| | | Gibson, Dunn & Crutcher LLP 811 Main Street Houston, TX 77002-6117 Tel 346.718.6600 www.gibsondunn.com |

| Attention: | Joseph Klinko |

| Re: | Aris Water Solutions, Inc. |

| cc: | William A. Zartler, Founder and Executive Chairman |

| | | Gibson, Dunn & Crutcher LLP 811 Main Street Houston, TX 77002-6117 Tel 346.718.6600 www.gibsondunn.com |

| Attention: | Joseph Klinko |

| Re: | Aris Water Solutions, Inc. |

| cc: | William A. Zartler, Founder and Executive Chairman |

| | | Per Share | | | Total | |

Initial public offering price | | | $ | | | $ |

Underwriting discounts and commissions(1) | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ |

| (1) | See “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

Goldman Sachs & Co. LLC | | | Citigroup |

J.P. Morgan | | | Wells Fargo Securities |

Barclays | | | Evercore ISI |

Capital One Securities | | | Johnson Rice & Company L.L.C. | | | Raymond James |

| | | | ||||

Stifel | | | | | U.S. Capital Advisors |

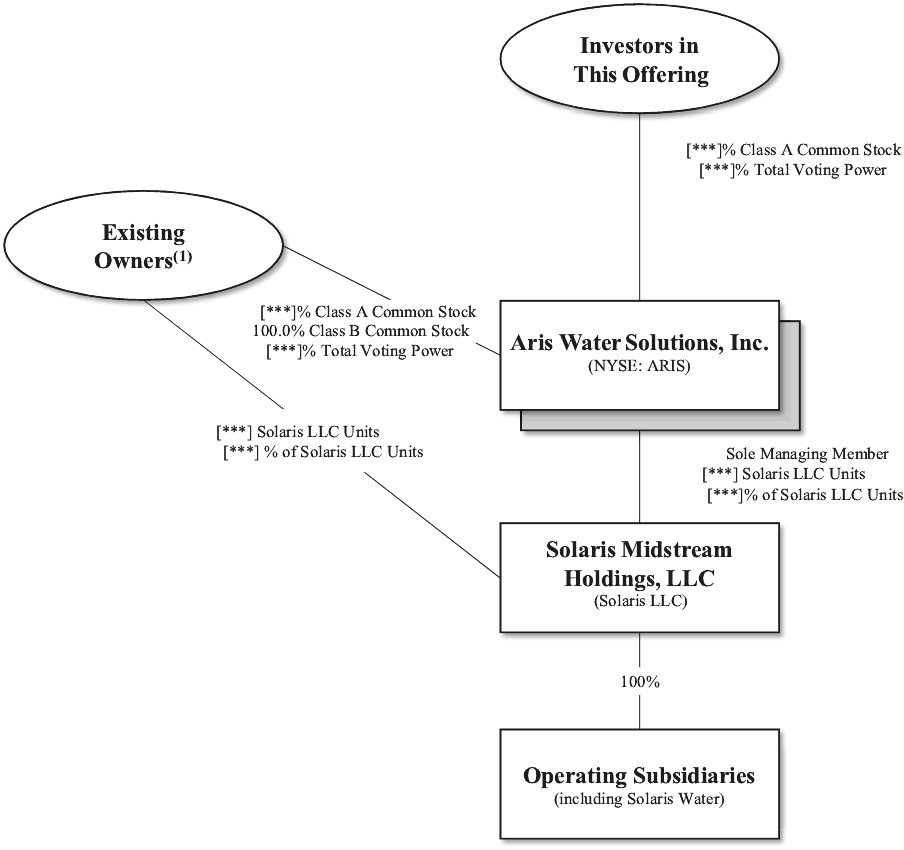

| (1) | Includes ConocoPhillips, Trilantic, Yorktown, certain of our officers and directors and the other current members of Solaris LLC. |

| (1) | Includes ConocoPhillips, Trilantic, Yorktown, certain of our officers and directors and the other current members of Solaris LLC. See “Corporate Reorganization.” |

| • | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and obtaining stockholder approval of any golden parachute payments not previously approved. |

| • | [***] shares of Class A common stock issuable upon exercise of the underwriters’ option to purchase additional shares; |

| • | [***] shares of Class A common stock issuable under our 2021 Equity Incentive Plan (the “2021 Plan”), including: |

| • | [***] shares of Class A common stock underlying restricted stock units or other awards that may be granted to certain employees and non-employee directors pursuant to the 2021 Plan after the closing of this offering, the terms of which have not been decided; and |

| • | [***] additional shares of Class A common stock to be reserved for future issuance of awards under the 2021 Plan; and |

| • | [***] shares of Class A common stock reserved for issuance upon exchange of the Solaris LLC Units (together with a corresponding number of shares of Class B common stock) that will be outstanding immediately after this offering. |

(Dollars in thousands, except per share and per barrel data) | | | Six Months Ended June 30, | | | Year Ended December 31, | ||||||

| | | 2021 | | | 2020 | | | 2020 | | | 2019 | |

| | | (unaudited) | | | | | ||||||

Pro Forma Statement of Operations Data(1) | | | | | | | | | ||||

Pro forma net income(2) | | | $[***] | | | | | $[***] | | | ||

Pro forma non-controlling interest(3) | | | [***] | | | | | [***] | | | ||

Pro forma net income (loss) attributable to common stockholders(2) | | | [***] | | | | | [***] | | | ||

Pro forma net income (loss) per share attributable to common stockholders(4) | | | | | | | | | ||||

Basic and diluted | | | $[***] | | | | | $[***] | | | ||

Pro forma weighted average shares outstanding | | | | | | | | | ||||

Basic and diluted | | | [***] | | | | | [***] | | | ||

Balance Sheet Data (at end of period): | | | | | | | | | ||||

Cash and cash equivalents | | | $31,123 | | | $14,986 | | | $24,932 | | | $7,083 |

Accounts receivable, net | | | 25,928 | | | 22,893 | | | 21,561 | | | 33,523 |

Accounts receivable from affiliates | | | 18,346 | | | 12,086 | | | 11,538 | | | 15,837 |

Total current assets | | | 80,824 | | | 52,950 | | | 66,068 | | | 60,763 |

Total property, plant and equipment, net | | | 649,980 | | | 596,074 | | | 618,188 | | | 481,790 |

Total assets | | | 1,088,762 | | | 1,033,165 | | | 1,057,805 | | | 838,234 |

Total current liabilities | | | 49,366 | | | 53,679 | | | 45,789 | | | 69,166 |

Long-term debt, net | | | 391,115 | | | 280,000 | | | 297,000 | | | 220,000 |

Total liabilities | | | 447,445 | | | 339,418 | | | 349,512 | | | 292,726 |

Total mezzanine equity | | | — | | | 72,391 | | | 74,378 | | | — |

Total members’ equity | | | 641,317 | | | 621,356 | | | 633,915 | | | 545,508 |

Consolidated Statements of Cash Flows Data: | | | | | | | | | ||||

Operating activities | | | $30,690 | | | $40,911 | | | $67,771 | | | $4,149 |

Investing activities | | | (42,353) | | | (92,581) | | | (139,589) | | | (228,368) |

Financing activities | | | 17,854 | | | 59,572 | | | 89,667 | | | 223,959 |

Non-GAAP Measures: | | | | | | | | | ||||

Adjusted EBITDA(5) | | | $54,029 | | | $35,919 | | | $73,896 | | | $47,199 |

Adjusted Operating Margin(5) | | | $63,820 | | | $43,780 | | | $91,020 | | | $62,431 |

Adjusted Operating Margin per Barrel(5) | | | $0.41 | | | $0.36 | | | $0.36 | | | $0.35 |

Operating Data (kbwpd): | | | | | | | | | ||||

Produced Water Handling Volumes | | | 684 | | | 562 | | | 570 | | | 343 |

Recycled Produced Water Volumes Sold | | | 88 | | | 29 | | | 44 | | | 20 |

Groundwater Water Volumes Sold | | | 51 | | | 65 | | | 61 | | | 77 |

Total Water Solutions Volumes Sold | | | 139 | | | 94 | | | 105 | | | 97 |

Groundwater Water Volumes Transferred | | | 43 | | | 11 | | | 11 | | | 49 |

Total Water Solutions Volumes Sold or Transferred | | | 182 | | | 105 | | | 116 | | | 146 |

