Exhibit 99.1 Consolidated Financial Statements STRONGBRIDGE BIOPHARMA plc September 30, 2021 and 2020

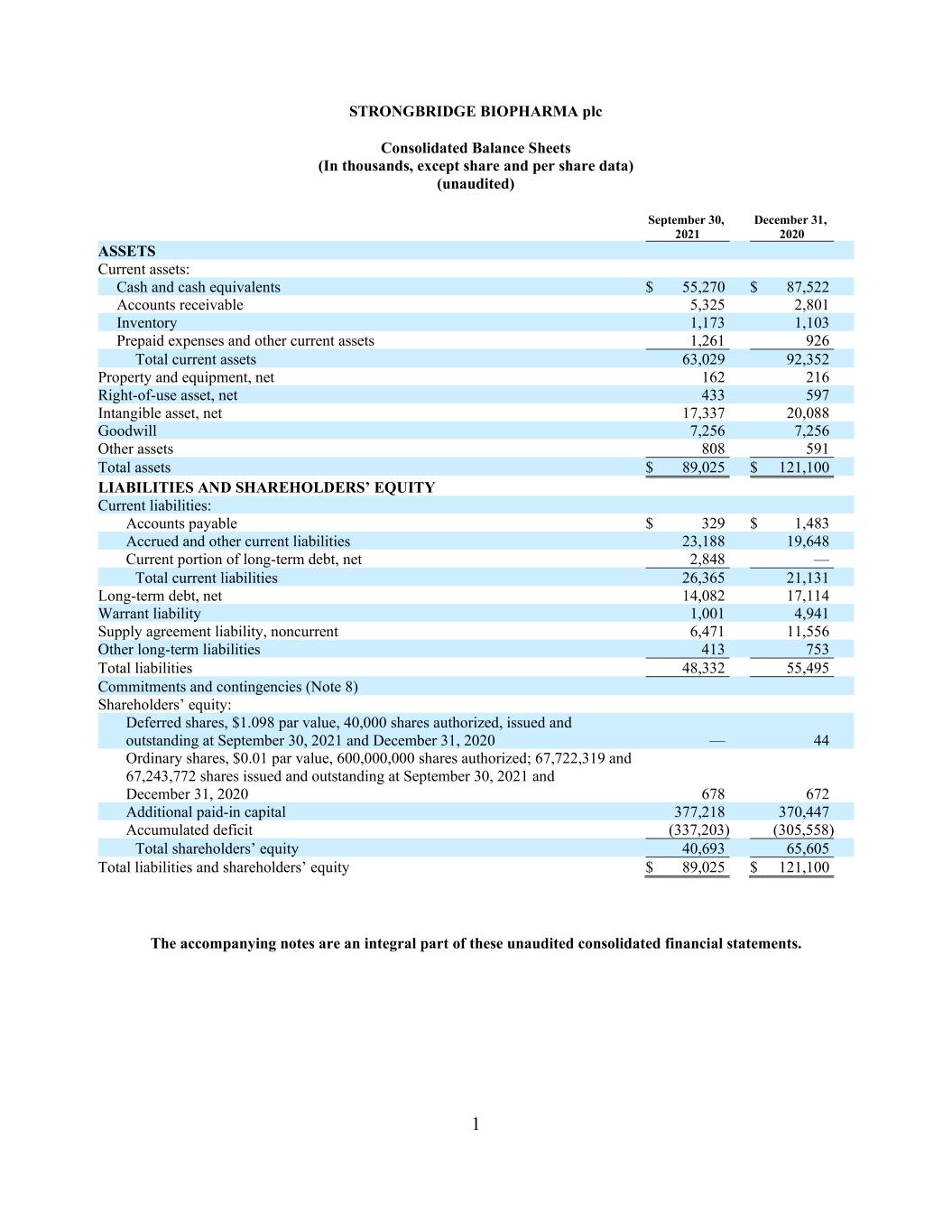

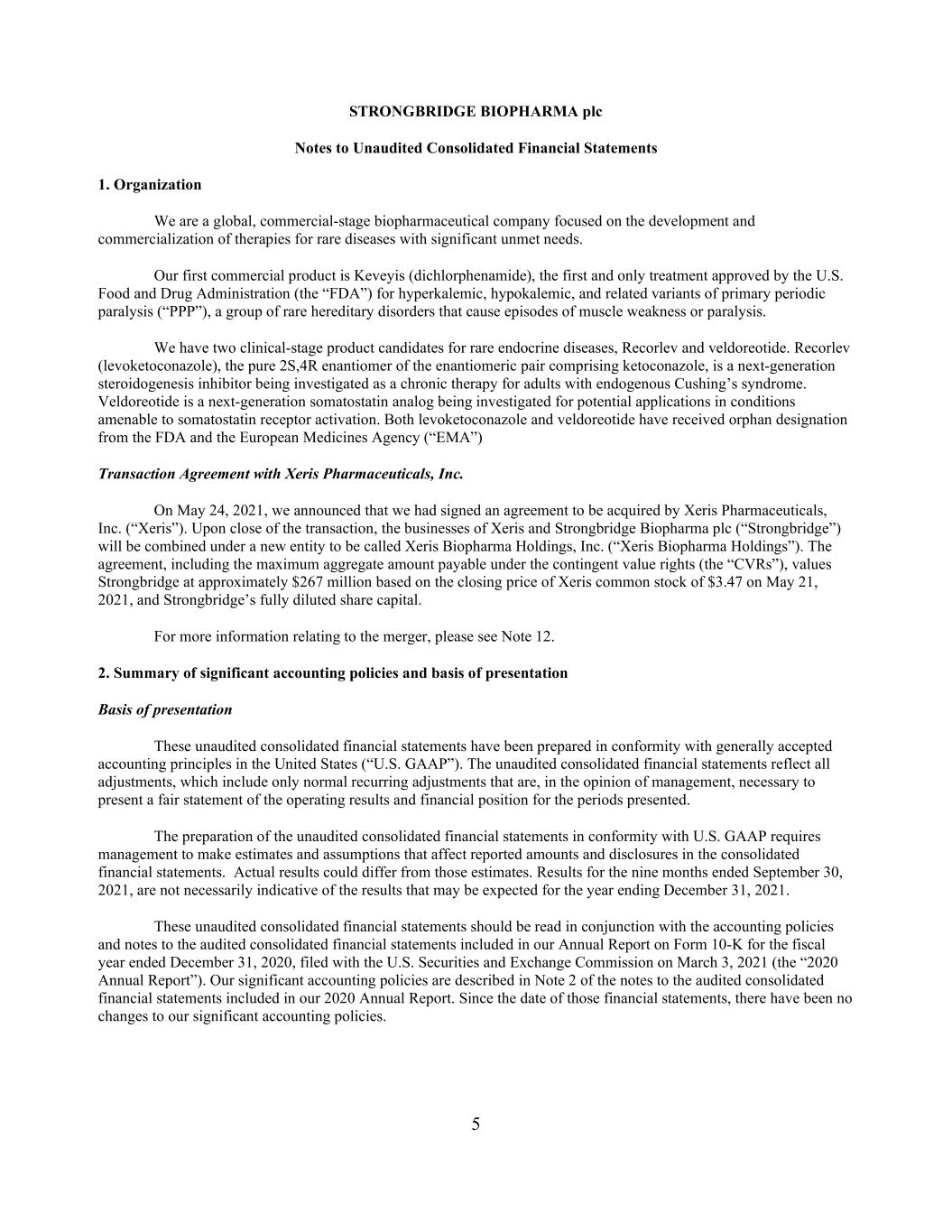

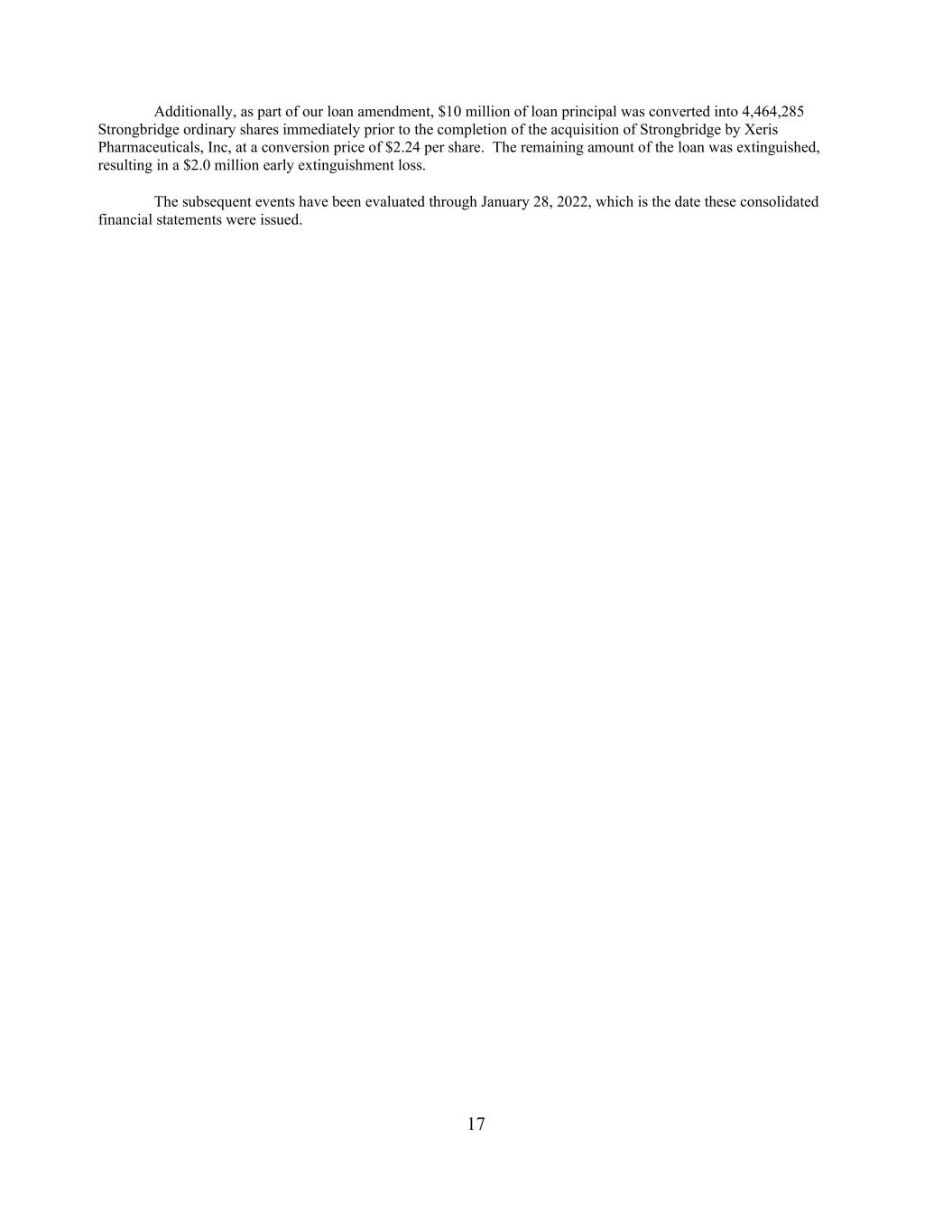

1 STRONGBRIDGE BIOPHARMA plc Consolidated Balance Sheets (In thousands, except share and per share data) (unaudited) September 30, December 31, 2021 2020 ASSETS Current assets: Cash and cash equivalents $ 55,270 $ 87,522 Accounts receivable 5,325 2,801 Inventory 1,173 1,103 Prepaid expenses and other current assets 1,261 926 Total current assets 63,029 92,352 Property and equipment, net 162 216 Right-of-use asset, net 433 597 Intangible asset, net 17,337 20,088 Goodwill 7,256 7,256 Other assets 808 591 Total assets $ 89,025 $ 121,100 LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable $ 329 $ 1,483 Accrued and other current liabilities 23,188 19,648 Current portion of long-term debt, net 2,848 — Total current liabilities 26,365 21,131 Long-term debt, net 14,082 17,114 Warrant liability 1,001 4,941 Supply agreement liability, noncurrent 6,471 11,556 Other long-term liabilities 413 753 Total liabilities 48,332 55,495 Commitments and contingencies (Note 8) Shareholders’ equity: Deferred shares, $1.098 par value, 40,000 shares authorized, issued and outstanding at September 30, 2021 and December 31, 2020 — 44 Ordinary shares, $0.01 par value, 600,000,000 shares authorized; 67,722,319 and 67,243,772 shares issued and outstanding at September 30, 2021 and December 31, 2020 678 672 Additional paid-in capital 377,218 370,447 Accumulated deficit (337,203) (305,558) Total shareholders’ equity 40,693 65,605 Total liabilities and shareholders’ equity $ 89,025 $ 121,100 The accompanying notes are an integral part of these unaudited consolidated financial statements.

