Filed by Insight Acquisition Corp.

Pursuant to Rule 425 under the Securities Act of 1933 and deemed

filed pursuant toRule 14a-12 under the Securities Exchange Act of 1934

Commission File No. 001-40775

Subject Company: Insight Acquisition Corp.

1 lpha modus January 2024 Filed by Insight Acquisition Corp. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant toRule 14a - 12 under the Securities Exchange Act of 1934 Commission File No. 001 - 40775 Subject Company: Insight Acquisition Corp.

Purpose The purpose (the “Purpose”) of this information presentation (“Presentation”) is to provide preliminary information regarding Alpha Modus, Corp. (the “Company”) to parties interested in assessing whether or not they wish to proceed with a more detailed review of the Company. Effective as of October 13, 2023, Alpha Modus entered into a business combination agreement (the “BCA”) with Insight Acquisition Corp. (“Insight”), pursuant to which Alpha Modus would be acquired by Insight (the “Business Combination”). The closing of the proposed Business Combination is subject to a number of conditions, as set out in the BCA, including but not limited to approval of the transaction by Insight’s stockholders and Alpha Modus’ stockholders, the SEC declaring Insight’s registration statement on Form S - 4 effective and other customary closing conditions. Important Information About the Proposed Business Combination and Where to Find It In connection with the proposed Business Combination, Insight and Alpha Modus have filed with the SEC a registration statement on Form S - 4, which includes Insight’s proxy statement on Schedule 14A, and which registration statement has not yet been declared effective by the SEC. The Company’s stockholders and other interested persons are advised to read, when available, the definitive proxy statement and documents incorporated by reference therein filed in connection with the proposed Business Combination, as these materials will contain important information about Insight and Alpha Modus, and the proposed Business Combination. Promptly after filing its definitive proxy statement relating to the proposed Business Combination with the SEC, Insight will mail the definitive proxy statement and a proxy card to each Insight stockholder entitled to vote at the special meeting on the Business Combination and the other proposals. Insight stockholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy statement, and other relevant materials filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov " www.sec.gov or upon written request to Insight Acquisition Corp. at 333 East 91st Street, #33AB New York, NY 10024. Participants in the Solicitation Insight and its directors and executive officers may be deemed participants in the solicitation of proxies from Insight’s stockholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Insight will be included in the proxy statement for the proposed Business Combination and be available at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement for the proposed Business Combination when available. Information about Insight’s directors and executive officers and their ownership of Insight’s common stock is set forth in the Company’s final prospectus, as filed with the SEC on September 7, 2021, or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed Business Combination when it becomes available. These documents can be obtained free of charge from the sources indicated above. Alpha Modus and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement for the proposed Business Combination. SAFE HARBOR STATEMENTS 2

No Offer or Solicitation This Presentation shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed Business Combination. This Presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. Forward - Looking Statements This Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Insight’s and Alpha Modus’ actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these forward - looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward - looking statements, but are not the exclusive means of identifying these statements. These forward - looking statements include, without limitation, Insight’s and Alpha Modus’ expectations with respect to future performance and anticipated financial impacts of the proposed Business Combination, the satisfaction of the closing conditions to the proposed Business Combination, and the timing of the completion of the proposed Business Combination. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward - looking statements. Most of these factors are outside Insight’s and Alpha Modus’ control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change, or other circumstances that could give rise to the termination of the business combination agreement between Insight and Alpha Modus (the “BCA”); (2) the outcome of any legal proceedings that may be instituted against Insight and Alpha Modus following the announcement of the BCA and the transactions contemplated therein; (3) the inability to complete the proposed the proposed Business Combination, including due to failure to obtain approval of the stockholders of Insight and Alpha Modus, certain regulatory approvals, or satisfy other conditions to closing in the BCA; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the BCA or could otherwise cause the transaction to fail to close; (5) the impact of COVID - 19 pandemic on Alpha Modus’ business and/or the ability of the parties to complete the proposed Business Combination; (6) the inability to obtain the listing of the combined company’s common stock on the Nasdaq Stock Market following the proposed Business Combination; (7) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the proposed Business Combination; (8) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of Alpha Modus to grow and manage growth profitably, and retain its key employees; (9) costs related to the proposed Business Combination; (10) changes in applicable laws or regulations; (11) the possibility that Insight and Alpha Modus may be adversely affected by other economic, business, and/or competitive factors; (12) risks relating to the uncertainty of the projected financial information with respect to Alpha Modus; (13) risks related to the organic and inorganic growth of Alpha Modus’ business and the timing of expected business milestones; (14) the amount of redemption requests made by Insight’s stockholders; and (15) other risks and uncertainties indicated from time to time in the final prospectus of Insight for its initial public offering and the registration statement on Form S - 4, including the proxy statement relating to the proposed Business Combination, including those enumerated under “Risk Factors” therein, and in Insight’s other filings with the SEC. Insight cautions that the foregoing list of factors is not exclusive. Insight and Alpha Modus caution readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Insight and Alpha Modus do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based. SAFE HARBOR STATEMENTS (CONTINUED) 3

