Filed by Bird Global, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Bird Global, Inc.

Registration No. 333-256187

Date: June 24, 2021

Bird Research Analyst Day June 24, 2021

Important Information About the Proposed Transaction and Where to Find It In connection with the proposed business combination, Bird Global, Inc. (“Bird Global”) filed a registration statement on Form S-4 (File No. 333-256187) (the “Form S-4”) with the Securities and Exchange Commission (the “SEC”). The Form S-4 includes a proxy statement of Switchback II Corporation (“Switchback”) and a prospectus of Bird Global. Additionally, Switchback II and Bird Global filed and will file other relevant materials with the SEC in connection with the business combination. Copies may be obtained free of charge at the SEC’s web site at www.sec.gov. Security holders of Switchback are urged to read the proxy statement/prospectus and the other relevant materials before making any voting decision with respect to the proposed business combination because they contain important information about the business combination and the parties to the business combination. The information contained on, or that may be accessed through, the websites referenced in this communication is not incorporated by reference into, and is not a part of, this presentation. Participants in the Solicitation Switchback and its directors and officers may be deemed participants in the solicitation of proxies of Switchback’s shareholders in connection with the proposed business combination. Bird Rides, Inc. (“Bird”) and its officers and directors may also be deemed participants in such solicitation. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Switchback’s executive officers and directors in the solicitation by reading Switchback’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and the proxy statement/prospectus and other relevant materials filed with the SEC in connection with the business combination. Information concerning the interests of Switchback’s participants in the solicitation, which may, in some cases, be different than those of their shareholders generally, is set forth in the proxy statement/prospectus relating to the business combination. Forward-Looking Statements The information in this presentation includes “forward-looking statements.” All statements, other than statements of present or historical fact included in this presentation, regarding Switchback’s proposed business combination with Bird, Switchback’s ability to consummate the transaction, the benefits of the transaction and the combined company’s future financial performance, as well as the combined company’s strategy, future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Switchback and Bird disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this communication. Switchback and Bird caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of either Switchback or Bird. In addition, Switchback and Bird caution you that the forward-looking statements contained in this communication are subject to the following factors: (i) the occurrence of any event, change or other circumstances that could delay the business combination or give rise to the termination of the agreements related thereto; (ii) the outcome of any legal proceedings that may be instituted against Switchback or Bird following announcement of the transactions; (iii) the inability to complete the business combination due to the failure to obtain approval of the shareholders of Switchback, or other conditions to closing in the transaction agreement; (iv) the risk that the proposed business combination disrupts Switchback’s or Bird’s current plans and operations as a result of the announcement of the transactions; (v) Bird’s ability to realize the anticipated benefits of the business combination, which may be affected by, among other things, competition and the ability of Bird to grow and manage growth profitably following the business combination; (vi) costs related to the business combination; (vii) changes in applicable laws or regulations; and (viii) the possibility that Bird may be adversely affected by other economic, business and/or competitive factors. Should one or more of the risks or uncertainties described in this presentation occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Switchback’s periodic filings with the SEC, including Switchback’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and in the Form S-4 filed by Bird Global. Switchback’s and Bird Global’s SEC filings are available publicly on the SEC’s website at www.sec.gov. No Offer or Solicitation This presentation shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed transaction. This shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). INDUSTRY AND MARKET DATA Although all information and opinions expressed in this presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Bird and Switchback have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Bird and Switchback, which are derived from their respective reviews of internal sources as well as the independent sources described above. This presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Bird and Switchback. USE OF PROJECTIONS This presentation contains projected financial information with respect to Bird. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See the “Forward-Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Switchback’s nor Bird’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. Disclaimer

NON-GAAP FINANCIAL MEASURES Some of the financial information and data contained in this Presentation, such as Gross Transaction Value, Adjusted EBITDA, Adjusted EBITDA Margin, Sharing Revenue and Ride Profit, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Switchback and Bird believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Bird’s financial condition and results of operations. Bird’s management uses these non-GAAP measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. Switchback and Bird believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Bird’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Bird’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. TRADEMARKS AND TRADE NAMES Bird and Switchback own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Bird or Switchback, or an endorsement or sponsorship by or of Bird or Switchback. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Bird or Switchback will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Disclaimer (cont’d)

Agenda Renaud Fages SVP, Global Operations Yibo Ling Chief Financial Officer Travis VanderZanden Founder & CEO Scott Rushforth Chief Vehicle Officer Jim Mutrie Founder & CEO Scott McNeill Founder & CEO 1 Company Overview Travis, Founder & CEO 2 Vehicles & Technology Scott, Chief Vehicle Officer 3 Operating Model Renaud, SVP, Global Operations 4 Unit Economics Shane, SVP, Corporate Development & Strategy 5 Financial Outlook Yibo, Chief Financial Officer 6 Management Q&A Shane Torchiana SVP, Corporate Development & Strategy

Company overview

Environmentally friendly transportation for everyone

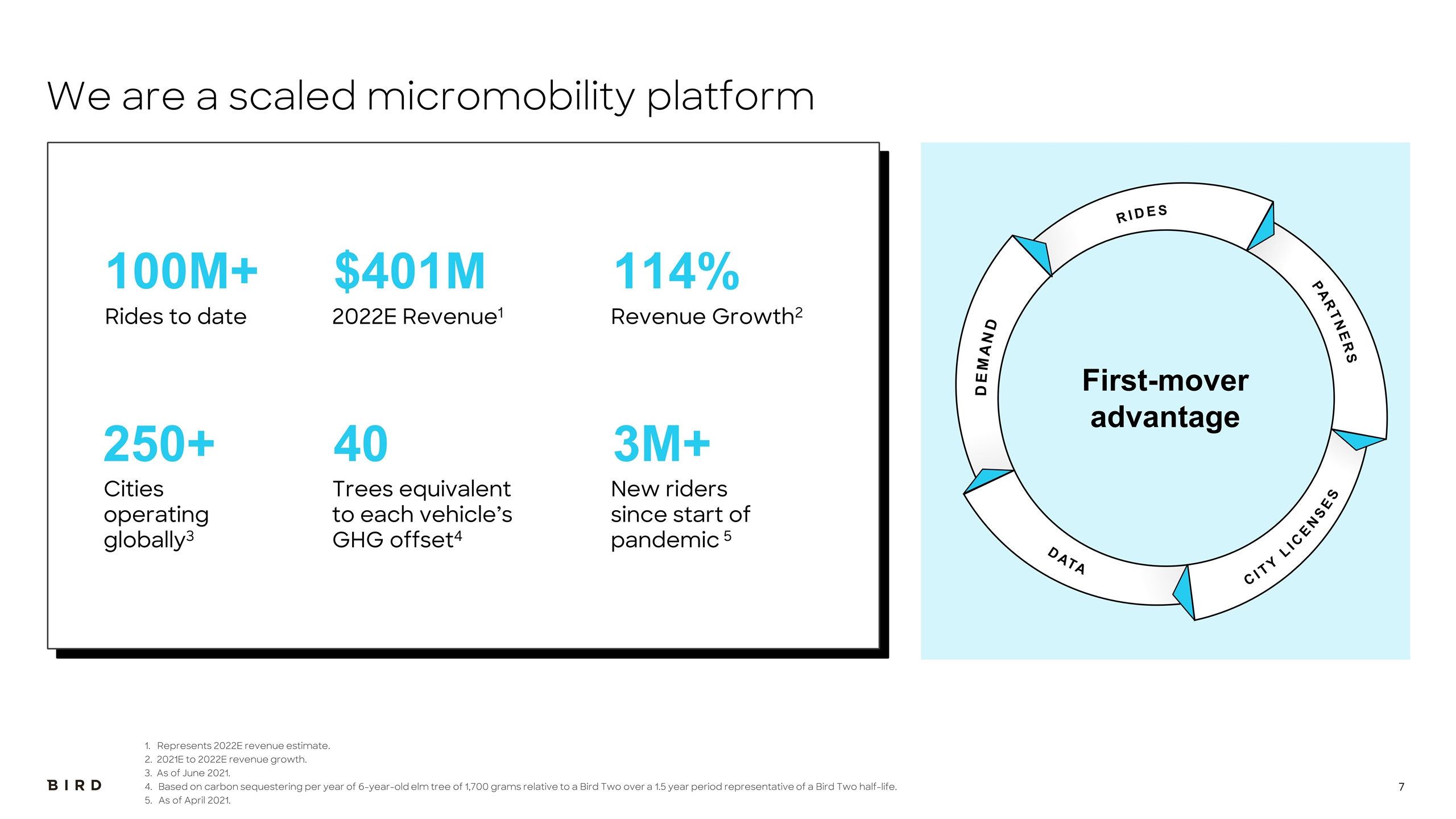

We are a scaled micromobility platform 1. Represents 2022E revenue estimate. 2. 2021E to 2022E revenue growth. 3. As of June 2021. Based on carbon sequestering per year of 6-year-old elm tree of 1,700 grams relative to a Bird Two over a 1.5 year period representative of a Bird Two half-life. As of April 2021. 3M+ 100M+ $401M 114% RIDES PARTNERS DEMAND DATA CITY LICENSES First-mover advantage 250+ Rides to date 2022E Revenue1 Revenue Growth2 Cities operating globally3 40 Trees equivalent to each vehicle’s GHG offset4 New riders since start of pandemic 5

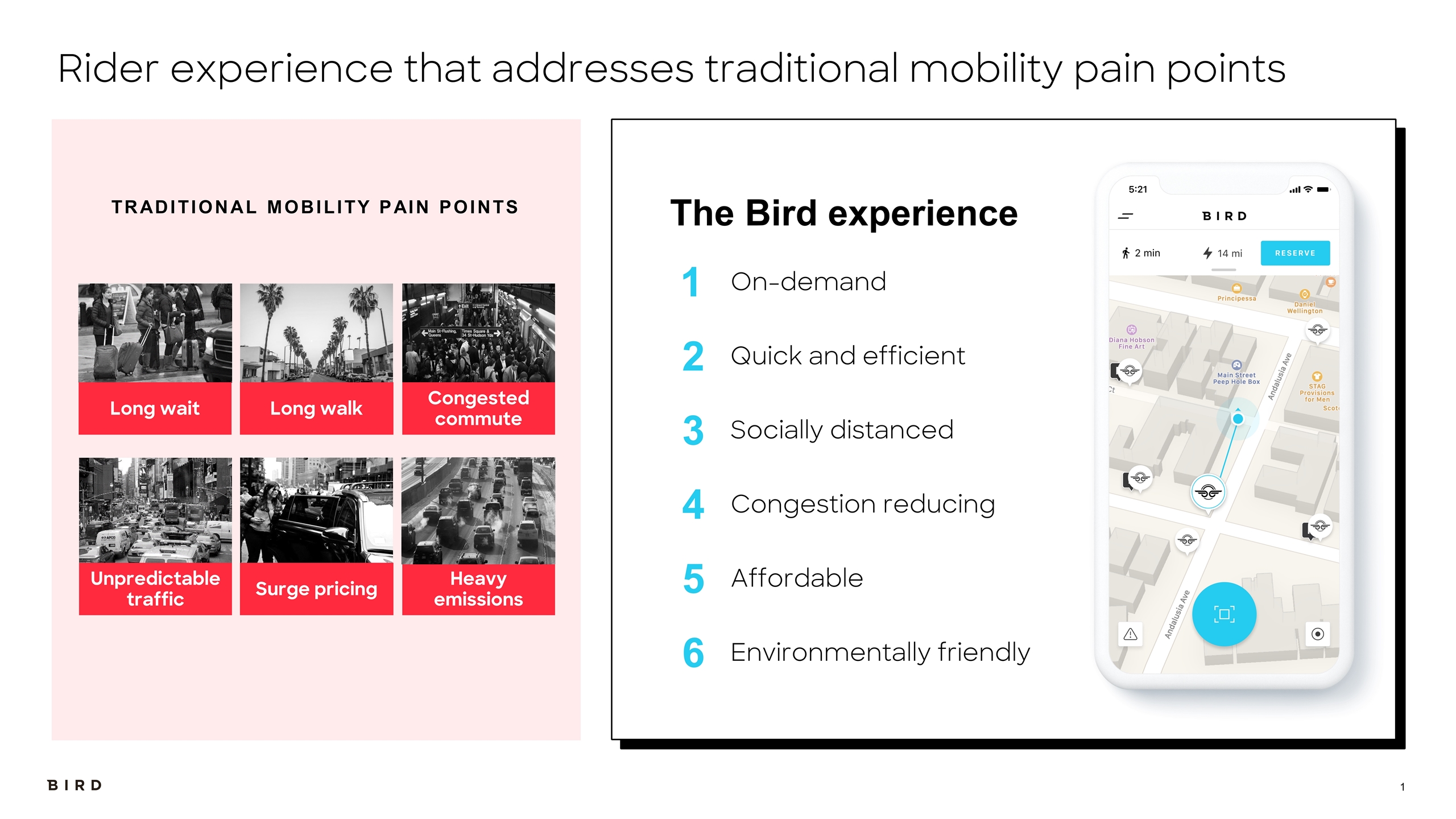

Rider experience that addresses traditional mobility pain points Unpredictable traffic The Bird experience On-demand Affordable Congestion reducing Environmentally friendly Socially distanced Congested commute Long walk Long wait TRADITIONAL MOBILITY PAIN POINTS Heavy emissions Quick and efficient Surge pricing 1 2 3 4 5 6

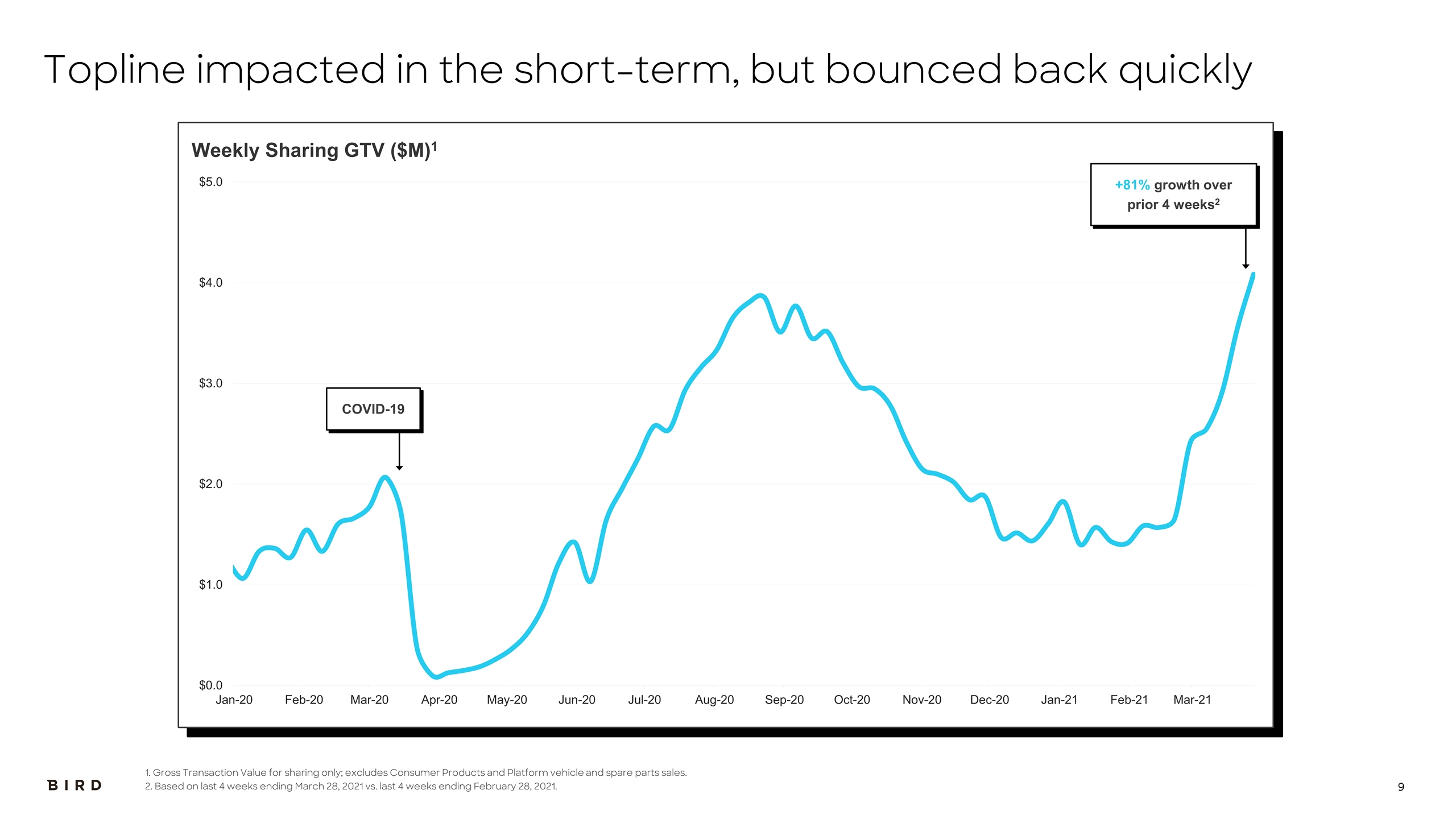

Weekly Sharing GTV ($M)1 Topline impacted in the short-term, but bounced back quickly 1. Gross Transaction Value for sharing only; excludes Consumer Products and Platform vehicle and spare parts sales. 2. Based on last 4 weeks ending March 28, 2021 vs. last 4 weeks ending February 28, 2021. +81% growth over prior 4 weeks2 COVID-19

