| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-280224-04 |

| | | |

| Strictly private and confidential | Herald Center |

Herald Center

BMO Capital Markets

| Strictly private and confidential | Herald Center |

FREE WRITING PROSPECTUS, DATED DECEMBER 20, 2024

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-280224) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, BMO Capital Markets Corp. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll free 1-888-200-0266.

The information in this file (the “File”) does not contain all information that is required to be included in the prospectus. This File should be reviewed only in conjunction with the entire prospectus. Prospective investors are advised to read carefully, and should rely on, the prospectus relating to the certificates referred to herein in making their investment decision. Methodologies used in deriving certain information contained in this File are more fully described elsewhere in the prospectus. The information in this File should not be viewed as projections, forecasts, predictions or opinions with respect to value.

The information in this File is preliminary and may be amended, completed and/or supplemented from time to time prior to the time of sale. The information in this File supersedes any contrary information contained in any prior File relating to the certificates and will be superseded by any contrary information contained in any subsequent File prior to the time of sale.

The securities related to this File are being offered when, as and if issued. This free writing prospectus is not an offer to sell or a solicitation of an offer to buy such securities in any state or other jurisdiction where such offer, solicitation or sale is not permitted. Such securities do not represent an interest in or obligation of the depositor, the sponsors, the originators, the master servicer, the special servicers, the trustee, the certificate administrator, the operating advisor, the asset representations reviewer, the controlling class representative, the risk retention consultation parties, the companion loan holders (or their representatives), the underwriters or any of their respective affiliates. Neither such securities nor the underlying mortgage loans are insured or guaranteed by any governmental agency or instrumentality or private insurer.

This File contains certain tables and other statistical analyses (the “Computational Materials”). Numerous assumptions were used in preparing the Computational Materials, which may or may not be stated in this File. As such, no assurance can be given as to whether the Computational Materials and/or the assumptions upon which they are based reflect actual present market conditions or future market performance. These Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountants and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the assets described in this File. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the Herald Center Mortgage Loan, including the Herald Center Subordinate Loan, will occur at rates higher or lower than the rates shown in the Computational Materials.

This File contains forward-looking statements. These forward looking statements are found in this File, including certain of the tables. Forward-looking statements are also found elsewhere in this File and include words like “expects”, “intends”, “anticipates”, “estimates” and other similar

| Strictly private and confidential | Herald Center |

words. These statements intend to convey our projections or expectations as of the date of this File. These statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this File. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor's view only as of the date of this File.

Notwithstanding anything to the contrary in this File, as of the date of this File, the Herald Center Mortgage Loan has not been originated. Therefore, the description of the terms of the Herald Center Mortgage Loan in this File is based on their respective expected terms if and when the Herald Center Mortgage Loan is originated by the Originators. As a result, the terms of the Herald Center Mortgage Loan and the descriptions thereof in this File are subject to revision. None of the Originators, any of their affiliates, or any other person is obligated to make the Herald Center Mortgage Loan and there can be no assurance that the Herald Center Mortgage Loan will be made.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Strictly private and confidential | Herald Center |

| Strictly private and confidential | Herald Center |

Herald Center – New York, NY

| 34th St-Herald Sq (2023 MTA): 34th Street-Herald Square Station experienced 23.7 million subway riders (65,780 travelers/day), which is a 12.9% increase over 2022 in ridership. This station was the 4th busiest station in New York City. 34th St-Penn Station (1,2,3) (2023 MTA): 34th Street-Penn Station for the 1,2,3 lines experienced 15.2 million subway riders (42,289 travelers/day), which is a 14.1% increase over 2022 ridership. 34th St-Penn Station (A,C,E) (2023 MTA): 34th Street-Penn Station for the A,C,E lines experienced 17.0 million subway riders (47,152 travelers/day), which is an 18.5% increase over 2022 ridership. Penn Station (2023): Amtrak: 10.3 million total travelers at Penn Station. PATH: 5.0 million total travelers at Penn Station. LIRR: 65.2 million total travelers. Approximately 60% of trips are from Penn Station. |

| Strictly private and confidential | Herald Center |

Herald Center – New York, NY

| 1-Mile Radius Median Household Income: $132,953

Households: 118,694

Population: 203,660 3-Mile Radius Median Household Income: $121,528

Households: 643,336

Population: 1,274,576 5-Mile Radius Median Household Income: $101,351

Households: 1,235,380

Population: 2,751,982 |

| Strictly private and confidential | Herald Center |

Table of Contents

| Executive Summary | Page 7 |

| | |

| Investment Highlights | Page 13 |

| | |

| Property Overview | Page 16 |

| | |

| Lender Underwriting | Page 28 |

| | |

| Market Overview | Page 32 |

| | |

| Appraisal Summary | Page 39 |

| | |

| Summary of Loan Terms | Page 49 |

| | |

| Sponsor Overview | Page 53 |

| Strictly private and confidential | Herald Center |

Executive Summary

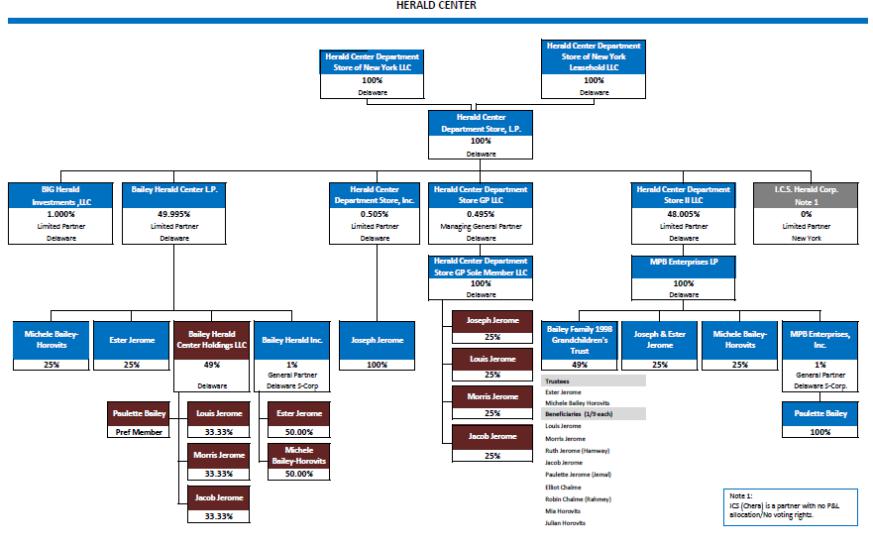

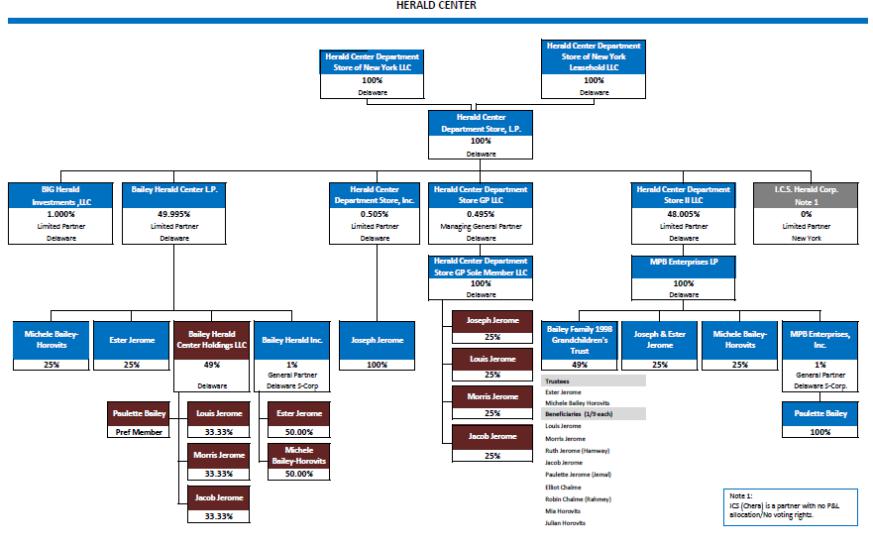

Bank of Montreal (“BMO” or the “Lender”) is looking to provide a five (5) year, fixed-rate, interest-only, $300 million loan (the “Loan”), secured by the fee estate and the leasehold estate in the Property, to two affiliated special purpose bankruptcy-remote entities owned and controlled by JEMB Realty Corporation (the “Sponsor”). One entity (the “Fee Borrower”) will be the fee simple owner of the Property. The other entity (the “Leasehold Borrower”) will be the owner of the leasehold interest in the Property created pursuant to a thirty-one (31) year ground lease between Leasehold Borrower, as ground lessee, and Fee Borrower, as ground lessor, entered into simultaneously with the closing of the Loan (the “Affiliated Ground Lease”). The Fee Borrower and Leasehold Borrower shall, on a joint and several basis, be the Borrower under the Loan.

The Loan will be secured by (i) a first priority fee mortgage on the Fee Borrower’s fee simple interest in Herald Center, comprised of 267,207 square feet of mixed-use retail and school space located at 1311 Broadway, New York, New York (collectively, the “Property”) and (ii) a first priority leasehold mortgage on the Leasehold Borrower’s leasehold interest in the Property pursuant to the Affiliated Ground Lease.

