As filed with the U.S. Securities and Exchange Commission on September 27, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CURRENC GROUP INC.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands | | 6770 | | 98-1602649 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

410 North Bridge Road,

SPACES City Hall,

Singapore

Tel: +65 6407-7362

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1 800-221-0102

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Andrew M. Tucker

Nelson Mullins Riley & Scarborough LLP

101 Constitution Ave NW, Suite 900

Washington, DC 20001

Telephone: (202) 689-2800

Approximate date of commencement of proposed sale to public: From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the SEC, acting pursuant to Section 8(a) of the Securities Act, may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED , 2024 |

Currenc Group Inc.

Secondary Offering of

Up to 40,930,554 Ordinary Shares

This prospectus relates to the offer and resale from time to time, upon the expiration of lock-up agreements, if applicable, of ordinary shares, par value $0.0001 per share (the “Ordinary Shares”), of Currenc Group Inc. (the “Company” or “Currenc”), by the selling shareholders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Shareholders” or “Selling Securityholders”) of (i) up to an aggregate of 40,000,000 Ordinary Shares issued at $10.00 per share (the “Exchange Consideration Shares”) issued to the former shareholders of Seamless, pursuant to the terms of the Business Combination Agreement, dated August 3, 2022 (as amended by an amendment dated October 20, 2022, an amendment dated November 29, 2022 and an amendment dated February 20, 2023, the “Business Combination Agreement”) by and among INFINT Acquisition Corporation (“INFINT”), FINTECH Merger Sub Corp., a Cayman Islands exempted company and a wholly owned subsidiary of INFINT (“Merger Sub”), (ii) up to 194,444 Ordinary Shares (the “PIPE Note Shares”) issuable upon conversion of the convertible promissory note in an aggregate principal amount of $1,944,444, for a purchase price of approximately $1.75 million issued in connection with the PIPE Agreement (the “PIPE Note”), convertible at $10.00 per share, (iii) up to 136,110 Ordinary Shares issuable upon the exercise of 136,110 warrants, at an exercise price of $11.50 per share (the “PIPE Warrants”) issued in connection with the Convertible Note Purchase Agreement, dated August 31, 2024 (the “PIPE Agreement”), by and among the Company, Seamless Group Inc., a Cayman Islands exempted company (“Seamless”), and Pine Mountain Holdings Limited, a company organized under the laws of the British Virgin Islands, or its designated affiliate (the “PIPE Investor”), (iv) 400,000 Ordinary Shares (the “Commitment Shares”) issued to the PIPE Investor in consideration for the PIPE Investor’s subscription of the PIPE Note, (v) 100,000 Ordinary Shares issued to Roth Capital Partners, LLC for advisory services and (vi) 100,000 Ordinary Shares issued to KEMP Services Limited for legal advisory services.

On August 30, 2024, INFINT completed a series of transactions (the “Closing”) that resulted in the combination (the “Business Combination”) of INFINT with Seamless, following the approval of the Business Combination and the other transaction contemplated by the Business Combination Agreement at the extraordinary general meeting of the shareholders of INFINT held on August 6, 2024 (the “Meeting”). On August 30, 2024, pursuant to the Business Combination Agreement, and as described in greater detail in the Company’s final prospectus and definitive proxy statement, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 12, 2024 (the “Proxy Statement/Prospectus”), Merger Sub merged with and into Seamless, with Seamless surviving the merger as a wholly owned subsidiary of INFINT, and INFINT changed its name to Currenc Group Inc. (“Currenc”). As consideration for the Business Combination, Currenc issued to Seamless shareholders 40,000,000 Exchange Consideration Shares. In addition, Currenc issued an aggregate of 200,000 shares to vendors in connection with the Closing, issued promissory notes for approximately $5.7 million to EF Hutton LLC (“EF Hutton”), approximately $3.2 million to Greenberg Traurig LLP, and $603,623 to INFINT Capital LLC (the “Sponsor”).

Simultaneous with the closing of the Business Combination, Currenc also completed a series of private financings, issuing the PIPE Note for $1.94 million, for a purchase price of approximately $1.75 million, 400,000 Commitment Shares, and PIPE Warrants to purchase 136,110 Ordinary Shares in a private placement to the PIPE Investor (the “PIPE Offering”).

Pursuant to the PIPE Agreement, Currenc agreed to issue an aggregate principal amount of $1,944,444 (the “Principal Amount”) in convertible promissory note to the PIPE Investor at an issue price of $1,750,000, which represents a 10% discount to the Principal Amount (the “PIPE Note Issuance”). Except with the written consent of Currenc, the PIPE Investor shall not own more than 4.99% of the Ordinary Shares in issue from time to time. In addition, the PIPE Note will not be convertible to the extent that such issuance of shares, together with any issuance of shares upon the exercise of the PIPE Warrants, would require shareholder approval under Nasdaq rules, until and unless such shareholder approval is obtained.

In connection with the Note Issuance, and as consideration of the PIPE Investor’s subscription for the PIPE Note, following the Business Combination Closing, the PIPE Investor was also issued (i) 400,000 Ordinary Shares, credited as fully-paid, and (ii) the five-year warrant PIPE Warrant to purchase up to an aggregate of 136,110 Ordinary Shares at an exercise price of $11.50 (the “PIPE Warrant Shares”). The PIPE Warrants have anti-dilution protection on the price with respect to future equity offerings of Currenc priced at or above $2.00 per share and full anti-dilution protection on price and quantity with respect to future equity offerings of Currenc priced below $2.00 per share. In the event the PIPE Warrant Shares are not registered within 12 months, warrant holders have the option to cashless exercise each PIPE Warrant for 0.8 Ordinary Shares. In addition, the PIPE Warrants are not exercisable to the extent that such issuance of shares together with any issuance of shares upon the conversion of the Note, would require shareholder approval under Nasdaq rules, until and unless such shareholder approval is obtained.

As described herein, the Selling Securityholders named in this prospectus or their permitted transferees, may resell from time to time up to 40,930,554 Ordinary Shares. We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of our Ordinary Shares, except with respect to amounts received by us upon the exercise of the PIPE Warrants. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of Ordinary Shares or PIPE Warrants. See section entitled “Plan of Distribution” beginning on page 170 of this prospectus.

We believe the likelihood that the warrant holder will exercise its PIPE Warrants, and therefore the amount of cash proceeds that we would receive is, among other things, dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the exercise price of $11.50, subject to adjustment as described herein, we believe such holder will be unlikely to exercise its PIPE Warrants, as applicable, For additional information, see “Risks Related to an Investment in Our Securities.”

The Ordinary Shares being registered for resale in this prospectus represent a substantial percentage of our public float and of our outstanding Ordinary Shares. The number of shares being registered in this prospectus represents approximately 87.35% of the total Ordinary Shares outstanding as of the date of this prospectus (assuming exercise of all PIPE Warrants and conversion of the PIPE Note). The sale of the securities being registered in this prospectus, or the perception in the market that such sales may occur, could result in a significant decline in the public trading price of our Ordinary Shares.

