Exhibit 99.1 December 2021 Creating A Differentiated U.S. Energy Company + C R E S C E N T E N E R G Y

Disclaimer This presentation relates to Crescent Energy Company (the “Company”) following its recent consummation of the business combination (the “Transaction”) between Independence Energy LLC (“Independence”) and Contango Oil & Gas (“Contango”) and contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Independence, Contango or the Company expects, believes or anticipates will or may occur in the future, including without limitation those relating to the Transaction, are forward-looking statements and are based on current expectations. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “possible,” “create,” “intend,” “should,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “view,” “efforts,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “commitment,” “approach,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance (including labels “NTM” and “E”) used in connection with any discussion of future plans, actions, or events identify forward-looking statements and express our expectations about future events. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities, anticipated future performance, future commodity prices, future production targets, future earnings, EBITDA, leverage targets, future capital spending plans, operational and cost efficiencies, inventory life, hedging activities, business strategy and market position, estimated reserves, cash flows, liquidity and accretive effects of the Transaction, financial strategy, budget, projections and future operating results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the ability to have successfully integrated the businesses, risks related to disruption of management time from ongoing business operations due to the closing of the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of the Company’s common stock, the risk that the closing of the Transaction could have a continuing adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the Company not operating as effectively and efficiently as expected, the risk that the Company may be unable to achieve synergies or that it may take longer than expected to achieve those synergies, the impact of reduced demand for the Company’s products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic, the uncertainties, costs and risks involved in the Company’s operations, including as a result of employee misconduct, natural disasters, pandemics, epidemics (including the COVID- 19 pandemic and any escalation or worsening thereof) or other public health conditions and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and may be beyond the Company’s control, including those detailed in that certain final prospectus on Form 424B3 (the “Final Prospectus”) filed with the U.S. Securities and Exchange Commission (the “SEC”) relating to the Transaction that is available on the SEC’s website at http://www.sec.gov and Contango’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8- K that are available on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on a number of assumptions, risks and uncertainties that the Company believes to be reasonable but that may not prove to be accurate. Many of such risks, uncertainties and assumptions are beyond the Company’s ability to control or predict. Because of these risks, uncertainties and assumptions, readers are cautioned not to, and should not, place undue reliance on these forward-looking statements. The Company does not give any assurance (1) that they will achieve their expectations, or (2) to any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to correct, revise or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. All subsequent written and oral forward-looking statements concerning the Company, Independence, Contango, the Transaction or other matters and attributable thereto or to any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reservoir engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Unless otherwise indicated, reserve estimates shown herein are based on third-party reserve reports as of December 31, 2020 and were prepared using commodity prices based on Henry Hub and West Texas Intermediate futures prices, referred to herein as “strip” pricing, rather than SEC pricing guidelines. The Company believes that the use of strip pricing provides useful information about its reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date. Strip prices are not necessarily a projection of future oil and natural gas prices and should be carefully considered in addition to, and not as a substitute for, SEC prices when considering the Company’s oil, natural gas and natural gas liquid reserves. This presentation includes certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These measures include (i) EBITDA, (ii) Adj. EBITDA, (iii) Net Debt, (iv) Leverage, (v) Levered Free Cash Flow and (vi) Reinvestment Rate. The Company defines EBITDA as net income (loss) before interest expense, taxes, depreciation, depletion and amortization, and oil and gas exploration expenses. Contango defines Adj. EBITDA as net income before interest expense, realized (gain) loss on interest expense derivatives, income tax expense, depreciation, depletion and amortization, exploration expense, non-cash gain (loss) on derivative contracts, impairment of oil and natural gas properties, equity-based compensation, other (income) expense, transaction expenses and other non-recurring expenses. The Company defines Net Debt as total debt less unrestricted cash & cash equivalents. The Company defines Leverage as the ratio of Net Debt to Adj. EBITDA. The Company defines Levered Free Cash Flow as Adj. EBITDA less cash paid for interest, cash paid or refunded for income tax and capital expenditures associated with the development of oil and gas properties and purchases of other property and equipment. The Company defines Reinvestment Rate as capital expenditures as a percentage of Adj. EBITDA. The Company has not provided reconciliations for forward-looking and pro forma non-GAAP measures because the Company cannot do so without unreasonable effort and any attempt to do so would be inherently imprecise. C R E S C E N T E N E R G Y 2

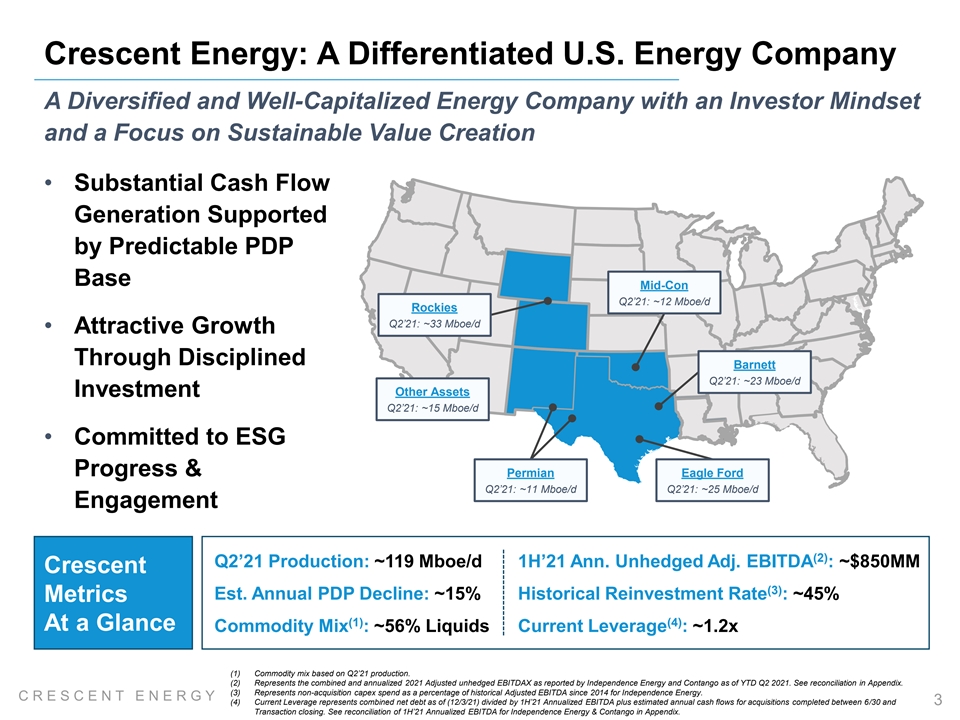

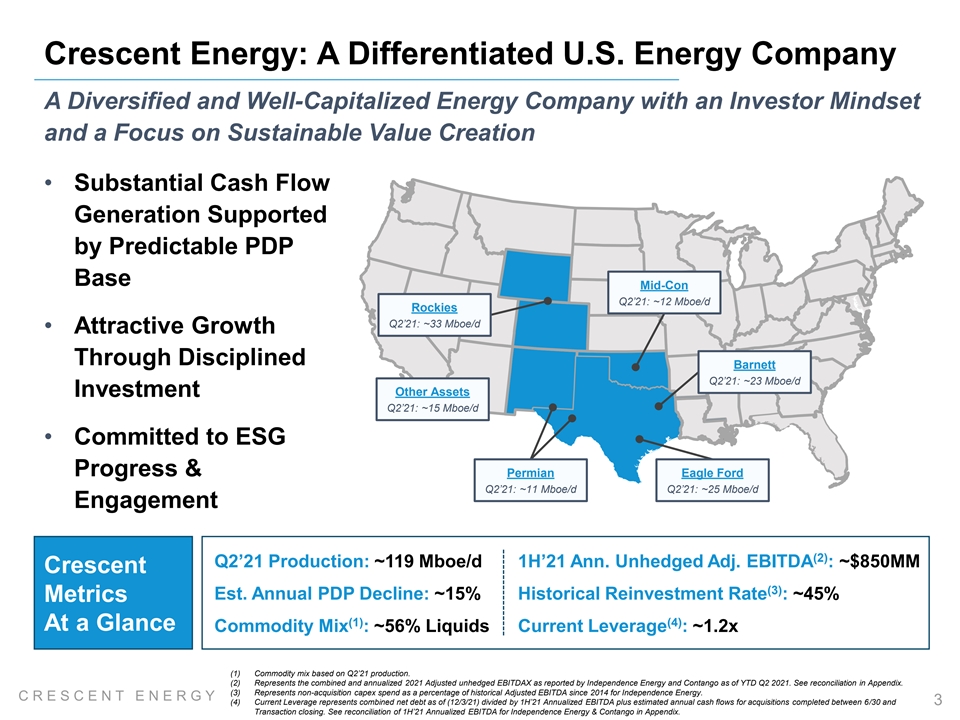

Crescent Energy: A Differentiated U.S. Energy Company A Diversified and Well-Capitalized Energy Company with an Investor Mindset and a Focus on Sustainable Value Creation • Substantial Cash Flow Generation Supported by Predictable PDP Base Mid-Con Q2’21: ~12 Mboe/d Rockies Q2’21: ~33 Mboe/d • Attractive Growth Through Disciplined Barnett Q2’21: ~23 Mboe/d Other Assets Investment Q2’21: ~15 Mboe/d • Committed to ESG Progress & Permian Eagle Ford Q2’21: ~11 Mboe/d Q2’21: ~25 Mboe/d Engagement (2) Q2’21 Production: ~119 Mboe/d 1H’21 Ann. Unhedged Adj. EBITDA : ~$850MM Crescent (3) Est. Annual PDP Decline: ~15% Historical Reinvestment Rate : ~45% Metrics (1) (4) At a Glance Commodity Mix : ~56% Liquids Current Leverage : ~1.2x (1) Commodity mix based on Q2’21 production. (2) Represents the combined and annualized 2021 Adjusted unhedged EBITDAX as reported by Independence Energy and Contango as of YTD Q2 2021. See reconciliation in Appendix. (3) Represents non-acquisition capex spend as a percentage of historical Adjusted EBITDA since 2014 for Independence Energy. C R E S C E N T E N E R G Y (4) Current Leverage represents combined net debt as of (12/3/21) divided by 1H’21 Annualized EBITDA plus estimated annual cash flows for acquisitions completed between 6/30 and 3 Transaction closing. See reconciliation of 1H’21 Annualized EBITDA for Independence Energy & Contango in Appendix.

