UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

| | |

Check the appropriate box: | | |

| |

☐ Preliminary Proxy Statement ☐ Definitive Proxy Statement | | ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ Definitive Additional Materials |

|

☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK ESG CAPITAL ALLOCATION TERM TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ☐ | Fee paid previously with preliminary materials. |

| | ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

BlackRock ESG Capital Allocation Term Trust (NYSE: ECAT) | |  |

« YOUR VOTE MATTERS «

MAKE YOUR VOICE HEARD BY VOTING ON THE ENCLOSED WHITE CARD AND PROTECT YOUR INVESTMENT

|

Why am I receiving this letter? An activist hedge fund managed by Saba Capital Management, L.P. (“Saba”) is attempting to take control of your Fund and replace the Fund’s independent, qualified and experienced Board members with Saba’s inexperienced and unqualified nominees. The Fund’s Board, including the Board Nominees, are committed to delivering value for all shareholders. Please do NOT send back any proxy card you may receive from Saba. |

|

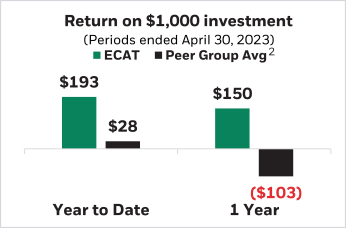

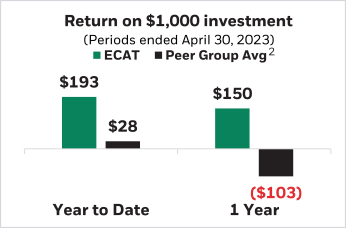

| #1 |

Performing

Fund in Peer Group1,2 |

|

| | |

| | Monthly Distribution The Fund consistently pays

monthly distribution |

| |

| | Share Repurchases ECAT has voluntarily

repurchased over $47 million

of its shares, generating over

$9 million of accretion to its

net asset value3 |

| |

| | Liquidity at NAV In 2033, shareholders will

have an opportunity to receive

100% liquidity at net asset value4 |

|

How does the Board recommend that I vote? ➣ The Board, including the independent Board Members, unanimously recommends a vote "FOR" the Board’s experienced, qualified, and diverse nominees, who have approved initiatives that have helped all shareholders, like share repurchases, using the WHITE proxy card. ➣ Please do NOT send back any proxy card you may receive from Saba, even to withhold votes on Saba’s nominees, as this will cancel your prior vote for the Board Nominees. Only your latest dated proxy will count at the meeting. ➣ If you have already sent back the proxy card you received from Saba, you can still change your vote by promptly completing, signing, dating and returning the WHITE proxy card, which will replace the proxy card you previously completed. |

Source: Morningstar data as of April 30, 2023. (1) Measured at the time of investment (2) Peer group is represented by the US CE Tactical Allocation Morningstar category. (3) Share repurchase data is as of 3/31/23. (4) In 2033, all shareholders will have an opportunity to receive 100% liquidity at net asset value via fund liquidation or tender offer.

| | | | |

| | |

| | Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s current distributions or from the terms of the Fund’s Plan. All investments involve risk, including the possible loss of the principal amount invested. Important information about the Fund This material is not an advertisement and is intended for existing shareholder use only. This document and the information contained herein relates solely to BlackRock ESG Capital Allocation Term Trust (ECAT). The information contained herein does not relate to, and is not relevant to, any other fund or product sponsored or distributed by BlackRock or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation of an offer to buy any securities. Common shares for the closed-end fund identified above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund’s dividend yield, market price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume reinvestment of all dividends. The market value and net asset value (NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount. © 2023 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners. | | |

| | | | | | |

| | June 2023 | BlackRock ESG Capital Allocation Term Trust (ECAT) | | Not FDIC Insured • May Lose Value • No Bank Guarantee | | |

| | | |

| | ECAT_LTR2 | | | | |