Unleash Time 2seventy bio company presentation January 2023

Cautionary note regarding forward-looking statements 2 These slides and the accompanying oral presentation may contain “forward-looking statements”. These statements include, but are not limited to: statements about our plans, strategies, timelines and expectations with respect to the development, manufacture or sale of our product candidates, including the design, initiation, enrollment and completion of pre-clinical and clinical studies; timelines for the results of ongoing and planned clinical trials for our product candidates and for ABECMA (ide-cel) in additional indications; the timing or likelihood of regulatory filings and acceptances and approvals thereof; expectations as to the market size for ABECMA and any other approved product we may successfully develop; the progress and results of our commercialization of ABECMA, including our goal of increasing manufacturing capacity and improving the manufacturing process and the number of patients that are expected to be treated with ABECMA in the commercial setting and potential late line global revenue for ABECMA; anticipated revenues resulting from sales of ABECMA; statements about the efficacy and perceived therapeutic benefits of our product candidates and the potential indications and market opportunities therefor; statements about the strategic plans for 2seventy bio and potential corporate development opportunities, including manufacturing expectations and benefits received from collaborations; statements about our ability to operate as a stand-alone company and execute our strategic priorities; and expectations regarding our use of capital, expenses and other future financial results, including our net cash spend, cash runway and U.S. net revenue for ABECMA in 2023. Any forward-looking statements in this presentation are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this presentation, including, without limitation, the risk that the market opportunities for our approved product or any future approved product are smaller than we believe they are; the risk that BMS, upon whom we rely for the successful development and commercialization of ABECMA does not devote sufficient resources thereto, is unsuccessful in its efforts, or chooses to terminate its agreements with us; the risk that we and/or BMS or our third party vendors will be unable to increase manufacturing and supply capacity for ABECMA; the risk that our BLAs, sBLAs and INDs will not be accepted for filing by the FDA on the timeline that we expect, or at all; the risk that our plans with respect to the preclinical and clinical development and regulatory approval of our product candidates may not be successfully achieved on the planned timeline, or at all; the risk that ABECMA will not be as commercially successful as we may anticipate; and the risk that we are unable to manage our operating expenses or cash use for operations. For a discussion of other risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in the information statement contained in our most recent Form 10-Q and most recent quarterly reports any other filings that we have made or will make with the Securities and Exchange Commission in the future. All information in this press release is as of the date of the release, and 2seventy bio undertakes no duty to update this information unless required by law. This presentation has been prepared by 2seventy bio for the exclusive use of the party to whom the Company delivers this presentation. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of the Company. The information contained herein is for informational purpose, and may not be relied upon in connection with the purchase or sale of any security. Neither the Company nor any of its affiliates or representatives makes any representation or warranty, expressed or implied, as to the accuracy or completeness of this presentation or any of the information contained herein, or any other written or oral communication transmitted or made available to the you or your affiliates or representatives. The Company and its affiliates and representatives expressly disclaim to the fullest extent permitted by law any and all liability based, in whole or in part, on the presentation or any information contained herein or any other written or oral communication transmitted or made available to you or your affiliates or representatives, including, without limitation, with respect to errors therein or omissions therefrom. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The sole mission of 2seventy is to “unleash the curative potential of the T cell” 3 Our experience in drug development and deep execution capabilities in cell therapy allow us to design & deliver multi-layered, multi-modality T cell-based solutions that address and overcome the immunologically evasive and suppressive properties of tumors. TIME GEEKS

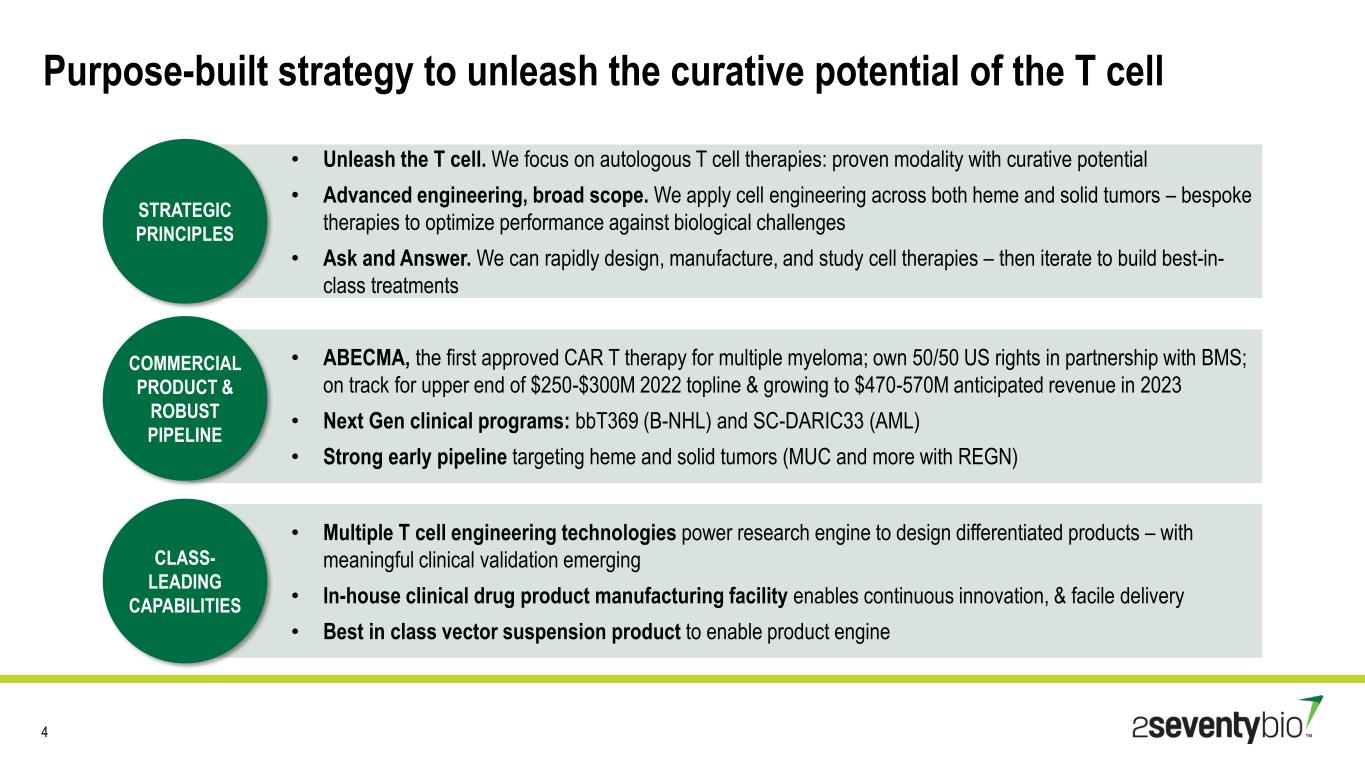

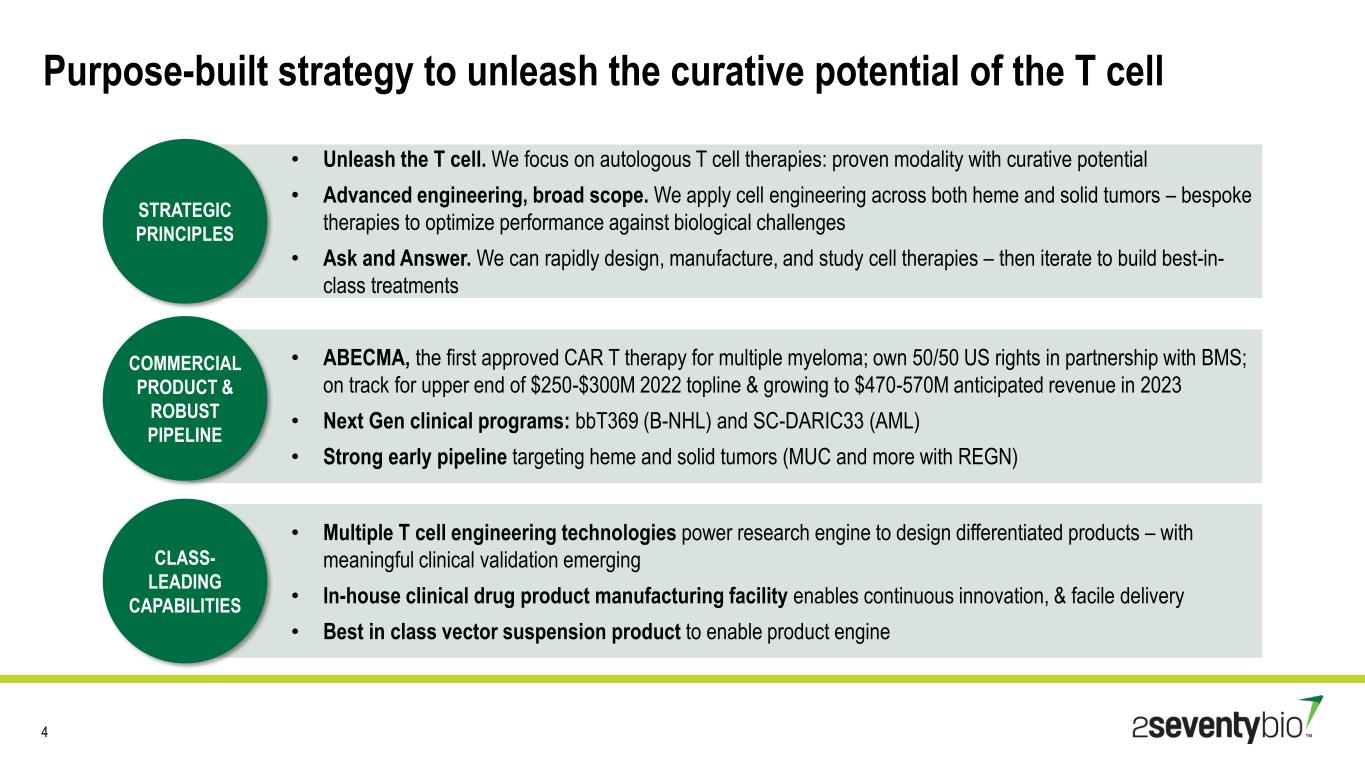

Purpose-built strategy to unleash the curative potential of the T cell 4 • Unleash the T cell. We focus on autologous T cell therapies: proven modality with curative potential • Advanced engineering, broad scope. We apply cell engineering across both heme and solid tumors – bespoke therapies to optimize performance against biological challenges • Ask and Answer. We can rapidly design, manufacture, and study cell therapies – then iterate to build best-in- class treatments • ABECMA, the first approved CAR T therapy for multiple myeloma; own 50/50 US rights in partnership with BMS; on track for upper end of $250-$300M 2022 topline & growing to $470-570M anticipated revenue in 2023 • Next Gen clinical programs: bbT369 (B-NHL) and SC-DARIC33 (AML) • Strong early pipeline targeting heme and solid tumors (MUC and more with REGN) • Multiple T cell engineering technologies power research engine to design differentiated products – with meaningful clinical validation emerging • In-house clinical drug product manufacturing facility enables continuous innovation, & facile delivery • Best in class vector suspension product to enable product engine STRATEGIC PRINCIPLES COMMERCIAL PRODUCT & ROBUST PIPELINE CLASS- LEADING CAPABILITIES

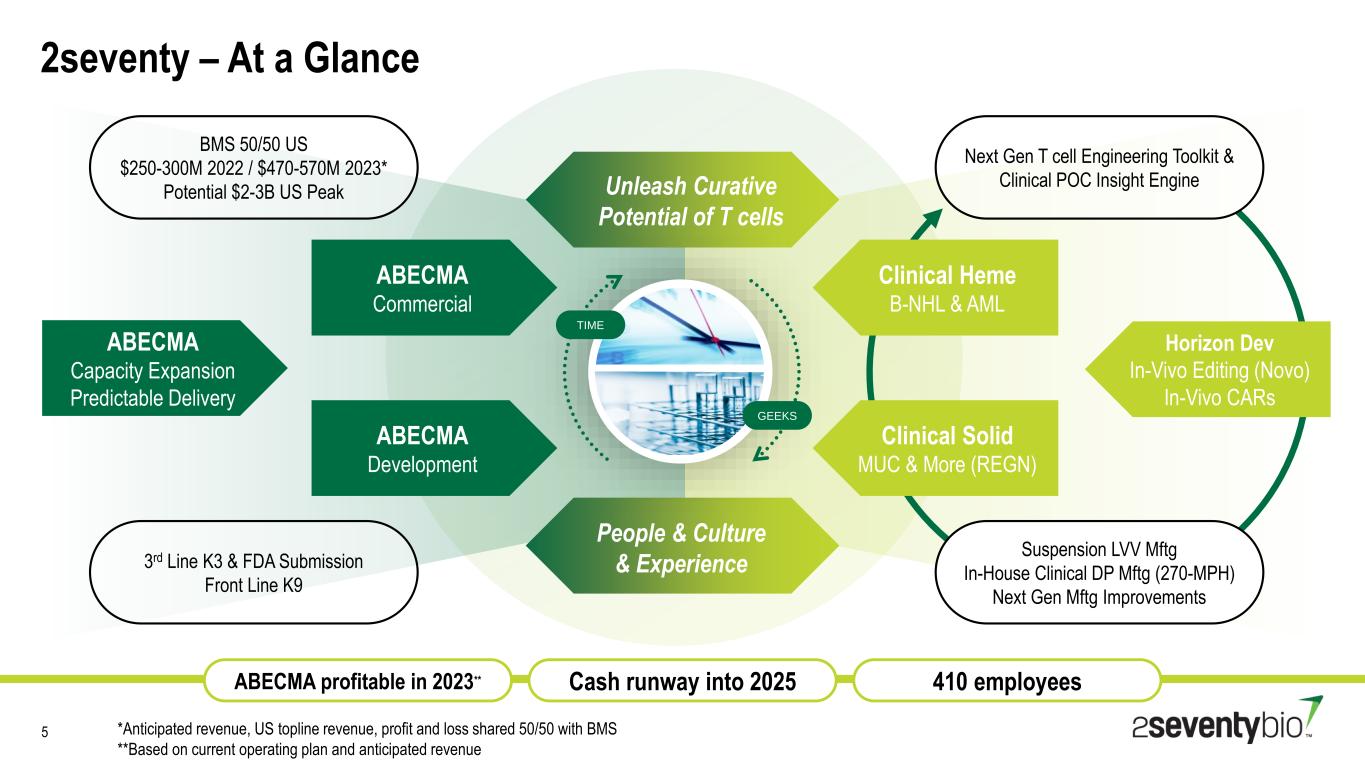

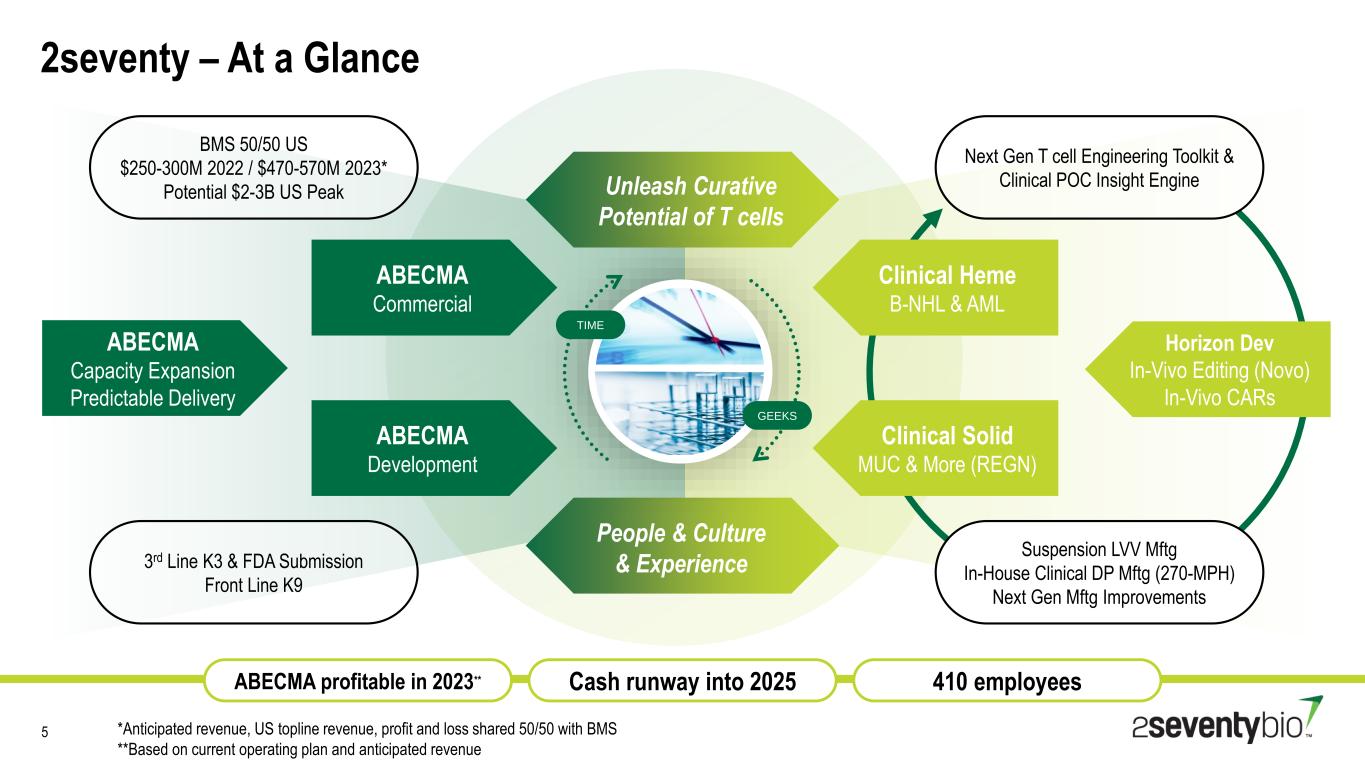

ABECMA Commercial ABECMA Development BMS 50/50 US $250-300M 2022 / $470-570M 2023* Potential $2-3B US Peak 3rd Line K3 & FDA Submission Front Line K9 ABECMA Capacity Expansion Predictable Delivery ABECMA profitable in 2023** Cash runway into 2025 410 employees 2seventy – At a Glance Unleash Curative Potential of T cells People & Culture & Experience TIME GEEKS Suspension LVV Mftg In-House Clinical DP Mftg (270-MPH) Next Gen Mftg Improvements Next Gen T cell Engineering Toolkit & Clinical POC Insight Engine Clinical Heme B-NHL & AML Clinical Solid MUC & More (REGN) Horizon Dev In-Vivo Editing (Novo) In-Vivo CARs 5 *Anticipated revenue, US topline revenue, profit and loss shared 50/50 with BMS **Based on current operating plan and anticipated revenue

6 2022 – 2seventy’s Foundational First Year 6 Reset & rebalanced company size, shape & burn Company/Platform Built in-house DP capability to support product engine Launched “Unleash T cell” vision, culture & core values End of year runway into 2025 ABECMA Pipeline • U.S. topline revenue tracking at upper end of $250-300 million range • Increased manufacturing capacity and reduced COGS • Positive KarMMa-3 data & announced KarMMa-9 NDMM study • Initiated enrollment of bbT369/B-NHL & SC-DARIC33/AML studies • Established strategic relationship with JW Therapeutics for clinical dev of our enhanced MAGE-A4 TCR in China • Signed expanded translational partnership with Regeneron enabling combinations of engineered T cells with mAbs/bi-specs • Selected NG-AML candidate for pre-clinical dev based on novel RESET architecture (2022 Horizon X Program) • Progressed F8 / Novo Nordisk megaTAL gene editing program to large animal studies

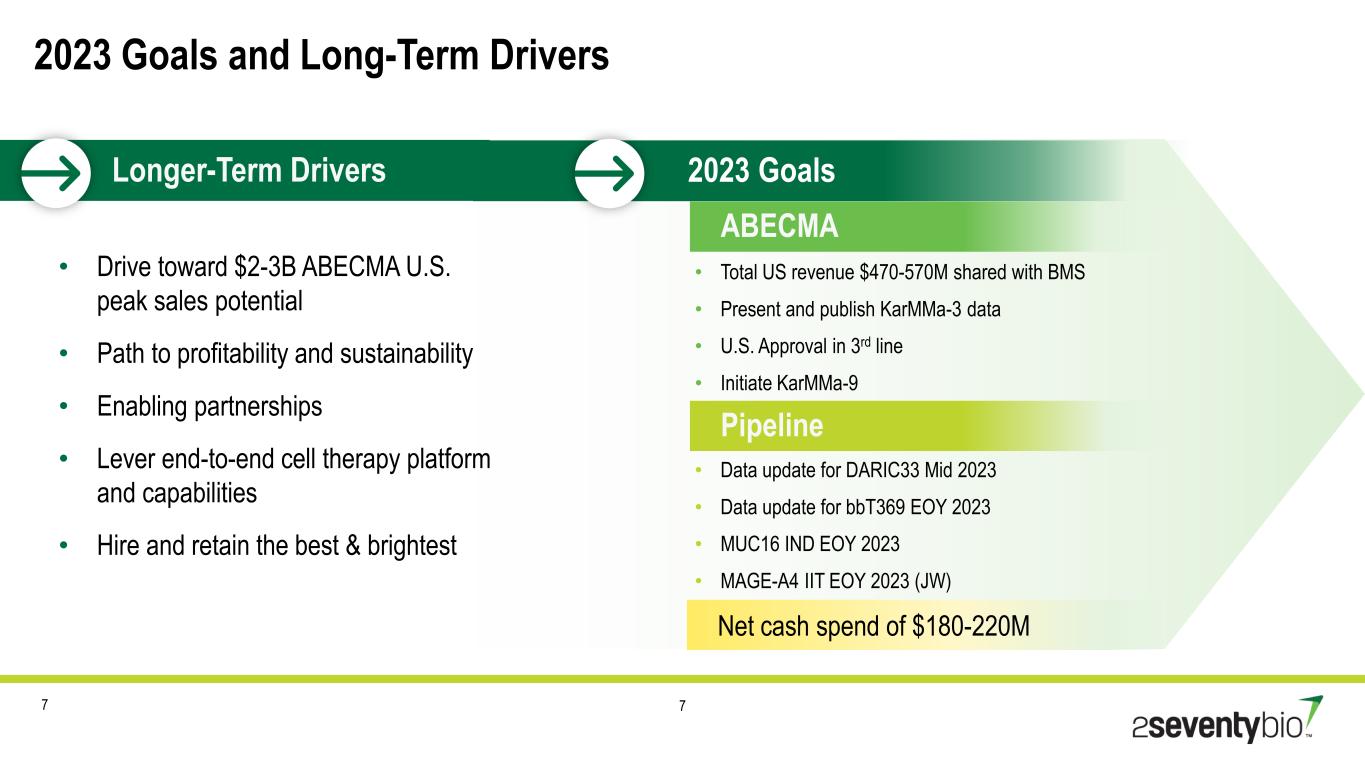

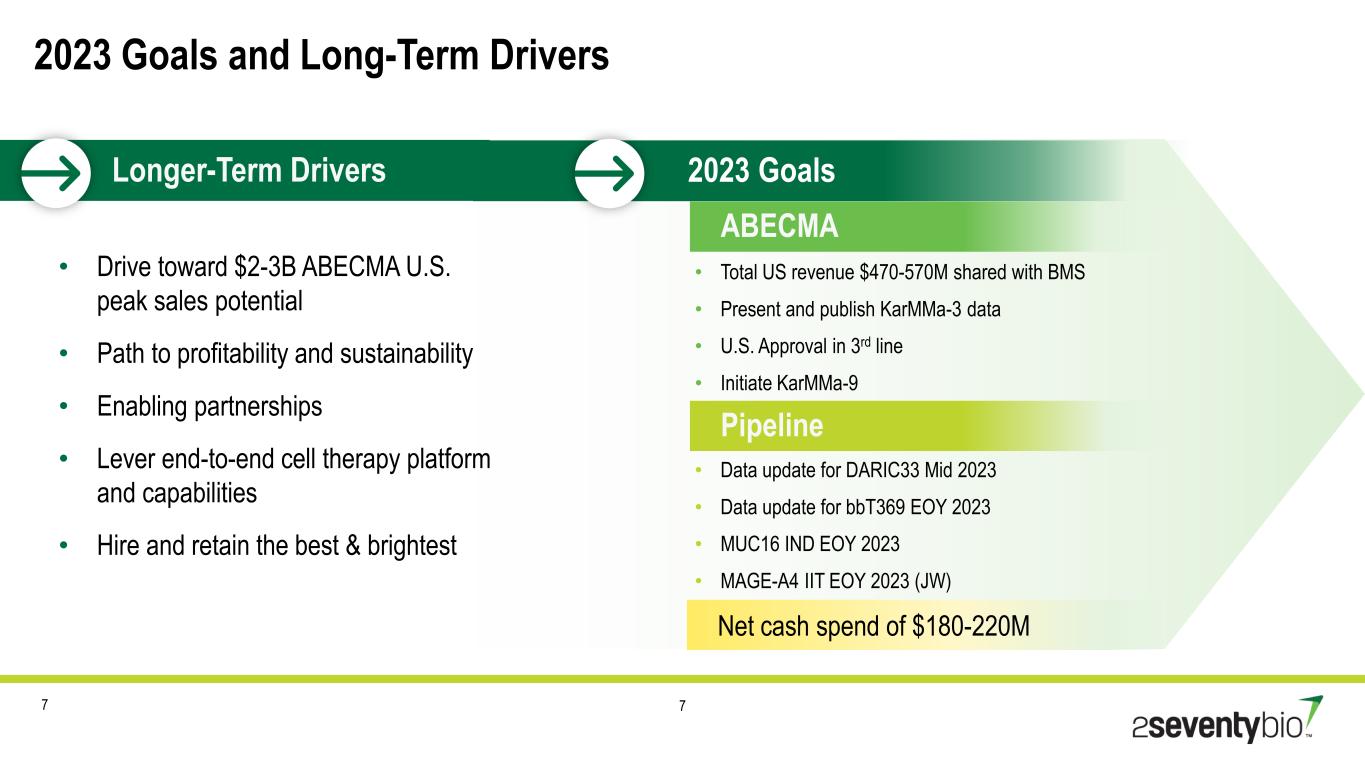

7 2023 Goals and Long-Term Drivers 7 Longer-Term Drivers ABECMA Pipeline • Drive toward $2-3B ABECMA U.S. peak sales potential • Path to profitability and sustainability • Enabling partnerships • Lever end-to-end cell therapy platform and capabilities • Hire and retain the best & brightest • Total US revenue $470-570M shared with BMS • Present and publish KarMMa-3 data • U.S. Approval in 3rd line • Initiate KarMMa-9 • Data update for DARIC33 Mid 2023 • Data update for bbT369 EOY 2023 • MUC16 IND EOY 2023 • MAGE-A4 IIT EOY 2023 (JW) 2023 Goals Net cash spend of $180-220M