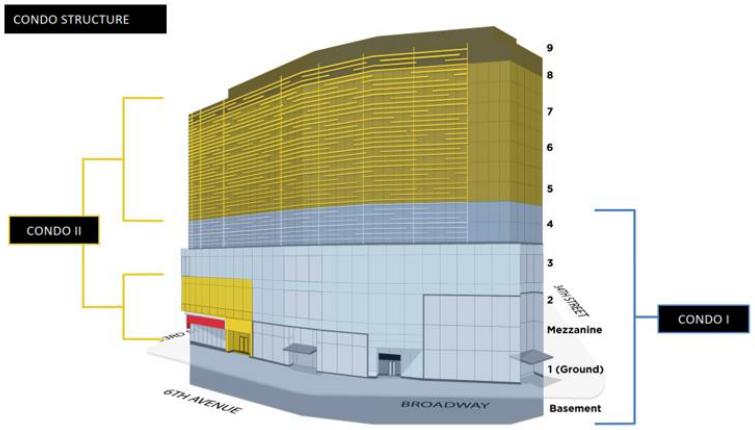

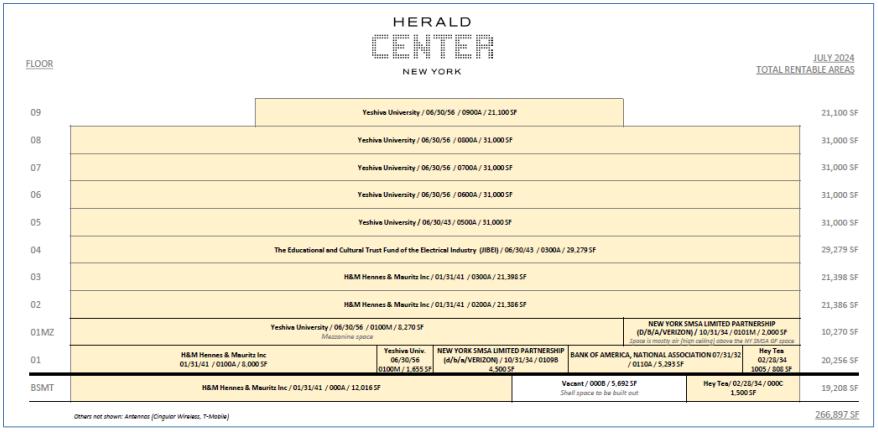

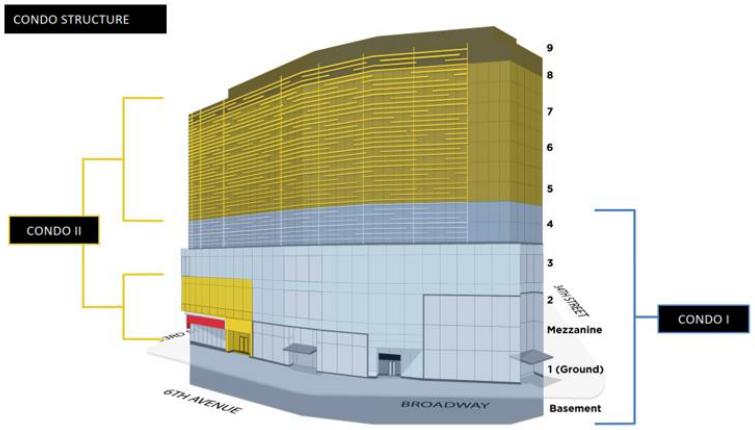

| ● | Following the closing of the Loan, the Leasehold Borrower will have the right to convert the Property to a leasehold condominium structure (anticipated to initially have two (2) units – Unit 2 will be retained by the Sponsor (the “Retail Unit”) and Unit 1 will be conveyed to Yeshiva University (the “Yeshiva Unit”)), which leasehold condominium will have a term of 31 years (co-terminus with the Affiliated Ground Lease). Additionally, the leasehold condominium will be subject and subordinate to the Affiliated Ground Lease. Following the creation of the leasehold condominium, (i) the fee mortgage will continue as a mortgage on the Fee Borrower’s fee simple interest in the entire Property, (ii) the leasehold mortgage will continue as a first priority mortgage on both the Retail Unit and the Yeshiva Unit, and (iii) upon the sale of the Yeshiva Unit to Yeshiva University (“Yeshiva”), the Yeshiva Unit will be released from the lien of the leasehold mortgage. In summary, after the leasehold condominium is formed and sold to Yeshiva, the collateral shall consist of the fee mortgage on the Property and the leasehold mortgage on the Retail Unit. The leasehold condominium will be subordinate to the Affiliated Ground Lease and the Affiliated Ground Lease will be subordinate to the Lender’s fee mortgage; however, as a condition to Yeshiva acquiring the Yeshiva Unit, Yeshiva will require that for so long as Yeshiva is not in default under the leasehold condominium documents and other documents related to the purchase of the Yeshiva Unit (collectively, the “Yeshiva Transaction Documents”), it will not be disturbed in a foreclosure or other exercise of remedies by Lender under the loan documents. The acquisition price of the Yeshiva Unit is $10.00 and Yeshiva will also be required to pay common charges which shall include a portion of the ground rent that is payable under the Affiliated Ground Lease and a portion of the operating expenses. For simplicity throughout this presentation, Yeshiva is represented as a tenant at the Property and its portion of the ground rent is represented as “Base Rent”. |

| ● | The Yeshiva Transaction Documents contemplate Yeshiva taking possession of its 155,025 SF premises across three tranches. The Yeshiva premises includes portions of the first floor, mezzanine floor and floors five through nine. Yeshiva accepted possession of Tranche 1 on November 1, 2024, which includes portions of the first floor, the mezzanine floor and sixth floor and the entirety of the fifth floor. The “Ground Rent Pass Through Date”, which is the date that Yeshiva will be obligated to start making its Base Rent payment for the applicable tranche, will be July 1, 2025 for Tranche 1. The possession date for Tranche 2, which includes portions of the sixth floor and the entirety of the seventh floor, will be no later than January 1, 2026. The Ground Rent Pass Through Date for Tranche 2 will be July 1, 2026. The possession date for Tranche 3, which includes the entirety of the eighth and ninth floors, will be no later than January 1, 2027. The Ground Rent Pass Through Date for Tranche 3 will be July 1, 2027. The Borrower is required to complete seller’s work as defined under the Yeshiva Transaction Documents prior to the possession date for each tranche. However, failure of Borrower to complete seller’s work will not provide Yeshiva any termination rights under the Yeshiva Transaction Documents and would not result in a delay of the obligation to pay Base Rent on the aforementioned Ground Rent Pass Through Dates. From the Possession Date of each tranche, Yeshiva is responsible for paying any utility charges (to the extent not included in common charges) and sundry charges with respect to each such tranche. Commencing on the first anniversary of the Ground Rent Pass Through Date of each tranche, Yeshiva will commence paying its |

| Strictly private and confidential | Herald Center |

percentage allocation of common charges (other than Base Rent which will be paid as previously described) with respect to each tranche. Finally, upon the sale of the Yeshiva Unit to Yeshiva, but no later than January 1, 2025, Yeshiva will be responsible for paying the Real Estate Taxes allocated to the Yeshiva Unit (Tranche 1, 2 and 3) until such time that the two condominium units are separately assessed, which equates to 50.6226% of the Real Estate Tax burden of the Property. When the condominium units are separately assessed, Yeshiva will be responsible for the real estate taxes levied on the Yeshiva Unit, which are anticipated to be fully abated as a result of Yeshiva applying for and being granted an exemption under 420-a of the New York Real Property Tax Law. In summary, Yeshiva will be required to pay Base Rent and its portion of operating expenses on the schedule described above with no express rights to terminate such obligations.

| ● | As of September 25, 2024, the New York Attorney General’s office issued a No Action Letter related to the formation of the leasehold condominium, which states that the Department of Law will not take enforcement action based on the leasehold condominium transaction that was presented in the application. This is a critical step towards forming the leasehold condominium. The Sponsor then obtained tentative tax lot numbers for the leasehold condominium from the New York City Department of Finance (“DOF”) and obtained approval of the proposed leasehold condominium subdivision from the New York City Department of Buildings (“DOB”). As of November 25, 2024, the Sponsor submitted the leasehold condominium documents to the DOF for approval. The leasehold condominium approval from the DOF is expected to take approximately 60 days. |

| ● | Prior to closing of the Loan, the Sponsor and Yeshiva will have entered into a Temporary Occupancy Agreement (“TOA”) which obligates Yeshiva starting no later than January 1, 2025 to perform all of the aforementioned obligations over the same duration that it agreed to under the Yeshiva Transaction Documents as if the leasehold condominium had been formed and the Yeshiva Unit was sold to Yeshiva on such date, regardless of whether such leasehold condominium has been formed and the Yeshiva Unit was sold to Yeshiva. For the avoidance of doubt, neither such TOA nor any of the Yeshiva Transaction Documents shall provide Yeshiva with any termination or contraction options. |

| ● | After the leasehold condominium structure is in place, the Retail Unit is anticipated to be 112,182 square feet and will encompass portions of the cellar, portions of the first floor, portions of the mezzanine floor and floors two to four. The Yeshiva Unit is anticipated to be 155,025 square feet and will encompass portions of the first floor, portions of the mezzanine floor and floors five to nine. General common elements of the leasehold condominium serving both Units will be located on the sub-cellar. Yeshiva will use the Yeshiva Unit for its health sciences program with a focus on a newly proposed dental school, and will have its own dedicated entrance at the Property. The Sponsor currently estimates that the buildout of the Yeshiva Unit will cost approximately $31 million and Yeshiva is expected to invest an additional $9 million of its own money to further improve the space. Additionally, the Sponsor will be responsible for landlord work currently estimated to cost $3.75 million, which results in a total approximate landlord contribution of $34.8 million, all of which will be reserved at closing, for the Yeshiva buildout. |

