Filed pursuant to Rule 424(b)(3)

File No. 333-256560

CASCADE PRIVATE CAPITAL FUND

(FORMERLY, Barings Private Equity Opportunities and Commitments Fund)

SUPPLEMENT DATED MARCH 14, 2024

TO

PROSPECTUS AND STATEMENT OF ADDITIONAL INFORMATION (“SAI”)

EACH DATED AUGUST 1, 2023, EACH AS SUPPLEMENTED

__________________________________________________________________________________

THIS SUPPLEMENT SUPERSEDES AND REPLACES THE SUPPLEMENT DATED FEBRUARY 28, 2024 RELATING TO THE FUND

This Supplement amends certain information in the Prospectus and SAI for the Cascade Private Capital Fund (formerly, the Barings Private Equity Opportunities and Commitments Fund) (the “Fund”) and should be read in conjunction with the Prospectus and SAI. Capitalized terms used in this Supplement and not otherwise defined herein shall have the meanings given to them in the Prospectus. Unless otherwise indicated, all other information included in the Prospectus and SAI that is not inconsistent with the information set forth in this Supplement remains unchanged.

In February 2024, the Board of Trustees (the “Prior Board”) of the Fund considered and approved by unanimous written consent the appointment of Paul S. Atkins, Dominic Garcia, Stephen L. Nesbitt and Paul J. Williams (collectively, the “New Board,” each a “New Trustee”) as Trustees of the Fund and each member of the Prior Board resigned from the Board, such actions to take place subject to the approval by the Fund’s shareholder. Shareholder approval of the appointment of the New Board and the resignation of the Prior Board occurred on February 26, 2024.

At a special meeting of the New Board held on February 27, 2024 (the “Meeting”), the New Board considered and approved the appointment of Cliffwater LLC (“Cliffwater”) as investment adviser of the Fund effective as of February 27, 2024 (the “Effective Date”). At the Meeting, the New Board also approved: (1) the termination of the Fund’s investment advisory agreement with Barings LLC and the implementation of a new investment advisory agreement between the Fund and Cliffwater; (2) the termination of Baring International Investment Limited as sub-adviser of the Fund; (3) the adoption of a fundamental policy, effective as of May 15, 2024, to conduct semi-annual repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding pursuant to Rule 23c-3 of the Investment Company Act of 1940, as amended; (4) certain other changes to the Fund’s fundamental policies; and (5) the adoption of the Third Amended and Restated Agreement and Declaration of Trust of the Fund. These changes were approved by the Fund’s shareholder.

In addition, at the Meeting, the New Board considered and approved, among other things, the following: (1) a change in the name of the Fund to Cascade Private Capital Fund; (2) a change in the address of the Fund to c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212; (3) the replacement of State Street Bank and Trust Company (“State Street”) with UMB Fund Services, Inc. as the Fund’s transfer agent; (4) the replacement of Barings LLC with State Street, the Fund’s former sub-administrator, as the Fund’s administrator; (5) the replacement of ALPS Distributors, LLC with Foreside Fund Services, LLC as the Fund’s principal underwriter; (6) the replacement of Deloitte & Touche LLP with Cohen & Company, Ltd. as the Fund’s independent registered public accounting firm; and (7) a change in the name of the Fund’s Class 1 Shares to Class I Shares.

As of the Effective Date, the following changes are made to the Prospectus and SAI:

| 1. | All references to “Barings Private Equity Opportunities and Commitments Fund” in the Prospectus and SAI are replaced with “Cascade Private Capital Fund.” |

| 2. | All references to “Barings LLC,” “Barings” and “Barings’” in the Prospectus and SAI are replaced with “Cliffwater LLC,” “Cliffwater” and “Cliffwater’s,” respectively. |

| 3. | All references to “Baring International Investment Limited,” “BIIL” and the “subadviser” in the Prospectus and SAI are deleted. |

| 4. | All references to “Advisers” and “Advisers’” in the Prospectus and SAI are replaced with “Adviser” and “Adviser’s,” respectively. |

| 5. | All references to “300 South Tryon Street, Suite 2500, Charlotte, NC 28202” in the Prospectus and SAI are replaced with “235 West Galena Street, Milwaukee, WI 53212.” |

| 6. | All references to “(704) 805-7200” in the Prospectus and SAI are replaced with “(888) 442-4420.” |

| 7. | All references to “https://www.Barings.com/fund” in the Prospectus and SAI are replaced with “https://www.cliffwaterfunds.com”. |

| 8. | All references to “ALPS Distributors, Inc.” in the Prospectus and SAI are replaced with “Foreside Fund Services, LLC.” |

| 9. | All references to “Class 1 Shares” and “Class 1” in the Prospectus and SAI are replaced with “Class I Shares” and “Class I,” respectively. |

| 10. | All references to “Class 2 Shares,” “Class 2,” “Class 3 Shares,” “Class 3,” Class 4 Shares” and “Class 4” in the Prospectus and SAI are deleted. |

| 11. | All references to “Private Equity Investment” and “Private Equity Investments” in the Prospectus and SAI are replaced with “Private Capital investment” and “Private Capital investments,” respectively. |

| 12. | All references to “Corporate Subsidiary” and “Corporate Subsidiaries” in the Prospectus and SAI are replaced with “Subsidiary” and “Subsidiaries,” respectively. |

As of the Effective Date, the following changes are made to the Prospectus:

| 1. | The following replaces the first and second paragraphs, including the list in between those paragraphs, on page 1 of the Prospectus: |

Cascade Private Capital Fund (formerly known as the Barings Private Equity Opportunities and Commitments Fund) is a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. Effective May 15, 2024, the Fund will have a fundamental policy with respect to repurchases pursuant to Rule 23c-3 of the 1940 Act. Cliffwater LLC (“Cliffwater” or the “Adviser”) serves as the investment adviser of the Fund.

The Fund’s investment objective is to generate long-term capital appreciation by investing in a portfolio of private equity, private debt, and other private market investments (together, “Private Capital”); that provide attractive risk-adjusted return potential. Private Capital investments are investments into the equity and/or debt of private companies. The Fund will seek to achieve its objective through exposure to a broad set of managers, strategies and transaction types across multiple sectors, geographies and vintage years. Under normal circumstances, the Fund intends to invest and/or make capital commitments of at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in assets representing investments in Private Capital (“Private Capital Assets”). This test is applied at the time of investment; later percentage changes caused by a change in the value of the Fund’s assets, including as a result of the issuance or repurchase of Shares, will not require the Fund to dispose of an investment.

Except as otherwise indicated, the Fund may change its investment objective and any of its investment policies, restrictions, strategies, and techniques without Shareholder approval. The investment objective of the Fund is not a fundamental policy of the Fund and may be changed by the Board of Trustees of the Fund (the “Board”) without the vote of a majority (as defined by the 1940 Act) of the Fund’s outstanding Shares. The Fund will notify Shareholders of any changes to its investment objective or any of its investment policies, restrictions, strategies or techniques.

| 2. | The following replaces the table and footnote 1 thereto on page 1 of the Prospectus: |

| | Class I Shares | Total Maximum |

| Price to Public(1) | Current NAV | Up to $500,000,000 |

| Sales Load | None | None |

| Proceeds to the Fund (Before Expenses)(2) | Amount Invested at Current NAV | Up to $500,000,000 |

| (1) | Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group) (the “Distributor”), acts as the principal underwriter of the Fund’s shares on a best-efforts basis. The Distributor is not obligated to sell any specific number of shares, nor have arrangements been made to place shareholders’ funds in escrow, trust, or similar arrangements. Generally, the stated minimum investment in the Fund is $25,000,000 for Class I Shares, which stated minimum may be reduced for certain investors. See “Purchasing Shares” below. |

| 3. | The following replaces the first paragraph on page 2 of the Prospectus: |

This prospectus (the “Prospectus”) applies to the offering of one class of shares of beneficial interests (“Shares”) in the Fund, designated as Class I Shares. Pursuant to exemptive relief obtained from the Securities and Exchange Commission (“SEC”), the Fund is permitted to offer more than one class of Shares. In the future, other classes of Shares may be registered or included in this offering. The Fund’s Shares are currently offered as of the first business day of each month based on the Fund’s NAV per Share as of the close of business on the business day immediately preceding such date. As used in this Prospectus, “business day” refers to any day that the New York Stock Exchange is open for business. The Fund intends to offer Shares in a continuous offering. When the Fund commences a continuous offering, the Shares will generally be offered for purchase on any business day, except that Shares may be offered more or less frequently as determined by the Fund in its sole discretion. The Fund has registered $500 million of Shares for sale under the registration statement to which this Prospectus relates. The Fund reserves the right to reject a purchase order for any reason.

