WHEN RECORDED MAIL TO:

Ameren Illinois Company

Craig W. Stensland

One Ameren Plaza (MC 1310)

1901 Chouteau Avenue

St. Louis, MO 63103

AMEREN ILLINOIS COMPANY

(SUCCESSOR TO ILLINOIS POWER COMPANY)

TO

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

AS SUCCESSOR TRUSTEE TO

HARRIS TRUST AND SAVINGS BANK

SUPPLEMENTAL INDENTURE

DATED AS OF OCTOBER 15, 2019

TO

GENERAL MORTGAGE INDENTURE AND DEED OF TRUST

DATED AS OF NOVEMBER 1, 1992

_____________________________________________________________________________________________

This instrument was prepared by Chonda J. Nwamu, Esq., Senior Vice President, General Counsel and Secretary of Ameren Illinois Company c/o Ameren Corporation, One Ameren Plaza, 1901 Chouteau Avenue, St. Louis, Missouri 63103.

_____________________________________________________________________________________________

SUPPLEMENTAL INDENTURE dated as of October 15, 2019 (“this Supplemental Indenture”), made by and between AMEREN ILLINOIS COMPANY (formerly named Central Illinois Public Service Company (“CIPS”) and successor to Illinois Power Company (“IP”) pursuant to the Merger, as defined below), a corporation organized and existing under the laws of the State of Illinois (hereinafter sometimes called the “Company”), party of the first part, and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., a national banking association organized and existing under the laws of the United States, as successor trustee to Harris Trust and Savings Bank, as Trustee (the “Trustee”) under the General Mortgage Indenture and Deed of Trust dated as of November 1, 1992, hereinafter mentioned, party of the second part;

WHEREAS, the Company has heretofore executed and delivered its General Mortgage Indenture and Deed of Trust dated as of November 1, 1992 as from time to time amended and supplemented (the “Indenture”), to the Trustee, for the security of the Bonds issued and to be issued thereunder (the “Bonds”); and

WHEREAS, as of 12:01 a.m. Central Time (the “Effective Time”) on October 1, 2010, pursuant to the Agreement and Plan of Merger dated as of April 13, 2010 among CIPS, IP and Central Illinois Light Company (“CILCO”), IP and CILCO were merged with and into the Company (the “Merger”) whereby the Company is the surviving corporation; and

WHEREAS, pursuant to Sections 13.01 and 14.01(a) of the Indenture, the Company and the Trustee executed the Supplemental Indenture dated as of October 1, 2010 whereby, among other things, the Company (a) assumed the due and punctual payment of the principal of and premium, if any, and interest, if any, on all of the Bonds then Outstanding and the performance and observance of every covenant and condition of the Indenture to be performed or observed by IP and (b) subjected to the Lien of the Indenture all equipment and fixtures (other than Excepted Property, which is expressly excepted and excluded from the Lien of the Indenture) that were owned by CIPS immediately prior to the Effective Time and were of the same kind and character as the Mortgaged Property immediately prior to the Effective Time; and

WHEREAS, pursuant to Sections 13.02 and 14.01(a)(i) of the Indenture, the Company has succeeded to, and has been substituted for, and may exercise every right and power of, IP under the Indenture with the same effect as if the Company had been named the “Company” in the Indenture; and

WHEREAS, pursuant to Section 14.01(a) of the Indenture, the Company and the Trustee executed 59 Supplemental Indentures dated as of January 15, 2011 subjecting to the Lien of the Indenture certain real property that was owned by CIPS immediately prior to the Merger; and

WHEREAS, pursuant to the terms and provisions of the Indenture there were created and authorized by supplemental indentures thereto bearing the following dates, respectively, the Mortgage Bonds of the series issued thereunder and respectively identified opposite such dates:

|

| | |

DATE OF

SUPPLEMENTAL

INDENTURE | IDENTIFICATION OF SERIES | CALLED |

| February 15, 1993 | 8% Series due 2023 (redeemed) | Bonds of the 2023 Series |

| March 15, 1993 | 6 1/8% Series due 2000 (paid at maturity) | Bonds of the 2000 Series |

| March 15, 1993 | 6 3/4% Series due 2005 (paid at maturity) | Bonds of the 2005 Series |

| July 15, 1993 | 7 1/2% Series due 2025 (redeemed) | Bonds of the 2025 Series |

| August 1, 1993 | 6 1/2% Series due 2003 (paid at maturity) | Bonds of the 2003 Series |

| October 15, 1993 | 5 5/8% Series due 2000 (paid at maturity) | Bonds of the Second 2000 Series |

