© Wejo Ltd. Investor Presentation April 2023 1

© Wejo Ltd. Disclaimer (1/2) 2 Disclaimer This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between TKB Critical Technologies 1 (“TKB”) and Wejo Group Limited (“Wejo” or the “Company”) and related transactions (the “Potential Business Combination”), and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Forward-Looking Information This Presentation (and oral statements regarding the subjects of this Presentation) contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Presentation are forward-looking statements. Forward-looking statements with respect to TKB, Wejo and the Potential Business Combination, include statements regarding the anticipated benefits of the Potential Business Combination, the anticipated timing of the Potential Business Combination, the products and services offered by Wejo and the markets in which it operates (including future market opportunities), Wejo’s projected future results, future financial condition and performance and expected financial impacts of the Potential Business Combination (including future revenue, pro forma enterprise value and cash balance), the satisfaction of closing conditions to the Potential Business Combination and the level of redemptions of TKB’s public shareholders, and Wejo’s expectations, intentions, strategies, assumptions or beliefs about future events, results of operations or performance or that do not solely relate to historical or current facts. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “opportunity,” “plan,” “potential,” “project,” “representative of,” “scales,” “should,” “strategy,” “valuation,” “will,” “will be,” “will continue,” “will likely result,” “would,” and similar expressions (or the negative versions of such words or expressions). Forward-looking statements are based on current assumptions, estimates, expectations, and projections of the management of TKB and Wejo and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the Potential Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of TKB’s and Wejo’s securities, (ii) the risk that the Potential Business Combination may not be completed by TKB’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by TKB, (iii) the failure to satisfy the conditions to the consummation of the Potential Business Combination, including the approval of the Potential Business Combination by the shareholders of TKB and Wejo, the satisfaction of the minimum trust account amount following any redemptions by TKB’s public shareholders (if applicable), the failure by Wejo to obtain the additional financing required to complete the Potential Business Combination, and the receipt of certain governmental and other third-party approvals (or that such approvals result in the imposition of conditions that could reduce the anticipated benefits from the Potential Business Combination or cause the parties to abandon the Potential Business Combination), (iv) the lack of a fairness opinion from Wejo in determining whether or not to pursue the Potential Business Combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreements relating to the Potential Business Combination, (vi) the effect of the announcement or pendency of the Potential Business Combination on Wejo’s business relationships, operating results, performance and business generally, (vii) risks that the Potential Business Combination disrupts current plans and operations of Wejo and the disruption of management's attention due to the Potential Business Combination, (viii) the outcome of any legal proceedings that may be instituted against TKB or Wejo related to the Potential Business Combination, (ix) the ability to maintain the listing of the securities of the surviving entity resulting from the Potential Business Combination on a national securities exchange, (x) changes in the combined capital structure of TKB and Wejo following the Potential Business Combination, (xi) changes in the competitive industries and markets in which Wejo operates or plans to operate, (xii) changes in laws and regulations affecting Wejo’s business, (xiii) the ability to implement business plans, forecasts, and other expectations after the completion of the Potential Business Combination, and identify and realize additional opportunities, (xiv) risks related to the uncertainty of Wejo’s projected financial information, (xv) risks related to Wejo’s rollout of its business and the timing of expected business milestones, (xvi) risks related to Wejo’s potential inability to achieve or maintain profitability and generate cash, (xvii) current and future conditions in the global economy, including as a result of the impact of the COVID-19 pandemic, inflation, supply chain constraints, and other macroeconomic factors and their impact on Wejo, its business and markets in which it operates, (xviii) the ability of Wejo to maintain relationships with customers, suppliers and others with whom Wejo does business, (xix) the potential inability of Wejo to manage growth effectively, (xx) the enforceability of Wejo’s intellectual property, including its patents and the potential infringement on the intellectual property rights of others, (xxi) costs or unexpected liabilities related to the Potential Business Combination and the failure to realize anticipated benefits of the Potential Business Combination or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions, (xxii) changes to the proposed structure of the Potential Business Combination that may be required or are appropriate as a result of applicable laws or regulations, (xxiii) the ability to recruit, train and retain qualified personnel, and (xxiv) the ability of the surviving entity resulting from the Potential Business Combination to issue equity or obtain financing. The foregoing list of factors that may affect the business, financial condition or operating results of TKB and/or Wejo is not exhaustive. Additional factors are set forth in their respective filings with the U.S. Securities and Exchange Commission (the “SEC”), and further information concerning TKB and Wejo may emerge from time to time. In particular, you should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of (a) TKB’s (i) prospectus filed with the SEC on October 28, 2021, (ii) Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 14, 2022, (iii) Forms 10-Q filed with the SEC on May 13, 2022, August 12, 2022 and November 12, 2022, (b) Wejo’s (i) Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 31, 2022 (as amended on April 11, 2022), (iii) Forms 10-Q filed with the SEC on May 16, 2022, August 15, 2022 and November 21, 2022, and (c) other documents filed or to be filed by TKB and/or Wejo with the SEC (including a registration statement on Form S-4 to be filed in connection with the Potential Business Combination). There may be additional risks that neither TKB nor Wejo presently know or that TKB and Wejo currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Readers are urged to consider these factors carefully in evaluating these forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements. TKB and Wejo expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in events, conditions, or circumstances on which any statement is based, except as required by law, whether as a result of new information, future events, or otherwise. Neither TKB nor Wejo gives any assurance that either TKB, Wejo or the combined company will achieve its expectations. Financial Information; Non-GAAP Measures Neither the independent auditor of TKB or Wejo has examined or compiled the financial information and data contained this Presentation, accordingly, no such independent auditor provides any assurance with respect to any financial information included herein. Such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement, prospectus, proxy statement or other report or document to be filed or furnished by TKB or Wejo, or any other report or document to be filed by the combined company following completion of the Potential Business Combination, with the SEC. In addition, this Presentation includes “pro forma” financial data. Any “pro forma” financial data included in this Presentation has not been prepared in accordance with Article 11 of Regulation S-X of the SEC, is presented for informational purposes only and may differ materially from the Regulation S-X compliant pro forma financial data of Wejo or the combined company to be included any filings with the SEC. This Presentation includes certain financial measures of Wejo not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, Adjusted EBITDA. The Company defines Adjusted EBITDA as Net Income or Loss from operations, excluding: (1) share-based payments to employees and third party vendors; (2) depreciation of equipment and amortization of intangible assets; (3) transaction-related bonuses and costs; and (4) restructuring charges. Other key performance indicators include: Annual Recurring Revenue (calculated by taking the gross Monthly Recurring Revenue (“MRR”) for the last month of the reporting period and multiplying it by twelve months. MRR for each month is calculated by aggregating revenue from customers with contracts with more than four months in duration and includes recurring software licenses, data licenses, and subscription agreements), Gross Bookings (defined as the total projected value of contracts signed in the relevant period, excluding taxes and renewal options available to customers in future periods), and Rolling Four Quarter Backlog (gross sales signed and expected to incur revenue in the next four quarters). Non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing Wejo’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Wejo’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Wejo believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Wejo’s financial condition and results of operations. Wejo believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing Wejo’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. 2

© Wejo Ltd. Use of Projections The financial and operating forecasts and projections of Wejo contained in this Presentation represent certain estimates of Wejo as of the date thereof. Wejo’s independent public accountants have not examined, reviewed or compiled the forecasts or projections and, accordingly, do not express an opinion or other form of assurance with respect thereto. These projections should not be relied upon as being indicative of future results. Furthermore, none of Wejo or its management team can give any assurance that the forecasts or projections contained herein accurately represents Wejo’s future operations or financial condition. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Wejo or that actual results will not differ materially from those presented in these materials. Some of the assumptions upon which the projections are based inevitably will not materialize and unanticipated events may occur that could affect results. Therefore, actual results achieved during the periods covered by the projections may vary and may vary materially from the projected results. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information are indicative of future results or will be achieved. In particular, this Presentation includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Wejo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included with respect to such projections. For the same reasons, Wejo is unable to address the probable significance of the unavailable information, which could be material to future results. No Representation or Warranty This Presentation is provided for informational purposes only and does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of TKB, Wejo, or the Potential Business Combination or otherwise make an investment decision with respect to the Potential Business Combination. Recipients of this Presentation should each make their own evaluation of TKB, Wejo, and the Potential Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. No representations or warranties, express or implied, are given in, or in respect of, this Presentation. The recipient acknowledges and agrees that the information contained in this Presentation is preliminary in nature and is subject to updating, completion, revision, verification and further amendment, and any such update, supplement, revision, verification or amendment may be material. TKB and Wejo disclaim any duty to update the information contained in this Presentation. None of TKB, Wejo or their respective affiliates has authorized anyone to provide interested parties with additional or different information. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with TKB, Wejo or their respective representatives, as investment, legal or tax advice. No Offer or Solicitation This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, as amended, or exemptions therefrom. NONE OF THE SEC NOR ANY OTHER SECURITIES COMMISSION OR SIMILAR REGULATORY AGENCY OF ANY OTHER U.S. OR NON-U.S. JURISDICTION HAS REVIEWED, EVALUATED, APPROVED, DISAPPROVED, PASSED UPON OR ENDORSED THE MERITS OF, THE POTENTIAL BUSINESS COMBINATION OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN, OR DETERMINED THAT THIS PRESENTATION IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. To the fullest extent permitted by law, in no circumstances will TKB, Wejo or any of their respective subsidiaries, shareholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents (including the internal economic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Additional Information and Where to Find It In connection with the Potential Business Combination, TKB and Wejo intend to file relevant materials with the SEC, including a registration statement on Form S-4, which will include a document that serves as a joint prospectus and proxy statement, referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all shareholders of TKB and Wejo. TKB and Wejo will also file other documents regarding the Potential Business Combination with the SEC. Before making any voting or investment decision, investors and security holders of TKB and Wejo are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the Potential Business Combination as they become available because they will contain important information about the Potential Business Combination. Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by TKB and Wejo through the website maintained by the SEC at www.sec.gov. The documents filed by TKB with the SEC also may be obtained free of charge upon written request to TKB Critical Technologies 1, 400 Continental Blvd, Suite 6000, El Segundo, CA 90245 or via email at ablatteis@tkbtech.com. The documents filed by Wejo with the SEC also may be obtained free of charge upon written request to Wejo Group Limited, ABC Building, 21-23 Quay Street, Manchester, M3 4A or via email at investor.relations@wejo.com. Industry and Market Data This Presentation has been prepared by TKB and Wejo and includes market data and other statistical information from third-party industry publications and sources as well as from research reports prepared for other purposes. Although TKB and Wejo believe these third-party sources are reliable as of their respective dates, none of TKB, Wejo, or any of their respective affiliates has independently verified the accuracy or completeness of this information and cannot assure you of (and make no representation or warranty, express or implied with respect to) the accuracy or completeness of such data or statistical information. Some data are also based on Wejo’s good faith estimates, which are derived from both internal sources and the third-party sources described herein. None of TKB, Wejo, their respective affiliates, or their respective directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy of such information. Trademarks and Intellectual Property TKB and Wejo own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks. service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties' trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with TKB or Wejo, or an endorsement or sponsorship by or of TKB or Wejo. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that TKB, Wejo or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Participants in the Solicitation TKB, Wejo and their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from TKB’s or Wejo’s shareholders in connection with the Potential Business Combination. A list of the names of such directors and executive officers, and information regarding their interests in the Potential Business Combination and their ownership of TKB’s or Wejo’s securities, as applicable, are, or will be, contained in their respective filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the Potential Business Combination may be obtained by reading the proxy statement/prospectus regarding the Potential Business Combination when it becomes available. You may obtain free copies of these documents as described above. Disclaimer (2/2) 3

