UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 11, 2024

Southport Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-41150 | 86-3483780 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

8 Bolling Place

Greenwich, CT | 06830 |

| (Address of principal executive offices) | (Zip Code) |

(917) 503-9722

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: None.

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one warrant | | PORTU | | None(1) |

| Class A common stock, $0.0001 par value per share | | PORT | | None(1) |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50, subject to adjustment | | PORTW | | None(1) |

(1) On April 8, 2024, the New York Stock Exchange (the “NYSE”) filed a Form 25 to delist the Company’s Class A common stock, $0.0001 par value per share (“Class A Common Stock”), warrants, with each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50, subject to adjustment (“Warrants”) and units, each consisting of one share of Class A Common Stock and one-half of one Warrant (“Units”) and remove such securities from registration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The delisting became effective 10 days after the filing of the Form 25. The deregistration of the Company’s Class A Common Stock, Warrants and Units under Section 12(b) of the Exchange Act became effective 90 days after the Form 25 filing. The Company’s securities remain registered under Section 12(g) of the Exchange Act. The Company’s Class A Common Stock, Warrants and Units began trading on the OTC Pink Marketplace on or about March 22, 2024 under the symbols “PORT”, “PORTW” and “PORTU”, respectively.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 11, 2024, Southport Acquisition Corporation, a Delaware corporation (“Southport”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among Southport, Sigma Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Southport (“Merger Sub”), and Angel Studios, Inc., a Delaware corporation (“Angel Studios”).

The Merger Agreement provides that, among other things and upon the terms and subject to the conditions thereof, the following transactions will occur:

| i. | at the closing of the transactions contemplated by the Merger Agreement (the “Closing”), upon the terms and subject to the conditions thereof, and in accordance with the Delaware General Corporation Law, as amended (the “DGCL”), Merger Sub will merge with and into Angel Studios, with Angel Studios continuing as the surviving corporation and a wholly owned subsidiary of Southport (the “Merger”); |

| ii. | at the Closing, all of the outstanding capital stock of Angel Studios (other than shares subject to Angel Studios options, shares held in treasury and any dissenting shares) will be converted into the right to receive shares of common stock, par value $0.0001 per share, of Southport (“Southport Common Stock”), in an aggregate amount equal to (x) $1,500,000,000 plus the aggregate gross proceeds of any capital raised by Angel Studios prior to the Closing, divided by (y) $10.00; |

| iii. | at the Closing, all of the outstanding options to acquire capital stock of Angel Studios will be converted into comparable options to acquire shares of Southport Common Stock (subject to appropriate adjustments to the number of shares of Southport Common Stock underlying such options and the exercise price of such options); |

| iv. | subject to the approval of the holders of Southport’s public warrants, Southport will amend its public warrants so that, immediately prior to the Closing, each of the issued and outstanding Southport public warrants automatically will convert into 0.1 newly issued share of Southport Class A Common Stock and such warrants will cease to be outstanding (the “Warrant Conversion”); and |

| v. | at the Closing, Southport will be renamed “Angel Studios, Inc.” |

The Board of Directors of Southport (the “Board”) has unanimously (i) approved and declared advisable the Merger Agreement and the Merger and (ii) resolved to recommend approval of the Merger Agreement and related matters by the stockholders of Southport.

The Merger Agreement is subject to the satisfaction or waiver of certain customary closing conditions, including, among others, the approval of the Merger Agreement and the transactions contemplated thereby by the respective stockholders of Southport and Angel Studios, and the approval by Southport’s stockholders of an extension to Southport’s deadline to consummate a business combination to September 30, 2025.

On September 11, 2024, Southport also entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”), by and among Southport, Southport Acquisition Sponsor LLC, a Delaware limited liability company (the “Sponsor”), and Angel Studios, pursuant to which the Sponsor has agreed to, among other things, (i) vote in favor of the Merger Agreement and the transactions contemplated thereby and (ii) not redeem its shares of Southport Common Stock in connection therewith. In addition, the Sponsor has agreed to forfeit all of the Southport private placement warrants held by it at the Closing for no additional consideration. The Sponsor has also agreed to cover certain expenses incurred by Southport that are unpaid and payable at the Closing in excess of a specified cap.

On September 11, 2024, Southport also entered into a Stockholder Support Agreement (the “Angel Studios Stockholder Support Agreement”) by and among Southport, Angel Studios and certain stockholders of Angel Studios (the “Key Stockholders”). Under the Angel Studios Stockholder Support Agreement, the Key Stockholders agreed, with respect to the outstanding shares of Angel Studios common stock held by such Key Stockholders, to vote their shares or execute and deliver a written consent adopting the Merger Agreement and related transactions and approving the Merger Agreement and transactions contemplated thereby.

A copy of the Merger Agreement, the Sponsor Support Agreement and the Angel Studios Stockholder Support Agreement will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibits 2.1, 10.1 and 10.2, respectively, and the foregoing descriptions of each of the Merger Agreement, the Sponsor Support Agreement and the Stockholder Support Agreement are qualified in their entirety by reference thereto.

Item 7.01 Regulation FD Disclosure.

On September 11, 2024, Southport and Angel Studios issued a joint press release (the “Press Release”) announcing the execution of the Merger Agreement. The Press Release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Attached as Exhibit 99.2 and incorporated herein by reference is the investor presentation dated September 11, 2024, for use by Southport and Angel Studios in meetings with certain of their respective stockholders as well as other persons with respect to the transactions described in this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of Southport under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2.

Additional Information and Where to Find It

In connection with the proposed transaction, Southport intends to file a registration statement on Form S-4 (as it may be amended, the “Registration Statement”) with the SEC, which will include a preliminary prospectus and joint proxy statement of Southport and Angel Studios, referred to as a joint proxy statement/prospectus. Such documents are not currently available. When available, a final joint proxy statement/prospectus will be sent to all Southport and Angel Studios stockholders. Southport and Angel Studios will also file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the Registration Statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Southport and Angel Studios (when available) through the website maintained by the SEC at http://www.sec.gov. The documents filed by Southport with the SEC also may be obtained free of charge upon written request to 8 Bolling Place, Greenwich, CT 06830. The documents filed by Angel Studios with the SEC also may be obtained free of charge on Angel Studios’ website at https://www.angel.com/legal/sec-filings or upon written request to 295 W Center Street, Provo, UT 84601.

Participants in Solicitation

Southport, Angel Studios and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Southport, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Southport’s Annual Report on Form 10-K for its fiscal year ended December 31, 2023, which was filed with the SEC on April 1, 2024, under the headings “Directors, Executive Officers and Corporate Governance,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Southport Common Stock by the directors and executive officers of Southport have changed from the amounts of Southport Common Stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Angel Studios, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Angel Studios’ amended Form 10, which was filed with the SEC on May 13, 2024, under the headings “Security Ownership of Certain Beneficial Owners and Management,” “Directors and Executive Officers,” “Executive Compensation,” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Angel Studios common stock by the directors and executive officers of Angel Studios have changed from the amounts of Angel Studios common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from Southport or Angel Studios using the sources indicated above.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Angel Studios and Southport. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of the combined company’s securities, (ii) the risk that the proposed transaction may not be completed by Southport’s business combination deadline and the potential failure to obtain an extension of the business combination deadline, (iii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Southport and Angel Studios, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the transaction on Angel Studios’ business relationships, operating results, and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of Angel Studios or diverts management’s attention from Angel Studios’ ongoing business operations and potential difficulties in Angel Studios employee retention as a result of the announcement and consummation of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Angel Studios or against Southport related to the Merger Agreement or the proposed transaction, (ix) the ability to list the combined company’s securities on a national securities exchange in connection with the transaction, (x) the price of Southport’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Southport plans to operate or Angel Studios operates, variations in operating performance across competitors, changes in laws and regulations affecting Southport’s or Angel Studios’ business, and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xii) the ability to recognize the anticipated benefits of the proposed transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees, (xiii) the evolution of the markets in which Angel Studios competes, (xiv) the costs related to the proposed transaction, (xv) Angel Studios’ expectations regarding its market opportunities, (xvi) risks related to domestic and international political and macroeconomic uncertainty, including the Russia-Ukraine conflict and the war in the Middle East, and (xvii) the risk of downturns and a changing regulatory landscape in the highly competitive industry in which Angel Studios operates. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Southport’s and Angel Studios’ annual reports on Form 10-K and Form 10, respectively, and quarterly reports on Form 10-Q, the Registration Statement on Form S-4 when available, including those under “Risk Factors” therein, and other documents filed by Southport and Angel Studios from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Angel Studios and Southport assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Angel Studios nor Southport gives any assurance that either Angel Studios or Southport, or the combined company, will achieve its expectations.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Southport Acquisition Corporation |

| | | |

| Date: September 11, 2024 | By: | /s/ Jeb Spencer |

| | | Name: Jeb Spencer |

| | | Title: Chief Executive Officer |

Exhibit 99.1

Angel Studios to Become a Publicly Traded Company via Business Combination with Southport Acquisition Corporation

Mission-Driven Differentiated Media Company Will Continue to Be Led by Co-Founder, Neal Harmon

Attractive Angel Guild Community Has Membership Based Recurring Revenue Model

Angel Studios Revenues of $45.0 Million for the Six Months Ended June 30, 2024, Up from $39.0 Million for the Six Months Ended 2023

Transaction With No Minimum Cash Condition, Closing Expected to be Completed in the First Half of 2025, Seeks to Support Company’s Continued Bitcoin Treasury Strategy

Provo, UT, & Del Mar, CA. (September 11, 2024)—Angel Studios—the studio empowering everyday fans to greenlight development and distribution of movies and TV shows—today announced it has entered into a definitive agreement to become a publicly listed company through a business combination with Southport Acquisition Corporation (OTC: PORT) (“Southport”), a special purpose acquisition company. Upon the closing of the transaction, the combined company’s Class A common stock is expected to be listed on the NYSE or Nasdaq under the ticker symbol “AGSD”.

Angel Studios is led by co-founder and CEO Neal Harmon, who will continue to lead the combined company following the closing of the transaction.

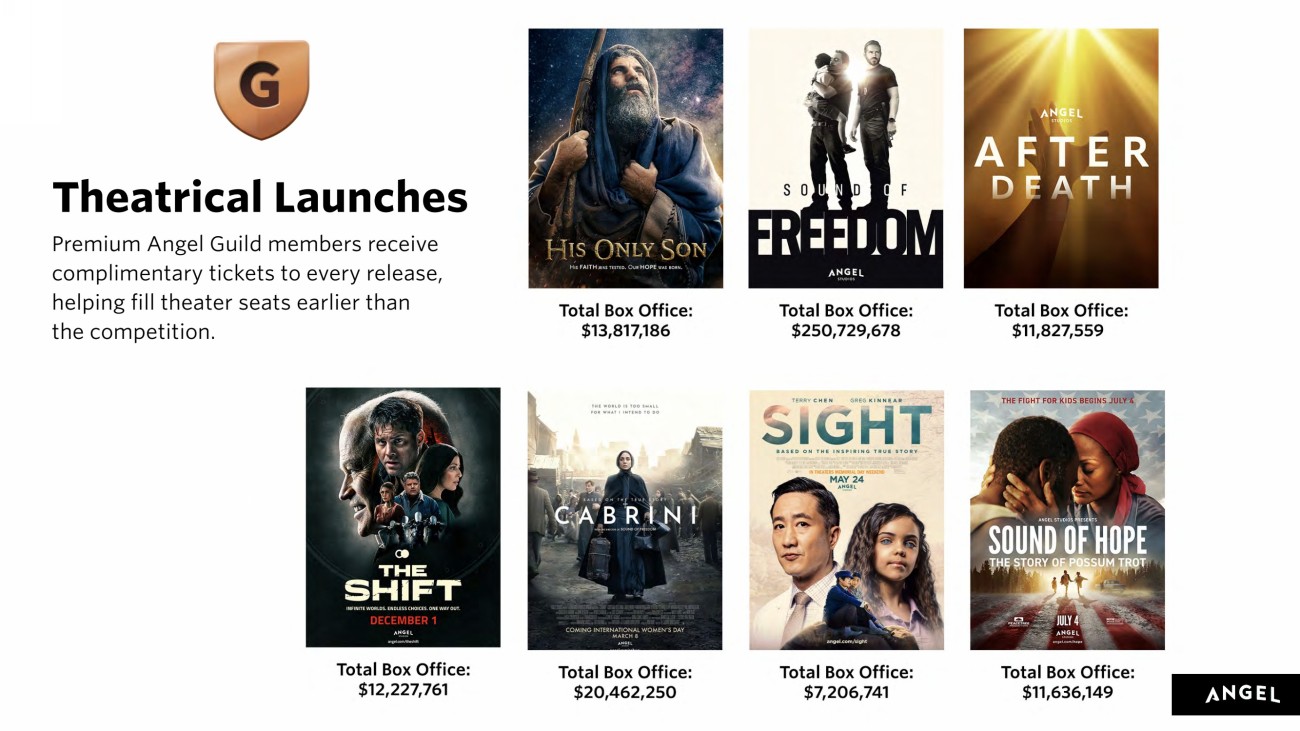

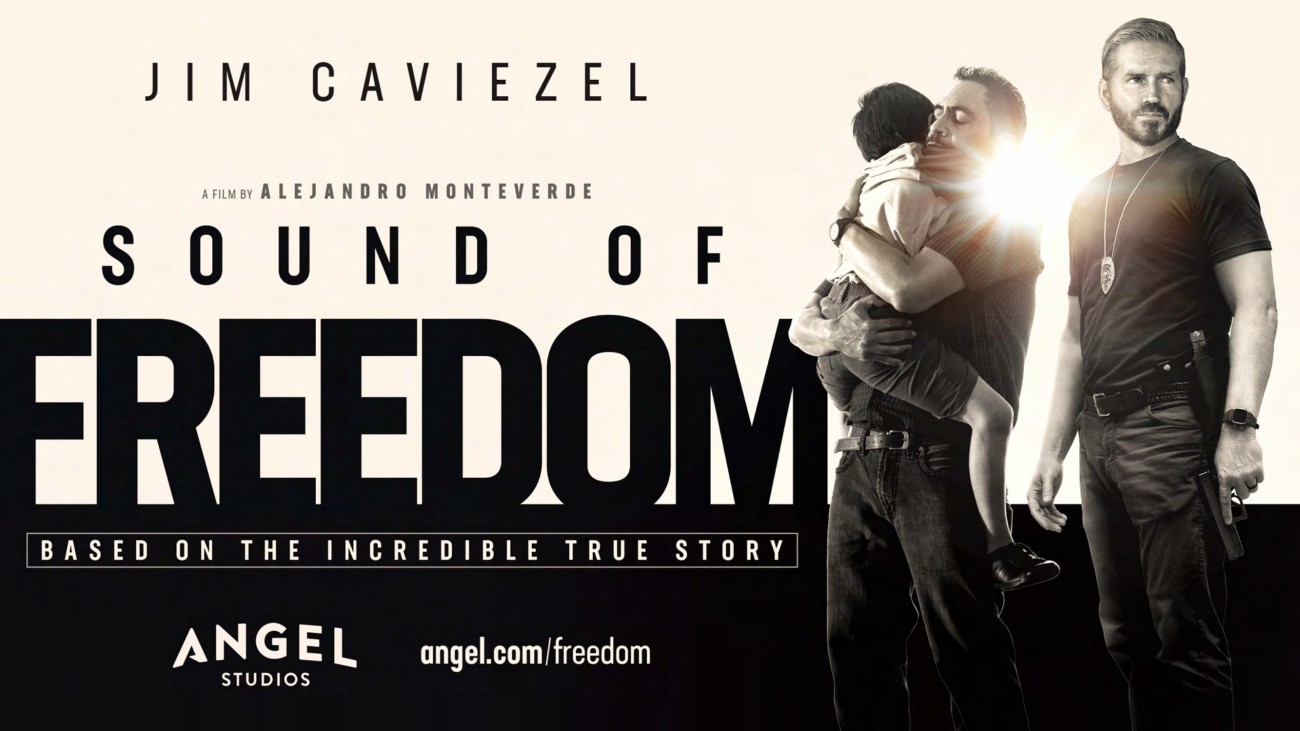

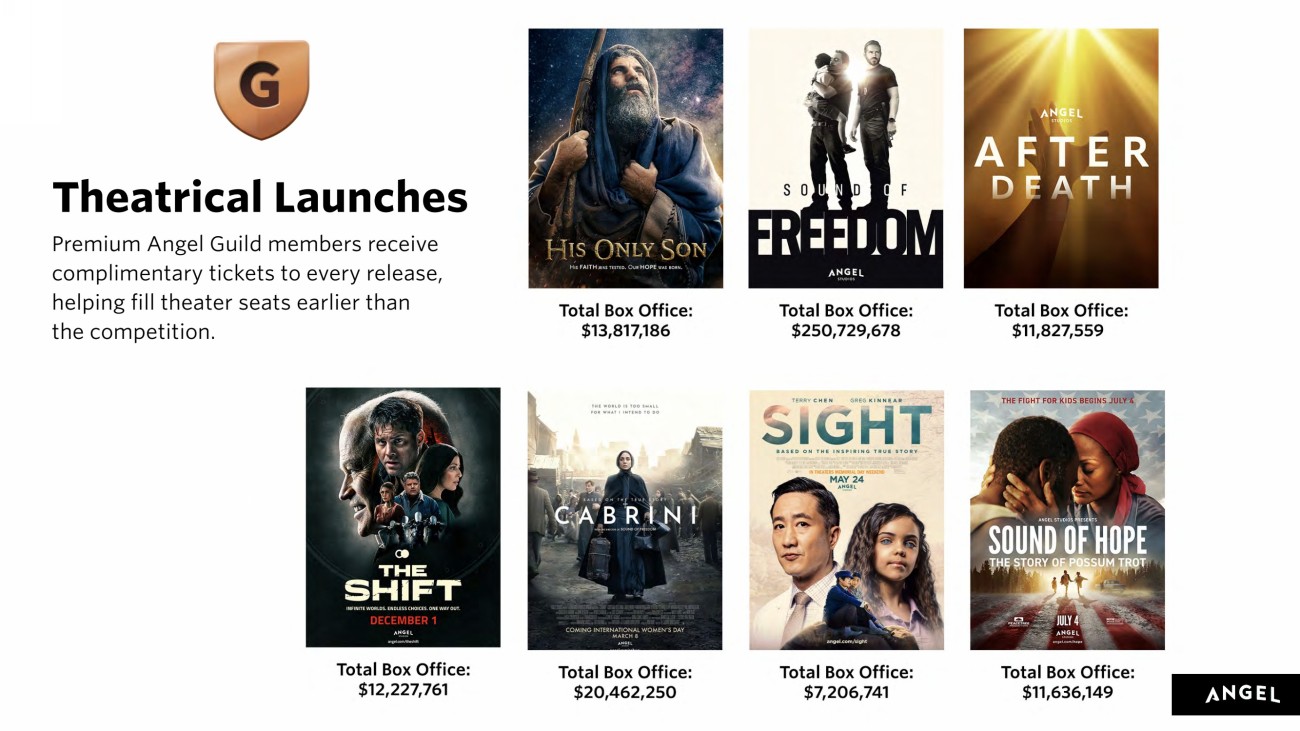

In March 2023, Angel Studios released its first theatrical film, HIS ONLY SON, grossing approximately $13.5 million in the box office. Angel Studio’s following film, SOUND OF FREEDOM, grossed approximately $250.0 million in the box office and became one of the top 10 grossing films in the United States that year.

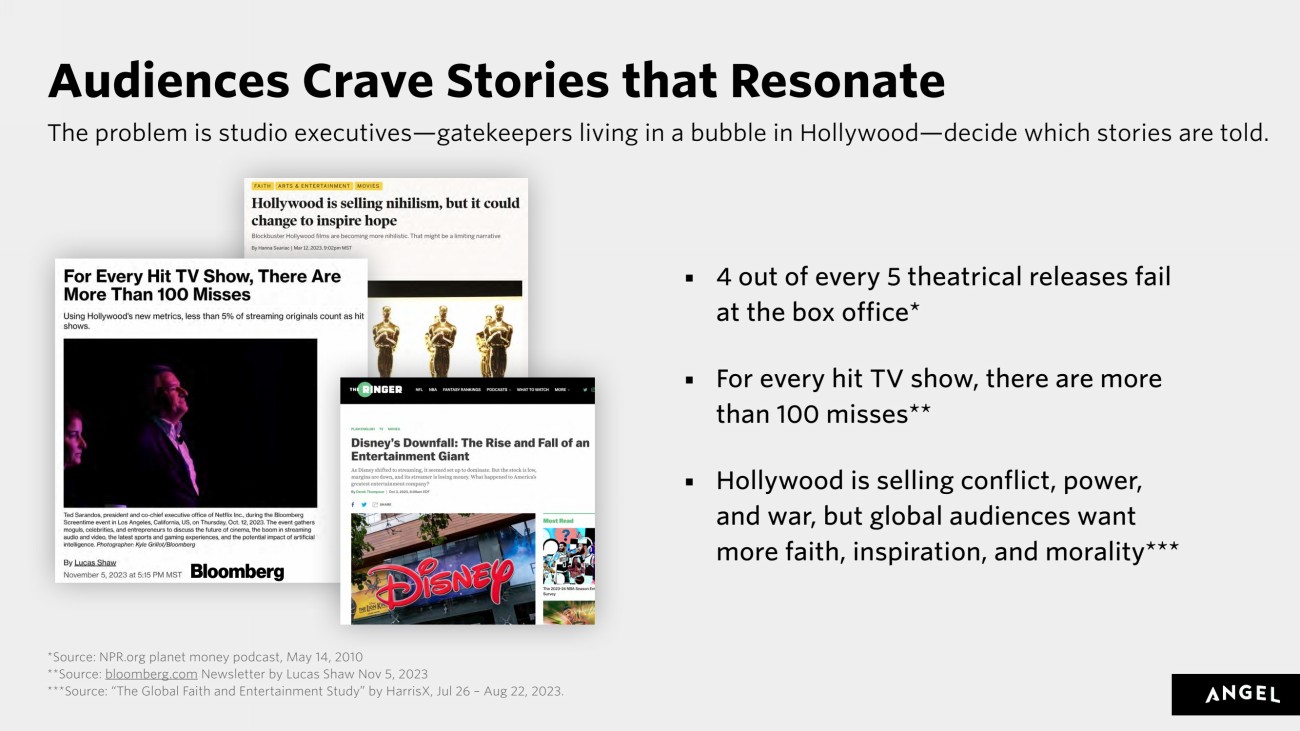

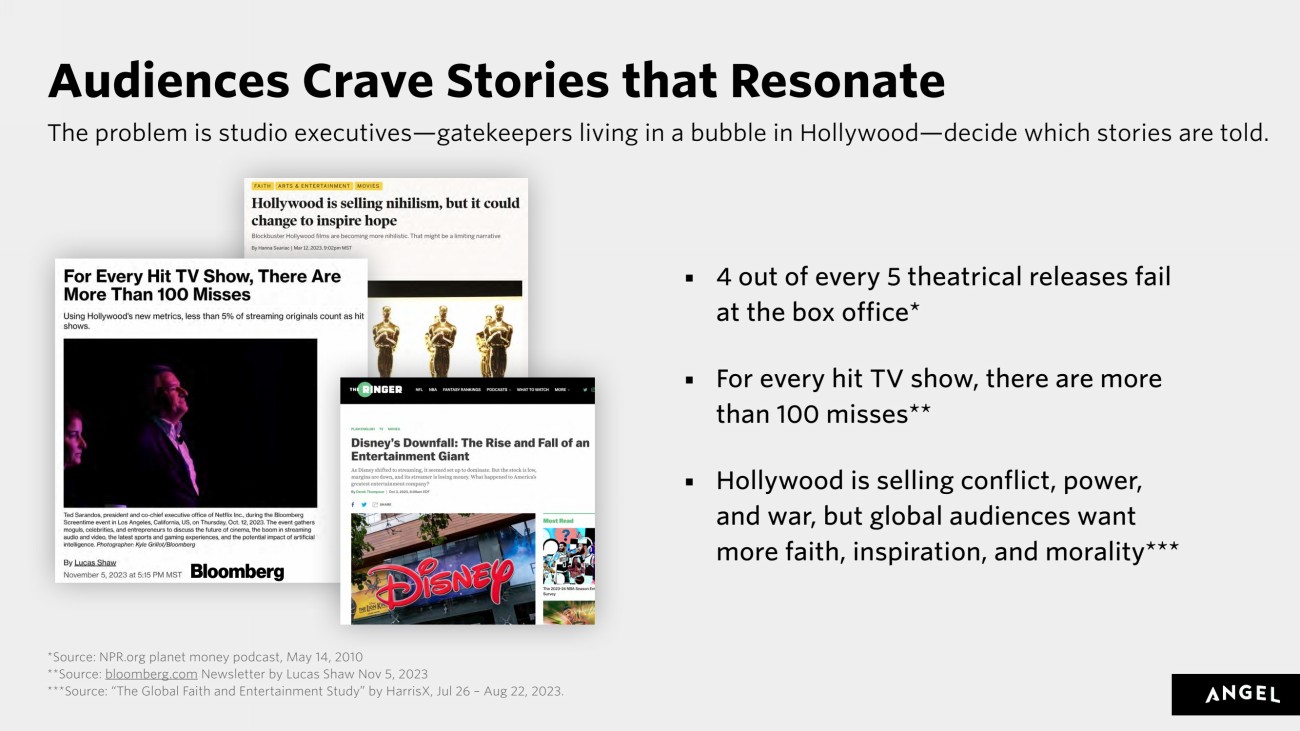

Audiences Crave Stories that Resonate

The problem that Angel Studios seeks to address is that a limited number of Hollywood studio decision-makers determine which films and television shows are made, and four out of five box office releases fail1. Additionally, for every hit TV show, there are a hundred misses2.