| November 1, 1993 | Pollution Control Series M (redeemed) | Bonds of the Pollution Control Series M |

|

| | |

DATE OF

SUPPLEMENTAL

INDENTURE | IDENTIFICATION OF SERIES | CALLED |

| November 1, 1993 | Pollution Control Series N (redeemed) | Bonds of the Pollution Control Series N |

| November 1, 1993 | Pollution Control Series O (redeemed) | Bonds of the Pollution Control Series O |

| April 1, 1997 | Pollution Control Series P (retired) | Bonds of the Pollution Control Series P |

| April 1, 1997 | Pollution Control Series Q (retired) | Bonds of the Pollution Control Series Q |

| April 1, 1997 | Pollution Control Series R (retired) | Bonds of the Pollution Control Series R |

| March 1, 1998 | Pollution Control Series S (redeemed) | Bonds of the Pollution Control Series S |

| March 1, 1998 | Pollution Control Series T (redeemed) | Bonds of the Pollution Control Series T |

| July 15, 1998 | 6 1/4% Series due 2002 (paid at maturity) | Bonds of the 2002 Series |

| September 15, 1998 | 6% Series due 2003 (paid at maturity) | Bonds of the Second 2003 Series |

| June 15, 1999 | 7.50% Series due 2009 (paid at maturity) | Bonds of the 2009 Series |

| July 15, 1999 | Pollution Control Series U (redeemed) | Bonds of the Pollution Control Series U |

| July 15, 1999 | Pollution Control Series V (redeemed) | Bonds of the Pollution Control Series V |

| May 1, 2001 | Pollution Control Series W (retired) | Bonds of the Pollution Control Series W |

| May 1, 2001 | Pollution Control Series X (retired) | Bonds of the Pollution Control Series X |

| July 1, 2002 | 10 5/8% Series due 2007 (not issued) | Bonds of the 2007 Series |

| July 1, 2002 | 10 5/8% Series due 2012 (not issued) | Bonds of the 2012 Series |

| December 15, 2002 | 11.50% Series due 2010 (redeemed) | Bonds of the 2010 Series |

| June 1, 2006 | Mortgage Bonds, Senior Notes Series AA (retired) | Bonds of Series AA |

| August 1, 2006 | Mortgage Bonds, 2006 Credit Agreement Series Bonds (retired) | 2006 Credit Agreement Series Bonds |

| March 1, 2007 | Mortgage Bonds, 2007 Credit Agreement Series Bonds (retired) | 2007 Credit Agreement Series Bonds |

| November 15, 2007 | Mortgage Bonds, Senior Notes Series BB (retired) | Bonds of Series BB |

| April 1, 2008 | Mortgage Bonds, Senior Notes Series CC (retired) | Bonds of Series CC |

| October 1, 2008 | Mortgage Bonds, Senior Notes Series DD (retired) | Bonds of Series DD |

|

| | |

DATE OF

SUPPLEMENTAL

INDENTURE | IDENTIFICATION OF SERIES | CALLED |

| June 15, 2009 | Mortgage Bonds, 2009 Credit Agreement Series Bonds (retired) | 2009 Credit Agreement Series Bonds |

| October 1, 2010 | Mortgage Bonds, Senior Notes Series CIPS-AA | Series CIPS-AA Mortgage Bonds |

| October 1, 2010 | Mortgage Bonds, Senior Notes Series CIPS-BB (retired) | Series CIPS-BB Mortgage Bonds |

| October 1, 2010 | Mortgage Bonds, Senior Notes Series CIPS-CC | Series CIPS-CC Mortgage Bonds |

| August 1, 2012 | First Mortgage Bonds, Senior Notes Series EE | Bonds of Series EE |

| December 1, 2013 | First Mortgage Bonds, Senior Notes Series FF | Bonds of Series FF |

| June 1, 2014 | First Mortgage Bonds, Senior Notes Series GG | Bonds of Series GG |

| December 1, 2014 | First Mortgage Bonds, Senior Notes Series HH | Bonds of Series HH |

| December 1, 2015 | First Mortgage Bonds, Senior Notes Series II | Bonds of Series II |

| November 1, 2017 | 3.70% First Mortgage Bonds due 2047 | Bonds of the 2047 Series |

| May 1, 2018 | 3.80% First Mortgage Bonds due 2028 | Bonds of the 2028 Series |

| November 1, 2018 | 4.50% First Mortgage Bonds due 2049 | Bonds of the 2049 Series |

and

WHEREAS, a supplemental indenture with respect to the Bonds of the 2007 Series and the Bonds of the 2012 Series listed above was executed and filed but such Bonds of the 2007 Series and Bonds of the 2012 Series were never issued and a release with respect to such supplemental indenture was subsequently executed and filed; and

