Exhibit 99.2 Wallbox NV NYSE:WBX Second Quarter 2O22 Earnings AU G U S T 1 0 , 2 0 2 2

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding Wallbox’s future financial results management expectations and new capabilities as a result of its recent acquisitions and partnerships. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “predict,”, “potential,” “continue” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause Wallbox’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: Wallbox’s history of operating losses as an early stage company; the adoption and demand for electric vehicles including the success of alternative fuels, changes to rebates, tax credits and the impact of government incentives; Wallbox’s ability to successfully manage its growth; the accuracy of Wallbox’s forecasts and projections including those regarding its market opportunity; competition; risks related to health pandemics including those of COVID-19; losses or disruptions in Wallbox’s supply or manufacturing partners; impacts resulting from the conflict between Russia and Ukraine; risks related to macro-economic conditions and inflation rate; Wallbox’s reliance on the third-parties outside of its control; risks related to Wallbox’s technology, intellectual property and infrastructure; and other important factors discussed under the caption “Risk Factors”; in Wallbox’s Annual Report on Form 20-F for the fiscal year ended December 31, 2021, as such factors maybe updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of Wallbox’s website at investors.wallbox.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any forward-looking statement that Wallbox makes in this presentation speaks only as of the date of such statement. Except as required by law, Wallbox disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise. 2

Corporate Overview Enric Asuncion, CEO 3

QUARTERLY HIGHLIGHTS – Q2 2022 “Gaining market share is % 124 1,100+ a key objective at Employees Q2 YoY Revenue Growth Wallbox, and doing so in an environment where EV manufacturing ~ +105 64K capacity and deliveries Countries with Chargers Sold Commercial Activity lag consumer demand is a testament to our % business model and solid 41.1 €127M 1 Gross Margin Cash on hand execution by the team.” 4 1. See slide 15 for definitions

