| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-255934-01 |

| | | |

| Dated January 27, 2022 | BMO 2022-C1 |

Free Writing Prospectus Structural and Collateral Term Sheet |

| |

BMO Mortgage Trust 2022-C1 |

| |

$1,122,007,709 (Approximate Mortgage Pool Balance) |

| |

$[ ] (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

| |

| |

Commercial Mortgage Pass-Through Certificates, Series 2022-C1 |

| |

|

| |

Bank of Montreal Starwood Mortgage Capital LLC KeyBank National Association SSOF SCRE AIV, L.P. German American Capital Corporation Mortgage Loan Sellers |

| BMO Capital Markets | Deutsche Bank Securities KeyBanc Capital Markets | Co-Lead Managers and Joint Bookrunners |

| | | |

| | Co-Lead Managers and Joint Bookrunners | |

Bancroft Capital, LLC

Co-Manager | | Drexel Hamilton

Co-Manager |

| | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Dated January 27, 2022 | BMO 2022-C1 |

This material is for your information, and none of BMO Capital Markets Corp., KeyBanc Capital Markets Inc., Deutsche Bank Securities Inc., Bancroft Capital, LLC and Drexel Hamilton, LLC (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-255934) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-866-864-7760. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2022-C1 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of Mortgaged

Properties | Aggregate

Cut-off Date Balance | % of IPB |

| BMO | 19 | 28 | $406,438,584 | 36.2% |

| SMC | 16 | 42 | $220,342,335 | 19.6% |

| KeyBank | 14 | 58 | $201,852,000 | 18.0% |

| Sabal | 24 | 69 | $147,374,790 | 13.1% |

| GACC | 3 | 3 | $106,000,000 | 9.4% |

| BMO/SMC | 1 | 34 | $40,000,000 | 3.6% |

| Total: | 77 | 234 | $1,122,007,709 | 100.0% |

| Loan Pool(1) | |

| | Initial Pool Balance (“IPB”): | $1,122,007,709 |

| | Number of Mortgage Loans: | 77 |

| | Number of Mortgaged Properties: | 234 |

| | Average Cut-off Date Balance per Mortgage Loan: | $14,571,529 |

| | Weighted Average Current Mortgage Rate: | 3.79281% |

| | 10 Largest Mortgage Loans as % of IPB: | 38.0% |

| | Weighted Average Remaining Term to Maturity: | 108 months |

| | Weighted Average Seasoning: | 2 months |

| | | |

| Credit Statistics(1) | |

| | Weighted Average UW NCF DSCR(2)(3): | 2.60x |

| | Weighted Average UW NOI Debt Yield(2)(4): | 10.9% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(4)(5): | 53.4% |

| | Weighted Average Maturity Date/ARD LTV(2)(5): | 50.8% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 23.3% |

| | % of Mortgage Loans with Single Tenants(6): | 12.9% |

| | % of Mortgage Loans secured by Multiple Properties: | 32.7% |

| Amortization | |

| | Weighted Average Original Amortization Term(7): | 344 months |

| | Weighted Average Remaining Amortization Term(7): | 342 months |

| | % of Mortgage Loans with Interest-Only: | 69.8% |

| | % of Mortgage Loans with Amortizing Balloon: | 12.9% |

| | % of Mortgage Loans with Interest-Only followed by ARD-Structure: | 3.7% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 14.5% |

| | | |

| Lockboxes(8) | |

| | % of Mortgage Loans with Hard Lockboxes: | 44.6% |

| | % of Mortgage Loans with Springing Lockboxes: | 29.9% |

| | % of Mortgage Loans with Soft Lockboxes: | 9.8% |

| | % of Mortgage Loans with No Lockbox: | 9.4% |

| | % of Mortgage Loans with Springing (Residential); Hard (Commercial) Lockbox: | 3.6% |

| | % of Mortgage Loans with Soft (Residential); Hard (Commercial) Lockbox: | 2.7% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 66.8% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 55.7% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 60.6% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(9): | 44.9% |

| (1) | The Loan Pool includes a cross-collateralized group of loans including Loan Nos. 36 and 37. All metrics to the crossed loans are presented on an aggregate basis. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (5) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 7 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value” in the Preliminary Prospectus for additional details. |

| (6) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

| (7) | Excludes 48 mortgage loans that are interest-only for the entire term or until the anticipated repayment date. |

| (8) | For a more detailed description of lockboxes, refer to “Description of the Mortgage Pool—Certain Calculations and Definitions” and “—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (9) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, mixed use, parking garage and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| | Ten Largest Mortgage Loans |

| |

| No. | Loan Name | City, State | Mortgage

Loan Seller | No.

of Prop. | Cut-off Date

Balance | % of IPB | Square

Feet /

Rooms /

Units | Property

Type | UW

NCF

DSCR(1) | UW NOI Debt Yield(1) | Cut-off

Date LTV(1) | Maturity Date/ARD LTV(1) |

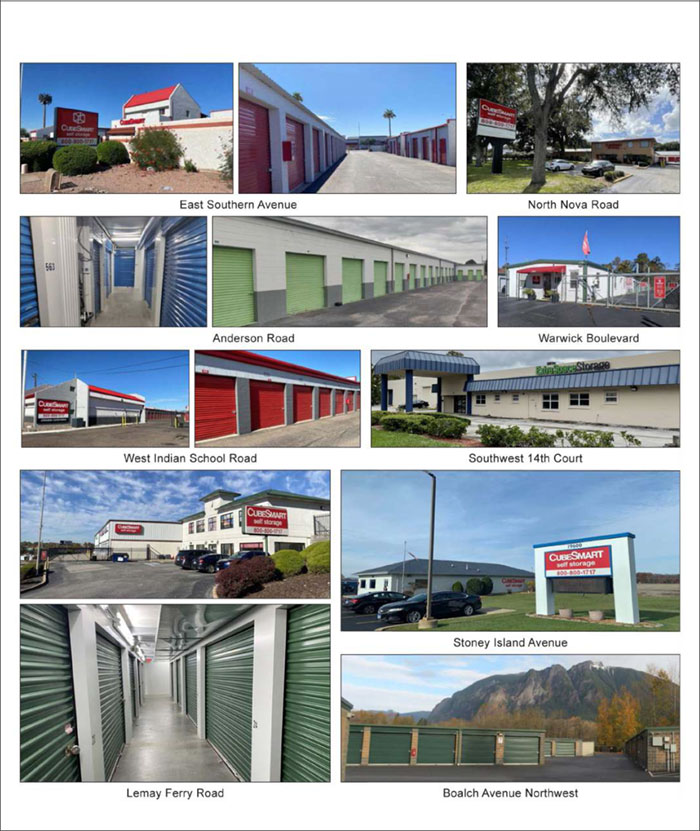

| 1 | IPCC National Storage Portfolio XVI | Various, Various | KeyBank | 19 | $60,000,000 | 5.3% | 1,133,018 | Self Storage | 2.29x | 8.6% | 47.8% | 47.8% |

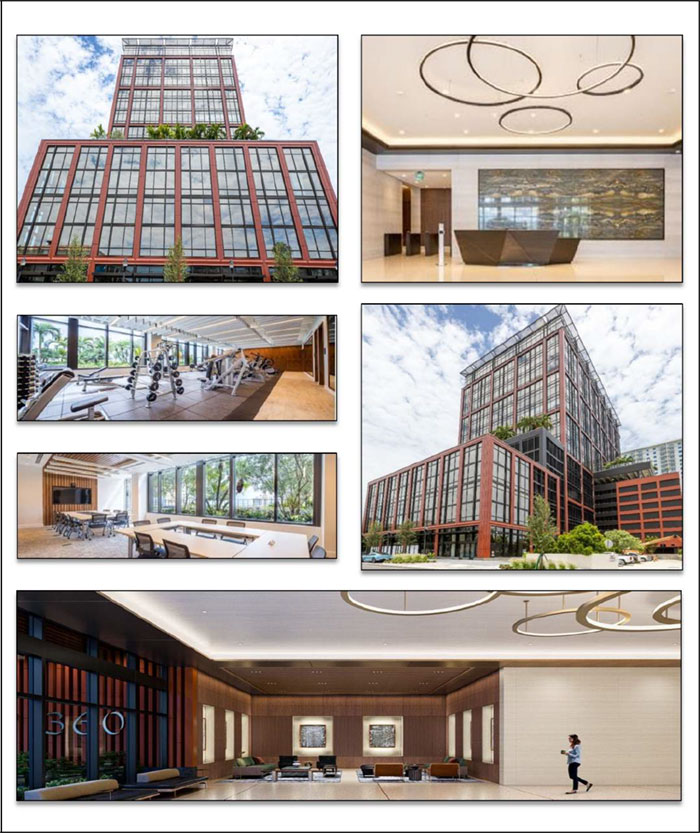

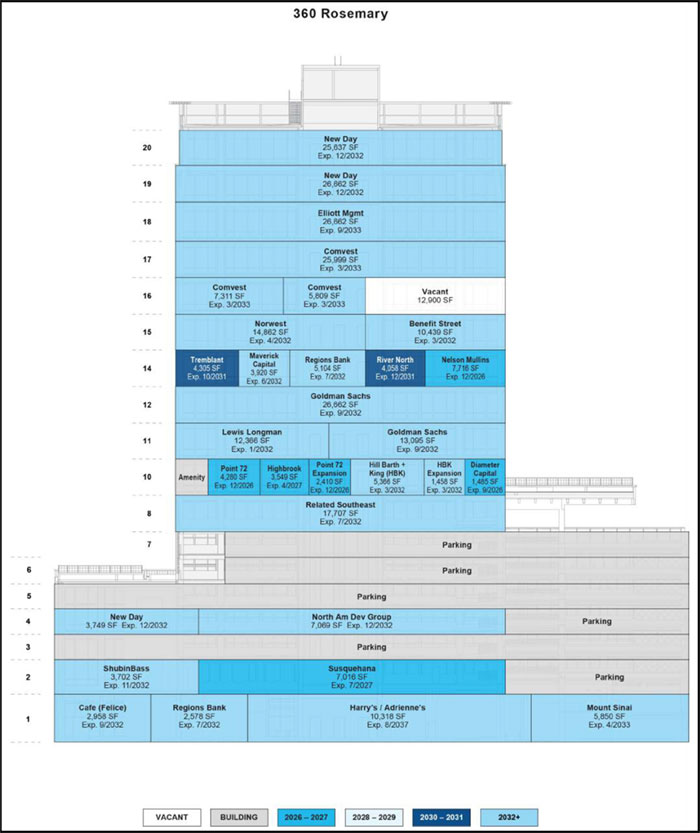

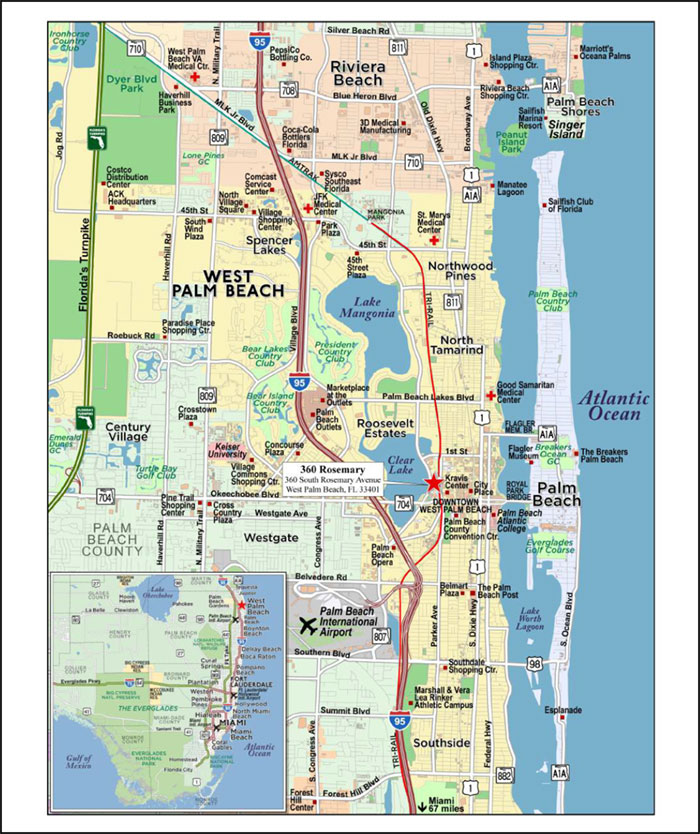

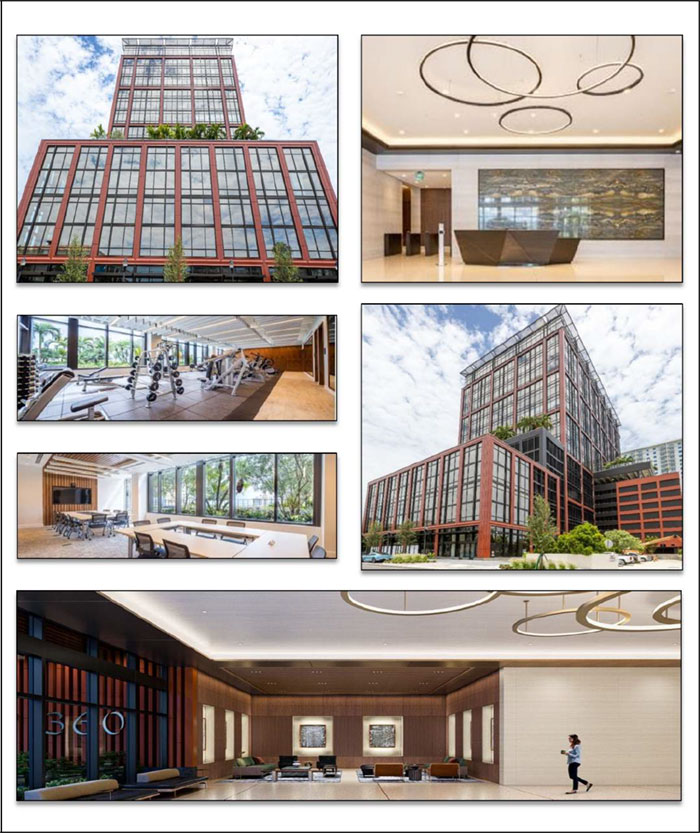

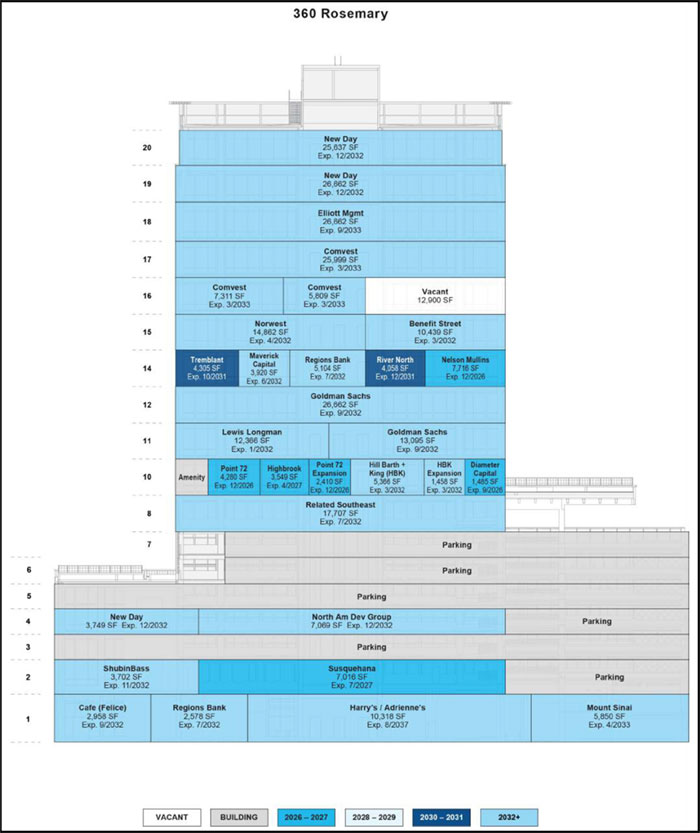

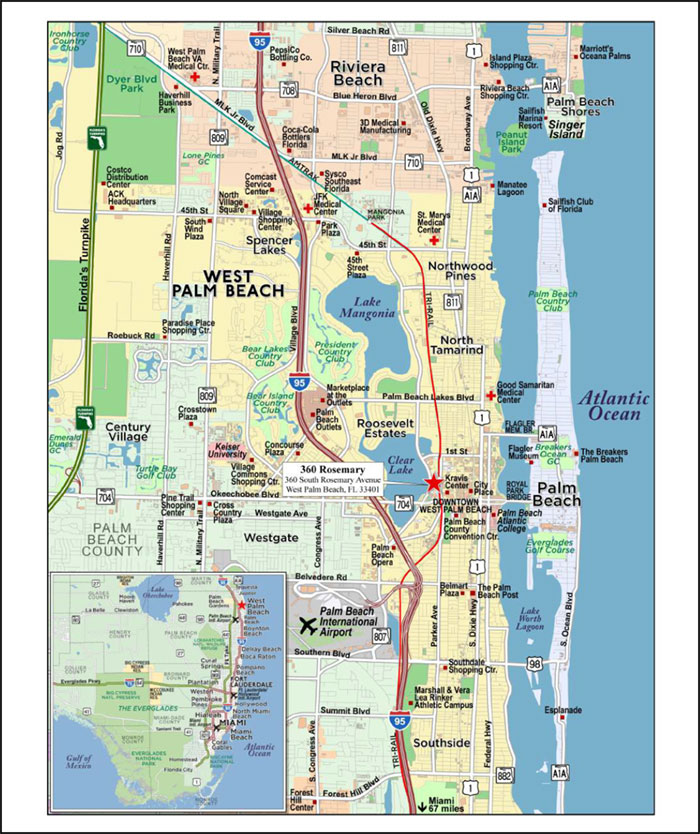

| 2 | 360 Rosemary | West Palm Beach, FL | BMO | 1 | $45,000,000 | 4.0% | 313,002 | Office | 4.35x | 17.8% | 26.6% | 26.6% |

