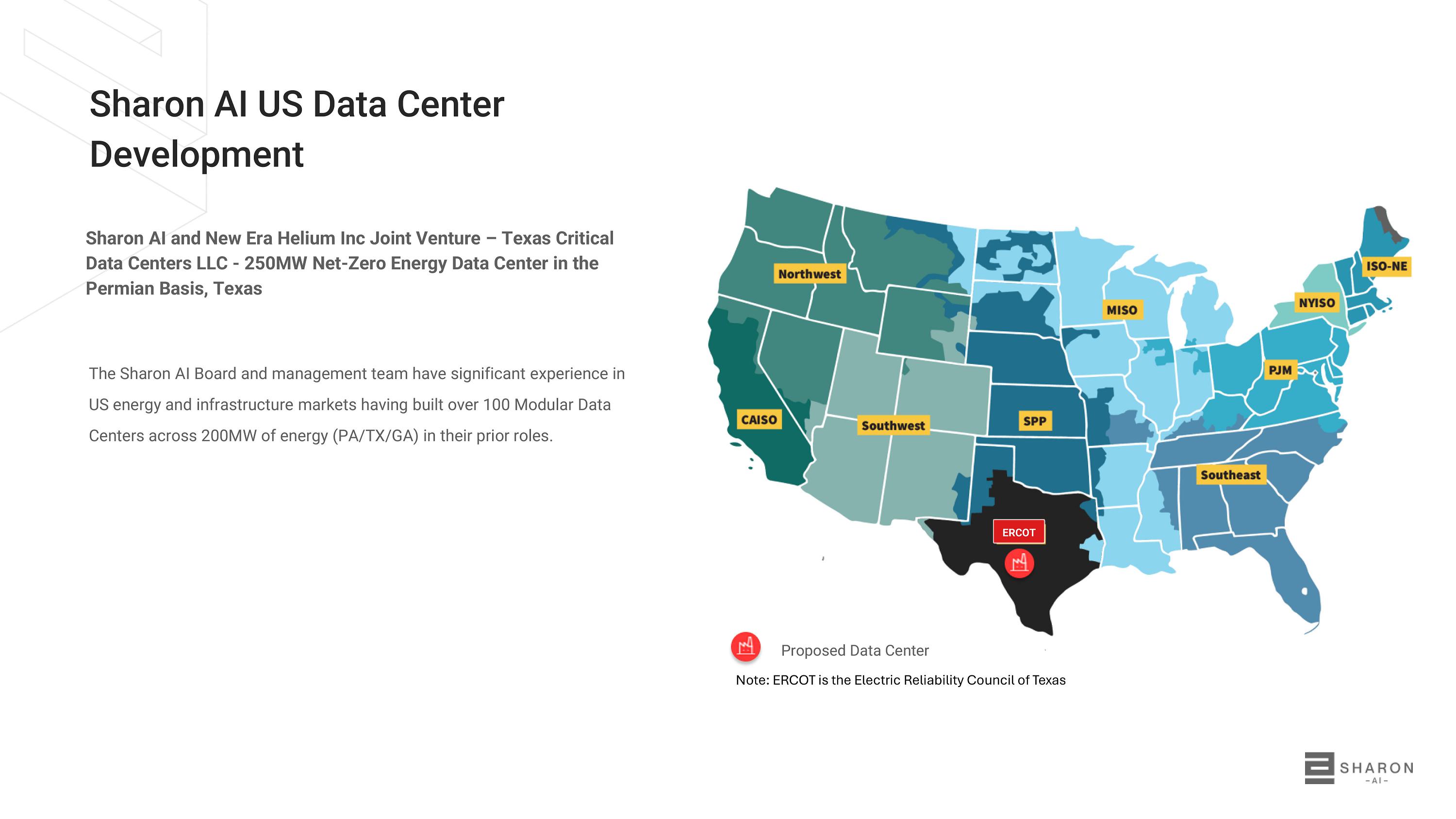

The Sharon AI Board and management team have significant experience in US energy and infrastructure markets having built over 100 Modular Data Centers across 200MW of energy (PA/TX/GA) in their prior roles. Sharon AI and New Era Helium Inc Joint Venture – Texas Critical Data Centers LLC - 250MW Net - Zero Energy Data Center in the Permian Basis, Texas Sharon AI US Data Center Development ERCOT Proposed Data Center Note: ERCOT is the Electric Reliability Council of Texas

1K GPU Cluster NVIDIA Reference Architecture - Sharon AI + NEXTDC A s a certified NVIDIA Cloud Partner, the Sharon AI team has invested considerable time with NVIDIA & NEXTDC engineers and solution architects throughout the planning and design phase for this planned H 200 GPU deployment . We believe this detailed design process ensures the cluster is aligned to the needs of large scale, Tier I Research, Financial Services & Insurance and Government customers given its comprehensive library of LLMs, tools and resources available in the NVIDIA AI Enterprise (NVAIE) software and Sharon AI’s proprietary orchestration and automation platform . In partnership with NEXTDC’s Tier IV co - location data center, expected deployment scale up in 2025 , with additional MW available for significant expansion . Sharon AI offers a broad range of enterprise AI/HPC GPU - as - a - Service (GPUaaS) – NVIDIA H100, L40S, A40 and RTX3090.

Direct Customers + Marketplaces + Key Relationships • Sharon AI has direct customers and participates across multiple marketplaces. We believe a diversified customer base is key to future growth. • We believe the planned 1K GPU Cluster will result in significant expansion of Tier 1 customers given it would be well suited to larger scale Research, Financial Services & Insurance and Government customers given its comprehensive library of LLMs, tools and resources available in the NVIDIA AI Enterprise (NVAIE) software and Sharon AI’s proprietary orchestration and automation platform. • Academia + Research are high priority targets for Sharon AI given the propensity for longer - term engagements. • Sharon AI and New Era Helium Inc Joint Venture – Texas Critical Data Centers LLC - for 250MW Net - Zero Energy Data Center in the Permian Basis, Texas preliminary discussions underway with potential tenants and other large offtake entities as anchor customers.

