Exhibit 3.157

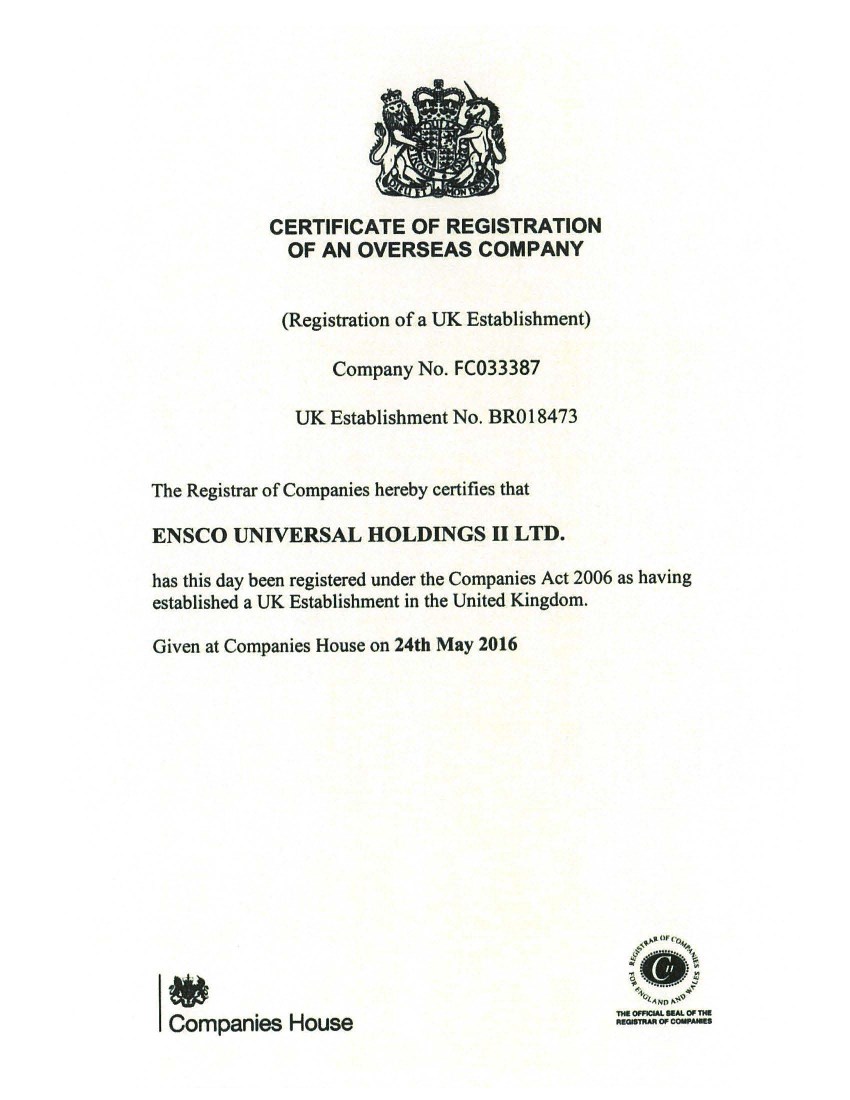

| CERTIFICATE OF REGISTRATION OF AN OVERSEAS COMPANY (Registration of a UK Establishment) Company No. FC033387 UK Establishment No. BR018473 The Registrar of Companies hereby certifies that ENSCO UNIVERSAL HOLDINGS II LTD. has this day been registered under the Companies Act 2006 as having established a UK Establishment in the United Kingdom. Given at Companies House on 24th May 2016 • Companies House |