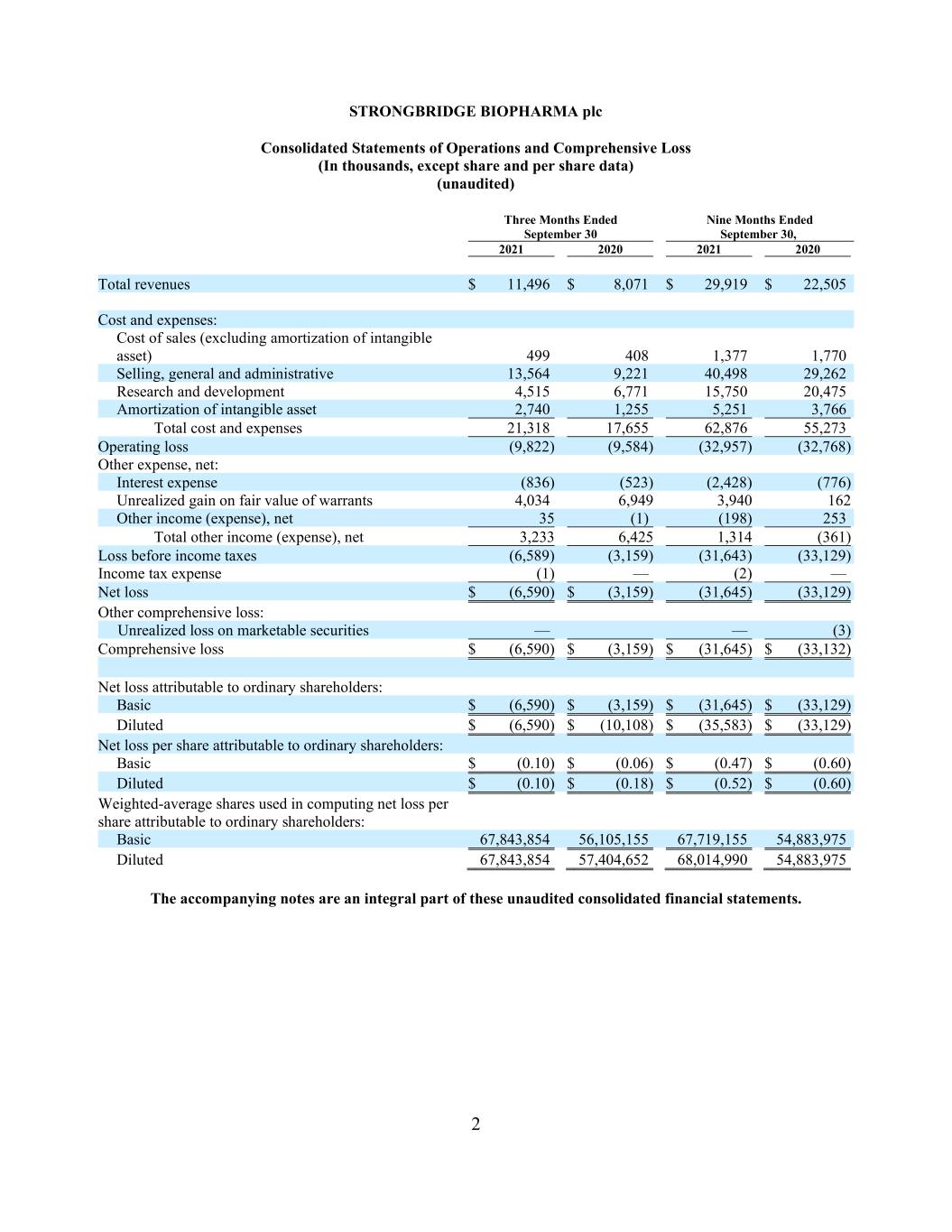

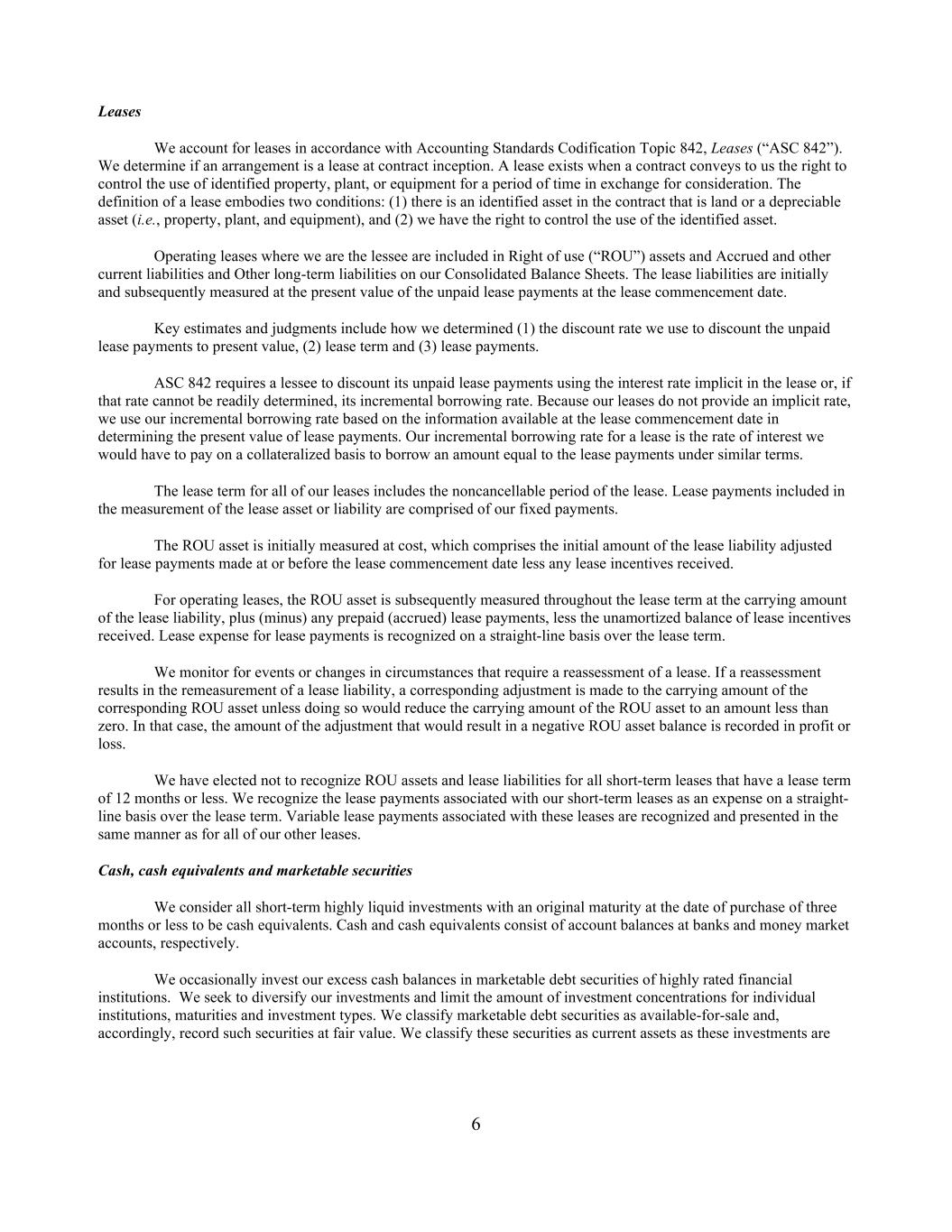

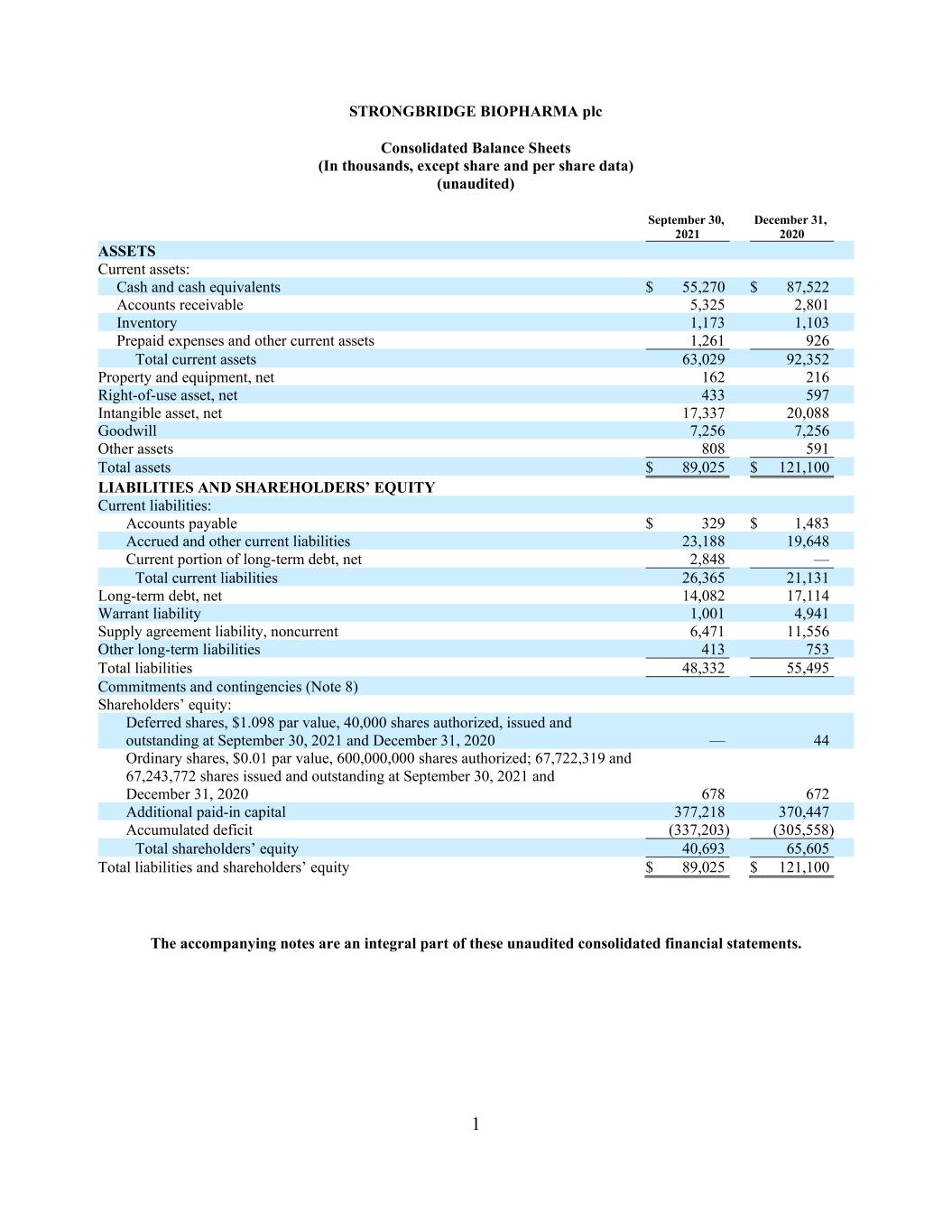

2 STRONGBRIDGE BIOPHARMA plc Consolidated Statements of Operations and Comprehensive Loss (In thousands, except share and per share data) (unaudited) Three Months Ended Nine Months Ended September 30 September 30, 2021 2020 2021 2020 Total revenues $ 11,496 $ 8,071 $ 29,919 $ 22,505 Cost and expenses: Cost of sales (excluding amortization of intangible asset) 499 408 1,377 1,770 Selling, general and administrative 13,564 9,221 40,498 29,262 Research and development 4,515 6,771 15,750 20,475 Amortization of intangible asset 2,740 1,255 5,251 3,766 Total cost and expenses 21,318 17,655 62,876 55,273 Operating loss (9,822) (9,584) (32,957) (32,768) Other expense, net: Interest expense (836) (523) (2,428) (776) Unrealized gain on fair value of warrants 4,034 6,949 3,940 162 Other income (expense), net 35 (1) (198) 253 Total other income (expense), net 3,233 6,425 1,314 (361) Loss before income taxes (6,589) (3,159) (31,643) (33,129) Income tax expense (1) — (2) — Net loss $ (6,590) $ (3,159) (31,645) (33,129) Other comprehensive loss: Unrealized loss on marketable securities — — (3) Comprehensive loss $ (6,590) $ (3,159) $ (31,645) $ (33,132) Net loss attributable to ordinary shareholders: Basic $ (6,590) $ (3,159) $ (31,645) $ (33,129) Diluted $ (6,590) $ (10,108) $ (35,583) $ (33,129) Net loss per share attributable to ordinary shareholders: Basic $ (0.10) $ (0.06) $ (0.47) $ (0.60) Diluted $ (0.10) $ (0.18) $ (0.52) $ (0.60) Weighted-average shares used in computing net loss per share attributable to ordinary shareholders: Basic 67,843,854 56,105,155 67,719,155 54,883,975 Diluted 67,843,854 57,404,652 68,014,990 54,883,975 The accompanying notes are an integral part of these unaudited consolidated financial statements.