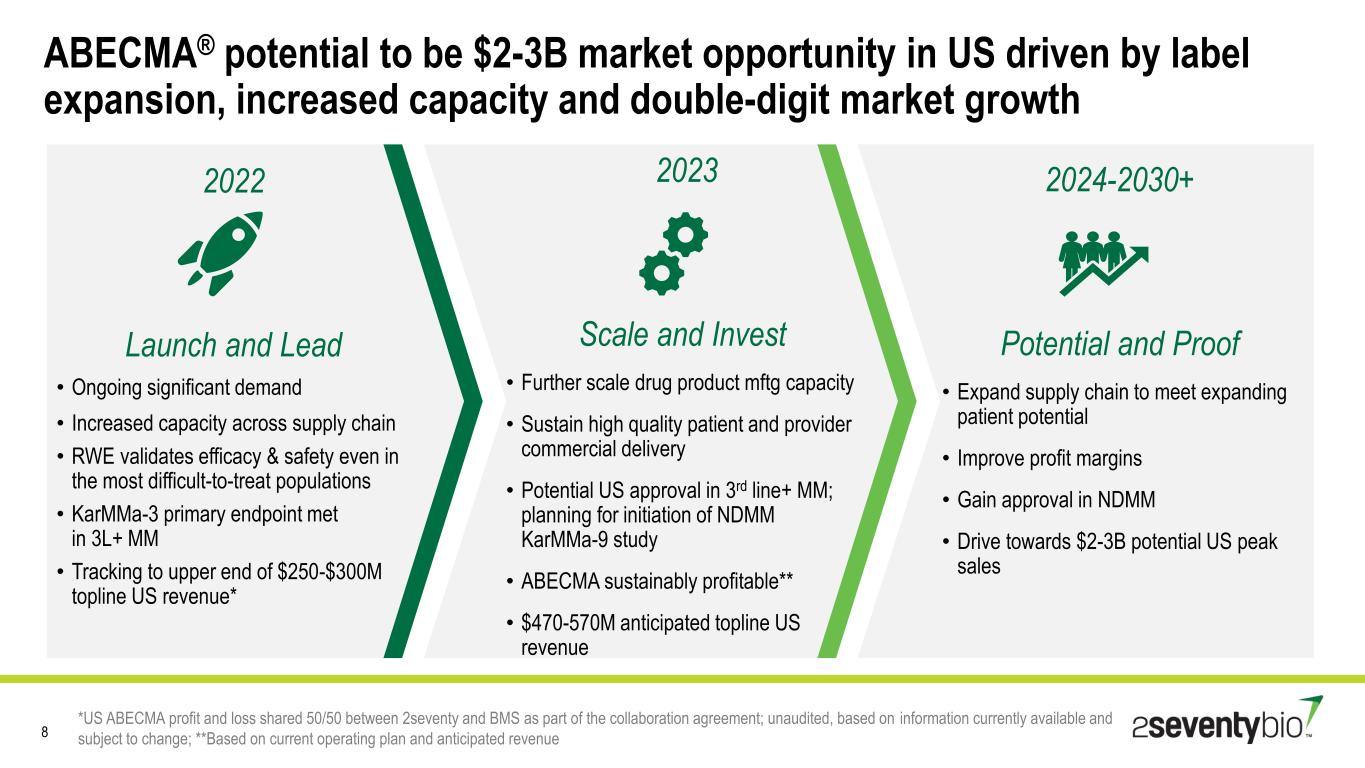

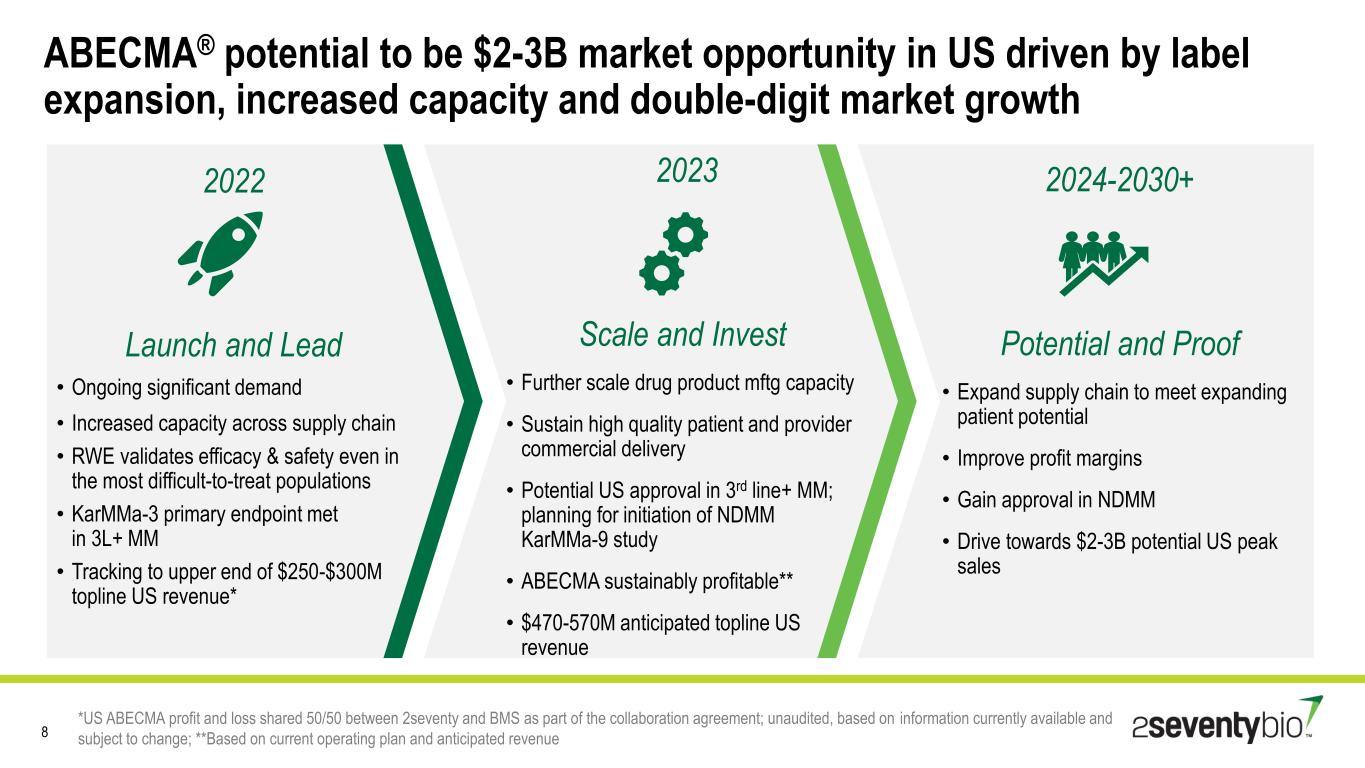

ABECMA® potential to be $2-3B market opportunity in US driven by label expansion, increased capacity and double-digit market growth 8 2022 Launch and Lead • Ongoing significant demand • Increased capacity across supply chain • RWE validates efficacy & safety even in the most difficult-to-treat populations • KarMMa-3 primary endpoint met in 3L+ MM • Tracking to upper end of $250-$300M topline US revenue* 2024-2030+ Potential and Proof • Expand supply chain to meet expanding patient potential • Improve profit margins • Gain approval in NDMM • Drive towards $2-3B potential US peak sales 2023 Scale and Invest • Further scale drug product mftg capacity • Sustain high quality patient and provider commercial delivery • Potential US approval in 3rd line+ MM; planning for initiation of NDMM KarMMa-9 study • ABECMA sustainably profitable** • $470-570M anticipated topline US revenue *US ABECMA profit and loss shared 50/50 between 2seventy and BMS as part of the collaboration agreement; unaudited, based on information currently available and subject to change; **Based on current operating plan and anticipated revenue

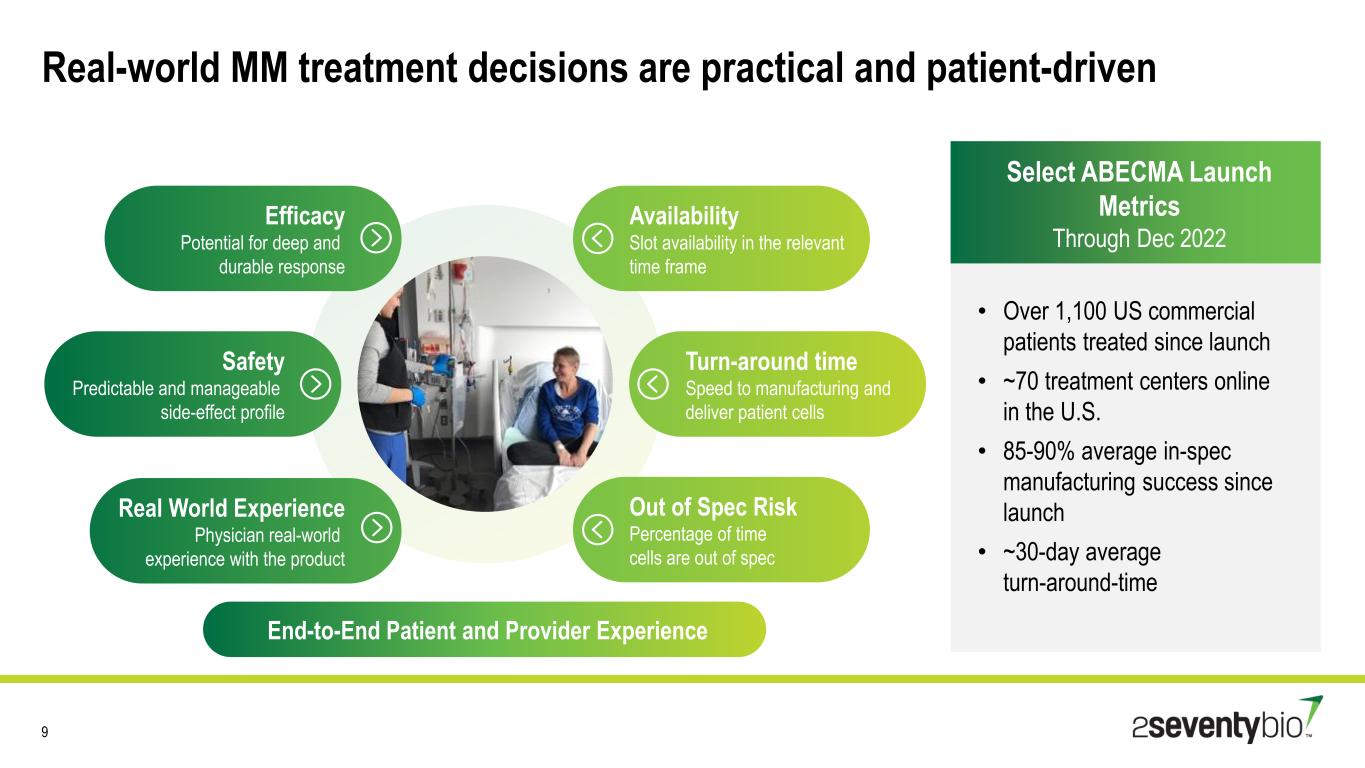

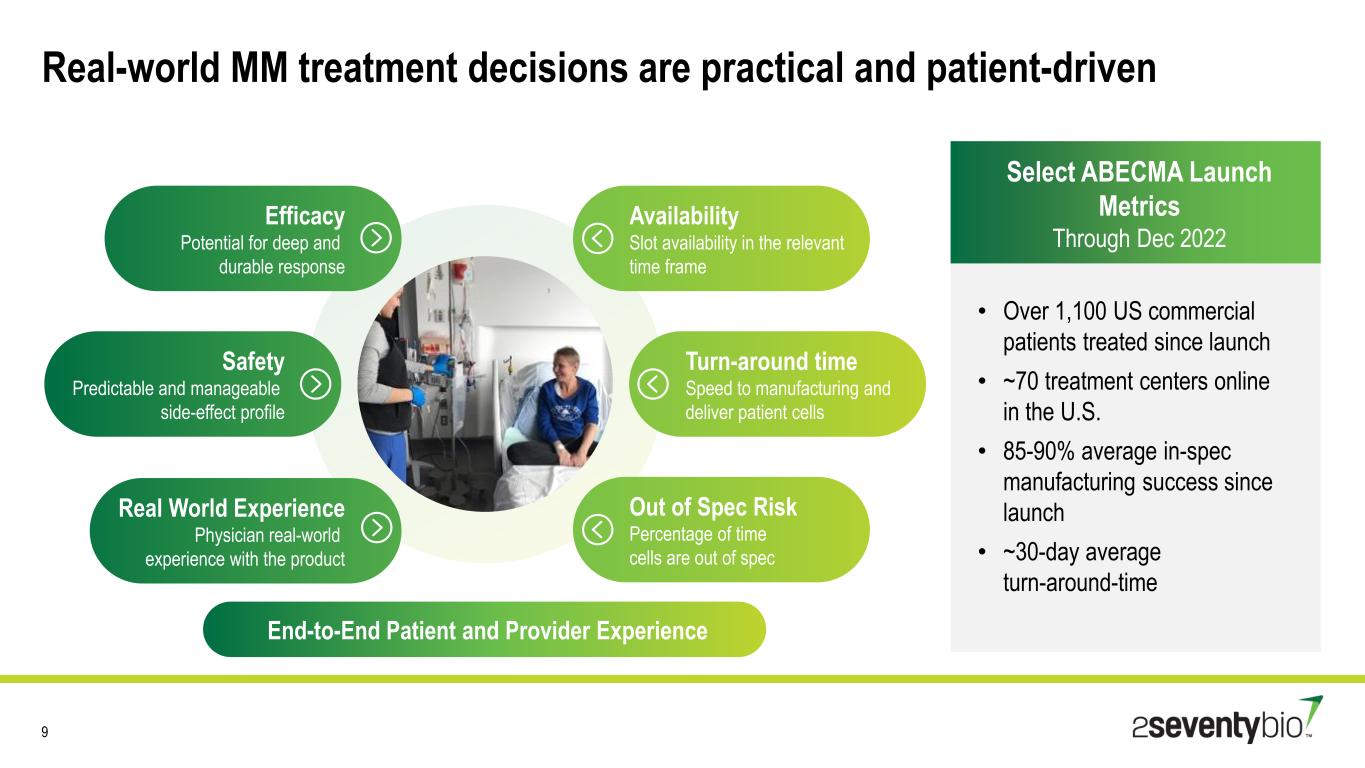

Real-world MM treatment decisions are practical and patient-driven Efficacy Potential for deep and durable response Safety Predictable and manageable side-effect profile Real World Experience Physician real-world experience with the product Availability Slot availability in the relevant time frame Turn-around time Speed to manufacturing and deliver patient cells Out of Spec Risk Percentage of time cells are out of spec Select ABECMA Launch Metrics Through Dec 2022 • Over 1,100 US commercial patients treated since launch • ~70 treatment centers online in the U.S. • 85-90% average in-spec manufacturing success since launch • ~30-day average turn-around-time 9 End-to-End Patient and Provider Experience

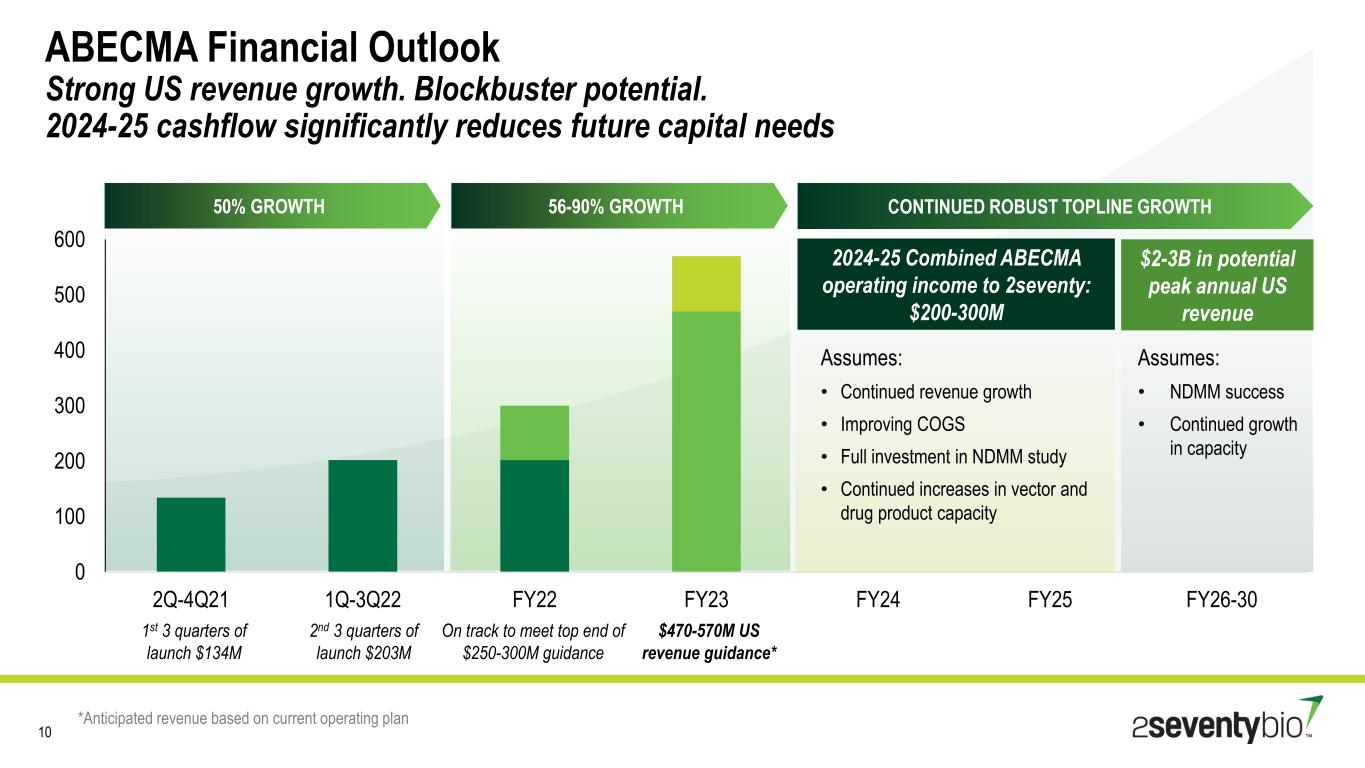

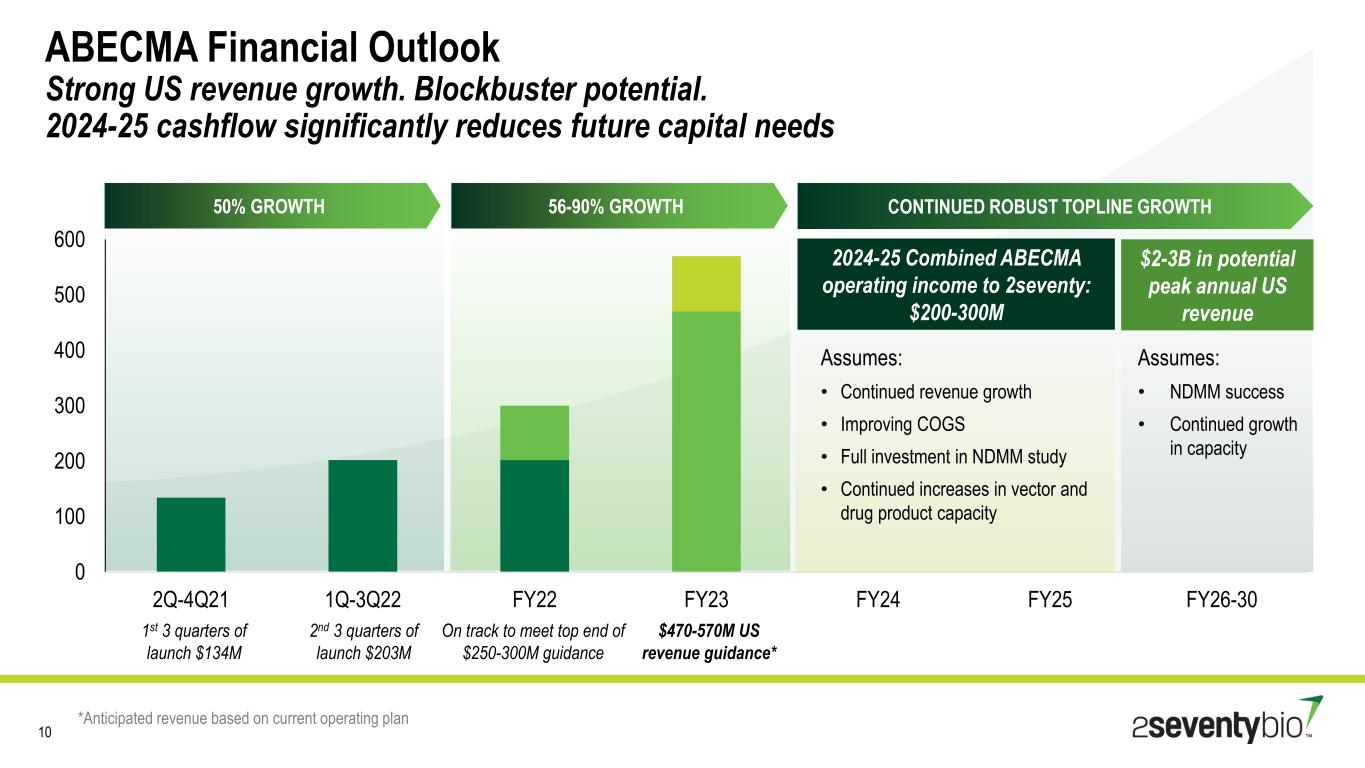

0 100 200 300 400 500 600 2Q-4Q21 1Q-3Q22 FY22 FY23 FY24 FY25 FY26-30 ABECMA Financial Outlook Strong US revenue growth. Blockbuster potential. 2024-25 cashflow significantly reduces future capital needs 10 1st 3 quarters of launch $134M 2nd 3 quarters of launch $203M On track to meet top end of $250-300M guidance $470-570M US revenue guidance* $2-3B in potential peak annual US revenue Assumes: • Continued revenue growth • Improving COGS • Full investment in NDMM study • Continued increases in vector and drug product capacity Assumes: • NDMM success • Continued growth in capacity 2024-25 Combined ABECMA operating income to 2seventy: $200-300M 50% GROWTH CONTINUED ROBUST TOPLINE GROWTH56-90% GROWTH *Anticipated revenue based on current operating plan

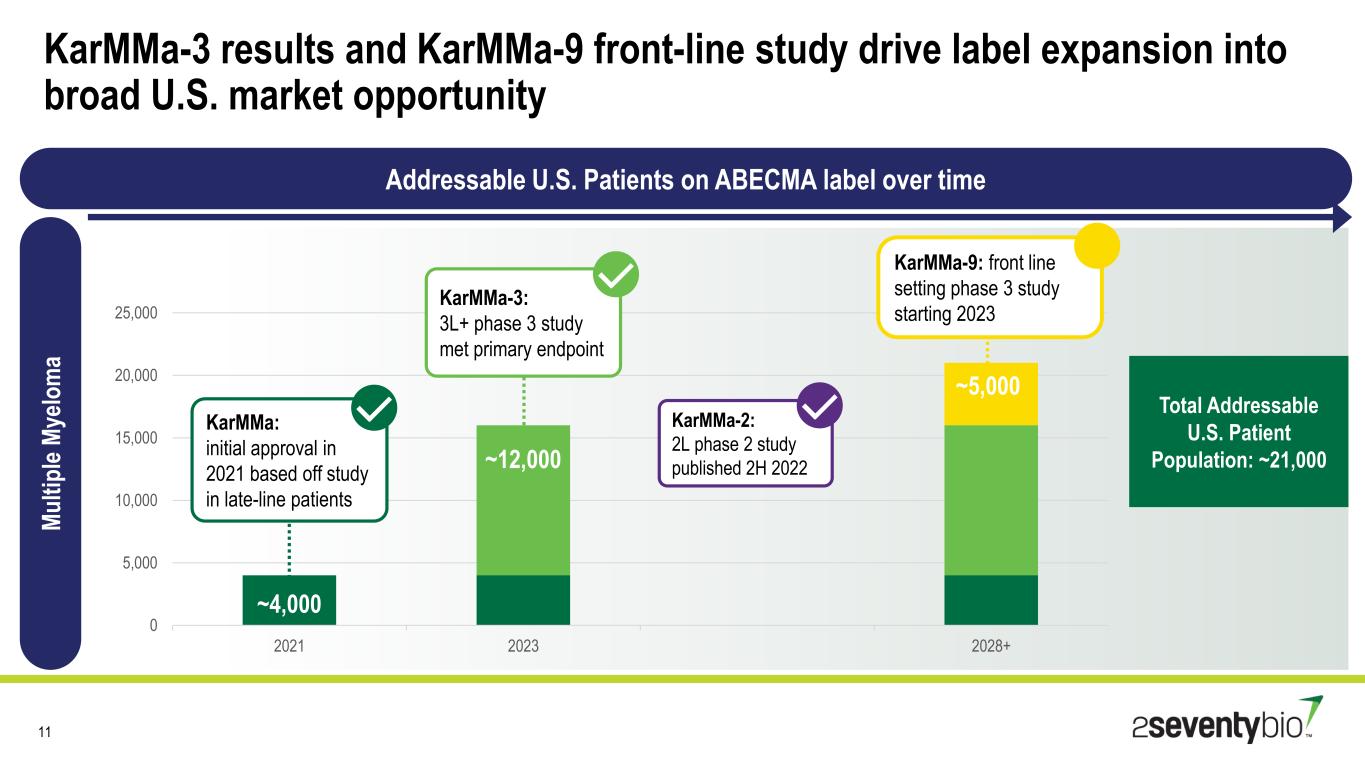

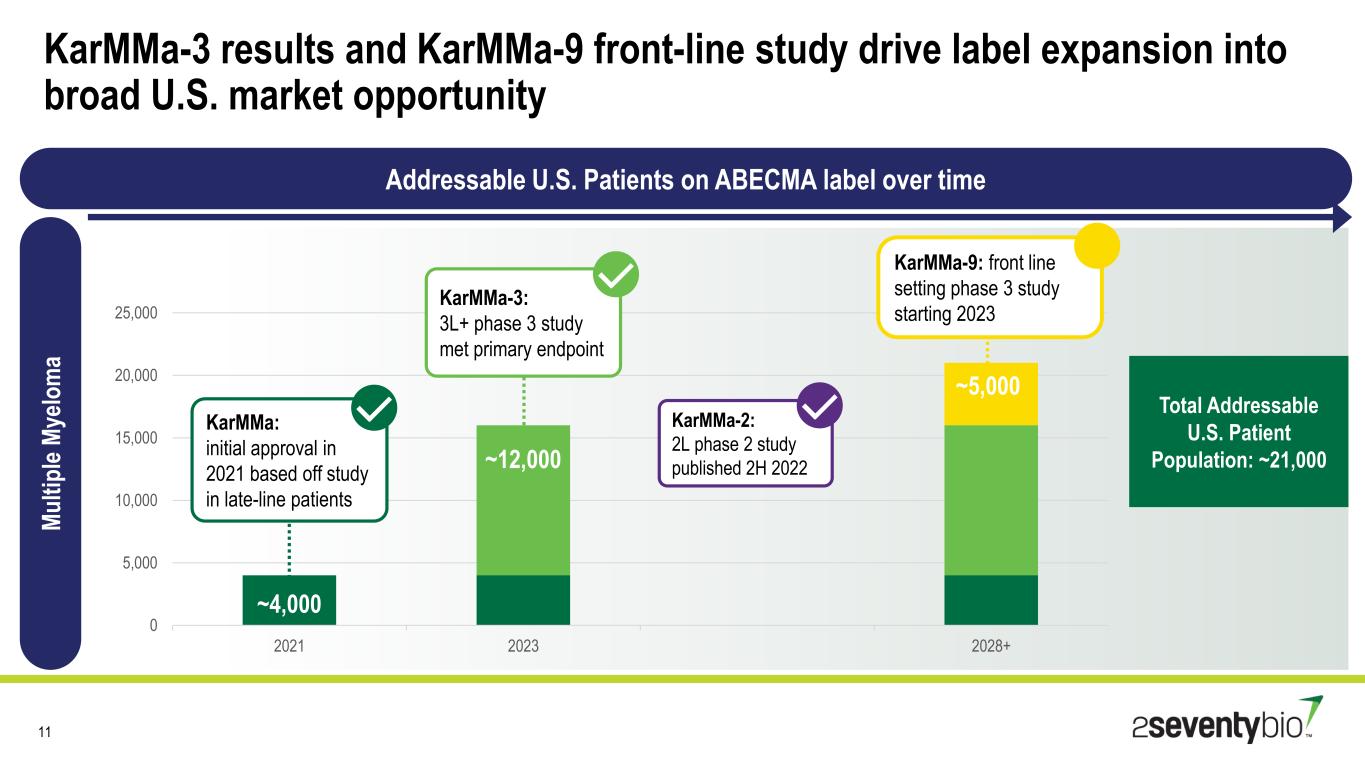

Addressable U.S. Patients on ABECMA label over time M u lt ip le M ye lo m a KarMMa-3 results and KarMMa-9 front-line study drive label expansion into broad U.S. market opportunity 11 Total Addressable U.S. Patient Population: ~21,000 0 5,000 10,000 15,000 20,000 25,000 2021 2023 2028+ ~4,000 ~12,000 ~5,000 KarMMa: initial approval in 2021 based off study in late-line patients KarMMa-9: front line setting phase 3 study starting 2023 KarMMa-3: 3L+ phase 3 study met primary endpoint KarMMa-2: 2L phase 2 study published 2H 2022