In addition, some of the shares being registered for resale were acquired by the Selling Securityholders for nominal consideration or purchased for prices considerably below the Business Combination price and the current market price of the Ordinary Shares, and certain Selling Securityholders have an incentive to sell because they will still profit on sales due to the lower price at which they acquired their shares as compared to the public investors. In particular, the PIPE Investor may experience a positive rate of return on the securities it purchased due to the differences in the purchase prices described above, to the extent they acquired such securities for less than the relevant trading price, and the public securityholders may not experience a similar rate of return on the securities they purchased due to the differences in the purchase prices described above.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbols “CURR”. On September 17, 2024, the closing price of our Ordinary Shares was $2.32.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Ordinary Shares and Warrants is highly speculative and involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The Selling Securityholders may sell up to 40,930,554 Ordinary Shares from time to time in one or more offerings as described in this prospectus, of which (i) 136,110 Ordinary Shares are issuable upon the exercise of the PIPE Warrants, and (ii) 194,444 Ordinary Shares are issuable upon conversion of the PIPE Note. We will not receive any proceeds from the sale of Ordinary Shares by the Selling Securityholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Ordinary Shares or Warrants, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell the Ordinary Shares or PIPE Warrants in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus, the terms “we,” “us,” “our” or “Currenc” refer to Currenc Group Inc., a Cayman Islands exempted company with limited liability, and its consolidated subsidiaries. In addition, in this prospectus:

“ancillary documents” means each agreement, instrument or document including the Registration Rights Agreement, the Lock-Up Agreement, the Shareholder Support Agreement, the Sponsor Support Agreement and the other agreements, certificates and instruments to be executed or delivered by any of the parties to the Business Combination Agreement in connection with or pursuant to the Business Combination Agreement;

“Articles” means the fifth amended and restated memorandum and articles of association of the Company, which will became the Company’s memorandum and articles of association immediately prior to the consummation of the Business Combination;

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including the merger;

“Business Combination Agreement” means the Business Combination Agreement, dated as of August 3, 2022, among INFINT, Merger Sub and Seamless, amended by an amendment dated October 20, 2022, an amendment dated November 29, 2022 and an amendment dated February 20, 2023;

“Closing” means the closing of the Business Combination, which occurred on August 30, 2024;

“Code” means the Internal Revenue Code of 1986, as amended;

“Commitment Shares” means 400,000 Ordinary Shares issued to the PIPE Investor in consideration for the PIPE Investor’s subscription of the PIPE Note;

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands, as amended, modified, re-enacted or replaced;

“Company” means INFINT prior to the Closing of the Business Combination and Currenc after the Closing of the Business Combination;

“Currenc” means Currenc Group Inc. (formerly named INFINT Acquisition Corporation) following the consummation of the Business Combination;

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

“Founder Shares” means the 5,833,083 INFINT Class B ordinary shares that were issued to INFINT initial shareholders prior to the INFINT IPO as follows: 4,483,026 to Sponsor, 1,250,058 to Other Class B shareholders, and 99,999 to Underwriter (each a Founder Share);

“GAAP” means generally accepted accounting principles in the United States;

“Incentive Plan” means Currenc Group Inc. 2024 Equity Incentive Plan;

“INFINT Class A ordinary shares” means the Class A ordinary shares, par value $0.0001 per share, of INFINT;

“INFINT Class B ordinary shares” means the Class B ordinary shares, par value $0.0001 per share, of INFINT, which shares were converted automatically in connection with the merger into INFINT Class A ordinary shares and cease to be outstanding; such shares are also referred to and defined herein as the “Founder Shares”;

“INFINT initial shareholders” means the Sponsor and each of INFINT’s directors and officers and underwriters that hold Founder Shares;

“INFINT IPO” means INFINT’s initial public offering, consummated on November 23, 2021, through the sale of 19,999,880 units (including the 2,608,680 units sold pursuant to the underwriters’ partial exercise of their over-allotment option at $10.00 per unit);

“INFINT ordinary shares” means the INFINT Class A ordinary shares and the INFINT Class B ordinary shares;

“Investment Company Act” means the U.S. Investment Company Act of 1940, as amended;

“IRS” means the U.S. Internal Revenue Service;

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012;

“JonesTrading” means JonesTrading Institutional Services LLC.

“Letter Agreement” means the letter agreement by and among INFINT, the Sponsor and each of directors of INFINT, dated November 23, 2021;

“Lock-up Agreement” means the lock-up agreement to be entered into among INFINT and certain Seamless Shareholders at the Closing;

“Meeting” means the extraordinary general meeting of INFINT, held on August 6, 2024;

“merger” means the merger of Merger Sub with Seamless, with Seamless surviving such merger and Seamless becoming a wholly owned subsidiary of INFINT, pursuant to the Business Combination Agreement;

“Merger Sub” means FINTECH Merger Sub Corp., a Cayman Islands exempted company incorporated with limited liability;

“Nasdaq” means Nasdaq Capital Market.

“ordinary resolution” means an ordinary resolution under Cayman Islands law, being the affirmative vote of the holders of a simple majority of the issued ordinary shares of the Company that are present in person or represented by proxy and entitled to vote thereon and who vote at the general meeting;

“Ordinary Shares” means the ordinary shares, par value $0.0001 per share, of Currenc;

“NYSE” means the New York Stock Exchange;

“PIPE Agreement” means the Convertible Note Purchase Agreement, dated August 31, 2024, by and among the Company, Seamless, and the PIPE Investor;

“PIPE Investor” means Pine Mountain Holdings Limited, a company organized under the laws of the British Virgin Islands;

“PIPE Note” means the convertible promissory note in an aggregate principal amount of $1,944,444, issued in connection with the PIPE Agreement;

“PIPE Note Shares” means 194,444 Ordinary Shares issuable upon conversion of the PIPE Note;

“PIPE Offering” means a series of private financings, issuing the PIPE Note, the Commitment Shares, and PIPE Warrants in a private placement to the PIPE Investor;

“PIPE Warrants” means warrants to purchase 136,110 Ordinary Shares at an exercise price of $11.50 per share;

“private warrants” are to the aggregate 7,796,842 warrants issued at a price of $1.00 per private warrant to the Sponsor in a private placement simultaneously with the closing of the INFINT IPO and the partial exercise of the underwriters’ over-allotment option to purchase additional units;

“public shareholders” means the holders of INFINT public shares, including the INFINT initial shareholders to the extent the INFINT initial shareholders purchased public shares; provided that the INFINT initial shareholders are considered a “public shareholder” only with respect to any public shares held by them;

“public shares” means INFINT Class A ordinary shares included in the units issued in the INFINT IPO;

“public warrants” are to the aggregate 9,999,940 warrants included in the units issued in the INFINT IPO, each of which is exercisable for one INFINT Class A ordinary share, in accordance with its terms.

“Registration Rights Agreement” means the registration rights agreement, entered into among INFINT, certain Seamless Shareholders and certain INFINT shareholders at the Closing;

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002;

“Seamless” means Seamless Group Inc., a Cayman Islands exempted company incorporated with limited liability;

“Seamless Incentive Plan” means the Seamless Group Inc. 2022 Equity Incentive Plan;

“Seamless ordinary shares” means the ordinary shares, par value $0.001 per share, of Seamless;

“SEC” means the U.S. Securities and Exchange Commission;

“Securities Act” means the U.S. Securities Act of 1933, as amended;

“Shareholder Support Agreement” means the Shareholder Support Agreement, dated August 3, 2022, by and among INFINT, Seamless and certain Seamless shareholders;

“special resolution” means a special resolution under Cayman Islands law, being the affirmative vote of the holders of at least a two-thirds majority of the issued ordinary shares of the company that are present in person or represented by proxy and entitled to vote thereon and who vote at the general meeting;

“Sponsor” means INFINT Capital LLC, a Delaware limited liability company;

“Sponsor Support Agreement” means the support agreement, dated as of August 3, 2022, among the Sponsor, INFINT and Seamless (a copy of which is attached hereto as Annex G);

“trust account” means the trust account that holds a portion of the proceeds of the INFINT IPO and the sale of the private warrants;

“Underwriters” means EF Hutton, division of Benchmark Investments, LLC, and JonesTrading, the underwriters for INFINT in the INFINT IPO.