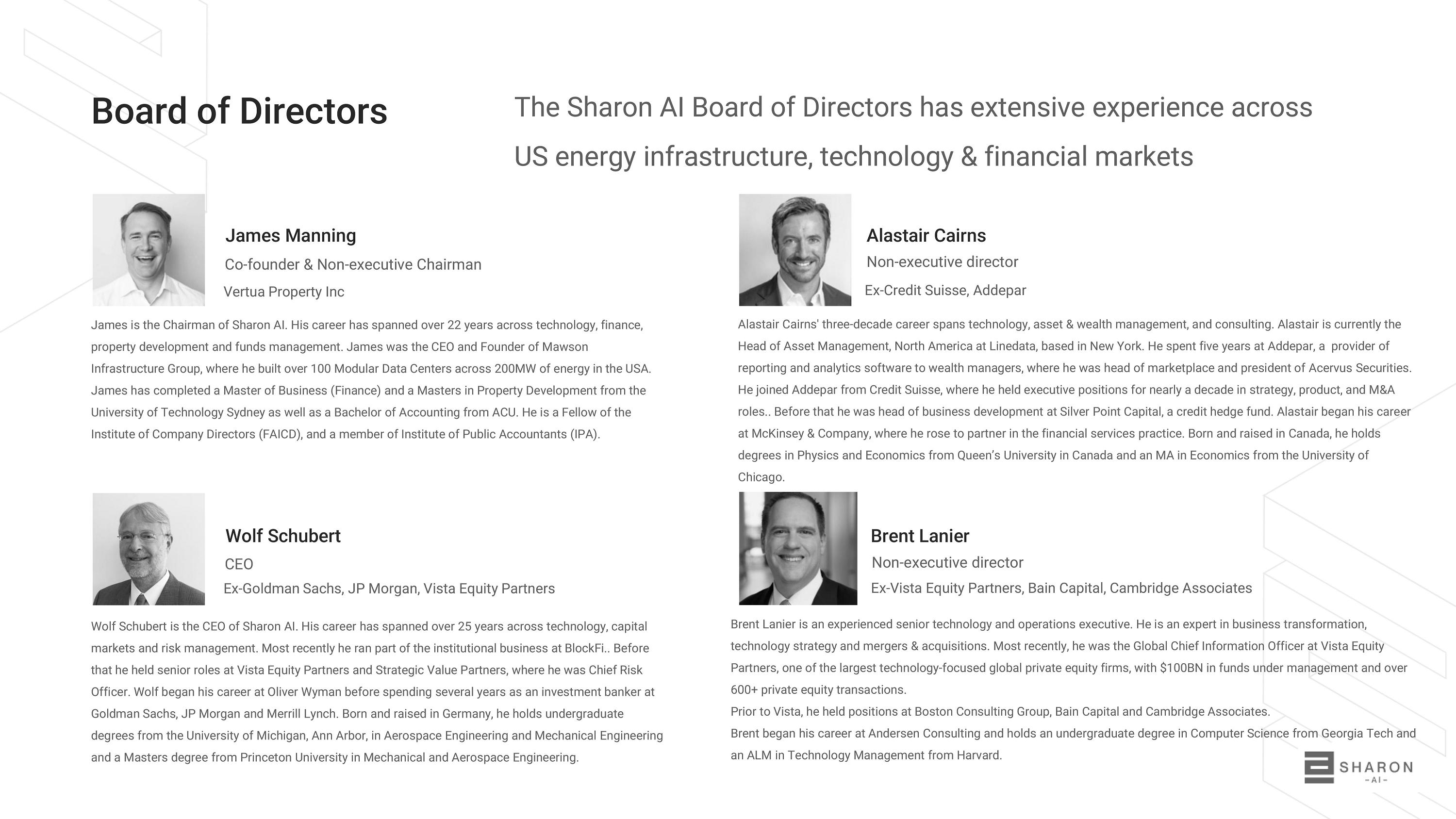

The Sharon AI Board of Directors has extensive experience across US energy infrastructure, technology & financial markets Board of Directors James Manning Co - founder & Non - executive Chairman Vertua Property Inc James is the Chairman of Sharon AI. His career has spanned over 22 years across technology, finance, property development and funds management. James was the CEO and Founder of Mawson Infrastructure Group, where he built over 100 Modular Data Centers across 200MW of energy in the USA. James has completed a Master of Business (Finance) and a Masters in Property Development from the University of Technology Sydney as well as a Bachelor of Accounting from ACU. He is a Fellow of the Institute of Company Directors (FAICD), and a member of Institute of Public Accountants (IPA). Wolf Schubert CEO Ex - Goldman Sachs, JP Morgan, Vista Equity Partners Wolf Schubert is the CEO of Sharon AI. His career has spanned over 25 years across technology, capital markets and risk management. Most recently he ran part of the institutional business at BlockFi.. Before that he held senior roles at Vista Equity Partners and Strategic Value Partners, where he was Chief Risk Officer. Wolf began his career at Oliver Wyman before spending several years as an investment banker at Goldman Sachs, JP Morgan and Merrill Lynch. Born and raised in Germany, he holds undergraduate degrees from the University of Michigan, Ann Arbor, in Aerospace Engineering and Mechanical Engineering and a Masters degree from Princeton University in Mechanical and Aerospace Engineering. Alastair Cairns Non - executive director Ex - Credit Suisse, Addepar Alastair Cairns' three - decade career spans technology, asset & wealth management, and consulting. Alastair is currently the Head of Asset Management, North America at Linedata, based in New York. He spent five years at Addepar, a provider of reporting and analytics software to wealth managers, where he was head of marketplace and president of Acervus Securities. He joined Addepar from Credit Suisse, where he held executive positions for nearly a decade in strategy, product, and M&A roles.. Before that he was head of business development at Silver Point Capital, a credit hedge fund. Alastair began his career at McKinsey & Company, where he rose to partner in the financial services practice. Born and raised in Canada, he holds degrees in Physics and Economics from Queen’s University in Canada and an MA in Economics from the University of Chicago. Brent Lanier Non - executive director Ex - Vista Equity Partners, Bain Capital, Cambridge Associates Brent Lanier is an experienced senior technology and operations executive. He is an expert in business transformation, technology strategy and mergers & acquisitions. Most recently, he was the Global Chief Information Officer at Vista Equity Partners, one of the largest technology - focused global private equity firms, with $100BN in funds under management and over 600+ private equity transactions. Prior to Vista, he held positions at Boston Consulting Group, Bain Capital and Cambridge Associates. Brent began his career at Andersen Consulting and holds an undergraduate degree in Computer Science from Georgia Tech and an ALM in Technology Management from Harvard.

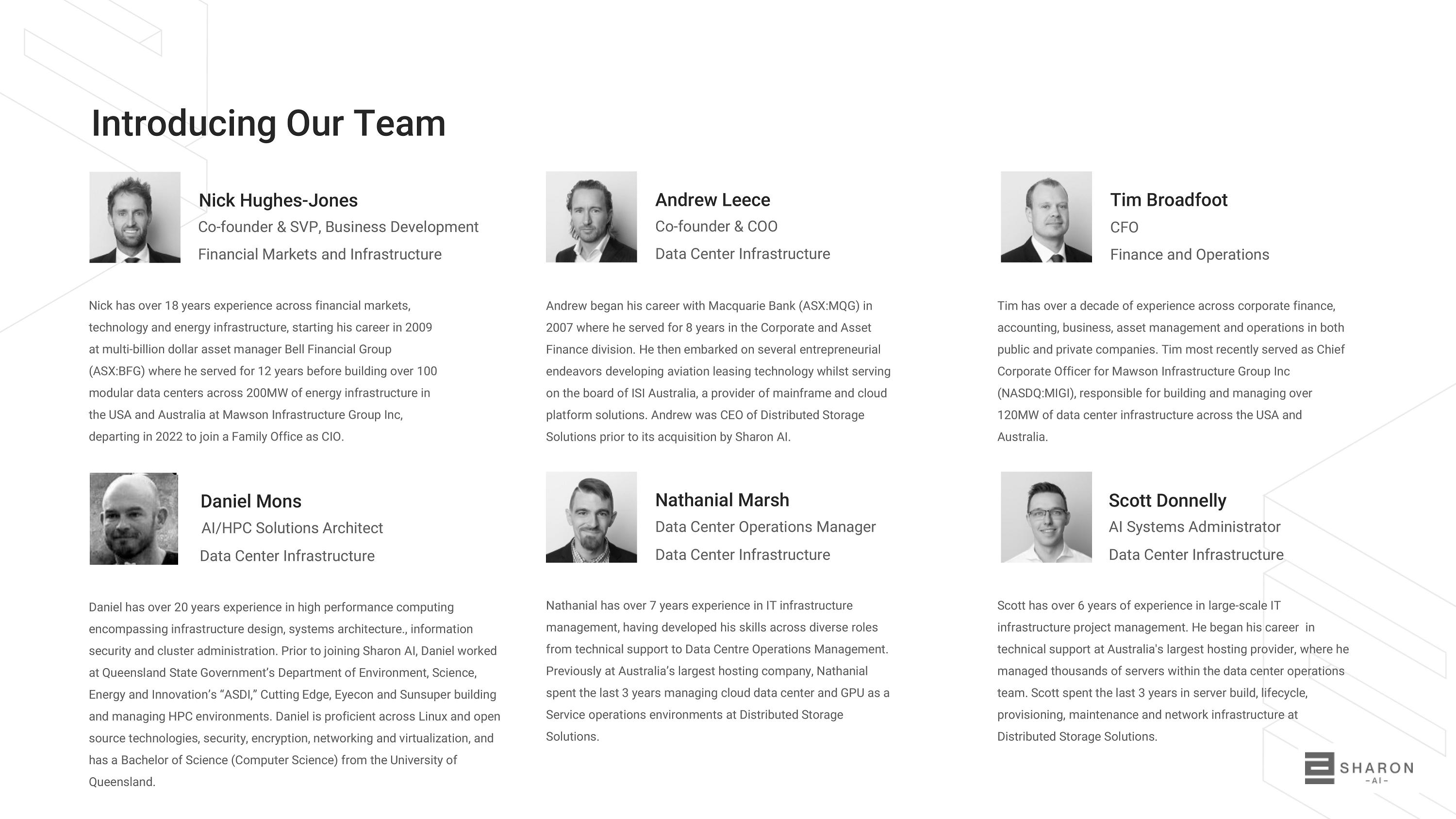

Nick Hughes - Jones Co - founder & SVP, Business Development Financial Markets & Infrastructure Nathanial Marsh Data Center Operations Manager Data Center Infrastructure Scott Donnelly AI Systems Administrator Data Center Infrastructure Andrew Leece Co - founder & COO Data Center Infrastructure Tim Broadfoot CFO Finance and Operations Daniel Mons AI/HPC Solutions Architect Data Center Infrastructure Led by a seasoned group of entrepreneurs and engineers with deep expertise in Energy Infrastructure, AI and Cloud Computing, our team is our greatest asset. Our Team See Appendix for detailed biographies.