No holder of Shares (each, a “Shareholder” and collectively, the “Shareholders”) will have the right to require the Fund to redeem its Shares. The Fund is a closed-end investment company that, effective May 15, 2024, will have a fundamental policy to make semi-annual repurchase offers, at per-class net asset value, of not less than 5% nor more than 25% of the Fund’s outstanding Shares on the repurchase request deadline. If the value of Shares tendered for repurchase exceeds the value the Fund intended to repurchase, the Fund may determine to repurchase less than the full number of Shares tendered. In such event, Shareholders will have their Shares repurchased on a pro rata basis, and tendering Shareholders will not have all of their tendered Shares repurchased by the Fund. There is no assurance that you will be able to tender your Shares when or in the amount that you desire. See “Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares,” “Repurchase Offers Risk,” and “Repurchases of Shares and Transfers.”

| 4. | The following replaces the disclosure beside the third bullet point on page 2 of the Prospectus: |

Although the Fund is required to implement a Share repurchase program, only a limited number of Shares will be eligible for repurchase by the Fund. Shares are not redeemable at a Shareholder’s sole option nor are they exchangeable for shares of any other fund. As a result, an investor may not be able to sell or otherwise liquidate his or her Shares.

| 5. | The following disclosures are added to page 2 of the Prospectus: |

| · | You should consider that you may not have access to the money you invest for an indefinite period of time. |

| · | All or a portion of an annual distribution may consist solely of a return of capital (i.e., from your original investment) and not a return of net investment income. |

| 6. | The following replaces the fourth sentence of the final paragraph on page 2 of the Prospectus: |

You can request a copy of the SAI and annual and semiannual reports of the Fund without charge by writing to the Fund, c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212, or by calling the Fund toll-free at (888) 442-4420.

| 7. | The fourth paragraph on page 3 of the Prospectus is deleted in its entirety. |

| 8. | The following replaces the disclosure within the section entitled “Summary – The Fund” beginning on page 5 of the Prospectus: |

Cascade Private Capital Fund (the “Fund”) (formerly known as the Barings Private Equity Opportunities and Commitments Fund) is a Delaware statutory trust that is registered under the 1940 Act as a non-diversified, closed-end management investment company. The Fund was organized as a Delaware statutory trust on May 24, 2021. Cliffwater LLC (“Cliffwater” or the “Adviser”) serves as the investment adviser of the Fund. Cliffwater has served as investment adviser of the Fund since February 27, 2024. Prior to that date, the Fund was advised by a different investment adviser.

Effective May 15, 2024, the Fund will have a fundamental policy to make semi-annual repurchase offers, at per-class NAV, of not less than 5% nor more than 25% of the Fund’s outstanding Shares on the repurchase request deadline. The Fund will offer to purchase only a small portion of its Shares in connection with each repurchase offer, and there is no guarantee that Shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. If a repurchase offer is oversubscribed, the Fund may repurchase only a pro rata portion of the Shares tendered by each Shareholder. The potential for proration may cause some investors to tender more Shares for repurchase than they wish to have repurchased or result in investors being unable to liquidate all or a given percentage of their investment during the particular repurchase offer.

Shares in the Fund provide limited liquidity since Shareholders will not be able to redeem Shares on a daily basis. A Shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. In addition, with very limited exceptions, Shares are not transferable, and liquidity will be provided only through repurchase offers made semi-annually by the Fund. Shares in the Fund are therefore suitable only for investors who can bear the risks associated with the limited liquidity of Shares and should be viewed as a long-term investment. See “Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares,” “Repurchase Offers Risk,” and “Repurchases of Shares and Transfers.”

The Fund is an appropriate investment only for those investors who can tolerate a high degree of risk and do not require a liquid investment.

The Fund offers one class of shares of beneficial interest (“Shares”) designated as Class I Shares. Pursuant to exemptive relief obtained from the SEC, the Fund is permitted to offer more than one class of Shares. The Fund may offer additional classes of Shares in the future.

| 9. | The following replaces the headings and disclosure beneath the headings “Private Equity Investment Strategy,” “Private Equity Financing Stages,” “Private Equity Investment Structures,” “Geographic Regions,” “Capitalization,” “Subsidiaries” and “Liquidity” within the section entitled “Summary – The Fund” beginning on page 5 of the Prospectus and the disclosure within the sections entitled “Investment Objective and Strategies” beginning on page 42 of the Prospectus and “Investment Process Overview” beginning on page 45 of the Prospectus: |

Investment Objective

The Fund’s investment objective is to generate long-term capital appreciation by investing in a portfolio of private equity, private debt, and other private market investments (together, “Private Capital”); that provide attractive risk-adjusted return potential. Private Capital investments are investments into the equity and/or debt of private companies. The Fund will seek to achieve its objective through exposure to a broad set of managers, strategies and transaction types across multiple sectors, geographies and vintage years. Under normal circumstances, the Fund intends to invest and/or make capital commitments of at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in assets representing investments in Private Capital (“Private Capital Assets”). This test is applied at the time of investment; later percentage changes caused by a change in the value of the Fund’s assets, including as a result of the issuance or repurchase of Shares, will not require the Fund to dispose of an investment.

Except as otherwise indicated, the Fund may change its investment objective and any of its investment policies, restrictions, strategies, and techniques without Shareholder approval. The investment objective of the Fund is not a fundamental policy of the Fund and may be changed by the Board without the vote of a majority (as defined by the 1940 Act) of the Fund’s outstanding Shares. The Fund will notify Shareholders of any changes to its investment objective or any of its investment policies, restrictions, strategies or techniques.

Investment Strategies and Overview of Investment Process

Private Capital refers to investments into the equity and/or debt of private companies. Private Capital investments can follow a variety of strategies including, without limitation, equity investments in which a mature company is acquired from current shareholders (“Buyouts”), equity investments in early stage or other high growth potential companies (“Venture Capital” and “Growth Equity,” respectively), and lending to businesses, broadly defined as providing capital or assets to businesses or individuals in exchange for regular payments (“Private Debt”).