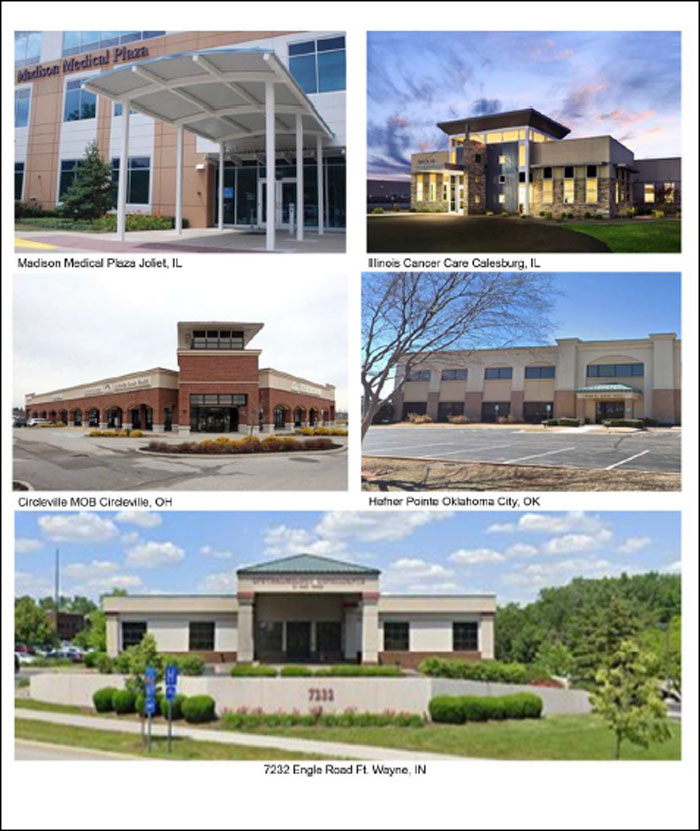

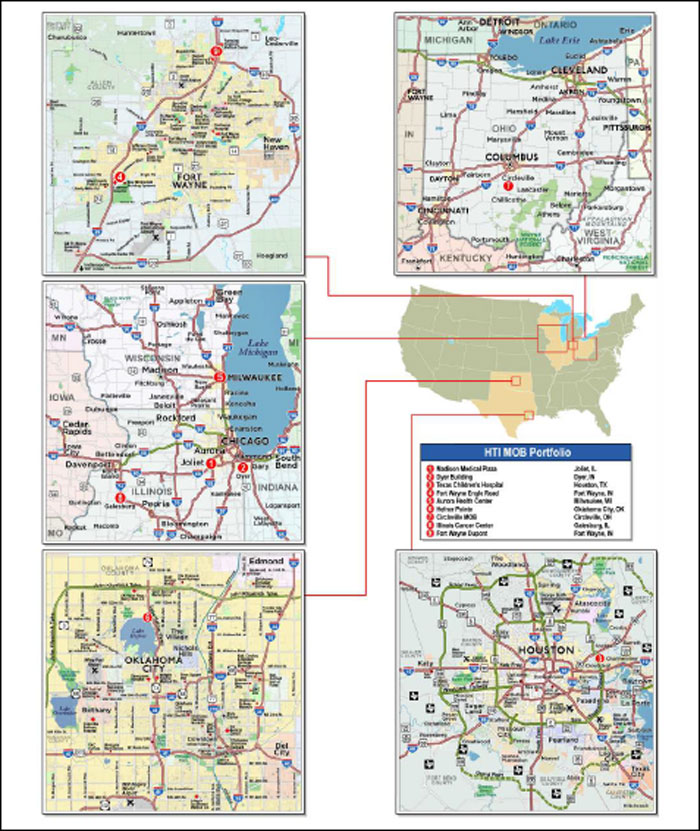

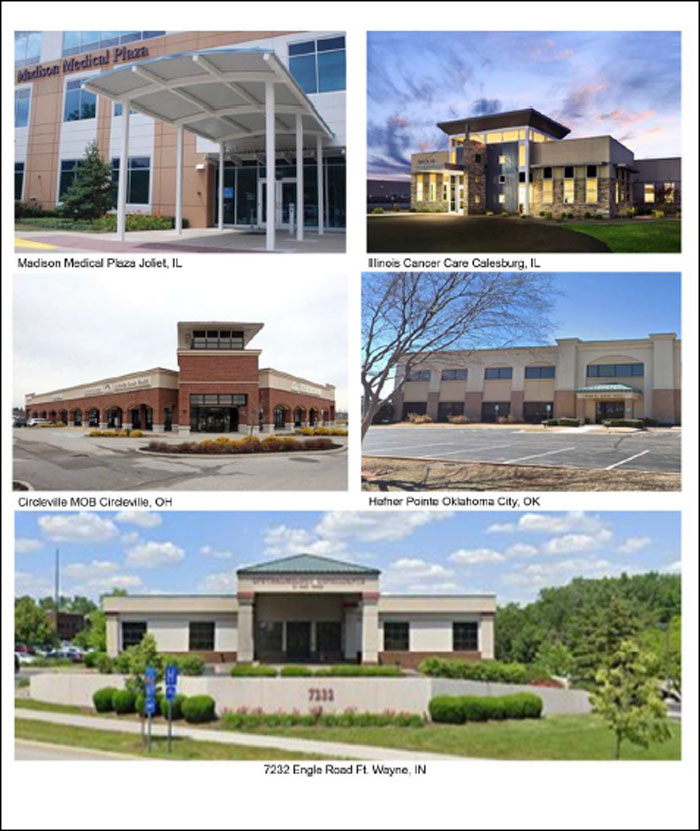

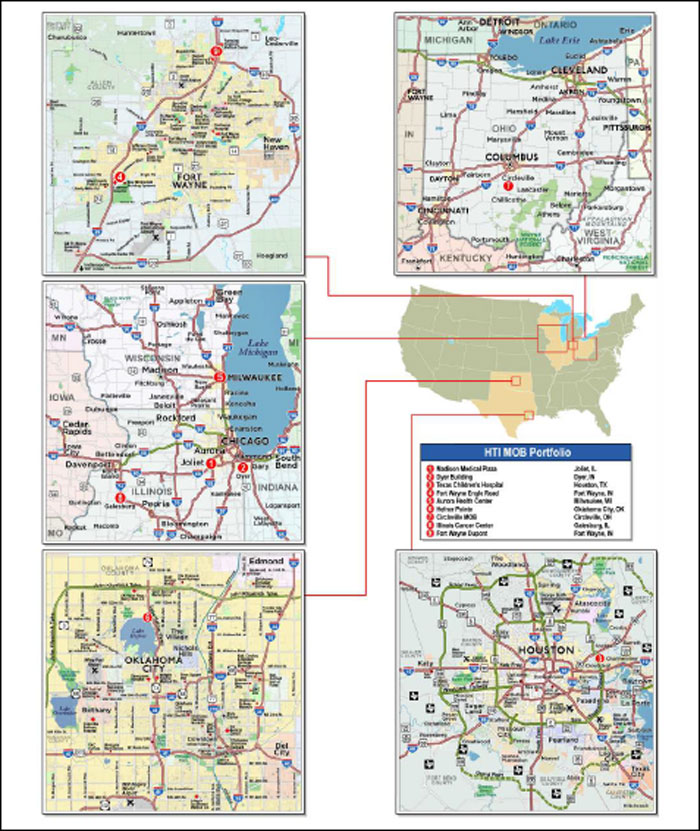

| 3 | HTI MOB Portfolio | Various, Various | BMO | 9 | $42,750,000 | 3.8% | 232,854 | Office | 3.79x | 11.5% | 55.5% | 55.5% |

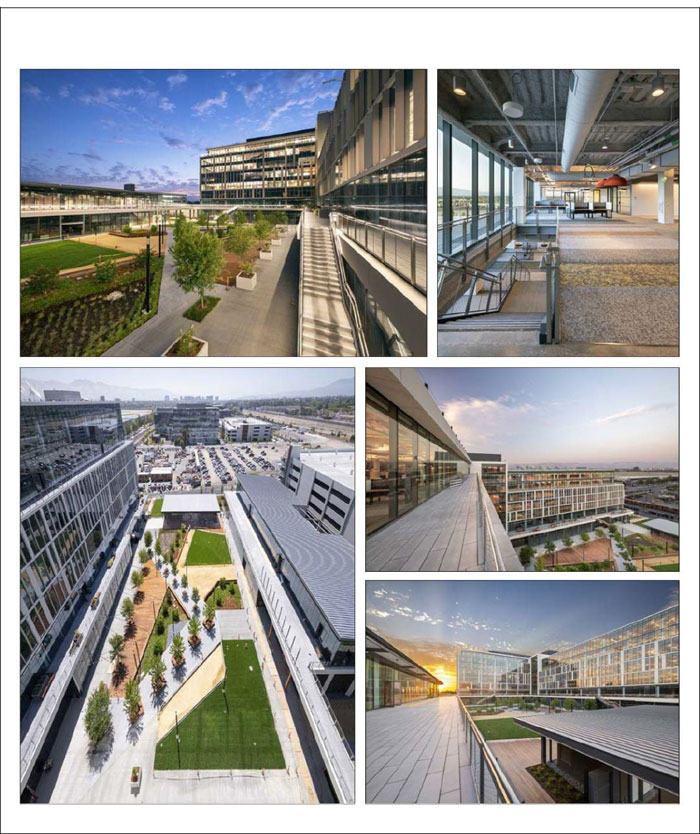

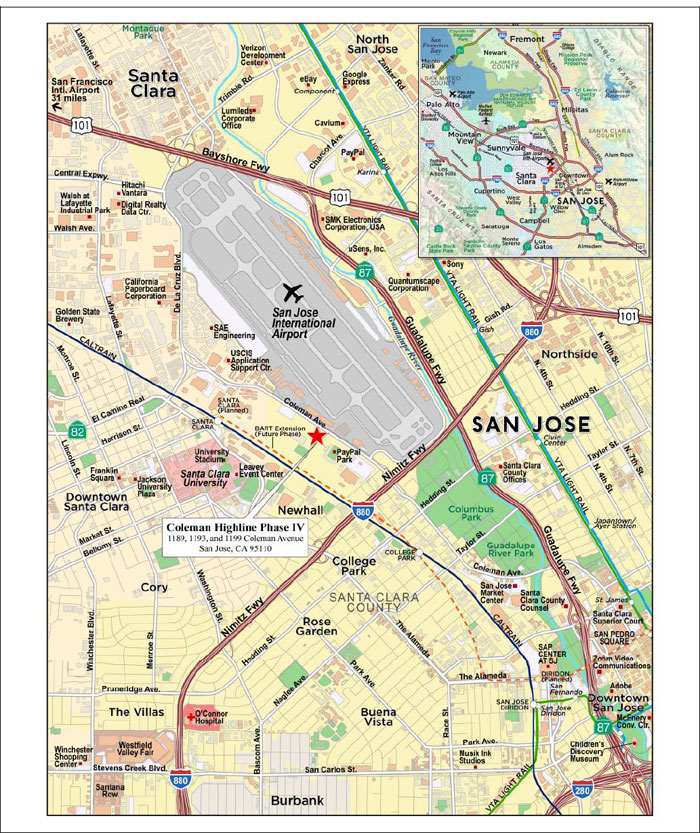

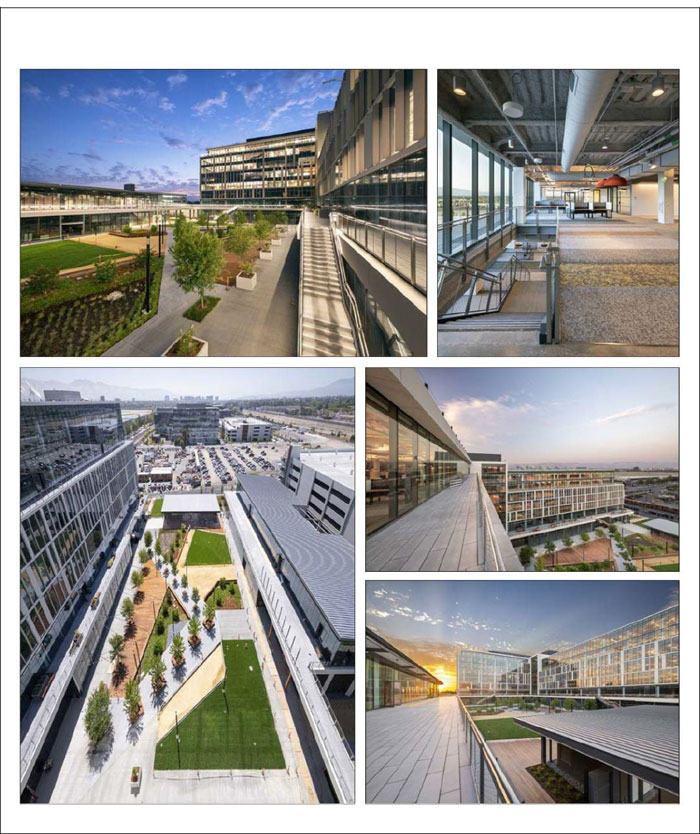

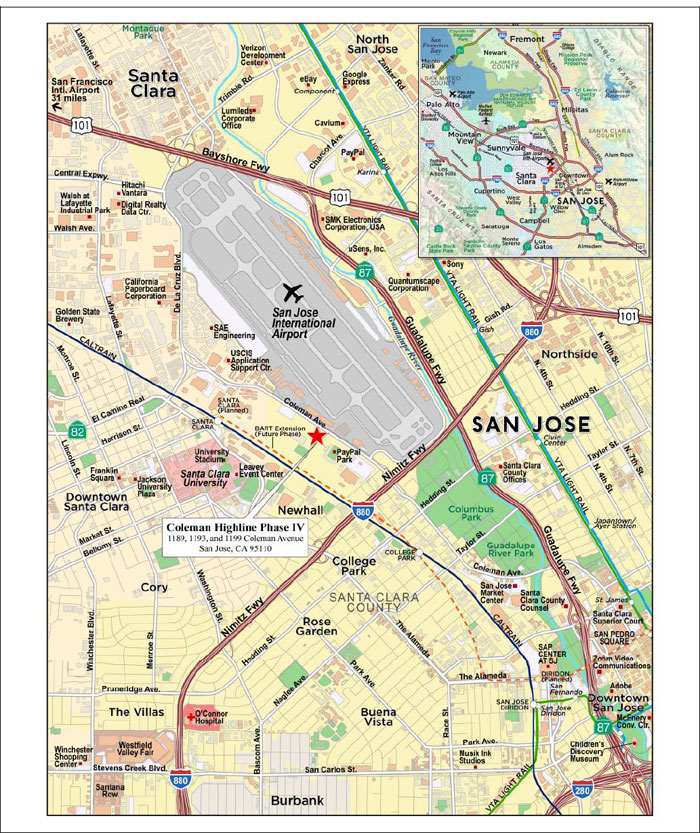

| 4 | Coleman Highline Phase IV | San Jose, CA | BMO | 1 | $41,400,000 | 3.7% | 657,934 | Office | 5.54x | 14.1% | 31.0% | 31.0% |