“units” means one INFINT Class A ordinary share and one-half of one warrant, whereby each warrant entitles the holder thereto to purchase one INFINT Class A ordinary share at an exercise price of $11.50 per share, sold in the INFINT IPO;

“warrants” means the public warrants and the private warrants; and

Unless specified otherwise, “$,” “USD,” “US$” and “U.S. dollar” each refers to the United States dollar.

Defined terms in the financial statements contained in this proxy statement/prospectus have the meanings ascribed to them in the financial statements.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including statements about the anticipated benefits of the Business Combination, and the financial conditions, results of operations, earnings outlook and prospects of Currenc and other statements about the period following the consummation of the Business Combination. Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business of Currenc.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of Currenc and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated.

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to Currenc or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, Currenc undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our Securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our Securities, you should read the entire prospectus carefully, including “Risk Factors” and the financial statements of Currenc and related notes thereto included elsewhere in this prospectus.

The Company

Currenc is one of the leading operators of global money transfer services in Southeast Asia. It operates a remittance business principally through Tranglo, which is a Malaysia-based leading platform and service provider of cross-border payment processing capabilities worldwide and also a leading international airtime transfer operator in Southeast Asia, and a retail airtime business in Indonesia through WalletKu.

Currenc’s business model is highly scalable and transferrable to other geographic markets. The knowledge it has gained from building its operations in Southeast Asia has helped it to understand the pain points faced by individuals and merchants in Asian markets, as well as to facilitate the development of its infrastructure, product and compliance processes, allowing it to rapidly replicate and build up its business across its core markets.

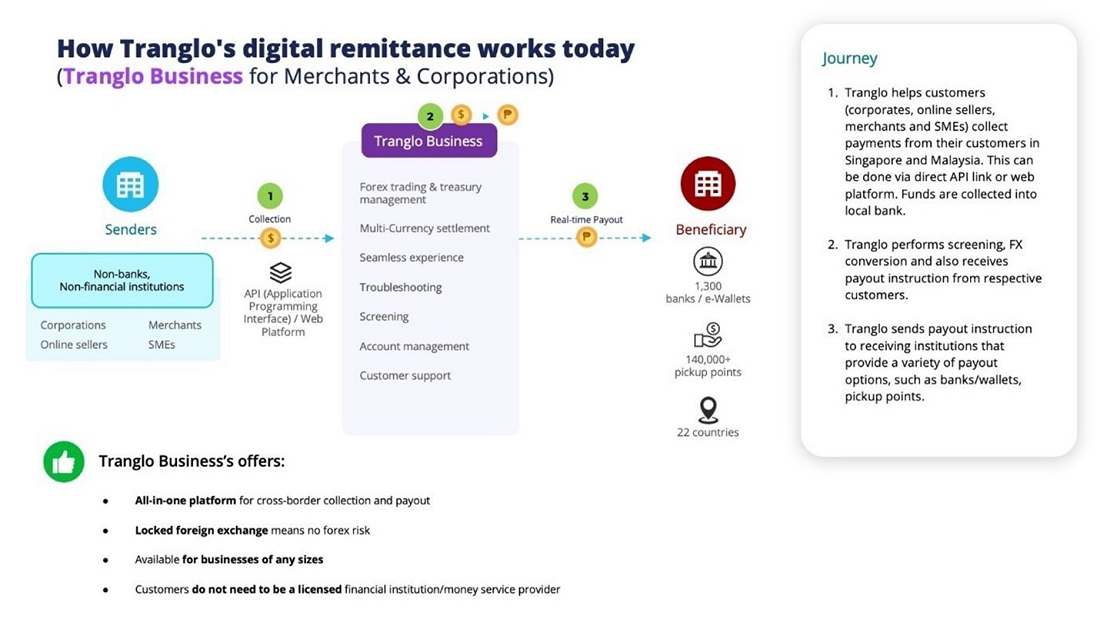

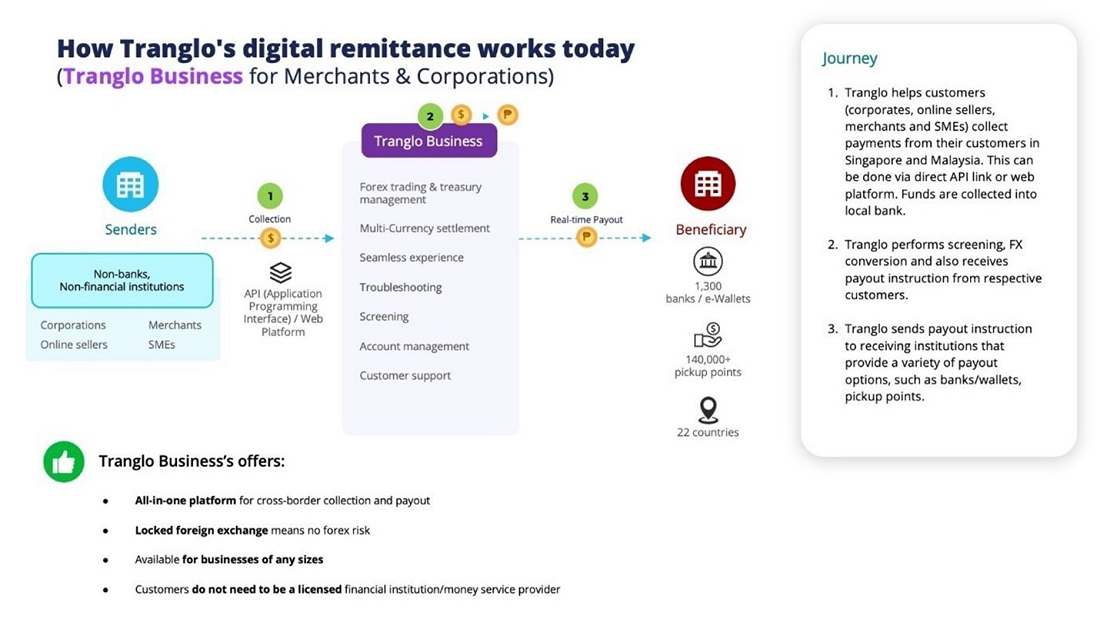

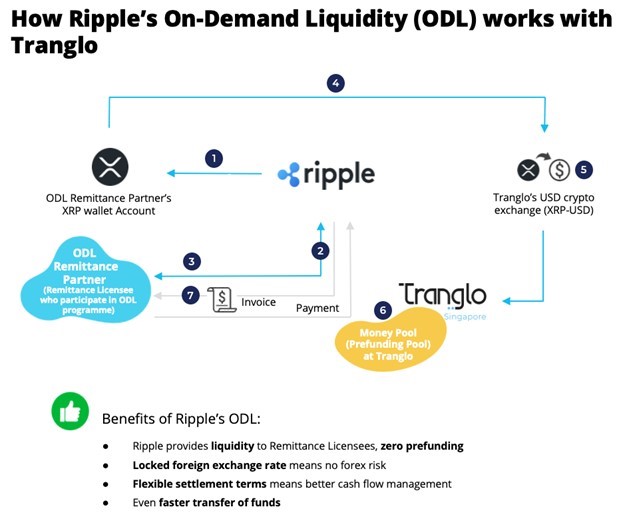

Tranglo’s global remittance business provides a single unified application programming interface for licensed banks and money service operators and acts as a one-stop settlement agent for cross-border money transfer, offering customers the ability to transfer money and process payments globally. Tranglo has built an extensive payout network across more than 70 countries covering more than 5,000 banks and 35 e-Wallet operators, while serving 124 corporate customers as of June 30, 2024, and it processed approximately 5.8 million transactions with a total value of $2.7 billion for the six-month period ended June 30, 2024.