Private Capital Strategy Descriptions

| · | Buyouts: Control investments in established, cash flow positive companies are generally classified as Buyouts. Buyout investments may focus on small-, mid- or large-capitalization companies, and such investments collectively represent a majority of the capital deployed in the overall private equity market. The use of debt financing, or leverage, is prevalent in buyout transactions — particularly in the large-cap segment. |

| · | Venture Capital: Investments in new and emerging companies are usually classified as Venture Capital. Such investments are often in technology, healthcare, or other high growth industries. Companies financed by Venture Capital are often not cash flow positive at the time of investment and may require several rounds of financing before they can be sold privately or taken public. Venture Capital investors may finance companies along the full path of development or focus on certain sub-stages (usually classified as seed, early-stage, and late-stage) and often do so in partnership with other investors. |

| · | Growth Equity: Growth Equity investments are usually minority investments in high growth companies that require additional capital to expand their businesses but are typically more mature than the recipients of traditional Venture Capital. Such companies are typically profitable, breakeven, or near-breakeven and have largely mitigated the basic risk in their business plan. Growth-stage companies range from companies that were previously funded by Venture Capital investors to those businesses with no third-party investors. Unlike buyout transactions, Growth Equity investments typically utilize low or no leverage. Investment returns in Growth Equity are driven by strong organic revenue growth and typically benefit from downside protection through a preferred position in a company’s capital structure. Growth Equity investors are adept in professionalizing and supporting fast-growing companies, adding value through introducing governance procedures, human capital, and industry-specific operating best practices. |

| · | Private Debt: Private Debt strategies entail lending to businesses, broadly defined as providing capital or assets to businesses or individuals in exchange for regular payments, the level of which is commensurate with the probability of loss for each investment or strategy, or through the provision of capital to businesses or individuals by acquiring assets from those businesses or individuals that produce regular cash flows as an alternative to a traditional loan, such as receivables factoring or a sale leaseback of real estate or equipment (“real assets”). Private Debt investments made by the Fund may take the form of secured or unsecured bonds and loans with a fixed or floating coupon, a structured capital instrument with a preference to common equity holders and a stated contractual interest payment or rate of return, assets with fixed lease payments, or other assets with predictable cash flow streams. Investments may be made directly or indirectly through a range of investment vehicles that the Adviser believes offer high current income across corporate, real asset and alternative credit opportunities. The Fund may invest some, or all, of its Private Debt target allocation in the Cliffwater Corporate Lending Fund (“CCLFX”), a registered closed-end investment company (a “Closed-End Fund”) that is also managed by Cliffwater. |

Private Capital Investment Structures

The Fund will seek to achieve its investment objective through broad exposure to Private Capital investments, including semi-liquid or listed investments, that may include: (i) direct investments in the equity and/or debt of a private company (“Direct Investments”); (ii) secondary purchases of interests in private funds (each a “Portfolio Fund,” and collectively, the “Portfolio Funds”) managed by third-party managers (“Portfolio Fund managers”) and other private assets (together, “Secondary Investments” or “secondaries”); (iii) primary fund commitments; (iv) direct or secondary purchases of liquid private equity instruments; (v) other liquid investments, including exchange-traded funds (“ETFs”); (vi) Closed-End Funds and private and public business development companies (“BDCs”) and (vii) short-term investments, including money market funds, short term treasuries, or other liquid investment vehicles. Portfolio Funds, mutual funds, ETFs, registered Closed-End Funds and BDCs in which the Fund may invest are collectively referred to as “Underlying Funds.”

The Fund’s investments will typically not be registered with the SEC or any state securities commission and will typically not be listed on any national securities exchange. The amount of public information available with respect to the issuers in which the Fund invests may generally be less extensive than that available for issuers of registered or exchange listed securities.

The Fund’s portfolio will be constructed with investments across the following Private Capital investment structures:

| · | Primary Investments: Primary investments (“Primary Investments” or “primaries”) are limited partnership interests in newly established private equity funds that are typically acquired by way of subscription during their initial fundraising period. Most private equity fund sponsors raise new funds every two to four years, and many top-performing funds are closed to new investors. Because of the limited windows of opportunity for making primary investments in particular funds, strong relationships with leading fund sponsors are highly important for investors in Primary Investments. |

Investors in primaries subscribe for interests during an initial fundraising period, and their capital commitments are then used to fund investments in a number of individual operating companies during a defined investment period and to pay associated management fees and expenses throughout the fund’s term. The investments of the fund are usually unknown at the time of commitment, and investors typically have little or no ability to influence the investments that are made during the fund’s life. Because primary investors must rely on the expertise of the fund manager, an accurate assessment of the manager’s capabilities is essential.

Primary Investments typically exhibit a value development pattern, commonly known as the “J-curve,” in which the fund’s NAV typically declines moderately during the early years of the fund’s life as investment-related fees and expenses are incurred before investment gains have been realized. As the fund matures and portfolio companies are sold, the pattern is expected to reverse with increasing NAV and distributions to fund investors. Primary Investments typically have a full term of ten to thirteen years with an average portfolio company investment hold period of three to eight years. Capital is typically deployed for new investments over the first three to five years, and the portfolio companies are then held for three to eight years before being sold with cash proceeds distributed back to fund investors. The private fund sponsor will often receive performance-based compensation, also called a carried interest allocation, typically entitling it to approximately 20% of net profits on the fund’s investments after meeting a minimum return. After all of the fund’s assets have been disposed, the fund is dissolved.

| · | Secondary Investments: Secondary Investments are the assumption or purchase of existing limited partner interests, typically in seasoned Private Capital funds or Co-Investments that are acquired in privately negotiated transactions. The original subscriber of the primary investment is often the seller of the asset. The stage of maturity for the asset can vary from early in the investment period of the fund to near full term of the fund. |

Pricing for a Secondary Investment is negotiated based on the reported NAV and expected timing of cash flows (capital calls for contributions to the Portfolio Fund, clawbacks of amounts distributed to the Portfolio Fund’s general partner and distributions of returns) of the Portfolio Fund(s) or Co-Investment(s). A majority of available secondaries have existing investments in portfolio companies. As a result, the secondary buyer has greater visibility to the assets being purchased. Investment returns are less impacted by the J-curve pattern (the tendency for a fund’s NAV to decline moderately during the early years of the fund’s life as investment-related fees and expenses are incurred before investment gains have been recognized) expected from a primary investment and distribution patterns may be accelerated as the buyer’s participation is at a later stage in the primary’s life. The secondary buyer does not participate in prior distributions from the acquired limited partnership interest or the previous growth in value of the assets. The Secondary Investment liquidates and dissolves in the same manner as a Primary Investment.

| · | Co-Investments: Co-investments (“Co-Investments”) are direct investments in specific companies or assets or indirect investments in specific companies or assets through a vehicle managed and controlled by a general partner or sponsor. Co-Investments are typically offered to Private Capital fund investors when the Private Capital fund sponsor believes that there is an attractive investment for the fund, but the total size of the potential holding exceeds the targeted size or allocation for the fund. Co-investors will generally participate in these investments at the same entry valuation as the Private Capital fund sponsor but with respect to any follow-on investment, such investment may be made at a different valuation. Co-investments, unlike investments in primary funds, often do not bear an additional layer of fees or bear significantly reduced fees. Co-investments typically have a three- to eight-year holding period. |

| · | Listed Investments: Listed Private Capital investments gain access to underlying private assets through investments in listed entities that invest in private transactions or private funds or that earn fees and/or carried interest from such assets. Historically, the prices of listed Private Capital investments have been sensitive to economic conditions and, at certain times, could be purchased at discounts relative to similar assets in private transactions. |

The Adviser will not cause the Fund to engage in co-investments alongside affiliates unless the Fund has received an order granting an exemption from Section 17 of the 1940 Act or unless such investments are not prohibited by Section 17(d) of the 1940 Act or interpretations of Section 17(d) as expressed in SEC no-action letters or other available guidance.

Investment Process Overview

Due Diligence and Selection of Investments

Cliffwater follows a disciplined approval process for the purpose of identifying investment opportunities within a consistent framework. Cliffwater’s philosophy is that a repeatable process and consistent team engagement leads to better investment outcomes, and the due diligence process is designed to evaluate opportunities against these criteria. Throughout due diligence, Cliffwater maintains a collaborative decision-making process designed to encourage frequent input from its investment committee and other investment professionals.