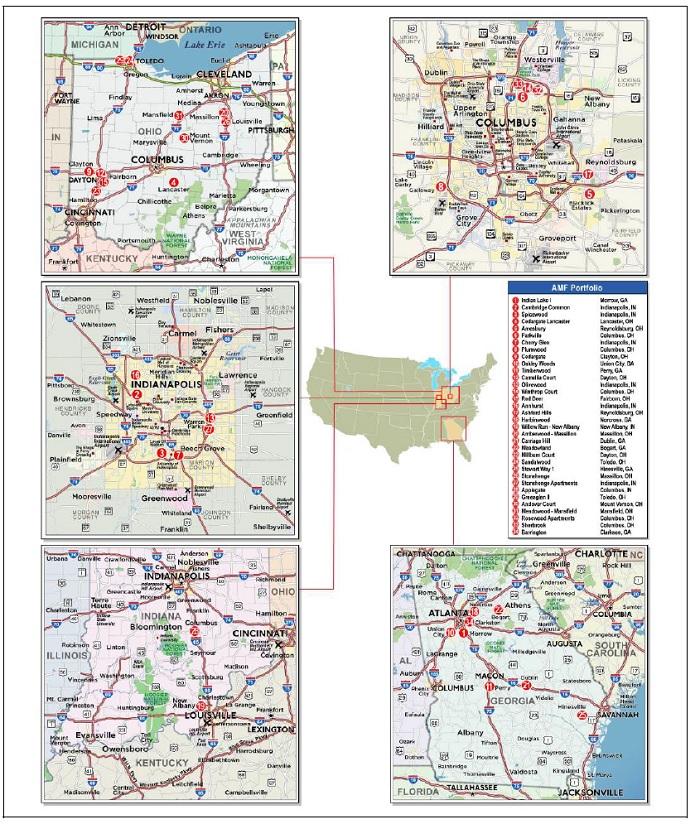

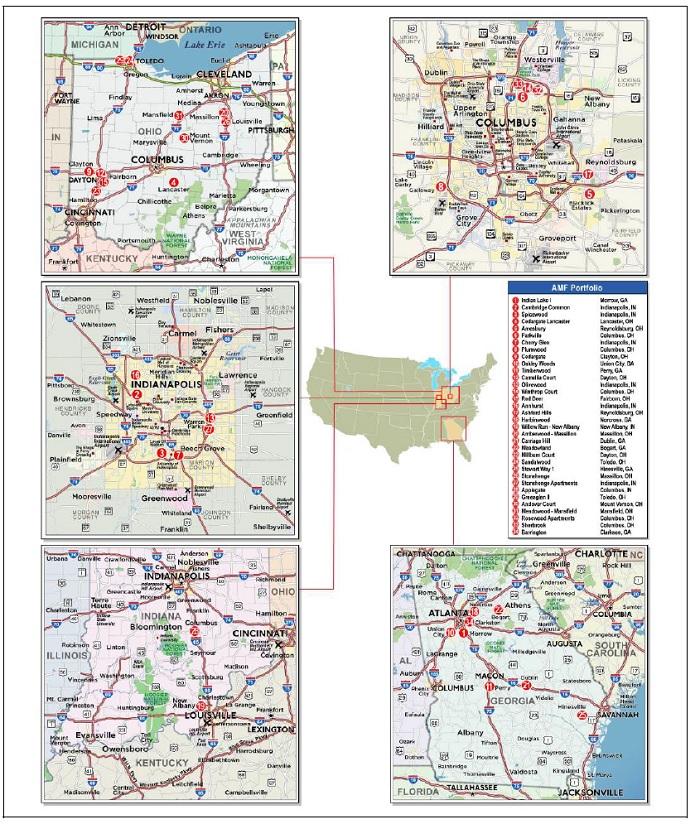

| 5 | AMF Portfolio | Various, Various | BMO/SMC | 34 | $40,000,000 | 3.6% | 3,299 | Multifamily | 1.51x | 9.8% | 61.3% | 56.9% |

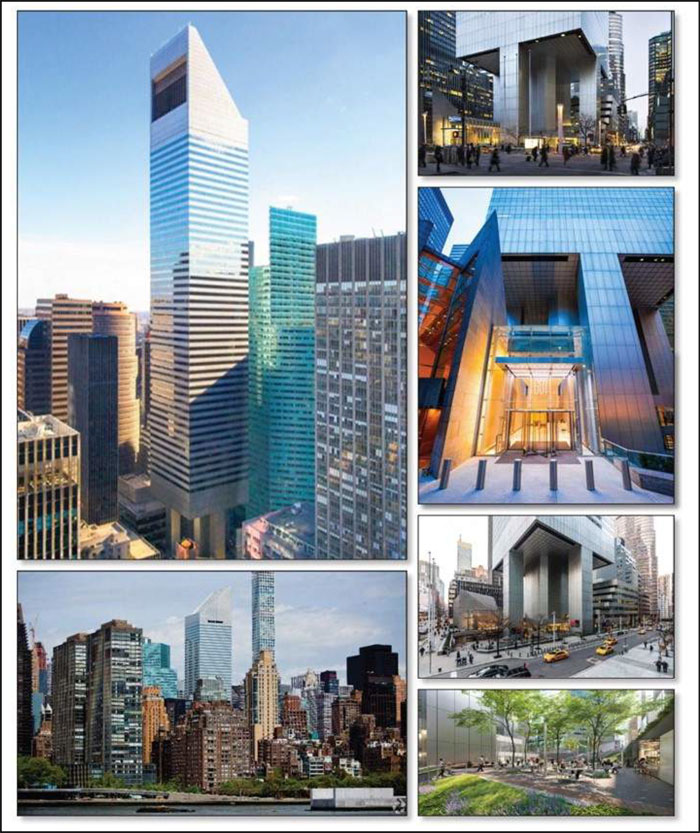

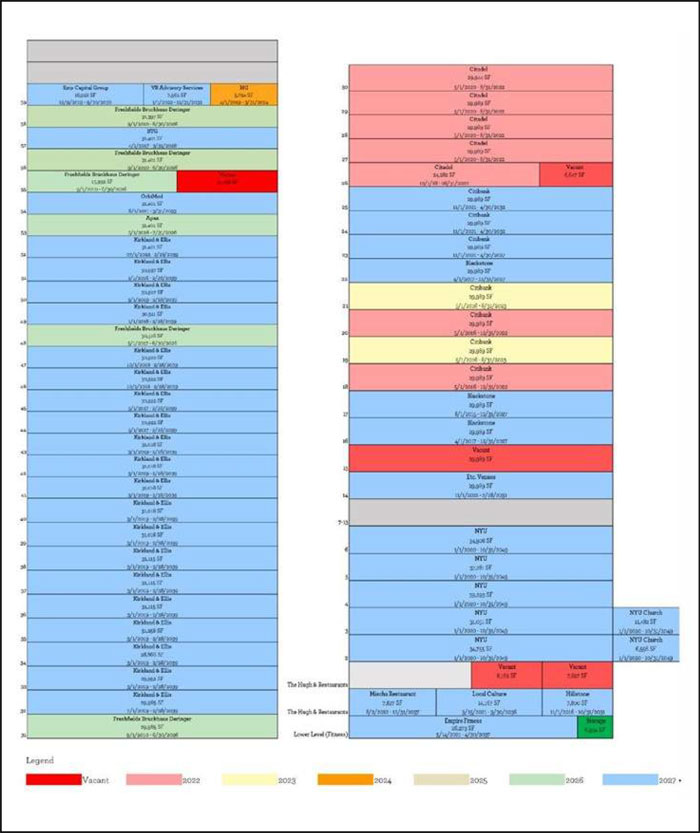

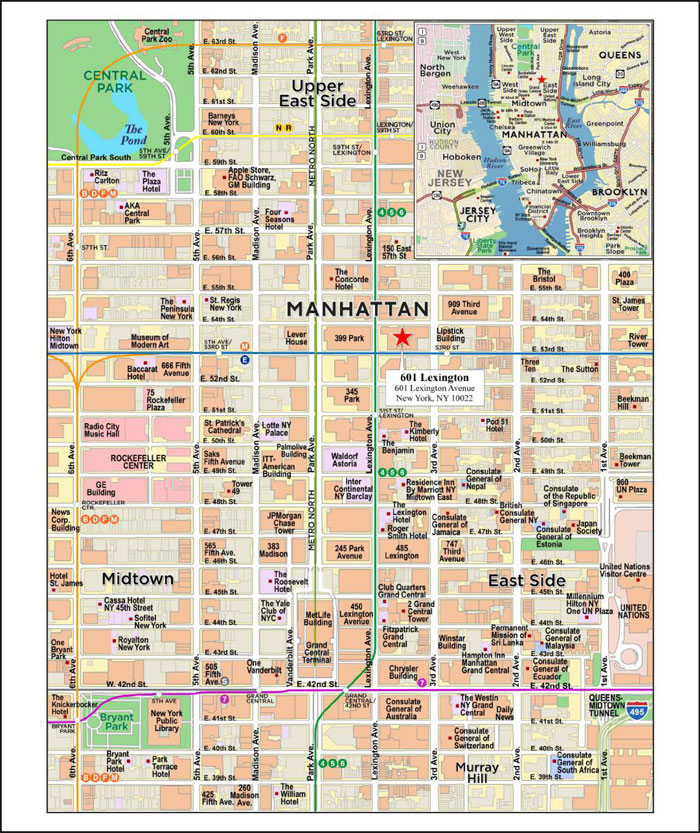

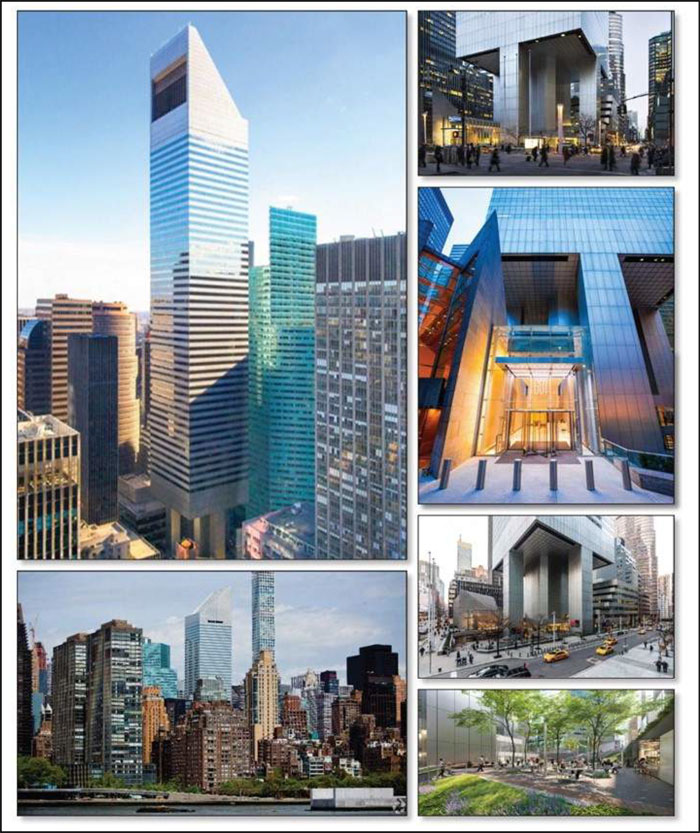

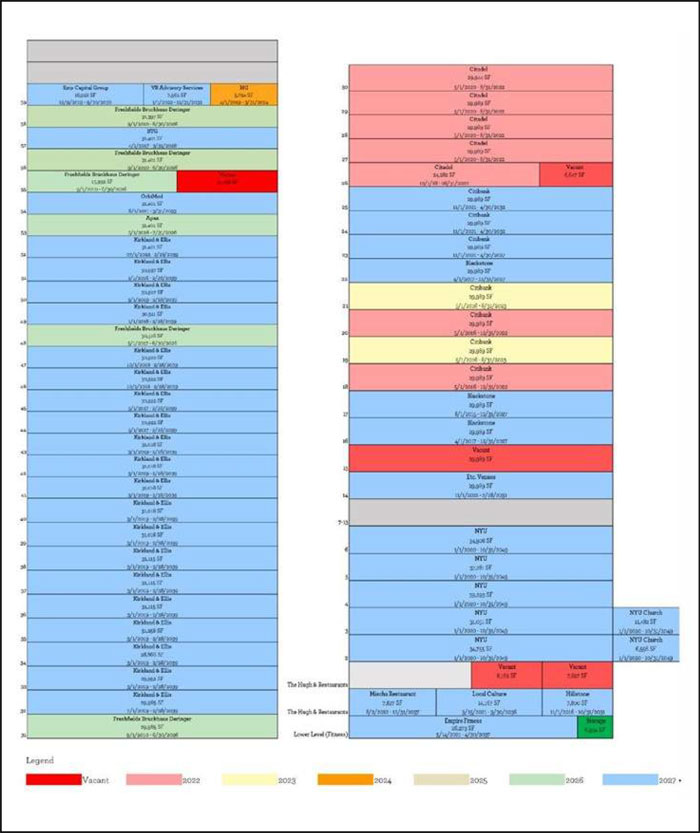

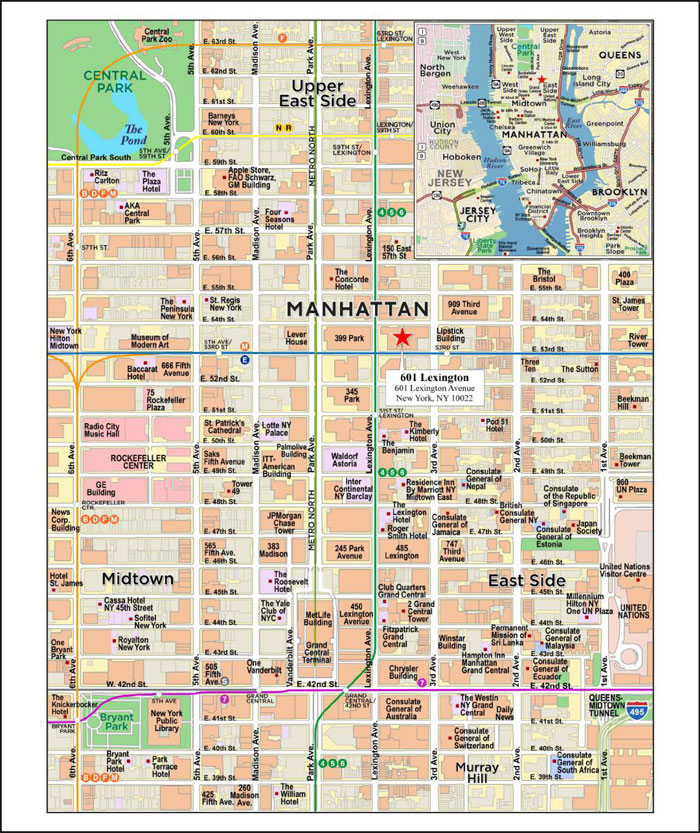

| 6 | 601 Lexington Avenue | New York, NY | GACC | 1 | $40,000,000 | 3.6% | 1,675,659 | Office | 4.50x | 13.2% | 42.5% | 42.5% |