4 Chris Chumas Chief Sales Officer Mr . Chumas has been the Chief Strategy Officer of Alpha Modus since June 2018 . Mr . Chumas has over 15 years of experience as a sales executive working for IBM, Erwin, and WorkFusion, it is anticipated that he will serve as Chief Sales Officer of the combined company upon closing the Business Combination with Insight Acquisition Corp . Rod Sperry Chief Financial Officer Mr . Sperry has over 14 years of experience in public accounting and consulting . He has served as outside controller for several public companies, responsible for SEC reporting and compliance, and it is anticipated that he will serve as Chief Financial Officer of the combined company upon closing the Business Combination with Insight Acquisition William Alessi Chief Executive Officer Mr . Alessi founded Alpha Modus in 2014 , is currently the sole member of the Alpha Modus board of directors and its Chief Executive Officer, and it is anticipated that he will be appointed to serve as the Chief Executive Officer of the combined company upon closing the Business Combination with Insight Acquisition Corp . Michael Garel Inventor and Advisor Mr . Garel founded eyeQ in 2013 , and Mr . Garel has been an advisor to Alpha Modus since Alpha Modus acquired eyeQ in 2018 . Mr . Garel has extensive experience in technology product development having worked at companies such as Accruent, Dell, and Omnicell over the course of his career . Corp. LEADERSHIP TEAM

WHAT WE DO 5 Alpha Modus engages in creating, developing and licensing data - driven technologies that are designed to drive advanced digital retail advertising experiences for the purpose of enhancing consumers’ in - store digital experience at the point of decision . Analyze consumer behavior and their interactions with retail products in real - time with the objective to provide brands and retailers the ability to: Enhance the Consumers In - Store Experience • Engage consumers with interactive output displays throughout brick - and - mortar retail stores to capture critical decision - making at the point of sale. • Cater to specific and immediate needs of the consumer. • Capture MAC address tracking data, user eye tracking, object identification of goods throughout the store. Manage Inventory and Create Smart Planograms • Assess the consumers product engagement and product tracking in real time. • Aid in inventory management and product placement throughout a store by creating smart planograms. Monetize Digital Insights • Curate tailored in - store marketing solutions. • Drive sales via engaging customers with digital experiences at the point of sale.

PATENT PORTFOLIO 6

• Consists of six issued patents with new claims pending and the ability to continue expanding claims. • Based on US Patent No. 10,360,571 which issued on July 23, 2019. • Priority dates to a provision patent application filed on July 19, 2013. ‘571 Patent Family 7 Covers a variety of advertising features, including the presentation and display of relevant and targeted advertising that is based on singular user/customer shopping habits, search history, or relevant other criteria. The ‘571 patent expires on May 25, 2037. The other patents in the ‘571 patent family expire on July 18, 2034. PATENT OVERVIEW