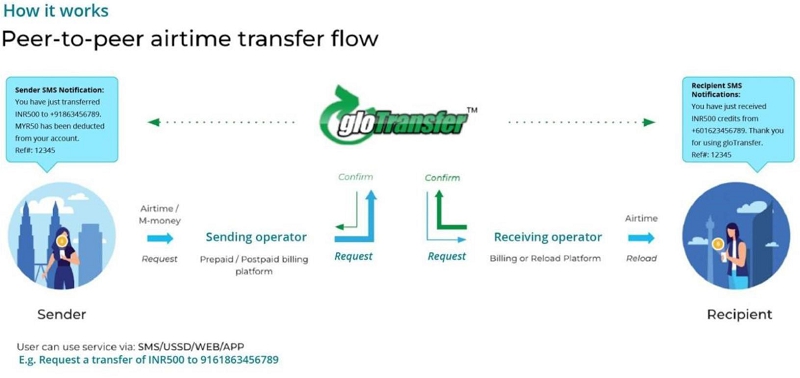

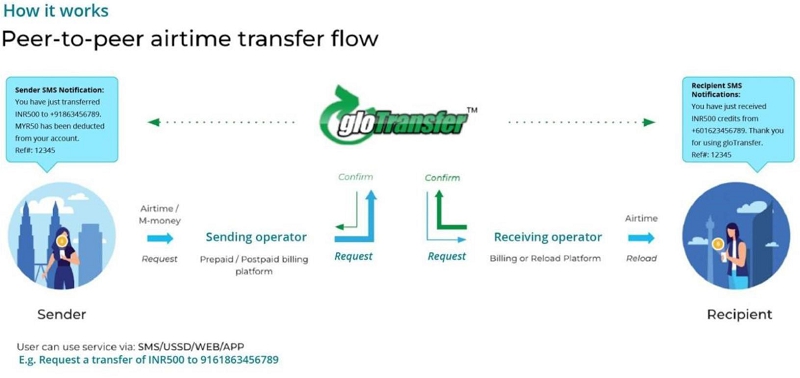

Tranglo also operates an international airtime transfer business, acting as a switching platform provider for telecom airtime transfer and wholesale reseller of foreign airtime. Tranglo’s proprietary technology enables customers to request for a variety of recharge options, including support for both pin and pinless airtime transfers. It operates one of the biggest airtime transfer networks in the world, serving more than 500 telecommunication operators in 150 countries as of June 30, 2024.

WalletKu provides retail airtime purchases and internet data top-up to mobile telecommunication users in the Indonesian market. WalletKu also allows users to make bill payments and other cash top-up and money transfers, including through its proprietary WalletKu app. As of June 30, 2024, WalletKu had approximately 132,000 merchant and individual users, more than 600 active users for WalletKu Digital and 2,600 active users for WalletKu Indosat. WalletKu is an authorized distributor for the second largest Indonesia telecommunication provider, Indosat Ooredoo Hutchison, and manages two of the 100+ cluster areas designated by Indosat.

WalletKu provides E-Money services by co-branding with PT E2Pay Global Utama, a registered E-Money services provider in Indonesia, allowing WalletKu to provide financial services to the unbanked population in Indonesia and act as a remittance platform for users to send and receive money domestically and, leveraging Seamless’ platform, internationally.

The Background

On August 30, 2024, INFINT completed a series of transactions that resulted in the combination of INFINT with Seamless pursuant to the Business Combination Agreement, following the approval at the Meeting held on August 6, 2024. On August 30, 2024, pursuant to the Business Combination Agreement, and as described in greater detail in the Company’s final prospectus and definitive proxy statement, which was filed with the SEC on July 12, 2024, Merger Sub merged with and into Seamless, with Seamless surviving the merger as a wholly owned subsidiary of INFINT, and INFINT changed its name to Currenc Group Inc. As consideration for the Business Combination, Currenc issued to Seamless shareholders 40,000,000 Exchange Consideration Shares. In addition, Currenc issued an aggregate of 200,000 Ordinary Shares to vendors in connection with the Closing, issued promissory notes for approximately $5.7 million to EF Hutton, approximately $3.2 million to Greenberg Traurig LLP, and $603,623 to the Sponsor.

Simultaneous with the closing of the Business Combination, Currenc also completed a series of private financings, issuing the PIPE Note for $1.94 million (receiving net proceeds of $1.75 million), 400,000 Commitment Shares, and PIPE Warrants to purchase 136,110 Ordinary Shares in a private placement to the PIPE Investor.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbols “CURR”. On September 17, 2024, the closing price of our Ordinary Shares was $2.32.

There is no assurance that the holders of the PIPE Warrants will elect to exercise any or all of the PIPE Warrants, which could impact our liquidity position. To the extent that the PIPE Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the PIPE Warrants will decrease. We believe the likelihood that PIPE Warrant holders will exercise their PIPE Warrants, and therefore the amount of cash proceeds that we would receive is, among other things, dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the applicable exercise price of $11.50, subject to adjustment as described herein, we believe such holders will be unlikely to exercise their PIPE Warrants. We believe, based on our current operating plan, that our existing cash and cash equivalents, together with the cash flows from operating activities, will be sufficient to meet our anticipated cash needs for working capital, financial liabilities, capital expenditures and business expansion for at least the next 12 months. To the extent the Company is able to raise additional financing, the Company will be in a position to expedite its business plan. To support its long-term business objectives, the Company expects to continue efforts to raise additional capital over at least the next three years. The Company does not believe this offering will have a significant impact on our ability to raise additional financing, although it may impact the per share price and shares issued in any capital raise.

The Ordinary Shares being registered for resale in this prospectus represent a substantial percentage of our public float and of our outstanding Ordinary Shares. The number of shares being registered in this prospectus represents approximately 87.35% of the total Ordinary Shares outstanding as of the date of this prospectus (assuming exercise of all PIPE Warrants and conversion of the PIPE Note). The sale of the securities being registered in this prospectus, or the perception in the market that such sales may occur, could result in a significant decline in the public trading price of our Ordinary Shares.

The rights of holders of our Ordinary Shares and PIPE Warrants are governed by our Articles and the Companies Act, and in the case of the PIPE Warrants, the PIPE Agreement. See the section entitled “Description of Capital Stock.”

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may benefit from specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| | ● | presentation of only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus; |

| | ● | reduced disclosure about our executive compensation arrangements; |

| | ● | no non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; |

| | ● | exemption from any requirement of the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); and |

| | ● | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may benefit from these exemptions until December 31, 2025, or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (1) the last day of the fiscal year following the fifth anniversary of the consummation of the INFINT IPO; (2) the first fiscal year after our annual gross revenues are $1.235 billion or more; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or (4) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act. We may choose to benefit from some but not all of these reduced disclosure obligations in future filings. If we do, the information that we provide shareholders may be different than you might get from other public companies in which you hold stock.