Appendix Supplemental Information

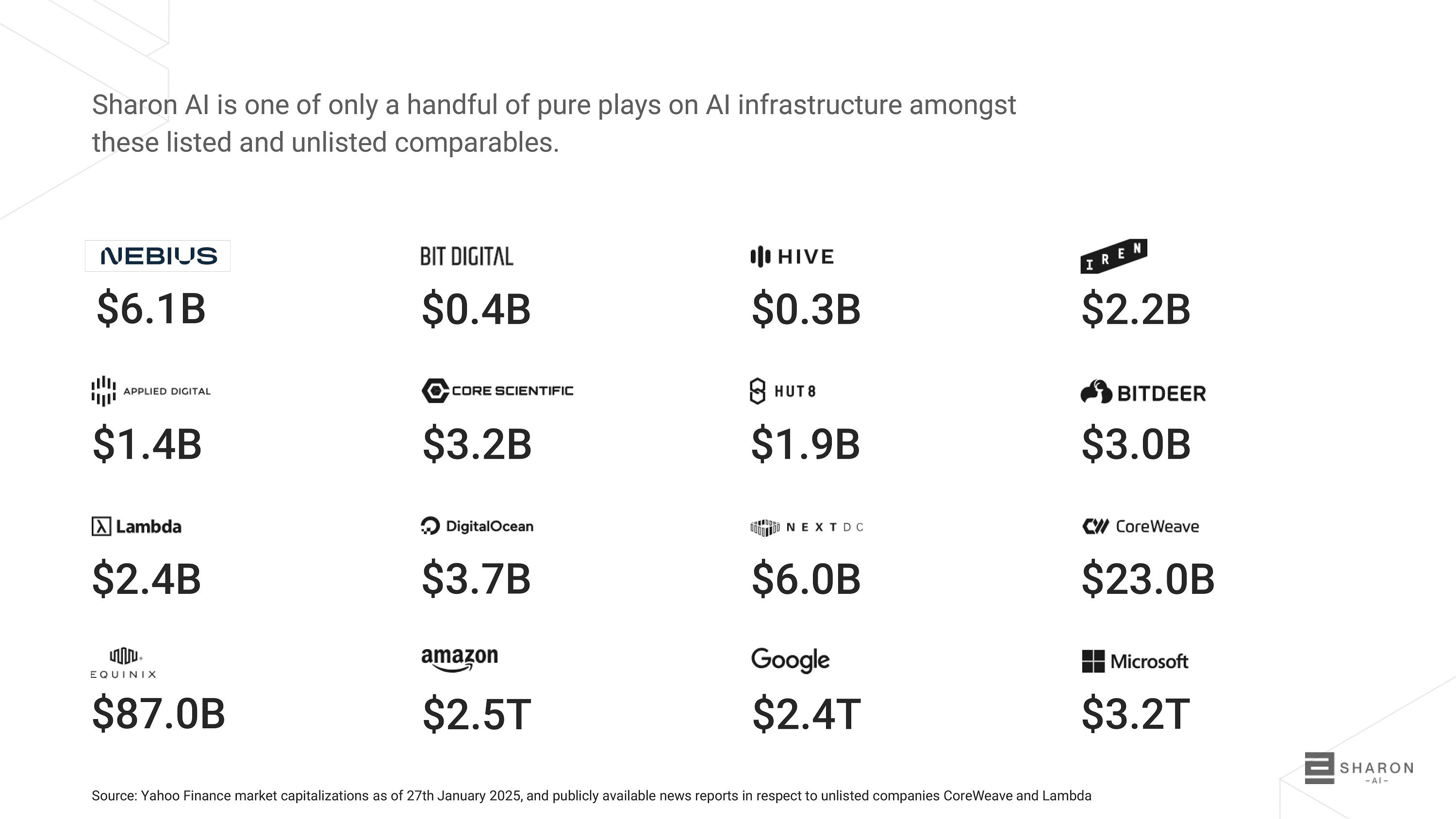

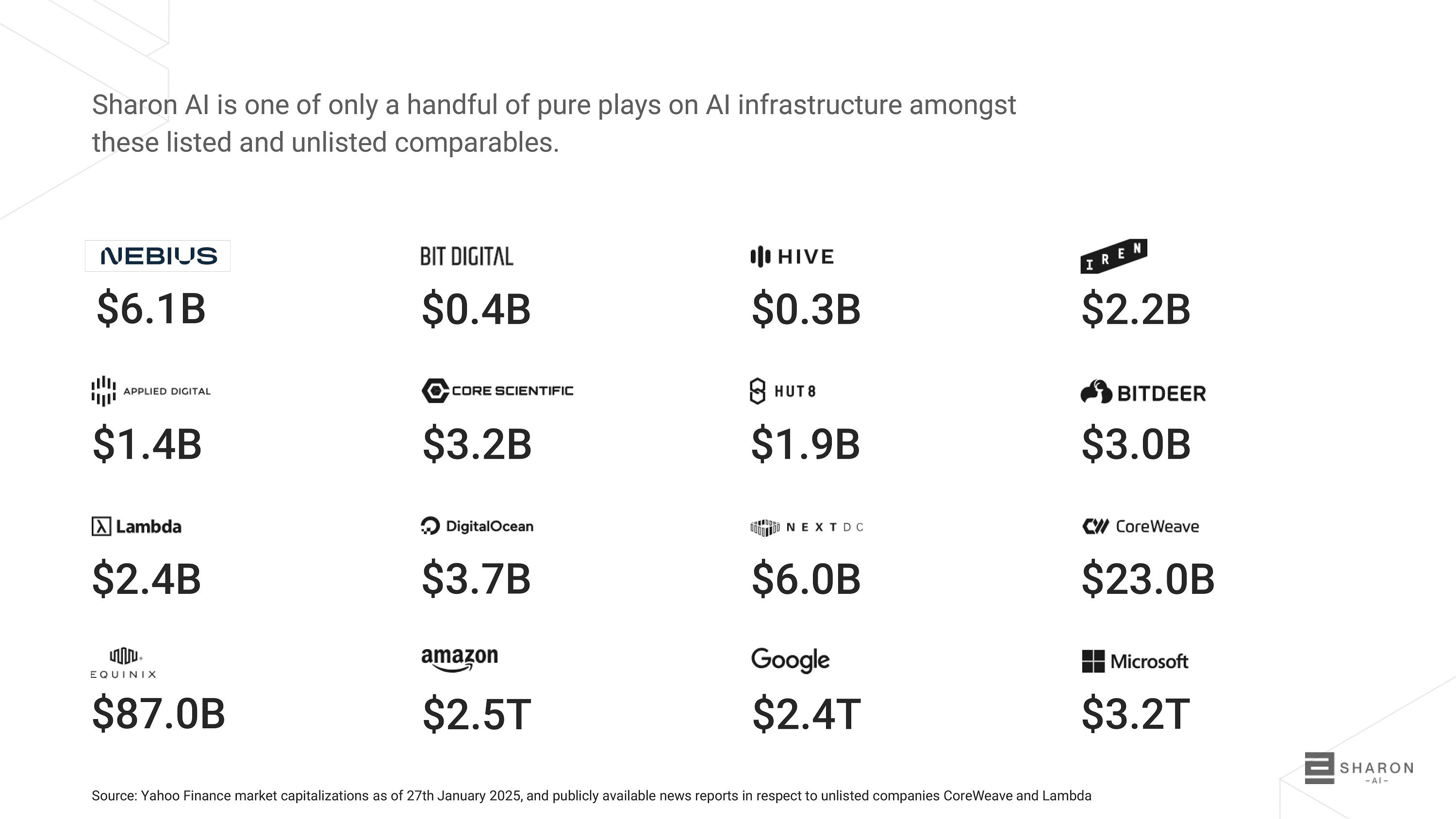

$2.2B $0.3B $0.4B $6.1B $3.0B $1.9B $3.2B $1.4B $23.0B $6.0B $3.7B $2.4B $3.2T $2.4T $2.5T $87.0B Sharon AI is one of only a handful of pure plays on AI infrastructure amongst these listed and unlisted comparables. Source: Yahoo Finance market capitalizations as of 27th January 2025, and publicly available news reports in respect to unlisted companies CoreWeave and Lambda

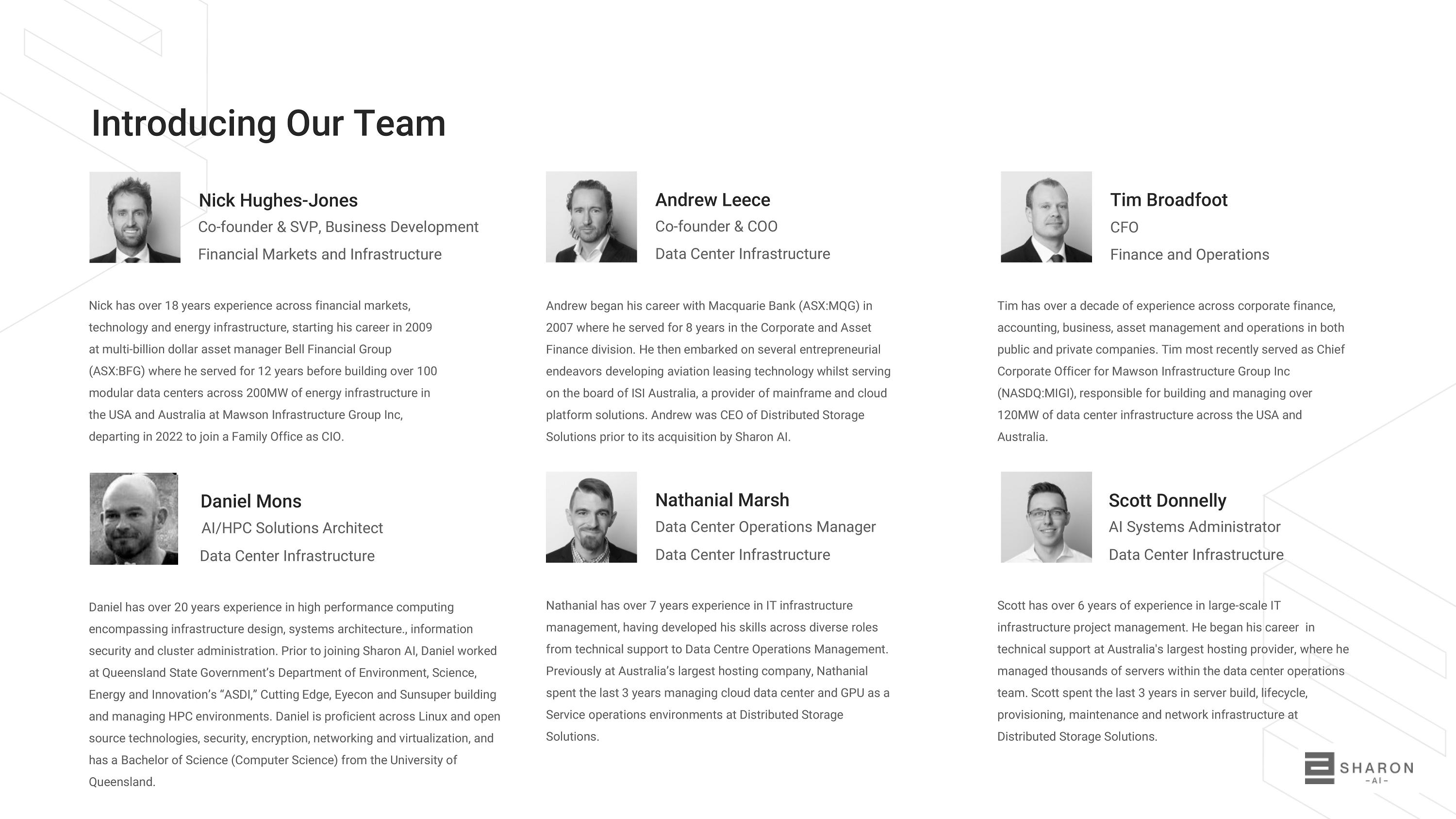

Daniel has over 20 years experience in high performance computing encompassing infrastructure design, systems architecture., information security and cluster administration. Prior to joining Sharon AI, Daniel worked at Queensland State Government’s Department of Environment, Science, Energy and Innovation’s “ASDI,” Cutting Edge, Eyecon and Sunsuper building and managing HPC environments. Daniel is proficient across Linux and open source technologies, security, encryption, networking and virtualization, and has a Bachelor of Science (Computer Science) from the University of Queensland. Nick has over 18 years experience across financial markets, technology and energy infrastructure, starting his career in 2009 at multi - billion dollar asset manager Bell Financial Group (ASX:BFG) where he served for 12 years before building over 100 modular data centers across 200MW of energy infrastructure in the USA and Australia at Mawson Infrastructure Group Inc, departing in 2022 to join a Family Office as CIO. Andrew began his career with Macquarie Bank (ASX:MQG) in 2007 where he served for 8 years in the Corporate and Asset Finance division. He then embarked on several entrepreneurial endeavors developing aviation leasing technology whilst serving on the board of ISI Australia, a provider of mainframe and cloud platform solutions. Andrew was CEO of Distributed Storage Solutions prior to its acquisition by Sharon AI. Nathanial has over 7 years experience in IT infrastructure management, having developed his skills across diverse roles from technical support to Data Centre Operations Management. Previously at Australia’s largest hosting company, Nathanial spent the last 3 years managing cloud data center and GPU as a Service operations environments at Distributed Storage Solutions. Tim has over a decade of experience across corporate finance, accounting, business, asset management and operations in both public and private companies. Tim most recently served as Chief Corporate Officer for Mawson Infrastructure Group Inc (NASDQ:MIGI), responsible for building and managing over 120MW of data center infrastructure across the USA and Australia. Scott has over 6 years of experience in large - scale IT infrastructure project management. He began his career in technical support at Australia's largest hosting provider, where he managed thousands of servers within the data center operations team. Scott spent the last 3 years in server build, lifecycle, provisioning, maintenance and network infrastructure at Distributed Storage Solutions. Daniel Mons AI/HPC Solutions Architect Data Center Infrastructure Nathanial Marsh Data Center Operations Manager Data Center Infrastructure Scott Donnelly AI Systems Administrator Data Center Infrastructure Andrew Leece Co - founder & COO Data Center Infrastructure Tim Broadfoot CFO Finance and Operations Nick Hughes - Jones Co - founder & SVP, Business Development Financial Markets and Infrastructure Introducing Our Team