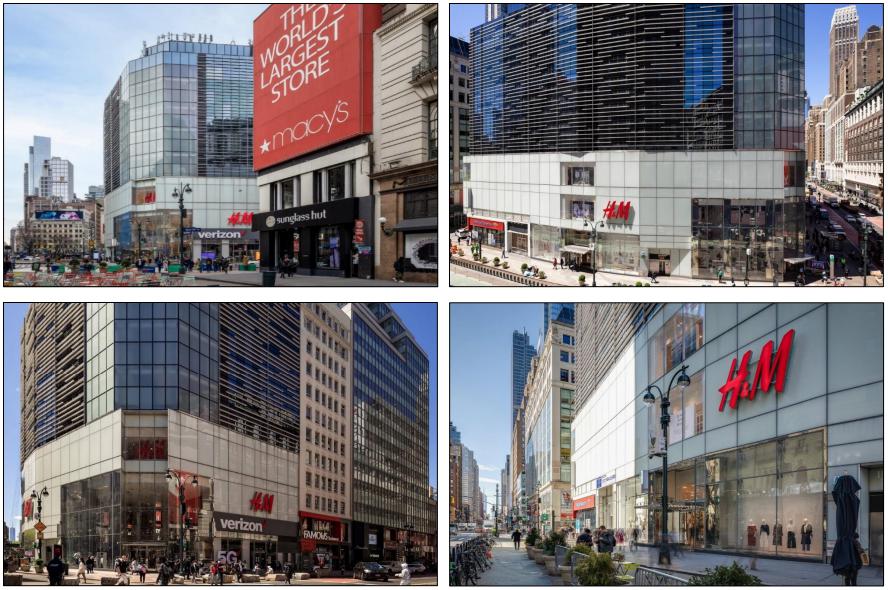

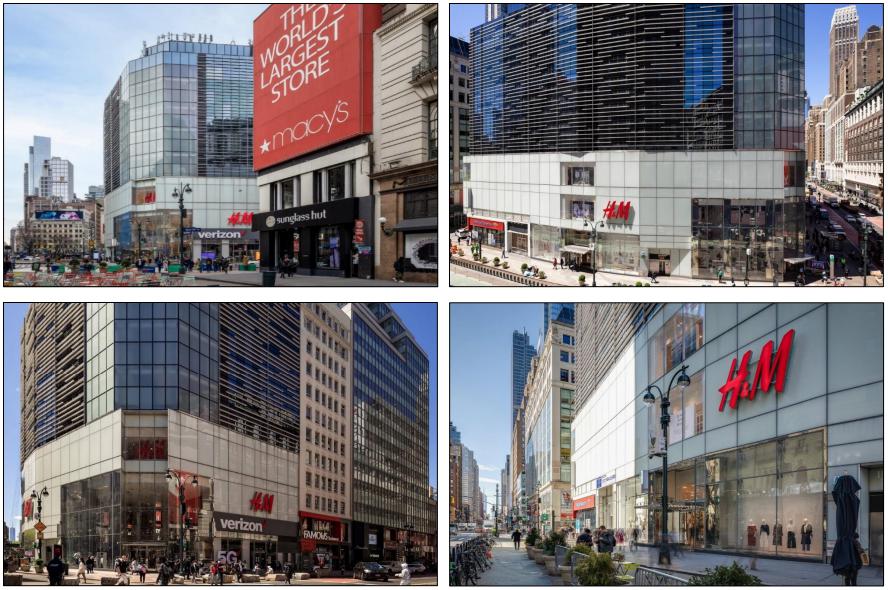

| ● | The Collateral for the subject Loan is the Herald Center comprising 267,207 square feet. Herald Center is a 267,207 square foot, 9-story, mixed-use retail and school/educational building situated in Herald Square in New York, New York. Currently, the Collateral is 100% leased with notable investment-grade tenants including H&M (S&P: BBB), Bank of America (S&P: A-, Moody’s: A1, Fitch: AA-), and New York SMSA Limited Partnership (Verizon) (S&P: BBB+, Moody’s: Baa1, Fitch: BBB+) comprising 72.6% of UW base rent and 27.9% of the square footage, with a combined weighted average remaining lease term of 15.3 years. Although Yeshiva is not a publicly rated entity, it has strong financials with net assets of approximately $564 million as of year-end 2022. If Yeshiva is included with the aforementioned investment grade tenants, these tenants represent 93.6% of UW base rent and 85.9% of the square footage, with a combined weighted average remaining lease term of 26.4 years. Located in Herald Square within the Penn Plaza District, the Property is in one of the country’s premier shopping corridors. The Property is well located directly across from Macy’s, the largest department store in the world, and benefits from Herald Square’s recently improved pedestrian areas, increasing pedestrian traffic to nearly 100 million passing pedestrians per year. The Property is located at the intersection of New York City’s main public transportation arteries, providing Herald Center with access to 15 nearby subway lines. |

| Strictly private and confidential | Herald Center |

| ● | The Property was originally built in 1902, subsequently rebuilt in 1986, and recently renovated in 2015 after the Sponsor carried out a $50 million beautification program. The Sponsor, JEMB Realty Corporation, has owned the Property since 1986 and completed the renovation to reposition Herald Center to take advantage of the Property’s location in the Broadway retail corridor. |

| ● | The Property is situated in a prime location for transit; located adjacent to a subway entrance, providing both tenants, guests and customers of the Property with direct access to 7 major subway lines as well as access to 8 other lines within a 15-minute walk. The Property is also 0.3 miles from Penn Station, the regional hub for the LIRR, PATH, and Amtrak train lines. These lines provide a wider range of pedestrian traffic as the LIRR and PATH are commuter lines for Long Island and New Jersey, respectively, while Amtrak has direct trains running to and from the greater east coast. The Property’s location is both an attractive destination for tourists and a convenient stop for passing commuters due to its wide variety of options for shopping and convenient location. |

| ● | The Property has a diverse tenant mix which includes banking services, communications products and services, fast fashion, and education. The in-place tenants have a weighted average remaining lease term of 25.1 years, which is well beyond the Loan term. These tenants are H&M, Yeshiva University (as a leasehold condominium unit owner), Hey-Tea, New York SMSA Limited (Verizon), Bank of America, JIBEI, and two antenna leases. The average rent among in-place tenants is $132.59 PSF. Comprising 23.5% of the Total NRA, H&M is the largest tenant by rent with a remaining lease term of 16.3 years and a current rent of $290.33 PSF. This H&M location serves as the brand’s flagship store with average sales of $449.44 PSF for the trailing twelve-month period ending August 2024. Anecdotally, H&M provided written confirmation that this location is one of their top performing stores in terms of sales and they have plans to make significant investment in the store within the next few years (see exhibit B). The Property has undergone significant leasing momentum in 2024, with Hey Tea, a Chinese Tea House Chain, signing a new lease, Verizon executing an early renewal for an additional 10 years of term and Yeshiva University purchasing the Yeshiva Unit. Together, Hey Tea, Verizon and Yeshiva University comprise 61.3% of NRA. The Property has a long-term contractual cashflow with minimal material rollover during the term. |

| ● | Benefitting from a prime location near ample public transportation and among modernized lifestyle developments, the Property attracts top tier tenants. Investment-grade tenants represent 73.4% of the property’s UW base rent. The property is 100% leased, with 5,692 SF of static vacant space, which outpaces the current submarket vacancy rate of 9.7% for Retail, per CoStar as of 8/6/2024. The low vacancy rate is driven by the abundant pedestrian traffic and high spending capacity in the area. According to CoStar, the estimated population within a 1, 3, and 5-mile radius of the Property is 203,660, 1.3 million, and 2.8 million respectively. The median household income within a 1, 3, and 5-mile radius of the Property is $132,953, $121,528, and $101,351, respectively. |

| ● | JEMB Realty Corporation, managing member of the Borrower, is a New York based real estate investment firm with extensive development, ownership, and operating experience. JEMB affiliates are active in repositioning real estate assets, construction projects, and financial structuring. The firm operates a real estate portfolio totaling more than 7 million square feet with holdings in the New York metro including Herald Center, Herald Towers, 1 Willoughby Square, and 150 Broadway among others. Herald Towers is situated across from the collateral further demonstrating the Sponsor’s commitment to the submarket. |

| Strictly private and confidential | Herald Center |

Transaction Sources & Uses

Proceeds from the financing and Sponsor Equity will be used to (i) retire the existing securitized debt, (ii) fund the buildout of the space for Yeshiva University, (iii) repay the existing preferred equity investment (iv) pay mortgage recording tax, (v) retire an M&T Pledge and (vi) pay closing costs. The estimated sources and uses for the proposed financing are outlined in the chart below:

Proposed Sources and Uses | | |

| Sources of Funds | $ Amount | $ PSF | % of Total |

| Mortgage Loan | $300,000,000 | $1,123 | 89.48% |

| Preferred Equity Investment | $30,000,000 | $112 | 8.95% |

| Sponsor Equity | $5,269,349 | $20 | 1.57% |

| Total Sources of Funds: | $335,269,349 | $1,255 | 100% |

| | | | |

| Uses of Funds | $ Amount | $ PSF | % of Total |

| Repayment of Existing Debt | $245,000,000 | $917 | 73.08% |

| Yeshiva University TI | $31,005,000 | $116 | 9.25% |

| Yeshiva University Landlord Work | $2,465,548 | $9 | 0.74% |

| Yeshiva University Leasing Commission | $9,476,232 | $35 | 2.83% |

| Real Estate Tax and Insurance Reserve | $1,196,026 | $4 | 0.36% |

| Free Rent Reserve | $268,391 | $1 | 0.08% |

| Immediate repairs Reserve | $502,807 | $2 | 0.15% |

| Preferred Equity Repayment | $22,860,000 | $86 | 6.82% |

| M&T Pledge | $4,926,427 | $18 | 1.47% |

| Closing Costs | $13,024,640 | $49 | 3.88% |

| Senior Deferred Interest | $2,484,028 | $9 | 0.74% |

| Mortgage Recording Tax | $1,260,000 | $5 | 0.38% |

| JIBEI Entrance Work Reserve | $800,250 | $3 | 0.24% |

| Total Uses of Funds | $335,269,349 | $1,255 | 100% |

| Strictly private and confidential | Herald Center |

The key credit metrics are summarized below:

| Loan and Preferred Equity Metrics | | | | | | |

| Tranche | Est. Rate | $ Amount | $PSF | As-Is LTV | % of Total | NCF Debt Yield | DSCR |

| Mortgage Loan | 6.5933% | $300,000,000 | $1,123 | 65.2% | 90.9% | 9.1% | 1.35x |

| Preferred Equity* | 8.0000% | $30,000,000 | $112 | 71.7% | 9.1% | 8.2% | 1.21x |

| Total / W.A. | 6.7212% | $330,000,000 | $1,235 | 71.7% | 100% | 8.2% | 1.21x |

| *The preferred equity will be provided by Basis Investment Group and has an 8.0% current pay and 5.0% PIK. |

| Strictly private and confidential | Herald Center |

Capital Structure

The capital structure is summarized in the chart below. Based on an estimated appraised value of $460 million ($1,722 PSF), the Sponsor will have approximately $130 million ($487 PSF) of implied equity in the Property at closing.

| Capital Stack | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | Cumulative Basis

