Exhibit 99.1

January 2025 US Champion Critical Materials Supply Chain Project Zeus

2 Proprietary and Confidential | Disclaimer - Cautionary Statement Regarding Forward - Looking Statements This presentation has been prepared by Welsbach Technology Metals Acquisition Corp (“WTMA”) and Evolution Metals LLC (“EM”) in order to assist interested parties in conducting their own evaluation of the proposed business combination (the “Business Combination”) of WTMA, EM and the target operating companies, Critical Mineral Recovery, Inc . (“CMR”), Handa Lab Co . , Ltd . (“Handa Lab”), KCM Industry Co . , Ltd . (“KCM”), KMMI INC . (“KMMI”) and NS World Co . , Ltd . (“NS World” and, collectively with CMR, Handa Lab, KCM and KMMI, the “Target Companies”) . In connection with the closing of the proposed Business Combination, WTMA intends to change its name to Evolution Metals & Technologies Corp . (such post - closing entity is referred to as “EM&T”) . This presentation does not purport to contain all information that may be required or desired by an interested party in investigating WTMA, EM, the Target Companies or their businesses or prospects, or the proposed Business Combination, and it shall not be deemed to be a complete description of the state of affairs of WTMA, EM or the Target Companies historically, at its stated date or in the future . Portions of this presentation have been prepared based on information received from WTMA, EM and other sources considered to be reliable ; however, neither WTMA nor EM have independently verified that such information is correct . None of WTMA, EM or any of their respective affiliates, control persons, officers, directors, employees, representatives or agents make any representation or warranty, express or implied as to the accuracy, completeness or reliability of the information contained in this presentation or any other information provided in conjunction with an evaluation of EM&T or the proposed Business Combination . Only those particular representations and warranties that may be made in relation to any legally binding definitive agreement signed by the parties relating to the proposed Business Combination, and subject to such limitations and restrictions as may be agreed upon, shall have any legal effect . Conditions and information reported in this presentation may change without any notice, and WTMA, EM and their respective affiliates and related persons disclaim any responsibility or liability to update the information contained in this presentation except to the extent required by applicable law or regulation . In addition, all of the market data included in this presentation involves a number of assumptions, limitations, projections, estimates and research . Such market data is necessarily subject to a high degree of uncertainty and risk and there can be no guarantee as to the accuracy or reliability of such assumptions . Cautionary Statements Regarding Forward - Looking Statements . Certain statements in this presentation may constitute “forward - looking statements” for purposes of the federal securities laws . Forward - looking statements are all statements other than those of historical fact, and include statements about the parties’ ability to close the proposed Business Combination, the anticipated benefits of the proposed Business Combination, and the financial condition, results of operations, earnings outlook and prospects of WTMA and/or EM and may include statements regarding the period following the consummation of the proposed Business Combination, including projected revenue and financial performance . In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements . The words “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “target,” “will,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking . The forward - looking statements are based on the current expectations and beliefs of the management of WTMA and EM, as applicable, and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement . There can be no assurance that future developments will be those that have been anticipated . These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements . These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the US Securities and Exchange Commission (“SEC”) by WTMA and the following : WTMA’s ability to complete the proposed Business Combination or, if WTMA does not consummate such proposed Business Combination, any other initial business combination ; the risk that the consummation of the proposed Business Combination is significantly delayed ; the ability to recognize the anticipated benefits of the proposed Business Combination ; the risk that the announcement and consummation of the proposed Business Combination disrupts EM’s current plans ; EM&T’s ability to successfully integrate the business and operations of the Target Companies into its ongoing business operations and realize the intended benefits of EM&T’s acquisition of the Target Companies ; EM&T’s ability to secure sufficient funding to successfully rebuild CMR’s recycling facility with significant expansion on management’s expected timeline and budget, or at all ; unexpected costs related to the proposed Business Combination ; expectations regarding EM&T’s strategies and future financial performance, including future business plans, expansion and acquisition plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, product and service acceptance, market trends, liquidity, cash flows and uses of cash, capital expenditures, and EM&T’s ability to invest in growth initiatives ; satisfaction or waiver (if applicable) of the conditions to the proposed Business Combination, including, among other things : ( i ) approval of the proposed Business Combination and related agreements and transactions by the WTMA stockholders, the holder of the EM member units and the holders of the equity interests of the other Target Companies, (ii) effectiveness of the registration statement on Form S - 4 filed with the SEC on November 12 , 2024 (the “Registration Statement”), (iii) receipt of approval for listing on Nasdaq the shares of WTMA common stock to be issued in connection with the Merger, and (iv) the absence of any injunctions ; that the amount of cash available in the trust account is at least equal to the minimum available cash condition amount ; the occurrence of any other event, change or other circumstances that could give rise to the termination of the proposed Business Combination ; the implementation, market acceptance and success of EM&T’s business model and growth strategy ; the ability to obtain or maintain the listing of EM&T common stock on Nasdaq following the proposed Business Combination ; limited liquidity and trading of WTMA’s public securities ; the amount of any redemptions by existing holders of WTMA common stock being greater than expected ; WTMA’s ability to raise financing in the future ; WTMA’s success in retaining or recruiting, or changes required in, our officers, key employees or directors following the completion of the proposed Business Combination ; WTMA officers and directors allocating their time to other businesses and potentially having conflicts of interest with WTMA’s business or in approving the proposed Business Combination ; the use of proceeds not held in the trust account or available to us from interest income on the trust account balance ; the impact of the regulatory environment and complexities with compliance related to such environment, including EM&T’s ability to meet, and continue to meet, applicable regulatory requirements ; EM&T’s ability to execute its business plan, including with respect to its technical development and commercialization of products, and its growth and go - to - market strategies ; EM&T’s ability to achieve sustained, long - term profitability and commercial success ; operational risks, including with respect to EM&T’s use of agents or resellers in certain jurisdictions, EM&T’s ability to scale up its manufacturing quantities of its products, EM&T’s outsourcing of manufacturing and such manufacturers’ ability to satisfy EM&T’s manufacturing needs on a timely basis, the availability of components or raw materials used to manufacture EM&T’s products and EM&T’s ability to process customer order backlog ; EM&T’s revenue deriving from a limited number of customers ; geopolitical risk and changes in applicable laws or regulations, including with respect to geopolitical risk and changes in applicable laws or regulations, including with respect to EM&T’s planned operations outside of the US and Korea ; EM&T’s ability to attract and retain talented personnel ; EM&T’s New EM’s ability to compete with companies that have significantly more resources ; EM&T’s ability to meet certain certification and compliance standards ; EM&T’s ability to protect its intellectual property rights and ability to protect itself against potential intellectual property infringement claims ; the outcome of any known and unknown litigation and regulatory proceedings, including any proceedings that may be instituted against WTMA or EM following announcement of the proposed Business Combination ; the potential characterization of EM&T as an investment company subject to the Investment Company Act of 1940 , as amended ; and other factors detailed under the section entitled “Risk Factors” in the Registration Statement . Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of WTMA, EM and the other Target Companies prove incorrect, actual results may vary in material respect from those projected in these forward - looking statements . Except to the extent required by applicable law or regulation, WTMA, EM and the other Target Companies undertake no obligation to update these forward - looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events . Market and Industry Data . Certain market, industry and other data used herein have been obtained or derived from third - party sources and publications, as well as from research reports prepared for other purposes . Although the information from these third - party sources is believed to be reliable, none of WTMA, EM or their respective management teams have independently verified the data obtained from these sources, and no assurances can be made regarding the accuracy or completeness of such data . Forecasts and other forward - looking information obtained from these sources are subject to the same qualifications and the additional uncertainties regarding the other forward - looking statements contained herein . Trademarks . This presentation contains trademarks, service marks, trade names, copyrights and logos of companies other than WTMA, EM or EM&T, which are the property of their respective owners . Unless otherwise stated, the use of these other trademarks, service marks, trade names, copyrights and logos herein does not imply an affiliation with, or endorsement of the information contained herein by, the owners of such trademarks, service marks, trade names, copyrights and logos . Additional Information and Where to Find It . WTMA has filed the Registration Statement with the SEC, which includes a document that serves as a proxy statement and prospectus of WTMA, referred to as a “proxy statement/prospectus,” containing information about the proposed Business Combination and the respective businesses of WTMA, EM and the Target Companies . WTMA will mail a definitive proxy statement/prospectus and other relevant documents after the SEC completes its review and the Registration Statement is declared effective . WTMA stockholders are urged to read the preliminary proxy statement/prospectus and any amendments thereto and, when available, the definitive proxy statement/prospectus in connection with the solicitation of proxies for the special meeting to be held to approve the proposed Business Combination, because these documents will contain important information about WTMA, EM, the Target Companies and the proposed Business Combination . The definitive proxy statement/prospectus will be mailed to stockholders of WTMA as of a record date to be established for voting on the proposed Business Combination . Stockholders of WTMA will also be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about WTMA without charge, at the SEC’s website ( www . sec . gov ) . Copies of the proxy statement/prospectus and WTMA’s other filings with the SEC can also be obtained, without charge, by directing a request to : chris@welsbach . sg . The information contained in, or that can be accessed through, WTMA’s website is not incorporated by reference in, and is not part of, this presentation . No Offer or Solicitation . This presentation does not constitute ( i ) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed Business Combination, or (ii) an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a definitive offering document . Participants in the Solicitation . WTMA and EM and their respective directors and officers or managers and other members of management and employees may be deemed participants in the solicitation of proxies in connection with the proposed Business Combination . WTMA stockholders and other interested persons may obtain, without charge, more detailed information regarding directors and officers of WTMA in WTMA’s proxy statement/prospectus . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from WTMA’s stockholders in connection with the proposed Business Combination will be included in the proxy statement/prospectus that WTMA intends to file with the SEC .

3 Proprietary and Confidential | China’s Dominance in Midstream Processing Why EM&T Now? EM&T Solution to Disrupt China 1 2 3 Proven Technologies Missouri Industrial Campus & Satellite Companies in Republic of Korea EM&T Contracts 6 7 8 EM&T Deeply Experienced Team EM&T Feedstock Strategy: End of Life Materials 4 5 Profitability, Milestones, Valuation 9 EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor Synergies and Operational Integration 10 EM&T PIPE Raise 11

4 Proprietary and Confidential | • US Domestic magnet and battery materials supply chains are in jeopardy given critical dependence on China . • China currently controls 80 % of global capacity to process critical minerals and an even larger share — nearly 90 % — of global processing capacity for rare earth elements : 1 » China imports 60 % of its rare earth feedstock and 40 % is sourced domestically . » This indicates there are limited constraints for the Rest of the World (outside China) of rare earth feedstock . » The constraint for the Rest of the World is the capacity to process feedstock and produce final products for the market . » This 60 % foreign feedstock can be redirected to US if US has its own midstream processing capabilities . • Western industries are critically dependent on China in critical materials due to Chinese dominance in midstream processing . • US laws and regulations including the Atomic Energy Act of 1954 , the Nuclear Non - Proliferation Act of 1978 , and the Nuclear Regulatory Commission Guidelines, as well as the Treaty on the Non - Proliferation of Nuclear Weapons - which US and its allies are signatories to – all directly and indirectly restrict the processing of radioactive material for US and its allies . » Very difficult for US and other non - Chinese countries to process low - grade radioactive ore at commercial scale . • China is able to control growth and scale in the critical materials supply chain by monopolizing the processing of the feedstock . • As China is the only large scale commercial processor of feedstock, China controls the pricing of the feedstock . • Due to the reasons stated above, China dominates oxides, metals, critical materials, carbonates, sulfates, pCAM and magnets production ; however, China’s ultimate objective is to dominate downstream sale of finished goods, including but not limited to EV automobiles, wind turbines, defense goods, and other products requiring critical materials . EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 1 1 https://bipartisanpolicy.org/download/?file=/wp - content/uploads/2024/05/BPC_The - Missing - Midstream - Report_May - 2024.pdf Without a commercial solution to disrupt China’s dominance in midstream processing, virtually all US industries will continue to be critically dependent on China for critical materials and finished products from these critical materials.

5 Proprietary and Confidential | • Escalating global geopolitical tensions, heightened by the COVID pandemic, have amplified the risks of China - dependent value chains . • Geopolitical tensions between the US and China continue to escalate : » October 2022 , US semiconductor export restrictions imposed on China . » December 2023 , China banned the export of certain intellectual property related to rare earth processing to protect national security : o These measures are part of a broader strategy to consolidate control over its rare earth industry ; o The restrictions aim to maintain China's market dominance while addressing global tensions over critical mineral supply chains . » December 2024 , in retaliation to US semiconductor export restrictions, China banned exports of critical minerals including gallium and germanium to the US, escalating trade tensions and highlighting its dominance in these essential materials . • Reliable sources 1 indicate China is consolidating its four major rare earth companies into Northern and Southern Rare Earth companies, enhancing its ability to : » Control global supply, off - take and pricing of critical materials . » Eliminate competitors by maintaining its monopoly on midstream processing . • Expected continued strong support from USG : » On December 10 , 2024 , President Donald Trump said his administration would expedite the regulatory approval of construction projects for companies that invest more than $ 1 billion . 2 • Additionally, rare earths are typically found in deposits with low grades of 2 - 3 % which also contain low grade levels of radioactive elements like thorium and uranium . » US, its allies and most countries cannot process rare earth ores due to laws and regulations which directly and indirectly restrict the processing of radioactive material . » Also this low grade requires the removal of 97 - 98 % of the ore as waste which requires large scale commercial processing capability . • Consequently, China, along with a small presence in Malaysia and Vietnam, are the only regions with existing commercial scale capability of processing rare earth ore with radioactive elements . 1 https://rawmaterials.net/further - consolidation - in - chinas - rare - earth - industry/ 1 https://www.lightnowblog.com/2024/01/china - consolidates - rare - earth - industry - restricts - processing - technology - exports/ 1 https://www.mining.com/web/china - bans - export - of - rare - earth - processing - tech - over - national - security/ 2 https://www.reuters.com/world/us/trump - says - anyone - investing - 1 - billion - us - will - receive - expedited - permits - 2024 - 12 - 10/ EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 2

6 Proprietary and Confidential | The recent "Unleashing American Energy" executive order, signed on January 20, 2025, presents a favorable environment for EM&T's operations in the critical materials sector. The key points include the following: 1 https://www.whitehouse.gov/presidential - actions/2025/01/unleashing - american - energy/ EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 2 Positioning the U.S. as a Global Leader in Critical Minerals • Section 2(b): The Executive Order establishes the U.S. objective to become "the leading producer and processor of non - fuel minerals, including rare earth minerals," creating jobs, strengthening domestic and allied supply chains, and reducing reliance on adversarial states. EM&T’s fully integrated supply chain aligns perfectly with this national strategy. Federal Support for Critical Mineral Projects • Section 9(e): The Secretary of Energy is tasked to ensure that "critical mineral projects, including the processing of critical minerals, receive consideration for Federal support," contingent on available funds. EM&T’s innovative recycling and processing capabilities position it as a prime candidate for such federal support. National Security Implications of Mineral Reliance • Section 9(g): The Secretary of Commerce will "assess the national security implications of the Nation’s mineral reliance and the potential for trade action." EM&T’s efforts to create a domestic, independent supply chain directly address these security concerns by reducing reliance on foreign processing, particularly from adversarial nations. Strengthening the National Defense Stockpile • Section 9( i ): The Secretary of Defense will ensure the National Defense Stockpile provides "a robust supply of critical minerals in the event of future shortfall." EM&T’s focus on recycling end - of - life materials and producing high - grade critical minerals aligns with national defense needs, securing a resilient and sustainable resource base for defense applications. Favorable Business Climate for Manufacturing • On January 23, 2025, addressing the World Economic Forum in Davos from Washington, President Trump stated, “Come make your product in America, and we will give you among the lowest taxes of any country on Earth. If you choose not to manufacture your product in America — which is entirely your prerogative — you will be subject to a tariff.” Reinforcing his commitment to domestic manufacturing, President Trump echoed his inauguration speech: “The United States is the best place to build factories and manufacturing centers.”