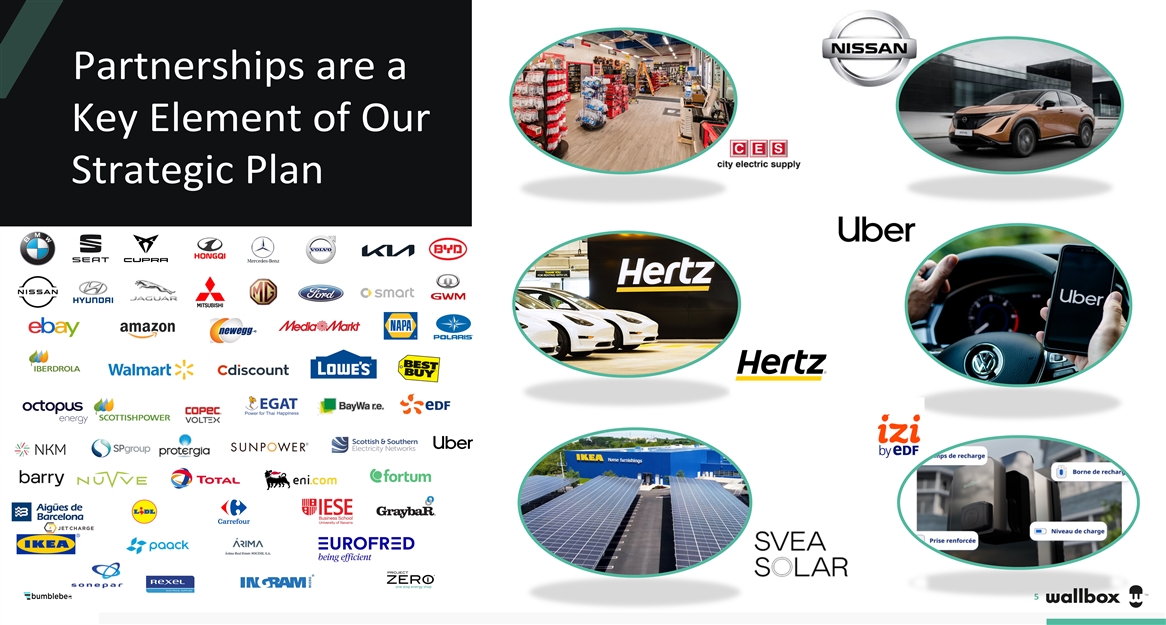

Partnerships are a Key Element of Our Strategic Plan 5

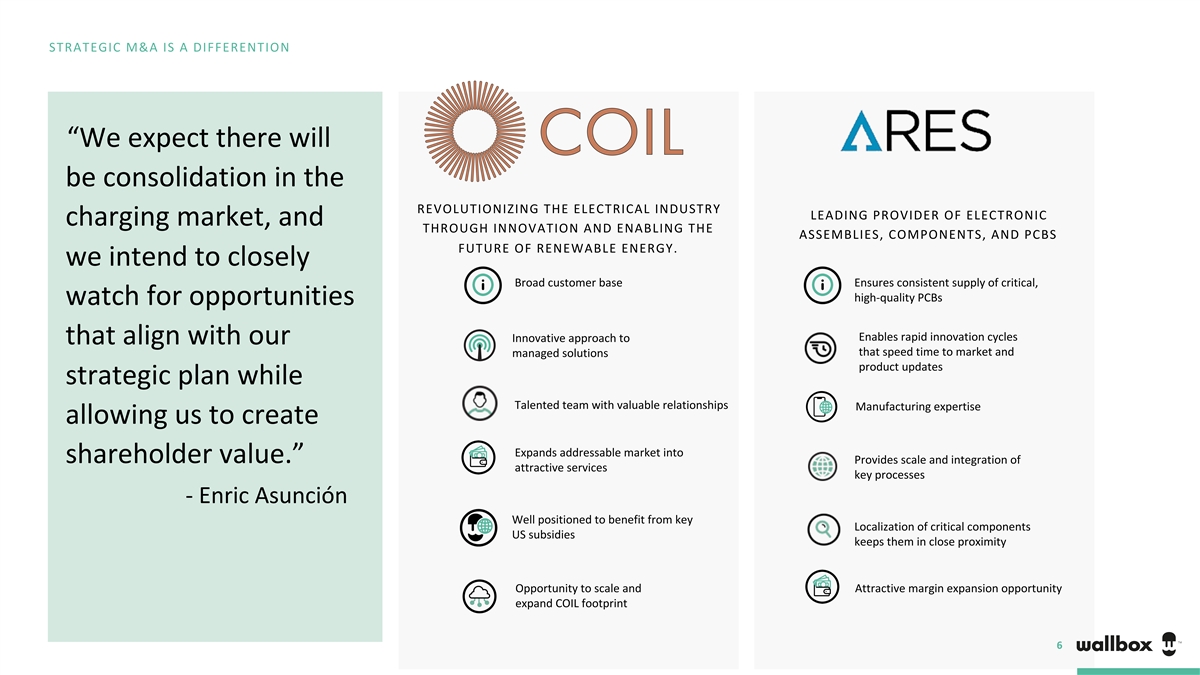

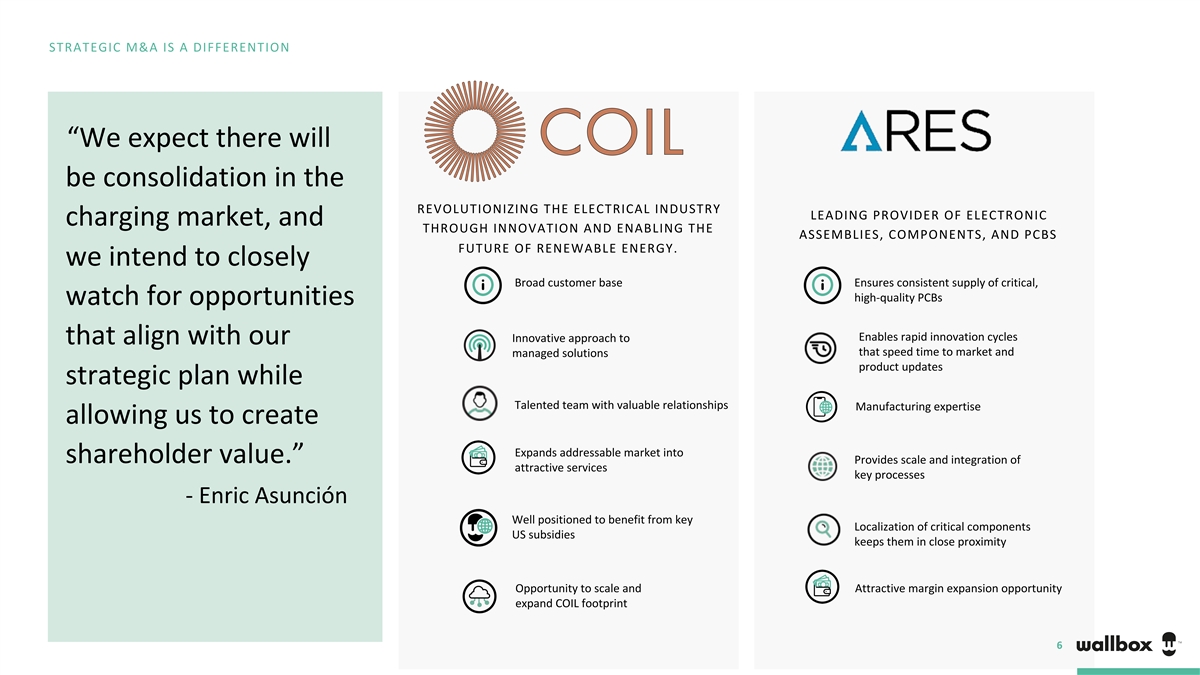

STRATEGIC M&A IS A DIFFERENTION “We expect there will be consolidation in the REVOLUTIONIZING THE ELECTRICAL INDUSTRY LEADING PROVIDER OF ELECTRONIC charging market, and THROUGH INNOVATION AND ENABLING THE ASSEMBLIES, COMPONENTS, AND PCBS FUTURE OF RENEWABLE ENERGY. we intend to closely Broad customer base Ensures consistent supply of critical, high-quality PCBs watch for opportunities Enables rapid innovation cycles Innovative approach to that align with our that speed time to market and managed solutions product updates strategic plan while Talented team with valuable relationships Manufacturing expertise allowing us to create Expands addressable market into shareholder value.” Provides scale and integration of attractive services key processes - Enric Asunción Well positioned to benefit from key Localization of critical components US subsidies keeps them in close proximity Opportunity to scale and Attractive margin expansion opportunity expand COIL footprint 6

