Exhibit 99.1

About this Presentation The following presentation (this “ Presentation ” ) is for informational purposes only and has been prepared by ZOOZ Power Ltd . (the “ Company ” or “ ZOOZ ” ) . The information contained in this Presentation is the property of Zooz . This Presentation may not be copied, published, reproduced or distributed, in whole or in part, at any time without the prior written consent of the Company . Any trade names, service marks, trademarks and trademark symbols used herein are the properties of their respective owners . The use and presentation of any such trade names, service marks, trademarks and trademark symbols is not intended to imply any relationship with Zooz or any endorsement or sponsorship of Zooz . Neither the Company nor any other person makes any representation or warranty, express or implied, as to the reasonableness of the assumptions made in this Presentation or the accuracy or completeness or the information contained in or referred to in this Presentation. Industry and Market Data The information contained in this Presentation includes information provided by third parties, such as market research firms . None of the Company or its representatives gives any express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use . No Offer or Solicitation This Presentation does not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to buy, any securities in any jurisdiction, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . This Presentation does not constitute either advice or a recommendation regarding any securities . No offering of securities shall be made in the United States except by means of a prospectus meeting the requirements of the Securities Act or an exemption therefrom .

Forward - Looking Information The following presentation (this “ Presentation ” ) is for informational purposes only and has been prepared by ZOOZ Power Ltd. (the “ Company ” or “ ZOOZ ” ). This Presentation contains “ forward - looking statements ” within the meaning of Section 27A of the U.S. Securities Act of 1933 as amended (the “ Securities Act ” ), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “ Exchange Act ” ), as well as within the meaning of the Israeli Securities Law, 1968 (the “ Securities Law ” ) . All statements other than statements of historical facts contained in this Presentation, including statements regarding the Company, and any of the Company ’ s strategy, future operations, future financial position, future market share, projected costs, prospects, plans, objectives of management and expected market growth are forward - looking statements . These statements involve known and unknown risks, uncertainties and other important factors that may cause the Company ’ s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements . These risks and other risks and uncertainties are more fully discussed in the “ Risk Factors ” section of the Company ’ s most recent Annual Report as filed with the Israel Securities Authority ( “ ISA ” ) as well as other documents that may be subsequently filed by the Company from time to time with the ISA . The words “ anticipate, ” “ believe, ” “ could, ” “ estimate, ” “ expect, ” “ intend, ” “ may, ” “ plan, ” “ potential, ” “ predict, ” “ project, ” “ should, ” “ target, ” “ will, ” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain these identifying words . These forward - looking statements are only estimations, and the Company may not actually achieve the plans, intentions or expectations disclosed in any forward - looking statements, so you should not place undue reliance on any forward - looking statements . Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward - looking statements made in this Presentation . Management of the Company has based these forward - looking statements largely on current expectations and projections about future events and trends that such persons believe may affect the Company ’ s business, financial condition and operating results . Forward - looking statements contained in this Presentation are made as of the date hereof, and none of the Company or any of its representatives or any other person undertakes any duty to update such information except as may be expressly required under applicable law .