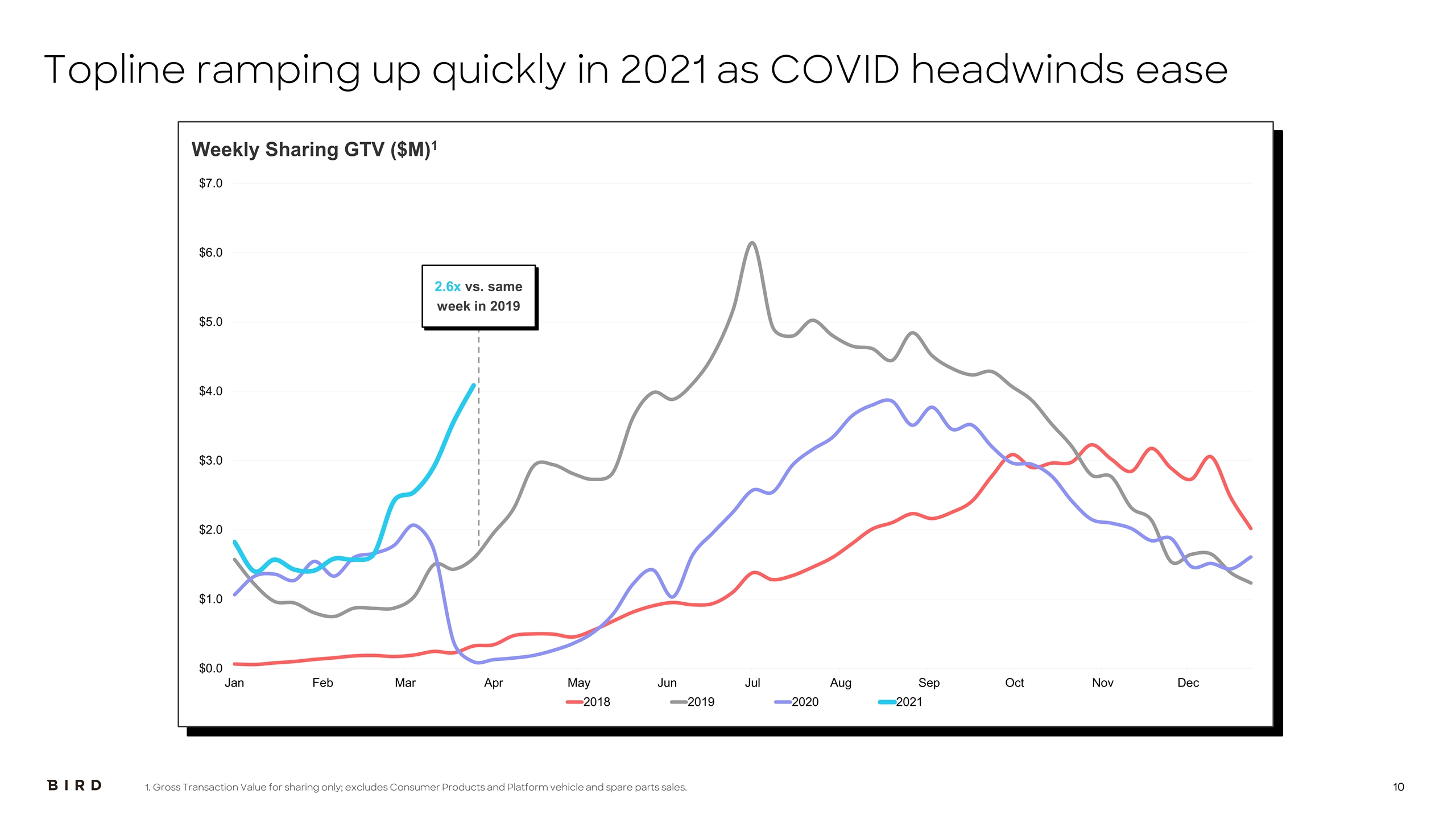

Weekly Sharing GTV ($M)1 Topline ramping up quickly in 2021 as COVID headwinds ease 1. Gross Transaction Value for sharing only; excludes Consumer Products and Platform vehicle and spare parts sales. 2.6x vs. same week in 2019

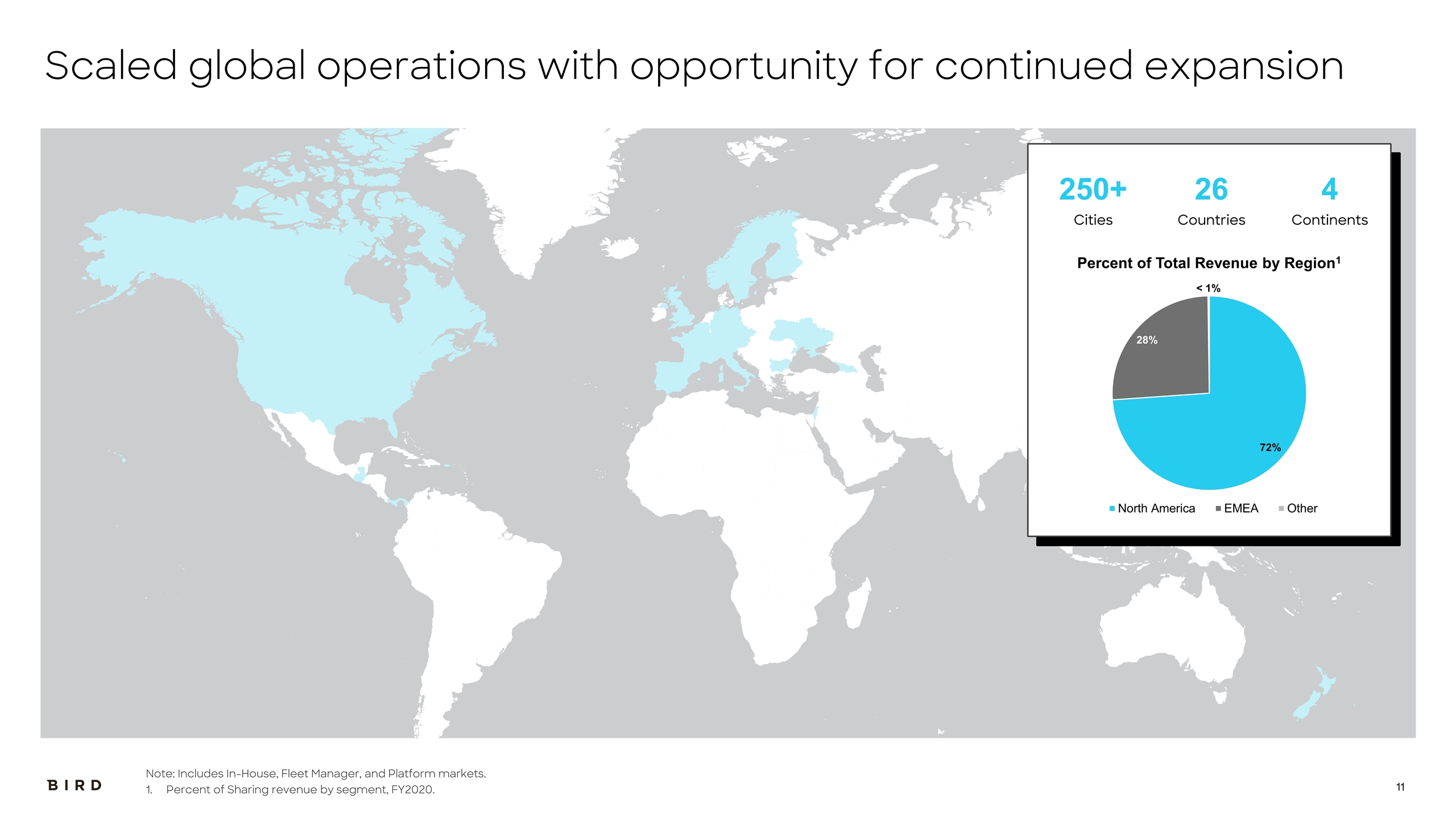

Scaled global operations with opportunity for continued expansion Note: Includes In-House, Fleet Manager, and Platform markets. Percent of Sharing revenue by segment, FY2020. 250+ Cities 26 Countries 4 Continents

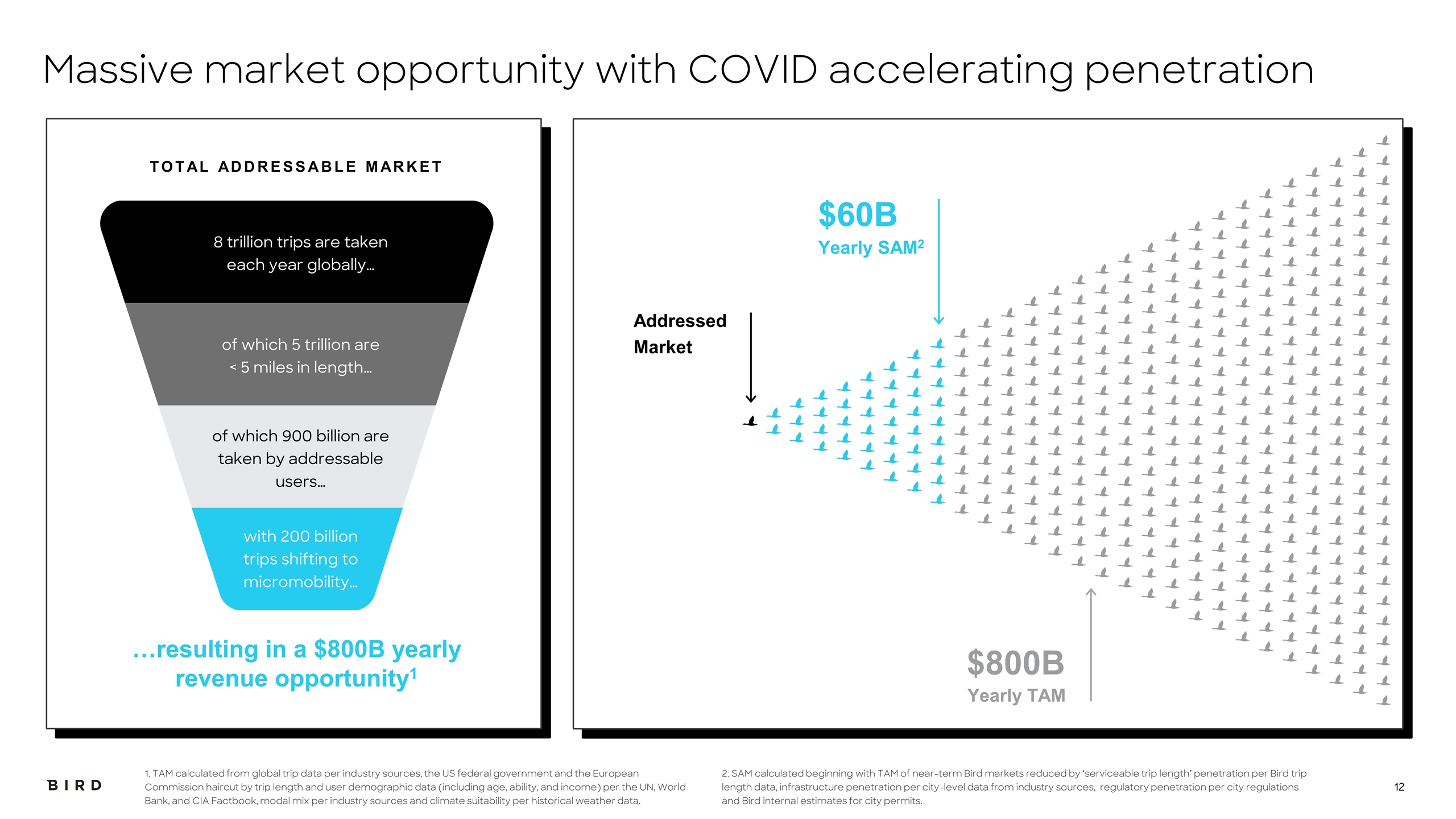

Addressed Market Yearly SAM2 $60B Yearly TAM $800B Massive market opportunity with COVID accelerating penetration 1. TAM calculated from global trip data per industry sources, the US federal government and the European Commission haircut by trip length and user demographic data (including age, ability, and income) per the UN, World Bank, and CIA Factbook, modal mix per industry sources and climate suitability per historical weather data. 2. SAM calculated beginning with TAM of near-term Bird markets reduced by ‘serviceable trip length’ penetration per Bird trip length data, infrastructure penetration per city-level data from industry sources, regulatory penetration per city regulations and Bird internal estimates for city permits. …resulting in a $800B yearly revenue opportunity1 TOTAL ADDRESSABLE MARKET 8 trillion trips are taken each year globally… of which 5 trillion are < 5 miles in length… of which 900 billion are taken by addressable users… with 200 billion trips shifting to micromobility…

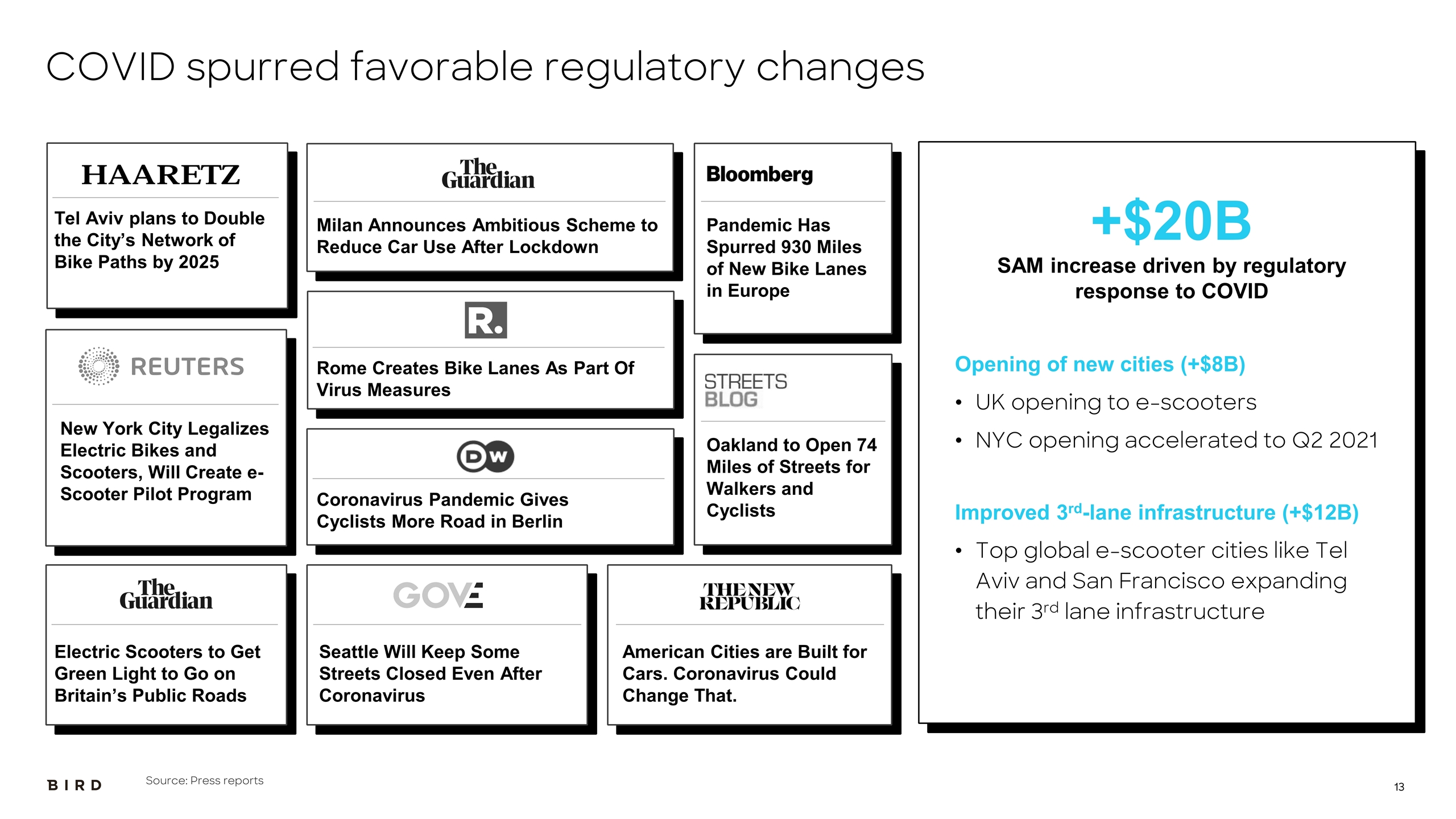

COVID spurred favorable regulatory changes New York City Legalizes Electric Bikes and Scooters, Will Create e-Scooter Pilot Program Electric Scooters to Get Green Light to Go on Britain’s Public Roads Rome Creates Bike Lanes As Part Of Virus Measures Coronavirus Pandemic Gives Cyclists More Road in Berlin Seattle Will Keep Some Streets Closed Even After Coronavirus American Cities are Built for Cars. Coronavirus Could Change That. Oakland to Open 74 Miles of Streets for Walkers and Cyclists Pandemic Has Spurred 930 Miles of New Bike Lanes in Europe Milan Announces Ambitious Scheme to Reduce Car Use After Lockdown Tel Aviv plans to Double the City’s Network of Bike Paths by 2025 Opening of new cities (+$8B) UK opening to e-scooters NYC opening accelerated to Q2 2021 Improved 3rd-lane infrastructure (+$12B) Top global e-scooter cities like Tel Aviv and San Francisco expanding their 3rd lane infrastructure +$20B SAM increase driven by regulatory response to COVID Source: Press reports

