DESCRIPTION OF THE REGISTRANT’S SECURITIES REGISTERED PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED The following description of the capital stock of Bird Global, Inc. (the “Company”, “we”, “us”, and “our”) and certain provisions of our amended and restated certification of incorporation (the “Charter”), amended and restated bylaws (the “Bylaws”) and Warrant Agreement between the Company, Switchback II Corporation (“Switchback”) and Continental Stock Transfer & Trust Company, dated as of January 7, 2021 (the “Warrant Agreement”) is not intended to be a complete summary of the rights and preferences of such securities and is qualified in its entirety by reference to the full text of Charter, Bylaws and Warrant Agreement, copies of which have been filed with the Securities and Exchange Commission. You are encouraged to read the applicable provisions of Delaware law, the Charter, the Bylaws and the Warrant Agreement in their entirety for a complete description of the rights and preferences of our securities. Capital Stock Authorized Capitalization Our Charter authorizes the issuance of 1,160,000,000 shares of capital stock, consisting of four classes: 1,000,000,000 shares of Class A common stock, par value $0.0001 per share, 10,000,000 shares of Class B common stock, par value $0.0001 per share, 50,000,000 shares of Class X common stock, par value $0.0001 per share, and 100,000,000 shares of preferred stock, par value $0.0001 per share. As of February 15, 2022, we had approximately 240,597,822 shares of Class A common stock outstanding and approximately 34,534,930 shares of Class X common stock outstanding. Class A Common Stock Voting Rights Our Charter provides that, except as otherwise expressly provided by our Charter or as provided by law, the holders of Class A common stock and Class X common stock will at all times vote together as a single class on all matters; provided, however, that except as otherwise required by law, holders of shares of Class A common stock and Class X common stock will not be entitled to vote on any amendment to our Charter that relates solely to the terms of one or more outstanding series of preferred stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to our Charter. Except as otherwise expressly provided in our Charter or by applicable law, each holder of Class A common stock will have the right to one vote per share of Class A common stock held of record by such holder. Dividend Rights Subject to preferences that may apply to any shares of our preferred stock outstanding at the time, shares of Class A common stock and Class X common stock will be treated equally, identically, and ratably, on a per share basis, with respect to any dividends or distributions as may be declared and paid from time to time by our board out of any assets of our company legally available therefor; provided, however, that in the event a dividend is paid in the form of shares of Class A common stock or Class X common stock (or rights to acquire such shares), then holders of Class A common stock will receive shares of Class A Common Stock (or rights to acquire such shares, as the case may be) and holders of Class X common stock will receive shares of Class X common stock (or rights to acquire such shares, as the case may be), with holders of shares of Class A common stock and Class X common stock receiving, on a per share basis, an identical number of shares of Class A Common Stock or Class X common stock, as applicable. Rights Upon Liquidation, Dissolution, and Winding Up Subject to any preferential or other rights of any holders of our preferred stock then outstanding, upon the liquidation, dissolution, or winding up of our company, whether voluntary or involuntary, holders of Class A common stock and Class X common stock will be entitled to receive ratably all assets of our company available for distribution to its stockholders.