WHEREAS, pursuant to Section 14.01(a)(xi) of the Indenture, the Company and the Trustee executed a Supplemental Indenture dated as of October 25, 2017 amending the Indenture and reserving rights to amend the Indenture; and

WHEREAS, pursuant to Section 14.01(a) of the Indenture, the Company elects to subject to the Lien of the Indenture certain property owned by CILCO immediately prior to the Effective Time and certain property acquired by the Company after the Effective Time; and

WHEREAS, the Company desires to create a new series of Bonds to be issued under the Indenture; and

WHEREAS, the Company (as successor to IP) has entered into an Indenture dated as of June 1, 2006 (as amended and supplemented, the “Senior Note Indenture”) with The Bank of New York Mellon Trust Company, N.A., as trustee (the “Senior Note Trustee”), providing for the issuance from time to time of senior notes thereunder; and

WHEREAS, the Company desires by this Supplemental Indenture to issue to the Senior Note Trustee the Series CILCO-AA Mortgage Bonds as security for $42,000,000 aggregate principal amount of the Company’s Senior Notes Series CILCO-AA (the “Series CILCO-AA Notes”) to be issued under the Senior Note Indenture; and

WHEREAS, the Company, in the exercise of the powers and authority conferred upon and reserved to it under the provisions of the Indenture, and pursuant to appropriate resolutions of the Board of Directors, has duly

resolved and determined to make, execute and deliver to the Trustee this Supplemental Indenture in the form hereof for the purposes herein provided; and

WHEREAS, all conditions and requirements necessary to make this Supplemental Indenture a valid, binding and legal instrument have been done, performed and fulfilled and the execution and delivery hereof have been in all respects duly authorized;

NOW, THEREFORE, THIS SUPPLEMENTAL INDENTURE WITNESSETH:

THAT to secure the payment of the principal of, premium, if any, and interest on all Bonds issued and Outstanding under the Indenture when payable in accordance with the provisions thereof and hereof, and to secure the performance by the Company of, and its compliance with, the covenants and conditions of the Indenture, and in consideration of the premises and of One Dollar paid to the Company by the Trustee and pursuant to Section 14.01 of the Indenture, the Company does hereby grant, bargain, sell, release, convey, quitclaim, assign, transfer, mortgage, pledge, set over and confirm unto the Trustee, and to its successors in trust and to its assigns, to the extent not already included in the Mortgaged Property, (a) all of the Company’s equipment and fixtures (other than Excepted Property, which is expressly excepted and excluded from the Lien of the Indenture) that were owned by CILCO immediately prior to the Merger and were of the same kind and character as the Mortgaged Property immediately prior to the Merger (the “CILCO Equipment and Fixtures”), (b) all property, real, personal and mixed, acquired by the Company after the Merger (other than Excepted Property, which is expressly excepted and excluded from the Lien of the Indenture) which constitutes an improvement, extension or addition to the CILCO Equipment and Fixtures or a renewal, replacement or substitution of or for any part thereof, and (c) all franchises, permits, licenses, easements and rights of way that are owned by the Company and are transferable and necessary for the operation and maintenance of the Mortgaged Property, which shall be and are as fully granted and conveyed by the Indenture and as fully embraced within the Lien of the Indenture as if such property, rights and interests in property were now owned by the Company and were specifically described herein and conveyed hereby; the Company expressly reserves the right, at any time and from time to time, by one or more supplemental indentures, to subject to the Lien and operation of the Indenture any part or all of the Excepted Property upon such terms and conditions and subject to such restrictions, limitations and reservations as may be set forth in such supplemental indenture or indentures; together with all other property of whatever kind and nature subjected to or intended to be subjected to the Lien of the Indenture by any of the terms and provisions thereof.

TO HAVE AND TO HOLD all such properties, rights and interests in property granted, bargained, sold, warranted, released, conveyed, assigned, transferred, mortgaged, pledged, set over and confirmed or in which a security interest has been granted by the Company in the Indenture or intended or agreed to be so granted, together with all the appurtenances thereto, unto the Trustee and its successors and assigns forever,

SUBJECT, HOWEVER, to Permitted Liens and to Liens which have been granted by the Company to other Persons prior to the date of the execution and delivery of this Supplemental Indenture, and subject also, as to any property hereafter acquired by the Company, to vendors’ Liens, purchase money mortgages and other Liens thereon at the time of the acquisition thereof (including, but not limited to the Lien of any Prior Mortgage), it being understood that with respect to any of such property which is now or hereafter becomes subject to the Lien of any Prior Mortgage, the Lien of the Indenture shall at all times be junior and subordinate to the Lien of such Prior Mortgage;