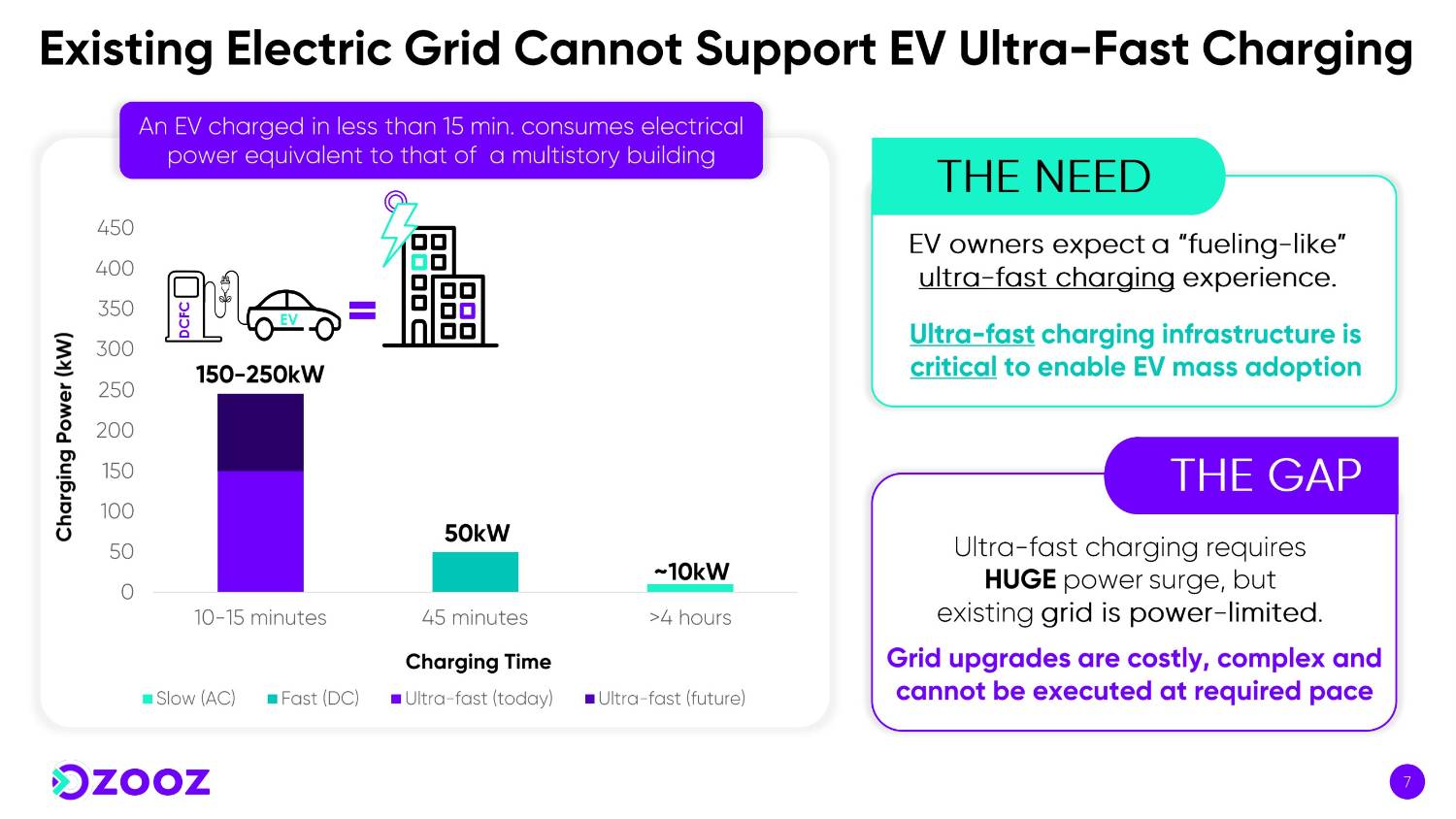

EV DCFC

* Estimation

Ρ

Ρ

Ρ • • • •

Ρ

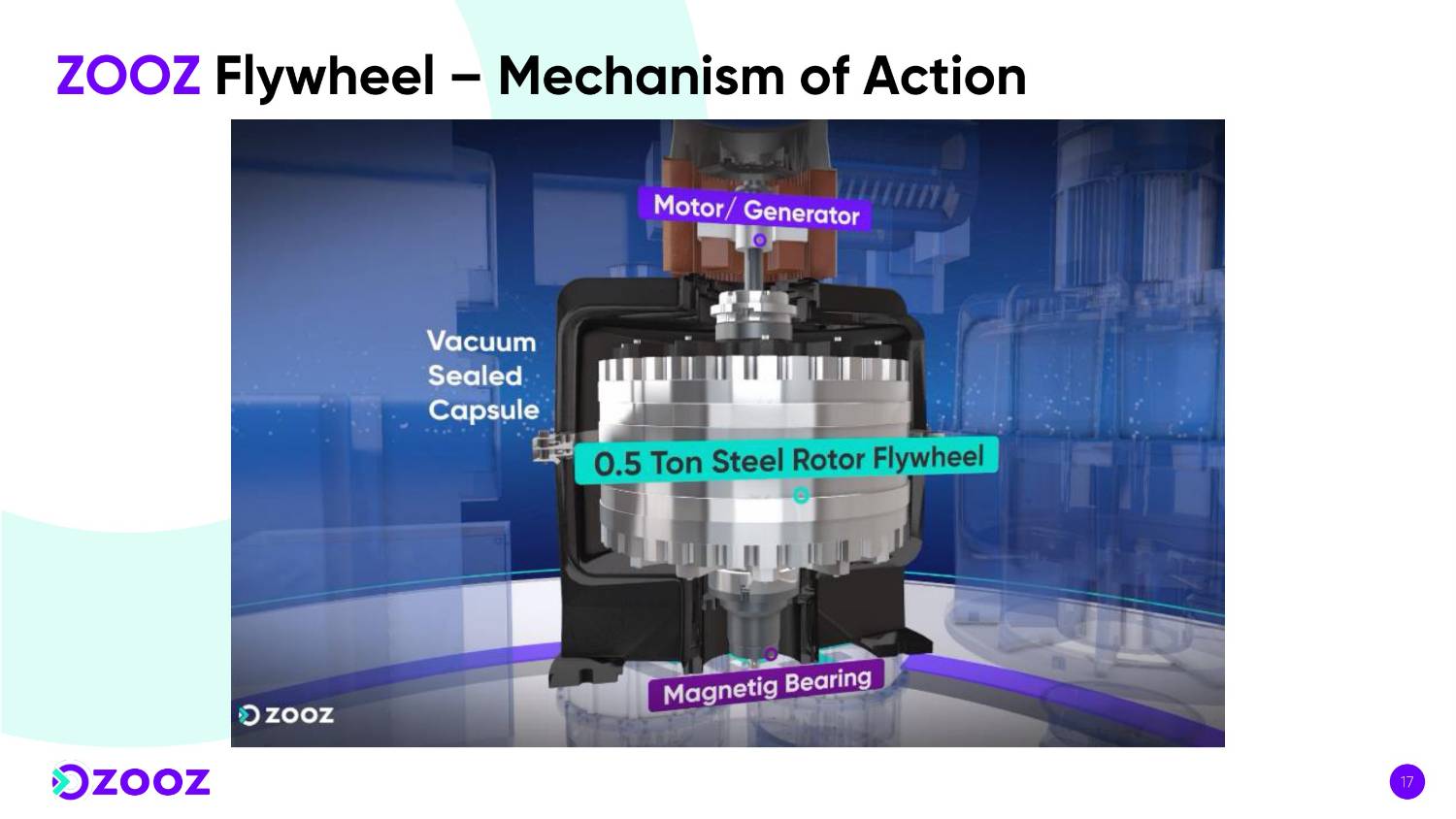

Unique high - speed, high - power, air - cooled, running in vacuum High efficiency, High reliability Sealed to hold vacuum 0.5 Ton rotor balanced at a precision level of a small Gyro. Inherently safe by design Cost - effective, recyclable Proprietary manuf. process geared to high - efficiency mass production Magnetic Bearing - 3rd generation Halbach array Rotation in vacuum environment – minimizing air friction •

ƒ ƒ ƒ ƒ

Note: these are examples of competitors. Additional competitors are active

26 * Company estimation, subject to changes

27 Car Rental Giant * Company estimation, subject to changes

:

