Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260534

PROSPECTUS SUPPLEMENT NO. 12

(to prospectus dated November 5, 2021)

ALGOMA STEEL GROUP INC.

129,836,439 Common Shares

604,000 Warrants to Purchase Common Shares

24,179,000 Common Shares Underlying Warrants

This prospectus supplement amends and supplements the prospectus dated November 5, 2021, as supplemented or amended from time to time (the “Prospectus”), which forms a part of our Registration Statement on Form F-1 (Registration Statement No. 333-260534). This prospectus supplement is being filed to update and supplement the information included or incorporated by reference in the Prospectus with the information contained in our Annual Report on Form 20-F, which was filed with the Securities and Exchange Commission on June 17, 2022 (the “Annual Report”). Accordingly, we have attached the Annual Report to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Shares and Warrants are listed on The Nasdaq Stock Market (“Nasdaq”) under the symbols “ASTL” and “ASTLW”, respectively, and on the Toronto Stock Exchange (the “TSX”) under the symbols “ASTL” and “ASTL.WT,” respectively. On June 16, 2022, the last reported sales prices of the Common Shares on Nasdaq and the TSX were $9.19 and C$11.93, respectively, and the last reported sales prices of the Warrants were $2.06 and C$2.67, respectively.

We are a “foreign private issuer” as defined in the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. Additionally, Nasdaq rules allow foreign private issuers to follow home country practices in lieu of certain of Nasdaq’s corporate governance rules. As a result, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all Nasdaq corporate governance requirements.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 7 of the Prospectus, and under similar headings in any amendment or supplements to the Prospectus.

None of the Securities and Exchange Commission, any state securities commission or the securities commission of any Canadian province or territory has approved or disapproved of the securities offered by this prospectus supplement or the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 17, 2022.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2022

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-40924

ALGOMA STEEL GROUP INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia

(Jurisdiction of incorporation or organization)

105 West Street

Sault Ste. Marie, Ontario

P6A 7B4, Canada

(Address of principal executive offices)

John Naccarato

Algoma Steel Group Inc.

105 West Street

Sault Ste. Marie, Ontario

P6A 7B4, Canada

Tel: (705) 945-2351

(Name, telephone, email and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares, without par value | ASTL | The NASDAQ Stock Market LLC | ||

| Warrants to purchase Common Shares | ASTLW | The NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: At March 31, 2022, 147,957,787 common shares, without par value, were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||||

| Non-Accelerated Filer | ☒ | Emerging growth company | ☐ | |||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued | Other ☐ | ||||||

| by the International Accounting Standards Board | ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

| Auditor Firm ID: 1208 | Auditor Name: Deloitte LLP | Auditor Location: Toronto, Ontario, Canada |

Table of Contents

Algoma Steel Group Inc.

| 1 | ||||

| 1 | ||||

| 4 | ||||

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 4 | |||

| 4 | ||||

| 4 | ||||

| 41 | ||||

| 60 | ||||

| 61 | ||||

| 99 | ||||

| 120 | ||||

| 124 | ||||

| 124 | ||||

| 125 | ||||

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 152 | |||

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 152 | |||

| 153 | ||||

| 153 | ||||

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 153 | |||

| 153 | ||||

| 153 | ||||

| 153 | ||||

| 154 | ||||

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 154 | |||

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 154 | |||

| 154 | ||||

| 155 | ||||

| 155 | ||||

| 156 | ||||

| 156 | ||||

| 156 | ||||

| 157 | ||||

| 157 | ||||

| 160 | ||||

| F-1 |

Table of Contents

Unless otherwise indicated, all references in this Annual Report on Form 20-F (“Annual Report”) to “Algoma,” “we,” “our,” “us,” “the Company” or similar terms refer to Algoma Steel Group Inc. and its consolidated subsidiaries.

We publish our consolidated financial statements in Canadian dollars. In this Annual Report, unless otherwise specified, all monetary amounts are in Canadian dollars, all references to “C$,” mean Canadian dollars and all references to “$” or “US$” and mean U.S. dollars.

This Annual Report on Form 20-F contains our audited consolidated financial statements and related notes for the years ended March 31, 2022, March 31, 2021 and March 31, 2020 (“Annual Financial Statements”). Our Annual Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board.

Unless otherwise indicated in this Annual Report, all references to: “fiscal 2022” are to the 12-month period ended March 31, 2022; “fiscal 2021” are to the 12-month period ended March 31, 2021; and “fiscal 2020” are to the 12-month period ended March 31, 2020.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities legislation (collectively, “forward looking statements”), that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and strategic objectives, Algoma’s expectation to pay a quarterly dividend, launch the SIB (as defined below), the expected timing of the EAF (as defined below) transformation and the resulting increase in raw steel production capacity and reduction in carbon emissions. In some cases, you can identify forward-looking statements by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” or the negative of these terms or other similar expressions. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances. The statements we make regarding the following matters are forward-looking by their nature:

| • | future financial performance; |

| • | future cash flow and liquidity; |

| • | future capital investment; |

| • | our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness, with a substantial amount of indebtedness; |

| • | significant domestic and international competition; |

| • | macroeconomic pressures in the markets in which we operate; |

| • | increased use of competitive products; |

| • | a protracted fall in steel prices resulting in impairment of assets; |

1

Table of Contents

| • | excess capacity, resulting in part from expanded production in China and other developing economies; |

| • | low-priced steel imports and decreased trade regulation, tariffs and other trade barriers; |

| • | protracted declines in steel consumption caused by poor economic conditions in North America or by the deterioration of the financial position of our key customers; |

| • | increases in annual funding obligations resulting from our under-funded pension plans; |

| • | supply and cost of raw materials and energy; |

| • | impact of a downgrade in credit rating and its impact on access to sources of liquidity; |

| • | currency fluctuations, including an increase in the value of the Canadian dollar against the U.S. dollar; |

| • | environmental compliance and remediation; |

| • | unexpected equipment failures and other business interruptions; |

| • | a protracted global recession or depression; |

| • | changes in or interpretation of royalty, tax, environmental, greenhouse gas, carbon, accounting and other laws or regulations, including potential environmental liabilities that are not covered by an effective indemnity or insurance; |

| • | risks associated with existing and potential lawsuits and regulatory actions made against us; |

| • | impact of disputes arising with our partners; |

| • | the ability of Algoma to implement and realize its business plans, including Algoma’s ability to complete its transition to electric arc furnace (“EAF”) steelmaking on time and at its anticipated cost; |