Other Rights The holders of Class A common stock do not have preemptive, subscription, or conversion rights. There are no redemption or sinking fund provisions applicable to the Class A common stock. The rights, preferences, and privileges of holders of shares of Class A common stock will be subject to those of the holders of any shares of preferred stock that we may issue in the future. Class B Common Stock Our Class B common stock has the same rights, powers, and preferences as our Class A common stock. Class X Common Stock Voting Rights Our Charter provides that, except as otherwise expressly provided by our Charter or as provided by law, the holders of Class A common stock and Class X common stock will at all times vote together as a single class on all matters; provided however, that, except as otherwise required by law, holders of shares of Class A common stock and Class X common stock will not be entitled to vote on any amendment to our Charter that relates solely to the terms of one or more outstanding series of preferred stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to our Charter. Except as otherwise expressly provided in our Charter or by applicable law, each holder of Class X common stock will have the right to 20 votes per share of Class X common stock held of record by such holder. Dividend Rights Subject to preferences that may apply to any shares of preferred stock outstanding at the time, shares of Class A common stock and Class X common stock will be treated equally, identically, and ratably, on a per share basis, with respect to any dividends or distributions as may be declared and paid from time to time by our board out of any assets of our company legally available therefor; provided, however, that in the event a dividend is paid in the form of shares of Class A common stock or Class X common stock (or rights to acquire such shares), then holders of Class A common stock will receive shares of Class A common stock (or rights to acquire such shares, as the case may be) and holders of Class X common stock will receive shares of Class X common stock (or rights to acquire such shares, as the case may be), with holders of shares of Class A common stock and Class X common stock receiving, on a per share basis, an identical number of shares of Class A common stock or Class X common stock, as applicable. Rights Upon Liquidation, Dissolution, and Winding Up Subject to any preferential or other rights of any holders of preferred stock then outstanding, upon the liquidation, dissolution, or winding up of our company, whether voluntary or involuntary, holders of Class A common stock and Class X Common Stock will be entitled to receive ratably all assets of our company available for distribution to its stockholders. Other Rights The holders of Class X common stock will not have preemptive or other subscription rights. There will be no redemption or sinking fund provisions applicable to the Class X common stock. The Class X common stock will be convertible into shares of Class A common stock on a one-to-one basis at the option of the holders of the Class X common stock at any time upon written notice to our transfer agent. In addition, the Class X common stock will automatically convert into shares of Class A common stock on the earliest to occur of (a) the date Travis VanderZanden is neither a senior executive officer nor a director of our company and (b) the date on which the holders of Class X common stock as of the consummation of the Business Combination have sold more than 75% of their shares, other than certain permitted transfers specified in our Charter (such date, the “Sunset Date”). The Class X common stock will also automatically convert into Class A common stock upon a transfer of the Class X common stock, other than certain permitted transfers specified in our Charter. The rights, preferences, and privileges of holders of shares of Class X common stock will be subject to those of the holders of any shares of preferred stock that we may issue in the future.

Preferred Stock Our Charter provides that shares of preferred stock may be issued from time to time in one or more series. Our board will be authorized to fix the designation, preferences, and relative, participating, optional, or other special rights, and qualifications, limitations, or restrictions thereof, including without limitation thereof, dividend rights, conversion rights, redemption privileges, and liquidation preferences, of the shares of each such series and to increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of any such series. The number of authorized shares of preferred stock may also be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then-outstanding shares of our capital stock entitled to vote thereon. The purpose of authorizing our board of directors to issue preferred stock and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions, future financings, and other corporate purposes, could have the effect of making it more difficult for a third party to acquire, or could discourage a third party from seeking to acquire, a majority of our outstanding voting stock. Additionally, the issuance of preferred stock may adversely affect the holders of our Class A common stock by restricting dividends on our Class A common stock, diluting the voting power of our Class A common stock, or subordinating the liquidation rights of our Class A common stock. As a result of these or other factors, the issuance of preferred stock could have an adverse impact on the market price of our Class A common stock. Dividends Declaration and payment of any dividend will be subject to the discretion of our board of directors. The time and amount of dividends will be dependent upon our business prospects, results of operations, financial condition, cash requirements and availability, debt repayment obligations, capital expenditure needs, contractual restrictions, covenants in the agreements governing our current and future indebtedness, industry trends, the provisions of Delaware law affecting the payment of distributions to stockholders, and any other factors our board of directors may consider relevant. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness, and therefore, do not anticipate declaring or paying any cash dividends on our Class A common stock in the foreseeable future. Certain Anti-Takeover Provisions of Delaware Law and Our Charter and Bylaws Our Charter and Bylaws contain provisions that may delay, defer, or discourage another party from acquiring control of us. We expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors, which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give our board of directors the power to discourage acquisitions that some stockholders may favor. Delaware Anti-Takeover Statute We have opted out of Section 203 of the Delaware General Corporation Law (“DGCL”) under our Charter and Bylaws. By operation of Section 203(b)(3) of the DGCL, the restrictions on business combinations (as defined in Section 203(c)(3) of the DGCL) under Section 203 of the DGCL shall continue to apply for twelve (12) months after November 3, 2021, at which time they shall cease to apply by virtue of the election set forth in the immediately preceding sentence (the “203 Opt-Out Effective Date”). From and after the 203 Opt-Out Effective Date, our Charter and Bylaws will have protections similar to those afforded by Section 203 of the DGCL, which will prohibit us from engaging in any business combination with any stockholder for a period of three years following the time that such stockholder (the “interested stockholder”) came to own at least 15% of the outstanding voting stock of our company (the “acquisition”), except if: • our board approved the acquisition prior to its consummation; • the interested stockholder owned at least 85% of the outstanding voting stock upon consummation of the acquisition; or • the business combination is approved by our board, and by a two-thirds vote of the other stockholders in a meeting.