This document is a free translation of the Hebrew original. In case of differences, the Hebrew version shall prevail

*Nasdaq Capital Market 01 02 03 Merger with KeyArch Acquisition Corp. SPAC traded on Nasdaq [KYCH*] The SPAC was established by a founder of an investment fund from Hong Kong and the SPAC leaders are with proven ability in the Chinese market Recognizing the potential of ZOOZ's solution and intending to assist ZOOZ penetrate the Chinese market (the most advanced EV market in the world) Transition to dual listing, also on Nasdaq Strengthening the recognition and positioning in the international markets, and in particular the US market, which is a strategic target market for ZOOZ A convenient platform for raising capital, required for ZOOZ’s business growth. Join forces with strategic partner, that can help ZOOZ accelerate its business growth All the above, while: Injection of capital into ZOOZ. Increased value for shareholders.

Injection of Capital Agreed Valuation of up to $100M (contingent on meeting certain milestone) According to the deal, ZOOZ’s agreed valuation is up to $100 million of which up to $40 million is contingent on meeting certain milestones (total of 10 million shares at a value of $10 per share)* Immediately post merger - 6 million shares at a value of $10 per share* Reflecting agreed value of $60M immediately prior to closing Entitlement to allocation of additional up to 4 million shares – contingent on ZOOZ achieving certain milestones (within 5 years) Reflecting agreed value of up to $40M immediately prior to closing Condition to closing – minimum capital injection of $10 million (net after all expenses) ZOOZ's listing on Nasdaq is expected to enable additional opportunities for capital raising to support company’s growth Join forces with strategic partner Strategic partner with ability to help ZOOZ to accelerate its penetration into the Chinese market KeyArch Sponsors have extensive experience in business development and significant network in the Chinese market, including the automotive ecosystem * As of immediately prior to closing

Injection of Capital Closing condition – a minimum of $10M capital injection (net after all expenses) PIPE will be considered The SPAC raised approximately $ 115 M and after the redemption (on 20 . 7 . 23 ) approx . $ 25 M* remain in the trust ZOOZ (the surviving company) Immediately post merger Dual listed on TASE & Nasdaq Traded in Tel - Aviv Stock Exchange With Reverse split by ~ 11 . 6 ** ratio ZOOZ’s shareholders (prior to merger) will hold 6 million shares reflecting valuation of $ 60 M (immediately prior to merger completion) ZOOZ’s Shareholders (prior to merger) will hold 40% - 50%*** of the merged company, following closing. ZOOZ's shareholders (prior to the merger) are entitled to an additional allocation of up to 4 million shares, reflecting a value of up to $40M (immediately prior to closing) depending on the company achieving certain milestones , during a period of up to 5 years after closing KeyArch SPAC, Traded on Nasdaq * An additional redemption is possible at the time of the convening of the general meeting of the SPAC to approve the merger ** Estimation - an up - to - date ratio will be published later, with the summoning of a shareholders' meeting to approve the deal *** Depending on the amount of capital that will be raised and the one that will remain in SPAC

The following milestones will entitle ZOOZ shareholders to allocation of Earnout Shares (one of two conditions to be met per each milestone): 1,000 Shares post merger 1,167 shares 1,400 shares 1,667 shares Example – a shareholder who currently holds 11,600 shares : 11,600 Shares today 1,000,000 $12 2,400,000 $16 4,000,000 $23 Reverse Split Allocation after achievement of 1 st milestone Allocation after achievement of 2 nd milestone Allocation after achievement of 3 rd milestone

Initial Sales in Europe 36 Initial Installation in the US Moving forward with our penetration into a fascinating and rapidly evolving market Excellent timing for ZOOZ to become publicly traded on

Ρ

Ρ

Ρ

0 100 200 300 400 500 600 700 6:00 6:10 6:20 6:30 6:40 6:50 7:00 8:00 9:00 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 Power Ρ

• • •