7 Proprietary and Confidential | • EM&T expects to be well positioned to help reduce US dependence on China and become the domestic magnet & battery materials marketplace champion. • By focusing on end - of - life materials through urban mining above ground, EM&T expects to avoid the challenge of separating radioa ctive elements and processes feedstock with significantly higher grades, reducing waste. China's historical willingness to manage radioactive wa ste has been a key barrier to entry for rare earth ore processing, making EM&T’s approach a game - changer in bypassing this hurdle entirely. • China has approximately 1.4bn population. US has approximately 340mm population. • US annual e - waste per capita: 21.3kg, roughly 3x China annual e - waste per capita of 8.5kg. 1 • E - waste includes anything with an electric current: white goods, microwaves, defense goods, hard disk drives, cell phones, whic h all contain magnets, from industries including automotive, aerospace, defense, healthcare, high tech, electronics, renewable energy, and others. • End - of - life materials contain no radioactive elements and can be extracted and resupplied into the supply chain with minimal was te. • EM&T is not a mining company. Rare earths are not rare, they are abundant, globally. • EM&T is not a finished magnet or battery manufacturing company. EM&T Solution to Disrupt China End - of - life Materials Pulverizer Hydromet & Pyromet EM&T End Products 1. Battery Carbonates/Sulfates/ pCAM (pre - cursor cathode active material) 2. Sintered & Bonded Magnets 3. Precious Metals 1 Source: UNITAR Global E - Waste Monitor 2024 Battery Gigafactories Across All Industries EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 3

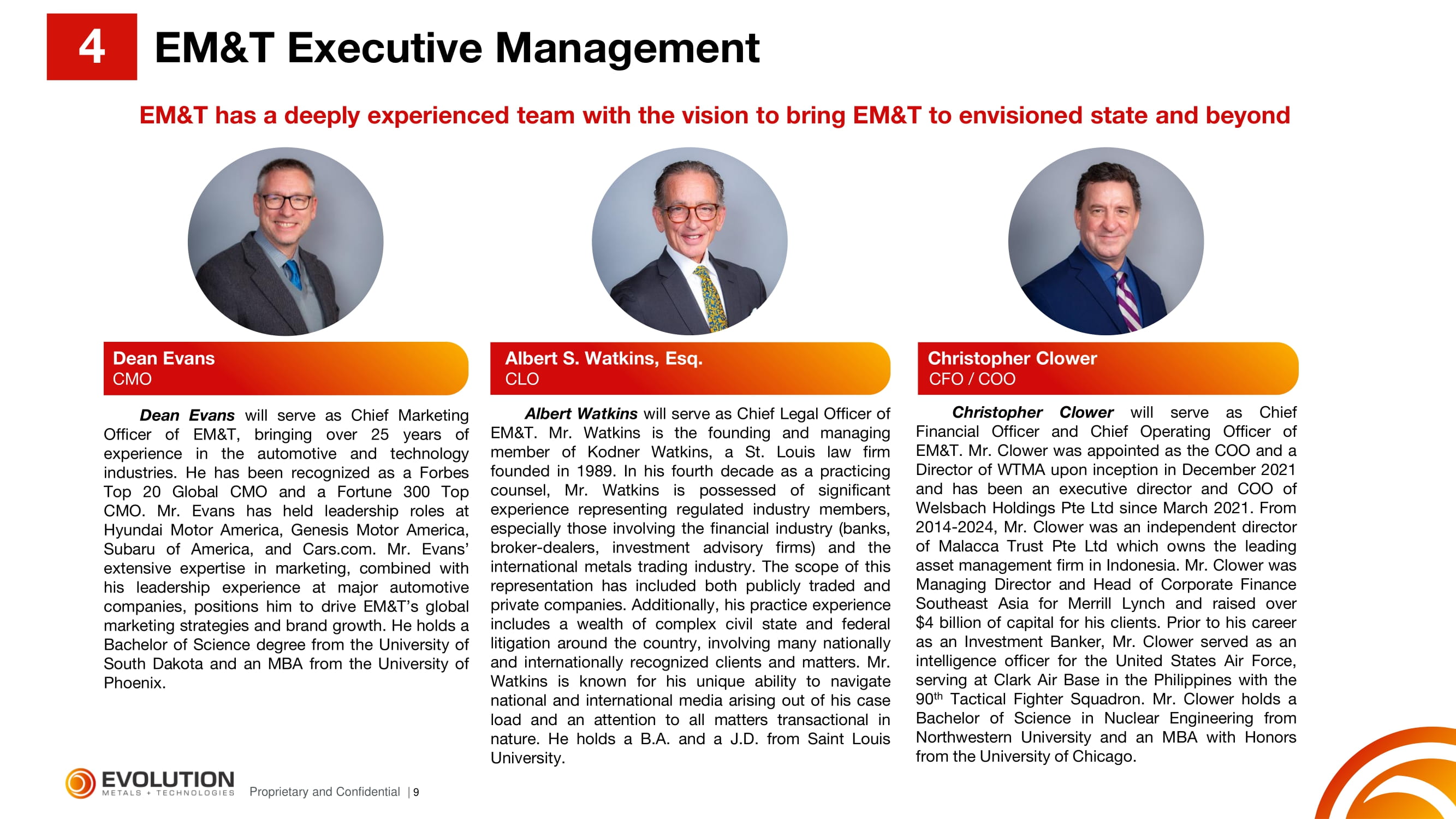

8 Proprietary and Confidential | Frank Moon will serve as Co - Chief Executive Officer for EM&T, overseeing operations in Asia and magnet midstream processing and downstream production . With over 35 years of experience in critical minerals and materials, Mr . Moon has held leadership roles in various prominent companies, including Australia Strategic Materials Ltd (ASX : ASM), ASM Korea, KSM Technologies, KSM Metals Co . , Ltd . , and Alkane Resources . He has also contributed his expertise to Kay Tech in Hong Kong, Samwha Group’s Steel Division, Hydro Tech Korea, and Kyungdong Group Global . Mr . Moon’s extensive career in the sector is underscored by his ability to manage complex projects and drive operational success in the processing of critical minerals and magnet materials . He holds a Bachelor of Science degree from the University of Sydney . Frank Moon Co - CEO – Asia / Head Magnet Production Andrew Knaggs will serve as President of EM&T , bringing over 25 years of experience in government, military, and manufacturing sectors . He founded Knaggs Law PLLC and was previously CEO of PACEM Solutions International . Prior to PACEM, he served as the Presidentially appointed Deputy Assistant Secretary of Defense . Mr . Knaggs also led research and engineering at a US Department of Defense agency, overseeing $ 1 bn R&D portfolio and a $ 300 mm budget . A former US Army Special Forces Green Beret officer, he holds a Bachelor of Science degree from West Point and a Juris Doctorate from William & Mary Law School . He is a member of the D . C . Bar and holds FINRA Series 65 certification . Andrew F. Knaggs, Esq. President David Wilcox will serve as Executive Chairman of the Board of EM&T . He is currently the Managing Member of Evolution Metals LLC . His career began at Deutsche Bank based in London and New York and operated across four continents . Mr . Wilcox became a derivatives trading specialist who has run teams for regulatory overhaul initiatives worldwide, driving value from government policy change . Mr . Wilcox’s vast experience in global finance and his leadership will be pivotal in steering EM&T’s strategic direction and governance as Executive Chairman of the Board . He has a Bachelors in Business Administration from the University of Tennessee and a Post Graduate Degree in International Business from St . Mary’s University England . David Wilcox Executive Chairman of the Board Rob Feldman Co - CEO – America/Head of Recycling Rob Feldman will serve as Co - Chief Executive Officer and Head of USA Operations and Recycling for EM&T . With over 28 years of experience in metals recycling, Mr . Feldman is recognized as an expert and visionary in the industry , known for his ability to identify market trading opportunities and optimize midstream processing . Prior to joining Evolution Metals, Mr . Feldman was the CEO and Founder of Interco Trading, one of the leading metal and electronics recyclers in the United States . He also founded and built one of the largest battery recycling facilities in the world . His extensive experience in the recycling industry , coupled with his leadership in building and scaling successful operations, positions him to drive growth in EM&T’s end - of - life recycling business . Mr . Feldman holds a Bachelor of Arts degree from Northwestern University . Andrew F. Knaggs, Esq. President Rob Feldman Co - CEO – America / Head of Recycling Frank Moon Co - CEO – Asia / Head of Magnet Production EM&T Executive Management 4 EM&T has a deeply experienced team with the vision to bring EM&T to envisioned state and beyond

9 Proprietary and Confidential | Dean Evans will serve as Chief Marketing Officer of EM&T , bringing over 25 years of experience in the automotive and technology industries . He has been recognized as a Forbes Top 20 Global CMO and a Fortune 300 Top CMO . Mr . Evans has held leadership roles at Hyundai Motor America, Genesis Motor America, Subaru of America, and Cars . com . Mr . Evans’ extensive expertise in marketing, combined with his leadership experience at major automotive companies, positions him to drive EM&T’s global marketing strategies and brand growth . He holds a Bachelor of Science degree from the University of South Dakota and an MBA from the University of Phoenix . Dean Evans CMO Albert Watkins will serve as Chief Legal Officer of EM&T . Mr . Watkins is the founding and managing member of Kodner Watkins, a St . Louis law firm founded in 1989 . In his fourth decade as a practicing counsel, Mr . Watkins is possessed of significant experience representing regulated industry members, especially those involving the financial industry (banks, broker - dealers, investment advisory firms) and the international metals trading industry . The scope of this representation has included both publicly traded and private companies . Additionally, his practice experience includes a wealth of complex civil state and federal litigation around the country, involving many nationally and internationally recognized clients and matters . Mr . Watkins is known for his unique ability to navigate national and international media arising out of his case load and an attention to all matters transactional in nature . He holds a B . A . and a J . D . from Saint Louis University . Albert S. Watkins, Esq. CLO Christopher Clower CFO / COO Christopher Clower will serve as Chief Financial Officer and Chief Operating Officer of EM&T . Mr . Clower was appointed as the COO and a Director of WTMA upon inception in December 2021 and has been an executive director and COO of Welsbach Holdings Pte Ltd since March 2021 . From 2014 - 2024 , Mr . Clower was an independent director of Malacca Trust Pte Ltd which owns the leading asset management firm in Indonesia . Mr . Clower was Managing Director and Head of Corporate Finance Southeast Asia for Merrill Lynch and raised over $ 4 billion of capital for his clients . Prior to his career as an Investment Banker, Mr . Clower served as an intelligence officer for the United States Air Force, serving at Clark Air Base in the Philippines with the 90 th Tactical Fighter Squadron . Mr . Clower holds a Bachelor of Science in Nuclear Engineering from Northwestern University and an MBA with Honors fro m the University of Chicago . EM&T Executive Management 4 EM&T has a deeply experienced team with the vision to bring EM&T to envisioned state and beyond

10 Proprietary and Confidential | • EM&T expects to have proprietary access to attractive and abundant feedstock, focusing on end - of - life materials to: • recycle e - scrap including DoD e - scrap to produce oxides, metals, alloy powder and flakes, and sintered and bonded magnets for in dustries including, but not limited to, renewable energy, automotive, aerospace, defense, healthcare, high tech, electronics and others; • recycle lithium - ion batteries to produce battery grade materials for OEM gigafactories; • recycle and reintroduce precious metals into the US domestic market. • Global Leader in L ithium - ion B attery R ecycling: base metals historically have had a very high recycling ra te: 50% of the world’s aluminum supply comes from recycling; copper is 100% recyclable, and nearly all copper ever mined is still in circulation due to near 100% recycling rat e. 1 EM&T intends to bring that recycling operationa l expertise to the lithium - ion battery space, which has high growth outlook as the world transitions to sustainable energy stora ge solutions needed to expand the renewable energy industry. • DoD e - Scrap Recycling Solution: historic sole solution to recycle DoD e - scrap is to incinerate, which is unreliable, environmentally poor, with small capacity. And not all the incinerators are secured facilities; for facilities that are not secured facilities, the classified e - scrap cannot b e stored on site. These incinerators produce a dust product that is bought only by China. • EM&T plans to offer the DoD a highly reliable recycling solution with large commercial capacity, utilizing pulverization inst ead of incineration. This process enables the recovery of precious metals from components like printed circuit boards, produces NdPr oxides for magnet manufacturing, and is significantly more environmentally friendly. • EM&T is expected to build a secured facility, allowing allow on - site storage of classified materials, enabling acceptance of all DoD shipments, even unscheduled, without disrupting plant operations. The ability to handle all classified shipments promptly, even unscheduled o nes , is critical for maintaining a strong, trusted relationship with the DoD, positioning EM&T as a reliable partner. • Having a secured facility maximizes capacity utilization and maximizes EBITDA, as EBITDA is highly sensitive to capacity util iza tion due to high fixed costs and overheads being constant. • Incinerators sell the dust product to China because the US and Western Countries have no midstream capacity to process the du st. • DoD, including all branches of the US military, multiple intelligence agencies and investigative agencies, and all of their s upp liers turn over electronics every 3 - 5 years. Millions of pounds of DoD e - scrap are being stored expensively due to no recycling solution in the past. 2 EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 5 1 https://www.visualcapitalist.com/sp/visualizing - all - the - known - copper - in - the - world 2 https://www.matrix - ndi.com/resources/maximizing - efficiency - the - three - to - five - year - it - infrastructure - refresh - cycle/

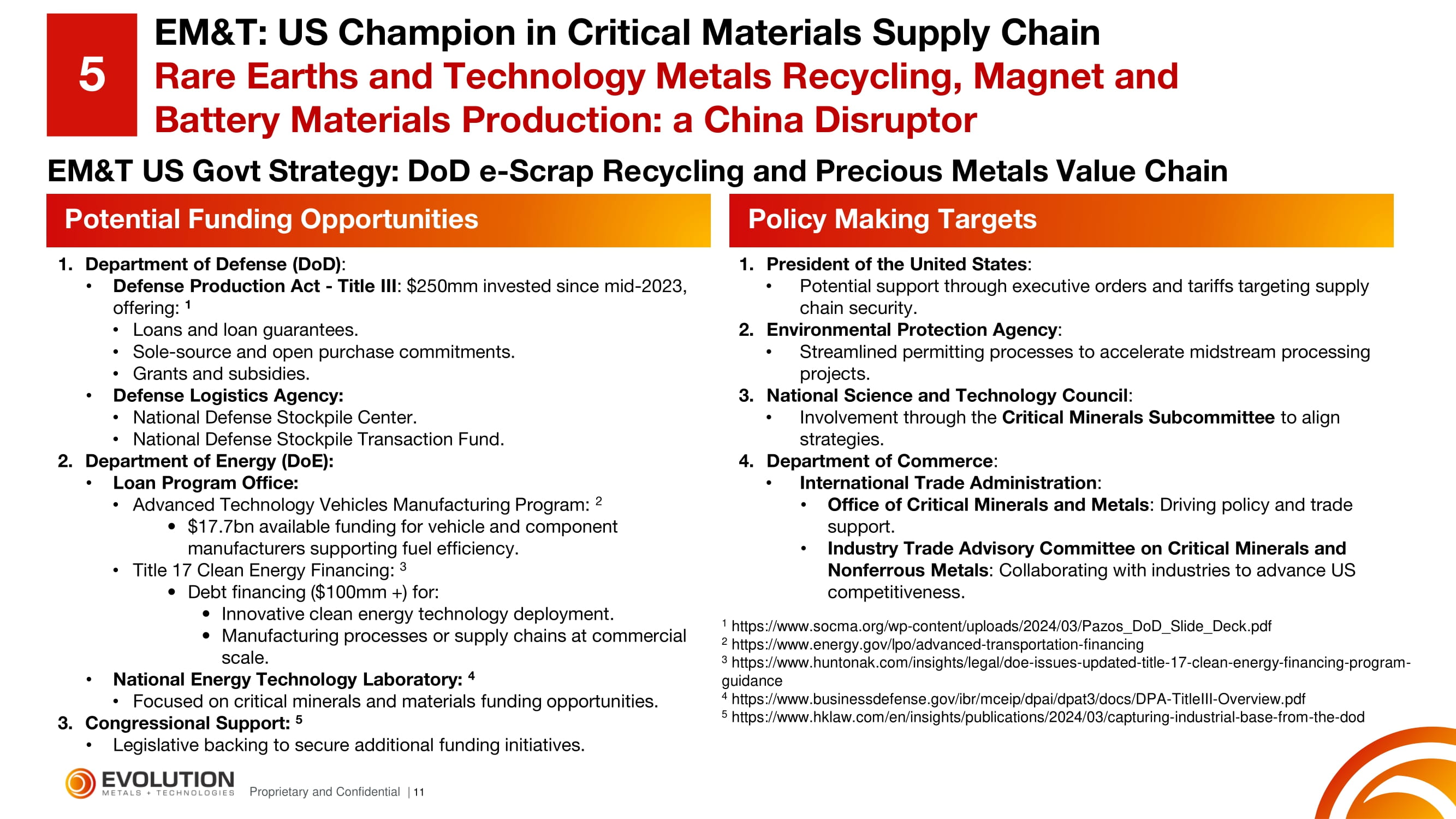

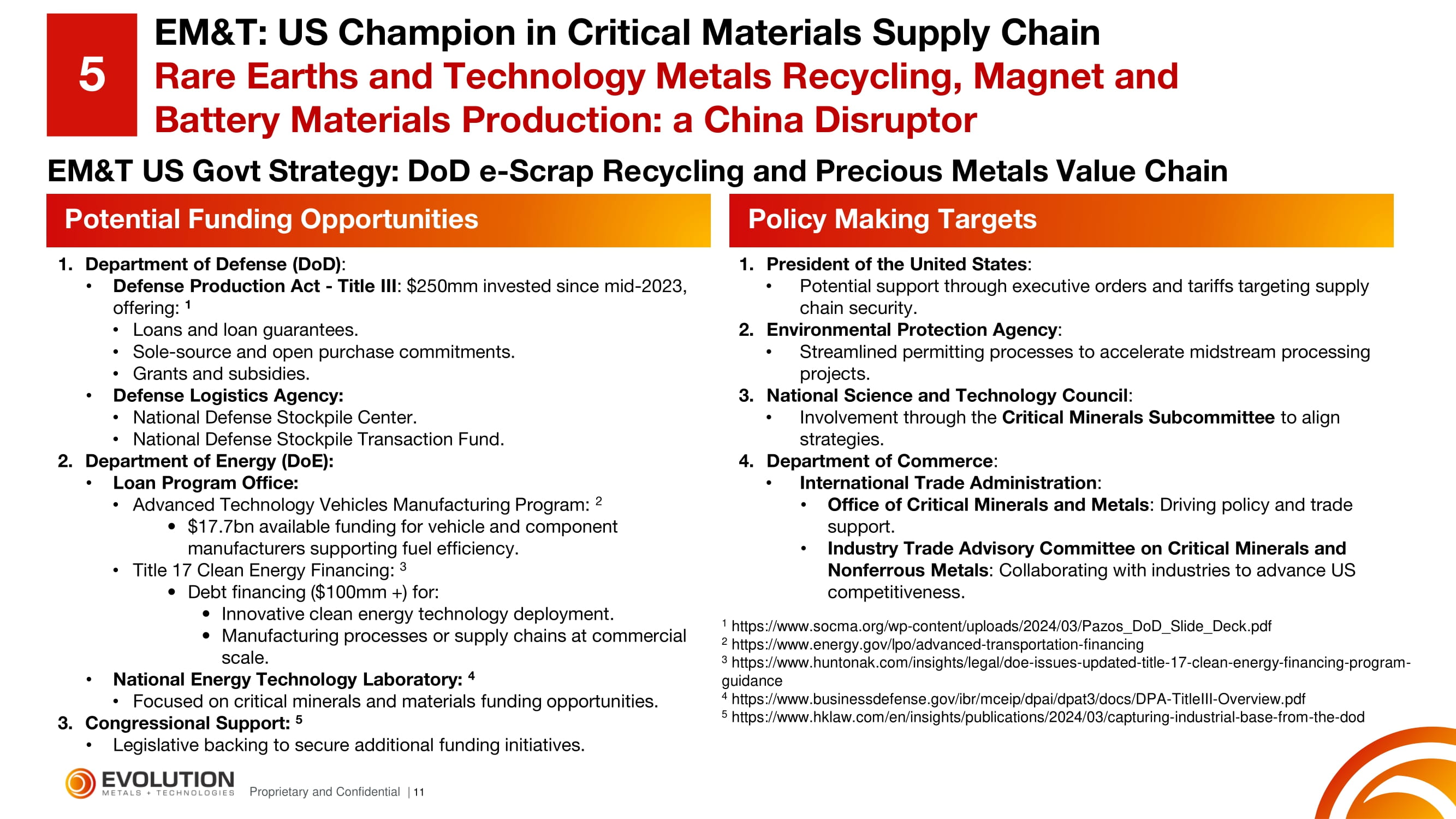

11 Proprietary and Confidential | EM&T US Govt Strategy: DoD e - Scrap Recycling and Precious Metals Value Chain Potential Funding Opportunities 1. Department of Defense (DoD) : • Defense Production Act - Title III : $250mm invested since mid - 2023, offering: 1 • Loans and loan guarantees. • Sole - source and open purchase commitments. • Grants and subsidies. • Defense Logistics Agency: • National Defense Stockpile Center. • National Defense Stockpile Transaction Fund. 2. Department of Energy (DoE): • Loan Program Office: • Advanced Technology Vehicles Manufacturing Program: 2 • $17.7bn available funding for vehicle and component manufacturers supporting fuel efficiency. • Title 17 Clean Energy Financing: 3 • Debt financing ($100mm +) for: • Innovative clean energy technology deployment. • Manufacturing processes or supply chains at commercial scale. • National Energy Technology Laboratory: 4 • Focused on critical minerals and materials funding opportunities. 3. Congressional Support: 5 • Legislative backing to secure additional funding initiatives. 1. President of the United States : • Potential support through executive orders and tariffs targeting supply chain security. 2. Environmental Protection Agency : • Streamlined permitting processes to accelerate midstream processing projects. 3. National Science and Technology Council : • Involvement through the Critical Minerals Subcommittee to align strategies. 4. Department of Commerce : • International Trade Administration : • Office of Critical Minerals and Metals : Driving policy and trade support. • Industry Trade Advisory Committee on Critical Minerals and Nonferrous Metals : Collaborating with industries to advance US competitiveness. Policy Making Targets EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 5 1 https://www.socma.org/wp - content/uploads/2024/03/Pazos_DoD_Slide_Deck.pdf 2 https://www.energy.gov/lpo/advanced - transportation - financing 3 https://www.huntonak.com/insights/legal/doe - issues - updated - title - 17 - clean - energy - financing - program - guidance 4 https://www.businessdefense.gov/ibr/mceip/dpai/dpat3/docs/DPA - TitleIII - Overview.pdf 5 https://www.hklaw.com/en/insights/publications/2024/03 /capturing - industrial - base - from - the - dod