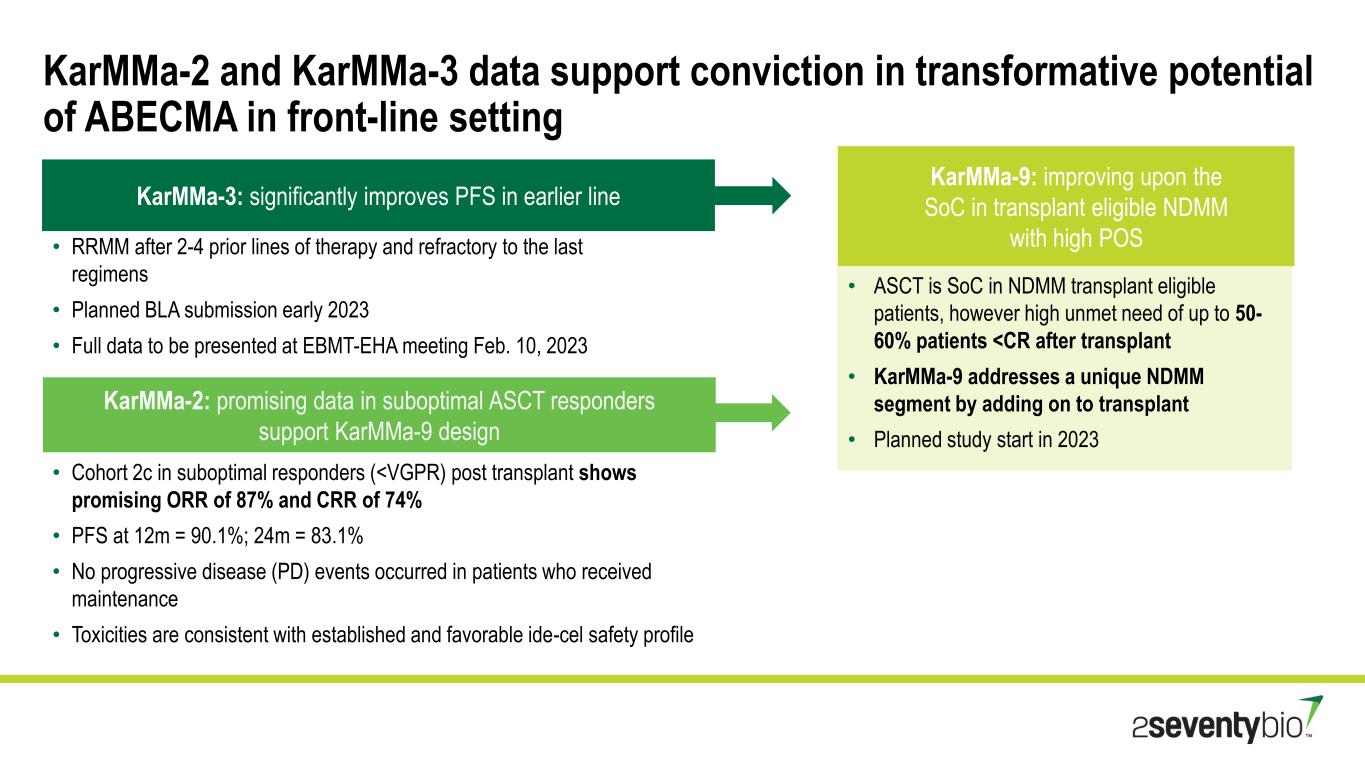

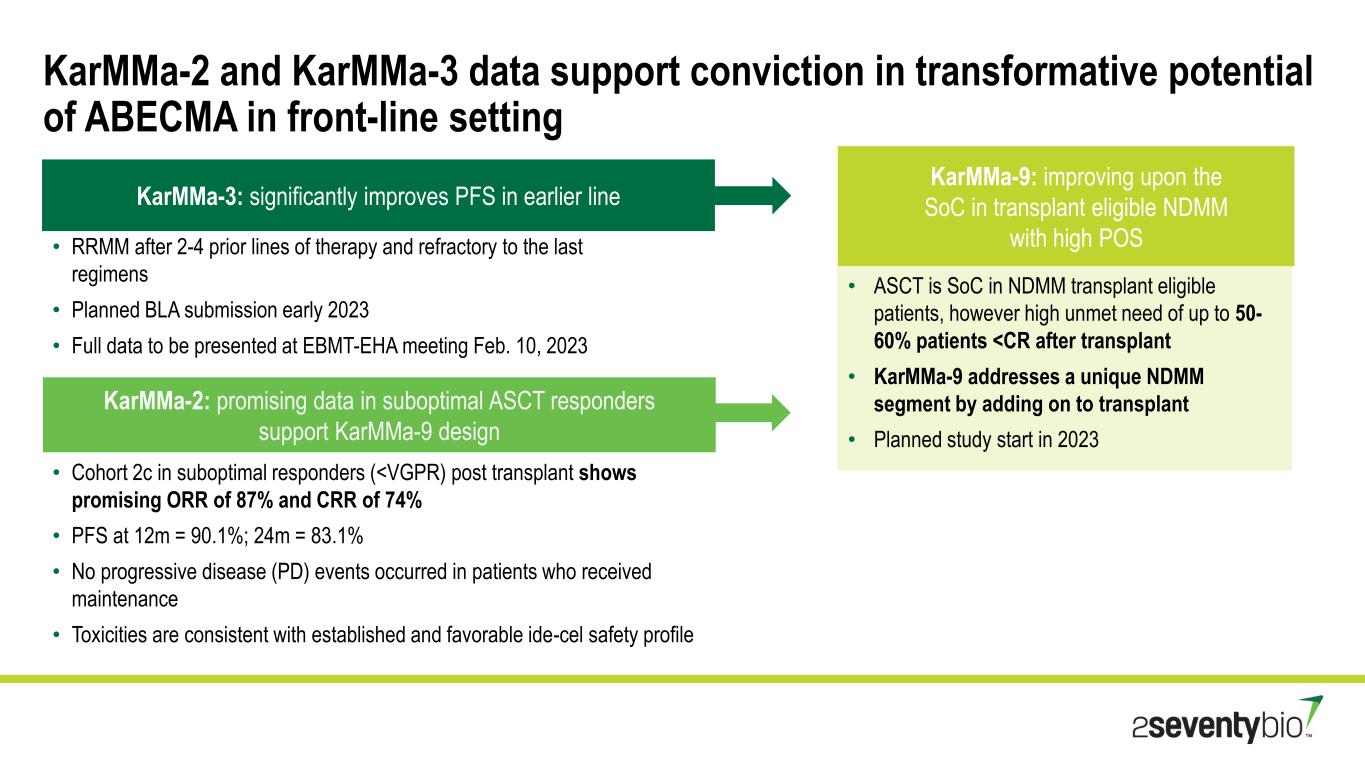

• RRMM after 2-4 prior lines of therapy and refractory to the last regimens • Planned BLA submission early 2023 • Full data to be presented at EBMT-EHA meeting Feb. 10, 2023 KarMMa-2 and KarMMa-3 data support conviction in transformative potential of ABECMA in front-line setting KarMMa-2: promising data in suboptimal ASCT responders support KarMMa-9 design • Cohort 2c in suboptimal responders (<VGPR) post transplant shows promising ORR of 87% and CRR of 74% • PFS at 12m = 90.1%; 24m = 83.1% • No progressive disease (PD) events occurred in patients who received maintenance • Toxicities are consistent with established and favorable ide-cel safety profile KarMMa-9: improving upon the SoC in transplant eligible NDMM with high POS • ASCT is SoC in NDMM transplant eligible patients, however high unmet need of up to 50- 60% patients <CR after transplant • KarMMa-9 addresses a unique NDMM segment by adding on to transplant • Planned study start in 2023 KarMMa-3: significantly improves PFS in earlier line

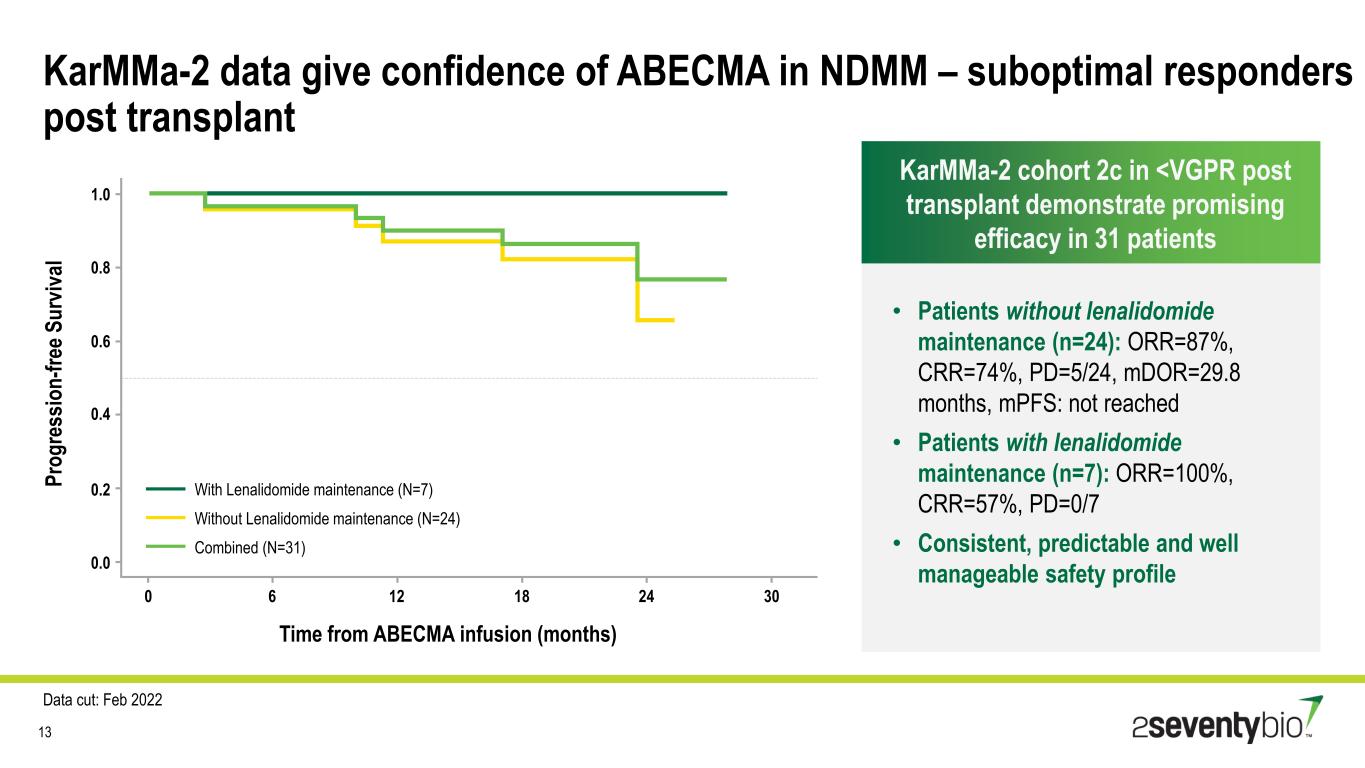

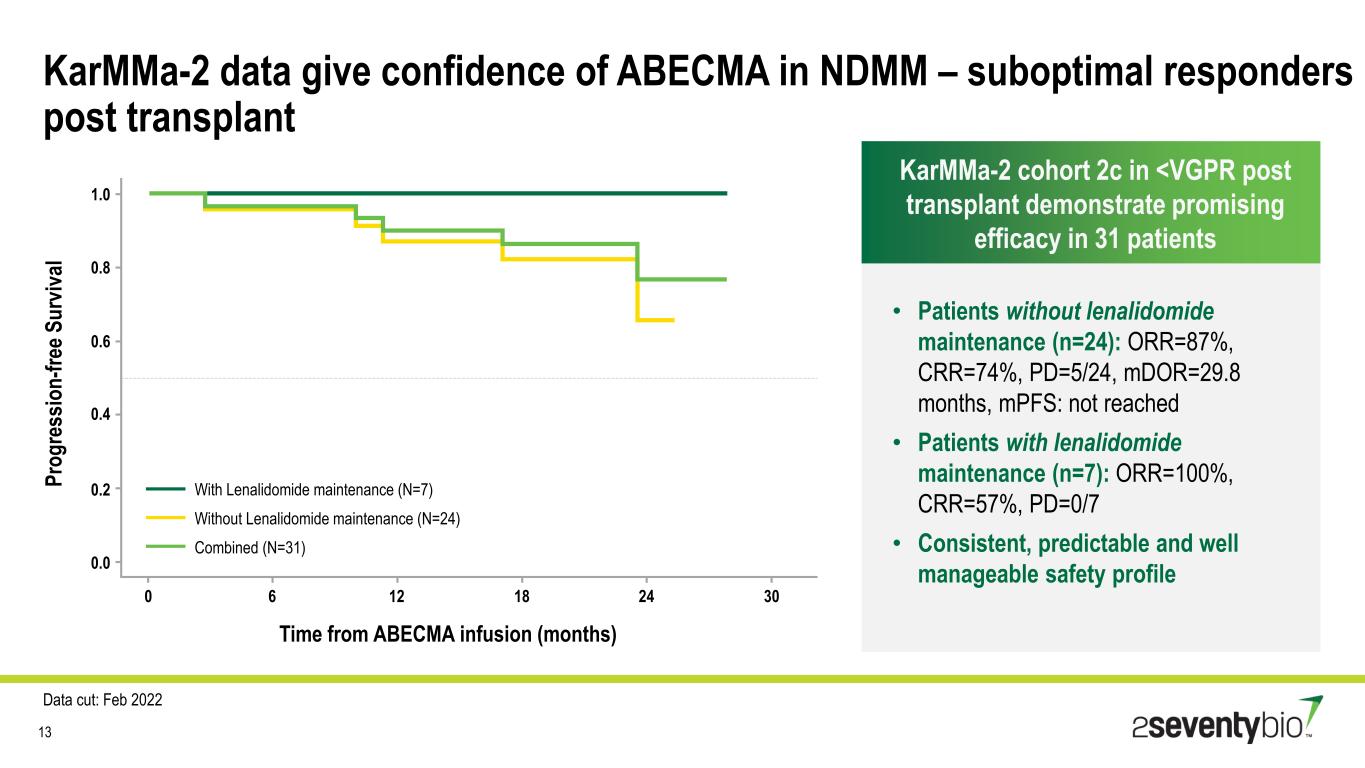

KarMMa-2 data give confidence of ABECMA in NDMM – suboptimal responders post transplant Data cut: Feb 2022 KarMMa-2 cohort 2c in <VGPR post transplant demonstrate promising efficacy in 31 patients • Patients without lenalidomide maintenance (n=24): ORR=87%, CRR=74%, PD=5/24, mDOR=29.8 months, mPFS: not reached • Patients with lenalidomide maintenance (n=7): ORR=100%, CRR=57%, PD=0/7 • Consistent, predictable and well manageable safety profile P ro g re ss io n -f re e S u rv iv al With Lenalidomide maintenance (N=7) Without Lenalidomide maintenance (N=24) Combined (N=31) 1.0 0.8 0.6 0.4 0.2 0.0 0 6 12 18 24 30 Time from ABECMA infusion (months) 13

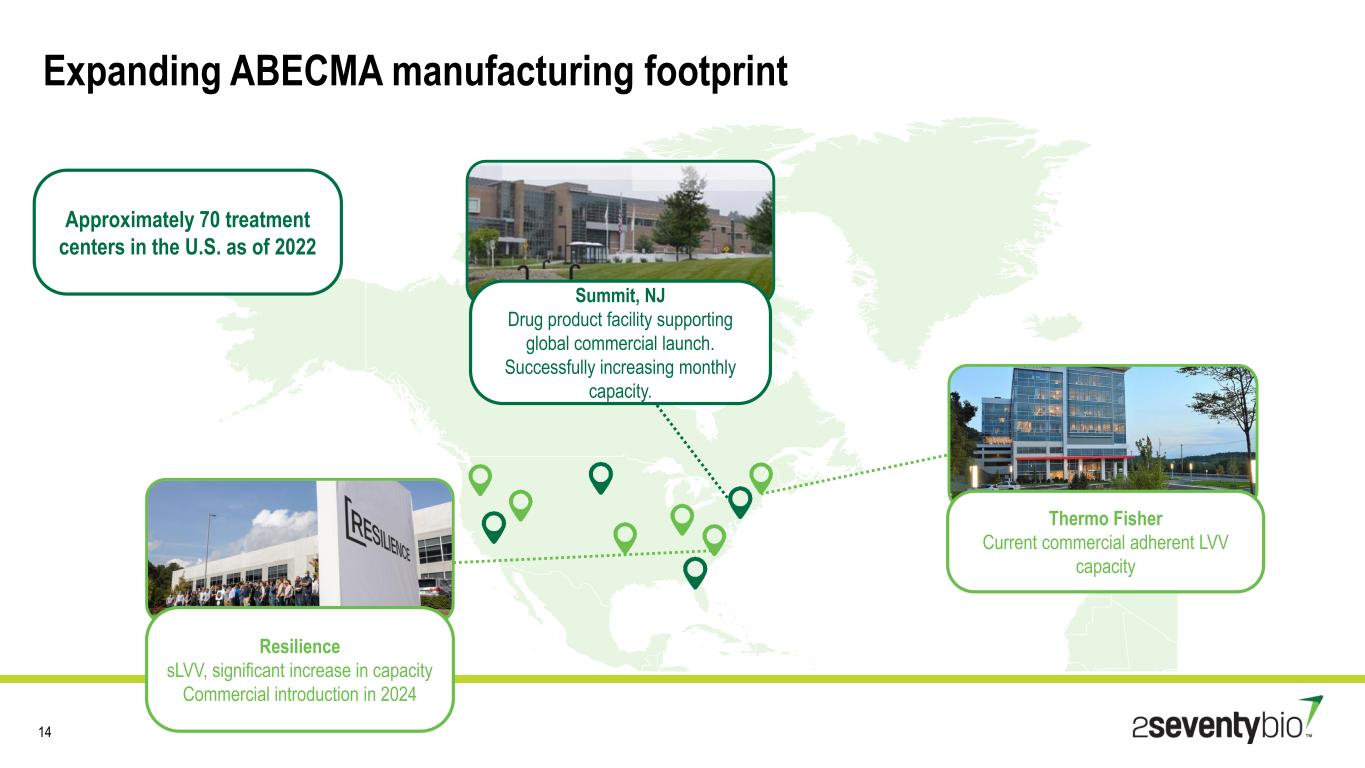

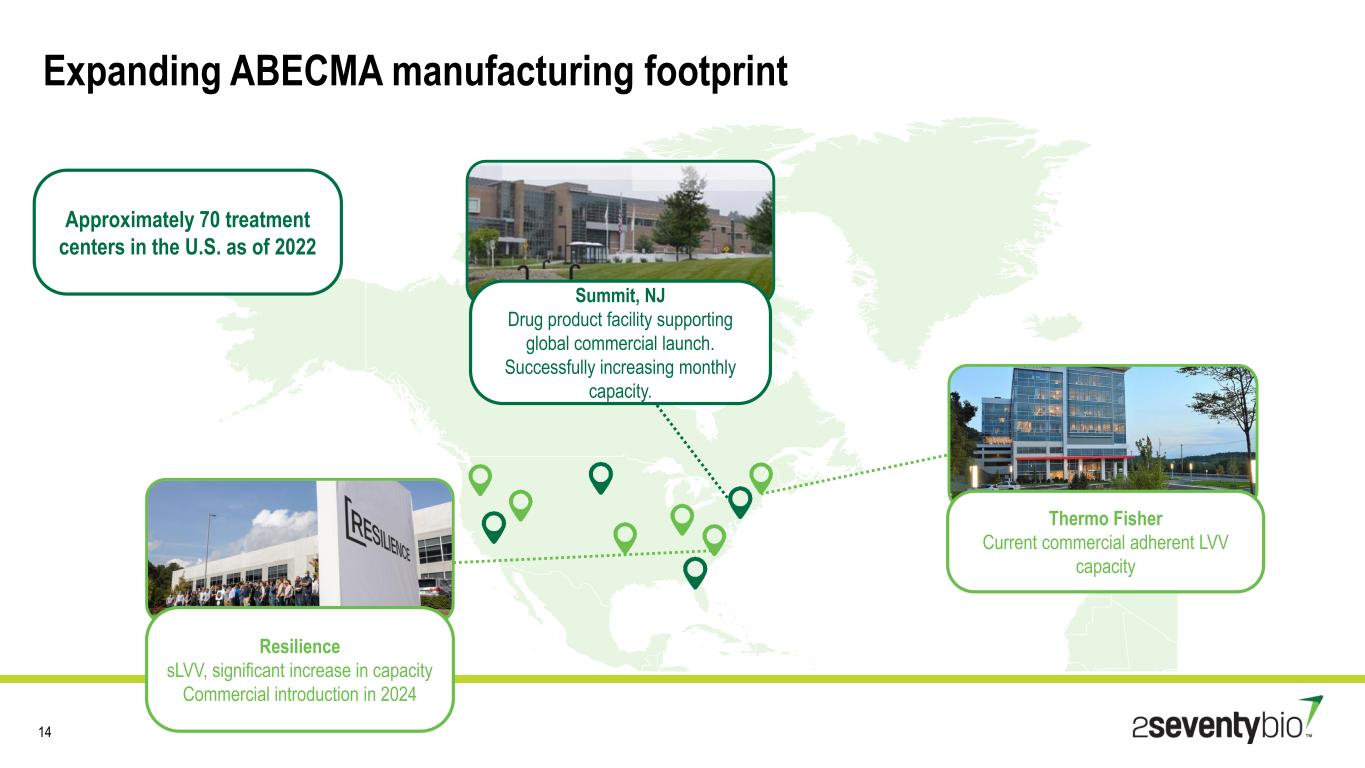

Expanding ABECMA manufacturing footprint 14 Thermo Fisher Current commercial adherent LVV capacity Approximately 70 treatment centers in the U.S. as of 2022 Summit, NJ Drug product facility supporting global commercial launch. Successfully increasing monthly capacity. Resilience sLVV, significant increase in capacity Commercial introduction in 2024

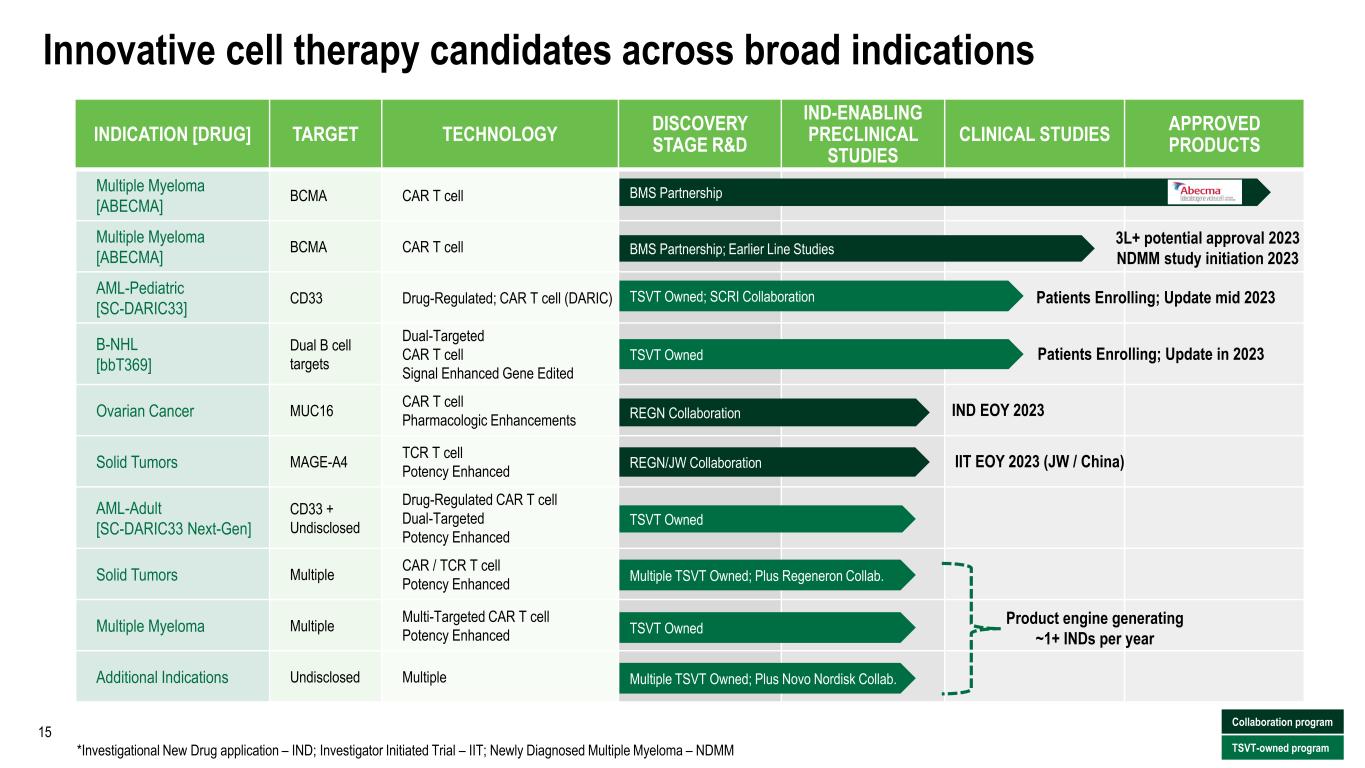

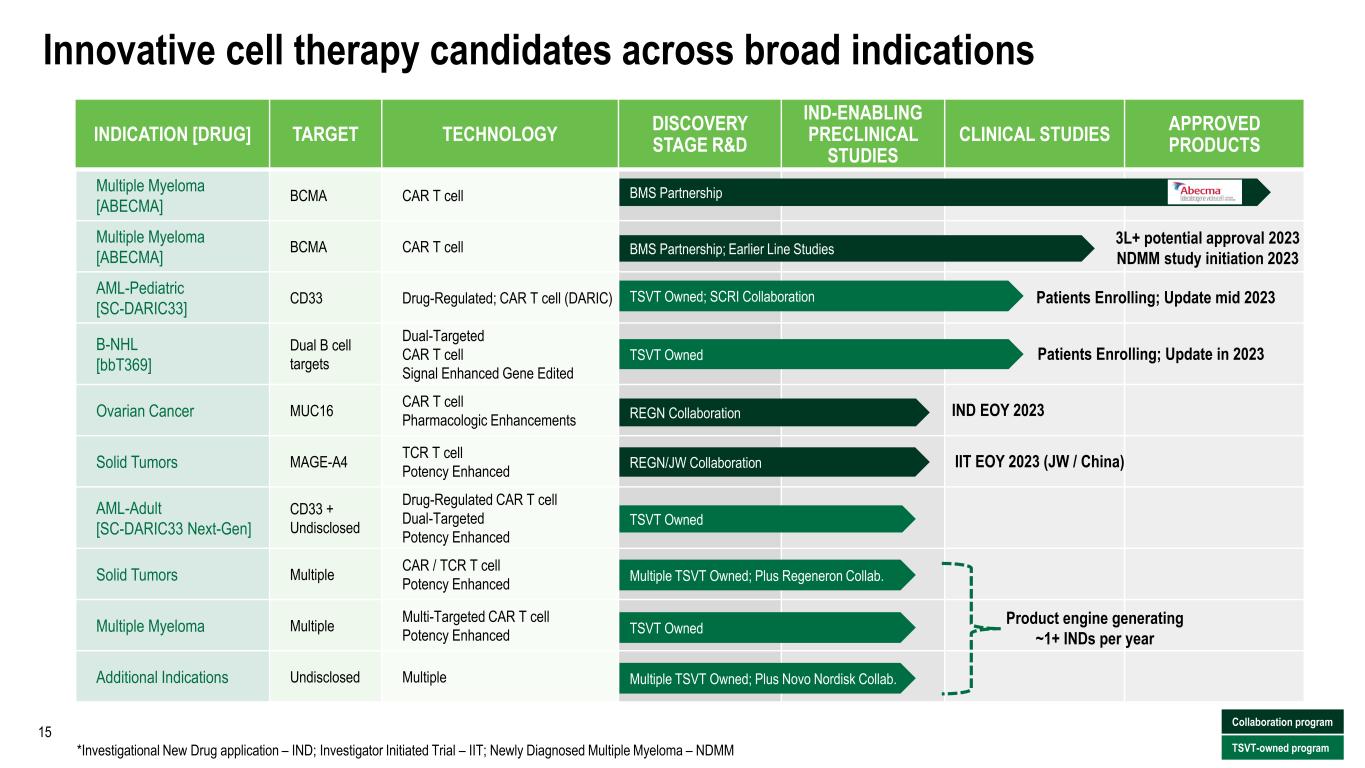

INDICATION [DRUG] TARGET TECHNOLOGY DISCOVERY STAGE R&D IND-ENABLING PRECLINICAL STUDIES CLINICAL STUDIES APPROVED PRODUCTS Multiple Myeloma [ABECMA] BCMA CAR T cell Multiple Myeloma [ABECMA] BCMA CAR T cell AML-Pediatric [SC-DARIC33] CD33 Drug-Regulated; CAR T cell (DARIC) B-NHL [bbT369] Dual B cell targets Dual-Targeted CAR T cell Signal Enhanced Gene Edited Ovarian Cancer MUC16 CAR T cell Pharmacologic Enhancements Solid Tumors MAGE-A4 TCR T cell Potency Enhanced AML-Adult [SC-DARIC33 Next-Gen] CD33 + Undisclosed Drug-Regulated CAR T cell Dual-Targeted Potency Enhanced Solid Tumors Multiple CAR / TCR T cell Potency Enhanced Multiple Myeloma Multiple Multi-Targeted CAR T cell Potency Enhanced Additional Indications Undisclosed Multiple Patients Enrolling; Update mid 2023 TSVT Owned TSVT Owned Multiple TSVT Owned; Plus Novo Nordisk Collab. TSVT Owned; SCRI Collaboration REGN Collaboration BMS Partnership TSVT Owned Multiple TSVT Owned; Plus Regeneron Collab. BMS Partnership; Earlier Line Studies 3L+ potential approval 2023 NDMM study initiation 2023 REGN/JW Collaboration Innovative cell therapy candidates across broad indications 15 IND EOY 2023 Product engine generating ~1+ INDs per year Patients Enrolling; Update in 2023 IIT EOY 2023 (JW / China) Collaboration program TSVT-owned program*Investigational New Drug application – IND; Investigator Initiated Trial – IIT; Newly Diagnosed Multiple Myeloma – NDMM