© Wejo Ltd. Company Overview 4

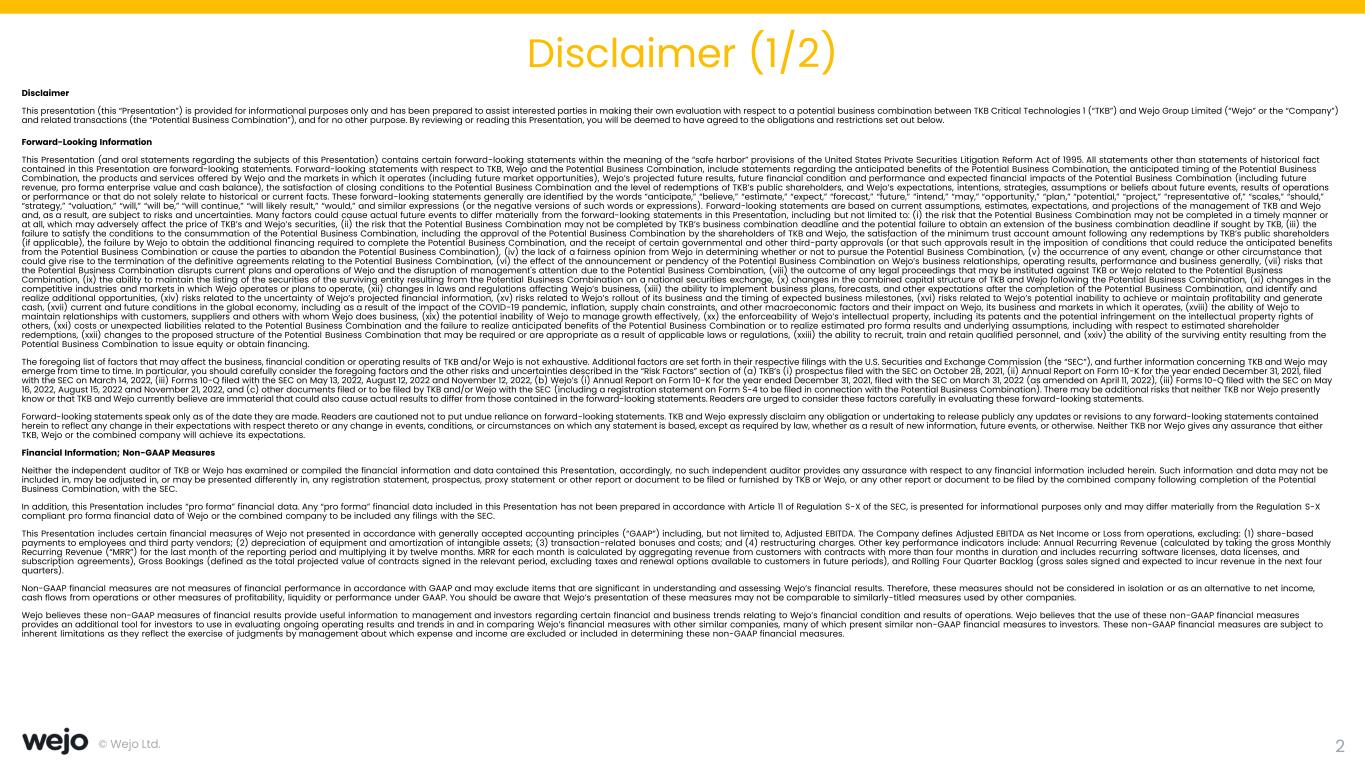

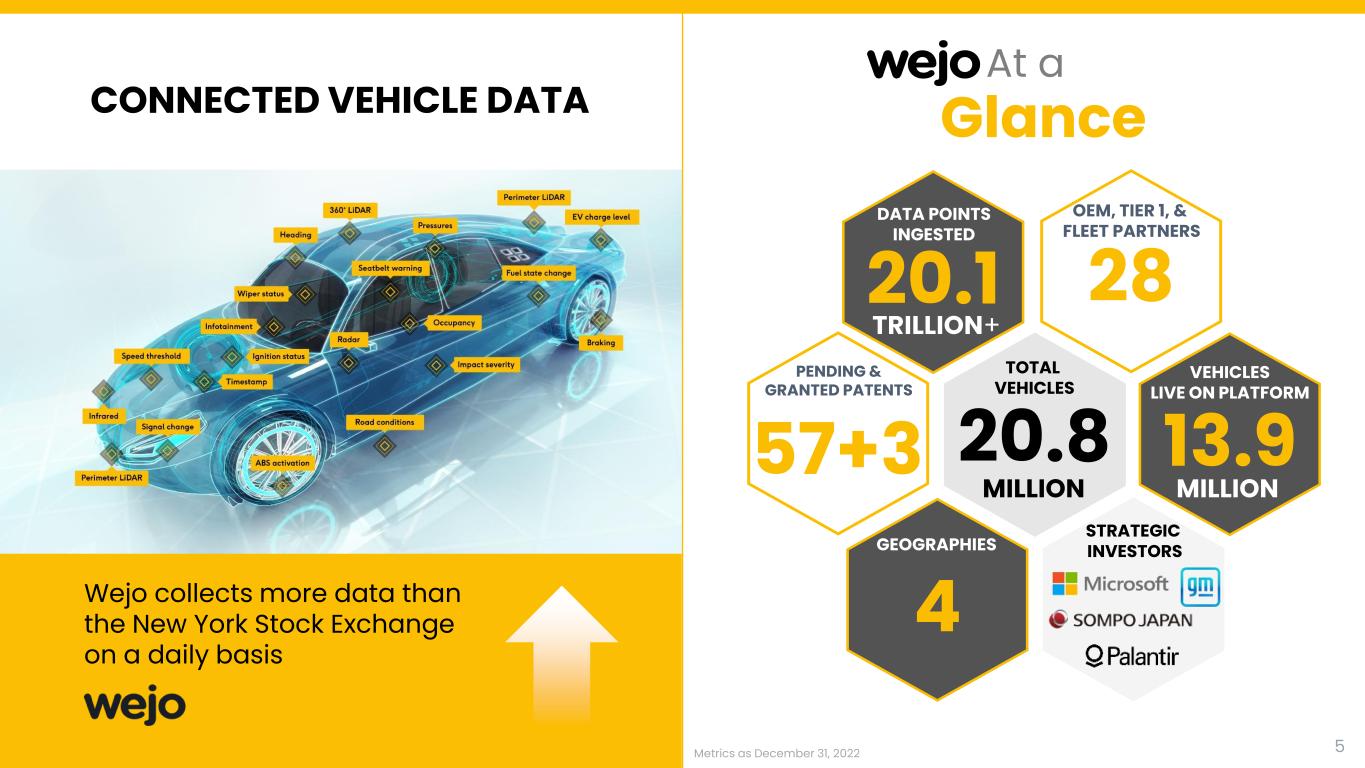

© Wejo Ltd. CONNECTED VEHICLE DATA Wejo collects more data than the New York Stock Exchange on a daily basis At a Glance 5Metrics as December 31, 2022 20.1 TRILLION+ TOTAL VEHICLES 20.8 STRATEGIC INVESTORS FIELDS OF USE PENDING & GRANTED PATENTS 57+3 OEM, TIER 1, & FLEET PARTNERS 28 MILLION DATA POINTS INGESTED 13.9 VEHICLES LIVE ON PLATFORM 4 GEOGRAPHIES MILLION