12 Proprietary and Confidential | Roll - Up, Not a Startup • EM&T plans to acquire one US company, which recycles lithium - ion batteries/battery materials, and a portfolio of Korean companies, which process oxides, metals, alloy powder and alloy flake and produces bonded and sintered magnets, and provide automation . • EM&T plans to consolidate established companies with operational infrastructure and proven technologies , ensuring reliability and scalability . EM&T is pursing a US - centric investment initiative , replicating the Korean capabilities into a singular industrial campus in Missouri to recycle end - of - life materials into magnet and battery materials that feed gigafactories and OEMs . » The Korean companies are operational . » On October 30 , 2024 , a fire occurred at our Missouri Li - ion battery recycling facility, resulting in a total financial loss of the facility . We plan to rebuild the facility with a significant capacity expansion ; however, the time required to rebuild and expand on the plant is contingent upon securing sufficient funding . Prior to the fire, the plant was fully operational with full capacity capability . The rebuild should be expedited as the same engineering plans are being used with operational improvements . Mitigating Technology Risk Investing in Next - Generation Technologies • All technologies expected to be utilized by EM&T are based on commercial - scale, proven processes operational in the US and Korea , minimizing execution risks . • EM&T expects to earmark funds to acquire and scale proven technologies that could improve operational efficiency, quality, and profitability for EM&T’s operations . EM&T plans to deploy existing and proven technologies; EM&T is not dependent upon new technology EM&T Roll - Up & Scaling of Operating Businesses with Proven Technologies 6

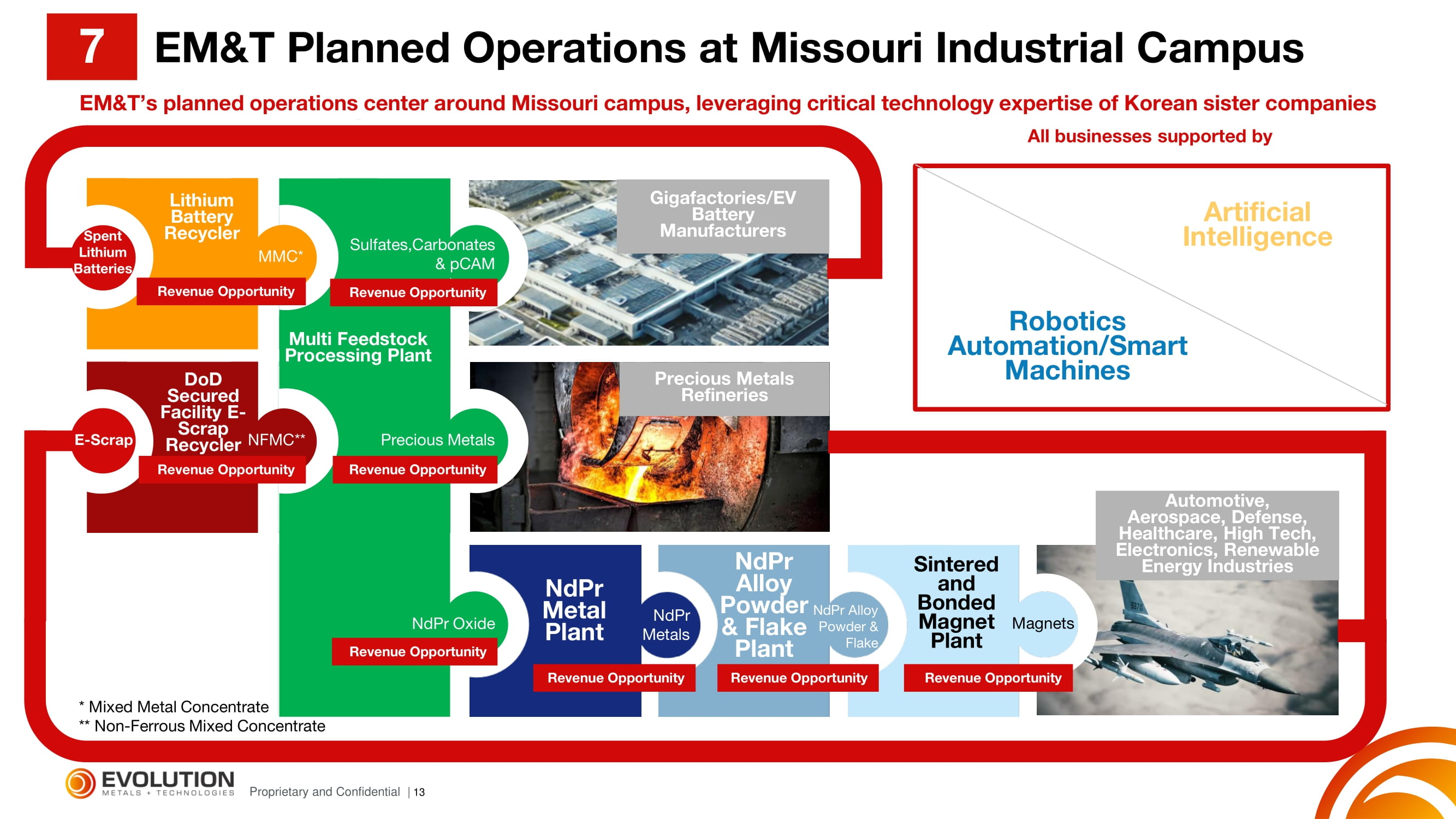

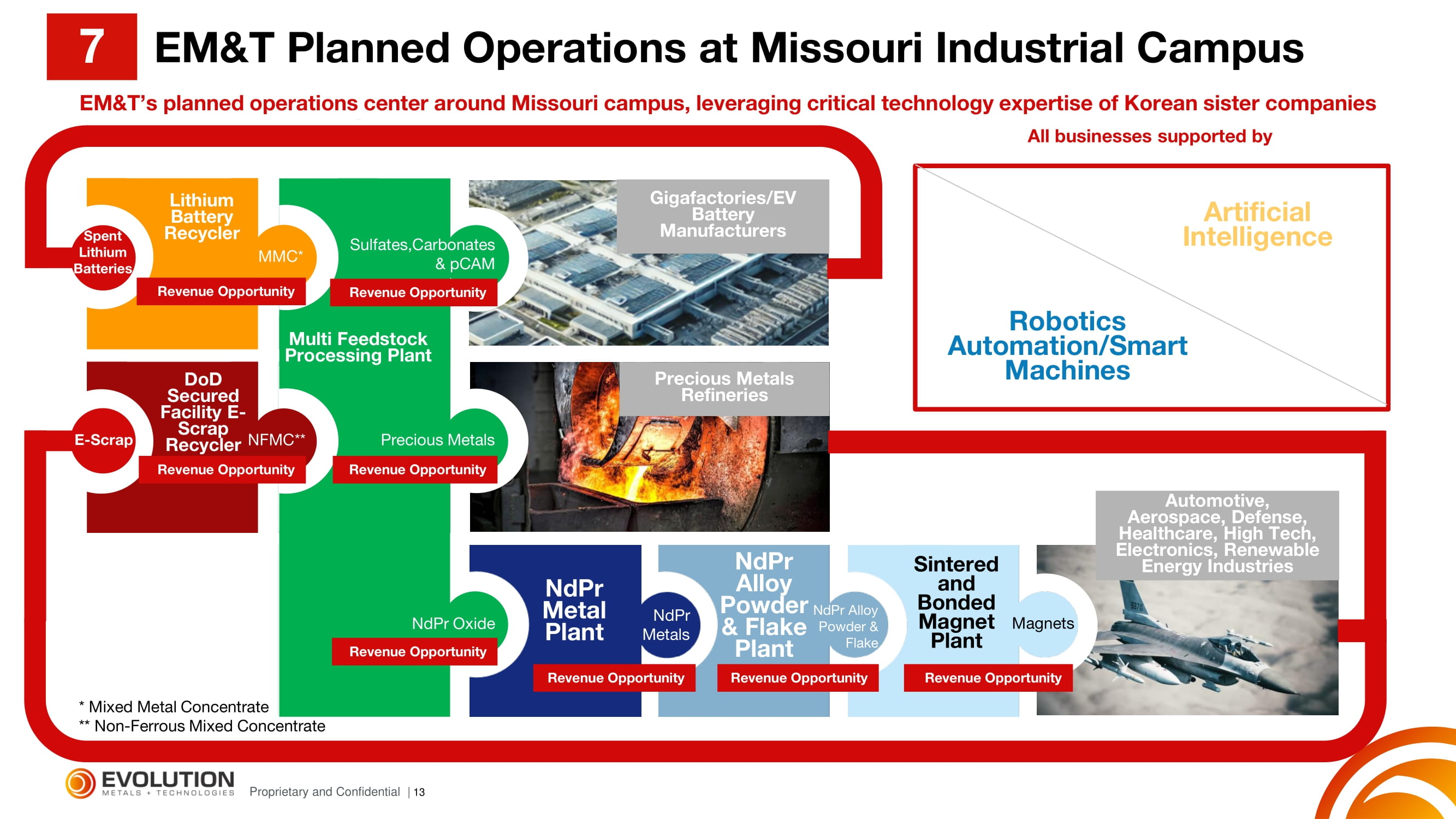

13 Proprietary and Confidential | Precious Metals Refineries Gigafactories/EV Battery Manufacturers Lithium Battery Recycler DoD Secured Facility E - Scrap Recycler Sulfates,Carbonates & pCAM Multi Feedstock Processing Plant MMC* NFMC** Precious Metals NdPr Oxide NdPr Metal Plant NdPr Metals NdPr Alloy Powder & Flake Plant NdPr Alloy Powder & Flake Sintered and Bonded Magnet Plant Magnets Automotive, Aerospace, Defense, Healthcare, High Tech, Electronics, Renewable Energy Industries Spent Lithium Batteries E - Scrap Robotics Automation/Smart Machines Artificial Intelligence All businesses supported by Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity * Mixed Metal Concentrate ** Non - Ferrous Mixed Concentrate EM&T Planned Operations at Missouri Industrial Campus 7 EM&T’s planned operations center around Missouri campus, leveraging critical technology expertise of Korean sister companies

