UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

ATLAS U.S. TACTICAL INCOME FUND, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

ATLAS U.S. TACTICAL INCOME FUND, INC.

Buchanan Office Center, Suite 201, Road 165 #40

Guaynabo, Puerto Rico 00968

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On January 28, 2022

To the Shareholders of Atlas U.S. Tactical Income Fund, Inc.:

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Shareholders of Atlas U.S. Tactical Income Fund, Inc. (the “Company”), a Puerto Rico corporation, will be held at the offices of the Company, Buchanan Office Center, Suite 201, Road 165 #40, Guaynabo, Puerto Rico 00968, on January 28, 2022 at 10:00 a.m., Atlantic time (the “Annual Meeting”), for the following purposes (each a “Proposal”):

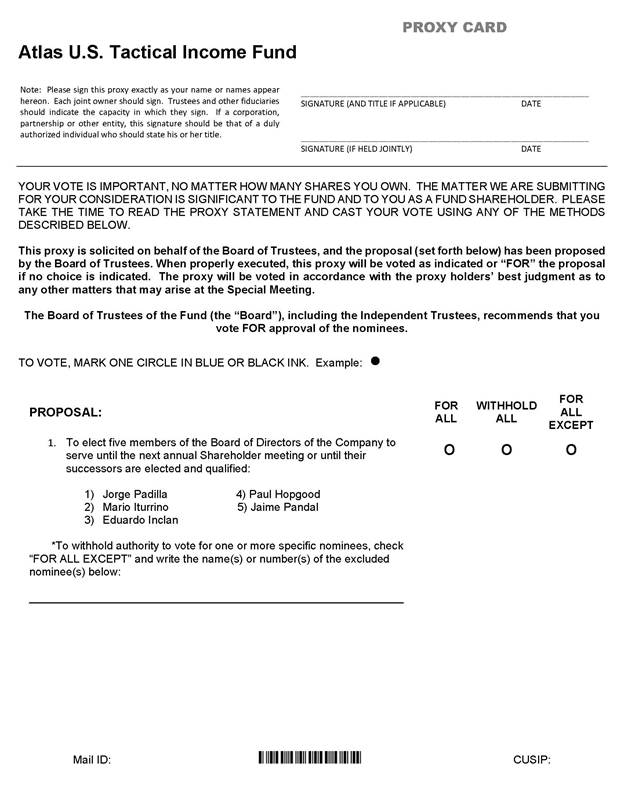

| | 1. | To elect five members of the Board of Directors of the Company to serve until the next annual Shareholder meeting or until their successors are elected and qualified. |

| | 2. | To transact any other business that may properly come before the Meeting or any adjournment thereof in the discretion of the proxies or their substitutes |

The Board of Directors has fixed the close of business on December 13, 2021, as the record date for the determination of Shareholders entitled to notice of, and to vote, at the Annual Meeting or any adjournments thereof.

The Board unanimously recommends that you cast your vote “FOR” the PROPOSALs TO re-elect each proposed individual as A Director of the Company.

The Company has enclosed a copy of the proxy statement and proxy card. A copy of the Notice of Shareholder Meeting, the Proxy Statement and Proxy Voting Ballot are available at [ ]. To assure your representation at the meeting, please complete the enclosed proxy and return it promptly in the accompanying envelope or by calling the number listed on your proxy card whether or not you expect to be present at the meeting.

If you attend the meeting, you may revoke your proxy and vote your shares in person.

YOUR VOTE IS IMPORTANT. PLEASE VOTE BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD TO AVOID UNNECESSARY EXPENSE AND DELAY. YOU MAY ALSO EXECUTE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

In light of the coronavirus (COVID-19) pandemic, we are urging all shareholders to take advantage of voting by mail, Internet or telephone (separate instructions are listed on the enclosed proxy card to vote by telephone or through the Internet). Additionally, while we anticipate that the Meeting will occur as planned on January 28, 2022, there is a possibility that, due to the COVID-19 pandemic, the Meeting may be postponed or the location or approach may need to be changed, including the possibility of holding a virtual meeting for the health and safety of all Meeting participants. Should this occur, we will notify you by issuing a press release and filing an announcement with the Securities and Exchange Commission as definitive additional soliciting material. If you plan to attend the Meeting in person, please note that we will be holding the Meeting in accordance with any recommended and required social distancing and safety guidelines, as applicable.