APPENDIX Hypothetical Scenario Analysis

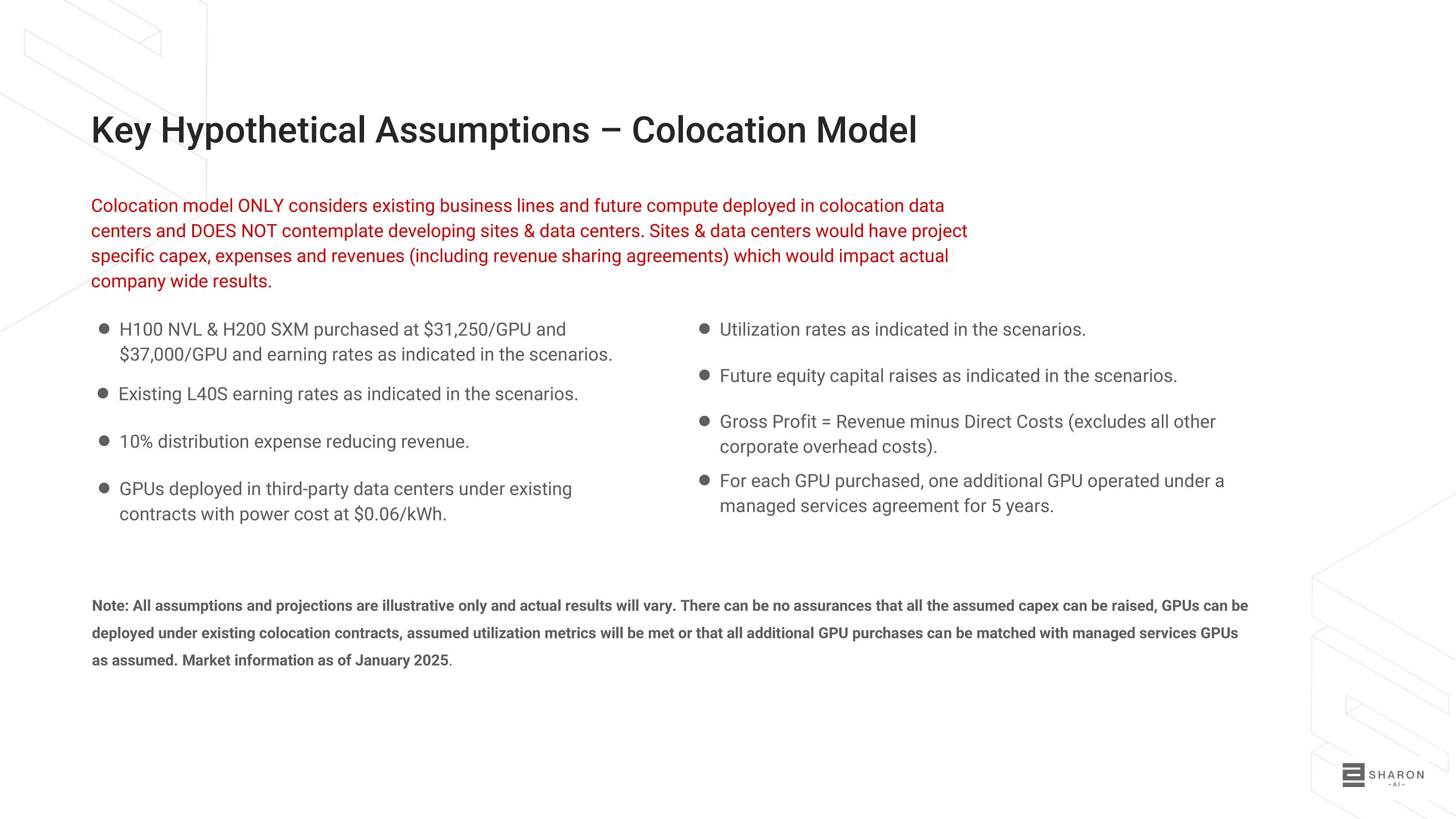

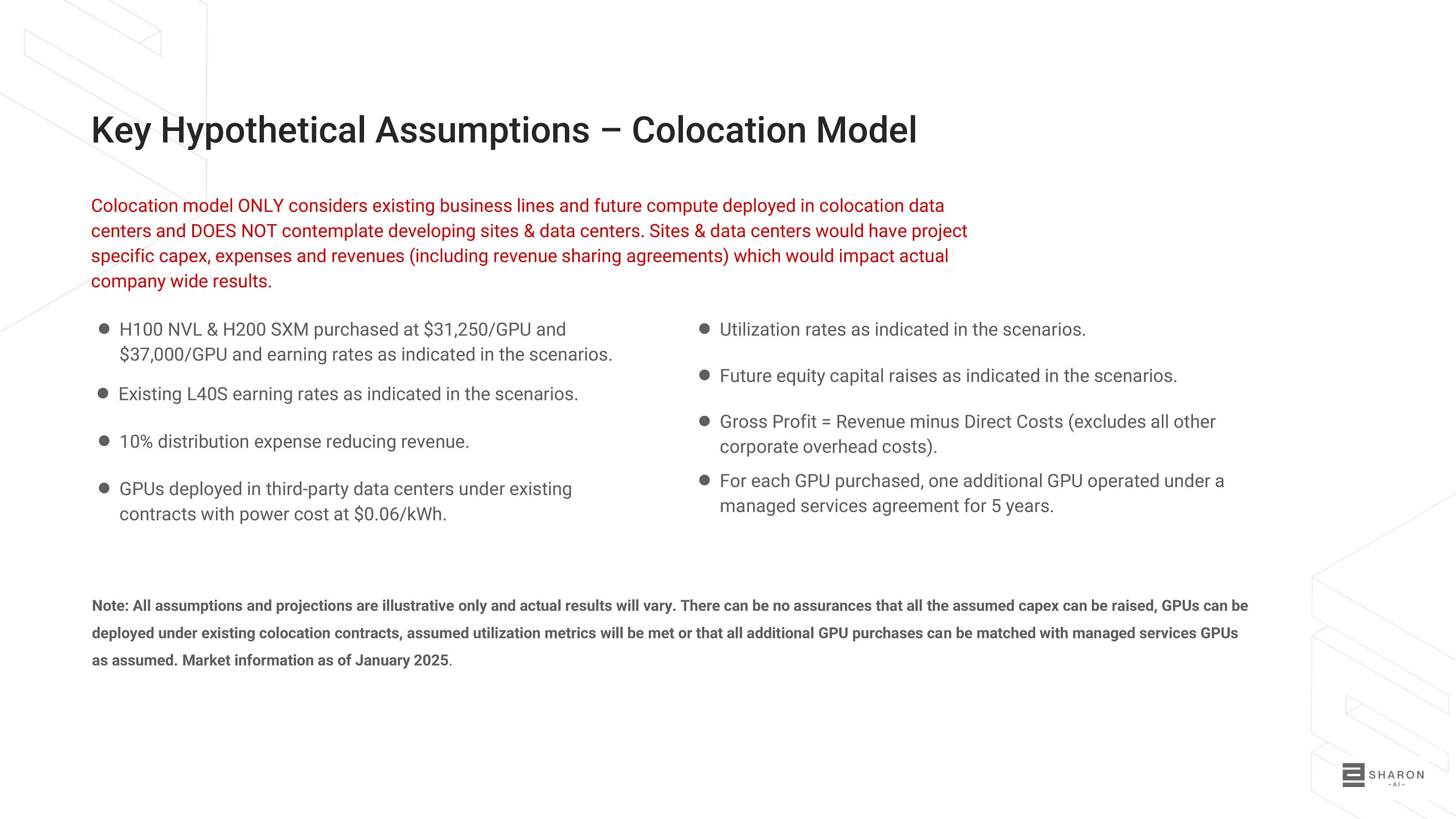

● H100 NVL & H200 SXM purchased at $31,250/GPU and $37,000/GPU and earning rates as indicated in the scenarios. ● Existing L40S earning rates as indicated in the scenarios. ● 10% distribution expense reducing revenue. ● GPUs deployed in third - party data centers under existing contracts with power cost at $0.06/kWh. ● Utilization rates as indicated in the scenarios. ● Future equity capital raises as indicated in the scenarios. ● Gross Profit = Revenue minus Direct Costs (excludes all other corporate overhead costs). ● For each GPU purchased, one additional GPU operated under a managed services agreement for 5 years. Colocation model ONLY considers existing business lines and future compute deployed in colocation data centers and DOES NOT contemplate developing sites & data centers. Sites & data centers would have project specific capex, expenses and revenues (including revenue sharing agreements) which would impact actual company wide results. Note: All assumptions and projections are illustrative only and actual results will vary. There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed. Market information as of January 2025 . Key Hypothetical Assumptions – Colocation Model