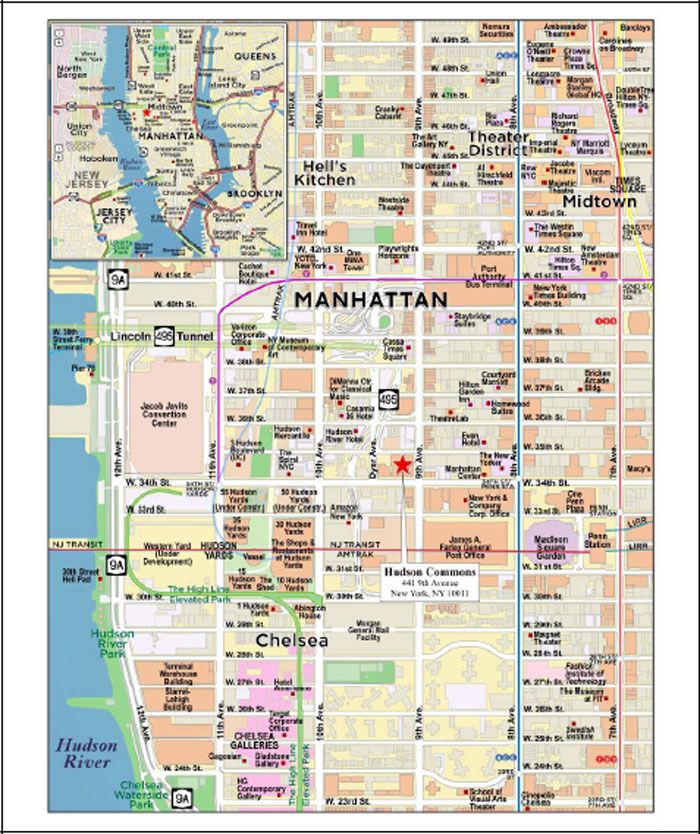

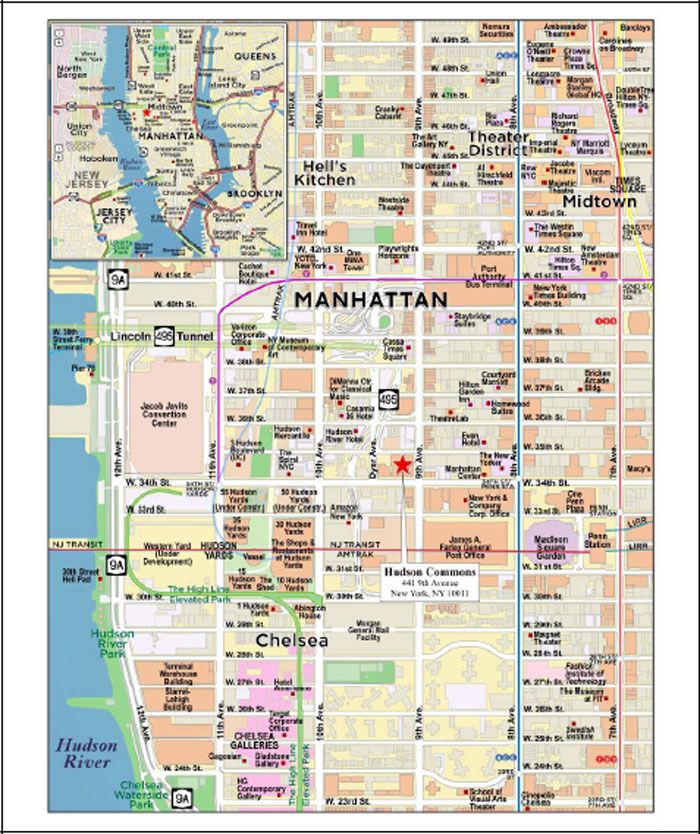

| 7 | Hudson Commons | New York, NY | GACC | 1 | $40,000,000 | 3.6% | 697960 | Office | 2.54x | 9.4% | 29.6% | 29.6% |

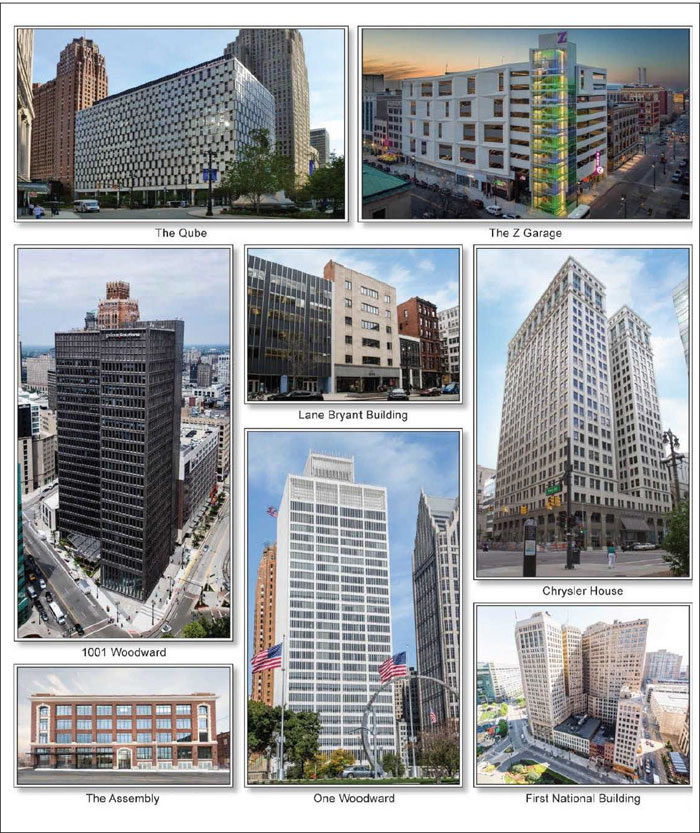

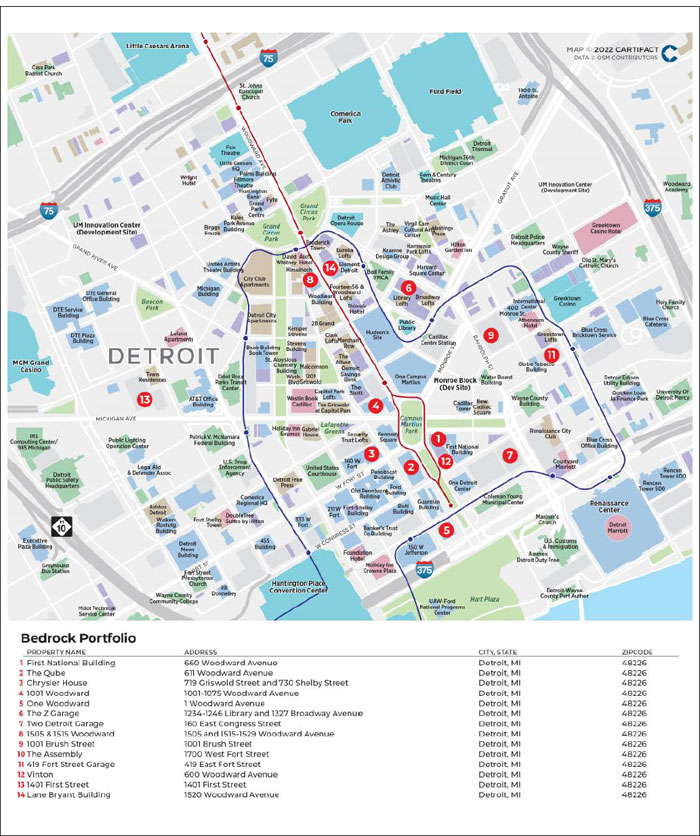

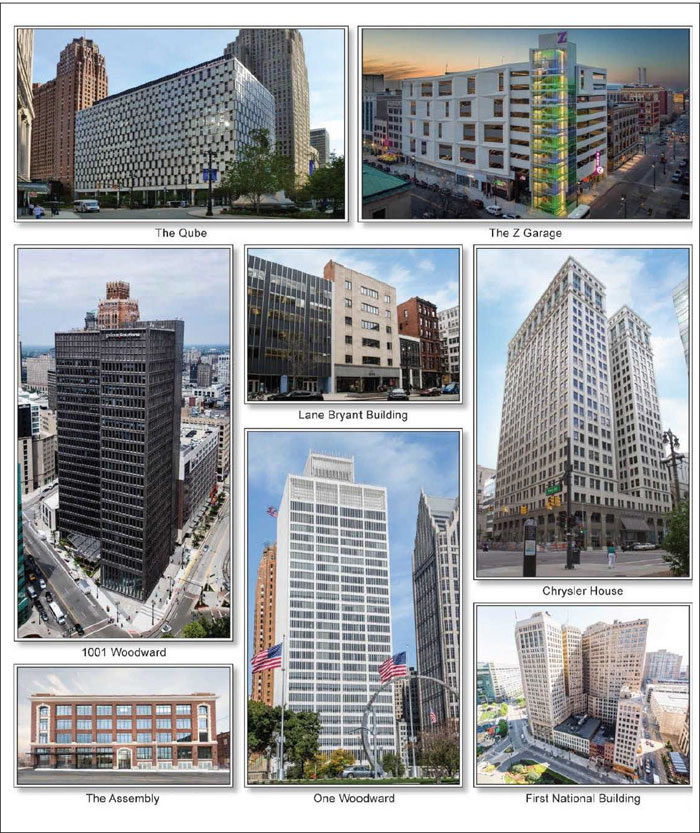

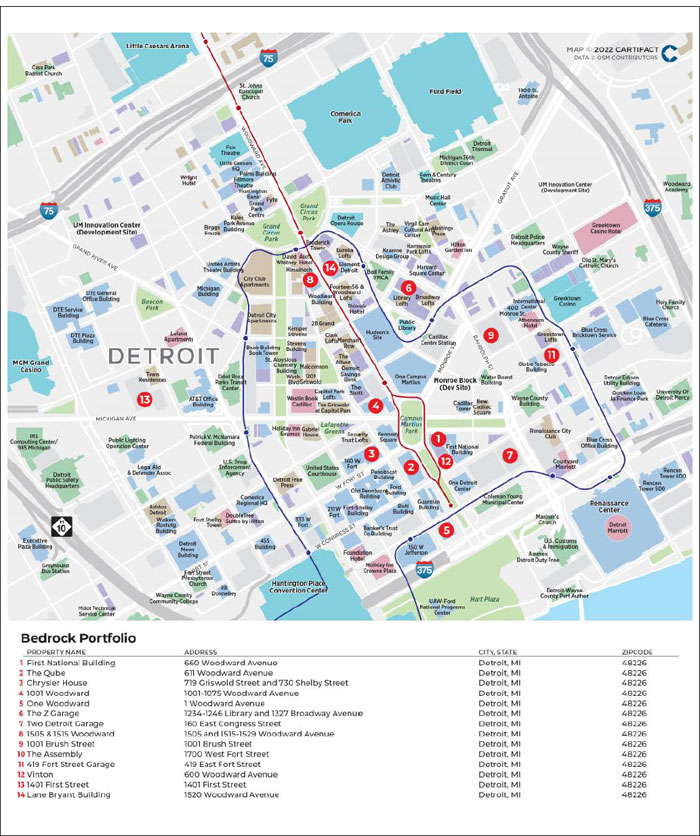

| 8 | Bedrock Portfolio | Detroit, MI | SMC | 14 | $40,000,000 | 3.6% | 2,694,627 | Various | 3.30x | 13.6% | 59.4% | 59.4% |

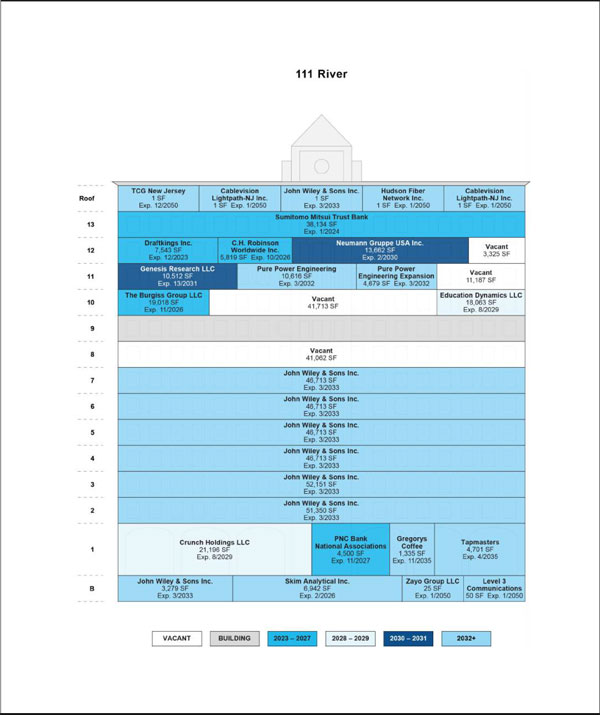

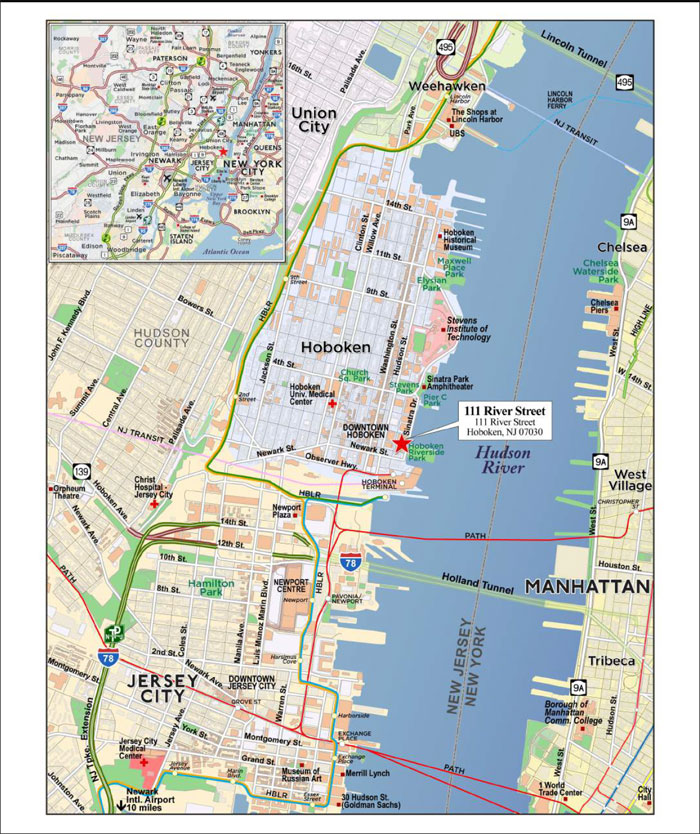

| 9 | IPCC National Storage Portfolio XV | Various, Various | KeyBank | 17 | $40,000,000 | 3.6% | 912,654 | Self Storage | 2.29x | 8.7% | 46.9% | 46.9% |