Consistently Executing Our Strategy We Seek to Deliver Attractive Risk-Adjusted Investment Returns and Predictable Cash Flows Across Cycles Employing a differentiated business model that combines an investor mindset and deep operational expertise Investing capital with discipline and a focus on cash flow Acquiring and developing a portfolio of low-risk assets Engaging on key Environmental, Social & Governance (“ESG”) principles with a commitment to continuous improvement Providing downside protection through strong risk management C R E S C E N T E N E R G Y 4

Sustainable Value Creation: Our Free Cash Flow Model Stable Asset Base Generates Predictable Free Cash Flow, Supported by Financial Discipline and Growth Through Returns-Driven Investing Cash flow is the foundation of our business, and each dollar flows through our disciplined framework Targeting 1.0x 10% of Focused on Value Creation Leverage Adj. EBITDA Disciplined Targeted Focused on debt Returned to our reinvestment into consolidation through service & shareholders as a (1) our assets to drive value accretive maintaining balance dividend attractive growth acquisitions sheet strength First Priority Growth through Returns-Driven Investing (1) All dividend payments are subject to approval by the Board of Directors. C R E S C E N T E N E R G Y 5

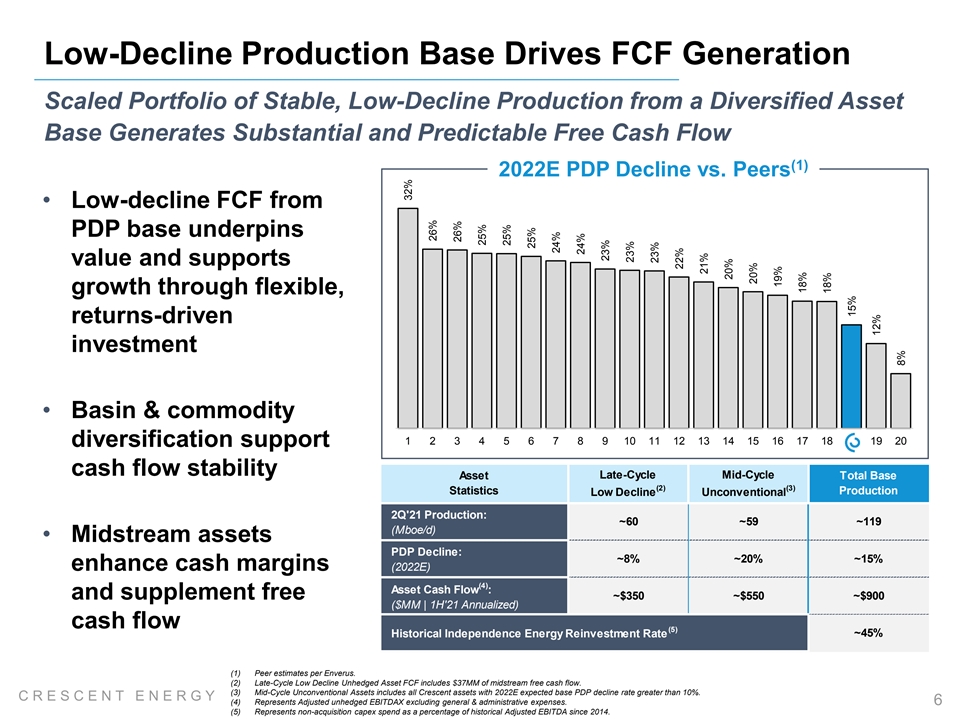

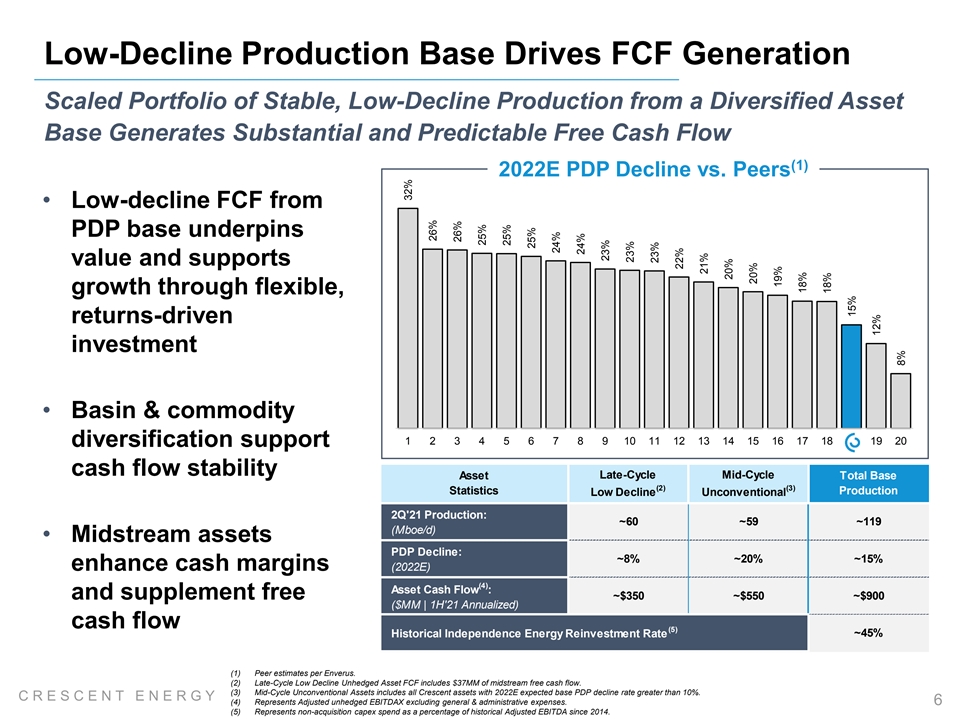

Low-Decline Production Base Drives FCF Generation Scaled Portfolio of Stable, Low-Decline Production from a Diversified Asset Base Generates Substantial and Predictable Free Cash Flow (1) 2022E PDP Decline vs. Peers • Low-decline FCF from PDP base underpins value and supports growth through flexible, returns-driven investment • Basin & commodity 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 diversification support cash flow stability Late-Cycle Mid-Cycle Asset Total Base (2) (3) Statistics Production Low Decline Unconventional 2Q'21 Production: ~60 ~59 ~119 (Mboe/d) • Midstream assets PDP Decline: ~8% ~20% ~15% enhance cash margins (2022E) (4) Asset Cash Flow : and supplement free ~$350 ~$550 ~$900 ($MM | 1H'21 Annualized) cash flow (5) Historical Independence Energy Reinvestment Rate ~45% (1) Peer estimates per Enverus. (2) Late-Cycle Low Decline Unhedged Asset FCF includes $37MM of midstream free cash flow. (3) Mid-Cycle Unconventional Assets includes all Crescent assets with 2022E expected base PDP decline rate greater than 10%. C R E S C E N T E N E R G Y (4) Represents Adjusted unhedged EBITDAX excluding general & administrative expenses. 6 (5) Represents non-acquisition capex spend as a percentage of historical Adjusted EBITDA since 2014. 32% 26% 26% 25% 25% 25% 24% 24% 23% 23% 23% 22% 21% 20% 20% 19% 18% 18% 15% 12% 8%