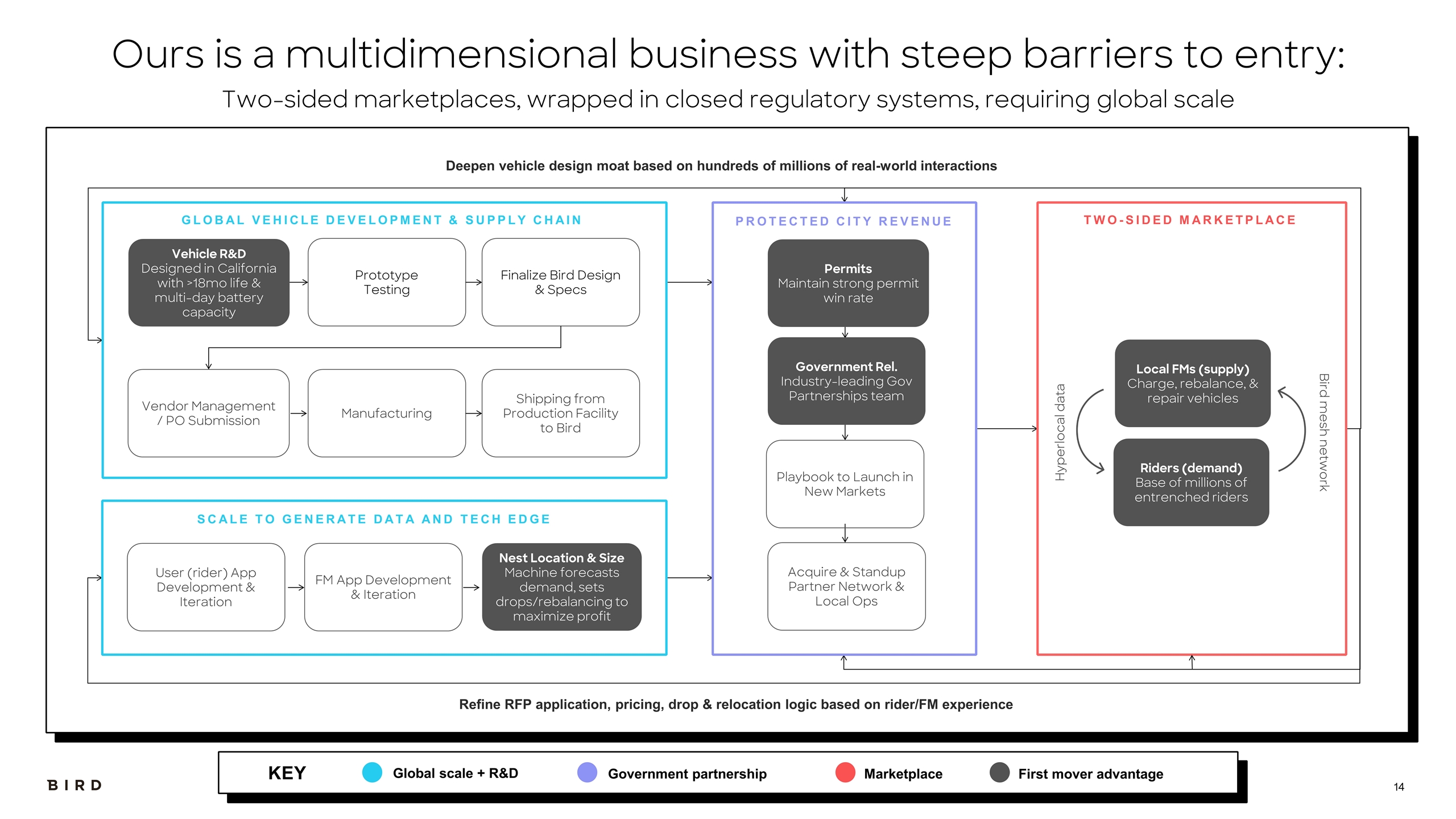

Ours is a multidimensional business with steep barriers to entry: Two-sided marketplaces, wrapped in closed regulatory systems, requiring global scale Deepen vehicle design moat based on hundreds of millions of real-world interactions Refine RFP application, pricing, drop & relocation logic based on rider/FM experience TWO-SIDED MARKETPLACE Acquire & Standup Partner Network & Local Ops PROTECTED CITY REVENUE Government Rel. Industry-leading Gov Partnerships team Playbook to Launch in New Markets Permits Maintain strong permit win rate User (rider) App Development & Iteration SCALE TO GENERATE DATA AND TECH EDGE FM App Development & Iteration Nest Location & Size Machine forecasts demand, sets drops/rebalancing to maximize profit GLOBAL VEHICLE DEVELOPMENT & SUPPLY CHAIN Vehicle R&D Designed in California with >18mo life & multi-day battery capacity Prototype Testing Finalize Bird Design & Specs Vendor Management / PO Submission Manufacturing Shipping from Production Facility to Bird Global scale + R&D Marketplace KEY Government partnership First mover advantage Bird mesh network Hyperlocal data Permits Maintain strong permit win rate Government Rel. Industry-leading Gov Partnerships team Riders (demand) Base of millions of entrenched riders Local FMs (supply) Charge, rebalance, & repair vehicles Nest Location & Size Machine forecasts demand, sets drops/rebalancing to maximize profit Vehicle R&D Designed in California with >18mo life & multi-day battery capacity

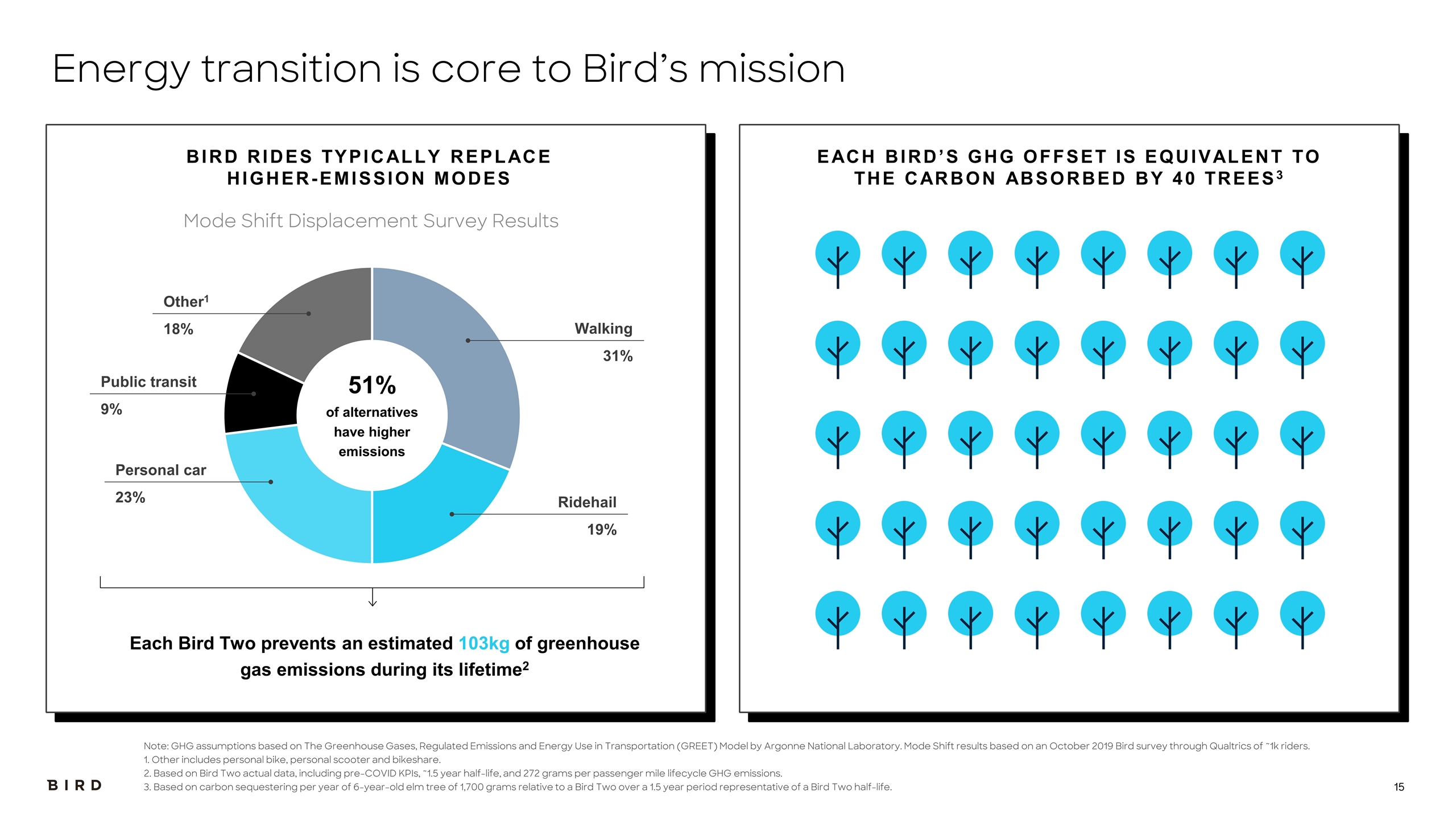

BIRD RIDES TYPICALLY REPLACE HIGHER-EMISSION MODES Mode Shift Displacement Survey Results Walking 31% Ridehail 19% Other1 18% Public transit 9% Personal car 23% Each Bird Two prevents an estimated 103kg of greenhouse gas emissions during its lifetime2 Note: GHG assumptions based on The Greenhouse Gases, Regulated Emissions and Energy Use in Transportation (GREET) Model by Argonne National Laboratory. Mode Shift results based on an October 2019 Bird survey through Qualtrics of ~1k riders. 1. Other includes personal bike, personal scooter and bikeshare. 2. Based on Bird Two actual data, including pre-COVID KPIs, ~1.5 year half-life, and 272 grams per passenger mile lifecycle GHG emissions. 3. Based on carbon sequestering per year of 6-year-old elm tree of 1,700 grams relative to a Bird Two over a 1.5 year period representative of a Bird Two half-life. 51% of alternatives have higher emissions Energy transition is core to Bird’s mission EACH BIRD’S GHG OFFSET IS EQUIVALENT TO THE CARBON ABSORBED BY 40 TREES3

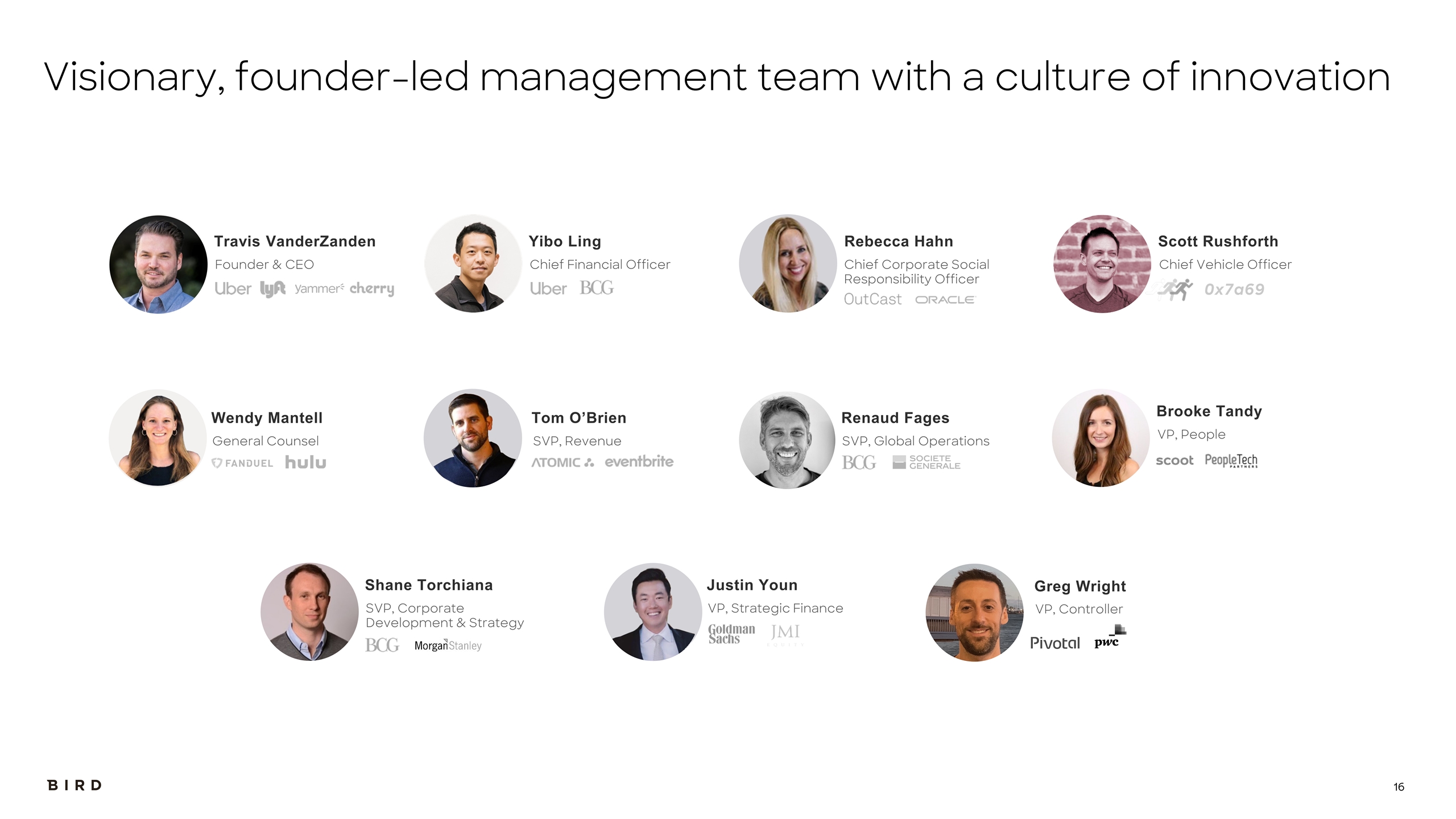

Visionary, founder-led management team with a culture of innovation Wendy Mantell General Counsel Tom O’Brien SVP, Revenue Renaud Fages SVP, Global Operations Justin Youn VP, Strategic Finance Brooke Tandy VP, People Shane Torchiana SVP, Corporate Development & Strategy Travis VanderZanden Founder & CEO Yibo Ling Chief Financial Officer Rebecca Hahn Chief Corporate Social Responsibility Officer 0x7a69 Scott Rushforth Chief Vehicle Officer VP, Controller Greg Wright

Vehicles & Technology

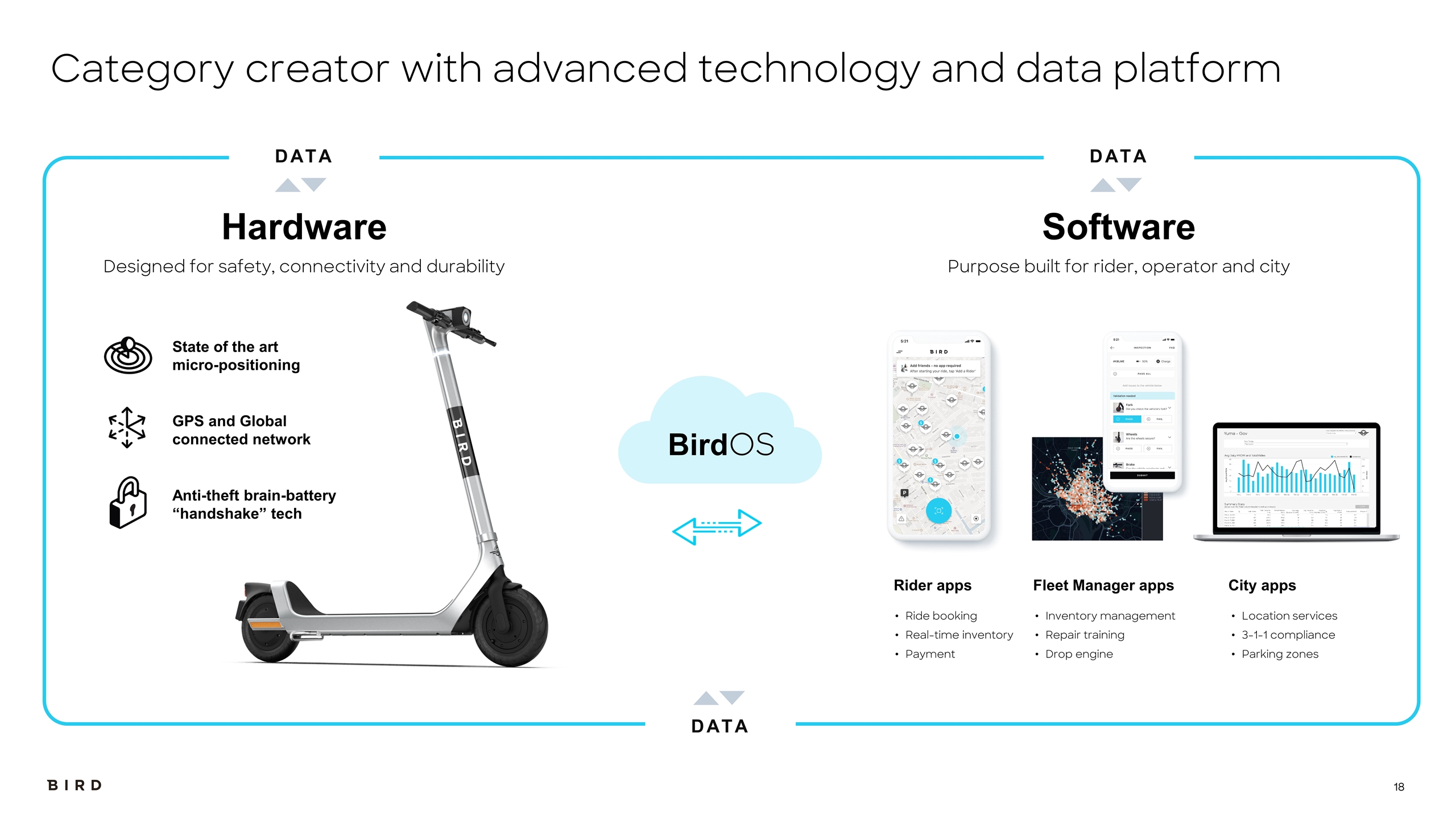

GPS and Global connected network State of the art micro-positioning Hardware Software DATA Rider apps Fleet Manager apps City apps Ride booking Real-time inventory Payment Inventory management Repair training Drop engine Location services 3-1-1 compliance Parking zones Designed for safety, connectivity and durability Purpose built for rider, operator and city Anti-theft brain-battery “handshake” tech DATA Category creator with advanced technology and data platform DATA BirdOS

Xiaomi M365 BirdZero BirdOne VEHICLE HALF-LIFE 3 - 4 months 12 months 14 months 18 months BIRD-DESIGNED OFF THE SHELF BirdTwo 24 months BirdThree KEY INNOVATIONS Oct 2018 Ruggedized for sharing Doubled battery life May 2019 Fully encrypted brain Modular body for easy repairs Mar 2021 Best-in-class safety features Anti-theft firmware and battery-brain encryption Aug 2019 Ultra-rugged fused body Large, efficient battery Note: Bird Zero, Bird One and Bird Two vehicle half-life implied based on methodology employed in audited GAAP financials; Bird Three estimated vehicle half-life implied based on equivalent methodology as prior vehicle models. Average unit cost of Bird Zero is approximately $550 and average cost of Bird Three is approximately $700. Sep 2017 First-ever shared scooter It all started with our scooters

