4Q24 Earnings Release February 2025

Note: Definitions are in the Appendix section of this Earnings Release. 1 2024 & 4Q24 Highlights Net Income Total Clients 60/30/30 R$973mm net income (2024) 11.7% ROE (2024) 36 + million clients Simplifying financial lives -29 16 -30 29 24 64 104 160 195 223 260 295 -5 0. 0 - 5 0. 1 0 .0 1 50 .0 2 0 .0 2 50 .0 3 0 .0 3 50 .0 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 18.6 20.7 22.8 24.7 26.3 27.8 29.4 30.4 31.7 33.3 34.9 36.1 1 5.0 2 0. 2 5.0 3 0. 3 5.0 R$10bn gross revenue (2024) R$41bn gross loan portfolio (2024) 8.3% Pix market share (4Q24) ~R$1.5t run-rate TPV (4Q24)

Our story has been about innovation, delivering a superior financial super app with low-cost products, disrupting a traditional and inefficient industry. As a result, we have acquired over 36 million clients that are simplifying their financial lives by using our platform. One of our key strengths has been our execution capability, which enables us to launch and optimize several products, scale to millions of clients and be profitable, all at the same time. In 2024, we have stayed true to our innovative DNA, by launching new products such as the Digital Payroll, Consumer Finance 2.0, and Forum, our in-app content platform. Engagement continued to rise as we attracted a record 4.2 million active clients to our platform. This increased engagement fosters cross-selling among our seven verticals, generating powerful network effects and allowing us to achieve remarkable results across all of them. To highlight a few examples: GMV in our shopping grew by 40%, AUC in investments increased by 54%, insurance net revenue rose by 15%, and the number of global accounts jumped by 79%. All of this contributed to an increase in Net ARPAC, which reached nearly R$34 in 4Q24, while we maintained low cost-to-serve, thus resulting in a continued expansion of the net margin per active client. Note: Definitions are in the Appendix section of this Earnings Release. 2 From Global CEO João Vitor Menin João Vitor Menin | Global CEO During 2024, we continued to execute our 60/30/30 plan, by balancing growth, profitability and long-term value creation. As a result, we delivered a growing ROE of 11.7% in 2024 and finished the year with R$973 million in net income, greater than our entire historical profitability combined. We enter 2025 with a strong balance sheet, one of the lowest costs of funding in the industry, a diversified credit portfolio, and asset quality metrics that continue to improve despite a more challenging scenario. I’m confident that our platform is exceptionally well positioned to continue succeeding in the years ahead. As always, I’m grateful to all who are with us on this journey: our employees, clients, partners, and shareholders. Thank you! CEO Letter

Loan Portfolio & Funding Franchise • Loans surpassed R$ 41 billion, a 33% YoY growth, with NPLs > 90 improving 38 bps YoY • Funding reached R$ 55 billion, up 27% YoY, with active clients holding about R$2,000 in deposits1 3 Revenue Growth • Strategic capital allocation strategy led to record NIMs, before and after cost of risk • 31% growth in net fees YoY, driven by growth in multiple products Business Updates Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update Note: Definitions are in the Appendix section of this Earnings Release. Note 1: Sum of demand and time deposits divided by total active clients in the 4Q24. Distribution Platform 32% Fee Income Ratio Record High NIM 9.7% NIM 2.0 19+ MM clients with deposits 2024 Strategic Update • Added 1 million net new active clients in the quarter and 4.2 million in the year • 3.9 million clients in our global vertical, targeting high-income Brazilians who travel and invest in the U.S. Growth & Innovation Activation & Engagement • Strong focus on branding and early engagement, leading to an activation rate of ~57% • Reached R$ 1.2 trillion TPV in 2024; Pix market share edged up to 8.3% in 4Q24 Profitability • Net income reached record level of R$973 million, R$907 million after minority interest • Healthy ROE expansion, reaching 11.7% for the year R$ 55BN funding ˜R$ 2.0k average deposits per active client1

4 2024 innovations Strategic Update Business Updates Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Note: Definitions are in the Appendix section of this Earnings Release. Note 1: As of January 20th, 2025. Nota 2: Considering 4Q24 GMV of on-us transactions. +7% GMV Converted to BNPL2 42% GMV Growth vs 2023 Shopping Global Expansion 3.9+ mm Global clients USD 1.2bn AuC, AuM & Deposits Loop 11+ mm clients Digital Payroll High margins Low operational costs Forum Our own content platform inside our financial super app1 8.6mm users Consumer Finance 2.0 R$695mm Portfolio

5 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Unit Economics Total Clients mm 36.1 34.9 30.4 +3.5% +19.0% Active Clients mm 20.6 19.5 16.4 +5.2% +25.3% Gross ARPAC R$ 49.3 47.2 45.9 +4.5% +7.2% CTS R$ 13.0 12.6 12.5 +3.2% +4.1% CAC R$ 33.3 34.4 24.6 -3.2% +35.0% Income Statement Total Gross Revenue R$ mm 2,963 2,684 2,197 +10.4% +34.9% Net Revenue R$ mm 1,844 1,676 1,313 +10.0% +40.5% Pre Tax Net Income R$ mm 340 294 208 +15.8% +63.4% Net Income R$ mm 295 260 160 +13.4% +84.7% Net Income Excl. Minority Int. R$ mm 275 243 151 +13.4% +82.4% Balance Sheet & Capital Variation % Funding R$ bn 55.1 50.3 43.5 +9.5% +26.5% Shareholders' Equity R$ bn 9.1 8.9 7.6 +2.3% +19.4% Tier I Ratio % 15.2% 17.% 23.% -1.8 p.p. -780.0% Volume KPIs Cards + PIX TPV R$ bn 364 320 253 +14.0% +44.1% GMV R$ mm 1,469 1,381 1,050 +6.3% +39.9% AuC R$ bn 141 122 92 +15.7% +53.9% Asset Quality NPL > 90 days % 4.2% 4.5% 4.6% -0.3 p.p. -0.4 p.p. NPL 15-90 days % 3.4% 3.6% 4.% -0.2 p.p. -0.6 p.p. Coverage Ratio % 136% 130% 134% +6.7 p.p. +1.9 p.p. Performance KPIs NIM 2.0 - IEP Only % 9.7% 9.6% 9.% +0.2 p.p. +0.7 p.p. NIM 2.0 - Including Tax Effect % 10.0% 9.7% 9.% +0.3 p.p. +1.0 p.p. Risk Adjusted NIM 2.0 - IEP Only % 5.9% 5.6% 5.% +0.3 p.p. +0.8 p.p. Risk Adjusted NIM 2.0 - Incl. Tax Effect % 6.2% 5.7% 5.% +0.4 p.p. +1.1 p.p. Cost of Funding % of CDI 64.2% 65.4% 59.2% -1.2 p.p. +5.0 p.p. Fee Income Ratio % 32.4% 32.3% 33.3% +0.1 p.p. -0.9 p.p. Efficiency Ratio % 50.1% 50.7% 51.4% -0.6 p.p. -1.2 p.p. ROE % 13.2% 11.9% 8.5% +1.2 p.p. +4.6 p.p. ROE Excl. Minority Int. % 12.5% 11.3% 8.2% +1.2 p.p. +4.3 p.p. Strategic Update Business Updates Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Quarter Highlights Note: Definitions are in the Appendix section of this Earnings Release. Note 1: Income tax effect of the double taxation agreement on securities issued abroad (notas estruturadas), considering an effective tax rate 45% (IR/CSLL) from Banco Inter S.A.. 1 1

Our targeted campaigns aimed at higher quality clients required more investments in CAC in 2024, which in turn improved our conversion rates. The slight CAC decrease observed in the 4Q24 is seasonally impacted. 6 CAC In R$ YoYQoQ -3% +35% +9% -0% -12% +95% Note: Definitions are in the Appendix section of this Earnings Release. Unit Economics 14.8 49% 13.0 44% 7.4 27% 8.4 32% 9.1 37% 14.4 50% 18.0 55% 20.1 58% 17.8 53% 15.6 51% 16.8 56% 19.7 73% 17.5 68% 15.5 63% 14.6 50% 14.6 45% 14.3 42% 15.5 47% 30.4 29.8 27.1 25.9 24.6 28.9 32.6 34.4 33.3 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Marketing Costs Operational Costs Appendix 4.2 MM 57 % Activation rate We finished 2024 with more than 36 million clients, 20.6 million active clients, and an activation rate of 57%. In 4Q24, we added 1 million net active clients, for a record 4.2 million net new active clients in a year. These results were driven by marketing efforts focused on attracting clients more likely to become primary users of our platform and activating them immediately after onboarding. The new branding campaign also boosted the quality of client acquisition in 2024. Additionally, hyper-personalization, with targeted offers, enables us to more effectively cross-sell and offer specialized products such as BNPL, Gift Cards, Home Equity, and Insurance, generating additional revenue and decreasing churn. Net new active clients in 2024 Client Growth & Engagement 51.0% 51.5% 52.2% 52.7% 54.0% 54.9% 55.3% 55.9% 56.9% 12.6 13.5 14.5 15.5 16.4 17.4 18.4 19.5 20.6 24.7 26.3 27.8 29.4 30.4 31.7 33.3 34.9 36.1 1 .0 6 .0 1 1.0 1 6.0 2 1.0 2 6.0 3 1.0 3 6.0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Act ive Clients YoYQoQ +3% +19% +5% +25% +94 bps +286 bps Total Clients In millions Business Updates Strategic Update Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals +286 bps YoY

Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 7 Business accounts increased by 21% in 2024, representing 6% of our total clients. With an activation rate of 80%, the expansion in the segment offers many opportunities to increase cross- selling by offering our credit and service products. Business Accounts In thousands Business Clients & Inter Pag Unit Economics Business Updates Strategic Update 1,496 1,571 1,668 1,796 1,854 1,927 2,058 2,190 2,249 1 5 0 1 1 ,0 01 1 ,5 01 2 ,0 0 1 2 ,5 01 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 +21%YoY We offer a full range of services to business clients, including free Pix transfers, customized credit lines, cards with loyalty program, API solutions, positioning us well to deliver long-term value for these clients. Net ARPAC of business clients is three times larger than that of non-business clients, while the marketing costs (which compound CAC) are less than 40% of the marketing costs for individuals. This combination reflects in a high margin per active client, reinforcing the potential of this segment. Note: Definitions are in the Appendix section of this Earnings Release.