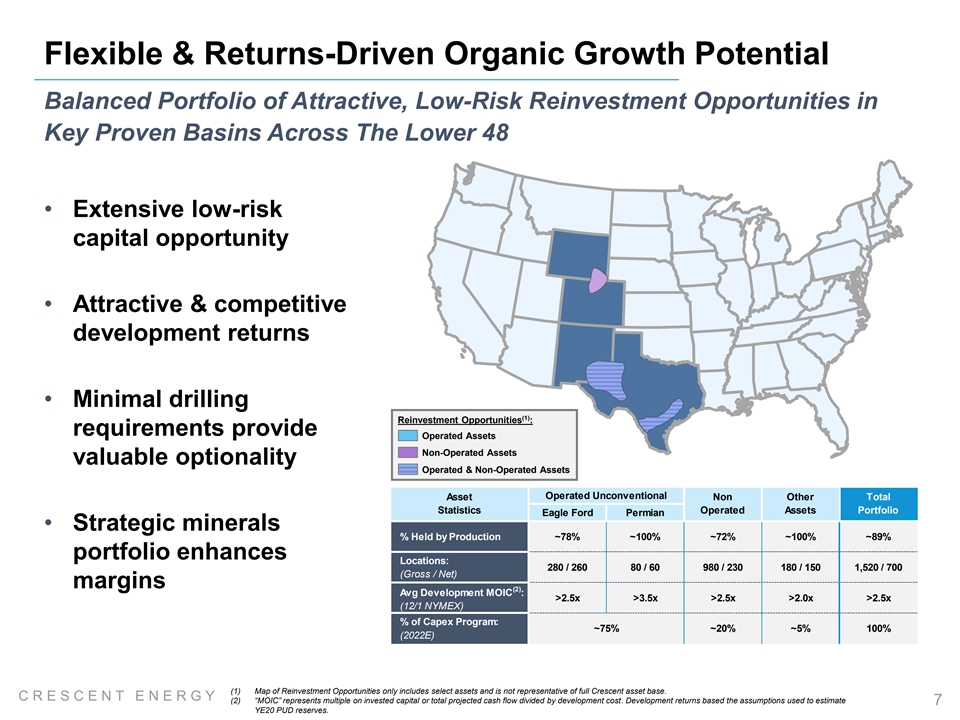

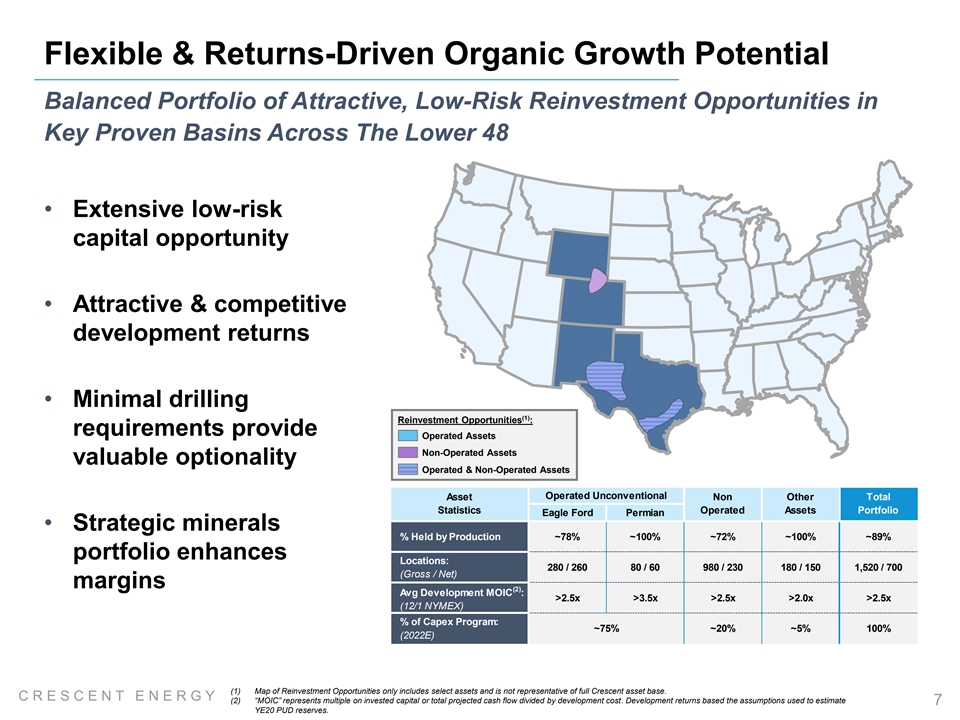

Flexible & Returns-Driven Organic Growth Potential Balanced Portfolio of Attractive, Low-Risk Reinvestment Opportunities in Key Proven Basins Across The Lower 48 • Extensive low-risk capital opportunity • Attractive & competitive development returns • Minimal drilling (1) Reinvestment Opportunities : requirements provide Operated Assets Non-Operated Assets valuable optionality Operated & Non-Operated Assets Operated Unconventional Asset Non Other Total Statistics Operated Assets Portfolio Eagle Ford Permian • Strategic minerals % Held by Production ~78% ~100% ~72% ~100% ~89% portfolio enhances TBU locations, % HBP & returns Locations: 280 / 260 80 / 60 980 / 230 180 / 150 1,520 / 700 (Gross / Net) based on current strip margins (2) Avg Development MOIC : >2.5x >3.5x >2.5x >2.0x >2.5x (12/1 NYMEX) % of Capex Program: ~75% ~20% ~5% 100% (2022E) (1) Map of Reinvestment Opportunities only includes select assets and is not representative of full Crescent asset base. C R E S C E N T E N E R G Y (2) “MOIC” represents multiple on invested capital or total projected cash flow divided by development cost. Development returns based the assumptions used to estimate 7 YE20 PUD reserves.

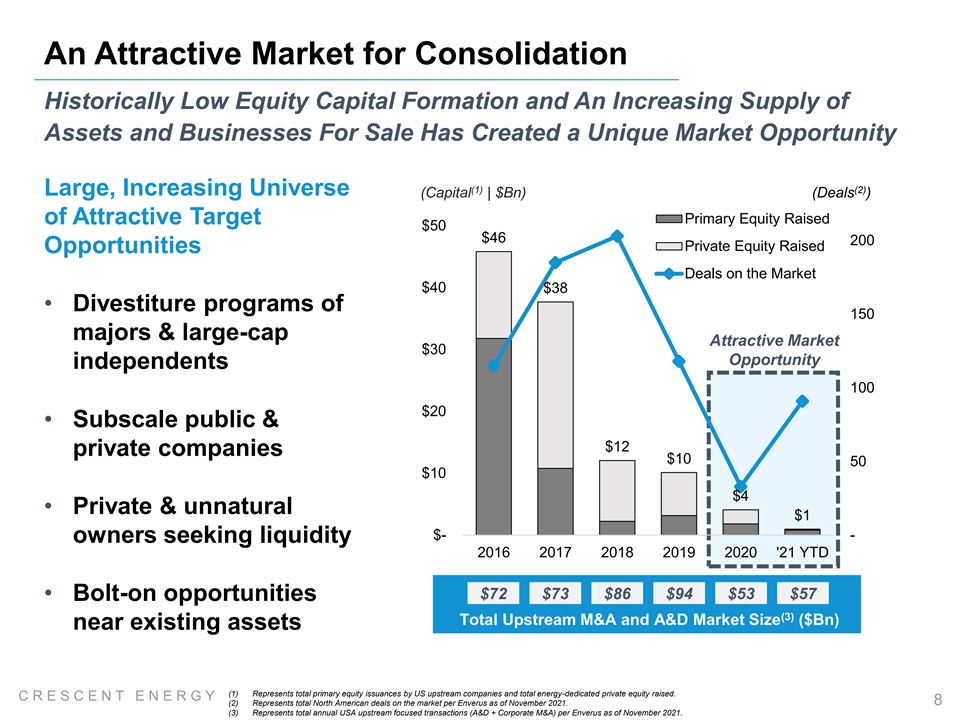

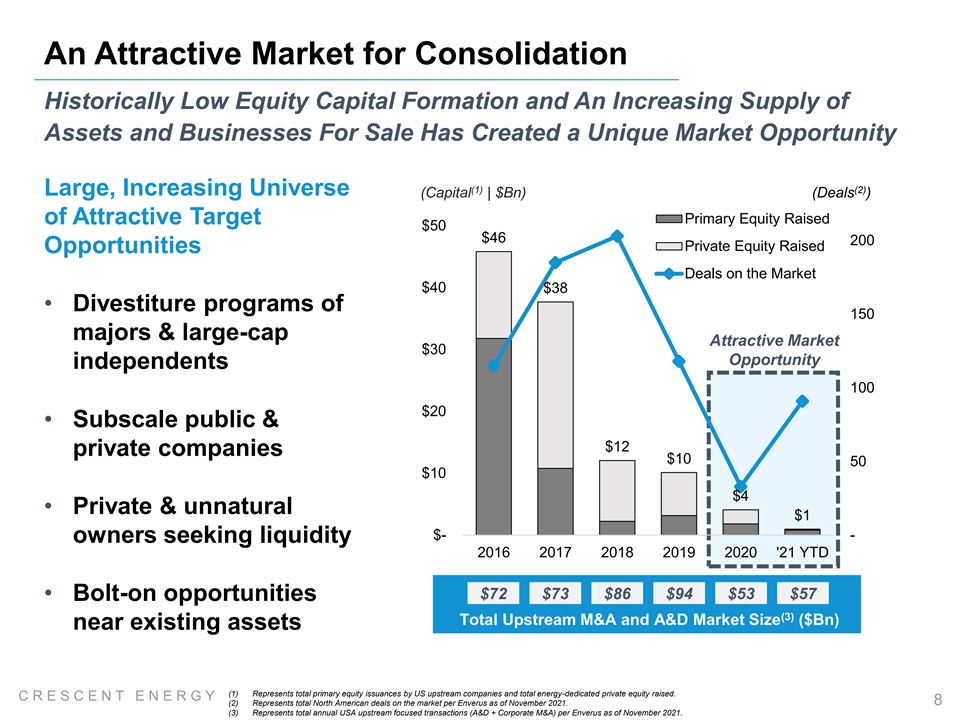

An Attractive Market for Consolidation Historically Low Equity Capital Formation and An Increasing Supply of Assets and Businesses For Sale Has Created a Unique Market Opportunity (1) (2) Large, Increasing Universe (Capital | $Bn) (Deals ) of Attractive Target Primary Equity Raised $50 $46 200 Private Equity Raised Opportunities Deals on the Market $40 $38 • Divestiture programs of 150 majors & large-cap Attractive Market $30 Opportunity independents 100 $20 • Subscale public & $12 private companies $10 50 $10 $4 • Private & unnatural $1 $- - owners seeking liquidity 2016 2017 2018 2019 2020 '21 YTD $72 $73 $86 $94 $53 $57 • Bolt-on opportunities (3) Total Upstream M&A and A&D Market Size ($Bn) near existing assets (1) Represents total primary equity issuances by US upstream companies and total energy-dedicated private equity raised. C R E S C E N T E N E R G Y 8 (2) Represents total North American deals on the market per Enverus as of November 2021. (3) Represents total annual USA upstream focused transactions (A&D + Corporate M&A) per Enverus as of November 2021.