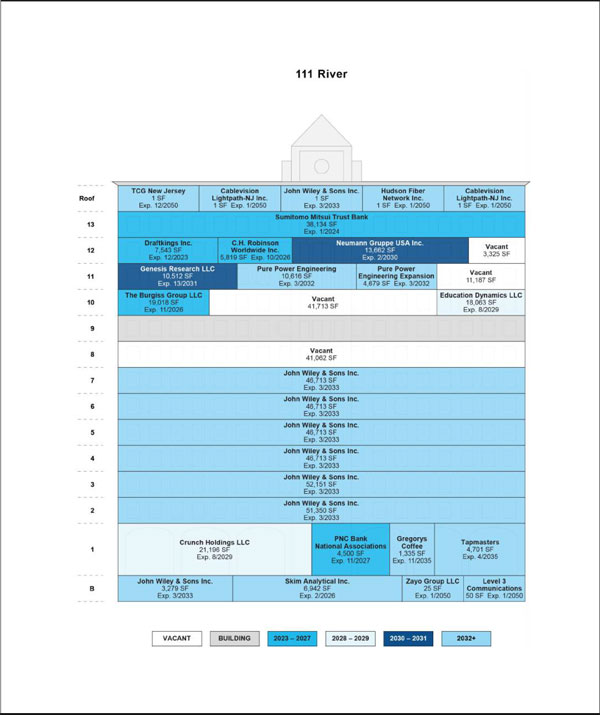

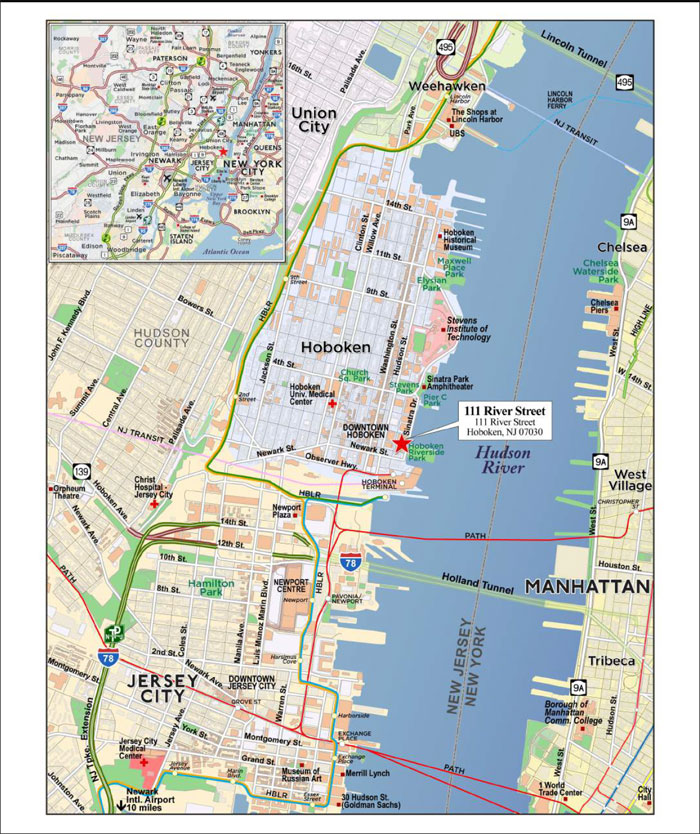

| 10 | 111 River Street | Hoboken, NJ | BMO | 1 | $37,500,000 | 3.3% | 557,719 | Office | 5.08x | 16.9% | 31.8% | 31.8% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | | 29 | $147,750,000 | 13.2% | | | 3.35x | 12.2% | 43.6% | 43.6% |

| | Top 5 Total/Weighted Average | | 64 | $229,150,000 | 20.4% | | | 3.43x | 12.2% | 44.4% | 43.6% |

| | Top 10 Total/Weighted Average | | 98 | $426,650,000 | 38.0% | | | 3.47x | 12.2% | 43.4% | 43.0% |

| | Non-Top 10 Total/Weighted Average(2)(3) | | 136 | $695,357,709 | 62.0% | | | 2.06x | 10.1% | 59.5% | 55.6% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (2) | The Non-Top 10 Total/Weighted Average includes a cross-collateralized group of loans including Loan Nos. 36 and 37. All metrics to the crossed loans are presented on an aggregate basis. |

| (3) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| |

No. | Loan Name | Mortgage Loan Seller | Trust Cut-off

Date Balance | Aggregate Pari

Passu Loan

Cut-off Date

Balance(1) | Controlling

Pooling/Trust &

Servicing

Agreement | Master Servicer | Special

Servicer | Related Pari Passu

Loan(s)

Securitizations | Related Pari

Passu Loan(s) Original Balance |

| 1 | IPCC National Storage Portfolio XVI | KeyBank | $60,000,000 | $117,000,000 | BMO 2022-C1 | KeyBank | CWCapital | Future Securitization(s) | $57,000,000 |

| 2 | 360 Rosemary | BMO | $45,000,000 | $85,000,000 | BMO 2022-C1 | KeyBank | CWCapital | Future Securitization(s) | $40,000,000 |

| 4 | Coleman Highline Phase IV | BMO | $41,400,000 | $245,000,000 | BMO 2022-C1 | KeyBank | Midland Loan Services | Future Securitization(s) | $203,600,000 |

| 5 | AMF Portfolio | BMO/SMC | $40,000,000 | $172,000,000 | BBCMS 2021-C12 | KeyBank | LNR | BBCMS 2021-C12 GSMS 2021-GSA3 Future Securitization(s) | $84,000,000 $38,000,000 $10,000,000 |

| 6 | 601 Lexington Avenue | GACC | $40,000,000 | $723,300,000 | BXP 2021-601L | Wells Fargo | Situs | BXP 2021-601L BANK 2022-BNK39 Benchmark 2022-B32 Future Securitization | $426,700,000 $110,000,000 $25,000,000 $121,600,000 |

| 7 | Hudson Commons | GACC | $40,000,000 | $305,000,000 | COMM 2022-HC | KeyBank | CWCapital | COMM 2022-HC | $265,000,000 |

| 8 | Bedrock Portfolio | SMC | $40,000,000 | $430,000,000 | Benchmark 2022-B32 | Midland Loan Services | Ellington | Benchmark 2022-B32 Future Securitization(s) | $125,000,000 $265,000,000 |

| 9 | IPCC National Storage Portfolio XV | KeyBank | $40,000,000 | $86,000,000 | BMO 2022-C1 | KeyBank | CWCapital | Future Securitization(s) | $46,000,000 |

| 10 | 111 River Street | BMO | $37,500,000 | $77,500,000 | BMO 2022-C1 | KeyBank | KeyBank | Future Securitization(s) | $40,000,000 |

| 11 | 2 Riverfront Plaza | BMO | $37,500,000 | $110,000,000 | BMO 2022-C1 | KeyBank | CWCapital | Future Securitization(s) | $40,000,000 |

| 15 | NYC MFRT Portfolio | BMO | $30,000,000 | $60,200,000 | BMO 2022-C1 | KeyBank | CWCapital | Future Securitization(s) | $30,200,000 |

| 20 | Wyndham National Hotel Portfolio | Sabal | $18,914,095 | $138,697,940 | UBS 2019-C18 | Wells Fargo | Rialto | UBS 2019-C18 BBCMS 2021-C10 BBCMS 2021-C11 WFCM 2021-C60 Future Securitization(s) | $3,000,000 $25,000,000 $20,000,000 $10,000,000 $62,000,000 |

| 22 | Meadowood Mall | BMO | $17,933,084 | $79,702,597 | BMO 2022-C1 | Wells Fargo | CWCapital | WFCM 2022-C61 Future Securitization(s) | $19,000,000 $43,000,000 |

| (1) | In the case of Loan Nos. 2, 4, 6, 7, 10 and 22, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan(s).

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off Date

Balance | Pari Passu

Loan(s) Cut-off

Date Balance | Subordinate

Debt Cut-off

Date

Balance(1)(2) | Total Debt

Cut-off

Date

Balance | Mortgage Loan UW NCF DSCR(3) | Total

Debt

UW

NCF

DSCR | Mortgage

Loan

Cut-off Date

LTV(3) | Total Debt Cut-off Date

LTV | Mortgage

Loan UW NOI

Debt

Yield(3) | Total Debt UW NOI Debt Yield |

| 2 | 360 Rosemary | $45,000,000 | $40,000,000 | $125,000,000 | $210,000,000 | 4.35x | 1.76x | 26.6% | 65.8% | 17.8% | 7.2% |

| 4 | Coleman Highline Phase IV | $41,400,000 | $203,600,000 | $268,500,000 | $513,500,000 | 5.54x | 2.64x | 31.0% | 65.0% | 14.1% | 6.7% |

| 5 | AMF Portfolio | $40,000,000 | $132,000,000 | $13,000,000 | $185,000,000 | 1.51x | 1.51x | 61.3% | 65.9% | 9.8% | 9.1% |

| 6 | 601 Lexington Avenue | $40,000,000 | $683,300,000 | $276,700,000 | $1,000,000,000 | 4.50x | 3.25x | 42.5% | 58.8% | 13.2% | 9.5% |

| 7 | Hudson Commons | $40,000,000 | $265,000,000 | $202,000,000 | $507,000,000 | 2.54x | 1.53x | 29.6% | 49.2% | 9.4% | 5.7% |

| 10 | 111 River Street | $37,500,000 | $40,000,000 | $76,250,000 | $153,750,000 | 5.08x | 2.56x | 31.8% | 63.0% | 16.9% | 8.5% |

| 22 | Meadowood Mall | $17,933,084 | $61,769,513 | $27,979,523 | $107,682,120 | 2.98x | 1.81x | 35.1% | 47.4% | 19.9% | 14.7% |

| (1) | In the case of Loan Nos. 2, 4 and 6 subordinate debt represents one or more Subordinate Companion Loans. |

| (2) | In the case of Loan No. 5 subordinate debt represents a subordinate mezzanine loan. |

| (3) | Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans (if applicable),but exclude the related Subordinate Companion Loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date

Principal

Balance | % of

IPB | UW

NCF

DSCR(2)(3) | UW

NOI

Debt

Yield(2)(4) | Cut-off

Date

LTV(2)(4)(5) | Maturity Date/ARD LTV(2)(5) |

| Office | CBD | 13 | $271,201,600 | 24.2% | 3.95x | 13.6% | 39.1% | 39.1% |

| | Medical | 10 | 46,550,000 | 4.1 | 3.71x | 11.5% | 56.2% | 56.2% |

| | Suburban | 3 | 19,697,000 | 1.8 | 2.24x | 10.4% | 66.9% | 64.1% |

| | Subtotal: | 26 | $337,448,600 | 30.1% | 3.82x | 13.1% | 43.0% | 42.9% |

| Retail | Anchored | 8 | $111,514,608 | 9.9% | 2.18x | 10.7% | 58.8% | 51.9% |

| | Single Tenant | 3 | 53,990,000 | 4.8 | 2.27x | 9.7% | 57.6% | 57.6% |

| | Unanchored | 6 | 47,573,538 | 4.2 | 2.02x | 9.3% | 59.2% | 58.6% |

| | Regional Mall | 1 | 17,933,084 | 1.6 | 2.98x | 19.9% | 35.1% | 30.7% |

| | Shadow Anchored | 3 | 16,945,500 | 1.5 | 1.74x | 10.4% | 65.6% | 57.4% |

| | Subtotal: | 21 | $247,956,731 | 22.1% | 2.19x | 10.9% | 57.3% | 53.3% |

| Self Storage | Self Storage | 56 | $177,662,346 | 15.8% | 2.28x | 8.9% | 52.0% | 51.5% |

| Multifamily | Garden | 44 | $122,557,425 | 10.9% | 1.69x | 9.3% | 61.5% | 55.8% |

| | Low Rise | 14 | 28,763,939 | 2.6 | 1.75x | 7.6% | 62.3% | 62.3% |

| | Mid Rise | 3 | 16,765,000 | 1.5 | 2.26x | 8.2% | 62.9% | 62.9% |

| | Student Housing | 1 | 2,489,468 | 0.2 | 1.49x | 8.7% | 62.4% | 49.6% |

| | Subtotal: | 62 | $170,575,832 | 15.2% | 1.76x | 8.9% | 61.8% | 57.5% |

| Hospitality | Extended Stay | 3 | $47,285,198 | 4.2% | 1.83x | 12.2% | 61.5% | 50.8% |

| | Limited Service | 44 | 18,914,095 | 1.7 | 1.69x | 14.8% | 64.5% | 46.7% |

| | Subtotal: | 47 | $66,199,293 | 5.9% | 1.79x | 12.9% | 62.4% | 49.6% |

| Industrial | Warehouse / Other | 1 | $31,500,000 | 2.8% | 2.21x | 8.7% | 58.7% | 58.7% |

| | Flex | 2 | 13,925,000 | 1.2 | 2.18x | 10.6% | 59.8% | 56.1% |

| | Warehouse | 2 | 11,350,000 | 1.0 | 1.39x | 8.9% | 61.3% | 57.7% |

| | Warehouse / Distribution | 1 | 2,392,654 | 0.2 | 2.04x | 9.7% | 54.2% | 54.2% |

| | Subtotal: | 6 | $59,167,654 | 5.3% | 2.04x | 9.2% | 59.3% | 57.7% |

| Mixed Use | Multifamily / Retail | 6 | $35,018,854 | 3.1% | 1.92x | 8.5% | 57.3% | 56.7% |

| | Office / Retail | 1 | 8,750,000 | 0.8 | 2.49x | 9.6% | 62.9% | 62.9% |

| | Office / Multifamily | 1 | 4,130,000 | 0.4 | 1.65x | 9.8% | 63.5% | 56.4% |

| | Retail / Multifamily | 1 | 3,300,000 | 0.3 | 2.01x | 8.0% | 62.3% | 62.3% |

| | Multifamily / Office / Retail | 1 | 1,276,000 | 0.1 | 3.30x | 13.6% | 59.4% | 59.4% |

| | Subtotal: | 10 | $52,474,854 | 4.7% | 2.03x | 8.9% | 59.1% | 58.1% |

| Other | Parking Garage | 5 | $8,222,400 | 0.7% | 3.30x | 13.6% | 59.4% | 59.4% |

| Manufactured Housing | Manufactured Housing | 1 | $2,300,000 | 0.2% | 1.45x | 8.3% | 65.9% | 59.7% |

| Total / Weighted Average: | 234 | $1,122,007,709 | 100.0% | 2.60x | 10.9% | 53.4% | 50.8% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (3) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (5) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 6 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Location(1) |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date

Principal Balance | % of

IPB | UW

NCF DSCR(2)(3) | UW

NOI Debt

Yield(2)(4) | Cut-off Date

LTV(2)(4)(5) | Maturity

Date/ARD

LTV(2)(5) |

| New York | 20 | $152,147,660 | 13.6% | 2.80x | 9.8% | 46.2% | 46.2% |

| Florida | 17 | 124,701,132 | 11.1 | 2.76x | 12.5% | 45.7% | 43.5% |

| New Jersey | 4 | 91,262,000 | 8.1 | 3.28x | 12.4% | 48.8% | 48.4% |

| California | 11 | 86,627,599 | 7.7 | 3.81x | 11.3% | 43.1% | 43.1% |

| Texas | 13 | 74,667,925 | 6.7 | 1.92x | 10.6% | 57.7% | 48.7% |

| Michigan | 20 | 71,164,936 | 6.3 | 2.67x | 11.7% | 59.9% | 57.4% |

| Illinois | 13 | 56,859,425 | 5.1 | 2.46x | 9.6% | 60.7% | 59.5% |

| Washington | 7 | 50,536,438 | 4.5 | 2.03x | 9.0% | 61.4% | 61.4% |

| Ohio | 22 | 49,804,191 | 4.4 | 1.73x | 10.2% | 60.3% | 51.1% |

| Oregon | 2 | 32,031,004 | 2.9 | 2.20x | 8.8% | 58.8% | 58.5% |

| South Dakota | 2 | 28,488,880 | 2.5 | 2.12x | 12.3% | 60.0% | 51.2% |

| Arizona | 7 | 27,955,670 | 2.5 | 2.30x | 10.0% | 59.8% | 58.2% |

| Pennsylvania | 6 | 27,699,086 | 2.5 | 1.99x | 9.9% | 58.6% | 50.4% |

| Missouri | 6 | 26,274,704 | 2.3 | 1.86x | 9.4% | 63.2% | 59.7% |

| Indiana | 12 | 25,798,645 | 2.3 | 2.55x | 10.4% | 59.6% | 56.4% |

| Wisconsin | 3 | 25,005,922 | 2.2 | 2.73x | 10.8% | 59.9% | 58.6% |

| Tennessee | 5 | 22,099,803 | 2.0 | 2.41x | 10.6% | 57.2% | 56.1% |

| Nevada | 3 | 21,390,120 | 1.9 | 2.85x | 18.2% | 37.6% | 33.4% |

| Oklahoma | 4 | 17,841,884 | 1.6 | 3.45x | 12.4% | 52.6% | 52.3% |

| Alabama | 4 | 15,858,284 | 1.4 | 1.97x | 8.7% | 53.6% | 50.1% |

| Minnesota | 2 | 13,968,541 | 1.2 | 2.73x | 11.0% | 55.2% | 55.1% |

| Massachusetts | 3 | 12,446,179 | 1.1 | 2.43x | 9.3% | 58.1% | 58.1% |

| South Carolina | 2 | 11,240,646 | 1.0 | 2.44x | 9.3% | 57.8% | 57.8% |

| Georgia | 8 | 9,158,157 | 0.8 | 1.51x | 9.8% | 61.3% | 56.9% |

| Virginia | 4 | 7,734,629 | 0.7 | 1.74x | 9.1% | 57.8% | 53.9% |

| Maine | 2 | 7,235,899 | 0.6 | 2.29x | 8.6% | 47.8% | 47.8% |

| North Carolina | 2 | 6,348,315 | 0.6 | 2.25x | 9.4% | 53.5% | 53.5% |

| Vermont | 1 | 5,800,000 | 0.5 | 2.97x | 10.3% | 63.7% | 63.7% |

| Kansas | 6 | 5,538,207 | 0.5 | 2.43x | 12.6% | 64.1% | 58.5% |

| Wyoming | 6 | 3,852,252 | 0.3 | 1.69x | 14.8% | 64.5% | 46.7% |

| Maryland | 2 | 3,812,350 | 0.3 | 2.27x | 8.8% | 48.3% | 47.8% |

| Nebraska | 4 | 2,183,106 | 0.2 | 1.69x | 14.8% | 64.5% | 46.7% |

| New Mexico | 3 | 2,034,027 | 0.2 | 1.69x | 14.8% | 64.5% | 46.7% |

| Montana | 2 | 786,082 | 0.1 | 1.69x | 14.8% | 64.5% | 46.7% |

| Iowa | 2 | 710,375 | 0.1 | 1.69x | 14.8% | 64.5% | 46.7% |

| Louisiana | 1 | 385,221 | 0.0 | 1.69x | 14.8% | 64.5% | 46.7% |

| Utah | 1 | 315,370 | 0.0 | 1.69x | 14.8% | 64.5% | 46.7% |

| North Dakota | 1 | 200,896 | 0.0 | 1.69x | 14.8% | 64.5% | 46.7% |

| Colorado | 1 | 42,149 | 0.0% | 1.69x | 14.8% | 64.5% | 46.7% |

| Total / Weighted Average: | 234 | $1,122,007,709 | 100.0% | 2.60x | 10.9% | 53.4% | 50.8% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (3) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (5) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 6 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to “Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