| • | Algoma’s ability to operate the EAF; |

| • | the risks that higher cost of internally generated power and market pricing for electricity sourced from Algoma’s current grid in Northern Ontario could have an adverse impact on our production and financial performance; |

| • | access to an adequate supply of the various grades of steel scrap at competitive prices; |

| • | the risks associated with the steel industry generally; |

| • | economic, social and political conditions in North America and certain international markets; |

| • | changes in general economic conditions, including as a result of the COVID-19 pandemic; or the conflict between Russia and Ukraine that commenced in February 2022; |

| • | risks associated with inflation rates; |

2

Table of Contents

| • | risks inherent in the Corporation’s corporate guidance; |

| • | failure to achieve cost and efficiency initiatives; |

| • | risks inherent in marketing operations; |

| • | risks associated with technology, including electronic, cyber and physical security breaches; |

| • | projected increases in capacity liquid steel as a result of the transformation to EAF steelmaking; |

| • | projected cost savings associated with the transformation to EAF steelmaking; |

| • | projected reduction in carbon dioxide (“CO2”) emissions associated with the transformation to EAF steelmaking, including with respect to the impact of such reductions on the Green Steel Funding and carbon taxes payable; |

| • | construction projects are subject to risks, including delays and cost overruns; |

| • | our ability to enter into contracts to source scrap and the availability of scrap; |

| • | the availability of alternative metallic supply; |

| • | the Company’s to launch and complete the SIB; |

| • | the Company’s expectation to declare and pay a quarterly dividend; and |

| • | business interruption or unexpected technical difficulties, including impact of weather; counterparty and credit risk; labor interruptions and difficulties |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks provided under “Risk Factors” in this Annual Report.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying assumptions will prove to be correct. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report, to conform these statements to actual results or to changes in our expectations.

3

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to our Business

Market and industry volatility could have a material adverse effect on our results. A protracted fall in steel prices, or any significant and sustained increase in the price of raw materials in the absence of corresponding steel price increases, would have a material adverse effect on our results.

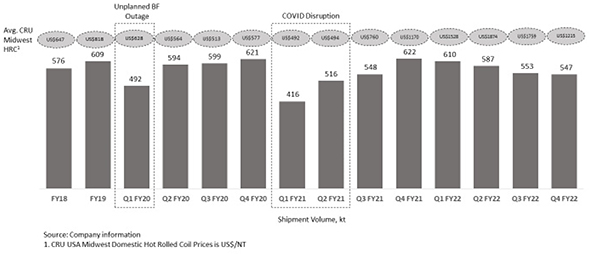

The steel market is a cyclical commodity business with significant volatility in prices in response to various factors, including market demand, supply chain inventory levels, and imports. Factors specific to our business include a prolonged cyclical downturn in the steel industry, macroeconomic trends such as global or regional recessions and trends in credit and capital markets more generally. Market price volatility results in a high level of cash flow volatility with prolonged periods of negative cash flow. Steel prices are volatile and the global steel industry has historically been cyclical. During 2015, hot rolled coil prices fell sharply by approximately $200/ton to $354/ton in the North American market, as a result of a significant increase in imports, driven primarily by the strengthening of the U.S. dollar against other currencies. In 2018, hot rolled coil prices rose to over $900/ton over a short period then fell to under $500/ton in the fall of 2019. Hot rolled coil prices recovered slightly, but fell to under $500/ton once again as a result of the COVID-19 pandemic and the related global economic slowdown. Since that low in 2020, hot rolled coil prices rose to an all-time high of $1,958/ton by the end of 2021. Subsequently prices fell to below $1,000/ton by March 2022. Thereafter prices increased and have settled around $1,200/ton so far in calendar 2022. (CRU U.S. Midwest Hot-Rolled Coil). These significant market price fluctuations also affect the cost of our raw material inputs and thus affect our bottom line. Any miscorrelation between finished product pricing and raw material inputs can have a material affect on our profitability. Protracted pricing or volume declines in the future would adversely affect our cash flow and ability to pay for our fixed costs, capital expenditures and other funding obligations.

4

Table of Contents

Steel production also requires the use of large volumes of bulk raw materials and energy, in particular iron ore and coal, as well as energy, alloys, scrap, oxygen, natural gas, electricity and other inputs, the prices of which can be subject to significant fluctuation. The prices of iron ore and coal can vary greatly from period to period and our results have historically been impacted by movements in coal and iron ore prices. Iron ore and coal prices have been volatile in recent years. In addition, to the extent that we have quoted prices to our customers and accepted customer orders for our products prior to purchasing necessary raw materials, we may be unable to raise the price of our products to cover all or part of the increased cost of the raw materials. Alternatively, we may be faced with having agreed to purchase raw materials and energy at prices that are above the then current market price or in greater volumes than required. The availability and prices of raw materials may also be negatively affected by new laws and regulations, allocation by suppliers, interruptions in production (including mining stoppages), accidents or natural disasters, changes in exchange rates, price fluctuations, the rate of inflation and the availability and cost of transportation. There can be no assurance that adequate supplies of electricity, natural gas, coal, iron ore, alloys, scrap and other inputs will be available in the future or that future increases in the cost of such materials will not adversely affect our financial performance.

Our largest input cost in the steel-making process is iron ore, which we purchase under our supply contracts with Cliffs Natural Resources (“Cliffs”) and United States Steel Corporation (“U.S. Steel”). We believe that our long-term agreements with Cliffs and U.S. Steel provide for the supply of iron ore pellets through to the close of the 2024 shipping season, but there can be no assurances that they will meet our needs or that we will be able to retain such long term contracts.

We face significant domestic and international competition, and there is a possibility that increased use of competitive products could cause our sales to decline.

We compete with numerous foreign and domestic steel producers. Significant global steel capacity growth through new and expanded production in recent years has caused and may continue to cause capacity to exceed global demand, which has resulted and may result in lower prices and steel shipments. Some of our competitors have greater financial and capital resources than we do and continue to invest heavily to achieve increased production efficiencies and improved product quality. We primarily compete with other steel producers based on the delivered price of finished products to our customers. Our costs are generally higher than many foreign producers; however, freight costs for steel can often make it uneconomical for distant steel producers to compete with us. Foreign producers may be able to successfully compete if their higher shipping costs are offset by lower cost of sales.

Although we are continually striving to improve our operating costs, we may not be successful in achieving cost improvements or gaining operating efficiencies that may be necessary to remain competitive on a global scale.