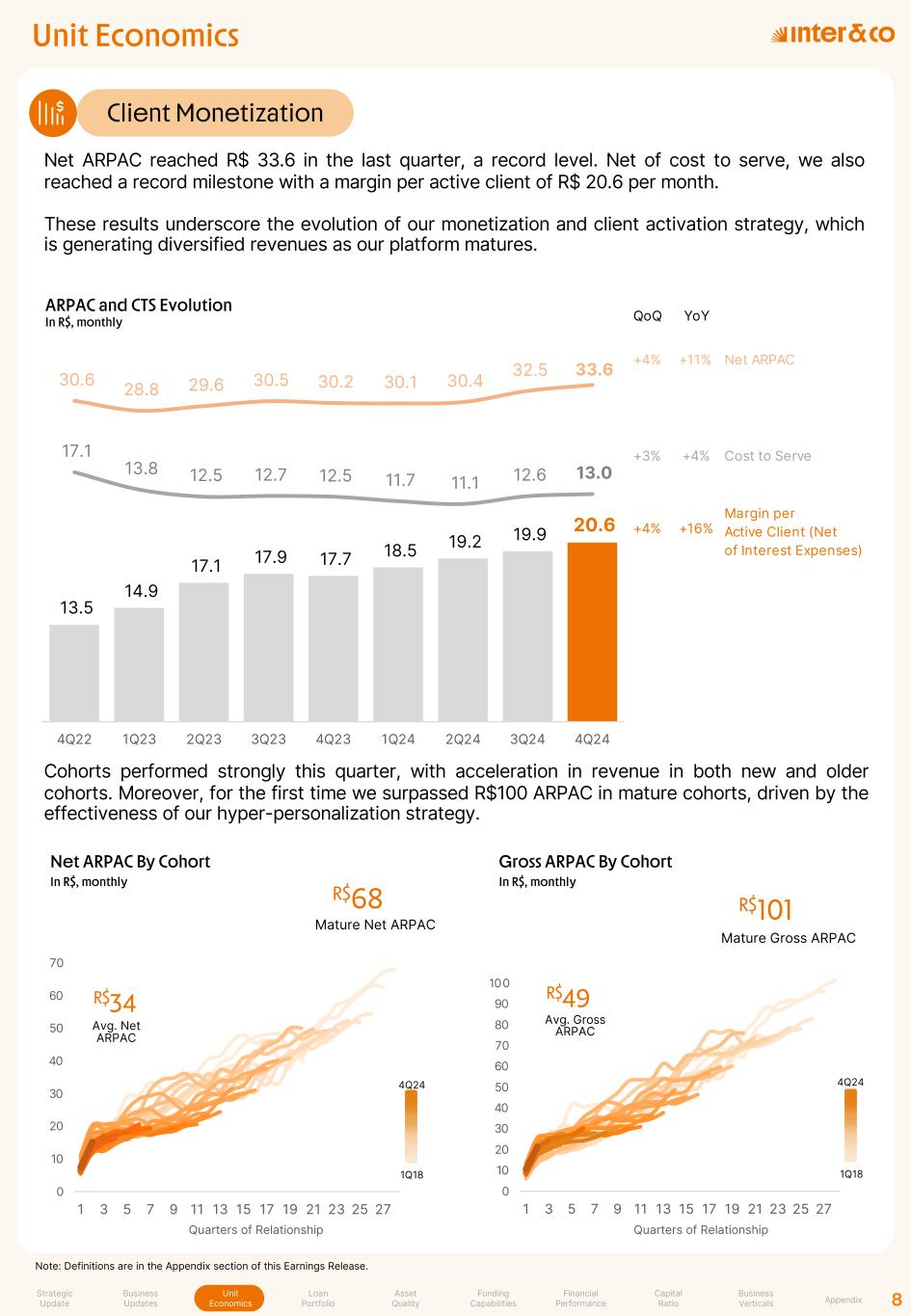

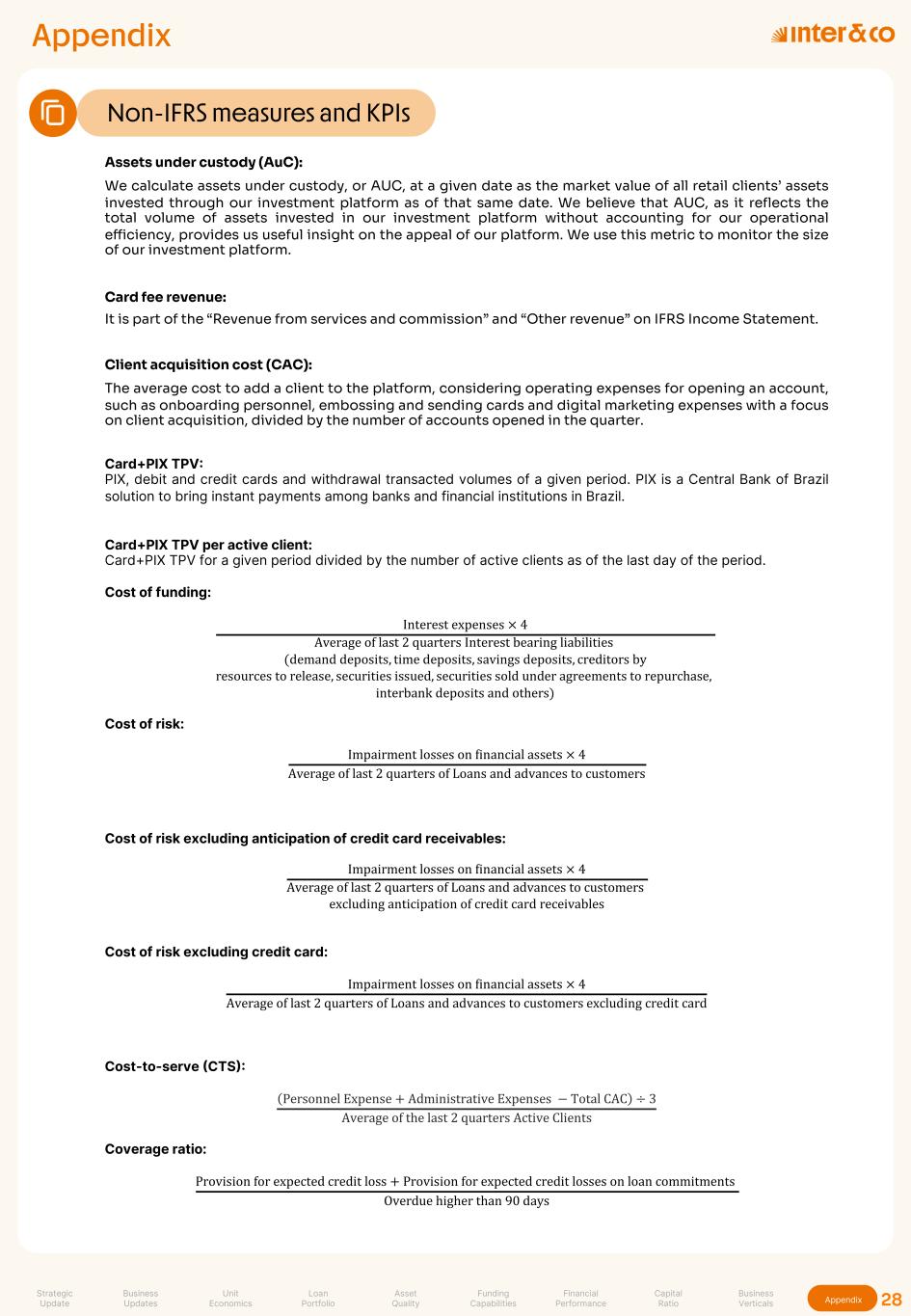

Unit Economics Client Monetization Gross ARPAC By Cohort In R$, monthly Quarters of RelationshipQuarters of Relationship Cohorts performed strongly this quarter, with acceleration in revenue in both new and older cohorts. Moreover, for the first time we surpassed R$100 ARPAC in mature cohorts, driven by the effectiveness of our hyper-personalization strategy. Net ARPAC reached R$ 33.6 in the last quarter, a record level. Net of cost to serve, we also reached a record milestone with a margin per active client of R$ 20.6 per month. These results underscore the evolution of our monetization and client activation strategy, which is generating diversified revenues as our platform matures. 4Q24 1Q18 ARPAC and CTS Evolution In R$, monthly Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 8 Note: Definitions are in the Appendix section of this Earnings Release. Net ARPAC By Cohort In R$, monthly R$68 Mature Net ARPAC R$34 Avg. Net ARPAC R$101 Mature Gross ARPAC QoQ YoY +4% +11% Net ARPAC +3% +4% Cost to Serve +4% +16% Margin per Active Client (Net of Interest Expenses) 13.5 14.9 17.1 17.9 17.7 18.5 19.2 19.9 20.6 30.6 28.8 29.6 30.5 30.2 30.1 30.4 32.5 33.6 17.1 13.8 12.5 12.7 12.5 11.7 11.1 12.6 13.0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Business Updates Strategic Update 0 10 20 30 40 50 60 70 80 90 100 1 3 5 7 9 11 13 15 17 19 21 23 25 27 4Q24 1Q18 R$49 Avg. Gross ARPAC 0 10 20 30 40 50 60 70 1 3 5 7 9 11 13 15 17 19 21 23 25 27