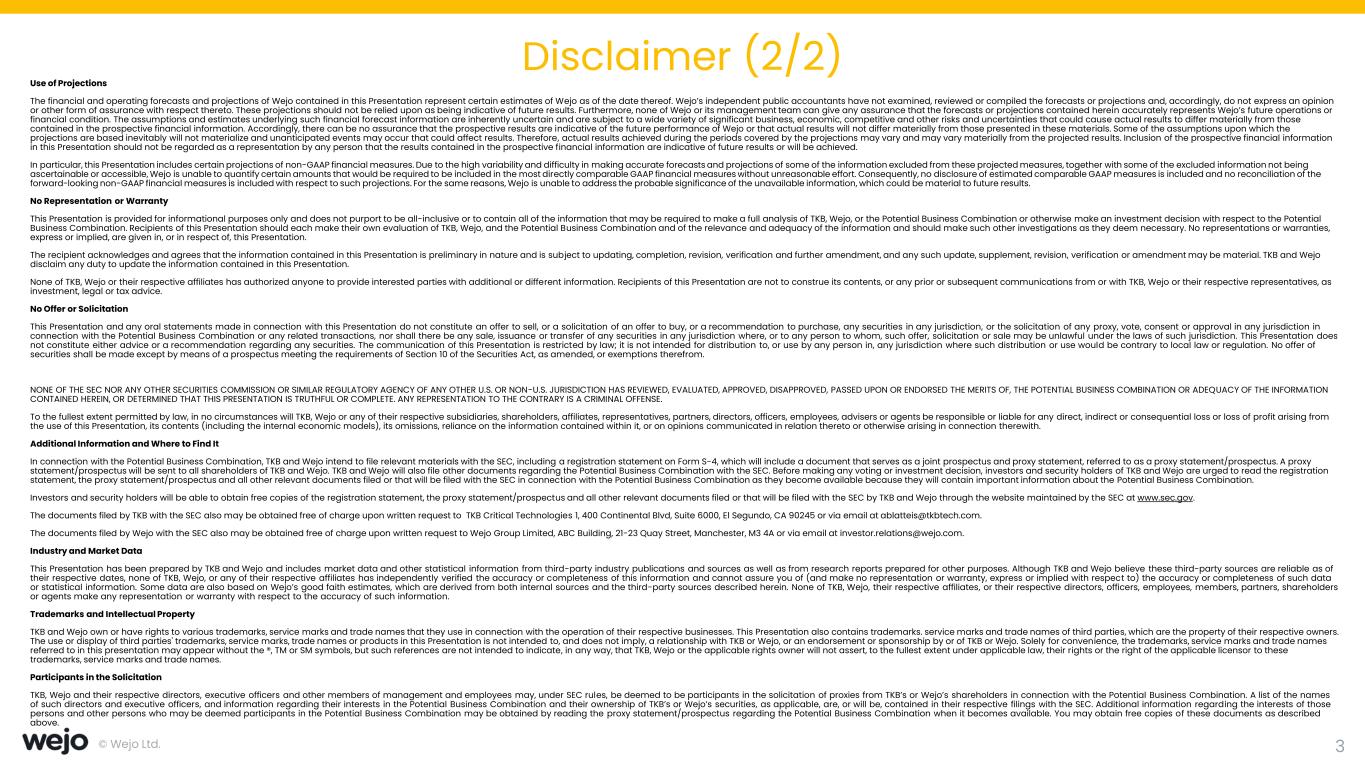

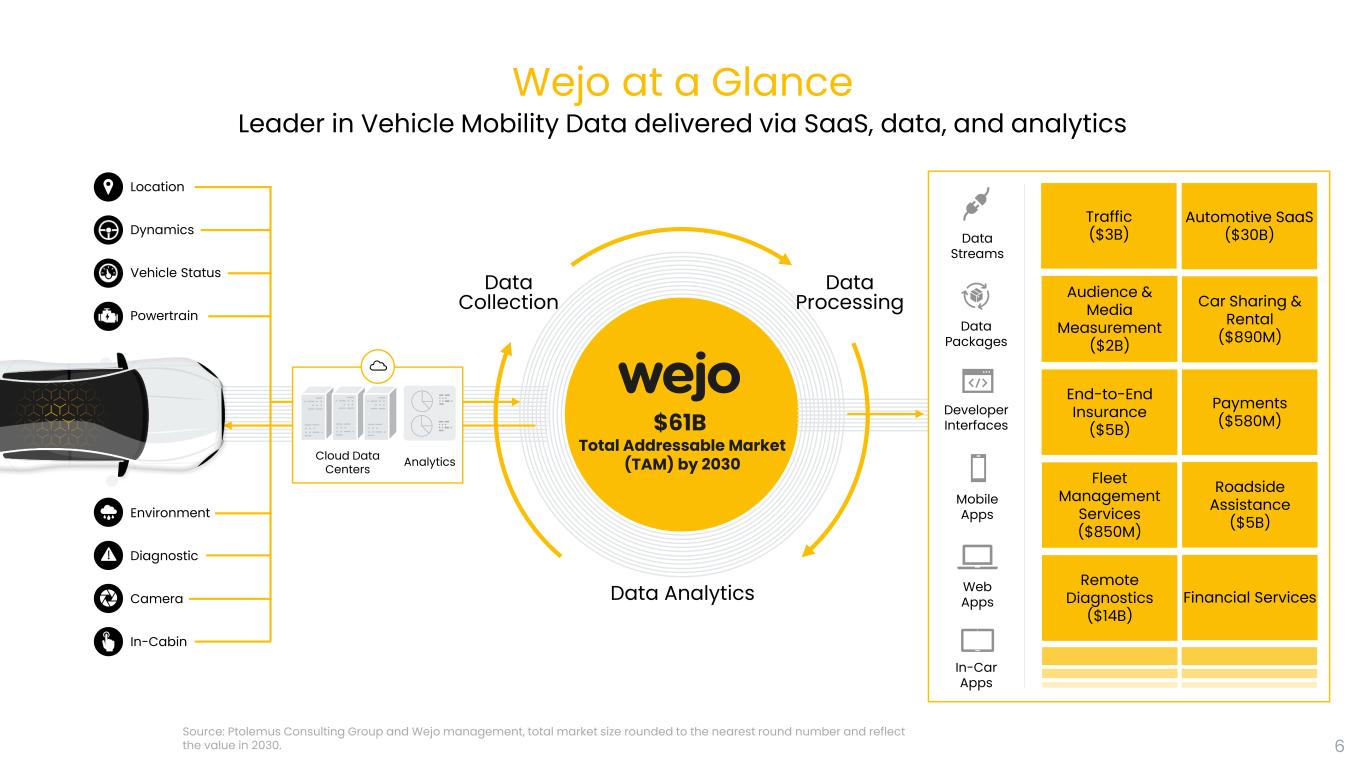

Wejo at a Glance Location Dynamics Vehicle Status Powertrain Environment Diagnostic Camera In-Cabin Data Streams Data Packages Developer Interfaces Mobile Apps Web Apps In-Car Apps Cloud Data Centers Analytics Automotive SaaS ($30B) Traffic ($3B) Remote Diagnostics ($14B) Financial Services End-to-End Insurance ($5B) Fleet Management Services ($850M) Roadside Assistance ($5B) Car Sharing & Rental ($890M) Audience & Media Measurement ($2B) Payments ($580M) Data Processing Data Collection $61B Total Addressable Market (TAM) by 2030 Data Analytics 6 Source: Ptolemus Consulting Group and Wejo management, total market size rounded to the nearest round number and reflect the value in 2030. Leader in Vehicle Mobility Data delivered via SaaS, data, and analytics

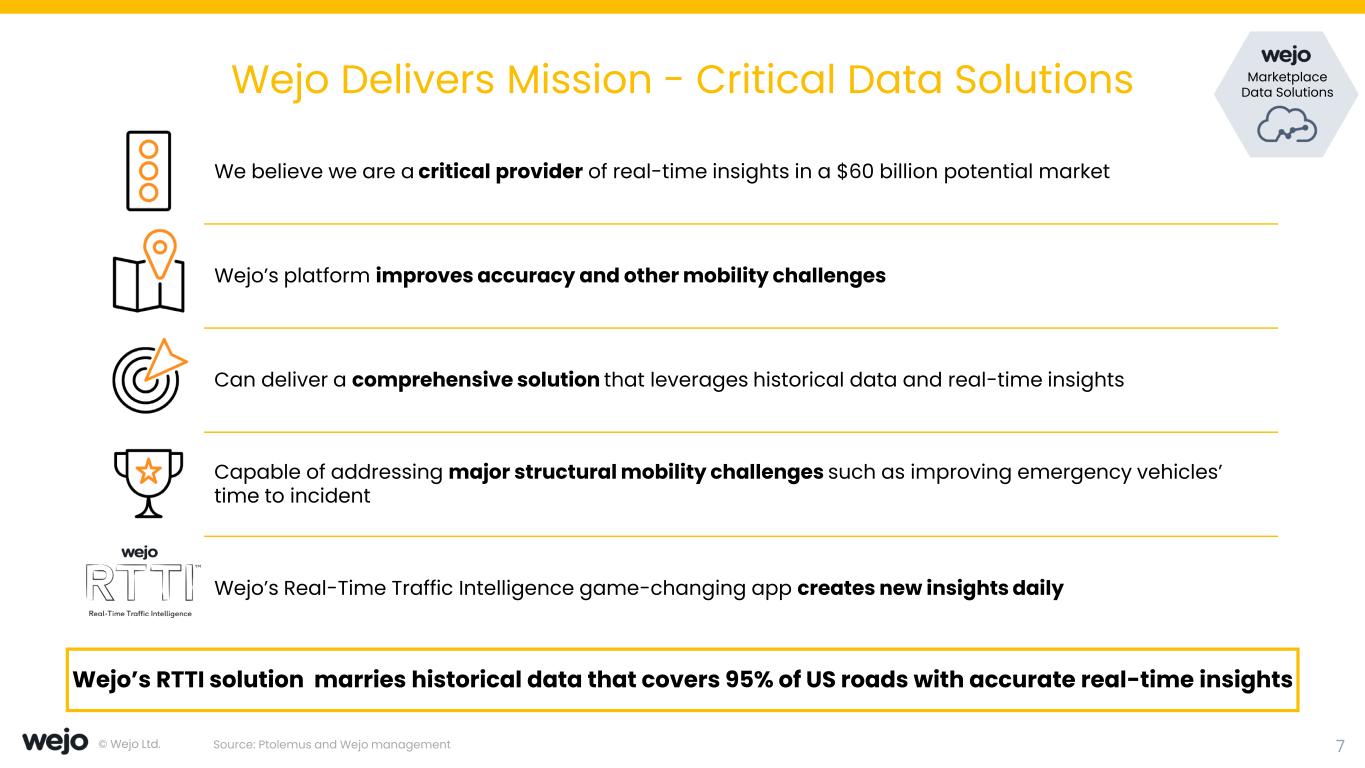

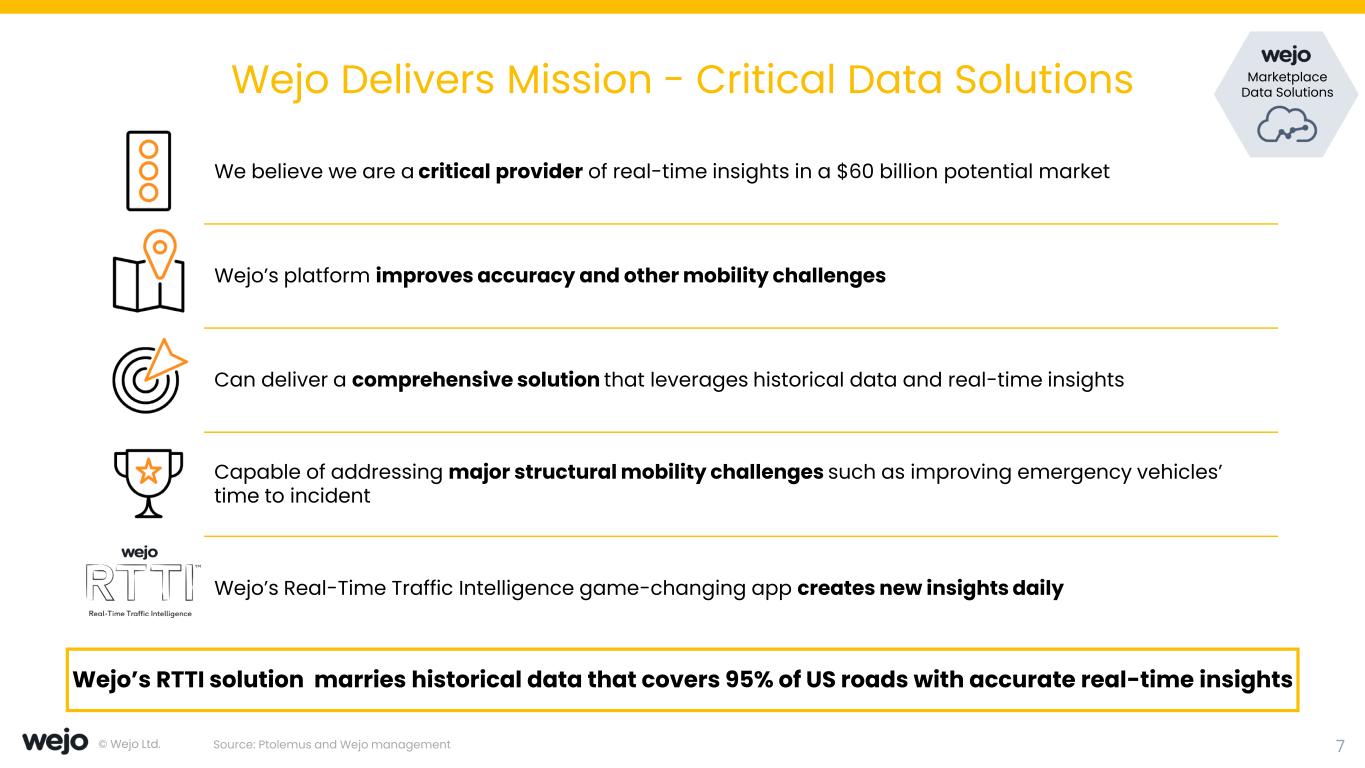

© Wejo Ltd. Wejo Delivers Mission - Critical Data Solutions Source: Ptolemus and Wejo management 7 Marketplace Data Solutions We believe we are a critical provider of real-time insights in a $60 billion potential market Wejo’s platform improves accuracy and other mobility challenges Can deliver a comprehensive solution that leverages historical data and real-time insights Capable of addressing major structural mobility challenges such as improving emergency vehicles’ time to incident Wejo’s Real-Time Traffic Intelligence game-changing app creates new insights daily Wejo’s RTTI solution marries historical data that covers 95% of US roads with accurate real-time insights