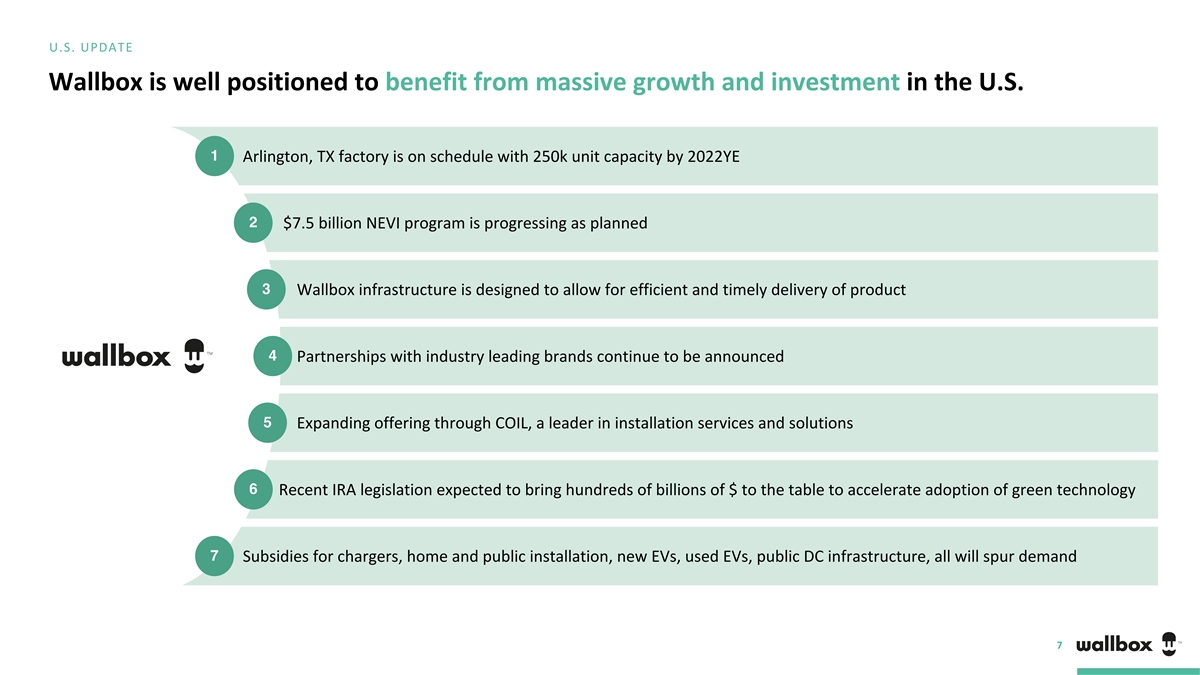

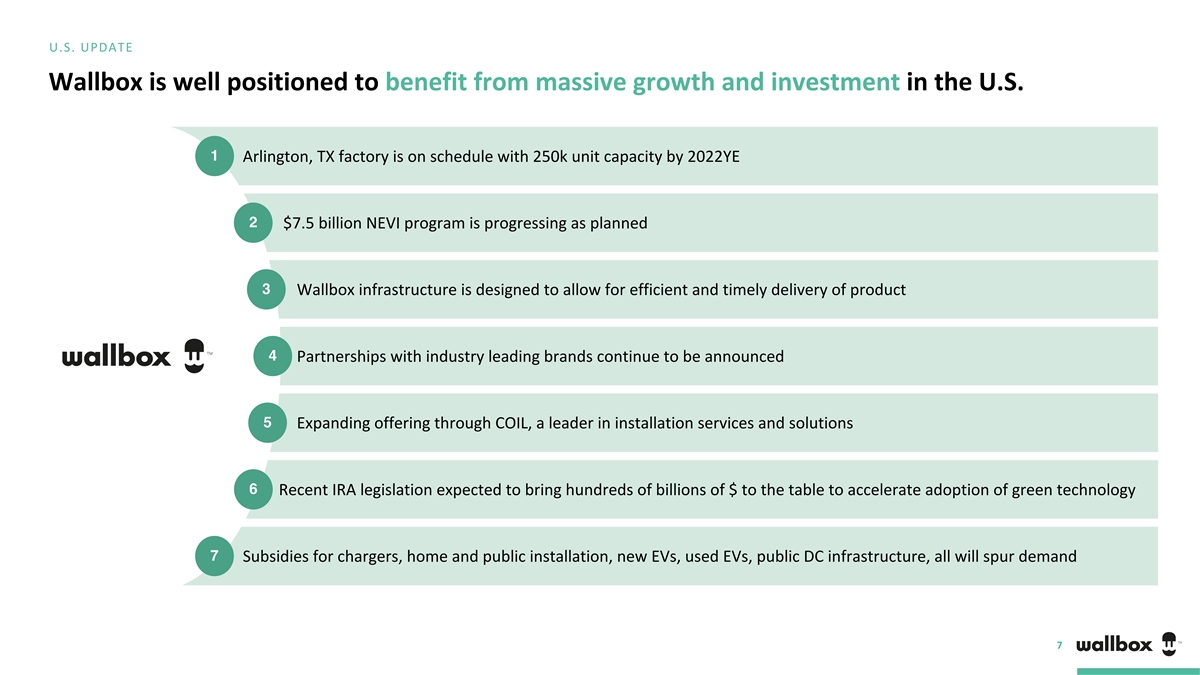

U.S. UPDATE Wallbox is well positioned to benefit from massive growth and investment in the U.S. 1 Arlington, TX factory is on schedule with 250k unit capacity by 2022YE 2 $7.5 billion NEVI program is progressing as planned 3 Wallbox infrastructure is designed to allow for efficient and timely delivery of product 4 Partnerships with industry leading brands continue to be announced 5 Expanding offering through COIL, a leader in installation services and solutions 6 Recent IRA legislation expected to bring hundreds of billions of $ to the table to accelerate adoption of green technology 7 Subsidies for chargers, home and public installation, new EVs, used EVs, public DC infrastructure, all will spur demand 7