TECHNOLOGY PORTFOLIO Innovation In Retail 8 Alpha Modus Corp. specializes in the development of innovative retail technologies. Alpha Modus’s technology portfolio, is the capability to analyze consumer behavior and product interaction in real - time. This advanced capability allows businesses to dynamically adjust their marketing strategies to meet the immediate needs of consumers at pivotal purchasing decision moments. The ’571 Patent relates to a method for monitoring and analyzing consumer behavior in real - time, particularly within retail environments. It utilizes various information monitoring devices to collect data about consumers, enhancing their shopping experience through targeted and personalized digital interactions. The inventors of the ’571 Patent identified a critical need in the retail industry, especially brick - and - mortar stores, to adapt to the evolving shopping habits influenced by online retail and social media. The patent addresses the challenge of providing an enriched in - store experience that rivals online shopping, thus countering trends like showrooming. The ’571 Patent describes and claims a specific method that involves using information monitoring devices, like video image devices, to gather data about shoppers. This data includes demographic characteristics (such as gender and age), sentiment, and tracking details (like movement and eye tracking). The patent details the process of analyzing this data in real - time and providing various responses, such as targeted marketing, personal engagement, or offering coupons, to enhance the shopping experience.

TECHNOLOGY PORTFOLIO The ’672 Patent introduces a novel system for real - time inventory management, marketing, and advertising within a retail store setting. The ’672 Patent addresses the emerging challenges in the retail sector, particularly for brick - and - mortar stores, in the context of the increasing prevalence of online shopping and the phenomenon of showrooming. The patent provides innovative solutions to enhance in - store customer experiences and counter the competitive pressures from online retail. The inventors of the ’672 Patent recognized that there existed a significant gap in the brick - and - mortar retail sector’s ability to provide real - time, personalized experiences to customers, a feature commonly leveraged by online retailers. The patent offers a method and system that bridges this gap by utilizing technology to analyze consumer behavior and dynamically adjust marketing and inventory strategies. 9

TECHNOLOGY PORTFOLIO The ’890 Patent The ’890 Patent relates to an improved method for enhancing customer assistance in retail stores through the use of advanced information monitoring systems. The inventors of the ’890 Patent recognized the need for brick - and - mortar retailers to adapt to the changing consumer behavior influenced by digital technology. The patent offers a solution by integrating technology to analyze customer interactions with products in real - time, providing targeted assistance and enhancing the shopping experience. The ’890 Patent provides several advancements over previous methods, such as real - time analysis of customer interactions with products, including sentiment and object identification information, and utilizing this data to manage inventory and offer personalized responses. 10