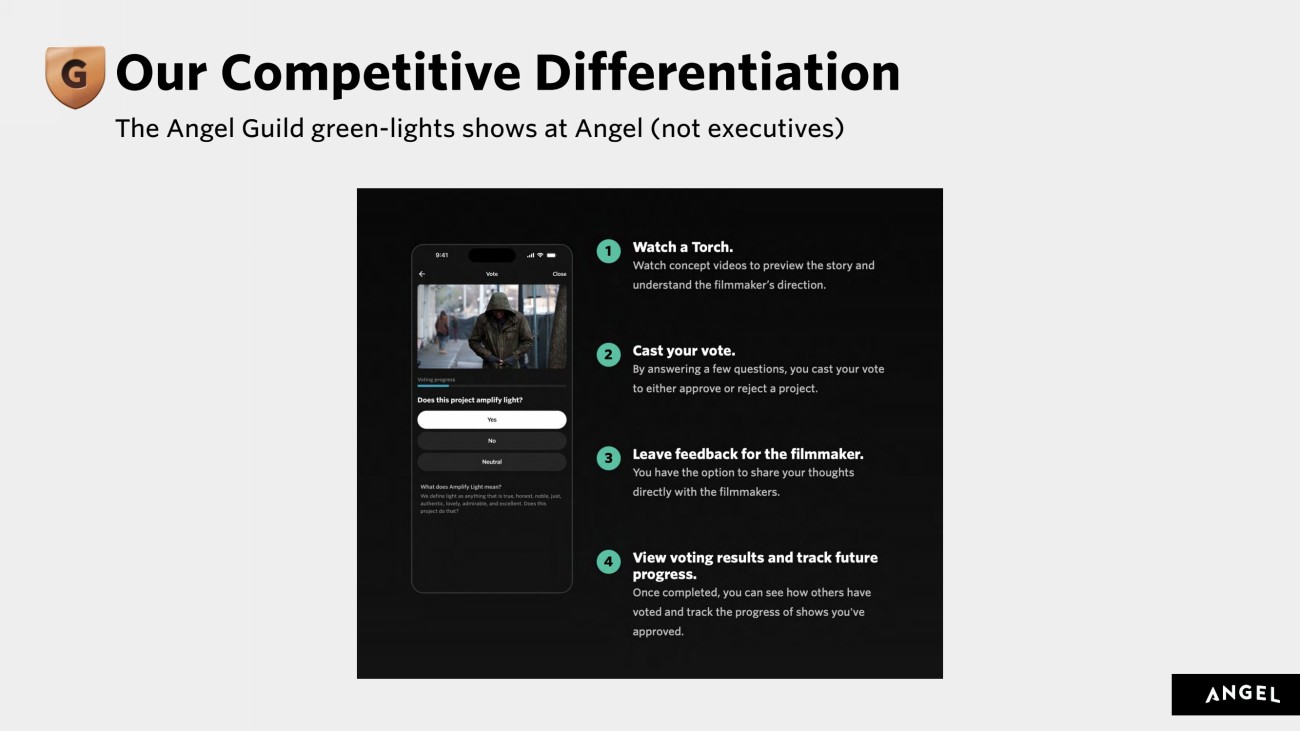

Angel Studios’ solution to this problem is to spread that decision-making power to the Angel Guild. This growing membership—rather than Hollywood executives—watch and select winning films and shows prior to release.

1 NPR.org planet money podcast, May 14, 2010

2 Bloomberg.com Newsletter by Lucas Shaw, Nov 5, 2023

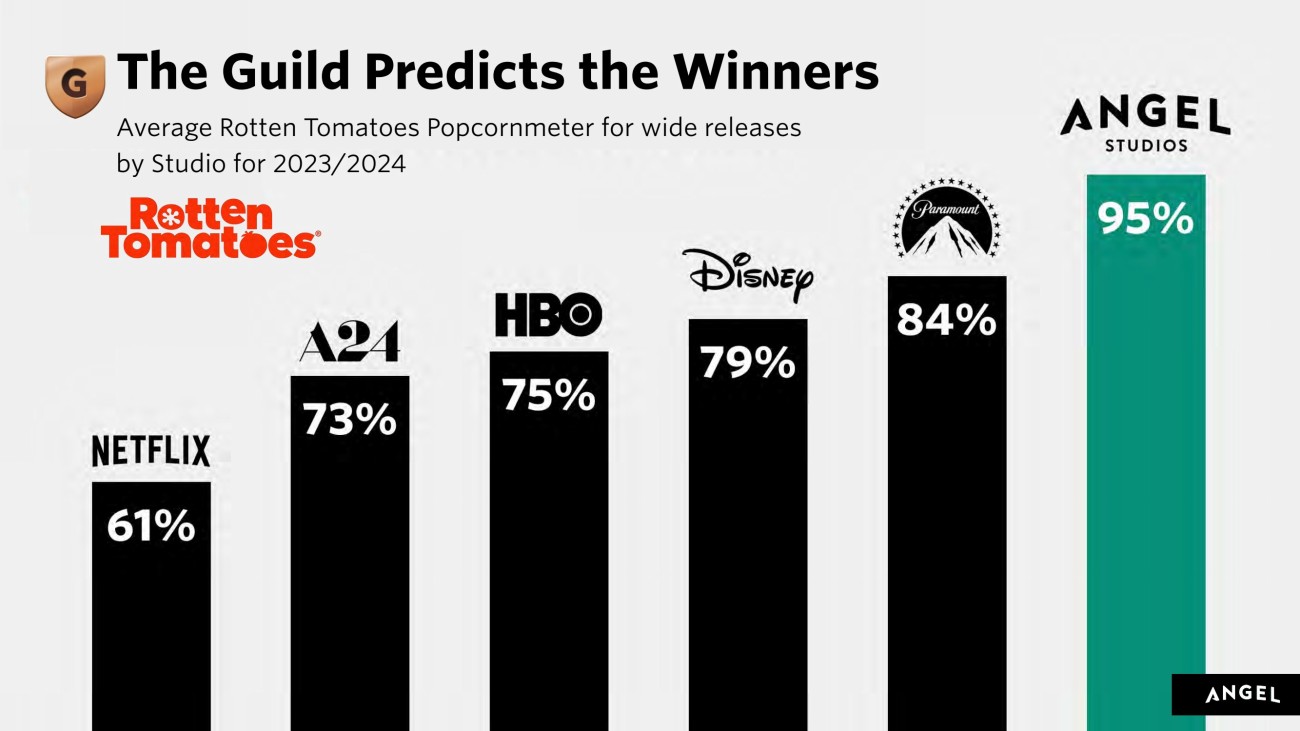

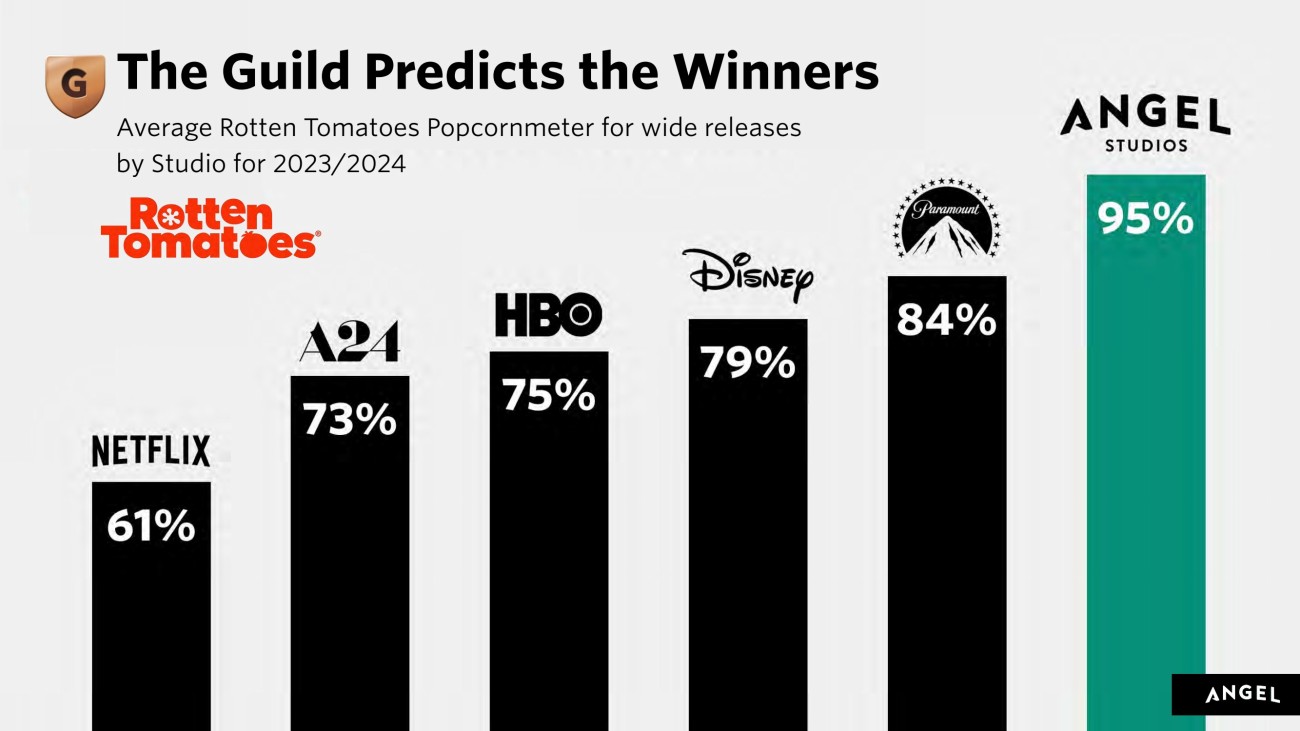

The Angel Guild has a strong track record of selecting winning content, with an average Rotten Tomatoes® wide release audience score of 95%, surpassing every other major distributor, including Paramount (84%), Disney (79%), HBO (75%), A24 (73%), and Netflix (61%)3.

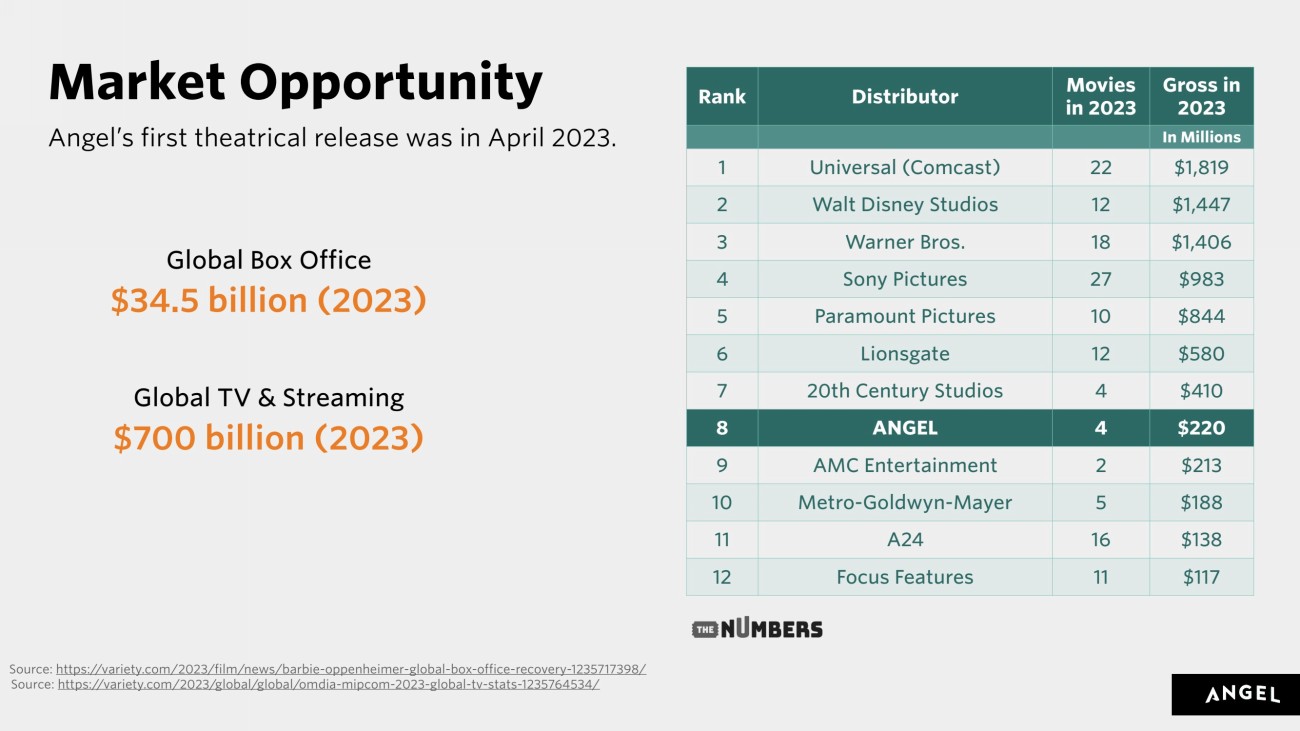

Angel Guild members are the “secret sauce” behind the discovery of global hits like SOUND OF FREEDOM, HIS ONLY SON, CABRINI, Tuttle Twins, Dry Bar Comedy, and other hit movies and television shows. Angel Studios was one of the top 10 studios in the US domestic box office in 2023, surging past Amazon’s MGM and A244.

Angel Studios Overview

Angel Studios is a values-based distribution company for stories that amplify light to mainstream audiences. Through the Angel Guild, 375,000 members choose which film and television projects the studio will market and distribute. 104,000 Angel Guild members in 155 countries have invested nearly $80.0 million in projects distributed by the studio to date.

Defining & Determining Light

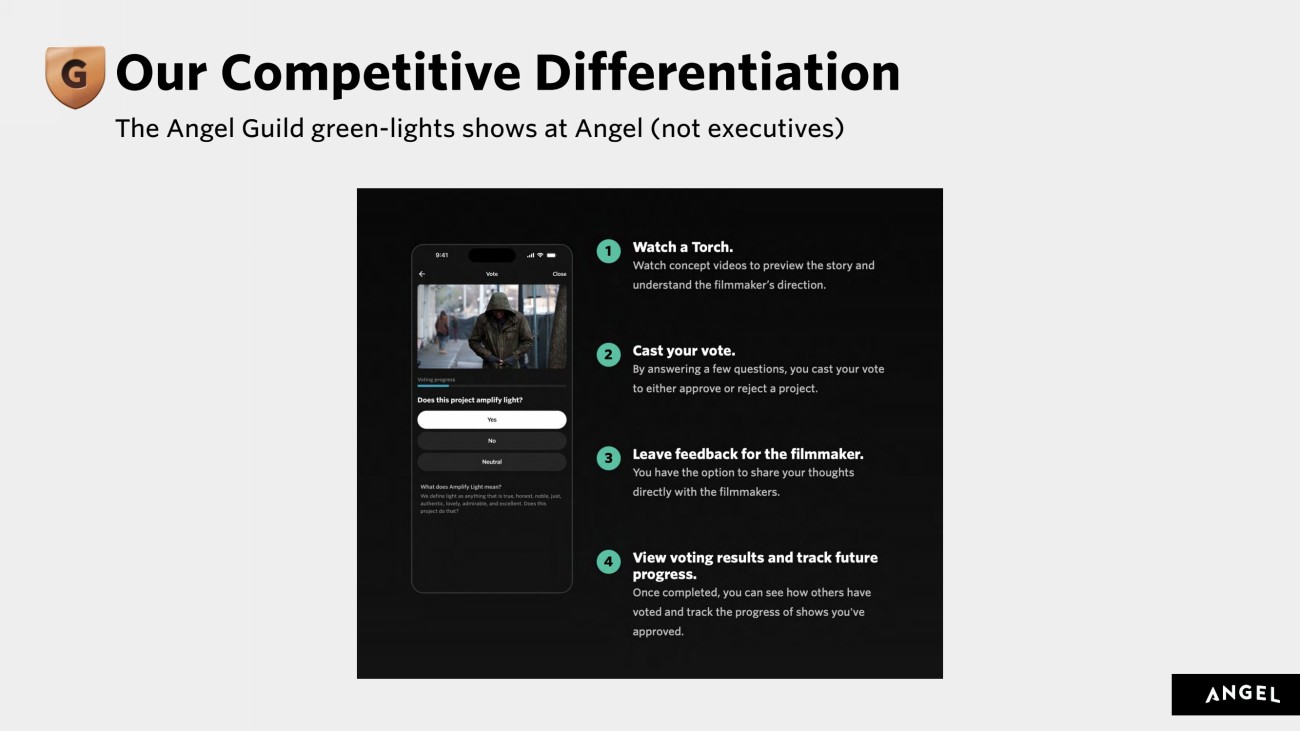

To determine whether or not a film or television show should be released, Angel Studios screens a short promotional version, or if available a full-length feature or episode, to a sample of members of the Angel Guild who vote on whether the project “amplifies light.”

The Angel Guild

The Angel Guild is a community of interested individuals who have invested in previous Angel Studios films or television shows, and individuals who pay a monthly or annual fee to Angel Studios to be a member of the Angel Guild. Upon watching a Torch, which is a concept video preview, Angel Guild members are asked for their feedback as to whether or not the Torch “amplifies light,” and their feedback is used to determine whether Angel Studios will move forward with production and/or distribution of the film or television show.