Total Volumes | | | 866 | | | 667 | | | 686 | | | 489 |

| (1) | For additional information regarding our pro forma information, please see the pro forma financial statements and the related notes thereto appearing elsewhere in this prospectus. |

| (2) | Pro forma net income reflects a pro forma income tax expense of $0.6 million and $3 thousand, respectively, for the six months ended June 30, 2021 and the year ended December 31, 2020, associated with the income tax effects of the corporate reorganization described under “Corporate Reorganization” and this offering. Aris Inc. is a corporation and is subject to U.S. federal and State of Texas income tax. Our predecessor, Solaris LLC, was not subject to U.S. federal income tax at an entity level. As a result, the consolidated net loss in our historical financial statements does not reflect the tax expense we would have incurred if we were subject to U.S. federal income tax at an entity level during such periods. |

| (3) | Reflects the pro forma adjustment to non-controlling interest and net income (loss) attributable to common stockholders to reflect the ownership of Solaris LLC Units by each of the Existing Owners. |

| (4) | Pro forma net income (loss) per share attributable to common stockholders and weighted average shares outstanding reflect the estimated number of shares of Class A common stock we expect to have outstanding upon the completion of our corporate reorganization described under “Corporate Reorganization.” Pro forma weighted average shares outstanding used to compute pro forma earnings per share for the six months ended June 30, 2021 and the year ended December 31, 2020 does not take into account any time-based restricted stock unit awards that may be granted after the closing of this offering since the terms of any such awards have not been determined. |

Distributions to Existing Owners | | | $[***] |

Underwriting discounts and commissions | | | [***] |

Offering expenses | | | [***] |

Retained proceeds | | | [***] |

Total gross proceeds | | | $[***] |

| • | on an actual basis; and |

| • | on an as adjusted basis after giving effect to (i) the transactions described under “Corporate Reorganization,” (ii) the sale of shares of our Class A common stock in this offering at the assumed initial offering price of $[***] per share (the midpoint of the range set forth on the cover of this prospectus) and (iii) the application of the net proceeds from this offering as set forth under “Use of Proceeds” |

| | | As of June 30, 2021 | ||||

(Dollars in thousands, except par values) | | | Actual | | | As Adjusted |

Cash and cash equivalents(1) | | | $31,123 | | | $[***] |

Long-term debt: | | | | | ||

Credit Facility | | | $— | | | $— |

7.625% Senior Sustainability-Linked Notes | | | 400,000 | | | $400,000 |

Unamortized deferred financing costs | | | (8,885) | | | (8,885) |

Total long-term debt | | | $391,115 | | | $391,115 |

Members’/Stockholders’ equity: | | | | | ||

Members’ equity | | | $641,317 | | | $— |

Class A common stock, $0.01 par value; no shares authorized, issued or outstanding (Actual); 600,000,000 shares authorized, [***] shares issued and outstanding (As Adjusted) | | | — | | | [***] |

Class B common stock, $0.01 par value; no shares authorized, issued or outstanding (Actual); 180,000,000 shares authorized, [***] shares issued and outstanding (As Adjusted) | | | — | | | — |

Additional paid-in capital | | | — | | | [***] |

Total members’/stockholders’ equity | | | $641,317 | | | $[***] |

Non-controlling interest | | | — | | | [***] |

Total capitalization | | | $1,032,432 | | | $[***] |

| (1) | Does not give effect to an expected payment of a transaction bonus of $3.25 million to officers and other employees in connection with this offering paid out of cash on hand. |

(Dollars in thousands) | | | Six Months Ended June 30, | | | Year Ended December 31, | ||||||

| | | 2021 | | | 2020 | | | 2020 | | | 2019 | |

| | | (unaudited) | | |||||||||

Operating expenses: | | | | | | | | | ||||

General and administrative | | | 10,012 | | | 8,648 | | | 18,663 | | | 15,299 |

(Gain) loss on disposal of asset, net | | | 217 | | | 67 | | | 133 | | | (5,100) |

Transaction costs | | | 77 | | | 3,099 | | | 3,389 | | | 1,010 |

Abandoned projects | | | 1,356 | | | 1,133 | | | 2,125 | | | 2,444 |

Total operating expenses | | | 11,662 | | | 12,947 | | | 24,310 | | | 13,653 |

Operating income | | | 17,733 | | | 1,934 | | | 7,704 | | | 13,497 |

Other expense: | | | | | | | | | ||||

Other expense | | | 380 | | | — | | | — | | | 176 |

Interest expense, net | | | 9,975 | | | 3,265 | | | 7,674 | | | 260 |

Total other expense | | | 10,355 | | | 3,265 | | | 7,674 | | | 436 |

Income (loss) before taxes | | | 7,378 | | | (1,331) | | | 30 | | | 13,061 |

Income tax expense | | | 2 | | | 6 | | | 23 | | | 1 |

Net income (loss) | | | $7,376 | | | $(1,337) | | | $7 | | | $13,060 |

(Dollars in thousands, except per share and per barrel data) | | | Six Months Ended June 30, | | | Year Ended December 31, | ||||||

| | | 2021 | | | 2020 | | | 2020 | | | 2019 | |

| | | (unaudited) | | | | | ||||||

Pro Forma Statement of Operations Data(1) | | | | | | | | | ||||

Pro forma net income (loss)(2) | | | $[***] | | | | | $[***] | | | ||

Pro forma non-controlling interest(3) | | | [***] | | | | | [***] | | | ||

Pro forma net income (loss) attributable to common stockholders(2) | | | [***] | | | | | [***] | | | ||

Pro forma net income (loss) per share attributable to common stockholders(4) | | | | | | | | | ||||

Basic and Diluted | | | $[***] | | | | | $[***] | | | ||

Pro forma weighted average shares outstanding | | | | | | | | | ||||

Basic and Diluted | | | [***] | | | | | [***] | | | ||

Balance Sheet Data (at end of period): | | | | | | | | | ||||

Cash and cash equivalents | | | $31,123 | | | $14,986 | | | $24,932 | | | $7,083 |

Accounts receivable, net | | | 25,928 | | | 22,893 | | | 22,457 | | | 33,523 |

Accounts receivable from affiliates | | | 18,346 | | | 12,086 | | | 10,642 | | | 15,837 |

Total current assets | | | 80,824 | | | 52,950 | | | 66,068 | | | 60,763 |

Total property, plant and equipment, net | | | 649,980 | | | 596,074 | | | 618,188 | | | 481,790 |

Total assets | | | $1,088,762 | | | 1,033,165 | | | 1,057,805 | | | 838,234 |

Total current liabilities | | | 49,366 | | | 53,679 | | | 45,789 | | | 69,166 |

Long-term debt, net | | | 391,115 | | | 280,000 | | | 297,000 | | | 220,000 |

Total liabilities | | | 447,445 | | | 339,418 | | | 349,512 | | | 292,726 |

Total mezzanine equity | | | — | | | 72,391 | | | 74,378 | | | — |

Total members’ equity | | | 641,317 | | | 621,356 | | | 633,915 | | | 545,508 |

Consolidated Statements of Cash Flows Data: | | | | | | | | | ||||

Operating activities | | | 30,690 | | | $40,911 | | | $67,771 | | | $4,149 |

Investing activities | | | (42,353) | | | (92,581) | | | (139,589) | | | (228,368) |

Financing activities | | | 17,854 | | | 59,572 | | | 89,667 | | | 223,959 |

(Dollars in thousands, except per share and per barrel data) | | | Six Months Ended June 30, | | | Year Ended December 31, | ||||||

| | | 2021 | | | 2020 | | | 2020 | | | 2019 | |

| | | (unaudited) | | | | | ||||||

Non-GAAP Measures | | | | | | | | | ||||

Net income (loss) | | | $7,376 | | | $(1,337) | | | $7 | | | $13,060 |

Interest expense, net | | | 9,975 | | | 3,265 | | | 7,674 | | | 260 |

Income tax expense | | | 2 | | | 6 | | | 23 | | | 1 |

Depreciation, amortization and accretion | | | 30,172 | | | 19,778 | | | 44,027 | | | 19,670 |

Abandoned projects | | | 1,356 | | | 1,133 | | | 2,125 | | | 2,444 |

Temporary power costs(5) | | | 4,253 | | | 9,121 | | | 14,979 | | | 15,611 |

(Gain) loss on sale of assets, net(6) | | | 217 | | | 67 | | | — | | | (5,173) |

Settled litigation(7) | | | — | | | 597 | | | 1,482 | | | 316 |

Transaction costs(8) | | | 77 | | | 3,099 | | | 3,389 | | | 1,010 |

Other(9) | | | 601 | | | 190 | | | 190 | | | — |

Adjusted EBITDA | | | $54,029 | | | $35,919 | | | $73,896 | | | $47,199 |

| | | | | | | | | |||||

Gross margin | | | $29,395 | | | $14,881 | | | $32,014 | | | $27,150 |

Depreciation, amortization and accretion | | | 30,172 | | | 19,778 | | | 44,027 | | | 19,670 |