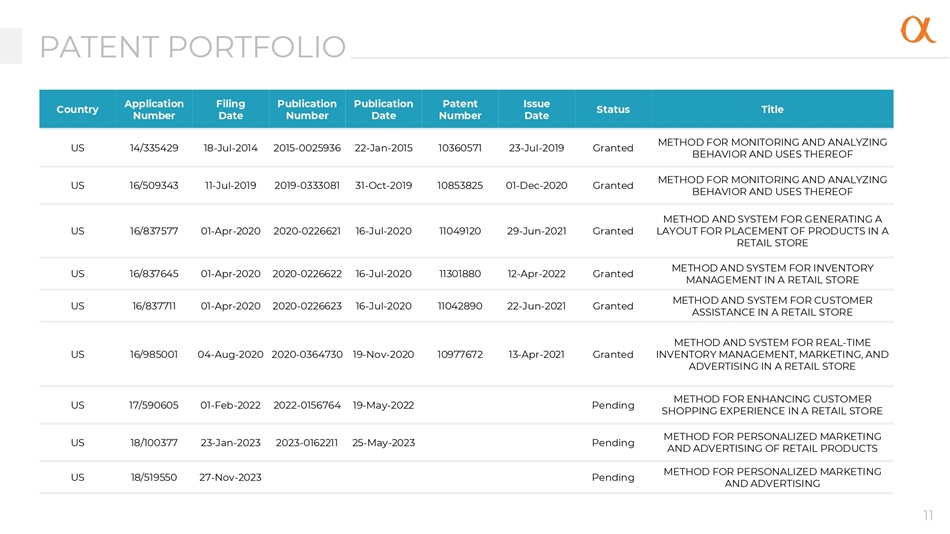

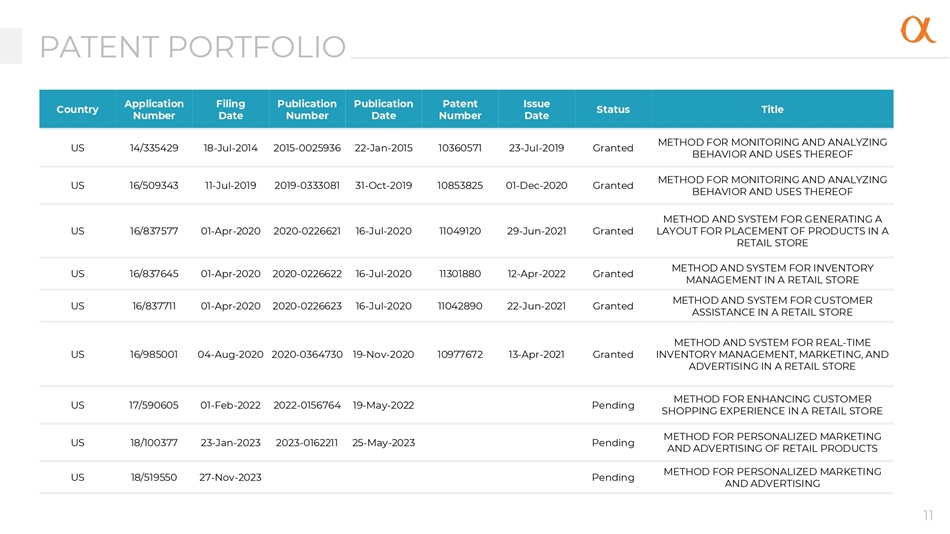

PATENT PORTFOLIO 11 Title Status Issue Date Patent Number Publication Date Publication Number Filing Date Application Number Country METHOD FOR MONITORING AND ANALYZING BEHAVIOR AND USES THEREOF Granted 23 - Jul - 2019 10360571 22 - Jan - 2015 2015 - 0025936 18 - Jul - 2014 14/335429 US METHOD FOR MONITORING AND ANALYZING BEHAVIOR AND USES THEREOF Granted 01 - Dec - 2020 10853825 31 - Oct - 2019 2019 - 0333081 11 - Jul - 2019 16/509343 US METHOD AND SYSTEM FOR GENERATING A LAYOUT FOR PLACEMENT OF PRODUCTS IN A RETAIL STORE Granted 29 - Jun - 2021 11049120 16 - Jul - 2020 2020 - 0226621 01 - Apr - 2020 16/837577 US METHOD AND SYSTEM FOR INVENTORY MANAGEMENT IN A RETAIL STORE Granted 12 - Apr - 2022 11301880 16 - Jul - 2020 2020 - 0226622 01 - Apr - 2020 16/837645 US METHOD AND SYSTEM FOR CUSTOMER ASSISTANCE IN A RETAIL STORE Granted 22 - Jun - 2021 11042890 16 - Jul - 2020 2020 - 0226623 01 - Apr - 2020 16/837711 US METHOD AND SYSTEM FOR REAL - TIME INVENTORY MANAGEMENT, MARKETING, AND ADVERTISING IN A RETAIL STORE Granted 13 - Apr - 2021 10977672 19 - Nov - 2020 2020 - 0364730 04 - Aug - 2020 16/985001 US METHOD FOR ENHANCING CUSTOMER SHOPPING EXPERIENCE IN A RETAIL STORE Pending 19 - May - 2022 2022 - 0156764 01 - Feb - 2022 17/590605 US METHOD FOR PERSONALIZED MARKETING AND ADVERTISING OF RETAIL PRODUCTS Pending 25 - May - 2023 2023 - 0162211 23 - Jan - 2023 18/100377 US METHOD FOR PERSONALIZED MARKETING AND ADVERTISING Pending 27 - Nov - 2023 18/519550 US

CURRENT RETAIL MARKETPLACE 12

USE CASES Individuals are being mined for metadata on a frequent basis. In today's world, individuals are being mined for metadata quite frequently. Whether you are at home, in your car, or out in public, consumer behavior is being harvested and catalogued by segments such as age, gender and sentiment. 13 Maximize advertising by getting the right ads in front of the right people at the right time .