ATLAS U.S. TACTICAL INCOME FUND, INC.

Buchanan Office Center, Suite 201, Road 165 #40

Guaynabo, Puerto Rico 00968

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On January 28, 2022

PROXY STATEMENT

GENERAL

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Atlas U.S. Tactical Income Fund, Inc. (the “Board”), a Puerto Rico corporation (the “Company”), for use at the Annual Meeting of Shareholders of the Company to be held on January 28, 2022 at 10:00 a.m., Atlantic time, at the offices of the Company, Buchanan Office Center, Suite 201, Road 165 #40, Guaynabo, Puerto Rico 00968, and any adjournments thereof (the “Annual Meeting”).

Please read this Proxy Statement before voting on the Proposals. You may call toll-free at [ ] if you have any questions about the Proxy Statement, or if you would like additional information on how to attend the Meeting and vote in person. Only shareholders of record as of the close of business on December 13, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

We anticipate that the Notice of Special Meeting of Shareholders, Proxy Statement and the proxy card will be mailed to shareholders (“Shareholders”) beginning on or about [ ], 2021.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF MATERIALS

The Proxy Statement for the Meeting is available online at [ ].

DESCRIPTION OF PROPOSAL

RE-ELECTION OF PROPOSED INDIVIDUALS TO THE BOARD OF DIRECTORS OF THE COMPANY

Background

Shareholders are being asked to vote on a proposal to re-elect five proposed individuals to the Board. Each of the proposed individuals currently serve as Directors of the Company (together, the “Incumbent Directors”) and are standing for election or re-election at the Meeting. Pursuant to the Company’s Bylaws, the Board may modify the number of members of the Board provided that the number of Directors will not be fewer than three or greater than fifteen. Directors of the Company are elected annually for a term of one year and serve until their successors are elected and qualified. The Board is currently comprised of five Directors.

Each Director named below has been nominated for election by the Board for a one-year term expiring in 2022. Each Director has agreed to serve as a Director if elected and has consented to be named as a nominee. No person being nominated as a Director is being proposed for election pursuant to any agreement or understanding between any such person and the Company.

A Shareholder can vote for or withhold his or her vote from any or all of the nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of all the nominees named below. If any of the nominees should decline or be unable to serve as a Director, it is intended that the proxy will be voted for the election of such person or persons as are nominated as replacements. The Board has no reason to believe that any of the persons named will be unable or unwilling to serve.

Information about the Board, Director Nominees and Executive Officers

The role of the Board is to provide general oversight of the Company’s business affairs, and to exercise all the Company’s powers except those reserved for the Shareholders. The Board also reviews contractual arrangements with entities that provide services to the Company and reviews the Company’s performance as part of its responsibilities as Directors under the Investment Company Act of 1940, as amended (the “1940 Act”).

A majority of the Board are not “interested persons” of the Company or Atlas Asset Management, LLC, its investment adviser (the “Adviser”), as defined in Section 2(a)(19) of the 1940 Act. These individuals are referred to as the Company’s independent directors (“Independent Directors”). Section 2(a)(19) of the 1940 Act defines an “interested person” to include, among other things, any person who has, or within the last two years had, a material business or professional relationship with the Company.

The Board is currently composed of five Directors, three of whom are Independent Directors. The Board has determined that the following Director nominees are Independent Directors: Messrs. Padilla, Iturrino and Inclán. Based upon information requested from each Director concerning his background, employment and affiliations, the Board has affirmatively determined that none of the Independent Directors has a material business or professional relationship with the Company, other than in his capacity as a member of the Board or any Board committee or as a Shareholder.