BUT IN TRUST, NEVERTHELESS, for the equal and proportionate benefit and security of all present and future holders of the Bonds and any coupons issued and to be issued thereunder and secured by the Lien of the Indenture, and to secure the payment of the principal of, premium, if any, and interest on the Bonds issued and Outstanding under the Indenture when payable in accordance with the provisions thereof and hereof, and to secure the performance of the Company, of, and its compliance with, the covenants and conditions of the Indenture without any preference, priority or distinction of any one Bond over any other Bond by reason of priority in the issue or negotiation thereof or otherwise;

PROVIDED, HOWEVER, that if, after the right, title and interest of the Trustee in and to the Mortgaged Property shall have ceased and become void in accordance with Article Nine, then and in that case the Indenture and the estate and rights thereby granted shall cease, terminate and be void, and the Trustee shall cancel and discharge

the Indenture and execute and deliver to the Company such instruments as the Company shall require to evidence the discharge thereof; otherwise the Indenture shall be and remain in full force and effect; and

IT IS HEREBY COVENANTED AND AGREED, by and between the Company and the Trustee, that all Bonds and coupons, if any, are to be authenticated, delivered and issued, and that all Mortgaged Property is to be held, subject to the further covenants, conditions, uses and trusts in the Indenture set forth, and the Company, for itself and its successor and assigns, hereby covenants and agrees to and with the Trustee and its successors in trust under the Indenture, for the benefit of those who shall hold Bonds, as follows:

ARTICLE I

DESCRIPTION OF THE SERIES CILCO-AA MORTGAGE BONDS

Section 1. The Company hereby creates a new series of Bonds to be known as “First Mortgage Bonds, Senior Notes Series CILCO-AA” (the “Series CILCO-AA Mortgage Bonds”). The Series CILCO-AA Mortgage Bonds shall be executed, authenticated and delivered in accordance with the provisions of, and shall in all respects be subject to, all of the terms, conditions and covenants of the Indenture, as supplemented and modified. The Series CILCO-AA Mortgage Bonds shall be issued in the name of the Senior Note Trustee under the Senior Note Indenture to secure any and all of the Company’s obligations under the Series CILCO-AA Notes and any other series of senior notes from time to time outstanding under the Senior Note Indenture.

The Series CILCO-AA Mortgage Bonds shall be dated as provided in Section 3.03 of Article Three of the Indenture. The Series CILCO-AA Mortgage Bonds shall mature on June 15, 2036, shall accrue interest from the dates set forth in the Series CILCO-AA Notes and shall bear interest at the same rate of interest as the Series CILCO-AA Notes. Interest on the Series CILCO-AA Mortgage Bonds is payable on the same dates as interest on the Series CILCO-AA Notes is paid, until the principal sum is paid in full.

Upon any payment or deemed payment of the principal of, premium, if any, and interest on, all or any portion of the Series CILCO-AA Notes, whether at maturity or prior to maturity by redemption or otherwise or upon provision for the payment thereof having been made in accordance with Section 5.01(a) of the Senior Note Indenture, the Series CILCO-AA Mortgage Bonds in a principal amount equal to the principal amount of such Series CILCO-AA Notes shall, to the extent of such payment of principal, premium, if any, and interest, be deemed paid and the obligation of the Company thereunder to make such payment shall be discharged to such extent and, in the case of the payment of principal (and premium, if any), such Series CILCO-AA Mortgage Bonds shall be surrendered to the Company for cancellation as provided in Section 4.08 of the Senior Note Indenture. The Trustee may at any time and all times conclusively assume that the obligation of the Company to make payments with respect to the principal of, premium, if any, and interest on the Series CILCO-AA Notes, so far as such payments at the time have become due, has been fully satisfied and discharged pursuant to the foregoing sentence unless and until the Trustee shall have received a written notice from the Senior Note Trustee signed by one of its officers stating (i) that timely payment of principal, or premium, if any, or interest on, the Series CILCO-AA Notes has not been made, (ii) that the Company is in arrears as to the payments required to be made by it to the Senior Note Trustee pursuant to the Senior Note Indenture, and (iii) the amount of the arrearage.