Generally, a “business combination” includes any merger, consolidation, asset or stock sale, or certain other transactions resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an “interested stockholder” is a person who, together with that person’s affiliates and associates, owns, or within the previous three years owned, 15% or more of our voting stock. Under certain circumstances, these anti-takeover provisions will make it more difficult for a person who would be an “interested stockholder” to effect various business combinations with us for a three-year period. This may encourage companies interested in acquiring our company to negotiate in advance with our board because the stockholder approval requirement would be avoided if our board approves the acquisition that results in the stockholder becoming an interested stockholder. This may also have the effect of preventing changes in our board and may make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests. Written Consent by Stockholders Under our Charter and Bylaws, subject to the rights of any series of preferred stock then outstanding, any action required or permitted to be taken by our stockholders (a) may be effected by a consent in writing by such stockholders until the Sunset Date and (b) following the Sunset Date, must be effected at a duly called annual or special meeting of our stockholders and may not be effected by any consent in writing by such stockholders. Special Meeting of Stockholders Under our Charter and Bylaws, special meetings of our stockholders may be called only by the chairperson of our board, our chief executive officer or president, our board acting pursuant to a resolution adopted by a majority of the total number of directors constituting our board, or, until the Sunset Date, our secretary upon a written request of any holder of record of at least 25% of the voting power of the issued and outstanding shares of our capital stock, and may not be called by any other person or persons. Only such business shall be considered at a special meeting of stockholders as shall have been stated in the notice for such meeting. Advance Notice Requirements for Stockholder Proposals and Director Nominations Under our Bylaws, advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders before any meeting of our stockholders shall be given in the manner and to the extent provided in our Bylaws. These provisions could have the effect of delaying stockholder actions that are favored by the holders of a majority of our outstanding voting securities until the next stockholder meeting. Authorized but Unissued Shares The authorized but unissued shares of our common stock and preferred stock are available for future issuance without stockholder approval, subject to any limitations imposed by NYSE rules. These additional shares may be used for a variety of corporate finance transactions, acquisitions, and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock could make more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger, or otherwise. Classified Board of Directors; Director Removal The Charter provides that our board of directors is divided into three classes, with the classes as nearly equal in number as possible and each class serving three-year staggered terms. The Charter also provides that, subject to the rights of the holders of any series of preferred stock then outstanding, (a) until the Sunset Date, directors on our board may be removed from office with or without cause and (b) following the Sunset Date, directors on our board may only be removed for cause, in each case, by the affirmative vote of the holders of at least a majority of the voting power of then-outstanding shares entitled to vote in the election of directors, voting together as a single class. These provisions may have the effect of deferring, delaying, or discouraging hostile takeovers, or changes in control of us or our management.

Amendment of Certificate of Incorporation or Bylaws The DGCL provides generally that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Our Charter and Bylaws, respectively require the affirmative vote of at least two-thirds of the voting power of the outstanding shares to (a) adopt, amend, or repeal our Bylaws and to (b) amend, alter, repeal, or rescind Article V(B), VI, VII, VIII, IX, X, XI, or XII of our Charter. Forum Selection Our Charter provides that the Court of Chancery of the State of Delaware (or, in the event that the Court of Chancery does not have jurisdiction, the federal district court for the District of Delaware or other state courts of the State of Delaware) and any appellate court thereof, is the sole and exclusive forum for the following types of actions or proceedings under Delaware statutory or common law: (a) any derivative action, suit, or proceeding brought on behalf of our company; (b) any action, suit, or proceeding asserting a claim of breach of a fiduciary