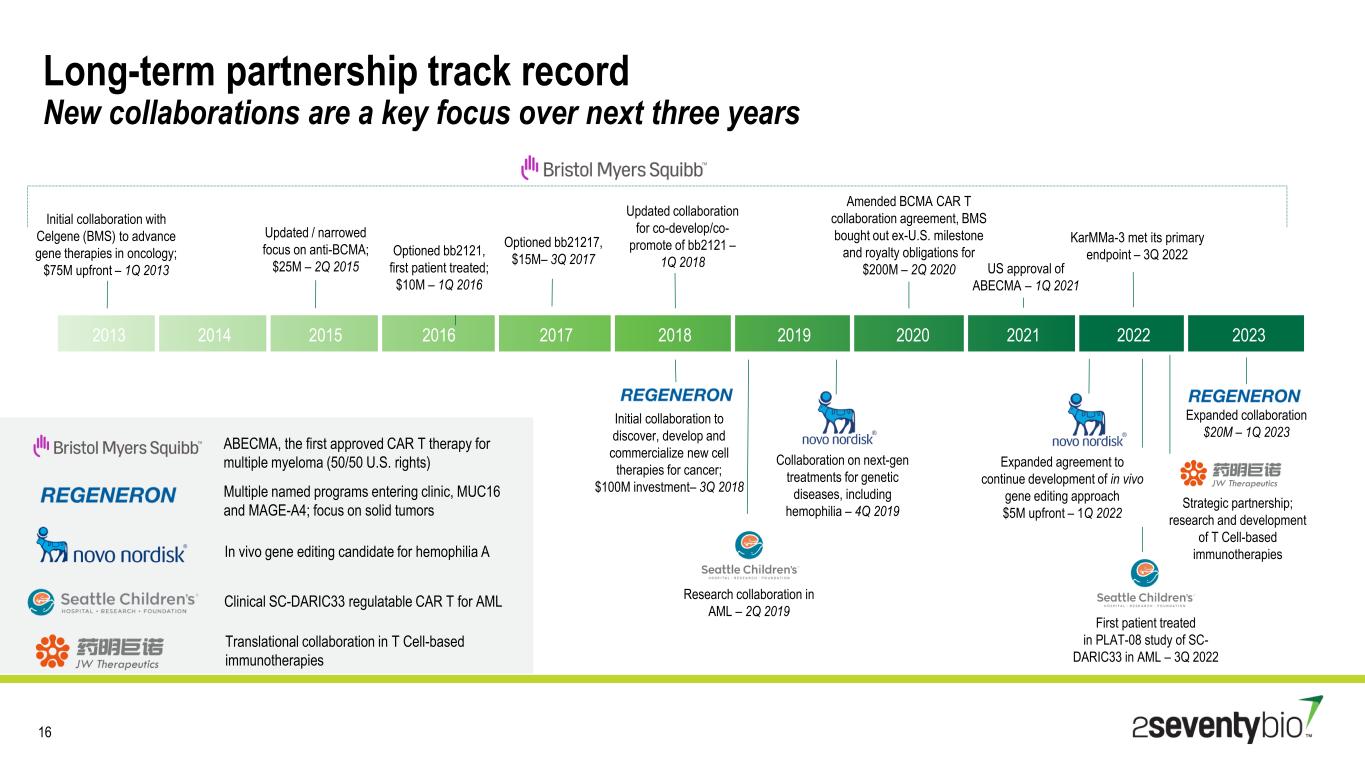

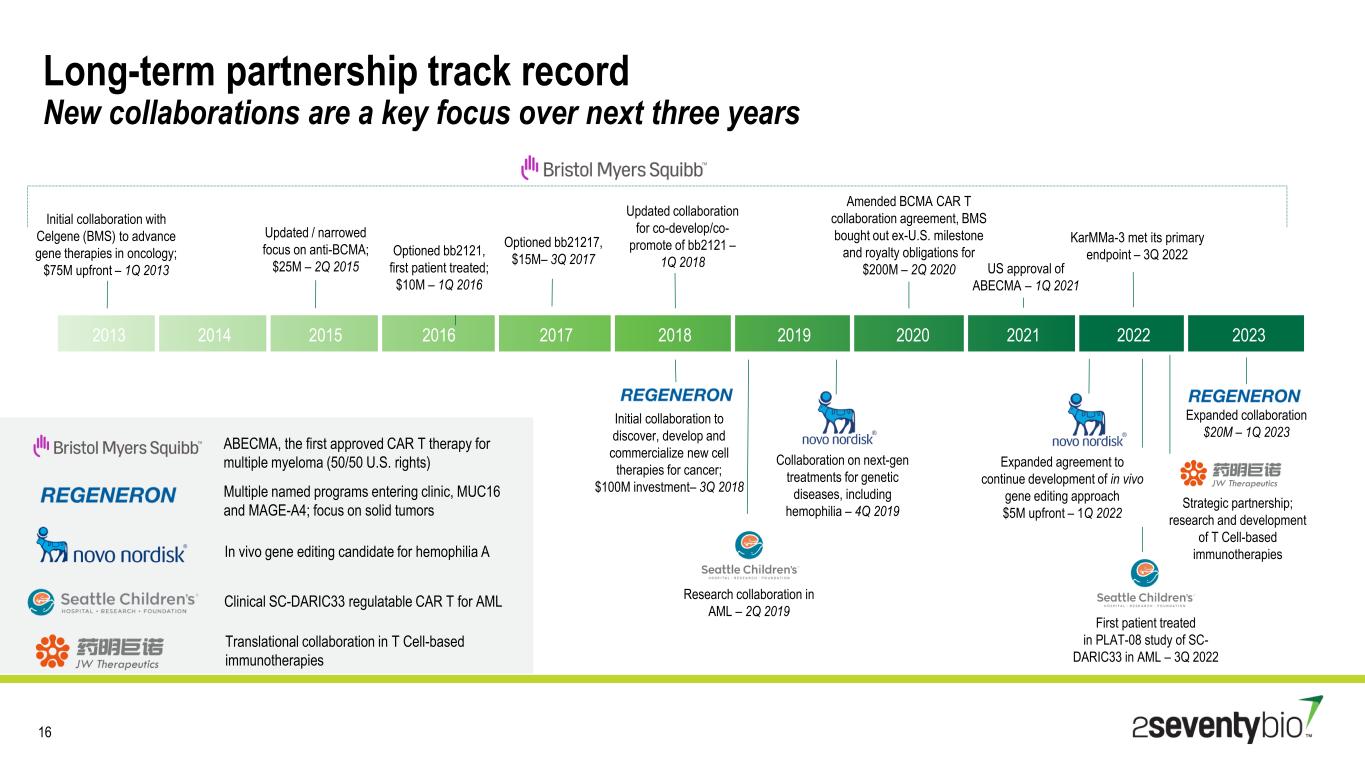

Long-term partnership track record New collaborations are a key focus over next three years 16 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Initial collaboration with Celgene (BMS) to advance gene therapies in oncology; $75M upfront – 1Q 2013 Updated / narrowed focus on anti-BCMA; $25M – 2Q 2015 Optioned bb21217, $15M– 3Q 2017 Updated collaboration for co-develop/co- promote of bb2121 – 1Q 2018 Amended BCMA CAR T collaboration agreement, BMS bought out ex-U.S. milestone and royalty obligations for $200M – 2Q 2020 Initial collaboration to discover, develop and commercialize new cell therapies for cancer; $100M investment– 3Q 2018 Research collaboration in AML – 2Q 2019 Collaboration on next-gen treatments for genetic diseases, including hemophilia – 4Q 2019 Optioned bb2121, first patient treated; $10M – 1Q 2016 US approval of ABECMA – 1Q 2021 Expanded agreement to continue development of in vivo gene editing approach $5M upfront – 1Q 2022 First patient treated in PLAT-08 study of SC- DARIC33 in AML – 3Q 2022 KarMMa-3 met its primary endpoint – 3Q 2022 Expanded collaboration $20M – 1Q 2023 ABECMA, the first approved CAR T therapy for multiple myeloma (50/50 U.S. rights) Multiple named programs entering clinic, MUC16 and MAGE-A4; focus on solid tumors Clinical SC-DARIC33 regulatable CAR T for AML In vivo gene editing candidate for hemophilia A Translational collaboration in T Cell-based immunotherapies Strategic partnership; research and development of T Cell-based immunotherapies

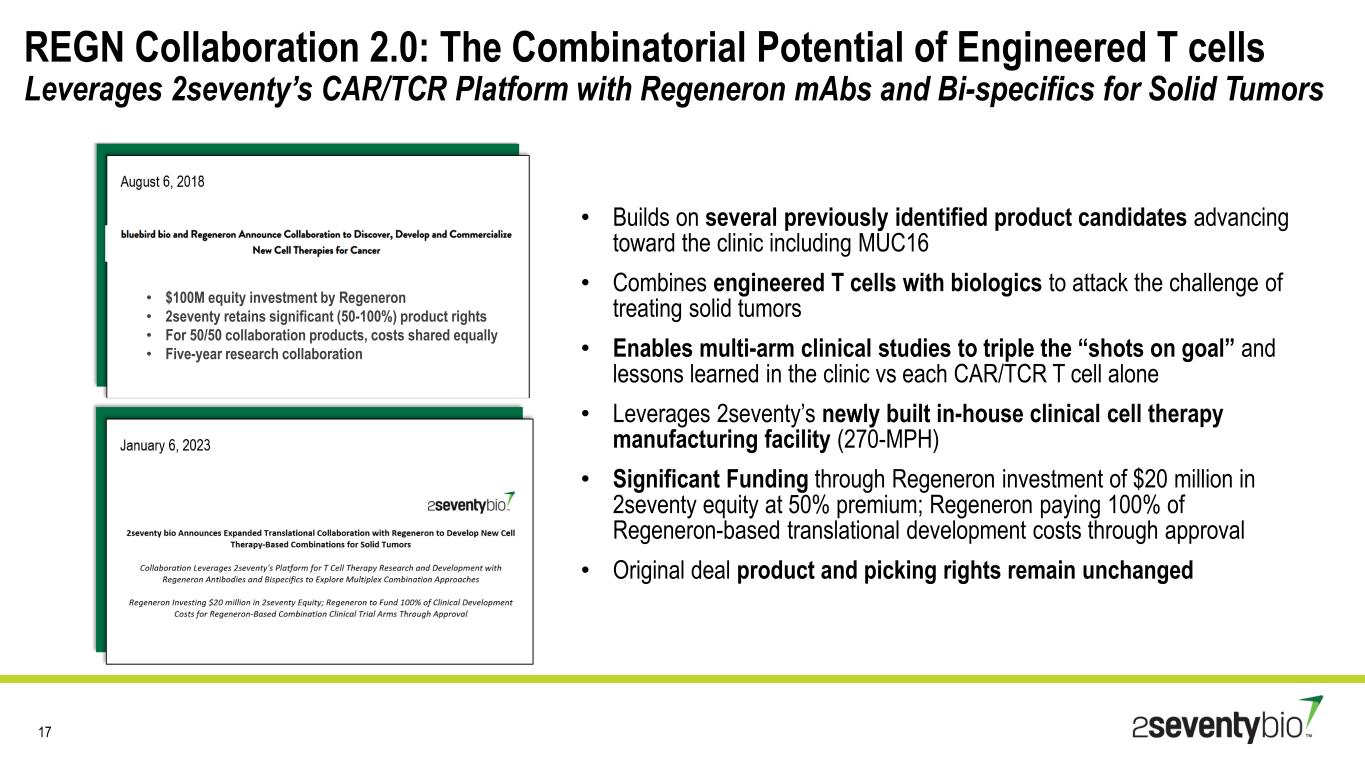

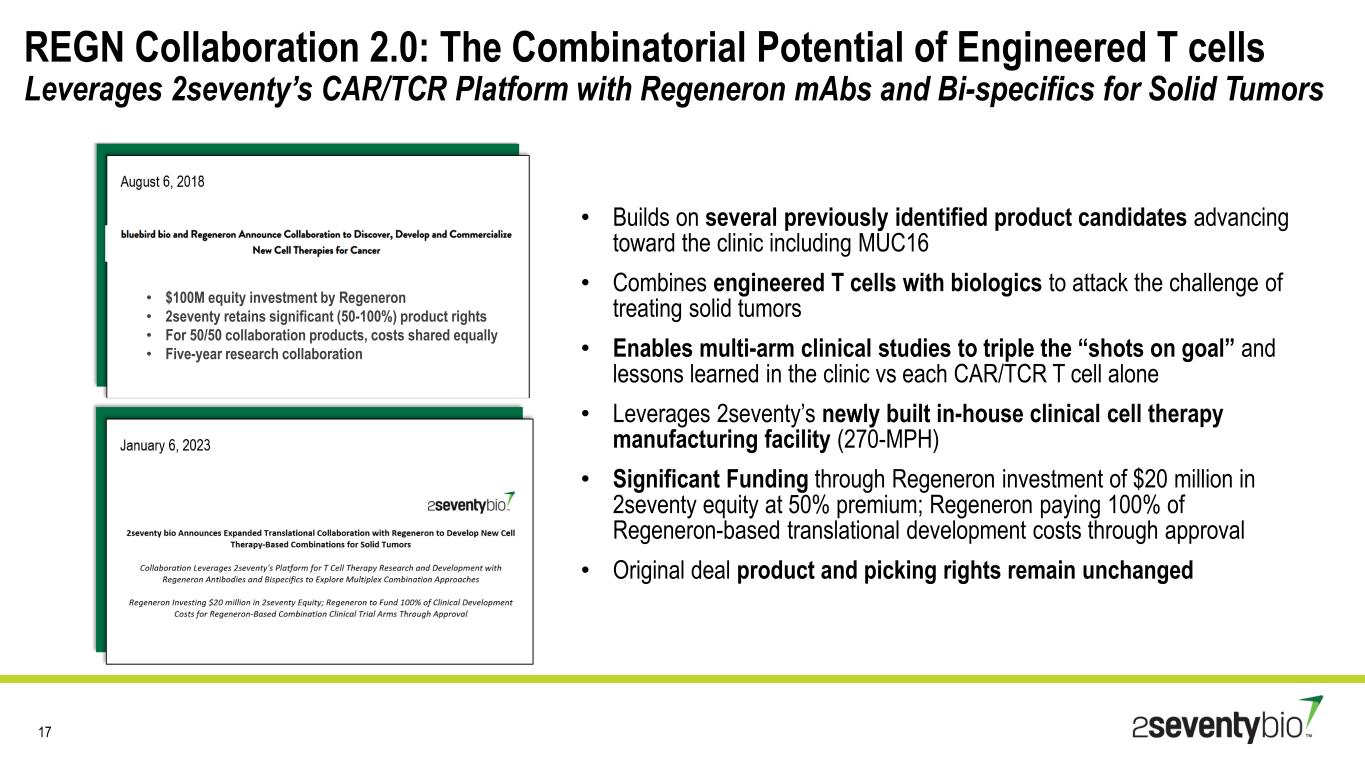

17 REGN Collaboration 2.0: The Combinatorial Potential of Engineered T cells Leverages 2seventy’s CAR/TCR Platform with Regeneron mAbs and Bi-specifics for Solid Tumors • Builds on several previously identified product candidates advancing toward the clinic including MUC16 • Combines engineered T cells with biologics to attack the challenge of treating solid tumors • Enables multi-arm clinical studies to triple the “shots on goal” and lessons learned in the clinic vs each CAR/TCR T cell alone • Leverages 2seventy’s newly built in-house clinical cell therapy manufacturing facility (270-MPH) • Significant Funding through Regeneron investment of $20 million in 2seventy equity at 50% premium; Regeneron paying 100% of Regeneron-based translational development costs through approval • Original deal product and picking rights remain unchanged • $100M equity investment by Regeneron • 2seventy retains significant (50-100%) product rights • For 50/50 collaboration products, costs shared equally • Five-year research collaboration

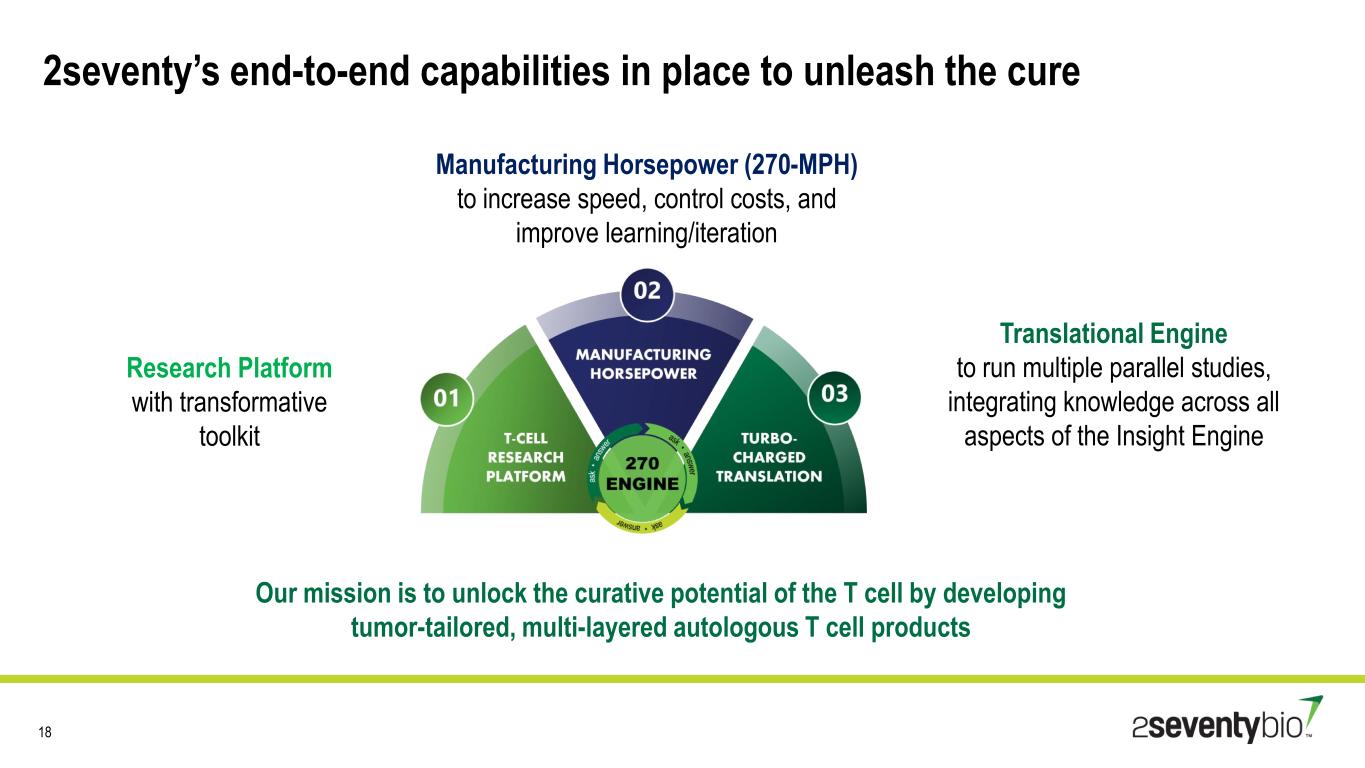

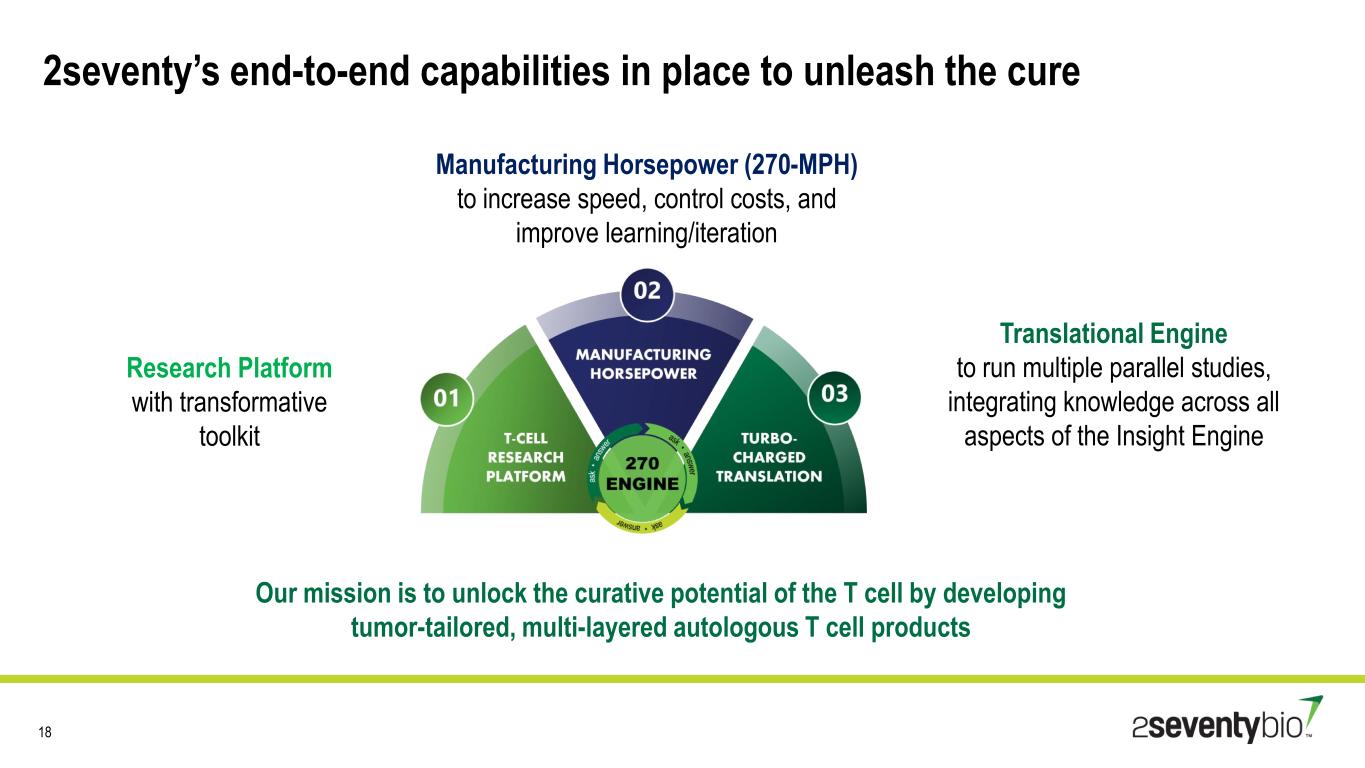

2seventy’s end-to-end capabilities in place to unleash the cure 18 Research Platform with transformative toolkit Manufacturing Horsepower (270-MPH) to increase speed, control costs, and improve learning/iteration Translational Engine to run multiple parallel studies, integrating knowledge across all aspects of the Insight Engine Our mission is to unlock the curative potential of the T cell by developing tumor-tailored, multi-layered autologous T cell products