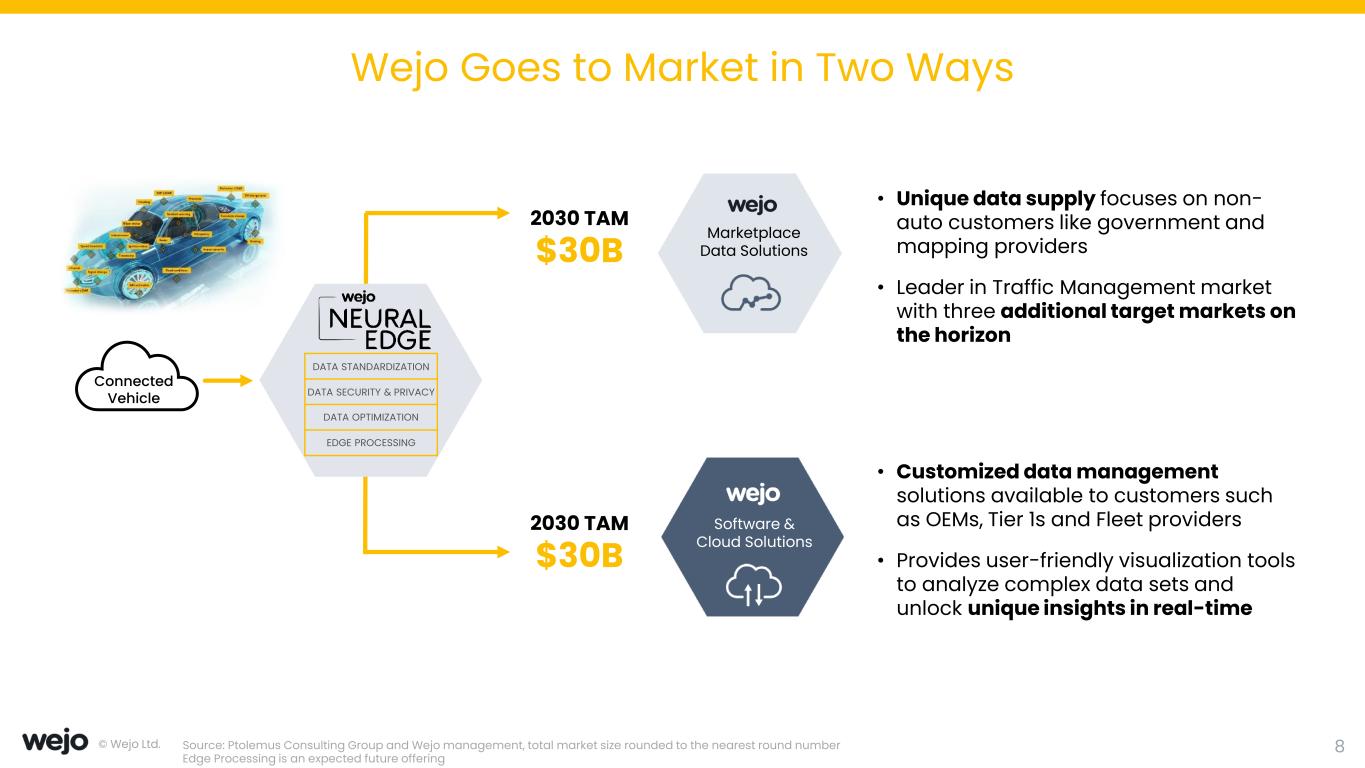

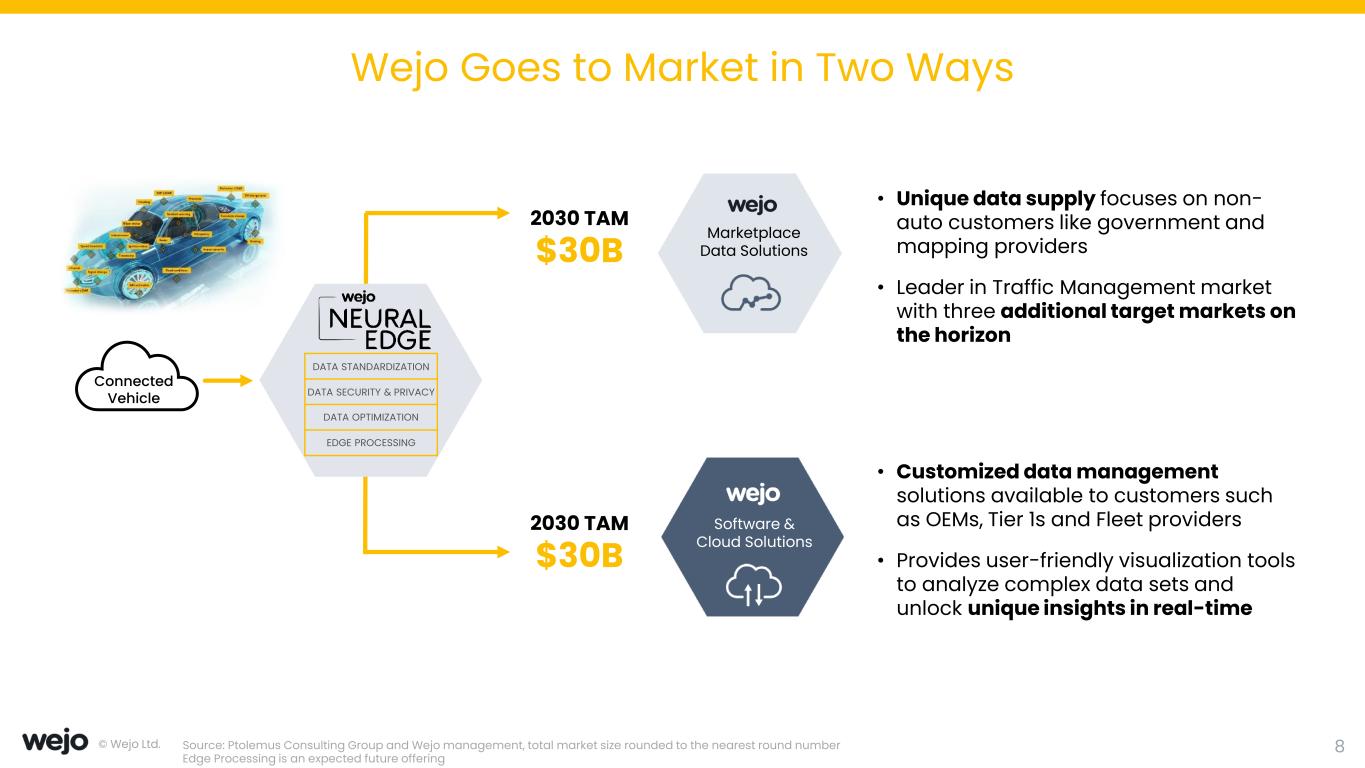

© Wejo Ltd. Source: Ptolemus Consulting Group and Wejo management, total market size rounded to the nearest round number Wejo Goes to Market in Two Ways 8 Marketplace Data Solutions • Unique data supply focuses on non- auto customers like government and mapping providers • Leader in Traffic Management market with three additional target markets on the horizon 2030 TAM $30B • Customized data management solutions available to customers such as OEMs, Tier 1s and Fleet providers • Provides user-friendly visualization tools to analyze complex data sets and unlock unique insights in real-time Software & Cloud Solutions 2030 TAM $30B Connected Vehicle DATA OPTIMIZATION EDGE PROCESSING DATA SECURITY & PRIVACY DATA STANDARDIZATION Edge Processing is an expected future offering

© Wejo Ltd. Introduction to Wejo / TKB Critical Technologies I Opportunity 9 Wejo Team TKB Critical Technologies I Team T R A N S A C T IO N O V E R V IE W Capital Structure Transaction Structure ⚫ Wejo (NASDAQ: WEJO) has entered into a business combination agreement with TKB Critical Technologies 1 (NASDAQ: USCTU). TKB shareholders will receive a number of newly issued shares of a newly formed Bermuda company equal to $11.25 divided by the Company’s weighted average stock price over a 15 consecutive trading day period ⚫ Post-closing: The newly formed Bermuda company will remain listed on the NASDAQ under the ticker WEJO Valuation & Ownership ⚫ At closing, Wejo will have a post-money enterprise value between ~$163 million and ~$457 million, pending mutual agreement of both TKB and the Company ⚫ Current Wejo shareholders will roll 100% of their equity and retain 27-69% of the Company based on the above transaction structure, the number of redemptions from the TKB trust and other factors ⚫ Transaction expected to deliver up to $100M in cash from TKB’s trust account and a PIPE ⚫ The cash proceeds from the transaction will help fund Wejo’s growth initiatives and position the company to execute on its strategic goals Angela Blatteis Co-CEO & CFO Greg Klein Co-CEO Philippe Tartavull Executive Chairman John Maxwell CFO Richard Barlow Founder & CEO