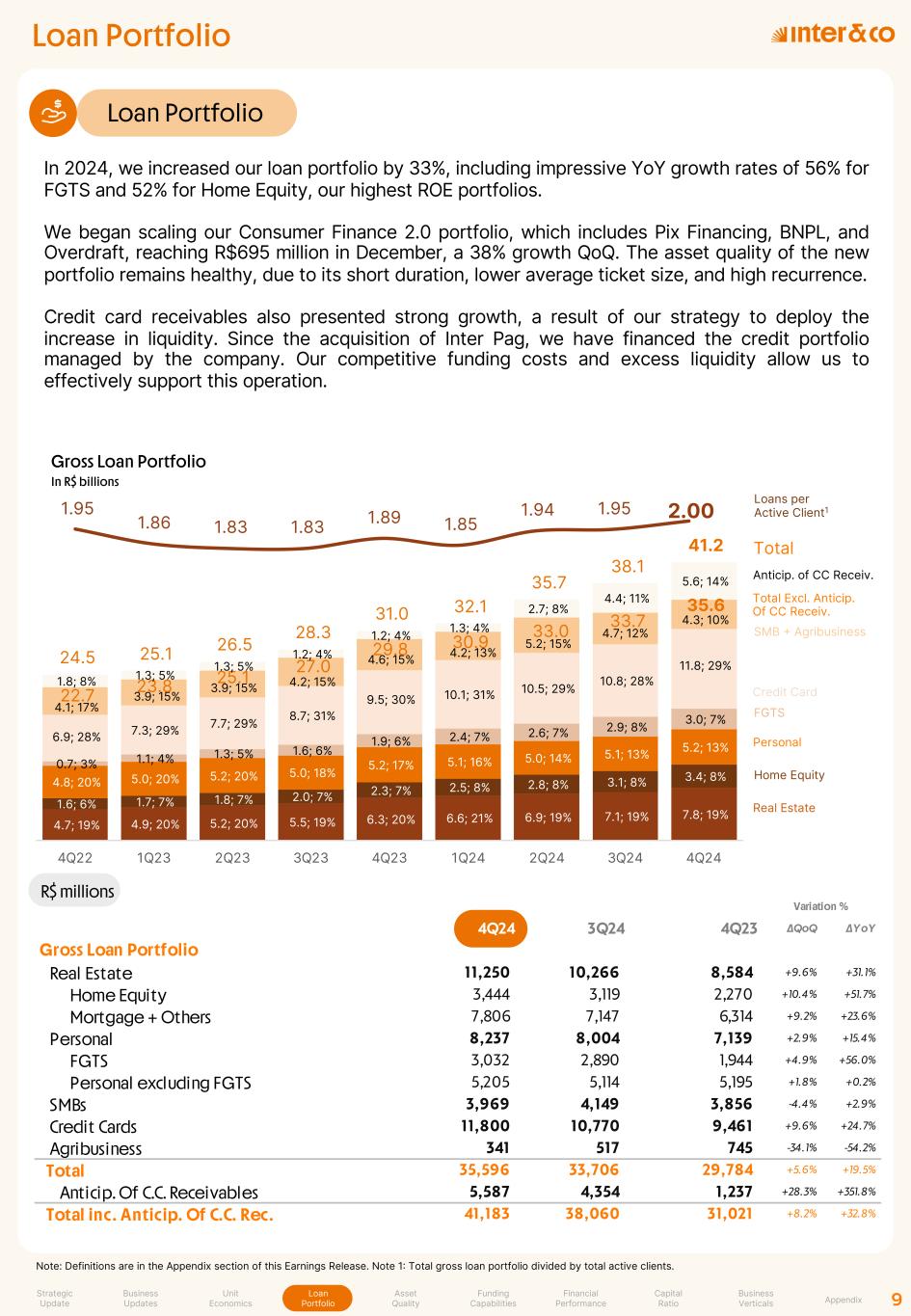

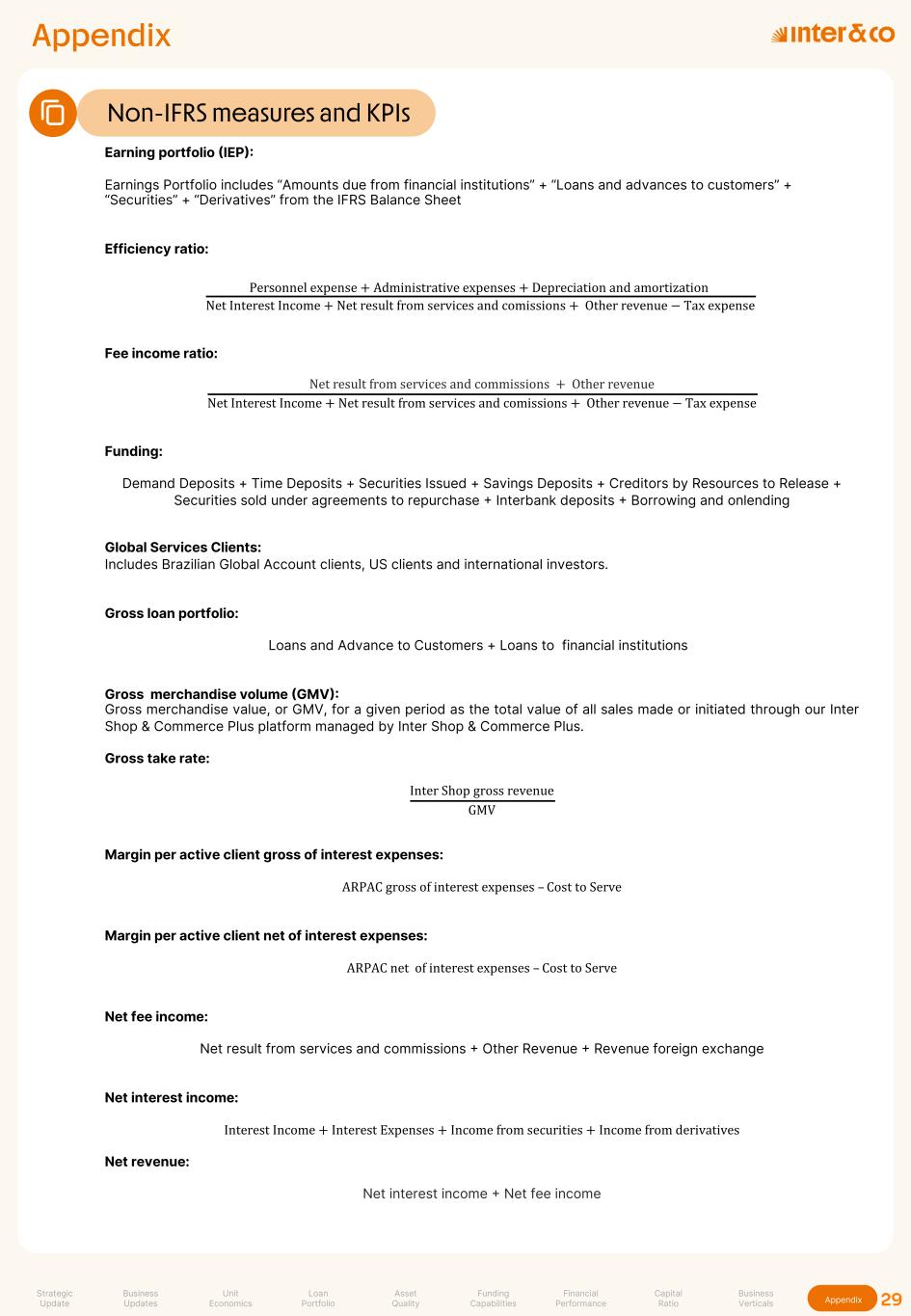

1.95 1.86 1.83 1.83 1.89 1.85 1.94 1.95 2.00 1 .60 1 .65 1 .70 1 .75 1 .80 1 .85 1 .90 1 .95 2 .0 2 .05 Loan Portfolio Loan Portfolio In 2024, we increased our loan portfolio by 33%, including impressive YoY growth rates of 56% for FGTS and 52% for Home Equity, our highest ROE portfolios. We began scaling our Consumer Finance 2.0 portfolio, which includes Pix Financing, BNPL, and Overdraft, reaching R$695 million in December, a 38% growth QoQ. The asset quality of the new portfolio remains healthy, due to its short duration, lower average ticket size, and high recurrence. Credit card receivables also presented strong growth, a result of our strategy to deploy the increase in liquidity. Since the acquisition of Inter Pag, we have financed the credit portfolio managed by the company. Our competitive funding costs and excess liquidity allow us to effectively support this operation. Real Estate Personal SMB + Agribusiness Credit Card Total FGTS Anticip. of CC Receiv. Home Equity Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 9 R$ millions Note: Definitions are in the Appendix section of this Earnings Release. Note 1: Total gross loan portfolio divided by total active clients. 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Gross Loan Portfolio Real Estate 11,250 10,266 8,584 +9.6% +31.1% Home Equity 3,444 3,119 2,270 +10.4% +51.7% Mortgage + Others 7,806 7,147 6,314 +9.2% +23.6% Personal 8,237 8,004 7,139 +2.9% +15.4% FGTS 3,032 2,890 1,944 +4.9% +56.0% Personal excluding FGTS 5,205 5,114 5,195 +1.8% +0.2% SMBs 3,969 4,149 3,856 -4.4% +2.9% Credit Cards 11,800 10,770 9,461 +9.6% +24.7% Agribusiness 341 517 745 -34.1% -54.2% Total 35,596 33,706 29,784 +5.6% +19.5% Anticip. Of C.C. Receivables 5,587 4,354 1,237 +28.3% +351.8% Total inc. Anticip. Of C.C. Rec. 41,183 38,060 31,021 +8.2% +32.8% Variation % Gross Loan Portfolio In R$ billions Business Updates Strategic Update Loans per Active Client1 Total Excl. Anticip. Of CC Receiv. 4.7; 19% 4.9; 20% 5.2; 20% 5.5; 19% 6.3; 20% 6.6; 21% 6.9; 19% 7.1; 19% 7.8; 19% 1.6; 6% 1.7; 7% 1.8; 7% 2.0; 7% 2.3; 7% 2.5; 8% 2.8; 8% 3.1; 8% 3.4; 8% 4.8; 20% 5.0; 20% 5.2; 20% 5.0; 18% 5.2; 17% 5.1; 16% 5.0; 14% 5.1; 13% 5.2; 13% 0.7; 3% 1.1; 4% 1.3; 5% 1.6; 6% 1.9; 6% 2.4; 7% 2.6; 7% 2.9; 8% 3.0; 7% 6.9; 28% 7.3; 29% 7.7; 29% 8.7; 31% 9.5; 30% 10.1; 31% 10.5; 29% 10.8; 28% 11.8; 29% 4.1; 17% 3.9; 15% 3.9; 15% 4.2; 15% 4.6; 15% 4.2; 13% 5.2; 15% 4.7; 12% 4.3; 10% 22.7 23.8 25.1 27.0 29.8 30.9 33.0 33.7 35.6 1.8; 8% 1.3; 5% 1.3; 5% 1.2; 4% 1.2; 4% 1.3; 4% 2.7; 8% 4.4; 11% 5.6; 14% 24.5 25.1 26.5 28.3 31.0 32.1 35.7 38.1 41.2 - 5 .0 1 0. 0 1 5. 0 2 0 .0 2 5. 0 3 0 .0 3 5. 0 4 0 .0 4 5. 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24

Loan Portfolio Portfolio Growth Our top-performing credit products, FGTS and Home Equity loans, have experienced remarkable growth levels, and continued to gain prominence in our loan mix, as well as relevant market share. In 4Q24, Home Equity for individuals reached a record 7.9% market share, a 179 bps growth when compared to 4Q23. In Credit Cards, we remain focused on reallocating limits among existing clients, while underwriting new limits with constantly updated models. The enhanced underwriting models and our interactive platform for clients seeking credit have allowed us to grow our credit card portfolio by 25% - 2x the market growth - at the same time we improved asset quality metrics. Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 10 Note: Definitions are in the Glossary section of this Earnings Release. Note 1: Home Equity includes both business and individuals’ portfolio. Note 2: Personal includes payroll deductible loans, overdraft, credit card renegotiations and other loans, excluding FGTS. Note3: Excluding Home Equity Loans. Note 4: Only Home Equity individuals’ portfolio. Note 5: Data from Banco Central do brasil. Note 6: Total FGTS portfolio estimated by multiplying Inter’s share in payments received of FGTS Withdraws (60-F – Saque Aniversário – Alienação ou Cessão Fiduciária) from 4Q24 by Inter’s Decmeberr/2024 FGTS loans portfolio. Note 7: Market data from ABECIP. 4Q24 Gross Loan Portfolio Growth and Balance In % YoY and in R$ billions Business Updates Strategic Update : ok Yo Y G ro w th Personal2,5 50%-75% Credit Card5 60%-75% FGTS7 50%-60% Home Equity1,6 30%-40%RWA Weight Loan Real Estate3,5 30%-40% SMB + Agribusiness5 80%-70% 12% 12% R$ 4.3 Bn Δ -0.3 bn -6% R$ 3.0 Bn Δ +1.1 bn 56% R$ 3.4 Bn Δ +1.1 bn 52% R$ 11.8 Bn Δ +2.3 bn 25% R$ 7.8 Bn Δ +1.5 bn 24% R$ 5.2 Bn Δ +0.1bn 0.2% 31% 25%4 13% 9% Portfolio Size Brazilian Market Growth Total Gross Loan Portfolio 33%