Financial Review Jordi Lainz, CFO 8

FINANCIAL HIGHLIGHTS Financial & Operating Highlights: Q2 2022 INCOME STATEMENT OPERATING METRICS BALANCE SHEET (€ IN MILLIONS) (€ IN MILLIONS) Units sold ~64,000 Revenue €39.548 Cash & Equivalents €126.515 Headcount ~1,100 YoY Growth 124% LT Debt €23.274 Countries +105 1 Gross Margin 41.1% 2022 Est. Mfg. Capacity +1,000,000 “We’re building a company that is delivering results in a time of hyper growth and expansion.” – Jordi Lainz “ 9 1. See slide 15 for definitions “

Closing Thoughts 10

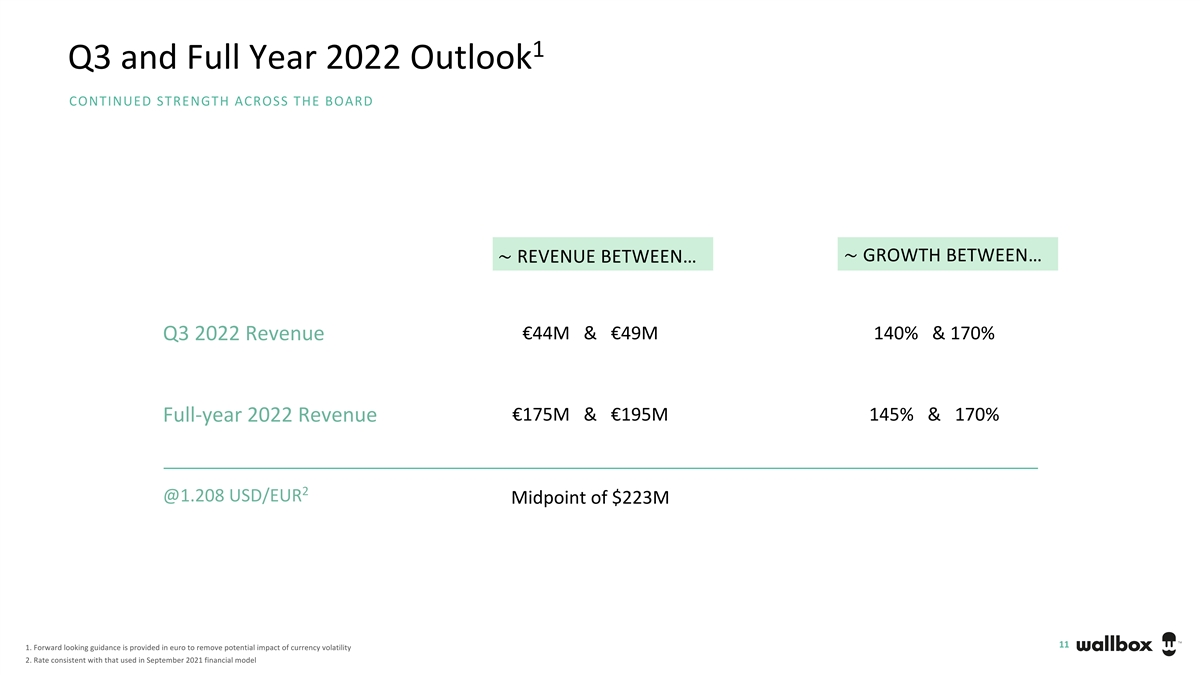

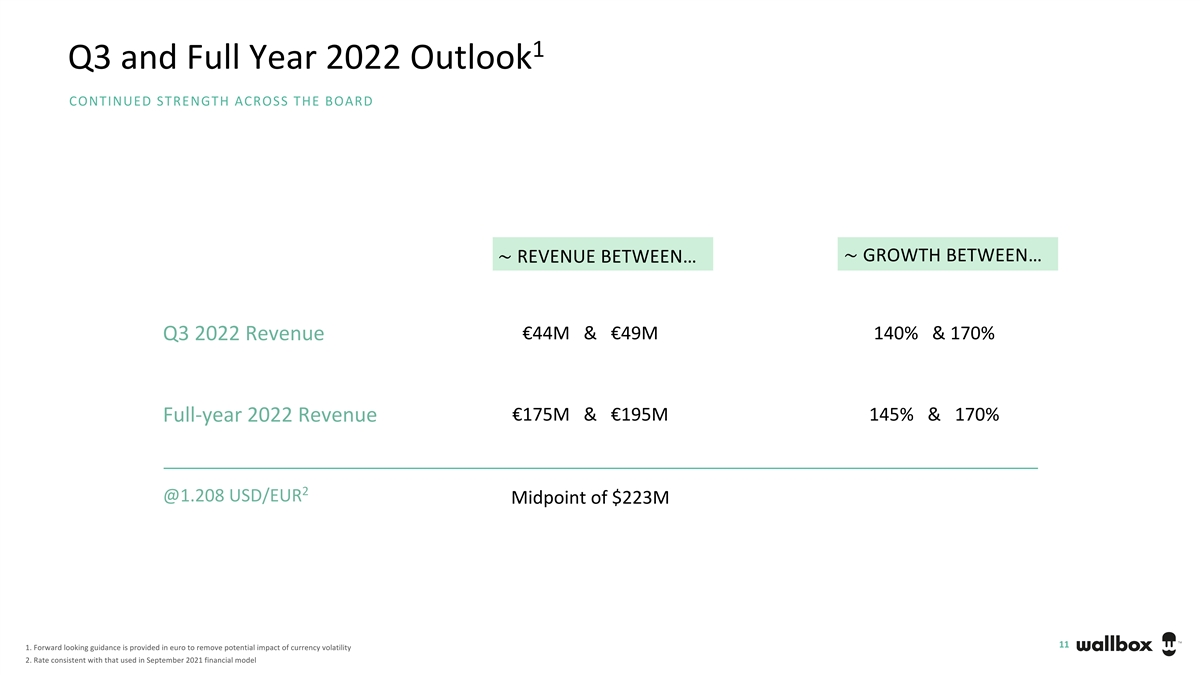

1 Q3 and Full Year 2022 Outlook CONTINUED STRENGTH ACROSS THE BOARD ~ GROWTH BETWEEN… ~ REVENUE BETWEEN… €44M & €49M 140% & 170% Q3 2022 Revenue €175M & €195M 145% & 170% Full-year 2022 Revenue 2 @1.208 USD/EUR Midpoint of $223M 11 1. Forward looking guidance is provided in euro to remove potential impact of currency volatility 2. Rate consistent with that used in September 2021 financial model