© Wejo Ltd. Business Lines 10

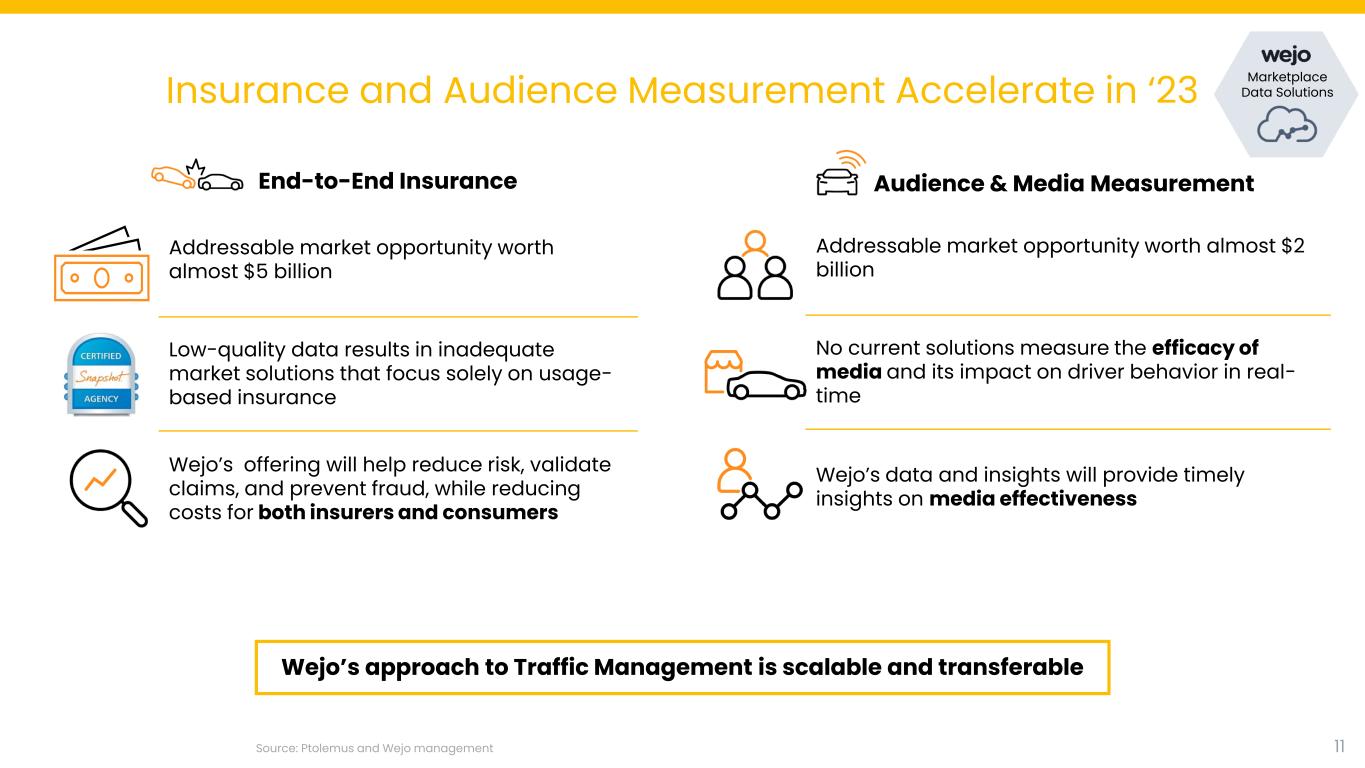

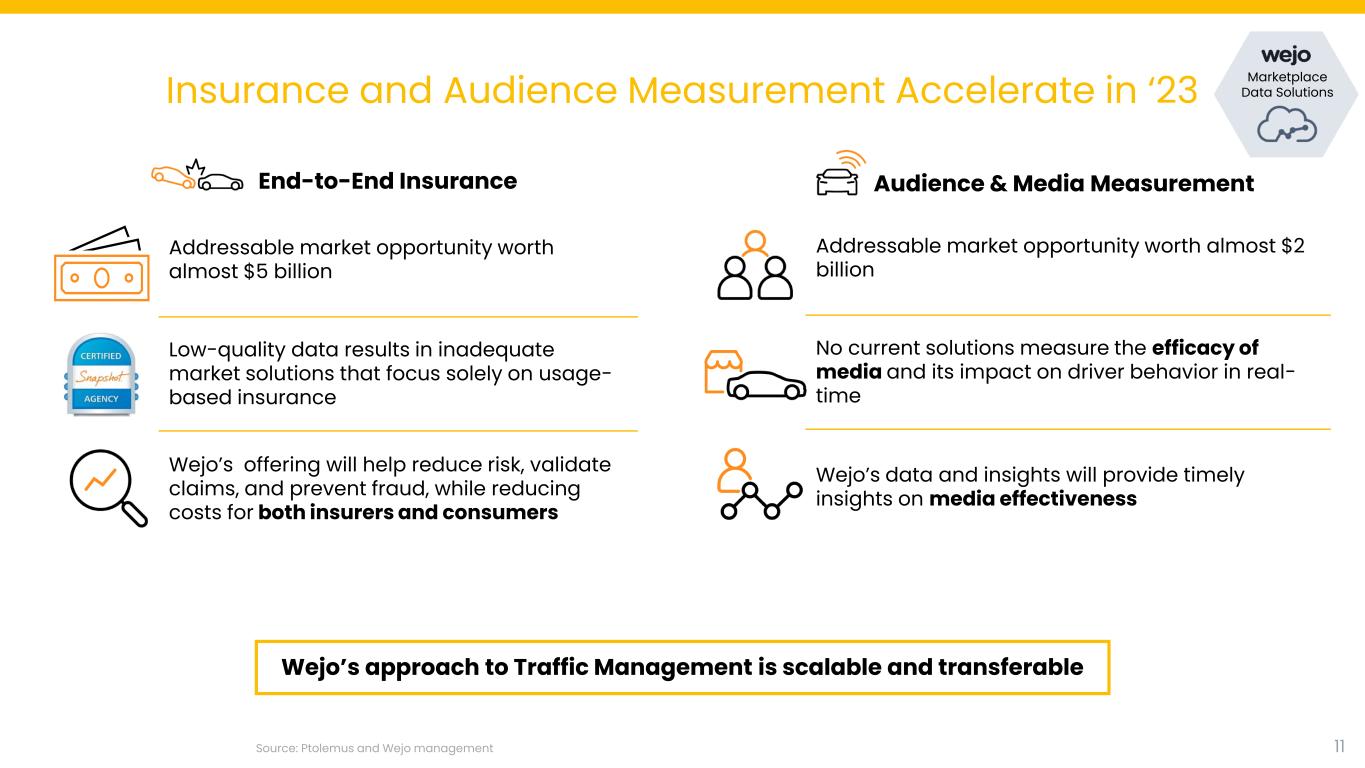

Insurance and Audience Measurement Accelerate in ‘23 Addressable market opportunity worth almost $5 billion Low-quality data results in inadequate market solutions that focus solely on usage- based insurance Wejo’s offering will help reduce risk, validate claims, and prevent fraud, while reducing costs for both insurers and consumers End-to-End Insurance Audience & Media Measurement Addressable market opportunity worth almost $2 billion No current solutions measure the efficacy of media and its impact on driver behavior in real- time Wejo’s data and insights will provide timely insights on media effectiveness Source: Ptolemus and Wejo management 11 Wejo’s approach to Traffic Management is scalable and transferable Marketplace Data Solutions

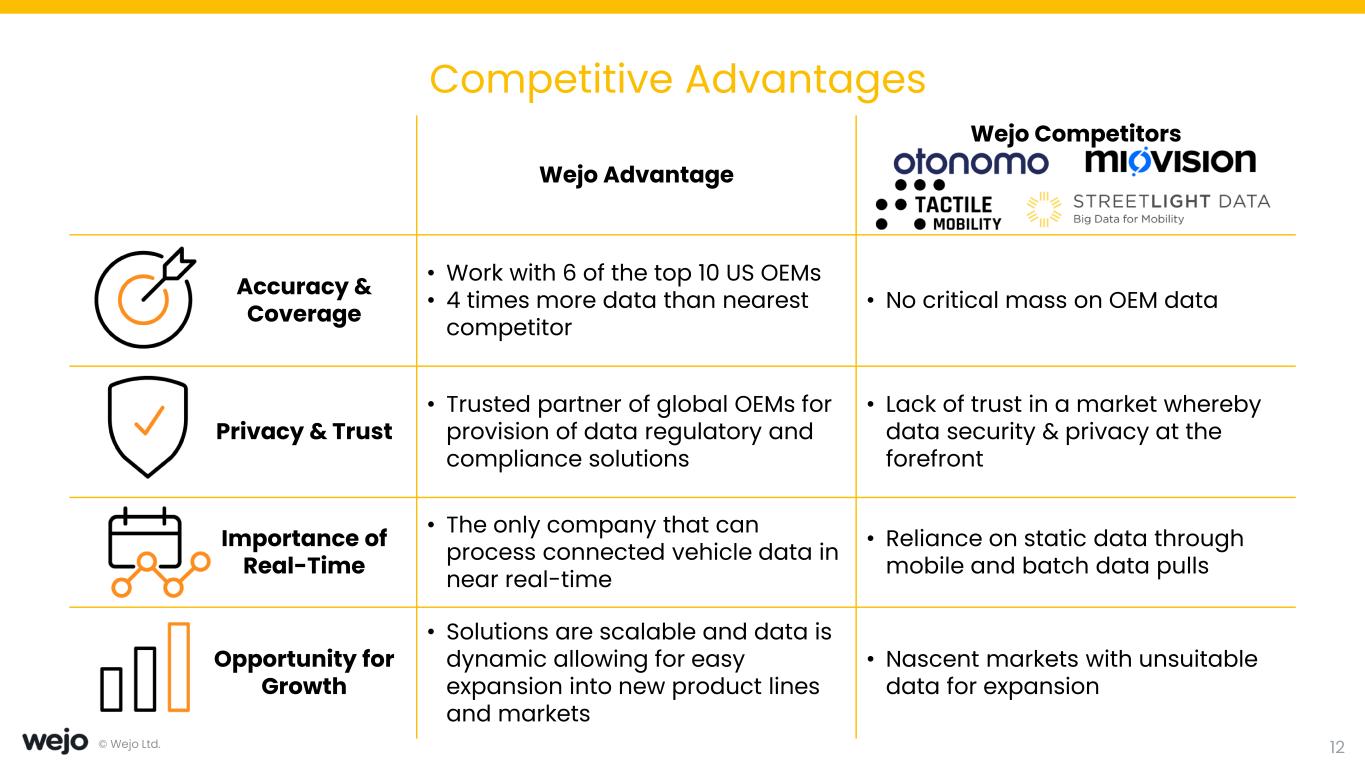

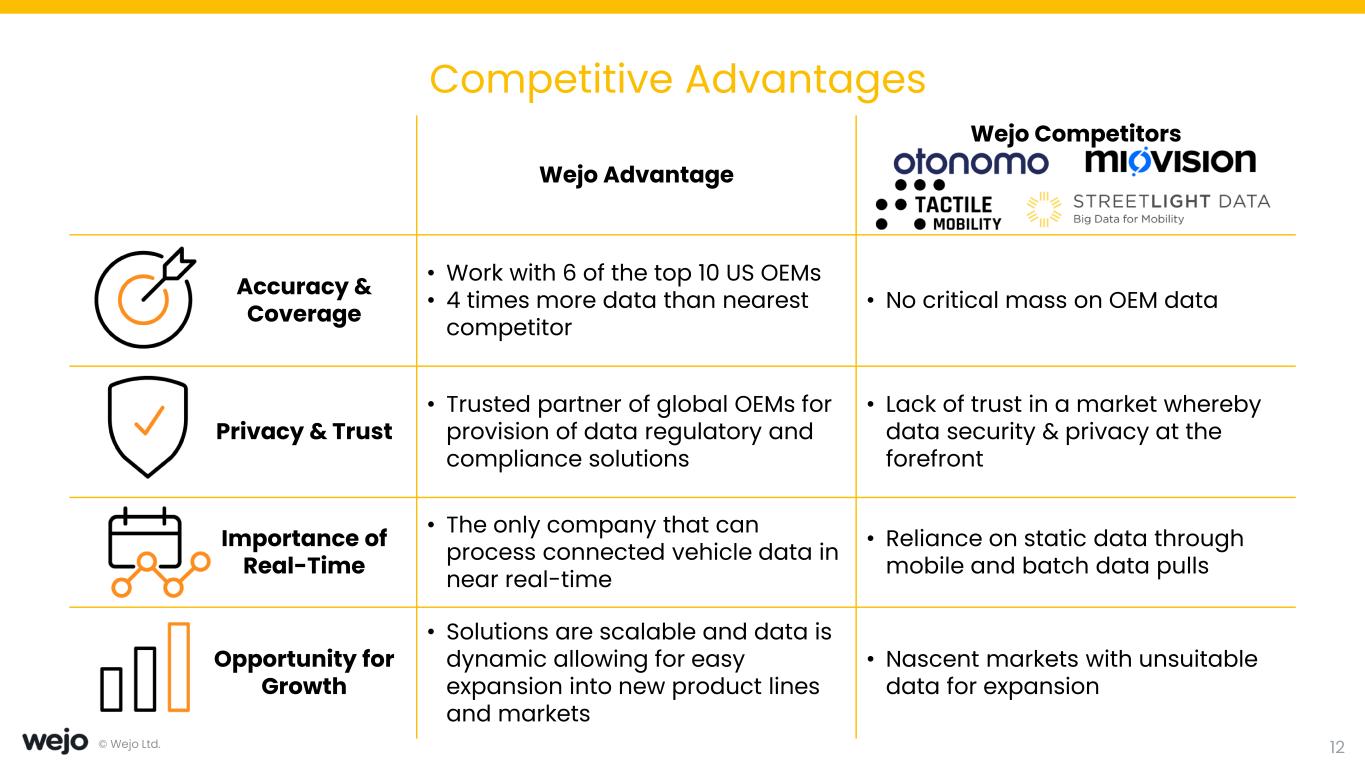

© Wejo Ltd. Competitive Advantages Wejo Advantage Wejo Competitors Accuracy & Coverage • Work with 6 of the top 10 US OEMs • 4 times more data than nearest competitor • No critical mass on OEM data Privacy & Trust • Trusted partner of global OEMs for provision of data regulatory and compliance solutions • Lack of trust in a market whereby data security & privacy at the forefront Importance of Real-Time • The only company that can process connected vehicle data in near real-time • Reliance on static data through mobile and batch data pulls Opportunity for Growth • Solutions are scalable and data is dynamic allowing for easy expansion into new product lines and markets • Nascent markets with unsuitable data for expansion 12