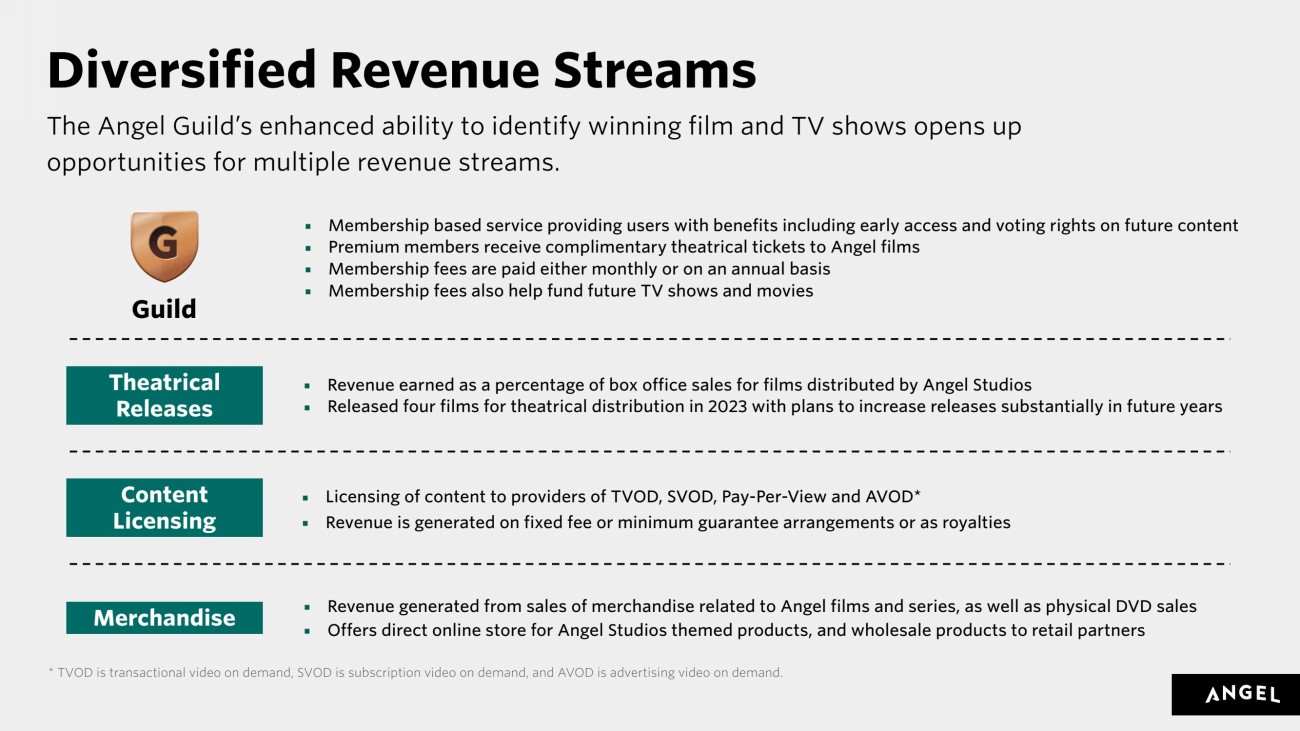

Angel Studios primarily generates revenue from these sources:

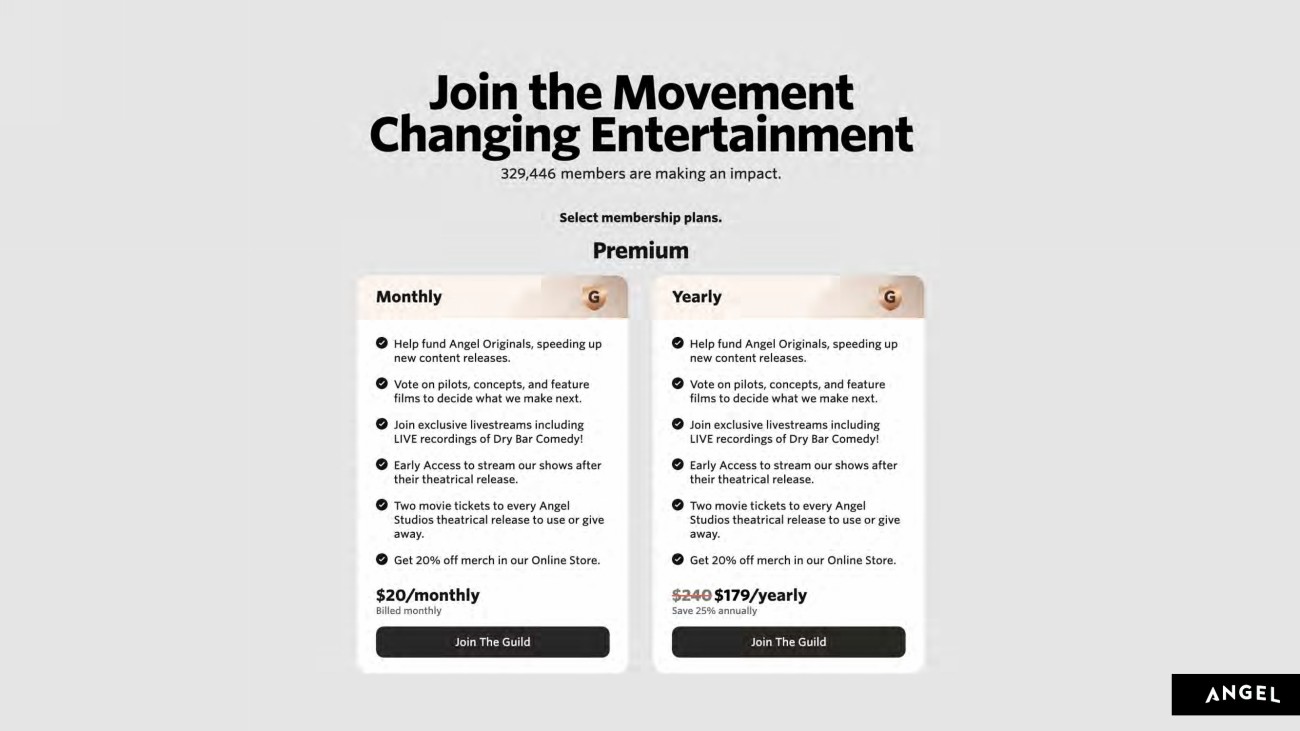

| ● | Angel Guild revenue comes from monthly or annual membership fees. Currently there are two possible tiers for membership, Basic and Premium. Both memberships allow voting for every Angel Studios release, give early access for streaming, and help fund Angel Studios original films, increasing new content releases. The primary difference between the two memberships is that Premium includes two complimentary tickets to every Angel Studios theatrical release and a discount for all merchandise. |

3 Average Rotten Tomatoes Popcornmeter for wide releases by Studio for 2023/2024

4 The Numbers, https://www.the-numbers.com/market/2023/distributors

| ● | Theatrical Distribution revenue comes from releasing Angel Studios original films with Angel Studios’ exhibitor partners. Every time a moviegoer purchases a ticket from the partner theaters, Angel Studios receives a percentage of the box office revenue. For most international theaters, the percentage of box office revenue is first paid to a distributor who then pays Angel Studios. |

| ● | Content Licensing from licensing Angel Studios’ films and television shows to other distributors such as Amazon, Apple, and Netflix. Angel Studios’ future plans include licensing the rights to its films and television shows for other experiences such as derivative shows, video games, theme parks and broadway-style plays. |

| ● | Merchandise revenue is generated from sales of merchandise related to Angel Studios films and series, as well as physical DVD sales. Angel Studios also offers direct online store for Angel Studios themed products, and wholesale products to retail partners. |

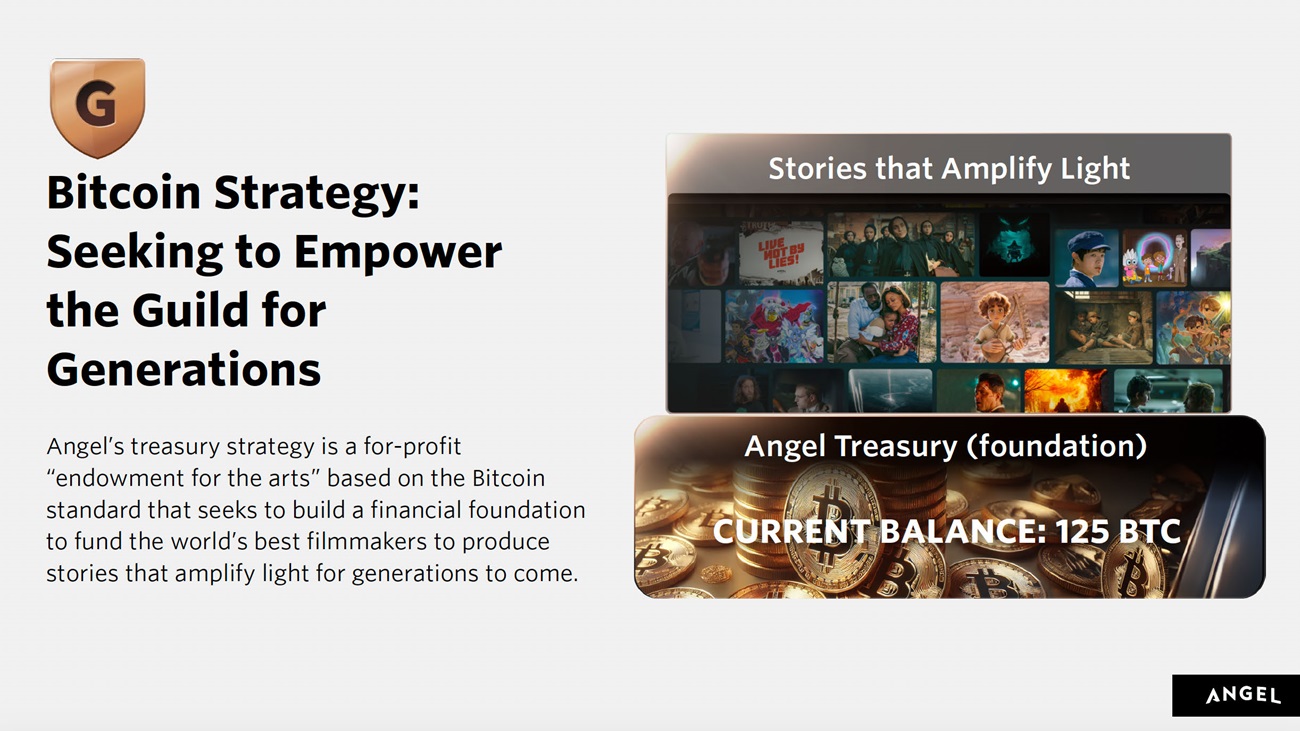

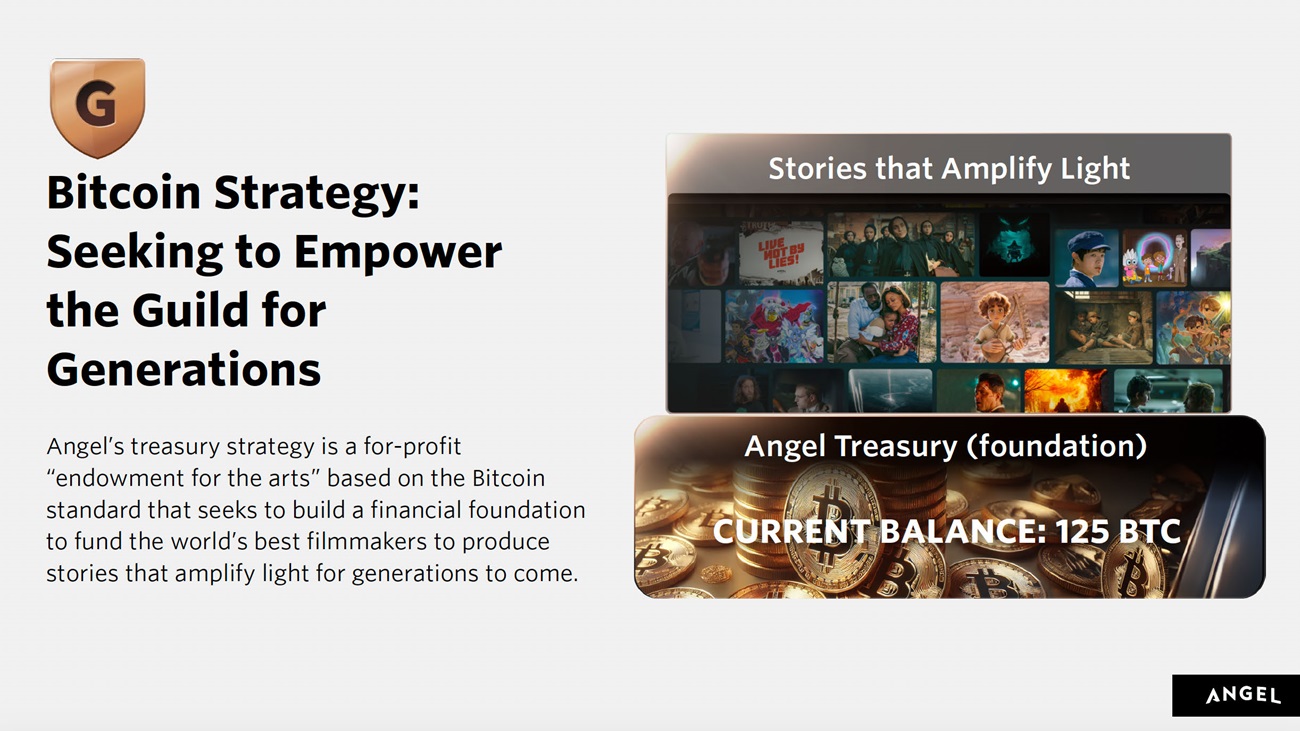

Bitcoin Treasury Strategy: Seeking to Empower the Angel Guild for Generations

| ● | Angel Studios has held 125 Bitcoin on the balance sheet since 2021 as a rainy day fund. |

| ● | Angel Studios plans on continuing to acquire and hold Bitcoin as a strategic treasury asset, and adjunct to its core film and television production and distribution business. |

| ● | The continued implementation of this Bitcoin reserve is intended to support Angel Studios’ mission-driven approach. |

| ● | Angel Studios Bitcoin Treasury is a for-profit “endowment for the arts” based on the Bitcoin standard that seeks to build a financial foundation to fund the world’s best filmmakers to produce stories that amplify light for generations to come. |

| ● | The Company is pleased to report that they have an agreement in principle with Off the Chain Capital, a leading Bitcoin asset management firm, for an investment of approximately $10 million to help back the Angel Studios treasury strategy. The pricing and certain other material terms of their investment remain subject to ongoing discussion. |

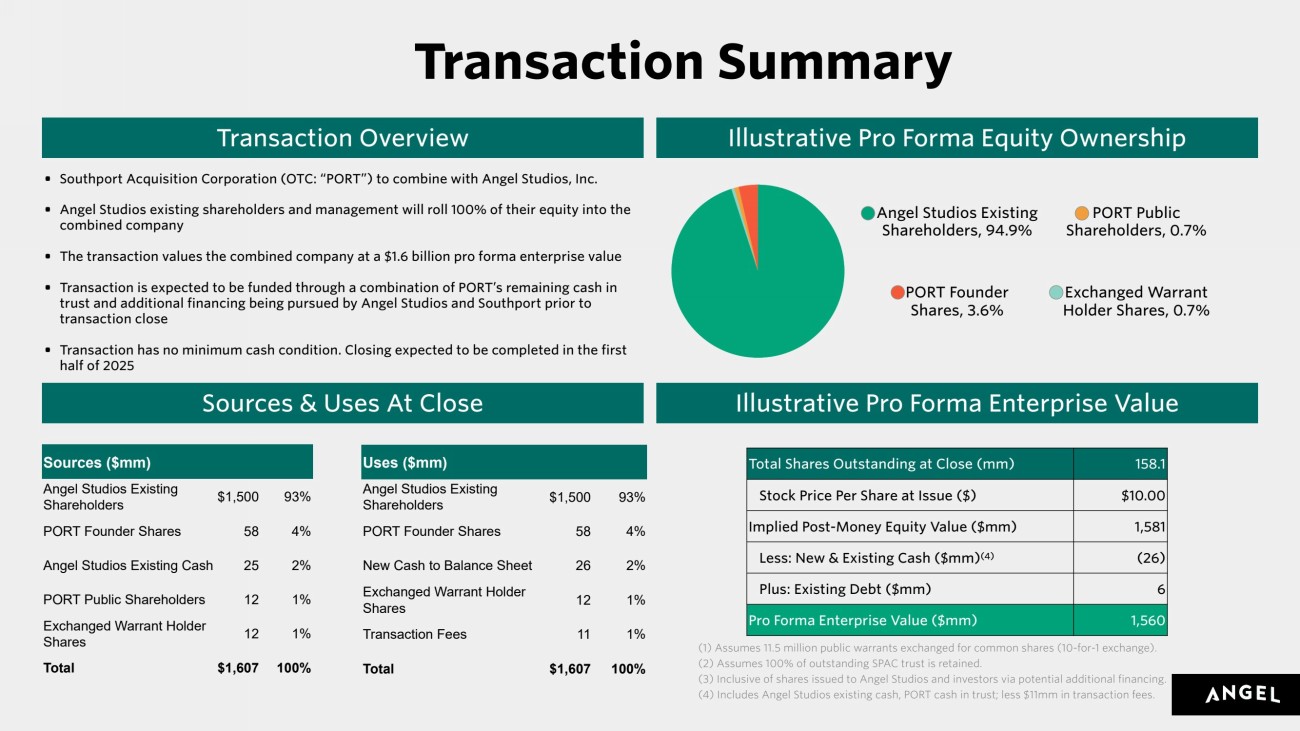

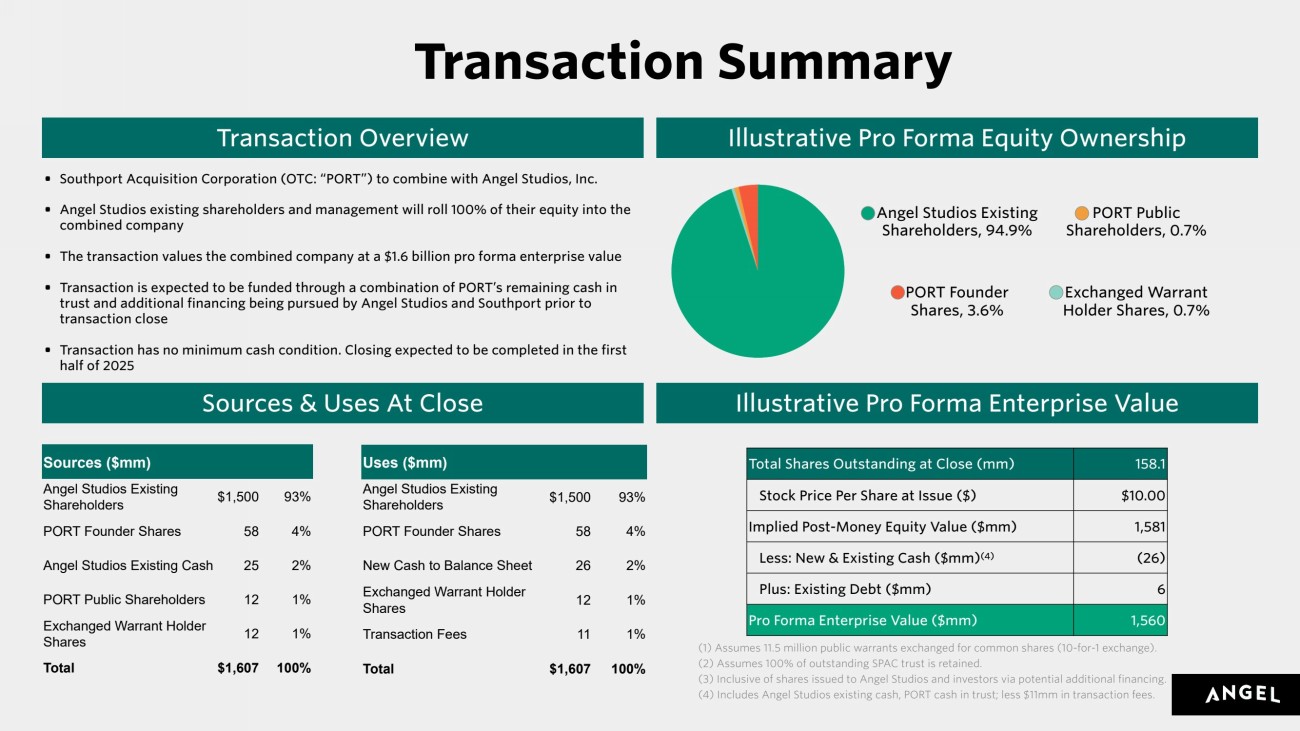

Transaction Overview

The transaction values the combined company at a $1.6 billion pro forma enterprise value. Existing Angel Studios stockholders will roll 100% of their equity in Angel Studios into the combined company.

The transaction will be effected through a merger of Angel Studios with a wholly owned subsidiary of Southport, with the surviving company becoming a wholly owned subsidiary of Southport. At closing of the transaction, Southport will change its name to Angel Studios, and its stock ticker to “AGSD.”

The boards of directors of Angel Studios and Southport have approved the transaction, the consummation of which is subject to customary closing conditions, including the filing and effectiveness of an S-4 registration statement with the Securities and Exchange Commission (the “SEC”), approval by Angel Studios’ and Southport’s stockholders, and regulatory approvals. The transaction is not subject to a minimum cash condition. The transaction is expected to close in the first half of 2025.

Additional information, including a copy of the agreement and plan of merger and an investor presentation, will be provided in a Current Report on Form 8-K to be filed by Southport and Angel Studios, respectively, with the SEC and will be available at the SEC’s website at www.sec.gov/.

Advisors

Oppenheimer & Co. is serving as financial and capital markets advisor to Southport. Mayer Brown LLP is acting as legal advisor to Angel Studios.

About Angel Studios, Inc.

Angel Studios is a community-driven, non-traditional, movie studio that seeks to empower audiences to decide which stories get produced and distributed, while creating communities around each project. Angel Studios was founded in 2013 by CEO Neal Harmon alongside his brothers Daniel, Jeffrey, and Jordan, who, as fathers of young children, were searching for high-quality films and TV shows that “amplify light.”

About Southport Acquisition Corporation

Southport Acquisition Corporation (OTC: PORT) is a blank check company formed in Delaware on April 13, 2021. Southport was formed for the purpose of effectuating a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more businesses. Southport is led by Chairman Jared Stone and Chief Executive Officer Jeb Spencer.

About Off the Chain Capital

Off the Chain Capital is the general partner and manager of Off the Chain, LP. The Firm utilizes a value approach to invest in digital assets and equity in blockchain companies with a goal of acquiring at a discount to their intrinsic value. This strategy is designed to provide downside protection without sacrificing upside, making it an option for family offices, endowments, foundations, and first-time investors in blockchain assets.

Additional Information and Where to Find It

In connection with the proposed transaction, Southport intends to file a registration statement on Form S-4 (as it may be amended, the “Registration Statement”) with the SEC, which will include a preliminary prospectus and proxy statement of Southport and Angel Studios, referred to as a joint proxy statement/prospectus. Such documents are not currently available. When available, a final joint proxy statement/prospectus will be sent to all Southport and Angel Studios stockholders. Southport and Angel Studios will also file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the Registration Statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Southport and Angel Studios (when available) through the website maintained by the SEC at http://www.sec.gov. The documents filed by Southport with the SEC also may be obtained free of charge upon written request to 8 Bolling Place, Greenwich, CT 06830. The documents filed by Angel Studios with the SEC also may be obtained free of charge on Angel Studios’ website at https://www.angel.com/legal/sec-filings or upon written request to 295 W Center Street, Provo, UT 84601.

Participants in Solicitation

Southport, Angel Studios and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Southport, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Southport’s Annual Report on Form 10-K for its fiscal year ended December 31, 2023, which was filed with the SEC on April 1, 2024, under the headings “Directors, Executive Officers and Corporate Governance,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Southport common stock by the directors and executive officers of Southport have changed from the amounts of Southport common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Angel Studios, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Angel Studios’ amended Form 10, which was filed with the SEC on May 13, 2024, under the headings “Security Ownership of Certain Beneficial Owners and Management,” “Directors and Executive Officers,” “Executive Compensation,” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Angel Studios common stock by the directors and executive officers of Angel Studios have changed from the amounts of Angel Studios common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the joint proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from Southport or Angel Studios using the sources indicated above.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Angel Studios and Southport. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of the combined company’s securities, (ii) the risk that the proposed transaction may not be completed by Southport’s business combination deadline and the potential failure to obtain an extension of the business combination deadline, (iii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the merger agreement by the stockholders of Southport and Angel Studios, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vi) the effect of the announcement or pendency of the transaction on Angel Studios’ business relationships, operating results, and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of Angel Studios or diverts management’s attention from Angel Studios’ ongoing business operations and potential difficulties in Angel Studios employee retention as a result of the announcement and consummation of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Angel Studios or against Southport related to the merger agreement or the proposed transaction, (ix) the ability to list the combined company’s securities on a national securities exchange in connection with the transaction, (x) the price of Southport’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Southport plans to operate or Angel Studios operates, variations in operating performance across competitors, changes in laws and regulations affecting Southport’s or Angel Studios’ business, and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xii) the ability to recognize the anticipated benefits of the proposed transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees, (xiii) the evolution of the markets in which Angel Studios competes, (xiv) the costs related to the proposed transaction, (xv) Angel Studios’ expectations regarding its market opportunities, (xvi) risks related to domestic and international political and macroeconomic uncertainty, including the Russia-Ukraine conflict and the war in the Middle East, and (xvii) the risk of downturns and a changing regulatory landscape in the highly competitive industry in which Angel Studios operates. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Southport’s and Angel Studios’ annual reports on Form 10-K and Form 10, respectively, and quarterly reports on Form 10-Q, the Registration Statement on Form S-4 when available, including those under “Risk Factors” therein, and other documents filed by Southport and Angel Studios from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Angel Studios and Southport assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Angel Studios nor Southport gives any assurance that either Angel Studios or Southport, or the combined company, will achieve its expectations.