duty owed by any director, officer, or stockholder of ours to our company or to our stockholders; (c) any action, suit, or proceeding arising pursuant to any provision of the DGCL or our Bylaws or Charter (as either may be amended from time to time); (d) any action, suit, or proceeding as to which the DGCL confers jurisdiction on the Court of Chancery; and (e) any action, suit, or proceeding asserting a claim against us or any current or former director, officer, or stockholder governed by the internal affairs doctrine. If any action the subject matter of which is within the scope of the immediately preceding sentence is filed in a court other than the courts in the State of Delaware (a “Foreign Action”) in the name of any stockholder, such stockholder will be deemed to have consented to (a) the personal jurisdiction of the state and federal courts in the State of Delaware in connection with any action brought in any such court to enforce the provisions of the immediately preceding sentence and (b) having service of process made upon such stockholder in any such action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder. Such exclusive forum provision will not apply to suits brought to enforce a duty or liability created by the Securities Act or the Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction. Unless we consent in writing to the selection of an alternative forum, to the fullest extent permitted by law, the federal district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. Limitations on Liability and Indemnification of Officers and Directors Our Charter and Bylaws provide indemnification and advancement of expenses for our directors and officers to the fullest extent permitted by the DGCL. In addition, as permitted by Delaware law, our Charter includes provisions that eliminate the personal liability of our directors for monetary damages resulting from breaches of certain fiduciary duties as a director. The effect of this provision is to restrict our rights and the rights of our stockholders in derivative suits to recover monetary damages against a director for breach of fiduciary duties as a director. These provisions may be held not to be enforceable for violations of the federal securities laws of the United States. We have also entered into indemnification agreements with each of our directors and certain of our officers which provide them with contractual rights to indemnification and expense advancement which are, in some cases, broader than the specific indemnification provisions contained under Delaware law. Warrants Public Warrants Public warrants may only be exercised for a whole number of shares of Class A common stock. No fractional public warrants were issued upon separation of Switchback’s units and only whole public warrants will trade. The public warrants became exercisable on January 12, 2022; provided that we have an effective registration statement under the Securities Act covering the shares of Class A common stock issuable upon exercise of the public warrants and a current prospectus relating to them is available and such shares are registered, qualified, or exempt from registration under the securities, or blue sky, laws of the state of residence of the holder (or we permit holders to exercise their public warrants on a cashless basis under certain circumstances). In the event that the conditions in the immediately preceding sentence are not satisfied with respect to a public warrant, the holder of such public warrant will not be

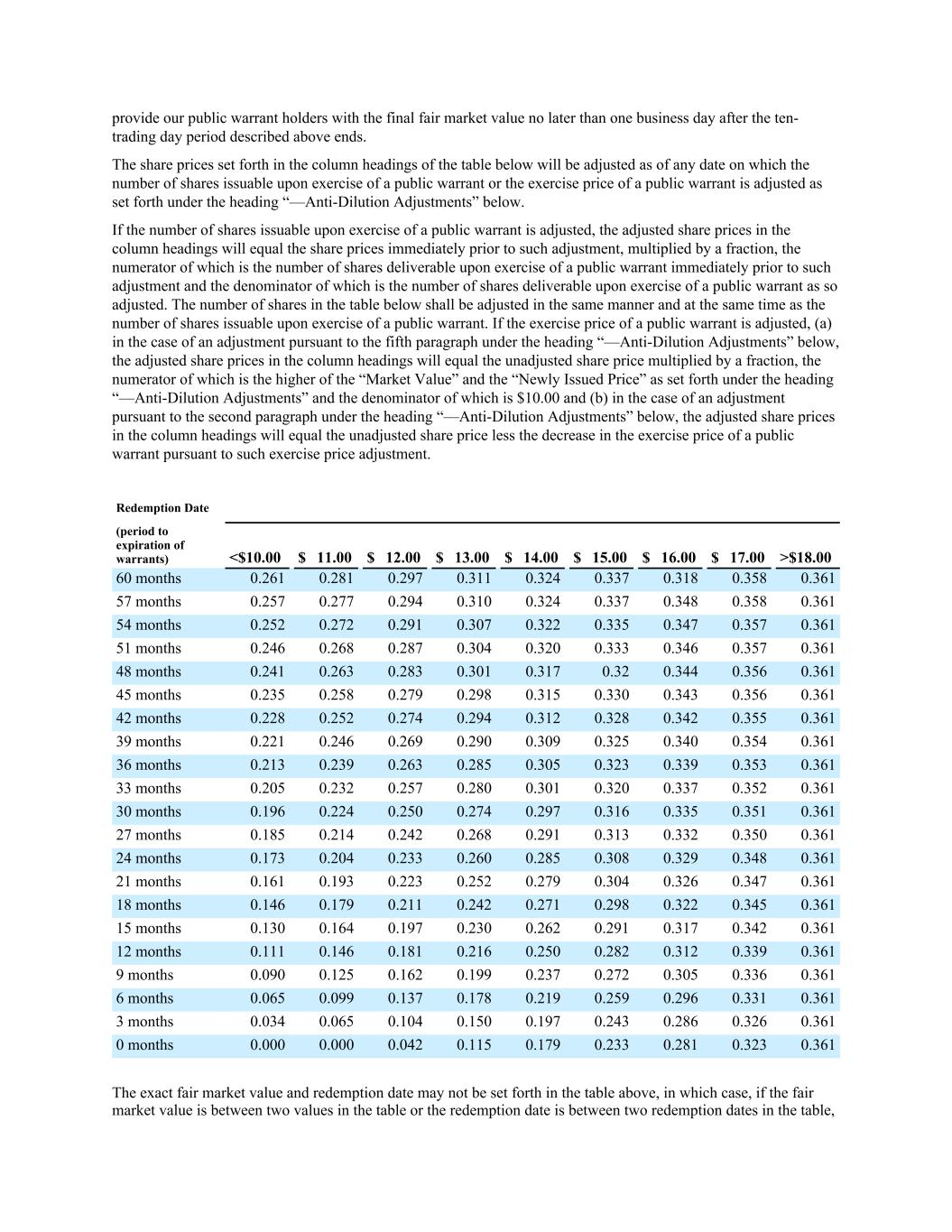

entitled to exercise such public warrant and such public warrant may have no value and expire worthless. The public warrants have an exercise price of $11.50 per share, subject to adjustments, and will expire at 5:00 p.m., New York City time, on November 4, 2026, or earlier upon redemption or liquidation. Redemption of Public Warrants When the Price Per Share of Class A Common Stock Equals or Exceeds $18.00 We may redeem the outstanding public warrants for cash: • in whole and not in part; • at a price of $0.01 per warrant; • upon a minimum of 30 days’ prior written notice of redemption (the “30-day redemption period”); and • if, and only if, the last sale price of our Class A common stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations, and the like) for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the public warrant holders. We will not redeem the public warrants for cash unless a registration statement under the Securities Act covering the shares of our Class A common stock issuable upon exercise of the warrants is effective and a current prospectus relating to those shares of our Class A common stock is available throughout the 30-day redemption period, except if the public warrants may be exercised on a cashless basis and such cashless exercise is exempt from registration under the Securities Act. If and when the public warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws. We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the public warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the public warrants, each public warrant holder will be entitled to exercise his, her or its public warrant prior to the scheduled redemption date. However, the price of the shares of our Class A common stock may fall below the $18.00 redemption trigger price (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a public warrant as described under the heading “— Anti-Dilution Adjustments”) as well as the $11.50 (for whole shares) public warrant exercise price after the redemption notice is issued. Redemption of Public Warrants When the Price Per Share of Class A Common Stock Equals or Exceeds $10.00 We may redeem the outstanding public warrants: • in whole and not in part; • at $0.10 per public warrant; provided that holders will be able to exercise their public warrants on a cashless basis prior to redemption and receive that number of shares of our Class A common stock to be determined by reference to the table below, based on the redemption date and the “fair market value” (as defined below) of our shares of our Class A common stock except as otherwise described below; • upon a minimum of 30 days’ prior written notice of redemption; and • if, and only if, the last sale price of our Class A common stock equals or exceeds $10.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations, and the like) on the trading day prior to the date on which we send the notice of redemption to the warrant holders. The “fair market value” of our Class A Common Stock means the average last reported sale price of our Class A common stock for the ten trading days immediately following the date on which the notice of redemption is sent to the holders of warrants. Beginning on the date the notice of redemption is given until the public warrants are redeemed or exercised, holders may elect to exercise their public warrants on a cashless basis. The numbers in the table below represent the number of shares of our Class A common stock that a public warrant holder will receive upon such cashless exercise in connection with a redemption by us pursuant to this redemption feature, based on the fair market value of our Class A common stock on the corresponding redemption date (assuming holders elect to exercise their public warrants and such public warrants are not redeemed for $0.10 per warrant) and the number of months that the corresponding redemption date precedes the expiration date of the public warrants, each as set forth in the table below. We will

provide our public warrant holders with the final fair market value no later than one business day after the ten- trading day period described above ends. The share prices set forth in the column headings of the table below will be adjusted as of any date on which the number of shares issuable upon exercise of a public warrant or the exercise price of a public warrant is adjusted as set forth under the heading “—Anti-Dilution Adjustments” below. If the number of shares issuable upon exercise of a public warrant is adjusted, the adjusted share prices in the column headings will equal the share prices immediately prior to such adjustment, multiplied by a fraction, the numerator of which is the number of shares deliverable upon exercise of a public warrant immediately prior to such adjustment and the denominator of which is the number of shares deliverable upon exercise of a public warrant as so adjusted. The number of shares in the table below shall be adjusted in the same manner and at the same time as the number of shares issuable upon exercise of a public warrant. If the exercise price of a public warrant is adjusted, (a) in the case of an adjustment pursuant to the fifth paragraph under the heading “—Anti-Dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share price multiplied by a fraction, the numerator of which is the higher of the “Market Value” and the “Newly Issued Price” as set forth under the heading “—Anti-Dilution Adjustments” and the denominator of which is $10.00 and (b) in the case of an adjustment pursuant to the second paragraph under the heading “—Anti-Dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share price less the decrease in the exercise price of a public warrant pursuant to such exercise price adjustment. Redemption Date (period to expiration of warrants) <$10.00 $ 11.00 $ 12.00 $ 13.00 $ 14.00 $ 15.00 $ 16.00 $ 17.00 >$18.00 60 months 0.261 0.281 0.297 0.311 0.324 0.337 0.318 0.358 0.361 57 months 0.257 0.277 0.294 0.310 0.324 0.337 0.348 0.358 0.361 54 months 0.252 0.272 0.291 0.307 0.322 0.335 0.347 0.357 0.361 51 months 0.246 0.268 0.287 0.304 0.320 0.333 0.346 0.357 0.361 48 months 0.241 0.263 0.283 0.301 0.317 0.32 0.344 0.356 0.361 45 months 0.235 0.258 0.279 0.298 0.315 0.330 0.343 0.356 0.361 42 months 0.228 0.252 0.274 0.294 