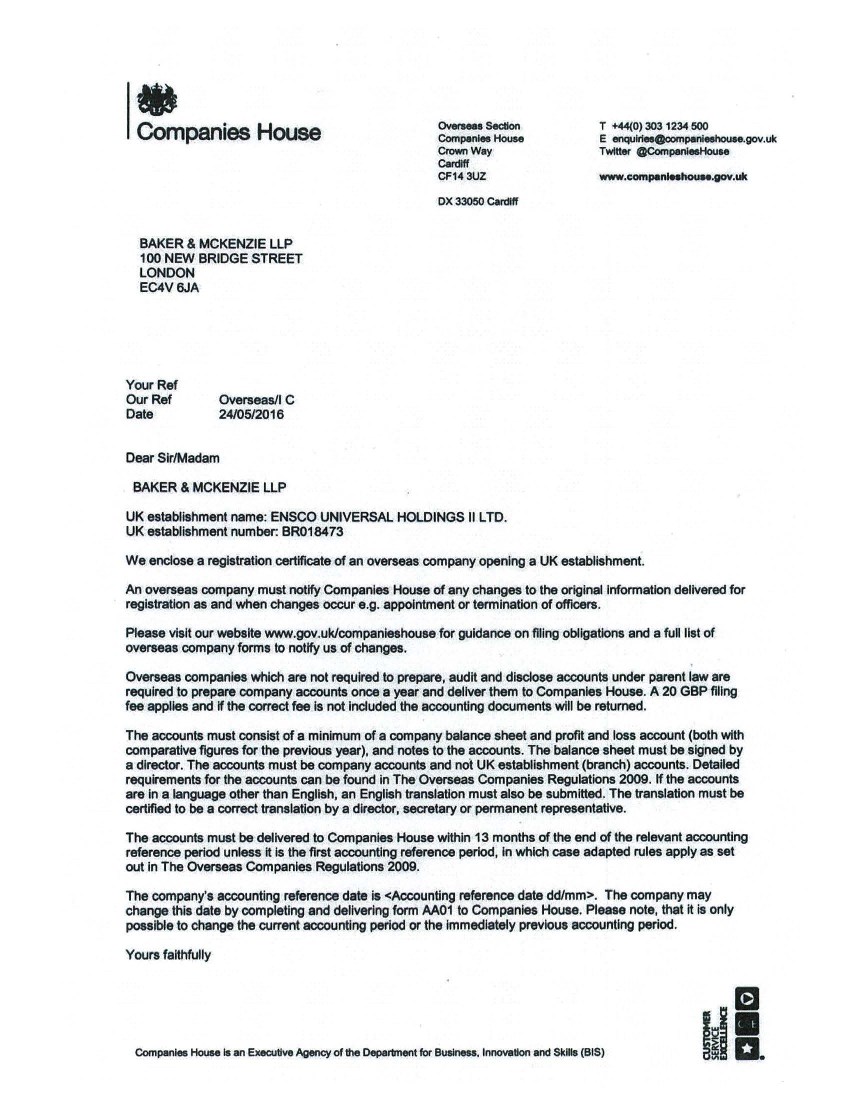

| • T +44(0) 303 1234 500 Companies House Overaen Section Companies House Crown Way Cardiff E enqulneaOoompanleehouff.gov.uk Twitter QCompanleaHouae CF143UZ _..,comp11n ... houN.gov.uk BAKER & MCKENZIE LLP 100 NEW BRIDGE STREET LONDON EC4V6JA Your Ref Our Ref Date Overseas/I C 24/05/2016 Dear Sir/Madam BAKER & MCKENZIE LLP DX 33050 Cardiff UK establishment name: ENSCO UNIVERSAL HOLDINGS II LTD. UK establishment number: BR0184 73 We enclose a registration certlfteate of an overseas company opening a UK establishment. An overseas company must notify Companies House of any changes to the original information delivered for registration as and when changes occur e.g. appointment or termination of officers. Please visit our website www.gov.uk/companieshouse for guidance on filing obligations and a fuU list of overseas company forms to notify us of changes. Overseas companies which are not required to prepare, audit and disclose accounts under parent law are required to prepare company accounts once a year and deliver them to Companies House. A 20 GBP filing fee applies and If the correct fee is not included the accounting documents will be returned. The accounts must consist of a minimum of a company balance sheet and profit and loss account (both with comparative figures for the previous year), and notes to the accounts. The balance sheet must be signed by a director. The accounts must be company accounts and not UK establishment (branch) accounts. Detailed requirements for the accounts can be found in The Overseas Companies Regulations 2009. If the accounts are in a language other than English, an English translation must also be submitted. The translation must be certified to be a correct translation by a director, secretary or permanent representative. The accounts must be delivered to Companies House within 13 months of the end of the relevant accounting reference period unless It Is the first accounting reference period, In which case adapted rules apply as set out in The Overseas Companies Regulations 2009. The company's accounting reference date is <Accounting reference date dd/mm>. The company may change this date by completing and delivering form AA01 to Companies House. Please note, that it is only possible to change the current accounting period or the Immediately previous accounting period. Yours faithfully Companies House Is an Executive AQertcy of the Department for Bullinen. Innovation and Skills (BIS) m Iii |