© Wejo Ltd. Financial Overview 13

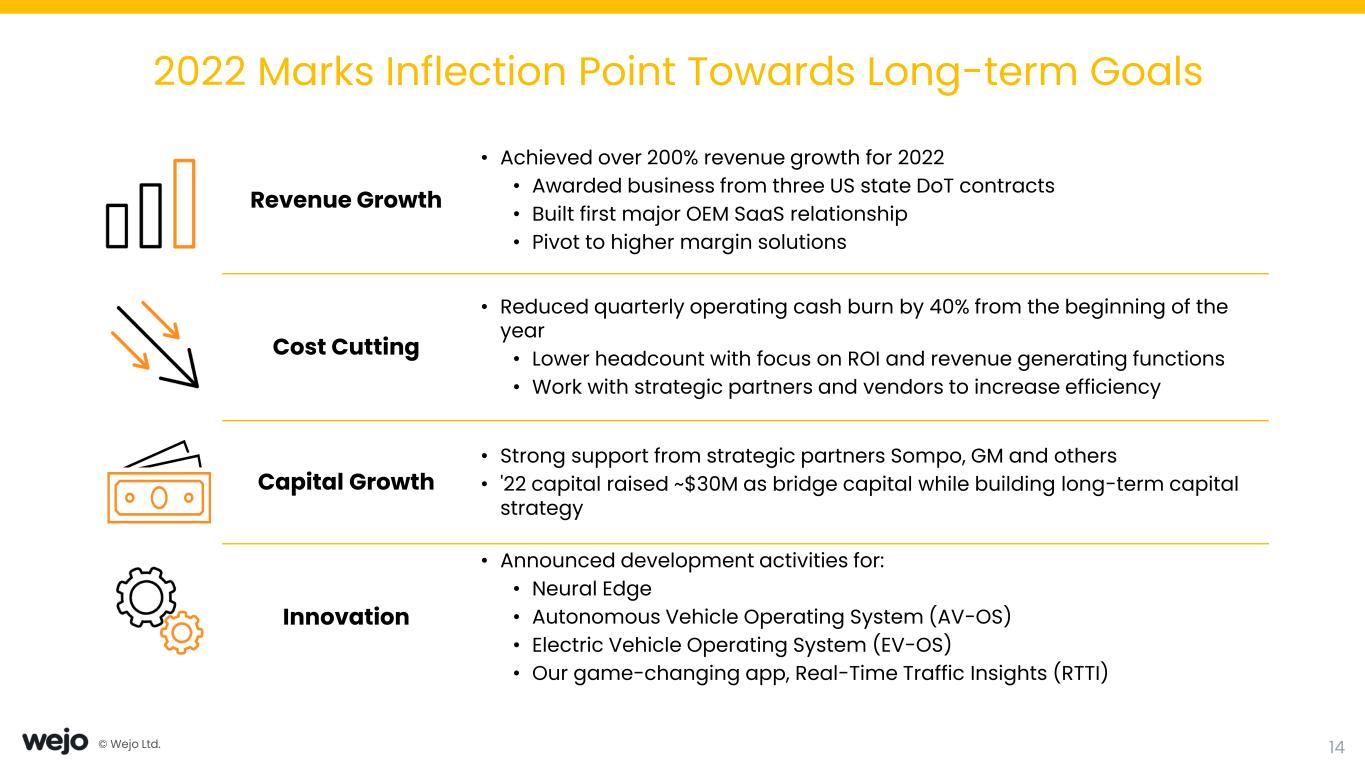

© Wejo Ltd. 2022 Marks Inflection Point Towards Long-term Goals Revenue Growth • Achieved over 200% revenue growth for 2022 • Awarded business from three US state DoT contracts • Built first major OEM SaaS relationship • Pivot to higher margin solutions Cost Cutting • Reduced quarterly operating cash burn by 40% from the beginning of the year • Lower headcount with focus on ROI and revenue generating functions • Work with strategic partners and vendors to increase efficiency Capital Growth • Strong support from strategic partners Sompo, GM and others • '22 capital raised ~$30M as bridge capital while building long-term capital strategy Innovation • Announced development activities for: • Neural Edge • Autonomous Vehicle Operating System (AV-OS) • Electric Vehicle Operating System (EV-OS) • Our game-changing app, Real-Time Traffic Insights (RTTI) 14

© Wejo Ltd. 2023 Accelerates Advancement Our Markets Revenue Growth • Continue ~200% growth rate towards the midpoint of our $20-30M revenue target • Starting year with ~$10M of 2023 revenue • Gross margins will expand as Wejo scales driving profitability Cost Efficiency Focus • Focus on continued cost reduction, while driving revenue generation • Cloud and data costs as a percent of revenue continue to decline • Leverage strategic partnerships to accelerate product opportunities Capital Growth • Raise capital necessary to achieve cash flow break even, projected to occur in mid-2024, assuming revenue and cost reduction goals are met • Complete TKB combination and PIPE over $100M • Deploy additional short-term funding initiatives to provide bridge capital until the transaction closes Innovation & Market Expansion • Continued accerlation of application expansion into audience and media measurement, end-to-end insurance, and fleet management services 15 With the combination of increased revenue, cost efficiency focus, and the capital gained through the TKB and PIPE transactions, we believe Wejo is sufficiently funded through cash flow breakeven projected to occur in mid-2024, assuming revenue and cost reduction goals are met

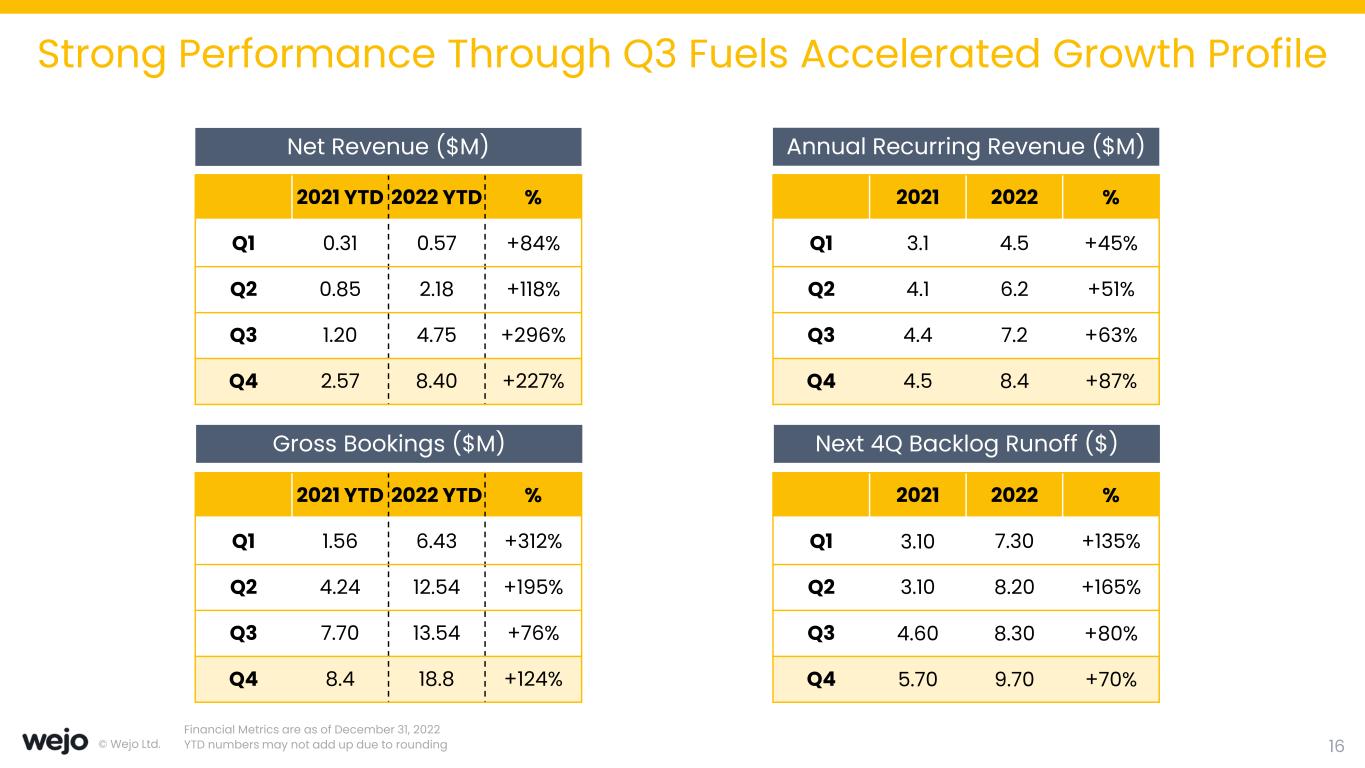

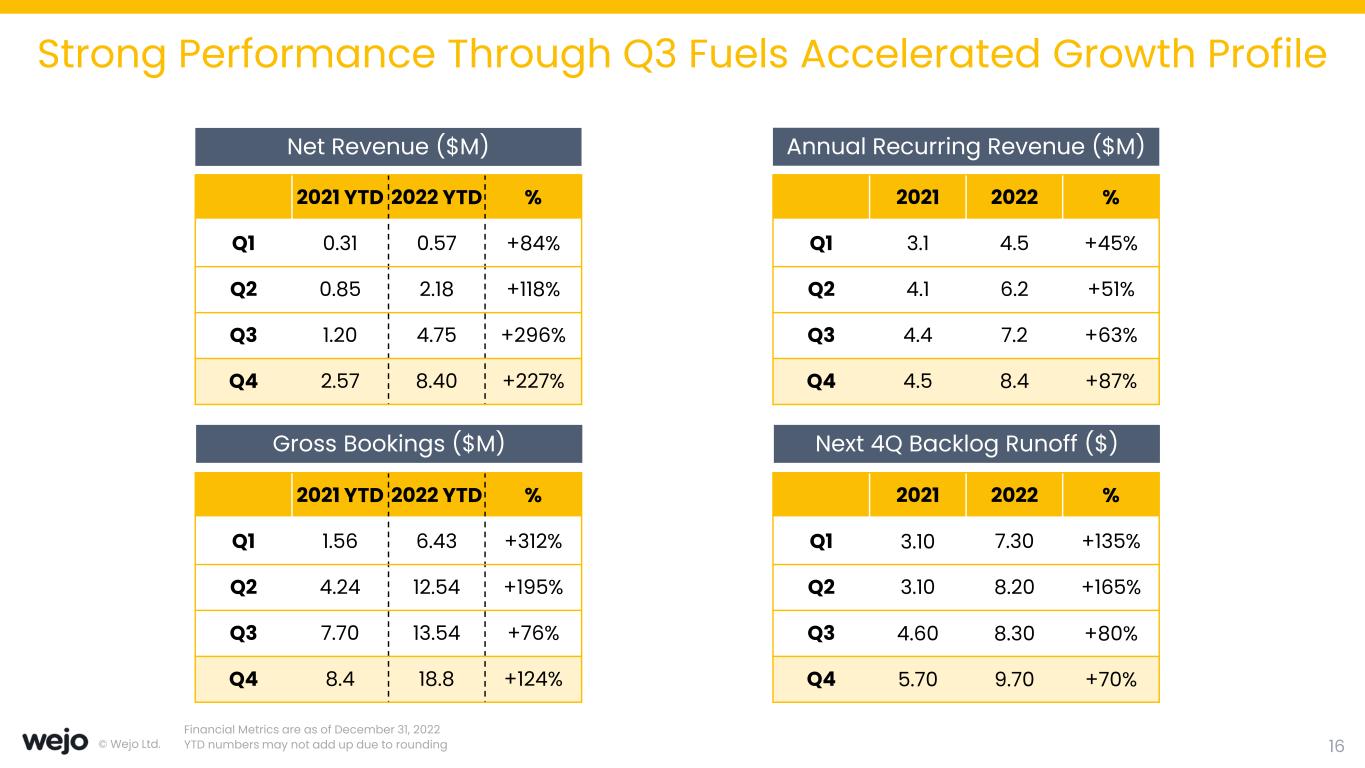

© Wejo Ltd. Strong Performance Through Q3 Fuels Accelerated Growth Profile Gross Bookings ($M) 16 Next 4Q Backlog Runoff ($) Financial Metrics are as of December 31, 2022 YTD numbers may not add up due to rounding Net Revenue ($M) Annual Recurring Revenue ($M) 2021 YTD 2022 YTD % Q1 0.31 0.57 +84% Q2 0.85 2.18 +118% Q3 1.20 4.75 +296% Q4 2.57 8.40 +227% 2021 2022 % Q1 3.1 4.5 +45% Q2 4.1 6.2 +51% Q3 4.4 7.2 +63% Q4 4.5 8.4 +87% 2021 2022 % Q1 3.10 7.30 +135% Q2 3.10 8.20 +165% Q3 4.60 8.30 +80% Q4 5.70 9.70 +70% 2021 YTD 2022 YTD % Q1 1.56 6.43 +312% Q2 4.24 12.54 +195% Q3 7.70 13.54 +76% Q4 8.4 18.8 +124%