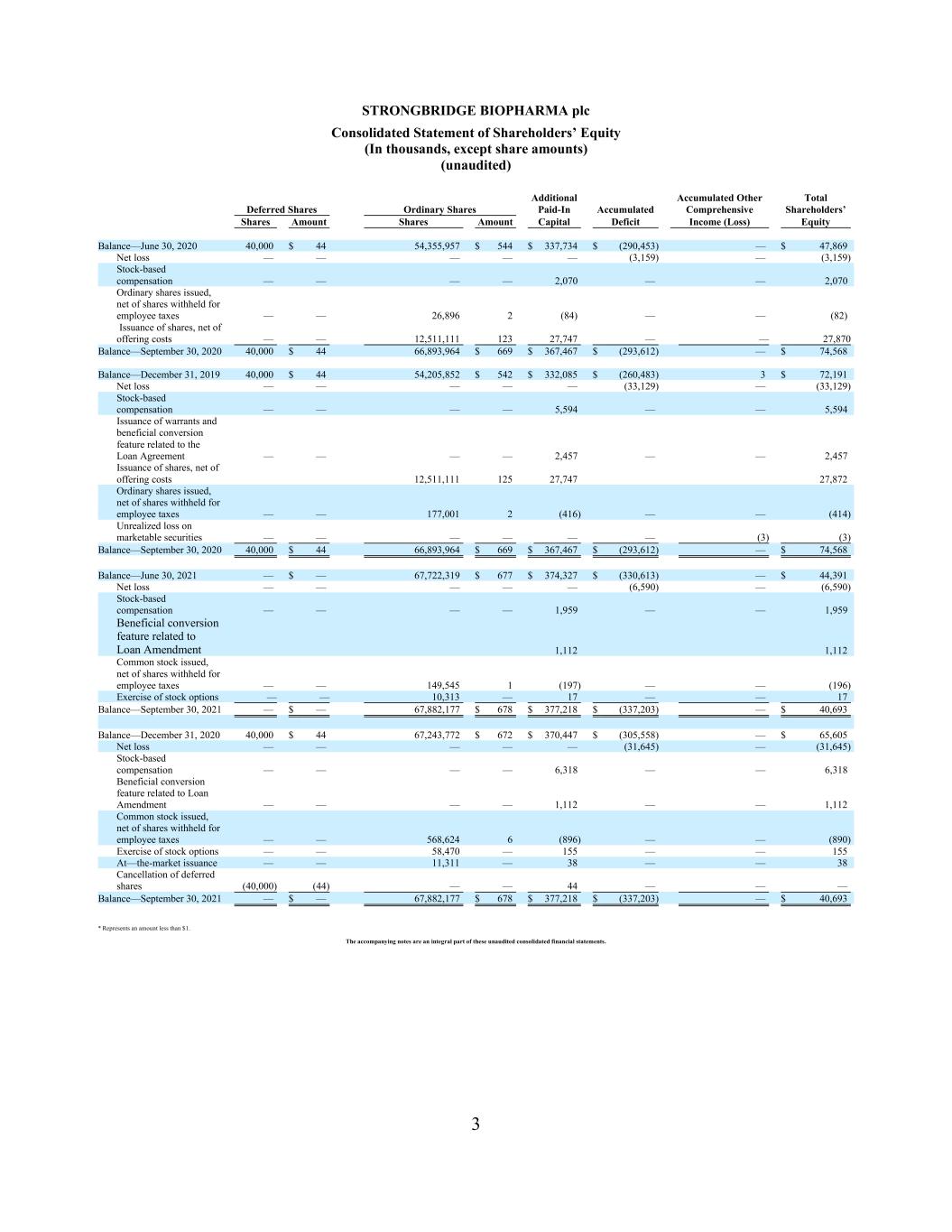

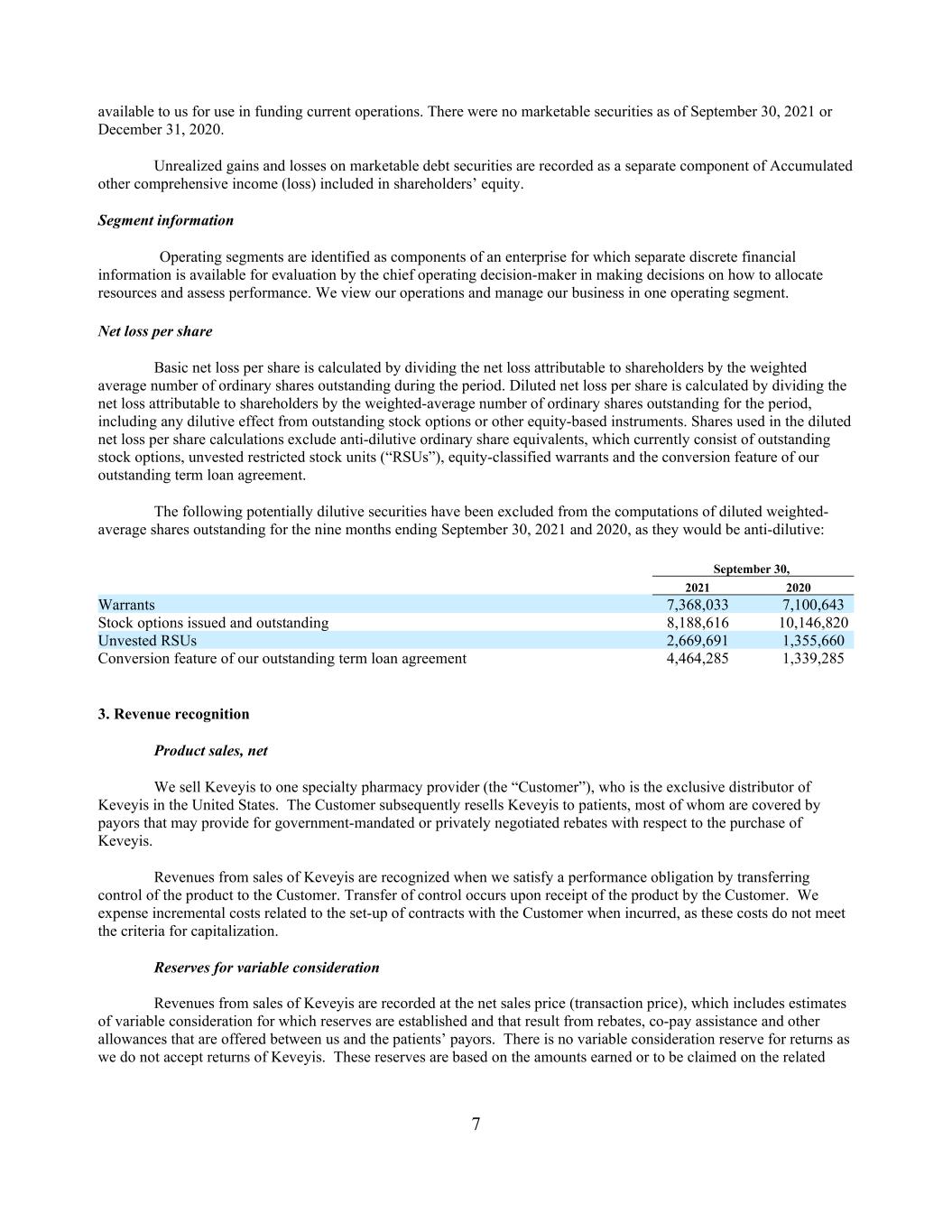

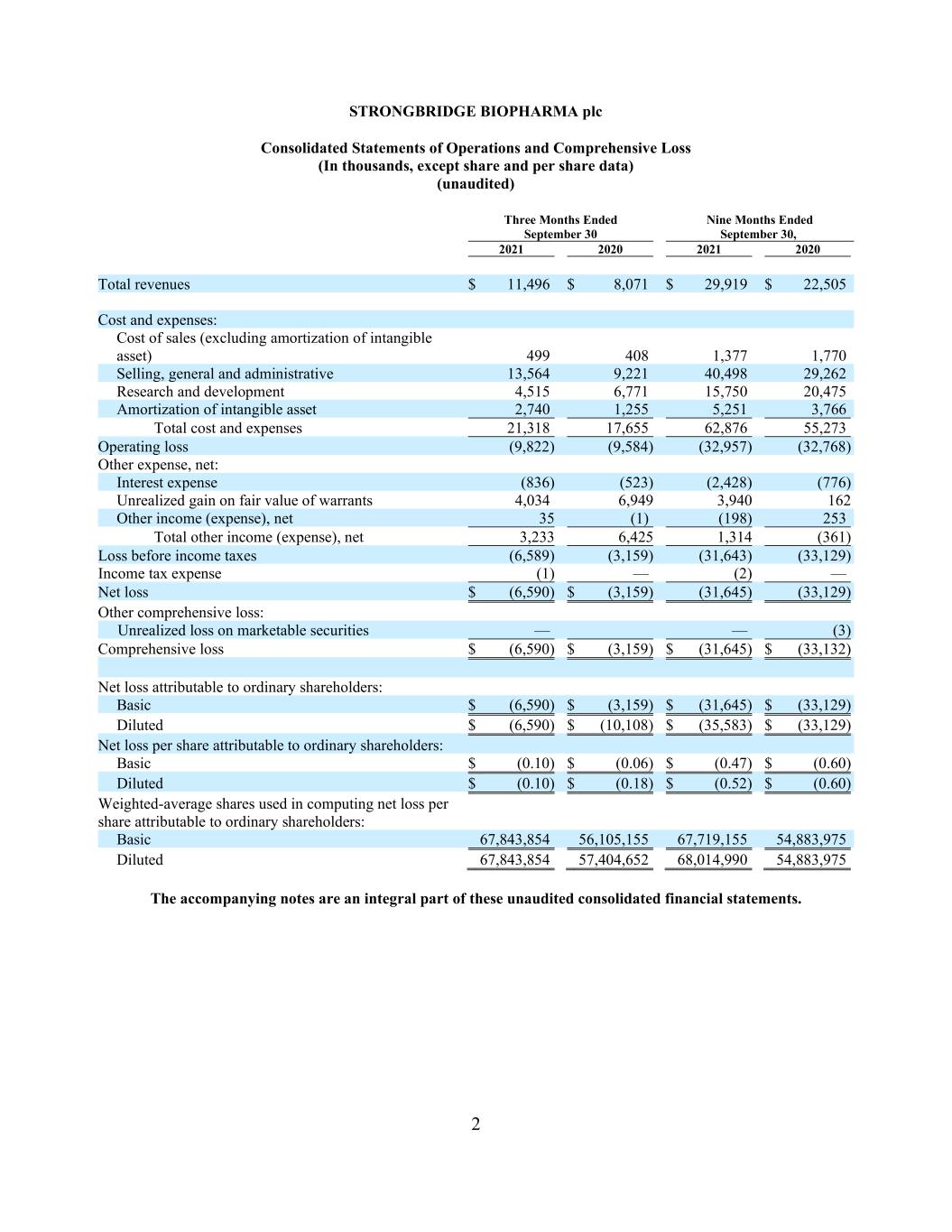

3 STRONGBRIDGE BIOPHARMA plc Consolidated Statement of Shareholders’ Equity (In thousands, except share amounts) (unaudited) Additional Accumulated Other Total Deferred Shares Ordinary Shares Paid-In Accumulated Comprehensive Shareholders’ Shares Amount Shares Amount Capital Deficit Income (Loss) Equity Balance—June 30, 2020 40,000 $ 44 54,355,957 $ 544 $ 337,734 $ (290,453) — $ 47,869 Net loss — — — — — (3,159) — (3,159) Stock-based compensation — — — — 2,070 — — 2,070 Ordinary shares issued, net of shares withheld for employee taxes — — 26,896 2 (84) — — (82) Issuance of shares, net of offering costs — — 12,511,111 123 27,747 — — 27,870 Balance—September 30, 2020 40,000 $ 44 66,893,964 $ 669 $ 367,467 $ (293,612) — $ 74,568 Balance—December 31, 2019 40,000 $ 44 54,205,852 $ 542 $ 332,085 $ (260,483) 3 $ 72,191 Net loss — — — — — (33,129) — (33,129) Stock-based compensation — — — — 5,594 — — 5,594 Issuance of warrants and beneficial conversion feature related to the Loan Agreement — — — — 2,457 — — 2,457 Issuance of shares, net of offering costs 12,511,111 125 27,747 27,872 Ordinary shares issued, net of shares withheld for employee taxes — — 177,001 2 (416) — — (414) Unrealized