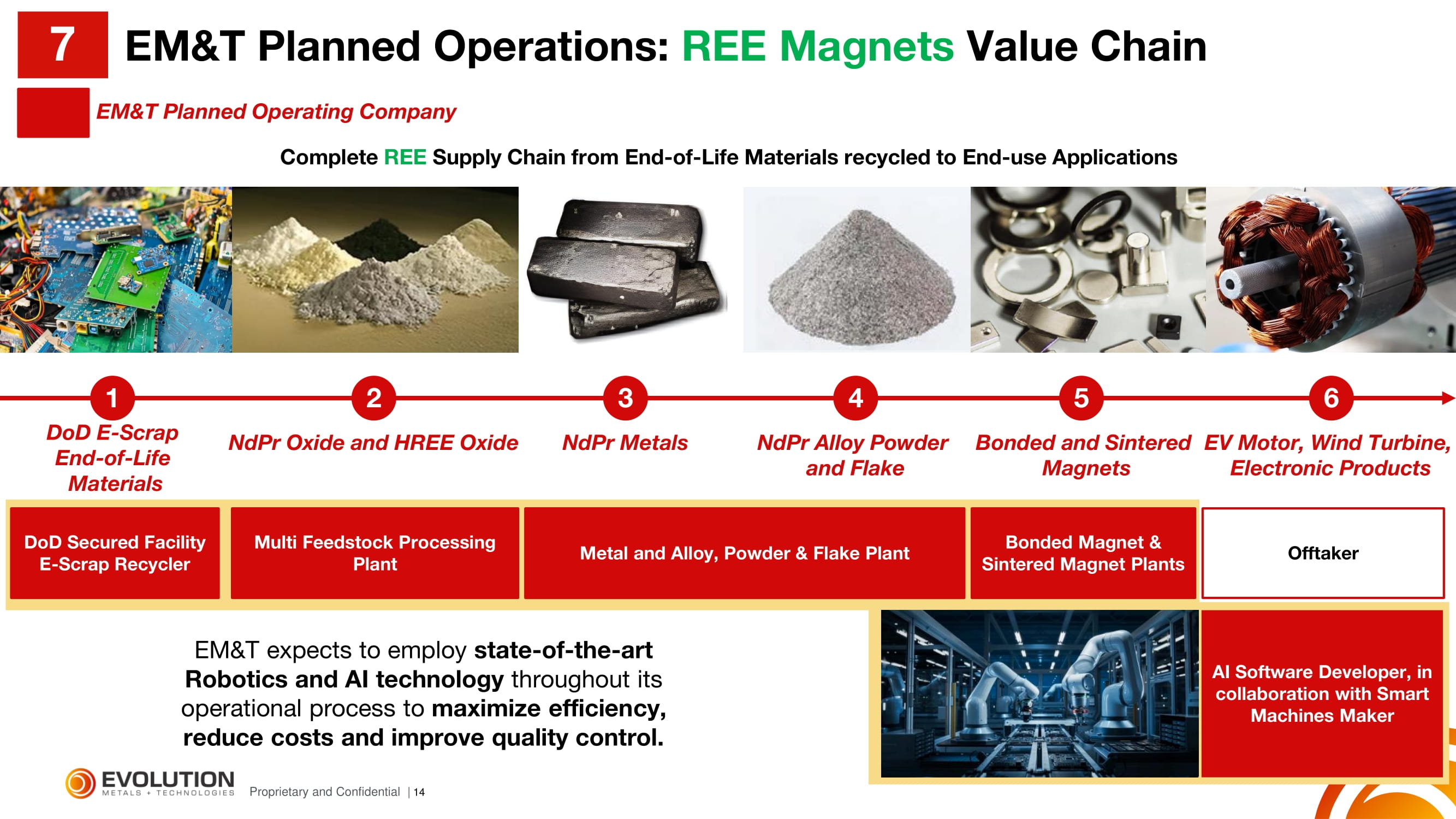

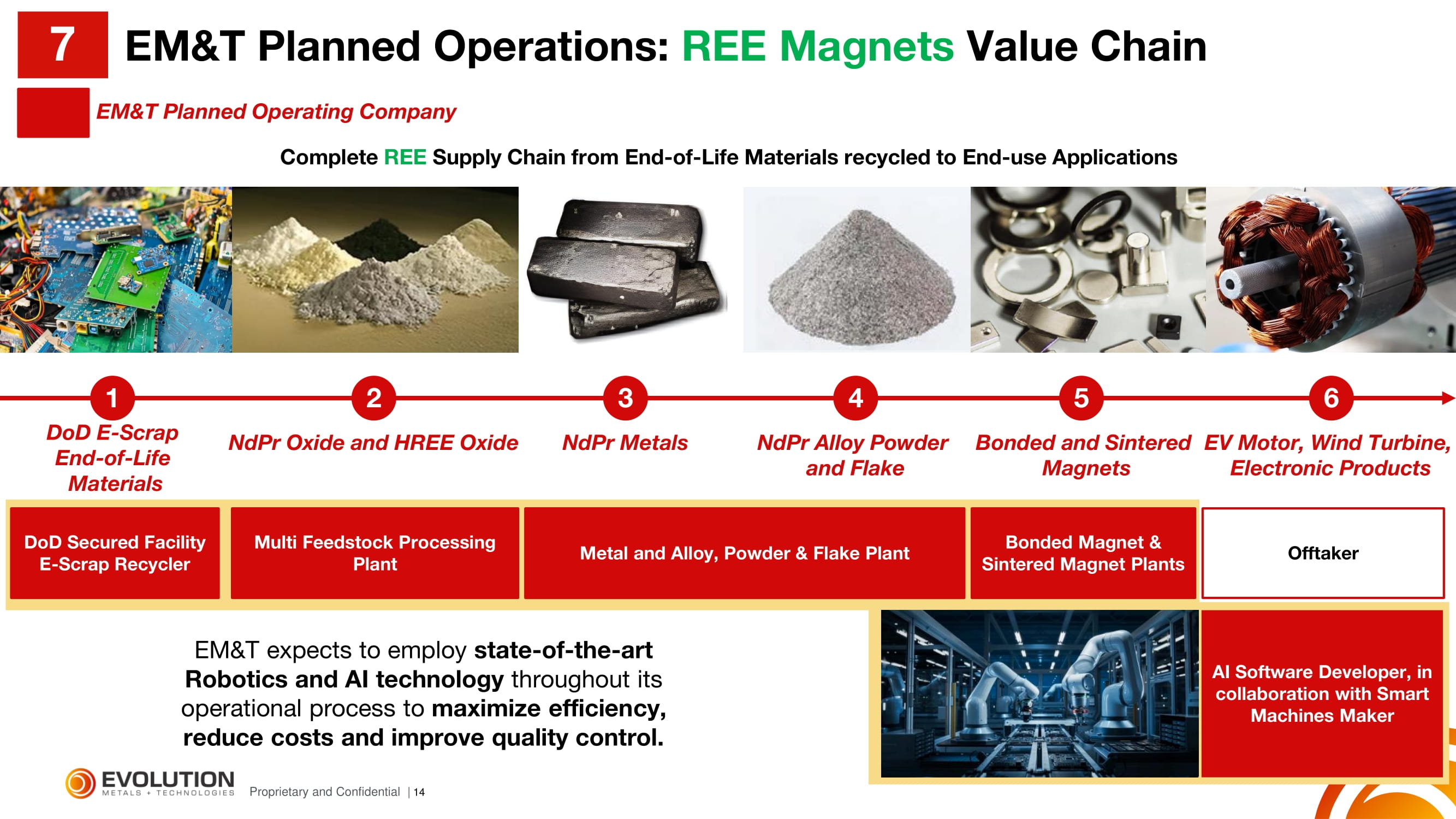

14 Proprietary and Confidential | EM&T expects to employ state - of - the - art Robotics and AI technology throughout its operational process to maximize efficiency, reduce costs and improve quality control. Complete REE Supply Chain from End - of - Life Materials recycled to End - use Applications DoD E - Scrap End - of - Life Materials 1 2 3 4 5 6 NdPr Oxide and HREE Oxide NdPr Metals NdPr Alloy Powder and Flake Bonded and Sintered Magnets EV Motor, Wind Turbine, Electronic Products Multi Feedstock Processing Plant Metal and Alloy, Powder & Flake Plant Bonded Magnet & Sintered Magnet Plants Offtaker AI Software Developer, in collaboration with Smart Machines Maker EM&T Planned Operating Company DoD Secured Facility E - Scrap Recycler EM&T Planned Operations: REE Magnets Value Chain 7

15 Proprietary and Confidential | Complete Battery Value Chain from End - of - Life Materials recycled to Gigafactory Input Materials Spent Lithium - ion Batteries and Battery Materials 1 2 3 4 Mixed Metal Concentrate Battery Sulfates/Carbonates & pCAM High - performance EV Lithium Batteries EV Lithium Battery Recycler Multi Feedstock Processing Plant Buyer/Gigafactories/ Battery Manufacturers AI Software Developer, in collaboration with Smart Machines Maker Spent EV Lithium Battery Suppliers/Interco EM&T Planned Operations: Lithium - Ion Battery Value Chain 7 EM&T Planned Operating Company EM&T expects to employ state - of - the - art Robotics and AI technology throughout its operational process to maximize efficiency, reduce costs and improve quality control.

16 Proprietary and Confidential | Complete E - Scrap & Precious Metals Value Chain from End - of - Life Materials recycled to End - use Applications DoD E - Scrap 1 2 3 4 Non - Ferrous Metal Concentrates Precious Metals (Gold, Silver, Palladium, Copper) Precious Metals Ingots DoD Secured Facility E - Scrap Recycler Multi Feedstock Processing Plant Global Buyer / Refinery / Ingot Maker E - Scrap Suppliers US DoD, all US military agencies, including US three letter agencies (DoD, NSA, CIA, FBI, etc.) and their suppliers AI Software Developer, in collaboration with Smart Machines Maker EM&T Planned Operations: DoD E - Scrap Value Chain 7 EM&T Planned Operating Company EM&T expects to employ state - of - the - art Robotics and AI technology throughout its operational process to maximize efficiency, reduce costs and improve quality control.

17 Proprietary and Confidential | Strong Political and Community Support 1. Missouri Leadership: • Governor Mike Parson and Governor - Elect Mike Kehoe are strong supporters of EM&T’s plans, with Mr. Kehoe assigning a dedicated state liaison, Ms. Sandra Cabot, to specifically assist with this project. • Ms. Cabot's connections with the Missouri Department of Natural Resources (DNR) and legislative liaisons bolster regulatory alignment. 2. Local Government and Law Enforcement: • Fredericktown and Madison County are supportive of EM&T’s initiatives. • Local police and firefighters have been engaged to secure the project site and support emergency preparedness. 3. Federal Representatives: • US Rep. Jason Smith, Chairman of the House Ways and Means Committee and Congressman of Fredericktown, Missouri, and Senator Josh Hawley have proactively supported the Project within Washington, D.C. • State Rep. Dale Wright represents Fredericktown, Missouri and also is strongly supportive of the plans of EM&T. • On 10 Dec 2024, President Donald J. Trump said his administration would speed the approval of big construction projects for companies that invest more than $1bn. 1 4. Community Engagement: • Local stakeholders, including the Fredericktown School Board, are being consulted, addressing concerns about facility proximity to schools. • Surrounding community in Fredericktown, Missouri being provided financial support. 1. Favorable Relationships with DNR and EPA: • DNR has been a collaborative partner for the past two years, supported by enhanced ties with the EPA’s Enforcement Division and TFS team. • This collaboration streamlines the permitting process and ensures compliance with environmental regulations. 2. Department of Transportation (DOT) defers to EPA Guidelines: • The DOT defers to EPA guidelines on regulatory overlaps, simplifying the licensing process for transportation - related aspects of the project. 3. Minimal Risk of Licensing: • We believe state and local licensing hurdles have a minimal risk profile, given the strong relationships and broad support from local and federal authorities. Regulatory Collaboration and Licensing Confidence 1 https:// www.wsj.com /politics/policy/trump - permit - promise - large - projects - b63ecbae EM&T Minimal Licensing Risk for Missouri Industrial Campus 7

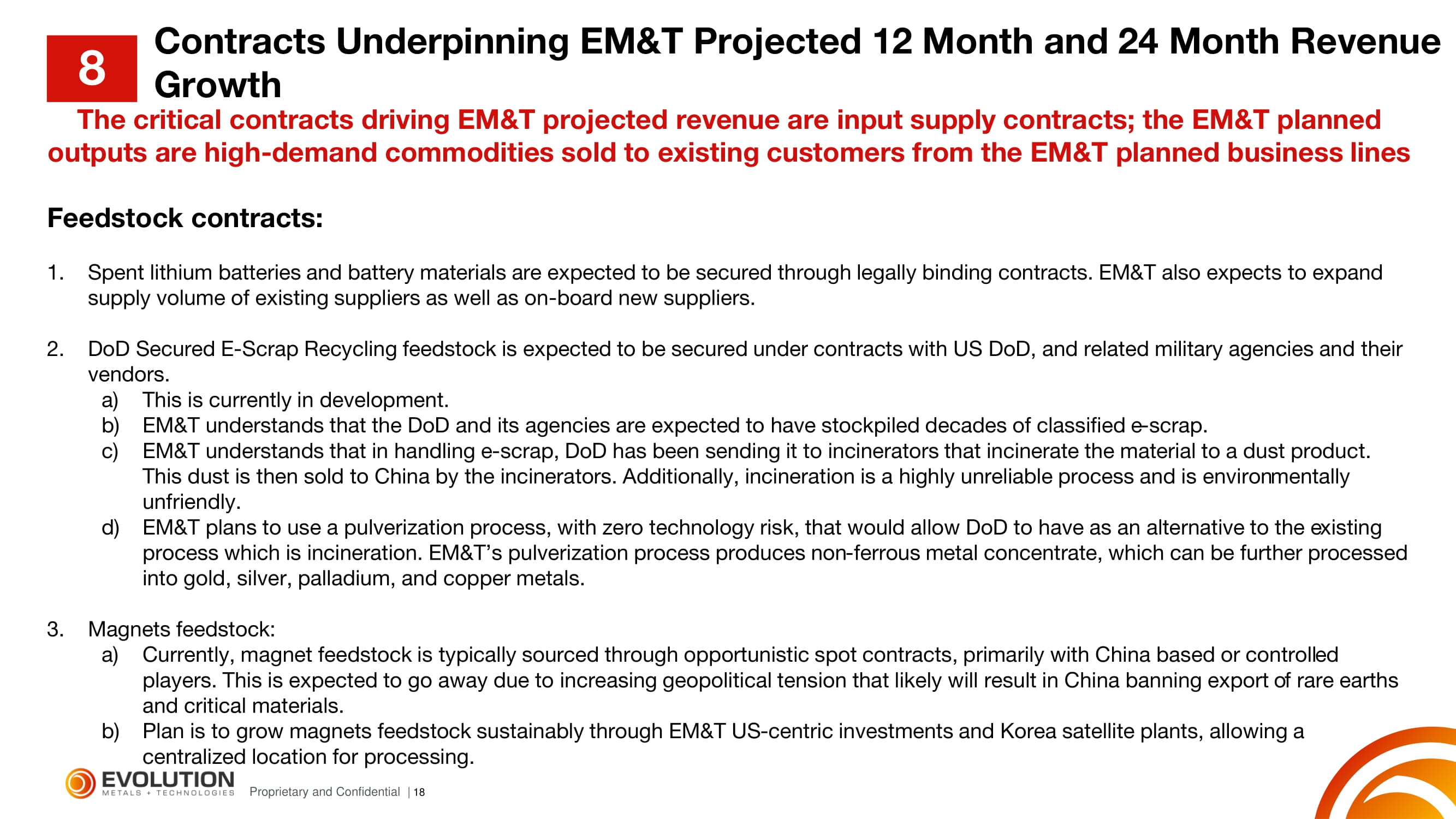

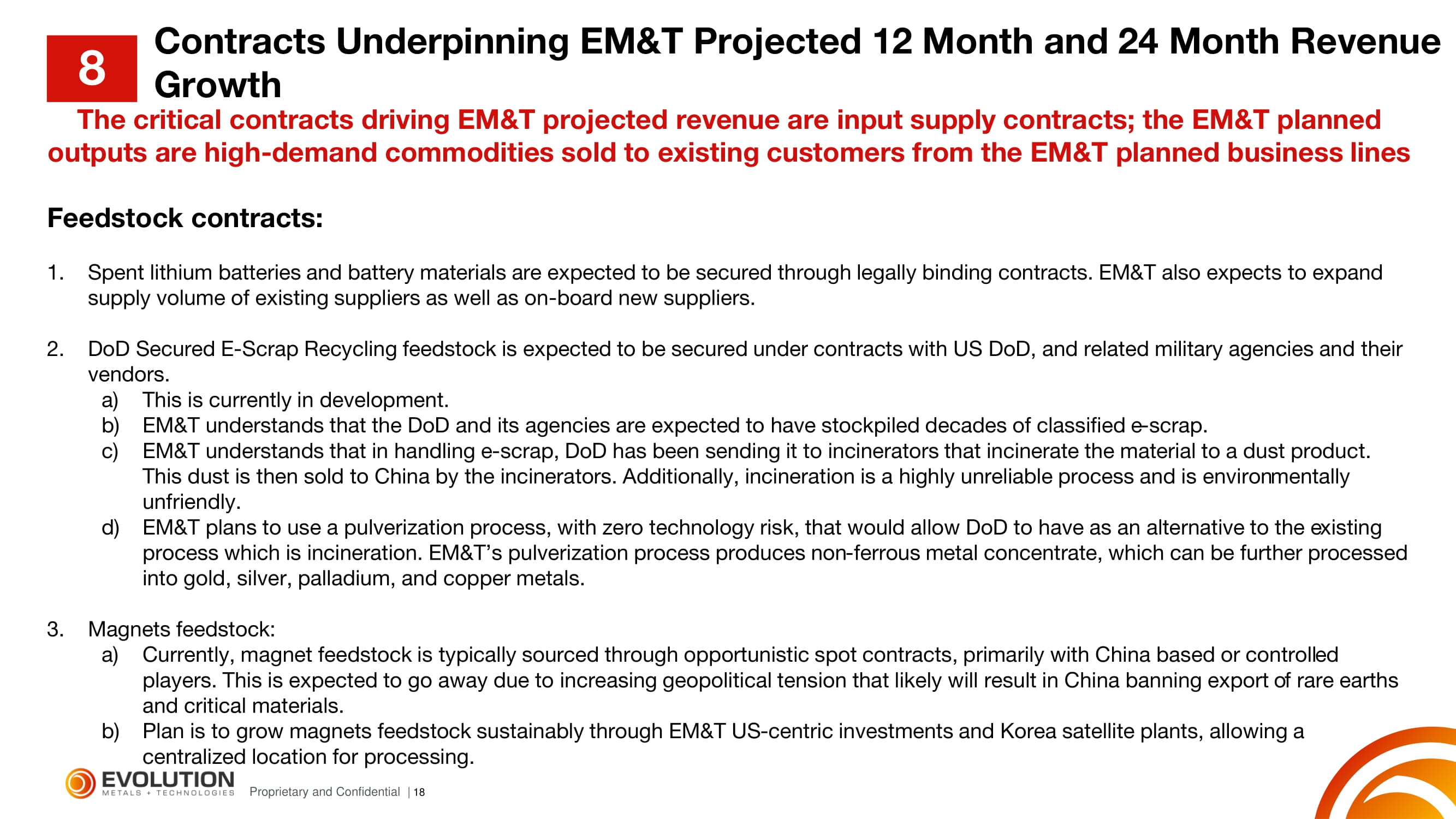

18 Proprietary and Confidential | The critical contracts driving EM&T projected revenue are input supply contracts; the EM&T planned outputs are high - demand commodities sold to existing customers from the EM&T planned business lines Feedstock contracts: 1. Spent lithium batteries and battery materials are expected to be secured through legally binding contracts. EM&T also expects to expand supply volume of existing suppliers as well as on - board new suppliers. 2. DoD Secured E - Scrap Recycling feedstock is expected to be secured under contracts with US DoD, and related military agencies and their vendors. a) This is currently in development. b) EM&T understands that the DoD and its agencies are expected to have stockpiled decades of classified e - scrap. c) EM&T understands that in handling e - scrap, DoD has been sending it to incinerators that incinerate the material to a dust produc t. This dust is then sold to China by the incinerators. Additionally, incineration is a highly unreliable process and is environ men tally unfriendly. d) EM&T plans to use a pulverization process, with zero technology risk, that would allow DoD to have as an alternative to the e xis ting process which is incineration. EM&T’s pulverization process produces non - ferrous metal concentrate, which can be further process ed into gold, silver, palladium, and copper metals. 3. Magnets feedstock: a) Currently, magnet feedstock is typically sourced through opportunistic spot contracts, primarily with China based or controll ed players. This is expected to go away due to increasing geopolitical tension that likely will result in China banning export o f r are earths and critical materials. b) Plan is to grow magnets feedstock sustainably through EM&T US - centric investments and Korea satellite plants, allowing a centralized location for processing. Contracts Underpinning EM&T Projected 12 Month and 24 Month Revenue Growth 8

19 Proprietary and Confidential | EM&T Planned Disruptive Cost Structure: Competing with China on Cost and Optimizing Profitability Recycling Operations to Support Magnet Making • Magnet making for EM&T has a large degree of strategic value globally to disrupt China’s monopoly in this space . • EM&T expects that EM&T’s magnet companies will have lower profitability due to China market competition and intentionally lowering the market price . • EM&T plans to continue producing magnets through the economic business cycles and through any Chinese retaliation to meet the global demand : • EM&T expects to generate revenue primarily through : (a) Battery Recycling and (b) US DoD E - Scrap Recycling . • These higher - margin operations are expected to support EM&T’s magnet making businesses and provide financial stability . Proven Operating Technologies • Operating companies in Korea and Missouri are expected to expand into a singular industrial campus in Missouri . • All technologies expected to be utilized by EM&T are based on proven commercial - scale processes, currently operating successfully in the US and Korea, ensuring reliability and scalability without technology risk . • EM&T plans to implement automation technologies through smart machines across EM&T’s planned operations to reduce costs and increase efficiency . • AI and Smart Machines Integration : EM&T is already in process to acquire an AI software company, which works with a smart machine making company, to develop industrial automation for EM&T’s plants . Focus on End - of - Life Materials • EM&T expects to focus on urban aboveground mining, recovering and reintroducing critical materials from end - of - life materials back into the supply chain . • EM&T expects to bring critical materials recycling to be as common as base metals recycling . • There is substantial amount of available e - waste feed material from DoD and its military agencies . • There are also commercially available materials from end - of - life automotive and battery sectors . • Substantial existing contracts with large OEMs including most of the world’s auto and Li - ion battery manufacturers such as LG, SK, GM, and Ford . • Recycling end - of - life materials, which typically contain higher concentrations of critical metals than ores, reduces mining and import costs while leveraging local supply chains and efficient technologies to disrupt China’s midstream processing . EM&T: US Champion in Critical Materials Supply Chain Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 9