Messrs. Hopgood and Pandal are the Company’s Interested Directors. Mr. Hopgood is interested because he owns 80% of the membership interests of the Company’s Adviser. Mr. Pandal is interested because he is a Vice President of the Adviser.

In considering each Director and the composition of the Board as a whole, the Board utilizes a diverse group of experiences, characteristics, attributes and skills, that the Board believes enables a Director to make a significant contribution to the Board, the Company and our shareholders. These experiences, characteristics, attributes and skills are more fully described below.

The following table sets forth certain information regarding the Independent Director and Interested Director nominees as well as the executive officers of the Company. Except as otherwise noted, the address for all individuals listed in the tables below is Buchanan Office Center, Suite 201, Road 165 #40, Guaynabo, Puerto Rico 00968:

Independent Directors

| Name (Year of Birth) | Position(s) Held with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex | Other Directorships |

| Jorge Padilla (1956) | Director | N/A | Director, Converge RE; Executive Director & Trustee, GDB Debt Recovery Authority; Treasurer Fundacion CAP; Former Senior Vice President and Chief Financial Officer of Universal Insurance Group, Inc.; Former President Universal Finance, Inc.; Certified Public Accountant since 1980. | 1 | None |

| Mario Iturrino (1959) | Director | N/A | President IT Consulting; Financial Advisor for several Financial Institutions; Professor at the University of Puerto Rico. | 1 | None |

| Eduardo Inclán (1975) | Director | N/A | Founder Bluhaus Capital; Founder Bluhaus Small Business Fund; Director East Island Excursions, Inc.; Former Senior Vice President Investment Banking Director Santander Securities. | 1 | None |

Interested Directors and Officers

| Name, Age | Position(s) Held with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships |

| Mr. Paul Hopgood1 (1976) | President and Director | Since inception. | President, Atlas Asset Management LLC; Former Chief Investment Officer of Santander Asset Management, LLC. | 1 | None |

| Mr. Jaime Pandal2 (1983) | Vice President, Director, Secretary and Treasurer | Since inception. | Vice President of Atlas Asset Management LLC; Former Senior Portfolio Analyst of Santander Asset Management, LLC. | 1 | None |

1 An “interested person” as defined by the 1940 Act. Mr. Hopgood is deemed to be an “interested” director because he is the owner of 100% of the membership interests of the Investment Adviser and also serves as its President.

2 An “interested person” as defined by the 1940 Act. Mr. Pandal is deemed to be an “interested” director because he serves as the Investment Adviser’s Vice President.

William H. Woolverton (1951) c/o Cipperman Compliance Services, LLC 480 E Swedesford Road Ste. 220, Wayne, PA 19087 | Chief Compliance Officer | Since May 2021 | Senior Compliance

Adviser, Cipperman

Compliance Services,

LLC (compliance

advisers) (since 2020);

Operating Partner,

Altamont Capital

Partners (private equity

firm) (since 2021);

Managing Director of

Waystone Governance Ltd.

(fund governance)

(2016-2019). | Not applicable | Thomas White Funds (Since 2015) |

Leadership Structure and Board of Directors

Overall responsibility for oversight of the Company rests with the Board. The Company has engaged the Investment Adviser to manage the Company on a day-to-day basis. The Board is responsible for overseeing the Investment Adviser and other service providers in the operation of the Company in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and the Company’s By-laws. The Board is currently composed of five members, three of whom are Independent Directors. The Board meets in-person at regularly scheduled meetings four times each year. In addition, the Board may hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regular meetings. As described below, the Board has established an Audit Committee and a Dividend Committee, and may establish ad hoc committees or working groups from time to time to assist the Board in fulfilling its oversight responsibilities.