Temporary power costs(5) | | | 4,253 | | | 9,121 | | | 14,979 | | | 15,611 |

Adjusted Operating Margin | | | $63,820 | | | $43,780 | | | $91,020 | | | $62,431 |

| (1) | For additional information regarding our pro forma information, please see the pro forma financial statements and the related notes thereto appearing elsewhere in this prospectus. |

| (2) | Pro forma net loss reflects a pro forma income tax expense of $0.6 million and $3 thousand, respectively, for the six months ended June 30, 2021 and the year ended December 31, 2020, associated with the income tax effects of the corporate reorganization described under “Corporate Reorganization” and this offering. Aris Inc. is a corporation and is subject to U.S. federal and State of Texas income tax. Our predecessor, Solaris LLC, was not subject to U.S. federal income tax at an entity level. As a result, the consolidated net loss in our historical financial statements does not reflect the tax expense we would have incurred if we were subject to U.S. federal income tax at an entity level during such periods. |

| (3) | Reflects the pro forma adjustment to non-controlling interest and net income (loss) attributable to common stockholders to reflect the ownership of Solaris, LLC Units by each of the Existing Owners. |

| (4) | Pro forma net loss per share attributable to common stockholders and weighted average shares outstanding reflect the estimated number of shares of Class A common stock we expect to have outstanding upon the completion of our corporate reorganization described under “Corporate Reorganization.” Pro forma weighted average shares outstanding used to compute pro forma earnings per share for the six months ended June 30, 2021 and the year ended December 31, 2020 does not take into account any time-based restricted stock unit awards that may be granted after the closing of this offering since the terms of any such awards have not been determined. |

| (5) | In the past, we constructed assets in advance of grid power infrastructure availability to secure long-term produced water handling contracts. As a result, we rented temporary power generation equipment that would not be necessary if grid power connections were available. Temporary power costs are calculated by taking temporary power and rental expenses incurred during the period and subtracting estimated expenses that would have been incurred during such period had permanent grid power been available. Power infrastructure and permanent power availability rapidly expanded in the Permian Basin in 2020 and the first quarter of 2021 and we made significant progress in reducing these expenses. Our temporary power expenses have been substantially eliminated as of the end of the second quarter of 2021. |

| (6) | Includes gains and losses on sale of assets. |

| (7) | Litigation is primarily related to a dispute regarding rights-of-way that we successfully settled in arbitration. Amount represents legal expenses solely related to this dispute. |

| (8) | Represents certain transaction expenses primarily related to certain advisory and legal expenses associated with a recapitalization process that was terminated in first quarter 2020 and the Concho Acquisitions (as defined herein). |

| (9) | Represents severance charge and loss on debt modification. |

| | | Year Ended December 31, | ||||

(Dollars in thousands) | | | 2020 | | | 2019 |

Depreciation expense | | | $23,388 | | | $13,450 |

Amortization expense | | | $20,413 | | | $6,075 |

Accretion expense | | | $226 | | | $145 |

Total | | | $44,027 | | | $19,670 |

| • | incur or guarantee additional indebtedness or issue certain preferred stock; |

| • | pay dividends on capital stock or redeem, repurchase or retire our capital stock or subordinated indebtedness; |

| • | transfer or sell assets; |

| • | make investments; |

| • | create certain liens; |

| • | enter into agreements that restrict dividends or other payments from our restricted subsidiaries to us; |

| • | consolidate, merge or transfer all or substantially all of our assets; |

| • | engage in transactions with affiliates; and |

| • | create unrestricted subsidiaries. |

Annual retainer for Board membership | | | $ 30,000 |

Annual retainer for Lead Independent Director | | | $ 10,000 |

Additional annual retainers | | | |

• Chair of the Audit Committee | | | $ 65,000 |

• Chair of the Compensation Committee | | | $ 20,000 |

• Chair of the Nominating and Corporate Governance Committee | | | $ 10,000 |

• Member of the Audit Committee (other than Chair) | | | $ 40,000 |

Underwriter | | | Number of Shares |

Goldman Sachs & Co. LLC | | | |

Citigroup Global Markets Inc. | | | |

J.P. Morgan Securities LLC | | | |

Wells Fargo Securities, LLC | | | |

Barclays Capital Inc. | | | |

Evercore Group L.L.C. | | | |

Capital One Securities, Inc. | | | |

Johnson Rice & Company L.L.C. | | | |

Raymond James & Associates, Inc. | | | |

Stifel, Nicolaus & Company, Incorporated | | | |

USCA Securities LLC | | | |

Total | | | [***] |

| | | Per Share | | | Total | |||||||

| | | Without Option | | | With Option | | | Without Option | | | With Option | |

Underwriting discounts and commissions paid by us | | | $ | | | $ | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ | | | $ | | | $ |

| • | the contemplated transactions described under “Corporate Reorganization” elsewhere in this prospectus; |

| • | the initial public offering of shares of Class A common stock and the use of the net proceeds therefrom as described in “Use of Proceeds” (the “Offering”). The net proceeds from the sale of the Class A common stock to be retained by the Company are expected to be $[***] million (based on an assumed initial offering price of $[***] per share, the midpoint of the range set forth on the cover of this prospectus), resulting from gross proceeds of $[***] million, reduced for of (i) underwriting discounts of approximately $[***] million and other offering costs of $[***] million and (ii) contribution to Solaris LLC of $[***] million in exchange for the acquisition of the Solaris LLC Units to be held by the Company; |

| • | a provision for corporate income taxes at an effective rate of 8% (which is derived from a total estimated rate of 23.5% for Solaris LLC, reduced by the estimated noncontrolling interest of [***]%) for the year ended December 31, 2020 and the six months ended June 30, 2021, inclusive of all U.S. federal, state and local income taxes; and |

| • | in connection with the offering, we will enter into a Tax Receivable Agreement with the TRA Holders which generally provides for a payment by us for 85% of net cash savings, if any, in U.S. federal, state and local income taxes that we realize. We have estimated this liability to be approximately $75.7 million. |

| | | Historical Solaris Midstream Holdings, LLC | | | Pro Forma Adjustments | | | | | Pro Forma Aris Water Solutions, Inc. | ||

Assets | | | | | | | | | ||||

Cash and Cash Equivalents | | | $31,123 | | | $[***] | | | (a) | | | $[***] |

Accounts Receivable, Net | | | 25,928 | | | — | | | | | 25,928 | |

Accounts Receivable from Affiliate | | | 18,346 | | | — | | | | | 18,346 | |

Other Receivables | | | 3,278 | | | — | | | | | 3,278 | |

Prepaids, Deposits and Other Current Assets | | | 2,149 | | | — | | | | | 2,149 | |

Total Current Assets | | | 80,824 | | | [***] | | | | | [***] | |

| | | | | | | | | |||||

Fixed Assets | | | | | | | | | ||||

Property, Plant and Equipment | | | 706,806 | | | — | | | | | 706,806 | |

Accumulated Depreciation | | | (56,826) | | | — | | | | | (56,826) | |

Total Property, Plant and Equipment, Net | | | 649,980 | | | — | | | | | 649,980 | |

Intangibles, Net | | | 321,233 | | | — | | | | | 321,233 | |

Goodwill | | | 34,585 | | | — | | | | | 34,585 | |

Deferred Tax Assets, Net | | | ― | | | 10,078 | | | (b) | | | 10,078 |

Other Assets | | | 2,140 | | | — | | | | | 2,140 | |

Total Assets | | | $ 1,088,762 | | | $[***] | | | | | $[***] | |

| | | | | | | | | |||||

Liabilities, Mezzanine Equity and Members' Equity | | | | | | | | | ||||

Accounts Payable | | | $10,414 | | | $— | | | | | $10,414 | |

Payables to Affiliate | | | 1,693 | | | — | | | | | 1,693 | |

Accrued and Other Current Liabilities | | | 37,259 | | | — | | | | | 37,259 | |

Total Current Liabilities | | | 49,366 | | | — | | | | | 49,366 | |

Asset Retirement Obligation | | | 5,629 | | | — | | | | | 5,629 | |

Long-Term Debt, Net of Debt Issuance Costs | | | 391,115 | | | — | | | | | 391,115 | |

Deferred Revenue Liability and Other Long-Term liabilities | | | 1,335 | | | — | | | | | 1,335 | |

Payable related to parties pursuant to tax receivable agreements | | | ― | | | 75,700 | | | (b) | | | 75,700 |