Investor Relations Contact:

Shannon Devine

MZ Group North America

Angel@mzgroup.us

| Investor Presentation 11 September 2024 |

| “The most powerful person in the world is the storyteller. The storyteller sets the vision, values and agenda of an entire generation that is to come.” STEVE JOBS |

| Disclaimer This presentation (the “presentation”) is being provided on a strictly confidential and non-reliance basis for informational purposes only. It shall not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Merger (as defined below) or (ii) an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase any securities, equity, debt or other financial instruments, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale or recommendation would be unlawful. This presentation has been prepared to assist interested parties in making their own evaluation with respect to a proposed business combination pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of September 11, 2024, by and among Southport Acquisition Corporation, a Delaware corporation (“Southport”), Sigma Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Southport (“Merger Sub”), and Angel Studios, Inc., a Delaware corporation (“Angel”). The Merger Agreement provides for, among other things, the merger of Merger Sub with and into Angel (the “Merger”), with Angel surviving the Merger as a wholly owned subsidiary of Southport after the Merger, to be renamed “Angel Studios, Inc.”, in accordance with the terms and subject to the conditions of the Merger Agreement. Neither the Securities and Exchange Commission (“SEC”) nor any securities commission of any other U.S. or non-U.S. jurisdiction has approved or disapproved of the proposed transaction, or determined that this presentation is truthful or complete. Any representation to the contrary is a criminal offense. This presentation and any related oral commentary are confidential and proprietary and are to be maintained in strict confidence and must not be replicated, copied, reproduced or disclosed, directly or indirectly, in whole or in part, to any other party. Each recipient agrees to maintain the confidentiality of the information contained in this presentation and communicated during any related oral commentary and use any such information in accordance with any contractual obligations to which it is subject, and applicable law, including U.S. federal and state securities laws. By receiving this presentation, each recipient also acknowledges that some or all of the information relating to it may be, or may become, material non-public information regarding Southport or Angel, or any of their respective affiliates, including any respective future affiliates, and that the securities laws of the U.S. and other relevant jurisdictions generally prohibit any persons who have material, non-public information in relation to a company from purchasing or selling securities of that company on the basis of such information or from communicating such information to any person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. In addition, this presentation is intended solely for investors that are, and by receiving this presentation, the recipient expressly confirms that they are, qualified institutional buyers or institutions, entities or persons that are accredited investors (as such terms are defined under the rules of the SEC). This presentation does not constitute a commitment on the part of Southport or Angel to provide the recipient with access to any additional information or to execute the proposed transaction. This presentation is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or applicable regulations or which would require any authorization, registration, notification or licensing within such jurisdiction. Persons into whose possession this presentation, any part of it or other information referred to herein comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. No representations or warranties, express or implied, are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will Southport, Angel or any of their respective subsidiaries, stockholders, equityholders, affiliates, representatives, directors, officers, employees, advisers, or agents be responsible or liable for a direct, indirect, or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Southport nor Angel has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to corrections and/or changes, with or without notice, and any such corrections and/or changes may be material. Southport and Angel, and their respective representatives disclaim any duty to update, revise, correct or confirm the information contained in this presentation. In addition, this presentation does not purport to be all-inclusive or to contain all of the information that may be required to evaluate a possible investment decisions or to make a full analysis of Southport, Angel, the proposed transaction or otherwise. Viewers of this presentation should each make their own evaluation of Southport and Angel and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. The information contained herein is as of September 11, 2024, and does not reflect any subsequent events. |

| FORWARD-LOOKING STATEMENTS This presentation may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Angel Studios and Southport. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of the combined company’s securities, (ii) the risk that the proposed transaction may not be completed by Southport’s business combination deadline and the potential failure to obtain an extension of the business combination deadline, (iii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Southport and Angel Studios, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the transaction on Angel Studios’ business relationships, operating results, and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of Angel Studios or diverts management’s attention from Angel Studios’ ongoing business operations and potential difficulties in Angel Studios employee retention as a result of the announcement and consummation of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Angel Studios or against Southport related to the Merger Agreement or the proposed transaction, (ix) the ability to list the combined company’s securities on a national securities exchange in connection with the transaction, (x) the price of Southport’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Southport plans to operate or Angel Studios operates, variations in operating performance across competitors, changes in laws and regulations affecting Southport’s or Angel Studios’ business, and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xii) the ability to recognize the anticipated benefits of the proposed transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees, (xiii) the evolution of the markets in which Angel Studios competes, (xiv) the costs related to the proposed transaction, (xv) Angel Studios’ expectations regarding its market opportunities, (xvi) risks related to domestic and international political and macroeconomic uncertainty, including the Russia-Ukraine conflict and the war in the Middle East, and (xvii) the risk of downturns and a changing regulatory landscape in the highly competitive industry in which Angel Studios operates. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Southport’s and Angel Studios’ annual reports on Form 10-K and Form 10, respectively, and quarterly reports on Form 10-Q, the Registration Statement on Form S-4 when available, including those under “Risk Factors” therein, and other documents filed by Southport and Angel Studios from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Angel Studios and Southport assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Angel Studios nor Southport gives any assurance that either Angel Studios or Southport, or the combined company, will achieve its expectations. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction, Southport intends to file a registration statement on Form S-4 (as it may be amended, the “Registration Statement”) with the SEC, which will include a preliminary prospectus and proxy statement of Southport and Angel Studios, referred to as a joint proxy statement/prospectus. Such documents are not currently available. When available, a final joint proxy statement/prospectus will be sent to all Southport and Angel Studios stockholders. Southport and Angel Studios will also file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the Registration Statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Southport and Angel Studios (when available) through the website maintained by the SEC at http://www.sec.gov. The documents filed by Southport with the SEC also may be obtained free of charge upon written request to 8 Bolling Place, Greenwich, CT 06830. The documents filed by Angel Studios with the SEC also may be obtained free of charge on Angel Studios’ website at https://www.angel.com/legal/sec-filings or upon written request to 295 W Center Street, Provo, UT 84601. PARTICIPANTS IN SOLICITATION Southport, Angel Studios and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Southport, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Southport’s Annual Report on Form 10-K for its fiscal year ended December 31, 2023, which was filed with the SEC on April 1, 2024, under the headings “Directors, Executive Officers and Corporate Governance,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Southport common stock by the directors and executive officers of Southport have changed from the amounts of Southport common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Angel Studios, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Angel Studios’ amended Form 10, which was filed with the SEC on May 13, 2024, under the headings “Security Ownership of Certain Beneficial Owners and Management,” “Directors and Executive Officers,” “Executive Compensation,” and “Certain Relationships and Related Transactions, and Director Independence.” To the extent holdings of Angel Studios common stock by the directors and executive officers of Angel Studios have changed from the amounts of Angel Studios common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the joint proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from Southport or Angel Studios using the sources indicated above. USE OF PROJECTIONS This presentation contains projected financial information. Such projected financial information is forward-looking and is for illustrative purposes only. It should not be relied upon as being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to many significant business, economic, competitive and other risks and uncertainties. Refer to “Forward-Looking Statements” above. Actual results may differ materially from the results presented in such projected financial information, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither Southport’s nor Angel Studios’ independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. TRADEMARKS This presentation contains trademarks, service marks, trade names and copyrights of Southport, Angel Studios and other companies which are the property of their respective owners. |

| SECTION I COMPANY OVERVIEW In Theaters November 22, 2024 |

| YOU help us choose which stories are: True Honest Noble Just We’re building a home for YOU — our Guild Members — to let filmmakers know which stories resonate, so you can positively impact the culture for future generations. Authentic Lovely Admirable Excellent Amplify “Light” MISSION |

| Join over 375,000 visionaries choosing and funding entertainment that amplifies light. |

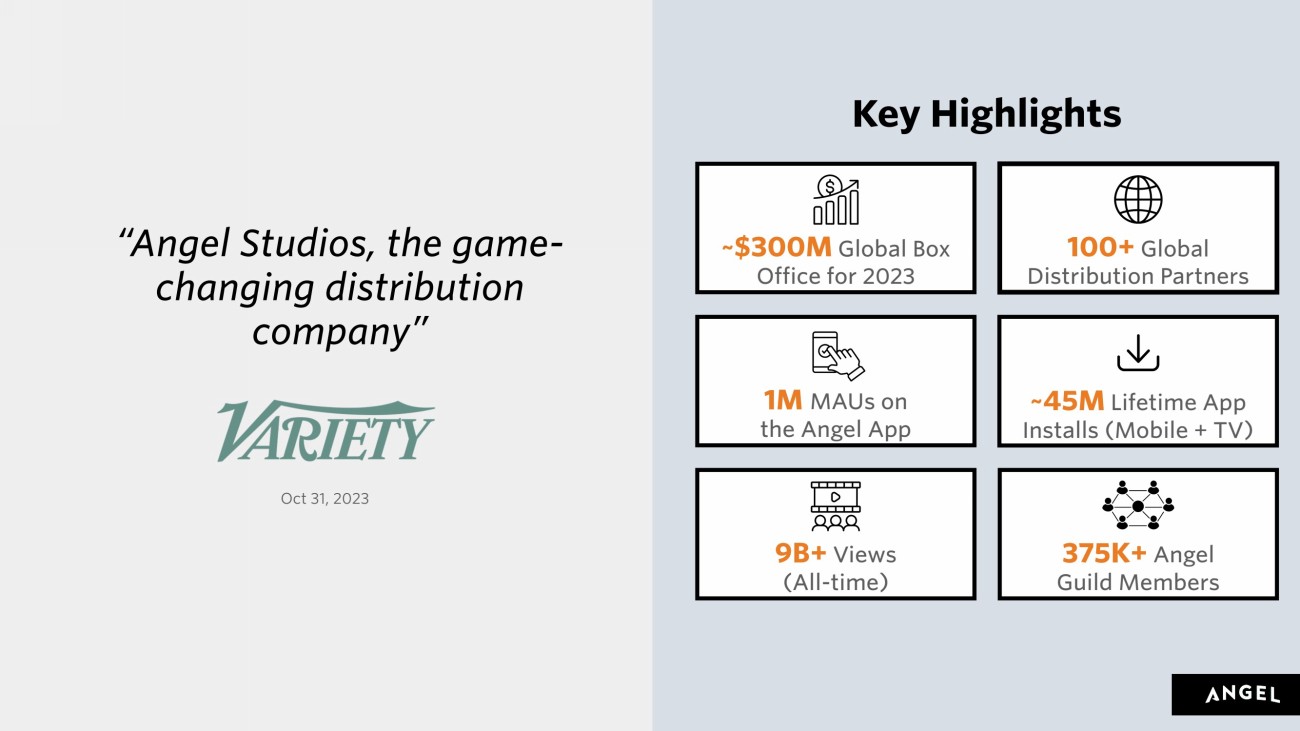

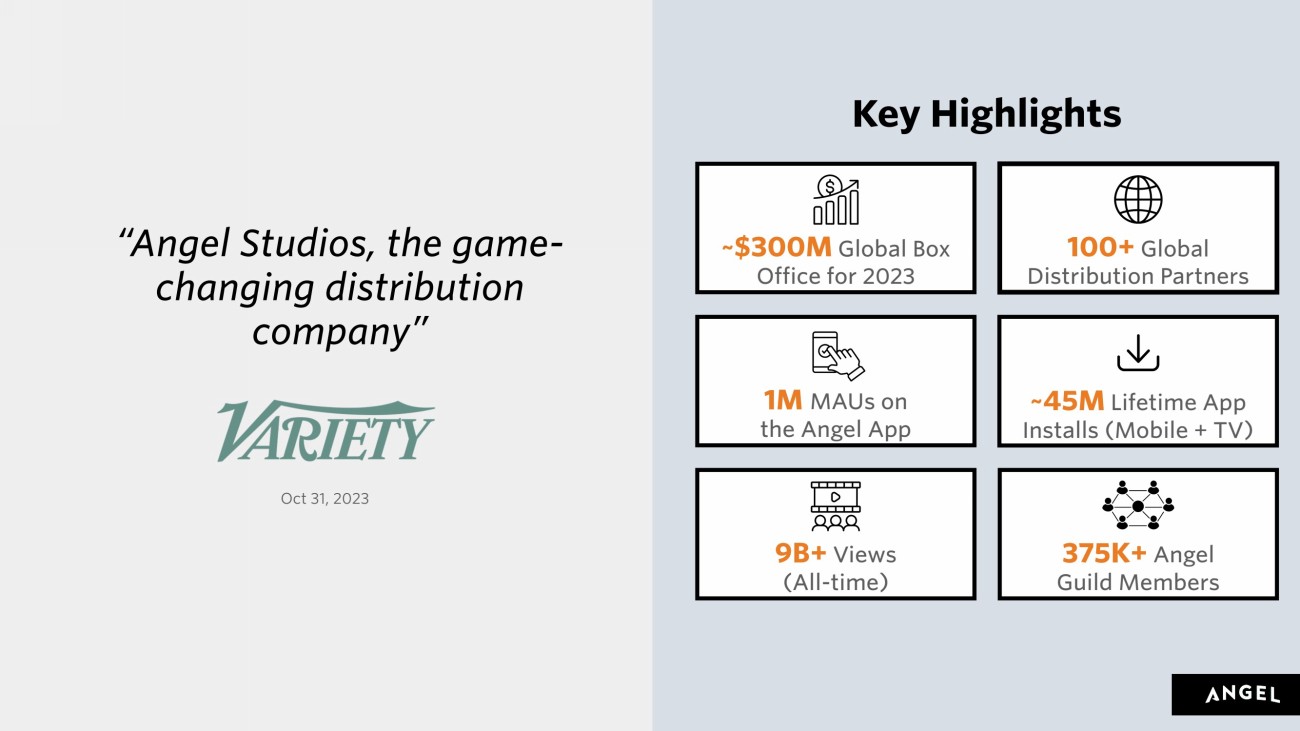

| “Angel Studios, the game-changing distribution company” Oct 31, 2023 Key Highlights ~$300M Global Box Office for 2023 1M MAUs on the Angel App 9B+ Views (All-time) 375K+ Angel Guild Members ~45M Lifetime App Installs (Mobile + TV) 100+ Global Distribution Partners |

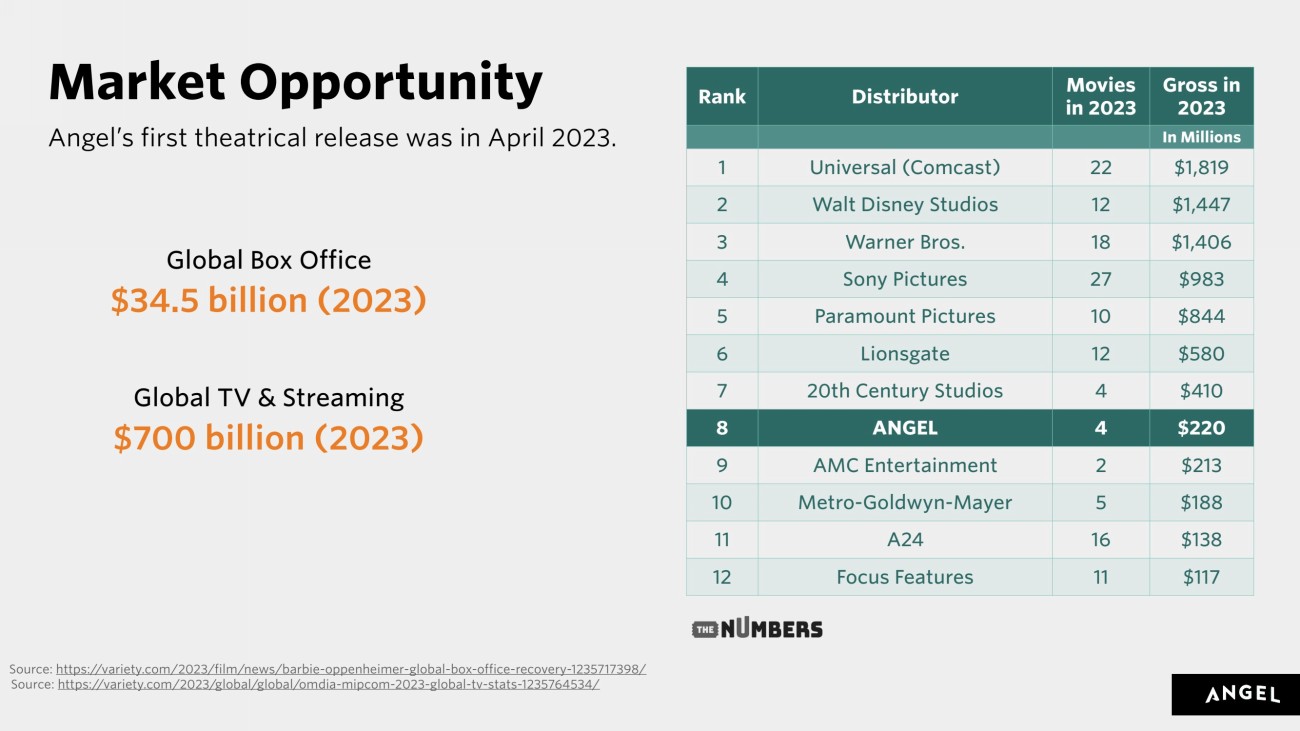

| Global Box Office $34.5 billion (2023) Global TV & Streaming $700 billion (2023) Source: https://variety.com/2023/film/news/barbie-oppenheimer-global-box-office-recovery-1235717398/ Source: https://variety.com/2023/global/global/omdia-mipcom-2023-global-tv-stats-1235764534/ Rank Distributor Movies in 2023 Gross in 2023 In Millions 1 Universal (Comcast) 22 $1,819 2 Walt Disney Studios 12 $1,447 3 Warner Bros. 18 $1,406 4 Sony Pictures 27 $983 5 Paramount Pictures 10 $844 6 Lionsgate 12 $580 7 20th Century Studios 4 $410 8 ANGEL 4 $220 9 AMC Entertainment 2 $213 10 Metro-Goldwyn-Mayer 5 $188 11 A24 16 $138 12 Focus Features 11 $117 Market Opportunity Angel’s first theatrical release was in April 2023. |

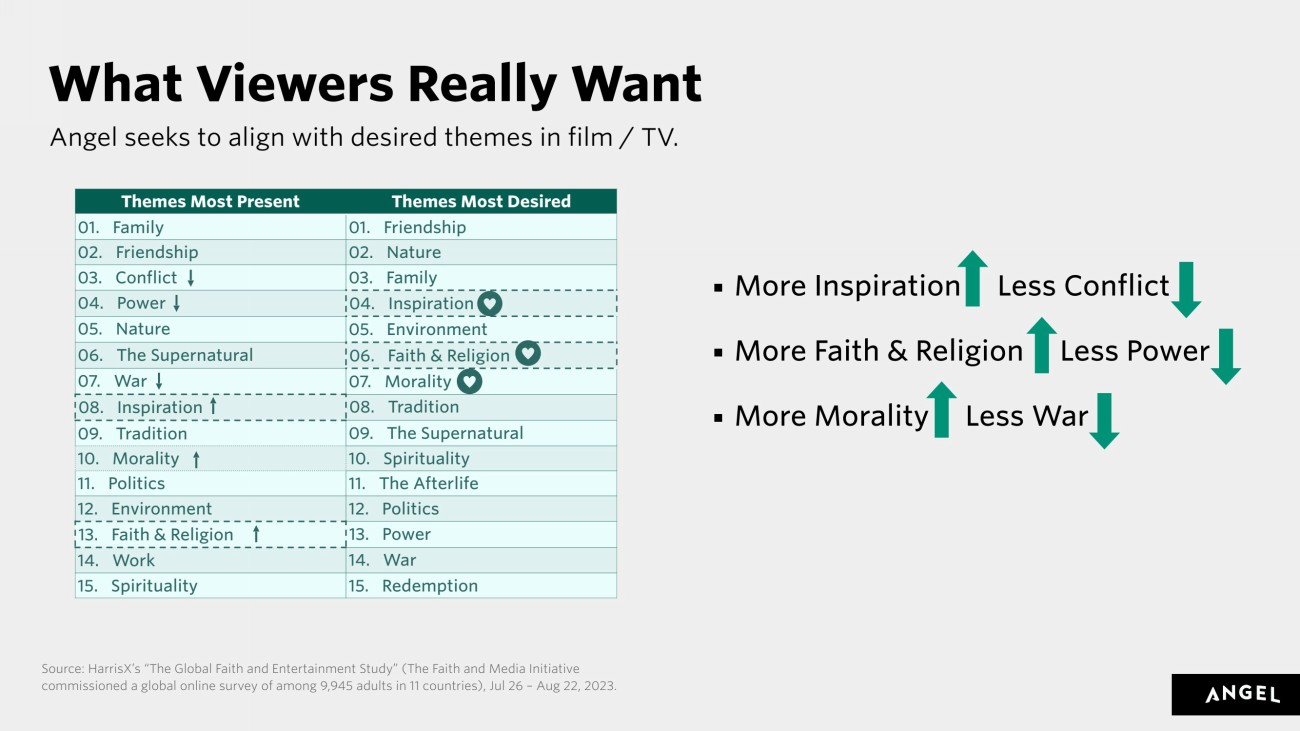

| ▪ 4 out of every 5 theatrical releases fail at the box office* ▪ For every hit TV show, there are more than 100 misses** ▪ Hollywood is selling conflict, power, and war, but global audiences want more faith, inspiration, and morality*** Audiences Crave Stories that Resonate The problem is studio executives—gatekeepers living in a bubble in Hollywood—decide which stories are told. *Source: NPR.org planet money podcast, May 14, 2010 **Source: bloomberg.com Newsletter by Lucas Shaw Nov 5, 2023 ***Source: “The Global Faith and Entertainment Study” by HarrisX, Jul 26 – Aug 22, 2023. |