The Board has appointed Paul Hopgood, an interested director, to serve in the role of Chairman. The Chairman’s role is to preside at all meetings of the Board and to act as liaison with the Investment Adviser, other service providers, counsel and other Directors generally between meetings. The Chairman serves as a key point person for dealings between management and the Directors. The Chairman may also perform such other functions as may be delegated by the Board from time to time. Jorge Padilla serves as the lead independent Director of the Company. The Board has determined that the Board’s leadership structure is appropriate because it allows the Board to exercise informed and independent judgment over matters under its purview and it allocates areas of responsibility among committees of Directors and the full Board in a manner that enhances effective oversight.

The Company is subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Board’s general oversight of the Company and is addressed as part of various Board and committee activities. Day-to-day risk management functions are subsumed within the responsibilities of the Investment Adviser and other service providers (depending on the nature of the risk), which carry out the Company’s investment management and business affairs. The Investment Adviser and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each of the Investment Adviser and other service providers have their own independent interests in risk management, and their policies and methods of risk management will depend on their functions and business models. The Board recognizes that it is not possible to identify all of the risks that may affect the Company or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board requires senior officers of the Company and the Investment Adviser to report to the full Board on a variety of matters at regular and special meetings of the Board, including matters relating to risk management. The Board, the Audit Committee and the Dividend Committee also receive regular reports from the Company’s independent registered public accounting firm on internal control and financial reporting matters. The Board also receives reports from certain of the Company’s other primary service providers on a periodic or regular basis. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

The Board has an Audit Committee, whose function is to oversee the Company’s accounting and financial reporting policies and practices and to recommend to the Board of Directors any action to ensure that the Company’s accounting and financial reporting are consistent with accepted accounting standards applicable to the mutual fund industry. The members of the Audit Committee are Messrs. Jorge Padilla, Mario Iturrino and Eduardo Inclán. During fiscal year ended September 30, 2020, the Audit Committee met 2 times.

The Board has a standing Dividend Committee, whose function is to determine the amount, form, and record date of any dividends to be declared and paid by the Company. The Dividend Committee has four members, three of whom are Independent Directors (Messrs. Jorge Padilla, Mario Iturrino and Eduardo Inclán) and one who is an Interested Director (Mr. Paul Hopgood). During fiscal year ended September 30, 2020, the Dividend Committee met 12 times.

Incumbent Director Qualifications

The information above includes each director nominee's principal occupations during the last five years. Each director nominee possesses extensive additional experience, skills and attributes relevant to his qualifications to serve as a director. The cumulative background of each director nominee led to the conclusion that each director nominee should serve as a director of the Company. Mr. Padilla has [DESCRIBE EXPERIENCE]. Mr. Iturrino has [DESCRIBE EXPERIENCE]. Mr. Inclán has [DESCRIBE EXPERIENCE]. Mr. Hopgood has [DESCRIBE EXPERIENCE]. Mr. Pandal has [DESCRIBE EXPERIENCE].

The Company has concluded that each of these Directors should serve on the Board because of his ability to review and understand information about the Company, to identify and request other information he may deem relevant to the performance of the Directors’ duties, to question management and other service providers regarding material factors bearing on the management and administration of the Company, and to exercise his business judgment in a manner that serves the best interests of the Company’s shareholders.

Director Compensation

Each Independent Director receives a stipend from the Company of up to $1,000.00 plus expenses for attendance at each meeting of the Board of Directors, and $500 plus expenses for attendance at each meeting of the Audit Committee of the Board, and $175 plus expenses for attendance at each meeting of the Dividend Committee of the Board. The Independent Directors do not receive retirement or other benefits as part of their compensation. The following table sets forth the compensation earned by the Independent Directors for the Company’s fiscal year ended September 30, 2020, assuming four meetings of the Board, two meetings of the Audit Committee, and twelve meetings of the Dividend Committee.