Section 2. The Series CILCO-AA Mortgage Bonds and the Trustee’s Certificate of Authentication shall be substantially in the following forms respectively:

[FORM OF FACE OF BOND]

NOTWITHSTANDING ANY PROVISIONS HEREOF OR IN THE INDENTURE, THIS BOND IS NOT ASSIGNABLE OR TRANSFERABLE EXCEPT AS PERMITTED BY SECTION 4.04 OF THE INDENTURE DATED AS OF JUNE 1, 2006, AS AMENDED AND SUPPLEMENTED, BETWEEN AMEREN ILLINOIS COMPANY (AS SUCCESSOR TO ILLINOIS POWER COMPANY) AND THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., AS TRUSTEE

AMEREN ILLINOIS COMPANY

(Incorporated under the laws of the State of Illinois)

Illinois Commerce Commission

Identification No.: Ill. C.C. ____

FIRST MORTGAGE BOND, SENIOR NOTES SERIES CILCO-AA

AMEREN ILLINOIS COMPANY, a corporation organized and existing under the laws of the State of Illinois (the “Company”), which term shall include any Successor Corporation as defined in the Indenture hereinafter referred to, for value received, hereby promises to pay to The Bank of New York Mellon Trust Company, N.A., as trustee (the “Senior Note Trustee”) under the Indenture dated as of June 1, 2006 (as amended and supplemented, the “Senior Note Indenture”), relating to the Company’s Senior Notes Series CILCO-AA (the “Senior Notes”) in the aggregate principal amount of $___________, between the Company and the Senior Note Trustee, or registered assigns, the principal sum of $___________ on June 15, 2036, in any coin or currency of the United States of America, which at the time of payment is legal tender for public and private debts, and to pay interest thereon in like coin or currency from the date of issuance (and thereafter from the dates set forth in the Senior Notes), and at the same rate of interest as the Senior Notes. Interest on overdue principal, premium, if any, and, to the extent permitted by law, on overdue interest, shall be payable at the interest rate payable on the Senior Notes. Interest on this Mortgage Bond is payable on the same dates as interest on the Senior Notes is paid, until the principal sum of this Mortgage Bond is paid in full. Pursuant to Article IV of the Senior Note Indenture, this Mortgage Bond is issued to the Senior Note Trustee to secure any and all obligations of the Company under the Senior Notes and any other series of senior notes from time to time outstanding under the Senior Note Indenture. Payment of principal of, or premium, if any, or interest on, the Senior Notes shall constitute payments on this Mortgage Bond as further provided herein and in the Supplemental Indenture of October 15, 2019 (as hereinafter defined) pursuant to which this Mortgage Bond has been issued. Both the principal of, premium, if any, and the interest on, this Mortgage Bond are payable at the office of the Senior Note Trustee.

Upon any payment or deemed payment of the principal of, premium, if any, and interest on, all or any portion of the Senior Notes, whether at maturity or prior to maturity by redemption or otherwise or upon provision for the payment thereof having been made in accordance with Section 5.01(a) of the Senior Note Indenture, a principal amount of this Mortgage Bond equal to the principal amount of such Senior Notes shall, to the extent of such payment of principal, premium, if any, and interest, be deemed paid and the obligation of the Company thereunder to make such payment shall be discharged to such extent and, in the case of the payment of principal (and premium, if any), such Mortgage Bonds shall be surrendered to the Company for cancellation as provided in Section 4.08 of the Senior Note Indenture. The Trustee (as hereinafter defined) may at any time and all times conclusively assume that the obligation of the Company to make payments with respect to the principal of, premium, if any, and interest on, the Senior Notes, so far as such payments at the time have become due, has been fully satisfied and discharged pursuant to the foregoing sentence unless and until the Trustee shall have received a

written notice from the Senior Note Trustee signed by one of its officers stating (i) that timely payment of principal of, premium, if any, or interest on, the Senior Notes has not been made, (ii) that the Company is in arrears as to the payments required to be made by it to the Senior Note Trustee pursuant to the Senior Note Indenture, and (iii) the amount of the arrearage.

For purposes of Section 4.09 of the Senior Note Indenture, this Mortgage Bond shall be deemed to be the “Related Series of Senior Note Mortgage Bonds” in respect of the Senior Notes.

This Mortgage Bond shall not be entitled to any benefit under the Indenture or any indenture supplemental thereto, or become valid or obligatory for any purpose, until the form of certificate endorsed hereon shall have been signed by or on behalf of The Bank of New York Mellon Trust Company, N.A., as successor trustee to Harris Trust and Savings Bank, the Trustee under the Indenture, or a successor trustee thereto under the Indenture (the “Trustee”).

The provisions of this Mortgage Bond are continued on the reverse hereof and such continued provisions shall for all purposes have the same effect as though fully set forth at this place.