Total Liabilities | | | 447,445 | | | 75,700 | | | | | 523,145 | |

| | | | | | | | | |||||

Commitment and Contingencies | | | ― | | | — | | | | | — | |

| | | | | | | | | |||||

Members' Equity | | | 641,317 | | | ([***]) | | | (c) | | | — |

Shareholders' Equity: | | | | | — | | | | | — | ||

Class A common stock | | | ― | | | [***] | | | (c) | | | [***] |

Class B common stock | | | ― | | | — | | | (c) | | | — |

Additional Paid-In Capital | | | ― | | | [***] | | | (c)(d) | | | [***] |

Total Members’ Equity and Aris Inc.’s Share of Equity | | | 641,317 | | | [***] | | | | | [***] | |

Non-Controlling Interest | | | ― | | | [***] | | | (e) | | | [***] |

Total Liabilities and Stockholders' Equity | | | $ 1,088,762 | | | $[***] | | | | | $[***] |

| | | Historical Solaris Midstream Holdings, LLC | | | Pro Forma Adjustments | | | | | Pro Forma Aris Water Solutions, Inc. | ||

Statement of Operations Data | | | | | | | | | ||||

Revenue | | | | | | | | | ||||

Produced Water Handling | | | $85,810 | | | $— | | | | | $85,810 | |

Water Solutions | | | 16,963 | | | — | | | | | 16,963 | |

Total Revenue | | | 102,773 | | | — | | | | | 102,773 | |

| | | | | | | | | |||||

Cost of Revenues | | | | | | | | | ||||

Direct Operating Costs | | | 43,206 | | | | | | | 43,206 | ||

Depreciation, Amortization and Accretion | | | 30,172 | | | | | | | 30,172 | ||

Total Cost of Revenue | | | 73,378 | | | — | | | | | 73,378 | |

| | | | | | | | | |||||

Operating Costs and Expenses | | | | | | | | | ||||

General and Administrative | | | 10,012 | | | | | | | 10,012 | ||

Loss on Disposal of Asset, Net | | | 217 | | | | | | | 217 | ||

Transaction Costs | | | 77 | | | | | | | 77 | ||

Abandoned Projects | | | 1,356 | | | | | | | 1,356 | ||

Total Operating Expenses | | | 11,662 | | | — | | | | | 11,662 | |

Operating Income | | | 17,733 | | | — | | | | | 17,733 | |

| | | | | | | | | |||||

Other Expense | | | | | | | | | ||||

Interest Expense, Net | | | 9,975 | | | | | | | 9,975 | ||

Loss on Debt Modification | | | 380 | | | | | | | 380 | ||

Total Other Expense | | | 10,355 | | | — | | | | | 10,355 | |

Income Before Taxes | | | 7,378 | | | — | | | | | 7,378 | |

Income Taxes | | | 2 | | | [***] | | | (f) | | | [***] |

Net Income (Loss) | | | 7,376 | | | [***] | | | | | [***] | |

Accretion and Dividend—Redeemable Preferred Units | | | 21 | | | | | | | [***] | ||

Net Income (Loss) Attributable to Members'/Stockholders’ Equity | | | 7,397 | | | [***] | | | | | [***] | |

Less: Net Income Attributable to Noncontrolling Interest | | | | | [***] | | | (g) | | | [***] | |

Net Income (Loss) Attributable to Aris Water Solutions, Inc. | | | $7,397 | | | $[***] | | | | | [***] | |

| | | | | | | | | |||||

Net Income (Loss) Per Share Class A Common Stock (h) | | | | | | | | | ||||

Basic and Diluted | | | | | | | | | $[***] | |||

| | | | | | | | | |||||

Weighted Average Shares Class A Common Stock Outstanding (h) | | | | | | | | | ||||

Basic and Diluted | | | | | | | | | [***] |

| | | Historical Solaris Midstream Holdings, LLC | | | Pro Forma Adjustments | | | | | Pro Forma Aris Water Solutions, Inc. | ||

Statement of Operations Data | | | | | | | | | ||||

Revenue | | | | | | | | | ||||

Produced Water Handling | | | $ 141,659 | | | $— | | | | | $141,659 | |

Water Solutions | | | 29,813 | | | — | | | | | 29,813 | |

Total Revenue | | | 171,472 | | | — | | | | | 171,472 | |

| | | | | | | | | |||||

Cost of Revenues | | | | | | | | | ||||

Direct Operating Costs | | | 95,431 | | | | | | | 95,431 | ||

Depreciation, Amortization and Accretion | | | 44,027 | | | | | | | 44,027 | ||

Total Cost of Revenue | | | 139,458 | | | — | | | | | 139,458 | |

| | | | | | | | | |||||

Operating Costs and Expenses | | | | | | | | | ||||

General and Administrative | | | 18,663 | | | | | | | 18,663 | ||

Loss on Disposal of Asset, Net | | | 133 | | | | | | | 133 | ||

Transaction Costs | | | 3,389 | | | | | | | 3,389 | ||

Abandoned Projects | | | 2,125 | | | | | | | 2,125 | ||

Total Operating Expenses | | | 24,310 | | | | | | | 24,310 | ||

Operating Income | | | 7,704 | | | | | | | 7,704 | ||

| | | | | | | | | |||||

Other Expense | | | | | | | | | ||||

Interest Expense, Net | | | 7,674 | | | | | | | 7,674 | ||

Loss on Debt Modification | | | — | | | | | | | — | ||

Total Other Expense | | | 7,674 | | | — | | | | | 7,674 | |

Income Before Taxes | | | 30 | | | | | | | 30 | ||

Income Taxes | | | 23 | | | [***] | | | (f) | | | [***] |

Net Income (Loss) | | | 7 | | | [***] | | | | | $[***] | |

Less: Accretion and Dividend—Redeemable Preferred Units | | | (4,335) | | | | | | | (4,335) | ||

Net Income Attributable to Members'/Stockholders’ Equity | | | $(4,328) | | | $[***] | | | | | $[***] | |

Less: Net Loss Attributable to Non-Controlling Interest | | | | | [***] | | | (g) | | | [***] | |

Net Income (Loss) Aris Water Solutions, Inc. | | | $(4,328) | | | $[***] | | | | | $[***] | |

| | | | | | | | | |||||

Net Income (Loss) Per Share Class A Common Stock (i) | | | | | | | | | ||||

Basic and Diluted | | | | | | | | | $[***] | |||

| | | | | | | | | |||||

Weighted Average Class A Common Stock Outstanding (i) | | | | | | | | | ||||

Basic and Diluted | | | | | | | | | [***] |

| i. | Net proceeds from the offering and use of proceeds as follows: |

Gross Proceeds from Offering | | | $[***] |

Less: | | | |

Underwriting Discounts and Commissions | | | [***] |

Issuance Expenses | | | [***] |

Proceeds, Net of Underwriting and Issuance Expenses | | | [***] |

Less: | | | |

Distribution in Exchange for Solaris LLC Units Being Sold by Existing Owners | | | [***] |

Retained Proceeds from the Offering | | | $[***] |

| ii. | Transaction bonus of $3.25 million to officers and employees in connection with the IPO paid out of cash on hand. |

| (b) | Reflects adjustments to give effect to tax adjustments associated with the Corporate Reorganization and adjustments to give effect to the Tax Receivable Agreement (as described in “Certain Relationships and Related Party Transactions—Tax Receivable Agreement”) based on the following assumptions: |

| i. | We expect to record $9.8 million in deferred tax assets for the estimated income tax effects of the differences in the tax basis and the books basis of the assets owned by Solaris Inc. following completion of the Corporate Reorganization (for purposes of these pro forma statements, we have also increased the deferred tax asset balance by $0.3 million to reflect the expected tax benefit associated with the transaction bonus described above); and |

| ii. | In connection with the offering, we will enter into a Tax Receivable Agreement with the TRA Holders which generally provides for a payment by us for 85% of net cash savings, if any, in U.S. federal, state and local income taxes that we realize. We have estimated this liability to be approximately $75.7 million. This estimate assumes [***] Solaris LLC Units will be redeemed by the existing owners, comprised of [***] units sold plus [***] units exchanged for shares of Class A common stock for tax planning purposes. The estimated Tax Receivable Agreement liability also includes significant assumptions including (i) all exchanges occurred on June 30, 2021; (ii) a price of $[***] per share (the midpoint of the price range set forth on the cover page of this prospectus); (iii) a constant combined federal and state corporate tax rate of 23.5%; (iv) sufficient future taxable income to fully utilize the tax benefits in the year the related tax deduction arises; and (v) no material changes in tax law. |