USE CASES 14 Enhancing the Consumer In - Store Digital Experience. Alpha Modus engages in creating, developing and licensing data driven technologies to enhance a consumer’s in - store digital experience at the point of decision. Analyze consumer purchasing behavior in real - time . When it matters most .

Data (proprietary and 3rd party) is being collected at home, in car, at work, and at the point of sale. Targeted digital ads are being delivered at the point of sale via kiosks, checkout, end caps, digital displays. Targeted digital ads are being delivered outside the point of sale to drive the consumer back to the point of sale via, radio, push notifications on mobile devices, PC’s, navigation screens. TARGETED DIGITAL ADS 15 15

MONETIZATION 16

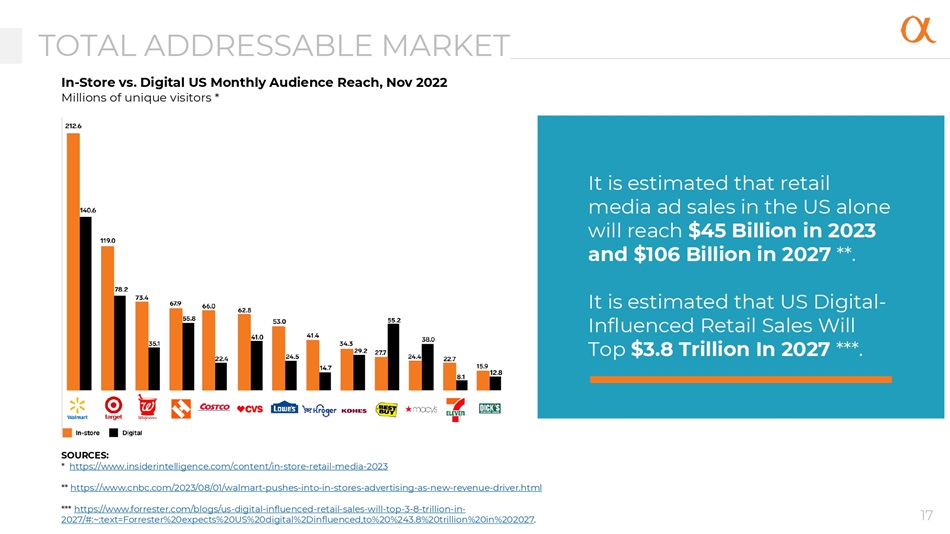

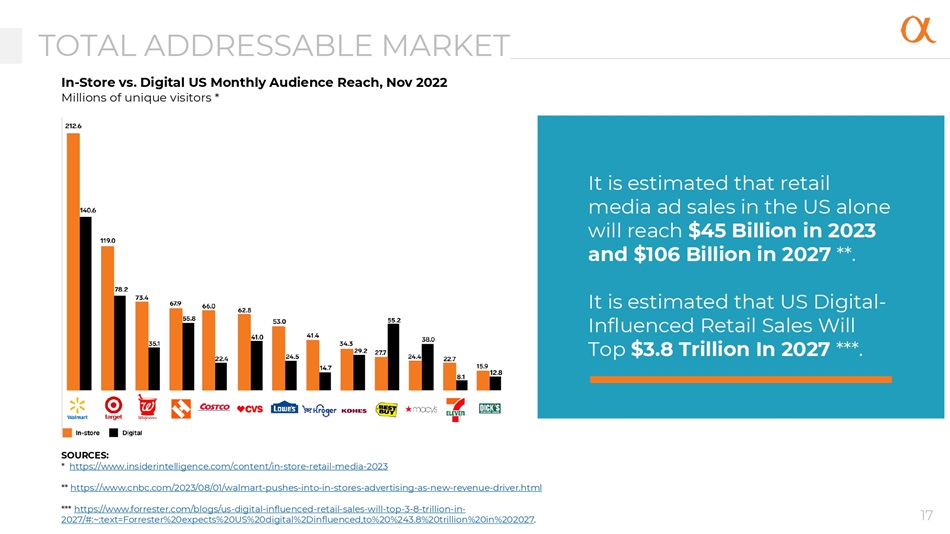

17 It is estimated that retail media ad sales in the US alone will reach $45 Billion in 2023 and $106 Billion in 2027 **. It is estimated that US Digital - Influenced Retail Sales Will Top $3.8 Trillion In 2027 ***. SOURCES: * https: //w ww .insiderintelligence.com/content/in - store - retail - media - 2023 ** https: //w ww .cnbc.com/2023/08/01/walmart - pushes - into - in - stores - advertising - as - new - revenue - driver.html *** https: //w ww .forrester.com/blogs/us - digital - influenced - retail - sales - will - top - 3 - 8 - trillion - in - 2027/#:~:text=Forrester%20expects%20US%20digital%2Dinfluenced,to%20%243.8%20trillion%20in%202027 . In - Store vs. Digital US Monthly Audience Reach, Nov 2022 Millions of unique visitors * TOTAL ADDRESSABLE MARKET

LICENSE DEVELOPMENTS Alpha Modus Announces Intellectual Property License Agreement with GZ6G Technologies Corp. On January 11, 2024, Alpha Modus entered into an intellectual property license agreement with GZ6G Technologies Corp. (OTCQB: GZIC). The license agreement gives GZ6G the right to use Alpha Modus’s patented intellectual property, and pertains to GZ6G’s promotional, advertising, and operational functions, including co - development arrangements with Alpha Modus for AI - driven advertising solutions for stadiums and event management. 18