Asset Quality NPLs Our commitment to prudently manage credit risk is reflected in the positive trends we have shown in asset quality. Both NPLs for 15 to 90 days and those over 90 days showed consistent improvement throughout the year, decreasing by 58 bps and 38 bps respectively. During 2024, we focused on improving delinquency rates, especially for credit cards, by further enhancing our collection processes and underwriting models. It is important to highlight that we continue to maintain a high-quality, highly collateralized credit portfolio, which makes it resilient to credit cycles. Since 3Q24, Stage 3 formation was impacted to converge with CMN Resolution 4966, which establishes a minimum cure period for renegotiated portfolios that must remain in Stage 3. Renegotiations after 3Q24 have moved to Stage 3, while the older ones remained in Stage 2, thus explaining the gap between stage 3 and NPL formation since then. Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 11 Months of Relationship 1.5% 1.5% 1.7% 1.7% 1.2% 1.5% 1.5% 1.7% 1.9% 1.8% 0 .0 % 1. 0% 2 .0 % 3 .0 % 4 .0 % 5 .0 % 6 .0 % 7 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 NPL Format ion Estage 3 Formation 5.2% 5.2% 5.0% 5.1% 5.0% 0 .0 % 1. 0% 2 .0 % 3 .0 % 4 .0 % 5 .0 % 6 .0 % 7 .0 % 8 .0 % 9 .0 % 10 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 134% 133% 130% 130% 136% 0 .0 % 2 0. 0% 4 0. 0% 6 0. 0% 8 0. 0% 10 0 .0 % 12 0 .0 % 14 0 .0 % 16 0 .0 % 18 0 .0 % 2 0 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 4Q21 4.6% 4.8% 4.7% 4.5% 4.2% 4.0% 4.4% 3.9% 3.6% 3.4% 0 .0 % 1. 0% 2 .0 % 3 .0 % 4 .0 % 5 .0 % 6 .0 % 7 .0 % 8 .0 % 9 .0 % 10 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 NPL > 90 days NPL 15 to 90 days Business Updates Strategic Update NPLs1 In % Note 1: Considering Gross Loan Portfolio, which includes anticipation of C.C. receivables. Note 2: Cohorts defined as the first date when the client has his limit available. NPL per cohort = NPL > 90 days balance of the cohort divided by total credit card portfolio of the same cohort. Note 3: Considering “Provision for expected credit losses on loan commitments”. Credit Cards NPL 90 days per cohort2 In % Cost of Risk In % NPL and Stage 3 Formation In % Start to converge to Resolution 4,966 3 4 5 6 7 8 9 10 11 12 Coverage Ratio3 In %

11.6; 36% 11.0; 33% 11.7; 33% 12.3; 31% 14.4; 33% 13.8; 32% 15.1; 32% 15.9; 32% 17.6; 32% 10.5; 32% 11.7; 35% 13.0; 36% 15.1; 38% 16.3; 38% 16.9; 39% 18.8; 39% 21.2; 42% 23.0; 42% 6.2; 19% 6.6; 20% 7.0; 20% 7.5; 19% 8.1; 19% 8.2; 19% 8.5; 18% 9.0; 18% 9.9; 18% 4.2; 13% 4.2; 13% 3.9; 11% 4.7; 12% 4.7; 11% 4.8; 11% 5.3; 11% 4.1; 8% 4.5; 8% 32.5 33.5 35.7 39.6 43.5 43.8 47.8 50.3 55.1 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Funding Deposits Note 1: Deposits per active client considers total demand deposits plus time deposits by the total number of active clients of the quarter. Note 2: Loans to deposits ratio considers total gross loan portfolio divided by total deposits. Note 3: Includes saving deposits, creditors by resources to release and liabilities with financial institutions (securities sold under agreements to repurchase, interbank deposits and borrowing and onlending). Note 4: Excluding Conta com Pontos balance. Note 5: Includes Conta com Pontos correspondent balance and demand deposits. Funding & Funding per Active Clients In R$ billions & in R$ thousand Cost of Funding6 In %, annualized Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 12 QoQ YoY +0.7 p.p. -1.1 p.p. Average CDI Rate -1,2 p.p. +5.0 p.p. Cost of Funding (% of CDI) +0.3 p.p. -0.1 p.p. Cost of Funding We had another solid quarter of funding growth, surpassing R$55 billion, a 27% increase YoY. Growth was driven primarily by time deposits and transactional deposits, which increased by 41% and 22%, respectively. Our active clients have an average of approximately R$2,000 on deposits, a strong indication of their use of Inter as their main financial institution for daily transactions. Notably, our "Meu Porquinho" savings product (”Piggy Bank" in English) has over 3 million clients with a total R$ 4.5 billion AuC. Our competitive cost of funding is a result of higher transactional deposits. Despite years of strong balance sheet growth, transactional deposits remain robust and funding cost among the lowest in the banking industry. Nominal cost of funding increase in the 4Q24 was a result of higher Selic rate as we entered a tightening monetary cycle. 7.5% 8.1% 8.0% 8.2% 7.2% 7.0% 6.8% 6.8% 7.1% 13.7% 13.7% 13.7% 13.3% 12.2% 11.3% 10.5% 10.4% 11.1% 54.8% 59.7% 58.6% 61.7% 59.2% 61.9% 64.3% 65.4% 64.2% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Business Updates Strategic Update 1.75 1.68 1.71 1.77 1.87 1.77 1.85 1.90 1.98 1 .60 1 .65 1 .70 1 .75 1 .80 1 .85 1 .90 1 .95 2 .0 QoQ YoY +4% +6% Deposits per Active Client -0.9 p.p. +3.5 p.p. Loans to Deposits Ratio +10% +27% Total +11% -3% Other +9% +22% Securities Issued +9% +41% Time Deposits +11% +22% Transactional Deposits 75% 75% 74% 71% 71% 73% 75% 76% 75% 7 0% 7 2% 7 4% 7 6% 7 8% 8 0% 1 2 3 4 5