Summary Risk Factors

You should consider all the information contained in this prospectus before making a decision to invest in our Securities. In particular, you should consider the risk factors described under “Risk Factors” beginning on page 6. Such risks include, but are not limited to, the following risks with respect to the Company subsequent to the Business Combination:

Risks Related to Currenc’s Business, Industry and Operations

| | ● | We may fail to keep pace with rapid technological developments to provide new and innovative products and services or make substantial investments in unsuccessful new products and services; |

| | ● | We face significant competition in the markets in which we operate, and we may fail to successfully compete against current or future competitors; |

| | ● | Our operations are dependent on our proprietary and external technology platforms and comprehensive ecosystems, and any systems failures, interruptions, delays in service, catastrophic events, and resulting interruptions in the availability of our products or services could result in harm to our business and our brand, loss of users, customers and partners and subject us to substantial liability; |

| | ● | Our services must integrate with a variety of operating systems, networks and devices; |

| | ● | We are experiencing ongoing rapid change and significant growth in our business and we may not succeed in managing or expanding our business across the expansive and diverse markets in which we operate; |

| | ● | Our cross-border payment and money transfer services are exposed to foreign exchange risk; |

| | ● | Failure to deal effectively with fraud, fictitious transactions, failed transactions or negative customer experiences would increase our loss rate and harm our business, and could severely diminish merchant, partner and user confidence in and use of our services; |

| | ● | We have a limited operating history in new and evolving markets and our historical results may not be indicative of our future results; |

| | ● | We require a significant amount of pre-funding in each market that we operate in order to facilitate our real-time foreign exchange services; insufficient pre-funding may result in an inability to complete real-time money transfer or exchange services on behalf of our customers; |

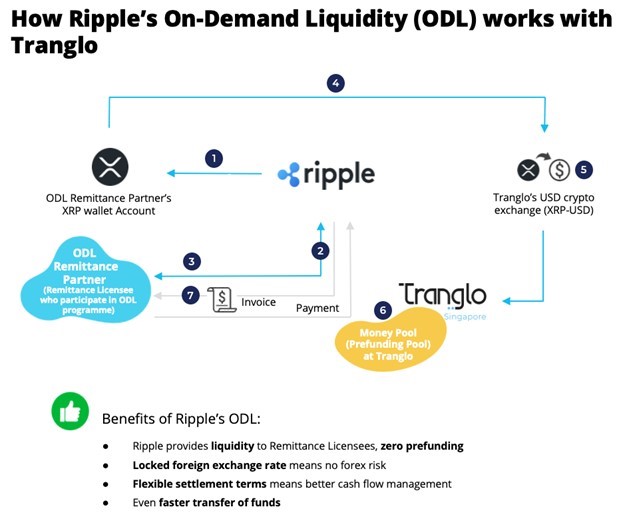

| | ● | The funding process used by certain customers of Tranglo relies on XRP, a cryptocurrency, and certain services provided by Ripple Services, Inc. and two cryptocurrency exchanges; if they are not able to continue to provide services due to regulatory change, our business, financial condition and results of operations may be materially adversely effected; |

| | ● | Increased adoption of the funding process Tranglo offers which relies on XRP may reduce our remittance revenue, and our business, financial condition and results of operations may be materially adversely effected; |

| | ● | Recent volatility, security breaches, manipulative practices, business failure and fraud in the cryptocurrency industry may adversely impact adoption and use by customers of Tranglo’s ODL service, and as a result our business, financial condition and results of operations may be materially adversely effected; and |

| | ● | We may not be able to protect our intellectual property rights; |

Risks Related to Investments Outside of the United States

| | ● | Changes in the economic, political or social conditions, government policies or regulatory developments in Asia could have a material adverse effect on our business and operations; |

| | ● | Our revenue and net income may be materially and adversely affected by any economic slowdown in any regions of Southeast Asia as well as globally; and |

| | ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are an exempted company under Cayman Islands law; |

Risks Related to the Government Regulation Regulatory Framework Applicable to Us

| | ● | Our business is subject to extensive government regulation and oversight across various geographies and our status under these regulations may change; |

| | ● | We may fail to obtain, maintain or renew requisite licenses and approvals; and |

| | ● | We are subject to anti-money laundering laws and regulations. |

Risks Related to Currenc’s Organization and Structure

| | ● | We will be an “emerging growth company,” and our reduced SEC reporting requirements may make our shares less attractive to investors; |

| | ● | Our management team may not successfully or efficiently manage its transition to being a public company; |

| | ● | We are an “emerging growth company,” and our reduced SEC reporting requirements may make our shares less attractive to investors; and |

| | ● | Currenc currently qualifies as a foreign private issuer, it will be exempt from a number of rules under the U.S. securities laws and will be permitted to file less information with the SEC than a U.S. domestic public company, which may limit the information available to its shareholders; |

Risks Related to an Investment in Our Securities

| | ● | An active market for Currenc’s securities may not develop, which would adversely affect the liquidity and price of Currenc’s securities.; |

| | ● | Failure to meet Nasdaq’s continued listing requirements could result in a delisting of Currenc’s Ordinary Shares; |

| | ● | The market price for our Ordinary Shares may decline following the Business Combination; |

| | ● | The Ordinary Share price may fluctuate, and you could lose all or part of your investment as a result; |

| | ● | Currenc shareholders may experience dilution in the future; and |

| | ● | The future exercise of registration rights may adversely affect the market price of the Ordinary Shares. |

Corporate Information

Currenc’s principal executive offices are located at 410 North Bridge Road, SPACES City Hall, Singapore, and Currenc’s telephone number is +65 6407-7362.

THE OFFERING

| Issuer | | Currenc Group Inc. |

| | | |

| Ordinary Shares Offered by the Selling Securityholders | | Up to 40,930,554 Ordinary Shares, of which (i) up to 136,110 Ordinary Shares are issuable upon the exercise of 136,110 PIPE Warrants, and (ii) up to 194,444 Ordinary Shares are issuable upon conversion of the PIPE Note. |

| | | |

| Exercise Price of PIPE Warrants | | $11.50 per share, subject to adjustment as defined herein. |

| | | |

| Shares Outstanding Prior to Exercise of All Warrants and conversion of the PIPE Note | | 46,527,999 shares. |

| | | |

| Shares Outstanding Assuming Exercise of All PIPE Warrants and conversion of the PIPE Note | | 46,858,553 shares. |

| | | |

| Use of proceeds | | We will not receive any proceeds from the sale of Ordinary Shares by the Selling Securityholders. We would receive up to an aggregate of approximately $1.6 million from the exercise of the warrants, assuming the exercise in full of all of such warrants for cash, however, it is not certain how many warrants would be exercised for cash or if at all. We expect to use the net proceeds from the exercise of any warrants for general corporate purposes. We believe the likelihood that the PIPE Warrant holder will exercise its PIPE Warrants, and therefore the amount of cash proceeds that we would receive is, among other things, dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the exercise price of $11.50, we believe such holders will be unlikely to exercise their Warrants. See “Use of Proceeds.” |

| | | |

| Market for Ordinary Shares | | Our Ordinary Shares are listed on the Nasdaq Global Market under the symbol “CURR.” |

| | | |

| Risk factors | | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

In this prospectus, unless otherwise indicated, the number of Ordinary Shares outstanding as of the date of this prospectus and the other information based thereon:

| | ● | Does not reflect 4,636,091 Ordinary Shares reserved for issuance under our Incentive Plan; |

| | ● | Does not reflect the exercise of the public warrants or the private warrants to purchase up to an aggregate of 17,796,782 Ordinary Shares. |

RISK FACTORS

You should carefully consider all the following risk factors, together with all of the other information included or incorporated by reference in this prospectus, including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary Note Regarding Forward-Looking Statements,” in evaluating an investment in the Ordinary Shares. The following risk factors apply to the business and operations of Currenc and its consolidated subsidiaries. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition and results of operations of Currenc following the consummation of the Business Combination. We may face additional risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations.