The North American steel industry has, in the past, experienced lengthy periods of difficult markets due to increased foreign imports. Due to unfavorable foreign economic conditions, excess foreign capacity and a stronger U.S. dollar compared to global currencies, imports of steel products to U.S. and Canadian markets have occasionally reached high levels.

5

Table of Contents

In addition, in the case of certain product applications, steel competes with a number of other materials such as plastic, aluminum, and composite materials. Improvements in the technology, production, pricing or acceptance of these competitive materials relative to steel or other changes in the industries for these competitive materials could cause our net sales to decline. There is ongoing research and technological developments with respect to the various processes associated with steel production which have the potential to reduce costs and improve quality and operational efficiency. Such research and technological developments could substantially impair our competitive position if other companies implement new technology that we elect not to implement or are unable to implement.

A number of steel producers have completed successful restructurings, through which they have made production improvements, achieved lower operating costs and been relieved of legacy obligations, including environmental and pension and retiree obligations. As a result, these entities may be able to operate with lower costs and cause us to face increased competition.

There has been a significant increase in new EAF steelmaking capacity commissioned in North America. EAF producers typically require lower capital expenditures for construction and maintenance of facilities, and may have lower total employment costs. In addition, the market pricing for our hot rolled steel is more correlated to scrap steel as the main material for EAF producers. While our transformation to EAF steelmaking is currently in process, the EAF transformation may never be completed or may only be completed after significant delays or at a substantially greater cost than anticipated. Failure to complete, or delays and/or cost overruns in completing the EAF transformation could adversely affect our results of operations and ability to compete in our industry.

Macroeconomic pressures in the markets in which we operate, including, but not limited to, the effects of inflation, and COVID-19 may adversely affect consumer spending and our financial results.

To varying degrees, our products are sensitive to changes in macroeconomic conditions that impact pricing for consumer products and consumer spending. As a result, consumers may be affected in many different ways, including for example:

| • | Whether or not they make a purchase; |

| • | Their choice of brand, model or price-point; and |

| • | How frequently they upgrade or replace their products containing steel, such as appliances and automobiles. |

Real GDP growth, consumer confidence, the COVID-19 pandemic, inflation, employment levels, oil prices, interest rates, tax rates, housing market conditions, foreign currency exchange rate fluctuations, costs for items such as fuel and food and other macroeconomic trends can adversely affect consumer demand for the products that we offer. Geopolitical issues around the world and how our markets are positioned can also impact the macroeconomic conditions and could have a material adverse impact on our financial results.

6

Table of Contents

Economic, social and political conditions in North America and certain international markets could adversely affect demand for the products we sell.

Sales of our products involve discretionary spending by consumers as well as our customers. Unfavorable economic conditions due to economic, social and political conditions in North America and certain international markets could result in less discretionary purchases by consumers, and discretionary project spending by our customers. Consumer spending may be affected by many economic and other factors outside of the Company’s control. Some of these factors include consumer disposable income levels, consumer confidence in current and future economic conditions, levels of employment, consumer credit availability, consumer debt levels, inflation, political conditions and the effect of weather, natural disasters, public health crises, including the recent outbreak of COVID-19 and the related reduced consumer demand, decreased sales and widespread temporary closures. Adverse economic changes in any of the regions in which we sell our products could reduce consumer confidence and adversely affect our ability to sell our products.

The outbreak of COVID-19 and the downturn in the global economy caused a sharp reduction in worldwide demand for steel. A protracted global recession or depression will have a material adverse effect on the steel industry and therefore our business and operations.

Our activities and financial performance are affected by international, national and regional economic conditions. The COVID-19 pandemic, which began during the first quarter of calendar year 2020, has had a profound impact on economies world-wide, with various levels of governments implementing border closings, travel restrictions, mandatory stay-at-home and work-from-home orders, mandatory business closures, cessation of certain construction activities, public gathering limitations and prolonged quarantines. These efforts and other governmental and individual reactions to the pandemic have led to lower consumer demand for goods and services and general uncertainty regarding the near-term and long-term impact of the COVID-19 pandemic on the domestic and international economy and on public health.

The manufacture of steel was deemed to be an essential service by the government of Ontario, and we continued to operate during the COVID-19 pandemic, in part with funds we received from government assistance programs. In spite of our continued operations, as the pandemic spread, slowdowns and disruptions in the operations of our customers led to a reduction in demand that had a negative impact on our business and operations. There is uncertainty regarding the full impact of the COVID-19 pandemic on our business and operations, or if any other similar epidemic or pandemic, will impact our business and operations in the future. There is no assurance that there will not be a renewed spread of COVID-19, including the spread of new variants, and, in such event, that efforts to contain the virus (including, but not limited to, voluntary and mandatory quarantines, vaccines, restrictions on travel, limiting gatherings of people, and reduced operations and extended closures of many businesses and institutions) will not materially impact our business, financial performance and financial position. Disruptions in our business activities, and costs incurred by us in response to changing conditions and regulations and reduction in demand for the steel products that we manufacture, could have a material adverse impact on our business, operating results and financial position. To the extent the COVID-19 pandemic, or any other similar epidemic or pandemic, adversely affects our businesses, it may also have the effect of exacerbating many of the other risks described in this Annual Report, any of which could have a material adverse effect on our business and operations.

7

Table of Contents

A significant and prolonged recession or depression in the United States, Canada or Europe, or significantly slower growth or the spread of recessionary conditions in emerging economies that are substantial consumers of steel (such as China, Brazil, Russia and India, as well as emerging Asian markets, the Middle East and the Commonwealth of Independent States) would exact a heavy toll on the steel industry. Financial weakness among substantial consumers of steel products, such as the automotive industry and the construction industry, or the bankruptcy of any large companies in such industries, would have a negative impact in market conditions. Protracted declines in steel consumption caused by poor economic conditions in North America or by the deterioration of the financial position of our key customers would have a material adverse effect on demand for our products and our operational and financial results.

Steel companies have significant fixed costs, which are difficult to reduce in response to reduced demand. However, we could implement a variety of measures in response to a market downturn and a decline in demand for steel products. These measures might include: curtailing the purchase of raw materials; spreading raw material contracts over a longer period of time; reducing capital spending; negotiating reduced pricing for major inputs, reducing headcount through temporary layoffs, limiting overtime and reducing use of contractors; managing fixed costs with changes in production levels; improving operational practices to reduce lead time; and venturing into export markets in order to increase capacity utilization. However, these initiatives may not prove sufficient, in terms of cost reduction or in realigning our production levels with reduced demand, to achieve profitability and maintain cash flow necessary to pay for capital expenditures and other funding needs.