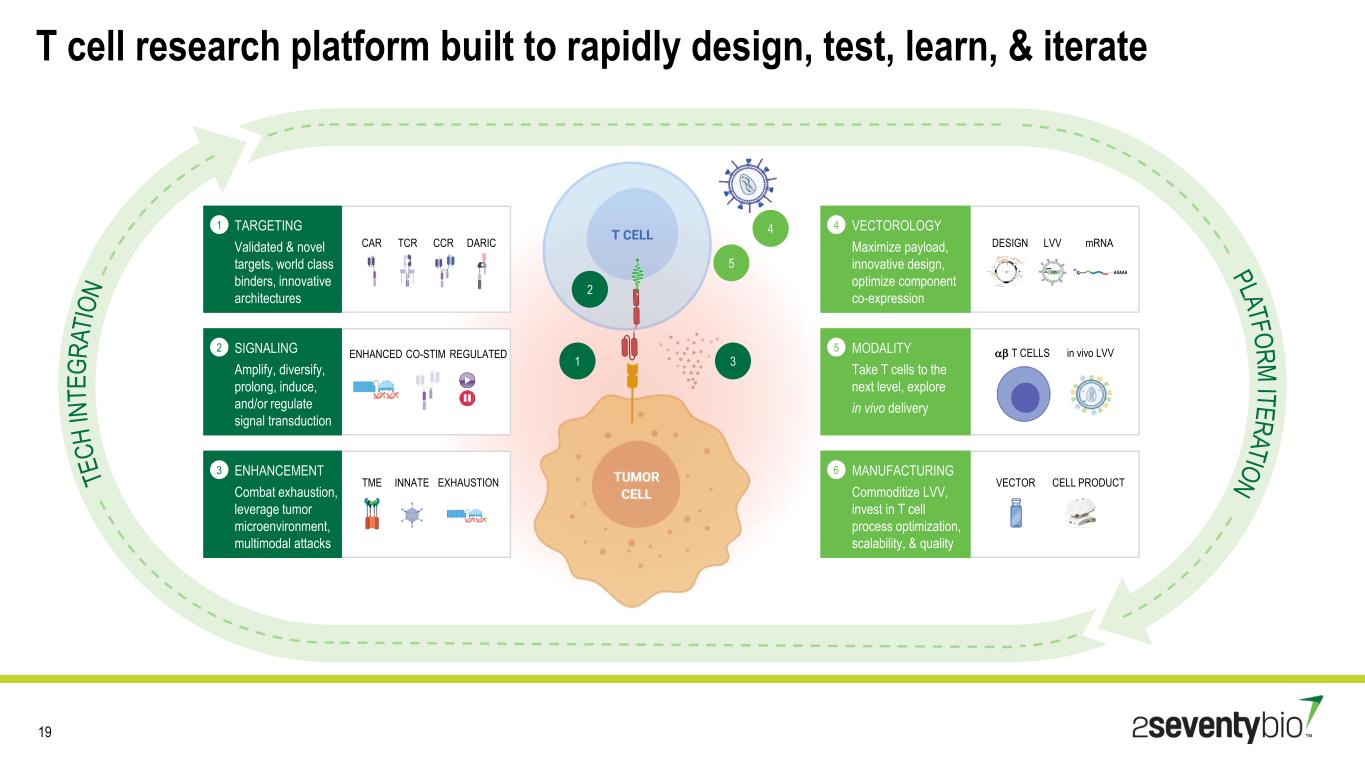

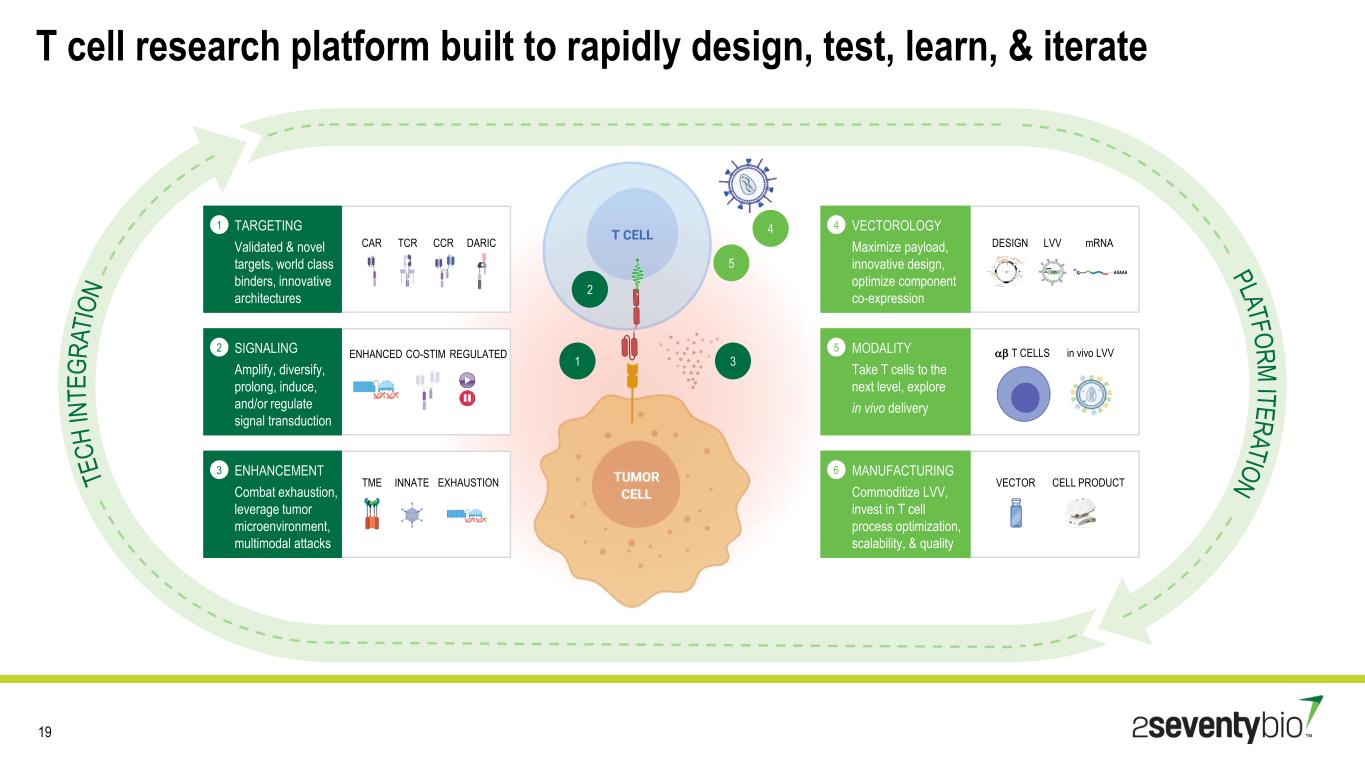

T cell research platform built to rapidly design, test, learn, & iterate 19 1 2 3 4 5 VECTOROLOGY Maximize payload, innovative design, optimize component co-expression 4 DESIGN LVV mRNA MODALITY Take T cells to the next level, explore in vivo delivery 5 ab T CELLS in vivo LVV MANUFACTURING Commoditize LVV, invest in T cell process optimization, scalability, & quality 6 VECTOR CELL PRODUCT TARGETING Validated & novel targets, world class binders, innovative architectures SIGNALING Amplify, diversify, prolong, induce, and/or regulate signal transduction ENHANCEMENT Combat exhaustion, leverage tumor microenvironment, multimodal attacks 1 TCR CCR DARICCAR 2 ENHANCED CO-STIM REGULATED 3 TME INNATE EXHAUSTION

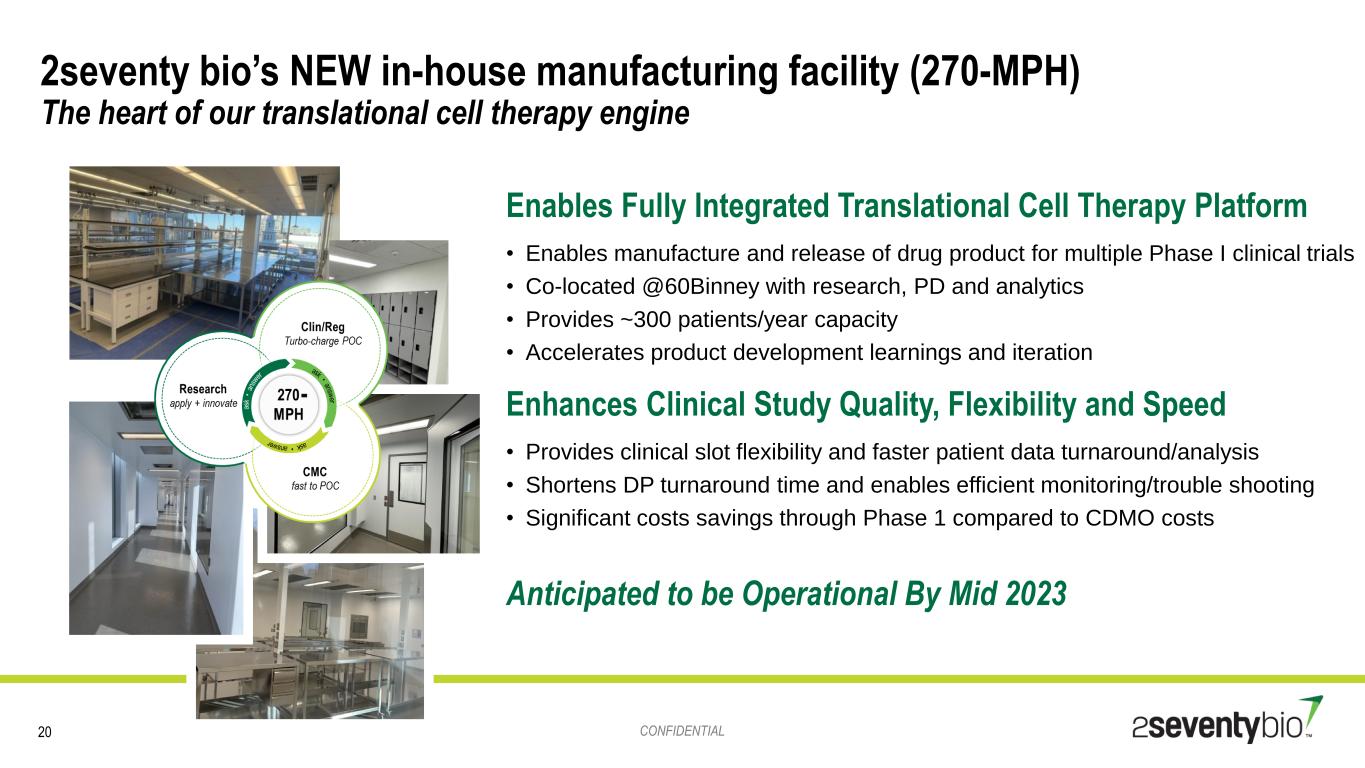

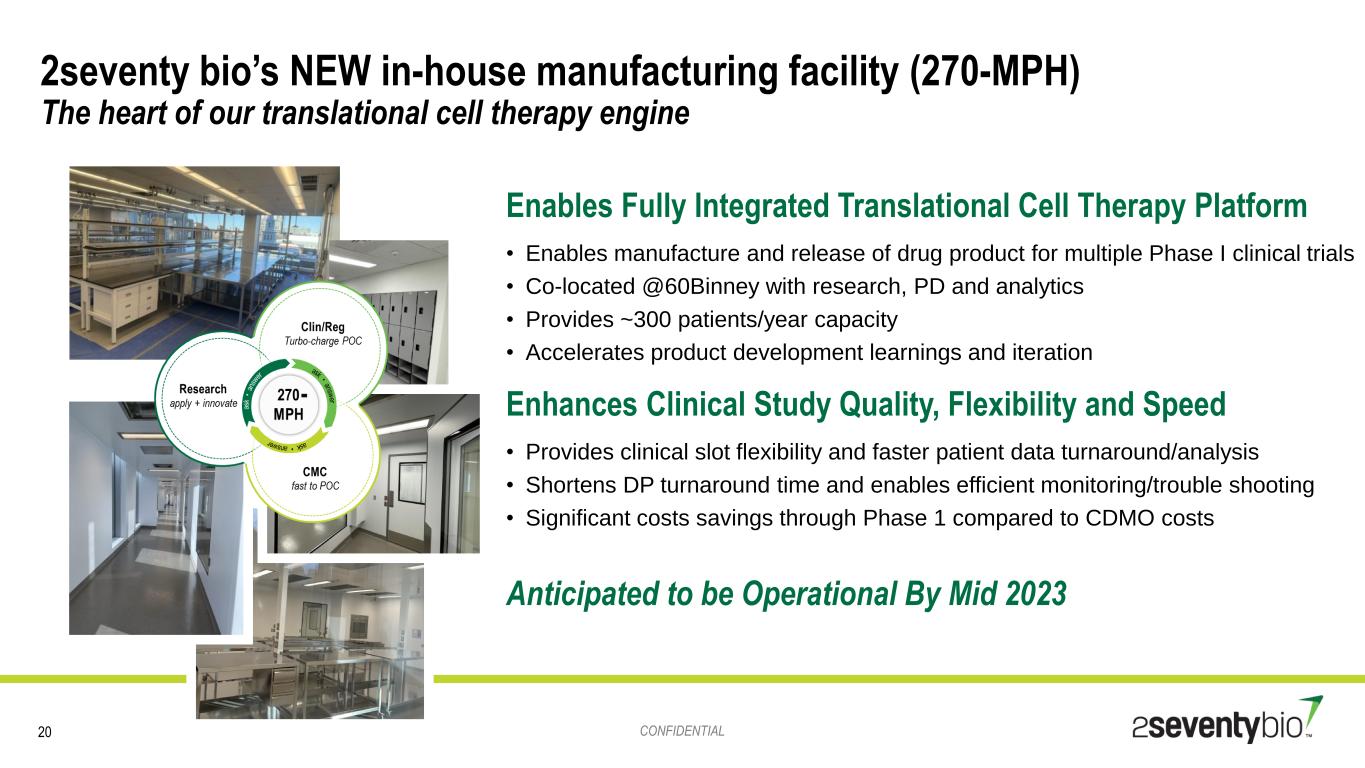

CONFIDENTIAL 2seventy bio’s NEW in-house manufacturing facility (270-MPH) The heart of our translational cell therapy engine 20 Enables Fully Integrated Translational Cell Therapy Platform • Enables manufacture and release of drug product for multiple Phase I clinical trials • Co-located @60Binney with research, PD and analytics • Provides ~300 patients/year capacity • Accelerates product development learnings and iteration Enhances Clinical Study Quality, Flexibility and Speed • Provides clinical slot flexibility and faster patient data turnaround/analysis • Shortens DP turnaround time and enables efficient monitoring/trouble shooting • Significant costs savings through Phase 1 compared to CDMO costs Anticipated to be Operational By Mid 2023 -

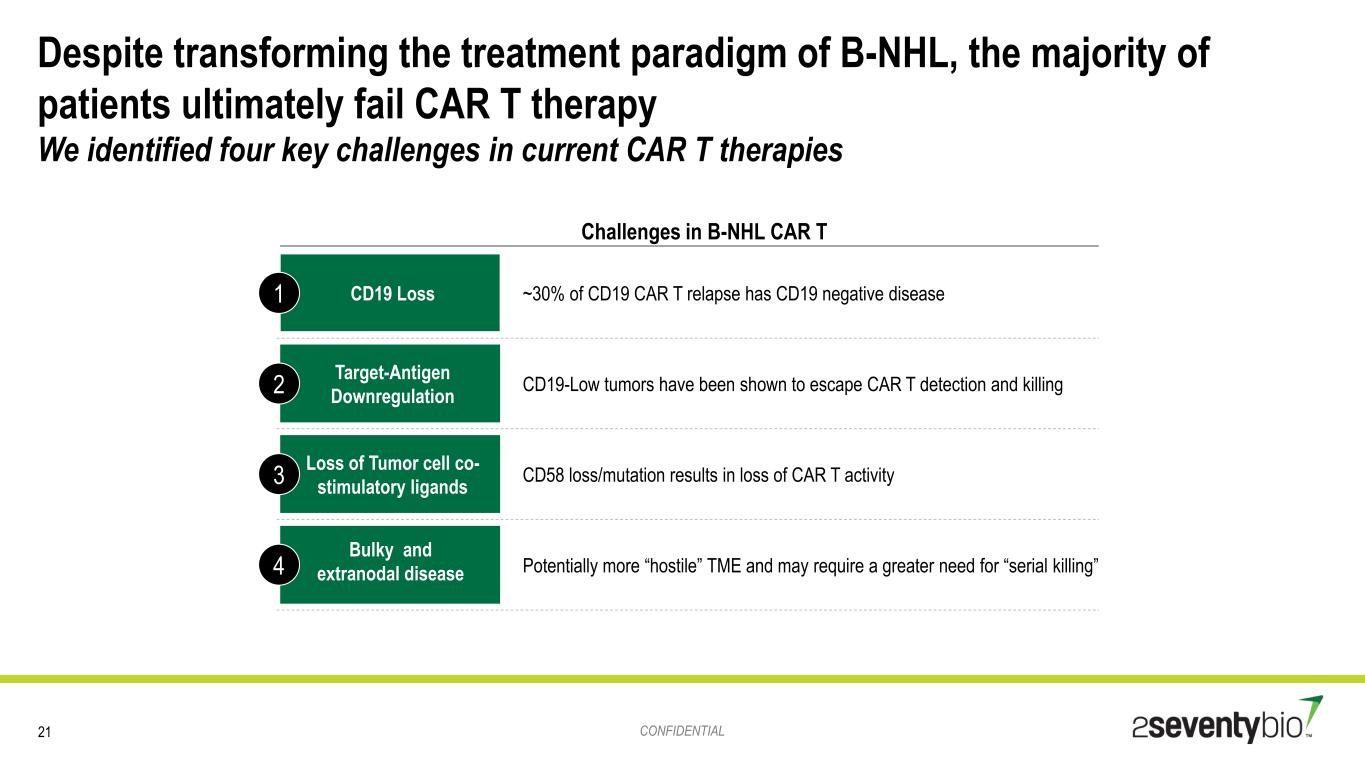

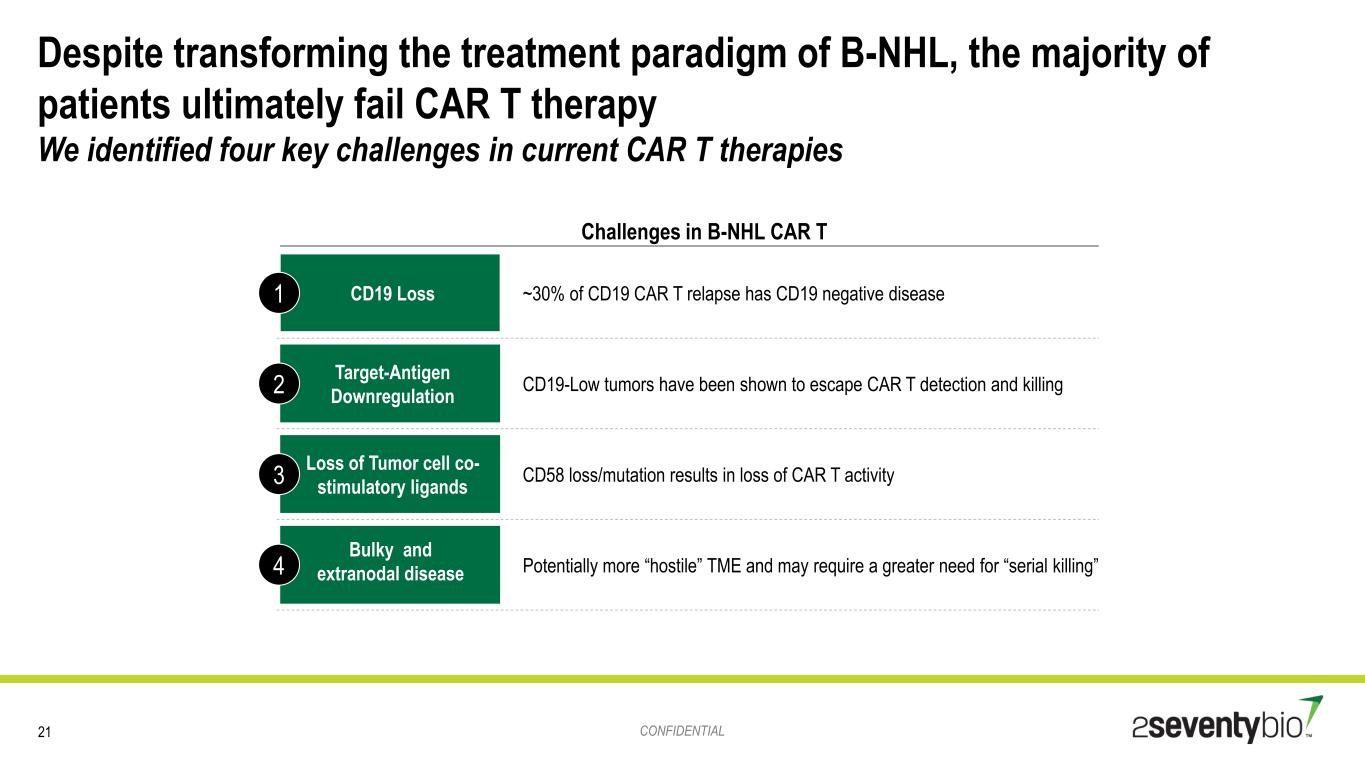

CONFIDENTIAL Despite transforming the treatment paradigm of B-NHL, the majority of patients ultimately fail CAR T therapy We identified four key challenges in current CAR T therapies 21 CD19 Loss Target-Antigen Downregulation Loss of Tumor cell co- stimulatory ligands Challenges in B-NHL CAR T ~30% of CD19 CAR T relapse has CD19 negative disease CD19-Low tumors have been shown to escape CAR T detection and killing CD58 loss/mutation results in loss of CAR T activity Potentially more “hostile” TME and may require a greater need for “serial killing” 1 2 3 4 Bulky and extranodal disease

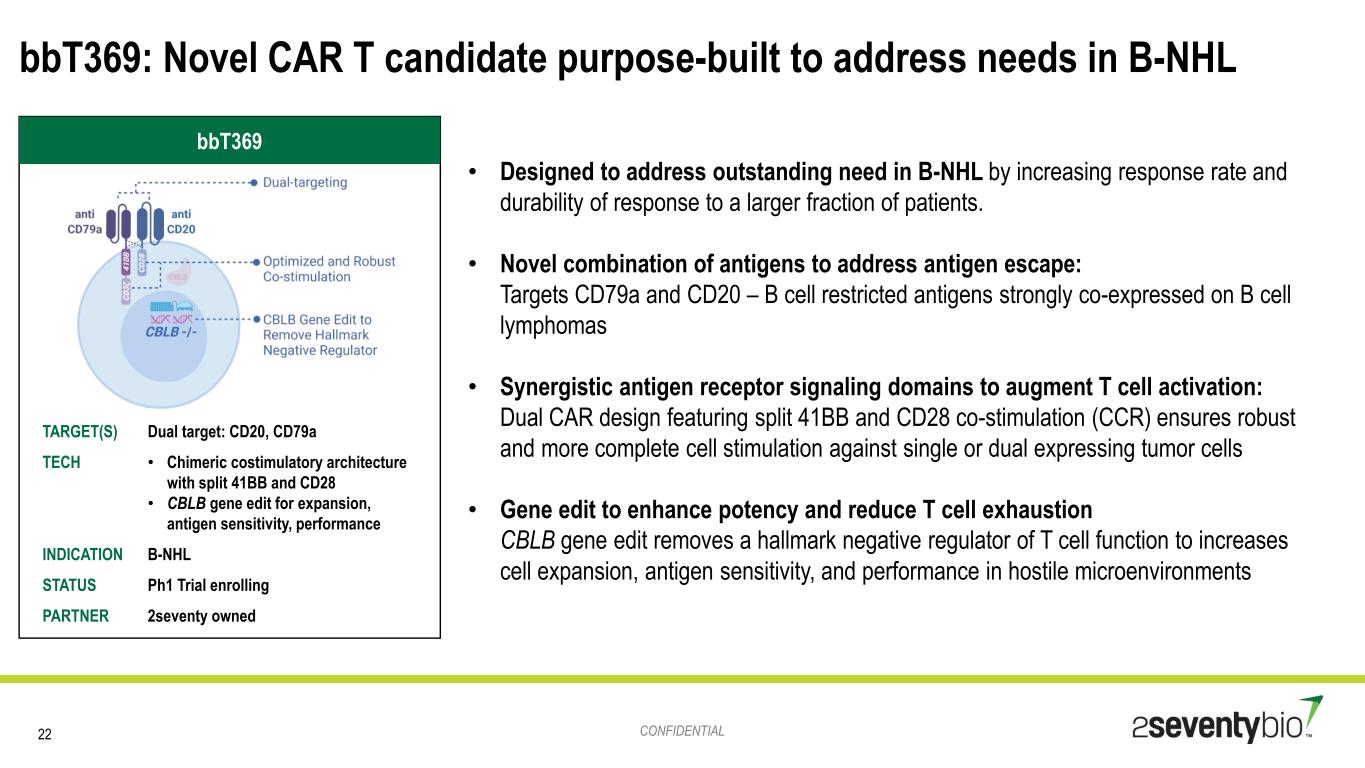

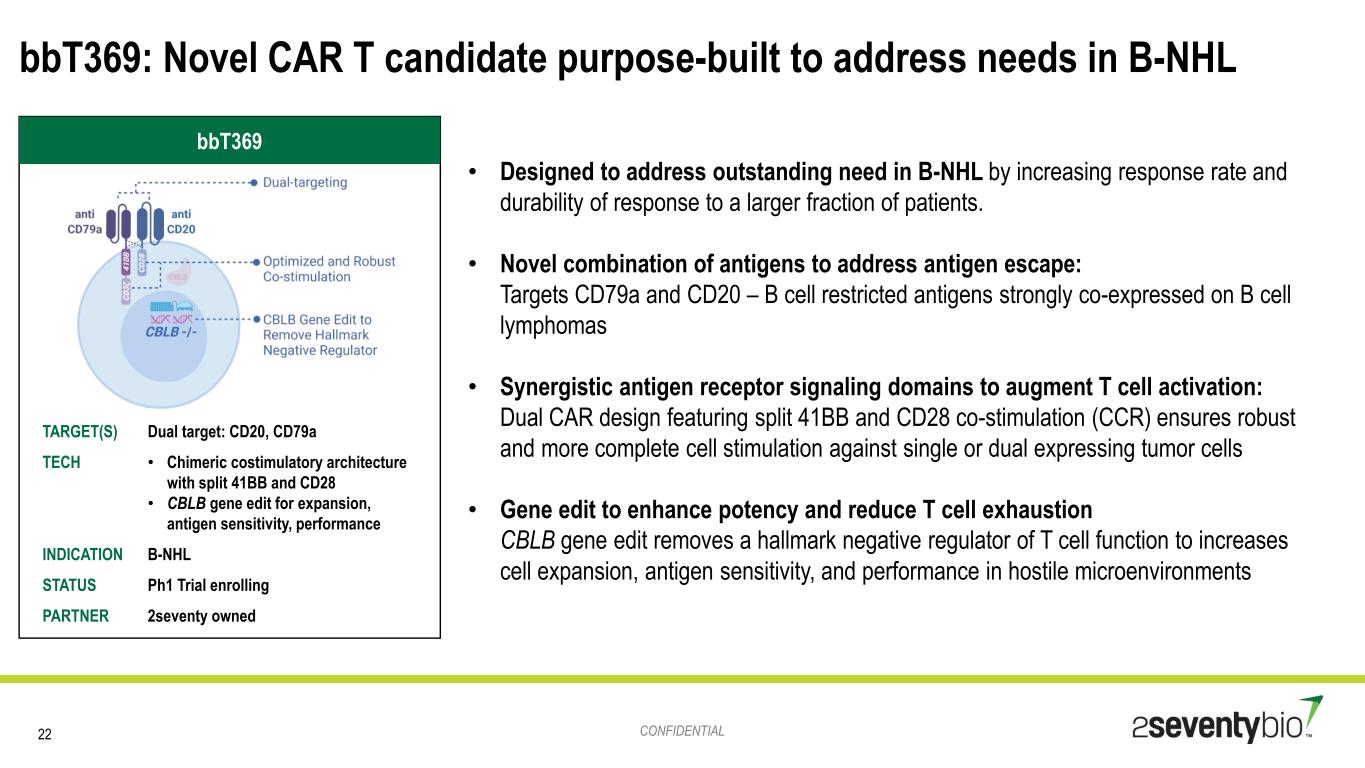

CONFIDENTIAL bbT369: Novel CAR T candidate purpose-built to address needs in B-NHL • Designed to address outstanding need in B-NHL by increasing response rate and durability of response to a larger fraction of patients. • Novel combination of antigens to address antigen escape: Targets CD79a and CD20 – B cell restricted antigens strongly co-expressed on B cell lymphomas • Synergistic antigen receptor signaling domains to augment T cell activation: Dual CAR design featuring split 41BB and CD28 co-stimulation (CCR) ensures robust and more complete cell stimulation against single or dual expressing tumor cells • Gene edit to enhance potency and reduce T cell exhaustion CBLB gene edit removes a hallmark negative regulator of T cell function to increases cell expansion, antigen sensitivity, and performance in hostile microenvironments 22 bbT369 TARGET(S) Dual target: CD20, CD79a TECH • Chimeric costimulatory architecture with split 41BB and CD28 • CBLB gene edit for expansion, antigen sensitivity, performance INDICATION B-NHL STATUS Ph1 Trial enrolling PARTNER 2seventy owned