IN WITNESS WHEREOF, Ameren Illinois Company has caused this Mortgage Bond to be signed (manually or by facsimile signature) in its name by an Authorized Executive Officer, as defined in the aforesaid Indenture, and attested (manually or by facsimile signature) by an Authorized Executive Officer, as defined in such Indenture on the date hereof.

|

| | | |

| Dated: | | | |

| | | | |

| | | AMEREN ILLINOIS COMPANY | |

| | | | |

| | | By:_______________________________________ | |

| | | AUTHORIZED EXECUTIVE OFFICER | |

| | | | |

| ATTEST: | | | |

| | | | |

| By:___________________________________ | | | |

| AUTHORIZED EXECUTIVE OFFICER | | | |

[FORM OF TRUSTEE’S CERTIFICATE OF AUTHENTICATION]

This is one of the Mortgage Bonds of the series designated therein referred to in the within-mentioned Indenture and the Supplemental Indenture dated as of October 15, 2019.

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

as successor trustee to

Harris Trust and Savings Bank,

TRUSTEE,

By:______________________________

AUTHORIZED SIGNATORY

[FORM OF REVERSE OF BOND]

This Mortgage Bond is one of a duly authorized issue of Mortgage Bonds of the Company (the “Mortgage Bonds”) in unlimited aggregate principal amount, of the series hereinafter specified, all issued and to be issued

under and equally secured by the General Mortgage Indenture and Deed of Trust (as amended and supplemented, the “Indenture”), dated as of November 1, 1992, executed by the Company (as successor to Illinois Power Company) to The Bank of New York Mellon Trust Company, N.A., as successor trustee to Harris Trust and Savings Bank (the “Trustee”) to which Indenture reference is hereby made for a description of the properties mortgaged and pledged, the nature and extent of the security, the rights of registered owners of the Mortgage Bonds and of the Trustee in respect thereof, and the terms and conditions upon which the Mortgage Bonds are, and are to be, secured. The Mortgage Bonds may be issued in series, for various principal sums, may mature at different times, may bear interest at different rates and may otherwise vary as provided in the Indenture. This Mortgage Bond is one of a series designated as the Series CILCO-AA Mortgage Bonds of the Company, unlimited in aggregate principal amount, issued under and secured by the Indenture and described in the Supplemental Indenture dated as of October 15, 2019 (the “Supplemental Indenture of October 15, 2019”), between the Company and the Trustee, supplemental to the Indenture.

This Series CILCO-AA Mortgage Bond is subject to redemption in accordance with the terms Article II of the Supplemental Indenture of October 15, 2019.

This Mortgage Bond shall be governed by and construed in accordance with the laws of the State of Illinois, except to the extent that the law of any other jurisdiction shall be mandatorily applicable.

In case an Event of Default, as defined in the Indenture, shall occur, the principal of all Mortgage Bonds at any such time outstanding under the Indenture may be declared or may become due and payable, upon the conditions and in the manner and with the effect provided in the Indenture. The Indenture provides that such declaration may be rescinded under certain circumstances.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modifications of the rights and obligations of the Company and the rights of the Holders under the Indenture at any time by the Company and the Trustee with the consent of the Holders of a majority in aggregate principal amount of the outstanding Mortgage Bonds of all series directly affected by such amendment or modifications, considered as one class. Each initial and future Holder of this Mortgage Bond, by its acquisition of an interest in this Mortgage Bond, irrevocably (a) consents to the amendments set forth in Article I of the Supplemental Indenture dated as of October 25, 2017, supplemental to the Indenture, without any other or further action by any Holder of this Mortgage Bond, and (b) designates the Trustee, and its successors, as its proxy with irrevocable instructions to vote and deliver written consents on behalf of such Holder in favor of such amendments at any meeting of Holders, in lieu of any meeting of Holders, in any consent solicitation or otherwise. Any such consent or waiver by the Holder of this Mortgage Bond shall be conclusive and binding upon such Holder and upon all future Holders of this Mortgage Bond and of any Mortgage Bond issued upon the registration of transfer hereof or in exchange therefor or in lieu thereof whether or not notation of such consent or waiver is made upon this Mortgage Bond.

ARTICLE II

REDEMPTION AND CONSENT TO AMENDMENTS

Section 1. The Series CILCO-AA Mortgage Bonds are not redeemable except on the date, in the principal amount and for the redemption price that correspond to the redemption date for, the principal amount to be redeemed of, and the redemption price for, the Series CILCO-AA Notes, and except as set forth in Section 2 of this Article.