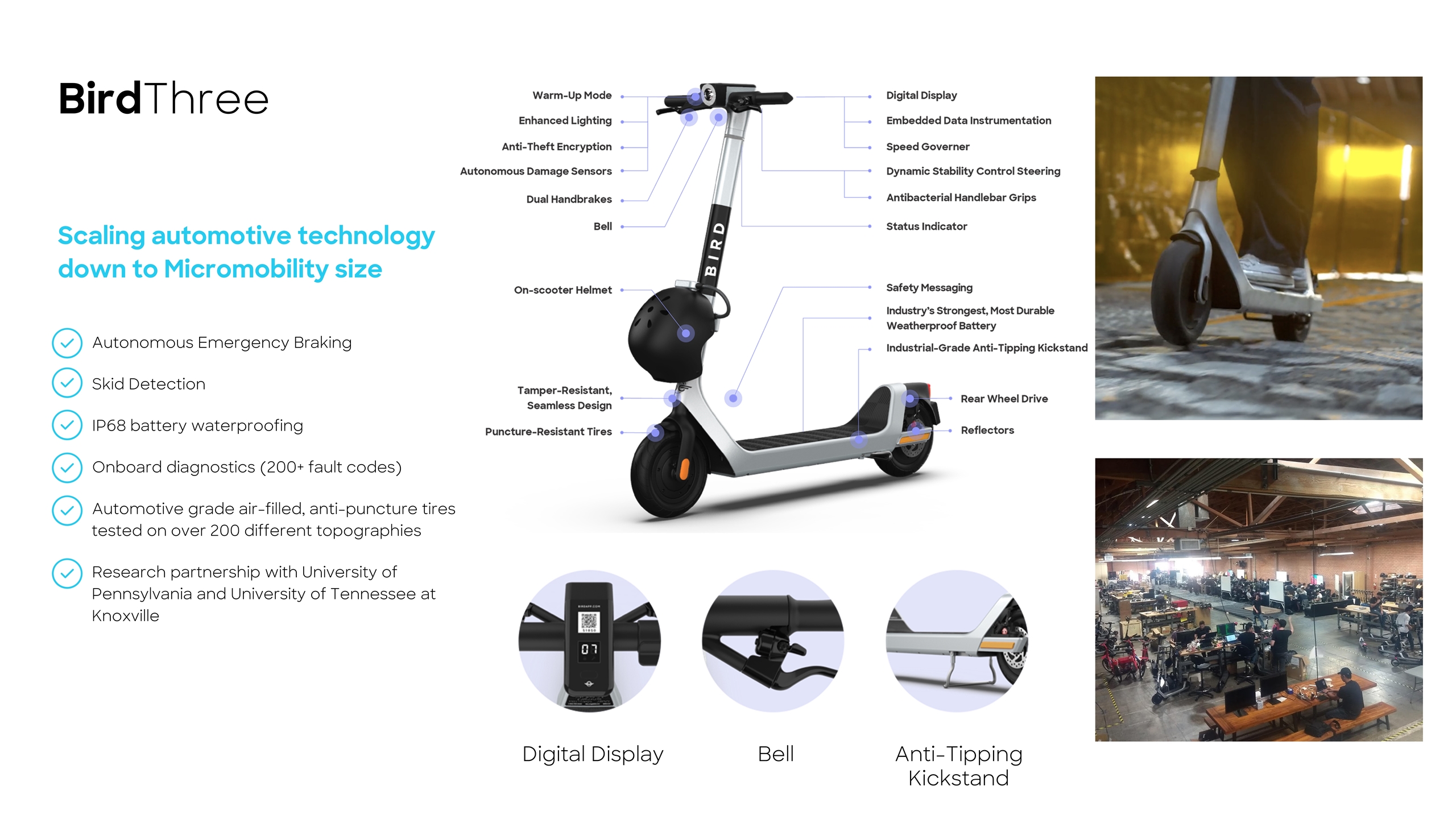

Scaling automotive technology down to Micromobility size Autonomous Emergency Braking Skid Detection IP68 battery waterproofing Onboard diagnostics (200+ fault codes) Automotive grade air-filled, anti-puncture tires tested on over 200 different topographies Research partnership with University of Pennsylvania and University of Tennessee at Knoxville Digital Display Bell Anti-Tipping Kickstand BirdThree

BirdOS Bird OS is Bird’s own operating system that powers every vehicle since Bird One. Designed from the ground up to be an incredibly secure platform for micromobility on the market.

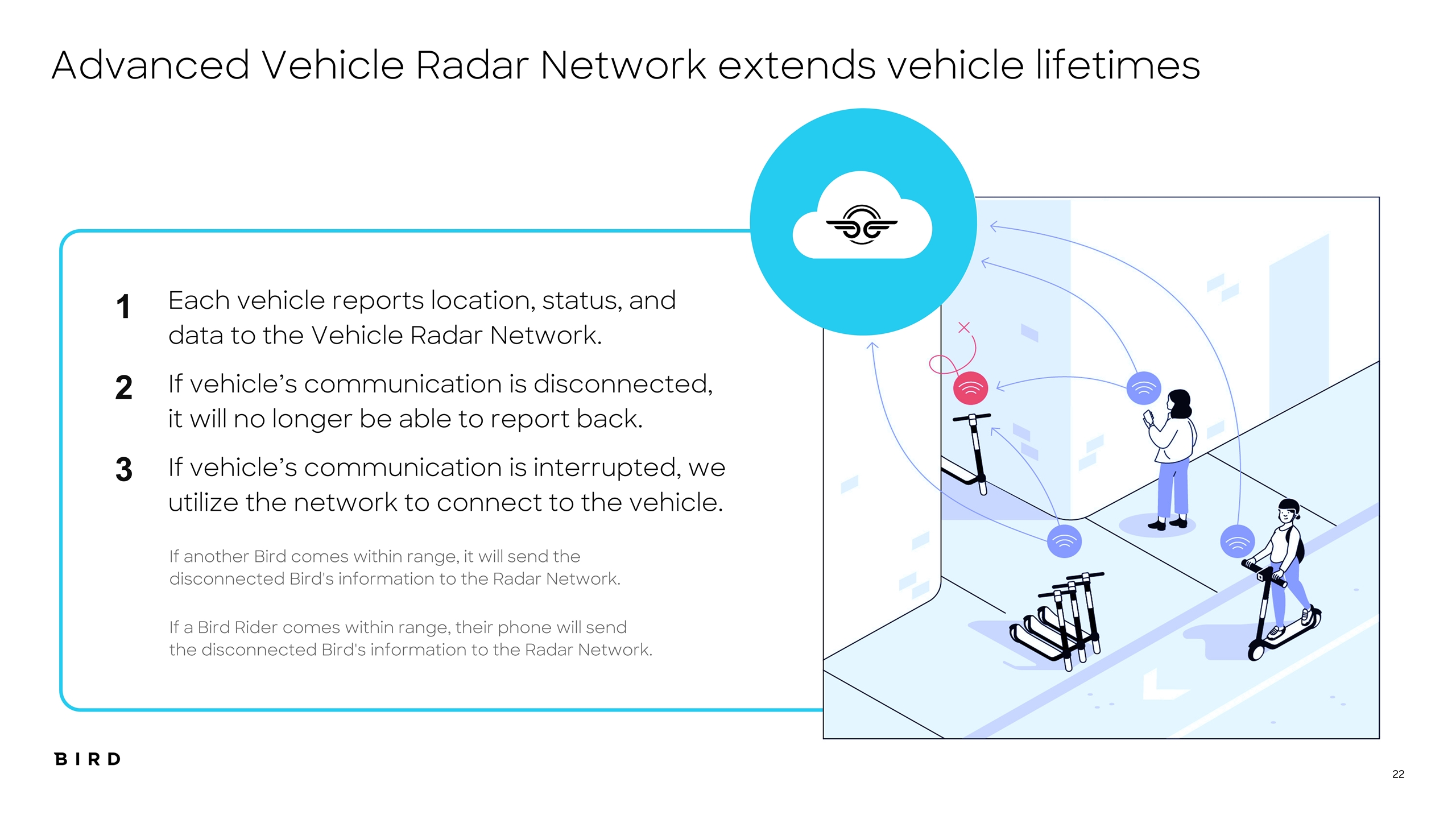

Each vehicle reports location, status, and data to the Vehicle Radar Network. If vehicle’s communication is disconnected, it will no longer be able to report back. If vehicle’s communication is interrupted, we utilize the network to connect to the vehicle. Advanced Vehicle Radar Network extends vehicle lifetimes If another Bird comes within range, it will send the disconnected Bird's information to the Radar Network. If a Bird Rider comes within range, their phone will send the disconnected Bird's information to the Radar Network. 1 2 3

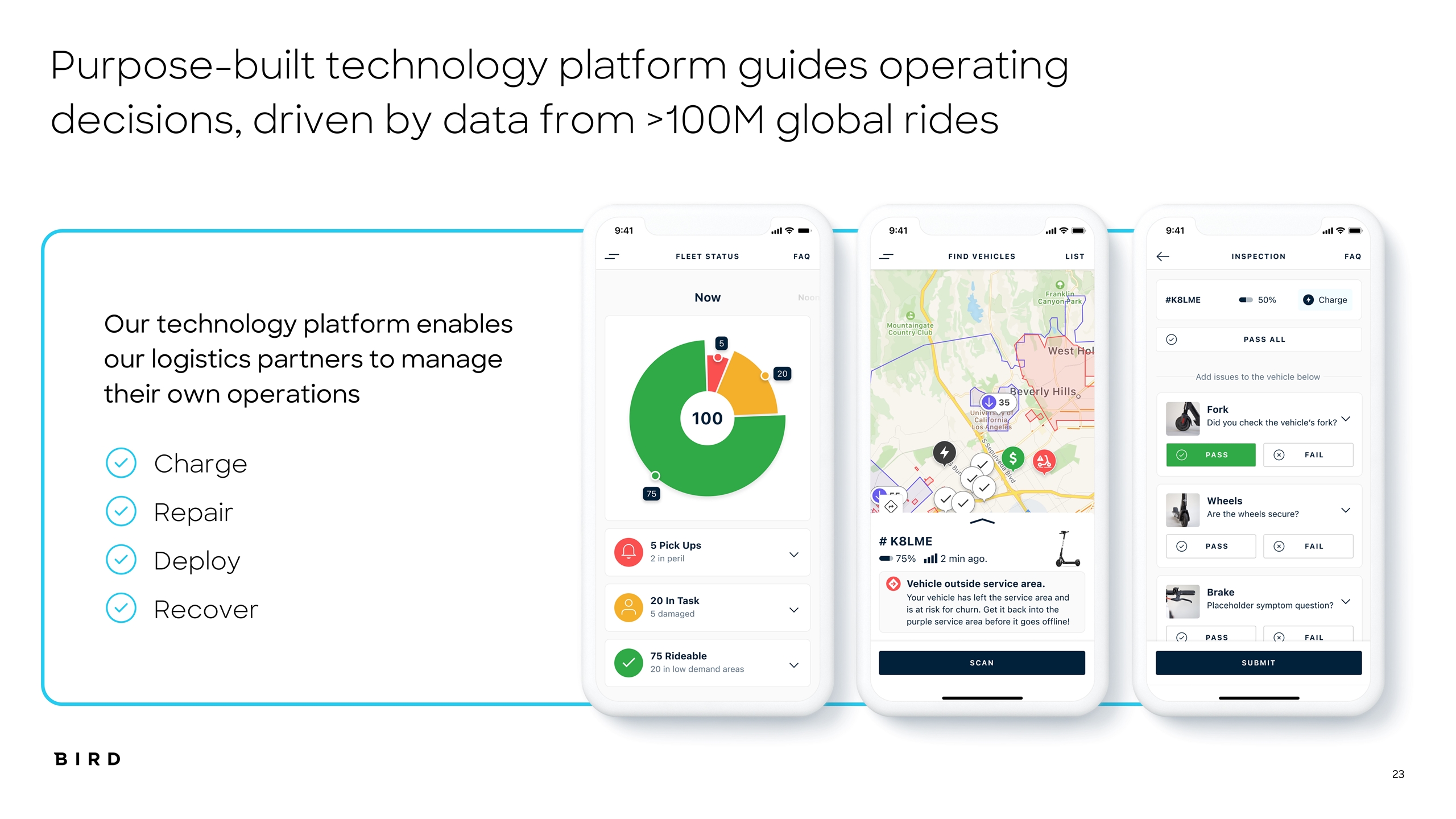

Our technology platform enables our logistics partners to manage their own operations Charge Repair Deploy Recover Purpose-built technology platform guides operating decisions, driven by data from >100M global rides

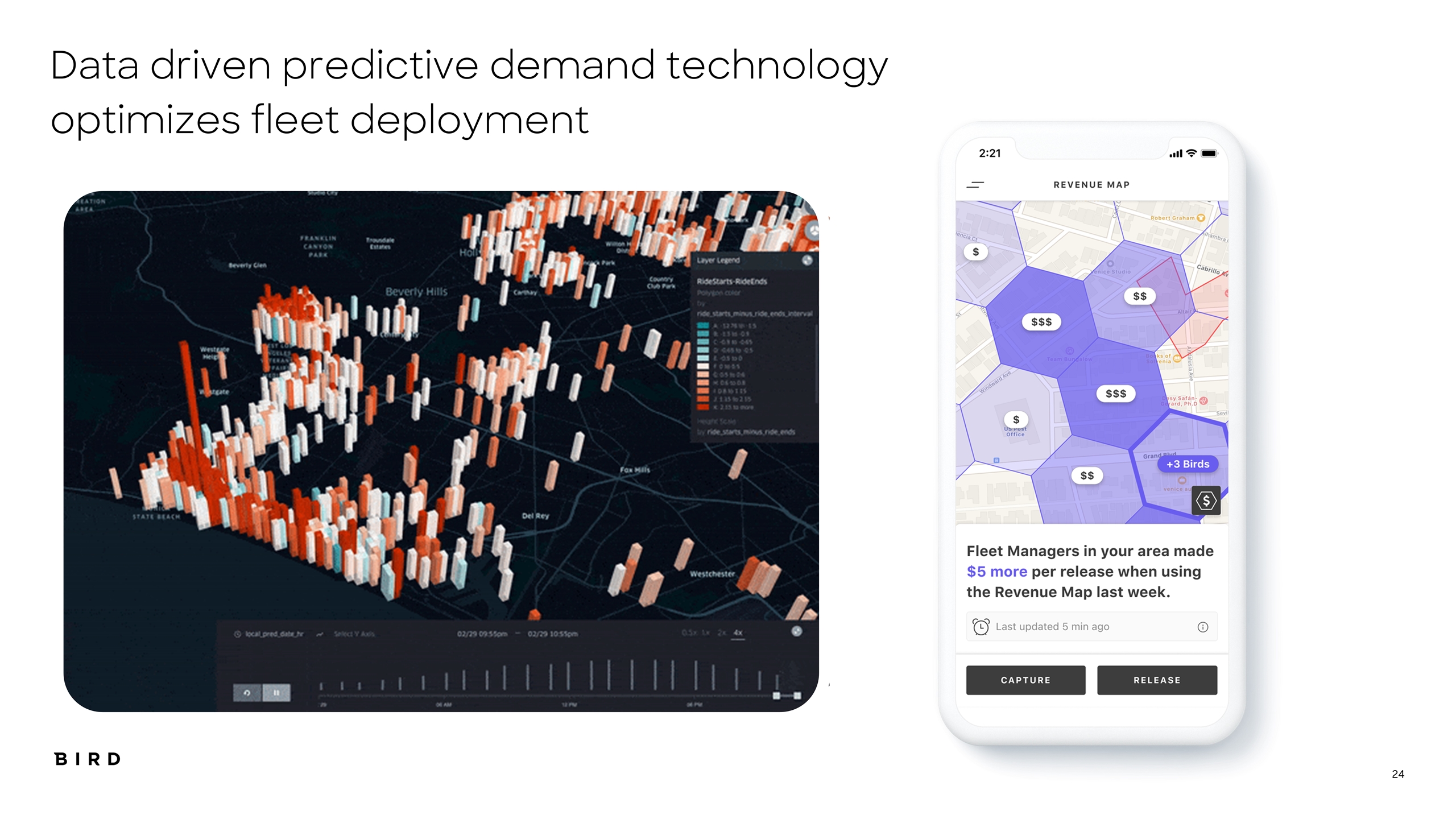

Data driven predictive demand technology optimizes fleet deployment

Operating Model

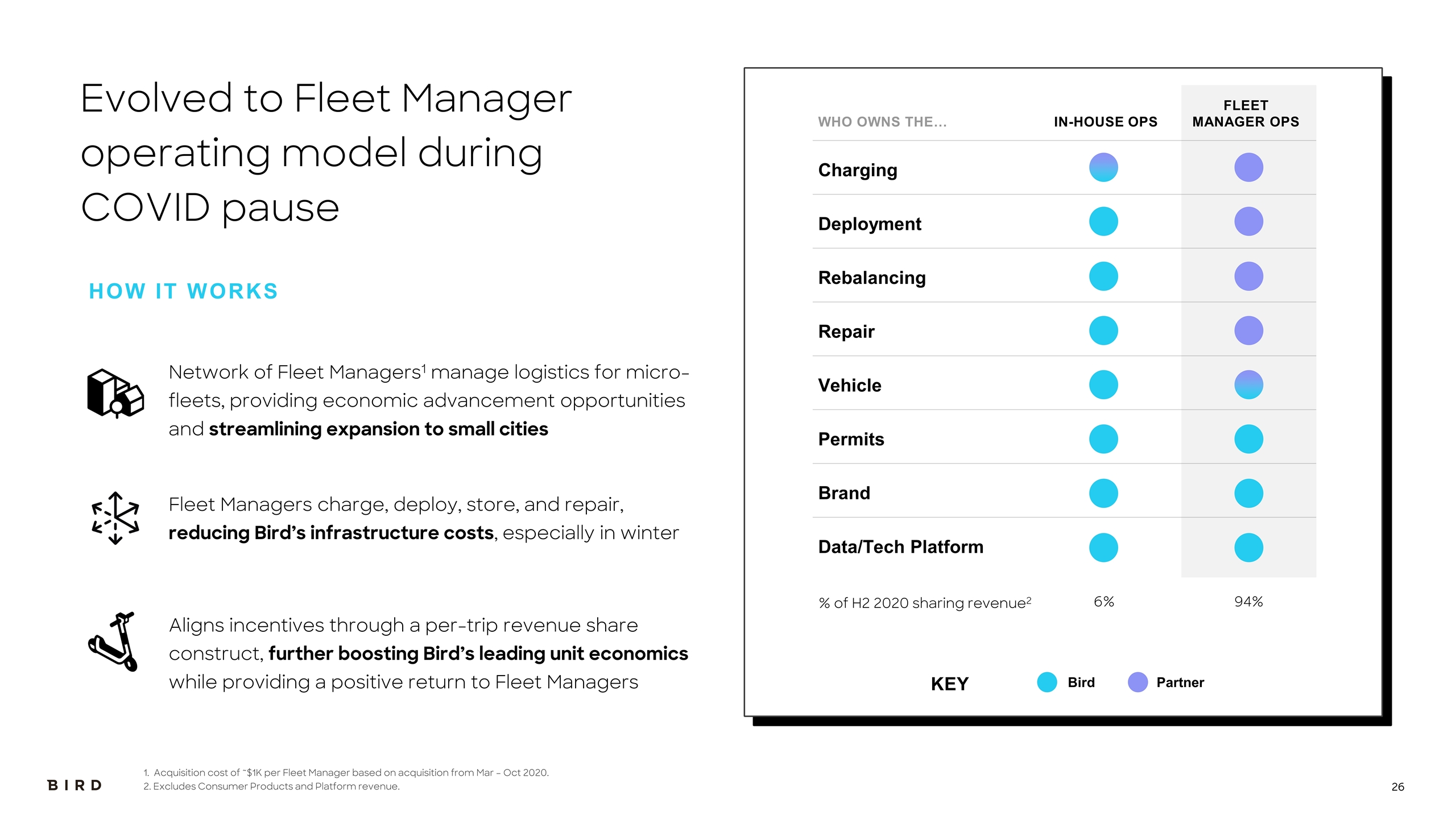

WHO OWNS THE… IN-HOUSE OPS FLEET MANAGER OPS Charging Deployment Rebalancing Repair Vehicle Permits Brand Data/Tech Platform Evolved to Fleet Manager operating model during COVID pause 1. Acquisition cost of ~$1K per Fleet Manager based on acquisition from Mar – Oct 2020. 2. Excludes Consumer Products and Platform revenue. Fleet Managers charge, deploy, store, and repair, reducing Bird’s infrastructure costs, especially in winter Network of Fleet Managers1 manage logistics for micro-fleets, providing economic advancement opportunities and streamlining expansion to small cities Aligns incentives through a per-trip revenue share construct, further boosting Bird’s leading unit economics while providing a positive return to Fleet Managers HOW IT WORKS % of H2 2020 sharing revenue2 6% 94% Bird Partner KEY