| (c) | Represents an adjustment to members’/stockholders’ equity reflecting: |

| i. | Par value of $0.01 for approximately [***] million shares of Class A common stock to be outstanding following this offering, and |

| ii. | A decrease of $[***] million in members’ equity to allocate a portion of Aris Water Solutions, Inc.’s equity to the noncontrolling interest. (See Note (e) below). |

| (d) | Represents the effect of the following: |

| i. | The issuance of shares of Class A common stock in this Offering and the application of the net proceeds therefrom, |

| ii. | The net impact of the recording of deferred tax assets and the payable related to the Corporate Reorganization and the Tax Receivable Agreement, as described under note (b) above, |

| iii. | The estimated impact of $[***] million for the historical book basis for existing LLC unit holders that have converted to Class A shares of Aris Water Solutions, Inc. for tax planning purposes, and |

| iv. | The transaction bonus of $3.25 million to officers and employees in connection with the IPO. |

| (e) | Represents non-controlling interest due to consolidation of financial results of Solaris LLC. As described in “Corporate Reorganization,” Aris water Solutions, Inc. will become the sole managing member of Solaris LLC. Aris Water Solutions, Inc. will initially have a minority economic interest in Solaris LLC, but will have control over the management of Solaris LLC. As a result, we will consolidate the financial results of Solaris LLC and will report a noncontrolling interest on our consolidated balance sheet for the percentage of Solaris LLC units not held by Aris Water Solutions, Inc. Upon completion of the contemplated transactions, the noncontrolling interest is expected to own approximately [***]% of Solaris LLC. Details for the adjustment for the noncontrolling interest are as follows: |

Historical Solaris Midstream Members' Equity as of June 30, 2021 | | | $ 641,317 |

Gross Proceeds from Offering | | | [***] |

Underwriting Discounts and Offering Costs | | | [***] |

Net Distribution to Existing LLC Unit Holders | | | [***] |

Transaction Bonus | | | (3,250) |

Pro Forma Solaris Midstream Member's Equity as of June 30, 2021 | | | $[***] |

Estimated Noncontrolling Interest Percentage of Aris Water Solutions, Inc. | | | [***]% |

Pro Forma Noncontrolling Interest of Aris Water Solutions, Inc. | | | $[***] |

| (f) | Reflects estimated incremental income tax expense of $0.6 million for the six months ended June 30, 2021 and $3 thousand for the year ended December 31, 2020 associated with the Company’s historical results of operations assuming the Company’s earnings had been subject to federal income tax as a subchapter C corporation using a statutory tax rate of approximately 23.5% and based on the Company’s ownership of approximately [***]% of Solaris LLC following completion of the contemplated transactions. This rate is inclusive of U.S. federal and state income taxes. |

| (g) | Reflects the reduction in consolidated net income attributable to non-controlling interest for Solaris LLC’s historical results of operations. Upon completion of the Corporate Reorganization, the non-controlling interest will be approximately [***]%. |

| (h) | On a pro forma basis, basic earnings per share and diluted earnings per share are the same as there were no antidilutive securities during the periods presented. Earnings per share on a pro forma basis is computed as follows: |

| | | Six Months Ended June 30, 2021 | | | Year Ended December 31, 2020 | |

Pro forma income before income taxes | | | $[***] | | | $[***] |

Pro forma income tax expense | | | [***] | | | [***] |

Pro forma net income | | | [***] | | | [***] |

Equity accretion and dividend related to redeemable preferred units | | | [***] | | | [***] |

Pro forma net income (loss) attributable to members'/stockholders’ equity | | | [***] | | | [***] |

Net income (loss) attributable to noncontrolling interests | | | [***] | | | [***] |

Pro forma income (loss) available to Class A common stock | | | $[***] | | | $[***] |

Weighted average shares of Class A common stock outstanding (1)(2) | | | [***] | | | [***] |

Pro forma net income (loss) available to Class A common stock per share(1)(2) | | | $[***] | | | $[***] |

| (1) | The pro forma weighted average share amounts for the periods presented have not been adjusted for the potential impacts of [***] shares of Class A common stock underlying restricted stock units or other awards that may be granted to certain employees and non-employee directors after the closing of this offering as the terms have not been finalized. For this purpose, we have assumed (1) the restricted stock units or other awards will be restricted only due to time-based vesting and (2) the restricted stock units or other awards will qualify as a participating security, but will not have a contractual obligation to share in the losses of the Company. Based on the two-class method for the six months ended June 30, 2021, pro forma income (loss) available to Class A common stock would have been reduced by approximately [***] or [***] thousand, which would have reduced basic and diluted pro forma net income per share to $[***]. There would be no impact to the year ended December 31, 2020, for the participating units since the Company was in a loss position. There would be no impact to basic or diluted shares outstanding. |

| (2) | The pro forma weighted average share amounts for the periods presented have not been adjusted to reflect the impact of additional conversion of the [***] Solaris LLC Units to Class A common stock as the impact on pro forma net income (loss) per share would be antidilutive. If we assumed that all [***] Solaris LLC units were converted to Class A common stock, both basic and diluted shares outstanding would increase to [***] million shares outstanding. As a result of the conversion, all earnings would be subject to state and federal income taxes and the company would increase taxes by [***] million and [***] thousand for the six months ended June 30, 2021 and the year ended December 31, 2020, respectively. Additionally, net income (loss) to attributable to noncontrolling interests would be reduced to zero. Assuming no restricted stock as discussed above, these adjustments would not result in an impact to earnings per share and basic and diluted earnings (loss) per share would remain [***] and $[***]for six months ended June 30, 2021 and the year ended December 31, 2021, respectively. |

Exhibit 3.1

FORM OF

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

ARIS WATER SOLUTIONS, INC.

Aris Water Solutions, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware as set forth in Title 8 of the Delaware Code (the “DGCL”), hereby certifies as follows:

1. The original Certificate of Incorporation of the Corporation (the “Original Certificate of Incorporation”) was filed with the Secretary of State of the State of Delaware on May 26, 2021 under the name Solaris Water, Inc.

2. This Amended and Restated Certificate of Incorporation, which restates, integrates and also further amends the Original Certificate of Incorporation, has been declared advisable by the board of directors of the Corporation (the “Board”), duly adopted by the stockholders of the Corporation and duly executed and acknowledged by an authorized officer of the Corporation in accordance with Sections 103, 228, 242 and 245 of the DGCL. References to this “Amended and Restated Certificate of Incorporation” herein refer to the Amended and Restated Certificate of Incorporation, as amended, restated, supplemented and otherwise modified from time to time.

3. The Original Certificate of Incorporation is hereby amended, integrated and restated in its entirety to read as follows

Article I

NAME

Section 1.1. Name. The name of the Corporation is Aris Water Solutions, Inc.

Article II

REGISTERED AGENT

Section 2.1. Registered Agent. The address of its registered office in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, Delaware 19801. The name of the Corporation’s registered agent at such address is The Corporation Trust Company.

Article III

PURPOSE

Section 3.1. Purpose. The nature of the business or purposes to be conducted or promoted by the Corporation is to engage in any lawful act or activity for which corporations may be organized under the DGCL as it currently exists or may hereafter be amended.

Article IV

CAPITALIZATION

Section 4.1. Number of Shares.

(A) The total number of shares of stock that the Corporation shall have authority to issue is shares of stock, classified as:

(1) shares of preferred stock, par value $0.01 per share (“Preferred Stock”);

(2) shares of Class A common stock, par value $0.01 per share (“Class A Common Stock”); and

(3) shares of Class B common stock (“Class B Common Stock” and, together with the Class A Common Stock, the “Common Stock”).

(B) The number of authorized shares of Preferred Stock or Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the outstanding shares of stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL (or any successor provision thereto), and no vote of the holders of either Preferred Stock or Common Stock voting separately as a class shall be required therefor. For purposes of this Amended and Restated Certificate of Incorporation, beneficial ownership of shares shall be determined in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Section 4.2. Provisions Relating to Preferred Stock.

(A) Preferred Stock may be issued from time to time in one or more series, the shares of each series to have such designations and powers, preferences, privileges and rights, and qualifications, limitations and restrictions thereof, as are stated and expressed herein and in the resolution or resolutions providing for the issue of such series adopted by the Board as hereafter prescribed (a “Preferred Stock Designation”).