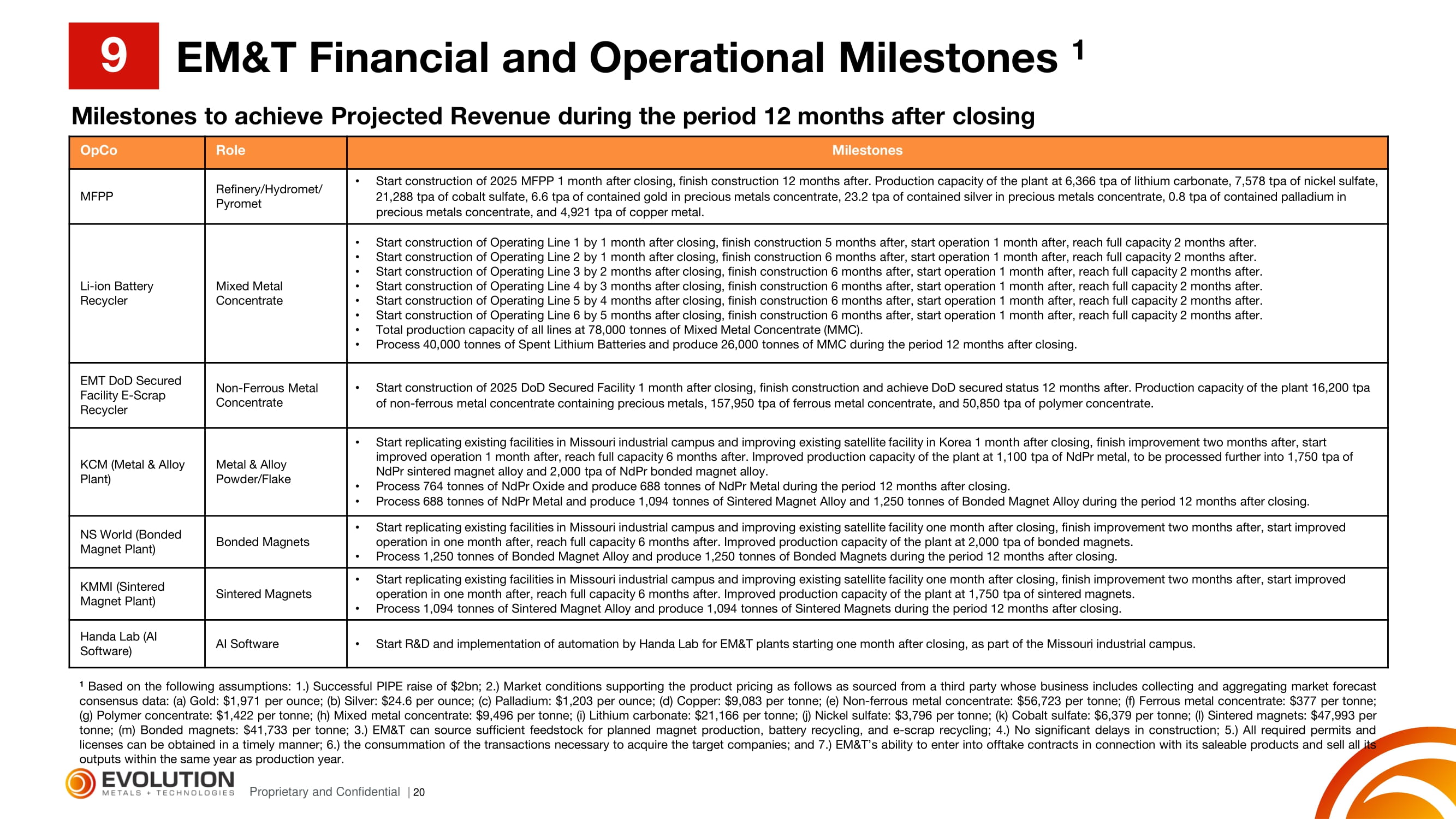

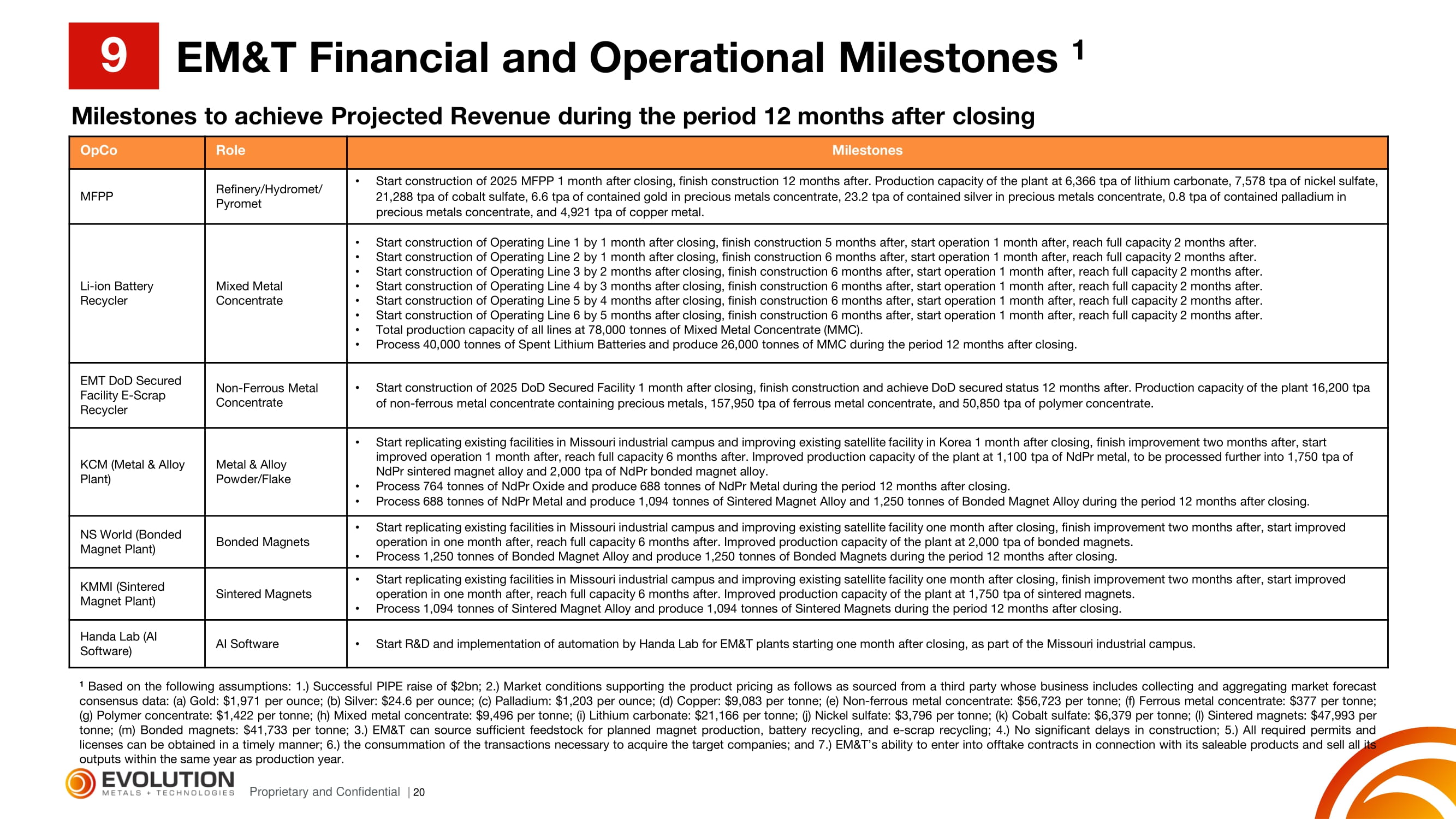

20 Proprietary and Confidential | Milestones to achieve Projected Revenue during the period 12 months after closing Milestones Role OpCo • Start construction of 2025 MFPP 1 month after closing, finish construction 12 months after. Production capacity of the plant at 6,366 tpa of lithium carbonate, 7,578 tpa of nickel sulfate, 21,288 tpa of cobalt sulfate, 6.6 tpa of contained gold in precious metals concentrate , 23.2 tpa of contained silver in precious metals concentrate , 0.8 tpa of contained palladium in precious metals concentrate , and 4,921 tpa of copper metal. Refinery/ Hydromet / Pyromet MFPP • Start construction of Operating Line 1 by 1 month after closing , finish construction 5 months after, start operation 1 month after, reach full capacity 2 months after. • Start construction of Operating Line 2 by 1 month after closing , finish construction 6 months after, start operation 1 month after, reach full capacity 2 months after. • Start construction of Operating Line 3 by 2 months after closing , finish construction 6 months after, start operation 1 month after, reach full capacity 2 months after. • Start construction of Operating Line 4 by 3 months after closing , finish construction 6 months after, start operation 1 month after, reach full capacity 2 months after. • Start construction of Operating Line 5 by 4 months after closing , finish construction 6 months after, start operation 1 month after, reach full capacity 2 months after. • Start construction of Operating Line 6 by 5 months after closing , finish construction 6 months after, start operation 1 month after, reach full capacity 2 months after. • Total production capacity of all lines at 78,000 tonnes of Mixed Metal Concentrate (MMC). • Process 40,000 tonnes of Spent Lithium Batteries and produce 26,000 tonnes of MMC during the period 12 months after closing. Mixed Metal Concentrate Li - ion Battery Recycler • Start construction of 2025 DoD Secured Facility 1 month after closing, finish construction and achieve DoD secured status 12 mon ths after. Production capacity of the plant 16,200 tpa of non - ferrous metal concentrate containing precious metals, 157,950 tpa of ferrous metal concentrate, and 50,850 tpa of polymer concentrate. Non - Ferrous Metal Concentrate EMT DoD Secured Facility E - Scrap Recycler • Start replicating existing facilities in Missouri industrial campus and improving existing satellite facility in Korea 1 mont h a fter closing, finish improvement two months after, start improved operation 1 month after, reach full capacity 6 months after. Improved production capacity of the plant at 1,100 tpa of NdPr metal, to be processed further into 1,750 tpa of NdPr sintered magnet alloy and 2,000 tpa of NdPr bonded magnet alloy. • Process 764 tonnes of NdPr Oxide and produce 688 tonnes of NdPr Metal during the period 12 months after closing . • Process 688 tonnes of NdPr Metal and produce 1,094 tonnes of Sintered Magnet Alloy and 1,250 tonnes of Bonded Magnet Alloy during the period 12 months after closing. Metal & Alloy Powder/Flake KCM (Metal & Alloy Plant) • Start replicating existing facilities in Missouri industrial campus and improving existing satellite facility one month after cl osing, finish improvement two months after, start improved operation in one month after, reach full capacity 6 months after. Improved production capacity of the plant at 2,000 tpa of bonded magnets. • Process 1,250 tonnes of Bonded Magnet Alloy and produce 1,250 tonnes of Bonded Magnets during the period 12 months after closing. Bonded Magnets NS World (Bonded Magnet Plant) • Start replicating existing facilities in Missouri industrial campus and improving existing satellite facility one month after cl osing, finish improvement two months after, start improved operation in one month after, reach full capacity 6 months after. Improved production capacity of the plant at 1,750 tpa of sintered magnets. • Process 1,094 tonnes of Sintered Magnet Alloy and produce 1,094 tonnes of Sintered Magnets during the period 12 months after closing. Sintered Magnets KMMI (Sintered Magnet Plant) • Start R&D and implementation of automation by Handa Lab for EM&T plants starting one month after closing, as part of the Miss our i industrial campus. AI Software Handa Lab (AI Software) EM&T Financial and Operational Milestones 1 9 1 Based on the following assumptions : 1 . ) Successful PIPE raise of $ 2 bn ; 2 . ) Market conditions supporting the product pricing as follows as sourced from a third party whose business includes collecting and aggregating market forecast consensus data : (a) Gold : $ 1 , 971 per ounce ; (b) Silver : $ 24 . 6 per ounce ; (c) Palladium : $ 1 , 203 per ounce ; (d) Copper : $ 9 , 083 per tonne ; (e) Non - ferrous metal concentrate : $ 56 , 723 per tonne ; (f) Ferrous metal concentrate : $ 377 per tonne ; (g) Polymer concentrate : $ 1 , 422 per tonne ; (h) Mixed metal concentrate : $ 9 , 496 per tonne ; ( i ) Lithium carbonate : $ 21 , 166 per tonne ; (j) Nickel sulfate : $ 3 , 796 per tonne ; (k) Cobalt sulfate : $ 6 , 379 per tonne ; (l) Sintered magnets : $ 47 , 993 per tonne ; (m) Bonded magnets : $ 41 , 733 per tonne ; 3 . ) EM&T can source sufficient feedstock for planned magnet production, battery recycling, and e - scrap recycling ; 4 . ) No significant delays in construction ; 5 . ) All required permits and licenses can be obtained in a timely manner ; 6 . ) the consummation of the transactions necessary to acquire the target companies ; and 7 . ) EM&T’s ability to enter into offtake contracts in connection with its saleable products and sell all its outputs within the same year as production year .

21 Proprietary and Confidential | Milestones to achieve Projected Revenue during the second 12 months after closing Milestones Role OpCo • Start operation of 2025 MFPP by 13 months after closing, reach full capacity 6 months after. • Start construction of 2026 MFPP 13 months after closing, finish construction 12 months after. Production capacity of the plant at 5,536 tpa of lithium carbonate, 25,650 tpa of nickel sulfate, 4,875 tpa of cobalt sulfate, 13.1 tpa of contained gold in precious metals concentrate, 46.4 tpa of contained silver in precious metals concentrate, 1.6 tpa of contained palladium in precious metals concentrate, 9,842 tpa of copper metal. • Process 20,583 tonnes of MMC and produces 5,040 tonnes of LiCO3, 6,000 tonnes of NiSO4, 16,853 tonnes of CoSO4 during the second 12 months after closing. • Process 6,413 tonnes of NFMC and produce 5.2 tonnes of contained Gold in precious metals concentrate , 18.4 tonnes of contained Silver in precious metals concentrate , 0.6 tonnes of contained Palladium in precious metals concentrate , 3,896 tonnes of Copper Metal during the second 12 months after closing. Processing Plant MFPP • Process 120,000 tonnes of Spent Lithium Batteries and produces 78,000 tonnes of MMC during the second 12 months after closing. Mixed Metal Concentrate Li - ion Battery Recycler • Start operation of 2025 DoD Secured Facility by 13 months after closing, reach full capacity 6 months after. • Start construction of 2026 Dod Secured Facility by 13 months after closing, finish construction and achieve DoD secured statu s 1 2 months after. Production capacity of the plant at • Process 178,125 tonnes of E - Scrap and produce 12,825 tonnes of NFMC, 125,044 tonnes of FMC, 40,256 tonnes of Polymer Concentrate during the second 12 months after closing. Non - Ferrous Metal Concentrate EMT DoD Secured Facility E - Scrap Recycler • Start construction of 2026 Metal Plant 13 months after closing, finish construction 12 months after. Production capacity of t he plant at 2,200 tpa of NdPr metal. • Start construction of 2026 Alloy Plant 13 months after closing, finish construction 12 months after. Production capacity of t he plant at 3,500 tpa of NdPr sintered magnet alloy and 4,000 tpa of NdPr bonded magnet alloy. • Process 1,222 tonnes of NdPr Oxide and produce 1,100 tonnes of NdPr Metal during the second 12 months after closing. • Process 1,100 tonnes of NdPr Metal and produce 1,750 tonnes of Sintered Magnet Alloy and 2,000 tonnes of Bonded Magnet Alloy during the second 12 months after closing. Metal & Alloy Powder/Flake KCM (Metal & Alloy Plant) • Start construction of 2026 Bonded Magnet Plant 13 months after closing, finish construction 12 months after. Production capac ity of the plant at 4,000 tpa of NdPr bonded magnets. • Process 2,000 tonnes of Bonded Magnet Alloy and produce 2,000 tonnes of Bonded Magnets during the second 12 months after closing. Bonded Magnets NS World (Bonded Magnet Plant) • Start construction of 2026 Sintered Magnet Plant 13 months after closing, finish construction 12 months after. Production cap aci ty of the plant at 3,500 tpa of NdPr sintered magnets. • Process 1,750 tonnes of Sintered Magnet Alloy and produce 1,750 tonnes of Sintered Magnets during the second 12 months after closing. Sintered Magnets KMMI (Sintered Magnet Plant) EM&T Financial and Operational Milestones 1 9 1 Based on the following assumptions : 1 . ) Successful PIPE raise of $ 2 bn ; 2 . ) Market conditions supporting the product pricing as follows as sourced from a third party whose business includes collecting and aggregating market forecast consensus data : (a) Gold : $ 1 , 882 per ounce ; (b) Silver : $ 23 . 9 per ounce ; (c) Palladium : $ 1 , 166 per ounce ; (d) Copper : $ 9 , 326 per tonne ; (e) Non - ferrous metal concentrate : $ 54 , 162 per tonne ; (f) Ferrous metal concentrate : $ 348 per tonne ; (g) Polymer concentrate : $ 1 , 383 per tonne ; (h) Mixed metal concentrate : $ 9 , 925 per tonne ; ( i ) Lithium carbonate : $ 22 , 249 per tonne ; (j) Nickel sulfate : $ 3 , 928 per tonne ; (k) Cobalt sulfate : $ 6 , 675 per tonne ; (l) Sintered magnets : $ 68 , 562 per tonne ; (m) Bonded magnets : $ 59 , 619 per tonne ; 3 . ) EM&T can source sufficient feedstock for planned magnet production, battery recycling, and e - scrap recycling ; 4 . ) No significant delays in construction ; 5 . ) All required permits and licenses can be obtained in a timely manner ; 6 . ) the consummation of the transactions necessary to acquire the target companies ; and 7 . ) EM&T’s ability to enter into offtake contracts in connection with its saleable products and sell all its outputs within the same year as production year .