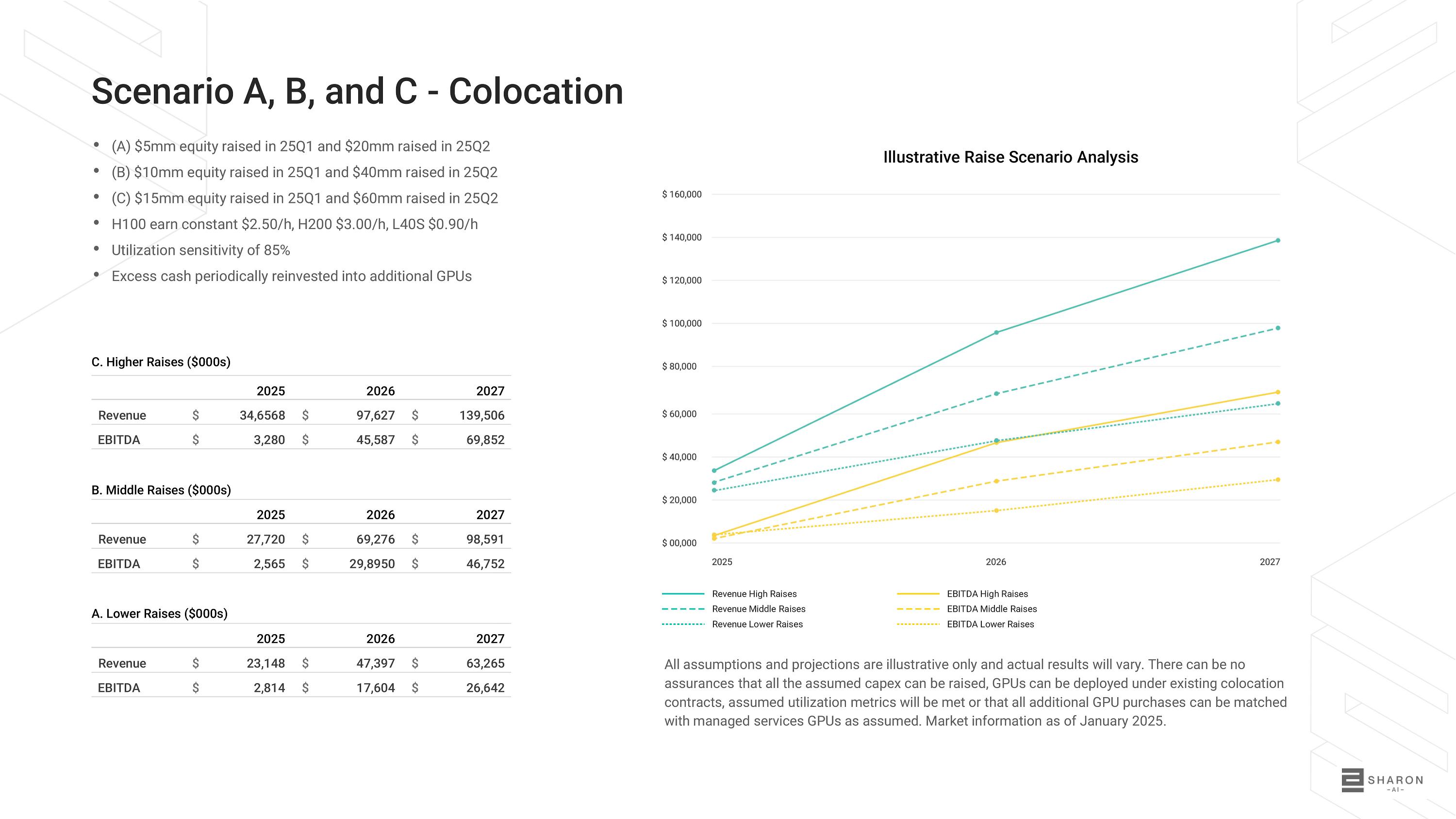

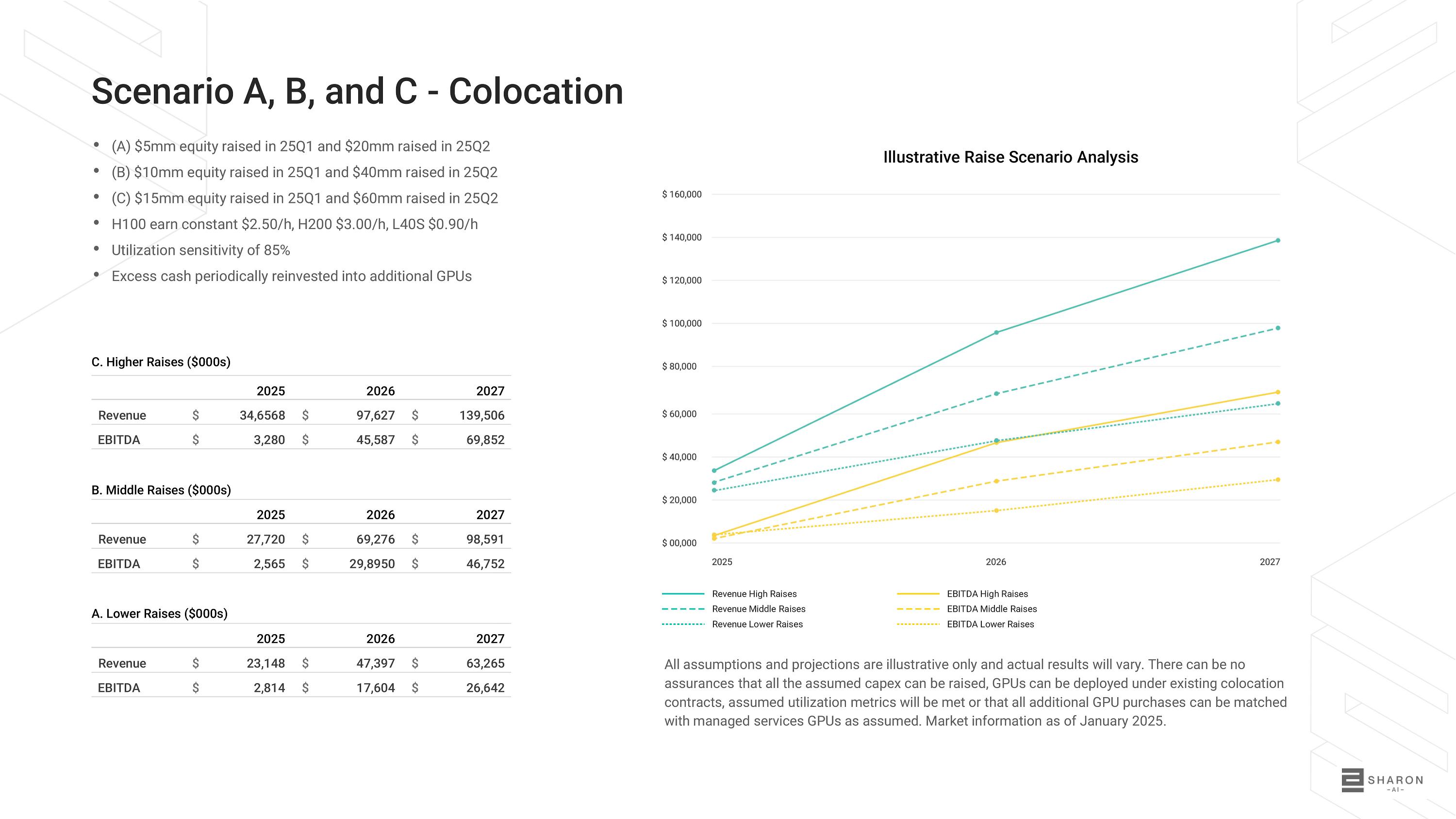

Illustrative Raise Scenario Analysis $ $ 2027 2026 2025 $ 63,265 $ 47,397 $ 23,148 Revenue $ 26,642 $ 17,604 $ 2,814 EBITDA 2025 27,720 $ 2,565 $ C. Higher Raises ($000s) 2027 2026 2025 $ 139,506 $ 97,627 $ 34,6568 Revenue $ 69,852 $ 45,587 $ 3,280 EBITDA B. Middle Raises ($000s) A. Lower Raises ($000s) Revenue EBITDA 2026 69,276 $ 29,8950 $ 2027 98,591 46,752 Scenario A, B, and C - Colocation • (A) $5mm equity raised in 25Q1 and $20mm raised in 25Q2 • (B) $10mm equity raised in 25Q1 and $40mm raised in 25Q2 • (C) $15mm equity raised in 25Q1 and $60mm raised in 25Q2 • H100 earn constant $2.50/h, H200 $3.00/h, L40S $0.90/h • Utilization sensitivity of 85% • Excess cash periodically reinvested into additional GPUs $ 160,000 $ 140,000 $ 120,000 $ 100,000 $ 80,000 $ 60,000 $ 40,000 $ 20,000 $ 00,000 2025 2026 2027 Revenue High Raises Revenue Middle Raises Revenue Lower Raises EBITDA High Raises EBITDA Middle Raises EBITDA Lower Raises All assumptions and projections are illustrative only and actual results will vary. There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed. Market information as of January 2025.