Failure to complete, or delays in completing, our EAF transformation could adversely affect our business and prospects. There are significant risks and uncertainties associated with, and we may fail to realize the anticipated benefits of, the EAF transformation.

The EAF transformation may never be completed or may only be completed after significant delays and/or cost overruns. Failure to complete, or delays in completing, the EAF transformation, could have a material adverse effect on our business, financial position, financial performance or prospects.

In addition, the EAF transformation will require significant capital expenditures and divert the attention of management from our business. The EAF transformation will also require a number of permits, including environmental compliance approvals in respect of sewage works and air/noise, as well as indigenous consultations and the adoption of site specific standards under the Canadian Environmental Protection Act, 1999 (“CEPA”), none of which are guaranteed to be granted or adopted. If we are not successful at integrating the EAF and related technology and equipment into our business, our cost of production relative to our competitors may increase and we may cease to be profitable or competitive. The EAF transformation may be more costly than expected to complete and entails additional risks as to whether the EAF and related technology and equipment will reduce our cost of production sufficiently to justify the capital expenditure to obtain them. Additionally, there is no guarantee that the EAF transformation will allow us to achieve our emissions targets. If such risks were to materialize, the anticipated benefits of the EAF transformation may not be fully realized, or realized at all.

8

Table of Contents

Construction projects are subject to risks, including delays and cost overruns, which could have an adverse impact on our liquidity and results of operations.

As part of our growth strategy with electric arc steelmaking, we must contract for the procurement of technology and construction services. Our construction projects are subject to the risks of delay or cost overruns inherent in any large construction project, including costs or delays resulting from the following:

| • | Unexpected long delivery times for, or shortages of, key equipment, parts and materials; |

| • | Shortages of skilled labor and other shipyard personnel necessary to perform the work; |

| • | Unforeseen increases in the cost of equipment, labor and raw materials, particularly steel; |

| • | Unforeseen design and engineering problems; |

| • | Unanticipated actual or purported change orders; |

| • | Work stoppages; |

| • | Latent damages or deterioration to equipment and machinery in excess of engineering estimates and assumptions; |

| • | Failure or delay of third-party service providers and labor disputes; |

| • | Disputes with fabricators and other suppliers; |

| • | Delays and unexpected costs of incorporating parts and materials needed for the completion of projects; |

| • | Financial or other difficulties of suppliers; |

| • | Adverse weather conditions; and |

| • | Inability to obtain required permits or approvals. |

If we experience delays and costs overruns in the construction of the EAF furnaces due to certain of the factors listed above, it could also adversely affect our business, financial condition and results of operations.

Our exposure to the higher cost of internally generated power and market pricing for electricity sourced from the current grid in Northern Ontario may have an adverse impact on our production and financial performance if we are able to complete the EAF transformation.

Electricity is a significant input required in EAF steelmaking, and competitor EAF producers typically enter into fixed-price electricity contracts. Our exposure to the higher cost of internally generated of power and market pricing for electricity sourced from the current grid in Northern Ontario may have an adverse impact on our production and financial performance if we are able to complete the EAF transformation. We have limited access to power from the current grid in Northern Ontario. As a result, we are planning to upgrade our internal natural gas power plant in order to supply sufficient power in combination with the available grid power to operate EAF furnaces. Delays in acquiring the specialized power equipment and associated specialty services may impact our timing to complete the EAF transformation. Furthermore, operating an internal power plant subjects us to planned and unplanned outages to maintain and/or repair the equipment, which would result in an associated outage of the steelmaking production.

9

Table of Contents

The Ontario provincial regulator, Independent Electricity System Operator (“IESO”), plans for the resources needed to meet Ontario’s future electricity needs. This includes accounting for Ontario’s forecasted electricity requirements, and carrying out integrated resource planning for energy efficiency, generation and transmission infrastructure to meet those requirements. This process is not within our control. We will need to operate our internal natural gas power plant until regional power system upgrades are determined and recommended by the IESO for installation. In the long-term, in order to operate EAF furnaces from grid power alone, we will require regional power system upgrades, with new transmission wires outside the city providing for more power to Sault Ste. Marie. These regional power system upgrades may not be completed until 2029 or later.

Due to our limited access to power from the current grid in Northern Ontario, our plan is to adapt our number 7 blast furnace (“Blast Furnace No. 7”) to run at a lower rate in order to feed liquid iron into the EAFs to reduce our power requirements and to balance the amount of power expected to be available from internal generation and available grid power. Operating the blast furnace at a reduced rate subjects us to planned and unplanned outages in order to maintain and/or repair the equipment, which would result in associated outages in steelmaking production.

Operating the blast furnace together with EAF steelmaking while using internal power generation from natural gas (“Hybrid Mode”) presents both an operating risk and a market risk, as we would be running the facilities at suboptimal levels and are subject to outages with internal power generation. Furthermore, the presence of ice and/or snow in steel scrap materials as they are introduced to EAF steelmaking could result in explosions which may result in further unplanned outages and/or health and safety consequences.

We are pursuing a local electricity transmission infrastructure upgrade and technical contingency solution to allow us to access more power sooner from the current grid into Sault Ste. Marie. Delays in designing, approving, and installing these local infrastructure upgrades may result in a delay or inability to access more power from the grid. This may result in a disruption to our steelmaking operations and/or failure to grow our business.

In connection with the EAF transformation, our access to an adequate supply of the various grades of steel scrap at competitive prices may result in a disruption to our operations and/or financial performance.

The principal raw material of our transformation to EAF steelmaking operations will be scrap metal derived from internal operations within our steel mills and industrial scrap generated as a by-product of manufacturing; obsolete scrap recovered from end-of-life manufactured goods such as automobiles, appliances, and machinery; and demolition scrap recovered from obsolete structures, containers and machines. Scrap is a global commodity influenced by economic conditions in a number of industrialized and emerging markets throughout Asia, Europe and North America.

The markets for scrap metals are highly competitive, both in the purchase of raw or unprocessed scrap, and processed scrap. As a result, we will need to compete with other steel mills in attempting to secure scrap supply through direct purchasing from scrap suppliers. Any failure to secure access to an adequate supply of the various grades of steel scrap at competitive prices may result in a disruption to our operations and/or financial performance.