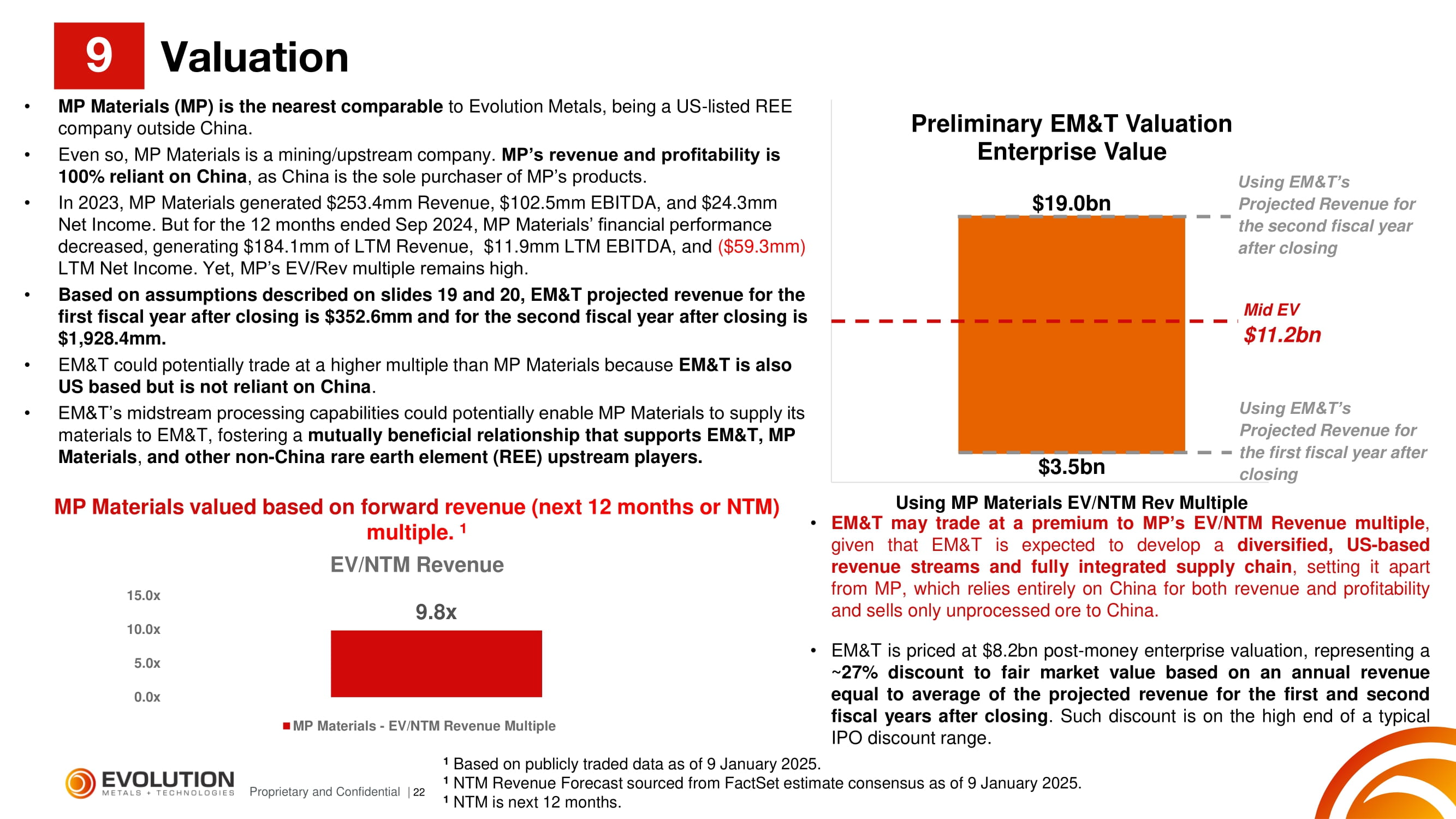

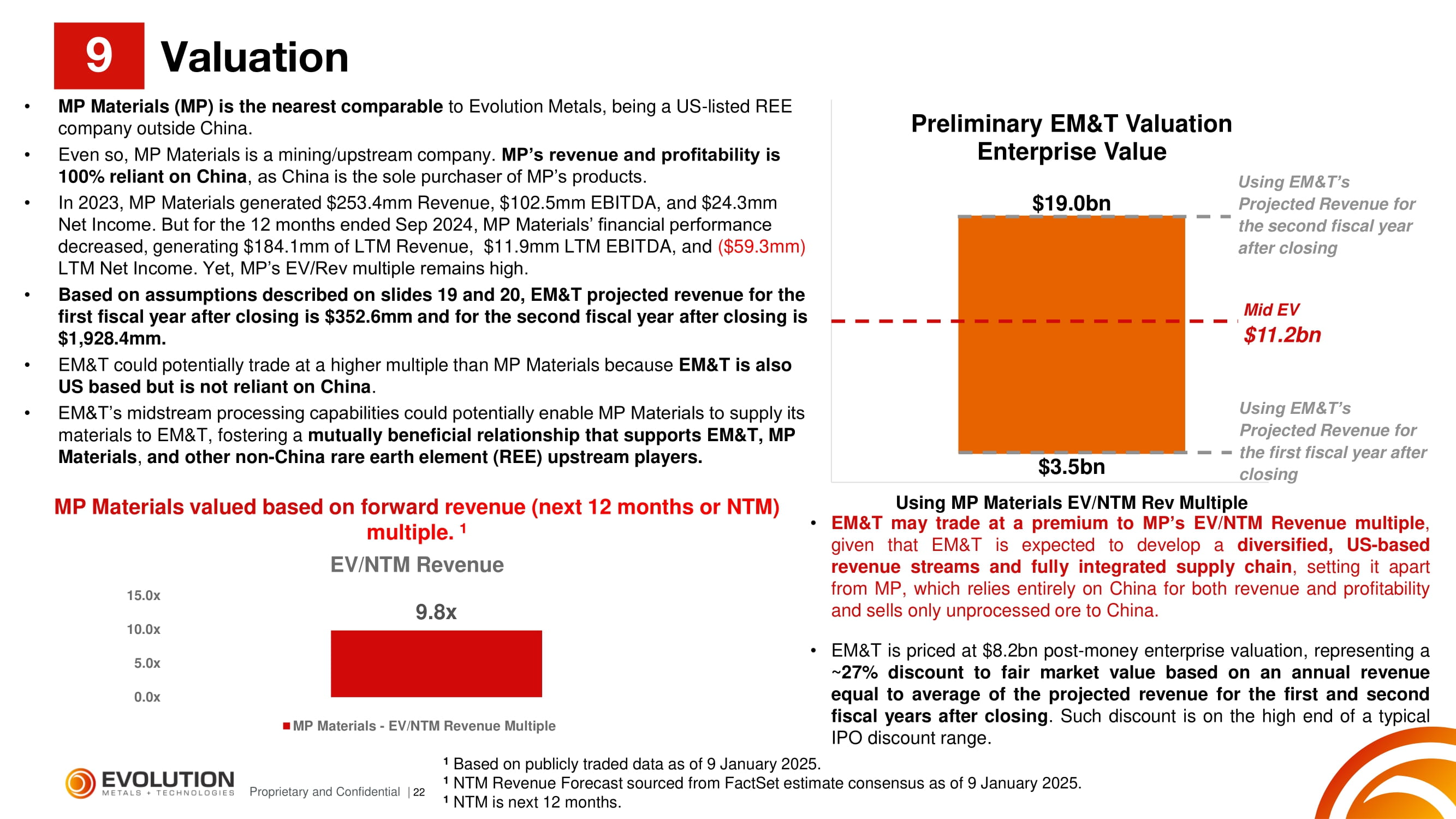

22 Proprietary and Confidential | $3.5bn $19.0bn Preliminary EM&T Valuation Enterprise Value Mid EV $11.2bn Using MP Materials EV/NTM Rev Multiple • MP Materials (MP) is the nearest comparable to Evolution Metals, being a US - listed REE company outside China. • Even so, MP Materials is a mining/upstream company. MP’s revenue and profitability is 100% reliant on China , as China is the sole purchaser of MP’s products. • In 2023, MP Materials generated $253.4mm Revenue, $102.5mm EBITDA, and $24.3mm Net Income. But for the 12 months ended Sep 2024, MP Materials’ financial performance decreased, generating $184.1mm of LTM Revenue, $11.9mm LTM EBITDA, and ($59.3mm) LTM Net Income. Yet, MP’s EV/Rev multiple remains high. • Based on assumptions described on slides 19 and 20, EM&T projected revenue for the first fiscal year after closing is $352.6mm and for the second fiscal year after closing is $1,928.4mm. • EM&T could potentially trade at a higher multiple than MP Materials because EM&T is also US based but is not reliant on China . • EM&T’s midstream processing capabilities could potentially enable MP Materials to supply its materials to EM&T, fostering a mutually beneficial relationship that supports EM&T, MP Materials , and other non - China rare earth element (REE) upstream players. MP Materials valued based on forward revenue (next 12 months or NTM) multiple. 1 • EM&T may trade at a premium to MP’s EV/NTM Revenue multiple , given that EM&T is expected to develop a diversified, US - based revenue streams and fully integrated supply chain , setting it apart from MP, which relies entirely on China for both revenue and profitability and sells only unprocessed ore to China . • EM&T is priced at $ 8 . 2 bn post - money enterprise valuation, representing a ~ 27 % discount to fair market value based on an annual revenue equal to average of the projected revenue for the first and second fiscal years after closing . Such discount is on the high end of a typical IPO discount range . Using EM&T’s Projected Revenue for the second fiscal year after closing Using EM&T’s Projected Revenue for the first fiscal year after closing 1 Based on publicly traded data as of 9 January 2025. 1 NTM Revenue Forecast sourced from FactSet estimate consensus as of 9 January 2025. 1 NTM is next 12 months. Valuation 9 9.8x 0.0x 5.0x 10.0x 15.0x EV/NTM Revenue MP Materials - EV/NTM Revenue Multiple

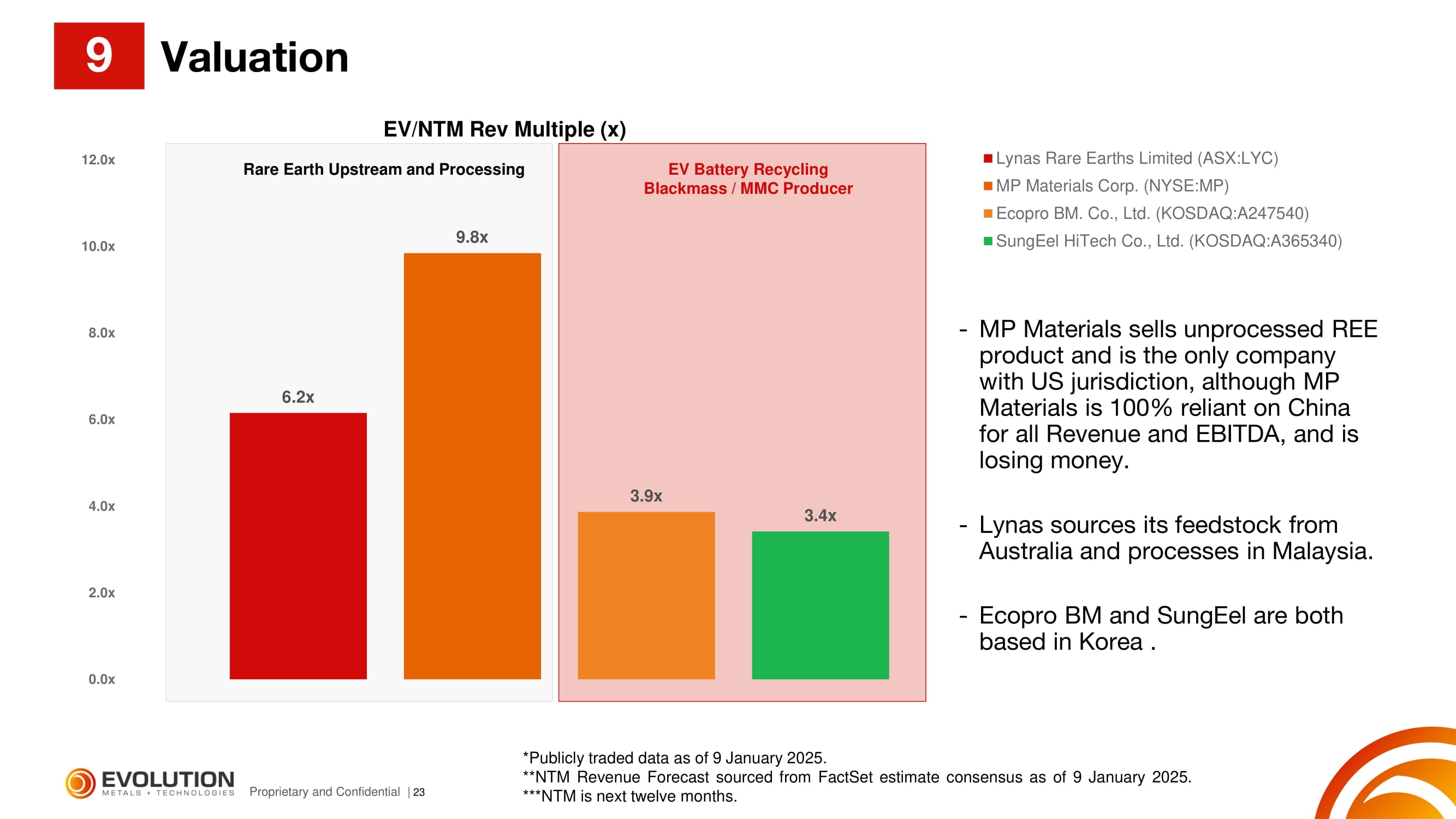

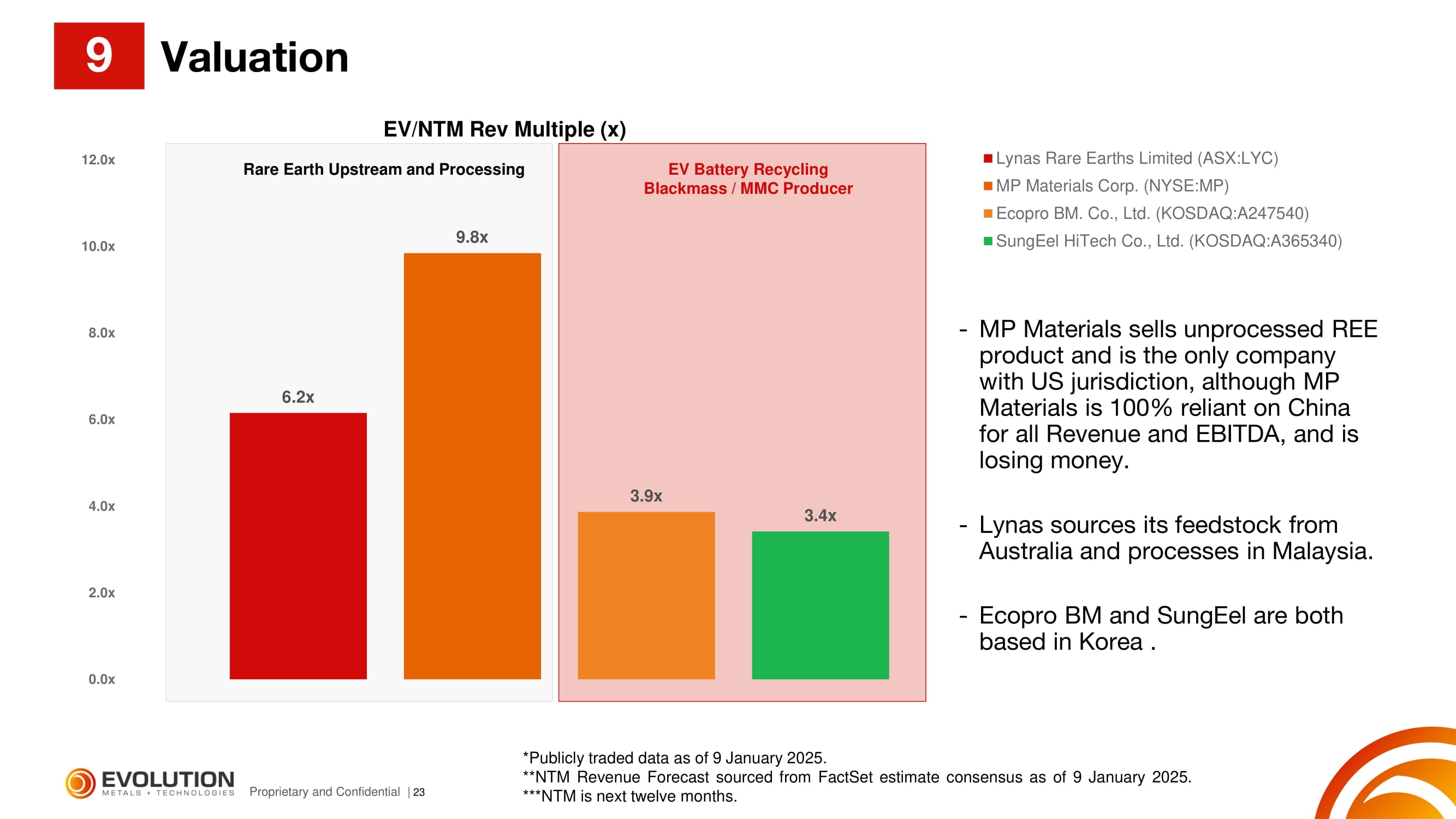

23 Proprietary and Confidential | 6.2x 9.8x 3.9x 3.4x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x EV/NTM Rev Multiple (x) Lynas Rare Earths Limited (ASX:LYC) MP Materials Corp. (NYSE:MP) Ecopro BM. Co., Ltd. (KOSDAQ:A247540) SungEel HiTech Co., Ltd. (KOSDAQ:A365340) *Publicly traded data as of 9 January 2025 . **NTM Revenue Forecast sourced from FactSet estimate consensus as of 9 January 2025 . ***NTM is next twelve months . Rare Earth Upstream and Processing EV Battery Recycling Blackmass / MMC Producer Valuation 9 - MP Materials sells unprocessed REE product and is the only company with US jurisdiction, although MP Materials is 100% reliant on China for all Revenue and EBITDA, and is losing money. - Lynas sources its feedstock from Australia and processes in Malaysia. - Ecopro BM and SungEel are both based in Korea .

