- CRGY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Crescent Energy (CRGY) 425Business combination disclosure

Filed: 8 Jun 21, 10:40am

Filed by IE PubCo Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Contango Oil & Gas Company

Commission File No.: 001-16317

The following communication was made available by IE PubCo Inc. on its website at www.independenceenergy.com on June 8, 2021:

Redefining Smart Energy Investing

Independence Energy is externally managed by KKR’s Energy Real Assets team

“…we are excited about the potential for continued value creation as we expand Independence Energy – executing our strategy over the last decade, we’ve built a unique platform with financial strength, asset scale and flexibility that we believe is well positioned to be a leader in a consolidating market.” - David Rockecharlie, Chief Executive Officer of Independence Energy; Partner and Head of KKR Energy Real Assets

About:

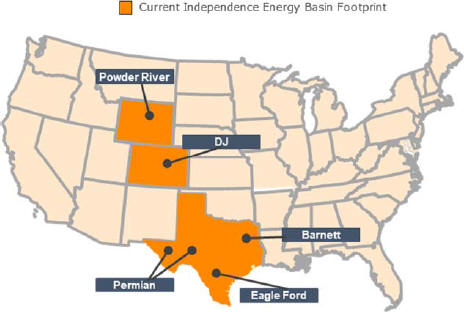

Independence Energy is a diversified, well capitalized, U.S. independent energy company with a portfolio of assets in key proven basins across the lower 48 states. Our leadership team is a group of experienced investment, financial and industry professionals who have been employing our strategy since 2011.

We seek to deliver attractive risk-adjusted investment returns and predictable cash flows across cycles by employing our differentiated approach to investing in the oil and gas industry. Our approach includes a cash flow-based investment mandate and an active risk management strategy with a focus on operated working interests, and is complemented by non-operated working interests, mineral and royalty interests, and midstream infrastructure.

Current Operations Across the L48

Leadership:

Our management team is employed by KKR through a management services agreement.

About KKR

KKR is a leading global investment firm that offers alternative asset management and capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of The Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

The company is managed by KKR’s Energy Real Assets team.

| • | David C. Rockecharlie – Chief Executive Officer of Independence Energy |

David Rockecharlie joined KKR in 2011 and is a Partner and Head of KKR’s Energy Real Assets business. Mr. Rockecharlie serves as Chairman of KKR’s Energy Investment Committee and as a member of the Board of Directors of Independence Energy. Prior to joining KKR, Mr. Rockecharlie was co-founder and co-CEO of RPM Energy, LLC, a privately-owned oil and gas company. Previously, Mr. Rockecharlie served as co-head of Jefferies & Company’s Energy Investment Banking Group from 2008-2010, and as a Partner, Managing Director and Head of Corporate Finance from 2003 until 2008 for Jefferies Randall & Dewey and its predecessor, Randall & Dewey, which became the Energy

Investment Banking Group of Jefferies & Company. Before that, he was an executive with El Paso Corp., where he led a variety of corporate activities. Prior to joining El Paso, he was an energy investment banker with Donaldson, Lufkin & Jenrette. Mr. Rockecharlie received an A.B., magna cum laude, from Princeton University.

| • | Brandi Kendall – Chief Financial Officer of Independence Energy |

| • | Brandi Kendall joined KKR in 2013 and is responsible for a broad range of portfolio management activities for the Energy Real Assets team, including finance, planning, risk management and corporate development. Ms. Kendall is a member of the Board of Directors of Independence Energy. Prior to joining KKR, Ms. Kendall served as director, finance and planning at Marlin Midstream and finance associate at NFR Energy. Ms. Kendall began her career in the energy investment banking industry, having held positions at JP Morgan and Tudor, Pickering, Holt & Co. Ms. Kendall earned a BA in Economics, Managerial Studies, and Kinesiology from Rice University. |

| • | Todd Falk – Chief Accounting Officer of Independence Energy |

| • | Todd Falk joined KKR in 2018 and is a Director and Chief Accounting Officer of KKR’s Energy Real Assets business. Prior to joining KKR, Mr. Falk served as director of finance and controller of Vitruvian Exploration where he was a member of a management team that identified, developed and divested positions in emerging oil and natural gas resource plays throughout Oklahoma and Texas. Mr. Falk began his career at Deloitte, where as a senior manager he assisted energy clients with complex financial reporting issues, specializing in initial public offerings and other interactions with the SEC. Mr. Falk has over 15 years of finance and accounting experience in the energy industry, is a Certified Public Accountant and holds a B.S., magna cum laude, in Accounting and an M.S. in Finance from Texas A&M University. |

| • | Ben Conner - Executive Vice President, Investments for Independence Energy |

| • | Ben Conner joined KKR in 2014 and is a member of the Energy Real Assets team. During his time at the firm, he has originated and been involved in numerous upstream oil and gas investments in North America within the Energy Income and Growth Fund. Prior to joining KKR, Mr. Conner was with Lime Rock Partners and was directly involved in numerous investments, with a particular focus in North American upstream oil and gas and oilfield equipment, manufacturing and services. Prior to joining Lime Rock, he was with the natural resources investment banking group of J.P. Morgan where he worked on numerous corporate advisory and financing transactions. He is a graduate of the McCombs School of Business at the University of Texas (M.P.A, B.B.A.). |

| • | Clay Rynd - Executive Vice President, Investments for Independence Energy |

| • | Clay Rynd joined KKR in 2015 and is a member of the Energy Real Assets team. During his time at the firm, he has originated and been involved in numerous upstream oil and gas investments in North America within the Energy Income and Growth Fund as well as KKR’s investment in Resource Environmental Solutions. Prior to joining KKR, Mr. Rynd was with Tudor, Pickering, Holt & Co. in the investment banking division, where he focused primarily on strategic advisory and M&A transactions for upstream oil and gas companies. Prior to that, he worked within the equity research division at Tudor, Pickering, Holt & Co. Mr. Rynd holds a B.A. in both Economics and History from Texas A&M University. |