Unless the context otherwise requires, all references in this subsection to the “Company,” “Seamless,” “we,” “us” or “our” refer to the business of Seamless prior to the consummation of the Business Combination, which is the business of Currenc following the consummation of the Business Combination.

Risks Related to Our Business, Industry, and Operations

We may fail to keep pace with rapid technological developments to provide new and innovative products and services or make substantial investments in unsuccessful new products and services.

Rapid, significant and disruptive technological changes continue to impact the industries in which we operate, including developments in electronic and mobile wallets and payments, money transfer, payment card tokenization, social commerce (i.e., e-commerce through social networks), authentication, virtual currencies, blockchain technologies, machine learning and artificial intelligence. We cannot predict the effects of technological changes on our business. In addition to our own initiatives and innovations, we rely in part on third parties for the development of and access to new technologies. We expect that new services and technologies applicable to the industries in which we operate will continue to emerge and may be superior to, or render obsolete, the technologies we currently use in our products and services. Developing and incorporating new technologies into our products and services may require substantial expenditures, take considerable time, and ultimately may not be successful. In addition, our ability to adopt new services and develop new technologies may be inhibited by industry-wide standards, new laws and regulations, resistance to change from consumers or merchants, or third parties’ intellectual property rights. Our success will depend on our ability to develop new technologies and adapt to technological changes and evolving industry standards.

We face significant competition in the markets in which we operate, and we may fail to successfully compete against current or future competitors.

We compete in a large number of markets characterized by vigorous competition, changing technology, changing customer needs, evolving industry standards and frequent introductions of new products and services. Money transfer and electronic payment services compete in a concentrated industry, with a small number of large competitors and a large number of small, niche competitors. Our competitors include domestic and regional mobile wallets, money transfer (customer-to-customer and customer-to-business) specialists, providers of digital payment solutions, traditional financial institutions, other well-established companies (such as social media platforms or applications) that develop electronic payment services, third parties that host electronic payment services, billers offering their own electronic payment services and other financial institutions. See “Seamless’ Business—Competition Analysis” for further details on our competitors.

We expect competition to intensify in the future as existing and new competitors introduce new services or enhance existing services. We compete against many companies to attract customers. Some of these companies have a longer operating history, greater financial resources and substantially larger customer bases than we do. Some of these companies may also be tied to established banks and other financial institutions and may therefore offer greater liquidity and generate greater consumer confidence in the safety and reliability of their services than ours. Some of these companies link digital payment solutions to their other existing services, such as social media platforms or applications, and such synergies may help them develop their customer bases more effectively than us, especially where these existing services have been successful for a considerable period of time and have already gained customer confidence and reliance. All of the above competitors may devote greater resources than we do to the development, promotion and sale of products and services, and they may be more effective in introducing innovative products and services. Mergers and acquisitions by or among these companies may lead to even larger competitors with more resources. Failure to keep pace with our competitors would hinder our growth.

We also expect new entrants to offer competitive products and services. For example, established banks and other financial institutions, existing social media platform and application service providers and other financial technology (“fintech”) startups that have yet to provide digital payment services could develop such technologies and enter the market. Companies already operating digital payment services in other Asian countries could also quickly enter into the region where we operate.

Certain merchants have longstanding preferential or near-exclusive relationships with our competitors to accept payment cards and/or other services that we offer. These exclusive or near-exclusive relationships may make it difficult or cost prohibitive for us to gain additional market share with respect to these merchants. If we are unable to differentiate ourselves from and successfully compete with our competitors, our business will suffer serious harm.

We may also face pricing pressures from competitors. If we fail to price our services appropriately relative to our competitors, consumers may not use our services, which could adversely affect our business and financial results. For example, the number of our transactions in certain key corridors where we face intense competition could be adversely affected by increasing pricing pressures between our money transfer services and those of some of our competitors, which could adversely affect our financial results. Our competitors have at times offered special foreign exchange rate promotions on their global money transfer services in order to attract business which has negatively impacted our business. On the other hand, if we reduce prices in order to more effectively compete in these corridors, this could also adversely affect our financial results.

Our operations are dependent on our proprietary and external technology platforms and comprehensive ecosystems, and any systems failures, interruptions, delays in service, catastrophic events, and resulting interruptions in the availability of our products or services could result in harm to our business and our brand, loss of users, customers and partners and subject us to substantial liability.

Our systems and those of our third-party service providers, including data center facilities, may experience hardware breakdown, service interruptions, computer viruses, denial-of-service and other cyberattacks, human error, earthquakes, hurricanes, floods, fires, natural disasters, power losses, disruptions in telecommunications services, fraud, military or political conflicts, terrorist attacks and other geopolitical unrest, or other events.

Moreover, when too many customers connect to our platform within a short period of time, we have in the past and may in the future experience system interruptions that render our platforms temporarily unavailable and prevent us from efficiently completing payment transactions. Our systems are also subject to break-ins, sabotage, and acts of vandalism. While we have backup systems and contingency plans for certain aspects of our operations and business processes, our planning does not account for all possible scenarios and eventualities.

We have experienced and will likely continue to experience denial-of-service attacks, system failures, and other events or conditions that interrupt the availability or reduce the speed or functionality of our products and services. In addition, we may need to incur significant expenses to repair or replace damaged equipment and to remedy data loss or corruption as a result of these events. A prolonged interruption in the availability or reduction in the speed or other functionality of our products or services could also materially and permanently harm our reputation, business and revenue. Frequent or persistent interruptions in our products and services could cause merchants, partners and users to believe that our products and services are unreliable, leading them to switch to our competitors or to stop using our products and services. Moreover, to the extent that any system failure or similar event causes losses to our customers or their businesses, these customers could seek compensation from us and those claims, even if unsuccessful, together with potential regulatory investigations, would likely be time-consuming and costly for us to address, and could divert management’s attention from operating our business.

Some of our agreements with third-party service providers do not require those providers to indemnify us for losses resulting from any disruption in service. Our agreements with some of our partners require us to indemnify them for losses resulting from any disruption in our services. As a result, our financial results may be significantly harmed.

If we fail to recruit new remittance partners and users or retain our existing remittance partners and users, our business and revenue will be harmed.

We must continually recruit new partners, merchants and users and retain existing partners, merchants and users in order to grow our business. Our ability to do so depends in large part on the success of our marketing efforts, our ability to enhance our services and our overall operating performance, to keep pace with changes in technology and our competitors and to expand our marketing partnerships and disbursement network.