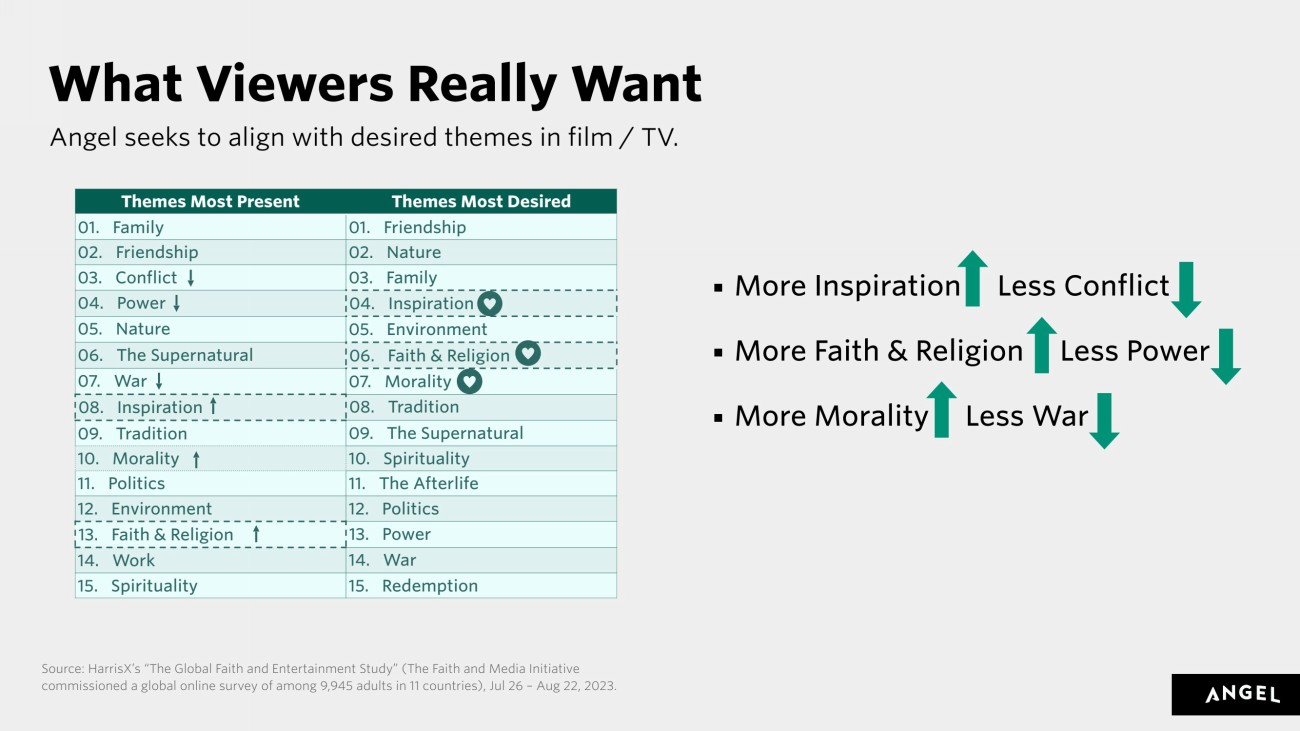

| ▪ More Inspiration Less Conflict ▪ More Faith & Religion Less Power ▪ More Morality Less War What Viewers Really Want Angel seeks to align with desired themes in film / TV. Themes Most Present Themes Most Desired 01. _Family 01. _Friendship 02. _Friendship 02. _Nature 03. _Conflict 03. _Family 04. _Power 04. _Inspiration 05. _Nature 05. _Environment 06. _The Supernatural 06. _Faith & Religion 07. _War 07. _Morality 08. _Inspiration 08. _Tradition 09. _Tradition 09. _The Supernatural 10. _Morality 10. _Spirituality 11. _Politics 11. _The Afterlife 12. _Environment 12. _Politics 13. _Faith & Religion 13. _Power 14. _Work 14. _War 15. _Spirituality 15. _Redemption Source: HarrisX’s “The Global Faith and Entertainment Study” (The Faith and Media Initiative commissioned a global online survey of among 9,945 adults in 11 countries), Jul 26 – Aug 22, 2023. |

| Angel Guild members — rather than Hollywood executives — select winning films and shows prior to release, while also providing the core revenue stream that is recurring and growing. Anyone can join the Guild. Angel’s Solution: THE GUILD Our solution to Hollywood gatekeepers is to give audiences green-light power. |

| The Guild Predicts the Winners Average Rotten Tomatoes Popcornmeter for wide releases by Studio for 2023/2024 |

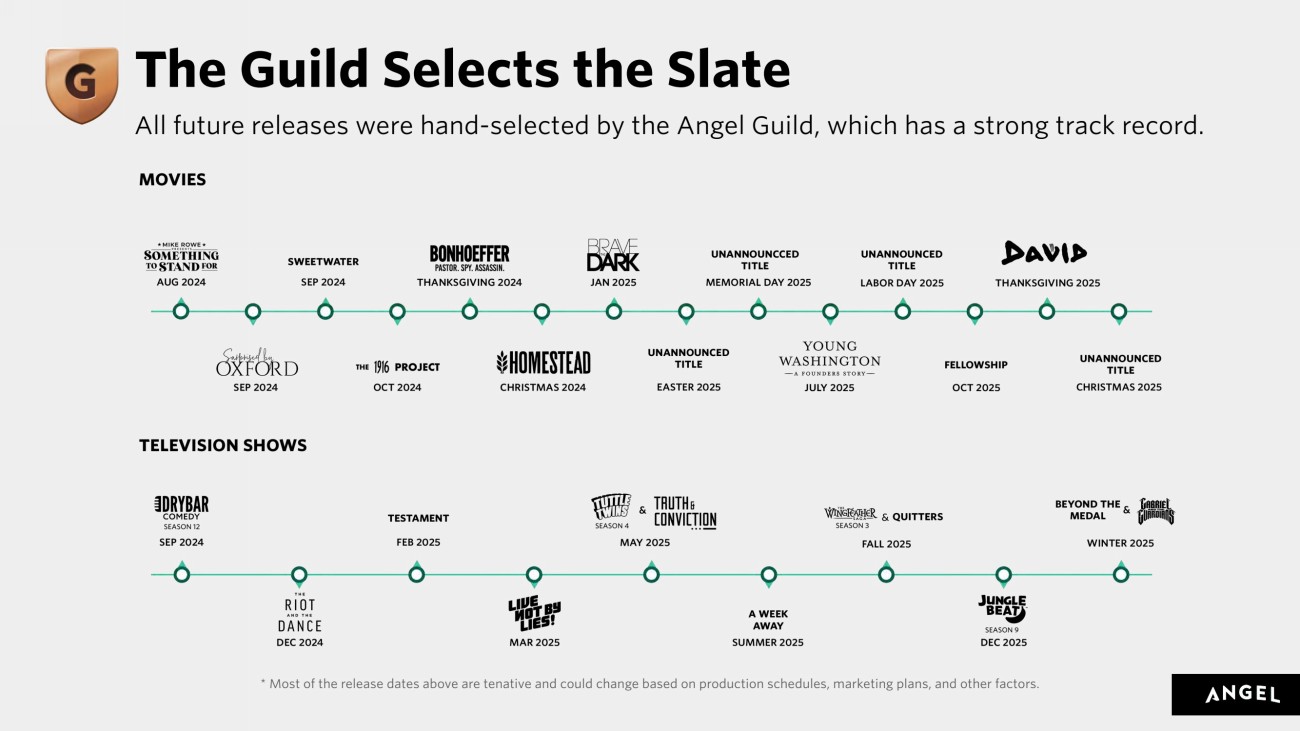

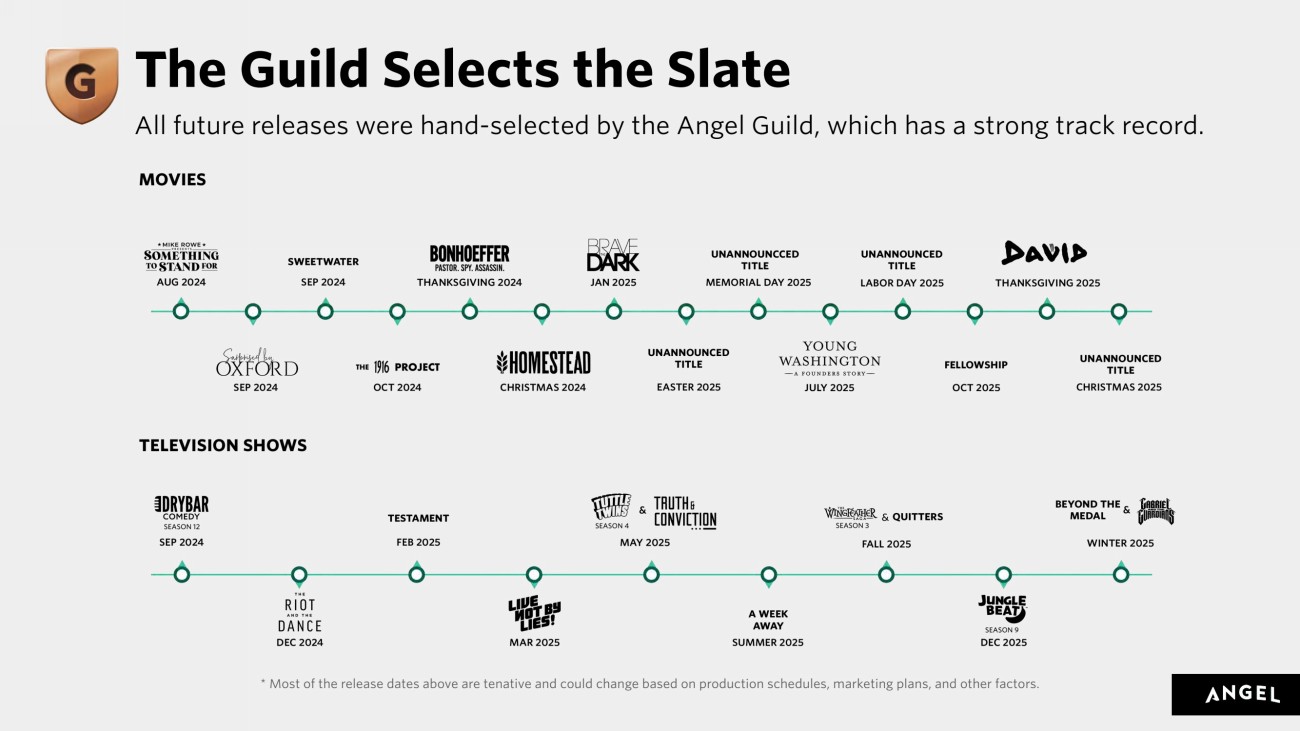

| The Guild Selects the Slate All future releases were hand-selected by the Angel Guild, which has a strong track record. * Most of the release dates above are tenative and could change based on production schedules, marketing plans, and other factors. |

| Theatrical Launches Premium Angel Guild members receive complimentary tickets to every release, helping fill theater seats earlier than the competition. |

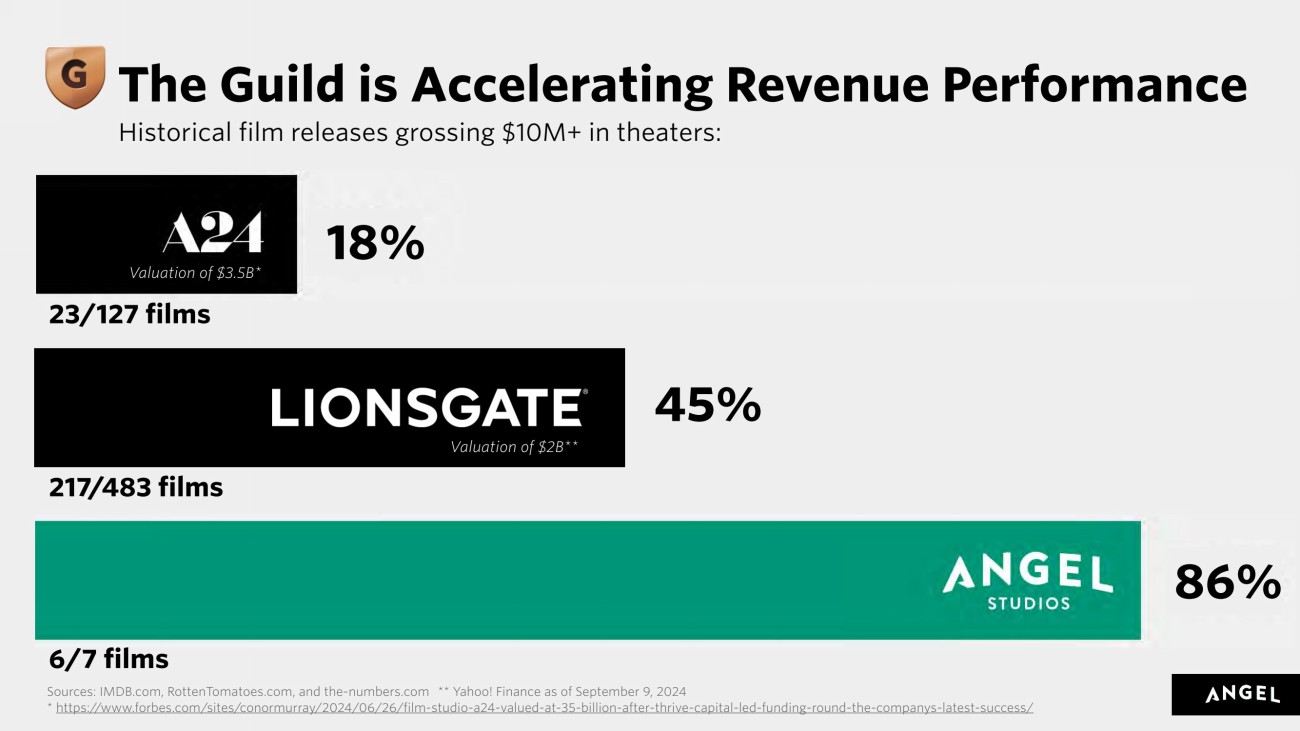

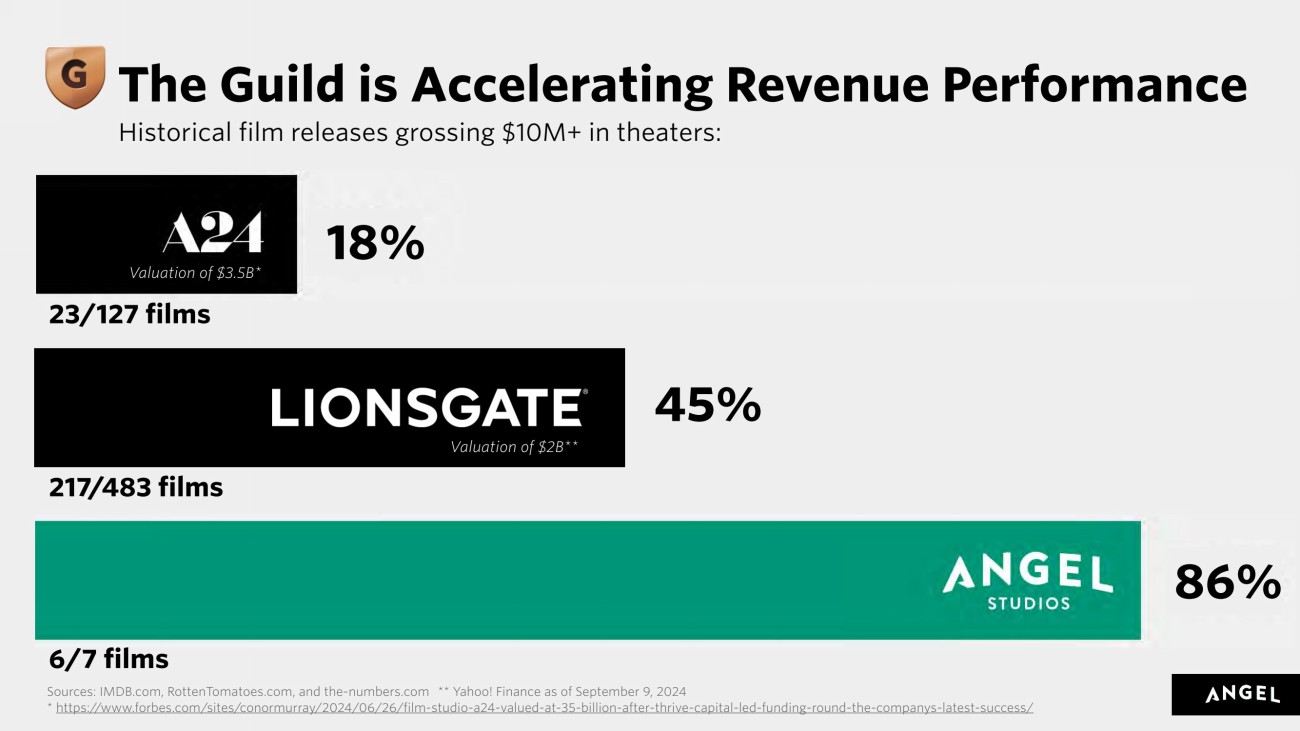

| * https://www.forbes.com/sites/conormurray/2024/06/26/film-studio-a24-valued-at-35-billion-after-thrive-capital-led-funding-round-the-companys-latest-success/ The Guild is Accelerating Revenue Performance Valuation of $3.5B* Valuation of $2B** 45% Sources: IMDB.com, RottenTomatoes.com, and the-numbers.com 6/7 films 217/483 films 23/127 films Historical film releases grossing $10M+ in theaters: 18% 86% ** Yahoo! Finance as of September 9, 2024 |

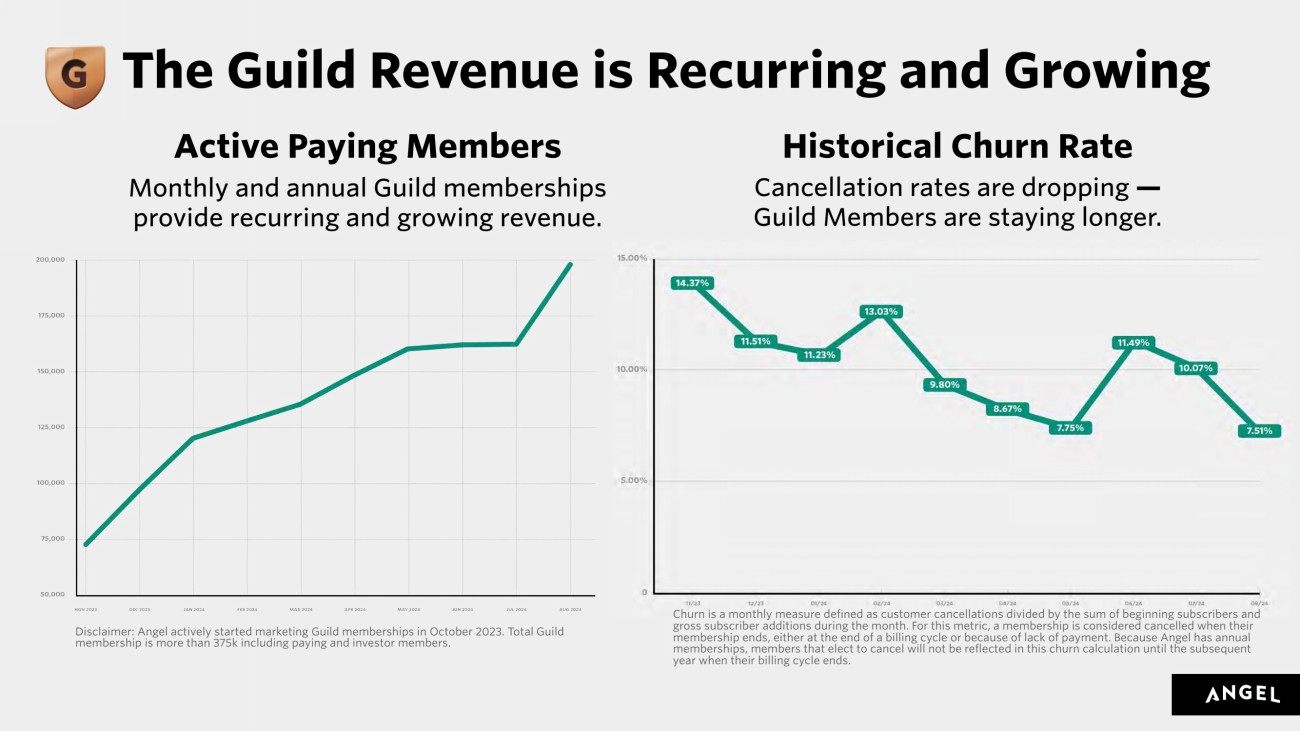

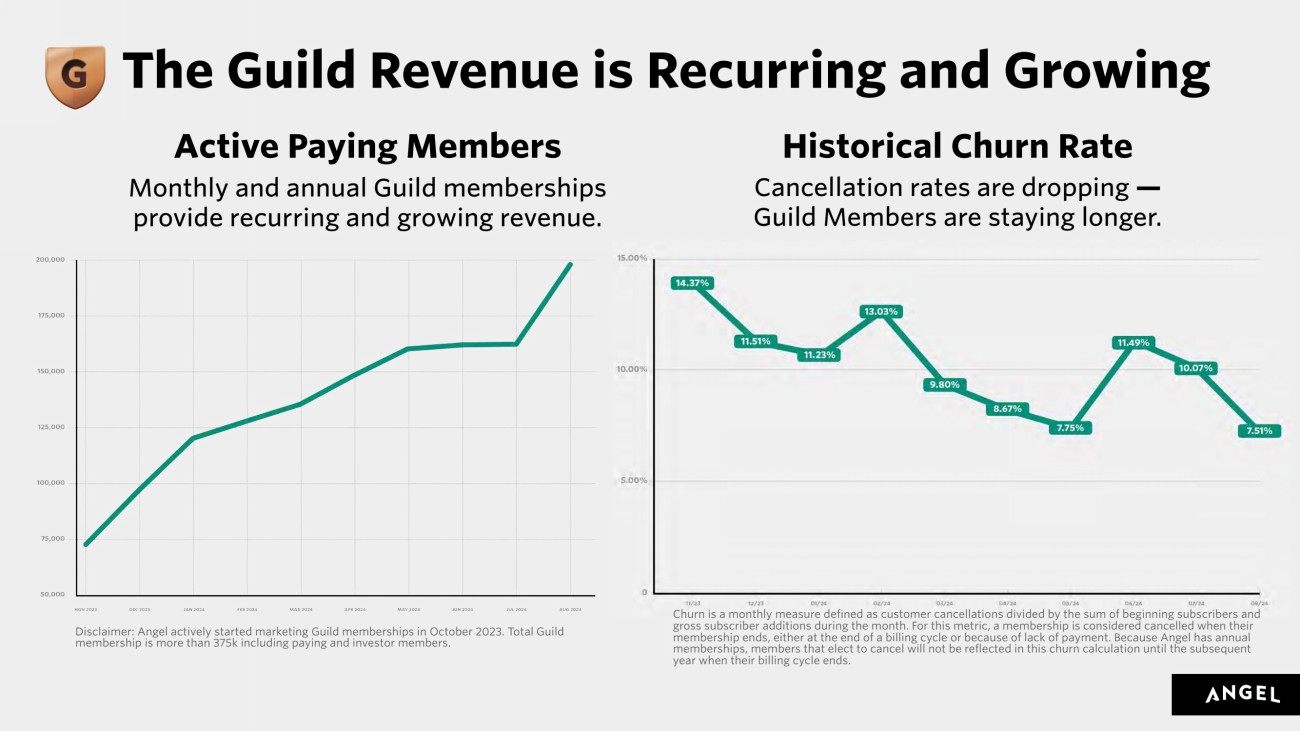

| The Guild Revenue is Recurring and Growing Disclaimer: Angel actively started marketing Guild memberships in October 2023. Total Guild membership is more than 375k including paying and investor members. Active Paying Members Monthly and annual Guild memberships provide recurring and growing revenue. Cancellation rates are dropping — Guild Members are staying longer. Historical Churn Rate Churn is a monthly measure defined as customer cancellations divided by the sum of beginning subscribers and gross subscriber additions during the month. For this metric, a membership is considered cancelled when their membership ends, either at the end of a billing cycle or because of lack of payment. Because Angel has annual memberships, members that elect to cancel will not be reflected in this churn calculation until the subsequent year when their billing cycle ends. |