(B) Subject to any limitations prescribed by law and the rights of any series of the Preferred Stock then outstanding, if any, authority is hereby expressly granted to and vested in the Board to authorize the issuance of Preferred Stock from time to time in one or more series, and with respect to each series of Preferred Stock, to fix and state by the Preferred Stock Designation the designations and the powers, preferences, privileges and rights, and qualifications, limitations and restrictions relating to each series of Preferred Stock, including, but not limited to, the following:

(1) whether or not the series is to have voting rights, full, special or limited, or is to be without voting rights, and whether or not such series is to be entitled to vote as a separate series either alone or together with the holders of one or more other classes or series of stock;

(2) the number of shares to constitute the series and the designation thereof;

(3) restrictions on the issuance of shares of the same series or of any other class or series;

(4) whether or not the shares of any series shall be redeemable at the option of the Corporation or the holders thereof or upon the happening of any specified event, and, if redeemable, the redemption price or prices (which may be payable or issuable in the form of cash, notes, securities or other property), and the time or times at which, and the terms and conditions upon which, such shares shall be redeemable and the manner of redemption;

(5) whether or not the shares of a series shall be subject to the operation of retirement or sinking funds to be applied to the purchase or redemption of such shares for retirement, and, if such retirement or sinking fund or funds are to be established, the annual amount thereof, and the terms and provisions relative to the operation thereof;

(6) the dividend rate, whether dividends are payable in cash, stock of the Corporation or other property, the conditions upon which and the times when such dividends are payable, the preference to or the relation to the payment of dividends payable on any other class or classes or series of stock, whether or not such dividends shall be cumulative or noncumulative, and if cumulative, the date or dates from which such dividends shall accumulate;

(7) the preferences, if any, and the amounts thereof which the holders of any series thereof shall be entitled to receive upon the voluntary or involuntary liquidation, dissolution or winding up of, or upon any distribution of the assets of, the Corporation;

(8) whether or not the shares of any series, at the option of the Corporation or the holder thereof or upon the happening of any specified event, shall be convertible into or exchangeable or redeemable for, the shares of any other class or classes or of any other series of the same or any other class or classes or series of stock, securities or other property of the Corporation and the conversion price or prices or ratio or ratios or the rate or rates at which such exchange or redemption may be made, with such adjustments, if any, as shall be stated and expressed or provided for in such resolution or resolutions; and

(9) such other powers, preferences, privileges and rights, and qualifications, limitations and restrictions with respect to any series as may to the Board seem advisable.

(C) The shares of each series of Preferred Stock may vary from the shares of any other series thereof in any or all of the foregoing respects.

Section 4.3. Provisions Relating to Common Stock.

(A) Except as may otherwise be provided in this Amended and Restated Certificate of Incorporation, each share of Common Stock shall have identical rights and privileges in every respect. Common Stock shall be subject to the express terms of Preferred Stock and any series thereof. Except as may otherwise be required by this Amended and Restated Certificate of Incorporation (including any Preferred Stock Designation) or by applicable law, the holders of shares of Common Stock shall be entitled to one vote for each such share upon all matters which the stockholders are entitled to vote, the holders of shares of Common Stock shall have the exclusive right to vote for the election of directors and on all other matters upon which the stockholders are entitled to vote, and the holders of Preferred Stock shall not be entitled to vote at or receive notice of any meeting of stockholders. Each holder of Common Stock shall be entitled to notice of any stockholders’ meeting in accordance with the bylaws of the Corporation (as in effect at the time in question) and applicable law on all matters put to a vote of the stockholders of the Corporation. Except as otherwise required in this Amended and Restated Certificate of Incorporation (including any Preferred Stock Designation) or by applicable law, the holders of Common Stock shall vote together as a single class on all matters (or, if any holders of Preferred Stock are entitled to vote together with the holders of Common Stock, the holders of Common Stock and the Preferred Stock shall vote together as a single class).

(B) Notwithstanding the foregoing, except as otherwise required by applicable law, holders of Common Stock, as such, shall not be entitled to vote on any amendment to this Amended and Restated Certificate of Incorporation (including any Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to this Amended and Restated Certificate of Incorporation (including any Preferred Stock Designation) or pursuant to the DGCL.

(C) Subject to the prior rights and preferences, if any, applicable to shares of Preferred Stock or any series thereof, the holders of shares of Class A Common Stock shall be entitled to receive ratably in proportion to the number of shares of Class A Common Stock held by them such dividends and distributions (payable in cash, stock or property), if, when and as may be declared thereon by the Board at any time and from time to time out of any funds of the Corporation legally available therefor. Dividends and other distributions shall not be declared or paid on the Class B Common Stock unless (i) the dividend consists of shares of Class B Common Stock or of rights, options, warrants or other securities convertible or exercisable into or exchangeable or redeemable for shares of Class B Common Stock paid proportionally with respect to each outstanding share of Class B Common Stock and (ii) a dividend consisting of shares of Class A Common Stock or of rights, options, warrants or other securities convertible or exercisable into or exchangeable or redeemable for shares of Class A Common Stock on equivalent terms is simultaneously paid to the holders of Class A Common Stock. If dividends are declared on the Class A Common Stock or the Class B Common Stock that are payable in shares of Common Stock, or securities convertible or exercisable into or exchangeable or redeemable for Common Stock, the dividends payable to the holders of Class A Common Stock shall be paid only in shares of Class A Common Stock (or securities convertible or exercisable into or exchangeable or redeemable for Class A Common Stock), the dividends payable to the holders of Class B Common Stock shall be paid only in shares of Class B Common Stock (or securities convertible or exercisable into or exchangeable or redeemable for Class B Common Stock), and such dividends shall be paid in the same number of shares (or fraction thereof) on a per share basis of the Class A Common Stock and Class B Common Stock, respectively (or securities convertible or exercisable into or exchangeable or redeemable for the same number of shares (or fraction thereof) on a per share basis of the Class A Common Stock and Class B Common Stock, respectively). In no event shall the shares of either Class A Common Stock or Class B Common Stock be split, divided, or combined unless the outstanding shares of the other class shall be proportionately split, divided or combined.

(D) In the event of any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, after distribution in full of the preferential amounts, if any, to be distributed to the holders of shares of Preferred Stock or any series thereof, the holders of shares of Class A Common Stock shall be entitled to receive all of the remaining assets of the Corporation available for distribution to its stockholders, ratably in proportion to the number of shares of Class A Common Stock held by them. The holders of shares of Class B Common Stock, as such, shall not be entitled to receive any assets of the Corporation in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation. A dissolution, liquidation or winding-up of the Corporation, as such terms are used in this paragraph (D), shall not be deemed to be occasioned by or to include any consolidation or merger of the Corporation with or into any other corporation or corporations or other entity or a sale, lease, exchange or conveyance of all or a part of the assets of the Corporation.

(E) Shares of Class B Common Stock shall be redeemable for shares of Class A Common Stock on the terms and subject to the conditions set forth in the Fourth Amended and Restated Limited Liability Agreement of Solaris Midstream Holdings, LLC dated as of , 2021 (the “LLC Agreement”). The Corporation will at all times reserve and keep available out of its authorized but unissued shares of Class A Common Stock, solely for the purpose of issuance upon redemption of the outstanding shares of Class B Common Stock for Class A Common Stock pursuant to the LLC Agreement, such number of shares of Class A Common Stock that shall be issuable upon any such redemption pursuant to the LLC Agreement; provided that nothing contained herein shall be construed to preclude the Corporation from satisfying its obligations in respect of any such redemption of shares of Class B Common Stock pursuant to the LLC Agreement by delivering to the holder of such shares of Class B Common Stock upon such redemption, cash in lieu of shares of Class A Common Stock in the amount permitted by and provided in the LLC Agreement or shares of Class A Common Stock which are held in the treasury of the Corporation. All shares of Class A Common Stock that shall be issued upon any such redemption will, upon issuance in accordance with the LLC Agreement, be validly issued, fully paid and non-assessable.

(F) No stockholder shall, by reason of the holding of shares of any class or series of capital stock of the Corporation, have any preemptive or preferential right to acquire or subscribe for any shares or securities of any class or series, whether now or hereafter authorized, which may at any time be issued, sold or offered for sale by the Corporation, unless specifically provided for in a Preferred Stock Designation.

Article V

DIRECTORS

Section 5.1. Term and Classes.