We have invested in software and technology in the past, and we expect to continue to spend significant amounts to acquire new partners, merchants and users and to keep existing remittance partners, merchants and users loyal to our service. We cannot assure you that the revenue from each partner, merchant and user we acquire will ultimately exceed the marketing, technology and development and promotion costs associated with acquiring them. We may not be able to acquire new partners, merchants and users in sufficient numbers to continue to grow our business, or we may be required to incur significantly higher expenses in order to acquire new partners, merchants and users. If the level of usage by our existing partners, merchants and users declines or does not continue as expected, we may suffer a decline in revenue. A decrease in the level of usage would harm our business and revenue.

Our business depends on our strong and trusted brands, and any failure to maintain, protect and enhance our brands would harm our business.

The brands under which we operate our business, including Tranglo and WalletKu, are important to our business. Our brands are predicated on the idea that partners, merchants and users will trust us and find value in building and growing their businesses with our products and services. Maintaining, protecting and enhancing our brand are critical to expanding our base of partners, merchants and users, as well as increasing engagement with our products and services. This will depend largely on our ability to maintain trust, be a technology leader, and continue to provide high-quality and secure products and services. Any negative publicity about our industry, our company, our controlling shareholder, the quality and reliability of our products and services, our risk management processes, changes to our products and services, our ability to effectively manage and resolve partners’, merchants’ and users’ complaints, our privacy and security practices, litigation, regulatory activity, the experience of partners, merchants and users with our products or services, and changes in the public opinion of us, could harm our reputation and the confidence in and use of our products and services. Harm to our brand can arise from many sources, including failure by us or our partners to satisfy expectations of service and quality; technological delays or failures; inadequate protection of sensitive information; compliance failures and claims; litigation and other claims; employee misconduct; and misconduct by our partners, service providers or other counterparties. If we do not successfully maintain strong and trusted brands, our business could be materially and adversely affected.

Our services must integrate with a variety of operating systems, networks and devices.

We are dependent on the ability of our products and services to integrate with a variety of operating systems and networks. Any changes in these systems or networks that degrade the functionality of our products and services, impose additional costs or requirements on us, or give preferential treatment to competitive services, including their own services, could seriously harm the levels of usage of our products and services. We also rely on bank platforms to process some of our transactions. If there are any issues with or service interruptions in these bank platforms, users may be unable to have their transactions completed in a timely manner or at all, which would have a material adverse effect on our business and results of operations. In addition, our hardware interoperates with mobile networks offered by telecom operators and mobile devices developed by third parties. Changes in these networks or in the design of these mobile devices may limit the interoperability of our hardware or software with such networks and devices and require modifications to our hardware or software. If we are unable to ensure that our hardware or software continues to interoperate effectively with such networks and devices, or if doing so is costly, our business may be materially and adversely affected.

We are experiencing ongoing rapid change and significant growth in our business and we may not succeed in managing or expanding our business across the expansive and diverse markets in which we operate.

Our business has become increasingly complex as we have expanded the number of platforms that we operate, the jurisdictions in which we operate, the types of products and services we offer, and the overall scale of our operations. We have significantly expanded and expect to continue to expand our headcount, office facilities, technology infrastructure and corporate functions. Failure to continue to do so could negatively affect our business. Moreover, the jurisdictions in which we operate are diverse and fragmented, with varying levels of economic and infrastructure development, and often do not operate efficiently across borders as a single or common market. Managing our growing businesses across these emerging markets requires considerable management attention and resources. Should we choose to expand into additional markets, these complexities and challenges could further increase. Each market presents its own unique challenges, and the scalability of our business is dependent on our ability to tailor our content and services to this diversity. In addition, the pace of regulatory change in the various jurisdictions in which we operate has been, and is expected to continue to be, rapid, while the impact and consequences of such change on our operations and our level of risk may be difficult to anticipate.

As a result of the pace of change in the types of products and services we offer and the number of jurisdictions in which we operate, we face the risk that our management and employees may not have the capacity to appropriately attend to all necessary aspects of our business. For example, our risk management policies and procedures may not be fully effective in mitigating our risk exposure in all market environments or against all types of risks, or be fully effective to identify, monitor, manage and remediate key risks. Additionally, our risk detection systems may be subject to a “false positive” risk detection rate, potentially making it difficult to identify real risks in a timely manner.

Further, as our business has grown and our service offerings have evolved, certain of our processes and systems have continued to rely on manual inputs which are more prone to errors and faults than more automated processes. There is a risk that the pace of our automation and systemization of these manual processes will be insufficient to prevent significant operational, reporting and regulatory errors.

Our growing multi-market operations also require certain additional costs, including costs relating to staffing, logistics, intellectual property protection, tariffs and potential trade barriers. Moreover, we may become subject to risks associated with:

| | ● | recruiting and retaining talented and capable management and employees in various markets; |

| | ● | challenges caused by distance, language and cultural differences; |

| | ● | providing products and services that appeal to the tastes and preferences of users in multiple markets; |

| | ● | implementing our businesses in a manner that complies with local laws and practices, which may differ significantly from market to market; |

| | ● | maintaining adequate internal and accounting control across various markets, each with its own accounting principles that must be reconciled to U.S. GAAP upon consolidation; |

| | ● | currency exchange rate fluctuations; |

| | ● | protectionist laws and business practices; |

| | ● | complex local tax regimes; |

| | ● | potential political, economic and social instability; and |

| | ● | higher costs associated with doing business in multiple markets. |

Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

If we fail to successfully identify and manage any of the above or other significant changes facing the business, or to identify and manage the risks to which we are or may be exposed, or successfully respond to technological developments in the industry, we may experience a material adverse effect on our business, financial condition and results of operations.

Our cross-border payment and money transfer services are exposed to foreign exchange risk.

The ability of our subsidiaries to effect cross-border payments and money transfers may be restricted by the foreign exchange control policies in the countries where we operate.

For example, Malaysia’s foreign exchange policies support the monitoring of capital flows into and out of the country in order to preserve its financial and economic stability. The foreign exchange policies are administered by the Foreign Exchange Administration, an arm of the Central Bank of Malaysia (Bank Negara Malaysia) (“BNM”) via a set of foreign exchange administration rules (“FEA Rules”). The FEA Rules, which monitor and regulate both residents and non-residents currently provide that non-residents are free to repatriate any amount of funds from Malaysia in foreign currency other than the currency of Israel at any time, including capital, divestment proceeds, profits, dividends, rental, fees and interest arising from investment in Malaysia, subject to any withholding tax. In the event Malaysia or any other country where we operate introduces any foreign exchange restrictions in the future, we may be affected in our ability to repatriate dividends or other payments from our subsidiaries in Malaysia or in such other countries.

The exchange control law in Indonesia provides that money transfer operators shall only make transfers to operators that are licensed in their respective jurisdictions. The arrangement between Indonesian money operators and their foreign counterparts is subject to approval if it exceeds a certain threshold (US $25,000) from Bank Indonesia, the central bank of Indonesia. Further, a party wishing to convert an amount of Indonesian Rupiah into foreign currency that exceeds certain thresholds is required to submit certain supporting documents to the bank handling the foreign exchange conversion, including the underlying transaction documents and a duly stamped statement confirming that the underlying transaction documents are valid and that the foreign currency will only be used to settle the relevant payment obligations. For conversions not exceeding the threshold, the person only needs to declare in a duly stamped letter that their aggregate foreign currency purchases have not exceeded the monthly threshold set forth in the Indonesian banking system.

We face risks in expanding into new geographic regions.