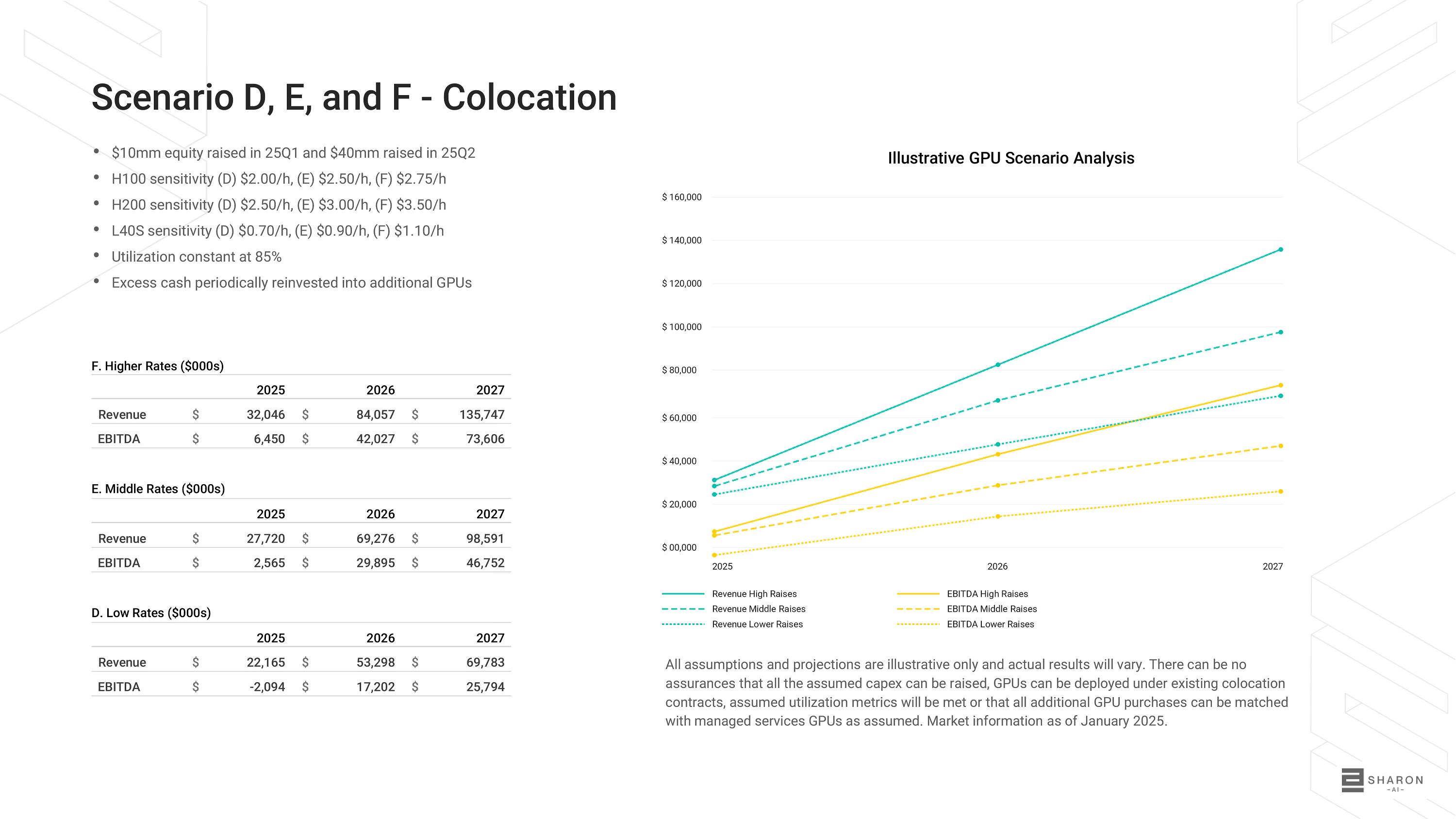

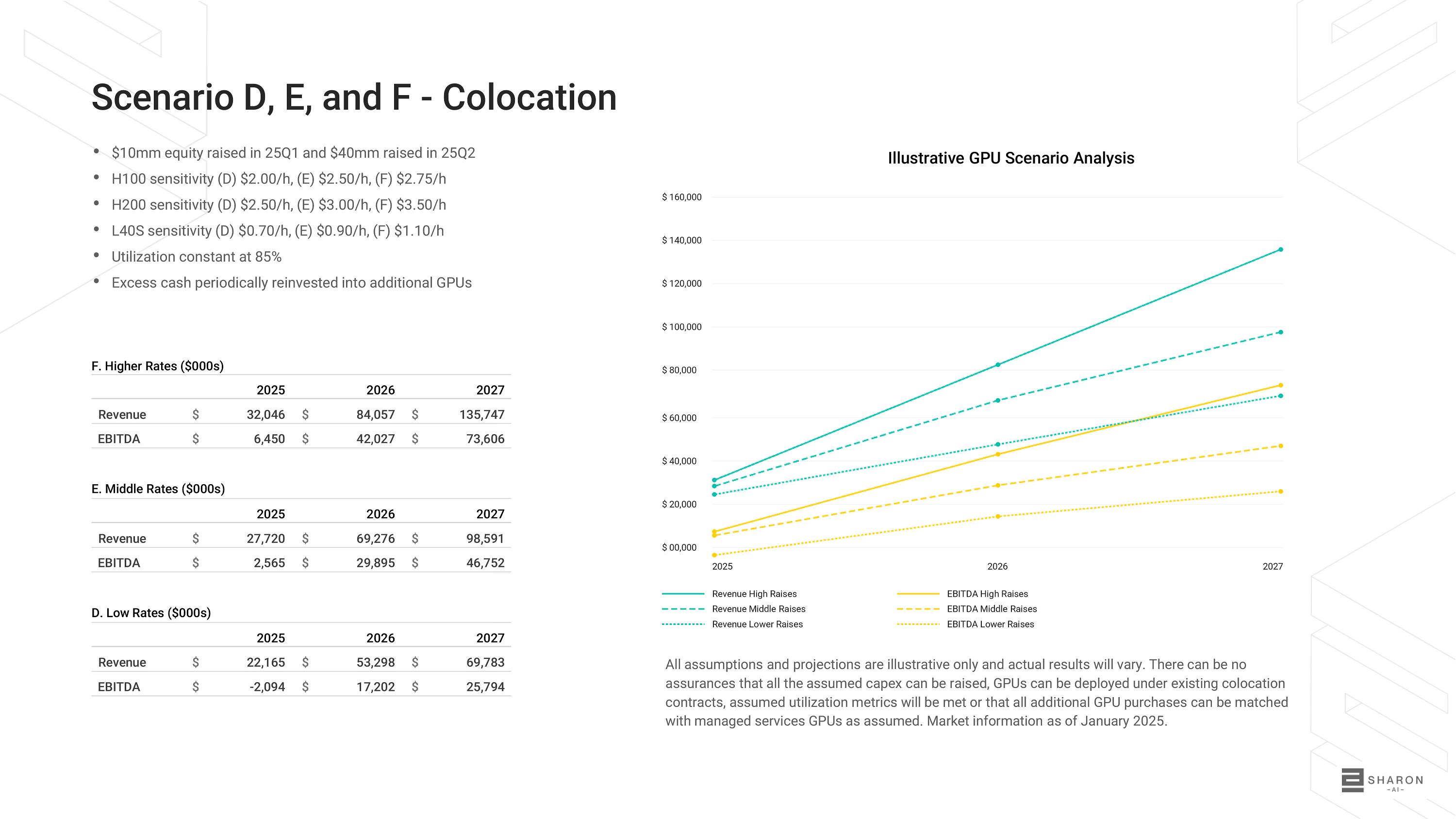

Illustrative GPU Scenario Analysis Scenario D, E, and F - Colocation • $10mm equity raised in 25Q1 and $40mm raised in 25Q2 • H100 sensitivity (D) $2.00/h, (E) $2.50/h, (F) $2.75/h • H200 sensitivity (D) $2.50/h, (E) $3.00/h, (F) $3.50/h • L40S sensitivity (D) $0.70/h, (E) $0.90/h, (F) $1.10/h • Utilization constant at 85% • Excess cash periodically reinvested into additional GPUs 2027 2026 2025 $ 60,000 $ 135,747 $ 84,057 Revenue $ 32,046 $ 73,606 $ 42,027 EBITDA $ 6,450 $ 40,000 E. Middle Rates ($000s) $ 20,000 2027 2026 2025 $ 98,591 $ 00,000 $ 69,276 $ 27,720 Revenue $ 46,752 $ 29,895 $ 2,565 EBITDA 2027 2026 2025 $ 69,783 $ 53,298 $ 22,165 Revenue $ 25,794 $ 17,202 $ - 2,094 EBITDA F. Higher Rates ($000s) D. Low Rates ($000s) $ 160,000 $ 140,000 $ 120,000 $ 100,000 $ 80,000 2025 2026 2027 Revenue High Raises Revenue Middle Raises Revenue Lower Raises EBITDA High Raises EBITDA Middle Raises EBITDA Lower Raises All assumptions and projections are illustrative only and actual results will vary. There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed. Market information as of January 2025.