loss on marketable securities — — — — — — (3) (3) Balance—September 30, 2020 40,000 $ 44 66,893,964 $ 669 $ 367,467 $ (293,612) — $ 74,568 Balance—June 30, 2021 — $ — 67,722,319 $ 677 $ 374,327 $ (330,613) — $ 44,391 Net loss — — — — — (6,590) — (6,590) Stock-based compensation — — — — 1,959 — — 1,959 Beneficial conversion feature related to Loan Amendment 1,112 1,112 Common stock issued, net of shares withheld for employee taxes — — 149,545 1 (197) — — (196) Exercise of stock options — — 10,313 — 17 — — 17 Balance—September 30, 2021 — $ — 67,882,177 $ 678 $ 377,218 $ (337,203) — $ 40,693 Balance—December 31, 2020 40,000 $ 44 67,243,772 $ 672 $ 370,447 $ (305,558) — $ 65,605 Net loss — — — — — (31,645) — (31,645) Stock-based compensation — — — — 6,318 — — 6,318 Beneficial conversion feature related to Loan Amendment — — — — 1,112 — — 1,112 Common stock issued, net of shares withheld for employee taxes — — 568,624 6 (896) — — (890) Exercise of stock options — — 58,470 — 155 — — 155 At—the-market issuance — — 11,311 — 38 — — 38 Cancellation of deferred shares (40,000) (44) — — 44 — — — Balance—September 30, 2021 — $ — 67,882,177 $ 678 $ 377,218 $ (337,203) — $ 40,693 * Represents an amount less than $1. The accompanying notes are an integral part of these unaudited consolidated financial statements.