PSF | As-Is

LTV | | UW NCF Debt Yield |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | $300,000,000 | | | | $1,123 | 65.2% | | 9.1% |

| | | | Mortgage Loan | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | $30,000,000 Preferred Equity | | | | $1,235 | 71.7% | | 8.2% |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | $130,000,000 Implied Sponsor Equity | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | |

| | |

| | |

| Strictly private and confidential | Herald Center |

Table of Contents

| Executive Summary | Page 7 |

| | |

| Investment Highlights | Page 13 |

| | |

| Property Overview | Page 16 |

| | |

| Lender Underwriting | Page 28 |

| | |

| Market Overview | Page 32 |

| | |

| Appraisal Summary | Page 39 |

| | |

| Summary of Loan Terms | Page 49 |

| | |

| Sponsor Overview | Page 53 |

| Strictly private and confidential | Herald Center |

Investment Highlights

Prime Midtown, High-Exposure Location

| ● | The Property is a premier mixed-use retail and school/educational property located in the Penn Plaza/Garment submarket of Manhattan. The Collateral occupies almost an entire block at the corner of Broadway and West 34th Street that provides prime frontage for the retail tenants. The Property is accessible from all major commuter transportation hubs and residential areas within Manhattan. Nearby subway stops include 34th Street Herald Square Station which is adjacent to the Property, where B, D, F, M, N, Q, R, and W trains are accessible; 34th Street Penn Station, where 1, 2, 3, A, C, E, LIRR, PATH, and Amtrak trains are available; and Times Square 42nd Street Station, where N, Q, R, Q, S, 1, 2, 3, and 7 trains are also available. The Property is well located across from Macy’s, the largest department store in the world, and benefits from Herald Square’s recent redevelopment which increased public pedestrian space reserved for park areas, seating areas, and bike lanes. |

| ● | In 2023, according to the Metro Transit Authority, the subway stations, 34th Street-Herald Sq and 34th Street-Penn Station (1,2,3,A,C,E), experienced over 33 million passengers, reflecting the prominence of this area in the greater New York Metro. The Property is in a prime position to capture this foot traffic and overall demand from both retail consumers and commuters. |

| ● | The Property is well-positioned to capitalize on New York City’s retail recovery as Penn Plaza’s leasing activity continues to stabilize. Historically, the Penn Plaza/Garment retail submarket has performed very well, only peaking at a vacancy of 3.4% in the previous recession and maintaining a sub 4% vacancy until 2020. Decreases in foot traffic due to Covid measures negatively impacted absorption in the submarket with over 300,000 SF of space vacating in 2020. This mass departure led to the vacancy rate increasing from 1.6% in 2019 to 8.3% in 2020. Per CoStar, the submarket’s vacancy rate in Q2 2024 was 9.7% for Retail and 17.3% for Office. However, the overall long-term outlook is considered positive, as the Penn Plaza/Garment submarket is home to some of New York City’s most prominent landmarks which will sustainably drive continued foot traffic to the area. |

| ● | The prime location and unrivaled signage visibility offers the largest tenant, H&M, tremendous value above the strong sales performance. H&M’s signage and facade spans the entirety of Broadway between 34th and 35th street in addition to signage on the corner 35th street directly across the flagship Macy’s store. According to the Sponsors, H&M highly values the marketing and advertisement that their signage at the Property offers the brand. |

Diversified Investment-Grade Tenant Base with Strong Retail Sales and No Rollover During the Loan Term (excluding antenna roll)

| ● | The Collateral is currently 100% leased to a mix of banking, communications products, fast fashion, and education tenants. H&M (62,800 SF, 23.5% of NRA, 52.3% of GPR), the largest tenant at the Property by rent, has 16.3 years of lease term remaining. H&M’s presence at the Property draws much of the foot traffic to the property due to it being the largest H&M store in the world and its selection of clothing at an affordable price point. H&M’s sales have nearly doubled since the pandemic with 2020 sales of nearly $15 million and 2023 sales of nearly $30 million. Additionally, sales in the first half of 2024 have already reached $15.6M. H&M’s net sales have increased by 3% in 2Q2024 over the previous quarter. The remaining ground floor retail suites are leased to a Bank of America branch, a Verizon store and Hey Tea with an average weighted base rent of $507.40 PSF between the three. |

| ● | Of the 8 in-place tenants (including two antennae tenants), 5 are investment-grade credit rated entities with ratings of at least BBB or Baa2 or higher. The investment-grade tenants have a weighted average remaining lease term of 15.2 years and comprise 28.0% of the NRA and 73.4% of the UW Gross Potential Rent, reflecting a viable, financially stable tenant base. |

| ● | The Sponsor recently reached an agreement with Yeshiva University to purchase the Yeshiva Unit and Yeshiva will occupy the fifth through the ninth floor of the Property along with portions of the first floor and portions of the mezzanine floor, bringing another well-established and respected institution into the tenancy. Yeshiva University will occupy the entirety of Yeshiva Unit for a 31-year term (which is the term of the leasehold |

| Strictly private and confidential | Herald Center |

condominium) that is further described in this presentation. Yeshiva University will use the space for its health sciences program with a focus on a newly proposed dental school. Yeshiva University is expecting to spend approximately $9 million of their own money to improve the space above the landlord contribution, which is estimated to be approximately $31 million.

| ● | H&M has a termination option at the Property in 2036, which requires 24 months’ notice. The Loan is structured on a 5-year term, providing extra security to the Lender as the effective date of H&M’s termination option is approximately 7 years following the maturity of the loan. |

| ● | There are 9 H&M locations throughout Manhattan. H&M continues to show its commitment to this market by opening a 10th store with the announcement of a new 18,359 SF lease in SoHo. |

| ● | The Property has undergone significant leasing and occupancy momentum in 2024, with Hey Tea, a Chinese Tea House Chain, signing a new lease, Verizon executing an early renewal for an additional 10 years of term and Yeshiva University purchasing the Yeshiva Unit. Together, Hey Tea, Verizon and Yeshiva University comprise 61.3% of NRA. Yeshiva University will occupy floors five through nine of the Property along with portions of the first floor and portions of the mezzanine floor and use the space for their health science programs. The Sponsor is investing $31 million into the space and Yeshiva University will invest an additional $9 million into the space to fit their needs. |

| ● | In May 2024, Verizon exercised an early renewal option, which extended the term of the lease an additional 10 years through October 2035 (original lease expiration date of October 2025). Additionally, Verizon recently made a significant investment in their store by performing a renovation of the interior and storefront at their own expense. The renovation was completed on November 25, 2024. The early extension of their term and the recently completed renovation of the store demonstrate Verizon’s commitment to the location. |

Strong Committed Sponsorship with New York City Presence

| ● | JEMB Realty Corporation, managing member of the Borrower, is a New York based real estate investment firm with extensive development, ownership, and operating experience encompassing 7 million SF. JEMB affiliates are active in repositioning real estate assets, construction projects, and financial structuring. |

| ● | Based out of New York, the Sponsor has extensive experience in the New York Market. Their projects include the ground-up development of the office building 1 Willoughby Square, the acquisition and re-establishment of the Resort Casino Hotel in Atlantic City, and the development of a residential building in downtown Manhattan. JEMB Realty Corporation’s headquarters are located three miles from the Property at 150 Broadway. |

| ● | The Sponsor has been committed to the Property since acquiring the asset in 1986. In 2015, the Sponsor invested $50 million in capital expenditures, completely overhauling the building’s façade to modernize the building. |

| ● | With Yeshiva’s occupancy at the Property, the Sponsor will invest approximately $31 million into their space to build out their capabilities as a medical space. This investment into the space shows the Sponsor’s continued investment in the long-term future of the Property. |

| Strictly private and confidential | Herald Center |

Table of Contents

| Executive Summary | Page 7 |

| | |

| Investment Highlights | Page 13 |

| | |

| Property Overview | Page 16 |

| | |

| Lender Underwriting | Page 28 |

| | |

| Market Overview | Page 32 |

| | |

| Appraisal Summary | Page 39 |

| | |

| Summary of Loan Terms | Page 49 |

| | |

| Sponsor Overview | Page 53 |

| Strictly private and confidential | Herald Center |

Property Overview

Collateral Overview

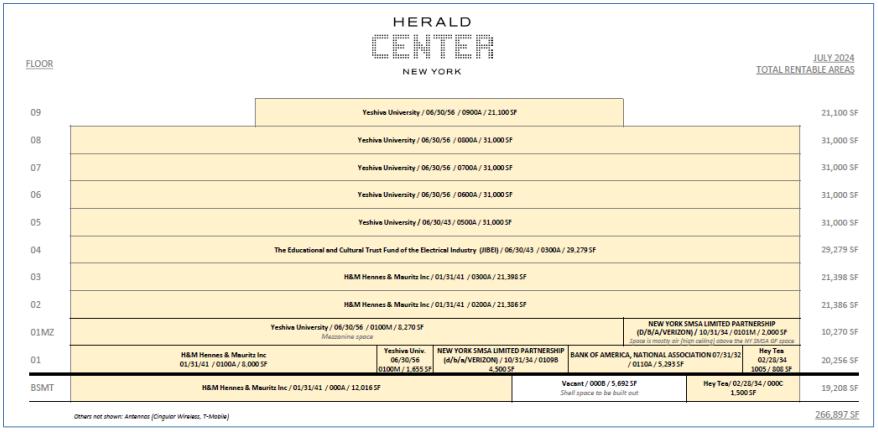

● Herald Center is a 267,207 square foot, 9-story, mixed-use retail and school/educational building situated in Herald Square in New York City, New York. As Herald Square continues to substantially increase pedestrian areas, the Property attracts top tier retail and education tenants. Currently, the Collateral is 100% occupied with banking, communications products, fast fashion, and education tenants. The building is located adjacent to 34th Street Herald Square Subway Station, is within two blocks of Penn Station, and is within a 15-minute walk to Times Square 42nd Street Station.

● Herald Center is a 267,207 square foot, 9-story, mixed-use retail and school/educational building situated in Herald Square in New York City, New York. As Herald Square continues to substantially increase pedestrian areas, the Property attracts top tier retail and education tenants. Currently, the Collateral is 100% occupied with banking, communications products, fast fashion, and education tenants. The building is located adjacent to 34th Street Herald Square Subway Station, is within two blocks of Penn Station, and is within a 15-minute walk to Times Square 42nd Street Station.