10

Table of Contents

We will also need to supplement our EAF operations with higher-purity substitutes for ferrous scrap which may be sourced from higher-quality-lower-residual prime scrap, or iron units such as pig iron, pelletized iron, hot briquetted iron, direct reduced iron, and other forms of processed iron. Any failure to secure access to an adequate supply of the substitutes for ferrous scrap at competitive prices may result in a disruption to our operations and/or financial performance. Furthermore, we may not be able to source competitive modes of freight transportation for inbound scrap and other materials.

Many variables can impact ferrous scrap prices, including the level of Canadian steel production, the level of exports of scrap from the United States and Canada, and the amount of obsolete scrap production. Canadian ferrous scrap prices generally have a strong correlation and spread to global pig iron pricing. Generally, as Canadian steel demand increases, so does scrap demand and resulting scrap prices. The reverse is also typically true with scrap prices following steel prices downward when supply exceeds demand, but this is not always the case. When scrap prices greatly accelerate, this can challenge one of the principal elements of an EAF based steel mill’s traditional lower cost structure – the cost of its metallic raw material.

Even if we are able to complete the EAF transformation, we may fail to achieve the anticipated benefits due to reduced product qualities.

Even if we are to complete the EAF transformation, we may fail to achieve the anticipated benefits. For example, as a result of residual chemistry attributes of steel from the EAF processing of scrap, we may be limited in our ability to produce a full range of product types and qualities. This may result in an inferior product or a more limited range of products we are able to produce, either of which could result in reduced sales and have a material adverse effect on our results of operations and/or adversely affect our reputation with existing and potential customers.

The recent Russia-Ukraine conflict and the consequent wave of international sanctions against Russia are expected to reduce the supply of steelmaking raw materials and steel products in international markets.

Armed conflict commenced between Russia and Ukraine in February 2022. In response, Canada, the United States, the United Kingdom, and the European Union, among others, have imposed a wave of sanctions against certain Russian institutions, companies and citizens. As a result of the conflict and related sanctions, energy prices have continually climbed and foreign trade transactions involving Russian and Ukrainian counterparties have been severely affected.

The extent and duration of the conflict, resulting sanctions and resulting future market disruptions are impossible to predict, but could be significant. Algoma’s board of directors is monitoring the potential impacts of the conflict in Ukraine on Algoma’s business overall and in particular, risks related to cybersecurity, sanctions and market disruptions.

Although we do not have business operations or customers in Russia or Ukraine, sanctions, an increase in cyberattacks and increases in energy costs, among other potential impacts on regional and global economic environment and currencies, may cause demand for our products and services to be volatile, cause abrupt changes in our customers’ buying patterns, interrupt our ability to obtain raw materials from those regions. In addition, in challenging economic times, our current or potential future customers may experience cash flow problems and as a result may modify, delay or cancel plans to purchase our products.

11

Table of Contents

Russia has a significant participation in the international trade of steel slabs, iron ore, pig iron, metallurgical coal and pulverized coal for injection and alloys. In addition, Ukraine has a significant participation in the international trade of pig iron, steel slabs and iron ore. The availability and pricing of these inputs in the international markets are expected to be volatile and could result in limitations to our production levels and higher costs, affecting our profitability and results of operations. As a result of the economic sanctions imposed on Russia, we may be required to purchase raw materials at increased prices.

In addition, there may be an increased risk of cyberattacks by state actors due to the current conflict between Russia and the Ukraine. Any increase in such attacks on us or our systems could adversely affect our operations. Although we maintain cybersecurity policies and procedures to manage risk to our information technology systems, continuously adapt our systems and processes to mitigate such threats, and plan to enhance our protections against such attacks, we may not be able to address these cybersecurity threats proactively or implement adequate preventative measures and we may be unable to promptly detect and address any such disruption or security breach, if at all.

We have a recent history of losses and may not return to or sustain profitability in the future.

Although we were profitable in the fiscal year ended March 31, 2022, we have incurred net losses in recent reporting periods, as recently as for the fiscal year ended March 31, 2021, when we had a net loss of approximately C$76.1 million. This history of our business incurring significant losses, among other things, led predecessor operators of our business to seek creditor protection and/or to complete corporate restructuring proceedings. See “– Predecessor operators of our business have sought creditor protection and completed corporate restructurings on a number of occasions.” We may not maintain profitability in future periods, our earnings could decline or grow more slowly than we expect and we may incur significant losses in the future for a number of reasons, including the risks described in this Annual Report.

Our cost and operational improvements plan may not continue to be effective.

Our cost and operational improvements strategy has resulted in reduced costs. However, there can be no assurance that we will continue to achieve such savings in the future or that we will realize the estimated future benefits of these plans. Moreover, our continued implementation of these plans may disrupt our operations and performance. Additionally, our estimated cost savings for these plans are based on several assumptions that may prove to be inaccurate and, as a result, there can be no assurance that we will realize these cost savings.

Our utilization rates may decline as a result of increased global steel production and imports.

In addition to economic conditions and prices, the steel industry is affected by other factors such as worldwide production capacity and fluctuations in steel imports/exports and tariffs. Historically, the steel industry has suffered from substantial overcapacity. If demand for steel products was to rapidly decline, it is possible that global production levels will fail to adjust fully. If production increases outstrip demand increases in the market, an extended period of depressed prices and market weakness may result.

12

Table of Contents

China is now the largest worldwide steel producing country by a significant margin and has significant unused capacity. In the future, any significant excess capacity utilization in China and increased exports by Chinese steel companies would depress steel prices in many markets.

We expect that consolidation in the steel sector in recent years should, as a general matter, help producers to maintain more consistent performance through the down cycles by preventing fewer duplicate investments and increasing producers’ utilization and therefore efficiency and economies of scale. However, overcapacity in the industry may re-emerge.

Increased imports of low-priced steel products into North America and decreased trade regulation could impact the North American steel market, resulting in a loss of sales volume and decreased pricing that could adversely impact our operating results and financial position.

Imports of flat-rolled steel to the U.S. accounted for approximately 6% of the U.S. market for flat-rolled steel products in 2021. Imports of flat-rolled steel to Canada accounted for approximately 19% of the Canadian market for flat-rolled steel products in 2021 (Statistics Canada, American Iron and Steel Institute, Phoenix SPI). Increases in future levels of imported steel to North America could reduce future market prices and demand levels for steel products produced in those markets and reduce our profitability.