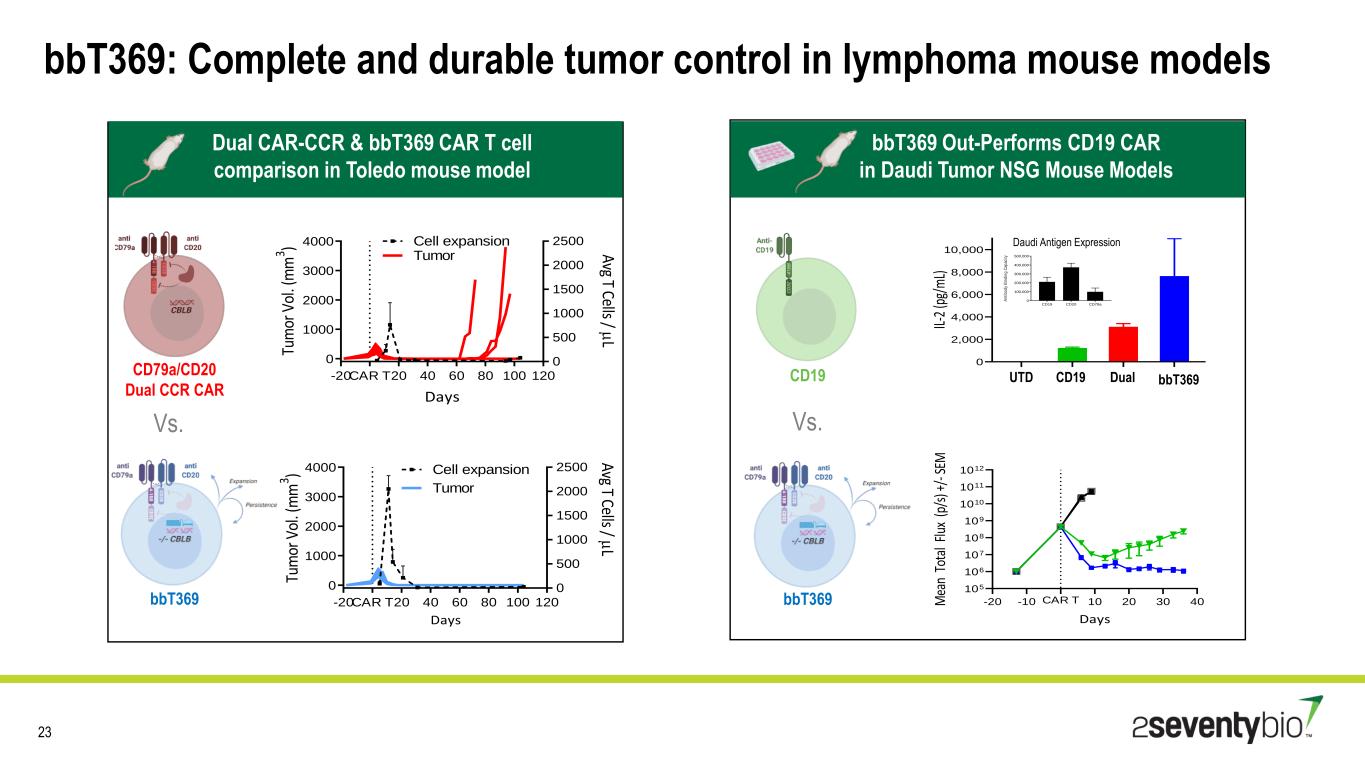

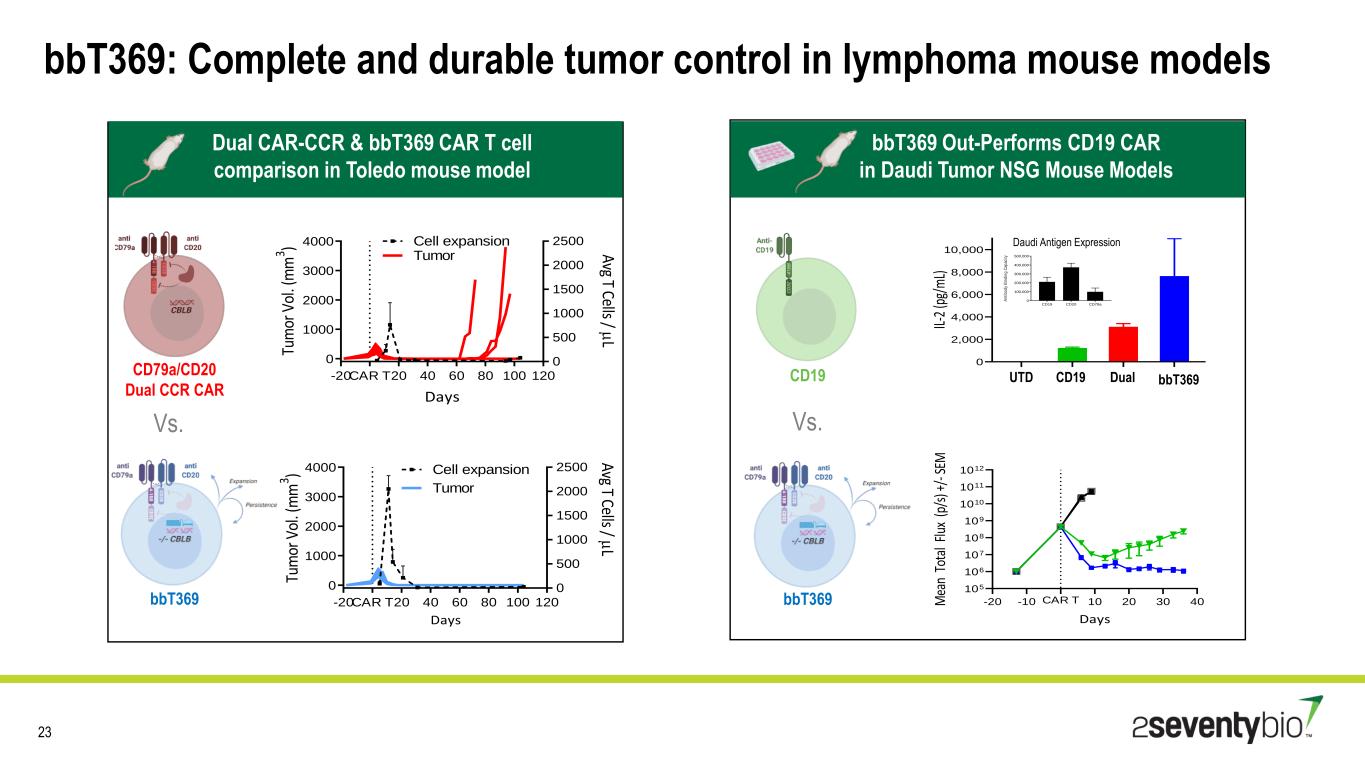

bbT369: Complete and durable tumor control in lymphoma mouse models 23 bbT369 -20 20 40 60 80 100 120 0 1000 2000 3000 4000 0 500 1000 1500 2000 2500 Days Tu m or V ol . ( m m 3 ) Avg T Cells / L CAR T Cell expansion Tumor -20 20 40 60 80 100 120 0 1000 2000 3000 4000 0 500 1000 1500 2000 2500 Days Tu m or V ol . ( m m 3 ) Avg T Cells / L CAR T Cell expansion Tumor CD79a/CD20 Dual CCR CAR Dual CAR-CCR & bbT369 CAR T cell comparison in Toledo mouse model 0 2,000 4,000 6,000 8,000 10,000 IL- 2 (p g/ m L) UTD CD19 Dual bbT369 bbT369 Out-Performs CD19 CAR in Daudi Tumor NSG Mouse Models -20 -10 10 20 30 40 105 106 107 108 109 1010 1011 1012 Days M ea n T ot al F lu x (p /s ) + /- S EM CAR T CD19 bbT369 Vs. CD19 CD20 CD79a 0 100,000 200,000 300,000 400,000 500,000 A n ti b o d y B in d in g C ap ac it y Daudi Antigen Expression Vs.

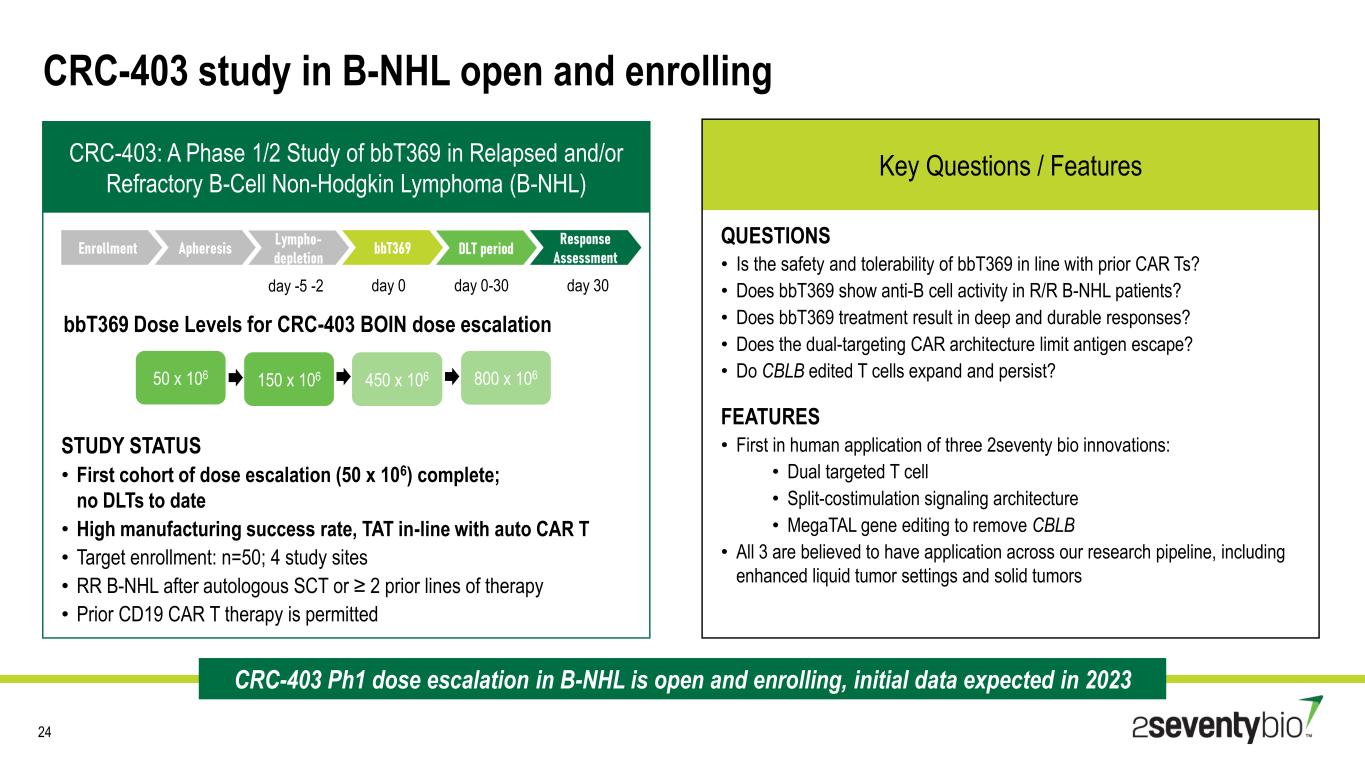

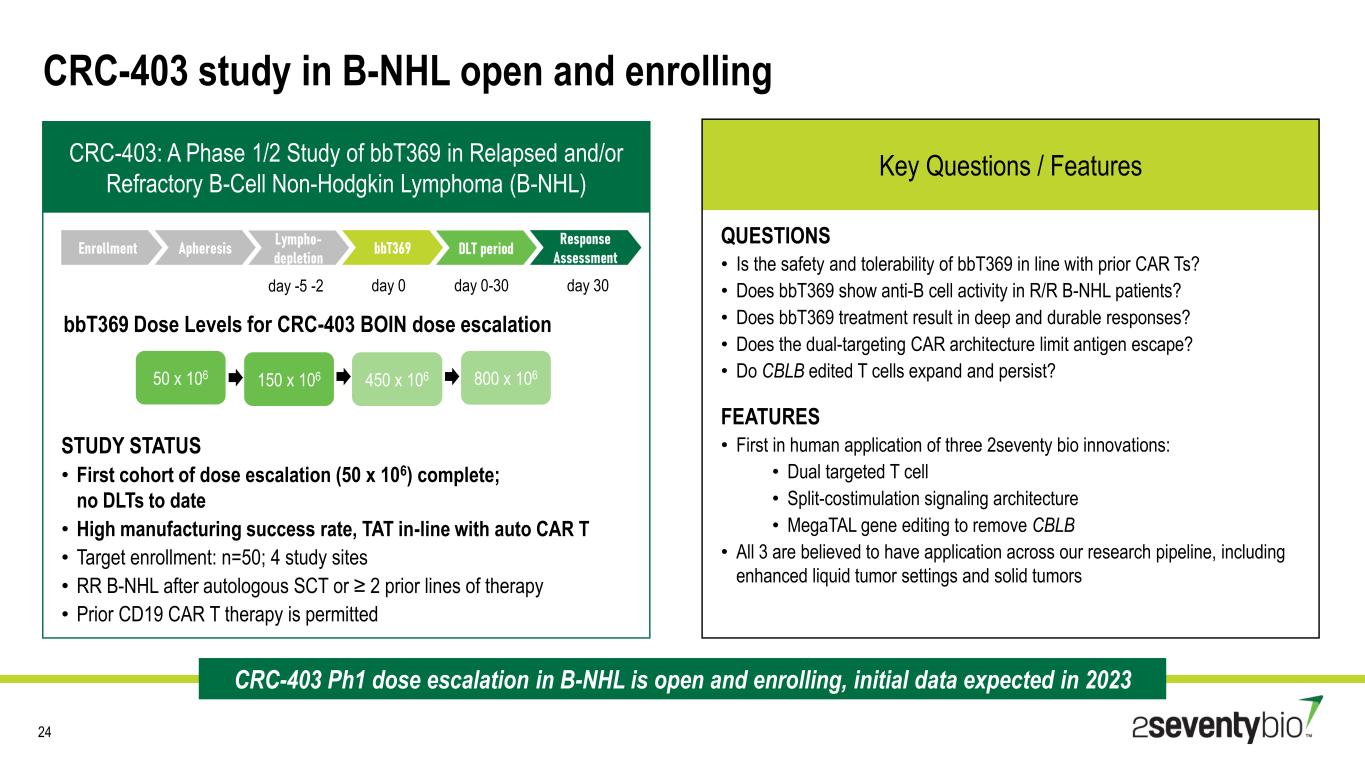

CRC-403 study in B-NHL open and enrolling 24 day -5 -2 day 0 day 0-30 day 30 CRC-403: A Phase 1/2 Study of bbT369 in Relapsed and/or Refractory B-Cell Non-Hodgkin Lymphoma (B-NHL) Key Questions / Features QUESTIONS • Is the safety and tolerability of bbT369 in line with prior CAR Ts? • Does bbT369 show anti-B cell activity in R/R B-NHL patients? • Does bbT369 treatment result in deep and durable responses? • Does the dual-targeting CAR architecture limit antigen escape? • Do CBLB edited T cells expand and persist? FEATURES • First in human application of three 2seventy bio innovations: • Dual targeted T cell • Split-costimulation signaling architecture • MegaTAL gene editing to remove CBLB • All 3 are believed to have application across our research pipeline, including enhanced liquid tumor settings and solid tumors STUDY STATUS • First cohort of dose escalation (50 x 106) complete; no DLTs to date • High manufacturing success rate, TAT in-line with auto CAR T • Target enrollment: n=50; 4 study sites • RR B-NHL after autologous SCT or ≥ 2 prior lines of therapy • Prior CD19 CAR T therapy is permitted 50 x 106 150 x 106 450 x 106 800 x 106 bbT369 Dose Levels for CRC-403 BOIN dose escalation CRC-403 Ph1 dose escalation in B-NHL is open and enrolling, initial data expected in 2023

Engineered cell therapies have the potential to overcome key challenges in AML Description of issue AML targets are expressed on healthy myeloid lineage & progenitor cells; Aplasia related toxicities are likely to emerge if targeted robustly & constitutively AML originates from myeloid progenitors that have intrinsic genetic diversity and developmental plasticity AML cell therapies have shown low response durability without consolidation with SCT Preliminary cell therapy efficacy data in AML has been underwhelming relative to other heme malignancies mOS <6 months for R/R AML patients, challenging for products requiring lengthy manufacturing time 25 Challenges in AML Aplasia Risk Disease Heterogeneity T cell Persistence Achieving Robust Efficacy Rapid Progression 1 2 3 4 5 AML = worst survival rates of any blood cancer … ~80% of patients relapse, life expectancy <1 year

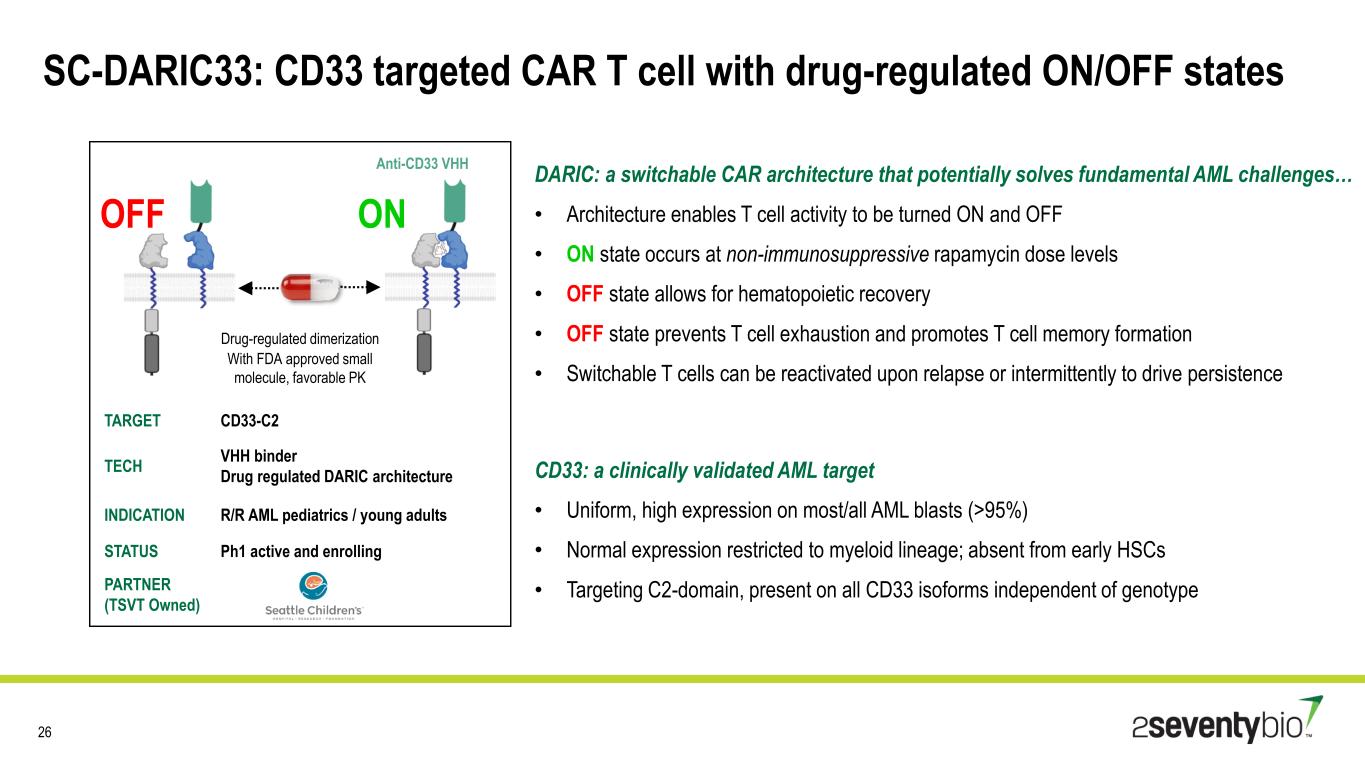

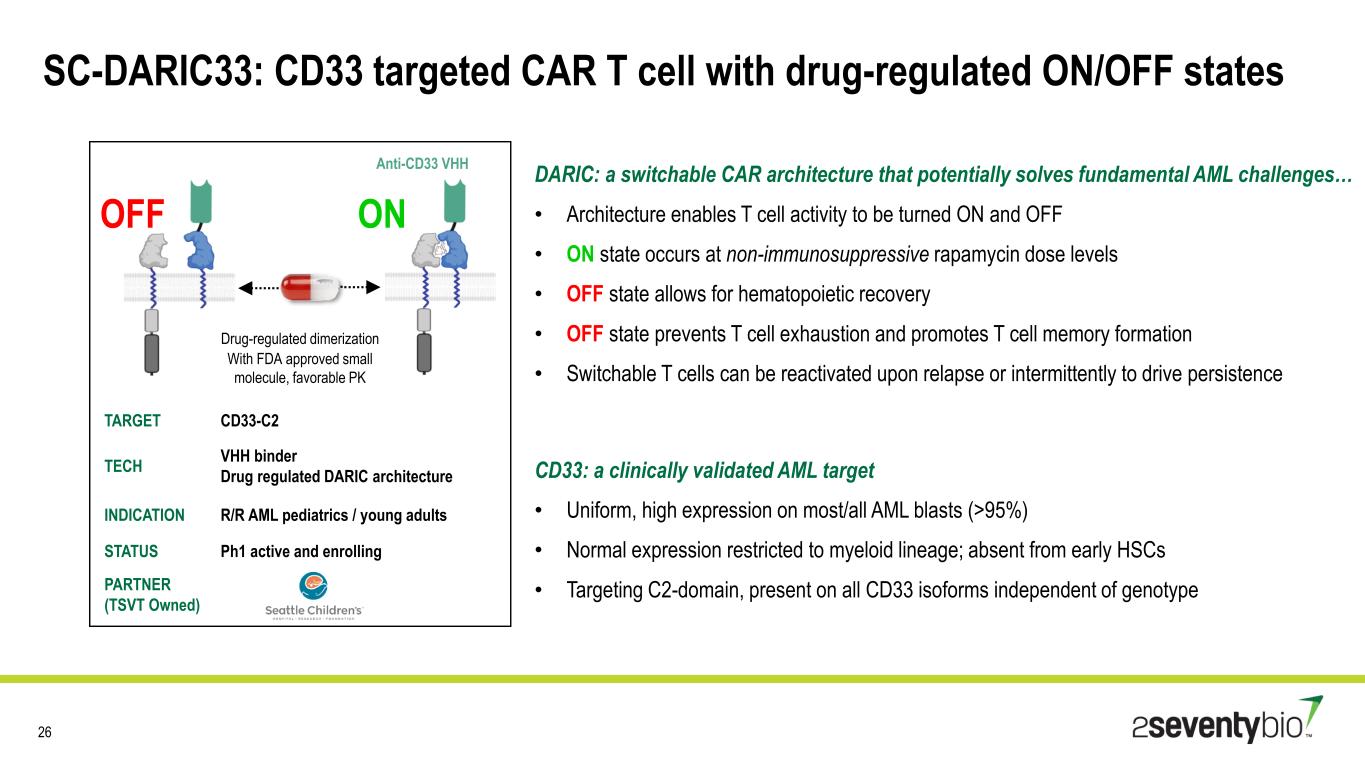

SC-DARIC33: CD33 targeted CAR T cell with drug-regulated ON/OFF states 26 DARIC: a switchable CAR architecture that potentially solves fundamental AML challenges… • Architecture enables T cell activity to be turned ON and OFF • ON state occurs at non-immunosuppressive rapamycin dose levels • OFF state allows for hematopoietic recovery • OFF state prevents T cell exhaustion and promotes T cell memory formation • Switchable T cells can be reactivated upon relapse or intermittently to drive persistence CD33: a clinically validated AML target • Uniform, high expression on most/all AML blasts (>95%) • Normal expression restricted to myeloid lineage; absent from early HSCs • Targeting C2-domain, present on all CD33 isoforms independent of genotype TARGET CD33-C2 TECH VHH binder Drug regulated DARIC architecture INDICATION R/R AML pediatrics / young adults STATUS Ph1 active and enrolling PARTNER (TSVT Owned) Drug-regulated dimerization With FDA approved small molecule, favorable PK OFF ON Anti-CD33 VHH

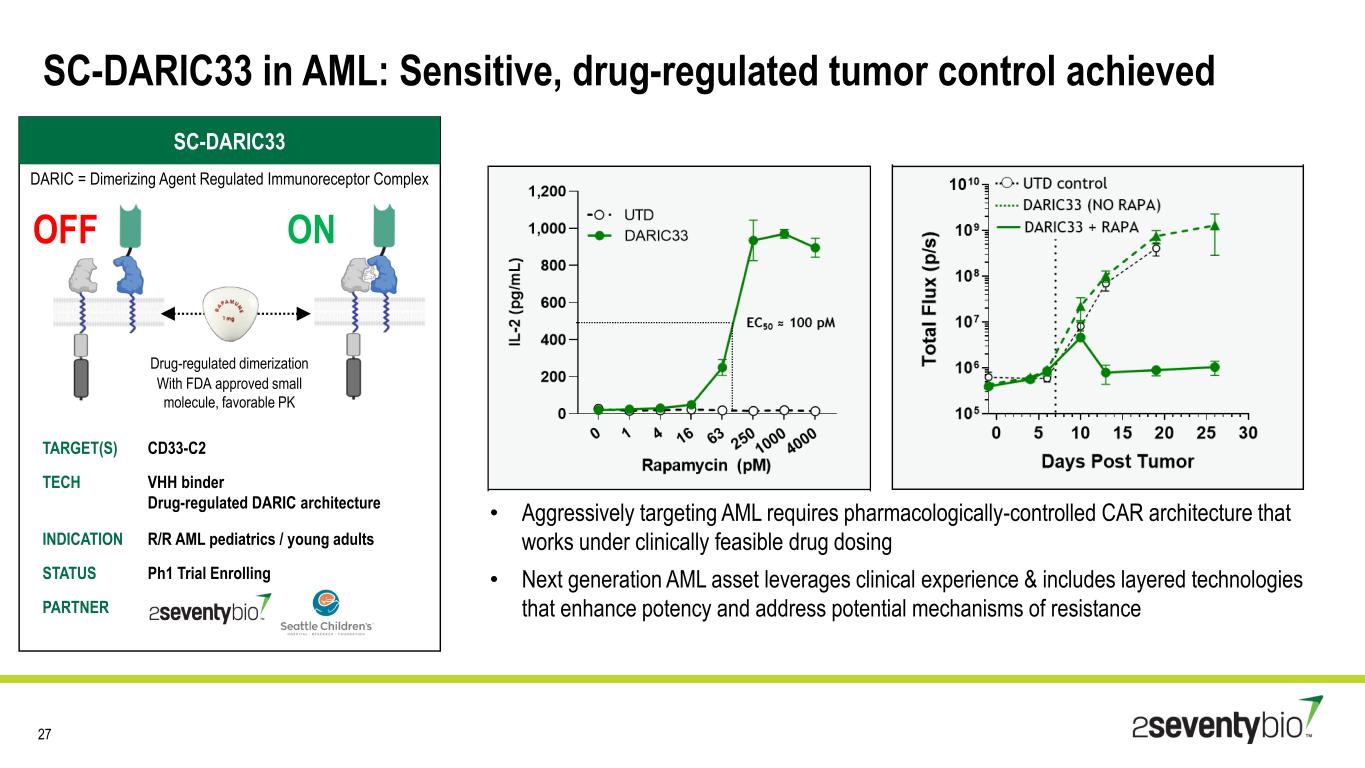

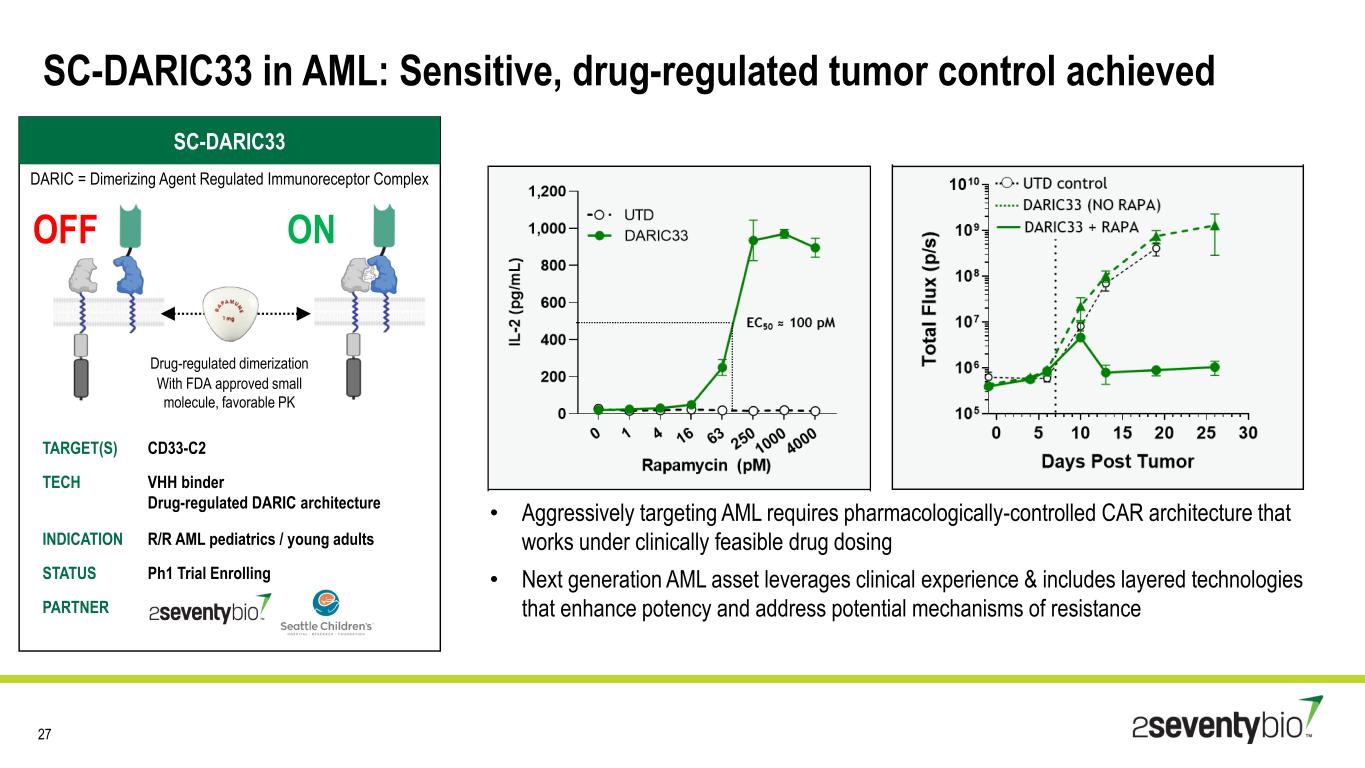

SC-DARIC33 in AML: Sensitive, drug-regulated tumor control achieved 27 SC-DARIC33 TARGET(S) CD33-C2 TECH VHH binder Drug-regulated DARIC architecture INDICATION R/R AML pediatrics / young adults STATUS Ph1 Trial Enrolling PARTNER • Aggressively targeting AML requires pharmacologically-controlled CAR architecture that works under clinically feasible drug dosing • Next generation AML asset leverages clinical experience & includes layered technologies that enhance potency and address potential mechanisms of resistance Drug-regulated dimerization With FDA approved small molecule, favorable PK OFF ON DARIC = Dimerizing Agent Regulated Immunoreceptor Complex