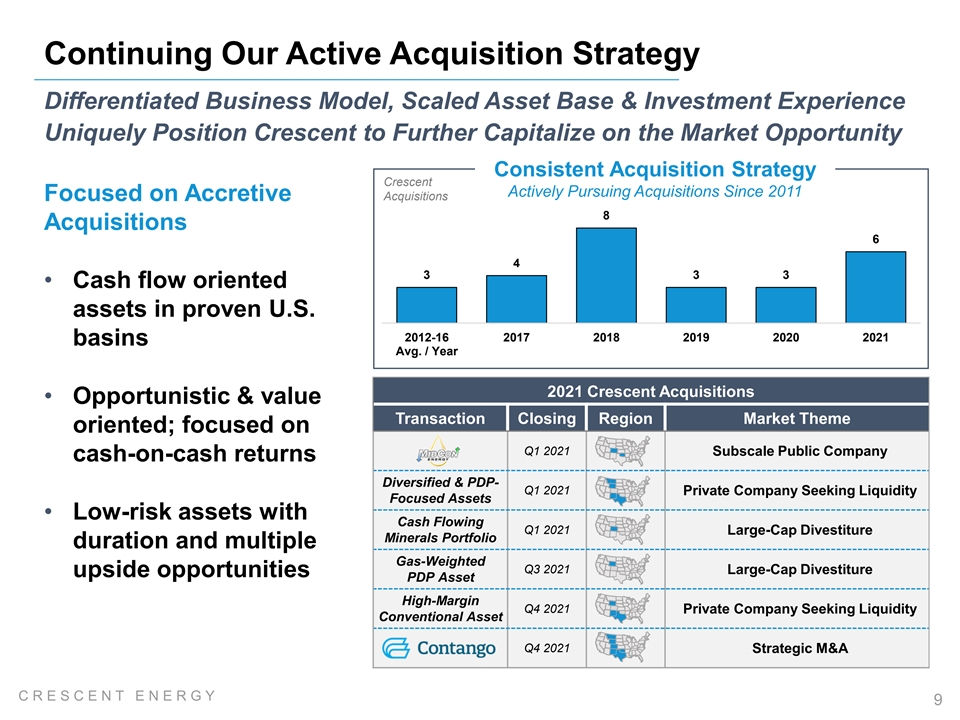

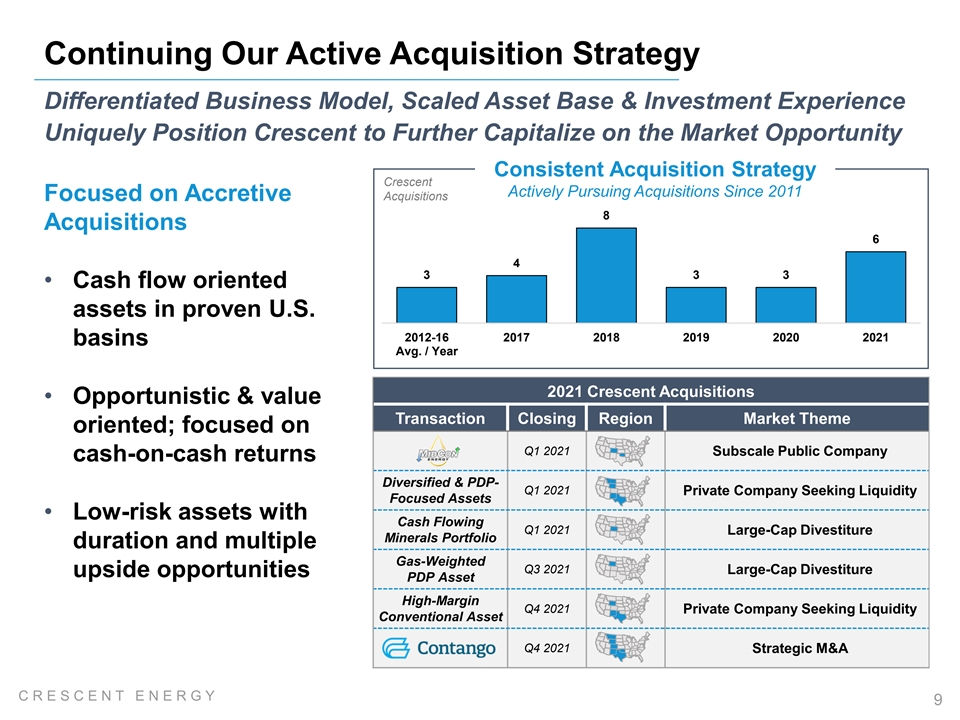

Continuing Our Active Acquisition Strategy Differentiated Business Model, Scaled Asset Base & Investment Experience Uniquely Position Crescent to Further Capitalize on the Market Opportunity Consistent Acquisition Strategy Crescent Actively Pursuing Acquisitions Since 2011 Acquisitions Focused on Accretive 8 Acquisitions 6 4 3 3 3 • Cash flow oriented assets in proven U.S. 2012-16 2017 2018 2019 2020 2021 basins Avg. / Year 2021 Crescent Acquisitions • Opportunistic & value Transaction Closing Region Market Theme oriented; focused on Q1 2021 Subscale Public Company cash-on-cash returns Diversified & PDP- Q1 2021 Private Company Seeking Liquidity Focused Assets • Low-risk assets with Cash Flowing Q1 2021 Large-Cap Divestiture Minerals Portfolio duration and multiple Gas-Weighted Q3 2021 Large-Cap Divestiture upside opportunities PDP Asset High-Margin Q4 2021 Private Company Seeking Liquidity Conventional Asset Q4 2021 Strategic M&A C R E S C E N T E N E R G Y 9

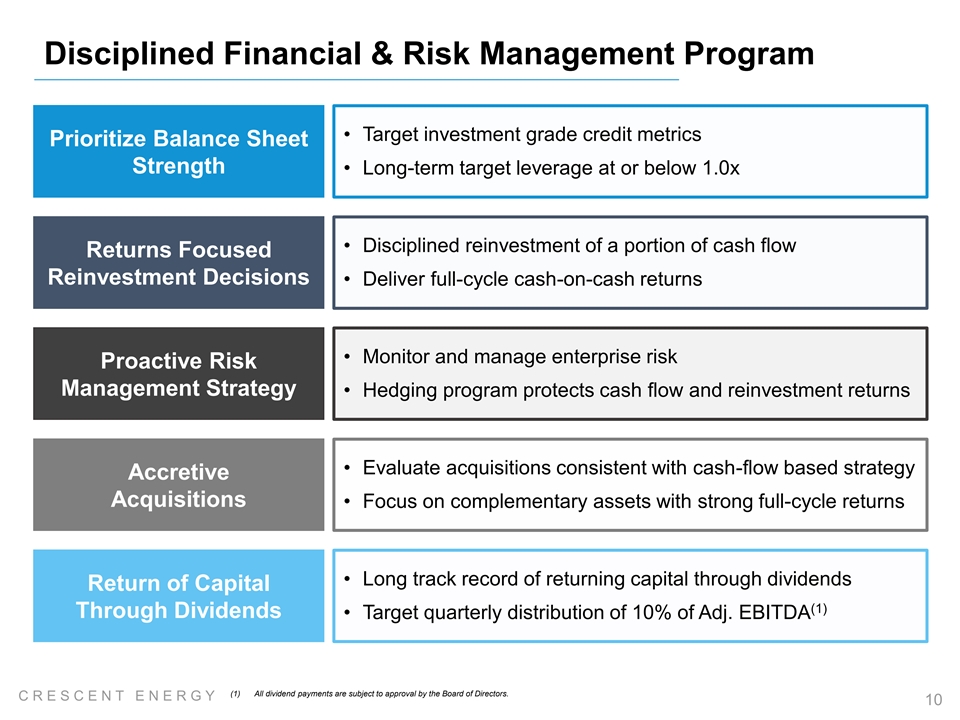

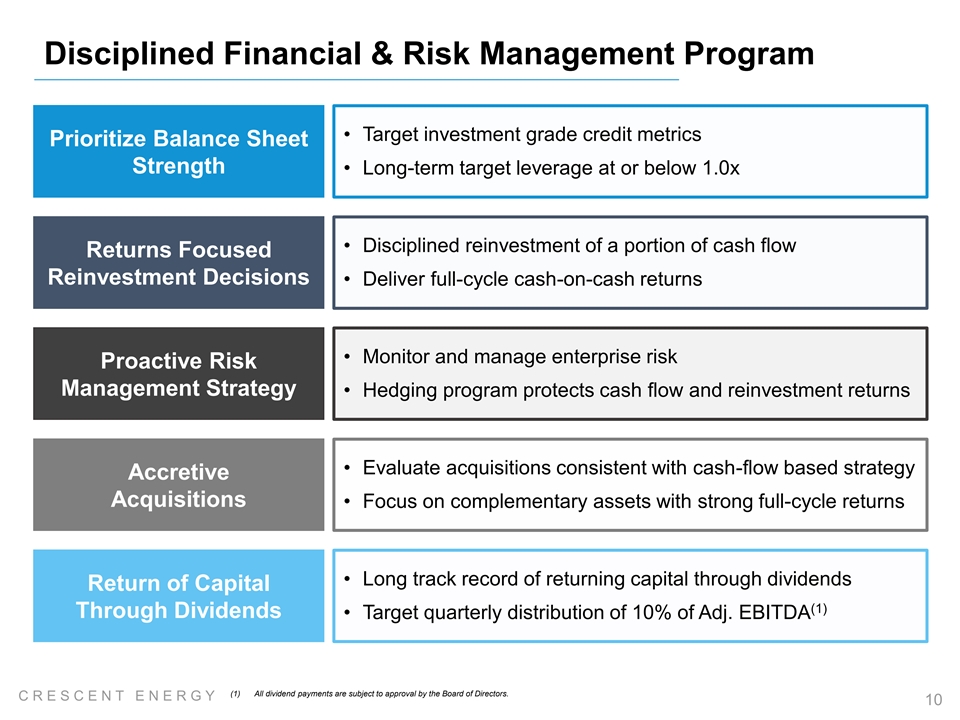

Disciplined Financial & Risk Management Program • Target investment grade credit metrics Prioritize Balance Sheet Strength • Long-term target leverage at or below 1.0x • Disciplined reinvestment of a portion of cash flow Returns Focused Reinvestment Decisions• Deliver full-cycle cash-on-cash returns • Monitor and manage enterprise risk Proactive Risk Management Strategy • Hedging program protects cash flow and reinvestment returns • Evaluate acquisitions consistent with cash-flow based strategy Accretive Acquisitions • Focus on complementary assets with strong full-cycle returns • Long track record of returning capital through dividends Return of Capital (1) Through Dividends • Target quarterly distribution of 10% of Adj. EBITDA (1) All dividend payments are subject to approval by the Board of Directors. C R E S C E N T E N E R G Y 10