In the event that the Company redeems any Series CILCO-AA Notes prior to maturity in accordance with the provisions of the Senior Note Indenture, the Senior Note Trustee shall on the same date deliver to the Company the Series CILCO-AA Mortgage Bonds in principal amount corresponding to the Series CILCO-AA Notes so redeemed, as provided in Section 4.08 of the Senior Note Indenture. The Company agrees to give the Trustee notice of any such redemption of the Series CILCO-AA Notes on or before the date fixed for any such redemption.

Section 2. Upon the occurrence of an Event of Default under the Senior Note Indenture (as defined therein) and the acceleration of the Series CILCO-AA Notes, the Series CILCO-AA Mortgage Bonds shall be redeemable in whole upon receipt by the Trustee (with a copy to the Company) of a written demand (hereinafter called a “CILCO-AA Redemption Demand”) from the Senior Note Trustee stating that there has occurred under the Senior Note Indenture both an Event of Default and a declaration of acceleration of payment of principal, accrued interest and premium, if any, on the Series CILCO-AA Notes specifying the last date to which interest on such Series CILCO-AA Notes has been paid (such date being hereinafter referred to as the “CILCO-AA Interest Accrual Date”) and demanding redemption of the Series CILCO-AA Mortgage Bonds. The Company waives any right it may have to prior notice of such redemption under the Indenture. Upon surrender of the Series CILCO-AA Mortgage Bonds by the Senior Note Trustee to the Trustee, the Series CILCO-AA Mortgage Bonds shall be redeemed at a redemption price equal to the principal amount thereof plus accrued interest thereon from the CILCO‑AA Interest Accrual Date to the redemption date; provided, however, that in the event of a rescission or annulment of acceleration of the Series CILCO-AA Notes pursuant to the last paragraph of Section 8.01(a) of the Senior Note Indenture, then any CILCO-AA Redemption Demand shall thereby be deemed to be rescinded by the Senior Note Trustee although no such rescission or annulment shall extend to or affect any subsequent default or impair any right consequent thereon.

Section 3. Each initial and future Holder of the Series CILCO-AA Mortgage Bonds, by its acquisition of an interest in such Series CILCO-AA Mortgage Bonds, irrevocably (a) consents to the amendments set forth in Article I of the Supplemental Indenture dated as of October 25, 2017, supplemental to the Indenture, without any other or further action by any Holder of such Series CILCO-AA Mortgage Bonds, and (b) designates the Trustee, and its successors, as its proxy with irrevocable instructions to vote and deliver written consents on behalf of such Holder in favor of such amendments at any meeting of Holders, in lieu of any meeting of Holders, in any consent solicitation or otherwise.

ARTICLE III

ISSUE OF THE SERIES CILCO-AA MORTGAGE BONDS.

Section 1. The Company hereby exercises the right to obtain the authentication of $42,000,000 principal amount of additional Bonds pursuant to the terms of Section 4.04 of the Indenture, all of which shall be Series CILCO-AA Mortgage Bonds. The principal amount of the Series CILCO-AA Mortgage Bonds outstanding from time to time shall always be equal to the principal amount of the Series CILCO-AA Notes which are outstanding from time to time under the Senior Note Indenture and to the extent the Senior Note Trustee holds Series CILCO-AA Mortgage Bonds in excess of such principal amount, such Series CILCO-AA Mortgage Bonds shall be deemed cancelled and retired and no longer outstanding under the Indenture.

Section 2. Such Series CILCO-AA Mortgage Bonds may be authenticated and delivered prior to the filing for recordation of this Supplemental Indenture.

Section 3. For purposes of Section 4.09 of the Senior Note Indenture, the Series CILCO-AA Mortgage Bonds shall be deemed to be the “Related Series of Senior Notes Mortgage Bonds” in respect of the Series CILCO‑AA Notes.

ARTICLE IV

THE TRUSTEE

The Trustee hereby accepts the trusts hereby declared and provided, and agrees to perform the same upon the terms and conditions in the Indenture set forth and upon the following terms and conditions:

The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Supplemental Indenture or the due execution hereof by the Company or for or in respect of the recitals contained herein, all of which recitals are made by the Company solely. In general, each and every term and

condition contained in Article Eleven of the Indenture shall apply to this Supplemental Indenture with the same force and effect as if the same were herein set forth in full, with such omissions, variations and modifications thereof as may be appropriate to make the same conform to this Supplemental Indenture.

ARTICLE V

MISCELLANEOUS PROVISIONS

Except as otherwise defined herein, capitalized terms defined in the Indenture are used herein as therein defined. This Supplemental Indenture may be simultaneously executed in any number of counterparts, each of which when so executed shall be deemed to be an original; but such counterparts shall together constitute but one and the same instrument.