0.312 0.328 0.342 0.355 0.361 39 months 0.221 0.246 0.269 0.290 0.309 0.325 0.340 0.354 0.361 36 months 0.213 0.239 0.263 0.285 0.305 0.323 0.339 0.353 0.361 33 months 0.205 0.232 0.257 0.280 0.301 0.320 0.337 0.352 0.361 30 months 0.196 0.224 0.250 0.274 0.297 0.316 0.335 0.351 0.361 27 months 0.185 0.214 0.242 0.268 0.291 0.313 0.332 0.350 0.361 24 months 0.173 0.204 0.233 0.260 0.285 0.308 0.329 0.348 0.361 21 months 0.161 0.193 0.223 0.252 0.279 0.304 0.326 0.347 0.361 18 months 0.146 0.179 0.211 0.242 0.271 0.298 0.322 0.345 0.361 15 months 0.130 0.164 0.197 0.230 0.262 0.291 0.317 0.342 0.361 12 months 0.111 0.146 0.181 0.216 0.250 0.282 0.312 0.339 0.361 9 months 0.090 0.125 0.162 0.199 0.237 0.272 0.305 0.336 0.361 6 months 0.065 0.099 0.137 0.178 0.219 0.259 0.296 0.331 0.361 3 months 0.034 0.065 0.104 0.150 0.197 0.243 0.286 0.326 0.361 0 months 0.000 0.000 0.042 0.115 0.179 0.233 0.281 0.323 0.361 The exact fair market value and redemption date may not be set forth in the table above, in which case, if the fair market value is between two values in the table or the redemption date is between two redemption dates in the table,

the number of shares of our Class A common stock to be issued for each public warrant exercised will be determined by a straight-line interpolation between the number of shares set forth for the higher and lower fair market values and the earlier and later redemption dates, as applicable, based on a 365- or 366-day year, as applicable. In no event will the public warrants be exercisable on a cashless basis in connection with this redemption feature for more than 0.361 shares of our Class A common stock per public warrant (subject to adjustment). Finally, as reflected in the table above, if the public warrants are out of the money and about to expire, they cannot be exercised on a cashless basis in connection with a redemption by us pursuant to this redemption feature, since they will not be exercisable for any shares of our Class A common stock. This redemption feature is structured to allow for all of the outstanding public warrants to be redeemed when the shares of our Class A common stock are trading at or above $10.00 per share, which may be at a time when the trading price of our shares of our Class A common stock is below the exercise price of the public warrants. We have established this redemption feature to provide us with the flexibility to redeem the public warrants without the public warrants having to reach the $18.00 per share threshold set forth above under “—Redemption of Public Warrants When the Price Per our Class A common stock Equals or Exceeds $18.00.” Holders choosing to exercise their public warrants in connection with a redemption pursuant to this feature will, in effect, receive a number of shares for their public warrants based on an option pricing model with a fixed volatility input as of the date of the final prospectus filed in connection with Switchback’s initial public offering. This redemption right provides us with an additional mechanism by which to redeem all of the outstanding public warrants, and therefore have certainty as to our capital structure as the public warrants would no longer be outstanding and would have been exercised or redeemed and we will be required to pay the applicable redemption price to public warrant holders if we choose to exercise this redemption right and it will allow us to quickly proceed with a redemption of the public warrants if we determine it is in our best interest to do so. As such, we would redeem the public warrants in this manner when we believe it is in our best interest to update our capital structure to remove the public warrants and pay the redemption price to the public warrant holders. As stated above, we can redeem the public warrants when the shares of our Class A common stock are trading at a price starting at $10.00, which is below the exercise price of $11.50, because it will provide certainty with respect to our capital structure and cash position while providing public warrant holders with the opportunity to exercise their public warrants on a cashless basis for the applicable number of shares. If we choose to redeem the public warrants when the shares of our Class A common stock are trading at a price below the exercise price of the public warrants, this could result in the public warrant holders receiving fewer shares of our Class A common stock than they would have received if they had chosen to wait to exercise their public warrants for shares of our Class A common stock if and when such shares of our Class A common stock were trading at a price higher than the exercise price of $11.50. No fractional shares of our Class A common stock will be issued upon exercise. If, upon exercise, a holder would be entitled to receive a fractional interest in a share, we will round down to the nearest whole number of shares of our Class A common stock to be