(A) The business and affairs of the Corporation shall be managed by or under the direction of the Board. In addition to the powers and authority expressly conferred upon them by statute or by this Amended and Restated Certificate of Incorporation or the bylaws of the Corporation, the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

(B) The directors, other than those who may be elected by the holders of any series of Preferred Stock specified in the related Preferred Stock Designation (the “Preferred Stock Directors”), shall be divided, with respect to the time for which they severally hold office, into three classes, as nearly equal in number as is reasonably possible, designated Class I, Class II, and Class III. The Board shall have the exclusive power to fix the number of directors in each class. Class I directors shall initially serve until the first annual meeting of stockholders following the initial effectiveness of this Section 5.1(B); Class II directors shall initially serve until the second annual meeting of stockholders following the initial effectiveness of this Section 5.1(B); and Class III directors shall initially serve until the third annual meeting of stockholders following the initial effectiveness of this Section 5.1(B). Commencing with the first annual meeting of stockholders following the initial effectiveness of this Section 5.1(B), directors of each class, the term of which shall then expire, shall be elected to hold office for a three-year term and until the election and qualification of their respective successors in office or until any such director’s earlier death, resignation, removal, retirement or disqualification. In case of any increase or decrease, from time to time, in the number of directors (other than Preferred Stock Directors), the number of directors in each class shall be fixed solely by the Board (as determined solely by the Board), provided, that, the number of directors in each class shall be apportioned as nearly equal as possible. The Board is authorized to assign members of the Board already in office to Class I, Class II or Class III.

Section 5.2. Vacancies and Newly Created Directorships. Subject to applicable law and the rights of the holders of any series of Preferred Stock then outstanding, any newly created directorship that results from an increase in the number of directors or any vacancy on the Board that results from the death, resignation, disqualification or removal of any director or from any other cause shall, unless otherwise required by law or by resolution of the Board, be filled solely by the affirmative vote of a majority of the directors then in office, even if less than a quorum, or by a sole remaining director, and shall not be filled by the stockholders, and any director so chosen shall hold office until the next election of the class for which such director shall have been chosen and until his or her successor shall have been duly elected and qualified. No decrease in the number of authorized directors constituting the Board shall shorten the term of any incumbent director.

Section 5.3. Removal. Subject to the rights of the holders of shares of any series of Preferred Stock, if any, to elect additional directors pursuant to this Amended and Restated Certificate of Incorporation (including any Preferred Stock Designation thereunder), any director may be removed only for cause, upon the affirmative vote of the holders of at least 66 ⅔% of the voting power of the outstanding shares of stock of the Corporation entitled to vote generally for the election of directors, voting together as a single class and acting at a meeting of the stockholders in accordance with the DGCL, this Amended and Restated Certificate of Incorporation and the bylaws of the Corporation. Except as applicable law otherwise provides, cause for the removal of a director shall be deemed to exist only if the director whose removal is proposed: (1) has been convicted of a felony by a court of competent jurisdiction and that conviction is no longer subject to direct appeal; (2) has been found to have been grossly negligent in the performance of his or her duties to the Corporation in any matter of substantial importance to the Corporation by a court of competent jurisdiction; or (3) has been adjudicated by a court of competent jurisdiction to be mentally incompetent, which mental incompetency directly affects his or her ability to serve as a director of the Corporation.

Section 5.4. Number. Subject to the rights of the holders of any series of Preferred Stock to elect directors under specified circumstances, if any, the number of directors shall be fixed from time to time exclusively pursuant to a resolution adopted by the affirmative vote of a majority of the Whole Board. Unless and except to the extent that the bylaws of the Corporation so provide, the election of directors need not be by written ballot. For purposes of this Amended and Restated Certificate of Incorporation, the term “Whole Board” shall mean the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships.

Article VI

STOCKHOLDER ACTION

Section 6.1. Written Consents. Subject to the rights of holders of any series of Preferred Stock with respect to such series of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation must be taken at a duly held annual or special meeting of stockholders and may not be taken by any consent in writing of such stockholders.

Article VII

SPECIAL MEETINGS

Section 7.1. Special Meetings. Except as otherwise required by law, and except as otherwise provided for or fixed pursuant to the provisions of Article IV hereof (including any Preferred Stock Designation thereunder), special meetings of stockholders of the Corporation may be called at any time only by (a) the Board pursuant to a resolution adopted by the affirmative vote of a majority of the Whole Board or (b) the Chairman of the Board. The Board shall fix the date, time and place, if any, of such special meeting. Subject to the rights of holders of any series of Preferred Stock, the stockholders of the Corporation shall not have the power to call or request a special meeting of stockholders of the Corporation. The Board may postpone, reschedule or cancel any special meeting of the stockholders previously scheduled by the Board.

Article VIII

BYLAWS

Section 8.1. Bylaws. In furtherance of, and not in limitation of, the powers conferred by the laws of the State of Delaware, the Board is expressly authorized to adopt, amend or repeal the bylaws of the Corporation. Any adoption, amendment or repeal of the bylaws of the Corporation by the Board shall require the approval of a majority of the Whole Board. Stockholders shall also have the power to adopt, amend or repeal the bylaws of the Corporation; provided, however, that, in addition to any vote of the holders of any class or series of stock of the Corporation required by law or by this Amended and Restated Certificate of Incorporation, the bylaws of the Corporation may be adopted, altered, amended or repealed by the stockholders of the Corporation only by the affirmative vote of holders of not less than 66 ⅔% in voting power of the then-outstanding shares of stock entitled to vote thereon, voting together as a single class. No bylaws hereafter made or adopted, nor any repeal of or amendment thereto, shall invalidate any prior act of the Board that was valid at the time it was taken.

Article IX

LIMITATION OF DIRECTOR LIABILITY

Section 9.1. Limitation of Director Liability. No director of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as it now exists. In addition to the circumstances in which a director of the Corporation is not personally liable as set forth in the preceding sentence, a director of the Corporation shall not be liable to the fullest extent permitted by any amendment to the DGCL hereafter enacted that further limits the liability of a director. Any amendment, repeal or modification of this Article IX shall be prospective only and shall not affect any limitation on liability of a director for acts or omissions occurring prior to the date of such amendment, repeal or modification.

Article X

CORPORATE OPPORTUNITY

Section 10.1. Corporate Opportunities. Designated Parties (defined below) may own substantial equity interests in other entities and may make investments and enter into advisory service agreements and other agreements from time to time. Certain Designated Parties may also serve as employees, partners, officers or directors of other companies and, at any given time, certain Designated Parties may be in direct or indirect competition with the Corporation and/or its subsidiaries. The Corporation waives, to the maximum extent permitted by law, the application of the doctrine of corporate opportunity (or any analogous doctrine) with respect to the Corporation to the Designated Parties, except, in the case of a Designated Party who is a director of the Corporation, any such corporate opportunity that is expressly offered to such Designated Party in writing solely in his or her capacity as a director of the Corporation. As a result of such waiver, no Designated Party shall have any obligation to refrain from: (A) engaging in or managing the same or similar activities or lines of business as the Corporation or any of its subsidiaries or developing or marketing any products or services that compete (directly or indirectly) with those of the Corporation or any of its subsidiaries; (B) investing in or owning any (public or private) interest in any Person engaged in the same or similar activities or lines of business as, or otherwise in competition with, the Corporation or any of its subsidiaries (including any Designated Party, a “Competing Person”); (C) developing a business relationship with any Competing Person; or (D) entering into any agreement to provide any service(s) to any Competing Person or acting as an officer, director, member, manager or advisor to, or other principal of, any Competing Person, regardless (in the case of each of (A) through (D)) of whether such activities are in direct or indirect competition with the business or activities of the Corporation or any of its subsidiaries (the activities described in (A) through (D) are referred to herein as “Specified Activities”). To the fullest extent permitted by law, the Corporation hereby renounces (for itself and on behalf of its subsidiaries) any interest or expectancy in, or in being offered an opportunity to participate in, any Specified Activity (a “Business Opportunity”) that may be presented to or become known to any Designated Party, except, in the case of a Designated Party who is a director of the Corporation, any such Business Opportunity that is expressly offered to such Designated Party in writing solely in his or her capacity as a director of the Corporation.

Section 10.2. Definitions. For purposes of this Article X, the following terms have the following definitions:

(A) “Affiliate” means, with respect to a specified Person, a Person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, such specified Person; with respect to any Designated Party member, an “Affiliate” shall include (1) any Person who is the direct or indirect ultimate holder of “equity securities” (as such term is described in Rule 405 under the Securities Act of 1933, as amended) of such Designated Party member, and (2) any investment fund, alternative investment vehicle, special purpose vehicle or holding company that is directly or indirectly managed, advised or controlled by such Designated Party member.

(B) “Designated Parties” means Yorktown Energy Partners XI, L.P., TCP Solaris SPV LLC, COG Operating LLC and their respective Affiliates (other than the Corporation) and all of their respective interests in other entities (existing and future) that participate in the energy or water infrastructure industry, as applicable.

(C) “Person” means any individual, corporation, partnership, limited liability company, joint venture, firm, association, or other entity.