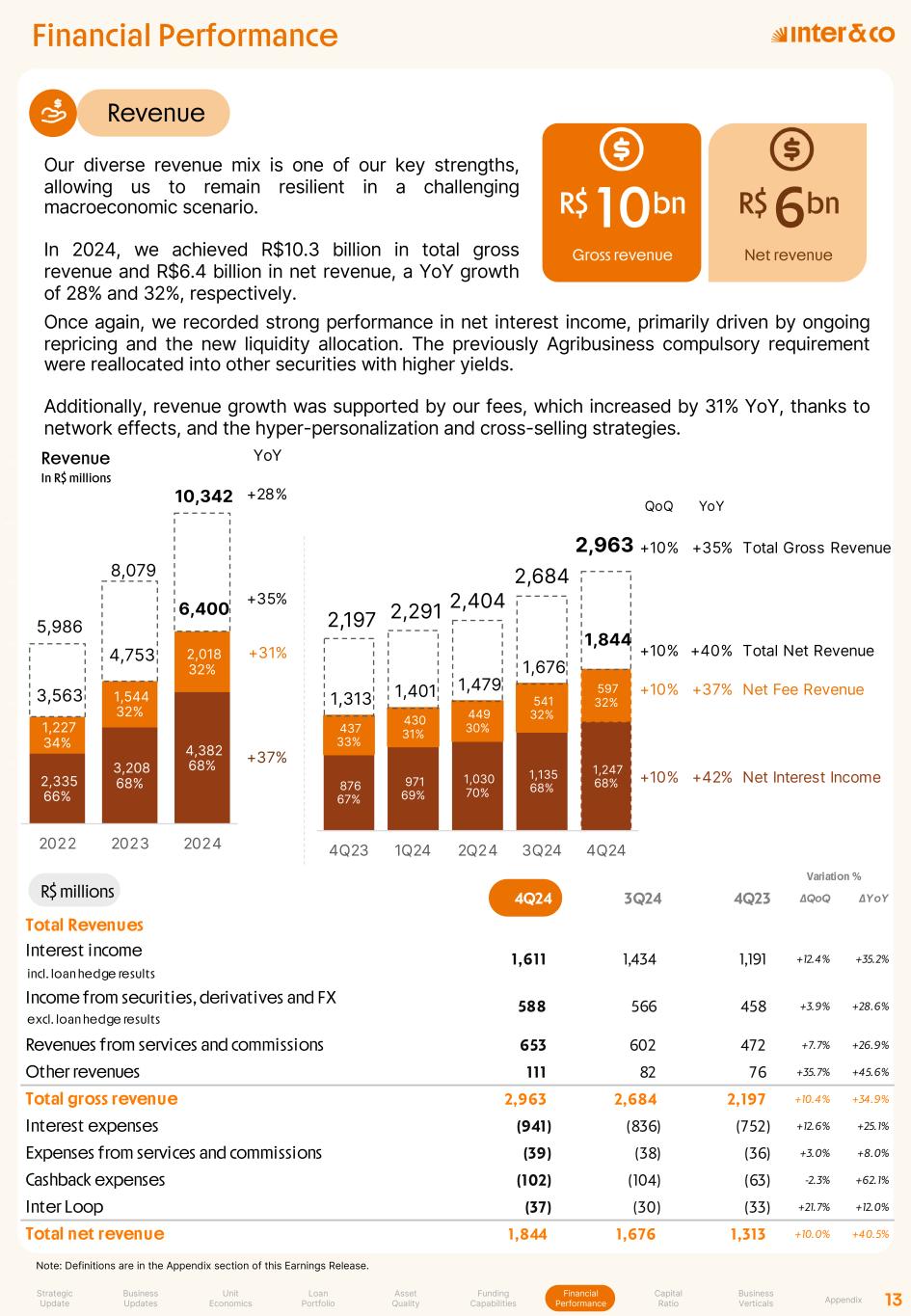

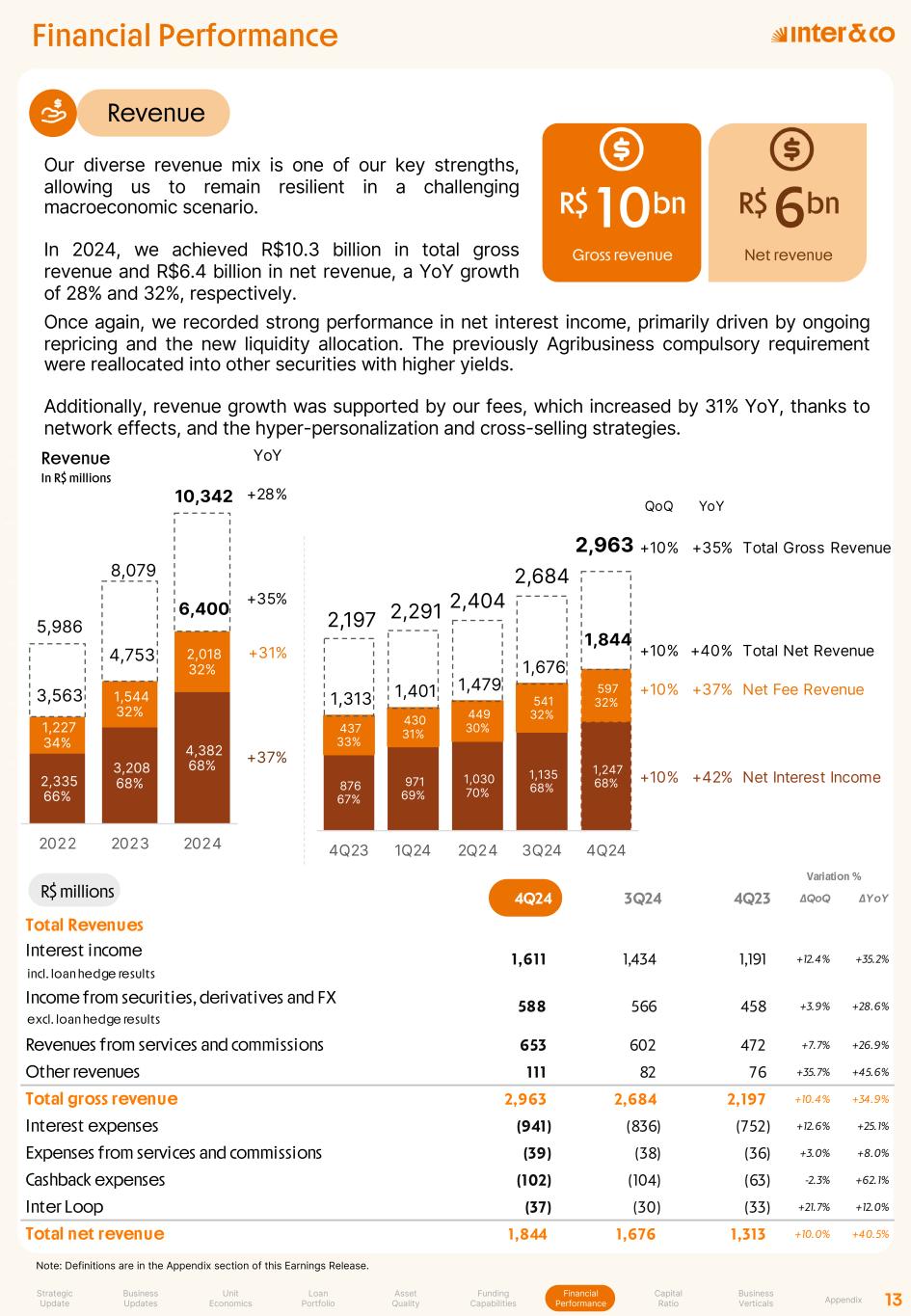

Financial Performance Revenue R$ millions Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 13 Our diverse revenue mix is one of our key strengths, allowing us to remain resilient in a challenging macroeconomic scenario. In 2024, we achieved R$10.3 billion in total gross revenue and R$6.4 billion in net revenue, a YoY growth of 28% and 32%, respectively. Note: Definitions are in the Appendix section of this Earnings Release. 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Total Revenues Interest income incl. loan hedge results Income from securities, derivatives and FX excl. loan hedge results Revenues from services and commissions 653 602 472 +7.7% +26.9% Other revenues 111 82 76 +35.7% +45.6% Total gross revenue 2,963 2,684 2,197 +10.4% +34.9% Interest expenses (941) (836) (752) +12.6% +25.1% Expenses from services and commissions (39) (38) (36) +3.0% +8.0% Cashback expenses (102) (104) (63) -2.3% +62.1% Inter Loop (37) (30) (33) +21.7% +12.0% Total net revenue 1,844 1,676 1,313 +10.0% +40.5% Variation % 1,611 1,434 1,191 +12.4% +35.2% 588 566 458 +3.9% +28.6% R$ 10bn R$ 6bn Net revenueGross revenue Business Updates Strategic Update Revenue In R$ millions Once again, we recorded strong performance in net interest income, primarily driven by ongoing repricing and the new liquidity allocation. The previously Agribusiness compulsory requirement were reallocated into other securities with higher yields. Additionally, revenue growth was supported by our fees, which increased by 31% YoY, thanks to network effects, and the hyper-personalization and cross-selling strategies. QoQ YoY +10% +35% Total Gross Revenue +10% +40% Total Net Revenue +10% +37% Net Fee Revenue +10% +42% Net Interest Income876 67% 971 69% 1,030 70% 1,135 68% 1,247 68% 437 33% 430 31% 449 30% 541 32% 597 32% 1,313 1,401 1,479 1,676 1,844 2,197 2,291 2,404 2,684 2,963 - 5 00 1, 00 0 1, 50 0 2 ,0 00 2 ,50 0 3 ,0 00 4Q23 1Q24 2Q24 3Q24 4Q24 2,335 66% 3,208 68% 4,382 68% 1,227 34% 1,544 32% 2,018 32% 3,563 4,753 6,400 5,986 8,079 10,342 - 2 ,0 00 4 ,0 00 6 ,0 00 8 ,0 00 10 ,0 00 12 ,0 00 2022 2023 2024 YoY +28% +35% +31% +37%

Financial Performance NIM Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 14 Our NIMs reached record levels in 4Q24 after consistent growth in previous quarters, mainly driven by ongoing improvements in our credit origination mix, improved client targeting, and enhanced capital allocation, both in credit and securities. In 4Q24, we optimized the treasury strategy implemented in the prior quarter, which involved reallocating lower yield Agribusiness compulsory loans into other securities. This resulted in an improved effective tax rate. Considering this reduction in the tax rate as gains in net interest income, we achieved a 10% NIM 2.1 (as below). NIM In % 9.7% NIM 2.0 Business Updates Strategic Update Risk-Adjusted NIM 1.0 Risk-Adjusted NIM 2.0 NIM 2.0 NIM 1.0 NIM 2.1 Incl. Income Tax Effect from Securities Issued Abroad1 NIM 1.1 Incl. Income Tax Effect from Securities Issued Abroad1 Risk Adjusted NIM 2.1 Incl. Income Tax Effect from Securities Issued Abroad1 Risk Adjusted NIM 1.1 Incl. Income Tax Effect from Securities Issued Abroad1 7.2% 7.4% 8.1% 7.8% 7.6% 7.8% 7.8% 8.1% 8.3% 8.4% 8.7% 9.5% 9.2% 9.0% 9.2% 9.2% 9.6% 9.7% 5.1% 4.4% 4.8% 4.6% 5.0% 5.3% 5.5% 5.6% 5.9% 4.4% 3.8% 4.1% 3.9% 4.3% 4.5% 4.6% 4.8% 5.0% 8.2% 8.5% 9.7% 10.0% 4.9% 5.2% 5.7% 6.2% 3. 0% 4. 0% 5. 0% 6. 0% 7. 0% 8. 0% 9. 0% 10. 0% 11.0 % 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Note: Definitions are in the Appendix section of this Earnings Release. Note 1: Income tax effect of the double taxation agreement on securities issued abroad (notas estruturadas), considering an effective tax rate 45% (IR/CSLL) from Banco Inter S.A..