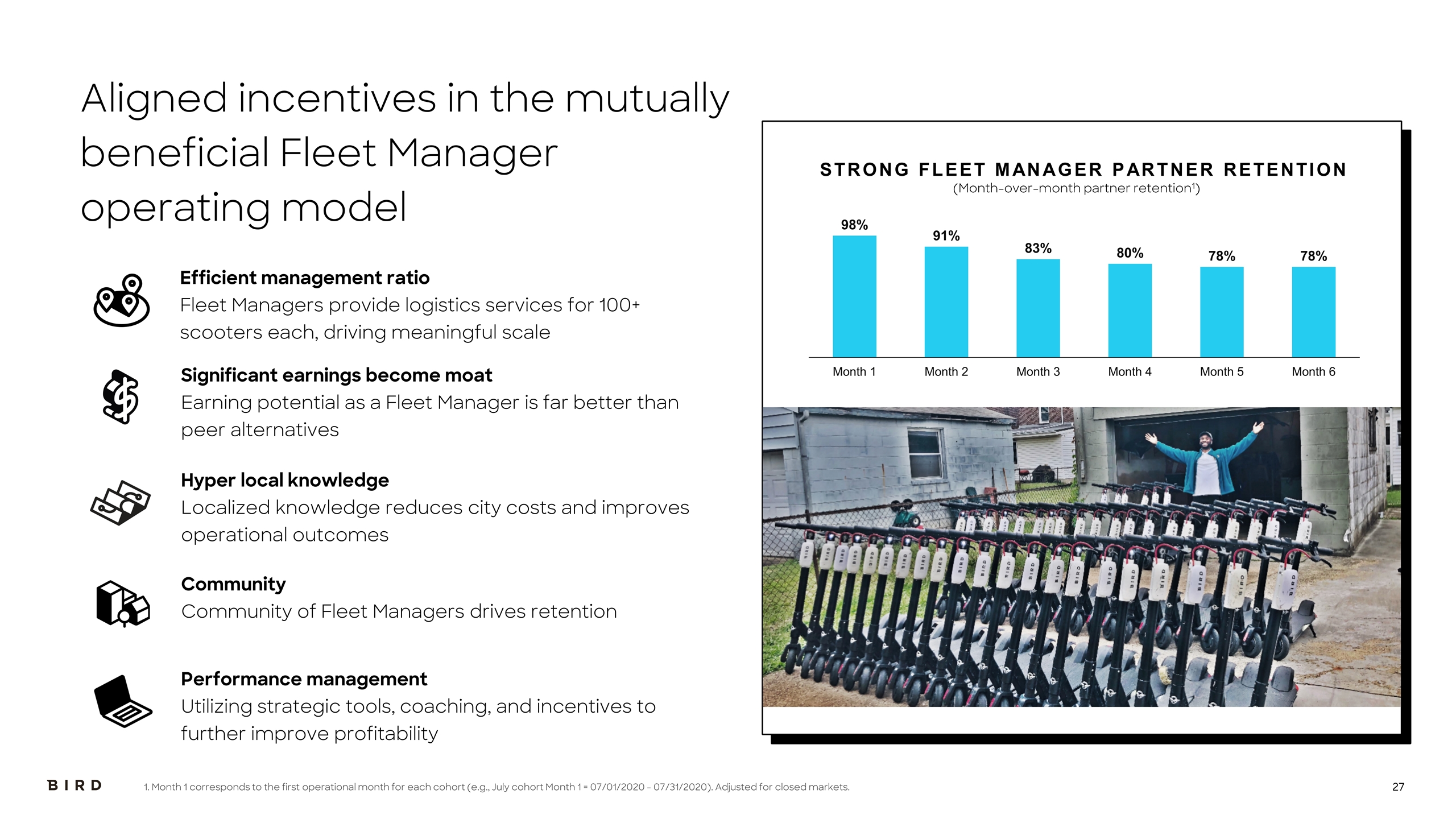

Significant earnings become moat Earning potential as a Fleet Manager is far better than peer alternatives Community Community of Fleet Managers drives retention Hyper local knowledge Localized knowledge reduces city costs and improves operational outcomes Efficient management ratio Fleet Managers provide logistics services for 100+ scooters each, driving meaningful scale STRONG FLEET MANAGER PARTNER RETENTION (Month-over-month partner retention1) 1. Month 1 corresponds to the first operational month for each cohort (e.g., July cohort Month 1 = 07/01/2020 - 07/31/2020). Adjusted for closed markets. Performance management Utilizing strategic tools, coaching, and incentives to further improve profitability Aligned incentives in the mutually beneficial Fleet Manager operating model

Unit Economics

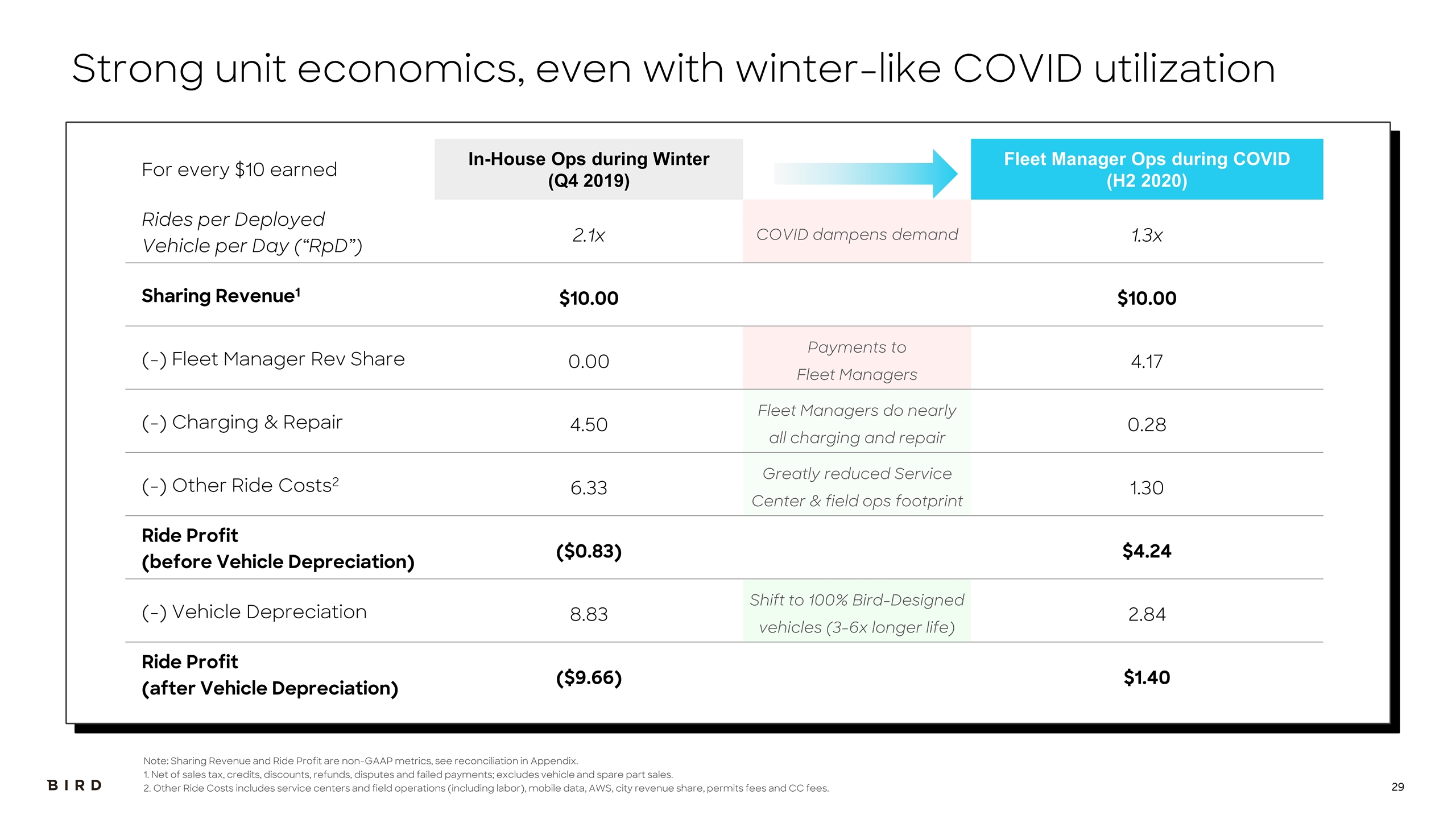

For every $10 earned In-House Ops during Winter (Q4 2019) Fleet Manager Ops during COVID (H2 2020) Rides per Deployed Vehicle per Day (“RpD”) 2.1x COVID dampens demand 1.3x Sharing Revenue1 $10.00 $10.00 (-) Fleet Manager Rev Share 0.00 Payments to Fleet Managers 4.17 (-) Charging & Repair 4.50 Fleet Managers do nearly all charging and repair 0.28 (-) Other Ride Costs2 6.33 Greatly reduced Service Center & field ops footprint 1.30 Ride Profit (before Vehicle Depreciation) ($0.83) $4.24 (-) Vehicle Depreciation 8.83 Shift to 100% Bird-Designed vehicles (3-6x longer life) 2.84 Ride Profit (after Vehicle Depreciation) ($9.66) $1.40 Strong unit economics, even with winter-like COVID utilization Note: Sharing Revenue and Ride Profit are non-GAAP metrics, see reconciliation in Appendix. 1. Net of sales tax, credits, discounts, refunds, disputes and failed payments; excludes vehicle and spare part sales. 2. Other Ride Costs includes service centers and field operations (including labor), mobile data, AWS, city revenue share, permits fees and CC fees.

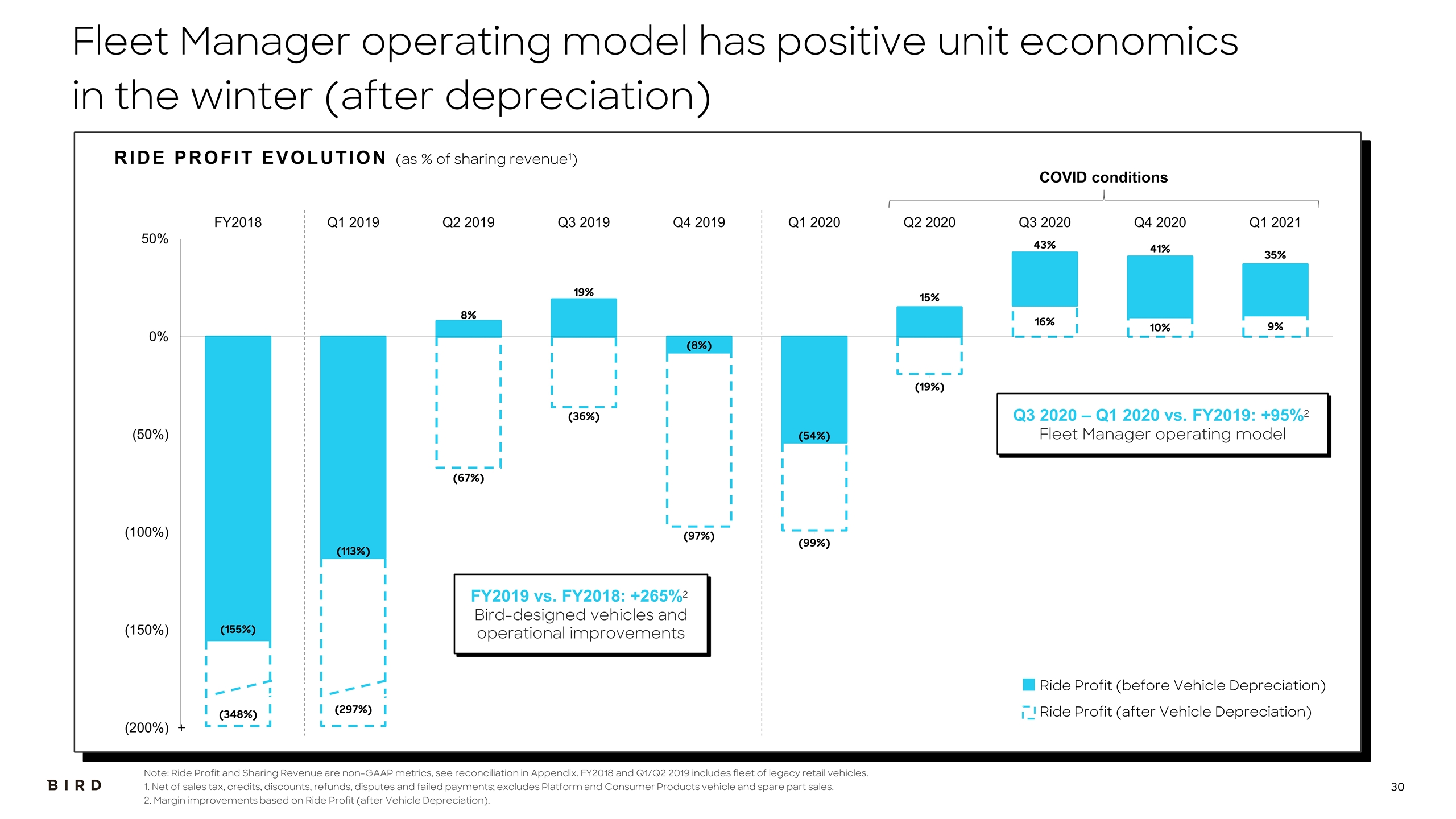

RIDE PROFIT EVOLUTION (as % of sharing revenue1) Note: Ride Profit and Sharing Revenue are non-GAAP metrics, see reconciliation in Appendix. FY2018 and Q1/Q2 2019 includes fleet of legacy retail vehicles. 1. Net of sales tax, credits, discounts, refunds, disputes and failed payments; excludes Platform and Consumer Products vehicle and spare part sales. 2. Margin improvements based on Ride Profit (after Vehicle Depreciation). COVID conditions Ride Profit (before Vehicle Depreciation) Ride Profit (after Vehicle Depreciation) + FY2019 vs. FY2018: +265%2 Bird-designed vehicles and operational improvements Q3 2020 – Q1 2020 vs. FY2019: +95%2 Fleet Manager operating model Fleet Manager operating model has positive unit economics in the winter (after depreciation)

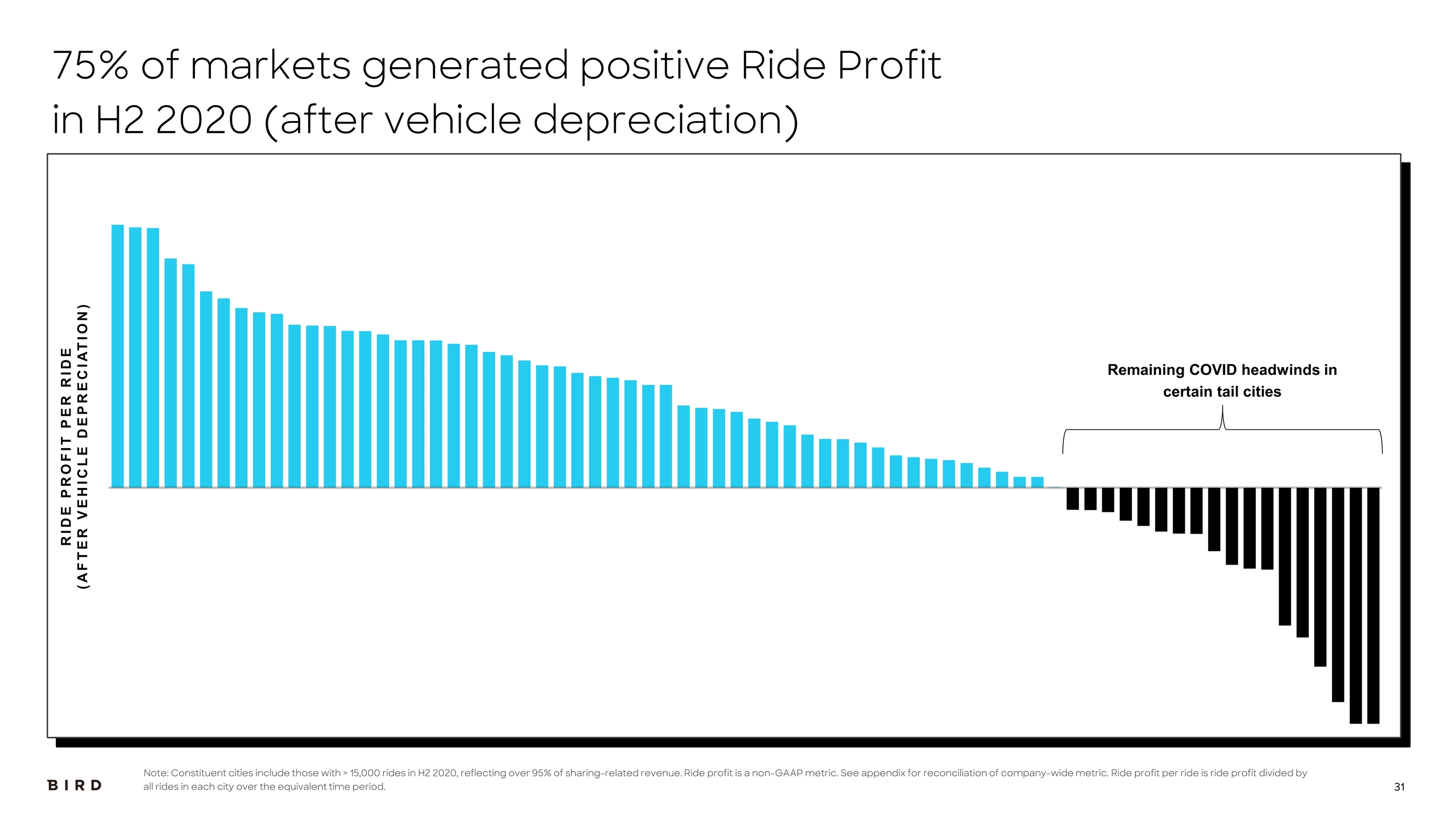

75% of markets generated positive Ride Profit in H2 2020 (after vehicle depreciation) RIDE PROFIT PER RIDE (AFTER VEHICLE DEPRECIATION) Note: Constituent cities include those with > 15,000 rides in H2 2020, reflecting over 95% of sharing-related revenue. Ride profit is a non-GAAP metric. See appendix for reconciliation of company-wide metric. Ride profit per ride is ride profit divided by all rides in each city over the equivalent time period. Remaining COVID headwinds in certain tail cities