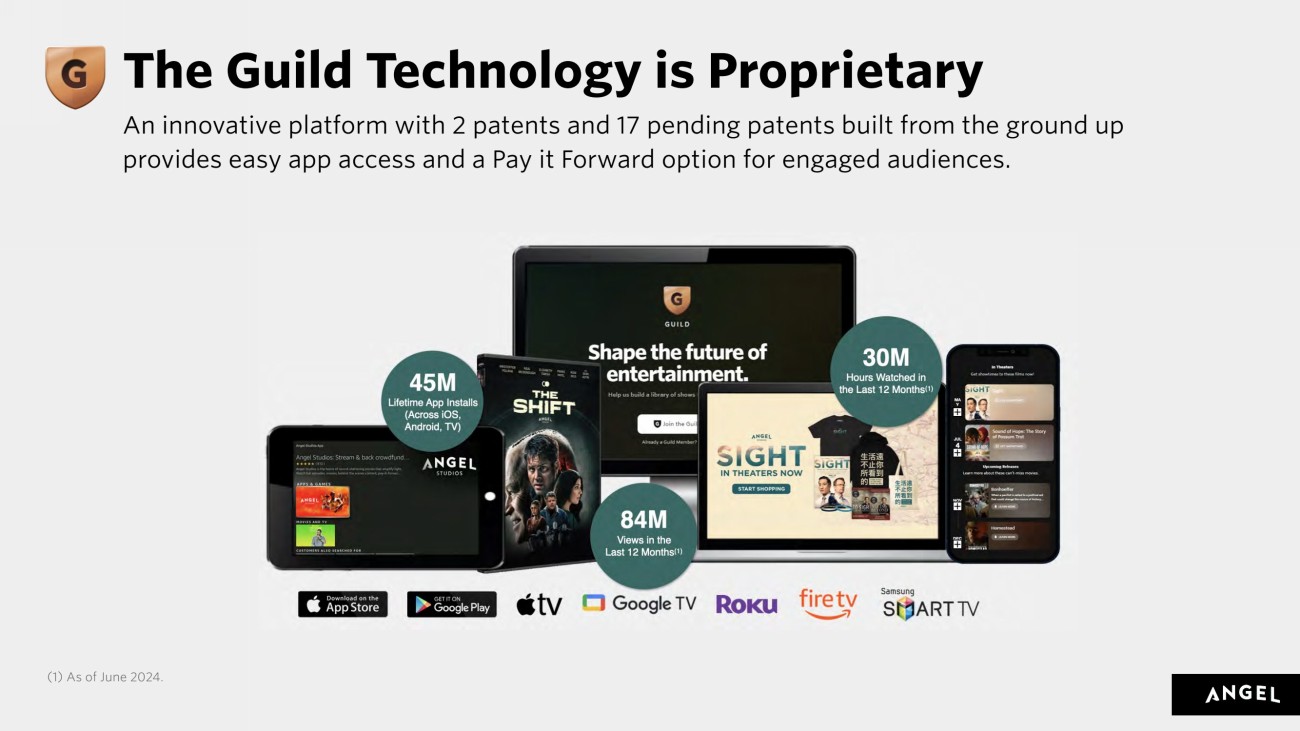

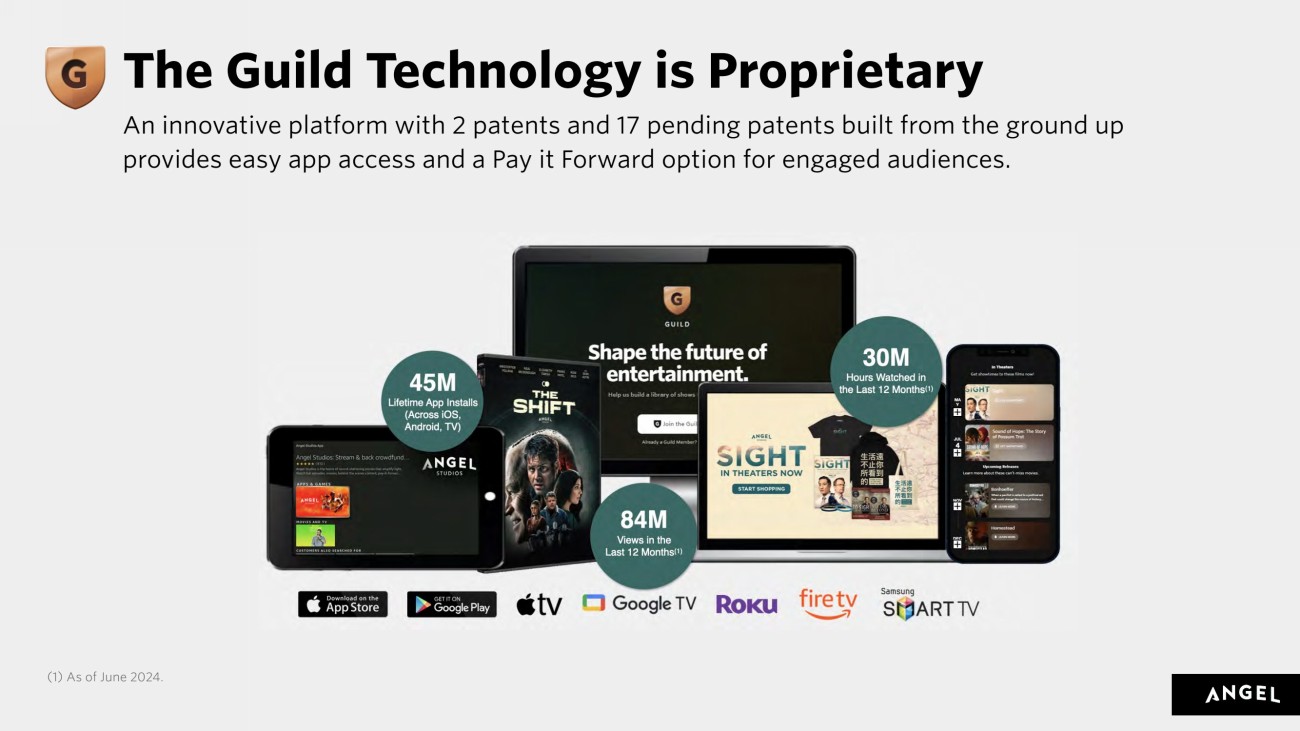

| The Guild Technology is Proprietary An innovative platform with 2 patents and 17 pending patents built from the ground up provides easy app access and a Pay it Forward option for engaged audiences. (1) As of June 2024. |

| SECTION II FINANCIAL OVERVIEW In Theaters December 20, 2024 |

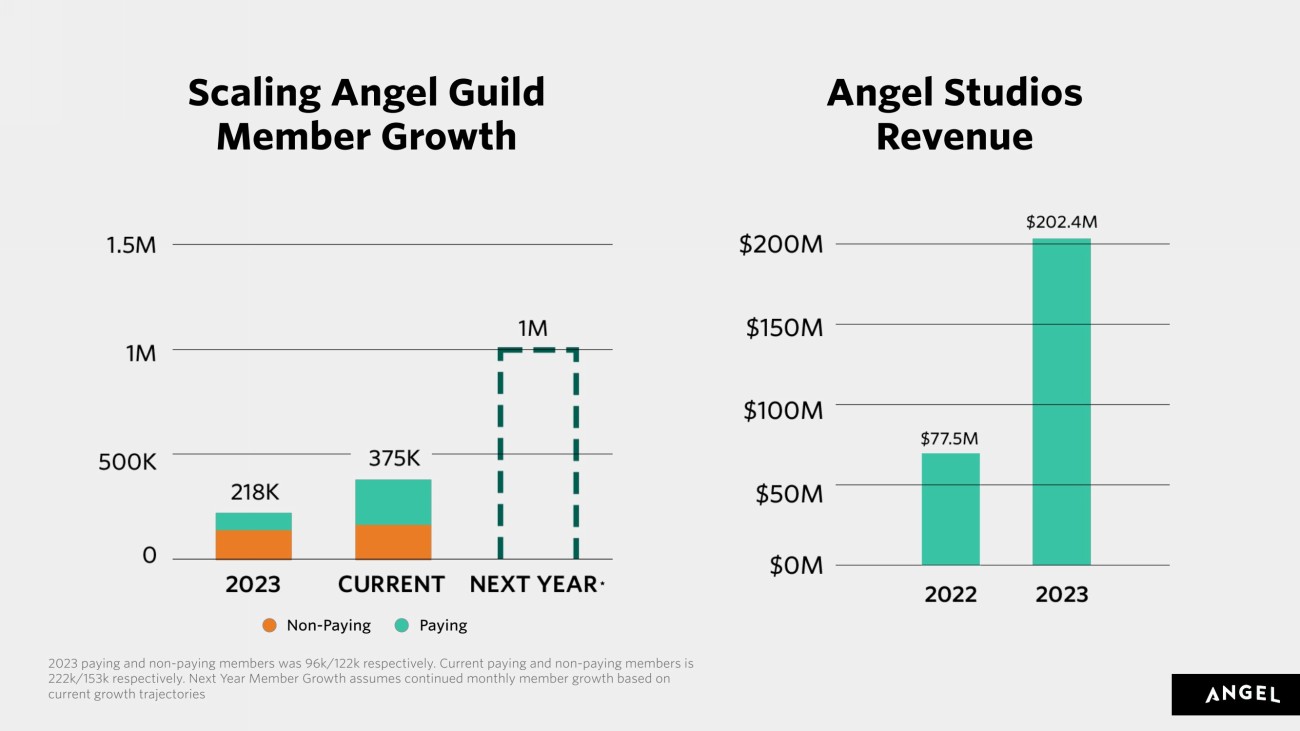

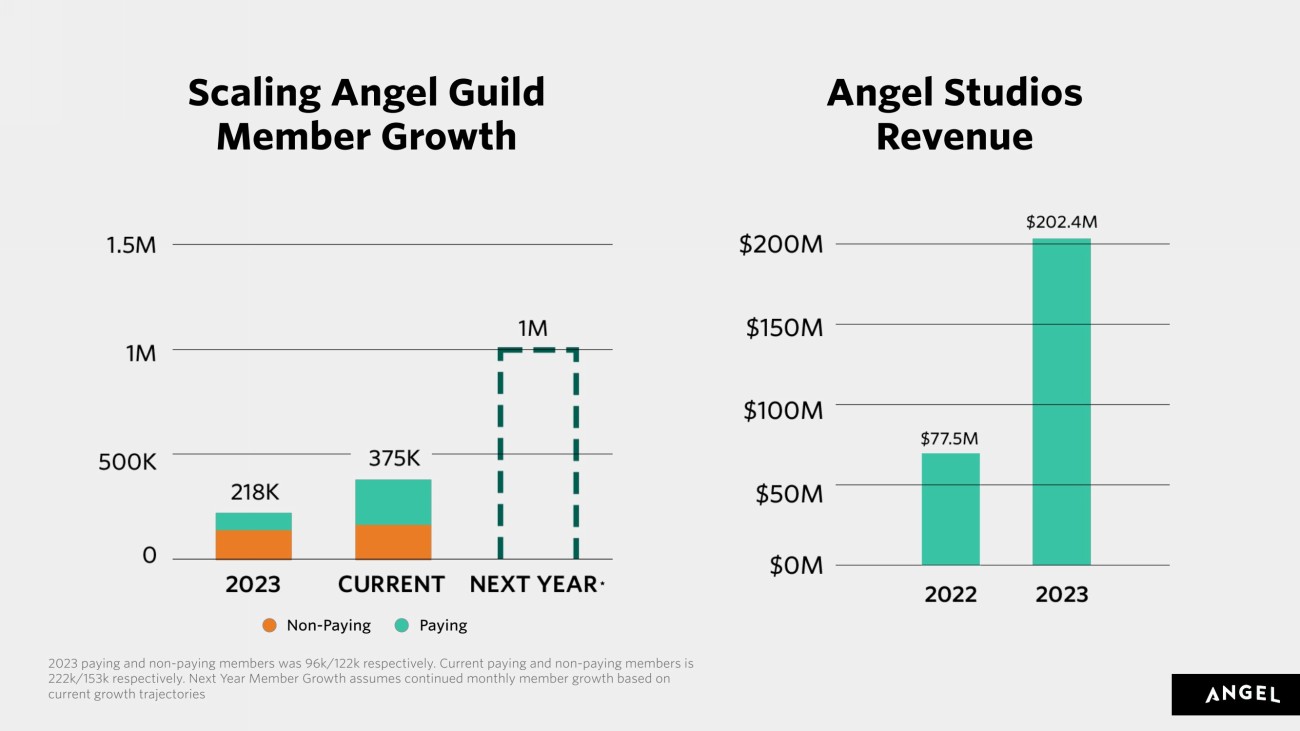

| 2023 paying and non-paying members was 96k/122k respectively. Current paying and non-paying members is 222k/153k respectively. Next Year Member Growth assumes continued monthly member growth based on current growth trajectories * Scaling Angel Guild Member Growth Non-Paying Paying Angel Studios Revenue |

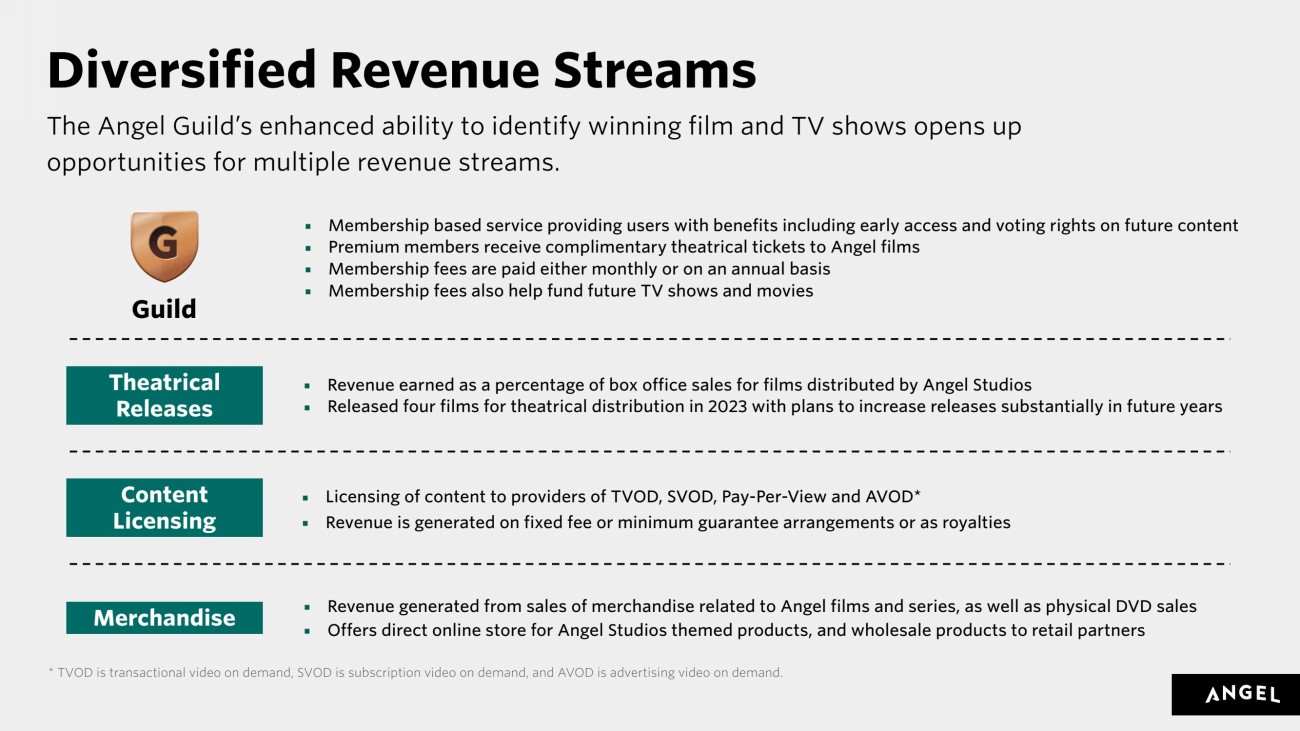

| Diversified Revenue Streams The Angel Guild’s enhanced ability to identify winning film and TV shows opens up opportunities for multiple revenue streams. ▪ Membership based service providing users with benefits including early access and voting rights on future content ▪ Premium members receive complimentary theatrical tickets to Angel films ▪ Membership fees are paid either monthly or on an annual basis ▪ Membership fees also help fund future TV shows and movies Merchandise ▪ Revenue generated from sales of merchandise related to Angel films and series, as well as physical DVD sales ▪ Offers direct online store for Angel Studios themed products, and wholesale products to retail partners Content Licensing ▪ Licensing of content to providers of TVOD, SVOD, Pay-Per-View and AVOD* ▪ Revenue is generated on fixed fee or minimum guarantee arrangements or as royalties Theatrical Releases ▪ Revenue earned as a percentage of box office sales for films distributed by Angel Studios ▪ Released four films for theatrical distribution in 2023 with plans to increase releases substantially in future years Guild * TVOD is transactional video on demand, SVOD is subscription video on demand, and AVOD is advertising video on demand. |

| Bitcoin Strategy: Seeking to Empower the Guild for Generations Angel’s treasury strategy is a for-profit “endowment for the arts” based on the Bitcoin standard that seeks to build a financial foundation to fund the world’s best filmmakers to produce stories that amplify light for generations to come. Angel Treasury (foundation) Stories that Amplify Light CURRENT BALANCE: 125 BTC |

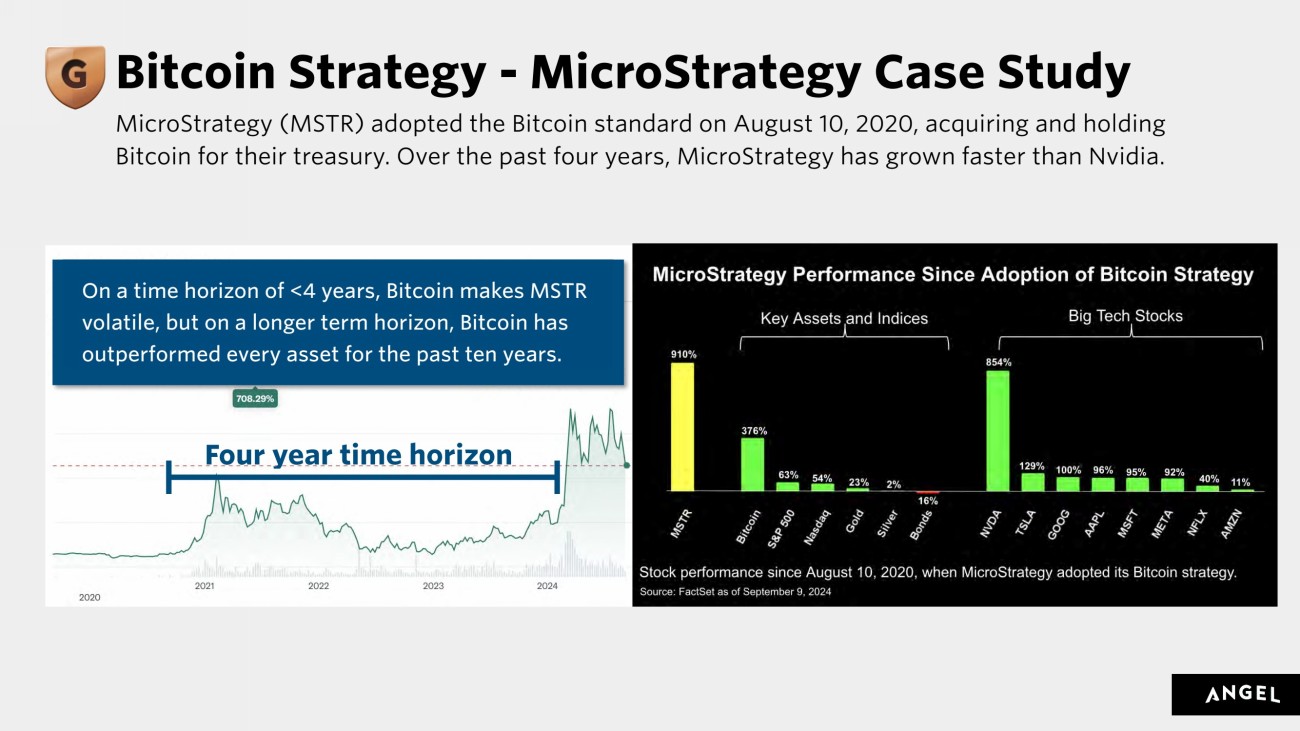

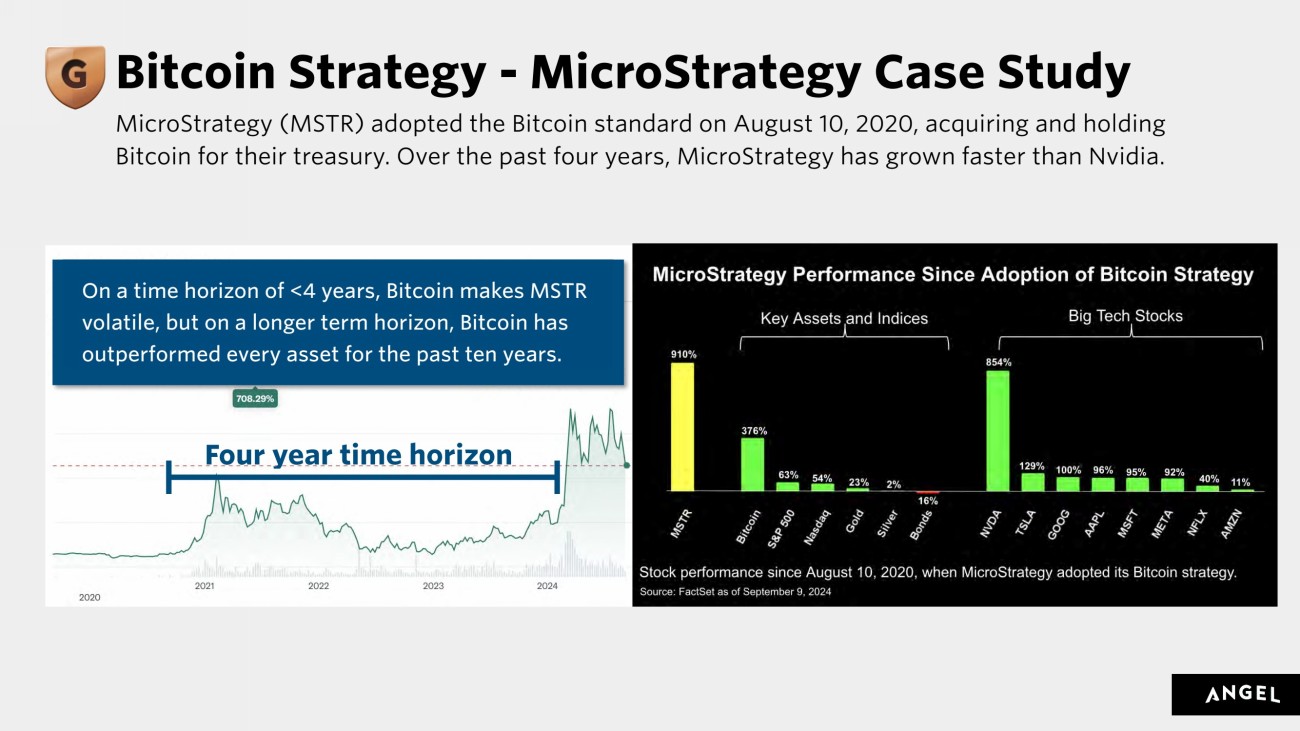

| Bitcoin Strategy - MicroStrategy Case Study MicroStrategy (MSTR) adopted the Bitcoin standard on August 10, 2020, acquiring and holding Bitcoin for their treasury. Over the past four years, MicroStrategy has grown faster than Nvidia. On a time horizon of <4 years, bitcoin makes MSTR volatile, but on a longer time horizon, bitcoin has outperformed every asset for the past ten years. Four year time horizon On a time horizon of <4 years, Bitcoin makes MSTR volatile, but on a longer term horizon, Bitcoin has outperformed every asset for the past ten years. |

