The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 19, 2021

PRELIMINARY PROSPECTUS

29,500,000 SHARES

ENSEMBLE HEALTH PARTNERS, INC.

CLASS A COMMON STOCK

$ per share

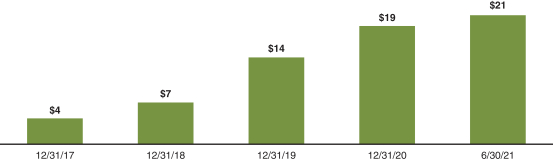

This is an initial public offering of shares of Class A common stock of Ensemble Health Partners, Inc. We are selling 29,500,000 shares of our Class A common stock. We currently expect the initial public offering price to be between $19.00 and $22.00 per share.

Prior to this offering, there has been no public market for shares of our Class A common stock. We have applied for listing of our common stock on the Nasdaq Global Select Market (the “Exchange”) under the symbol “ENSB.”

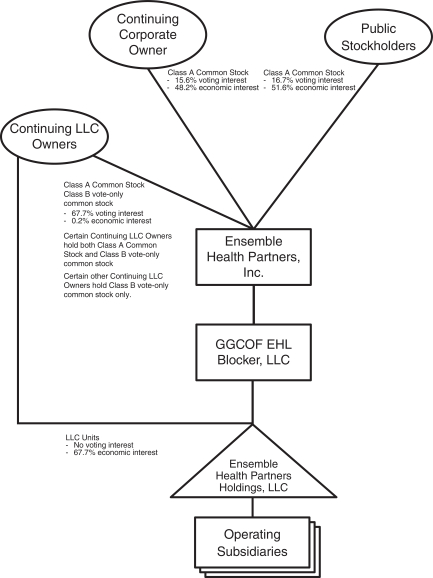

We intend to use the net proceeds from the sale of 29,500,000 shares of Class A common stock in this offering to (a) purchase directly or indirectly (i) 22,000,000 newly-issued common units, which we refer to as “LLC Units,” of Ensemble Health Partners Holdings, LLC and (ii) 4,672,900 issued and outstanding LLC Units and an equal number of shares of Class B common stock from certain Continuing LLC Owners (as defined below) (or 7,310,701 LLC Units and an equal number of shares of Class B common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock) at a purchase price per unit equal to the initial public offering price per share of Class A common stock, less underwriting discounts and commissions, (b) pay $54,768,003 to the Continuing Corporate Owner (as defined below) which represents cash proceeds for 2,827,100 of the issued and outstanding LLC Units that the Company indirectly acquired in connection with the merger of a former corporate subsidiary of the Company with GGCOF EHL Blocker, LLC and (c) assuming the underwriters exercise in full their option to purchase additional shares of Class A common stock, to repurchase 1,787,198 shares of Class A common stock from the Continuing Corporate Owner. We refer to the holders of LLC Units following the closing of this offering (other than the Company and our subsidiaries) as “Continuing LLC Owners.” We refer to those of our pre-initial public offering (“pre-IPO”) investors and certain of their affiliates who will receive shares of Class A common stock in connection with the Reorganization Transactions (as defined herein) and who do not hold LLC Units as the “Continuing Corporate Owner,” and together with the Continuing LLC Owners, as “Continuing Owners.”

We have two classes of authorized common stock: the Class A common stock offered hereby and Class B common stock, each of which is entitled to one vote per share. The Continuing LLC Owners will own all of our shares of Class B common stock, on a one-to-one basis with the number of LLC Units they own. Each LLC Unit will be exchangeable for (1) one share of Class A common stock or, at our option, cash (based on the market price of our Class A Common stock), and we will cancel a share of Class B common stock held by the exchanging member in connection therewith and (2) payments of additional amounts pursuant to a tax receivable agreement. Immediately following this offering, the holders of shares of our Class A common stock issued in this offering collectively will hold 51.6% of the economic interests in us and 16.7% of the voting power in us, the Continuing Corporate Owner, through their ownership of shares of Class A common stock, collectively will hold 48.2% of the economic interests in us and 15.6% of the voting power in us, and the Continuing LLC Owners, through their ownership of shares of Class A common stock and all of the outstanding Class B common stock, collectively will hold the remaining 0.2% of the economic interest in us and the remaining 67.7% of the voting power in us. We will be a holding company, and upon consummation of this offering and the application of proceeds therefrom, our principal asset will be the LLC Units we directly and indirectly hold, representing an aggregate 32.3% economic interest in Ensemble Health Partners Holdings, LLC. The Continuing LLC Owners through their ownership of LLC Units will own the remaining 67.7% economic interest in Ensemble Health Partners Holdings, LLC.

After the completion of this offering, Golden Gate Capital and Bon Secours Mercy Health Innovations LLC (“Innovations”, and together with Golden Gate Capital, our “Sponsors”) will continue to have significant influence over us, including control over decisions that require the approval of stockholders. After the completion of this offering, we will qualify as a “controlled company” within the meaning of the corporate governance standards of the Exchange. See “Risk factors - Risks related to this offering and ownership shares of our common stock”.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our Class A common stock involves risk. See “Risk factors” beginning on page 28.

| | | | | | | | |

| | | Per Share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions(1) | | $ | | | | $ | | |

Proceeds before expenses | | $ | | | | $ | | |

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for additional information regarding underwriting compensation. |

At our request, an affiliate of BofA Securities, Inc., a participating underwriter, has reserved for sale, at the initial public offering price, up to 2% of the shares offered by this prospectus for sale to some of our and our clients’ directors, officers, employees and affiliates. See “Underwriting—Reserved share program.”

To the extent that the underwriters sell more than 29,500,000 shares of our Class A common stock, we have granted the underwriters the option to purchase up to 4,425,000 additional shares of our Class A common stock at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to our investors on or about , 2021.

| | | | | | |

| Goldman Sachs & Co. LLC | | BofA Securities | | Deutsche Bank Securities | | Guggenheim Securities |

| | | | | | |

Credit Suisse | | Evercore ISI | | Wells Fargo Securities | | SVB Leerink |

| | |

Baird | | William Blair |

| Academy Securities | | Loop Capital Markets |

Prospectus dated , 2021