In addition, our business has historically been affected by “dumping” – the selling of steel into Canadian or U.S. markets at prices below cost or below the price prevailing in a foreign company’s domestic market. Dumping may result in injury to steel producers in Canada or the U.S. in the form of suppressed prices, lost sales, lower profits and reductions in production, employment levels and the ability to raise capital. Some foreign steel producers are owned, controlled or subsidized by foreign governments. Decisions by these foreign producers to continue production at marginal facilities may be influenced to a greater degree by political and economic policy considerations than by prevailing market conditions and may further contribute to excess global capacity. Although trade legislation to limit dumping has had some success, it may be inadequate to prevent future unfair import pricing practices which individually or collectively could materially adversely affect our business. If Canadian or U.S. trade laws are weakened, an increase in the market share of imports into the U.S. and Canada may occur, which would have a material adverse effect on our business and financial performance.

The Canadian steel industry has worked with the Canadian government to modernize the Canadian trade remedy system to provide the appropriate tools to respond to unfair trade. These changes came into force in 2017, 2019 and again in 2022, through a number of amendments to the Special Import Measures Act and related trade remedy regulations to strengthen the trade remedy system, while remaining aligned with international trade rules. Although the Government of Canada continues to work with industry to respond to unfair trade practices, there can be no assurance that such measures will sufficiently offset any resulting loss caused to us by such unfair practices, and there can be no assurance that the protective measures put in place by the Government of Canada and/or the Canadian International Trade Tribunal will be kept in place and, as a result, such unfair trade practices may have a material adverse effect on our business, financial position, results or operations and cash flow.

13

Table of Contents

Tariffs and other trade barriers may restrict our ability to compete internationally.

We have a significant number of customers located in the United States. For the year ended March 31, 2022, 63% of our revenue was from customers located in the United States. Our ability to sell to these customers and compete with producers located in the United States could be negatively affected by tariffs and/or trade restrictions imposed on our products.

On April 20, 2017, the United States issued an executive order directing the United States Department of Commerce to investigate whether imports of foreign steel are harming U.S. national security. The directive falls under Section 232 of the Trade Expansion Act of 1962, which allows the U.S. president to restrict trade of a good if such trade is determined to be harmful to U.S. national security. On February 16, 2018, the United States Department of Commerce released its report regarding the Section 232 investigation. The recommendations in that report include options regarding tariffs and/or quotas that are intended to adjust the level of steel imports into the United States as it has been determined that those imports are an impairment to national security. Subsequently, the United States announced tariffs of 25% by presidential proclamation dated March 8, 2018 on steel and aluminum imports. Canada, Mexico and certain other countries were granted temporary exemptions, which expired on May 31, 2018. As a result, Canadian steel producers became subject to 25% tariffs on all steel revenues earned on shipments made to the United States effective as of June 1, 2018. Effective on July 1, 2018, Canada began imposing a series of counter tariffs on certain U.S. goods, including steel products. The Canadian government has also announced various relief measures aimed to helping companies affected by the tariffs and counter tariffs on goods imported from the United States.

The United States lifted these tariffs as they relate to Canadian imports effective May 2019, subject to a mutual understanding with Canada on maintaining certain trade levels into the United States. The Canadian government subsequently lifted counter tariffs on goods imported from the United States. As the trade understanding is between countries, there is no assurance that the Canadian domestic steel industry will maintain adherence to the trade level guidelines set out in the understanding. As a result, there can be no assurance that the United States will not once again levy tariffs on our products shipped to customers in the United States.

All of our operations are currently conducted at one facility using one blast furnace and are subject to unexpected equipment failures and other business interruptions.

Our manufacturing processes are dependent upon critical steelmaking equipment such as furnaces, continuous casters, rolling mills and electrical equipment (such as transformers), and this equipment may incur downtime as a result of unanticipated failures. In particular, as a single blast furnace operation, any unplanned or prolonged outage in the operation of the blast furnace and/or steelmaking facility may have a material adverse effect on our ability to produce steel and satisfy pending and new orders, which will materially impact our revenues, cash flows and profitability. We have insurance coverage for property damage and business interruption losses after a specified minimum damage. Our business interruption insurance, which is subject to specific retentions, provides coverage for loss of gross profit resulting from the interruption of business operations.

Our predecessor, Essar Steel Algoma Inc. (“Old Steelco”), experienced plant shutdowns or periods of reduced production as a result of such equipment failures.

On January 21, 2011, Blast Furnace No. 7 experienced significant water leakage and this ultimately led to the chilling of the furnace. Production of raw steel was halted for 23 days with production returning to normal after 33 days.

14

Table of Contents

During fiscal year 2012, a substantial number of stack plate coolers were replaced and a leak detection system was installed at Blast Furnace No. 7. This program has continued into the current fiscal year. The purpose of these measures is to detect and prevent incidents of water into the furnace hearth.

During April 2019, we experienced an unplanned outage that disrupted production in our Blast Furnace No. 7 as a result of an operator error causing a chemistry imbalance of certain materials. The resulting lost production led to a shipping volume reduction during the three-month period ended June 30, 2019, of over 100,000 tons. During April 2019, we recorded a capacity utilization adjustment of C$32.7 million to cost of steel products sold.

On October 18, 2019, there was a rupture of a steam drain line which was located below an electrical room in our cokemaking by-products plant (“BP”), which resulted in a loss of power to the BP. In accordance with our emergency procedures, the coke oven gas bleeders were lit to flare the coke oven gas. Additionally, the loss of power caused the cokemaking south raw liquor tank and the tar running tanks to overflow. Raw liquor was conveyed to the main water filter plant (“MWFP”) via a sewer located in the BP. This resulted in effluent exceedances at the MWFP for phenol, ammonia and total cyanide and a toxicity failure for rainbow trout. The incident remains under investigation by the Ontario Ministry of the Environment, Conservation and Parks (“MECP”).

As a single blast furnace operation, our ability to curtail our operating configuration in response to declining market conditions is very limited.

Unexpected interruptions in production capabilities and unexpected failures in our computer systems would adversely affect productivity and financial performance for the affected period. No assurance can be given that a significant shutdown will not occur in the future or that such a shutdown will not have a material adverse effect on our business, financial position or financial performance.

It is also possible that operations may be disrupted due to other unforeseen circumstances such as power outages, explosions, fires, floods, pandemics, states of emergency declared by governmental agencies, environmental incidents, accidents, severe weather conditions and cyberattacks. To the extent that lost production could not be compensated for at unaffected facilities and depending on the length of the outage, our sales and our unit production costs could be adversely affected.