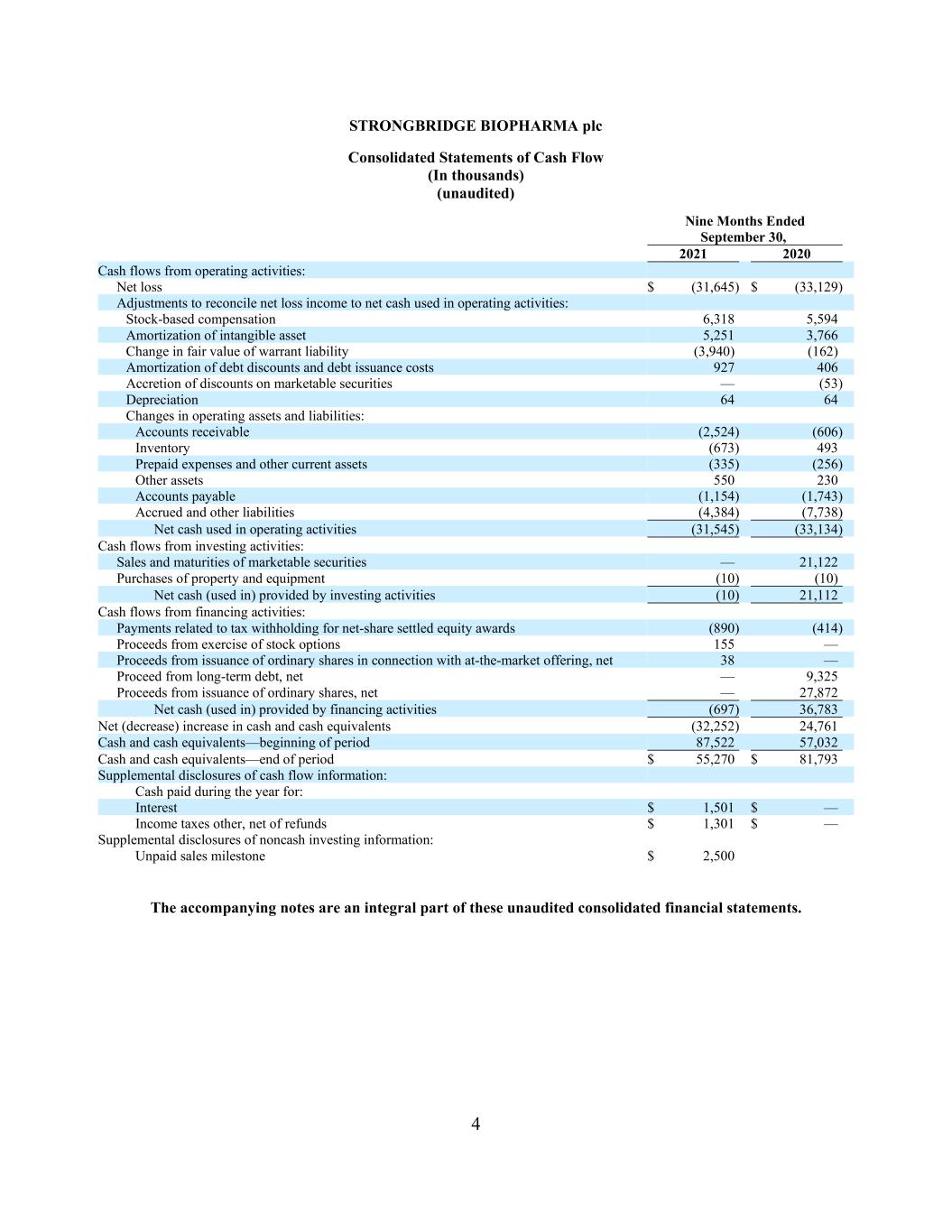

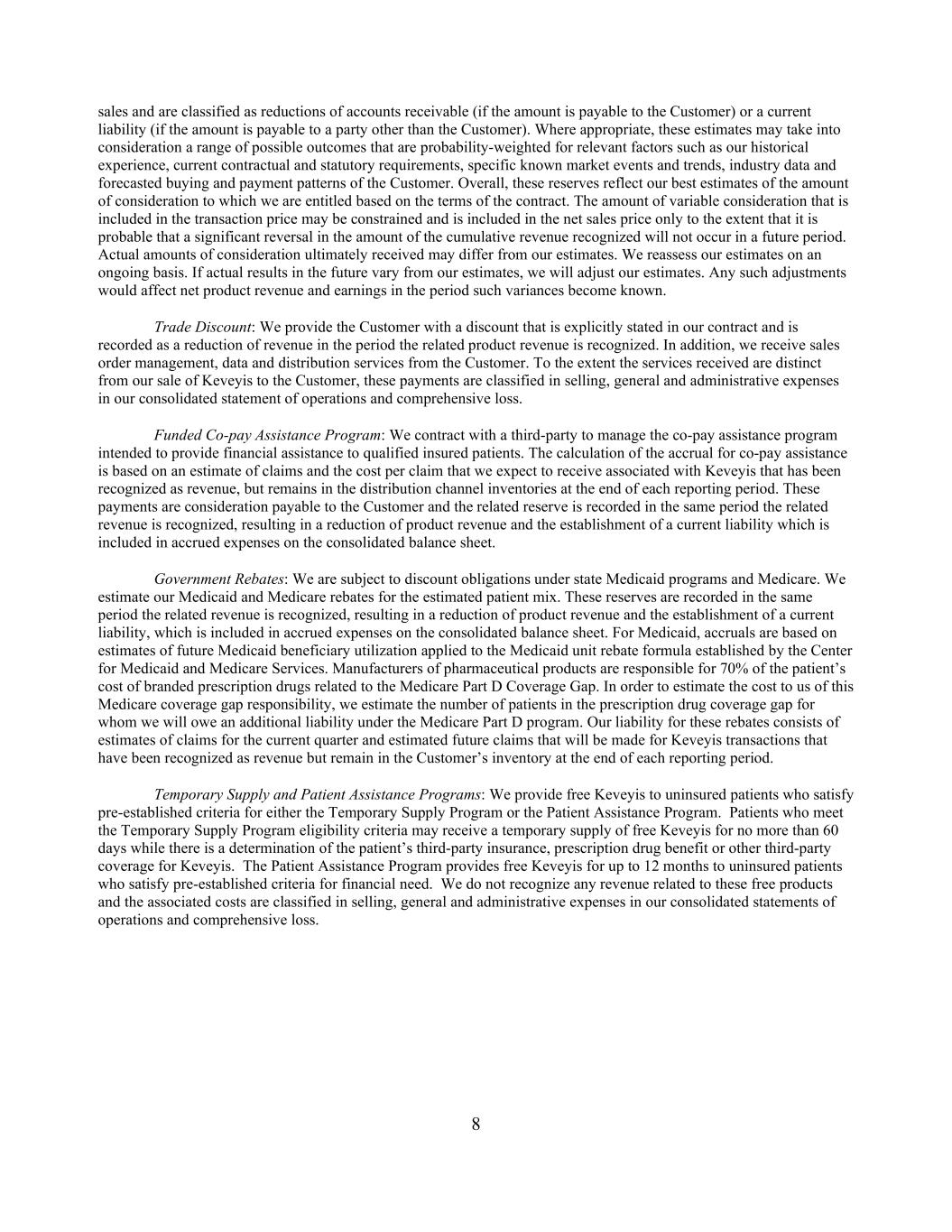

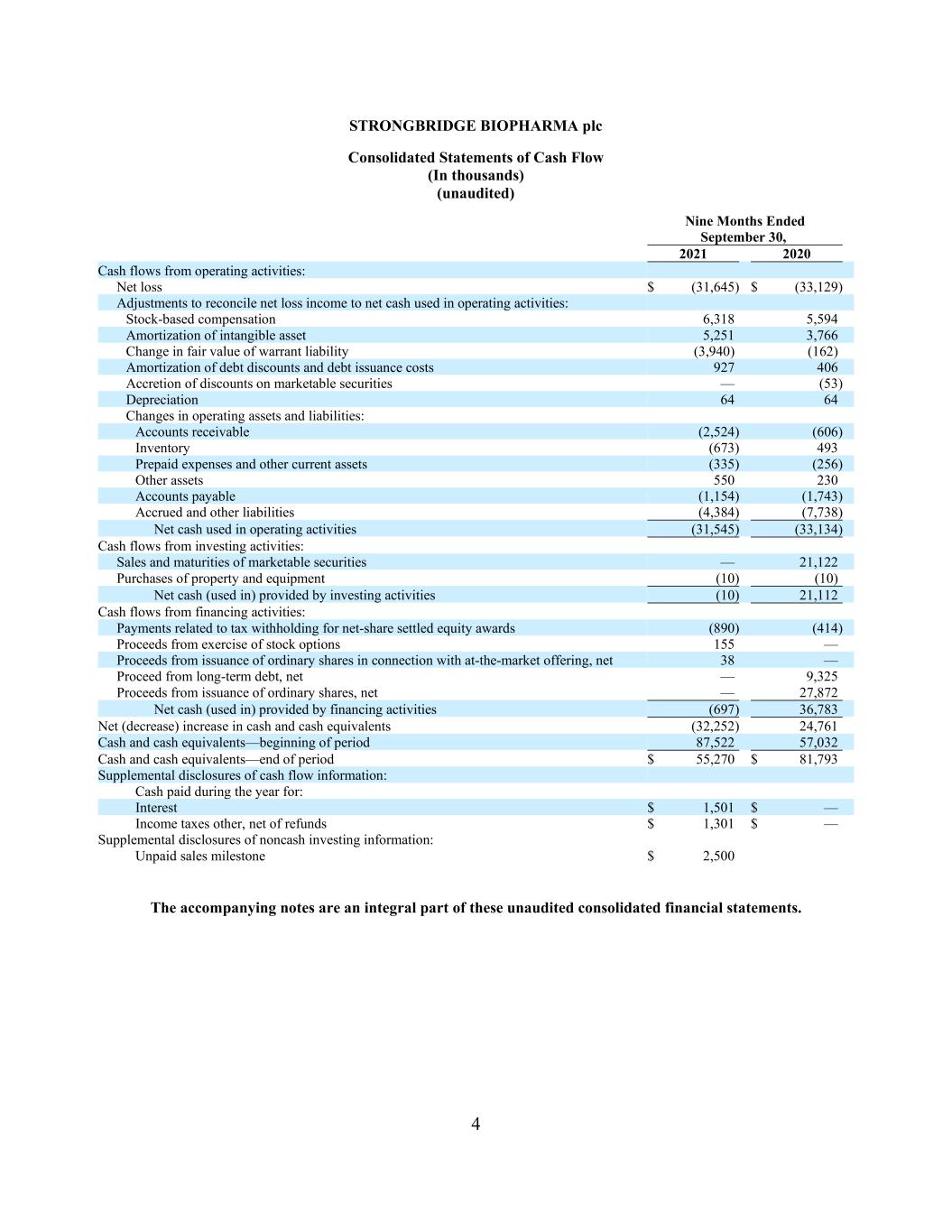

4 STRONGBRIDGE BIOPHARMA plc Consolidated Statements of Cash Flow (In thousands) (unaudited) Nine Months Ended September 30, 2021 2020 Cash flows from operating activities: Net loss $ (31,645) $ (33,129) Adjustments to reconcile net loss income to net cash used in operating activities: Stock-based compensation 6,318 5,594 Amortization of intangible asset 5,251 3,766 Change in fair value of warrant liability (3,940) (162) Amortization of debt discounts and debt issuance costs 927 406 Accretion of discounts on marketable securities — (53) Depreciation 64 64 Changes in operating assets and liabilities: Accounts receivable (2,524) (606) Inventory (673) 493 Prepaid expenses and other current assets (335) (256) Other assets 550 230 Accounts payable (1,154) (1,743) Accrued and other liabilities (4,384) (7,738) Net cash used in operating activities (31,545) (33,134) Cash flows from investing activities: Sales and maturities of marketable securities — 21,122 Purchases of property and equipment (10) (10) Net cash (used in) provided by investing activities (10) 21,112 Cash flows from financing activities: Payments related to tax withholding for net-share settled equity awards (890) (414) Proceeds from exercise of stock options 155 — Proceeds from issuance of ordinary shares in connection with at-the-market offering, net 38 — Proceed from long-term debt, net — 9,325 Proceeds from issuance of ordinary shares, net — 27,872 Net cash (used in) provided by financing activities (697) 36,783 Net (decrease) increase in cash and cash equivalents (32,252) 24,761 Cash and cash equivalents—beginning of period 87,522 57,032 Cash and cash equivalents—end of period $ 55,270 $ 81,793 Supplemental disclosures of cash flow information: Cash paid during the year for: Interest $ 1,501 $ — Income taxes other, net of refunds $ 1,301 $ — Supplemental disclosures of noncash investing information: Unpaid sales milestone $ 2,500 The accompanying notes are an integral part of these unaudited consolidated financial statements.

5 STRONGBRIDGE BIOPHARMA plc Notes to Unaudited Consolidated Financial Statements 1. Organization We are a global, commercial-stage biopharmaceutical company focused on the development and commercialization of therapies for rare diseases with significant unmet needs. Our first commercial product is Keveyis (dichlorphenamide), the first and only treatment approved by the U.S. Food and Drug Administration (the “FDA”) for hyperkalemic, hypokalemic, and