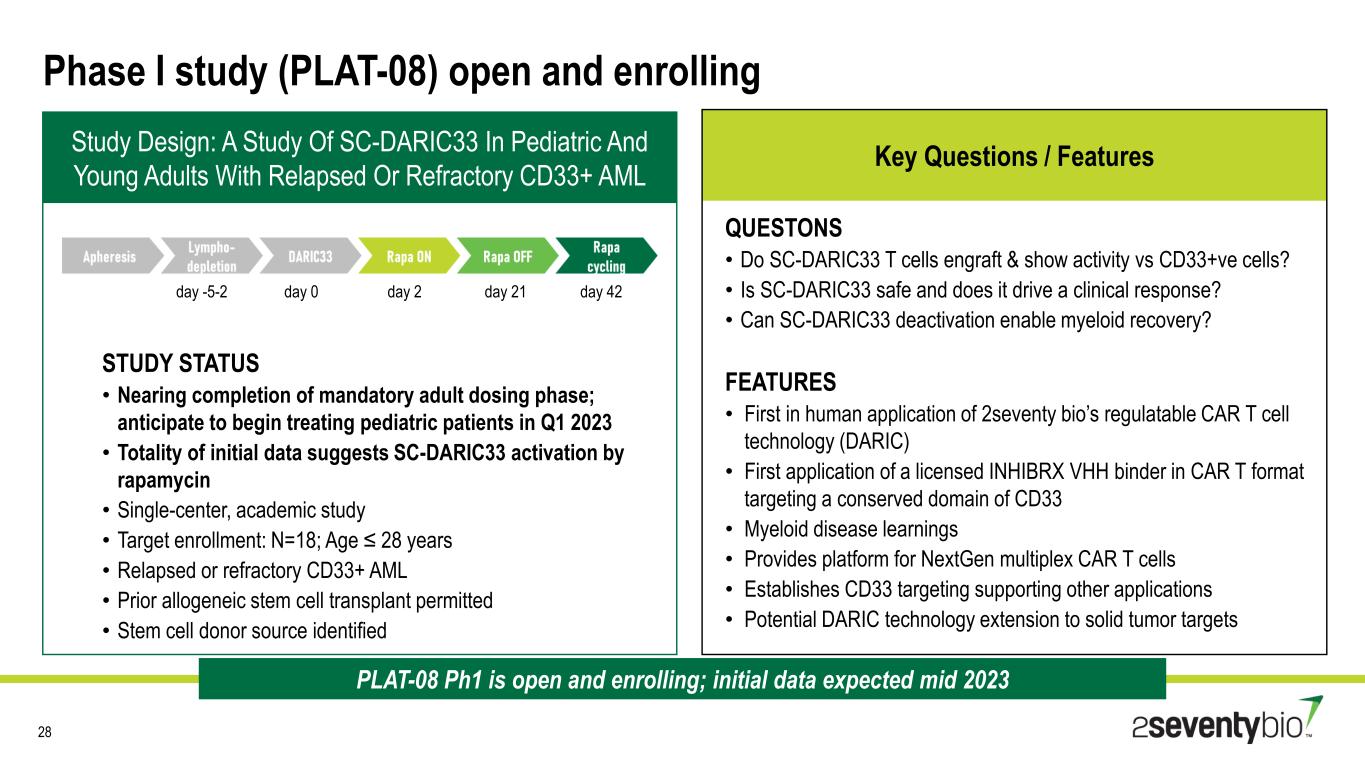

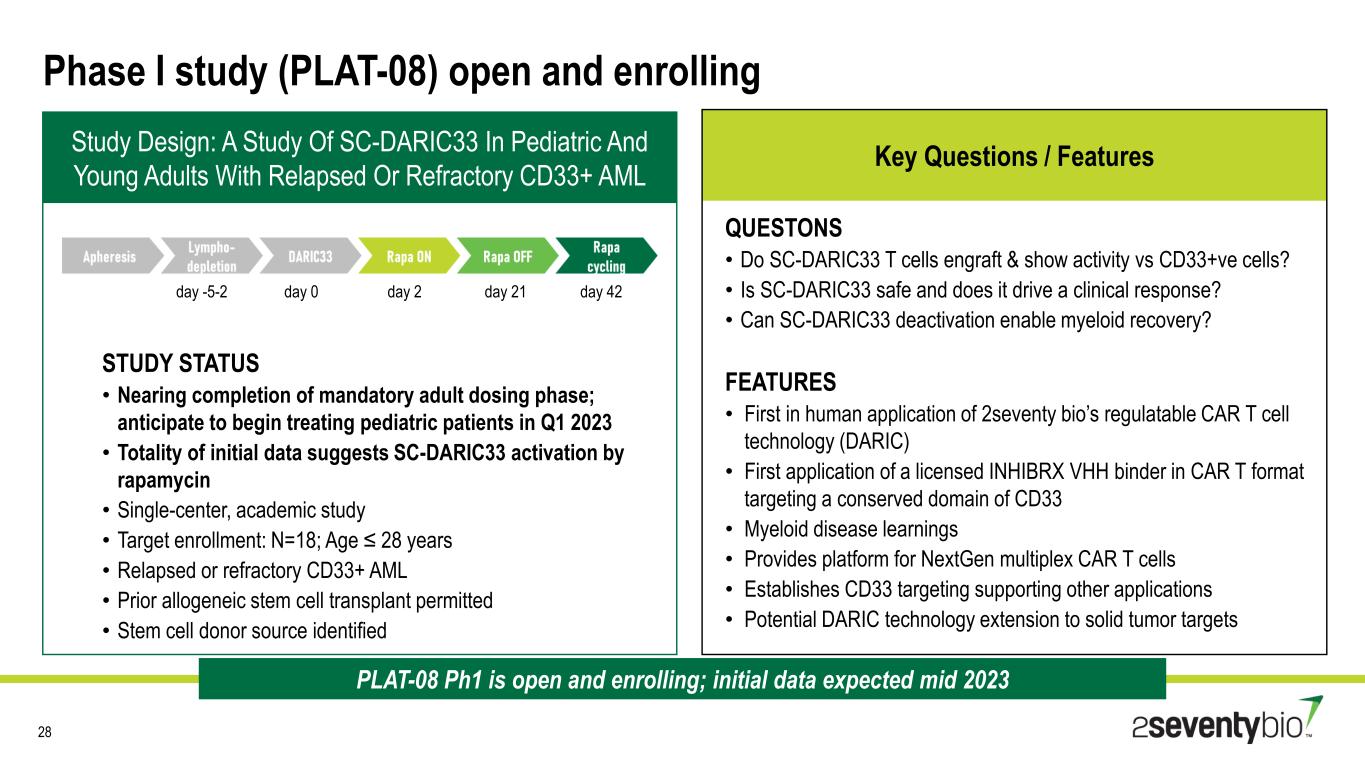

Phase I study (PLAT-08) open and enrolling 28 Study Design: A Study Of SC-DARIC33 In Pediatric And Young Adults With Relapsed Or Refractory CD33+ AML Key Questions / Features QUESTONS • Do SC-DARIC33 T cells engraft & show activity vs CD33+ve cells? • Is SC-DARIC33 safe and does it drive a clinical response? • Can SC-DARIC33 deactivation enable myeloid recovery? FEATURES • First in human application of 2seventy bio’s regulatable CAR T cell technology (DARIC) • First application of a licensed INHIBRX VHH binder in CAR T format targeting a conserved domain of CD33 • Myeloid disease learnings • Provides platform for NextGen multiplex CAR T cells • Establishes CD33 targeting supporting other applications • Potential DARIC technology extension to solid tumor targets STUDY STATUS • Nearing completion of mandatory adult dosing phase; anticipate to begin treating pediatric patients in Q1 2023 • Totality of initial data suggests SC-DARIC33 activation by rapamycin • Single-center, academic study • Target enrollment: N=18; Age ≤ 28 years • Relapsed or refractory CD33+ AML • Prior allogeneic stem cell transplant permitted • Stem cell donor source identified day -5-2 day 0 day 2 day 21 day 42 PLAT-08 Ph1 is open and enrolling; initial data expected mid 2023

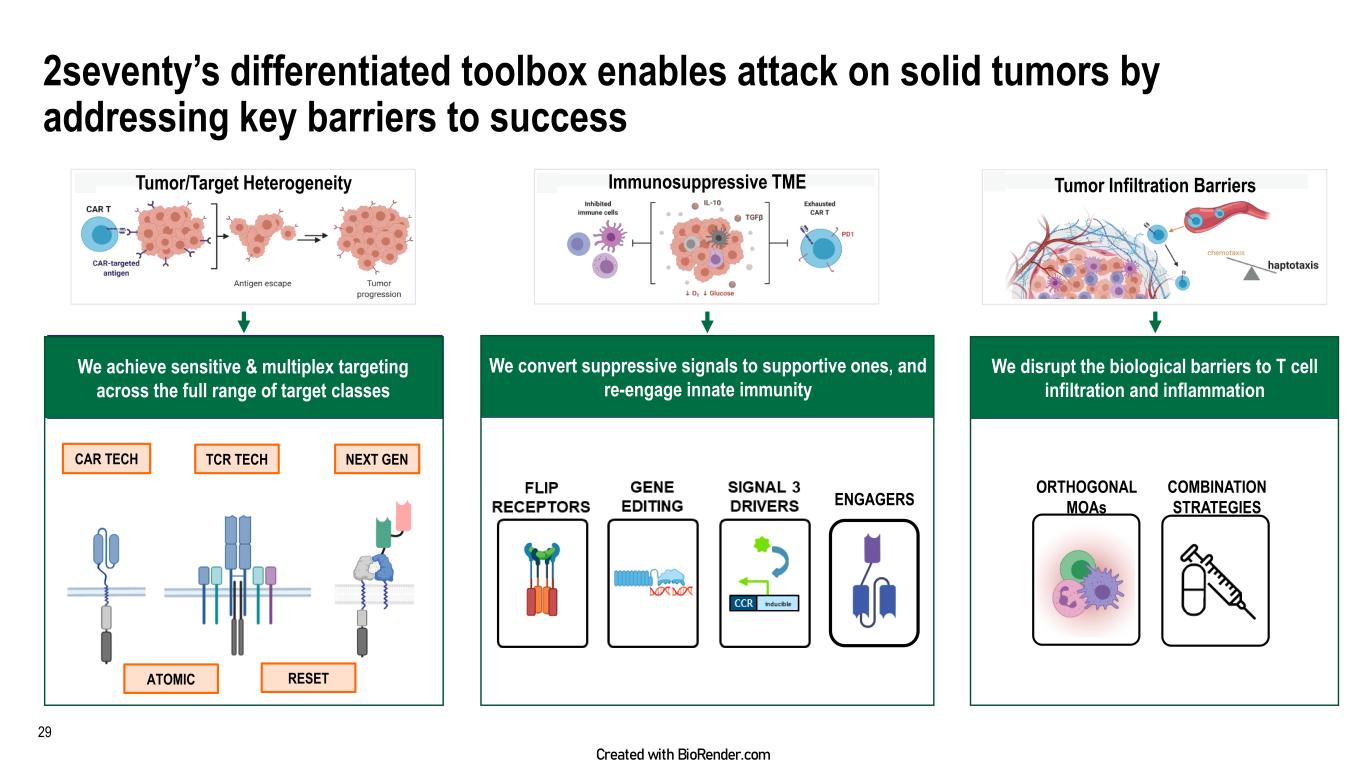

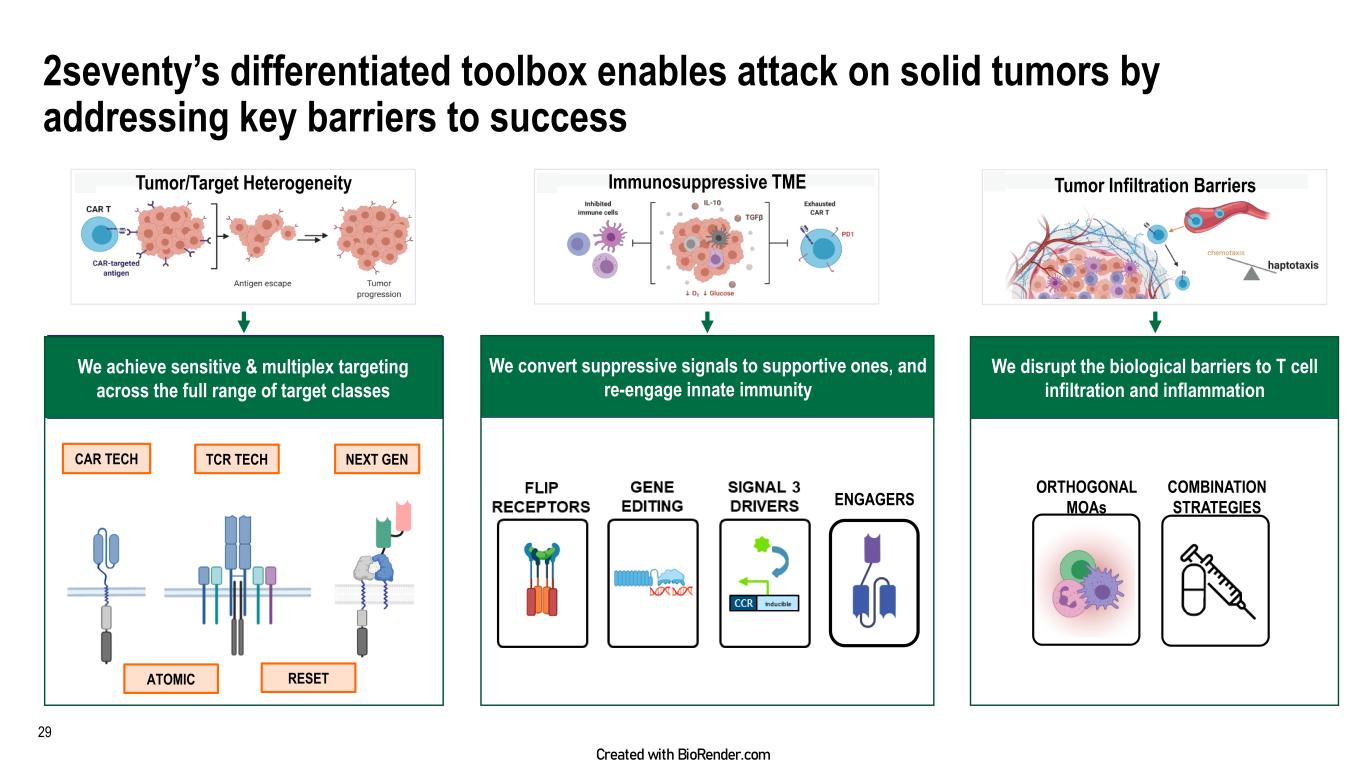

2seventy’s differentiated toolbox enables attack on solid tumors by addressing key barriers to success We achieve sensitive & multiplex targeting across the full range of target classes Tumor/Target Heterogeneity 29 CAR TECH TCR TECH NEXT GEN We disrupt the biological barriers to T cell infiltration and inflammation COMBINATION STRATEGIES ORTHOGONAL MOAs Tumor Infiltration BarriersImmunosuppressive TME We convert suppressive signals to supportive ones, and re-engage innate immunity ENGAGERS ATOMIC RESET Created with BioRender.com

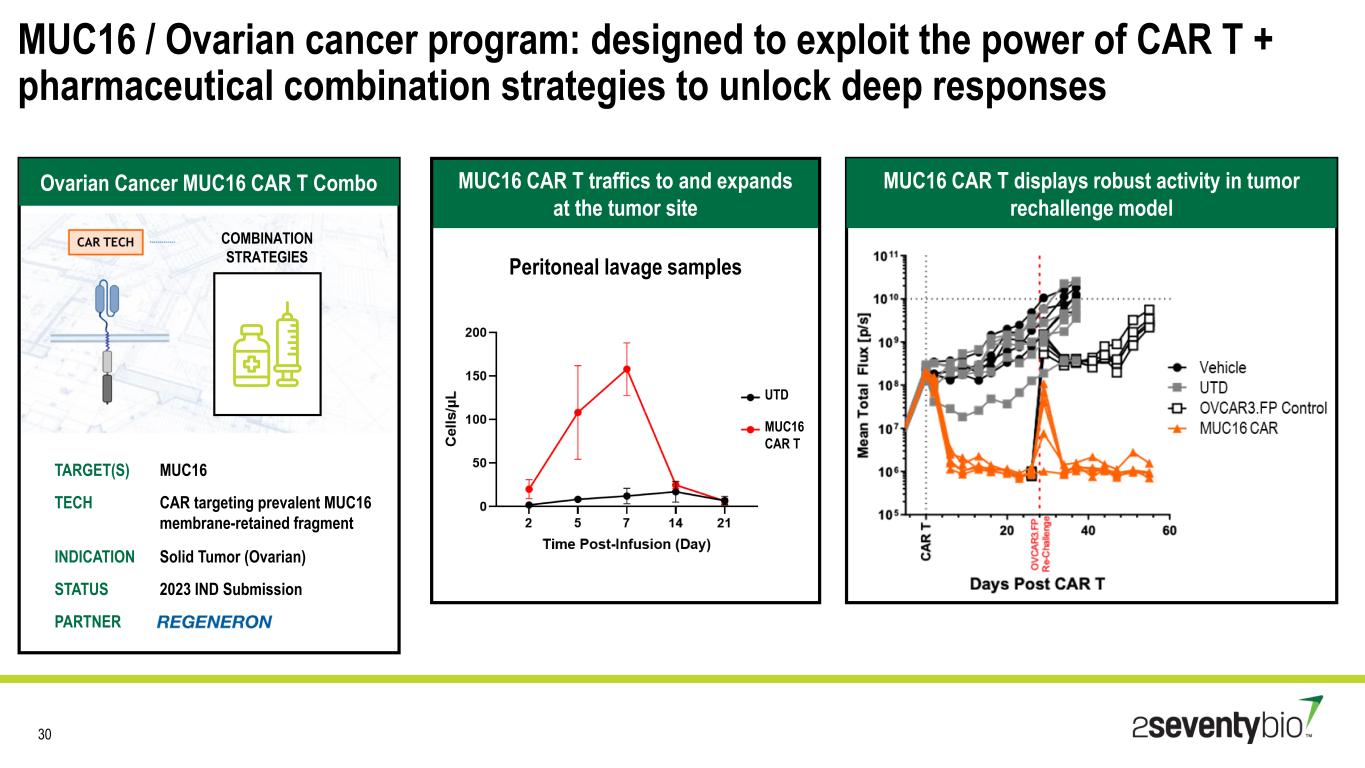

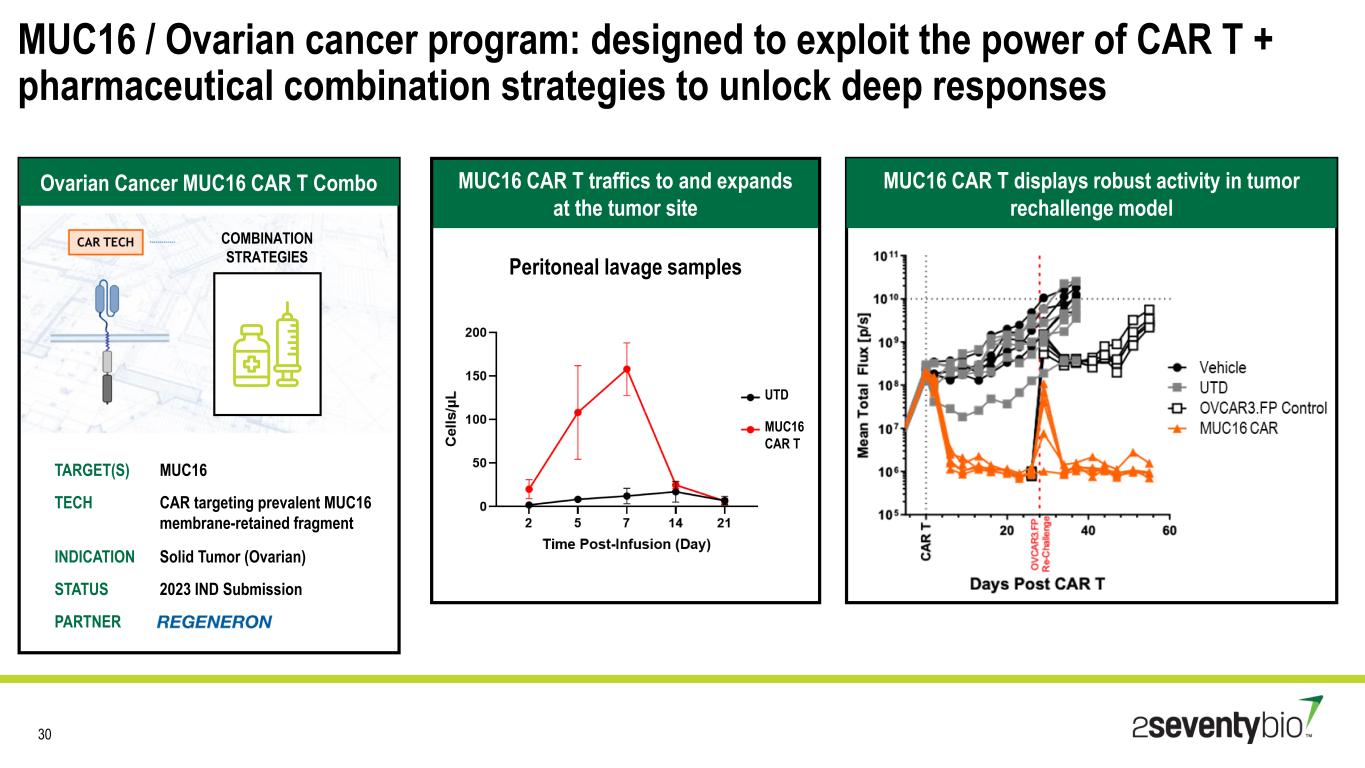

MUC16 CAR T displays robust activity in tumor rechallenge model MUC16 / Ovarian cancer program: designed to exploit the power of CAR T + pharmaceutical combination strategies to unlock deep responses Ovarian Cancer MUC16 CAR T Combo TARGET(S) MUC16 TECH CAR targeting prevalent MUC16 membrane-retained fragment INDICATION Solid Tumor (Ovarian) STATUS 2023 IND Submission PARTNER 30 COMBINATION STRATEGIES MUC16 CAR T traffics to and expands at the tumor site UTD MUC16 CAR T Peritoneal lavage samples