Range of Cut-off Date Principal

Balances | Number of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term(1) | UW

NCF

DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date

LTV(1)(3)(4) | Maturity

Date/ARD

LTV(1)(4) |

| $1,425,000 | - | $4,999,999 | 23 | $73,511,945 | 6.6% | 4.00742% | 110 | 1.82x | 9.2% | 62.5% | 57.6% |

| $5,000,000 | - | $9,999,999 | 19 | 130,841,250 | 11.7 | 3.87612% | 112 | 2.12x | 9.3% | 61.5% | 59.4% |

| $10,000,000 | - | $19,999,999 | 16 | 220,327,377 | 19.6 | 3.93276% | 112 | 2.30x | 11.6% | 58.2% | 52.8% |

| $20,000,000 | - | $29,999,999 | 4 | 101,300,000 | 9.0 | 4.28436% | 119 | 1.89x | 10.3% | 58.2% | 53.3% |

| $30,000,000 | - | $39,999,999 | 6 | 206,877,137 | 18.4 | 4.02987% | 108 | 2.48x | 10.4% | 54.3% | 52.4% |

| $40,000,000 | - | $60,000,000 | 9 | 389,150,000 | 34.7 | 3.39103% | 102 | 3.32x | 11.8% | 44.5% | 44.0% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term(1) | UW

NCF

DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date

LTV(1)(3)(4) | Maturity

Date/ARD

LTV(1)(4) |

| 2.49450 | - | 3.24999 | 3 | $124,150,000 | 11.1% | 2.72653% | 98 | 4.60x | 12.9% | 43.1% | 43.1% |

| 3.25000 | - | 3.74999 | 27 | 401,422,000 | 35.8 | 3.53720% | 106 | 2.53x | 10.2% | 51.1% | 49.4% |

| 3.75000 | - | 3.99999 | 19 | 256,274,344 | 22.8 | 3.87372% | 108 | 2.83x | 12.5% | 51.2% | 49.8% |

| 4.00000 | - | 4.24999 | 12 | 95,870,134 | 8.5 | 4.04616% | 119 | 2.03x | 9.7% | 62.0% | 58.7% |

| 4.25000 | - | 4.49999 | 8 | 156,877,137 | 14.0 | 4.37653% | 119 | 1.74x | 9.4% | 61.4% | 55.8% |

| 4.50000 | - | 4.74999 | 4 | 31,725,000 | 2.8 | 4.69939% | 111 | 1.60x | 8.2% | 57.9% | 57.2% |

| 4.75000 | - | 5.44000 | 4 | 55,689,095 | 5.0 | 5.04306% | 100 | 1.54x | 11.8% | 62.6% | 51.1% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term(1) | UW

NCF

DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date

LTV(1)(3)(4) | Maturity

Date/ARD

LTV(1)(4) |

| 60 | 7 | $154,208,084 | 13.7% | 3.38373% | 59 | 3.91x | 13.7% | 34.9% | 34.0% |

| 84 | 4 | 55,895,500 | 5.0 | 3.76348% | 83 | 2.94x | 12.6% | 60.3% | 59.6% |

| 120 | 66 | 911,904,125 | 81.3 | 3.86378% | 118 | 2.35x | 10.3% | 56.1% | 53.1% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

Range of Remaining Term to

Maturity in Months | Number of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term(1) | UW

NCF

DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date

LTV(1)(3)(4) | Maturity

Date/ARD

LTV(1)(4) |

| 55 | - | 60 | 7 | $154,208,084 | 13.7% | 3.38373% | 59 | 3.91x | 13.7% | 34.9% | 34.0% |

| 82 | - | 94 | 5 | 74,809,595 | 6.7 | 4.03819% | 86 | 2.62x | 13.2% | 61.4% | 56.3% |

| 115 | - | 120 | 65 | 892,990,030 | 79.6 | 3.84289% | 119 | 2.37x | 10.2% | 55.9% | 53.3% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (4) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 6 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to ““Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value”” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| Interest Only | 48 | $824,445,000 | 73.5% | 3.66756% | 108 | 2.91x | 10.7% | 50.9% | 50.9% |

| 240 | 1 | 15,000,000 | 1.3 | 4.41000% | 120 | 1.36x | 11.1% | 58.8% | 36.2% |

| 270 | 1 | 18,914,095 | 1.7 | 4.85000% | 94 | 1.69x | 14.8% | 64.5% | 46.7% |

| 300 | 2 | 20,927,376 | 1.9 | 3.90854% | 67 | 2.80x | 18.7% | 38.6% | 32.4% |

| 360 | 25 | 242,721,238 | 21.6 | 4.08774% | 113 | 1.66x | 10.4% | 62.0% | 53.4% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| Interest Only | 48 | $824,445,000 | 73.5% | 3.66756% | 108 | 2.91x | 10.7% | 50.9% | 50.9% |

| 240 | - | 244 | 2 | 33,914,095 | 3.0 | 4.65539% | 105 | 1.54x | 13.2% | 62.0% | 42.1% |

| 298 | - | 299 | 2 | 20,927,376 | 1.9 | 3.90854% | 67 | 2.80x | 18.7% | 38.6% | 32.4% |

| 357 | - | 360 | 25 | 242,721,238 | 21.6 | 4.08774% | 113 | 1.66x | 10.4% | 62.0% | 53.4% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| | | | | | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| Interest Only | 47 | $783,045,000 | 69.8% | 3.72958% | 111 | 2.77x | 10.6% | 51.9% | 51.9% |

| Interest Only, Amortizing Balloon | 17 | 163,104,500 | 14.5 | 3.91251% | 116 | 1.70x | 10.5% | 62.3% | 54.9% |

| Amortizing Balloon | 12 | 134,458,209 | 12.0 | 4.41560% | 101 | 1.76x | 12.3% | 58.0% | 45.5% |

| Interest Only - ARD | 1 | 41,400,000 | 3.7 | 2.49450% | 58 | 5.54x | 14.1% | 31.0% | 31.0% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| 1.26x | - | 1.59x | 15 | $156,121,540 | 13.9% | 4.38379% | 113 | 1.44x | 9.6% | 61.4% | 52.1% |

| 1.60x | - | 1.69x | 7 | 80,191,095 | 7.1 | 4.44228% | 113 | 1.65x | 10.0% | 61.9% | 55.1% |

| 1.70x | - | 1.79x | 1 | 2,994,292 | 0.3 | 3.78000% | 119 | 1.74x | 11.7% | 59.9% | 42.8% |

| 1.80x | - | 1.89x | 8 | 82,337,500 | 7.3 | 3.97927% | 115 | 1.87x | 9.5% | 63.6% | 60.3% |

| 1.90x | - | 1.99x | 4 | 21,500,000 | 1.9 | 4.13893% | 119 | 1.92x | 8.2% | 65.6% | 65.6% |

| 2.00x | - | 2.49x | 25 | 388,290,198 | 34.6 | 3.78932% | 118 | 2.23x | 9.4% | 55.9% | 54.6% |

| 2.50x | - | 2.99x | 9 | 126,273,084 | 11.3 | 3.69770% | 89 | 2.70x | 11.7% | 45.8% | 45.2% |

| 3.00x | | 3.99x | 4 | 100,400,000 | 8.9 | 3.31674% | 104 | 3.52x | 12.5% | 56.5% | 56.5% |

| 4.00x | | 5.54x | 4 | 163,900,000 | 14.6 | 3.14644% | 90 | 4.85x | 15.5% | 32.8% | 32.8% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (4) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 6 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to ““Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value”” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(1)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| 26.6% | - | 49.9% | 9 | $333,083,084 | 29.7% | 3.38572% | 94 | 3.63x | 12.8% | 37.4% | 37.2% |

| 50.0% | - | 59.9% | 24 | $349,653,429 | 31.2 | 3.85515% | 114 | 2.47x | 10.4% | 56.6% | 53.9% |

| 60.0% | - | 64.9% | 33 | $378,088,761 | 33.7 | 4.05014% | 116 | 1.93x | 10.0% | 62.3% | 57.9% |

| 65.0% | - | 68.5% | 11 | $61,182,436 | 5.5 | 4.06250% | 109 | 1.86x | 9.4% | 66.9% | 63.2% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| LTV Ratios as of the Maturity Date(1)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| 26.6% | - | 49.9% | 17 | $422,820,075 | 37.7% | 3.60755% | 98 | 3.18x | 12.4% | 42.3% | 39.0% |

| 50.0% | - | 59.9% | 35 | 454,527,134 | 40.5 | 3.84949% | 113 | 2.32x | 10.4% | 58.4% | 55.3% |

| 60.0% | - | 64.9% | 22 | 215,585,500 | 19.2 | 3.99995% | 116 | 2.09x | 9.0% | 62.7% | 62.3% |

| 65.0% | - | 68.5% | 3 | 29,075,000 | 2.6 | 4.06475% | 119 | 2.17x | 9.1% | 67.1% | 67.1% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| | | | | Weighted Average |

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| Defeasance | 50 | $667,704,478 | 59.5% | 3.90807% | 112 | 2.34x | 10.6% | 56.9% | 53.8% |

| Yield Maintenance | 21 | 274,153,231 | 24.4 | 3.87978% | 110 | 2.30x | 10.1% | 55.8% | 52.7% |

| Defeasance or Yield Maintenance | 6 | 180,150,000 | 16.1 | 3.23325% | 92 | 3.99x | 13.1% | 36.9% | 36.9% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| | | | | Weighted Average |

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(1)(2) | UW

NOI

DY(1)(3) | Cut-off

Date LTV(1)(3)(4) | Maturity Date/ARD LTV(1)(4) |

| Refinance | 48 | $646,791,179 | 57.6% | 3.96490% | 115 | 2.40x | 10.9% | 55.9% | 53.0% |

| Acquisition | 28 | 432,466,530 | 38.5 | 3.62468% | 98 | 2.77x | 10.8% | 49.5% | 47.1% |

| Recapitalization | 1 | 42,750,000 | 3.8 | 2.89000% | 118 | 3.79x | 11.5% | 55.5% | 55.5% |

| Total / Weighted Average: | 77 | $1,122,007,709 | 100.0% | 3.79281% | 108 | 2.60x | 10.9% | 53.4% | 50.8% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 4, 5, 6, 7, 10 and 22, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date/ARD LTV calculations exclude the related Subordinate Companion Loans. |

| (2) | For the mortgage loans that are interest-only for the entire term or until the anticipated repayment date and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 13, the Cut-off Date LTV and UW NOI Debt Yield are based on Cut-off Date Principal Balance after netting out a $1,500,000 holdback reserve. The Cut-off Date LTV and UW NOI Debt Yield based on Cut-off Date Principal Balance without netting out the holdback reserve is 62.7% and 8.6%, respectively. |

| (4) | In the case of Loan Nos. 1, 9, 18 and 23, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on an as-portfolio assumption. In the case of Loan Nos. 2 and 38 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on an as stabilized assumption. In the case of Loan No. 6 the Cut-off Date LTV and Maturity/ARD LTV are calculated by using an appraised value based on a market value assuming present value of ICAP tax savings are excluded and outstanding leasing costs reserved assumption. Refer to ““Description of the Mortgage Pool—Certain Calculations and Definitions—Appraised Value”” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Mortgage Loan Seller | Loan Name | Location | Property Type | Cut-off Date Principal Balance | % of IPB | Previous Securitization |

| 5 | BMO/SMC | AMF Portfolio | Various | Multifamily | $40,000,000 | 3.6% | CF 2019-MF1 |

| 8.01 | SMC | First National Building | Detroit, MI | Office | $9,222,400 | 0.8% | JPMBB 2015-C32, JPMCC 2015-JP1 |

| 8.03 | SMC | Chrysler House | Detroit, MI | Office | $4,584,000 | 0.4% | WFRBS 2013-C16 |

| 8.04 | SMC | 1001 Woodward | Detroit, MI | Office | $4,554,400 | 0.4% | JPMBB 2014-C19 |

| 8.05 | SMC | One Woodward | Detroit, MI | Office | $3,301,600 | 0.3% | COMM 2014-UBS6 |

| 11 | BMO | 2 Riverfront Plaza | Newark, NJ | Office | $37,500,000 | 3.3% | LCCM 2017-LC26 |

| 12.01 | SMC | Center Plaza | Federal Way, WA | Retail | $17,692,308 | 1.6% | JPMBB 2015-C31 |

| 12.02 | SMC | Village by the Creek | Mill Creek, WA | Retail | $7,628,205 | 0.7% | MSBAM 2016-C30 |

| 12.03 | SMC | Riverway Plaza | Kelso, WA | Retail | $6,538,462 | 0.6% | COMM 2015-CR25 |

| 19 | SMC | BJ’s Wholesale Club - Kendall | Miami, FL | Retail | $22,100,000 | 2.0% | CSAIL 2016-C7 |

| 22 | BMO | Meadowood Mall | Reno, NV | Retail | $17,933,084 | 1.6% | GSMS 2012-GC6 |

| 25 | Sabal | Midway Market Square | Elyria, OH | Retail | $15,000,000 | 1.3% | FCRE 2018-1A |

| 26 | SMC | Peoria Center at Arrowhead | Peoria, AZ | Office | $14,425,000 | 1.3% | GSMS 2014-GC26 |

| 27 | BMO | Mills Fleet Farm Carver | Carver, MN | Retail | $13,890,000 | 1.2% | CSMC 2016-MFF |

| 44 | SMC | West Allen Plaza | Woodhaven, MI | Retail | $7,050,000 | 0.6% | JPMCC 2012-CBX |

| 55 | KeyBank | Laguna Beach Mixed Use | Laguna Beach, CA | Mixed Use | $5,000,000 | 0.4% | BOC 2019-Q010 |

| 63 | Sabal | The Wash Apartments | Indianapolis, IN | Multifamily | $3,535,000 | 0.3% | M360 2018-CRE1 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