We could incur significant cash expenses for temporary and potential permanent idling of facilities.

We perform strategic reviews of our business, which may include evaluating each of our plants and operating units to assess their viability and strategic benefits. As part of these reviews, we may idle, whether temporarily or permanently, certain of our existing facilities in order to reduce participation in markets where we determine that our returns are not acceptable. If we decide to permanently idle any facility or assets, we are likely to incur significant cash expenses, including those relating to labor benefit obligations, take-or-pay supply agreements and accelerated environmental remediation costs, as well as substantial non-cash charges for impairment of those assets. If we elect to permanently idle material facilities or assets, it could adversely affect our operations, financial results and cash flows. In the past, certain of our facilities have been idled as a result of poor profitability.

15

Table of Contents

For any temporarily idled facilities, we may not be able to respond in an efficient manner when restarting these to fully realize the benefits from changing market conditions that are favorable to integrated steel producers. When we restart idled facilities, we incur certain costs to replenish raw material inventories, prepare the previously idled facilities for operation, perform the required repair and maintenance activities and prepare employees to return to work safely and resume production responsibilities. The amount of any such costs can be material, depending on a variety of factors, such as the period of time during which the facilities remained idle, necessary repairs and available employees, and is difficult to project.

The North American steel industry and certain industries we serve, such as the automotive, construction, appliance, machinery and equipment, and transportation industries, are cyclical, and prolonged economic declines would have a material adverse effect on our business.

The North American steel industry is cyclical in nature and sensitive to general economic conditions, including the COVID-19 pandemic. The financial position and financial performance of companies in the steel industry are generally affected by macroeconomic fluctuations in the Canadian, U.S. and global economies. Due mainly to our product mix, we have a higher exposure to spot markets than most of our North American competitors. We are therefore subject to more volatility in selling prices. In addition, steel prices are sensitive to trends in cyclical industries such as the North American automotive, construction, appliance, machinery and equipment, and transportation industries, which are significant markets for our products. Recent economic situations resulting from the COVID-19 pandemic have negatively impacted our performance.

In addition, many of our customers are also affected by economic downturns, including as a result of the COVID-19 pandemic, which may in the future result in defaults in the payment of accounts receivable owing to us and a resulting negative impact on our financial results and cash flows.

There can be no assurance that economic or market conditions will be favorable to the steel industry or any of the end-use industries that we intend to serve in the future. Economic downturns, a stagnant economy or otherwise unfavorable economic or market conditions may adversely affect our business, financial performance and financial position.

The lag between the time an order is placed and when it is fulfilled can have a material impact on our financial results, which could be adverse.

As we have a substantial portion of spot-based sales, orders are priced at current prices, subject to discounts, incentives and other negotiated terms, for production and delivery in the future. Generally, there is a lag of approximately six to eight weeks between when an order is booked and ultimately delivered. At certain times, particularly in rapidly increasing price environments, lead times could grow even longer based on increased customer demand and orders. As a result, our financial performance generally lags changes in market price, both positive and negative. Furthermore, in the circumstances where market prices are falling, our customers may seek to cancel orders or seek to renegotiate more favorable pricing to reflect the changes in market price. Our financial position and financial performance could be materially adversely affected in such circumstances.

16

Table of Contents

Predecessor operators of our business have sought creditor protection and completed corporate restructurings on a number of occasions.

Old Steelco’s predecessor company initiated a bankruptcy proceeding in 1990 and subsequently emerged from bankruptcy protection by way of a C$60 million bridge loan from the Government of Ontario. As a result of business, operational and financial challenges, Old Steelco’s predecessor company later filed for protection under the Canadian Companies’ Creditors Arrangement Act (the “CCAA”) in April 2001 and emerged from creditor protection in 2002 following the completion of a corporate restructuring.

In 2014, as a result of depressed steel prices, a legacy iron ore supply contract that contained above-market pricing terms, substantial pension funding obligations and a significant amount of debt and related interest expense, all of which negatively impacted Old Steelco’s operations, financial position and liquidity, Old Steelco implemented an arrangement under section 192 of the Canada Business Corporations Act (“CBCA”). The CBCA proceedings enabled Old Steelco to restructure its unsecured notes, refinance its secured debt and obtain a significant capital infusion. Old Steelco also commenced a recognition proceeding in the United States under Chapter 15 of the United States Bankruptcy Code, in order to recognize and enforce the arrangement in the United States. On September 15, 2014, the Canadian court issued a final order approving the arrangement, which order was recognized by the U.S. court on September 24, 2014. The arrangement was completed in November 2014.

On November 9, 2015, Old Steelco sought and obtained CCAA protection as a result of, among other things, a dispute with a critical supplier of iron ore, a significant decrease in steel prices, an inability to comply with payment and other obligations under its credit agreements, and operational cost issues. Old Steelco carried out a sale and investment solicitation process that ultimately resulted in Opco’s (as defined below) acquisition of substantially all of the operating assets of Old Steelco on November 30, 2018 (the “Purchase Transaction”). The transaction resulted in a significant capital structure deleveraging and negotiated arrangements with a number of labor, pension, and governmental stakeholders. The CCAA proceedings and our acquisition of the business were given effect in the United States pursuant to a recognition proceeding under Chapter 15 of the United States Bankruptcy Code.

There can be no assurance that we will not experience serious financial difficulties in the future that would necessitate the commencement of restructuring proceedings, which could have a material adverse effect on our business, financial position, financial performance and prospects and the legal and economic entitlements of our stakeholders.

We are reliant on information technology systems, including cyber security systems, and any failure or breach of such systems could disrupt our operations.

We are reliant on the continuous and uninterrupted operation of our Information Technology (“IT”) systems. User access and security of all sites and corporate IT systems can be critical elements to our operations. Protection against cyber security incidents, cloud security and security of all of our IT systems are critical to our operations. Any IT failure pertaining to availability, access or system security could result in disruption for personnel and could adversely affect our reputation, operations or financial performance.