Questions & Answers 12

Appendix 13

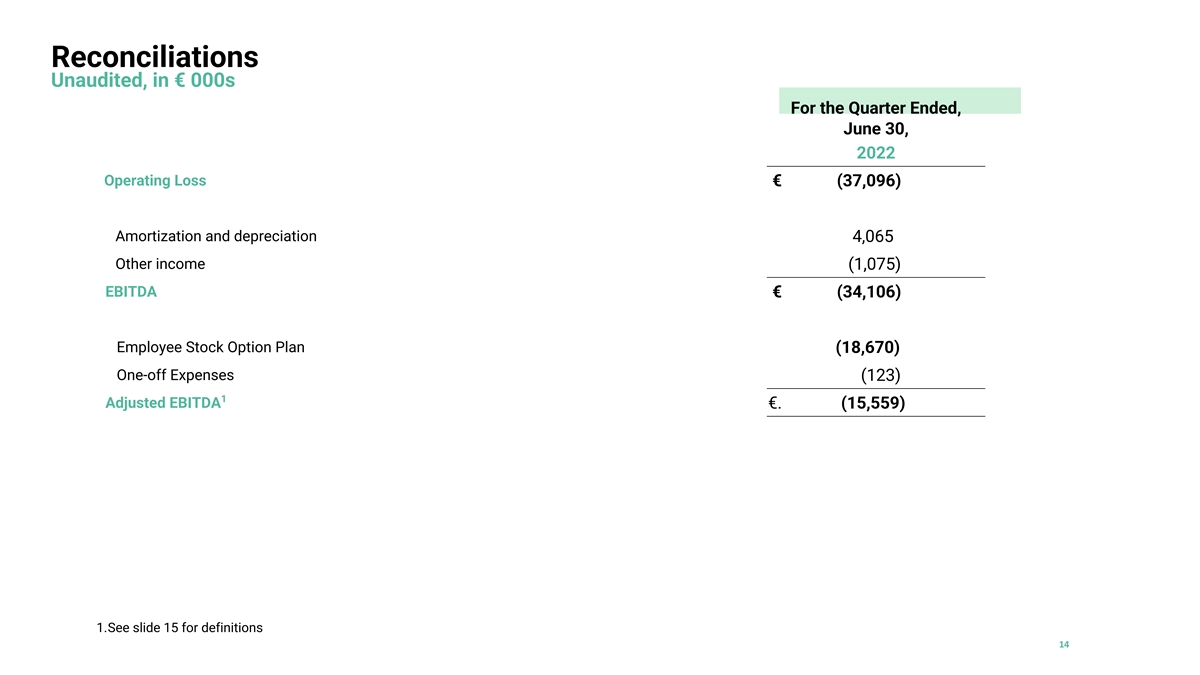

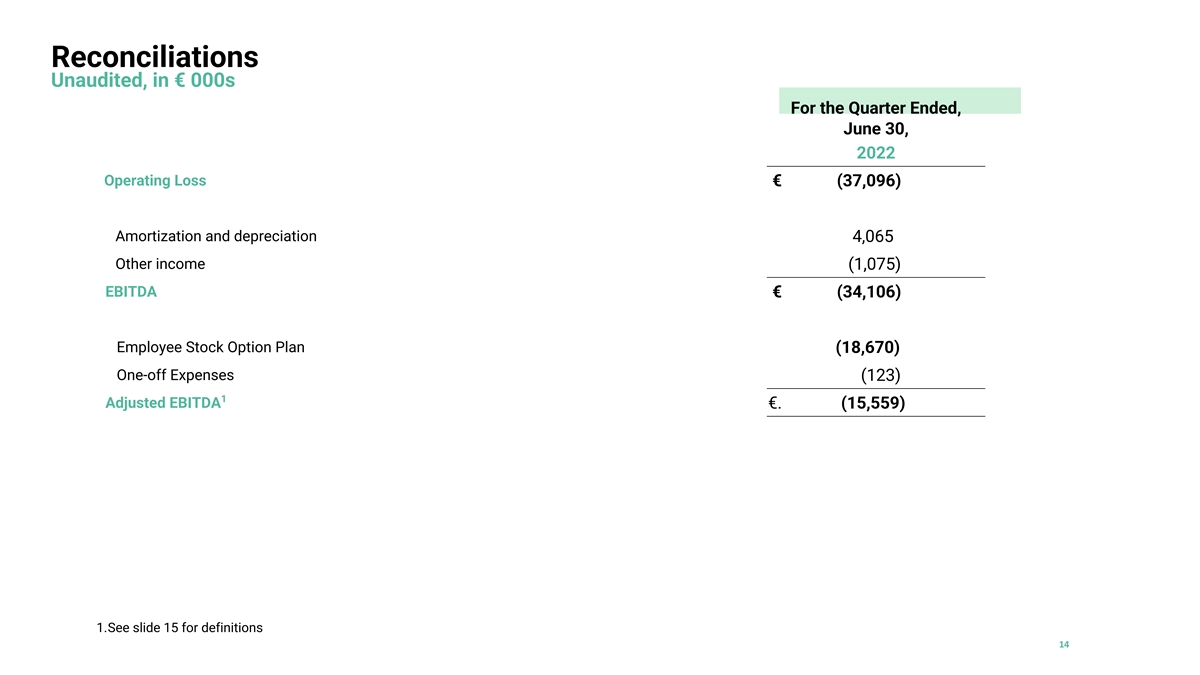

Reconciliations Unaudited, in € 000s For the Quarter Ended, June 30, 2022 Operating Loss € (37,096) Amortization and depreciation 4,065 Other income (1,075) EBITDA € (34,106) Employee Stock Option Plan (18,670) One-off Expenses (123) 1 Adjusted EBITDA €. (15,559) 1.See slide 15 for definitions 14