Financial outlook

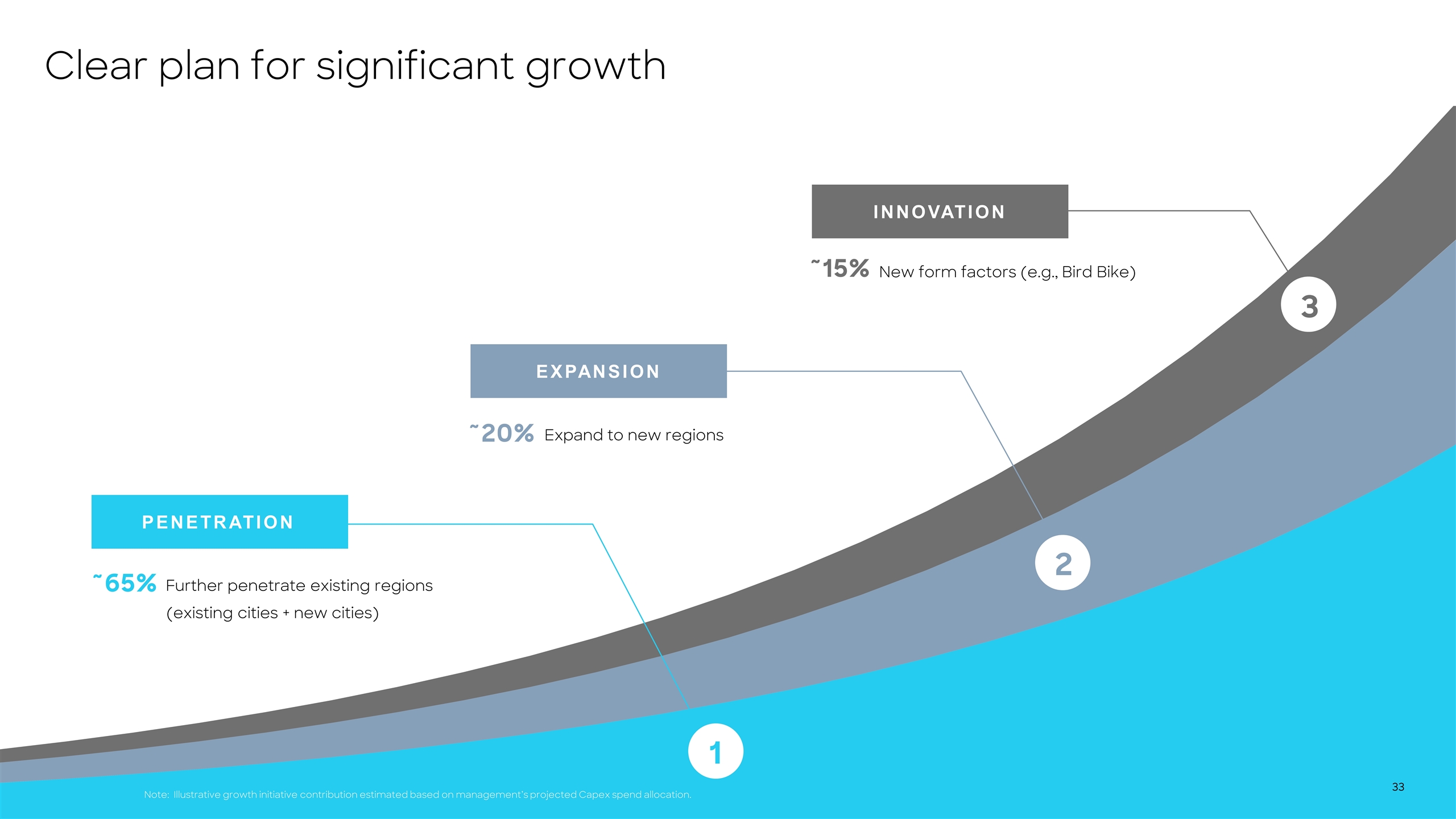

Clear plan for significant growth Further penetrate existing regions (existing cities + new cities) 1 Expand to new regions 2 New form factors (e.g., Bird Bike) 3 ~65% ~20% ~15% Note: Illustrative growth initiative contribution estimated based on management’s projected Capex spend allocation. PENETRATION EXPANSION INNOVATION

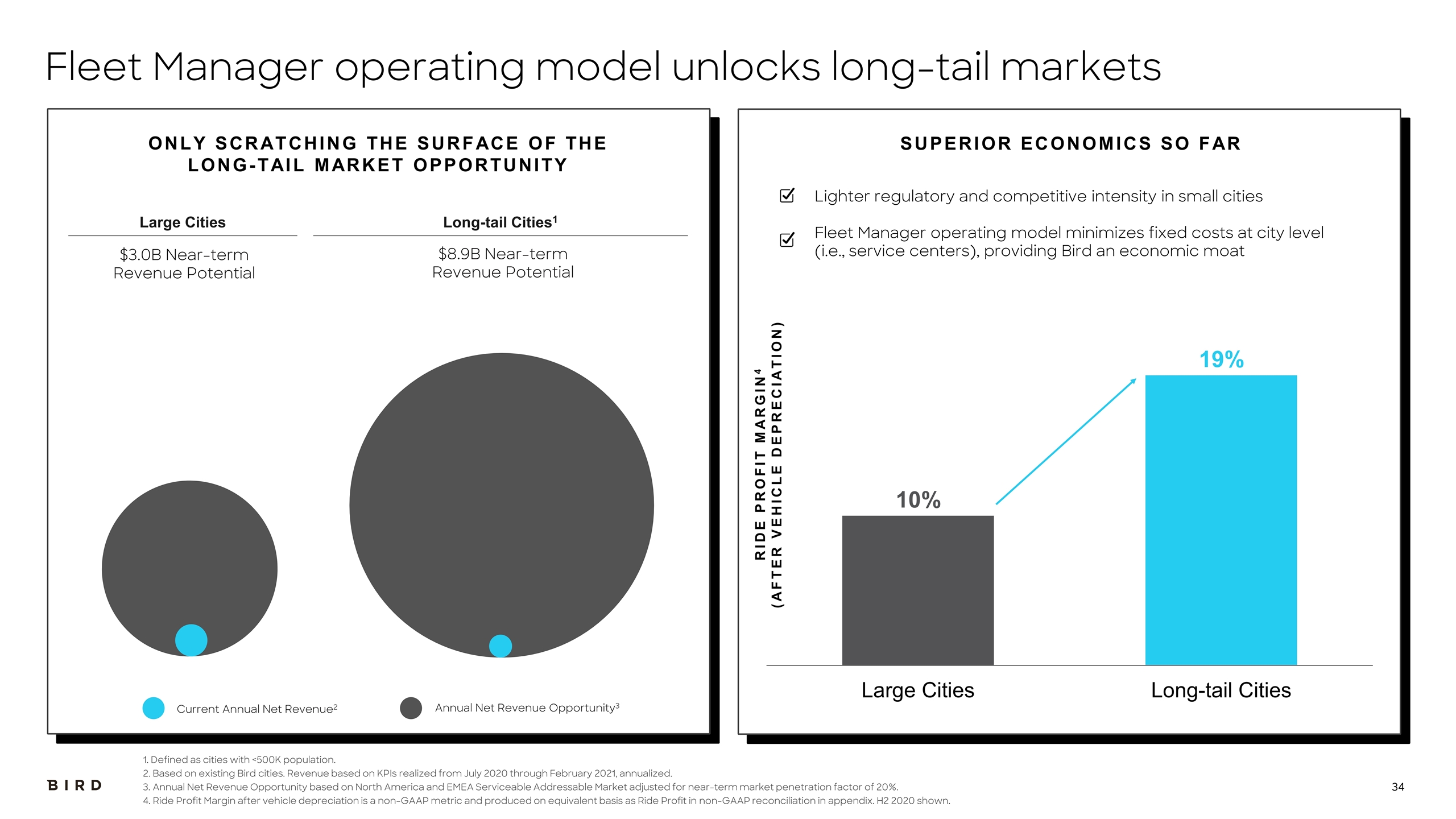

Fleet Manager operating model unlocks long-tail markets Lighter regulatory and competitive intensity in small cities Fleet Manager operating model minimizes fixed costs at city level (i.e., service centers), providing Bird an economic moat 1. Defined as cities with <500K population. 2. Based on existing Bird cities. Revenue based on KPIs realized from July 2020 through February 2021, annualized. 3. Annual Net Revenue Opportunity based on North America and EMEA Serviceable Addressable Market adjusted for near-term market penetration factor of 20%. 4. Ride Profit Margin after vehicle depreciation is a non-GAAP metric and produced on equivalent basis as Ride Profit in non-GAAP reconciliation in appendix. H2 2020 shown. ONLY SCRATCHING THE SURFACE OF THE LONG-TAIL MARKET OPPORTUNITY SUPERIOR ECONOMICS SO FAR Current Annual Net Revenue2 Annual Net Revenue Opportunity3 $3.0B Near-term Revenue Potential $8.9B Near-term Revenue Potential Large Cities Long-tail Cities1 RIDE PROFIT MARGIN4 (AFTER VEHICLE DEPRECIATION)

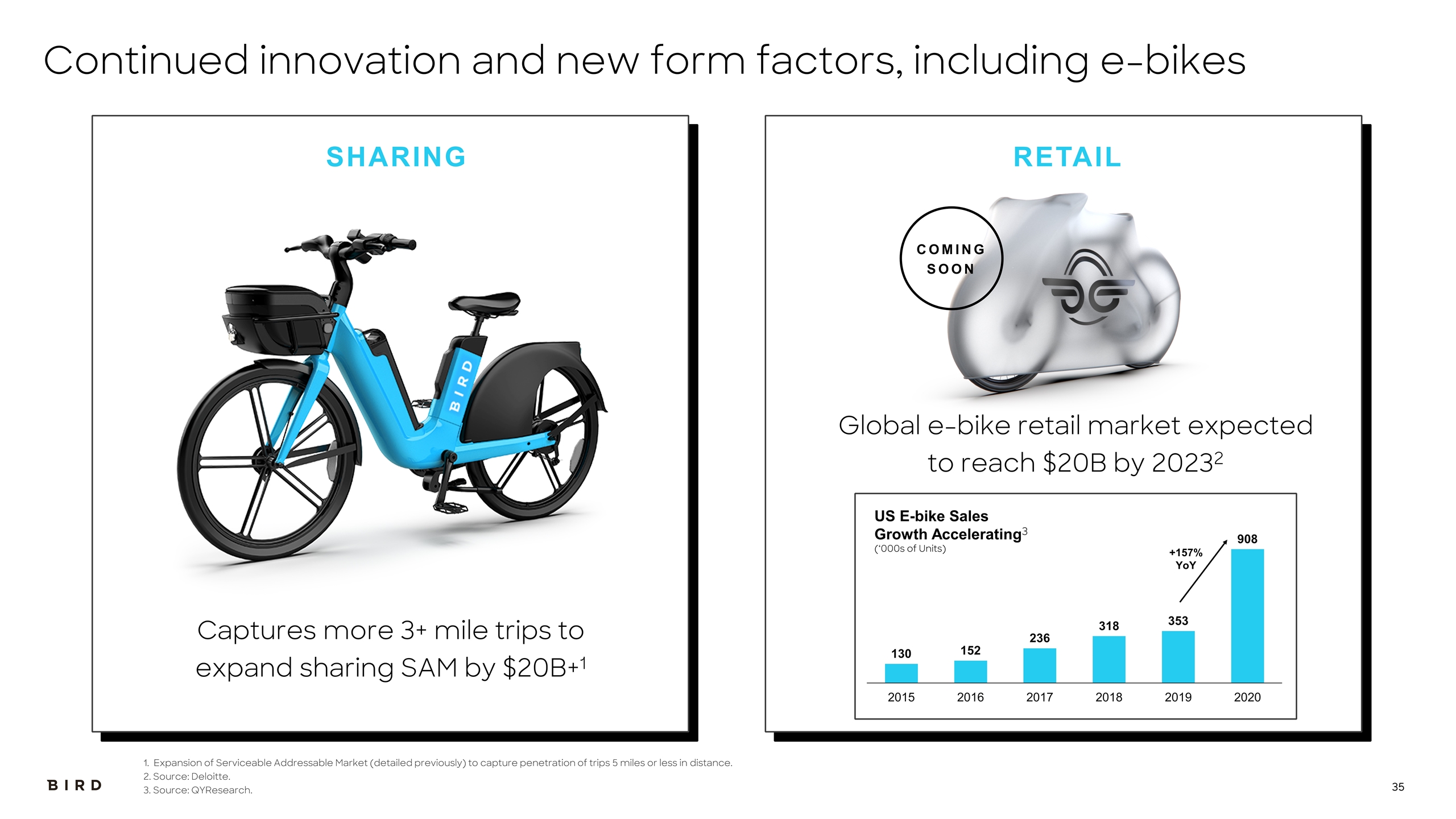

1. Expansion of Serviceable Addressable Market (detailed previously) to capture penetration of trips 5 miles or less in distance. 2. Source: Deloitte. 3. Source: QYResearch. US E-bike Sales Growth Accelerating3 (‘000s of Units) +157% YoY Continued innovation and new form factors, including e-bikes COMING SOON SHARING Captures more 3+ mile trips to expand sharing SAM by $20B+1 RETAIL Global e-bike retail market expected to reach $20B by 20232

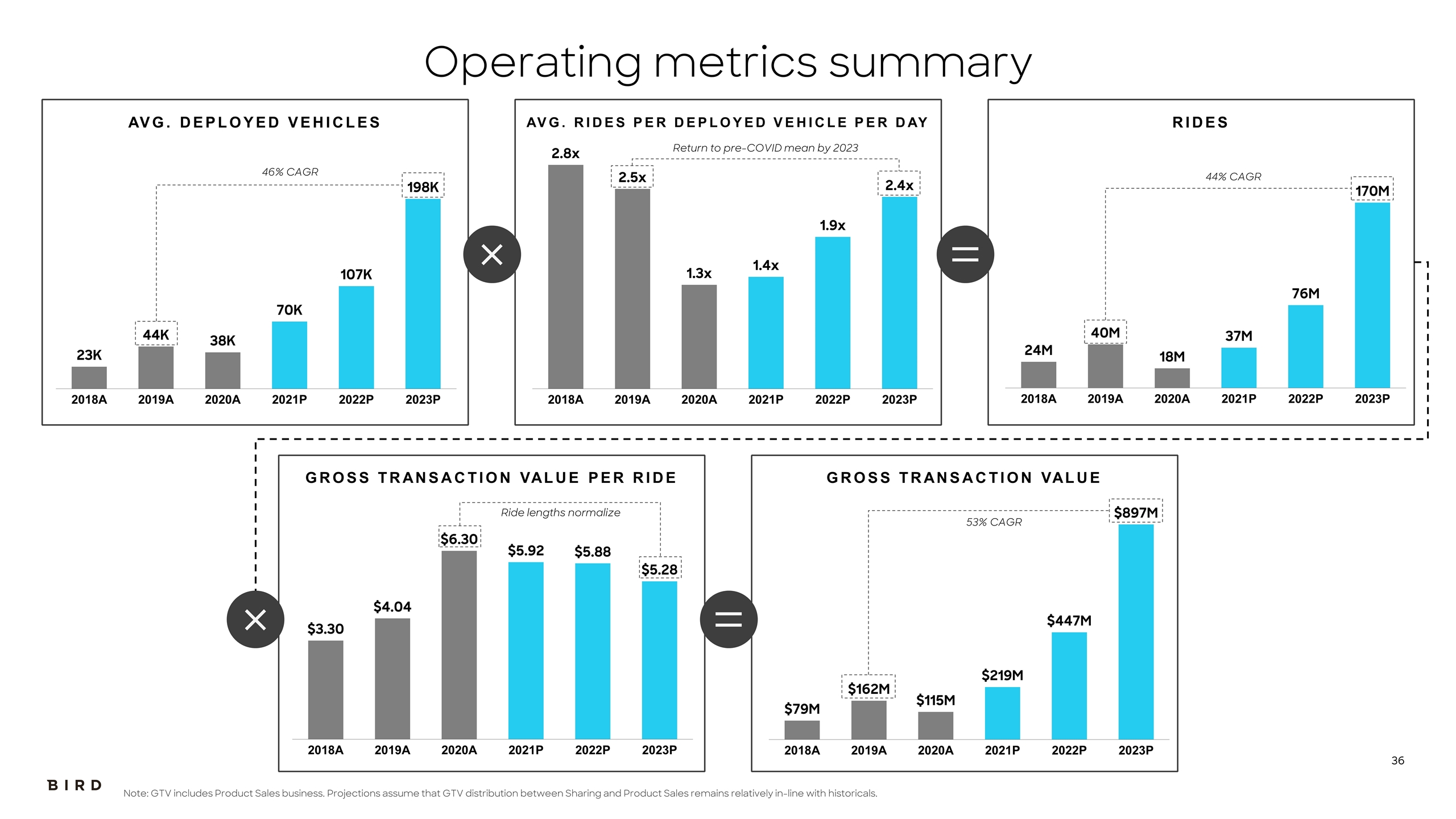

Operating metrics summary AVG. DEPLOYED VEHICLES 46% CAGR AVG. RIDES PER DEPLOYED VEHICLE PER DAY Return to pre-COVID mean by 2023 RIDES 44% CAGR GROSS TRANSACTION VALUE PER RIDE Ride lengths normalize GROSS TRANSACTION VALUE 53% CAGR Note: GTV includes Product Sales business. Projections assume that GTV distribution between Sharing and Product Sales remains relatively in-line with historicals.