24 Proprietary and Confidential | 1. Team, Business, and Capital Synergies 2. Feedstock Synergies for Permanent Magnets 3. Technological Innovation for Permanent Magnet Synergies • EM&T’s expected leadership includes experts in operations, government relations, and capital markets, ensuring efficient execution. • Proven operating entities (CMR, KMMI, KCM, NS World, and Handa Lab) expected to provide scalable infrastructure and reliable outputs. • Expected ability to secure funding as a planned Nasdaq - listed company to support innovation, capacity expansion, and independence from foreign influence. • EM&T’s expected expert leadership in sourcing rare earth feedstocks. • EM&T anticipated DoD supply agreements ensure a steady, cost - effective supply of end - of - life magnet feedstock. • Commitment to expanding supplier networks and sustainable sourcing practices strengthen supply chain resilience. • Planned client - driven innovation ensures magnet products meet specific industry needs. • Integrated supply chain expected to optimize operations from feedstock procurement to final magnet production. • Automation technologies expected to improve cost efficiency and product quality, potentially positioning EM&T as a market leader. 4. Spent Hard Disk Drives (HDDs) as Source of Permanent Magnet Feedstock 5. Lithium - Ion Battery and Recycling Synergies 6. DoD E - Scrap Recycling • AI - driven automation expected to enable cost - effective HDD disassembly and magnet extraction. • Anticipated DoD partnerships expected to provide access to decommissioned HDDs, ensuring a reliable material flow. • Technological advancements expected to streamline processes to maximize material recovery. • Comprehensive recycling transforms spent EV batteries into MMC, and further processes it into battery sulfates/carbonates/ pCAM for gigafactories. • Downstream integration expected to minimize reliance on external suppliers and enhance sustainability. • EM&T expects to offer a comprehensive, one - stop solution for gigafactories. • EM&T plans to develop a government certified, cleared facility, allowing handling and storage of classified DoD materials. • Plan to leverage EM&T leadership's network to identify DoD's unmet e - scrap recycling requirements and win sole - source contracts for high - margin materials such as non - ferrous products. • Anticipated further downstream processing of non - ferrous products into precious metals. EM&T Anticipated Synergies 10

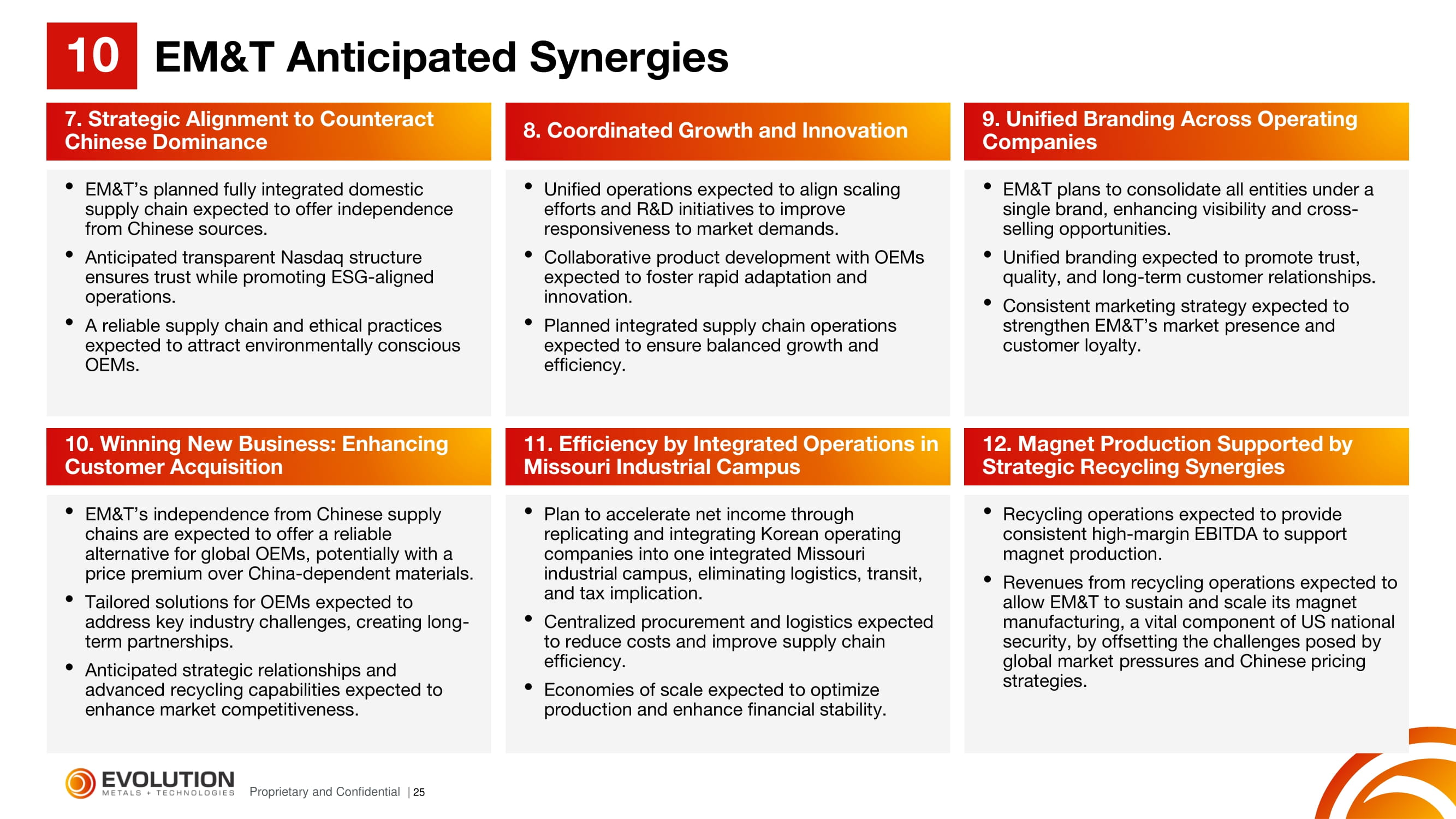

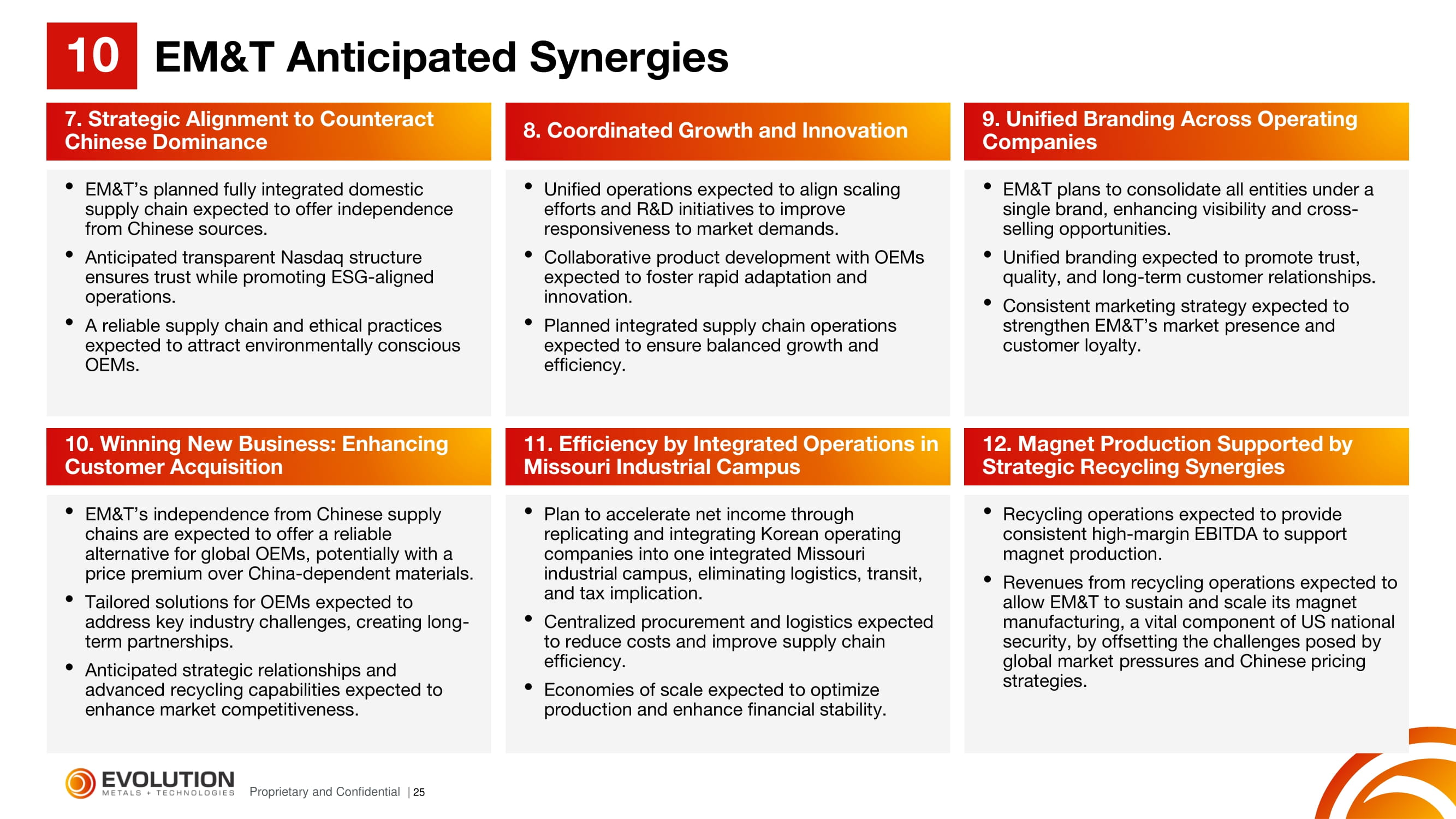

25 Proprietary and Confidential | 7. Strategic Alignment to Counteract Chinese Dominance 8. Coordinated Growth and Innovation 9. Unified Branding Across Operating Companies • EM&T’s planned fully integrated domestic supply chain expected to offer independence from Chinese sources. • Anticipated transparent Nasdaq structure ensures trust while promoting ESG - aligned operations. • A reliable supply chain and ethical practices expected to attract environmentally conscious OEMs. • Unified operations expected to align scaling efforts and R&D initiatives to improve responsiveness to market demands. • Collaborative product development with OEMs expected to foster rapid adaptation and innovation. • Planned integrated supply chain operations expected to ensure balanced growth and efficiency. • EM&T plans to consolidate all entities under a single brand, enhancing visibility and cross - selling opportunities. • Unified branding expected to promote trust, quality, and long - term customer relationships. • Consistent marketing strategy expected to strengthen EM&T’s market presence and customer loyalty. 10. Winning New Business: Enhancing Customer Acquisition 11. Efficiency by Integrated Operations in Missouri Industrial Campus 12. Magnet Production Supported by Strategic Recycling Synergies • EM&T’s independence from Chinese supply chains are expected to offer a reliable alternative for global OEMs, potentially with a price premium over China - dependent materials. • Tailored solutions for OEMs expected to address key industry challenges, creating long - term partnerships. • Anticipated strategic relationships and advanced recycling capabilities expected to enhance market competitiveness. • Plan to accelerate net income through replicating and integrating Korean operating companies into one integrated Missouri industrial campus, eliminating logistics, transit, and tax implication. • Centralized procurement and logistics expected to reduce costs and improve supply chain efficiency. • Economies of scale expected to optimize production and enhance financial stability. • Recycling operations expected to provide consistent high - margin EBITDA to support magnet production. • Revenues from recycling operations expected to allow EM&T to sustain and scale its magnet manufacturing, a vital component of US national security, by offsetting the challenges posed by global market pressures and Chinese pricing strategies. EM&T Anticipated Synergies 10

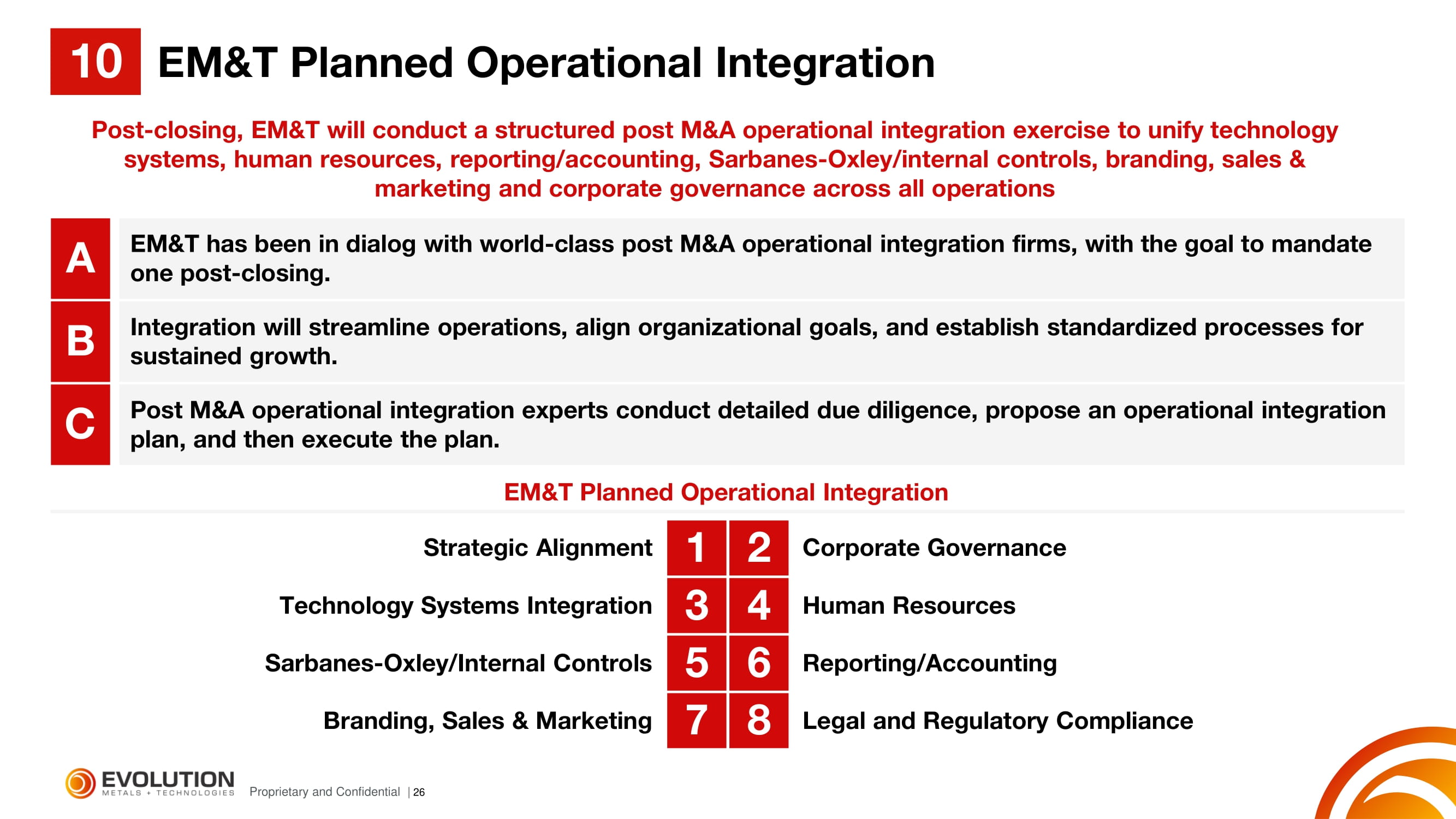

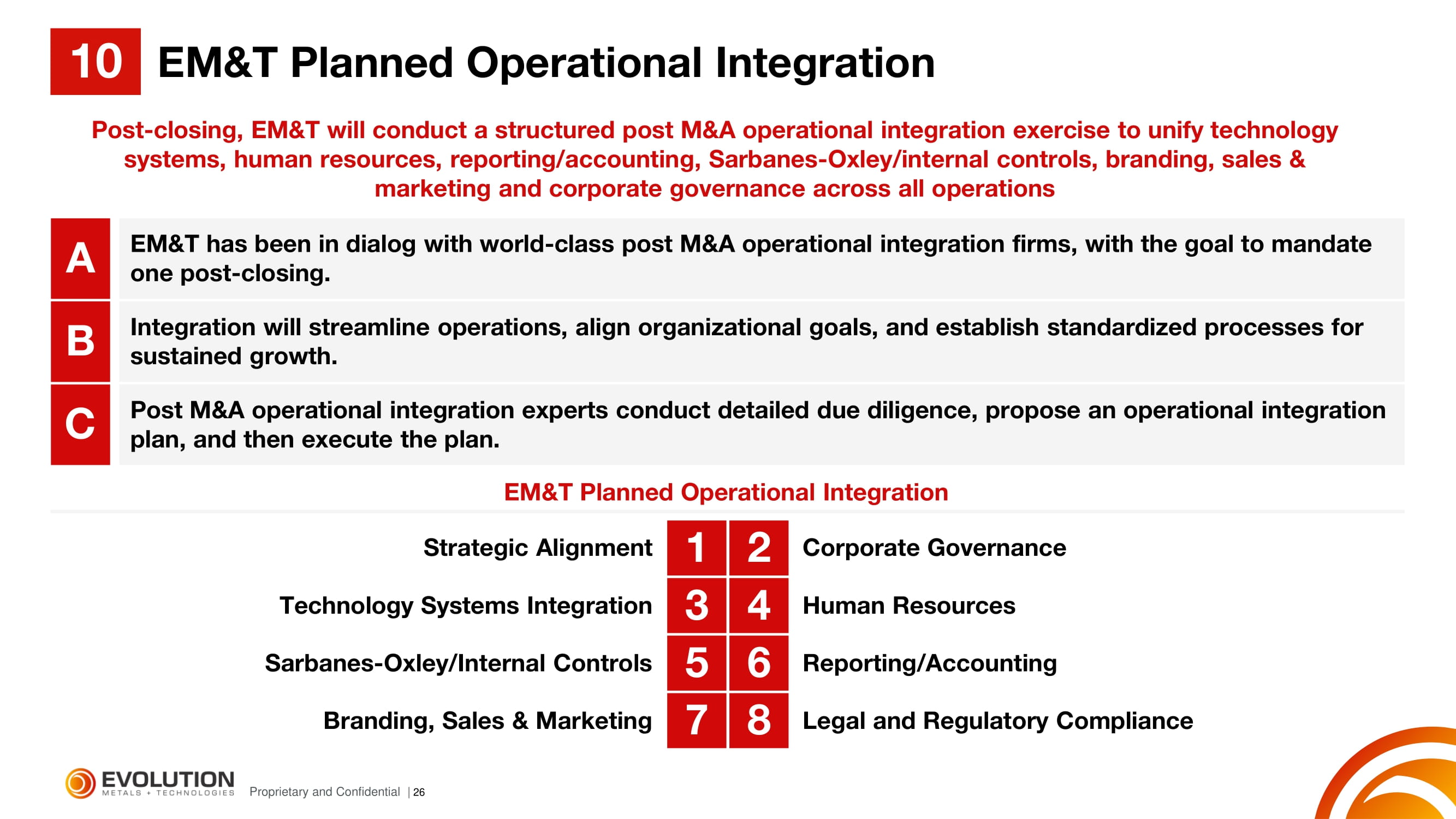

26 Proprietary and Confidential | A EM&T has been in dialog with world - class post M&A operational integration firms, with the goal to mandate one post - closing. B Integration will streamline operations, align organizational goals, and establish standardized processes for sustained growth. C Post M&A operational integration experts conduct detailed due diligence, propose an operational integration plan, and then execute the plan. Post - closing, EM&T will conduct a structured post M&A operational integration exercise to unify technology systems, human resources, reporting/accounting, Sarbanes - Oxley/internal controls, branding, sales & marketing and corporate governance across all operations 1 3 5 2 4 6 Corporate Governance Strategic Alignment Human Resources Technology Systems Integration Reporting/Accounting Sarbanes - Oxley/Internal Controls 7 8 Legal and Regulatory Compliance Branding, Sales & Marketing EM&T Planned Operational Integration EM&T Planned Operational Integration 10