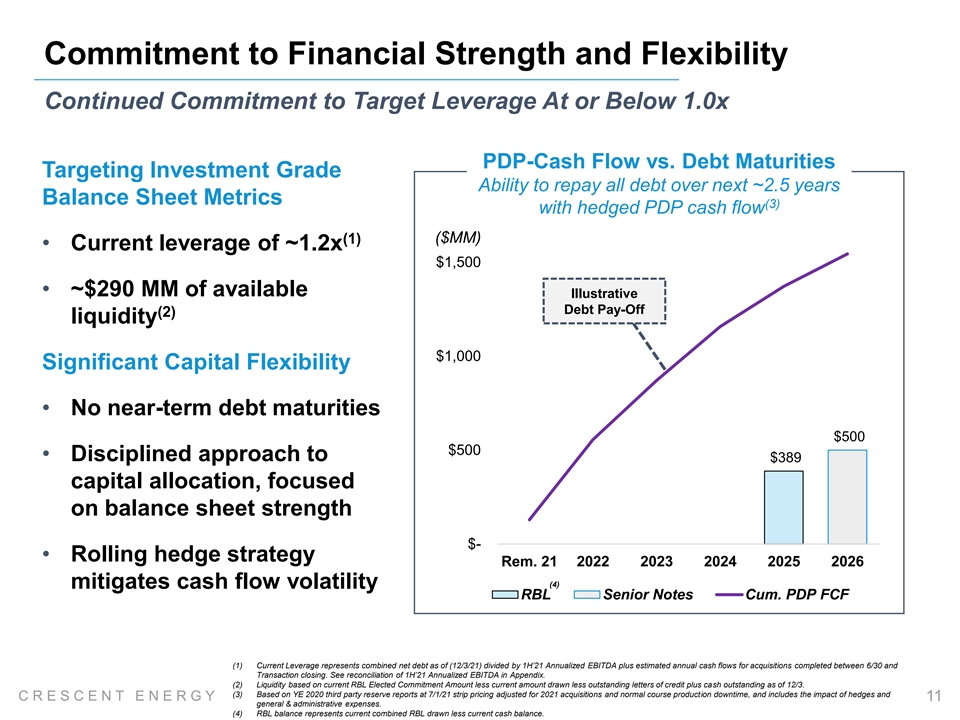

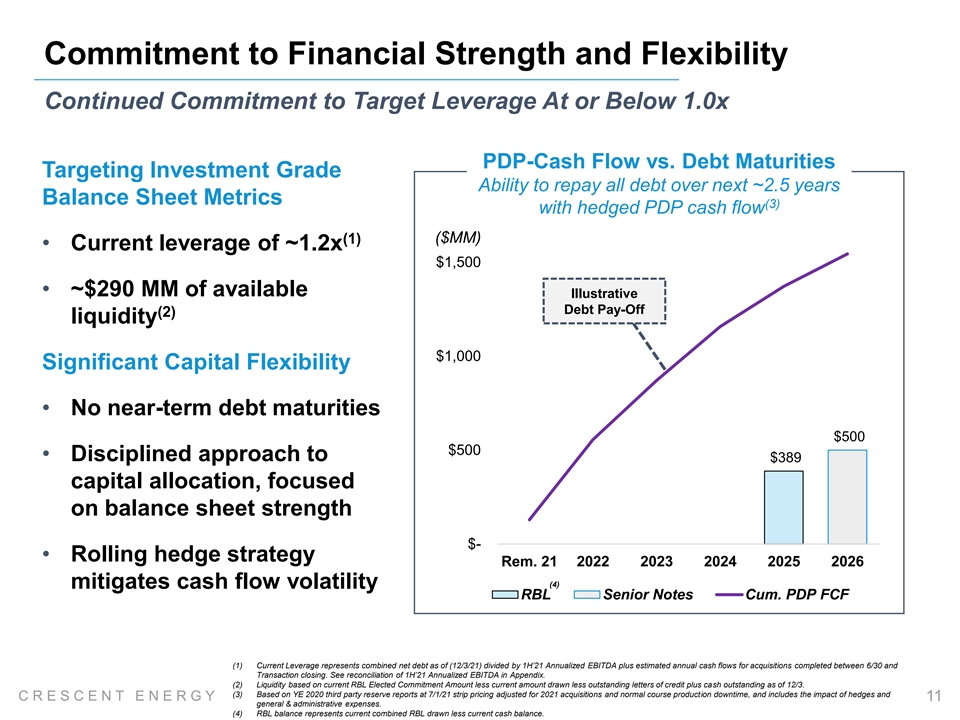

Commitment to Financial Strength and Flexibility Continued Commitment to Target Leverage At or Below 1.0x PDP-Cash Flow vs. Debt Maturities Targeting Investment Grade Ability to repay all debt over next ~2.5 years Balance Sheet Metrics (3) with hedged PDP cash flow ($MM) (1) • Current leverage of ~1.2x $1,500 • ~$290 MM of available Illustrative Debt Pay-Off (2) liquidity $1,000 Significant Capital Flexibility • No near-term debt maturities $500 $500 • Disciplined approach to $389 capital allocation, focused on balance sheet strength $- • Rolling hedge strategy Rem. 21 2022 2023 2024 2025 2026 (4) mitigates cash flow volatility RBL Senior Notes Cum. PDP FCF (1) Current Leverage represents combined net debt as of (12/3/21) divided by 1H’21 Annualized EBITDA plus estimated annual cash flows for acquisitions completed between 6/30 and Transaction closing. See reconciliation of 1H’21 Annualized EBITDA in Appendix. (2) Liquidity based on current RBL Elected Commitment Amount less current amount drawn less outstanding letters of credit plus cash outstanding as of 12/3. (3) Based on YE 2020 third party reserve reports at 7/1/21 strip pricing adjusted for 2021 acquisitions and normal course production downtime, and includes the impact of hedges and C R E S C E N T E N E R G Y 11 general & administrative expenses. (4) RBL balance represents current combined RBL drawn less current cash balance.