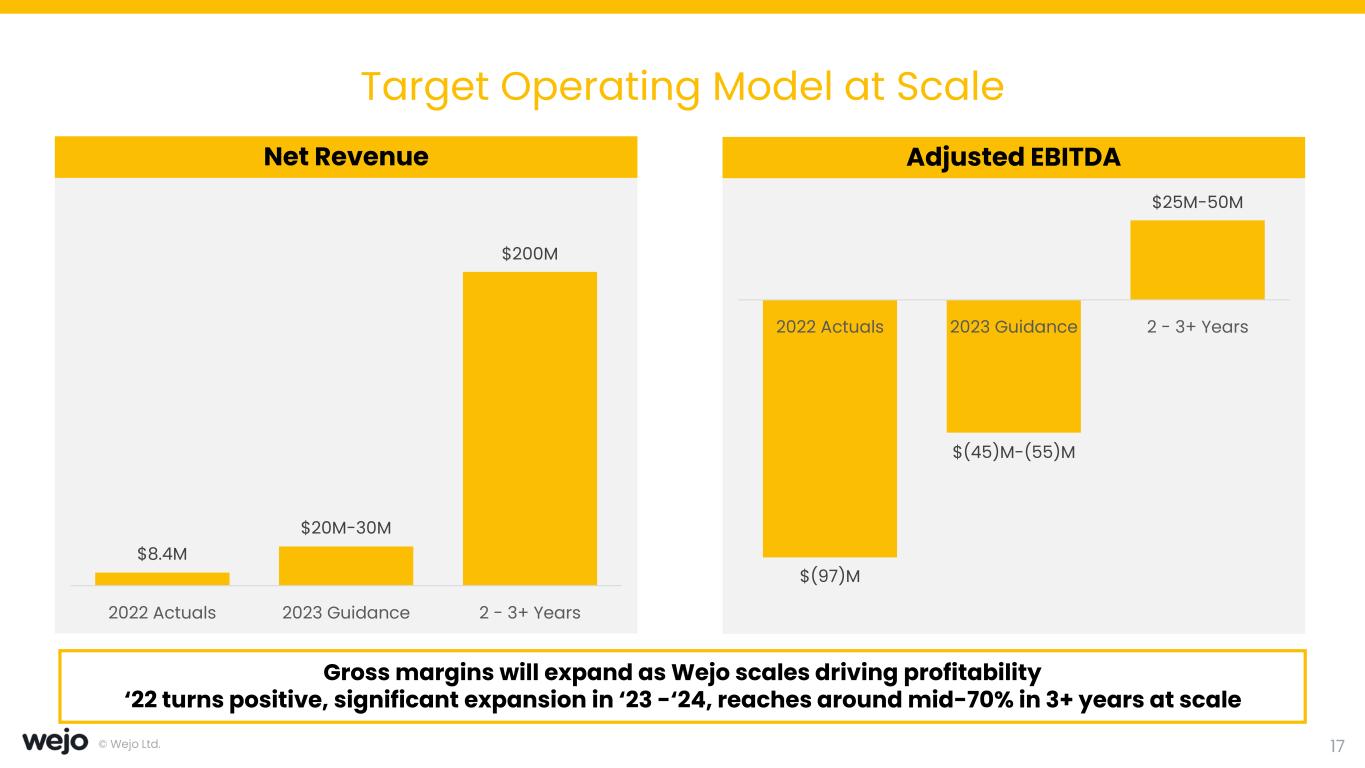

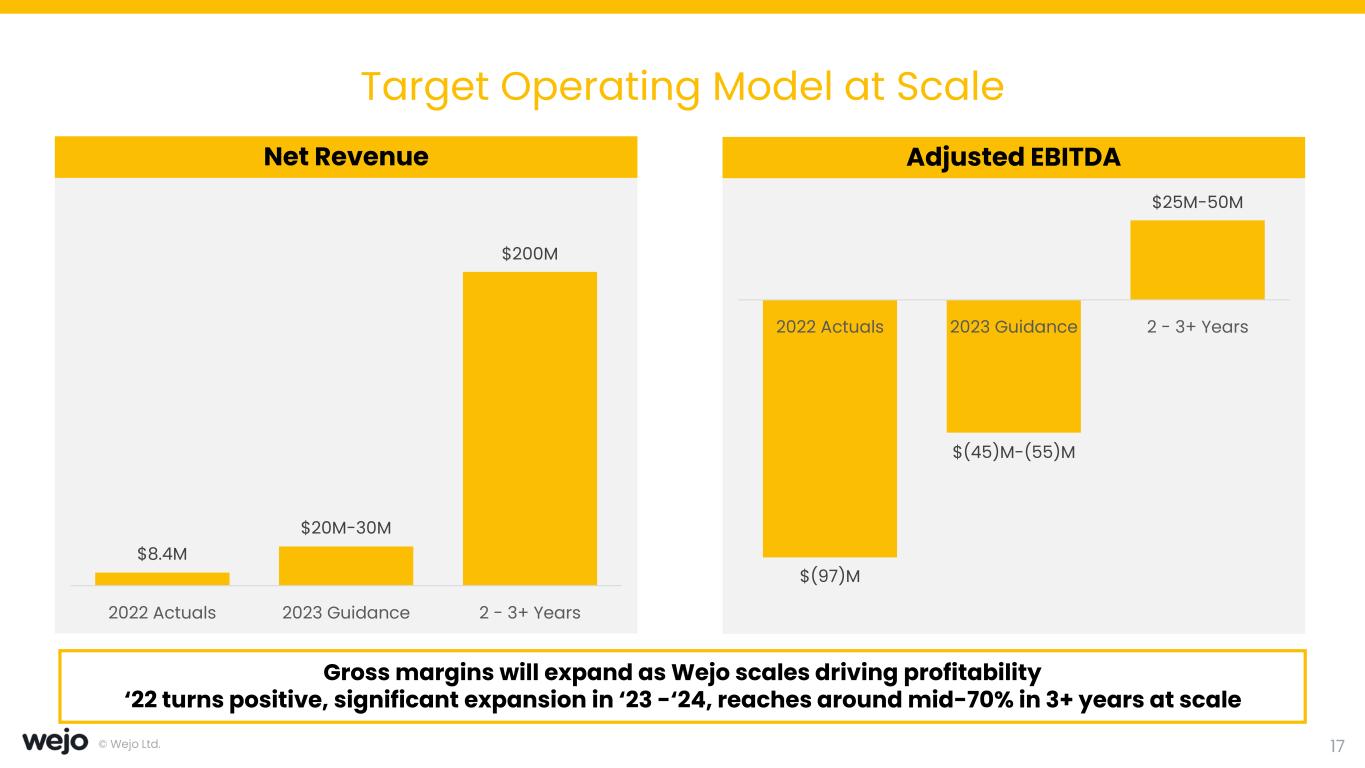

© Wejo Ltd. Target Operating Model at Scale $8.4M $20M-30M $200M 2022 Actuals 2023 Guidance 2 - 3+ Years Net Revenue $(97)M $(45)M-(55)M $25M-50M 2022 Actuals 2023 Guidance 2 - 3+ Years Adjusted EBITDA 17 Gross margins will expand as Wejo scales driving profitability ‘22 turns positive, significant expansion in ‘23 -‘24, reaches around mid-70% in 3+ years at scale

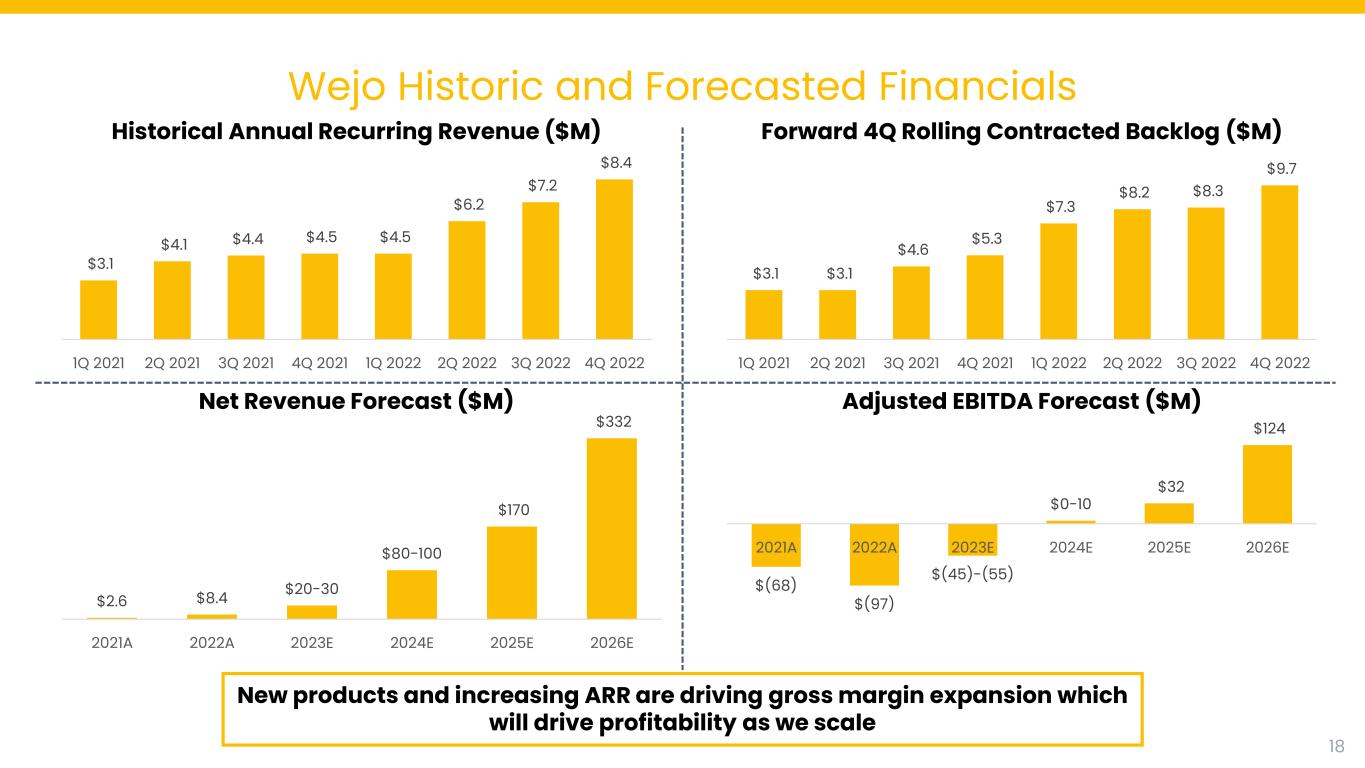

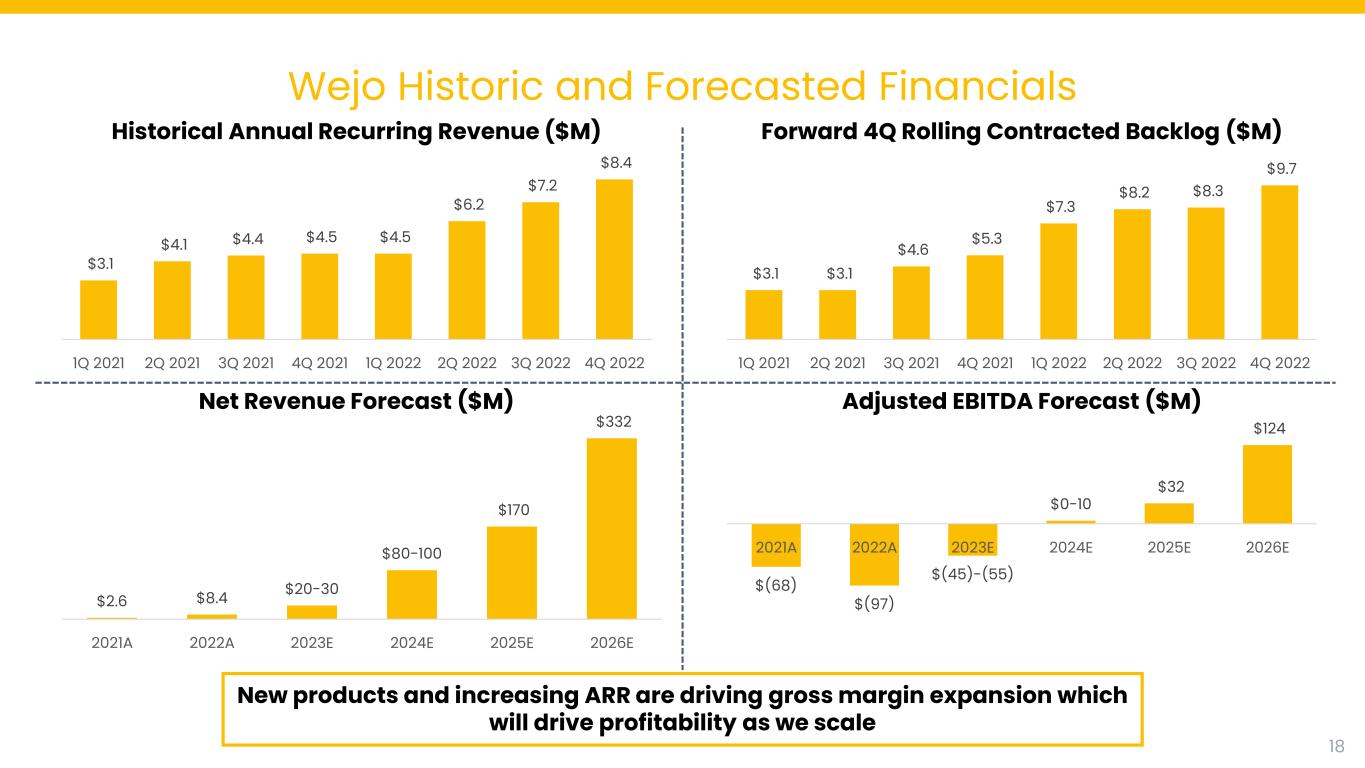

© Wejo Ltd. Wejo Historic and Forecasted Financials Net Revenue Forecast ($M) $(68) $(97) $(45)-(55) $0-10 $32 $124 2021A 2022A 2023E 2024E 2025E 2026E Adjusted EBITDA Forecast ($M) Historical Annual Recurring Revenue ($M) $3.1 $3.1 $4.6 $5.3 $7.3 $8.2 $8.3 $9.7 1Q 2021 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 Forward 4Q Rolling Contracted Backlog ($M) $3.1 $4.1 $4.4 $4.5 $4.5 $6.2 $7.2 $8.4 1Q 2021 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 $2.6 $8.4 $20-30 $80-100 $170 $332 2021A 2022A 2023E 2024E 2025E 2026E 18 New products and increasing ARR are driving gross margin expansion which will drive profitability as we scale

© Wejo Ltd. Why Invest in Wejo The combination of accelerated revenue growth, substantial cost reductions, and incoming capital enables Wejo to reach cash flow breakeven by mid-2024 Wejo is the leader in mobility data At the close of the business combination with TKB, Wejo expects to have raised >$100M in capital Substantial cost reductions implemented to reduce cash burn by 50% by the end of 2023 19 Wejo has reached an inflection point driving accelerated revenue growth and a clear path to profitability

© Wejo Ltd. TKB Transaction Sumary 20

© Wejo Ltd. TKB Transaction Rationale 21 Innovative business combination of two public companies targeted to provide over $100 million in capital to Wejo Major funding step towards Wejo cash flow breakeven expected in 2024 Offers Wejo shareholders opportunity to issue capital at premium to market Offers TKB Shareholders the ability to invest in Wejo at a discounted rate to its fundamental value or drive strong short-term returns to trust holders TKB transaction is a win-win for both companies and their shareholders

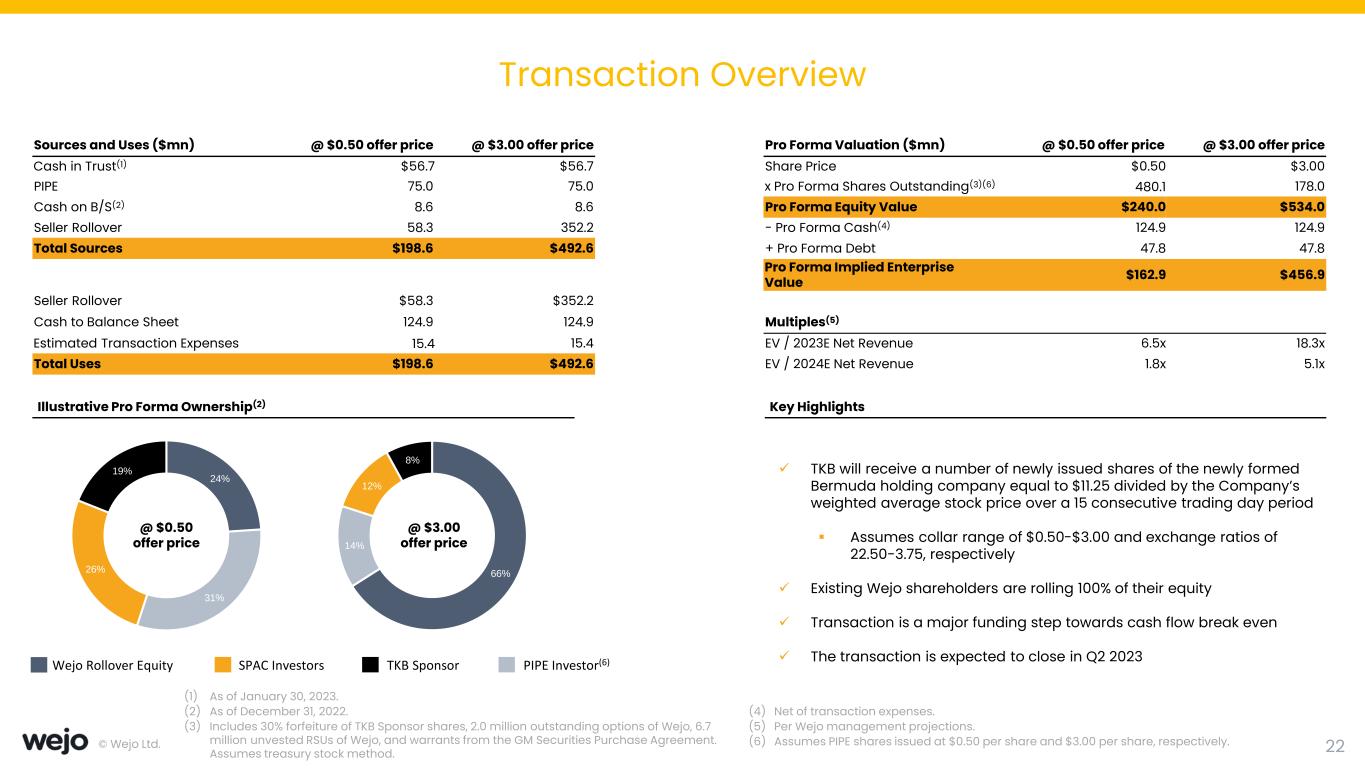

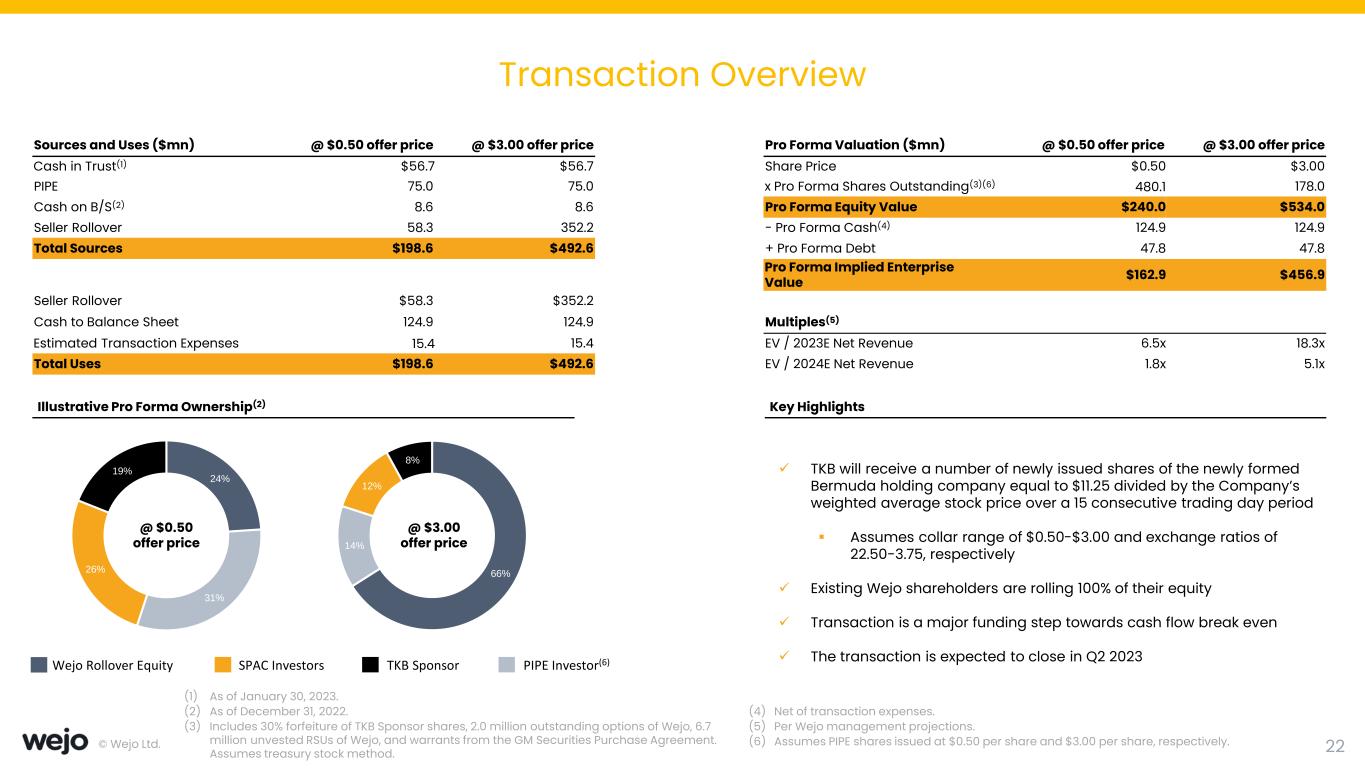

© Wejo Ltd. Transaction Overview 22 (1) As of January 30, 2023. (2) As of December 31, 2022. (3) Includes 30% forfeiture of TKB Sponsor shares, 2.0 million outstanding options of Wejo, 6.7 million unvested RSUs of Wejo, and warrants from the GM Securities Purchase Agreement. Assumes treasury stock method. (4) Net of transaction expenses. (5) Per Wejo management projections. (6) Assumes PIPE shares issued at $0.50 per share and $3.00 per share, respectively. Sources and Uses ($mn) @ $0.50 offer price @ $3.00 offer price Pro Forma Valuation ($mn) @ $0.50 offer price @ $3.00 offer price Cash in Trust(1) $56.7 $56.7 Share Price $0.50 $3.00 PIPE 75.0 75.0 x Pro Forma Shares Outstanding(3)(6) 480.1 178.0 Cash on B/S(2) 8.6 8.6 Pro Forma Equity Value $240.0 $534.0 Seller Rollover 58.3 352.2 - Pro Forma Cash(4) 124.9 124.9 Total Sources $198.6 $492.6 + Pro Forma Debt 47.8 47.8 Pro Forma Implied Enterprise Value $162.9 $456.9 Seller Rollover $58.3 $352.2 Cash to Balance Sheet 124.9 124.9 Multiples(5) Estimated Transaction Expenses 15.4 15.4 EV / 2023E Net Revenue 6.5x 18.3x Total Uses $198.6 $492.6 EV / 2024E Net Revenue 1.8x 5.1x Illustrative Pro Forma Ownership(2) Key Highlights 66% 14% 12% 8% ✓ TKB will receive a number of newly issued shares of the newly formed Bermuda holding company equal to $11.25 divided by the Company’s weighted average stock price over a 15 consecutive trading day period ▪ Assumes collar range of $0.50-$3.00 and exchange ratios of 22.50-3.75, respectively ✓ Existing Wejo shareholders are rolling 100% of their equity ✓ Transaction is a major funding step towards cash flow break even ✓ The transaction is expected to close in Q2 2023 24% 31% 26% 19% @ $0.50 offer price @ $3.00 offer price Wejo Rollover Equity SPAC Investors TKB Sponsor PIPE Investor(6)

© Wejo Ltd. Thank You 23