Our Values & Approach:

We believe Independence Energy is a differentiated platform and, similar to our external manager, we are guided by our core values:

| • | Transparency |

| • | We set the bar high, for ourselves and for our investments, and we will clearly present outcomes |

| • | Partnership |

| • | We are focused on long-term value creation for all invested with us and are committed to responsible investment practices on behalf of all stakeholders |

| • | Integrity |

| • | We are open-minded, sensible, hardworking people – and everybody that works with us is the same way |

Our Strong Operating Culture

Our organization has invested a significant amount of time and resources to create an “owner mentality” around operations that is aligned with Independence’s overall strategy

It starts with people: We hire experienced industry professionals who are highly motivated individuals to drive the day to day operations of our assets

| • | Currently employ ~350 technical and administrative professionals across four operating subsidiaries |

| • | Field offices located in: South Texas, West Texas, North Texas, Rockies and California |

Alignment is key: Operating teams are fully aligned with Independence strategy of prioritizing free cash flow and returns and are incentivized by long-term asset value creation

| • | Economically driven culture: Our people talk about business in terms of margins, profitability and cash-on-cash returns rather than drilling wells and production growth |

| • | Our operating teams are experienced in their respective disciplines and basins and drive value creation through: |

| • | Maximizing cash flow from existing production |

| • | Making informed, returns-driven re-investment decisions |

| • | Culture of risk management, safety and ESG |

Importance of ESG Management:

We are focused on developing industry leading Environmental, Social and Governance (ESG) programs with the support of KKR’s experience helping portfolio companies to develop and implement ESG best practices. In its operations, Independence Energy seeks to be a leader on ESG performance. This commitment includes strong attention to:

| • | Reducing operations’ greenhouse gas emissions |

| • | Enabling best practices in workplace safety |

| • | Managing and reducing water usage |

| • | Constructively engaging with surrounding communities |

| • | Developing a diverse workforce |

Leveraging the network of the broader KKR platform, Independence Energy is partnering with thought leaders to establish thorough ESG-related benchmarks and key performance indicators in order to track, measure and report ESG performance to the company’s stakeholders. Our investment approach is subject to KKR’s Responsible Investment Policy. [link: https://kkresg.com/assets/uploads/pdfs/KKR-Overall-RI-Policy-2020-vF.pdf ]

The latest news

Independence Energy to Create Value in Energy Market

Contact Us:

Learn more about Independence Energy. Contact us: IR@independenceenergy.com

No Offer or Solicitation

This communication relates to a proposed business combination transaction (the “Transaction”) between Independence Energy LLC (“Independence”) and Contango Oil & Gas Company (“Contango”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Important Additional Information

In connection with the Transaction, IE PubCo Inc., a wholly owned subsidiary of Independence (“NewCo”), will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a proxy statement of Contango and a prospectus of NewCo. The Transaction will be submitted to Contango’s stockholders for their consideration. NewCo and Contango may also file other documents with the SEC regarding the Transaction. The definitive proxy statement/prospectus will be sent to Contango’s stockholders. This document is not a substitute for the registration statement and proxy statement/prospectus that will be filed with the SEC or any other documents that Contango or NewCo may file with the SEC or send to stockholders of Contango in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF CONTANGO ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by Contango or NewCo through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by NewCo will be made available free of charge on Independence’s website at http://www.independenceenergy.com, under the heading “SEC Filings,” or by directing a request to Investor Relations, Independence Energy LLC, IR@IndependenceEnergy.com, Tel. No. (713) 343-5142. Copies of documents filed with the SEC by Contango will be made available free of charge on Contango’s website at http://www.contango.com, or by directing a request to Investor Relations, Contango Oil & Gas Company, 717 Texas Avenue, Suite 2900, Tel. No. (713) 236-7400.

Participants in the Solicitation

Contango, Independence and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Transaction. Information regarding Contango’s executive officers and directors is contained in the proxy statement for Contango’s 2021 Annual Meeting of Stockholders filed with the SEC on April 30, 2021, and certain of its Current Reports on Form 8-K. You can obtain free copies of these documents at the SEC’s website at www.sec.gov or by accessing Contango’s website at http://www.contango.com. Information about Independence’s executive officers will be contained in the proxy statement/prospectus that NewCo file with the SEC. When available, you can obtain free copies of these documents at the SEC’s website at www.sec.gov.

Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Transaction by reading the proxy statement/prospectus regarding the Transaction when it becomes available. You may obtain free copies of this document as described above.

Forward-Looking Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Contango or Independence expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement, the possibility that stockholders of Contango may not approve the Transaction, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Contango’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of Contango and Independence to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies, the impact of reduced demand for Contango’s or Independence’s products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic; the uncertainties, costs and risks involved in Contango’s and Independence’s operations, including as a result of employee misconduct; natural disasters, pandemics, epidemics (including COVID-19 and any escalation or worsening thereof) or other public health conditions and other important factors that could cause actual results to differ materially from those projected.

All such factors are difficult to predict and are beyond Contango’s or Independence’s control, including those detailed in Contango’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at http://www.contango.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that Contango or Independence believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Contango and Independence undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.