Manager/Fund Selection

Throughout the course of due diligence on a Fund investment (each a “Fund Investment,” and collectively, the “Fund Investments”), Cliffwater focuses on assessing several important attributes of the sponsor, including (i) track record benchmarking and analysis (including a fundamental analysis around key indicators of the sponsor’s historical value creation and a revaluation of the unrealized portfolio), (ii) team quality, experience, continuity, and depth, (iii) consistency and attractiveness of strategy, investment parameters and an ability to deploy capital in the size of assets in which the sponsor has a demonstrable track record of success, and (iv) economic alignment (allocation of carry and the size of the general partner commitment). Cliffwater’s operations team also conducts operational due diligence on the sponsor and Cliffwater’s legal due diligence team conducts legal due diligence on the fund documents.

Cliffwater believes that investors benefit by selecting management firms that specialize in each strategy. Cliffwater maintains a global database exceeding 4,600 Private Capital fund managers, conducting due diligence, and giving an A, B, or C-rating to each fund.

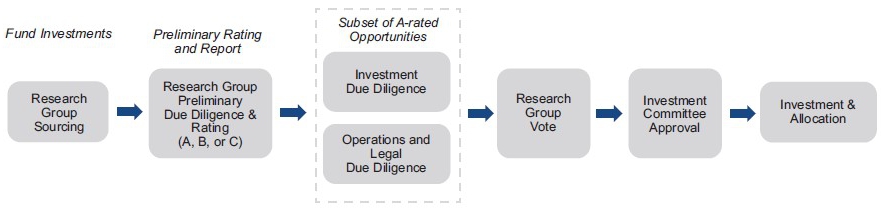

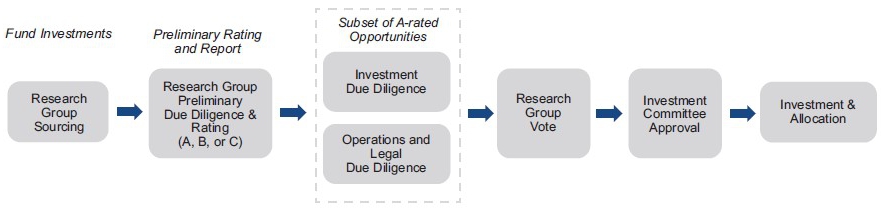

The Fund investment selection process is illustrated by the diagram below.

| • | Sourcing. Cliffwater’s Private Capital research team is responsible for sourcing investment opportunities and funds. These professionals are responsible for primary fund opportunities across a wide spectrum of private equity, Private Debt, and private real asset opportunities and managers. Each has developed sector specialization and manager knowledge from their years of experience, which extends globally. The manager relationships lead to origination of co-investment and secondary opportunities. |

| • | Rating. Each research team member then rates (A, B, or C) investments and fund opportunities and prepares a preliminary due diligence report supporting their rating. A-ratings generally comprise a small fraction 10-20% of the universe of opportunities. Ratings can change as the research team re-evaluates over time. |

| • | Due Diligence. Cliffwater next conducts thorough due diligence on the top A-rated investments and fund opportunities. This involves separate investment and operations due diligence teams and separate investment and operational reports that further describe and assess the opportunity. In addition, Cliffwater expects to regularly communicate with private equity general partnerships (“GPs”) and limited partners (“LPs”) of Private Capital funds (collectively referred to as “Private Equity Investors”), managers and other personnel about statistical and factual information regarding economic factors and trends to utilize in making the investment decisions for the Fund. This interaction facilitates ongoing portfolio analysis and may help to address potential issues, such as loss of key team members or proposed changes in constituent documents. It also provides ongoing due diligence feedback, as additional Co-Investments with a particular GP are considered. Cliffwater may also perform background and reference checks on investment fund personnel. |

Key value drivers in Cliffwater’s investment due diligence process include:

| i. | Organization: Evaluation of the quality, experience, continuity, and depth of the team and the backing provided by their platform. |

| ii. | Investment process: Assessment of repeatable and differentiated processes for sourcing investment opportunities, transaction analysis, and overall investment strategy; consistency in strategy, investment parameters and an ability to deploy capital in the size of assets in which the sponsor has a demonstrable track record of success. |

| iii. | Portfolio construction: Transaction mix (capital structure, industry, sector, geography, etc.), position sizing, financing sources, economic alignment (allocation of carry and the size of the general partner commitment), and expenses. |

| iv. | Track record: Demonstrable track record of successfully originating, underwriting, and securing deals, and meeting return targets; fundamental analysis around key indicators of the sponsor’s historical value creation. |

Separately, Cliffwater’s operations due diligence team conducts an independent assessment of the operational risks of the investment opportunity.

Key value drivers in Cliffwater’s operations due diligence process include:

| i. | Governance: Evaluation of the regulatory and compliance program, role of the advisory board, and business risk management practices. |

| ii. | Infrastructure: Assessment of the non-investment personnel, segregation of duties and cash controls, service provider selection, and technology infrastructure. |

| iii. | Processes: Review of financing arrangements, investor transparency and disclosures, and ongoing investor communication. |

| iv. | Valuation: Evaluation of the valuation methodology, valuation review procedures, accounting processes, and fund expenses. |

| • | Approval — Research Group. The research team next votes to approve the investment or requests additional information if appropriate. |

| • | Final Approval — Investment Committee. Cliffwater’s Investment Committee approves all final investments/funds. If approved by the research team, the appropriate research professional will present the investment opportunity, with supporting reports, to the Investment Committee for final approval. |

| • | Ongoing Monitoring. Following the close of an investment, Cliffwater implements a diligent monitoring process that includes frequent meetings or calls with underlying investment managers, review of quarterly reports and annual audited financial statements, ongoing monitoring of key performance indicators related to portfolio holdings and underlying exposures, and performance analysis using a wide array of analytical tools and systems. |

Co-Investment Selection

Throughout the course of due diligence on a Co-Investment, Cliffwater focuses on evaluating various key aspects of each opportunity, which involves (i) performing an analysis of the sponsor that is leading the transaction, (ii) assessing the underlying sectors and industries where the investment operates and competes, (iii) understanding the target investment’s operating model, historical financial information and business plans, (iv) producing base case and downside cases as well as developing sensitivities around key drivers, and (v) conducting a detailed review of the proposed transaction terms, including valuation, capital structure, legal, tax and governance.

Portfolio Construction & Liquidity Management

In addition to asset selection, Cliffwater believes that portfolio construction is critical to the successful execution of the Fund’s investment strategy. Additionally, Cliffwater has established portfolio parameters to manage exposure across Primary Investments, Secondary Investments, and Co-Investments. These parameters are set with an understanding of the return, risk and cash flow attributes of each investment type, while also considering the portfolio effect provided by diverse investment opportunities, in an effort to (i) mitigate the “J-curve” (the tendency for a fund’s NAV to decline moderately during the early years of the fund’s life as investment-related fees and expenses are incurred before investment gains have been realized), (ii) reduce blind-pool risk (the risk associated with the wide flexibility and broad investment mandate afforded to certain pooled investment vehicles at the time the investment is made by the Fund), (iii) deploy investor capital in an efficient manner based on investment opportunity, (iv) grow and return investor capital sooner than typical illiquid, private equity structures, (v) manage portfolio volatility, and (vi) deliver superior risk-adjusted returns to its investors.

By tracking certain features, such as commitments, capital calls, distributions and valuations, Cliffwater will use a range of techniques to balance total returns with reoccurring distributions and liquidity targets, including (i) diversifying commitments across Private Capital Assets at different parts of fund lifecycles through the use of Primary Investments, Secondary Investments and Co-Investments, (ii) actively managing cash and liquid assets, and (iii) modeling and actively monitoring cash flows to mitigate cash drag and maintain appropriate levels of committed capital. In addition, the Fund may seek to establish credit lines to provide liquidity to satisfy Shareholder tender requests.