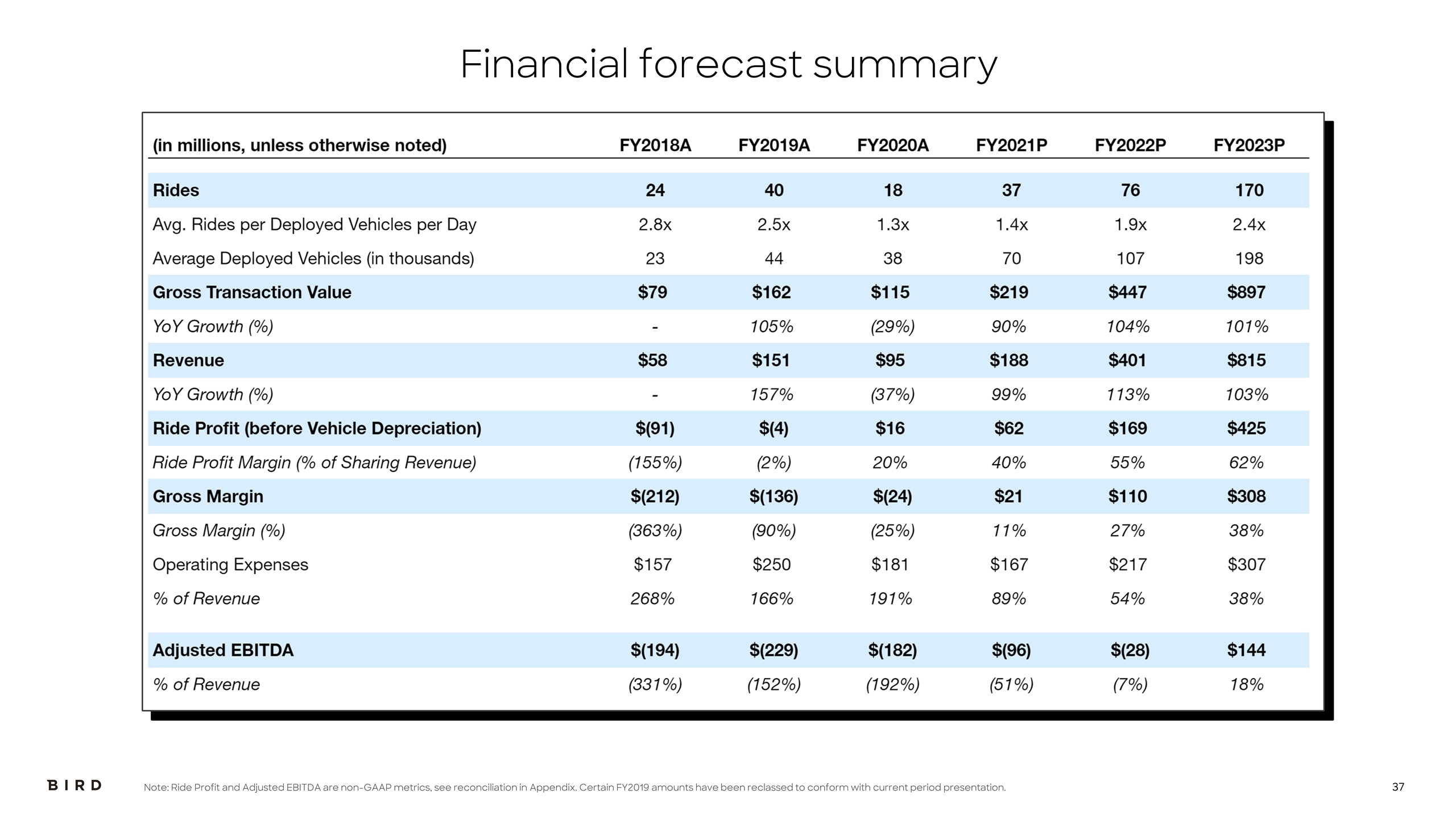

Financial forecast summary Note: Ride Profit and Adjusted EBITDA are non-GAAP metrics, see reconciliation in Appendix. Certain FY2019 amounts have been reclassed to conform with current period presentation.

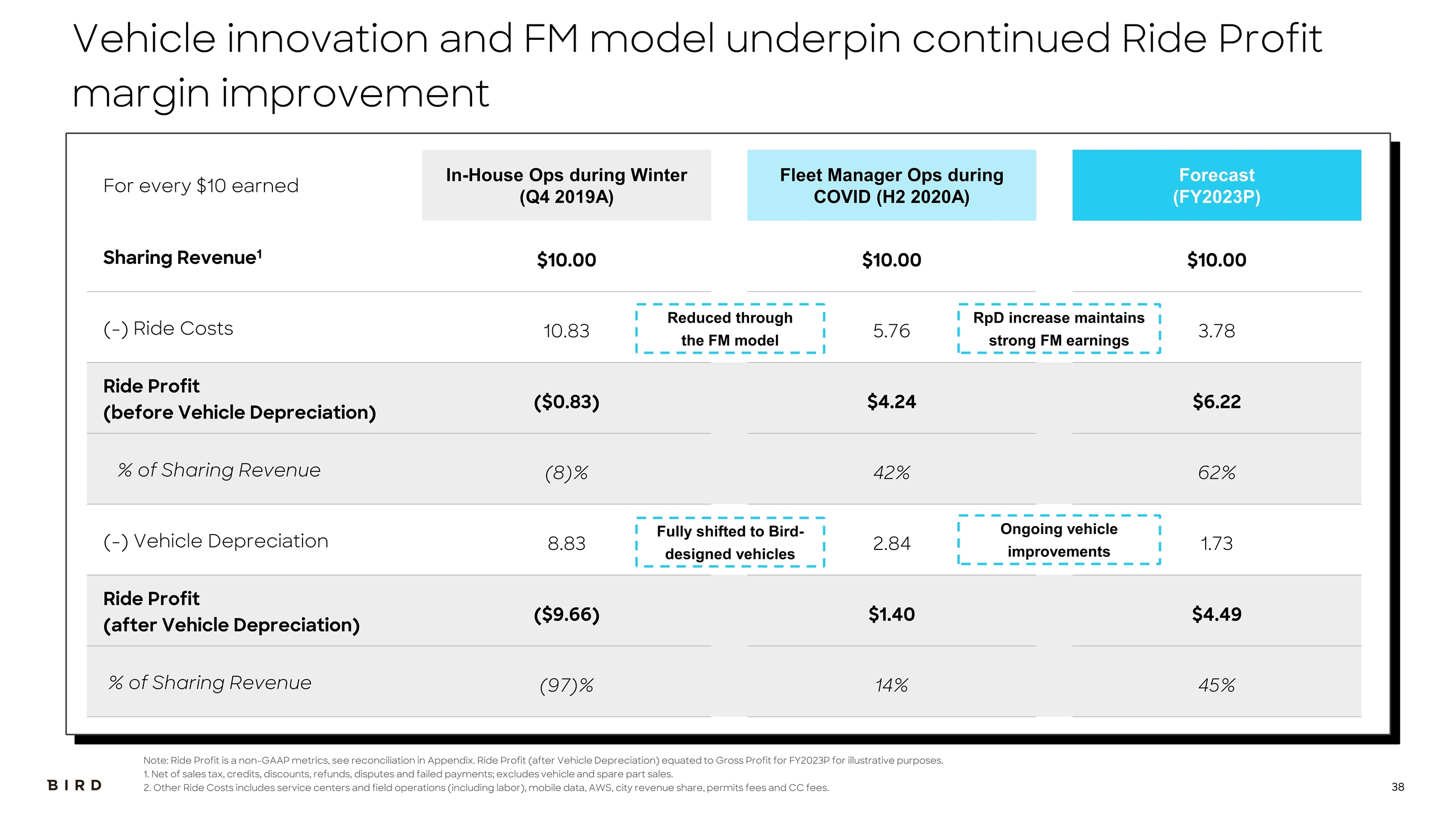

For every $10 earned In-House Ops during Winter (Q4 2019A) Fleet Manager Ops during COVID (H2 2020A) Forecast (FY2023P) Sharing Revenue1 $10.00 $10.00 $10.00 (-) Ride Costs 10.83 5.76 3.78 Ride Profit (before Vehicle Depreciation) ($0.83) $4.24 $6.22 % of Sharing Revenue (8)% 42% 62% (-) Vehicle Depreciation 8.83 2.84 1.73 Ride Profit (after Vehicle Depreciation) ($9.66) $1.40 $4.49 % of Sharing Revenue (97)% 14% 45% Vehicle innovation and FM model underpin continued Ride Profit margin improvement Note: Ride Profit is a non-GAAP metrics, see reconciliation in Appendix. Ride Profit (after Vehicle Depreciation) equated to Gross Profit for FY2023P for illustrative purposes. 1. Net of sales tax, credits, discounts, refunds, disputes and failed payments; excludes vehicle and spare part sales. 2. Other Ride Costs includes service centers and field operations (including labor), mobile data, AWS, city revenue share, permits fees and CC fees. Reduced through the FM model RpD increase maintains strong FM earnings Fully shifted to Bird-designed vehicles Ongoing vehicle improvements

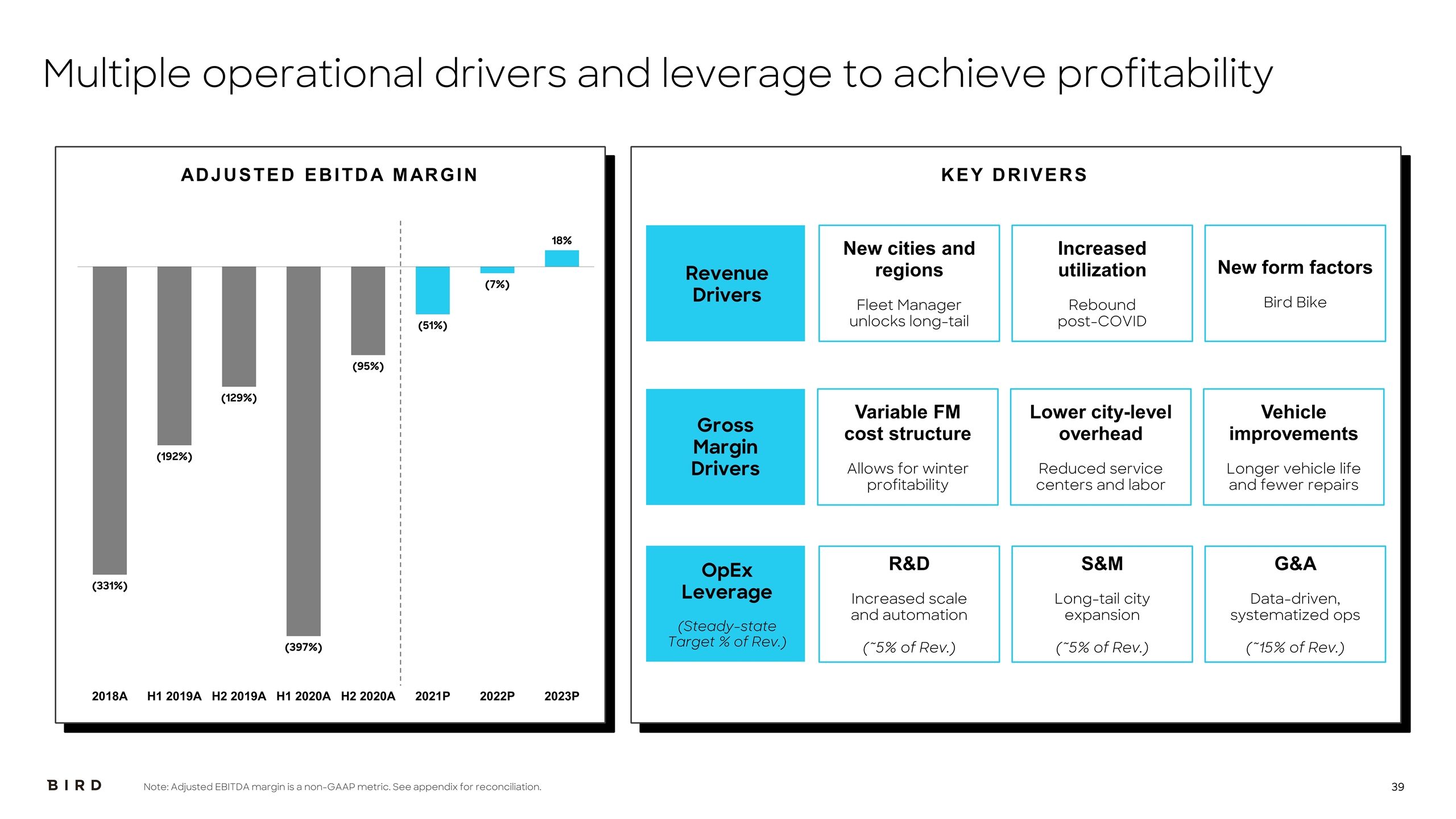

Multiple operational drivers and leverage to achieve profitability ADJUSTED EBITDA MARGIN KEY DRIVERS (2) Revenue Drivers Gross Margin Drivers OpEx Leverage (Steady-state Target % of Rev.) Vehicle improvements Longer vehicle life and fewer repairs Lower city-level overhead Reduced service centers and labor Variable FM cost structure Allows for winter profitability Note: Adjusted EBITDA margin is a non-GAAP metric. See appendix for reconciliation. New form factors Bird Bike Increased utilization Rebound post-COVID New cities and regions Fleet Manager unlocks long-tail G&A Data-driven, systematized ops (~15% of Rev.) S&M Long-tail city expansion (~5% of Rev.) R&D Increased scale and automation (~5% of Rev.)

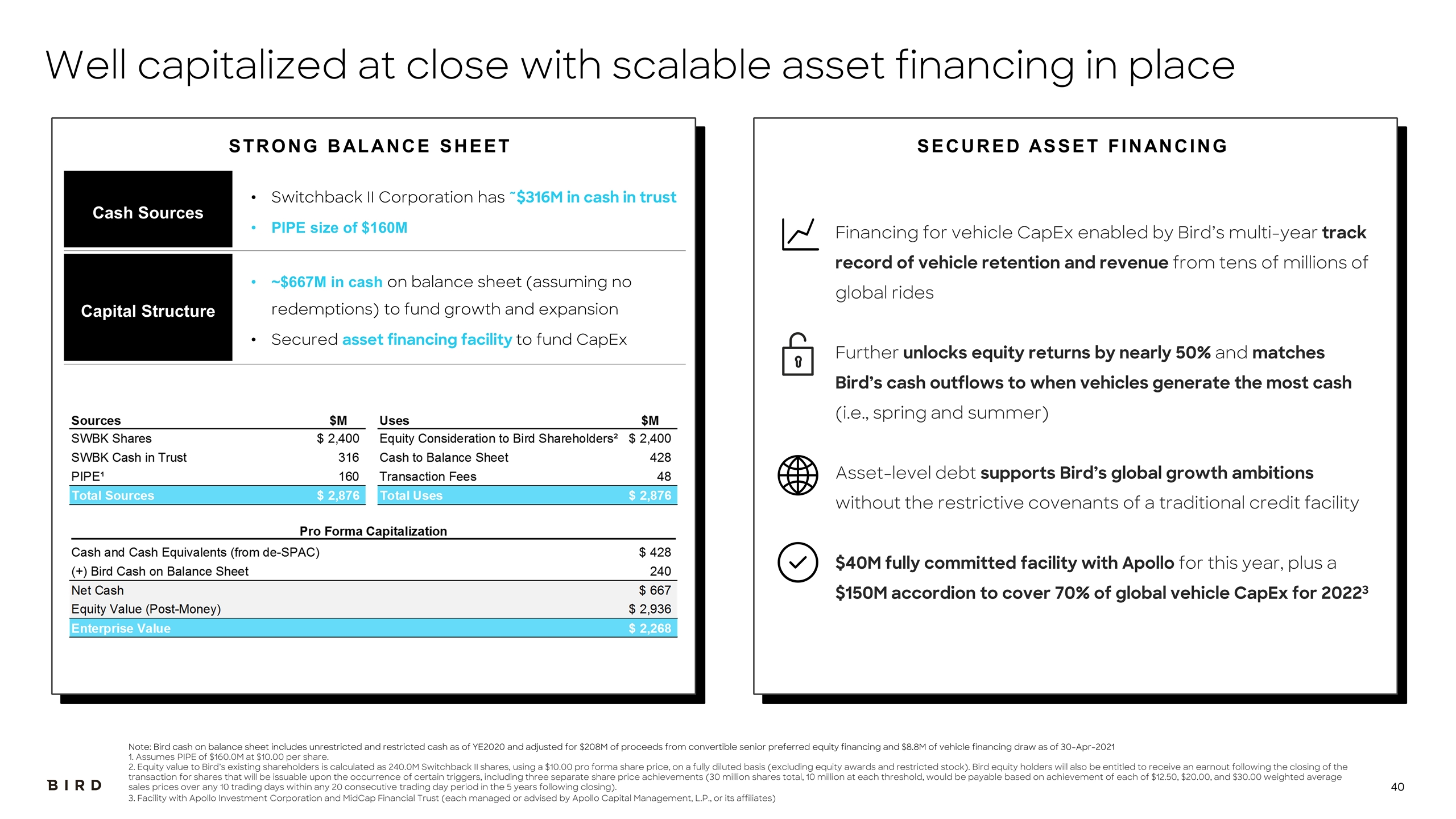

Well capitalized at close with scalable asset financing in place Note: Bird cash on balance sheet includes unrestricted and restricted cash as of YE2020 and adjusted for $208M of proceeds from convertible senior preferred equity financing and $8.8M of vehicle financing draw as of 30-Apr-2021 1. Assumes PIPE of $160.0M at $10.00 per share. 2. Equity value to Bird’s existing shareholders is calculated as 240.0M Switchback II shares, using a $10.00 pro forma share price, on a fully diluted basis (excluding equity awards and restricted stock). Bird equity holders will also be entitled to receive an earnout following the closing of the transaction for shares that will be issuable upon the occurrence of certain triggers, including three separate share price achievements (30 million shares total, 10 million at each threshold, would be payable based on achievement of each of $12.50, $20.00, and $30.00 weighted average sales prices over any 10 trading days within any 20 consecutive trading day period in the 5 years following closing). 3. Facility with Apollo Investment Corporation and MidCap Financial Trust (each managed or advised by Apollo Capital Management, L.P., or its affiliates) Financing for vehicle CapEx enabled by Bird’s multi-year track record of vehicle retention and revenue from tens of millions of global rides Further unlocks equity returns by nearly 50% and matches Bird’s cash outflows to when vehicles generate the most cash (i.e., spring and summer) Asset-level debt supports Bird’s global growth ambitions without the restrictive covenants of a traditional credit facility $40M fully committed facility with Apollo for this year, plus a $150M accordion to cover 70% of global vehicle CapEx for 20223 STRONG BALANCE SHEET SECURED ASSET FINANCING Cash Sources Switchback II Corporation has ~$316M in cash in trust PIPE size of $160M Capital Structure ~$667M in cash on balance sheet (assuming no redemptions) to fund growth and expansion Secured asset financing facility to fund CapEx

