Class B Common Stock) exchanged, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications.

Redemption Rights

Following the Offering, under the Solaris LLC Agreement, Legacy Owners of Solaris LLC units, subject to certain limitations, have the right, pursuant to a redemption right, to cause Solaris LLC to acquire all or a portion of their Solaris LLC units for, at Solaris LLC’s election, (x) shares of our Class A common stock at a redemption ratio of 1 share of Class A common stock for each Solaris LLC unit redeemed, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications or (y) an equivalent amount of cash. Alternatively, upon the exercise of the redemption right, we have the right, pursuant to a call right, to acquire each tendered Solaris LLC unit directly from the Legacy Owner for, at our election, (x) 1 share of Class A common stock or (y) an equivalent amount of cash.

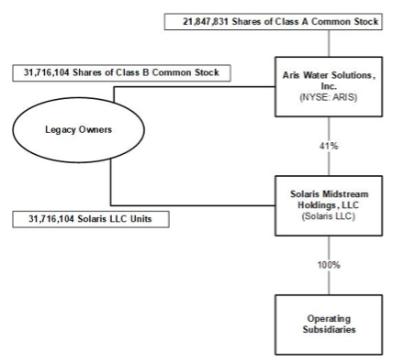

On December 6, 2021, 1,486,396 Solaris LLC units were converted to shares of our Class A common stock. As of December 31, 2021, we own approximately 41% of Solaris LLC. On February 28, 2022, an additional 148,087 Solaris LLC units were converted to shares of our Class A common stock.

Corporate Reorganization

The transactions described above, (altogether, the “Corporate Reorganization”) have been accounted for as a reorganization of entities under common control. As a result, our consolidated financial statements recognize the assets and liabilities received in the Corporate Reorganization at their historical carrying amounts, as reflected in the historical financial statements of Solaris LLC.

2.Significant Accounting Policies

Basis of Presentation

All dollar amounts, except per unit amounts, in the financial statements and tables in the notes are stated in thousands of dollars unless otherwise indicated.

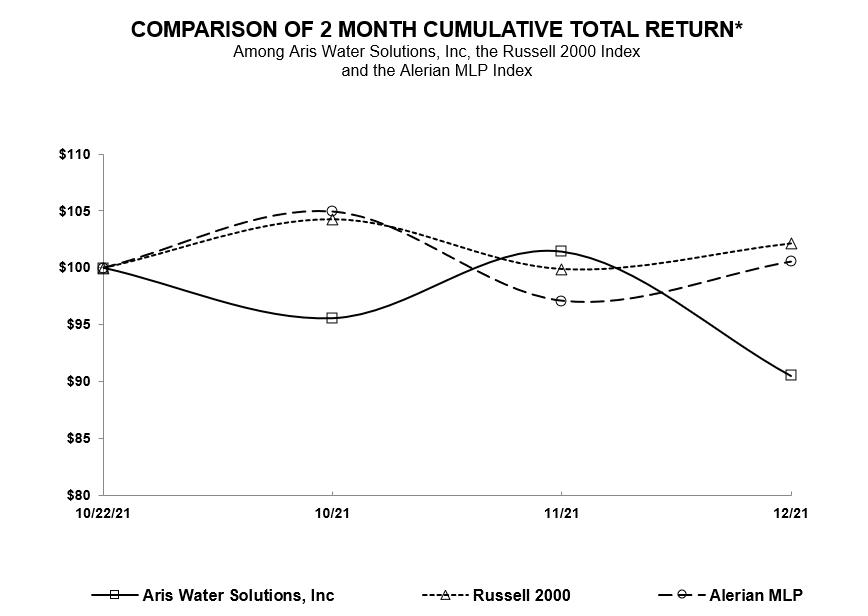

In these consolidated financial statements, periods prior to IPO closing on October 26, 2021 reflect the financial statements of Solaris LLC and its subsidiaries, described below (referred to herein as the “Predecessor”). Periods subsequent to IPO closing on October 26, 2021 reflect the financial statements of the consolidated Company including Aris Inc., Solaris LLC and Solaris LLC’s subsidiaries (referred to herein as the “Successor”).

On January 15, 2021, ConocoPhillips acquired Concho Resources, Inc. (“Concho”). We refer to Concho as ConocoPhillips, their successor, throughout these consolidated financial statements.

Consolidation

We have determined that the members with equity at risk in Solaris LLC lack the authority, through voting rights or similar rights, to direct the activities that most significantly impact Solaris LLC’s economic performance; therefore, Solaris LLC is considered a variable interest entity (“VIE”). As the managing member of Solaris LLC, we operate and control all of the business and affairs of Solaris LLC as well as have the obligation to absorb losses or the right to receive benefits that could be potentially significant to us. Therefore, we are considered the primary beneficiary and consolidate Solaris LLC.

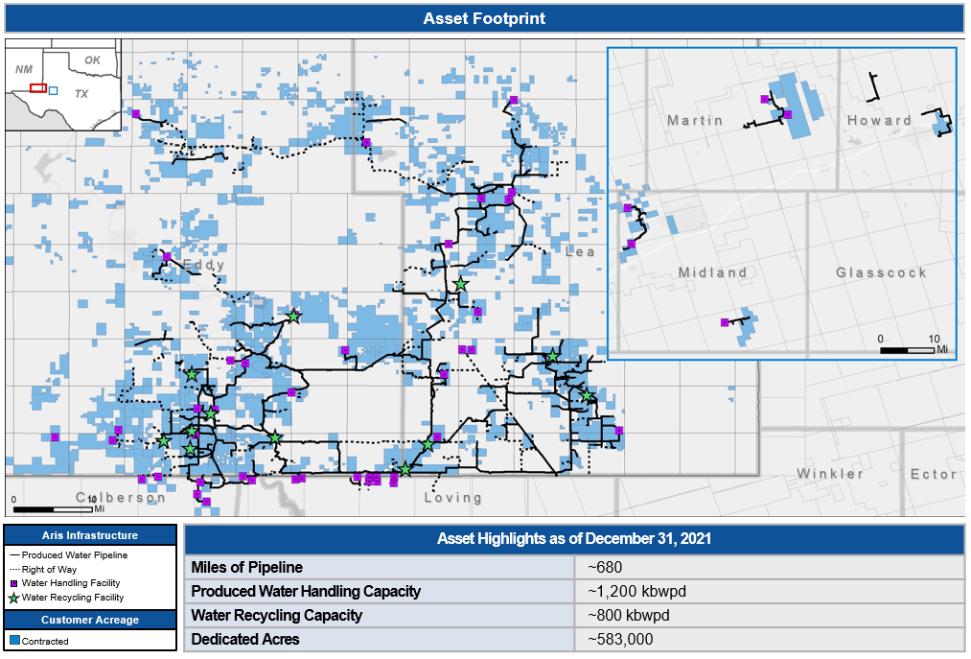

The financial statements include the accounts of the Company, Solaris LLC and Solaris LLC’s wholly owned subsidiaries which include Solaris Water Midstream, LLC, Solaris Midstream DB-TX, LLC, Solaris Midstream MB, LLC, Solaris Midstream DB-NM, LLC, 829 Martin County Pipeline, LLC and Clean H2O Technologies,