To enhance the Fund’s liquidity, particularly in times of possible net outflows through the tender of Shares by shareholders, Cliffwater may from time to time determine to sell certain of the Fund’s assets. The Fund may also invest in liquid assets that may include both fixed income and equity assets as well as public and private vehicles that derive their investment returns from fixed income and equity securities, including publicly listed companies that pursue the business of private equity investing; publicly listed companies that invest in private equity transactions or funds; alternative asset managers, holding companies, investment trusts, ETFs, closed-end funds, financial institutions and other vehicles whose primary purpose is to invest in, lend capital to or provide services to privately held companies; and certain derivatives, such as options and futures.

There can be no assurance that the objective of the Fund with respect to liquidity management will be achieved or that the Fund’s portfolio design strategies will be successful. Prospective investors should refer to the discussion of the risks associated with the investment strategy and structure of the Fund found under “General risks” and “Limits of Risk Disclosure.”

Portfolio Monitoring

Cliffwater monitors each investment, including performance measurement relative to initial investment expectations, frequent interactions and periodic in-person visits with the sponsors and attendance of annual general meetings and advisory board meetings. The ongoing monitoring process measures key performance indicators, transactional milestones, investment pacing, volatility metrics, investment consistency relative to the stated strategy, qualitative factors on the sponsor and its professionals, reporting quality and various macro factors.

Description of Adviser’s Experience with Private Capital

The Adviser has been advising on private equity and private equity funds since its founding in 2004. It has been recommending such investments to its advisory clients since that time. The Adviser has dedicated significant resources to developing its expertise in Private Capital and cultivating relationships with investment advisers that it believes to be top-tier. The Adviser brings to the management of the Fund its expertise, experience and access in Private Capital.

The Adviser’s research also shows that there is no single investment style that is demonstrably better than others, and the Adviser believes that a superior outcome can be achieved when experienced investment advisers of different styles are combined.

Geographic Regions and Foreign Currency Exposure

The Fund may, directly or indirectly, make investments outside of the United States, including in emerging markets. The Fund’s non-U.S. investments are expected to be primarily in Europe, Asia, and Canada and, to a lesser extent in Latin America and the Middle East. Emerging market countries are those countries included in the MSCI Emerging Markets Index.

The Fund’s investment and strategies will involve exposure to foreign currencies. The Fund may seek to hedge all or a portion of the Fund’s foreign currency risk. Depending on market conditions and the views of the Adviser, the Fund may or may not hedge all or a portion of its currency exposures.

Subsidiaries

The Fund may make investments through direct and indirect wholly owned subsidiaries (each a “Subsidiary” and collectively, the “Subsidiaries”). Such Subsidiaries will not be registered under the 1940 Act; however, the Fund will wholly own and control any Subsidiaries. The Board has oversight responsibility for the investment activities of the Fund, including its investment in any Subsidiary, and the Fund's role as sole direct or indirect shareholder of any Subsidiary. To the extent applicable to the investment activities of a Subsidiary, the Subsidiary will follow the same compliance policies and procedures as the Fund. The Fund would “look through” any such Subsidiary to determine compliance with its investment policies.

Borrowing by the Fund

Cliffwater believes the Fund’s investment strategy favors a modest amount of leverage consistent with the statutory limitations. Accordingly, the Fund may utilize leverage from borrowings, including through borrowings by one or more special purpose vehicles (“SPVs”) that are Subsidiaries of the Fund, to enhance yield within the 300% asset coverage (up to 50% of the Fund’s net assets) requirements of an investment company. Certain investments may be held by these SPVs. The Fund is authorized to borrow cash in connection with its investment activities, to satisfy repurchase requests from Fund shareholders, and to otherwise provide the Fund with temporary liquidity. Borrowings will be limited to 33.33% of the Fund’s assets (50% of its net assets).

Other Information Regarding Investment Strategy

The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategy in attempting to respond to adverse market, economic, political or other conditions. During such times, Cliffwater may determine that a large portion of the Fund’s assets should be invested in cash or cash equivalents, including money market instruments, prime commercial paper, repurchase agreements, municipal bonds, bank accounts, Treasury bills and other short-term obligations of the U.S. Government, its agencies or instrumentalities and other high-quality debt instruments maturing in one year or less from the time of investment. In these and in other cases, the Fund may not achieve its investment objective. Cliffwater may invest the Fund’s cash balances in any investments it deems appropriate.

The frequency and amount of portfolio purchases and sales (known as the “portfolio turnover rate”) of the Fund may vary from year to year. The Fund’s portfolio turnover rate will not be a limiting factor when Cliffwater deems portfolio changes appropriate. The Fund may engage in short-term trading strategies, and securities may be sold without regard to the length of time held when, in the opinion of Cliffwater, investment considerations warrant such action. These policies may have the effect of increasing the annual rate of portfolio turnover of the Fund. If securities are not held for the applicable holding periods, dividends paid on them will not qualify for the advantageous federal tax rates.

No guarantee or representation is made that the investment program of the Fund will be successful, that the various Fund Investments selected will produce positive returns, or that the Fund will achieve its investment objective.

| 10. | The following replaces the disclosure beneath the headings “Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares” within the sections entitled “Summary – Risk Factors” on page 10 of the Prospectus and “General Risks” on page 47 of the Prospectus: |

The Fund has been organized as a non-diversified, closed-end management investment company and it is designed primarily for long-term investors. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not intend to list the Shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the Shares. Effective May 15, 2024, the Fund will have a fundamental policy to make semi-annual repurchase offers, at per-class NAV, of not less than 5% and not more than 25% of the Fund’s outstanding Shares on the repurchase request deadline. The Fund will offer to purchase only a small portion of its Shares during each repurchase offer, and there is no guarantee that Shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. If a repurchase offer is oversubscribed, the Fund may repurchase only a pro rata portion of the Shares tendered by each Shareholder. The potential for proration may cause some investors to tender more Shares for repurchase than they wish to have repurchased or result in investors being unable to liquidate all or a given percentage of their investment during the particular repurchase offer.

Shares in the Fund provide limited liquidity since Shareholders will not be able to redeem Shares on a daily basis. A Shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. In addition, with very limited exceptions, Shares are not transferable, and liquidity will be provided only through repurchase offers made semi-annually by the Fund. See “Repurchase Offers Risk” and “Repurchases of Shares and Transfers.”