issued to the holder. Redemption Procedures A holder of a public warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such public warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to Continental Stock Transfer and Trust Company’s actual knowledge, would beneficially own in excess of 9.8% (or such other amount as specified by the holder) of the shares of our Class A common stock outstanding immediately after giving effect to such exercise. Anti-Dilution Adjustments If the number of outstanding shares of our Class A common stock is increased by a share capitalization payable in shares of our Class A common stock, or by a stock split or other similar event, then, on the effective date of such share capitalization, stock split, or similar event, the number of shares of our Class A common stock issuable on exercise of each public warrant will be increased in proportion to such increase in the outstanding number of shares of common stock. A rights offering to holders of our Class A common stock entitling holders to purchase shares of our Class A common stock at a price less than the “historical fair market value” (as defined below) will be deemed a share capitalization of a number of shares of our Class A common stock equal to the product of (i) the number of shares of our Class A common stock actually sold in such rights offering (or issuable under any other equity

securities sold in such rights offering that are convertible into or exercisable for shares of our Class A common stock) multiplied by (ii) one minus the quotient of (x) the price per share of our Class A common stock paid in such rights offering and divided by (y) the historical fair market value. For these purposes (i) if the rights offering is for securities convertible into or exercisable for shares of our Class A common stock, in determining the price payable for shares of our Class A common stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) “historical fair market value” means the volume weighted average price of shares of our Class A common stock as reported during the ten-trading day period ending on the trading day prior to the first date on which the shares of our Class A common stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights. In addition, if we, at any time while the public warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities, or other assets to holders of shares of our Class A common stock on account of such shares of our Class A common stock (or other securities into which the public warrants are convertible), other than (a) as described above, or (b) any cash dividends or cash distributions which, when combined on a per share basis with all other cash dividends and cash distributions paid on the shares of our Class A common stock during the 365- day period ending on the date of declaration of such dividend or distribution (as adjusted to appropriately reflect any other adjustments and excluding cash dividends or cash distributions that resulted in an adjustment to the exercise price or to the number of shares of our Class A common stock issuable on exercise of each public warrant) does not exceed $0.50, then the public warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each share of our Class A common stock in respect of such event. If the number of outstanding shares of our Class A common stock is decreased by a consolidation, combination, reverse share split, or reclassification of shares of our Class A common stock or other similar event, then, on the effective date of such consolidation, combination, reverse share split, reclassification, or similar event, the number of shares of our Class A common stock issuable on exercise of each public warrant will be decreased in proportion to such decrease in outstanding shares of our Class A common stock. Whenever the number of shares of our Class A common stock purchasable upon the exercise of the public warrants is adjusted, as described above, the public warrant exercise price will be adjusted by multiplying the public warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of shares of our Class A common stock purchasable upon the exercise of the public warrants immediately prior to such adjustment, and (y) the denominator of which will be the number of shares of our Class A common stock so purchasable immediately thereafter. In case of any reclassification or reorganization of the outstanding shares of our Class A common stock (other than those described above or that solely affects the par value of such shares of our Class A common stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our outstanding shares of our Class A common stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the public warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the public warrants and in lieu of the shares of our Class A common stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of our Class A common stock or