| Independent Director | Compensation from Company |

| Jorge Padilla | $7,100 |

| Mario Iturrino | $7,100 |

| Eduardo Inclán | $7,100 |

The following tables show the dollar ranges of securities beneficially owned by the Directors in the Company as of [ ]. No Independent Directors or his or her immediate family member owns beneficially or of record an interest in the Investment Adviser or in any person directly or indirectly controlling, controlled by, or under common control with the Investment Adviser. As of [ ], the Directors and Officers as a group held 1.91% of the outstanding Class A shares and less than 1% of the outstanding Class C shares of the Company.

| | Dollar Range of Equity Securities in the Company |

| Independent Directors | |

| Jorge Padilla | over $100,000 |

| Mario Iturrino | $0 |

| Eduardo Inclán | $0 |

| Interested Directors | |

| Paul Hopgood | over $100,000 |

| Jaime Pandal | $10,001-$50,000 |

ADDITIONAL INFORMATION

Record Date

Only shareholders of record at the close of business on December 13, 2021 will be entitled to vote at the Meeting and at any adjournment thereof.

Required Vote and Voting Information

In accordance with the By-Laws of the Company, all elections for Directors shall be decided by plurality vote (i.e. by the candidate who receives the greatest number of votes if two or more candidates compete for the same directorship). All other questions shall be decided by majority vote of those stockholders present in person or by proxy except as otherwise provided by the Certificate of Incorporation or the laws of Puerto Rico.

The presence in person or by proxy of the holders of more than one-half of the outstanding shares of the Corporation entitled to vote, represented in person or by proxy, shall constitute a quorum. If less than said number of the outstanding shares are represented at a meeting, a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. The stockholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough stockholders to leave less than a quorum.

For purposes of determining the presence of a quorum, abstentions, broker "non-votes" or withheld votes will be counted as present. Abstentions will have no effect upon the election of directors, but will have the effect of a "no" vote for purposes of obtaining the requisite approval. Broker "non-votes" (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated the same as abstentions.

Audit Fees

The Company’s Audit Committee selected, and the Board of Directors ratified, the appointment of BBD, LLP (“BBD”), 1835 Market Street, 3rd floor, Philadelphia, PA 19103 as the Company’s new independent registered public accounting firm at a meeting held on May 21, 2021. The Company is not asking shareholders to ratify the appointment by the Board of BBD as the independent registered public accounting firm for the Company.

Representatives of BBD are not expected to attend the Meeting or be available to respond to questions. However, BBD will have an opportunity to make a statement if it desires to do so. The Company knows of no direct financial or material indirect financial interest of BBD in the Company. BBD did not serve as the Company’s independent registered public accounting firm in prior fiscal years. BDO (Puerto Rico) (“BDO”) 1302 Ponce De Leon Ave. 1st Floor, San Juan, Puerto Rico 00907 served as the Company’s independent registered public accounting firm for the fiscal year ended September 30, 2020 and prior thereto. BDO was engaged on an annual basis and was effectively dismissed with the Board and Audit Committee’s approval of BBD on May 21, 2021. BDO’s report on the financial statements for either of the past two years did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles. There were no disagreements between management and BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure during the prior two fiscal years.

Set forth in the table below are audit fees and non-audit related fees billed to the Company by BDO for professional services performed for the Company’s fiscal years ended September 30, 2020 and 2019:

| Fiscal Year | Audit Fees1 | Audit Related Fees2 | Tax Fees3 | All Other Fees4 |

| 2020 | $[ ] | $[ ] | $[ ] | $[ ] |

| 2019 | $[ ] | $[ ] | $[ ] | $[ ] |

(1) “Audit Fees” are fees for professional services for the audit of annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

(2) “Audit-Related Fees” are for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under “Audit Fees.” This includes reviews of semi-annual financial statements.

(3) “Tax Fees” are for professional services for preparing tax returns.

(4) “All Other Fees” are for products and services other than those services reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.”