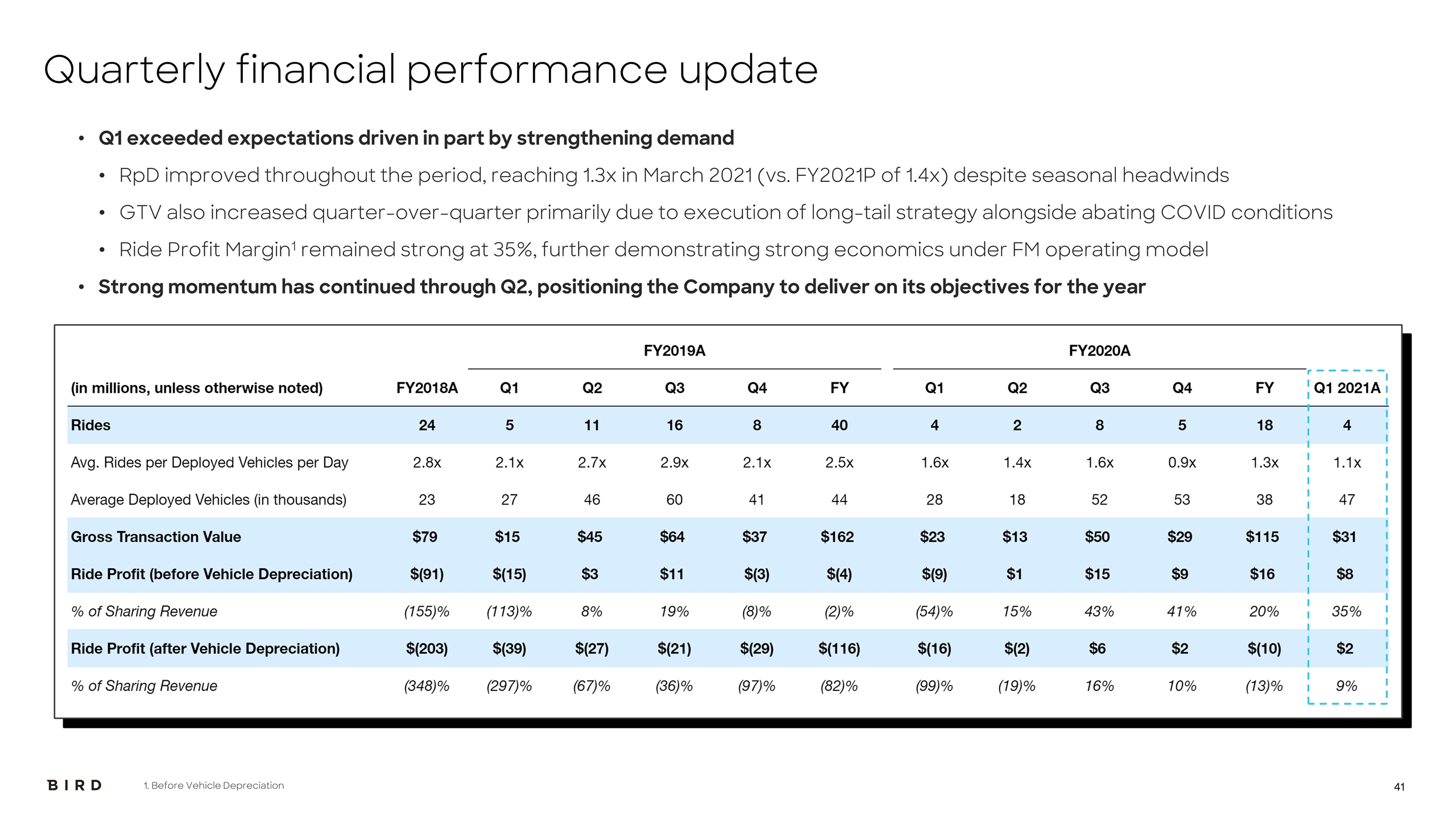

Quarterly financial performance update 1. Before Vehicle Depreciation Q1 exceeded expectations driven in part by strengthening demand RpD improved throughout the period, reaching 1.3x in March 2021 (vs. FY2021P of 1.4x) despite seasonal headwinds GTV also increased quarter-over-quarter primarily due to execution of long-tail strategy alongside abating COVID conditions Ride Profit Margin1 remained strong at 35%, further demonstrating strong economics under FM operating model Strong momentum has continued through Q2, positioning the Company to deliver on its objectives for the year

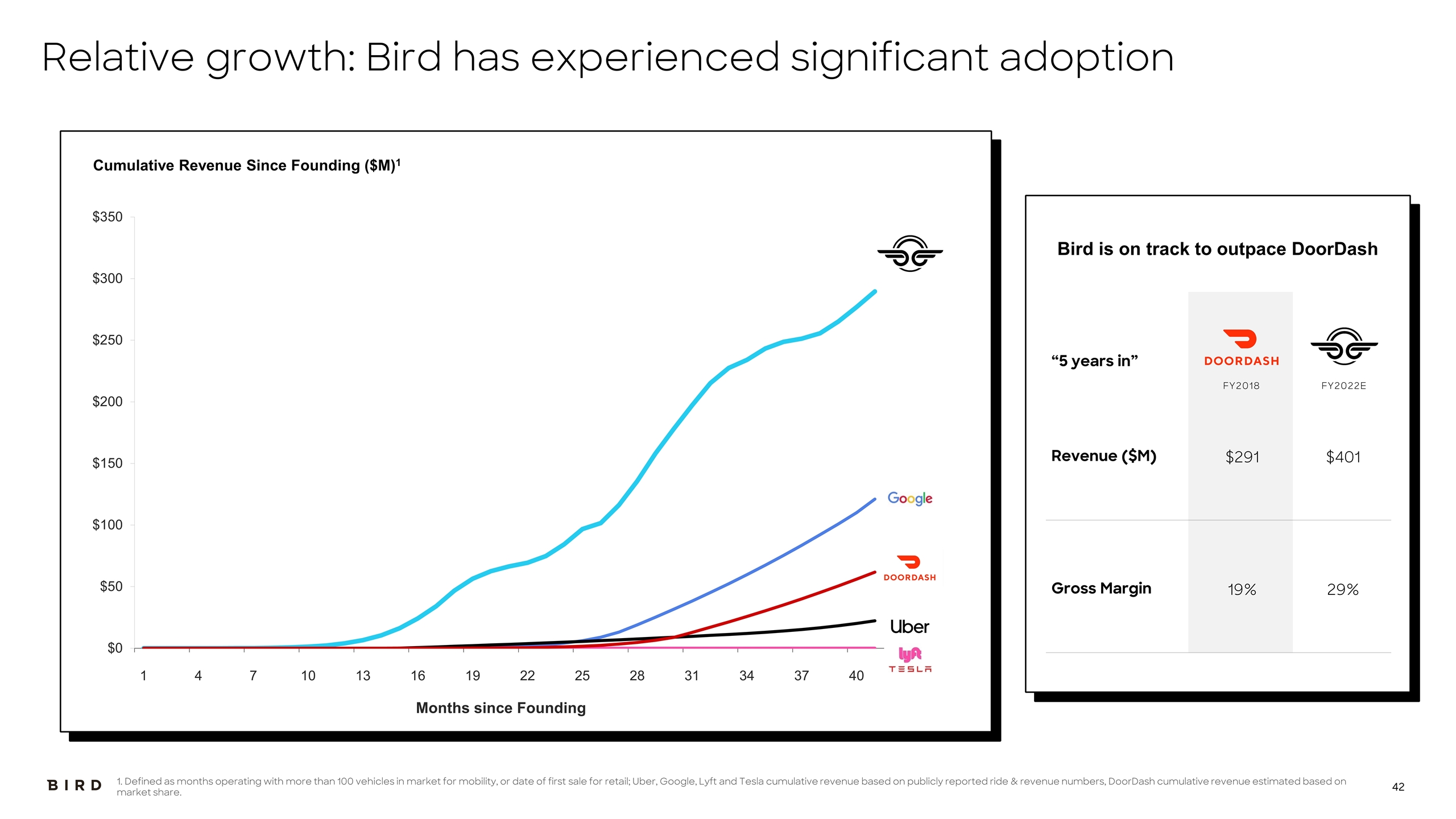

Relative growth: Bird has experienced significant adoption 1. Defined as months operating with more than 100 vehicles in market for mobility, or date of first sale for retail; Uber, Google, Lyft and Tesla cumulative revenue based on publicly reported ride & revenue numbers, DoorDash cumulative revenue estimated based on market share. Cumulative Revenue Since Founding ($M)1 Months since Founding “5 years in” Revenue ($M) $291 $401 Gross Margin 19% 29% Bird is on track to outpace DoorDash FY2018 FY2022E

Closing Remarks

Why Bird wins 1 Aligned incentives in the Fleet Manager operating model 2 Strong unit economics 3 Category creator with strong barriers to entry 4 Unparalleled leadership team 5 Electrification of transportation tailwinds 6 Advanced electric micromobility vehicles

Q&A

Appendix

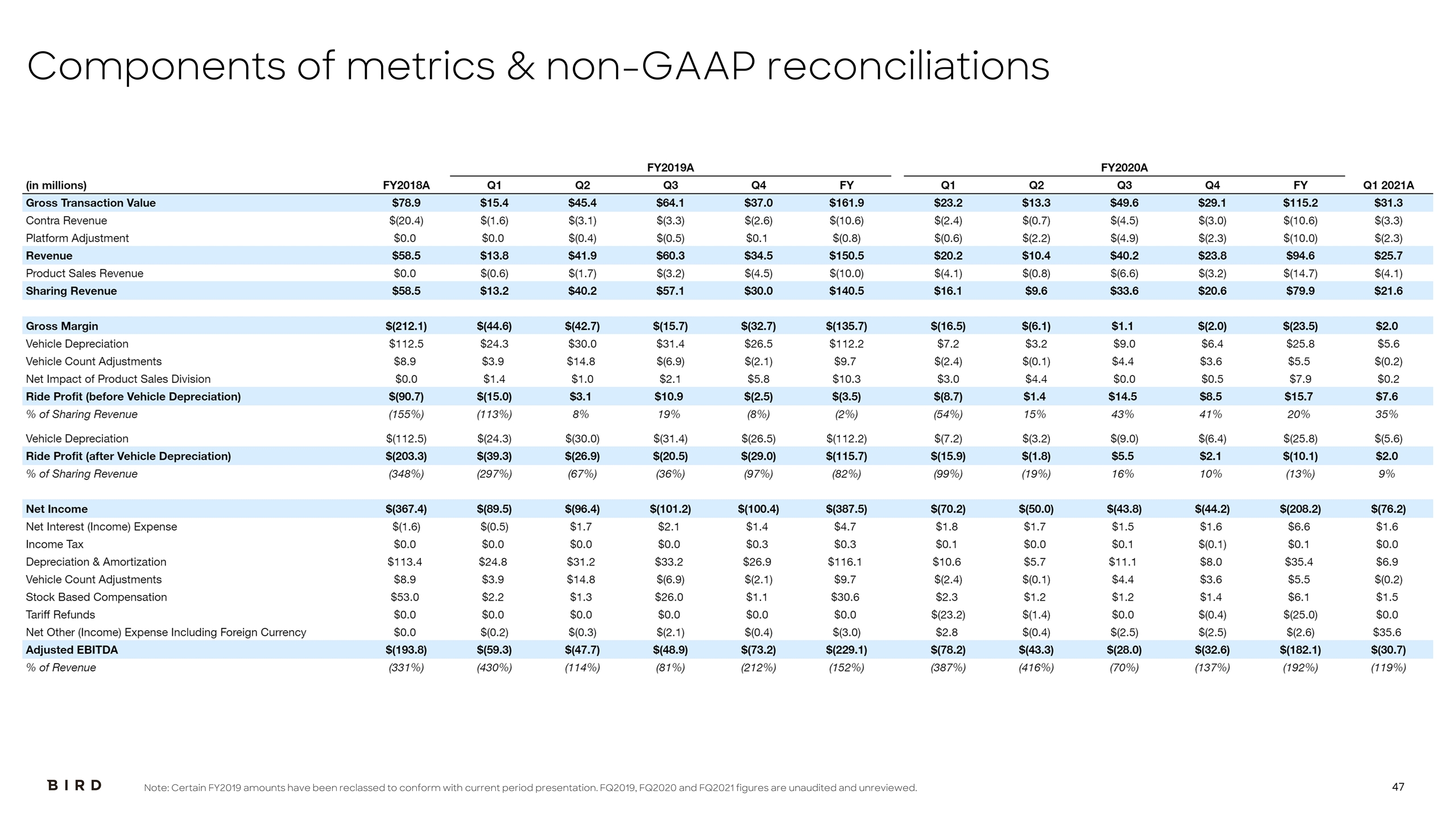

Components of metrics & non-GAAP reconciliations Note: Certain FY2019 amounts have been reclassed to conform with current period presentation. FQ2019, FQ2020 and FQ2021 figures are unaudited and unreviewed.

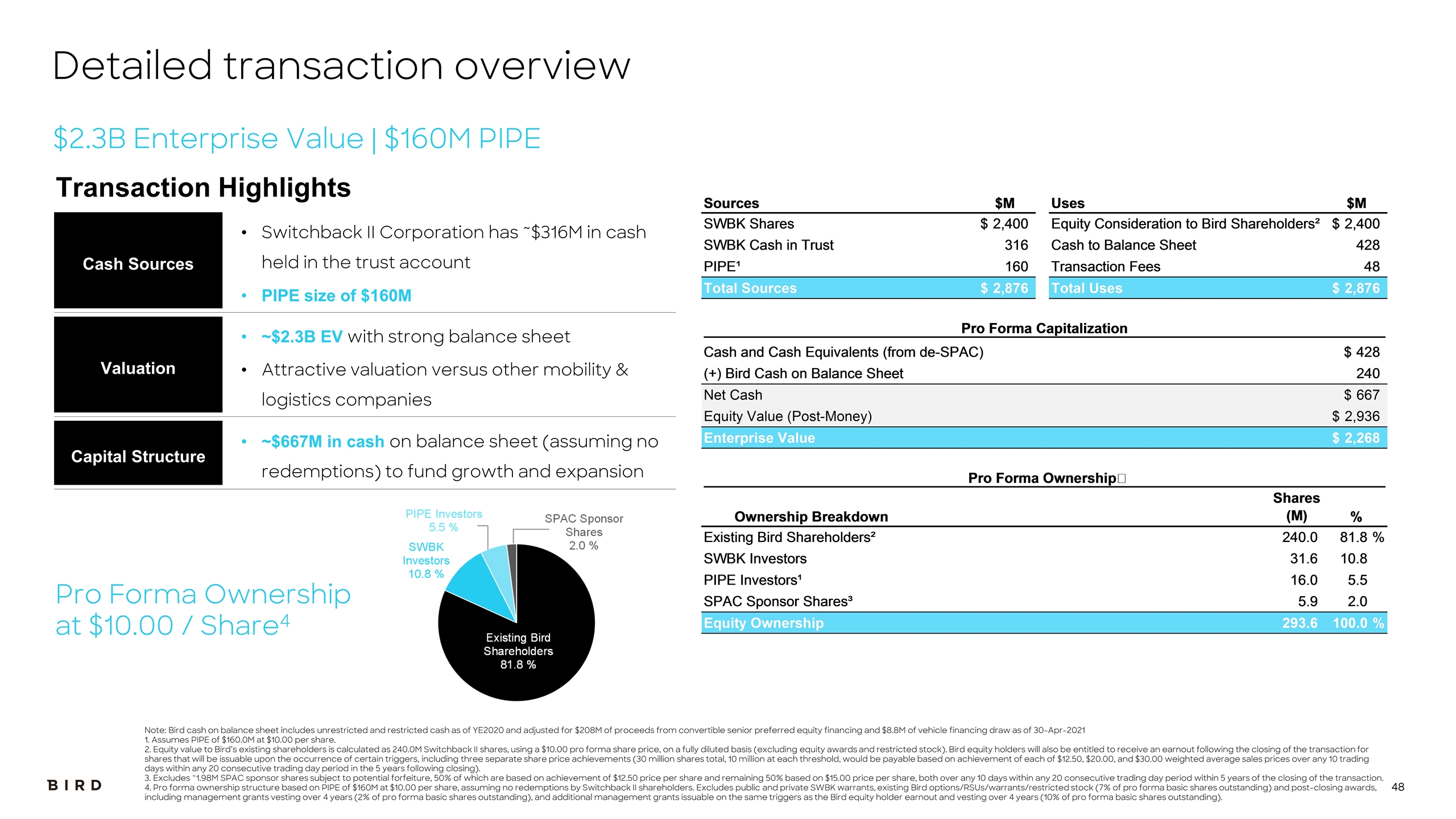

Detailed transaction overview Note: Bird cash on balance sheet includes unrestricted and restricted cash as of YE2020 and adjusted for $208M of proceeds from convertible senior preferred equity financing and $8.8M of vehicle financing draw as of 30-Apr-2021 1. Assumes PIPE of $160.0M at $10.00 per share. 2. Equity value to Bird’s existing shareholders is calculated as 240.0M Switchback II shares, using a $10.00 pro forma share price, on a fully diluted basis (excluding equity awards and restricted stock). Bird equity holders will also be entitled to receive an earnout following the closing of the transaction for shares that will be issuable upon the occurrence of certain triggers, including three separate share price achievements (30 million shares total, 10 million at each threshold, would be payable based on achievement of each of $12.50, $20.00, and $30.00 weighted average sales prices over any 10 trading days within any 20 consecutive trading day period in the 5 years following closing). 3. Excludes ~1.98M SPAC sponsor shares subject to potential forfeiture, 50% of which are based on achievement of $12.50 price per share and remaining 50% based on $15.00 price per share, both over any 10 days within any 20 consecutive trading day period within 5 years of the closing of the transaction. 4. Pro forma ownership structure based on PIPE of $160M at $10.00 per share, assuming no redemptions by Switchback II shareholders. Excludes public and private SWBK warrants, existing Bird options/RSUs/warrants/restricted stock (7% of pro forma basic shares outstanding) and post-closing awards, including management grants vesting over 4 years (2% of pro forma basic shares outstanding), and additional management grants issuable on the same triggers as the Bird equity holder earnout and vesting over 4 years (10% of pro forma basic shares outstanding). $2.3B Enterprise Value | $160M PIPE Cash Sources Switchback II Corporation has ~$316M in cash held in the trust account PIPE size of $160M Valuation ~$2.3B EV with strong balance sheet Attractive valuation versus other mobility & logistics companies Capital Structure ~$667M in cash on balance sheet (assuming no redemptions) to fund growth and expansion Transaction Highlights Pro Forma Ownership at $10.00 / Share4