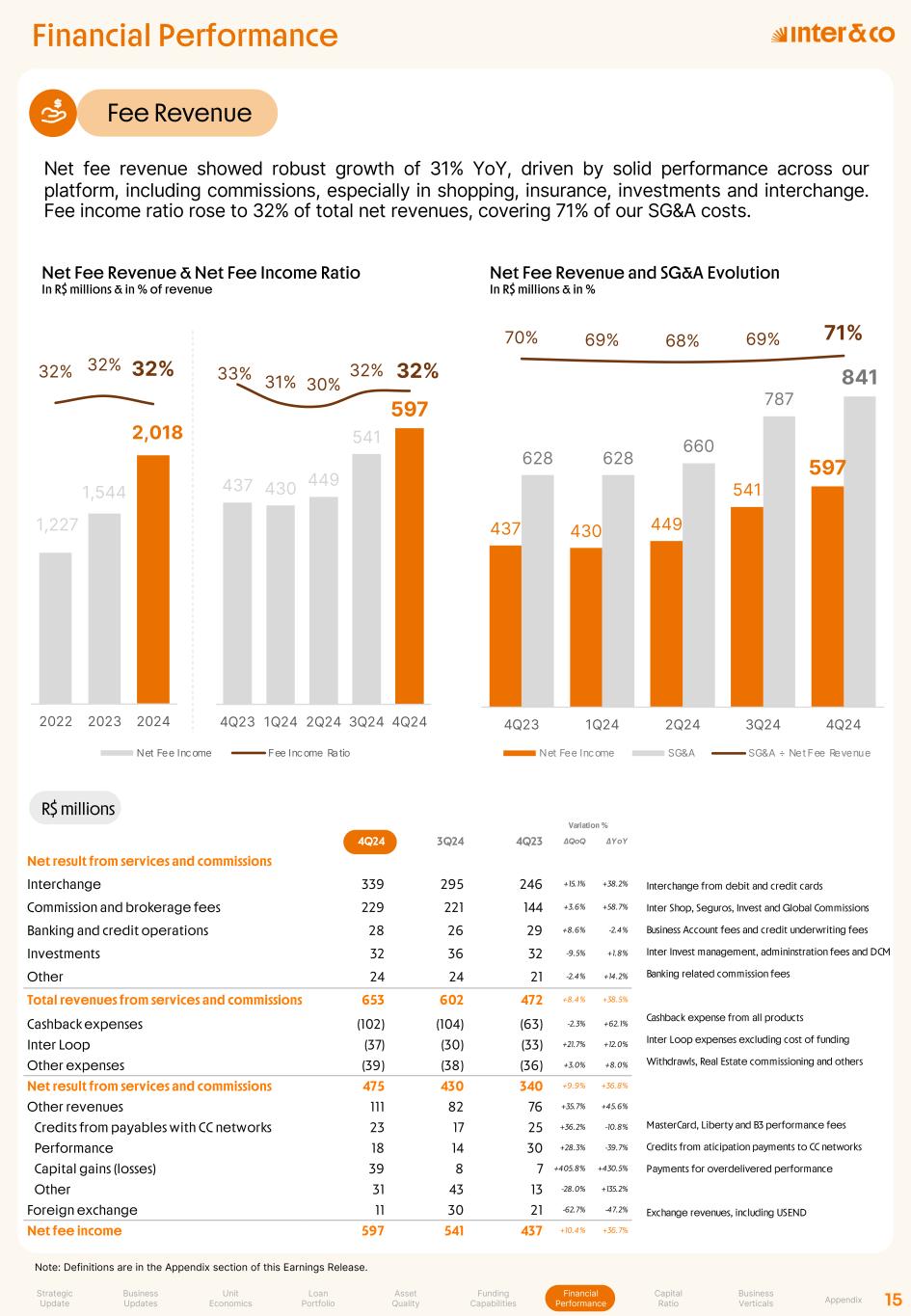

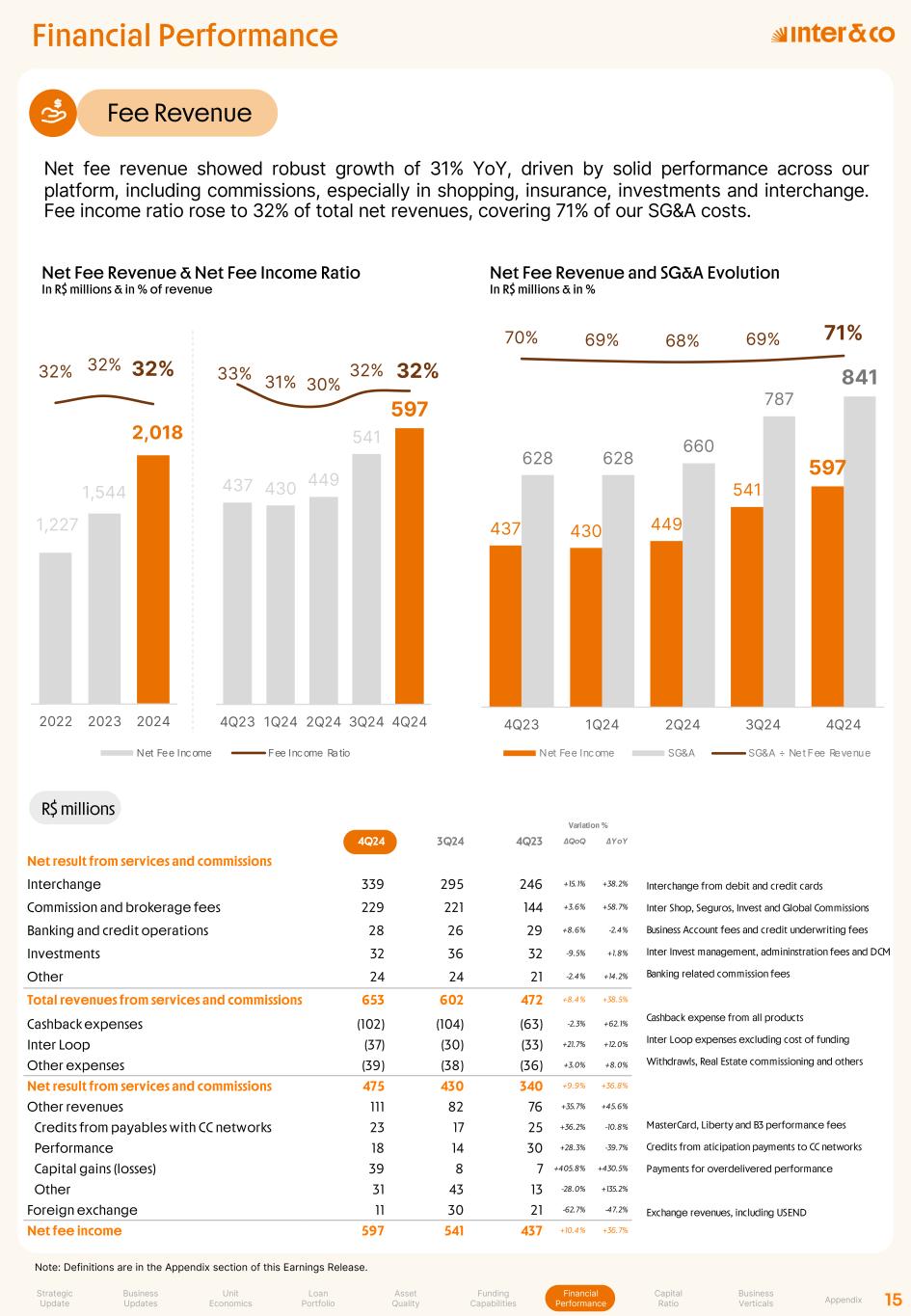

4Q24 3Q24 4Q23 ∆QoQ ∆YoY Cashback expenses (102) (104) (63) -2.3% +62.1% Inter Loop (37) (30) (33) +21.7% +12.0% Other expenses (39) (38) (36) +3.0% +8.0% Net result from services and commissions 475 430 340 +9.9% +36.8% Other revenues 111 82 76 +35.7% +45.6% Credits from payables with CC networks 23 17 25 +36.2% -10.8% Performance 18 14 30 +28.3% -39.7% Capital gains (losses) 39 8 7 +405.8% +430.5% Other 31 43 13 -28.0% +135.2% Foreign exchange 11 30 21 -62.7% -47.2% Net fee income 597 541 437 +10.4% +36.7% Variation % Financial Performance Fee Revenue Net Fee Revenue & Net Fee Income Ratio In R$ millions & in % of revenue Net Fee Revenue and SG&A Evolution In R$ millions & in % Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 15 Net fee revenue showed robust growth of 31% YoY, driven by solid performance across our platform, including commissions, especially in shopping, insurance, investments and interchange. Fee income ratio rose to 32% of total net revenues, covering 71% of our SG&A costs. Note: Definitions are in the Appendix section of this Earnings Release. R$ millions 437 430 449 541 597 33% 31% 30% 32% 32% -10% -5% 0% 5% 10% 15% 20 % 25% 30 % 35% 40 % - 1 0 2 0 0 3 0 0 4 0 0 5 0 0 6 0 0 7 0 0 8 0 0 4Q23 1Q24 2Q24 3Q24 4Q24 Net Fee Income Fee Income Ratio 437 430 449 541 597628 628 660 787 841 70% 69% 68% 69% 71% -100 % -80 % -60 % -40 % -20 % 0% 20 % 40 % 60 % 80 % - 1 0 2 0 0 3 0 0 4 0 0 5 0 0 6 0 0 7 0 0 8 0 0 9 0 0 1 ,0 0 4Q23 1Q24 2Q24 3Q24 4Q24 Net Fee Income SG&A SG&A ÷ Net Fee Revenue 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Net result from services and commissions Interchange 339 295 246 +15.1% +38.2% Commission and brokerage fees 229 221 144 +3.6% +58.7% Banking and credit operations 28 26 29 +8.6% -2.4% Investments 32 36 32 -9.5% +1.8% Other 24 24 21 -2.4% +14.2% Total revenues from services and commissions 653 602 472 +8.4% +38.5% Variation % Interchange from debit and credit cards Inter Shop, Seguros, Invest and Global Commissions Business Account fees and credit underwriting fees Inter Invest management, admininstration fees and DCM Banking related commission fees Cashback expense from all products Inter Loop expenses excluding cost of funding Withdrawls, Real Estate commissioning and others Business Updates Strategic Update 1,227 1,544 2,018 32% 32% 32% -5% 0% 5% 10% 15% 20 % 25% 30 % 35% 40 % - 5 0 0 1 ,0 0 1 ,5 0 2 ,0 0 0 2 ,5 0 3 ,0 0 0 2022 2023 2024 MasterCard, Liberty and B3 performance fees Credits from aticipation payments to CC networks Payments for overdelivered performance Exchange revenues, including USEND

Financial Performance Expenses Note 1: IFRS Financial Statements lines: “Personnel expenses”, “Depreciation and Amortization”, “Administrative Expenses”. Note 2: Others = rent, condominium fee and property maintenance; provisions for contingencies and Financial System services. Note 3: Data processing and information technology. Note 4: Personnel Expenses including Share- based and M&A Expenses. Salaries and benefits (including Board). Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 16 Expenses Breakdown In R$ millions 2024 has been a year of significant strategic investment aimed at strengthening our market presence and enhancing customer engagement. Main areas of investments were marketing and technology, while we continued to seek optimization in processes and team allocation. Our branding and marketing efforts were concentrated on targeted campaigns designed to attract more active clients, and increasing brand awareness. We are dedicated to deliver the best experience to our clients through the adoption of innovative technologies, including AI and hyper-personalization. 2 4 3 Business Updates Strategic Update 734; 31% 791; 33% 938; 32% 696; 29% 779; 32% 798; 27% 138; 6% 94; 4% 235; 8% 164; 7% 160; 7% 209; 7% 286; 12% 269; 11% 425; 15% 374; 16% 319; 13% 312; 11% 2,392 2,413 2,916 - 5 0 0 1 ,0 0 1 ,5 0 2 ,0 0 0 2 ,5 0 3 ,0 0 0 3 ,5 0 2022 2023 2024 YoY +21% -2% +58% +30% +151% +2% +19% 221; 35% 190; 30% 204; 31% 259; 33% 284; 34% 180; 29% 207; 33% 173; 26% 188; 24% 230; 27% 30; 5% 34; 5% 49; 7% 81; 10% 71; 8% 41; 7% 42; 7% 53; 8% 53; 7% 61; 7% 63; 10 % 67; 11% 83; 13% 153; 19% 122; 14% 91; 15% 87; 14% 98; 15% 53; 7% 74; 9% 628 628 660 787 841 - 1 0 2 0 0 3 0 0 4 0 0 5 0 0 6 0 0 7 0 0 8 0 0 9 0 0 4Q23 1Q24 2Q24 3Q24 4Q24 QoQ YoY +7% +34% Total +40% -19% Other -20% +93% Third party and financial system services +13% +47% D&A -13% +132% Advertisement and marketing +22% +27% Data processing and information technology +10% +28% Personnel

Financial Performance Efficiency R$ millions Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 17 After keeping expenses flat during 2023, in 2024 we opted to increase strategic investments, particularly in marketing and technology. These efforts enhanced our client activation, resulting in a stronger client base that is more likely to start using Inter within a shorter timeframe than before. As a result, our cost to serve reached R$ 13 in 4Q24, a growth of 4% compared to 4Q23. Note: Definitions are in the Appendix section of this Earnings Release. Cost-to-Serve In R$, monthly 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Total expenses (841) (787) (627) +6.8% +34.0% Personnel expenses (284) (259) (221) +9.7% +28.3% Depreciation and amortization (61) (53) (41) +13.5% +47.2% Administrative expenses (496) (475) (365) +4.5% +35.9% Total net revenues 1,677 1,553 1,222 +8.0% +37.2% Net interest income and income from securities, derivatives and FX 1,258 1,164 897 +8.1% +40.3% Net result from services and commissions 475 430 340 +10.5% +39.9% Other revenues 111 82 76 +35.7% +45.6% Tax expenses (168) (124) (91) +35.6% +83.9% Efficiency Ratio 50.1% 50.7% 51.4% -0.6 p.p. -1.3 p.p. Personnel Efficiency Ratio 16.9% 16.7% 18.1% +0.2 p.p. -1.2 p.p. Administrative Efficiency Ratio 33.2% 34.0% 33.2% -0.8 p.p. +0.0 p.p. Variation % Business Updates Strategic Update 17.1 13.8 12.5 12.7 12.5 11.7 11.1 12.6 13.0 - 2 .0 4 .0 6 .0 8 .0 10 .0 12 .0 14 .0 16 .0 18 .0 2 0. 0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 +4%YoY

Financial Performance Efficiency Revenue vs. Expenses In %, index in a 100 basis Efficiency Ratio In % Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 18 With cost structure optimization and accelerated revenue growth, we finished the year with an efficiency ratio of 50.1%. The gap between the growth rates of net revenue and expenses is consistently increasing, in line with our 60/30/30 plan. We continue to focus relentlessly on identifying efficiency improvements to optimize operational leverage. Personnel + Adm Expenses Net revenue1 Business Updates Strategic Update 73.4% 62.4% 53.4% 52.4% 51.4% 47.7% 47.9% 50.7% 50.1% 25.7% 18.0% 17.3% 18.0% 18.1% 14.5% 14.8% 16.7% 16.9% 47.7% 44.3% 36.1% 34.4% 33.2% 33.3% 33.1% 34.0% 33.2% 0 0 .1 0 .2 0 .3 0 .4 0 .5 0 .6 0 .7 0 .8 0 .9 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Total Administrative Eff. Ratio Personnel Eff. Ratio 102 115 126 131 141 148 166 180 100 89 85 91 93 93 97 117 124 7 0 10 0 13 0 16 0 19 0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Note: Definitions are in the Appendix section of this Earnings Release. Note 1: Total net revenue minus tax expenses.