● Rebuilt in 1982 and renovated by the Sponsor in 2015, the Property uses its LED paneling to capture a large audience for its retailers. The Property is well located on the corner of 34th Street and Broadway in Midtown Manhattan’s Herald Square, one of the most densely travelled retail districts in New York City. The Property also benefits from its location directly across from Macy’s Flagship store in Herald Square which is the largest department store in the United States and internationally. The prime location and unrivaled signage visibility offers the largest tenant, H&M, tremendous value above the strong sales performance. H&M’s signage and facade span the entirety of Broadway between 34th and 35th street in addition to signage on the corner 35th street directly across the flagship Macy’s store. According to the Sponsors, H&M highly values the marketing and advertisement that their signage at the Property offers the brand.

● The Property’s rent roll features five investment grade retail tenants. These tenants include H&M ((BBB, 62,800 SF, 53.7% of GPR),), Bank of America (S&P: BBB+, Moody’s: A1, Fitch: AA-, 5,293 SF, 10.2% of GPR), New York SMSA Limited Partnership (Verizon) (S&P: BBB+, Moody’s: Baa1, Fitch: A-, 6,500 SF, 9.7% of GPR), T-Mobile (S&P:BBB, Moody’s: Baa2, Fitch: BBB+, 210 SF, 0.3% of GPR) and New Cingular Wireless PCS, LLC (AT&T) (S&P: BBB, Moody’s: Baa2, Fitch: BBB+, 100 SF, <0.1% of GPR). Most of these tenants have been in-place for more than five years and continue to attract foot traffic to the property with their well-established brands.

● Yeshiva University will enter into a purchase and sale agreement and related documents to purchase the Yeshiva Unit to occupy approximately 155K SF at the Subject on floors five through nine along with portions of the first floor and portions of the mezzanine floor, including a dedicated private entrance. As part of the agreement, the Sponsor will be investing an estimated $31 million into the space to build out its capabilities as a medical facility for the University. Yeshiva is expected to invest approximately $9 million into the space and will be taking occupancy in three tranches between 2025 and 2027. The Joint Industry Board of the Electrical Industry (JIBEI) also signed a new lease at the Subject in April 2023 which accounts for 11.0% of NRA (29,279 SF). JIBEI’s space includes a separate ground-floor entrance, and the tenant occupies the entire fourth floor of the building. This recent education leasing follows the lease signed by Touro University in Times Square demonstrating a growing trend for education tenants to value proximity to subway access for the students and professionals.

● The building has a long term, contractual cashflow with minimal rollover during the term. Of the 8 in-place tenants, the two antennae tenants representing only 0.1% of NRA will roll prior to the loan’s maturity date. The Subject has a weighted average remaining lease term of 25.1 years.

| Strictly private and confidential | Herald Center |

| ● | The Property is accessible from all major Manhattan commuter transportation hubs. Nearby subway stops include 34th Street Herald Square Station which is adjacent to the Property, where B, D, F, M, N, Q, R, and W trains are accessible; 34th Street Penn Station (3 minute walk), where 1, 2, 3, A, C, E, LIRR, PATH, and Amtrak trains are available; and Times Square 42nd Street Station (7 minute walk), where N, Q, R, Q, S, 1, 2, 3, and 7 trains are also available. |

| ● | The Sponsor, JEMB Realty Corporation, is a New York based real estate investment firm with extensive development, ownership, and operating experience. JEMB affiliates are active in repositioning real estate assets, construction projects, and financial structuring. The firm’s holdings in the New York metro include Herald Center as well as Herald Towers, 75 Broad, 1 Willoughby Square, and 150 Broadway among others. |

| ● | Yeshiva University’s buildout is anticipated to cost approximately $40 million (258 PSF) across the landlord and tenant contribution, which will be used to transform the space into the newest installation of the Yeshiva University medical school. As a result, the tenant’s contribution of over $9 million is expected to be in excess of what the tenant would spend if this were a more traditional office or standard classroom buildout. One of the major aspects of the project is to create large arched window bays to allow additional natural light into the Yeshiva University space. See below for renderings of the window bays: |

| Strictly private and confidential | Herald Center |

| Strictly private and confidential | Herald Center |

Property Overview (continued)

Tenancy Overview

| ● | The Property is currently 100% leased to a diverse mix of banking, communications products, fast fashion, and education tenants who are attracted to the Property given its prime location in New York City, and more specifically Penn Plaza/Garment submarket. Major tenants include Yeshiva University (as a leasehold condominium unit owner) (NR, 150,459 SF, 20.9% of GPR), H&M (BBB, 62,800 SF, 52.3% of GPR), JIBEI (29,279 SF, 4.6% of GPR), and Verizon (BBB+, 6,500 SF, 10.0% of GPR). The Property benefits from a strong location, easy access to public transit, and an experienced owner/operator. |

| ● | The in-place tenants at the Property represent 100% of the NRA with a weighted average remaining lease term of 25.1 years and a weighted average base rent of $129.05 PSF. |

| Tenant | Tenant Type | Initial Lease Start | Lease Expiration | Remaining Term (months) | SF | % of SF | UW Base Rent (2) | Base Rent/SF | Rent Step Increase |

| H&M Fashion USA, Inc. | Anchor | 8/1/2014 | 1/31/2041 | 16.1 | 62,800 | 23.50% | $18,232,724 | $290.33 | $911,499 |

| YESHIVA UNIVERSITY | Office | 7/1/2025 | 6/30/2056 | 31.5 | 56,425 | 21.12% | $2,651,975 | $47.00 | $0 |

| YESHIVA UNIVERSITY | Office | 7/1/2026 | 6/30/2056 | 31.5 | 46,500 | 17.40% | $2,185,500 | $47.00 | $0 |

| YESHIVA UNIVERSITY | Office | 7/1/2027 | 6/30/2056 | 31.5 | 52,100 | 19.50% | $2,448,700 | $47.00 | $0 |

| BANK OF AMERICA | Inline | 7/11/2002 | 7/31/2032 | 7.6 | 5,293 | 1.98% | $3,270,915 | $617.97 | $373,077 |

| CL VISTA HOLDINGS LLC | Inline | 3/1/2024 | 2/28/2034 | 9.2 | 2,308 | 0.86% | $384,005 | $166.38 | $11,515 |

| New Cingular Wireless PCS, LLC | Antenna | 12/7/2016 | 4/30/2026 | 1.3 | 100 | 0.04% | $93,600 | $936.00 | $0 |

| NEW YORK SMSA LIMITED PARTNERSHIP | Inline | 4/15/2015 | 10/31/2035 | 10.8 | 6,500 | 2.43% | $3,500,000 | $538.46 | $0 |

| JIBEI | Office | 4/12/2023 | 12/31/2043 | 19.0 | 29,279 | 10.96% | $1,610,345 | $55.00 | $0 |

| T-Mobile Northeast LLC | Antenna | 11/1/1996 | 10/31/2028 | 3.8 | 210 | 0.08% | $106,247 | $505.94 | $4,251 |

| Vacant | | 1/0/1900 | 1/0/1900 | 0.0 | 5,692 | 2.13% | $0 | $0.00 | $0 |

| In-place Total | | | | 24.6 | 267,207 | 100.0% | $34,484,012 | $129.05 | $1,300,342 |

| 1) Rent Step as of 1/01/2026 | | |

| 2) Solely reflective of the In-Place Base Rent | | |

| Strictly private and confidential | Herald Center |

Property Overview (Condo Structure)

Following the closing of the Loan, Borrower shall have the right to submit the property to a condominium regime. The condominium will be bifurcated into two condominium units. As of September 25, 2024, the New York Attorney General’s office issued a No Action Letter related to the formation of the leasehold condominium, which states that the Department of Law will not take enforcement action based on the leasehold condominium transaction that was presented in the application. The Retail Unit is anticipated to be 112,182 square feet and will encompass portions of the sub-cellar, portions of the cellar, portions of the first floor, portions of the mezzanine floor and floors two to four. The Yeshiva Unit is anticipated to be 155,025 square feet and will encompass portions of the first floor, portions of the mezzanine floor and floors five to nine. Currently, the building holds air rights of approximately 180,000 SF, which cannot be accessed without the consent of the Lender’s condominium interest.

| Strictly private and confidential | Herald Center |

Property Overview (Condo Structure Continued)

Condominium II (or the Retail Unit) is 112,182 SF and encompasses portions of the sub-cellar, portions of the cellar, portions of the first floor, portions of the mezzanine floor and floors two to four. Condominium I (or the Yeshiva Unit) represents 155,025 SF spread over portions of the first floor, portions of the mezzanine floor and floors five to nine. Yeshiva University (YU), a private Orthodox Jewish institution, will purchase the Yeshiva Unit which ownership will be for 31-years pursuant to the terms of the Affiliated Ground Lease and the leasehold condominium documents, which includes floors 5 to 9 and part of the mezzanine and ground floor. The 31-year lease and leasehold condominium structure will allow the Yeshiva Unit to be tax exempt, thus creating a significant saving to the Landlord and Yeshiva University. Yeshiva University will take occupancy of their space in three tranches from 2025 through 2027.

| Strictly private and confidential | Herald Center |

Property Overview (Tenancy)