We plan to continue expanding into new geographic regions, and we currently face and will continue to face risks entering markets in which we have limited or no experience and in which we may not be well-known. Offering our services in new geographic regions often requires substantial expenditures and takes considerable time, and we may not be successful enough in these new geographies to recoup our investments in a timely manner or at all. We may be unable to attract a sufficient number of merchants, partners or users, fail to anticipate competitive conditions, or face difficulties in operating effectively in these new markets. The expansion of our products and services globally exposes us to risks relating to staffing and managing cross-border operations; increased costs and difficulty protecting intellectual property and sensitive data; tariffs and other trade barriers; differing and potentially adverse tax consequences; increased and conflicting regulatory compliance requirements, including with respect to data privacy and security; lack of acceptance of our products and services; challenges caused by distance, language, and cultural differences; exchange rate risk; and political instability. Accordingly, our efforts to expand our global operations may not be successful, which could limit our ability to grow our business.

Acquisitions, partnerships, joint ventures, entries into new businesses, and divestitures could disrupt our business, divert management attention and harm our financial conditions.

We have in the past engaged in acquisitions and partnerships. In the future, we may engage in similar ventures, including joint ventures, new businesses, mergers and other growth opportunities such as the purchase of assets and technologies, especially as we expand into new markets. Acquisitions, partnerships or joint ventures and the subsequent integration of new companies or businesses require significant attention from our management, in particular to ensure that the corporate action does not disrupt any existing collaborations, or affect our users’, partners’ and merchants’ opinions and perceptions of our services and customer support. Investments and acquisitions could result in the use of substantial amounts of cash, increased leverage, potentially dilutive issuances of equity securities, goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business, and the invested or acquired assets or businesses may not generate the financial results we expect. Moreover, the costs of identifying and consummating these transactions may be significant. In addition to receiving the necessary corporate governance approvals, we may also need to obtain approvals and licenses from relevant government authorities for the acquisitions to comply with applicable laws and regulations, which could result in increased costs and delays.

For example, in November 2018, we acquired Tranglo, a leading provider of cross-border payment processing services worldwide. In July 2018, we acquired WalletKu, based in Indonesia, which provides mobile payment and airtime top-up services in Indonesia. In March 2021, we disposed of a controlling interest in WalletKu. In June 2022, we reacquired sufficient interest in WalletKu to hold a controlling interest in it.

The acquisitions of Tranglo and WalletKu, and the subsequent integration of these and future acquired businesses into ours, have required and will require significant attention from our management, in particular to ensure that the acquisitions or partnerships do not disrupt any existing collaborations, or affect our users’, partners’ and merchants’ opinions and perceptions of our services and customer support. Whether we realize the anticipated benefits from these acquisitions or partnerships depends, to a significant extent, on the integration of the target businesses into our group, the performance and development of the underlying services or technologies, our correct assessment of assumed liabilities and the management of the relevant operations. We may not be able to successfully integrate these businesses or products and the integration may divert our management’s focus from our core business and result in disruption to our normal business operations. The diversion of our management’s attention and any difficulties encountered in the integration could have a material adverse effect on our ability to manage our business.

Unauthorized disclosure of sensitive or confidential merchant, partner or user information or our failure or the perception that we failed to comply with privacy laws or properly address privacy concerns could harm our business and standing with merchants, partners and users.

We collect, store, process, and use large amounts of personal information and other sensitive data in our business. A significant risk associated with our industry is the secure transmission of confidential information over public networks. The perception of privacy concerns, whether or not valid, may harm our business and results of operations. We must ensure that all processing, collection, use, storage, dissemination, transfer and disposal of data for which we are responsible comply with relevant data protection and privacy laws, which differ from jurisdiction to jurisdiction. The protection of our merchant, partner, user and company data is critical to us. We rely on commercially available systems, software, tools and monitoring to provide secure processing, transmission and storage of confidential information, such as names, addresses, personal identification numbers, payment card numbers and expiration dates, bank account information, purchase histories and other data.

Despite the security measures we have in place, our facilities and systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events, and our security measures may fail to prevent security breaches. Any security breach, or any perceived failure involving the misappropriation, loss or other unauthorized disclosure of confidential information, as well as any failure or perceived failure to comply with laws, policies, legal obligations or industry standards regarding data privacy and protection, whether by us or our merchants or partners, could damage our reputation, expose us to litigation risk and liability, require us to expend significant funds to remedy problems and implement measures to prevent further breaches, subject us to regulatory scrutiny and potential fines or other disciplinary actions, subject us to negative publicity, disrupt our operations and have a material adverse effect on our business and standing with merchants, partners and users.

Failure to deal effectively with fraud, fictitious transactions, failed transactions or negative customer experiences would increase our loss rate and harm our business, and could severely diminish merchant, partner and user confidence in and use of our services.

We have in the past experienced, and may in the future continue to experience instances of fraud, fictitious transactions, failed transactions and disputes between senders and recipients. We also incur losses for claims that the transaction was fraudulent, made from erroneous transmissions or from closed bank accounts or have insufficient funds in them to satisfy payments.

If losses incurred by us relating to fraud, fictitious transactions and failed transactions become excessive, they could potentially result in the termination of our relationships with merchants, partners or users. In such case, the number of transactions processed through our platforms could decrease substantially and our business could be harmed. We are similarly subject to the risk of fraudulent activity associated with merchants, partners and third parties handling our user information. We have taken measures to detect and reduce the risk of fraud, but these measures need to be continually improved and may not be effective against new and continually evolving forms of fraud or in connection with new product offerings. If these measures do not succeed, our business could be materially and adversely affected.

We have a limited operating history in new and evolving markets and our historical results may not be indicative of our future results.

We have a limited operating history upon which to evaluate the viability and sustainability of our businesses. Our history of operating each of our businesses together is relatively short: WalletKu was launched in November 2017 and was acquired by us in July 2018; we acquired Tranglo in November 2018. As these businesses are expanding rapidly, our historical results may not be indicative of our future performance and you should consider our future prospects in light of the risks and uncertainties of early stage companies operating in fast evolving high-tech industries in emerging markets. Some of these risks and uncertainties relate to our ability to:

| | ● | retain existing partners, merchants and users, attract new partners, merchants and users, and increase their engagement and monetization; |

| | ● | maintain growth rates across our platforms in multiple markets; |

| | ● | maintain and expand our network of domestic, regional and global industry value chain partners; |

| | ● | upgrade our technology and infrastructure to support increased traffic and expanded offerings of products and services; |

| | ● | anticipate and adapt to changing partner, merchant and user preferences; |

| | ● | increase awareness of our brand; |

| | ● | adapt to competitive market conditions; |

| | ● | maintain adequate control of our expenses; and |

| | ● | attract and retain qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business, financial condition and results of operations may be materially and adversely affected.

Our business model may change in the future and we may provide services that are not currently provided or planned for in our strategies.

We operate in a highly competitive and fast evolving industry which requires us to constantly make changes depending on industry dynamics, regulatory environment and our partners’, merchants’ and users’ needs. We may have to change our current business model for our business to cope with such changes and we cannot guarantee that our current business model will remain the same going forward. For example, our acquisition of Tranglo in November 2018 moved us into the upstream payment processing business where we can provide switching services and our July 2018 acquisition of WalletKu marked our entry into the mobile payment and airtime top-up businesses in Indonesia. Furthermore, we cannot assure you that our business model, as it currently exists or as it may evolve, will enable us to become profitable or to sustain operations.