PATENT ENFORCEMENT Alpha Modus files patent infringement action against The Kroger Company On January 16, 2024, Alpha Modus initiated a patent infringement action against The Kroger Company (NYSE: KR) alleging patent infringement of several Alpha Modus patents pertaining to the Company’s ‘571 patent portfolio encompassing retail marketing and advertising data - driven technologies to enhance consumer’s in - store experience at the point of decision. 19

PROFESSIONAL ADVISORS 20

CAPITAL MARKETS ADVISOR Pickwick Capital Partners, LLC Mark Grundman 445 Hamilton Avenue Suite 1102 White Plains, NY 10601 Mobile: 201 - 294 - 5931 Email: grundmanm@pickwickcapital.com 21 CAPITAL MARKETS ADVISOR Chardan Capital Markets, LLC Shai Gerson 17 State Street, 21 st Floor New York, NY 10004 Direct: 646 - 465 - 9008 Email: sgerson@chardan.com INVESTOR RELATIONS MZ North America Shannon Devine / Rory Rumore MZ North America 5055 Avenida Encinas, Carlsbad, CA 92008 Office Direct: 203 - 663 - 3550 Email: alphamodus@mzgroup.us PATENT PROSECUTION Dickinson Wright, PLLC Ross Garsson 607 W. 3rd Street Suite 2500 Austin, Texas 78701 Direct: 512 - 770 - 4222 Fax: 844 - 670 - 6009 Email: rgarsson@dickinsonwright.com PATENT LITIGATION Dickinson Wright, PLLC Christopher Hanba 607 W. 3rd Street Suite 2500 Austin, Texas 78701 Direct: 512 - 582 - 6889 Fax:844 - 670 - 6009 Email: chanba@dickinsonwright.com PCAOB AUDIT COMPLETED (2021 – 2022 with 2023 Q3 reviewed) Turner, Stone & Company, LLP Samuel Berridge1 2700 Park Central Drive Suite 1400 Dallas, TX 75251 Mobile: 972 - 239 - 1660 Fax: 972 - 239 - 1665 Email: samb@turnerstone.com SECURITIES COUNSEL Brunson, Chandler & Jones, PLLC Lance Brunson Walker Center (14 th floor) 175 S. Main Street, Suite 1410 Salt Lake City, UT 84111 Office Direct: 801 - 303 - 5737 Email: lance@bcjlaw.com