An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of Shares and the underlying investments of the Fund. The Shares should be viewed as a long-term investment. Also, because Shares are not listed on any securities exchange, the Fund is not required, and does not intend, to hold annual meetings of its Shareholders unless required under the provisions of the 1940 Act.

| 11. | The following replaces the second paragraph beneath the heading previously entitled “Dependence on Barings” within the section entitled “Summary – Risk Factors” on page 11 of the Prospectus and the second paragraph beneath the heading previously entitled “Dependence on Barings” within the section entitled “General Risks” on page 48 of the Prospectus: |

Cliffwater maintains responsibility for a number of other important obligations, including, among other things, board reporting and assistance in the annual advisory contract renewal process. Cliffwater also provides advice and recommendations to the Board, and performs such review and oversight functions as the Board may reasonably request, as to the continuing appropriateness of the investment objective, strategies, and policies of the Fund, valuations of portfolio securities, and other matters relating generally to the investment program of the Fund.

| 12. | The following replaces the sixth sentence of the paragraph beneath the heading “Concentration of Investments” within the section entitled “Summary – Risk Factors” beginning on page 11 of the Prospectus: |

The Fund’s investment portfolio is, however, subject to the asset diversification requirements applicable to a regulated investment company (“RIC”), and may thus be limited by the Fund’s intention to qualify and be eligible to be treated as such.

| 13. | The following replaces the first paragraph beneath the heading “Multiple Levels of Fees and Expenses” within the section entitled “Summary – Risk Factors” on page 17 of the Prospectus and the first paragraph beneath the heading “Multiple Levels of Fees and Expenses” within the section entitled “General Risks” on page 53 of the Prospectus: |

Although in many cases investor access to the Portfolio Funds may be limited or unavailable, an investor who meets the conditions imposed by a Portfolio Fund may be able to invest directly with the Portfolio Fund. By investing in Portfolio Funds indirectly through the Fund, the investor bears asset-based fees charged by the Fund, in addition to any asset-based fees and performance-based fees and allocations at the Portfolio Fund level. Moreover, an investor in the Fund bears a proportionate share of the fees and expenses of the Fund (including, among other things and as applicable, operating costs, brokerage transaction expenses, management fees, administrative and custody fees, and repurchase offer expenses) and, indirectly, similar expenses of the Portfolio Funds. Thus, an investor in the Fund may be subject to higher operating expenses than if he or she invested in a Portfolio Fund directly or in a closed-end fund that did not invest through Portfolio Funds. The Fund may also invest in CCLFX, a registered closed-end management investment company advised by Cliffwater that is considered an affiliate of the Fund. Cliffwater has agreed to reimburse the Fund for the investment management fees paid on the Fund’s investment in CCLFX, although the Fund will be subject to asset-based and other non-management fees charged by CCLFX.

| 14. | The following disclosures are added immediately following the final paragraph beneath the heading “Publicly Traded Private Equity Risk” within the sections entitled “Summary – Risk Factors” on page 20 of the Prospectus and “General Risks” beginning on page 56 of the Prospectus: |

Defaulted Debt Securities and Other Securities of Distressed Companies. The Fund’s Private Capital Assets may include low grade or unrated debt securities (“high yield” or “junk” bonds or leveraged loans) or investments in securities of distressed companies. Such investments involve substantial, highly significant risks. For example, high yield bonds are regarded as being predominantly speculative as to the issuer’s ability to make payments of principal and interest. Issuers of high yield debt may be highly leveraged and may not have available to them more traditional methods of financing. Therefore, the risks associated with acquiring the securities of such issuers generally are greater than is the case with higher rated securities. In addition, the risk of loss due to default by the issuer is significantly greater for the holders of high yield bonds because such securities may be unsecured and may be subordinated to other creditors of the issuer. Similar risks apply to other Private Debt securities. Successful investing in distressed companies involves substantial time, effort and expertise, as compared to other types of investments. Information necessary to properly evaluate a distress situation may be difficult to obtain or be unavailable and the risks attendant to a restructuring or reorganization may not necessarily be identifiable or susceptible to considered analysis at the time of investment.

Fixed-Income Securities Risks. Fixed-income securities in which the Fund may invest are generally subject to the following risks:

Interest Rate Risk. The market value of bonds and other fixed-income securities changes in response to interest rate changes and other factors. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise. Interest rates in the United States and many other countries have risen in recent periods and may again rise in the future. Actions by governments and central banking authorities can result in increases or decreases in interest rates. To the extent the Fund or a Fund Investment borrows money to finance its investments, the Fund’s or a Fund Investment’s performance will depend, in part, upon the difference between the rate at which it borrows funds and the rate at which it invests those funds. In periods of rising interest rates, the Fund’s or a Fund Investment’s cost of funds could increase. Adverse developments resulting from changes in interest rates could have a material adverse effect on the Fund’s or a Fund Investment’s financial condition and results of operations. In addition, a decline in the prices of the debt the Fund or a Fund Investment owns could adversely affect the Fund’s NAV. Changes in market interest rates could also affect the ability of operating companies in which the Fund or a Fund Investment invests to service debt, which could materially impact the Fund or a Fund Investment may invest, thus impacting the Fund.

There is a risk that interest rates will continue to rise, which would likely drive down prices of bonds and other fixed-income securities. The magnitude of these fluctuations in the market price of bonds and other fixed-income securities is generally greater for securities with longer maturities. Fluctuations in the market price of the Fund’s investments will not affect interest income derived from instruments already owned by the Fund, but will be reflected in the Fund’s NAV. The Fund may lose money if short-term or long-term interest rates rise sharply in a manner not anticipated by the Adviser. Moreover, because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the NAV of the Fund to the extent that it invests in floating rate debt securities.

The Fund may invest in variable and floating rate debt instruments, which generally are less sensitive to interest rate changes than longer duration fixed rate instruments but may decline in value in response to rising interest rates if, for example, the rates at which they pay interest do not rise as much, or as quickly, as market interest rates in general.

Conversely, variable and floating rate instruments generally will not increase in value if interest rates decline. To the extent the Fund holds variable or floating rate instruments, a decrease in market interest rates will adversely affect the income received from such securities, which may adversely affect the NAV of the Fund’s Shares.

Issuer and Spread Risk. The value of fixed-income securities may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage, reduced demand for the issuer’s goods and services, historical and prospective earnings of the issuer and the value of the assets of the issuer. In addition, wider credit spreads and decreasing market values typically represent a deterioration of a debt security’s credit soundness and a perceived greater likelihood of risk or default by the issuer.

Credit Risk. Credit risk is the risk that one or more fixed-income securities in the Fund’s portfolio will decline in price or fail to pay interest or principal when due because the issuer of the security experiences a decline in its financial status. Credit risk is increased when a portfolio security is downgraded or the perceived creditworthiness of the issuer deteriorates. To the extent the Fund invests in below investment grade securities, it will be exposed to a greater amount of credit risk than a fund that only invests in investment grade securities. In addition, to the extent the Fund uses credit derivatives, such use will expose it to additional risk in the event that the bonds underlying the derivatives default. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Prepayment or “Call” Risk. During periods of declining interest rates, borrowers may exercise their option to prepay principal earlier than scheduled. For fixed rate securities, such payments often occur during periods of declining interest rates, forcing the Fund to reinvest in lower yielding securities, resulting in a possible decline in the Fund’s income and distributions to shareholders. This is known as prepayment or “call” risk. Below investment grade securities frequently have call features that allow the issuer to redeem the security at dates prior to its stated maturity at a specified price (typically greater than par) only if certain prescribed conditions are met (i.e., “call protection”). For premium bonds (bonds acquired at prices that exceed their par or principal value) purchased by the Fund, prepayment risk may be increased.

Reinvestment Risk. Reinvestment risk is the risk that income from the Fund’s portfolio will decline if the Fund invests the proceeds from matured, traded or called fixed-income securities at market interest rates that are below the Fund portfolio’s current earnings rate.

Duration and Maturity Risk. The Fund has no set policy regarding the duration or maturity of the fixed-income securities it may hold. In general, the longer the duration of any fixed-income securities in the Fund’s portfolio, the more exposure the Fund will have to the interest rate risks described above. The Adviser may seek to adjust the portfolio’s duration or maturity based on its assessment of current and projected market conditions and any other factors that the Adviser deems relevant. There can be no assurance that the Adviser’s assessment of current and projected market conditions will be correct or that any strategy to adjust the portfolio’s duration or maturity will be successful at any given time.

LIBOR Discontinuation Risk. The London Interbank Offered Rate (“LIBOR”) has been used extensively in the U.S. and globally as a “benchmark rate” or “reference rate” for various commercial and financial contracts, including corporate and municipal bonds, bank loans, asset-backed and mortgage-related securities, interest rate swaps and other derivatives. Instruments in which the Fund invests may have historically paid interest at floating rates based on LIBOR or may have been subject to interest caps or floors based on LIBOR. The Fund and issuers of instruments in which the Fund invests may have also historically obtained financing at floating rates based on LIBOR.