To the fullest extent permitted by applicable law, any Person purchasing or otherwise acquiring any interest in any shares of capital stock of the Corporation shall be deemed to have notice of, and to have consented to, the provisions of this Article X. This Article X shall not limit any protections or defenses available to, or indemnification or advancement rights of, any director or officer of the Corporation under this Amended and Restated Certificate of Incorporation, the bylaws of the Corporation or any applicable law.

Article XI

BUSINESS COMBINATIONS WITH INTERESTED STOCKHOLDERS

Section 11.1. Opt Out. The Corporation expressly elects not to be governed by or subject to the provisions of Section 203 of the DGCL as now in effect or hereafter amended, or any successor statute thereto, and the restrictions contained in Section 203 of the DGCL shall not apply to the Corporation.

Section 11.2. Applicable Restrictions to Business Combinations. Notwithstanding the foregoing, the Corporation shall not engage in any business combination (as defined below), at any point in time at which any class of Common Stock is registered under Section 12(b) or 12(g) of the Exchange Act with any interested stockholder (as defined below) for a period of three years following the time that such stockholder became an interested stockholder, unless:

(a) prior to such time, the Board approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder, or

(b) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock (as defined below) of the Corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned by (A) persons who are directors and also officers and (B) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer, or

(c) at or subsequent to such time, the business combination is approved by the Board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 ⅔% in voting power of the outstanding shares of stock of the Corporation entitled to vote thereon which is not owned by the interested stockholder.

Section 11.3. Certain Definitions. For purposes of this Article XI, references to:

(a) “affiliate” means a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, another person.

(b) “associate,” when used to indicate a relationship with any person, means: (i) any corporation, partnership, unincorporated association or other entity of which such person is a director, officer or partner or is, directly or indirectly, the owner of 20% or more of any class of voting stock; (ii) any trust or other estate in which such person has at least a 20% beneficial interest or as to which such person serves as trustee or in a similar fiduciary capacity; and (iii) any relative or spouse of such person, or any relative of such spouse, who has the same residence as such person.

(c) “business combination,” when used in reference to the Corporation and any interested stockholder of the Corporation, means:

(i) any merger or consolidation of the Corporation or any direct or indirect majority-owned subsidiary of the Corporation (A) with the interested stockholder, or (B) with any other corporation, partnership, unincorporated association or other entity if the merger or consolidation is caused by the interested stockholder and as a result of such merger or consolidation this Article XI is not applicable to the surviving entity;

(ii) any sale, lease, exchange, mortgage, pledge, transfer or other disposition (in one transaction or a series of transactions), except proportionately as a stockholder of the Corporation, to or with the interested stockholder, whether as part of a dissolution or otherwise, of assets of the Corporation or of any direct or indirect majority-owned subsidiary of the Corporation which assets have an aggregate market value equal to 10% or more of either the aggregate market value of all the assets of the Corporation determined on a consolidated basis or the aggregate market value of all the outstanding stock of the Corporation;

(iii) any transaction which results in the issuance or transfer by the Corporation or by any direct or indirect majority-owned subsidiary of the Corporation of any stock of the Corporation or of such subsidiary to the interested stockholder, except: (A) pursuant to the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which securities were outstanding prior to the time that the interested stockholder became such; (B) pursuant to a merger under Section 251(g) of the DGCL; (C) pursuant to a dividend or distribution paid or made, or the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which security is distributed, pro rata to all holders of a class or series of stock of the Corporation subsequent to the time the interested stockholder became such; (D) pursuant to an exchange offer by the Corporation to purchase stock made on the same terms to all holders of said stock; or (E) any issuance or transfer of stock by the Corporation; provided, however, that in no case under items (C) through (E) of this subsection (iii) shall there be an increase in the interested stockholder’s proportionate share of the stock of any class or series of the Corporation or of the voting stock of the Corporation (except as a result of immaterial changes due to fractional share adjustments);

(iv) any transaction involving the Corporation or any direct or indirect majority-owned subsidiary of the Corporation which has the effect, directly or indirectly, of increasing the proportionate share of the stock of any class or series, or securities convertible into the stock of any class or series, of the Corporation or of any such subsidiary which is owned by the interested stockholder, except as a result of immaterial changes due to fractional share adjustments or as a result of any purchase or redemption of any shares of stock not caused, directly or indirectly, by the interested stockholder; or

(v) any receipt by the interested stockholder of the benefit, directly or indirectly (except proportionately as a stockholder of the Corporation), of any loans, advances, guarantees, pledges, or other financial benefits (other than those expressly permitted in subsections (i) through (iv) above) provided by or through the Corporation or any direct or indirect majority-owned subsidiary.

(d) “control,” including the terms “controlling,” “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting stock, by contract, or otherwise. A person who is the owner of 20% or more of the outstanding voting stock of a corporation, partnership, unincorporated association or other entity shall be presumed to have control of such entity, in the absence of proof by a preponderance of the evidence to the contrary. Notwithstanding the foregoing, a presumption of control shall not apply where such person holds voting stock, in good faith and not for the purpose of circumventing this Article XI, as an agent, bank, broker, nominee, custodian or trustee for one or more owners who do not individually or as a group have control of such entity.

(e) “interested stockholder” means any person (other than the Corporation or any direct or indirect majority-owned subsidiary of the Corporation) that (i) is the owner of 15% or more of the outstanding voting stock of the Corporation, or (ii) is an affiliate or associate of the Corporation and was the owner of 15% or more of the outstanding voting stock of the Corporation at any time within the three-year period immediately prior to the date on which it is sought to be determined whether such person is an interested stockholder; and the affiliates and associates of such person; provided, however, that the term “interested stockholder” shall not include (A) any Principal Holder, Principal Holder Direct Transferee or Principal Holder Indirect Transferee, (B) a stockholder that becomes an interested stockholder inadvertently and (x) as soon as practicable divests itself of ownership of sufficient shares so that such stockholder ceases to be an interested stockholder and (y) would not, at any time within the three-year period immediately prior to a business combination between the Corporation and such stockholder, have been an interested stockholder but for the inadvertent acquisition of ownership or (C) any person whose ownership of shares in excess of the 15% limitation set forth herein is the result of any action taken solely by the Corporation; provided, however, that such person specified in this clause (C) shall be an interested stockholder if thereafter such person acquires additional shares of voting stock of the Corporation, except as a result of further corporate action not caused, directly or indirectly, by such person. For the purpose of determining whether a person is an interested stockholder, the voting stock of the Corporation deemed to be outstanding shall include stock deemed to be owned by the person through application of the definition of “owner” below but shall not include any other unissued stock of the Corporation which may be issuable pursuant to any agreement, arrangement or understanding, or upon exercise of conversion rights, warrants or options, or otherwise.

(f) “owner,” including the terms “own” and “owned,” when used with respect to any stock, means a person that individually or with or through any of its affiliates or associates:

(i) beneficially owns such stock, directly or indirectly; or

(ii) has (A) the right to acquire such stock (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding, or upon the exercise of conversion rights, exchange rights, warrants or options, or otherwise; provided, however, that a person shall not be deemed the owner of stock tendered pursuant to a tender or exchange offer made by such person or any of such person’s affiliates or associates until such tendered stock is accepted for purchase or exchange; or (B) the right to vote such stock pursuant to any agreement, arrangement or understanding; provided, however, that a person shall not be deemed the owner of any stock because of such person’s right to vote such stock if the agreement, arrangement or understanding to vote such stock arises solely from a revocable proxy or consent given in response to a proxy or consent solicitation made to 10 or more persons; or

(iii) has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting (except voting pursuant to a revocable proxy or consent as described in clause (B) of subsection (ii) above), or disposing of such stock with any other person that beneficially owns, or whose affiliates or associates beneficially own, directly or indirectly, such stock.

(g) “person” means any individual, corporation, partnership, unincorporated association or other entity.

(h) “Principal Holder Direct Transferee” means any person that acquires (other than in a registered public offering), directly from one or more of the Principal Holders, beneficial ownership of 15% or more of the then-outstanding voting stock of the Corporation.

(i) “Principal Holder Indirect Transferee” means any person that acquires (other than in a registered public offering) directly from any Principal Holder Direct Transferee or any other Principal Holder Indirect Transferee beneficial ownership of 15% or more of the then-outstanding voting stock of the Corporation.

(j) “Principal Holders” means Yorktown Energy Partners XI, L.P., TCP Solaris SPV LLC, COG Operating LLC and their respective successors and affiliates; provided, however, that the term “Principal Holders” shall not include (i) the Corporation or any of the Corporation’s direct or indirect subsidiaries and (ii) any of the Principal Holders’ respective portfolio companies (as such term is commonly understood).