We may fall victim to successful cyber-attacks and may incur substantial costs and suffer other negative consequences as a result, which may include, but are not limited to, a material disruption in our ability to produce and/or ship steel products, excessive remediation costs that may include liability for stolen assets or information, repairing system damage that may have been caused, and potentially making ransom payments in connection with a cyber-attack. We and our business partners maintain significant amounts of data electronically in locations on and

17

Table of Contents

off our site. This data relates to all aspects of our business, including current and future products, and also contains certain customer, consumer, supplier, partner and employee data. We maintain systems and processes designed to protect this data, including operating in the Cloud and contracting with third-party system security providers, but notwithstanding such protective measures, there is a risk of intrusion, cyber-attacks or tampering that could compromise the integrity and privacy of this data. In addition, we provide confidential and proprietary information to our third-party business partners in certain cases where doing so is necessary to conduct our business. While we obtain assurances from those parties that they have systems and processes in place to protect such data, and where applicable, that they will take steps to assure the protections of such data by third parties, nonetheless those partners may also be subject to data intrusion or otherwise compromise the protection of such data. Any compromise of the confidential data of our customers, consumers, suppliers, partners, employees or ourselves, or failure to prevent or mitigate the loss of or damage to this data through breach of our information technology systems or other means could substantially disrupt our operations, including production delays or downtimes, harm our customers, consumers, employees and other business partners, damage our reputation, violate applicable laws and regulations, subject us to potentially significant costs and liabilities and result in a loss of business that could be material.

Increased global information technology security requirements, vulnerabilities, threats and a rise in sophisticated and targeted cybercrime pose a risk to the security of our systems, our information networks, and to the confidentiality, availability and integrity of our data, as well as to the functionality of our automated and electronically controlled manufacturing operating systems and data collection and analytics capabilities, which our management believes are important and are expected to contribute to our ability to efficiently operate and compete. Although we have adopted procedures and controls, including operating in the Cloud and contracting with third-party system security providers, to protect our information and operating technology, including sensitive proprietary information and confidential and personal data, there can be no assurance that a system or network failure, or security breach, will not occur. This could lead to system interruption, production delays or downtimes and operational disruptions and/or the disclosure, modification or destruction of proprietary and other key information, which could have an adverse effect on our reputation, financial results and financial performance.

Changes to global data privacy laws and cross-border transfer requirements could adversely affect our business and operations.

Our business depends on the transfer of data between our affiliated entities, to and from our business partners, and with third-party service providers, which may be subject to global data privacy laws and cross-border transfer restrictions. While we take steps to comply with these legal requirements, changes to the applicability of those laws may impact our ability to effectively transfer data across borders in support of our business operations.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results or financial position.

IFRS and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, including but not limited to revenue recognition, impairment of goodwill and intangible assets, inventory, income taxes and litigation, are highly complex and involve many subjective assumptions, estimates and judgments. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments could significantly change our financial performance or financial position in accordance with IFRS.

18

Table of Contents

Our products may not benefit from intellectual property protection and we must respect intellectual property rights of others.

Some information about our products including product chemistries and methods and processes of production are publicly known. Thus, other facilities could produce competitive products using such information. As a result, we may not be able to distinguish our products from competitors that use the same publicly known chemistries, methods and processes that we use. Other information related to our products including product chemistries and methods and processes used to make them are proprietary to third parties who hold intellectual property rights such as patents or trade secrets therein. Our commercial success depends on our ability to operate without infringing the patents and other proprietary rights of third parties, and there can be no assurance that our operations, product chemistries and methods and processes of production do not or will not infringe the patents or proprietary rights of others. Further, if our competitors use their own proprietary intellectual property rights in their products that we do not have access to, such competitors may have an advantage over us which could have an adverse effect on our business.

Our operations could be materially affected by labor interruptions and difficulties.

We had 2,734 full-time employees as of March 31, 2022, of which approximately 95% are represented by two locals of the United Steelworkers of Canada (“USW”) under two collective bargaining agreements. On June 26, 2018, Local 2251 members and Local 2724 members voted to ratify new collective bargaining agreements. These agreements were conditional upon closing of the sale transaction discussed above pursuant to which we acquired substantially all of the operating assets of Old Steelco. The agreements with Local 2251 and Local 2724 expire on July 31, 2022.

Our customers, or companies upon whom we are dependent for raw materials, transportation or other services, could also be affected by labor difficulties. Any such activities, disruptions or difficulties could result in a significant loss of production and sales and could have a material adverse effect on our financial position or financial performance.

Our operations, production levels, sales, financial results and cash flows could be adversely affected by transportation, raw material or energy supply disruptions, or poor quality of raw materials, particularly coal and iron ore.

Due to our location on Lake Superior, we are dependent on seasonally available waterways for the delivery of substantial amounts of raw materials, including coal and iron ore. The waterways close from approximately mid-January to the end of March each year. Extreme cold weather conditions in the United States and Canada impact shipping on the Great Lakes and could disrupt the delivery of iron ore to us and/or increase our costs related to iron ore. Failure to have adequate coal and iron ore on site prior to the closure of the waterways would adversely affect our ability to operate during such closure and could have a material adverse effect on our production levels, business, financial position, financial performance and prospects. For example, during the period from January through April 2014, the upper Great Lakes suffered a severe freeze-over, which resulted in the waterways being generally inaccessible for shipping until early May 2014. As a result, raw material supply was depleted and production was therefore reduced. In addition, extreme weather conditions may limit the availability of railcars or

19

Table of Contents

otherwise affect our capacity to receive inbound raw materials, and/or ship products to our customers, which may have a material impact on increasing our costs and /or realizing our revenues. Finally, such disruptions or quality issues, whether the result of severe financial hardships or bankruptcies of suppliers, natural or man-made disasters or other adverse weather events, or other unforeseen circumstances or events, could reduce production or increase costs at our plants and potentially adversely affect customers or markets to which we sell our products. Any resulting financial impact could constrain our ability to fund additional capital investments and maintain adequate levels of liquidity and working capital.

Our business requires substantial capital investment, capital commitments and maintenance expenditures, which we may have difficulty in meeting and will cause us to incur operating costs.

Our operations are capital intensive. We expect to make ongoing capital and maintenance expenditures to achieve and maintain competitive levels of capacity, cost, productivity and product quality. We may not generate sufficient future operating cash flow and external financing sources may not be available in an amount sufficient to enable us to make anticipated capital expenditures, service or refinance our indebtedness, or fund other liquidity needs. Failure to make sufficient capital investment, capital commitments and maintenance expenditures could have a material adverse effect on our business, financial position, financial performance and prospects.

Our Blast Furnace No. 7 was last relined in 2007 which resulted in a downtime of 52 days and capital expenditure of C$72 million. Relines generally last for 20 years. We monitor the health of our furnace. We will expect Blast Furnace No. 7 to require a future reline, which we anticipate occurring no sooner than 2024, which will result in downtime and capital expenditure, which could have a material adverse effect on our business, financial position, financial performance or prospects.