As of June 30, 2023, almost all settings of LIBOR have ceased to be published, except that certain widely used U.S. dollar LIBORs will continue to be published on a temporary, synthetic and non-representative basis through at least September 30, 2024. In some instances, regulators have restricted new use of LIBORs prior to the date when synthetic LIBORs will cease to be published. The Secured Overnight Financing Rate (“SOFR”), which has been used increasingly on a voluntary basis in new instruments and transactions, is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market. On December 16, 2022, the Federal Reserve Board adopted regulations implementing the Adjustable Interest Rate Act, which provides a statutory fallback mechanism to replace LIBOR, by identifying benchmark rates based on SOFR that replaced LIBOR in certain financial contracts after June 30, 2023. These regulations apply only to contracts governed by U.S. law, among other limitations. The regulations include provisions that (i) provide a safe harbor for selection or use of a replacement benchmark rate selected by the Federal Reserve Board; (ii) clarify who may choose the replacement benchmark rate selected by the Federal Reserve Board; and (iii) ensure that contracts adopting a replacement benchmark rate selected by the Federal Reserve Board will not be interrupted or terminated following the replacement of LIBOR. Uncertainty related to the liquidity impact of the change in rates, and how to appropriately adjust these rates at the time of transition, poses risks for the Fund. The transition away from LIBOR could have a significant impact on the financial markets in general and may also present heightened risk to market participants, including public companies, investment advisers, investment companies, and broker-dealers. The risks associated with this discontinuation and transition will be exacerbated if the work necessary to effect an orderly transition to an alternative reference rate is not completed in a timely manner. For example, current information technology systems may be unable to accommodate new instruments and rates with features that differ from LIBOR. Accordingly, it is difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and fallbacks for both legacy and new instruments and contracts are commercially accepted and market practices become settled.

SOFR RISK. SOFR is intended to be a broad measure of the cost of borrowing funds overnight in transactions that are collateralized by U.S. Treasury securities. SOFR is calculated based on transaction-level repo data collected from various sources. For each trading day, SOFR is calculated as a volume-weighted median rate derived from such data. SOFR is calculated and published by the Federal Reserve Bank of New York (“FRBNY”). If data from a given source required by the FRBNY to calculate SOFR is unavailable for any day, then the most recently available data for that segment will be used, with certain adjustments. If errors are discovered in the transaction data or the calculations underlying SOFR after its initial publication on a given day, SOFR may be republished at a later time that day. Rate revisions will be effected only on the day of initial publication and will be republished only if the change in the rate exceeds one basis point.

Because SOFR is a financing rate based on overnight secured funding transactions, it differs fundamentally from LIBOR. LIBOR is intended to be an unsecured rate that represents interbank funding costs for different short-term maturities or tenors. It is a forward-looking rate reflecting expectations regarding interest rates for the applicable tenor. Thus, LIBOR is intended to be sensitive, in certain respects, to bank credit risk and to term interest rate risk. In contrast, SOFR is a secured overnight rate reflecting the credit of U.S. Treasury securities as collateral. Thus, it is largely insensitive to credit-risk considerations and to short-term interest rate risks. SOFR is a transaction-based rate, and it has been more volatile than other benchmark or market rates, such as three-month LIBOR, during certain periods. For these reasons, among others, there is no assurance that SOFR, or rates derived from SOFR, will perform in the same or similar way as LIBOR would have performed at any time, and there is no assurance that SOFR-based rates will be a suitable substitute for LIBOR. SOFR has a limited history, having been first published in April 2018. The future performance of SOFR, and SOFR-based reference rates, cannot be predicted based on SOFR’s history or otherwise. Levels of SOFR in the future, including following the discontinuation of LIBOR, may bear little or no relation to historical levels of SOFR, LIBOR or other rates.

U.S. Debt Securities Risk. U.S. debt securities generally involve lower levels of credit risk than other types of fixed income securities of similar maturities, although, as a result, the yields available from U.S. debt securities are generally lower than the yields available from such other securities. Like other fixed income securities, the values of U.S. debt securities change as interest rates fluctuate. On August 1, 2023, Fitch lowered its long-term sovereign credit rating on U.S. debt securities to AA+ from AAA. Any future downgrades by other rating agencies could increase volatility in both stock and bond markets, result in higher interest rates and higher Treasury yields and increase borrowing costs generally. These events could have significant adverse effects on the economy generally and could result in significant adverse impacts on securities issuers and the Fund. The Adviser cannot predict the effects of these or similar events in the future on the U.S. economy and securities markets or on the Fund’s portfolio.

Hedging. The Fund may seek to hedge against interest rate and currency exchange rate fluctuations and credit risk by using structured financial instruments such as futures, options, swaps and forward contracts, subject to the requirements of the1940 Act. Use of structured financial instruments for hedging purposes may present significant risks, including the risk of loss of the amounts invested. Defaults by the other party to a hedging transaction can result in losses in the hedging transaction. Hedging activities also involve the risk of an imperfect correlation between the hedging instrument and the asset being hedged, which could result in losses both on the hedging transaction and on the instrument being hedged. Use of hedging activities may not prevent significant losses and could increase losses. Further, hedging transactions may reduce cash available to pay distributions to Shareholders.

| 15. | The following replaces the disclosure beneath the heading “Investment in Other Investment Companies Risk” within the section entitled “Summary – Risk Factors” on page 20 of the Prospectus and beneath the heading “Investment in Other Investment Companies Risk” within the section entitled “Summary – Risk Factors” on page 56 of the Prospectus: |

Investment in Other Investment Companies, Including Affiliated Investment Companies. As with other investments, investments in other investment companies, including ETFs, are subject to market and manager risk. In addition, the Fund will incur higher and duplicative expenses, including advisory fees, when it invests in shares of registered investment companies, including mutual funds, BDCs, closed-end funds, ETFs and other registered and private investment funds (together, “Underlying Funds”). The Fund may invest in CCLFX, a registered closed-end investment company that is also managed by Cliffwater. With respect to the Fund’s investments in CCLFX, Cliffwater has agreed to reimburse the Fund in the amount of the management fee that would otherwise be charged to the Fund for its investments in CCLFX, although the Fund will still pay non-management fees on its investment in the affiliated fund.

SEC rules permit funds to invest in other investment companies under certain circumstances. While Rule 12d1-4 permits more types of fund of funds arrangements without reliance on an exemptive order or no-action letters, it imposes certain conditions, including limits on control and voting of acquired funds’ shares, evaluations and findings by investment advisers, fund investment agreements and limits on most three-tier fund structures.

Cliffwater may be subject to potential conflicts of interest with respect to Fund investments in affiliated investment companies, particularly when such investment companies have low assets, or in determining the allocation of the Fund’s assets among investment companies. Such conflicts arise because Cliffwater may, due to its own financial interest or other business considerations, have incentives to invest in funds managed by Cliffwater rather than investing in funds managed or sponsored by others, including that fees paid to Cliffwater by an affiliated underlying investment company may be higher than unaffiliated investment companies or an affiliated underlying investment company may be in need of assets to enhance its appeal to other investors, liquidity and trading and/or to enable it to carry out its investment strategies. Cliffwater is a fiduciary to the Fund and is legally obligated to act in the Fund’s best interest when selecting Underlying Funds.

| 16. | The following replaces the disclosure beneath the heading “Repurchase Offers Risk” within the section entitled “Summary – Risk Factors” beginning on page 21 of the Prospectus and beneath the heading “Repurchase Offers Risk” within the section entitled “General Risks” beginning on page 57 of the Prospectus: |

The Fund has adopted a fundamental policy, to take effect as of May 15, 2024, to conduct semi-annual repurchase offers. The Fund will offer to purchase only a small portion of its Shares in connection with each repurchase offer, and there is no guarantee that Shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. See “Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares.”