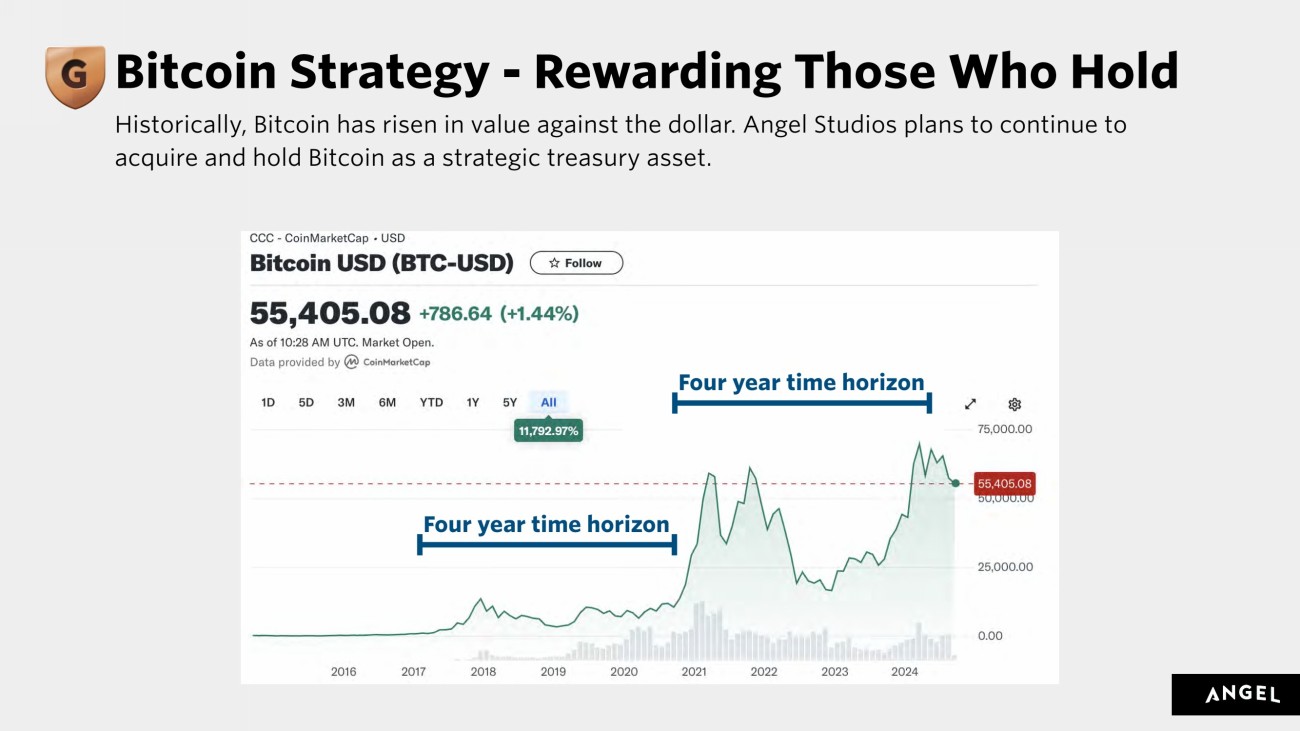

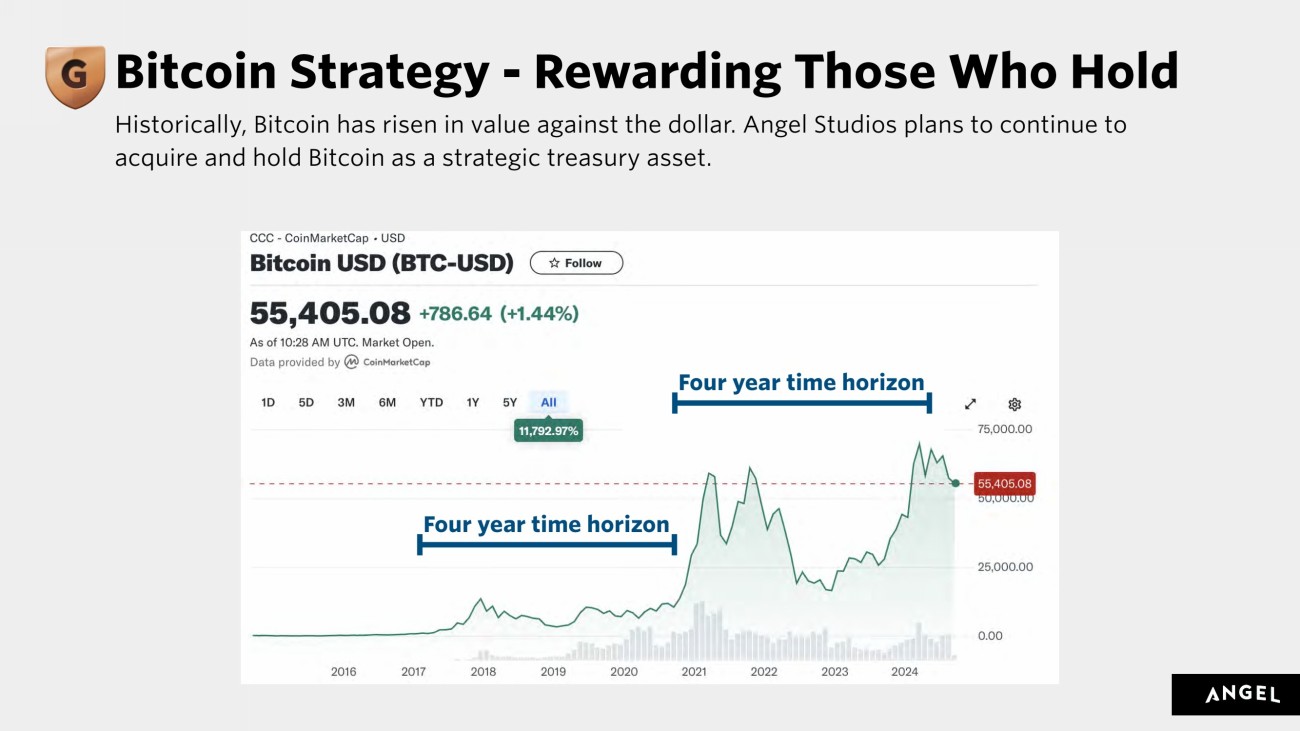

| Bitcoin Strategy - Rewarding Those Who Hold Historically, Bitcoin has risen in value against the dollar. Angel Studios plans to continue to acquire and hold Bitcoin as a strategic treasury asset. Four year time horizon Four year time horizon |

| • Giving the green-light power to the Guild • Continuing financial performance of audience-first film and TV choices • Funding filmmakers who serve the audience first • Shaping the future of the entertainment industry • Supporting Angel’s mission to tell stories that amplify light • Indirectly owning bitcoin, Angel’s strategic treasury asset Buying and Holding Angel Long-Term Means: |

| November 2025 SECTION III WHAT’S NEXT? In Theaters November 2025 |

| Transaction Summary Illustrative Pro Forma Equity Ownership Sources & Uses At Close Illustrative Pro Forma Enterprise Value Transaction Overview • Southport Acquisition Corporation (OTC: “PORT”) to combine with Angel Studios, Inc. • Angel Studios existing shareholders and management will roll 100% of their equity into the combined company • The transaction values the combined company at a $1.6 billion pro forma enterprise value • Transaction is expected to be funded through a combination of PORT’s remaining cash in trust and additional financing being pursued by Angel Studios and Southport prior to transaction close • Transaction has no minimum cash condition. Closing expected to be completed in the first half of 2025 Sources ($mm) Angel Studios Existing Shareholders $1,500 93% PORT Founder Shares 58 4% Angel Studios Existing Cash 25 2% PORT Public Shareholders 12 1% Exchanged Warrant Holder Shares 12 1% Total $1,607 100% Uses ($mm) Angel Studios Existing Shareholders $1,500 93% PORT Founder Shares 58 4% New Cash to Balance Sheet 26 2% Exchanged Warrant Holder Shares 12 1% Transaction Fees 11 1% Total $1,607 100% Total Shares Outstanding at Close (mm) 158.1 Stock Price Per Share at Issue ($) $10.00 Implied Post-Money Equity Value ($mm) 1,581 Less: New & Existing Cash ($mm)(4) (26) Plus: Existing Debt ($mm) 6 Pro Forma Enterprise Value ($mm) 1,560 (1) Assumes 11.5 million public warrants exchanged for common shares (10-for-1 exchange). (2) Assumes 100% of outstanding SPAC trust is retained. (3) Inclusive of shares issued to Angel Studios and investors via potential additional financing. (4) Includes Angel Studios existing cash, PORT cash in trust; less $11mm in transaction fees. PORT Founder Shares, 3.6% Exchanged Warrant Holder Shares, 0.7% PORT Public Shareholders, 0.7% Angel Studios Existing Shareholders, 94.9% |

| Management Team Experienced leadership team across entertainment and technology poised for continued growth Neal Harmon • Co-Founder of Angel Studios, Orabrush, Harmon Brothers • Holds a BA and MS from Brigham Young University Chief Executive Officer Angel Studios Patrick Reilly • Over 15 years of financial leadership • Holds a BS from Utah Valley University and MBA from University of Utah Chief Financial Officer Angel Studios Jeb Spencer • Co-Founder and Managing Partner of TVC Capital since 2006 • Currently serves on the board of directors of 8 software companies, previously served on 7 others • Holds a BA from Boston College and MBA from Harvard Business School Chief Executive Officer & Board Member Southport Acquisition Corp Ajay Madhok • Managing Partner of Angel Acceleration Fund • Co-Founder of ReBoot Digital, MOOVE Network, InLoop Network, AmSoft Systems, Equals • Holds a BE and Masters from Birla Institute of Technology and Science Executive Vice President of Business Strategy Angel Studios Jared Stone • Over 27 years of experience leading investments on behalf of institutional and family investors • Co-Founder of Northgate Capital, serving as • Managing Partner from 2001 to 2015 • Holds a BA from Yale Law School and MBA from Harvard Business School Chairman Southport Acquisition Corp Jennifer Nuckles • Over 28 years of experience in the technology sector • CEO and Chairperson of the Board of R-Zero • Previous EVP and NEO of NASDAQ: SOFI and CMO of NASDAQ: ZNGA • Holds a BA from UC Berkeley and MBA from Harvard Business School Chairman of the Audit Committee & Board Member Southport Acquisition Corp |

| Join the movement to build and empower millions of Guild members for generations to come. |

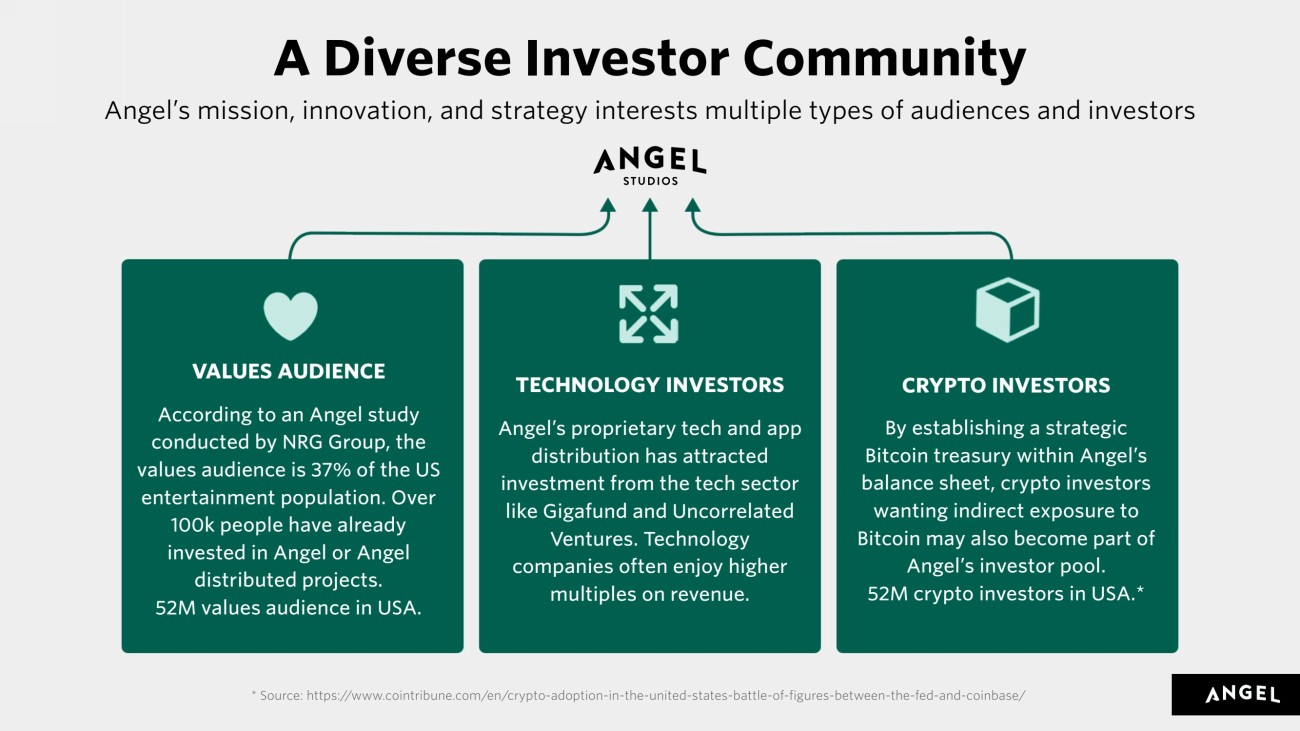

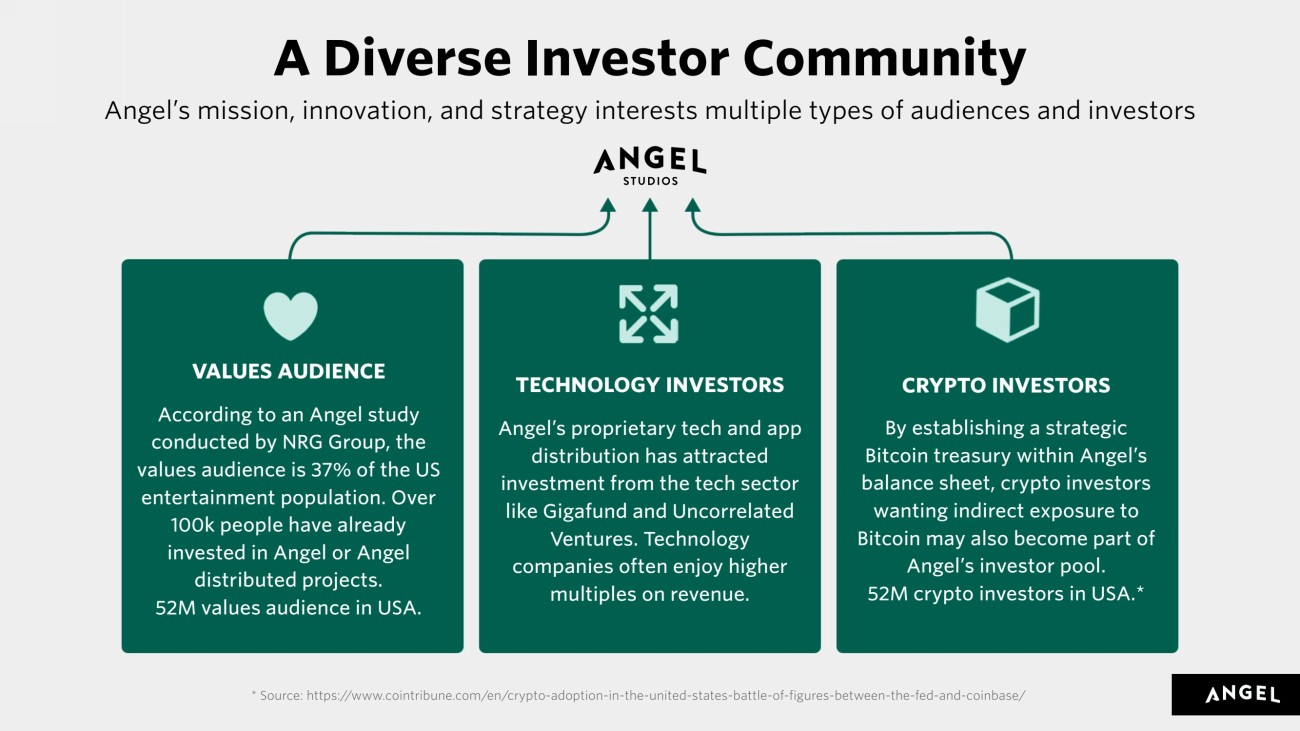

| A Diverse Investor Community VALUES AUDIENCE According to an Angel study conducted by NRG Group, the values audience is 37% of the US entertainment population. Over 100k people have already invested in Angel or Angel distributed projects. 52M values audience in USA. TECHNOLOGY INVESTORS Angel’s proprietary tech and app distribution has attracted investment from the tech sector like Gigafund and Uncorrelated Ventures. Technology companies often enjoy higher multiples on revenue. CRYPTO INVESTORS By establishing a strategic Bitcoin treasury within Angel’s balance sheet, crypto investors wanting indirect exposure to Bitcoin may also become part of Angel’s investor pool. 52M crypto investors in USA.* Angel’s mission, innovation, and strategy interests multiple types of audiences and investors * Source: https://www.cointribune.com/en/crypto-adoption-in-the-united-states-battle-of-figures-between-the-fed-and-coinbase/ |

| Whether as an investor, customer, or team member, thank you for joining us! Investor Relations investment@angel.com |

| SECTION IV APPENDIX |

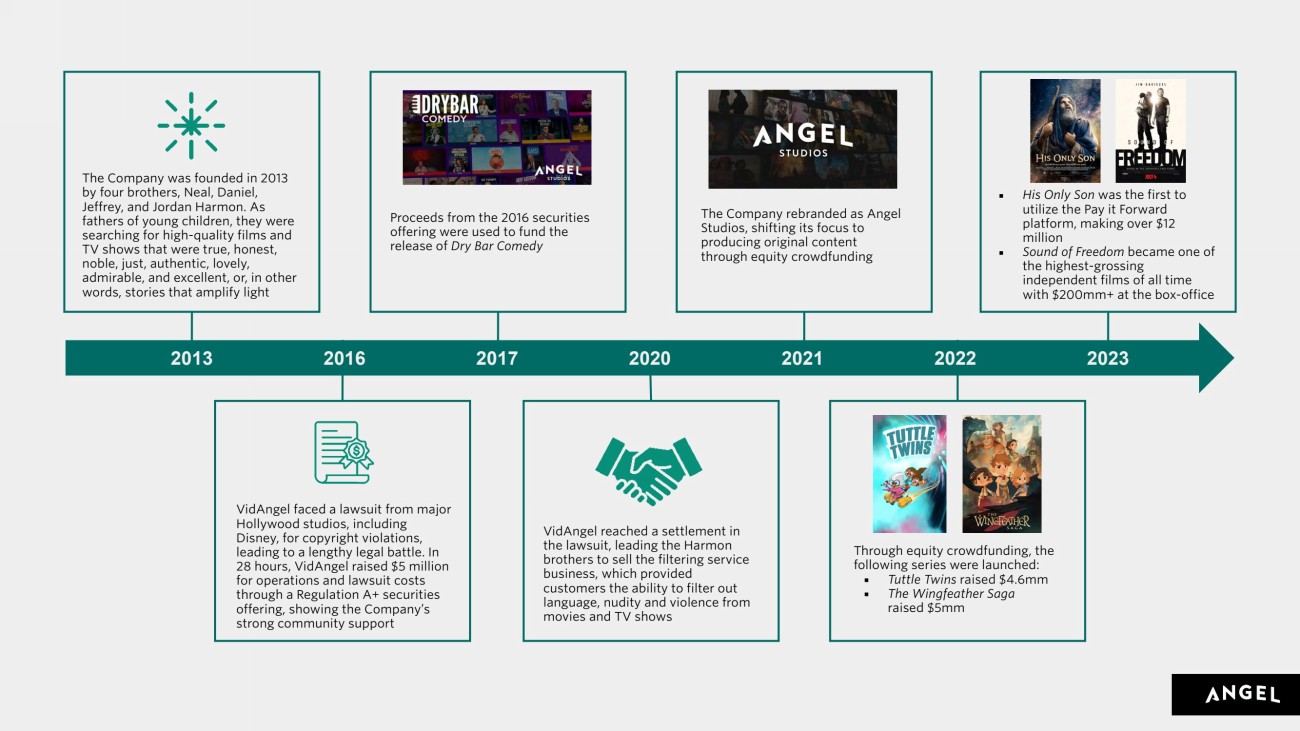

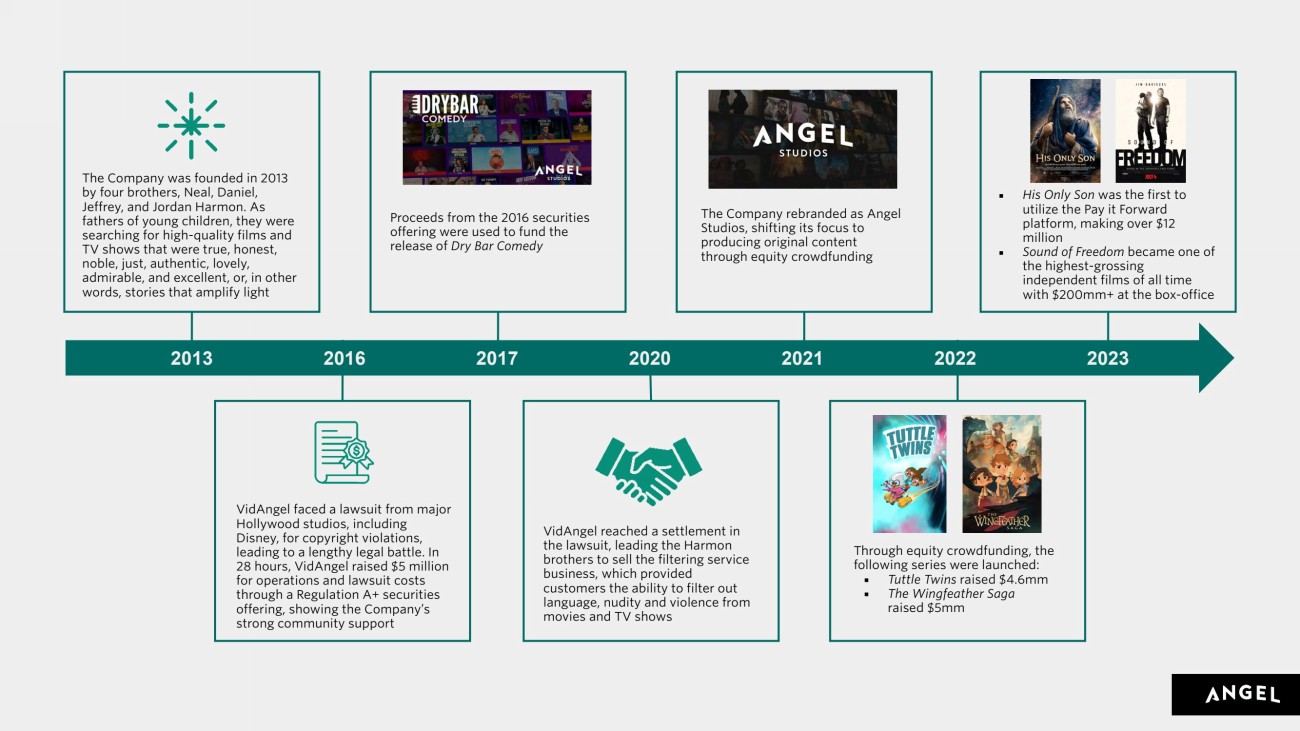

| VidAngel faced a lawsuit from major Hollywood studios, including Disney, for copyright violations, leading to a lengthy legal battle. In 28 hours, VidAngel raised $5 million for operations and lawsuit costs through a Regulation A+ securities offering, showing the Company’s strong community support VidAngel reached a settlement in the lawsuit, leading the Harmon brothers to sell the filtering service business, which provided customers the ability to filter out language, nudity and violence from movies and TV shows The Company rebranded as Angel Studios, shifting its focus to producing original content through equity crowdfunding Through equity crowdfunding, the following series were launched: ▪ Tuttle Twins raised $4.6mm ▪ The Wingfeather Saga raised $5mm ▪ His Only Son was the first to utilize the Pay it Forward platform, making over $12 million ▪ Sound of Freedom became one of the highest-grossing independent films of all time with $200mm+ at the box-office Proceeds from the 2016 securities offering were used to fund the release of Dry Bar Comedy The Company was founded in 2013 by four brothers, Neal, Daniel, Jeffrey, and Jordan Harmon. As fathers of young children, they were searching for high-quality films and TV shows that were true, honest, noble, just, authentic, lovely, admirable, and excellent, or, in other words, stories that amplify light 2013 2016 2017 2020 2021 2022 2023 |