related variants of primary periodic paralysis (“PPP”), a group of rare hereditary disorders that cause episodes of muscle weakness or paralysis. We have two clinical-stage product candidates for rare endocrine diseases, Recorlev and veldoreotide. Recorlev (levoketoconazole), the pure 2S,4R enantiomer of the enantiomeric pair comprising ketoconazole, is a next-generation steroidogenesis inhibitor being investigated as a chronic therapy for adults with endogenous Cushing’s syndrome. Veldoreotide is a next-generation somatostatin analog being investigated for potential applications in conditions amenable to somatostatin receptor activation. Both levoketoconazole and veldoreotide have received orphan designation from the FDA and the European Medicines Agency (“EMA”) Transaction Agreement with Xeris Pharmaceuticals, Inc. On May 24, 2021, we announced that we had signed an agreement to be acquired by Xeris Pharmaceuticals, Inc. (“Xeris”). Upon close of the transaction, the businesses of Xeris and Strongbridge Biopharma plc (“Strongbridge”) will be combined under a new entity to be called Xeris Biopharma Holdings, Inc. (“Xeris Biopharma Holdings”). The agreement, including the maximum aggregate amount payable under the contingent value rights (the “CVRs”), values Strongbridge at approximately $267 million based on the closing price of Xeris common stock of $3.47 on May 21, 2021, and Strongbridge’s fully diluted share capital. For more information relating to the merger, please see Note 12. 2. Summary of significant accounting policies and basis of presentation Basis of presentation These unaudited consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“U.S. GAAP”). The unaudited consolidated financial statements reflect all adjustments, which include only normal recurring adjustments that are, in the opinion of management, necessary to present a fair statement of the operating results and financial position for the periods presented. The preparation of the unaudited consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts and disclosures in the consolidated financial statements. Actual results could differ from those estimates. Results for the nine months ended September 30, 2021, are not necessarily indicative of the results that may be expected for the year ending December 31, 2021. These unaudited consolidated financial statements should be read in conjunction with the accounting policies and notes to the audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the U.S. Securities and Exchange Commission on March 3, 2021 (the “2020 Annual Report”). