UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23700

Barings Access Pine Point Fund

(Exact name of registrant as specified in charter)

300 South Tryon Street, Suite 2500, Charlotte, NC 28202

(Address of principal executive offices)

Ashlee Steinnerd

Secretary

Barings Access Pine Point Fund

300 South Tryon Street, Suite 2500

Charlotte, NC 28202

(Name and address of agent for service)

Copies to:

Brian D. McCabe

Ropes & Gray LLP

Prudential Tower,

800 Boylston Street,

Boston, MA 02199-3600

Registrant’s telephone number, including area code: (704) 805-7200

Date of fiscal year end: March 31, 2023

Date of reporting period: September 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for Barings Access Pine Point Fund. Investors should consider the Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Barings Access Pine Point Fund – President’s Letter to Shareholders (Unaudited) |

To Our Shareholders,

Mina Nazemi

President

September 30, 2022

I am pleased to present you with the first Semi-Annual Report for the Barings Access Pine Point Fund (the “Fund”).

The Fund’s investment objective is to generate long-term capital appreciation by investing in a broad cross section of private equity assets in order to seek, over time: long-term capital appreciation; a diversified portfolio of private equity assets; and an investment alternative for investors seeking to allocate a portion of their long-term portfolios primarily to lower- and middle-market buyout and growth equity assets through a single investment.

From inception on January 7, 2022 through September 30, 2022, the Fund’s shares returned 10.60%, outperforming the -23.79% return of the Russell 2000® Index* (the “benchmark”), which measures the performance of the small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

It is our pleasure as the Fund’s investment adviser to provide a framework for the recently constructed portfolio as well as our expectations for the coming quarters. The private equity asset class, unlike public equity markets that have daily pricing visibility, is, as the asset class suggests, made up of private companies with no readily tradable market. Investments are privately negotiated and subject to varying competitive conditions. Assets are typically fair valued monthly by the Fund’s adviser based on the most recent quarterly valuation provided by the private equity sponsor, with monthly adjustments primarily reflecting cash movements and occasional material subsequent events, such as an announced sale; market dislocations, like a pandemic or military conflict; or material and measurable changes in the operations of the asset. Short-term value changes are typically relatively small, with longer-term value creation strategies implemented over time. The performance of each investment is typically driven by a combination of changes in revenue and expenses, changes to the balance sheet and prevailing market conditions. The weighting of each will vary based on the company, its sector, and the strategy deployed by the controlling equity participant.

The Fund implements its investment objective by pursuing a private equity strategy of investing through co-investments (minority equity stakes in companies), secondary vehicles (purchase of existing private equity fund assets), and primary funds (blind pool investment vehicles) in what we believe are attractive opportunities focused on small to medium-sized private companies in developed markets alongside high-quality private equity sponsors.

As of September 30, 2022, the Fund had committed $111.1 million across 21 investments alongside 18 discrete private equity sponsors, including nine co-investments, nine secondaries, and three primary funds. Secondaries have been a higher percentage of the portfolio mix (49% of total committed capital), as more private equity sponsors have used the secondary market to retain control of seasoned portfolio assets, offer existing investors liquidity, and raise additional capital for continued growth. The Fund has sought to benefit from this development by investing with strong sponsors in high-quality companies with which the sponsor has long-term familiarity. The Fund’s portfolio has a current weighting to lower- and middle-market companies (86% of total committed capital), North American geographic domiciles (89%), and buyout (100%) structures (control investments in established, cash flow-positive businesses where leverage may be used to support acquisition prices). The headline sector mix is skewed toward information technology (36% of total committed capital) and industrials (32%), but the underlying sub-sector

1

Barings Access Pine Point Fund – President’s Letter to Shareholders (Unaudited) (Continued) |

segmentation is diversified across industries such as government services, health care compliance, consumer data management, payment systems, financial services connectivity, aerospace & defense, environmental services, HVAC services, testing, inspection & compliance services, and automotive aftermarket, among others.

Performance for this newly constructed portfolio of assets has been as we expected, with little change. The value creation strategies underwritten for each of the investments are in their early stages.

Looking forward, in a market of changing dynamics with increasing inflation, rising interest rates, labor shortages, and supply chain disruptions, we believe the Fund’s portfolio is appropriately diversified and well positioned for continued growth, given its exposure to companies with leading competitive positions in strong end markets, high-margin, mission-critical products and services, and flexible capital structures with access to growth capital.

Over the remainder of the year, we believe the Fund has the potential for slow, but steady, value growth across the portfolio. New investor capital will be targeted toward opportunities that we expect to be additive to the current portfolio mix and long-term performance, using a list of well-defined criteria to prioritize allocations.

Sincerely,

Mina Nazemi

President

Barings Access Pine Point Fund

2

Barings Access Pine Point Fund – Portfolio Summary (Unaudited) |

Barings Access Pine Point Fund

Country Table

(% of Net Assets) on 9/30/22 |

United States | 87.5% |

Guernsey | 5.1% |

Luxembourg | 4.9% |

Total Investments | 97.5% |

| | |

Barings Access Pine Point Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/22 |

Secondary Fund | 43.3% |

Co-Investment | 32.6% |

Primary Fund | 12.5% |

Total Long-Term Investments | 88.4% |

Short-Term Investments and Other Assets and Liabilities | 11.6% |

Net Assets | 100.0% |

| | |

3

MassMutual Access Pine Point Fund – Portfolio Summary (Unaudited) (Continued) |

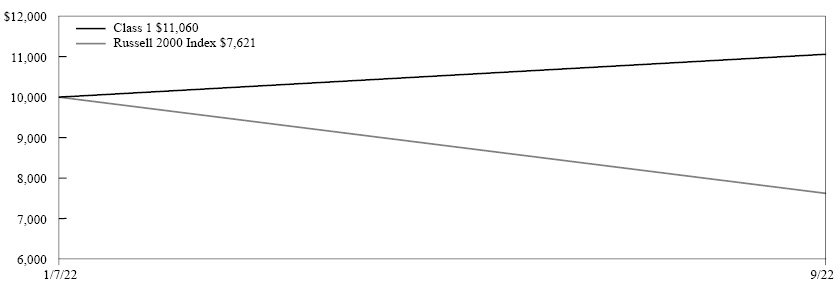

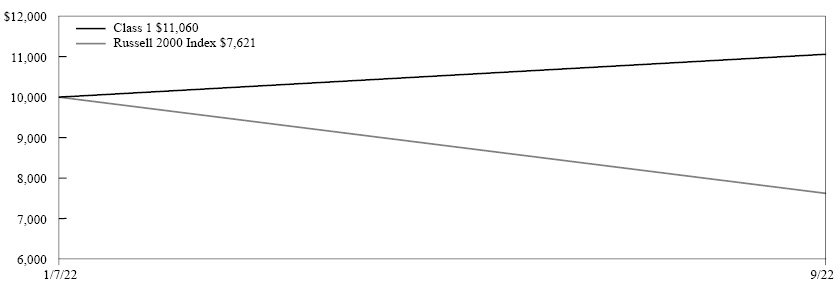

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION - CLASS 1

The graph above illustrates a representative class of the Fund’s historical performance since the Fund’s inception in comparison to its benchmark index. The performance of other share classes will be greater than or less than the class depicted above.

The graph above illustrates a representative class of the Fund’s historical performance since the Fund’s inception in comparison to its benchmark index. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

| Inception Date

of Class | 6 Months | Since Inception |

Class 1 | 1/07/2022 | 2.69% | 10.60% |

Russell 2000 Index | | -19.81% | -23.79% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-704-805-7200.

Investors should note that the Fund is a professionally managed closed-end fund, while the Russell 2000 Index is unmanaged, does not incur fees, expenses, or taxes, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

4

Barings Access Pine Point Fund – Consolidated Portfolio of Investments (Unaudited) |

September 30, 2022 |

Name | | Initial Acquisition

Date | | | Geographic

Region | | | Unfunded

Commitment | | | Cost | | | Fair

Value | |

Primary Fund Investments — 12.5% | | | | | | | | | | | | | | | | | | | | |

Bertram Growth Capital IV-A, LP (a) (c) | 1/07/2022 | | | North America | | | | 1,934,857 | | | $ | 3,098,477 | | | $ | 3,844,731 | |

Gryphon Partners VI-A, LP (a) (c) | 1/07/2022 | | | North America | | | | 2,887,591 | | | | 4,581,220 | | | | 4,931,133 | |

OceanSound Partners Fund, LP (a) (c) | 1/07/2022 | | | North America | | | | 3,198,111 | | | | 4,301,889 | | | | 5,542,274 | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | 11,981,586 | | | $ | 14,318,138 | |

| | | | | | | | | | | | | | | | | | | | | |

Secondary Fund Investments — 43.3% | | | | | | | | | | | | | | | | | | | | |

AE Industrial Partners Extended Value Fund, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 123,102 | | | $ | 1,429,362 | | | $ | 1,603,949 | |

BC Partners Galileo (1) LP (a) (b) (c) (d) | 1/07/2022 | | | Europe | | | | — | | | | 4,820,942 | | | | 5,853,796 | |

FB HA Holdings LP (a) (b) (c) (f) | 1/07/2022 | | | North America | | | | — | | | | 5,025,000 | | | | 5,006,252 | |

Icon Partners V, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 2,592,593 | | | | 7,407,407 | | | | 7,714,333 | |

JFL-NG Continuation Fund, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 2,132,654 | | | | 7,867,346 | | | | 11,315,179 | |

Montagu + SCSp (a) (b) (c) (e) | 1/07/2022 | | | Europe | | | | 1,598,726 | | | | 5,175,659 | | | | 5,622,511 | |

NSH Verisma Holdco, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 1,453,497 | | | | 4,548,337 | | | | 4,512,423 | |

Stork SPV, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 2,019,004 | | | | 2,488,828 | | | | 3,329,816 | |

TSCP CV I, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 898,345 | | | | 4,121,231 | | | | 4,647,454 | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | 42,884,112 | | | $ | 49,605,713 | |

| | | | | | | | | | | | | | | | | | | | | |

Co-Investments — 32.6% | | | | | | | | | | | | | | | | | | | | |

BSP TS Co-Invest I LLC (a) (b) (c) | 1/07/2022 | | | North America | | | | — | | | $ | 5,043,046 | | | $ | 5,010,841 | |

EPP Holdings LLC (a) (b) (c) (f) | 1/07/2022 | | | North America | | | | 858,000 | | | | 1,747,817 | | | | 2,900,725 | |

Gallant Screening Holdco, Inc. (a) (b) (c) | 1/07/2022 | | | North America | | | | — | | | | 4,784,071 | | | | 6,017,639 | |

GoCanvas TopCo, LLC (a) (b) (c) | 1/07/2022 | | | North America | | | | — | | | | 1,635,500 | | | | 1,716,174 | |

HH-Dayco Parent LP (a) (b) (c) | 9/20/2022 | | | North America | | | | — | | | | 5,000,000 | | | | 5,000,000 | |

Home Services Aggregator LP (a) (b) (c) | 1/07/2022 | | | North America | | | | 1,050,000 | | | | 4,219,307 | | | | 5,382,102 | |

NEFCO Acquisitions, Inc. (a) (b) (c) | 8/05/2022 | | | North America | | | | — | | | | 2,658,294 | | | | 2,658,294 | |

OceanSound Partners Co-Invest II, LP (a) (b) (c) | 1/07/2022 | | | North America | | | | — | | | | 3,612,781 | | | | 3,587,495 | |

TSS Co-Invest Holdings LP (a) (c) | 9/09/2022 | | | North America | | | | — | | | | 5,000,000 | | | | 5,000,000 | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | 33,700,816 | | | $ | 37,273,270 | |

The accompanying notes are an integral part of the consolidated financial statements.

5

Barings Access Pine Point Fund – Consolidated Portfolio of Investments (Unaudited) (Continued) |

| |

| | | Principal

Amount | | | Cost | | | Value | |

SHORT-TERM INVESTMENTS — 9.1% | | | | |

| | | | | | | | | | | | |

Commercial Paper — 9.1% | | | | | | | | |

Dentsply Sirona, Inc. | | | | | | | | | | | | |

4.018% 10/26/22 (g) | | $ | 2,000,000 | | | $ | 1,994,514 | | | $ | 1,994,822 | |

Nutrien Ltd. | | | | | | | | | | | | |

3.769% 11/07/22 (g) | | | 1,400,000 | | | | 1,394,676 | | | | 1,394,743 | |

Raytheon Technologies Corp. | | | | | | | | | | | | |

3.583% 11/03/22 (g) | | | 2,000,000 | | | | 1,993,583 | | | | 1,993,291 | |

Rogers Communications, Inc. | | | | | | | | | | | | |

4.024% 11/03/22 (g) | | | 2,000,000 | | | | 1,992,758 | | | | 1,993,291 | |

Tampa Electric Co. | | | | | | | | | | | | |

3.508% 10/14/22 (g) | | | 2,000,000 | | | | 1,997,509 | | | | 1,997,608 | |

Transcanada Pipelines Ltd. | | | | | | | | | | | | |

3.663% 11/01/22 (g) | | | 1,000,000 | | | | 996,900 | | | | 996,857 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS Total | | | | | | $ | 10,369,940 | | | $ | 10,370,612 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS — 97.5% (Cost $98,936,454) | | | | | | | | | | $ | 111,567,733 | |

| | | | | | | | | | | | | |

Other Assets/(Liabilities) — 2.5% | | | | | | | | | | | 2,897,672 | |

| | | | | | | | | | | | | |

NET ASSETS — 100.0% | | | | | | | | | | $ | 114,465,405 | |

Notes to Portfolio of Investments

Percentages are stated as a percent of net assets.

(b) | Non-income producing security. |

(c) | Fair value estimated by management using significant unobservable inputs. |

(d) | Foreign security denominated in Eurodollars. Total commitment and remaining commitment are €4,200,000 and €0, respectively. Amounts converted to U.S. dollar. |

(e) | Foreign security denominated in Eurodollars. Total commitment and remaining commitment are €6,190,795 and €1,631,270, respectively. Amounts converted to U.S.dollar. |

(f) | Held in MassMutual Private Equity Funds Subsidiary LLC. (See Note 1 in the “Notes to Consolidated Portfolio of Investments” section for more information on this entity). |

Notes to Portfolio of Investments (Continued)

(g) | Security is exempt from registration under Regulation S or Rule 144A of the Securities Act of 1933. These securities are considered restricted and may be resold in transactions exempt from registration. At September 30, 2022, the aggregate market value of these securities amounted to $10,370,612 or 9.06% of net assets. |

The accompanying notes are an integral part of the consolidated financial statements.

6

Barings Access Pine Point Fund – Consolidated Financial Statements |

Consolidated Statement of Assets and Liabilities

September 30, 2022 (Unaudited) |

Assets: | | | | |

Investments, at fair value (a) | | $ | 101,197,121 | |

Short-term investments, at fair value (b) | | | 10,370,612 | |

Total investments, at fair value | | | 111,567,733 | |

Cash | | | 4,035,411 | |

Total assets | | | 115,603,144 | |

Liabilities: | | | | |

Payables for: | | | | |

Investment advisory fees | | | 488,552 | |

Administration fee | | | 73,150 | |

Deferred tax expense | | | 240,402 | |

Accrued expenses and other liabilities | | | 335,635 | |

Total liabilities | | | 1,137,739 | |

Net assets | | $ | 114,465,405 | |

Commitments and contingencies (See Note 2) | | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 103,407,582 | |

Accumulated earnings (loss) | | | 11,057,823 | |

Net assets | | $ | 114,465,405 | |

(a) | Cost of investments: | | $ | 88,566,514 | |

(b) | Cost of short-term investments | | $ | 10,369,940 | |

The accompanying notes are an integral part of the consolidated financial statements.

7

Barings Access Pine Point Fund – Consolidated Financial Statements (Continued) |

Consolidated Statement of Assets and Liabilities

September 30, 2022 (Unaudited) |

Class 1 shares: | | | | |

Net assets | | $ | 114,465,405 | |

Shares outstanding (a) | | | 10,350,808 | |

Net asset value, and redemption price per share | | $ | 11.06 | |

(a) | Authorized unlimited number of shares with no par value. |

The accompanying notes are an integral part of the consolidated financial statements.

8

Barings Access Pine Point Fund – Consolidated Financial Statements (Continued) |

Consolidated Statement of Operations

For the Six Months Ended September 30, 2022 (Unaudited) |

Investment income: | | | | |

Dividends | | $ | 3,363 | |

Interest | | | 229,270 | |

Total investment income | | | 232,633 | |

Expenses: | | | | |

Investment advisory fees | | | 726,627 | |

Legal fees | | | 118,193 | |

Trustees’ fees | | | 88,743 | |

Audit and tax fees | | | 59,914 | |

Registration and filing fees | | | 55,151 | |

Administrative fees | | | 50,137 | |

Transfer agent fees | | | 25,342 | |

Shareholder reporting fees | | | 8,549 | |

Custody fees | | | 1,354 | |

Other fees | | | 251 | |

Net expenses: | | | 1,134,261 | |

Net investment income (loss) | | | (901,628 | ) |

Realized and unrealized gain (loss): | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | (7 | ) |

Foreign currency transactions | | | (32 | ) |

Net realized gain (loss) | | | (39 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investment transactions | | | 4,111,606 | |

Change in deferred tax | | | (240,402 | ) |

Net change in unrealized appreciation (depreciation) | | | 3,871,204 | |

Net realized gain (loss) and change in unrealized appreciation (depreciation) | | | 3,871,165 | |

Net increase (decrease) in net assets resulting from operations | | $ | 2,969,537 | |

The accompanying notes are an integral part of the consolidated financial statements.

9

Barings Access Pine Point Fund – Consolidated Financial Statements (Continued) |

Consolidated Statements of Changes in Net Assets

|

| | Six Months

Ended

September 30, 2022

(Unaudited) | | | Period

Ended March 31,

2022 (a) | |

Increase (Decrease) in Net Assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (901,628 | ) | | $ | (431,387 | ) |

Net realized gain (loss) | | | (39 | ) | | | — | |

Net change in unrealized appreciation (depreciation) | | | 3,871,204 | | | | 8,519,673 | |

Net increase in net assets resulting from operations | | | 2,969,537 | | | | 8,088,286 | |

Net fund share transactions: | | | | | | | | |

Class 1 | | | — | | | | 103,307,582 | |

Increase in net assets from fund share transactions | | | — | | | | 103,307,582 | |

Total increase in net assets | | | 2,969,537 | | | | 111,395,868 | |

Net assets | | | | | | | | |

Beginning of period | | | 111,495,868 | | | | 100,000 | |

End of period | | $ | 114,465,405 | | | $ | 111,495,868 | |

(a) | Fund commenced operations on January 7, 2022 |

The accompanying notes are an integral part of the consolidated financial statements.

10

Barings Access Pine Point Fund – Consolidated Financial Statements (Continued) |

Consolidated Statement of Cash Flows

For the Six Months Ended September 30, 2022 (Unaudited) |

Cash flows from operating activities: | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 2,969,537 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

Investments purchased | | | (15,398,802 | ) |

Net proceeds from investments | | | 274,867 | |

(Purchase) Sale of short-term investments, net | | | 17,318,328 | |

(Increase) Decrease in other receivables | | | 45,487 | |

Increase (Decrease) in payable for administration fees | | | 50,136 | |

(Increase) Decrease in receivable for investment advisory fees | | | 66,726 | |

Increase (Decrease) in payable for investment advisory fees | | | 215,107 | |

Increase (Decrease) in payable for accrued expenses and other liabilities | | | 78,439 | |

Increase (Decrease) in payable for deferred tax expense | | | 240,402 | |

Net change in unrealized (appreciation) depreciation on investments | | | (4,111,606 | ) |

Net realized (gain) loss | | | 39 | |

Net cash from (used in) operating activities | | | 1,748,660 | |

| | | | | |

Net increase (decrease) in cash | | | 1,748,660 | |

Cash at beginning of period | | | 2,286,751 | |

Cash at end of period | | $ | 4,035,411 | |

| | | | | |

| | | | | |

| | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

11

Barings Access Pine Point Fund – Consolidated Financial Statements (Continued) |

Consolidated Financial Highlights (For a share outstanding throughout each period) |

| | | | | | | Income (loss) from investment

operations | | | | | | | | | | | | | | | Ratios / Supplemental Data | |

| | | Net

asset

value,

beginning

of the

period | | | Net

investment

income

(loss)c | | | Net

realized

and

unrealized

gain (loss)

on

investments | | | Total

income

(loss) from

investment

operations | | | Net

asset

value,

end of

the

period | | | Total

return | | | Net

assets,

end of

the

period

(000)’s | | | Ratio of

expenses

to average

daily net

assets

before

expense

waivers | | | Ratio of

expenses

to average

daily net

assets

after

expense

waivers | | | Net

investment

income

(loss) to

average

daily net

assets | |

Class 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

9/30/22r | | $ | 10.77 | | | $ | (0.09 | ) | | $ | 0.38 | | | $ | 0.29 | | | $ | 11.06 | | | | 2.69 | %b | | $ | 114,465 | | | | 2.02 | %a | | | 2.02 | %a | | | (1.61 | %)a |

3/31/22i | | | 10.00 | | | | (0.05 | ) | | | 0.82 | | | | 0.77 | | | | 10.77 | | | | 7.72 | %b | | | 111,496 | | | | 2.86 | %a | | | 2.54 | %a | | | (2.02 | %)a |

| | Six months ended

September 30, 2022b,r | Period ended

March 31, 2022 |

Portfolio turnover rate | 0% | 0% |

b | Percentage represents the results for the period and is not annualized. |

c | Per share amount calculated on the average shares method. |

i | Fund commenced operations on January 7, 2022. |

The accompanying notes are an integral part of the consolidated financial statements.

12

Notes to Consolidated Financial Statements (Unaudited) |

1. Organization:

Barings Access Pine Point Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is organized under the laws of the State of Delaware as a Delaware statutory trust pursuant to a Certificate of Trust dated May 24, 2021, as amended and restated on September 27, 2022, as it may be further amended from time to time. The Fund intends to qualify as a regulated investment company (a “RIC”). The Fund commenced operations on January 7, 2022.

The Fund currently offers Class 1 shares on a continuous basis at the net asset value (“NAV”) per share. The minimum investment is $1,000,000 and there is no sales charge associated with the share class. Massachusetts Mutual Life Insurance Company (“MassMutual”) owns 100% of the outstanding Class 1 shares.

The Fund’s investment objective is to generate long-term capital appreciation. In pursuing its investment objective, the Fund intends to invest primarily and/or make capital commitments in private equity investments (“Private Equity Investments”), including primary and secondary private equity funds (“Portfolio Funds”) and co-investments, directly or indirectly in private portfolio companies (“Co-Investments”); investments intended to provide an investment return while offering better liquidity than Private Equity Investments; and cash, cash equivalents and other short-term investments. Capital not invested in private equity may be invested in short-term debt securities, public equities or money market funds pending investment pursuant to the Fund’s investment objective and strategies. In addition, subject to applicable law, the Fund may maintain a portion of its assets in cash or short-term debt securities or money market funds to meet operational and liquidity needs or for temporary defensive purposes.

Basis of Consolidation – On January 7, 2022, MassMutual performed an in-kind purchase transaction whereby it contributed the assets and liabilities of MassMutual Private Equity Funds LLC (“MMPEF”) and its subsidiary, MassMutual Private Equity Funds Subsidiary LLC (“MMPEF Subsidiary”) to the Fund in exchange for shares of the Fund. The consolidated financial statements of the Fund include MMPEF and MMPEF Subsidiary in which the Fund invests and the results of which are reported on a consolidated basis with the Fund. Both MMPEF and MMPEF Subsidiary are wholly owned subsidiaries of the Fund; therefore, all intercompany accounts and transactions have been eliminated. MMPEF and MMPEF Subsidiary will hold all of the Fund’s Private Equity Investments and Co-Investments, while short-term investments are held directly by the Fund. As of September 30, 2022, MMPEF and MMPEF Subsidiary hold investments in the amount of $93,290,144 and $7,906,977, respectively.

Fund Changes – Effective September 27, 2022, the Fund changed its name from “MassMutual AccessSM Pine Point Fund” to “Barings Access Pine Point Fund”. Also effective September 27, 2022, the investment adviser and administrator for the Fund changed from MML Investment Advisers, LLC (“MML Advisers”) to Barings, LLC (“Barings”). Barings International Investment Limited (“BIIL”), which previously served as investment sub-subadviser became the Fund’s investment subadviser, and MML Distributors LLC ceased to serve as the Fund’s principal underwriter.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America (“generally accepted accounting principles”). The preparation of the financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC Topic 946”), and applying the specialized accounting and reporting guidance in ASC Topic 946.

13

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

Investment Valuation Policies:

Valuations are formally established on a monthly basis and typically reflect the most recent available quarterly valuation provided by the private equity sponsor, adjusted for capital flows and significant subsequent events, such as an announced sale; market dislocations, like a pandemic or military conflict.

The NAV of the Fund’s shares is determined as of the close of business on the last business day of each month, as of the date of any distribution, and at such other times as Barings, as the Fund’s valuation designee under Rule 2a-5 of the 1940 Act, shall determine the fair value of the Fund’s investments, subject to the general oversight of the Board. The determination of fair value by Barings is performed by an internal valuation committee that is separated from the investment process.

The fair value of Private Equity Investments held by the Fund is generally based on estimated valuations reported by general partners or managers of the Portfolio Funds, or sponsors of the Co-Investments, in which the Fund invests on a quarterly basis. Adjustments are made to reported estimates on an intra-quarter basis to consider capital flow activity and significant events. In the case of new investments, transaction cost is typically regarded as the best estimate of fair value.

Typically, the most recently available information for a Private Equity Investment is as of a date that is earlier than the date the Fund is calculating its NAV. This factor may result in a difference between the reported fair value of the investment and the proceeds the Fund could receive upon the sale of the investment.

For investments in commercial paper, Barings will use an observable market price or accreted cost as the best estimate in determining fair value.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-tier hierarchy is utilized to classify assets based on the use of observable versus unobservable market data inputs of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in valuing the asset or liability. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs may include the adviser’s own assumptions in determining the fair value of investments. The three-tier hierarchy of inputs is summarized in the three broad levels listed below. The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to each security.

Level 1 – quoted prices (unadjusted) in active markets for identical investments that the Fund can access at the measurement date

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs, to the extent observable inputs are not available (including the Fund’s own assumptions in determining the fair value of investments)

The availability of observable inputs can vary by security and is affected by a variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy. In addition, in periods of market dislocation, the observability of prices and inputs may be reduced for many instruments. This condition, as well as changes related to liquidity of investments, could cause a security to be reclassified between levels.

14

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the overall fair value measurement.

The following is the aggregate value by input level, as of September 30, 2022 for the Fund’s investments:

Investment Type | | Level 1 | | | Level 2 | | | Level 3 | | | Investments

Valued at NAV | | | Total | |

Private Equity Investments | | | | | | | | | | | | | | | | | | | | |

Primary Fund Investments | | $ | — | | | $ | — | | | $ | — | | | $ | 14,318,138 | | | $ | 14,318,138 | |

Secondary Fund Investments | | | — | | | | — | | | | — | | | | 49,605,713 | | | | 49,605,713 | |

Co-Investments | | | — | | | | — | | | | 21,576,658 | | | | 15,696,612 | | | | 37,273,270 | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Commercial Paper | | | — | | | | 10,370,612 | | | | — | | | | — | | | | 10,370,612 | |

Total Investments | | $ | — | | | $ | 10,370,612 | | | $ | 21,576,658 | | | $ | 79,620,463 | | | $ | 111,567,733 | |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Co-Investments | | | Total | |

Balance as of April 1, 2022 | | $ | — | | | $ | — | |

Purchases | | | 13,019,081 | | | | 13,019,081 | |

Sales | | | (232,899 | ) | | | (232,899 | ) |

Realized Gain | | | — | | | | — | |

Change in Unrealized Appreciation/(Depreciation) | | | 2,389,550 | | | | 2,389,550 | |

Transfer in | | | 6,400,926 | | | | 6,400,926 | |

Transfer out | | | — | | | | — | |

Balance as of September 30, 2022 | | $ | 21,576,658 | | | $ | 21,576,658 | |

Net change in Unrealized Appreciation attributable to Level 3 Investments held at September 30, 2022 | | $ | 2,389,550 | | | | 2,389,550 | |

The following table summarizes the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy as of September 30, 2022. The table below is not intended to be all inclusive, but rather provide information on the significant Level 3 inputs as they relate to the Fund’s fair value measurements:

Investment Type | | Value at

9/30/2022 | | | Valuation

Technique | | | Unobservable

Input(s) | | | Range | | | Weighted

Average | |

Private Equity Investments | | | | | | | | | | | | | | | | | | | | |

Co-Investments - Market Multiples | | $ | 8,918,364 | | | | Public Company Comparables | | | | Enterprise value to EBITDA Multiple(a) | | | | (148.7x) - 24.1x | | | | 11.6x | |

| | | | | | | | Transaction Comparables | | | | Enterprise value to EBITDA Multiple(a) | | | | 7.0x - 28.6x | | | | 14.3x | |

| | | | | | | | Discount for Minority Ownership | | | | Discount Rate(b) | | | | 10% | | | | N/A | |

Co-Investments - Acquisition Cost | | | 12,658,294 | | | | Recent Transaction | | | | Acquisition Cost(a) | | | | $2,658,294 - $5,000,000 | | | | $4,508,232 | |

Total | | $ | 21,576,658 | | | | | | | | | | | | | | | | | |

(a) | An increase of the input would indicate an increase in fair value. |

(b) | An increase of the input would indicate an decrease in fair value. |

15

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

The Fund does not have the right to redeem Private Equity Investments and therefore, they are considered illiquid.

Unfunded Commitments:

As of September 30, 2022, the Fund had total unfunded commitments of $20,746,480 which consist of $8,020,559 for primary private equity funds, $10,817,921 for secondary private equity funds and $1,908,000 for co-investments.

Accounting for Investment Transactions:

Investment transactions are accounted for on the trade date. Realized gains and losses on sales of investments and unrealized appreciation and depreciation of investments are computed by the specific identification cost method. Dividend income and realized capital gain distributions are recorded on the ex-dividend date. Non-cash dividends received in the form of stock are recorded as dividend income at market value. Withholding taxes on foreign interest, dividends, and capital gains have been provided for in accordance with the applicable country’s tax rules and rates. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Distributions received on securities that represent a return of capital or capital gains are recorded as a reduction of cost of investments and/or as a realized gain, respectively.

Dividends and Distributions to Shareholders:

Dividends from net investment income and distributions of any net realized capital gains of the Fund are declared and paid annually and at other times as may be required to satisfy tax or regulatory requirements. Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. As a result, net investment income and net realized capital gains on investment transactions for a reporting period may differ significantly from distributions during such period.

Foreign Currency Translation:

The books and records of the Fund are maintained in U.S. dollars. The market values of foreign currencies, foreign securities, and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate on the date of the report. Purchases and sales of foreign securities and income and expense items are translated at the rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations arising from changes in the exchange rates from that portion arising from changes in the market prices of securities. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of dividends or interest recorded on the books of the Fund and the amount actually received.

Indemnifications:

Under the Fund’s organizational documents, current and former Trustees and Officers are provided with specified rights to indemnification against liabilities arising in connection with the performance of their duties to the Fund, and shareholders shall not be subject to any personal liability for obligations of the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

16

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

3. General Risks

General Risks. An investment in the Fund involves a considerable amount of risk. An investor may lose money. Before making an investment decision, a prospective shareholder should (i) consider the suitability of this investment with respect to the shareholder’s investment objectives and personal situation and (ii) consider factors such as the investor’s personal net worth, income, age, risk tolerance and liquidity needs. The Fund is an illiquid investment. Shareholders have no right to require the Fund to redeem their shares of the Fund.

Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares. The Fund has been organized as a non-diversified, closed-end management investment company and designed primarily for long-term investors. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not intend to list the shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the shares. Although the Fund intends to offer a limited degree of liquidity by conducting quarterly repurchase offers, a shareholder may not be able to tender its shares in the Fund promptly after it has made a decision to do so. There is no assurance that you will be able to tender your shares when or in the amount that you desire or that the Fund will repurchase shares quarterly. In addition, with very limited exceptions, shares are not transferable, and liquidity will be provided only through quarterly repurchase offers made by the Fund. The Fund expects any quarterly repurchase offer to apply to no more than 5% of the net assets of the Fund. Shares are considerably less liquid than shares of funds that trade on a stock exchange or shares of open-end registered investment companies, and are therefore suitable only for investors who can bear the risks associated with the limited liquidity of shares, and should be viewed as a long-term investment.

There will be a substantial period of time between the date as of which shareholders must submit a request to have their shares repurchased and the date they can expect to receive payment for their shares from the Fund. The Fund currently intends, under normal market conditions, to provide payment with respect to 95% of the tender offer proceeds within 65 days of the expiration of the tender offer, and may hold back 5% of the tender offer proceeds until after the Fund’s year-end audit. Shareholders whose shares are accepted for repurchase bear the risk that the Fund’s NAV may fluctuate significantly between the time that they submit their repurchase requests and the date as of which such Shares are valued for purposes of such repurchase. Shareholders will have to decide whether to request that the Fund repurchase their shares without the benefit of having current information regarding the value of shares on a date proximate to the date on which shares are valued by the Fund for purposes of effecting such repurchases.

Repurchases of shares, if any, may be suspended, postponed or terminated by the Board under certain circumstances. An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of shares and the underlying investments of the Fund. Also, because shares are not listed on any securities exchange, the Fund is not required, and does not intend, to hold annual meetings of its shareholders unless required under the provisions of the 1940 Act.

Dependence on Barings. Barings is the Fund’s investment adviser and is responsible for selecting fund investments as opportunities arise. The Fund and, accordingly, shareholders, must rely upon the ability of Barings to identify and implement fund investments consistent with the Fund’s investment objective. Shareholders will not receive or otherwise be privy to due diligence or risk information prepared by or for Barings in respect of fund investments and Co-Investments. Barings has the authority and responsibility for asset allocation, the selection of fund investments and all other investment decisions for the Fund. The success of the Fund depends upon the ability of Barings to develop and implement investment strategies that achieve the investment objective of the Fund. Shareholders will have no right or power to participate in the management or control of the Fund or fund investments, or the terms of any such investments. There can be no assurance that Barings will be able to select or implement successful strategies or achieve the Fund’s investment objectives. No person should invest in the Fund unless such person is willing to entrust all aspects of the investment decisions of the Fund to Barings.

Barings contracts with BIIL to help manage the Fund. Subject to the oversight of the Board, Barings has the ultimate responsibility to oversee any subadviser of the Fund and to recommend the hiring, termination, and replacement of any subadviser of the Fund. This responsibility includes, but is not limited to, analysis and review of subadviser performance, as well as assistance in the identification and vetting of new or replacement subadvisers. In addition, Barings maintains responsibility for a number of

17

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

other important obligations, including, among other things, board reporting, assistance in the annual advisory contract renewal process, and, in general, the performance of all obligations not delegated to a subadviser. Barings also provides advice and recommendations to the Board, and performs such review and oversight functions as the Board may reasonably request, as to the continuing appropriateness of the investment objective, strategies, and policies of the Fund, valuations of portfolio securities, and other matters relating generally to the investment program of the Fund.

Liquidity and Valuation Risk. Liquidity risk is the risk that securities may be difficult or impossible to sell at the time the Fund would like or at the price it believes the security is currently worth. Liquidity risk may be increased for certain Fund investments, including those investments in funds with gating provisions or other limitations on investor withdrawals and restricted or illiquid securities. The Fund’s current Private Equity Investments do not have provisions which permit the Fund to redeem its investment. To the extent that the Fund seeks to reduce or sell out of its investment at a time or in an amount that is prohibited, the Fund may not have the liquidity necessary to participate in other investment opportunities or may need to sell other investments that it may not have otherwise sold.

The Fund may also invest in securities that, at the time of investment, are illiquid, as determined by using the SEC’s standard applicable to registered investment companies (i.e., securities that cannot be disposed of by the Fund within seven calendar days in the ordinary course of business at approximately the amount at which the Fund has valued the securities). Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liquid securities, which may adversely affect the price that the Fund pays for or recovers upon the sale of such securities. Investment of the Fund’s assets in illiquid and restricted securities may also restrict the Fund’s ability to take advantage of market opportunities.

Valuation risk is the risk that one or more of the securities in which the Fund invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more difficult, in which case the Funds’ judgment may play a greater role in the valuation process.

Valuations of Private Equity Investments; Valuations Subject to Adjustment. A large percentage of the securities in which the Fund invests will not have a readily determinable market price and will be carried at an estimated fair value.

In addition, a large percentage of the securities in which the Portfolio Funds invest and the Co-Investments will not have a readily determinable market price and will be valued periodically by the Portfolio Fund manager or the Co-Investment or Co-Investment sponsor. In this regard, a Portfolio Fund manager or a Co-Investment sponsor may face a conflict of interest in valuing the securities, as their value may affect the Portfolio Fund manager’s or the Co-Investment sponsor’s compensation or the manager’s or sponsor’s ability to raise additional funds in the future.

Prior to investing in any Private Equity Investment, Barings will conduct a due diligence review of the valuation methodology used by the Portfolio Fund manager. No assurances can be given regarding the valuation methodology or the sufficiency of systems utilized by any Portfolio Fund manager or Co-Investment or Co-Investment sponsor, the accuracy of the valuations provided by the Portfolio Fund managers, the Co-Investment or the Co-Investment sponsor, that the Portfolio Fund managers, Co-Investments or Co-Investment sponsors will comply with their own internal policies or procedures for keeping records or making valuations, or that the Portfolio Fund managers’, the Co-Investments or the Co-Investment sponsors’ policies and procedures and systems will not change without notice to the Fund. As a result, valuations of the securities may be subjective and could subsequently prove to have been inaccurate, potentially by significant amounts.

Barings has been designated by the Board as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. In its capacity as valuation designee, Barings, among other things, is responsible for establishing fair valuation methodologies and determining, in good faith, the fair value of all of the assets of the Fund for which there are no readily available market quotations in accordance with the Fund Valuation Procedures. The determination of fair value is performed by an internal valuation committee that is separated from the investment process.

18

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

The valuation methodology set forth in the Fund Valuation Procedures incorporates general private equity valuation principles. Based on the methodology, Barings may adjust a Portfolio Fund manager’s periodic valuation of a Portfolio Fund, or a Co-Investment’s valuation, as appropriate.

The valuations reported by the Portfolio Funds and Co-Investments based upon which the Fund determines its month-end NAV may be subject to later adjustment or revision. For example, NAV calculations may be revised as a result of fiscal year-end audits. Other adjustments may occur from time to time. Because such adjustments or revisions, whether increasing or decreasing the NAV of the Fund, at the time they occur, relate to information available only at the time of the adjustment or revision, the adjustment or revision may not affect the amount of the repurchase proceeds of the Fund received by investors who had their shares repurchased prior to such adjustments and received their repurchase proceeds, subject to the ability of the Fund to adjust or recoup the repurchase proceeds received by shareholders under certain circumstances. As a result, to the extent that such subsequently adjusted valuations from the Portfolio Funds, Co-Investments, direct private equity investments or the Fund adversely affect the Fund’s NAV, the outstanding shares may be adversely affected by prior repurchases to the benefit of shareholders who had their shares repurchased at a NAV higher than the adjusted amount. Conversely, any increases in the NAV resulting from such subsequently adjusted valuations may be entirely for the benefit of the outstanding shares and to the detriment of shareholders who previously had their shares repurchased at a NAV lower than the adjusted amount. The same principles apply to the purchase of shares. New shareholders may be affected in a similar way.

4. Advisory Fee and Other Transactions:

Investment Adviser and Investment Subadviser:

Barings, an indirect a wholly-owned subsidiary of MassMutual, serves as investment adviser to the Fund. Under an investment advisory agreement between Barings and the Fund, Barings is responsible for providing investment management services for the Fund. In return for these services, Barings receives an advisory fee at an annual rate of 1.25% of the net assets of the Fund as of the end of each quarter. Pursuant to the agreement, the Fund incurred $726,627 in Investment Advisory Fees for the six months ended September 30, 2022, which is included in the Consolidated Statement of Operations. As of September 30, 2022 the payable due to the Adviser was $488,552.

Barings has entered into an investment subadvisory agreement with BIIL on behalf of the Fund. This agreement provides that BIIL help manage the investment and reinvestment of assets of the Fund. As compensation under the subadvisory agreement, Barings pays BIIL a quarterly Subadvisory Fee equal to 10% of the advisory fee received.

Prior to September 27, 2022, MML Advisers served as investment adviser to the Fund. Under the prior investment advisory agreement between MML Advisers and the Fund, MML Advisers received an advisory fee at an annual rate of 1.30% of the net assets of the Fund as of the end of each month.

Barings has also entered into an administrative and shareholding services agreement to provide the Fund certain administration, accounting, and compliance services. The Fund does not incur charges associated with these services.

Expense Caps and Waivers:

Barings has agreed to cap the fees and expenses of the Fund (including organizational and offering expenses, but excluding extraordinary legal and other expenses, Acquired Fund Fees and Expenses, interest expense, expenses related to borrowings, securities lending, leverage, taxes, and brokerage, short sale dividend and loan expense, or other non-recurring or unusual expenses such as shareholder meeting expenses, as applicable) through January 7, 2024, to the extent that Total Annual Fund Operating Expenses after Expense Reimbursement would otherwise exceed the applicable class of shares of the Fund, as follows:

19

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

Prior to September 27, 2022, the former investment adviser, MML Advisers, agreed to cap fees and expenses for Class 1 shares of the Fund at 2.55%.

Expense caps and waiver amounts are reflected as a reduction of expenses on the Consolidated Statement of Operations.

Barings is entitled to recoup in later periods expenses that Barings has paid or otherwise borne (whether through reduction of its advisory fee or otherwise) to the extent that the expenses for the Fund (including organizational and offering expenses, but excluding Excluded Expenses) after such recoupment do not exceed the lower of (i) the annual expense limitation rate in effect at the time of the actual waiver/ recoupment and (ii) the annual expense limitation rate in effect at the time of the recoupment; provided that Barings shall not be permitted to recoup any such fees or expenses beyond three years from the end of the month in which such fee was reduced or such expense was reimbursed.

Officers and Trustees:

Certain officers and/or trustees of the Fund are officers and/or trustees of Barings or its affiliates. The compensation of a trustee who is not an employee of Barings is borne by the Fund.

5. Federal Income Tax Information:

The Fund intends to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to a RIC. Under such provisions, the Fund would not be subject to federal income taxes on their ordinary income and net realized capital gains to the extent they are distributed or deemed to have been distributed to their shareholders. Therefore, the Fund has not made any provision for federal income tax other than a deferred tax related to MMPEF Subsidiary.

The Fund and its subsidiaries have adopted a tax year end of September 30. The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by U.S. federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2022, the Fund has not filed any tax returns but is subject to examination by the major tax jurisdictions under the statute of limitations.

The Fund is taxed as a RIC and is therefore limited as to the amount of non-qualified income that it may receive as a result of operating a trade or business, e.g. the Fund’s pro rata share of income allocable to the Fund by a partnership operating company. The Fund’s violation of this limitation could result in the loss of its status as a RIC, thereby subjecting all its net income and capital gains to corporate taxes prior to distribution to shareholders. The Fund, from time-to time, identifies investment opportunities that could cause such trade or business income to be allocated to the Fund. MMPEF Subsidiary was formed to hold all investments in such securities without adversely affecting the Fund’s status as a RIC.

Net capital loss carryforwards may be applied against any net realized taxable gains in succeeding years, subject to the carryforward period limitations, where applicable. Capital losses may be carried forward indefinitely, and retain the character of the original loss. The Fund had short-term capital loss carryforward of $7.

The Fund elected to defer to the fiscal year beginning October 1, 2022, late year ordinary losses in the amount of $1,333,047.

The tax basis components of distributable earnings at September 30, 2022 are as follows:

Capital loss carryforward | : | | $ | (7 | ) |

Other temporary differences | : | | | (1,333,047 | ) |

Unrealized appreciation | : | | | 12,631,279 | |

Deferred tax liability | : | | | (240,402 | ) |

Total | : | | $ | 11,057,823 | |

20

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

MMPEF Subsidiary is not taxed as a RIC. Accordingly, prior to the Fund receiving any distributions from MMPEF Subsidiary, all MMPEF Subsidiary’s taxable income and realized gains is subject to taxation at prevailing corporate tax rates. As of September 30, 2022, MMPEF Subsidiary has incurred income tax expense of $0.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of the existing MMPEF Subsidiary assets and liabilities and their respective tax basis. As of September 30, 2022, MMPEF Subsidiary had $240,402 of deferred tax liability.

At September 30, 2022, the aggregate cost of investments and the unrealized appreciation (depreciation) in the value of all investments owned by the Fund, as computed on a federal income tax basis, were as follows:

| | Federal Income Tax Cost | | | Tax Basis Unrealized Appreciation | | | Tax Basis Unrealized (Depreciation) | | | Net Unrealized Appreciation (Depreciation) | |

| | $ | 98,936,454 | | | $ | 12,743,432 | | | $ | (112,153 | ) | | $ | 12,631,279 | |

6. Capital Share Transactions:

The Fund will engage in a continuous offering of shares. Shareholders do not have the right to require the Fund to redeem their shares. To provide a limited degree of liquidity to shareholders, the Fund may, from time to time, offer to repurchase shares pursuant to written tenders by shareholders. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Board of Trustees, in its sole discretion. With respect to any repurchase offer, shareholders tendering shares for repurchase must do so by a date specified in the notice describing the terms of the repurchase offer. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of shares from a shareholder at any time prior to the day immediately preceding the one-year anniversary of the shareholder’s purchase of shares. Such repurchase fee will be retained by the Fund and will benefit the Fund’s remaining shareholders.

During the reporting period, the Board authorized the Fund to offer to repurchase Class 1 shares from shareholders on two occasions, March 22, 2022 and June 22, 2022. On March 22, 2022, the Fund offered to repurchase up to 417,038 Class 1 shares (approximately 5% of outstanding Class 1 shares of the Fund as of January 31, 2022) from shareholders, with a June 30, 2022 valuation date. There were no tender requests received for the Class 1 shares in connection with such offer. On June 22, 2022, the Fund offered to repurchase up to 517,540 Class 1 shares (approximately 5% of outstanding Class 1 shares of the Fund as of April 30, 2022) from shareholders, with a September 30, 2022 valuation date. There were no tender requests received for the Class 1 shares in connection with such offer.

Changes in shares outstanding for the Fund were as follow:

| | | Six Months Ended

September 30, 2022 | | | Period Ended

March 31, 2022(a) (b) | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class 1 | | | | | | | | | | | | | | | | |

Sold | | | — | | | $ | — | | | | 10,340,808 | | | $ | 103,307,582 | |

Issued as reinvestment of dividends | | | — | | | | — | | | | — | | | | — | |

Redeemed | | | — | | | | — | | | | — | | | | — | |

Net increase (decrease) | | | — | | | $ | — | | | | 10,340,808 | | | $ | 103,307,582 | |

(a) | Fund commenced operations on January 7, 2022. |

(b) | 7,428,948 shares and $74,289,476 were part of the in-kind transfer described in Note 1. |

21

Notes to Consolidated Financial Statements (Unaudited) (Continued) |

7. Purchase and Sales of Investments:

Cost of purchases and proceeds from sales of investment securities (excluding short-term investments) for the period ended September 30, 2022, were as follows:

| | | Purchases | | | Sales | | |

| | | Long-Term U.S.

Government

Securities | | | Other

Long-Term

Securities | | | Long-Term U.S.

Government

Securities | | | Other

Long-Term

Securities | | |

| | | $ | — | | | $ | 15,398,802 | | | $ | — | | | $ | 42,000 | | |

8. Subsequent Events

As discussed in Note 6 above, to provide a limited degree of liquidity to shareholders, the Fund may, from time to time, offer to repurchase shares pursuant to written tenders by shareholders. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Board of Trustees, in its sole discretion. With respect to any repurchase offer, shareholders tendering shares for repurchase must do so by a date specified in the notice describing the terms of the repurchase offer. On November 10, 2022, the Fund offered to repurchase up to 517,540 Class I shares (approximately 5% of outstanding Class 1 shares of the Fund as of December 27, 2022) from shareholders, with a December 31, 2022 valuation date.

The Fund has evaluated the possibility of subsequent events after the balance sheet date of September 30, 2022, through the date that the financial statements are issued. The Fund has determined that there are no additional material events that would require recognition or disclosure in this report through this date.

22

Other Information (Unaudited) |

Proxy Voting

A description of the policies and procedures that the Fund’s investment adviser and subadviser uses to vote proxies relating to the Fund’s portfolio securities is available, without charge, upon request, by calling 1-704-805-7200, and on the SEC’s EDGAR database on its website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available, on the SEC’s EDGAR database on its website at http://www.sec.gov or by calling 1-704-805-7200.

Quarterly Reporting

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Forms N-PORT are available on the SEC’s EDGAR database on its website at http://www.sec.gov.

Advisory & Sub-Advisory Agreements

At their meeting in September 2022 (the “Meeting”), the Trustees, including the Trustees who are not “interested persons” (as such term is defined in the 1940 Act) of the Fund, (the “Independent Trustees”), approved the (i) investment advisory agreement with Barings (the “Investment Management Agreement”) and the (ii) subadvisory agreement between Barings and BIIL (the “Investment Subadvisory Agreement”) for the Fund and MassMutual Private Equity Funds LLC (“MMPEF” and together with the Fund, collectively, the “Funds”). In preparation for the Meeting, the Trustees requested, and Barings provided in advance, certain materials relevant to the consideration of the Investment Management Agreement and Investment Subadvisory Agreement (the “Board Materials”). In all of their deliberations, the Trustees were advised by independent counsel.

At the Meeting, information was presented by Barings, which included among other things: (i) the financial condition, stability, and business strategy of Barings; (ii) the ability of Barings with respect to regulatory compliance and its ability to monitor compliance with the investment policies of the Funds; (iii) Barings’ ability to provide investment oversight, administrative, and shareholder services; and (iv) the experience and qualifications of the personnel of Barings that perform, or oversee the performance of, the services provided to the Funds and the needs of the Funds for administrative and shareholder services. The Independent Trustees also reviewed and considered information included in the Board Materials or discussed at the Meeting concerning possible economies of scale and potential profitability of Barings’ advisory relationship with the Funds.

Also at the Meeting, the Independent Trustees, with respect to the Investment Subadvisory Agreement for the Funds, discussed with Barings and considered a wide range of information presented at the Meeting about, among other things: (i) the terms of the Investment Subadvisory Agreement; (ii) the scope and quality of services that BIIL will provide under the Investment Subadvisory Agreement; (iii) past investment performance of BIIL; and (iv) the fees payable to BIIL by Barings, and the effect of such fees on the profitability to Barings.

Prior to the votes being taken to approve the Investment Management Agreement and Investment Subadvisory Agreement, the Independent Trustees met separately in executive session to discuss the appropriateness of such contracts. The Independent Trustees weighed the foregoing matters in light of the advice given to them by their independent legal counsel as to the law applicable to the review of investment advisory contracts. In arriving at a decision, the Trustees, including the Independent Trustees, did not identify any single matter as all-important or controlling. The foregoing summary does not detail all of the matters considered.

The Independent Trustees concluded, with respect to the Investment Management Agreement and Investment Subadvisory Agreement, that: (i) overall, they were satisfied with the nature, extent, and quality of the services expected to be provided under the Investment Management Agreement and Investment Subadvisory Agreement; (ii) Barings’ projected levels of profitability from its relationship to the Funds are not excessive and the advisory and subadvisory fee amounts under the Investment Management Agreement and Investment Subadvisory Agreement, respectively, and the Funds’ total expenses are fair and reasonable; (iii) the investment strategy of Barings appears well suited to the Funds given the investment objectives and policies; and (iv) the terms of the Investment Management Agreement and Investment Subadvisory Agreement are fair and reasonable with respect to the Funds, and are in the best interests of the Funds’ shareholders.

23

Other Information (Unaudited) (Continued) |

The Investment Management Agreement and Investment Subadvisory Agreement each became effective on September 27, 2022.

The Board also considered the information presented and discussed regarding the investment management agreement and subadvisory agreement between Barings and BIIL, as applicable for the MMPEF Subsidiary. All of the agreements for the MMPEF Subsidiary also became effective on September 27, 2022.

24

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

| (b) | Not applicable to the Registrant. |

Item 2. Code of Ethics.

The information required by this Item 2 is only required in an annual report on this Form N-CSR.

Item 3. Audit Committee Financial Expert.

The information required by this Item 3 is only required in an annual report on this Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The information required by this Item 4 is only required in an annual report on this Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

The information required by this Item 5 is only required in an annual report on this Form N-CSR.

Item 6. Schedule of Investments.

| (a) | The information required by this Item 6 is included as part of the semiannual report to shareholders filed under Item 1 of this Form N-CSR. |

| (b) | Not applicable to this filing. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The information required by this Item 7 is only required in an annual report on this Form N-CSR.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Information pertaining to the portfolio managers of the Registrant, as of September 30, 2022, is set forth below. The portfolio managers of the Fund are:

Mina Pacheco Nazemi

Mina Pacheco Nazemi is the Head of the Barings Diversified Alternative Equity team and serves on the investment committee. She is also responsible for originating, underwriting and monitoring primary fund, direct/co-investments, and secondary fund opportunities for private equity and real assets. Mina has worked in the industry since 1998 with experience as a general partner and limited partner in private markets and focused on underwriting direct/co-investment opportunities. Prior to joining Barings in 2017, Mina held several leadership and investment positions including co-founder and partner at Aldea Capital Partners and partner and investment committee member at GCM Grosvenor Customized Fund Investment Group (formerly Credit Suisse CFIG).

Antonio Cruz

Antonio Cruz is part of the Barings Diversified Alternative Equity team and is responsible for portfolio management. Antonio has worked in the industry since 2008 and has experience investing in and managing private equity assets as a direct investor and as a limited partner. Prior to joining Barings in 2021, Antonio was a senior associate and founding member at Diverse Communities Impact Fund (DCIF), where he focused on underwriting impact investments and monitoring back office functions. Prior to DCIF, he was an associate at Energy Power Partners (EPP), executing direct private equity investments and acting as controller for several portfolio companies within the fund. Prior to EPP, Antonio was an investment analyst at the Credit Suisse Customized Fund Investment Group.

J.R. Keeve

J.R. Keeve is a member of the Barings Diversified Alternative Equity team and is responsible for the underwriting and monitoring of private equity funds and co-investments in North America. J.R. has worked in the industry since 2011. Prior to joining Barings in 2016, he was with Fidus Investment Advisors, where he focused on the analysis, structuring and documentation of direct mezzanine and private equity co-investments. Prior to Fidus, he worked in a mergers and acquisitions advisory role at Edgeview Partners (now Piper Sandler).

Other Accounts Managed by the Portfolio Managers

The following tables lists the number and types of accounts, other than the Fund, managed by the Fund’s portfolio managers and assets under management in those accounts, as of September 30, 2022 ($ in millions).

| | | Registered Investment

Companies | | | Other Pooled

Investment Vehicles | | | Other Accounts | |

| Portfolio Manager | | Number of

Accounts | | | Total Assets

($ in millions) | | | Number of Accounts | | | Total Assets

($ in millions) | | | Number of

Accounts | | | Total Assets

($ in millions) | | |

| Mina Pacheco Nazemi | | | 0 | | | $ | 0 | | | | 2 | | | $ | 304.7 | | | | 10 | | | $ | 5,320.7 | | |

| Antonio Cruz | | | 0 | | | $ | 0 | | | | 0 | | | $ | 0 | | | | 0 | | | $ | 0 | | |

| J.R. Keeve | | | 0 | | | $ | 0 | | | | 0 | | | $ | 0 | | | | 0 | | | $ | 0 | | |

Compensation

The discussion below describes the portfolio managers’ compensation as of September 30, 2022.

Compensation packages at Barings are structured such that key professionals have a vested interest in the continuing success of each firm. Portfolio managers’ compensation is comprised of base salary, and a discretionary, performance-driven annual bonus. Certain key individuals may also receive a long-term incentive award and/or a performance fee award. As part of the firm’s continuing effort to monitor retention, Barings participate in annual compensation surveys of investment management firms and subsidiaries to ensure that Barings’ compensation is competitive with industry standards.

The base salary component is generally positioned at mid-market. Increases are tied to market, individual performance evaluations and budget constraints.

Portfolio managers may receive a yearly bonus. Factors impacting the potential bonuses include but are not limited to: i) investment performance of funds/accounts managed by a portfolio manager, ii) financial performance of Barings, iii) client satisfaction, and iv) teamwork.

Long-term incentives are designed to share the long-term success of the firm and take the form of deferred cash awards, which may include an award that resembles phantom restricted stock; linking the value of the award to a formula which includes Barings’ overall earnings. A voluntary separation of service will result in a forfeiture of unvested long-term incentive awards.

Ownership of Securities

As of September 30, 2022, none of the portfolio managers had any direct or indirect beneficial ownership of the Fund.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

There were no purchases made by or on behalf of the Registrant or any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) under the Exchange Act (17 CFR 240.10b-18(a)(3)), of shares or other units of any class of the registrant’s equity securities that is registered by the Registrant pursuant to Section 12 of the Exchange Act (15 U.S.C. 781).

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees since the Registrant last provided disclosure in response to this item.

Item 11. Controls and Procedures.