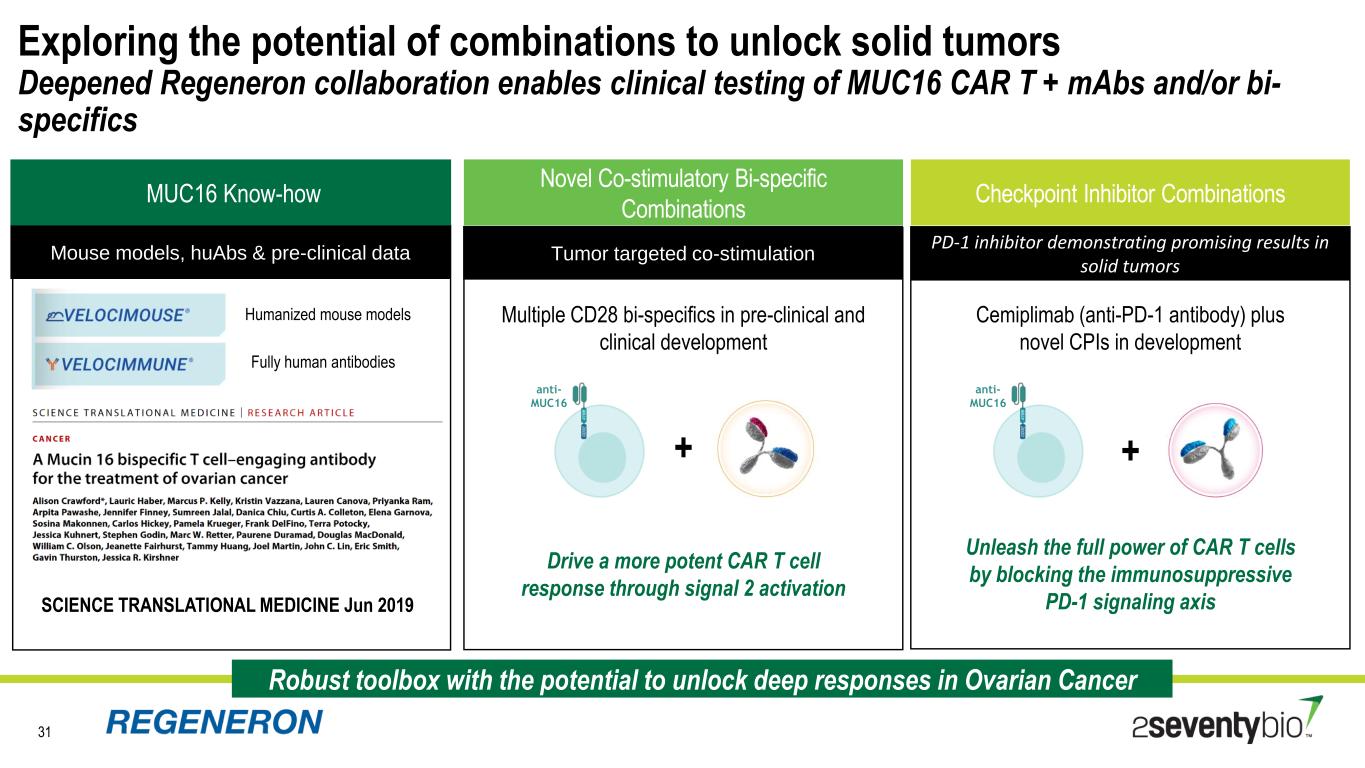

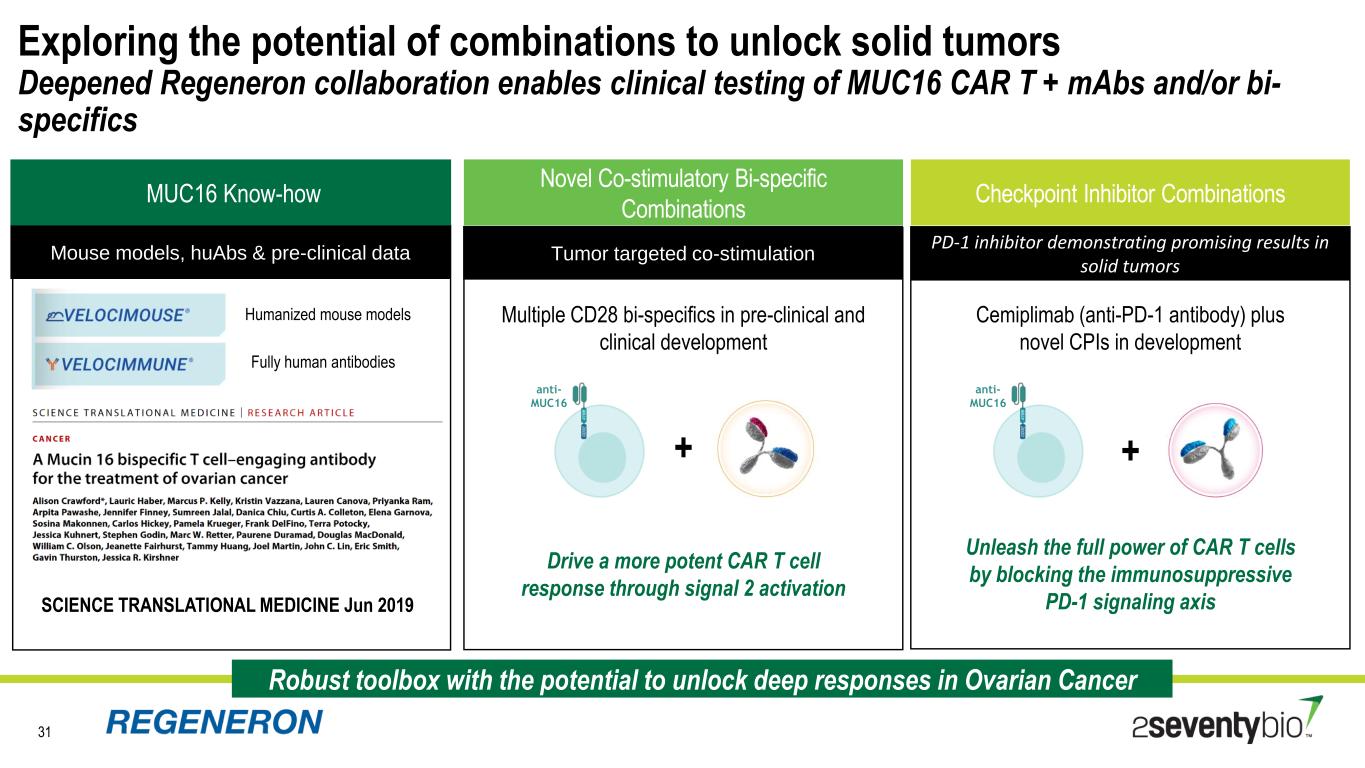

Exploring the potential of combinations to unlock solid tumors Deepened Regeneron collaboration enables clinical testing of MUC16 CAR T + mAbs and/or bi- specifics 31 Anti-CD28 Tumor targeted co-stimulation Robust toolbox with the potential to unlock deep responses in Ovarian Cancer PD-1 inhibitor demonstrating promising results in solid tumors Mouse models, huAbs & pre-clinical data SCIENCE TRANSLATIONAL MEDICINE Jun 2019 Cemiplimab (anti-PD-1 antibody) plus novel CPIs in development Multiple CD28 bi-specifics in pre-clinical and clinical development Fully human antibodies Humanized mouse models MUC16 Know-how Novel Co-stimulatory Bi-specific Combinations Checkpoint Inhibitor Combinations Unleash the full power of CAR T cells by blocking the immunosuppressive PD-1 signaling axis Drive a more potent CAR T cell response through signal 2 activation anti- MUC16 + anti- MUC16 +

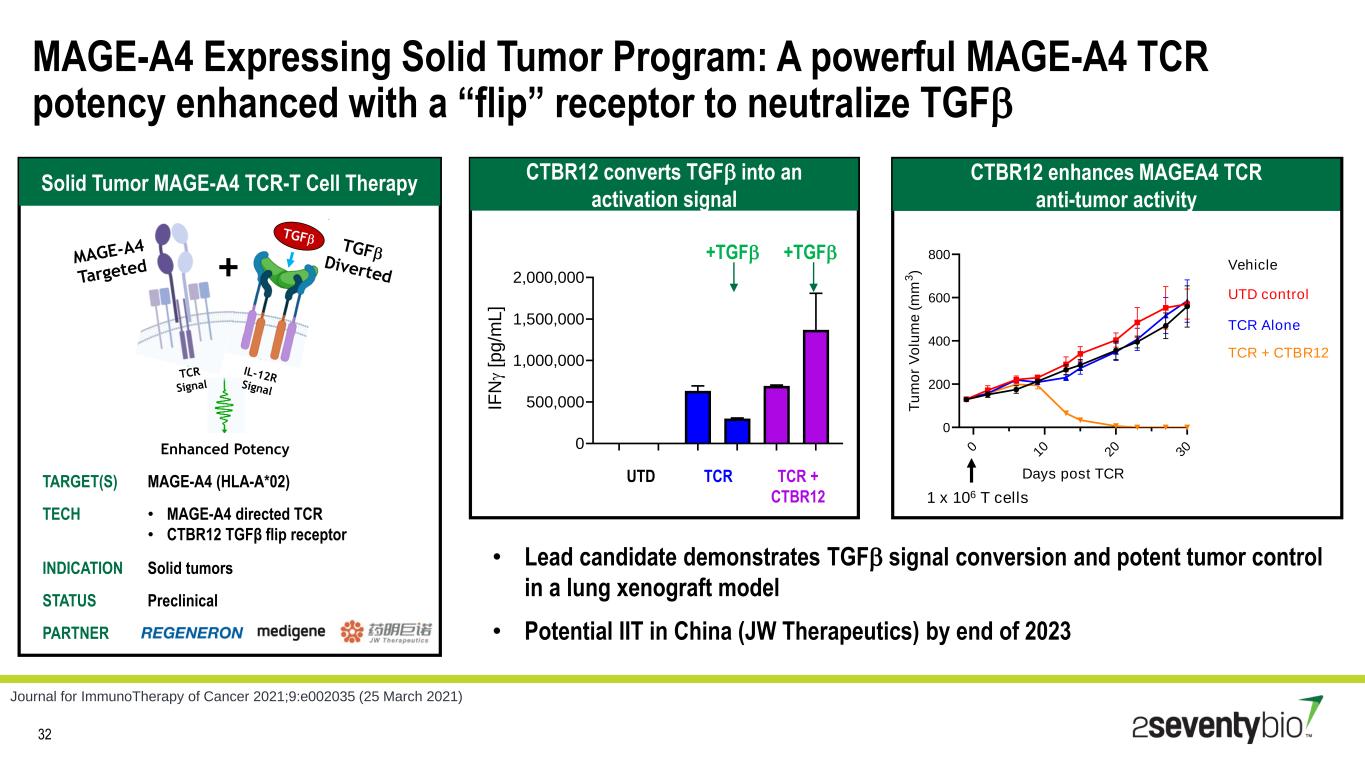

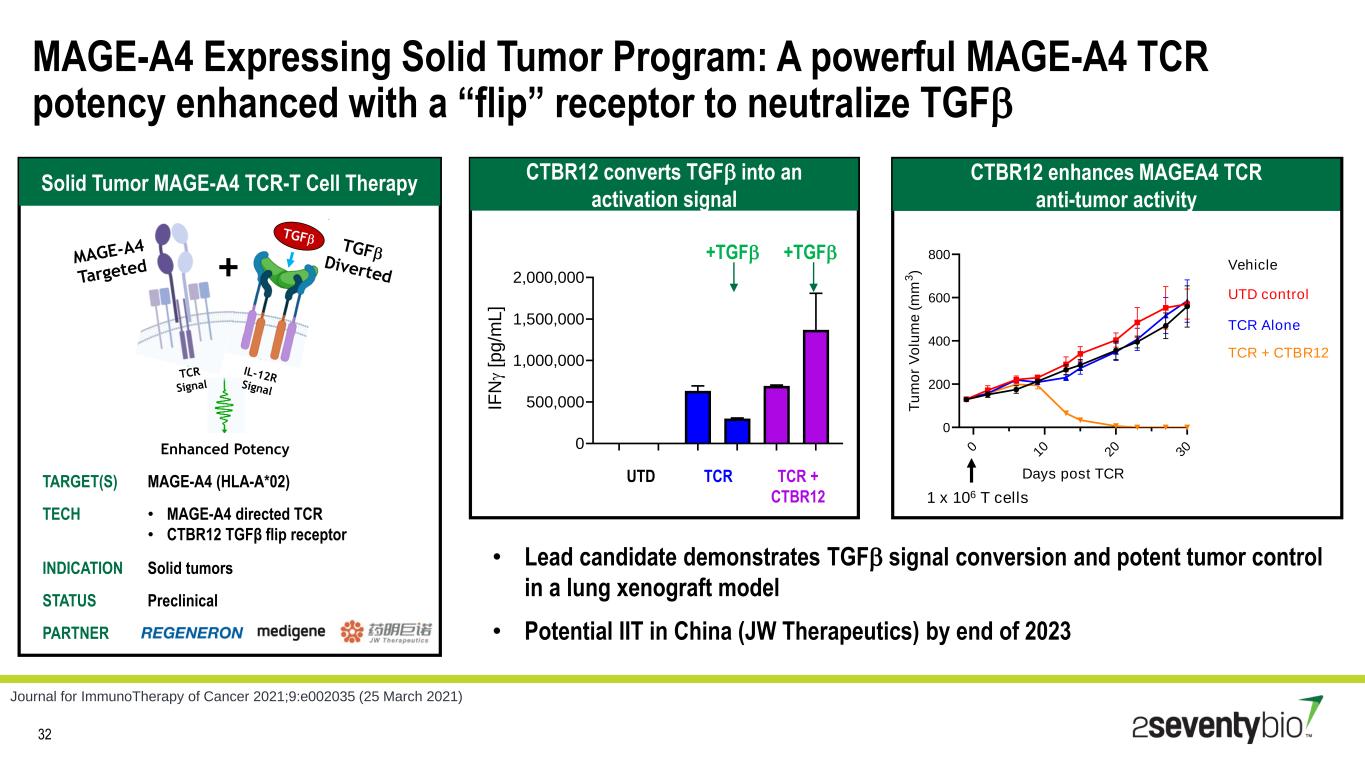

MAGE-A4 Expressing Solid Tumor Program: A powerful MAGE-A4 TCR potency enhanced with a “flip” receptor to neutralize TGFb Solid Tumor MAGE-A4 TCR-T Cell Therapy TARGET(S) MAGE-A4 (HLA-A*02) TECH • MAGE-A4 directed TCR • CTBR12 TGFβ flip receptor INDICATION Solid tumors STATUS Preclinical PARTNER + Enhanced Potency TCR + CTBR12 • Lead candidate demonstrates TGFb signal conversion and potent tumor control in a lung xenograft model • Potential IIT in China (JW Therapeutics) by end of 2023 Journal for ImmunoTherapy of Cancer 2021;9:e002035 (25 March 2021) Vehicle UTD control TCR Alone 0 10 20 30 0 200 400 600 800 Days post TCR T u m o r V o lu m e ( m m 3 ) 1 x 106 T cells 32 UTDU TD U TD +T G Fb B W 28 26 B W 28 26 (+ T G Fb) B W 91 61 B W 91 61 (+ T G Fb) 0 500,000 1,000,000 1,500,000 2,000,000 IF N [p g /m L ] TCR TCR + CTBR12 +TGFb +TGFb CTBR12 converts TGFb into an activation signal CTBR12 enhances MAGEA4 TCR anti-tumor activity

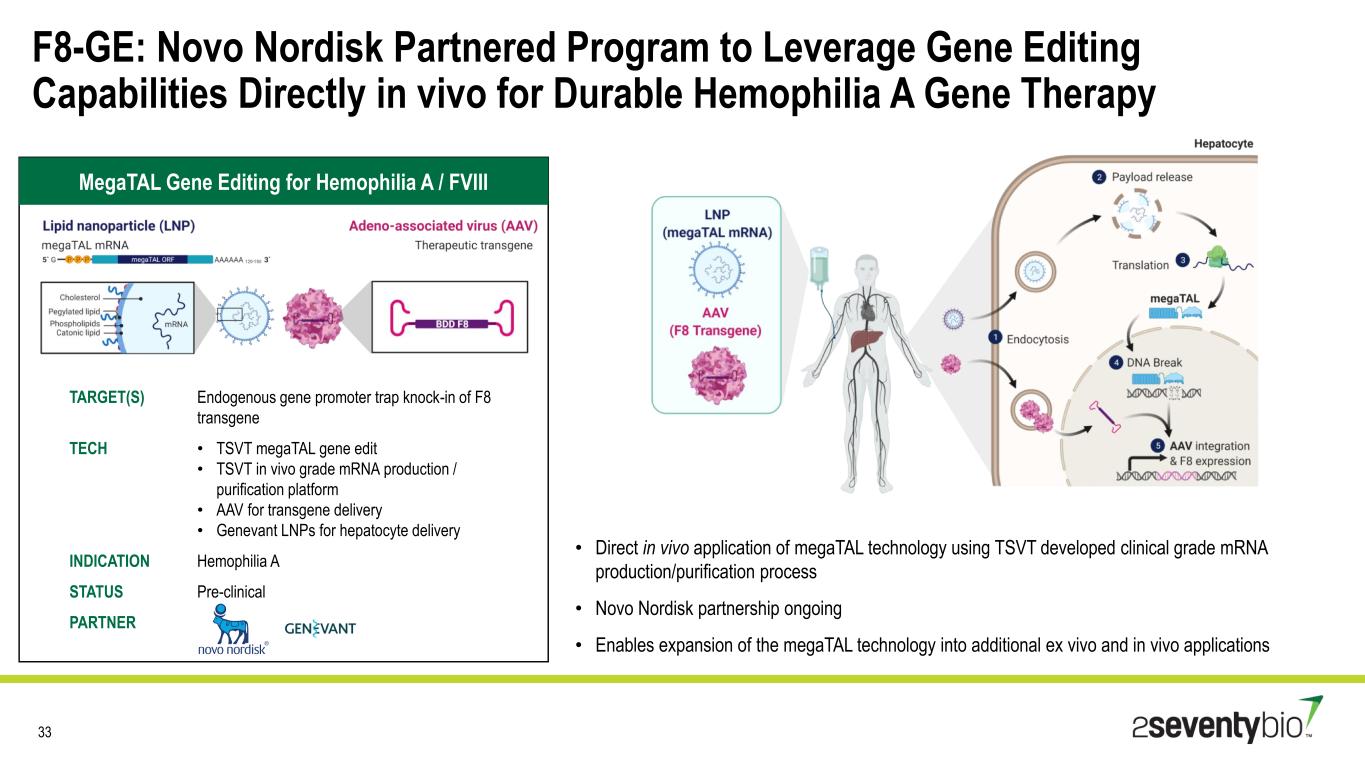

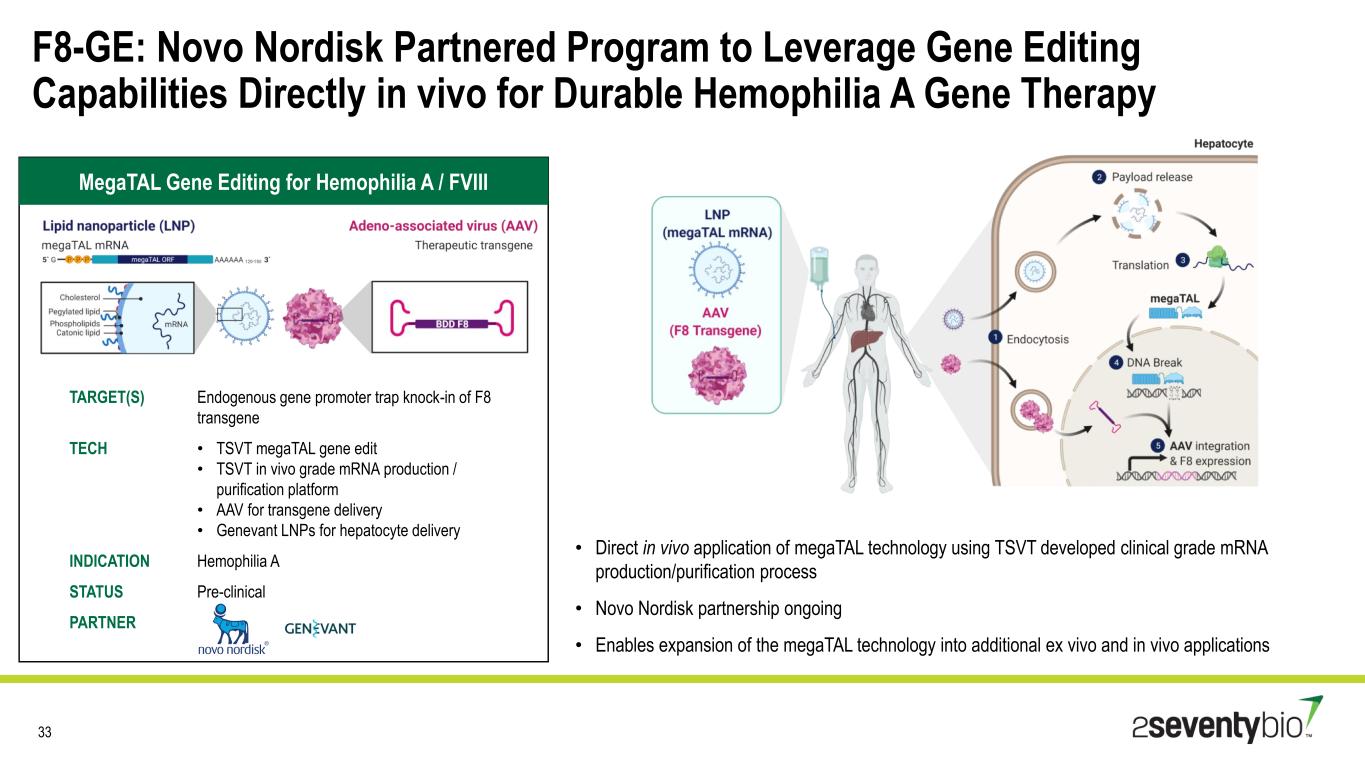

MegaTAL Gene Editing for Hemophilia A / FVIII TARGET(S) Endogenous gene promoter trap knock-in of F8 transgene TECH • TSVT megaTAL gene edit • TSVT in vivo grade mRNA production / purification platform • AAV for transgene delivery • Genevant LNPs for hepatocyte delivery INDICATION Hemophilia A STATUS Pre-clinical PARTNER F8-GE: Novo Nordisk Partnered Program to Leverage Gene Editing Capabilities Directly in vivo for Durable Hemophilia A Gene Therapy 33 • Direct in vivo application of megaTAL technology using TSVT developed clinical grade mRNA production/purification process • Novo Nordisk partnership ongoing • Enables expansion of the megaTAL technology into additional ex vivo and in vivo applications

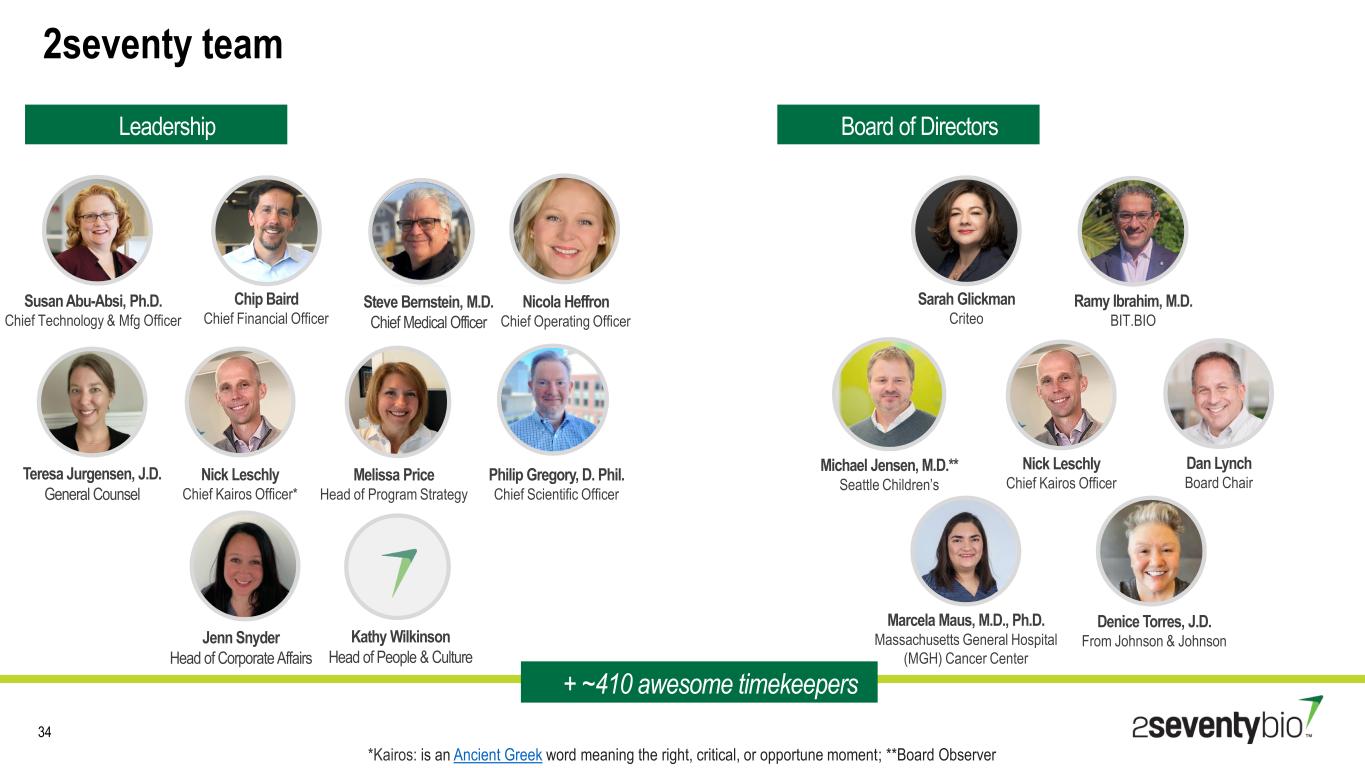

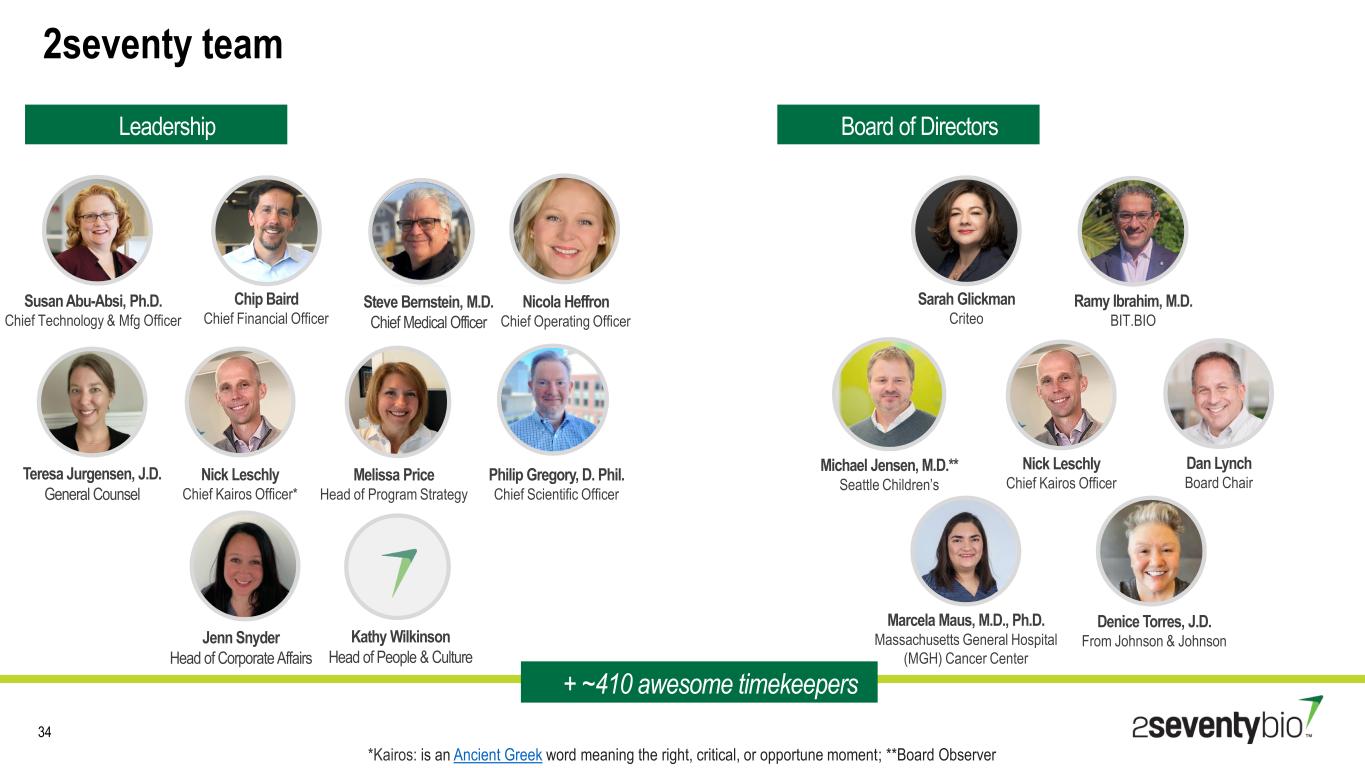

Leadership 2seventy team 34 Board of Directors Philip Gregory, D. Phil. Chief Scientific Officer Chip Baird Chief Financial Officer Nick Leschly Chief Kairos Officer* Dan Lynch Board Chair Jenn Snyder Head of Corporate Affairs Nicola Heffron Chief Operating Officer + ~410 awesome timekeepers Ramy Ibrahim, M.D. BIT.BIO Marcela Maus, M.D., Ph.D. Massachusetts General Hospital (MGH) Cancer Center Sarah Glickman Criteo Nick Leschly Chief Kairos Officer Teresa Jurgensen, J.D. General Counsel Denice Torres, J.D. From Johnson & Johnson Michael Jensen, M.D.** Seattle Children’s Kathy Wilkinson Head of People & Culture *Kairos: is an Ancient Greek word meaning the right, critical, or opportune moment; **Board Observer Susan Abu-Absi, Ph.D. Chief Technology & Mfg Officer Steve Bernstein, M.D. Chief Medical Officer Melissa Price Head of Program Strategy

thank you