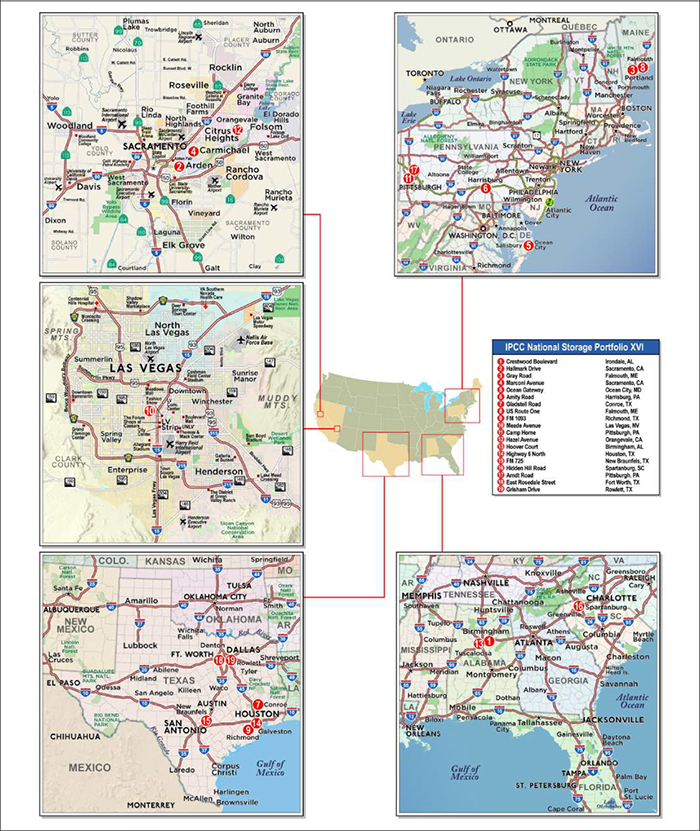

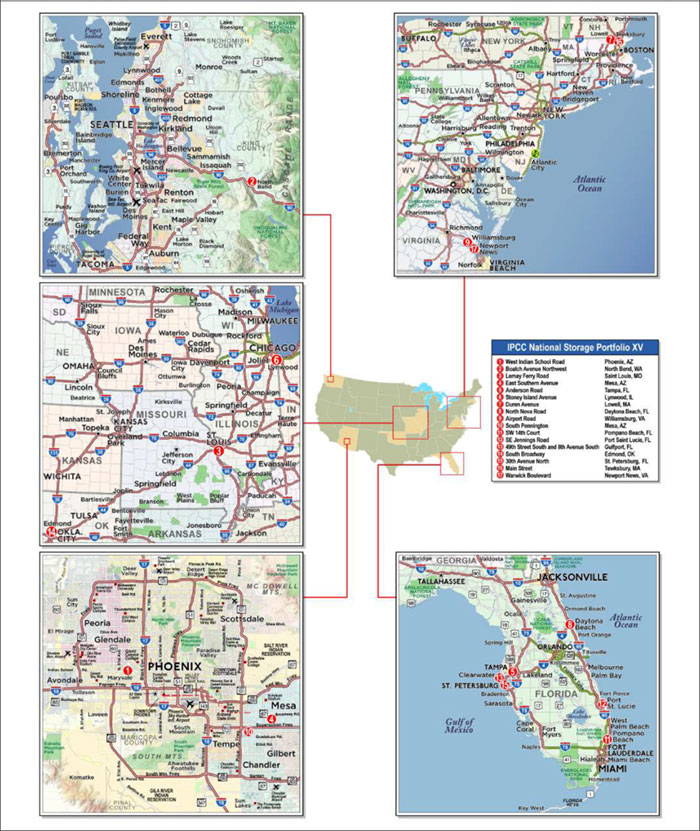

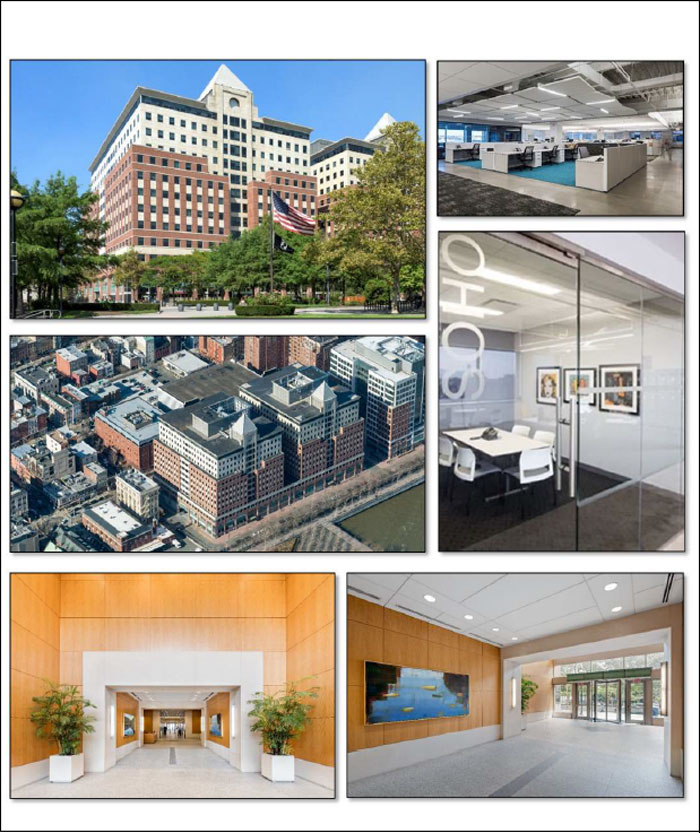

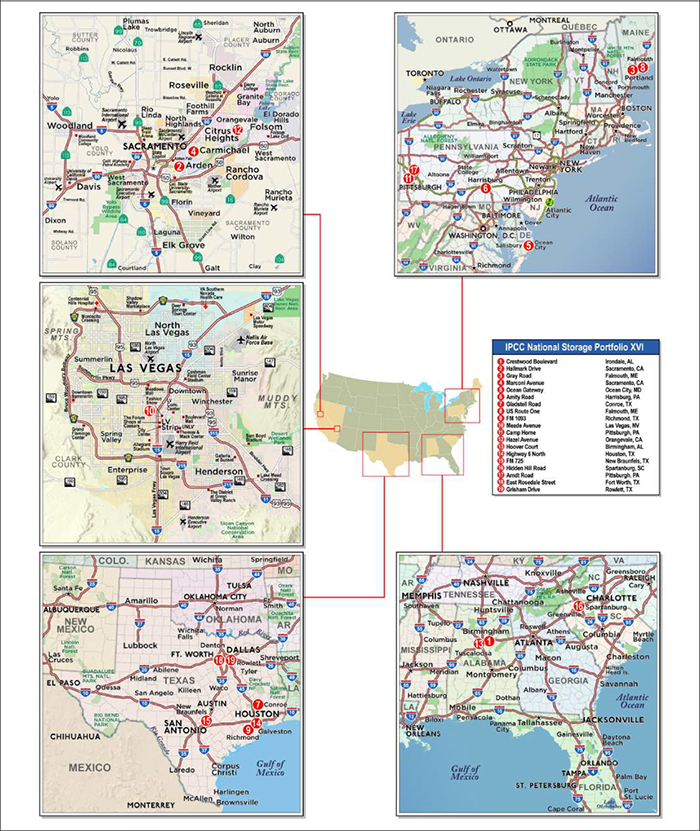

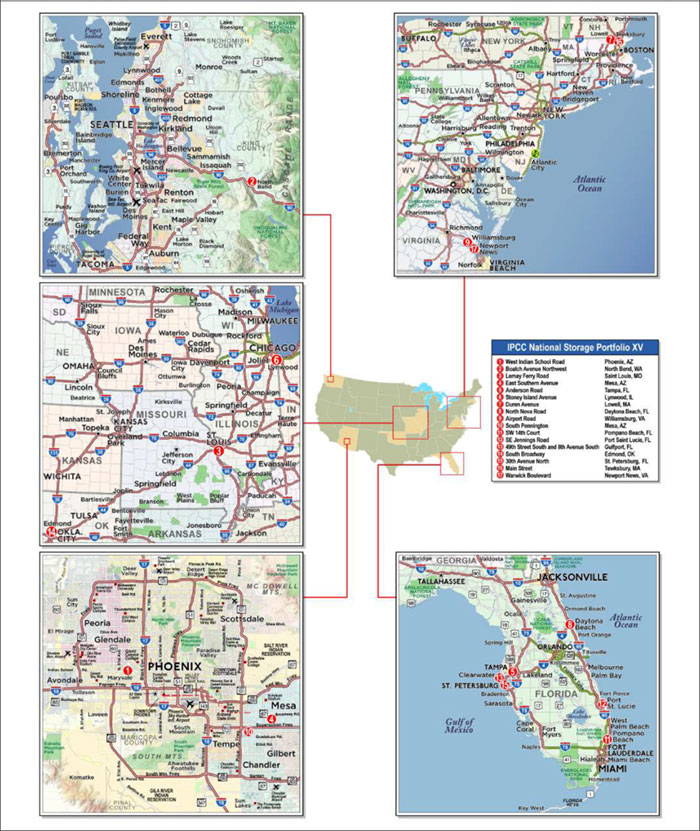

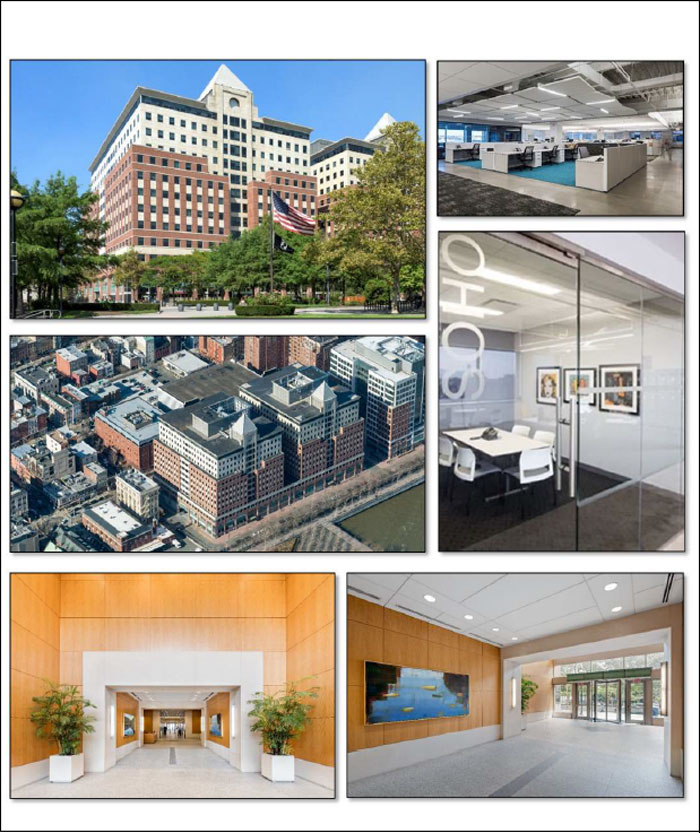

| No. 1 – IPCC National Storage Portfolio XVI |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | KeyBank | | Single Asset / Portfolio: | Portfolio |

| Original Principal Balance(1): | $60,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $60,000,000 | | Property Type - Subtype: | Self-Storage – Self-Storage |

| % of IPB: | 5.3% | | Net Rentable Area (SF): | 1,133,018 |

| Loan Purpose: | Acquisition | | Location: | Various |

| Borrower: | Self-Storage Portfolio XVI DST | | Year Built / Renovated: | Various / Various |

| Borrower Sponsor: | Inland Private Capital Corporation | | Occupancy: | 93.1% |

| Interest Rate: | 3.62800% | | Occupancy Date: | 11/17/2021 |

| Note Date: | 12/16/2021 | | 4th Most Recent NOI (As of): | NAV |

| Maturity Date: | 1/1/2032 | | 3rd Most Recent NOI (As of): | NAV |

| Interest-only Period: | 120 months | | 2nd Most Recent NOI (As of)(3): | $7,887,456 (12/31/2020) |

| Original Term: | 120 months | | Most Recent NOI (As of)(3): | $9,583,737 (TTM 10/31/2021) |

| Original Amortization Term: | None | | UW Economic Occupancy: | 86.4% |

| Amortization Type: | Interest Only | | UW Revenues: | $16,218,302 |

| Call Protection: | L(25),YM1(92),O(3) | | UW Expenses: | $6,202,684 |

| Lockbox / Cash Management: | None / Springing | | UW NOI: | $10,015,618 |

| Additional Debt(1): | Yes | | UW NCF: | $9,834,867 |

| Additional Debt Balance(1): | $57,000,000 | | Appraised Value / Per SF(4): | $244,900,000 / $216 |

| Additional Debt Type(1): | Pari Passu | | Appraisal Date(4): | 11/4/2021-11/24/2021 |

| | | | | |

| Escrows and Reserves(2) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | | $103 | |

| Taxes: | $0 | Springing | N/A | | Maturity Date Loan / SF: | | $103 | |

| Insurance: | $0 | Springing | N/A | | Cut-off Date LTV(4): | | 47.8% | |

| Replacement Reserves: | $246,500 | Springing | $246,500 | | Maturity Date LTV(4): | | 47.8% | |

| Flood Insurance Reserve: | $486,615 | $0 | N/A | | UW NCF DSCR: | | 2.29x | |

| | | | | | UW NOI Debt Yield: | | 8.6% | |

| | | | | | | | | |

| | | | | | | | |

| |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Loan Combination(1) | $117,000,000 | 46.4% | | Purchase Price | $243,118,000 | 96.4% |

| Borrower Sponsor Equity | 135,299,554 | 53.6 | | Trust Reserve(2) | 5,974,400 | 2.4 |

| | | | | Closing Costs | 2,474,039 | 1.0 |

| | | | | Upfront Reserves | 733,115 | 0.3 |

| Total Sources | $252,299,554 | 100.0% | | Total Uses | $252,299,554 | 100.0% |

| | | | | | | | | | | |

| (1) | The IPCC National Storage Portfolio XVI Mortgage Loan (as defined below) is part of a loan combination evidenced by five pari passu notes with an aggregate original principal balance of $117,000,000. The financial information presented in the charts above is based on the $117,000,000 IPCC National Storage Portfolio XVI Loan Combination (as defined below). |

| (2) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. Additionally, under the terms of the master lease, described under “The Borrower” below, the IPCC National Storage Portfolio XVI Borrower funded $5,974,400 at loan origination into a trust reserve account for the benefit of the IPCC National Storage Portfolio XVI Borrower, which is collateral for the IPCC National Storage Portfolio XVI Loan Combination but is not held with the lender and is separate from the $246,500 initial replacement reserve. Collectively, the initial replacement reserve and the trust reserve account will be used to pay for (i) repairs and replacements of the structure, foundation, roof, exterior walls, and parking lot improvements at the IPCC National Storage Portfolio XVI Properties (as defined below), (ii) leasing commissions, (iii) any environmental costs, (iv) any repairs identified in the property condition reports, (v) insurance deductibles and (vi) any other necessary property improvements. |

| (3) | The increase from 2nd Most Recent NOI to Most Recent NOI is primarily due to a mixture of either increased occupancy or aggressive rental rate increases at certain IPCC National Storage Portfolio XVI Properties. |

| (4) | The Appraised Value reflects a portfolio premium of approximately 15.3% over the aggregate “as-is” value of the individual IPCC National Storage Portfolio XVI Properties. The sum of the values on an individual basis is $212,410,000, which represents a Cut-off Date LTV and Maturity Date LTV of 55.1%. |

The Loan. The largest mortgage loan is part of a loan combination evidenced by five pari passu promissory notes in the aggregate original principal amount of $117,000,000 (the “IPCC National Storage Portfolio XVI Loan Combination”), which is secured by a first priority fee mortgage encumbering 19 self-storage properties located in eight states (the “IPCC National Storage Portfolio XVI Properties”). The controlling Note A-1 and non-controlling Note A-4 (collectively, the “IPCC National Storage Portfolio XVI Mortgage Loan”), with an aggregate original principal amount of $60,000,000, will be included in the BMO 2022-C1 securitization trust. The non-controlling Note A-2, Note A-3, and Note A-5, with an aggregate original principal amount of $57,000,000, are currently held by KeyBank

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

and are expected to be contributed to one or more future securitization trusts. The IPCC National Storage Portfolio XVI Loan Combination will be serviced pursuant to the pooling and servicing agreement for the BMO 2022-C1 securitization trust. Proceeds of the IPCC National Storage Portfolio XVI Loan Combination, along with approximately $135.3 million of borrower sponsor equity, were used to acquire the IPCC National Storage Portfolio XVI Properties, fund reserves and pay closing costs. See “Description of the Mortgage Pool—The Loan Combinations—The Serviced Pari Passu Loan Combinations” in the Preliminary Prospectus. The IPCC National Storage Portfolio XVI Mortgage Loan has a 10-year term and is interest only for the entire term.