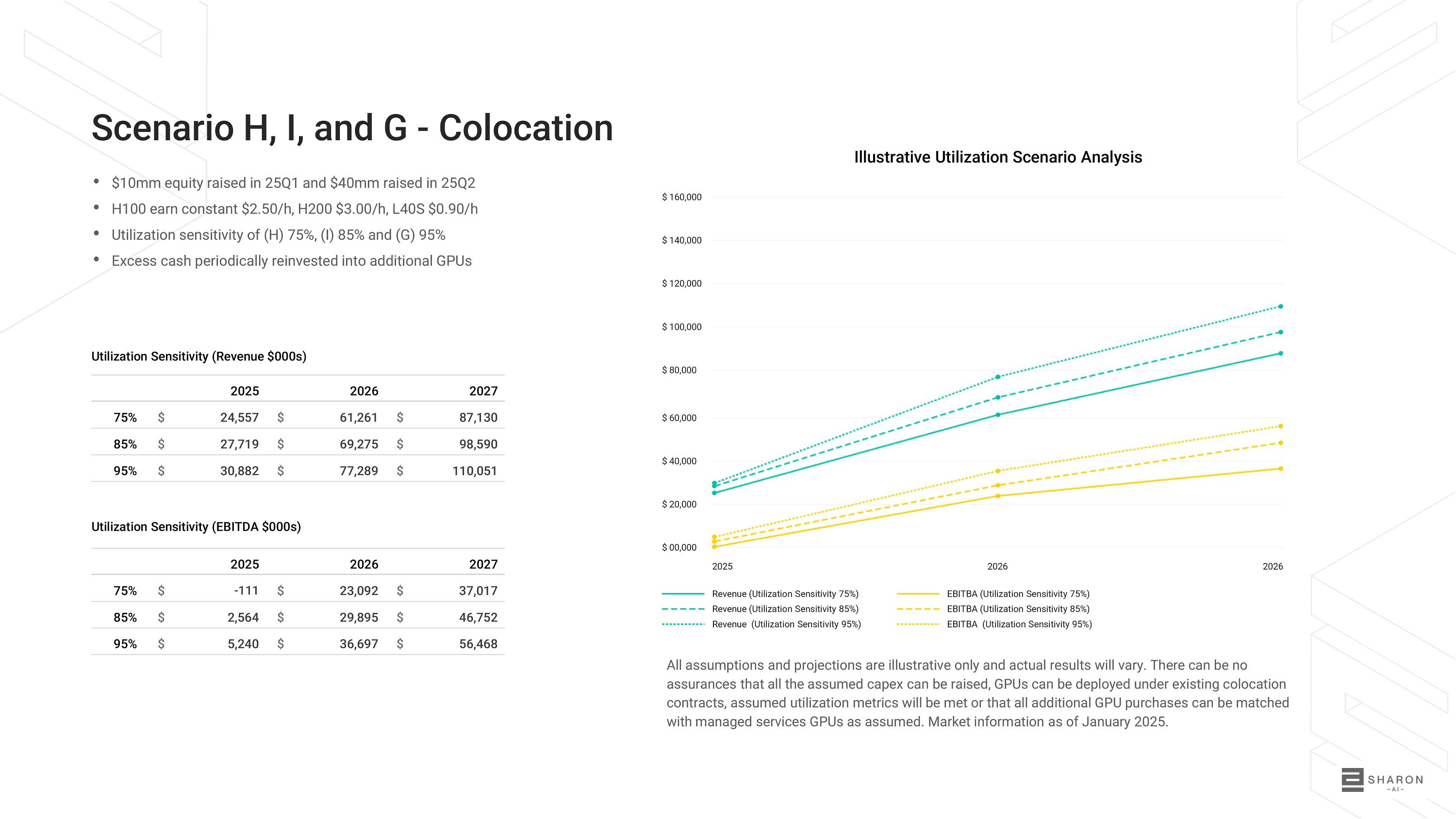

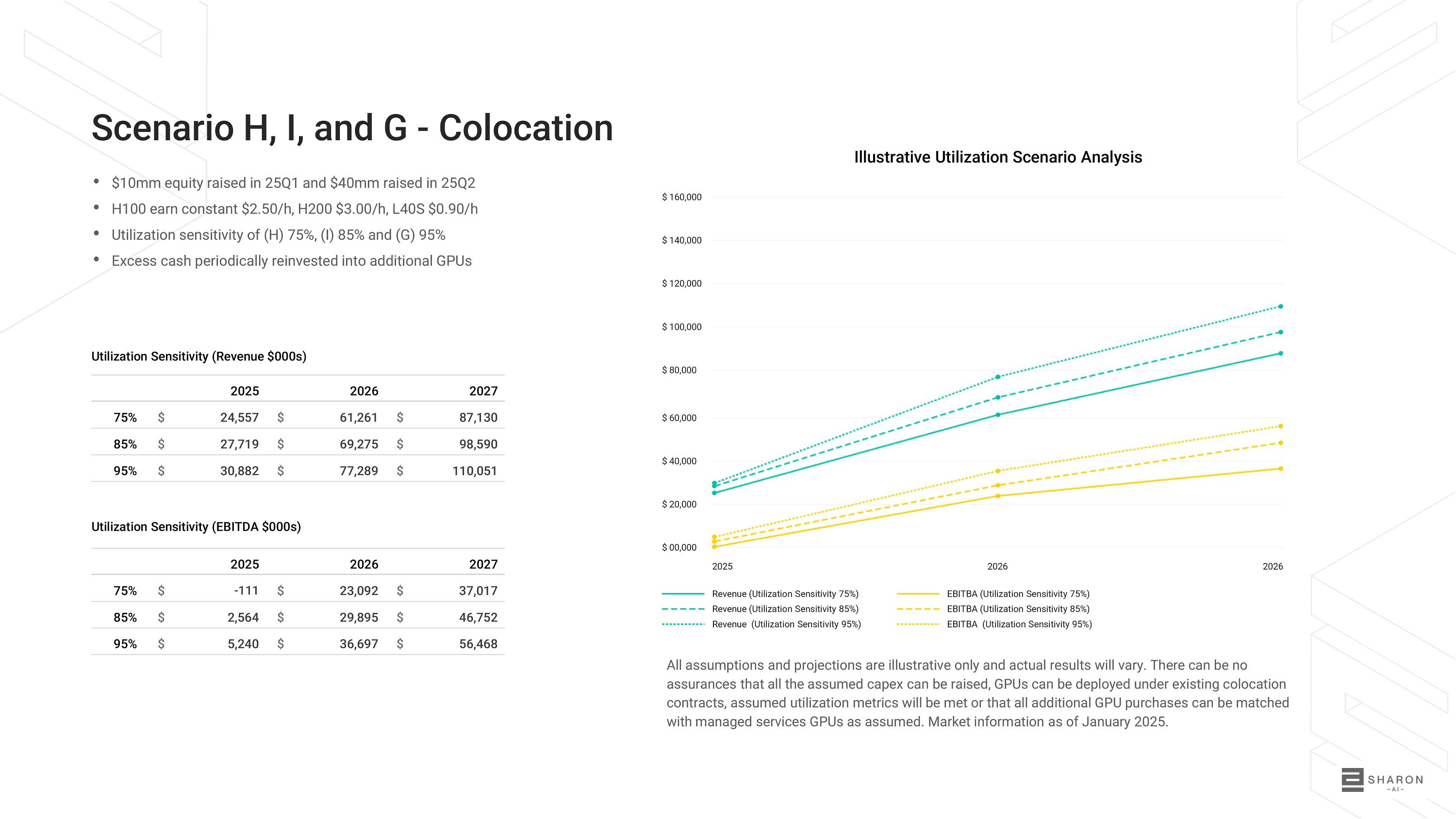

Scenario H, I, and G - Colocation • $10mm equity raised in 25Q1 and $40mm raised in 25Q2 • H100 earn constant $2.50/h, H200 $3.00/h, L40S $0.90/h • Utilization sensitivity of (H) 75%, (I) 85% and (G) 95% • Excess cash periodically reinvested into additional GPUs Illustrative Utilization Scenario Analysis 2027 2026 2025 $ 87,130 $ 61,261 $ 24,557 75% $ 98,590 $ 69,275 $ 27,719 85% $ 110,051 $ 77,289 $ 30,882 95% 2025 Utilization Sensitivity (Revenue $000s) Utilization Sensitivity (EBITDA $000s) 2026 2027 All assumptions and projections are illustrative only and actual results will vary. There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed. Market information as of January 2025. $ 160,000 $ 140,000 $ 120,000 $ 100,000 $ 80,000 $ 60,000 $ 40,000 $ 20,000 $ 00,000 2025 2026 2026 Revenue (Utilization Sensitivity 75%) EBITBA (Utilization Sensitivity 75%) $ 37,017 $ 23,092 $ - 111 75% EBITBA (Utilization Sensitivity 85%) EBITBA (Utilization Sensitivity 95%) Revenue (Utilization Sensitivity 85%) Revenue (Utilization Sensitivity 95%) 46,752 $ 29,895 $ 2,564 $ 85% 56,468 $ 36,697 $ 5,240 $ 95%