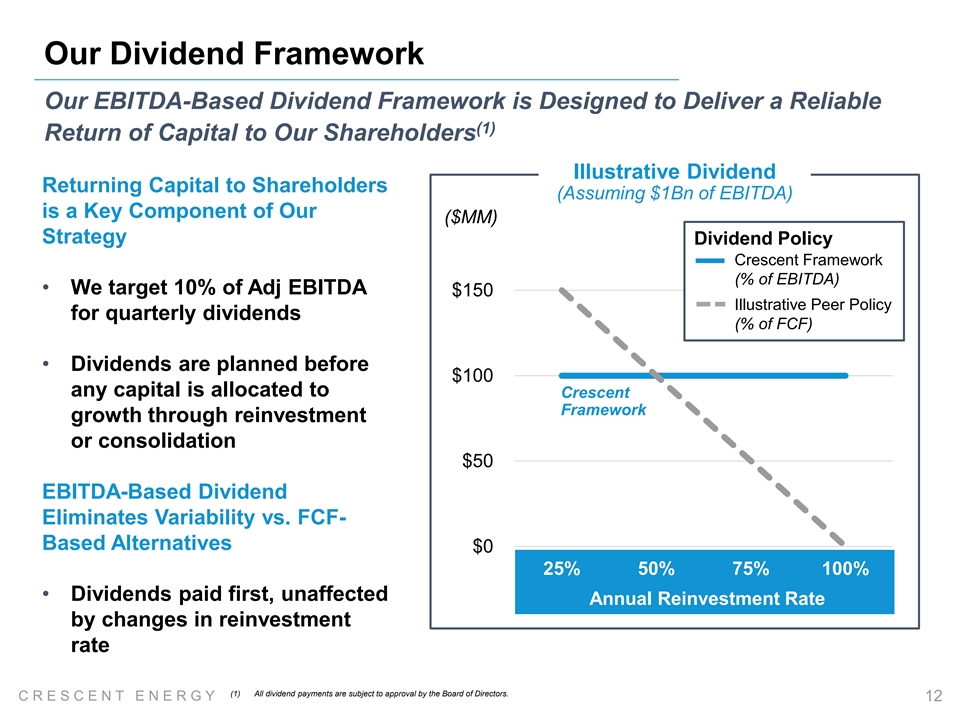

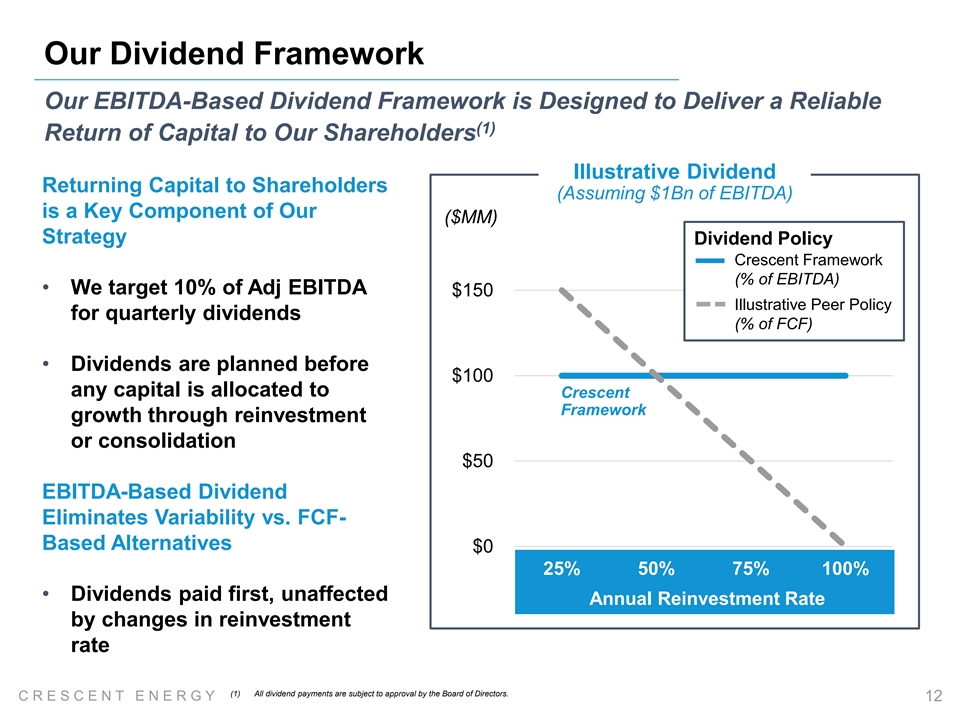

Our Dividend Framework Our EBITDA-Based Dividend Framework is Designed to Deliver a Reliable (1) Return of Capital to Our Shareholders Illustrative Dividend Returning Capital to Shareholders (Assuming $1Bn of EBITDA) is a Key Component of Our ($MM) Strategy Dividend Policy Crescent Framework (% of EBITDA) • We target 10% of Adj EBITDA $150 Illustrative Peer Policy for quarterly dividends (% of FCF) • Dividends are planned before $100 any capital is allocated to Crescent Framework growth through reinvestment or consolidation $50 EBITDA-Based Dividend Eliminates Variability vs. FCF- Based Alternatives $0 25% 50% 75% 100% • Dividends paid first, unaffected Annual Reinvestment Rate by changes in reinvestment rate (1) All dividend payments are subject to approval by the Board of Directors. C R E S C E N T E N E R G Y 12

Our Commitment to ESG Progress We seek to be a quantitative leader in ESG stewardship. We are currently in the process of establishing a baseline for the combined business and plan to release an inaugural ESG report before year-end Our key guiding principles include the following: We will improve the ESG performance of assets during ownership Crescent operations will seek to continuously improve environmental, health and safety performance, water management, workplace diversity and inclusion, and community relations as well as reduce greenhouse gas emissions (GHG) We will be transparent with our performance with all of our stakeholders Crescent will establish consistent benchmarks and key performance indicators (KPIs) to track, measure and publicly report on ESG performance. We will collaborate with NGOs, external advisors and third-party experts to continuously improve ESG performance We intend to develop a strategy to operate our business and implement these principles in a manner consistent with our understanding of the transition to a net- zero world Crescent will establish ambitious GHG reduction targets; reduce methane emissions, with a focus on eliminating flaring and minimizing leaks; and identify and execute on capital projects in existing fields to drive sustained operational improvements C R E S C E N T E N E R G Y 13

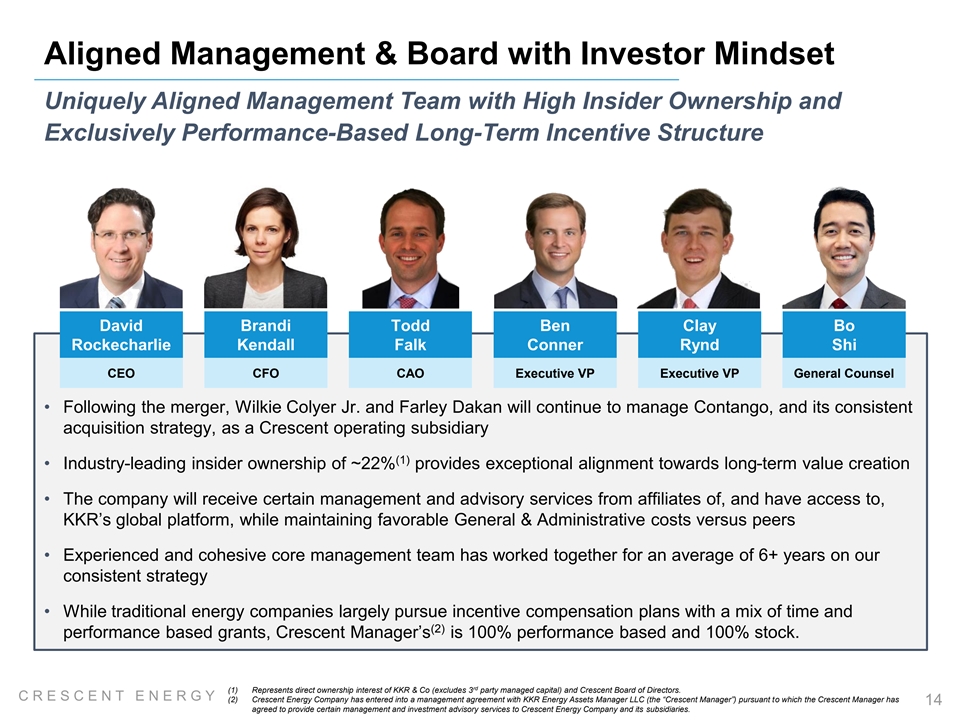

Aligned Management & Board with Investor Mindset Uniquely Aligned Management Team with High Insider Ownership and Exclusively Performance-Based Long-Term Incentive Structure David Brandi Todd Ben Clay Bo Rockecharlie Kendall Falk Conner Rynd Shi CEO CFO CAO Executive VP Executive VP General Counsel • Following the merger, Wilkie Colyer Jr. and Farley Dakan will continue to manage Contango, and its consistent acquisition strategy, as a Crescent operating subsidiary (1) • Industry-leading insider ownership of ~22% provides exceptional alignment towards long-term value creation • The company will receive certain management and advisory services from affiliates of, and have access to, KKR’s global platform, while maintaining favorable General & Administrative costs versus peers • Experienced and cohesive core management team has worked together for an average of 6+ years on our consistent strategy • While traditional energy companies largely pursue incentive compensation plans with a mix of time and (2) performance based grants, Crescent Manager’s is 100% performance based and 100% stock. rd (1) Represents direct ownership interest of KKR & Co (excludes 3 party managed capital) and Crescent Board of Directors. C R E S C E N T E N E R G Y (2) Crescent Energy Company has entered into a management agreement with KKR Energy Assets Manager LLC (the “Crescent Manager”) pursuant to which the Crescent Manager has 14 agreed to provide certain management and investment advisory services to Crescent Energy Company and its subsidiaries.

Crescent Energy: A Compelling Investment A Diversified and Well-Capitalized Energy Company with an Investor Mindset and a Focus on Sustainable Value Creation Unique business model combining an investor mindset & deep operational expertise Investing capital with discipline and a focus on cash flow Acquiring and developing a portfolio of low risk assets Engaging on key ESG principles with a commitment to continuous improvement Providing downside protection through strong risk management C R E S C E N T E N E R G Y 15

Appendix C R E S C E N T E N E R G Y

Our Operating Model Employing a Differentiated Business Model that Combines an Investor Mindset and Deep Operational Expertise to Deliver Sustainable Value Creation • Operating through three scaled asset strategies with financial incentives tied directly to cash-on-cash returns • Crescent Energy executive leadership focused on capital allocation, financing & capital market activity and long-term corporate strategy along with day-to-day operation of the business • Crescent Energy will benefit from the perspectives of KKR resources, including KKR’s Global Macro team, Public Affairs team, KKR Capital Markets, the KKR Global Institute, the Client and Partner Group and KKR’s Sustainability Expert Advisory Council Operated Operated Non-Operated & Conventional & Unconventional Minerals Low-Decline C R E S C E N T E N E R G Y 17