Top Tenant Descriptions

Hennes & Mauritz (H&M) (BBB / 62,800 SF / 23.7% of NRA / 52.3% of UW Gross Rent / LXD in January 2041) |  |

| ● | Founded in 1947 by Erling Persson, H&M Hennes & Mauritz AB (Nasdaq Stockholm: HM B) is a multinational clothing company based in Sweden that focuses on fast-fashion clothing for men, women, teenagers, and children. As of May 2024, H&M Group operated in 77 geographical markets (online sales in 60 markets) with 4,338 stores under the various company brands, with over 150,000 employees. The company provides its products under the H&M, H&M HOME, COS, Weekday, Monki, & Other Stories, ARKET, and Afound brand names. The company reported net sales of SEK 236 billion ($22.44 bn) for fiscal year 2023, up by 6% from 2022. Furthermore, approximately 30% of the revenues come from online sales. |

| ● | H&M currently occupies the entire first, second and third floors, and a unit in the basement. The tenant has a remaining lease term of 16.3 years and contractual rent steps of 5.0% biennially through 2040. H&M reimburses real estate taxes over a base year. |

| ● | The prime location and unrivaled signage visibility offers H&M tremendous value above the strong sales performance. H&M’s signage and facade spans the entirety of Broadway between 34th and 35th street in addition to signage on the corner 35th street directly across the flagship Macy’s store. According to the Sponsors, H&M highly values the marketing and advertisement that their signage at the Property offers the brand. |

| ● | Sales PSF at Herald Center in 2023 outpaced pre-pandemic averages for all H&M locations. According to Retail Maxim, from 2015 to 2019, H&M’s average sales PSF was $300.80, 30% lower than the $432.40 PSF at the Property. |

| ● | According to an article dated October 9, 2024, H&M is planning to rebuild or refresh all 12 stores located in New York City, showing additional commitment to the market and their existing locations, including the subject Property. Please see exhibit C for the full article. |

| ● | H&M signed a 25-year lease which commenced on 8/1/2014 and expires 1/31/2041 with one 5-year renewal option at lease expiration. The tenant has been at the Property for nearly ten years, showing a commitment to the space. H&M’s US subsidiary who signs all of their US leases, Hennes & Mauritz L.P., is the tenant under the lease. |

| ● | The tenant has reportedly invested approximately $50.0 million ($201 per sf) into its space on capital improvements and finishes. |

| ● | The tenant has a termination option commencing 1/1/2036 which requires 24 months’ notice. The termination date is well beyond the Loan’s term. |

Yeshiva University (As a Leasehold Condominium Owner) (155,025 SF / 58.0% of NRA / 20.9% of UW Gross Rent / LXD in June 2056) |  |

| ● | Yeshiva University is a private Orthodox Jewish university with four campuses in New York City. Since its founding in 1886 in the Lower East Side with a singular elementary school, the university further expanded to comprise about 20 colleges, schools, affiliates, centers and institutions with several affiliated hospitals and other healthcare institutions. |

| Strictly private and confidential | Herald Center |

| ● | In 2022, the university received a financial endowment of $484 million. As of year-end 2022, the university had net assets of approximately $564 million. |

| ● | For the 2023-2024 academic year, Yeshiva University enrolled approximately 2,250 undergraduate students, and 2,700 graduate students. |

| ● | The University will occupy all of the Yeshiva Unit of the Property, with floors 5 to 9, as well as part of the mezzanine and ground floor, for a total area of 155,025 SF for their medical faculty. |

| ● | Yeshiva University, as the owner of the Yeshiva Unit, will remain liable under the purchase and sale agreement, Affiliated Ground Lease and the leasehold condominium documents following any transfer of the Yeshiva Unit. |

Bank of America (A- / 5,293 SF / 2.0% of NRA / 10.4% of UW Gross Rent / LXD in July 2032) |  |

| ● | Bank of America (NYSE: BAC) is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses, and large corporations with a full range of financial services including banking, investing, asset management and risk management products. The company serves approximately 66 million consumers with approximately 4,200 retail financial centers, 17,000 ATMs, and digital banking for about 41 million active users. The company serves clients through operations across the United States, its territories and in over 35 countries. The Company generated $94.9bn in revenue, which yielded a net income of $26.0bn in 2022. |

| ● | Bank of America occupies one retail ground level suite at the Subject (0110A), comprising of 5,293 SF with rent increases of 11.5% every five years. The tenant has a remaining lease term of 7.8 years and reimburses real estate taxes and CAM expenses over a base year. |

| ● | Bank of America has operated at the Property since 2002, originally as a Fleet National Bank branch, and subsequently converted to a Bank of America branch following the companies’ merger in 2004. Bank of America is currently in the second renewal phase of its original lease which was extended to approximately 12.5 years ending 7/31/2032. Bank of America has one remaining extension option for an additional five years. |

New York SMSA Limited Partnership (VERIZON) (BBB+ / 6,500 SF / 2.4% of NRA / 10.0% of UW Gross Rent / LXD in October 2035) |  |

| ● | Verizon Communications Inc. (NYSE, Nasdaq: VZ) is one of the world's leading providers of technology and communications services. The company offers voice, data and video services and solutions on its networks and platforms, delivering on customers' demand for mobility, reliable network connectivity, security, and control. Verizon was the first mobile operator in the world to launch commercial 5G network. Headquartered in New York City, with a presence internationally, Verizon generated $136.8bn in revenue with a net income of $21.2bn in 2022. |

| ● | Verizon occupies two retail suites (0109B and 0101M), totaling 6,500 SF with a remaining lease term of 11.1 years. Additionally, Verizon reimburses real estate taxes over a base year. |

| ● | Verizon’s lease was originally structured for 10-and-a-half years commencing on 4/15/2015 and expiring on 10/31/2025. In May 2024, the Tenant negotiated a 10-year extension through 10/31/2035. |

| ● | Verizon recently invested in their store by performing a renovation of the interior and storefront at their own expense, which is outlined in the May 2025 lease amendment/extension. |

| Strictly private and confidential | Herald Center |

The Educational and Cultural Trust Fund of The Electrical Industry (JIBEI) (29,279 SF / 11.0% of NRA / 4.6% of UW Gross Rent / LXD in Dec 2045) |  |

| ● | JIBEI is a joint-management cooperative organization by the International Brotherhood of Electrical Workers Local Union No. 3 and the National Electrical Contractors Association enacted to promote cohesion between employers and employees, administer benefits for members and their families, and improve the electrical construction industry through progressive management, education, training, and advanced technology. The organization provides educational benefits to over 70,000 members within the jointly administered plans and programs managed by JIB. |

| ● | Starting in April 2023 JIBEI occupies the entire fourth floor of the Subject for their school (suite 0400A) comprising of 29,279 SF with rent increases of 8.0% every five years. Along with the fourth floor, JIBEI will have a separate entrance for their space. JIBEI reimburses real estate taxes and CAM over a base year and recently signed a 2-year lease which commences in April 2023. |

| Strictly private and confidential | Herald Center |

Property Overview (Retail Sales)

| Tenant | SF | 2019 | PSF | 2020 | PSF | 2021 | PSF | 2022 | PSF | 2023 | PSF | August 2024 T12 | PSF |

| H&M Hennes & Mauritz Inc | 62,800 | $40,438,633 | $643.93 | $15,100,287 | $240.45 | $25,415,123 | $404.70 | $29,774,991 | $474.12 | $27,154,502 | $432.40 | $28,224,919 | $449.44 |

Strong Recovery in Anchor Sales

| ● | In 2020, H&M’s sales PSF at the property were $240.45. H&M has since had sales of $473.65 PSF in 2022, $432.40 PSF in 2023 and $449.44 in the August 2024 T12 period, nearly doubling 2020 totals. |

| ● | The rapid recovery of this major tenant demonstrates the Property’s long-term viability in the Penn Plaza/Garment submarket. The Property’s new leasing of JIBEI also shows that this recovery is not only applicable to retail tenants at the Property, as the wide array of public transportation around the Property allows for easy access for commuters to office tenants as well. |

| ● | Anecdotally, the Sponsor provided correspondence from a representative of H&M who confirmed that this location is one of the top performing stores in terms of sales and they have plans to make significant investment in the store in the future. Please see exhibit B. |

Anchor’s Unrivaled Signage and Commitment to the New York Market

| ● | The prime location and unrivaled signage visibility offers the largest tenant, H&M, tremendous value above the strong sales performance. H&M’s signage and facade spans the entirety of Broadway between 34th and 35th street in addition to signage on the corner 35th street directly across the flagship Macy’s store. The visibility of the storefront in such a highly trafficked area of New York City offers significant brand marketing value to the tenant over the store’s sales performance. This type of advertising for the brand cannot be replicated at many other locations across the world. |

| ● | H&M’s location at Herald Center is the brand’s largest store in the world at 62,800 SF and is H&M’s flagship location. This location is almost 6,000 SF larger than H&M’s prior largest store, also located in New York City at 589 Fifth Avenue. |

| ● | Currently, there are 9 H&M locations throughout Manhattan. H&M continues to expand in this market with a 10th store opening soon after the announcement of a new 18,359 SF lease in SoHo. |

| ● | Sales PSF at Herald Center in 2023 still outpaced pre-pandemic averages for all H&M locations. According to Retail Maxim, from 2015 to 2019, H&M’s average sales PSF was $300.80, 30% lower than the $432.40 PSF at the Property. |

Retail Sales Growth in Manhattan

| ● | Total sales for Q2 2024 were up 19.5% from the same period a year ago. With brand name tenants such as H&M, Verizon, and Bank of America, the Property stands to benefit from this macroeconomic growth as consumers continue to spend more in prime retail corridors such as Herald Square. |

| ● | New York City’s tourism board anticipates approximately 64.5 million travelers arriving in Manhattan in 2024 – an 8% increase in domestic travelers and a 15% increase in international visitors compared to 2023. The long-term outlook for Retail in Manhattan is encouraging, with a 2024 forecast that is roughly in line with the 10-year pre-pandemic average annual sales growth of 3.6%. |

| Strictly private and confidential | Herald Center |

Property Overview (Rollover Profile)