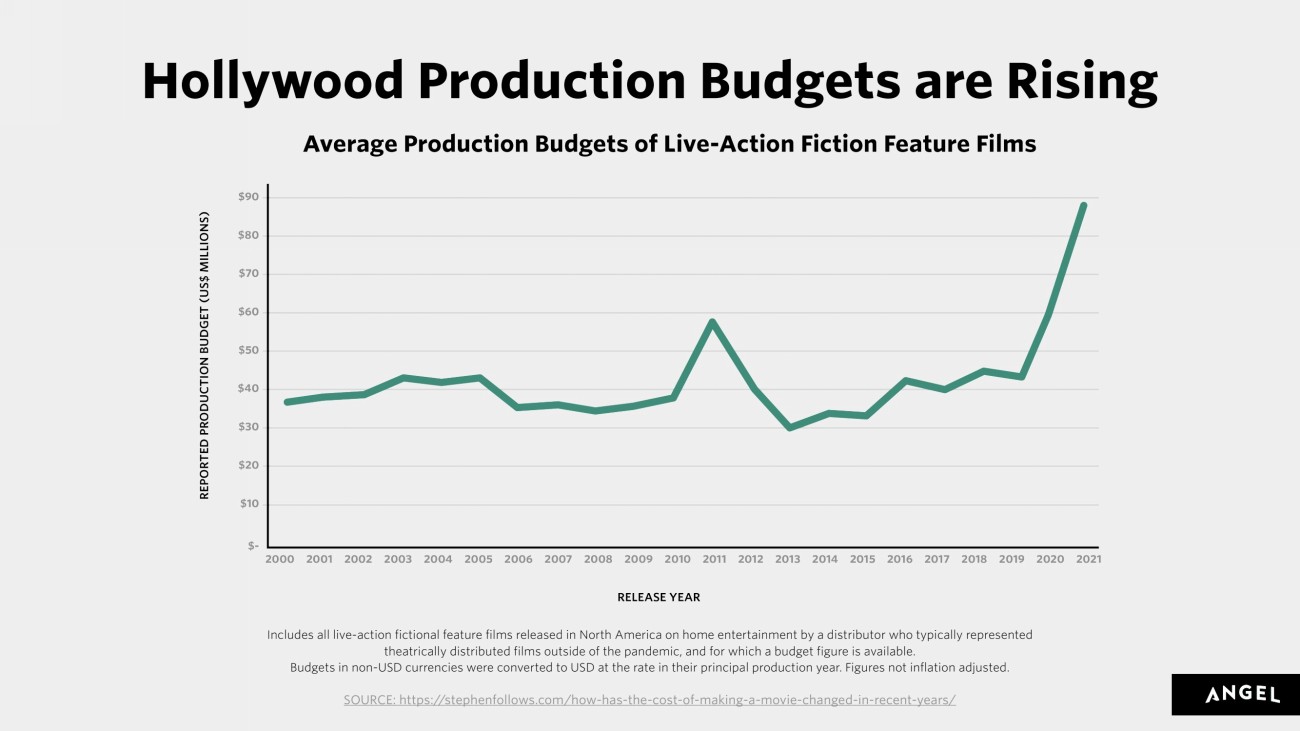

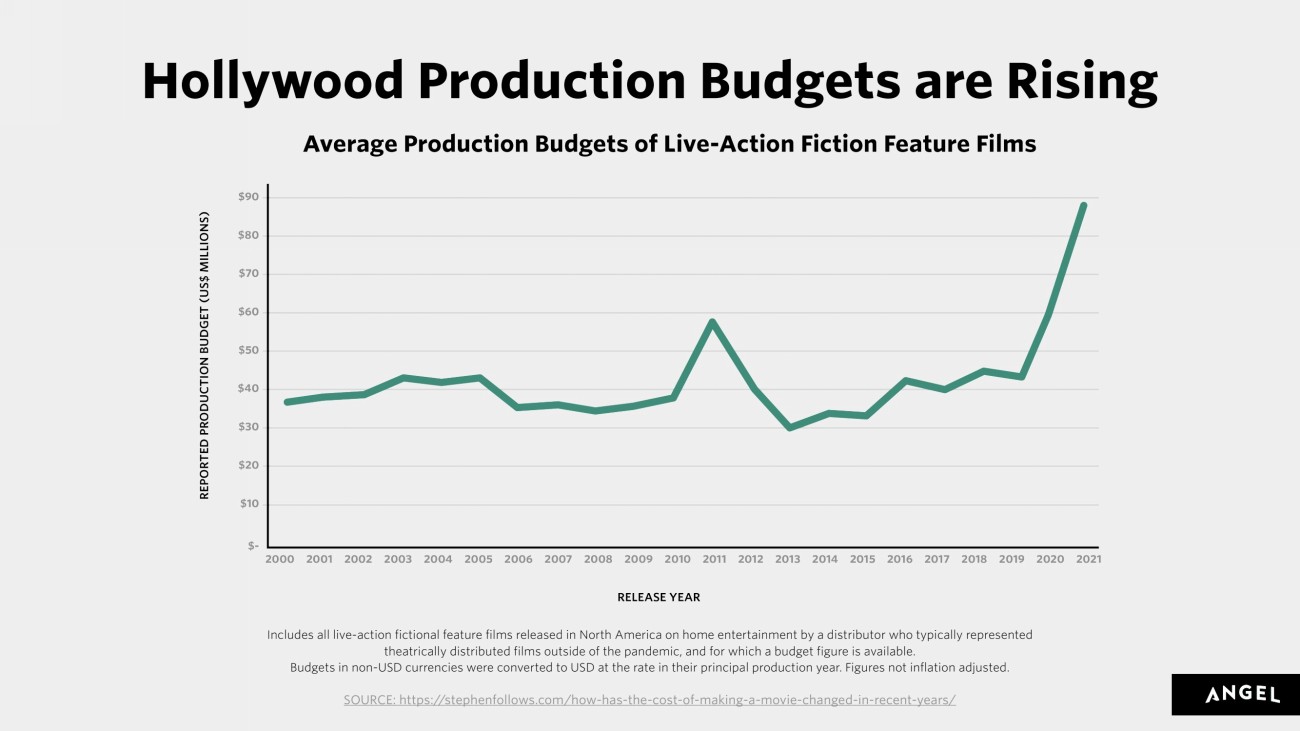

| SOURCE: https://stephenfollows.com/how-has-the-cost-of-making-a-movie-changed-in-recent-years/ Hollywood Production Budgets are Rising Includes all live-action fictional feature films released in North America on home entertainment by a distributor who typically represented theatrically distributed films outside of the pandemic, and for which a budget figure is available. Budgets in non-USD currencies were converted to USD at the rate in their principal production year. Figures not inflation adjusted. |

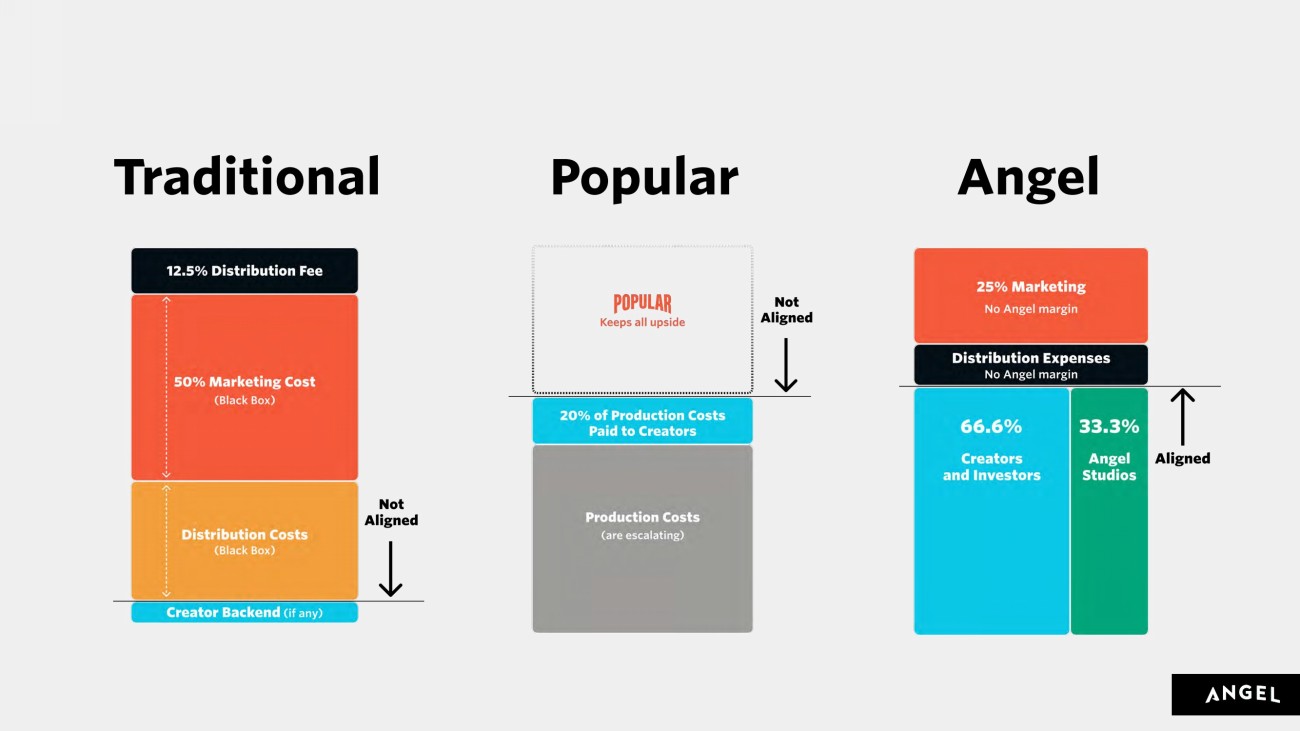

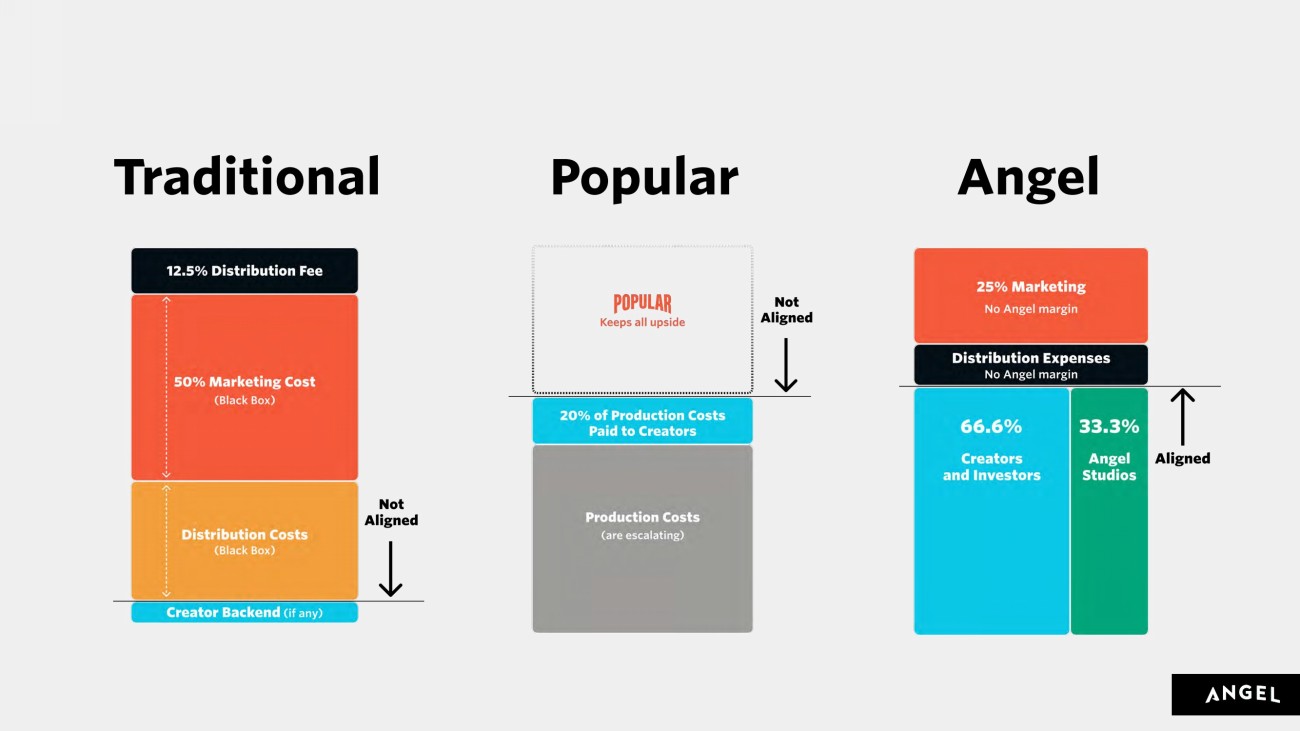

| Angel’s waterfall is better than Hollywood. The model aligns incentives for investors, filmmakers, and Angel, while holding down production costs and increasing upside. Angel Waterfall Alignment |

| Traditional Popular Angel |

| MEMBERSHIP & CURATION |

| Our Competitive Differentiation The Angel Guild green-lights shows at Angel (not executives) |

| BOX OFFICE TECH |

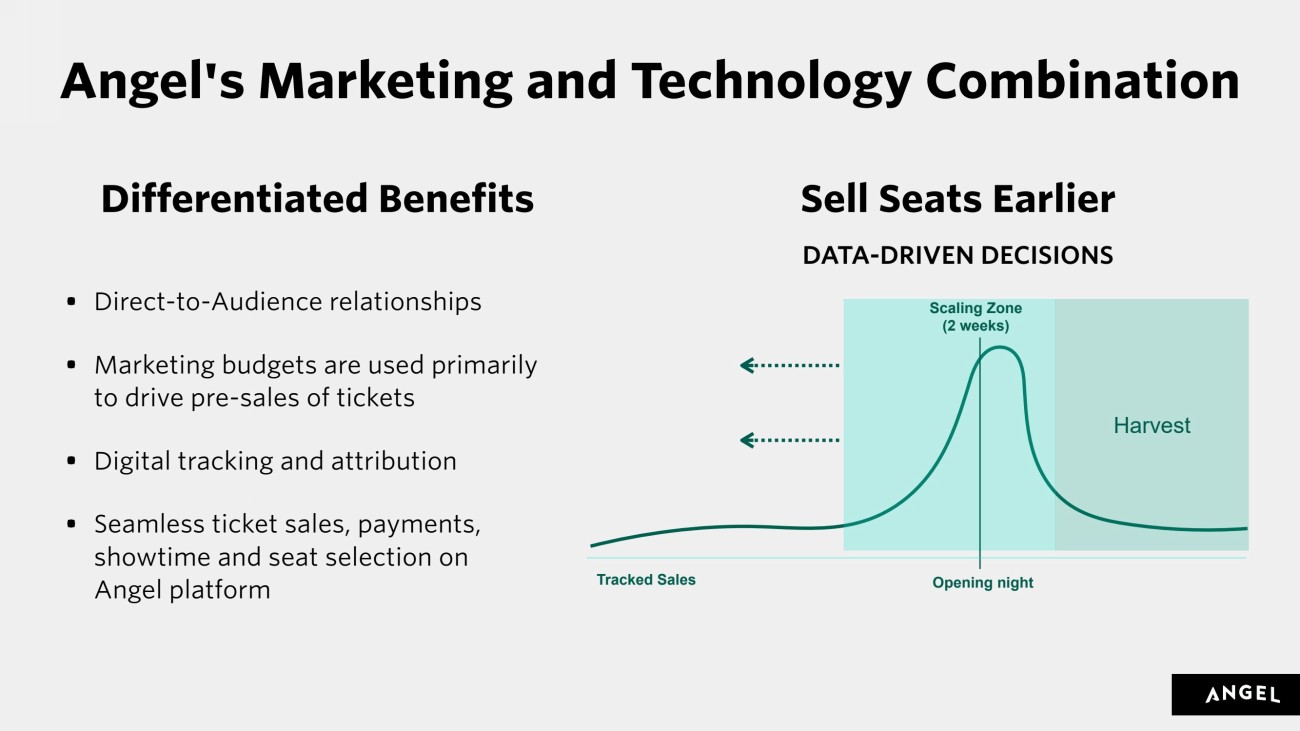

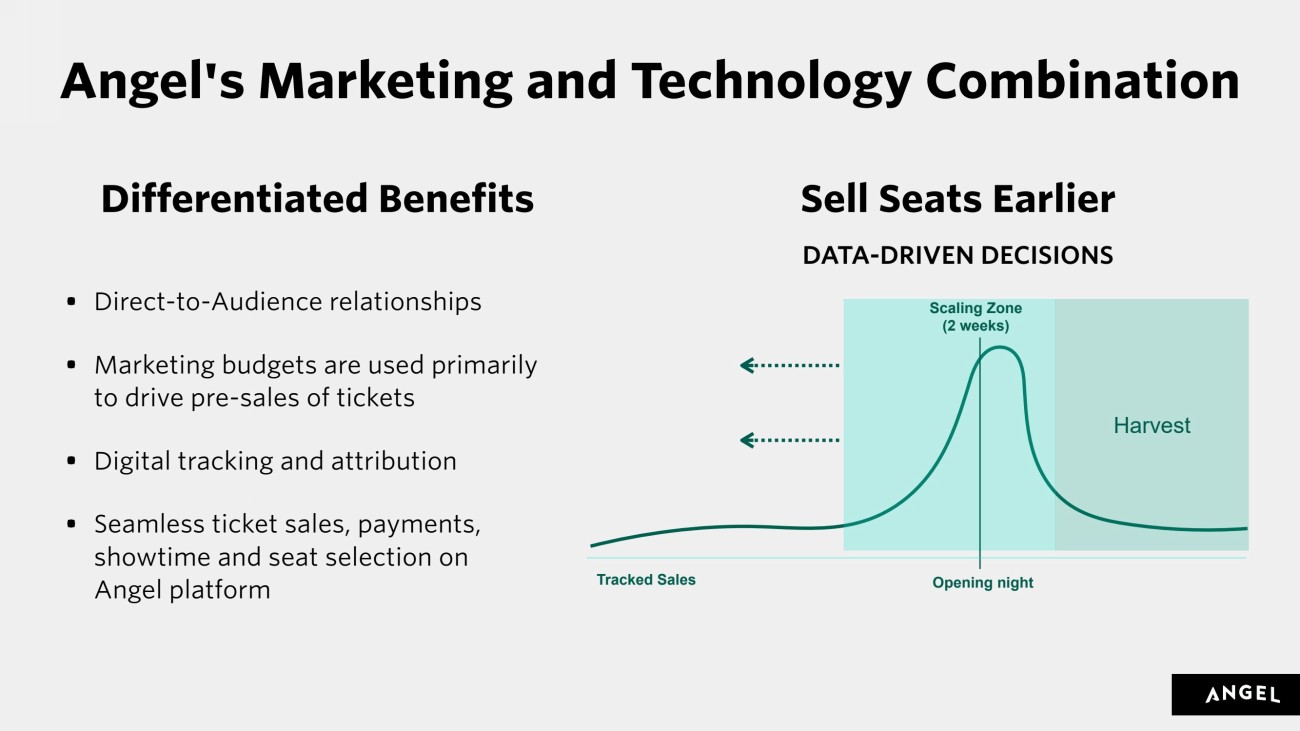

| Sell Seats Earlier Scaling Zone (2 weeks) Opening night Harvest Tracked Sales • Direct-to-Audience relationships • Marketing budgets are used primarily to drive pre-sales of tickets • Digital tracking and attribution • Seamless ticket sales, payments, showtime and seat selection on Angel platform Differentiated Benefits DATA-DRIVEN DECISIONS Angel's Marketing and Technology Combination |