Financial Performance Net Income Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 19 We delivered a strong second year of the 60/30/30 plan, with an 11.7% ROE and a record net income of R$ 973 million in 2024. Excluding minority interest, net income reached R$ 907 million, 3x greater than 2023. These outcomes are a testament to our dedication, focus, and ability to execute our strategic plan, delivering consistent and resilient results. We remain committed to driving innovation, delivering best-in-class products and services to our clients, value to our shareholders, and always pursuing new growth opportunities. Note: Definitions are in the Appendix section of this Earnings Release. Net Income & ROE In R$ millions & In % Net Income ROE Net Income Excluding Minority Int. ROE Excl. Minority Int. R$ 973MM 11.7% Net income ROE Business Updates Strategic Update +176% YoY +6.9 p.p. YoY 32 11 49 91 151 183 206 243 275 29 24 64 104 160 195 223 260 295 - 50 100 150 200 250 300 350 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 -0.2% 4.8% 11.7% -0.2% 4.2% 11.1% (11) 302 907 (14) 352 973 -10 0 10 0 30 0 50 0 70 0 90 0 2022 2023 2024 1.6% 1.4% 3.6% 5.7% 8.5% 9.7% 10.4% 11.9% 13.2% 1.8% 0.7% 2.7% 5.0% 8.2% 9.2% 9.8% 11.3% 12.5%

4Q24 3Q24 4Q23 ∆QoQ ∆YoY Capital Ratio Reference Equity - Tier I (RE) 5,262 5,558 6,138 -5.3% -14.3% Risk-Weighted Asset (RWA) 34,642 32,686 26,746 +6.0% +29.5% Capital Requirement 6,409 6,047 4,948 +6.0% +29.5% Margin on Capital Requirements 6,887 7,684 9,468 -10.4% -27.3% Tier-I Ratio (RE/RWA) 15.2% 17.0% 23.0% -1.8 p.p. -7.8 p.p. Variation % Capital Ratio Capital Ratio One of our key competitive advantages is our robust capital base, which is entirely comprised of high-quality Tier I capital, with no hybrid instruments. To sustain this advantage over time, we have established a ROE-driven underwriting framework based on the return on allocated capital. To further optimize our capital structure, we have focused on increasing our capital base at the holding level. In 4Q24 the excess capital in the holding level reached R$ 1.5 billion. At the banking level (Banco Inter S.A.) the Tier-I ratio decreased to 15.2%, primarily due to (1) growth in loans and investments, (2) dividend payments from Banco Inter S.A. to Inter&Co, (3) increase in deferred tax assets, attributed to negative mark-to-market results in securities available for sale, which adversely impacts reference equity. Reference Equity In R$ billions Gross Loan Portfolio Growth QoQ Tier-I Ratio RWA Growth QoQ RWA & Tier I Ratio In R$ millions & in % Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 20 Tier-I Ratio – Banco Inter S.A. In % Minimum Capital Requirement3 Banco Inter S.A. Excess Capital2 Banco Inter S.A. Source: Banco Inter Bacen GAAP Financial Statements. Note 1: Capital hold at the Inter&Co Holding level. Note 2: Additional reference equity considering minimum capital requirement of 10.5%. Note 3: Considering a Tier-1 Ratio of 10.5%. 23.0% 20.3% 19.3% 17.0% 15.2% 0 .0 % 5 .0 % 10 .0 % 15 .0 % 2 0. 0% 2 5. 0% 4Q23 1Q24 2Q24 3Q24 4Q24 6% 8% 6% 7% 6% 10% 4% 11% 7% 8% 0% 2% 4% 6% 8% 10% 12% 3.6 3.6 1.6 1.6 1.5 5.3 6.8 - 1 .0 2 .0 3 .0 4 .0 5 .0 6 .0 7 .0 8 .0 Banco Inter Inter&Co Excess Capital Inter&Co1 +28% Business Updates Strategic Update

8.6 8.6 9.2 10.3 11.7 11.9 12.3 12.9 14.1 10.5 9.9 10.4 10.9 12.2 11.3 12.0 12.6 13.7 158 163 177 198 230 234 266 294 337 178 181 197 219 253 257 290 320 364 - 10 .0 2 0. 0 3 0. 0 4 0. 0 5 0. 0 6 0. 0 7 0. 0 8 0. 0 9 0. 0 10 0. 0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Business Verticals Our Ecosystem BANKING & SPENDING SHOPPING INVESTMENTS INSURANCE GLOBALCREDIT LOYALTY Cards + Pix TPV Gross Loan Portfolio GMV Highest GMV ever AuC Strong AuC growth Sales High margin business Global Clients Brazilian clients as main focus Clients Attractive new revenue stream Banking Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 21 Debit Credit Pix Total Cards + Pix TPV In R$ billions 7.300,35 Our financial super app offers an integrated digital experience with a comprehensive suite of commercial and banking products. We continue to focus on enhancing our platform to meet our clients’ needs and improving the customer experience. We surpassed R$1.2 trillion in transactions via Pix, debit, and credit cards from our customers in 2024. Most of the transactions were processed through Pix, totaling R$1.1 trillion in volume for the year and a 47% increase YoY. Additionally, credit card TPV grew almost 30% in a year, bolstering our interchange revenue. Note: Definitions are in the Appendix section of this Earnings Release. +44% YoY 5.4mm 3.9mm 11.3mm1,231bnR$ 41.2bnR$ 5.0bnR$ 144bnR$ Business Updates Strategic Update 30.3 39.8 51.2 36.2 43.3 49.6 512 768 1,131 578 851 1,231 - 5 0. 0 10 0. 0 15 0. 0 2 00 .0 2 50. 0 3 00 .0 3 50. 0 2022 2023 2024

Business Verticals Loyalty Shopping Investments Insurance Global Active Contracts & Sales In millions & in thousands AuC & Deposits in US Dollars In USD millions Active Clients & GMV In millions & in % Active Clients & AuC In millions & in R$ billions Loyalty Clients In millions Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 22 We posted record-breaking growth in Insurance in 2024, across all financial and operational metrics. Our active contract base more than tripled compared to 2023, reaching 5.3 million. Our leadership position in the market is a result of our diversified portfolio, integrated experiences, scale, and profitability. Our Global Account business reached 3.9 million clients and USD 1.2 billion in AuC. We also launched Loop and dollar-denominated Credit Cards for Global clients, enabling us to target and engage these clients even more. During 2024, 6 million clients shopped with us, 3.6 million in 4Q24 alone, generating a yearly GMV of approximately R$5 billion, representing 40% growth YoY. We are actively reaccelerating our GMV by increasing cashback as a strategic initiative to offer BNPL operations to our Shopping clients. In 4Q24, nearly 7% of the on-us operations’ GMV was converted to BNPL transactions. We ended 2024 with R$ 141 billion of total AuC and added approximately 2 million active clients in the year, achieving 6.8 million Investments clients. This growth demonstrates our ability to provide value-added services and ensure a seamless and engaging experience for our clients. Loop surpassed 11 million clients in 4Q24, which means we almost tripled the number of clients engaging with our loyalty program. This demonstrates our ability to successfully influence client behavior and foster engagement across verticals. Note: Definitions are in the Appendix section of this Earnings Release. GMV Active Clients Active Clients AuC Policies Sold Active Contracts 364 1,157 - 2 0 0 4 0 0 6 0 0 8 0 0 1 ,0 0 1 ,2 0 1 ,4 0 4Q23 4Q24 389 2,7031.7 5.3 -3. 0 -2. 0 -1.0 - 1. 0 2.0 3.0 4.0 5.0 6.0 - 5 0 0 1 ,0 0 1 ,5 0 2 ,0 0 2 ,5 0 3 ,0 0 3 ,5 0 4Q23 4Q24 91.8 141.24.7 6.8 3 0 .0 5 0 .0 7 0. 0 9 0 .0 1 10 .0 1 30 .0 1 50 .0 1 70 .0 4Q23 4Q24 1.0 1.5 3.0 3.6 - 0 .5 1 .0 1 .5 2 .0 4Q23 4Q24 4.0 11.3 0 .0 2 .0 4 .0 6 .0 8 .0 10 .0 12 .0 4Q23 4Q24 Business Updates Strategic Update

Appendix Balance Sheet Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 23 R$ millions 12/31/2024 09/30/2024 12/31/2023 ∆QoQ ∆YoY Balance Sheet Assets Cash and cash equivalents 1,108 2,274 4,259 -51.2% -74.0% Amounts due from financial institutions 6,195 5,225 3,719 +18.6% +66.6% Compulsory deposits 5,285 4,185 2,664 +26.3% +98.4% Securities 23,898 20,586 16,868 +16.1% +41.7% Derivative financial instruments 1 18 4 -97.0% -86.7% Net loans and advances to customers 33,327 31,478 27,901 +5.9% +19.5% Non-current assets held-for-sale 235 185 174 +26.9% +34.6% Equity accounted investees 10 10 91 -0.0% -88.5% Property and equipment 370 360 168 +2.7% +120.8% Intangible assets 1,836 1,711 1,345 +7.3% +36.5% Deferred tax assets 1,705 1,411 1,034 +20.8% +65.0% Variation % Other assets 2,488 2,483 2,125 +0.2% +17.1% Total assets 76,458 69,928 60,352 +9.3% +26.7% Liabilities Liabilities with financial institutions 11,320 10,404 9,522 +8.8% +18.9% Liabilities with clients 42,803 39,130 32,652 +9.4% +31.1% Securities issued 9,890 9,048 8,095 +9.3% +22.2% Derivative financial liabilities 70 9 15 +698.0% +365.0% Other liabilities 2,386 1,797 1,897 +32.8% +25.8% Total Liabilities 67,386 61,061 52,755 +10.4% +27.7% Equity Total shareholder's equity of controlling shareholders 8,895 8,707 7,472 +2.2% +19.0% Non-controlling interest 177 160 125 +10.6% +41.8% Total shareholder's equity 9,072 8,867 7,597 +2.3% +19.4% Total liabilities and shareholder's equity 76,458 69,928 60,352 +9.3% +26.7% Business Updates Strategic Update

Appendix Income Statement R$ millions Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 24 4Q24 3Q24 4Q23 ∆QoQ ∆YoY Income Statement Interest income from loans 1,337 1,412 1,279 -5.3% +4.5% Interest expenses (941) (836) (752) +12.6% +25.1% Income from securities and derivatives and FX 862 588 370 +46.7% +132.9% Net interest income and income from securities, derivatives and FX 1,258 1,164 897 +8.1% +40.3% Revenues from services and commissions 514 468 376 +9.9% +36.8% Expenses from services and commissions (39) (38) (36) +3.0% +8.0% Other revenues 111 82 76 +35.7% +45.6% Revenue 1,844 1,676 1,313 +10.0% +40.5% Impairment losses on financial assets (496) (471) (384) +5.2% +28.9% Net result of losses 1,349 1,205 928 +12.0% +45.3% Variation % Administrative expenses (496) (475) (365) +4.5% +35.9% Personnel expenses (284) (259) (221) +9.7% +28.3% Tax expenses (168) (124) (91) +35.6% +83.9% Depreciation and amortization (61) (53) (41) +13.5% +47.2% Income from equity interests in affiliates - - (1) N/M N/M Profit / (loss) before income tax 340 294 208 +15.8% +63.4% Income tax and social contribution (45) (34) (49) +33.5% -6.7% Profit / (loss) 295 260 160 +13.4% +84.7% Business Updates Strategic Update

Appendix Income Statement R$ millions Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 25 Variation % 2024 2023 ∆YoY Income Statement Interest income from loans 5,139 4,550 +13.0% Interest expenses (3,312) (2,888) +14.7% Income from securities and derivatives and FX 2,629 1,635 +60.9% Net interest income 4,457 3,297 +35.2% Revenues from services and commissions 1,753 1,304 +34.4% Expenses from services and commissions (143) (136) +5.8% Other revenues 334 287 +16.2% Revenue 6,400 4,753 +34.7% Impairment losses on financial assets (1,799) (1,542) +16.7% Net result of losses 4,601 3,211 +43.3% Administrative expenses (1,769) (1,461) +21.1% Personnel expenses (938) (791) +18.6% Tax expenses (477) (327) +46.1% Depreciation and amortization (209) (160) +30.2% Income from equity interests in affiliates (2) (32) -92.3% Profit / (loss) before income tax 1,206 440 +174.1% Income tax and social contribution (233) (88) +165.7% Profit / (loss) 973 352 +176.2% Business Updates Strategic Update