Lease Rollover

| ● | The Property’s rent roll exhibits a weighted average remaining lease term of 25.1 years. 2 antenna tenants representing 0.6% of UW base rent will roll before 2029. |

| ● | The Property is well-positioned to capitalize on the Penn Plaza/Garment recovery as leasing activity continues to rise. Herald Square’s redevelopment to promote increased foot traffic provides a favorable outlook on tenancy in this market. Based on indicators from the first quarter of 2024, nearby Times Square foot traffic has reached 86% of pre-pandemic levels with 23.6 million visitors, a nearly 6% increase compared to Q1 2023. |

| ● | The Property’s rollover schedule is outlined in the chart below: |

| Year | SF | % of SF | Cumulative % of SF | UW Total Rent (1) | UW Total Rent PSF | % of UW Total Rent |

| Vacant | 5,692 | 2.1% | 2.1% | $0 | $0.00 | 0.00% |

| 2024 | 0 | 0.0% | 2.1% | $0 | $0.00 | 0.00% |

| 2025 | 0 | 0.0% | 2.1% | $0 | $0.00 | 0.00% |

| 2026 | 100 | 0.0% | 2.2% | $109,868 | $1,098.68 | 0.29% |

| 2027 | 0 | 0.0% | 2.2% | $0 | $0.00 | 0.00% |

| 2028 | 210 | 0.1% | 2.2% | $129,828 | $618.23 | 0.34% |

| 2029 | 0 | 0.0% | 2.2% | $0 | $0.00 | 0.00% |

| 2030 | 0 | 0.0% | 2.2% | $0 | $0.00 | 0.00% |

| 2031 | 0 | 0.0% | 2.2% | $0 | $0.00 | 0.00% |

| 2032 | 5,293 | 2.0% | 4.2% | $3,750,022 | $708.49 | 9.80% |

| 2033 | 0 | 0.0% | 4.2% | $0 | $0.00 | 0.00% |

| 2034 | 2,308 | 0.9% | 5.1% | $413,700 | $179.25 | 1.08% |

| >2034 | 253,604 | 94.9% | 100.0% | $33,880,040 | $133.59 | 88.50% |

| Total / W.A | 267,207 | 100.0% | 100.0% | $38,283,458 | $146.39 | 100.00% |

| (1) Inclusive of In-Place Base Rent, Rent Steps, Recoveries, and Straight-line Rent | |

| Strictly private and confidential | Herald Center |

Table of Contents

| Executive Summary | Page 7 |

| | |

| Investment Highlights | Page 13 |

| | |

| Property Overview | Page 16 |

| | |

| Lender Underwriting | Page 28 |

| | |

| Market Overview | Page 32 |

| | |

| Appraisal Summary | Page 39 |

| | |

| Summary of Loan Terms | Page 49 |

| | |

| Sponsor Overview | Page 53 |

| Strictly private and confidential | Herald Center |

Lender Underwriting

HERALD CENTER

Cash Flow Analysis | 2022 Actual | $/SF | 2023 Actual | $/SF | Aug TTM Actual | $/SF | Year 1 Proforma | $/SF | Year 4 Proforma | $/SF | Year 1 - As Is Appraisal | $/SF | Year 1 - As Stabilized Appraisal | $/SF | BMO Capital Markets Stabilized Underwriting | $/SF |

| Occupancy | | | | | | | | | 100.0% | | 100.0% | | 100.0% | | 98.6% | |

| | | | | | | | | | | | | | | | | |

| Gross Potential Rent (H&M) | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $18,232,724 | $68.23 |

| Gross Potential Rent (YESHIVA UNIVERSITY - 7/1/2025) | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $2,651,975 | $9.92 |

| Gross Potential Rent (YESHIVA UNIVERSITY - 7/1/2026) | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $2,185,500 | $8.18 |

| Gross Potential Rent (YESHIVA UNIVERSITY - 7/1/2027) | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $2,448,700 | $9.16 |

| Gross Potential Rent (Others) | $33,715,691 | $126.18 | $27,733,867 | $103.79 | $29,158,635 | $109.12 | $36,006,993 | $134.75 | $36,943,745 | $138.26 | $28,327,374 | $106.01 | $36,363,253 | $136.09 | $8,965,113 | $33.55 |

| Rent Steps | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $1,300,342 | 4.87 |

| Reimbursement Income | $2,323,932 | 8.70 | $548,975 | 2.05 | $701,108 | 2.62 | $1,013,094 | 3.79 | $2,371,662 | 8.88 | $795,341 | 2.98 | $1,805,749 | 6.76 | $2,126,340 | 7.96 |

| Straight Line Rent | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $372,764 | 1.40 |

| Gross Revenue | $36,039,623 | $134.88 | $28,282,842 | $105.85 | $29,859,742 | $111.75 | $37,020,087 | $138.54 | $39,315,407 | $147.13 | $29,122,715 | $108.99 | $38,169,002 | $142.84 | $38,283,458 | $143.27 |

| | | | | | | | | | | | | | | | | |

| Bad Debt | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 | $0 | 0.00 |

| | | | | | | | | | | | | | | | | |

| Actual Vacancy | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | ($7,183,928) | -19.4% | $0 | 0.0% | ($492,079) | -1.7% | ($405,615) | -1.1% | $0 | 0.0% |

| Underwriting Vacancy | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | ($535,473) | -1.4% |

| Total Vacancy | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% | ($7,183,928) | -19.4% | $0 | 0.0% | ($492,079) | -1.7% | ($405,615) | -1.1% | ($535,473) | -1.4% |

| | | | | | | | | | | | | | | | | |

| Net Rental Collections | $36,039,623 | $134.88 | $28,282,842 | $105.85 | $29,859,742 | $111.75 | $29,836,159 | $111.66 | $39,315,407 | $147.13 | $28,630,636 | $107.15 | $37,763,387 | $141.33 | $37,747,985 | $141.27 |

| | | | | | | | | | | | | | | | | |

| Other Income (U & O) | $499,577 | $1.87 | $325,465 | $1.22 | $446,687 | $1.67 | $44,908 | $0.17 | $49,072 | $0.18 | $388,144 | $1.45 | $424,672 | $1.59 | $49,072 | $0.18 |

| | | | | | | | | | | | | | | | | |

| Total Income | $36,539,200 | $136.74 | $28,608,307 | $107.06 | $30,306,429 | $113.42 | $29,881,067 | $111.83 | $39,364,479 | $147.32 | $29,018,780 | $108.60 | $38,188,059 | $142.92 | $37,797,057 | $141.45 |

| | | | | | | | | | | | | | | | | |

| Real Estate Taxes | $5,306,836 | $19.86 | $6,043,289 | $22.62 | $6,464,057 | $24.19 | $3,529,676 | $13.21 | $4,179,865 | $15.64 | $4,850,773 | $18.15 | $4,146,597 | $15.52 | $5,258,148 | $19.68 |

| Insurance | $354,262 | 1.33 | $343,751 | 1.29 | $383,294 | 1.43 | $364,803 | 1.37 | $398,630 | 1.49 | $365,000 | 1.37 | $398,845 | 1.49 | $432,972 | 1.62 |

| Management Fee | $730,321 | 2.0% | $824,791 | 2.9% | $850,421 | 2.8% | $597,621 | 2.0% | $787,290 | 2.0% | $170,000 | 0.6% | $185,764 | 0.5% | $1,133,912 | 3.0% |

| Utilities | $770,347 | 2.88 | $701,177 | 2.62 | $795,022 | 2.98 | $813,182 | 3.04 | $1,316,771 | 4.93 | $820,000 | 3.07 | $896,035 | 3.35 | $1,316,771 | 4.93 |

| Repairs and Maintenance | $1,122,650 | 4.20 | $1,096,988 | 4.11 | $1,149,460 | 4.30 | $1,076,731 | 4.03 | $1,280,867 | 4.79 | $1,075,000 | 4.02 | $1,174,681 | 4.40 | $1,280,867 | 4.79 |

| Cleaning | $292,613 | 1.10 | $271,690 | 1.02 | $353,830 | 1.32 | $337,429 | 1.26 | $368,718 | 1.38 | $325,000 | 1.22 | $355,136 | 1.33 | $368,718 | 1.38 |

| Payroll and Related | $788,546 | 2.95 | $896,939 | 3.36 | $860,980 | 3.22 | $591,466 | 2.21 | $646,311 | 2.42 | $600,000 | 2.25 | $655,636 | 2.45 | $646,311 | 2.42 |

| General and Administrative | $148,251 | 0.55 | $191,203 | 0.72 | $174,835 | 0.65 | $141,588 | 0.53 | $154,717 | 0.58 | $125,000 | 0.47 | $136,591 | 0.51 | $154,717 | 0.58 |

| Total Expenses | $9,513,825 | $35.60 | $10,369,830 | $38.81 | $11,031,899 | $41.29 | $7,452,496 | $27.89 | $9,133,170 | $34.18 | $8,330,773 | $31.18 | $7,949,285 | $29.75 | $10,592,417 | $39.64 |

| Expense Reimbursement Ratio | 24.4% | | 5.3% | | 6.4% | | 13.6% | | 26.0% | | 9.5% | | 22.7% | | 20.1% | |

| Expense Ratio | 26.0% | | 36.2% | | 36.4% | | 24.9% | | 23.2% | | 28.7% | | 20.8% | | 28.0% | |

| | | | | | | | | | | | | | | | | |

| Net Operating Income | $27,025,375 | $101.14 | $18,238,477 | $68.26 | $19,274,531 | $72.13 | $22,428,571 | $83.94 | $30,231,309 | $113.14 | $20,688,007 | $77.42 | $30,238,774 | $113.17 | $27,204,641 | $101.81 |

| | | | | | | | | | | | | | | | | |

| Tenant Improvements | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $13,535,000 | $50.65 | $0 | $0.00 | $0.00 | $0.00 |

| Leasing Commissions | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $3,158,778 | $11.82 | $0 | $0.00 | $0.00 | $0.00 |

| Capital Expenditure | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $550,778 | $2.06 | $0 | $0.00 | $0.00 | $0.00 |

| Replacement Reserves | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $133,449 | $0.50 | $145,823 | $0.55 | $53,441 | $0.20 |

| Total Leasing & Capital Cost | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $0 | $0.00 | $17,378,005 | $65.04 | $145,823 | $0.55 | $53,441 | $0.20 |

| | | | | | | | | | | | | | | | | |

| Net Cash Flow | $27,025,375 | $101.14 | $18,238,477 | $68.26 | $19,274,531 | $72.13 | $22,428,571 | $83.94 | $30,231,309 | $113.14 | $3,310,002 | $12.39 | $30,092,951 | $112.62 | $27,151,200 | $101.61 |

| Strictly private and confidential | Herald Center |

Lender Underwriting (continued)