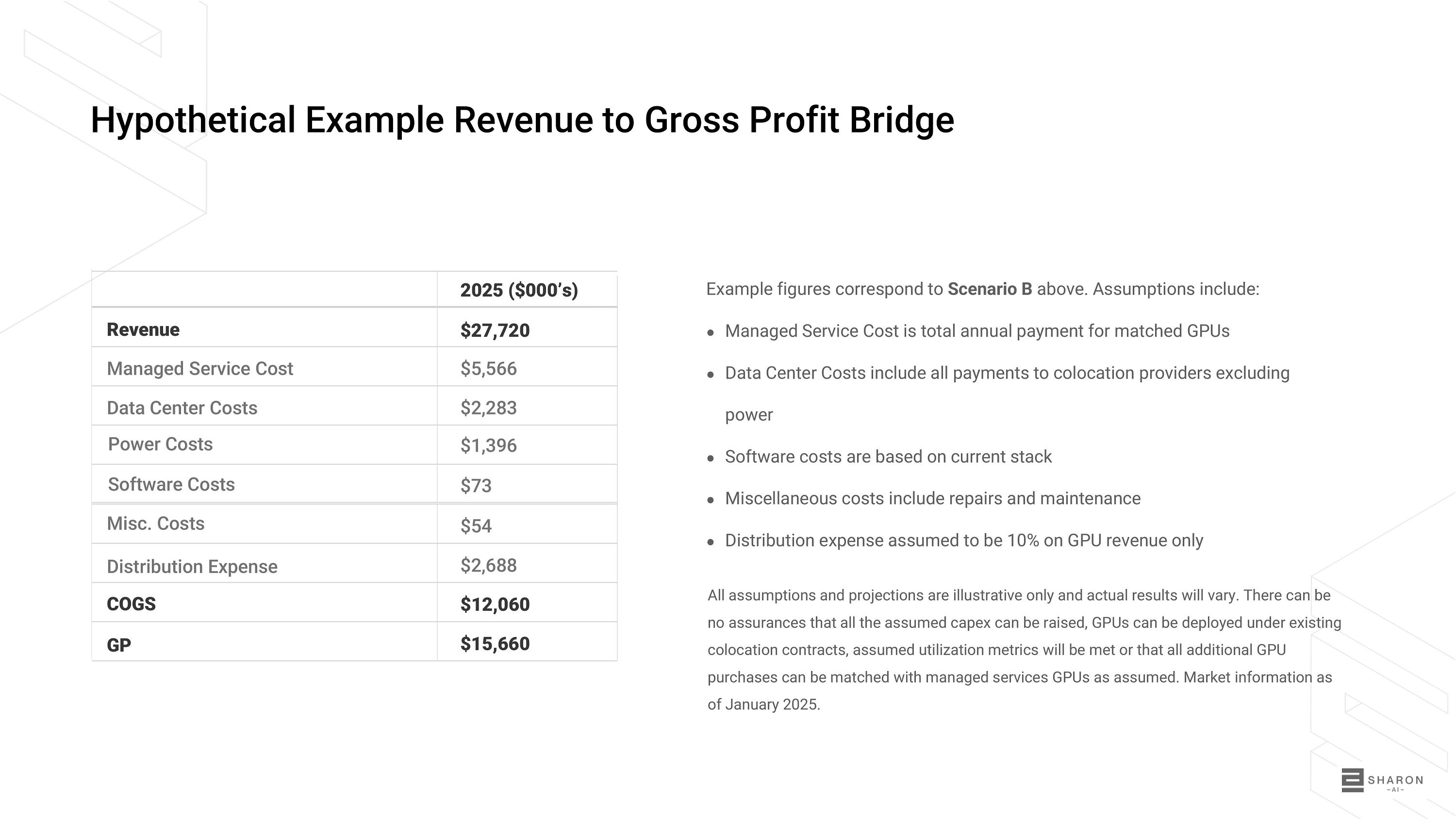

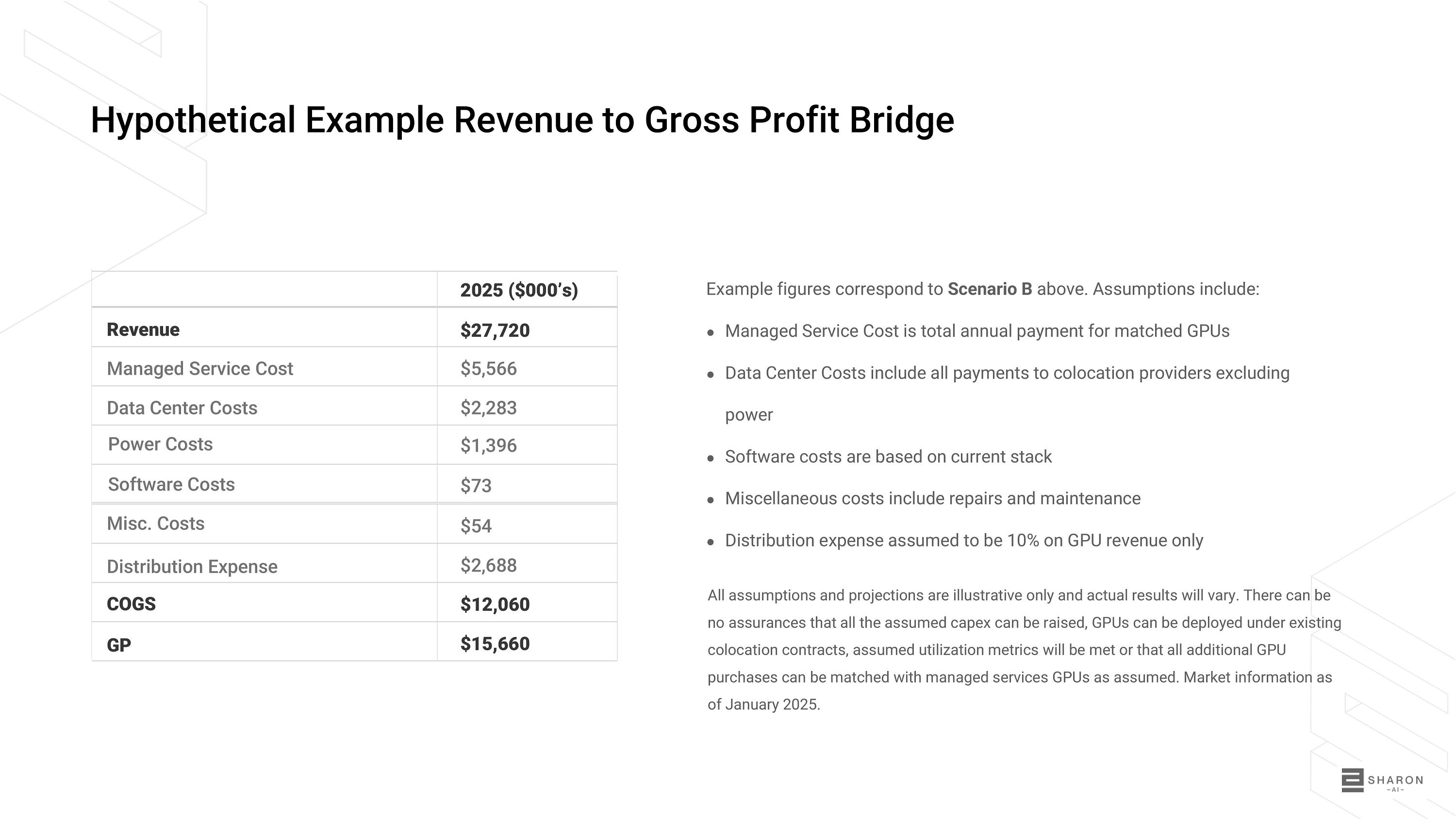

Hypothetical Example Revenue to Gross Profit Bridge 2025 ($000’s) $27,720 Revenue $5,566 Managed Service Cost $2,283 Data Center Costs $1,396 Power Costs $73 Software Costs $54 Misc. Costs $2,688 Distribution Expense $12,060 COGS $15,660 GP Example figures correspond to Scenario B above. Assumptions include: ● Managed Service Cost is total annual payment for matched GPUs ● Data Center Costs include all payments to colocation providers excluding power ● Software costs are based on current stack ● Miscellaneous costs include repairs and maintenance ● Distribution expense assumed to be 10% on GPU revenue only All assumptions and projections are illustrative only and actual results will vary. There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed. Market information as of January 2025.

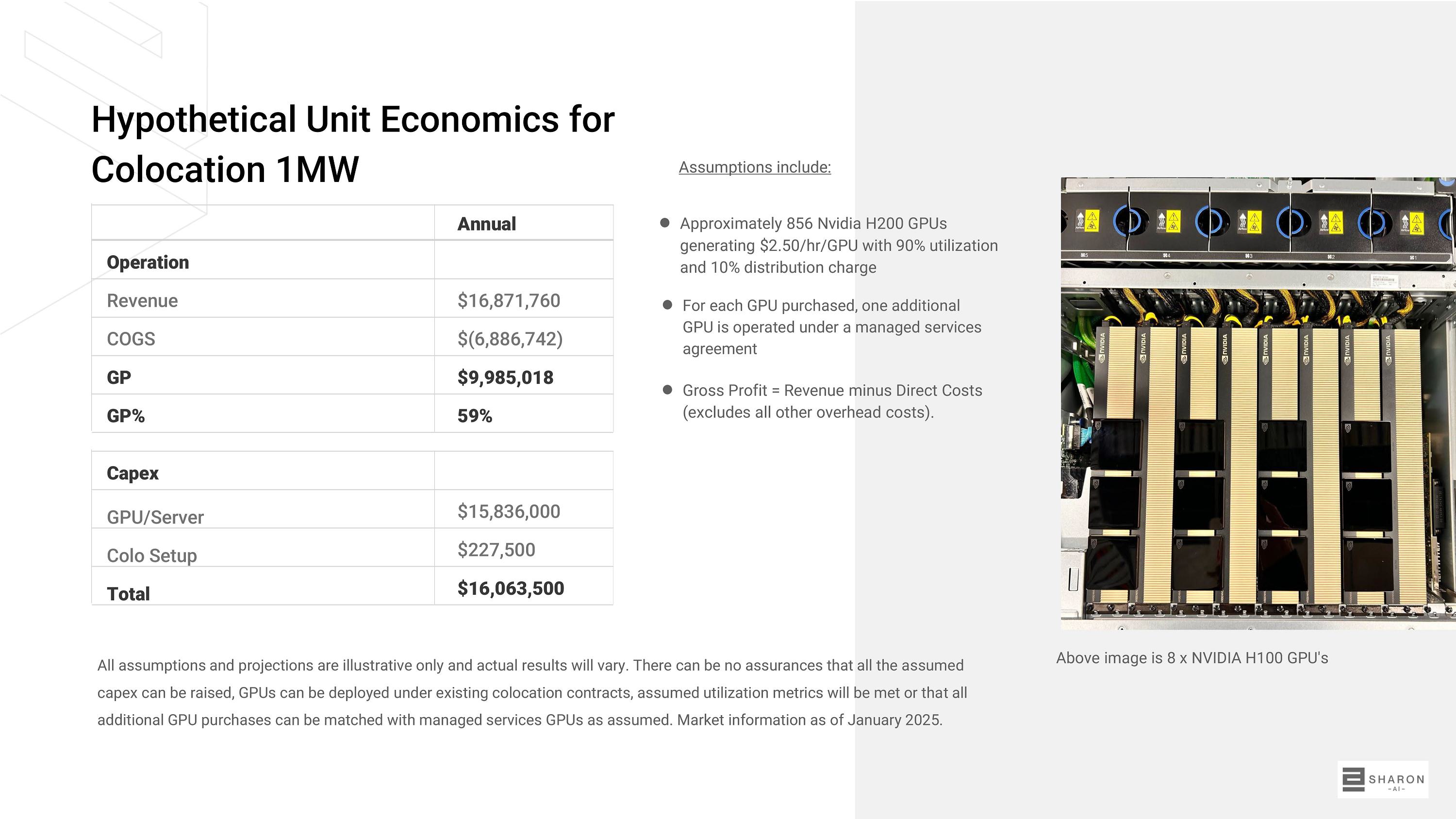

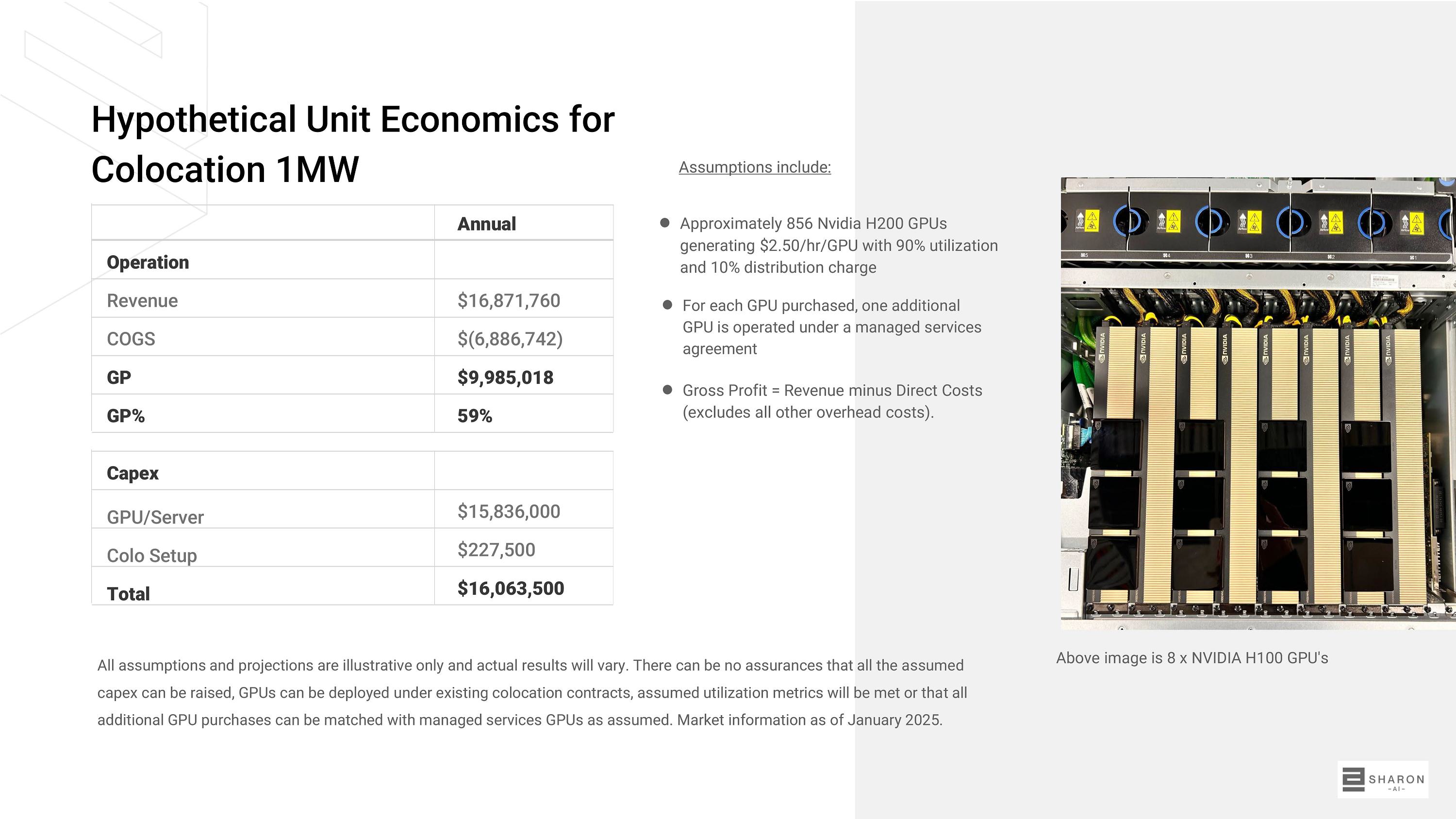

Hypothetical Unit Economics for Colocation 1MW Annual Operation $16,871,760 Revenue $(6,886,742) COGS $9,985,018 GP 59% GP% Capex GPU/Server Colo Setup Total $15,836,000 $227,500 $16,063,500 ● Approximately 856 Nvidia H200 GPUs generating $2.50/hr/GPU with 90% utilization and 10% distribution charge ● For each GPU purchased, one additional GPU is operated under a managed services agreement ● Gross Profit = Revenue minus Direct Costs (excludes all other overhead costs). All assumptions and projections are illustrative only and actual results will vary . There can be no assurances that all the assumed capex can be raised, GPUs can be deployed under existing colocation contracts, assumed utilization metrics will be met or that all additional GPU purchases can be matched with managed services GPUs as assumed . Market information as of January 2025 . Assumptions include: Above image is 8 x NVIDIA H100 GPU's

Sharon AI Inc 745 Fifth Avenue, Suite 500 New York, NY 10151 Please contact us for more information at info@sharonai.com www.sharonai.com @sharon ai Sharon AI