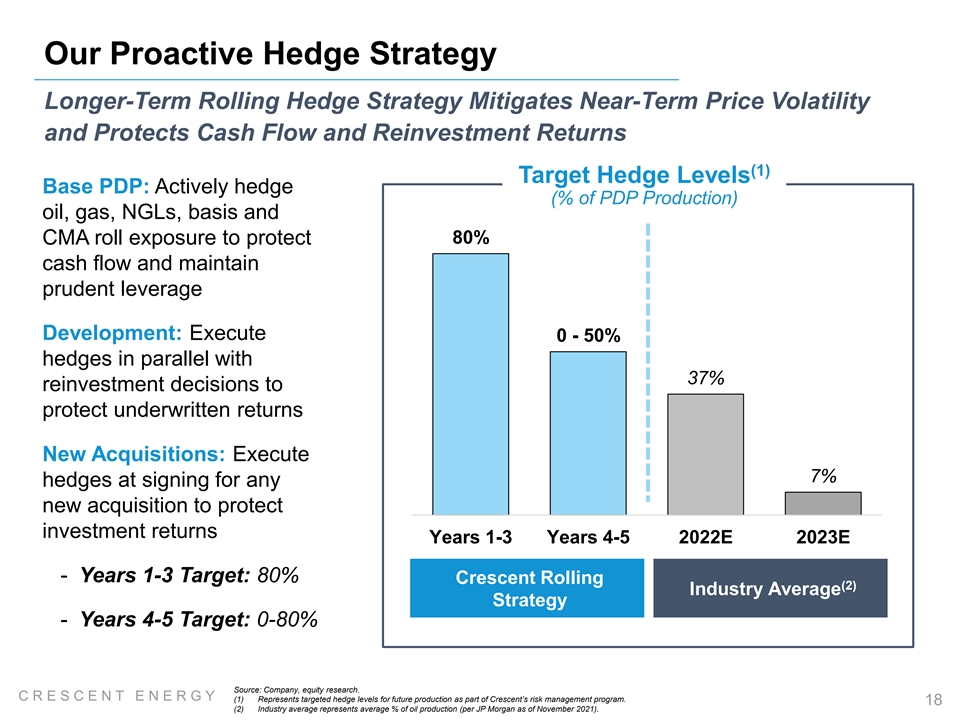

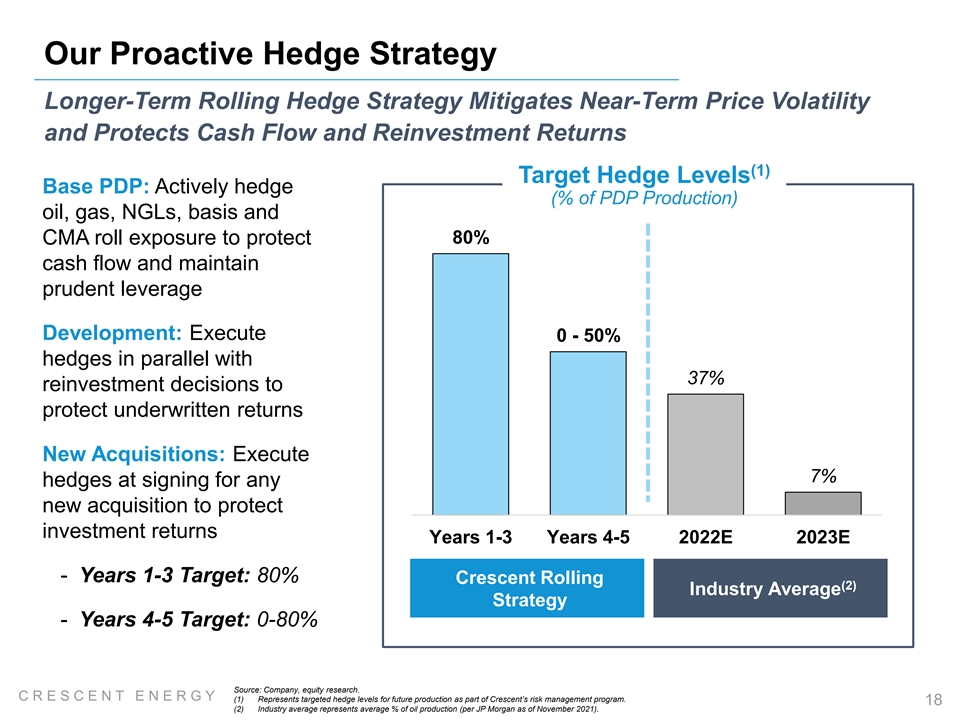

Our Proactive Hedge Strategy Longer-Term Rolling Hedge Strategy Mitigates Near-Term Price Volatility and Protects Cash Flow and Reinvestment Returns (1) Target Hedge Levels Base PDP: Actively hedge (% of PDP Production) oil, gas, NGLs, basis and 80% CMA roll exposure to protect cash flow and maintain prudent leverage Development: Execute 0 - 50% hedges in parallel with 37% reinvestment decisions to protect underwritten returns New Acquisitions: Execute 7% hedges at signing for any new acquisition to protect investment returns Years 1-3 Years 4-5 2022E 2023E - Years 1-3 Target: 80% Crescent Rolling (2) Industry Average Strategy - Years 4-5 Target: 0-80% Source: Company, equity research. C R E S C E N T E N E R G Y (1) Represents targeted hedge levels for future production as part of Crescent’s risk management program. 18 (2) Industry average represents average % of oil production (per JP Morgan as of November 2021).

Our Board of Directors Crescent’s Board of Directors Brings Together a Diverse Group of Seasoned Executives with a Broad Range of Valuable Expertise (1) • Crescent Board comprised of more than 75% Independent Directors • One Director to serve on separate and dedicated ESG Advisory Council John Goff David Erich • Crescent Board Rockecharlie Bobinsky Chairman • Crescent CEO• Director, Liberty Mutual • Founder, Crescent Real Investments • Partner & Head of KKR Estate & Goff Capital Energy Real Assets Bevin Brown Claire Farley Bob Gwin • Board member of • Board member of • Managing Director, Technip FMC & Pembina Pipeline Corp Liberty Mutual Investments LyondellBasell N.V. & Enable Midstream Partners • Former Partner, KKR • Former President, • Former President, Anadarko Corporation Texaco North America Brandi Lon McCain Karen Simon • Board member of • Board member of Kendall Cheniere Energy Energean PLC & Aker • Crescent CFO Partners, GP & ASA Continental Resources • Managing Director, KKR • Former Vice Chairman, Energy Real Assets • Former CFO, Ellora Investment Banking at Energy, Inc JP Morgan (1) Based on NYSE independent director criteria. C R E S C E N T E N E R G Y 19

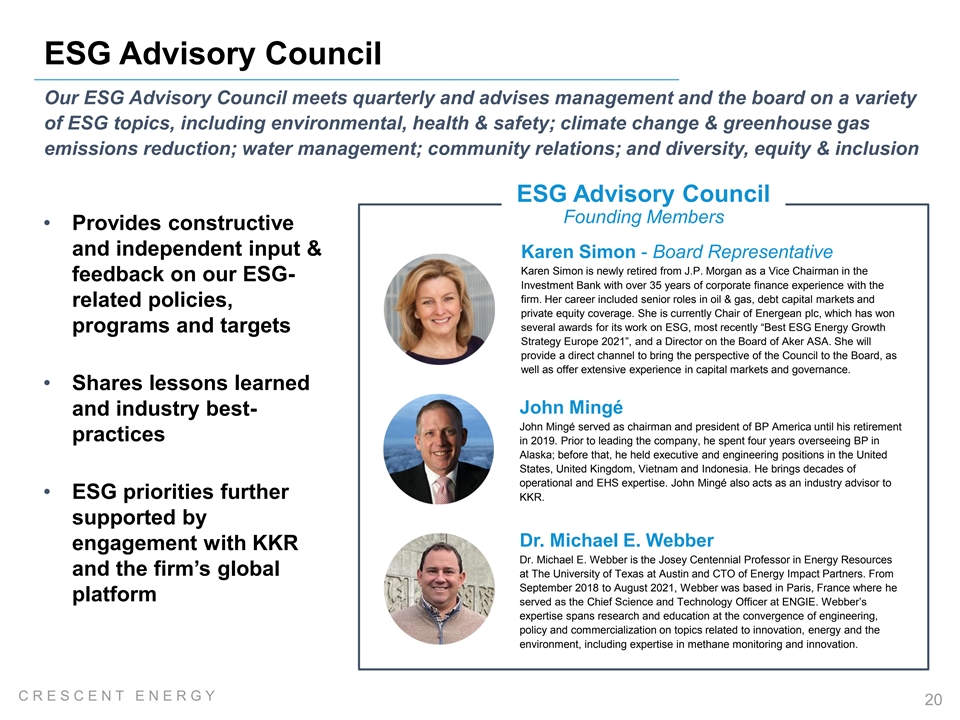

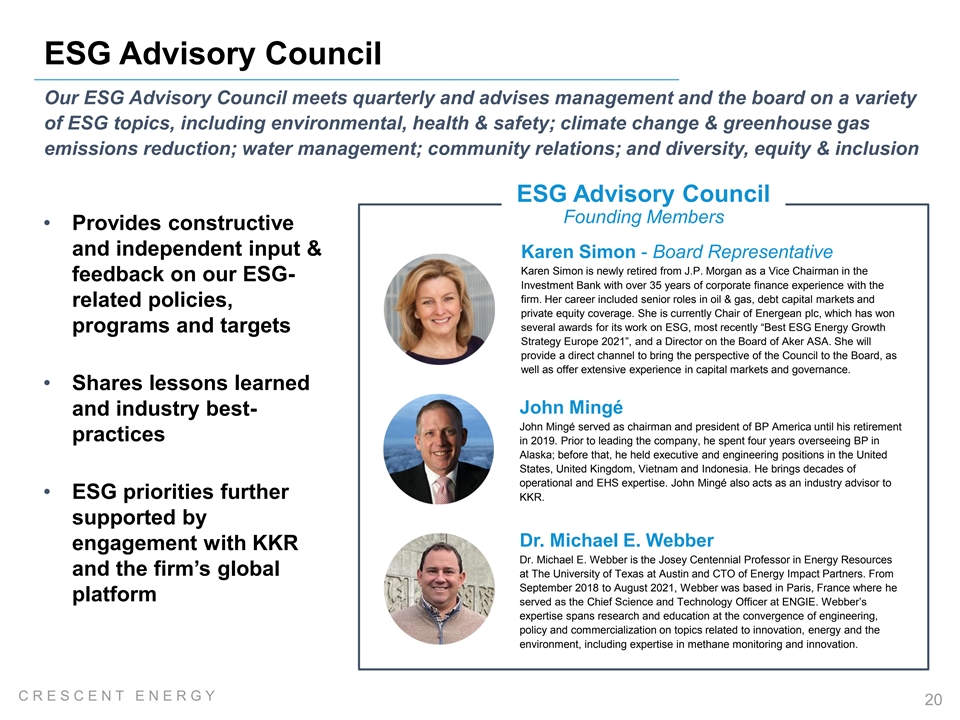

ESG Advisory Council Our ESG Advisory Council meets quarterly and advises management and the board on a variety of ESG topics, including environmental, health & safety; climate change & greenhouse gas emissions reduction; water management; community relations; and diversity, equity & inclusion ESG Advisory Council Founding Members • Provides constructive and independent input & Karen Simon - Board Representative Karen Simon is newly retired from J.P. Morgan as a Vice Chairman in the feedback on our ESG- Investment Bank with over 35 years of corporate finance experience with the firm. Her career included senior roles in oil & gas, debt capital markets and related policies, private equity coverage. She is currently Chair of Energean plc, which has won several awards for its work on ESG, most recently “Best ESG Energy Growth programs and targets Strategy Europe 2021”, and a Director on the Board of Aker ASA. She will provide a direct channel to bring the perspective of the Council to the Board, as well as offer extensive experience in capital markets and governance. • Shares lessons learned John Mingé and industry best- John Mingé served as chairman and president of BP America until his retirement practices in 2019. Prior to leading the company, he spent four years overseeing BP in Alaska; before that, he held executive and engineering positions in the United States, United Kingdom, Vietnam and Indonesia. He brings decades of operational and EHS expertise. John Mingé also acts as an industry advisor to • ESG priorities further KKR. supported by Dr. Michael E. Webber engagement with KKR Dr. Michael E. Webber is the Josey Centennial Professor in Energy Resources and the firm’s global at The University of Texas at Austin and CTO of Energy Impact Partners. From September 2018 to August 2021, Webber was based in Paris, France where he platform served as the Chief Science and Technology Officer at ENGIE. Webber’s expertise spans research and education at the convergence of engineering, policy and commercialization on topics related to innovation, energy and the environment, including expertise in methane monitoring and innovation. C R E S C E N T E N E R G Y 20