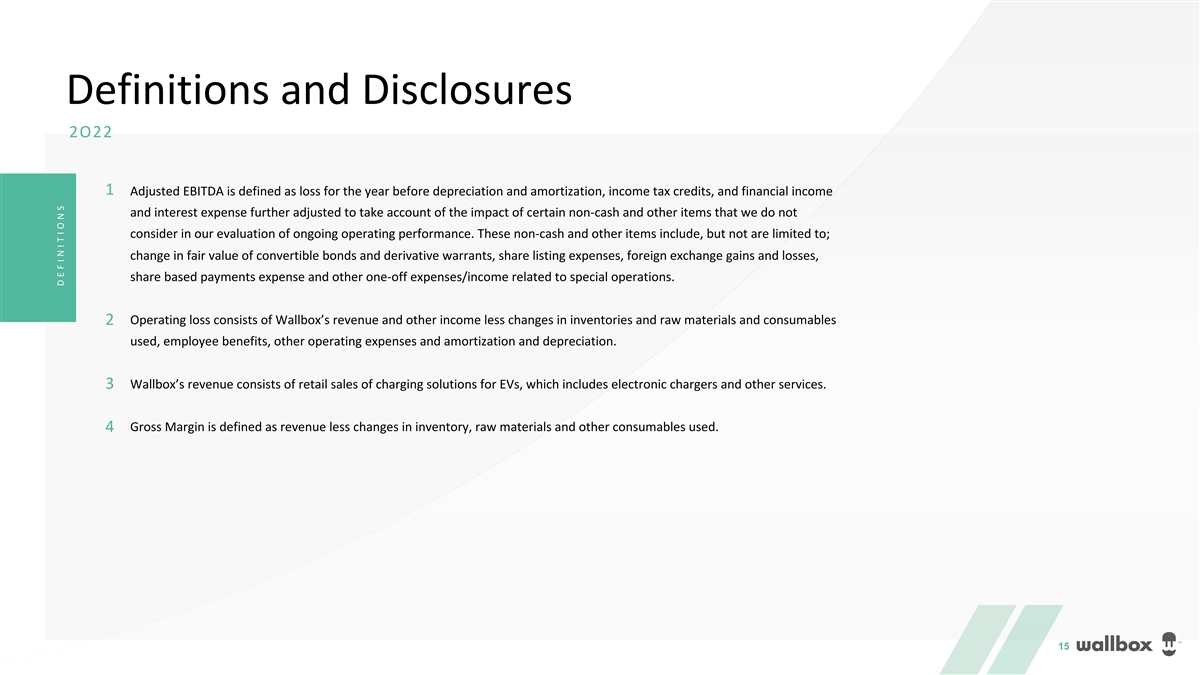

Definitions and Disclosures 2O22 1 Adjusted EBITDA is defined as loss for the year before depreciation and amortization, income tax credits, and financial income and interest expense further adjusted to take account of the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These non-cash and other items include, but not are limited to; change in fair value of convertible bonds and derivative warrants, share listing expenses, foreign exchange gains and losses, share based payments expense and other one-off expenses/income related to special operations. Operating loss consists of Wallbox’s revenue and other income less changes in inventories and raw materials and consumables 2 used, employee benefits, other operating expenses and amortization and depreciation. Wallbox’s revenue consists of retail sales of charging solutions for EVs, which includes electronic chargers and other services. 3 Gross Margin is defined as revenue less changes in inventory, raw materials and other consumables used. 4 15 DE FI NI T I ONS