Notices of each repurchase offer are sent to shareholders at least 21 days before the “Repurchase Request Deadline” (i.e., the date by which Shareholders can tender their Shares in response to a repurchase offer). The Fund determines the NAV applicable to repurchases no later than the fourteen (14) days after the Repurchase Request Deadline (or the next business day, if the 14th day is not a business day) (the “Repurchase Pricing Date”). The Fund expects to distribute payment to Shareholders between one and three business days after the Repurchase Pricing Date and will distribute payment no later than seven (7) calendar days after such date. If a Shareholder tenders all of its Shares (or a portion of its Shares) in connection with a repurchase offer made by the Fund, that tender may not be rescinded by the Shareholder after the Repurchase Request Deadline. Because the NAV applicable to a repurchase is calculated 14 days after the Repurchase Request Deadline, a Shareholder will not know its repurchase price until after it has irrevocably tendered its Shares. See “Repurchases of Shares and Transfers.” Shareholders may be subject to market risk in relation to the tender of their Shares for repurchase because like other market investments, the value of the Fund’s Shares may move up or down, sometimes rapidly and unpredictably, between the date a repurchase offer terminates and the repurchase date. Likewise, because the Fund’s investments may include securities denominated in foreign currencies, changes in currency values between the date a repurchase offer terminates and the repurchase date may also adversely affect the value of the Fund’s Shares.

The Fund may be limited in its ability to liquidate its holdings in Portfolio Funds to meet repurchase requests. Repurchase offers principally will be funded by cash and cash equivalents, as well as by the sale of certain liquid securities. Accordingly, the Fund may repurchase fewer Shares than Shareholders may wish to sell, resulting in the proration of Shareholder repurchases. See “Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares.”

Substantial requests for the Fund to repurchase Shares could require the Fund to liquidate certain of its investments more rapidly than otherwise desirable for the purpose of raising cash to fund the repurchases. This could have a material adverse effect on the value of the Shares and the performance of the Fund. In addition, substantial repurchases of Shares may decrease the Fund’s total assets and accordingly may increase its expenses as a percentage of average net assets.

| 17. | The headings and disclosure beneath the headings “Risks Relating to Borrowing” and “Leverage” within the sections entitled “Summary – Risk Factors” on pages 24 and 25 of the Prospectus and “General Risks” on pages 59 and 60 of the Prospectus are replaced with the following: |

Borrowing, Use of Leverage. The Fund may leverage its investments, including through borrowings by one or more SPVs that are Subsidiaries of the Fund. Certain Fund investments may be held by these SPVs. The use of leverage increases both risk of loss and profit potential. The Fund is subject to the 1940 Act requirement that an investment company satisfy an asset coverage requirement of 300% of its indebtedness, including amounts borrowed (including through one or more SPVs that are Subsidiaries of the Fund), measured at the time the investment company incurs the indebtedness. This means that at any given time the value of the Fund’s total indebtedness may not exceed one-third the value of its total assets (including such indebtedness). The interests of persons with whom the Fund (or SPVs that are Subsidiaries of the Fund) enters into leverage arrangements may not necessarily be aligned with the interests of the Fund’s Shareholders and such persons may have claims on the Fund’s assets that are senior to those of the Fund’s Shareholders. In addition to the risks created by the Fund’s use of leverage, the Fund is subject to the additional risk that it would be unable to timely, or at all, obtain leverage borrowing. The Fund might also be required to de-leverage, selling securities at a potentially inopportune time and incurring tax consequences. Further, the Fund’s ability to generate income from the use of leverage would be adversely affected.

Under the 1940 Act, the Fund is not permitted to issue preferred stock unless immediately after such issuance, the value of the Fund’s total assets (including the proceeds of such issuance) less all liabilities and indebtedness not represented by senior securities is at least equal to 200% of the total of the aggregate amount of senior securities representing indebtedness plus the aggregate liquidation value of any outstanding preferred stock. Stated another way, the Fund may not issue preferred stock that, together with outstanding preferred stock and debt securities, has a total aggregate liquidation value and outstanding principal amount of more than 50% of the value of the Fund’s total assets, including the proceeds of such issuance, less liabilities and indebtedness not represented by senior securities. In addition, the Fund is not permitted to declare any distribution on its common stock, or purchase any of the Fund’s shares of common stock (through repurchase offers or otherwise) unless the Fund would satisfy this 200% asset coverage requirement test after deducting the amount of such distribution or share price, as the case may be. The Fund may, as a result of market conditions or otherwise, be required to purchase or redeem preferred stock, or sell a portion of its investments when it may be disadvantageous to do so, in order to maintain the required asset coverage. Common stockholders would bear the costs of issuing additional preferred stock, which may include offering expenses and the ongoing payment of distributions. Under the 1940 Act, the Fund may only issue one class of preferred stock.

In addition, the Portfolio Fund managers may employ leverage through borrowings, and the Portfolio Fund managers and Fund are likely to directly or indirectly acquire interests in companies with highly leveraged capital structures. If income and appreciation on investments made with borrowed funds are less than the cost of the leverage, the value of the relevant portfolio or investment will decrease. Accordingly, any event that adversely affects the value of a Private Capital investment will be magnified to the extent leverage is employed. The cumulative effect of the use of leverage by the Fund or the Portfolio Funds in a market that moves adversely to the relevant investments could result in substantial losses, exceeding those that would have been incurred if leverage had not been employed.

| 18. | The headings and disclosure beneath the headings “Inability to Vote” within the sections entitled “Summary – Risk Factors” on page 26 of the Prospectus and “General Risks” on page 61 of the Prospectus are deleted in their entirety. |

| 19. | The following disclosure is added immediately following the final paragraph beneath the heading “Brexit Risk” within the section entitled “Summary – Risk Factors” on page 32 of the Prospectus and final paragraph beneath the heading “Brexit Risk” within the section entitled “General Risks” on page 66 of the Prospectus: |

Divergence of Resources. Neither Cliffwater nor its affiliates, including individuals employed by Cliffwater or its affiliates, are prohibited from raising money for and managing another investment entity that makes the same types of investments as those the Fund will target. As a result, the time and resources that these individuals may devote to the Fund may be diverted. In addition, the Fund may compete with any such investment entity for the same investors and investment opportunities.

| 20. | The following replaces the final sentence of the paragraph within the section entitled “Summary – Management” on page 33 of the Prospectus: |

To the extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board or Cliffwater.

| 21. | The following replaces the paragraph within the section previously entitled “Summary – Barings” on page 33 of the Prospectus: |

Pursuant to an investment management agreement (the “Investment Management Agreement”), Cliffwater LLC, an investment adviser registered under the Advisers Act, serves as the Fund’s and the Subsidiaries’ investment adviser. Cliffwater’s principal place of business is 4640 Admiralty Way, 11th Floor, Marina del Rey, CA 90292. As of January 31, 2024, Cliffwater had approximately $22 billion in assets under management and $101 billion in assets under advisement (including discretionary and non-discretionary accounts).

| 22. | The section entitled “Summary – MassMutual Commitment” on page 33 of the Prospectus is deleted in its entirety. |

| 23. | The section entitled “Summary – The Subadviser” on page 33 of the Prospectus is deleted in its entirety. |

| 24. | The following replaces the first two paragraphs within the section entitled “Summary – Fund Services” on page 33 of the Prospectus: |