other securities or property (including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the public warrants would have received if such holder had exercised their public warrants immediately prior to such event. However, if such holders were entitled to exercise a right of election as to the kind or amount of securities, cash, or other assets receivable upon such consolidation or merger, then the kind and amount of securities, cash or other assets for which each public warrant will become exercisable will be deemed to be the weighted average of the kind and amount received per share by such holders in such consolidation or merger that affirmatively make such election, and if a tender, exchange, or redemption offer has been made to and accepted by such holders under circumstances in which, upon completion of such tender or exchange offer, the maker thereof, together with members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange Act) of which such maker is a part, and together with any affiliate or associate of such maker (within the meaning of Rule 12b-2 under the Exchange Act) and any members of any such group of which any such affiliate or associate is

a part, own beneficially (within the meaning of Rule 13d-3 under the Exchange Act) more than 50% of the outstanding shares of our Class A common stock, the holder of a public warrant will be entitled to receive the highest amount of cash, securities or other property to which such holder would actually have been entitled as a shareholder if such public warrant holder had exercised the public warrant prior to the expiration of such tender or exchange offer, accepted such offer and all of the shares of our Class A common stock held by such holder had been purchased pursuant to such tender or exchange offer, subject to adjustment (from and after the consummation of such tender or exchange offer) as nearly equivalent as possible to the adjustments provided for in the Warrant Agreement. Additionally, if less than 70% of the consideration receivable by the holders of shares of our Class A common stock in such a transaction is payable in the form of shares of our Class A common stock in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the public warrant properly exercises the public warrant within thirty days following public disclosure of such transaction, the public warrant exercise price will be reduced as specified in the Warrant Agreement based on the Black-Scholes Warrant Value (as defined in the Warrant Agreement) of the public warrant. The purpose of such exercise price reduction is to provide additional value to holders of the public warrants when an extraordinary transaction occurs during the exercise period of the public warrants pursuant to which the holders of the public warrants otherwise do not receive the full potential value of the public warrants. The public warrants are issued in registered form under a Warrant Agreement between Continental Stock Transfer & Trust Company, as warrant agent, and us. The Warrant Agreement provides that the terms of the public warrants may be amended without the consent of any holder to cure any ambiguity or correct any defective provision, but requires the approval by the holders of at least a majority of then-outstanding public warrants to make any change that adversely affects the interests of the registered holders. The public warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of Continental Stock Transfer & Trust Company, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number of public warrants being exercised. The public warrant holders do not have the rights or privileges of holders of common stock and any voting rights until they exercise their public warrants and receive shares of our Class A common stock. After the issuance of shares of our Class A common stock upon exercise of the public warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by shareholders. We have agreed that, subject to applicable law, any action, proceeding or claim against us arising out of or relating in any way to the Warrant Agreement will be brought and enforced in the courts of the State of New York or the United States District Court for the Southern District of New York, and we irrevocably submit to such jurisdiction, which jurisdiction will be the exclusive forum for any such action, proceeding or claim. This provision applies to claims under the Securities Act but does not apply to claims under the Exchange Act or any claim for which the federal district courts of the United States of America are the sole and exclusive forum. Warrant Agent, Transfer Agent, and Registrar The warrant agent for our warrants and the transfer agent and registrar for our Class A common stock is Continental Stock Transfer & Trust Company. Trading Symbol and Market Our Class A common stock and public warrants are listed on the NYSE under the symbols “BRDS” and “BRDS WS,” respectively.