Appendix Non-IFRS measures and KPIs Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 26Business Updates Strategic Update NIM 2.1 Incl. Income Tax Benefit from Securities Issued Abroad 3Q24 4Q24 NII Income Tax Benefit from Securities Issued Abroad 1,151 1,285 Interest income 1,412 1,337 Interest expenses (836) (941) Income from securities and derivatives 558 851 (+) Tax Benefit from Securities Issued Abroad 17 38 IEP 48,746 53,870 Amounts due from financial institutions 5,225 6,195 Securities 20,586 23,898 Net loans and advances to customers excluding non int. CC Receivables 22,916 23,777 Net loans and advances to customers 31,478 33,327 (-) Non int. CC receivables 8,563 9,550 Derivative financial assets 18 1 (=) NIM 2.1 (Incl. Income Tax Benefit from Securities Issued Abroad) 9.7% 10.0% Risk-Adjusted NIM 2.1 Incl. Income Tax Benefit from Securities Issued Abroad 3Q24 4Q24 NII After Cost of Risk Income Tax Benefit from Securities Issued Abroad 680 789 Interest income 1,412 1,337 Interest expenses (836) (941) Income from securities and derivatives 558 851 (+) Tax Benefit from Securities Issued Abroad 17 38 (-) Provision expenses (471) (496) IEP 48,746 53,870 Amounts due from financial institutions 5,225 6,195 Securities 20,586 23,898 Net loans and advances to customers excluding non int. CC Receivables 22,916 23,777 Net loans and advances to customers 31,478 33,327 (-) Non int. CC receivables 8,563 9,550 Derivative financial assets 18 1 (=) Risk-Adjusted NIM 2.1 (Income Tax Benefit from Securities Issued Abroad) 5.7% 6.2% NIM 1.1 Incl. Income Tax Benefit from Securities Issued Abroad 3Q24 4Q24 NII Income Tax Benefit from Securities Issued Abroad 1,151 1,285 Interest income 1,412 1,337 Interest expenses (836) (941) Income from securities and derivatives 558 851 (+) Tax Benefit from Securities Issued Abroad 17 38 IEP + Non int. CC receivables 57,309 63,420 Amounts due from financial institutions 5,225 6,195 Securities 20,586 23,898 Net loans and advances to customers 31,478 33,327 Derivative financial assets 18 1 (=) NIM 2.1 (Incl. Income Tax Benefit from Securities Issued Abroad) 8.2% 8.5% Risk-Adjusted NIM 1.1 Incl. Income Tax Benefit from Securities Issued Abroad 3Q24 4Q24 NII After Cost of Risk Income Tax Benefit from Securities Issued Abroad 680 789 Interest income 1,412 1,337 Interest expenses (836) (941) Income from securities and derivatives 558 851 (+) Tax Benefit from Securities Issued Abroad 17 38 (-) Provision expenses (471) (496) IEP + Non int. CC receivables 57,309 63,420 Amounts due from financial institutions 5,225 6,195 Securities 20,586 23,898 Net loans and advances to customers 31,478 33,327 Derivative financial assets 18 1 (=) Risk-Adjusted NIM 2.1 (Income Tax Benefit from Securities Issued Abroad) 4.9% 5.2% Note 1: Income tax effect of the double taxation agreement on securities issued abroad (notas estruturadas), considering an effective tax rate 45% (IR/CSLL) from Banco Inter S.A..

Appendix Non-IFRS measures and KPIs Activation Rate: Number of active clients at the end of the quarter Total number of clients at the end of the quarter Active clients: We define an active client as a customer at any given date that was the source of any amount of revenue for us in the preceding three months, or/and a customer that used products in the preceding three months. For Inter insurance, we calculate the number of active clients for our insurance brokerage vertical as the number of beneficiaries of insurance policies e!ective as of a particular date. For Inter Invest, we calculate the number of active clients as the number of individual accounts that have invested on our platform over the applicable period. Active clients per employee: Number of active clients at the end of the quarter Total number of employees at the end of the quarter, including interns Administrative e!ciency ratio: Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Annualized interest rates: Yearly rate calculated by multiplying the quarterly interest by four, over the average portfolio of the last two quarters. All-in loans rate considers Real Estate, Personnal +FGTS, SMBs, Credit Card, excluding non- interest earnings credit card receivables, and Anticipation of Credit Card Receivables. Anticipation of credit card receivables: Disclosed in note 9.a of the Financial Statements, line " "Loans to financial institutions”. ARPAC gross of interest expenses: (Interest income + (Revenue from services and comissions − Cashback − Inter rewards) + Income from securities and derivarives + Other revenue) ÷ 3 Average of the last 2 quarters Active Clients ARPAC net of interest expenses: (Revenue − Interest expenses) ÷ 3 Average of the last 2 quarters Active Clients ARPAC per quarterly cohort: Total Gross revenue net of interest expenses in a given cohort divided by the average number of active clients in the current and previous periods1. Cohort is defined as the period in which the client started his relationship with Inter. 1 - Average number of active clients in the current and previous periods: For the first period, is used the total number of active clients in the end of the period. Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 27Business Updates Strategic Update

Appendix Non-IFRS measures and KPIs Assets under custody (AuC): We calculate assets under custody, or AUC, at a given date as the market value of all retail clients’ assets invested through our investment platform as of that same date. We believe that AUC, as it reflects the total volume of assets invested in our investment platform without accounting for our operational e"ciency, provides us useful insight on the appeal of our platform. We use this metric to monitor the size of our investment platform. Card fee revenue: It is part of the “Revenue from services and commission” and “Other revenue” on IFRS Income Statement. Client acquisition cost (CAC): The average cost to add a client to the platform, considering operating expenses for opening an account, such as onboarding personnel, embossing and sending cards and digital marketing expenses with a focus on client acquisition, divided by the number of accounts opened in the quarter. Card+PIX TPV: PIX, debit and credit cards and withdrawal transacted volumes of a given period. PIX is a Central Bank of Brazil solution to bring instant payments among banks and financial institutions in Brazil. Card+PIX TPV per active client: Card+PIX TPV for a given period divided by the number of active clients as of the last day of the period. Cost of funding: Interest expenses × 4 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of risk: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers Cost of risk excluding anticipation of credit card receivables: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding anticipation of credit card receivables Cost of risk excluding credit card: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding credit card Cost-to-serve (CTS): Personnel Expense + Administrative Expenses − Total CAC ÷ 3 Average of the last 2 quarters Active Clients Coverage ratio: Provision for expected credit loss + Provision for expected credit losses on loan commitments Overdue higher than 90 days Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 28Business Updates Strategic Update

Appendix Non-IFRS measures and KPIs Earning portfolio (IEP): Earnings Portfolio includes “Amounts due from financial institutions” + “Loans and advances to customers” + “Securities” + “Derivatives” from the IFRS Balance Sheet Efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Fee income ratio: Net result from services and commissions + Other revenue Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Funding: Demand Deposits + Time Deposits + Securities Issued + Savings Deposits + Creditors by Resources to Release + Securities sold under agreements to repurchase + Interbank deposits + Borrowing and onlending Global Services Clients: Includes Brazilian Global Account clients, US clients and international investors. Gross loan portfolio: Loans and Advance to Customers + Loans to financial institutions Gross merchandise volume (GMV): Gross merchandise value, or GMV, for a given period as the total value of all sales made or initiated through our Inter Shop & Commerce Plus platform managed by Inter Shop & Commerce Plus. Gross take rate: Inter Shop gross revenue GMV Margin per active client gross of interest expenses: ARPAC gross of interest expenses – Cost to Serve Margin per active client net of interest expenses: ARPAC net of interest expenses – Cost to Serve Net fee income: Net result from services and commissions + Other Revenue + Revenue foreign exchange Net interest income: Interest Income + Interest Expenses + Income from securities + Income from derivatives Net revenue: Net interest income + Net fee income Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 29Business Updates Strategic Update

Appendix Non-IFRS measures and KPIs Net take rate: Inter Shop net revenue GMV NIM 1.0 – IEP + Credit Card Transactional Portfolio: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) + Credit card transactor portfolio NIM 2.0 – IEP Only: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) NIM 1.1 – IEP + Credit Card Transactional Portfolio Incl. Income tax effect from Securities Issued Abroad: (Net interest income + Income tax effect from Securities Issued Abroad) x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) + Credit card transactor portfolio NIM 2.1 – IEP Only Portfolio Incl. Income tax effect from Securities Issued Abroad : (Net interest income + Income tax effect from Securities Issued Abroad) x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) NPL 15 to 90 days: Overdue 15 to 90 days Loans and Advance to Costumers + Loans to Minancial institutions NPL > 90 days: Overdue higher than 90 days Loans and Advance to Costumers + Loans to Minancial institutions NPL formation: Overdue balance higher than 90 days in the current quarter – Overdue balance higher than 90 days inthe previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter Personal efficiency ratio: Personnel expense Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Primary Banking Relationship: A client who has 50% or more of their income after tax for that period flowing to their bank account with us during the month. Return on average equity (ROE): (ProMit / (loss) for the quarter)× 4 Average of last 2 quarters of total shareholder`s equity Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 30Business Updates Strategic Update

Appendix Non-IFRS measures and KPIs Risk-adjusted efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense − Impairment losses on Minancial assets Risk-adjusted NIM 1.0 Net interest income − Impairment losses on Minancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) + Credit card transactor portfolio Risk-adjusted NIM 1.1 Incl. Income tax effect from Securities Issued Abroad Net interest income − Impairment losses on Minancial assets + Income tax effect from Securities Issued Abroad x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) + Credit card transactor portfolio Risk-Adjusted NIM 2.0: Net interest income − Impairment losses on Minancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) Risk-Adjusted NIM 2.1 Incl. Income tax effect from Securities Issued Abroad : Net interest income − Impairment losses on Minancial assetsIncome tax effect from Securities Issued Abroad x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) SG&A: Administrative Expenses + Personnel Expenses + Depreciation and Amortization Securities: Income from securities and derivatives – Income from derivatives Stage 3 formation: Stage 3 balance in the current quarter – Stage 3 balance in the previous quarter +Write − off change in the current quarter Total loans and advance to customers in the previous quarter Tier I ratio: Tier I referential equity Risk weighted assets Total gross revenue: Interest income + Revenue from services and commissions − Cashback expenses − Inter rewards + Income from securities and derivatives + Other revenue Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 31Business Updates Strategic Update

Appendix Disclaimer This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the amount of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial numbers that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward-looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements. These forward-looking statements are based on Inter's expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20-F. The numbers for our key metrics (Unit Economics), which include active users, as average revenue per active client (ARPAC), cost-to-serve (CTS), are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, but there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and make adjustments to improve accuracy, including adjustments that may result in recalculating our historical metrics. About Non-IFRS Financial Measures To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, cost-to-serve, Cost of Funding, Efficiency Ratio, Underwriting, NPL > 90 days, NPL 15 to 90 days, NPL and Stage 3 Formation, Cost of Risk, Coverage Ratio, Funding, All-in Cost of Funding, Gross Merchandise Volume (GMV), Premiuns, Net Inflows, Global Services Deposits and Investments, Fee Income Ratio, Client Acquisition Cost, Cards+Pix TPV, Gross ARPAC, Net ARPAC, Marginal NIM 1.0, Marginal NIM 2.0, Net Interest Margin IEP + Non-int. CC Receivables (1.0), Net Interest Margin IEP (2.0), Cost-to-Serve. A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies. Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Appendix 32Business Updates Strategic Update