| Loan Combination Summary |

| Note | Original Balance | Note Holder | Controlling Piece |

| A-1 | $50,000,000 | BMO 2022-C1 | Yes |

| A-2 | $30,000,000 | KeyBank | No |

| A-3 | $20,000,000 | KeyBank | No |

| A-4 | $10,000,000 | BMO 2022-C1 | No |

| A-5 | $7,000,000 | KeyBank | No |

| Total | $117,000,000 | | |

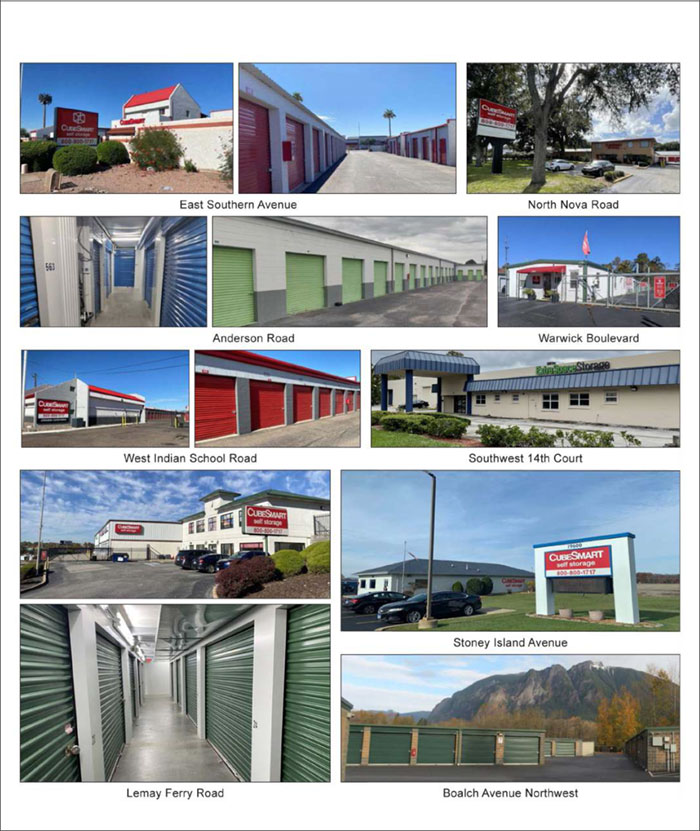

The Properties. The IPCC National Storage Portfolio XVI Properties are comprised of 19 self-storage properties totaling 1,133,018 square feet within 9,046 storage units located in eight states. The top three states by allocated loan amount are Texas (six properties, 24.6% of allocated loan amount, 24.8% of UW NOI), California (three properties, 20.1% of allocated loan amount, 19.9% of UW NOI), and Alabama (two properties, 15.8% of allocated loan amount, 15.7% of UW NOI). The remaining five states are Pennsylvania, Maine, Maryland, Nevada, and South Carolina, none of which represent more than 13.7% of the allocated loan amount or more than 13.7% of the UW NOI. The IPCC National Storage Portfolio XVI Properties were built between 1954 and 2018. The IPCC National Storage Portfolio XVI Properties range in size from 30,350 to 128,046 SF and contain 251 to 1,055 units, with no individual property comprising more than 11.3% of the total net rentable area based on square footage or more than 11.7% of the total storage units.

The IPCC National Storage Portfolio XVI Properties contain a total of 9,046 self-storage units, of which 3,647 are climate-controlled. The IPCC National Storage Portfolio XVI Properties also include 504 leasable parking spaces that are 83.5% leased as of November 17, 2021, as well as 38 commercial units totaling 29,629 square feet that are 92.1% occupied. Based on self-storage net rentable area, the IPCC National Storage Portfolio XVI Properties were 93.1% occupied as of November 17, 2021, with individual property occupancies ranging from 82.7% to 98.6%.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

The following table presents certain information relating to the IPCC National Storage Portfolio XVI Properties:

| Portfolio Summary |

| Property Name | Location | Allocated

Whole Loan Amount (“ALA”) | % of ALA | Occupancy(1) | Year Built/

Renovated | Net

Rentable Area

(SF)(1) | Storage

Units | Appraised

Value(2) | % of

UW

NOI |

| Crestwood Boulevard | Irondale, AL | $13,162,213 | 11.2% | 82.7% | 1954/2021 | 128,046 | 1,055 | $27,200,000 | 11.2% |

| Hallmark Drive | Sacramento, CA | 10,347,573 | 8.8 | 95.5% | 1974/NAP | 72,706 | 623 | $20,670,000 | 8.9 |

| Gray Road | Falmouth, ME | 7,668,757 | 6.6 | 93.2% | 2015-2017/ NAP | 65,125 | 415 | $11,700,000 | 6.5 |

| Marconi Avenue | Sacramento, CA | 7,645,935 | 6.5 | 97.4% | 1964/2014 | 51,739 | 400 | $16,390,000 | 6.4 |

| Ocean Gateway | Ocean City, MD | 7,230,592 | 6.2 | 93.0% | 1988, 1995, 1996, 1999, 2001/NAP | 63,650 | 487 | $11,620,000 | 6.2 |

| Amity Road | Harrisburg, PA | 7,032,044 | 6.0 | 95.0% | 1972, 1990/ 2008 | 58,432 | 606 | $12,750,000 | 6.0 |

| Gladstell Road | Conroe, TX | 6,819,129 | 5.8 | 89.4% | 1997/NAP | 66,575 | 546 | $10,600,000 | 6.1 |

| US Route One | Falmouth, ME | 6,441,247 | 5.5 | 93.9% | 2016-2018/ NAP | 46,925 | 305 | $9,650,000 | 5.5 |

| Farm to Market 1093 | Richmond, TX | 6,432,578 | 5.5 | 95.2% | 2002/NAP | 74,606 | 508 | $9,800,000 | 5.4 |

| Meade Avenue | Las Vegas, NV | 5,673,357 | 4.8 | 91.6% | 1978/NAP | 57,274 | 456 | $13,080,000 | 4.9 |

| Camp Horne | Pittsburgh, PA | 5,672,416 | 4.8 | 97.2% | 2003/NAP | 52,194 | 445 | $9,470,000 | 4.9 |

| Hazel Avenue | Orangevale, CA | 5,505,970 | 4.7 | 92.3% | 1989/NAP | 44,062 | 417 | $11,820,000 | 4.6 |

| Hoover Court | Birmingham, AL | 5,300,941 | 4.5 | 92.2% | 1959/2016 | 41,412 | 419 | $9,140,000 | 4.6 |

| Highway 6 North | Houston, TX | 5,218,804 | 4.5 | 95.4% | 1981/NAP | 68,012 | 616 | $8,600,000 | 4.5 |

| Farm to Market 725 | New Braunfels, TX | 4,693,612 | 4.0 | 96.1% | 1984, 1985, 1995, 1997, 2017/NAP | 67,300 | 572 | $7,700,000 | 4.1 |

| Hidden Hill Road | Spartanburg, SC | 3,316,260 | 2.8 | 94.6% | 2003/2016 | 54,100 | 309 | $5,320,000 | 2.8 |

| Arndt Road | Pittsburgh, PA | 3,269,512 | 2.8 | 93.7% | 2007/2010 | 30,350 | 251 | $6,050,000 | 2.8 |

| East Rosedale Street | Fort Worth, TX | 2,865,552 | 2.4 | 98.6% | 1972/2015 | 41,935 | 272 | $6,090,000 | 2.4 |

| Grisham Drive | Rowlett, TX | 2,703,508 | 2.3 | 96.8% | 1981/NAP | 48,575 | 344 | $4,760,000 | 2.3 |

| Total | | $117,000,000 | 100.0% | 93.1% | | 1,133,018 | 9,046 | $244,900,000 | 100.0% |

| (1) | Occupancy and Net Rentable Area (SF) reflect storage units only, excluding parking spaces and commercial units. |

| (2) | The Total Appraised Value reflects a portfolio premium of approximately 15.3% over the aggregate “as-is” value of the individual IPCC National Storage Portfolio XVI Properties. The sum of the values on an individual basis is $212,410,000. |

The following table presents detailed information with respect to the unit mix of the IPCC National Storage Portfolio XVI Properties:

| Unit Mix |

| Unit Type | Square Feet | % of Total

Square Feet | Occupancy

(SF)(1) | Units | % of Total

Units | Occupancy

(Units)(1) |

| Non-Climate Controlled Storage Units | 752,563 | 64.7% | 93.6% | 5,399 | 56.3% | 93.4% |

| Climate Controlled Storage Units | 380,456 | 32.7 | 92.3% | 3,647 | 38.0 | 91.6% |

| Parking Units | N/A | N/A | N/A | 504 | 5.3 | 83.5% |

| Commercial Units | 29,629 | 2.5 | 92.1% | 38 | 0.4 | 89.5% |

| Total / Wtd. Avg. | 1,162,647 | 100.0% | 93.1% | 9,588 | 100.0% | 92.2% |

| (1) | Occupancy is based on the underwritten rent roll dated November 17, 2021. |

COVID-19 Update. As of December 16, 2021, the IPCC National Storage Portfolio XVI Properties are open and operating. The borrower sponsor provided an accounts receivable report dated October 31, 2021, which showed approximately $29,813 (0.2% of underwritten base rent) more than 30 days delinquent. As of the date of this term sheet, the IPCC National Storage Portfolio XVI Properties Loan Combination is not subject to any modification or forbearance requests.

Environmental. According to the Phase I environmental assessments dated December 6, 2021, there was no evidence of any recognized environmental conditions at the IPCC National Storage Portfolio XVI Properties.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

| Historical and Current Occupancy |

| 2018(1) | 2019(1)(2) | 2020(2) | Current(3) |

| NAV | 90.4% | 91.2% | 93.1% |

| (1) | 2018 Historical Occupancy was not provided by the seller. 2019 Historical Occupancy excludes occupancy for seven of the IPCC National Storage Portfolio XVI Properties, which the seller did not provide. |

| (2) | Historical Occupancies are as of December 31 of each respective year and are based on self-storage square footage. |

| (3) | Current Occupancy is based on the underwritten rent rolls dated as of November 17, 2021 and based on self-storage square footage. |

| Operating History and Underwritten Net Cash Flow |

| | 2020 | TTM(1) | Underwritten | Per Square Foot | %(2) |

| Rents in Place | $12,864,040 | $14,639,949 | $15,230,256 | $13.44 | 90.8% |

| Vacant Income | 2,449,469 | 0 | 1,539,707 | 1.36 | 9.2 |

| Gross Potential Rent | $15,313,509 | $14,639,949 | $16,769,963 | $14.80 | 100.0% |

| (Vacancy / Credit Loss) | (3,013,576) | (616,944) | (2,281,148) | (2.01) | (13.6) |

| Parking Income | 304,044 | 341,633 | 516,861 | 0.46 | 3.1 |

| Other Income(3) | 790,752 | 875,399 | 1,212,626 | 1.07 | 7.2 |

| Effective Gross Income(4) | $13,394,730 | $15,240,037 | $16,218,302 | $14.31 | 96.7% |

| | | | | | |

| Total Expenses | $5,507,273 | $5,656,300 | $6,202,684 | $5.47 | 38.2% |

| | | | | | |

| Net Operating Income | $7,887,456 | $9,583,737 | $10,015,618 | $8.84 | 61.8% |

| Total TI / LC, Capex / RR | 0 | 0 | 180,751 | 0.16 | 1.1 |

| Net Cash Flow | $7,887,456 | $9,583,737 | $9,834,867 | $8.68 | 60.6% |

| (1) | TTM reflects the trailing 12-month period ending October 31, 2021. |

| (2) | % column represents percent of Gross Potential Rent for all revenue lines and represents percent of Effective Gross Income for the remainder of fields. |

| (3) | Other Income includes merchandise sales, tenant insurance, late fees, administrative fees, and for Underwritten Other Income only, $279,816 of commercial unit income. |

| (4) | Effective Gross Income increased from 2020 to TTM primarily due to a mixture of either increased occupancy or aggressive rental rate increases at certain IPCC National Storage Portfolio XVI Properties. |

The Market. The IPCC National Storage Portfolio XVI Properties are located across eight states and 11 different metropolitan statistical areas, with three IPCC National Storage Portfolio XVI Properties located within the Sacramento, California metropolitan area (20.1% of allocated loan amount, 19.9% of UW NOI), three within the Houston, Texas metropolitan area (15.8% of allocated loan amount, 16.0% of UW NOI), and two within the Birmingham, Alabama metropolitan area (15.8% of allocated loan amount, 15.7% of UW NOI).

According to the appraisals, as of the third quarter of 2021, the Sacramento self-storage market reported an average vacancy rate of 9.7%, with average monthly rents of $130.81 and $144.27 per unit for 10x10 foot non-climate controlled and climate controlled units, respectively. The Houston self-storage market reported an average vacancy rate of 12.5%, with average monthly rents of $85.69 and $135.23 per unit for 10x10 foot non-climate controlled and climate controlled units, respectively. The Birmingham self-storage market reported an average vacancy rate of 9.3%, with average monthly rents of $78.13 and $123.13 per unit for 10x10 foot non-climate controlled and climate controlled units, respectively. The portfolio appraisal concluded stabilized effective gross income of $14.99 per square foot for the IPCC National Storage Portfolio XVI Properties.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

| Structural and Collateral Term Sheet | | BMO 2022-C1 |

| |

| No. 1 – IPCC National Storage Portfolio XVI |

The following table presents certain 2021 demographic information for the IPCC National Storage Portfolio XVI Properties:

| Demographics Summary(1) |

| Property Name | City, State | 1-mile Population | 3-mile Population | 5-mile Population | 1-mile Median Household Income | 3-mile Median Household Income | 5-mile Median Household Income |

| Crestwood Boulevard | Irondale, AL | 2,882 | 36,557 | 86,757 | $56,240 | $46,358 | $56,271 |

| Hallmark Drive | Sacramento, CA | 20,549 | 140,487 | 388,658 | $40,486 | $57,872 | $62,076 |

| Gray Road | Falmouth, ME | 1,931 | 24,080 | 69,851 | $131,309 | $93,617 | $78,452 |

| Marconi Avenue | Sacramento, CA | 16,367 | 132,095 | 379,411 | $71,365 | $60,748 | $60,254 |

| Ocean Gateway | Ocean City, MD | 849 | 12,957 | 31,264 | $104,076 | $74,323 | $73,979 |

| Amity Road | Harrisburg, PA | 12,794 | 93,043 | 188,107 | $50,382 | $47,803 | $57,522 |

| Gladstell Road | Conroe, TX | 11,946 | 57,517 | 109,749 | $46,918 | $54,692 | $72,291 |

| US Route One | Falmouth, ME | 2,408 | 9,111 | 35,842 | $159,210 | $151,677 | $105,298 |

| Farm to Market 1093 | Richmond, TX | 12,709 | 89,061 | 220,535 | $130,184 | $134,279 | $126,523 |

| Meade Avenue | Las Vegas, NV | 39,520 | 187,429 | 484,795 | $34,720 | $43,084 | $43,812 |

| Camp Horne | Pittsburgh, PA | 4,492 | 47,525 | 146,544 | $79,005 | $68,021 | $69,031 |

| Hazel Avenue | Orangevale, CA | 14,308 | 94,717 | 256,485 | $84,438 | $85,247 | $86,989 |

| Hoover Court | Birmingham, AL | 8,020 | 64,601 | 132,361 | $64,308 | $76,071 | $83,099 |

| Highway 6 North | Houston, TX | 17,598 | 150,983 | 317,570 | $69,761 | $74,444 | $77,185 |

| Farm to Market 725 | New Braunfels, TX | 3,262 | 34,500 | 84,610 | $73,510 | $71,849 | $71,094 |

| Hidden Hill Road | Spartanburg, SC | 5,913 | 43,205 | 82,780 | $48,938 | $53,042 | $50,400 |

| Arndt Road | Pittsburgh, PA | 4,418 | 36,674 | 117,025 | $135,810 | $102,635 | $82,927 |

| East Rosedale Street | Fort Worth, TX | 8,389 | 95,623 | 234,254 | $40,956 | $45,390 | $52,962 |

| Grisham Drive | Rowlett, TX | 9,383 | 82,484 | 270,907 | $90,495 | $80,497 | $74,776 |

| (1) | Source: Third party market data provider. |