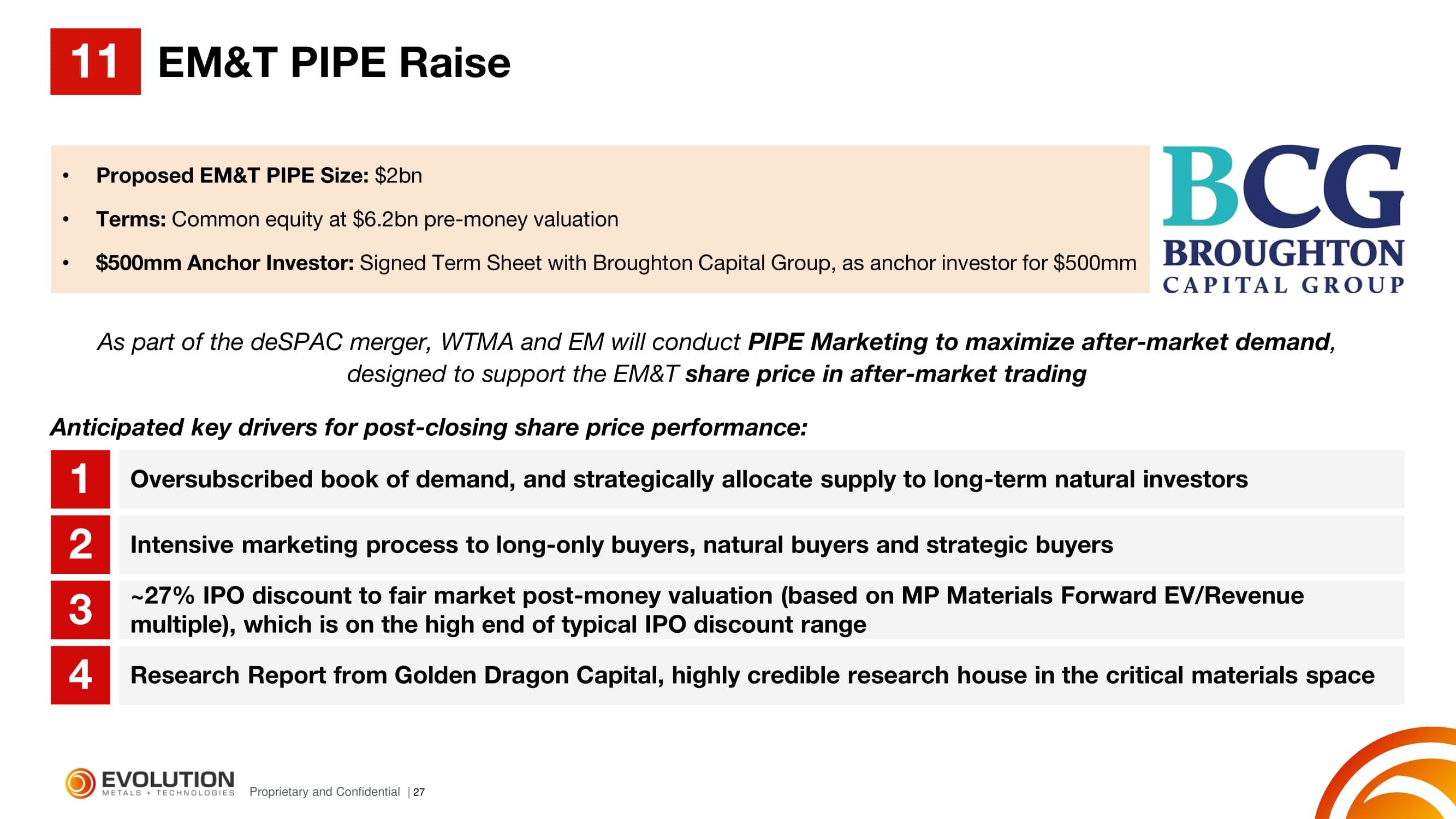

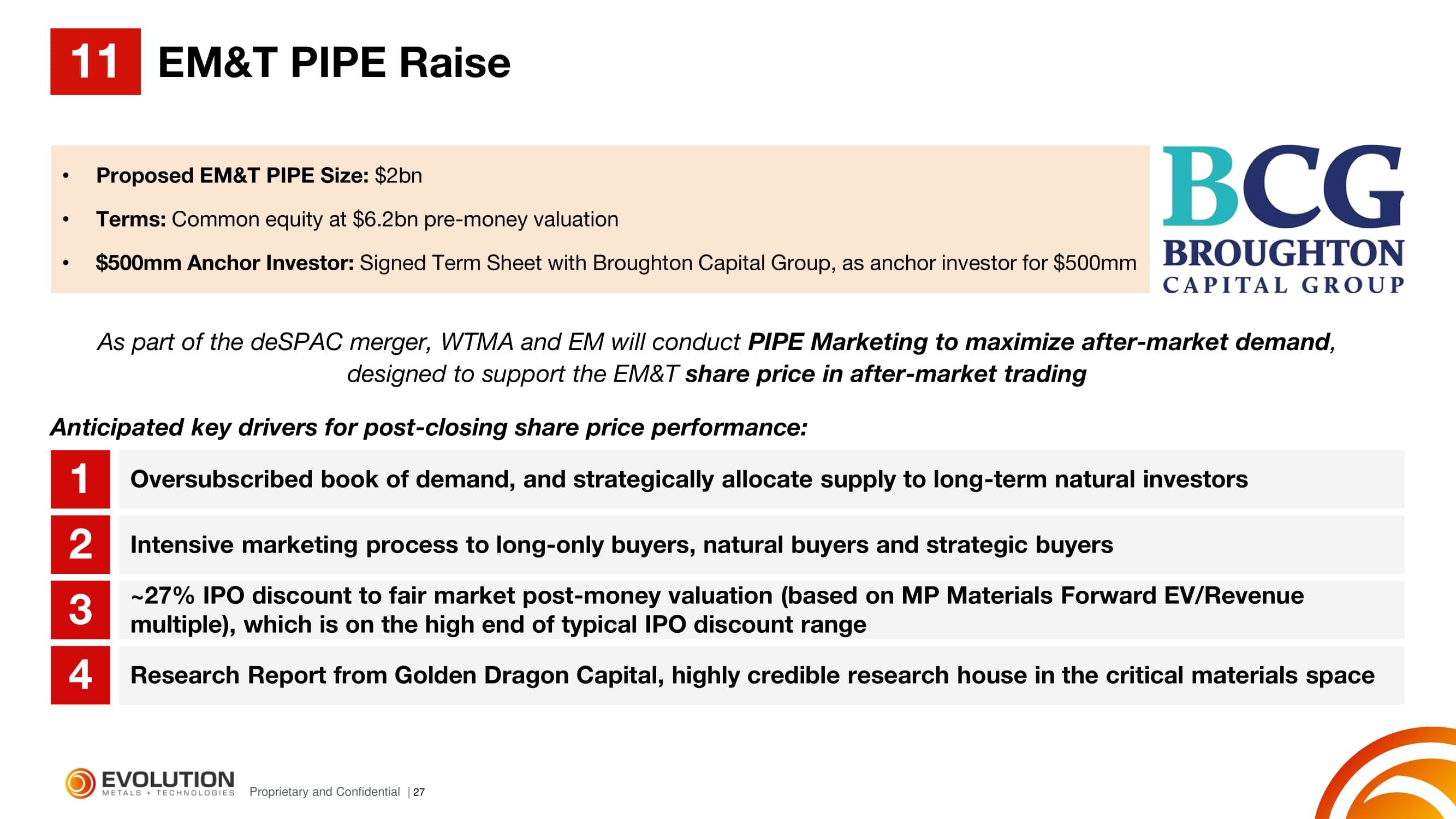

27 Proprietary and Confidential | As part of the deSPAC merger, WTMA and EM will conduct PIPE Marketing to maximize after - market demand , designed to support the EM&T share price in after - market trading Anticipated key drivers for post - closing share price performance: 1 Oversubscribed book of demand, and strategically allocate supply to long - term natural investors 2 Intensive marketing process to long - only buyers, natural buyers and strategic buyers 3 ~27% IPO discount to fair market post - money valuation (based on MP Materials Forward EV/Revenue multiple), which is on the high end of typical IPO discount range 4 Research Report from Golden Dragon Capital, highly credible research house in the critical materials space • Proposed EM&T PIPE Size: $2bn • Terms: Common equity at $6.2bn pre - money valuation • $500mm Anchor Investor: Signed Term Sheet with Broughton Capital Group, as anchor investor for $500mm EM&T PIPE Raise 11

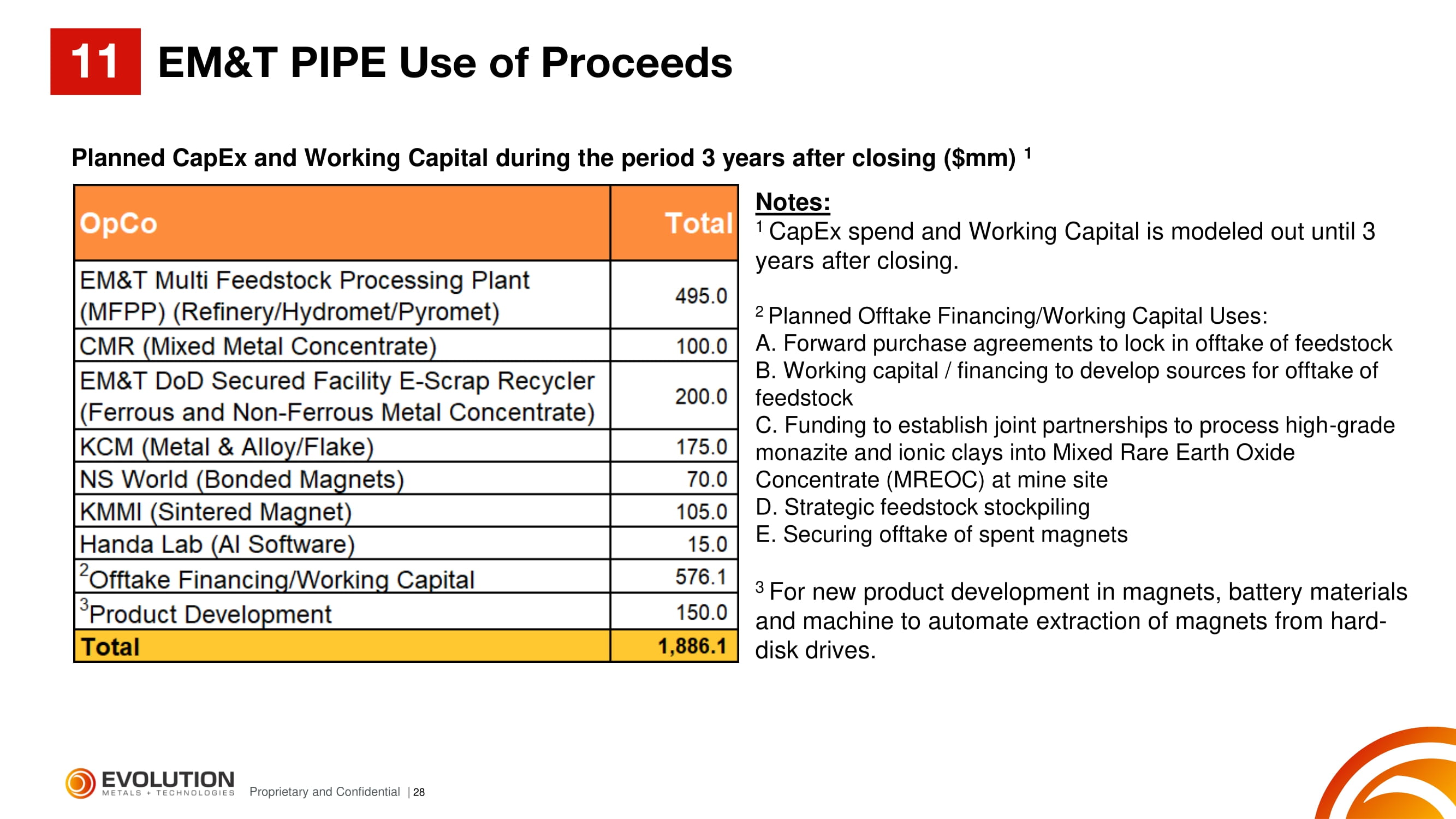

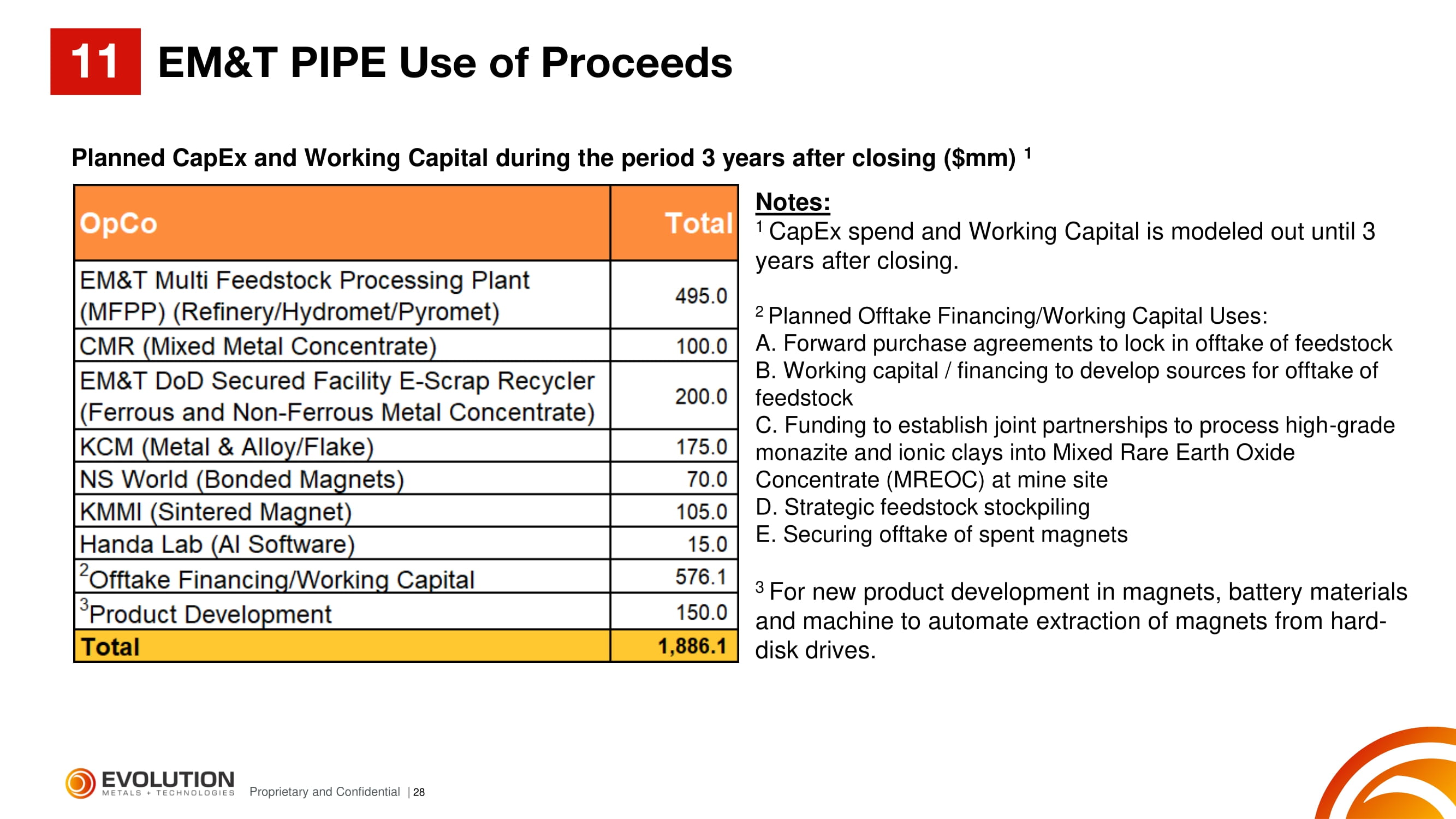

28 Proprietary and Confidential | Planned CapEx and Working Capital during the period 3 years after closing ($mm) 1 Notes: 1 CapEx spend and Working Capital is modeled out until 3 years after closing. 2 Planned Offtake Financing/Working Capital Uses: A. Forward purchase agreements to lock in offtake of feedstock B. Working capital / financing to develop sources for offtake of feedstock C. Funding to establish joint partnerships to process high - grade monazite and ionic clays into Mixed Rare Earth Oxide Concentrate (MREOC) at mine site D. Strategic feedstock stockpiling E. Securing offtake of spent magnets 3 For new product development in magnets, battery materials and machine to automate extraction of magnets from hard - disk drives. EM&T PIPE Use of Proceeds 11