Our Current Hedge Book: 2022 - 2024 Crude Oil Natural Gas NGLs Hedged Volume Weighted Average Hedged Volume Weighted Average Hedged Volume Weighted Average (MBbl) Price ($ / Bbl) (MMcf) Price ($ / MMBtu) (MBbl) Price ($ / Bbl) Q1 2022 2,985 $61.45 22,534 $2.79 914 $17.20 Q2 2022 2,789 $60.98 21,690 $2.77 873 $17.13 Q3 2022 2,645 $59.53 20,634 $2.76 610 $29.87 Q4 2022 2,545 $59.58 20,180 $2.78 587 $29.74 Q1 2023 2,378 $57.55 18,289 $2.60 Q2 2023 2,088 $58.37 15,914 $2.55 Q3 2023 1,870 $58.35 11,931 $2.49 Q4 2023 1,818 $58.33 11,145 $2.49 Q1 2024 1,387 $55.21 2,394 $3.57 Q2 2024 1,269 $59.32 2,390 $3.00 Q3 2024 451 $60.98 2,412 $3.03 Q4 2024 58 $57.75 2,408 $3.25 Note: As of 12/1/21. Weighted average price for minor collar positions calculated off 12/1 Strip. Weighted average floor price for Henry Hub collars in Q1 2022, Q1 2023 and 2024 of C R E S C E N T E N E R G Y $3.00 / MMBtu, $2.75 / MMBtu and $3.00 / MMBtu, respectively. Weighted average ceiling price for Henry Hub collars in Q1 2022, Q1 2023 and 2024 of $3.41 / MMBtu, $3.29 / 21 MMBtu and $3.87/MMbtu, respectively.

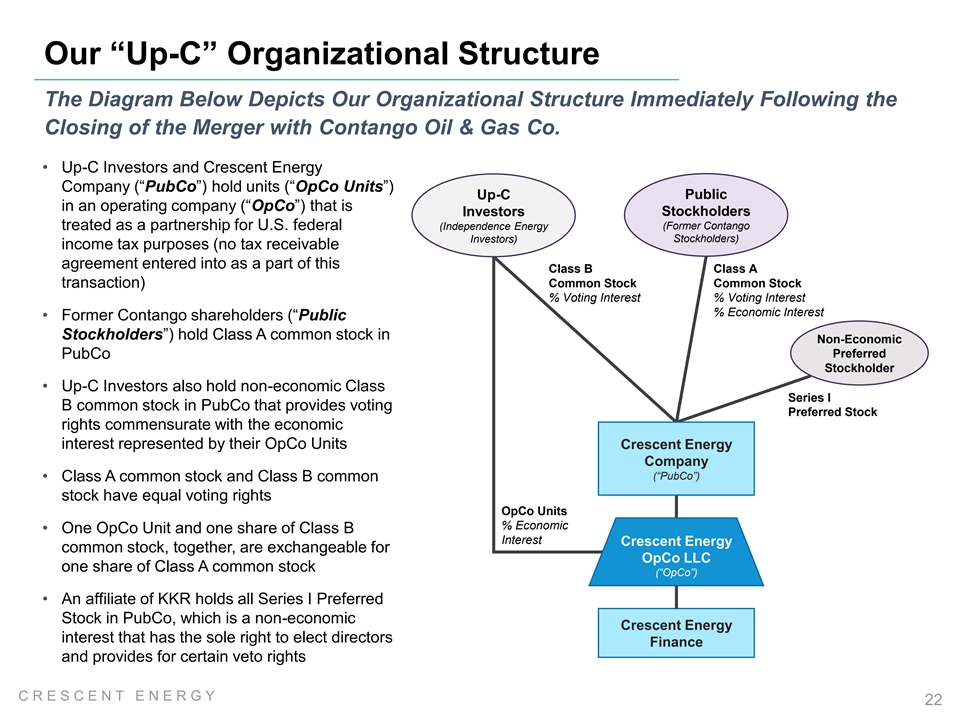

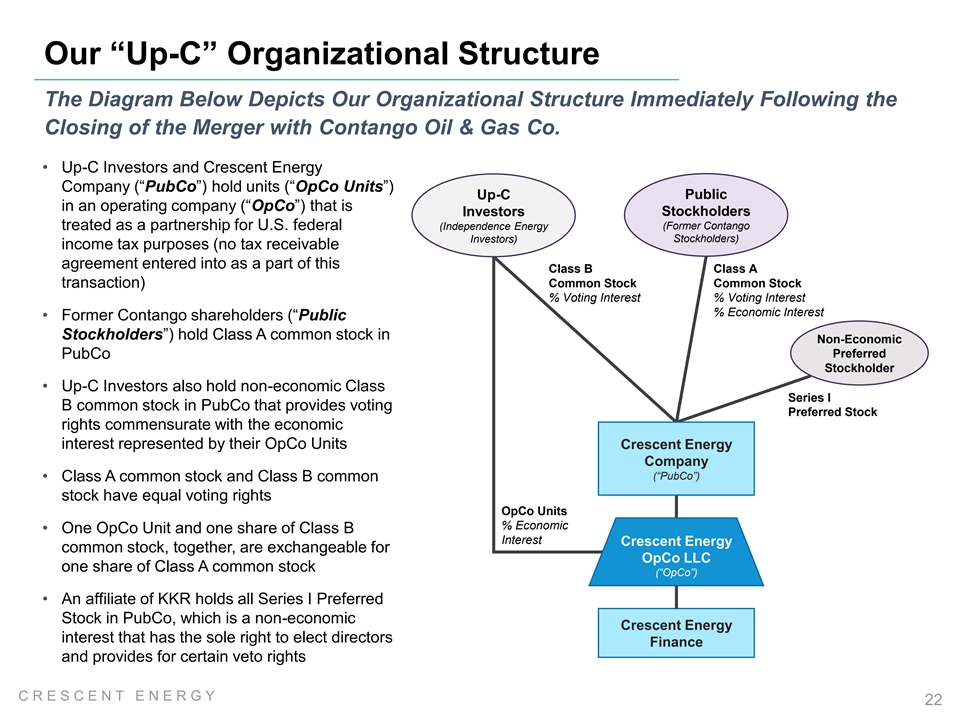

Our “Up-C” Organizational Structure The Diagram Below Depicts Our Organizational Structure Immediately Following the Closing of the Merger with Contango Oil & Gas Co. • Up-C Investors and Crescent Energy Company (“PubCo”) hold units (“OpCo Units”) Public Up-C in an operating company (“OpCo”) that is Investors Stockholders (Former Contango treated as a partnership for U.S. federal (Independence Energy Investors) Stockholders) income tax purposes (no tax receivable agreement entered into as a part of this Class B Class A transaction) Common Stock Common Stock % Voting Interest % Voting Interest % Economic Interest • Former Contango shareholders (“Public Stockholders”) hold Class A common stock in Non-Economic Preferred PubCo Stockholder • Up-C Investors also hold non-economic Class Series I B common stock in PubCo that provides voting Preferred Stock rights commensurate with the economic interest represented by their OpCo Units Crescent Energy Company (“PubCo”) • Class A common stock and Class B common stock have equal voting rights OpCo Units % Economic • One OpCo Unit and one share of Class B Interest Crescent Energy common stock, together, are exchangeable for OpCo LLC one share of Class A common stock (“OpCo”) • An affiliate of KKR holds all Series I Preferred Stock in PubCo, which is a non-economic Crescent Energy interest that has the sole right to elect directors Finance and provides for certain veto rights C R E S C E N T E N E R G Y 22

Non-GAAP Reconciliation Six months ended June 30, 2021 (1) ($ In Thousands) Combined Crescent Energy Net income (loss) ($476,064) Adjustments to reconcile to Adjusted EBITDAX: Interest expense 2 7,384 Realized (gain) loss on interest rate derivatives 7 ,022 Income tax (benefit) provision 369 Depreciation, depletion and amortization 180,696 Exploration expense 363 Non-cash (gain) loss on derivatives 365,319 Impairment of oil and natural gas properties 178 Equity-based compensation expense 1 4,625 (Gain) loss on sale of assets (9,765) Investment in affiliates 804 Other (income) expense 6 (2) 8 ,105 Transaction expenses (3) 1 98,688 Early settlement of derivative contracts Nonrecurring expenses 471 Adjusted EBITDAX $318,201 Realized (gain) loss on commodity derivatives 1 01,342 Unhedged Adjusted EBITDAX $419,543 (1) Represents the combined Adjusted EBITDAX for the six months ended June 30, 2021 as reported on a standalone basis by Independence Energy and Contango. (2) Transaction expenses of $8.1 million were primarily related to legal, consulting and other fees. C R E S C E N T E N E R G Y (3) Represents the June 2021 settlement of certain of our outstanding derivative oil contracts associated with calendar years 2022 & 2023. Subsequent to the settlement, we 23 entered into new commodity derivative contracts at prevailing market prices.

Stay Connected. Emily Newport IR@crescentenergyco.com 600 Travis Street Suite 7200 Houston, Texas 77002 + 1 (713) 332-7001 www.crescentenergyco.com