Underwriting Notes

| 1. | Base Rent: UW to the in-place RR. |

| 2. | Step Rent: Rent steps taken through 1/1/2026. |

| 3. | CAM Recoveries*: UW to the calculated recoveries based on in-place leases. Includes Real Estate Taxes, CAM, and inflated submetered Utilities. Real Estate Tax recoveries were calculated utilizing the average of the Sponsor's Budgeted tax figures for the full building across the loan term. |

| 4. | Straight Line Rent: IG tenants credit rent through the loan term. |

| 5. | Underwriting Vacancy: Based on Vacancy Assumption of 5.0% for all tenants other than H&M, Verizon and Bank of America, which were excluded from the vacancy calculation because they are IG credits. |

| 6. | Management Fee: 3.0% of Effective Gross Income. |

| 7. | Variable Expenses: UW to the Year 4 Proforma amount, which is the assumed year of stabilization as Yeshiva will be paying rent and reimbursements on all three tranches of their space. |

| 8. | Real Estate Taxes*: UW to the average of Lender’s tax and condominium counsel’s (Rosenberg Estis) estimated calendar year taxes across the loan term plus the Appraiser’s estimate of the BID tax. According to the leasehold condominium documents and the Temporary Occupancy Agreement, Yeshiva University will be responsible for 50.6226% of the total building Real Estate Tax burden until such time that the two condominiums are assessed separately. Lender tax and condominium counsel estimates that the two condominiums will be separately assessed starting in the 2026/2027 tax year. It is expected that Yeshiva University will apply for and receive a 100% tax exemption from New York City for the amount owed on their condominium. |

| 9. | Insurance: UW to the actual insurance premium grown at 3%. |

| 10. | Replacement Reserves: $0.20 PSF. |

| Strictly private and confidential | Herald Center |

*Rosenberg Estis is outside tax and condominium council hired by Lender to provide an expert opinion on how the Real Estate Taxes might be assessed by the Department of Finance when the two newly formed condominiums are assessed separately. Rosenberg Estis projected that the retail condominium would see a substantial increase in assessed value and therefore, real estate tax expense, starting in the 2026/2027 tax year. This projected increase in the assessed value would be phased in over the next 5 tax years. The Sponsor and their tax experts at Marcus Pollack disagree with the timing and magnitude of the increase in assessed value projected by Rosenberg Estis.

The tenants other than Yeshiva reimburse Real Estate Taxes based on the Real Estate Tax expense for the entire building over a base year. BMO utilized the Rosenberg Estis estimate for the UW Real Estate Tax expense and calculated Real Estate Tax recoveries using the Sponsors budgeted Real Estate Tax expense, which is lower and results in lower recoveries than if BMO utilized the Rosenberg Estis estimates to calculate Real Estate Tax recoveries. If BMO utilized the average of the Sponsors budgeted Real Estate Taxes for the UW Real Estate Tax expense, the underwritten net cashflow would result in a debt yield of 9.5%.

| Strictly private and confidential | Herald Center |

Table of Contents

| Executive Summary | Page 7 |

| | |

| Investment Highlights | Page 13 |

| | |

| Property Overview | Page 16 |

| | |

| Lender Underwriting | Page 28 |

| | |

| Market Overview | Page 32 |

| | |

| Appraisal Summary | Page 39 |

| | |

| Summary of Loan Terms | Page 49 |

| | |

| Sponsor Overview | Page 53 |

| Strictly private and confidential | Herald Center |

Market Overview

New York - MSA

The Property is situated in the New York Metropolitan Statistical Area (MSA), which encompasses New York City and its surrounding areas. The MSA is a vast region that includes five counties at the mouth of the Hudson River in the southeastern area of New York State. These counties are Manhattan, Brooklyn, Queens, Staten Island, and the Bronx, also known as New York, Kings, Queens, Richmond, and Bronx counties, respectively. By population, the NYC MSA is the largest in the country consisting of 19.0 million people in 13,318 square miles.

The city has a well-integrated network of highways with a well-developed mass transportation system. Vehicular transportation in the region and the borough is facilitated through a network of highways while the Metropolitan Transit Authority operates a rail and bus network. Two of the area’s airports, LaGuardia and JFK International Airports are both located within Queens. Within Manhattan, of the two major business areas, Midtown is an easier commute than downtown due to its proximity to the commuter train system. While driving is the primary mode of transportation surrounding New York City, Manhattan is primarily travelled by means of the mass transportation system, specifically through subways. The Long Island Expressway, the Grand Central Parkway, and the Belt Parkway are main thoroughfares for drivers in the surrounding area. The Triborough Bridge, Queensboro, Brooklyn Bridge, Williamsburg Bridge, Manhattan Bridge, Midtown Tunnel and Brooklyn-Battery Tunnel provide drivers direct access to Manhattan.

New York City is the economic, cultural, and geographical center of the metropolitan area. It consists of five distinct boroughs, each with its unique character and attractions. Manhattan, where the Property is located, is one of the most iconic and vibrant boroughs, known for its world-famous landmarks and bustling business districts. While NYC is renowned for its diverse range of industries, it primarily serves as the financial capital of the world. It houses major financial institutions, including the New York Stock Exchange and NASDAQ Stock Market. Wall Street, located in Lower Manhattan, is the epicenter of global finance and home to numerous investment banks, brokerage firms, and commercial banking institutions such as Citigroup, JPMorgan Chase, Goldman Sachs, Barclays, and Bank of America.

In addition to finance, the MSA boasts a thriving economy in sectors such as international trade, media, real estate, education, fashion, entertainment, tourism, biotechnology, and manufacturing. The area is home to prestigious institutions of higher education, including Columbia University (36,649 students), New York University (51,123 students), Juilliard (939 students), and St. John’s University (20,448 students) which are globally renowned for their academic excellence.

New York City's economy is predominantly service-oriented, with approximately 95% of current employment within the service producing sector.

As of July 1st, 2024, New York City had an estimated population of 19.0 million, representing a 0.51% increase from 2023. Manhattan experienced a 3.6% increase in population between 2010 and 2020, and it is expected to have the second-highest population increase among the boroughs, with a projected 1.6% growth in the next five years.

The subject is in the Penn Station/Garment neighborhood of Manhattan, which borders the neighborhoods of Grand Central and Times Square. The area benefits from proximity to major demand generators such as Bryant Park, Times Square, and Rockefeller Center and its accessibility via multiple subway and bus lines. Midtown Manhattan is the central part of the NYC borough of Manhattan and is home to the city’s primary business district. Attractions in the area include the Empire State Building, the Chrysler Building, the Hudson Yards Redevelopment Project, the headquarters of the United Nations,

| Strictly private and confidential | Herald Center |

Grand Central Terminal, and Rockefeller Center. Other tourist destinations consist of Broadway, Times Square, and Koreatown. The majority of the city’s skyscrapers, including its tallest hotels and apartment towers, are in Midtown. The area is home to the headquarters of Barnes and Noble, Bloomberg L.P., Ernst and Young, Calvin Klein, Cantor Fitzgerald, CBS Corporation, Citigroup, Colgate Palmolive, Cushman and Wakefield, DC Comics, Deloitte, Duane Reade, Estée Lauder Companies, Foot Locker, Frederator Studios, JPMorgan Chase, Hess Corporation, and other multinational groups.

With its diverse economy, extensive transportation network, and rich cultural scene, the New York Metropolitan Statistical Area provides a dynamic and vibrant environment for businesses and residents alike. The area's constant innovation, global influence, and unparalleled opportunities make it one of the most important economic regions in the world.

Herald Center is in the iconic Herald Square, a major public and commercial hub in New York City. Located in a prime position within the neighborhood, the Property benefits from its direct access to major subway lines and proximity to the rest of Manhattan. According to CoStar, within five miles of the property, there is an estimated population of 2,751,982 with a median household income of $101,351.

| Strictly private and confidential | Herald Center |

Market Overview (continued)

New York Retail Market Overview

The New York retail market is in one of its tightest fundamental positions on record at the start of 2Q24. Steady levels of demand and limited new supply have resulted in availability creeping downward over the past three years.

As of Q2 2024, the New York retail market had a total inventory of 644,611,317 SF, with 2,215,931 SF currently under construction, more than half of which are expected to be delivered within the next year, while the Penn Plaza/Garment submarket has 0 SF under construction. The overall vacancy rate was 4.1% and the overall average asking rent was $47.10 PSF. Vacancy levels are forecast to remain stable over the next 12 months.

Overall, the vacancy rate increased by 10 bps from YE 2022 to 4.1%, which historically, is in-line with the 5-year average of 4.5%. As of 2Q24, the overall asking rental rate decreased by $0.2 (or 0.4%) since YE 2023 to $46.10 PSF but is projected to increase to $46.97 PSF in 2024, and then continue to steadily increase through 2028 to $49.83 PSF. Rents are projected to continue ticking upward as vacancy levels are expected to remain stable.

Despite a projected slowdown in economic growth in 2024, absorption levels over the next 12 months are forecast to remain positive, with the availabilities ticking downward and continued rent growth observed over this span. Positive absorption is expected with an annual average absorption of 1.6 million SF between 2024-2028. This sustained positive absorption and minimal new supply are projected to keep vacancy levels stable over the long term.

New York has one the largest supply pipelines of all U.S. metros at 2.3 million SF, though it should be noted that construction activity has moderated considerably in recent years. Strong pre-leasing activity in new projects has suppressed the vacancy rate in previous years, but lease-up progress has been, and likely will continue at a slow pace, despite the retail sector improving over the past 12 months. The largest project underway is Glenwood Green, a 360,000-SF shopping center in Old Bridge, New Jersey, being developed by Regency Centers. The project appears to be leasing up ahead of its 2024 delivery, with large commitments made by Target (134,000 SF), Rendina (72,000 SF), and Shoprite (80,000 SF.).

Market participants have noted a marked improvement in business conditions across New York City. The Big Apple continues to benefit from rising foot traffic, which is supported by year-over-year increases across mass transit ridership, hotel occupancies, tourism visits, rising office utilization rates, increased business formations and continued hiring across the retail sector. NYC reported 62 million visitors in 2023 with an expected 64 million in 2024, closing the gap on the record setting 2019 with 66.6 million visitors. This has also led to notable improvements across mass-transit ridership and hotel occupancies.

| Strictly private and confidential | Herald Center |

New York Office Market Overview

The Property is located within the New York office market. The top three submarkets by inventory (SF) are World Trade Center, Penn Plaza/Garment, and Grand Central.