The Company’s Audit Committee reviews, negotiates and approves in advance the scope of work, any related engagement letter and the fees to be charged by the independent auditors for audit services and permitted non-audit services for the Company. All of the audit and non-audit services described above for which BDO billed the Company for the fiscal years ended September 30, 2020 and September 30, 2019 were pre-approved by the Audit Committee. [There were no non-audit fees billed by BDO for services rendered to the Adviser or any entity controlling, controlled by or under common control with the Adviser during each of the last two fiscal years of the Company.]

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

A principal shareholder is any person who owns (either of record or beneficially) 5% or more of the outstanding shares of the Company. A control person is one who owns, either directly or indirectly, more than 25% of the voting securities of a fund or acknowledges the existence of such control. A shareholder owning of record or beneficially more than 25% of the Fund's outstanding shares may be considered a controlling person. That shareholder's vote could have more significant effect on matters presented at a shareholder's meeting than votes of other shareholders.

As of the Record Date, the following shareholders were beneficial owners of 5% or more of the outstanding shares listed because they possessed voting or investment power with respect to such shares:

| Name & Address | Percentage of Portfolio Share Class |

Class A Shares | |

Asociacion De Empleados Del Ela PO Box 364508 San Juan, PR 00936-4508 | 8.57% |

Pershing, LLC PO Box 2052 Jersey City, NJ 07303-9998 | 5.17% |

Class C Shares | |

Pershing, LLC PO Box 2052 Jersey City, NJ 07303-9998 | 7.71% |

Shareholder Proposals

The Company does not intend to hold meetings of shareholders except to the extent that such meetings may be required under the 1940 Act or state law. Under the Company's By-Laws, shareholders owning in the aggregate 10% of the outstanding Shares of all classes of the Company have the right to call a meeting of shareholders to consider the removal of one or more directors. Shareholders who wish to submit proposals for inclusion in the proxy statement for a subsequent shareholder meeting should submit their written proposals to the Company at its principal office within a reasonable time before such meeting. The timely submission of a proposal does not guarantee its consideration at the meeting.

COST OF SOLICITATION

The Board is making this solicitation of proxies. The Company has engaged [ ], a proxy solicitation firm, to assist in the solicitation. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any additional materials relating to the meeting and the cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, the Company will request banks, brokers and other custodial nominees and fiduciaries to supply proxy materials to the respective beneficial owners of shares of the Company of whom they have knowledge, and the Company will reimburse them for their expenses in so doing. Certain officers, employees and agents of the Company may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation. The estimated fees anticipated to be paid to the proxy

solicitor are approximately $[ ]. The proxy solicitor will prepare and mail the Proxy Statement, Notice of Special Meeting and all materials relating to the meeting and will solicit and tabulate votes of the shareholders.

OTHER MATTERS

The Board knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the Meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

The Company will furnish, without charge, a copy of the Company’s most recent annual report or semi-annual report succeeding to a shareholder upon request. To obtain a free copy of the SAI or any shareholder report, or to make any other inquiries about the Company, you may call the Company at 1 (855) 969-8440 or write to the Company at Atlas U.S. Tactical Income Fund, Inc., c/o Ultimus Fund Solutions, P.O. Box 541150, Omaha, Nebraska 68154.

PROXY DELIVERY

If you and another shareholder share the same address, the Company may only send one Proxy Statement unless you or the other shareholder(s) request otherwise. Call or write to the Company if you wish to receive a separate copy of the Proxy Statement, and the Company will promptly mail a copy to you. You may also call or write to the Company’s proxy firm if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call our proxy information line at [ ].

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on January 28, 2022.

A copy of the Notice of Shareholder Meeting, the Proxy Statement, and Proxy Card are available online at [ ]

If you have any questions before you vote, please call our proxy information line at [ ]. Representatives are available Monday through Friday 9 a.m. to 10 p.m., Eastern Time to answer your questions about the proxy material or about how to how to cast your vote. You may also receive a telephone call reminding you to vote your shares. Thank you for your participation in this important initiative.

PLEASE DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED REPLY ENVELOPE OR CALL THE NUMBER LISTED ON YOUR PROXY CARD.