The Indenture, as supplemented and amended by this Supplemental Indenture and all other indentures supplemental thereto, is in all respects ratified and confirmed, and the Indenture, this Supplemental Indenture and all indentures supplemental thereto shall be read, taken and construed as one and the same instrument.

IN WITNESS WHEREOF, said Ameren Illinois Company has caused this Supplemental Indenture to be executed on its behalf by an Authorized Executive Officer as defined in the Indenture, and its corporate seal to be hereto affixed and said seal and this Supplemental Indenture to be attested by an Authorized Executive Officer as defined in the Indenture; and said The Bank of New York Mellon Trust Company, N.A., as successor trustee to Harris Trust and Savings Bank, in evidence of its acceptance of the trust hereby created, has caused this Supplemental Indenture to be executed on its behalf by one of its Vice Presidents and this Supplemental Indenture to be attested by its Secretary or one of its Vice Presidents; all as of October 15, 2019.

AMEREN ILLINOIS COMPANY

|

| | | | |

| | | |

| (CORPORATE SEAL) | | |

| | | By: | /s/ Darryl T. Sagel |

| | | | Name: | Darryl T. Sagel |

| | | | Title: | Vice President and Treasurer |

ATTEST:

|

| | | | |

| By: | /s/ Craig W. Stensland | | |

| | Name: | Craig W. Stensland | | |

| | Title: | Assistant Secretary | | |

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

successor trustee to

Harris Trust and Savings Bank,

TRUSTEE,

|

| | | | |

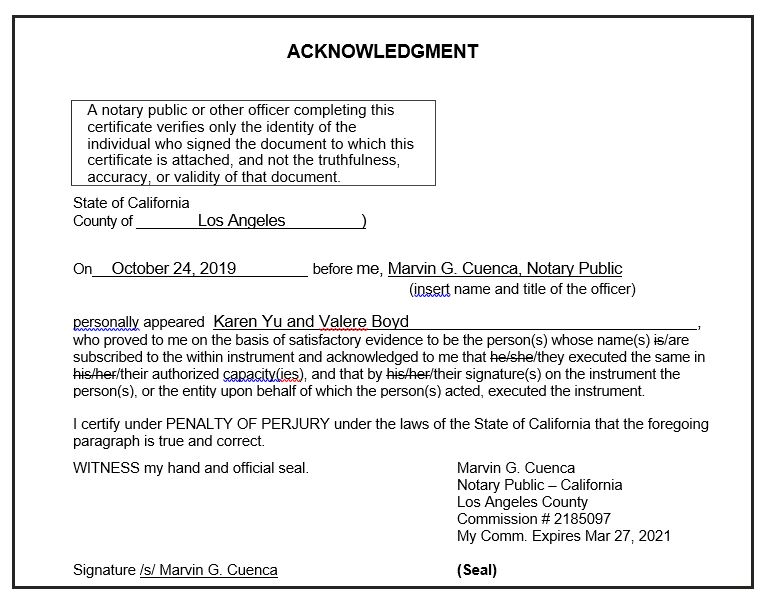

| | | By: | /s/ Karen Yu |

| (CORPORATE SEAL) | | | Name: | Karen Yu |

| | | | Title: | Vice President |

ATTEST:

|

| | | | |

| By: | /s/ Valere Boyd | | |

| | Name: | Valere Boyd | | |

| | Title: | Vice President | | |

|

| | |

| STATE OF MISSOURI | ) | |

| | | ss. |

| CITY OF ST. LOUIS | ) | |

BE IT REMEMBERED, that on this 25th day of October, 2019, before me, the undersigned, a Notary Public within and for the City and State aforesaid, personally came Darryl T. Sagel, Vice President and Treasurer, and Craig W. Stensland, Assistant Secretary, of Ameren Illinois Company, a corporation duly organized, incorporated and existing under the laws of the State of Illinois, who are personally known to me to be such officers, and who are personally known to me to be the same persons who executed as such officers the within instrument of writing, and such persons duly acknowledged that they signed, sealed and delivered the said instrument as their free and voluntary act as such officers and as the free and voluntary act of said Ameren Illinois Company for the uses and purposes therein set forth.

IN WITNESS WHEREOF, I have hereunto subscribed my name and affixed my official seal on the day and year last above written.

|

| |

| | /s/ Kelly J. Roth |

| | NOTARY PUBLIC

Kelly J. Roth Notary Public - Notary Seal State of Missouri Commissioned for St. Charles County My Commission Expires: May 12, 2022 Commission Number: 14440245

|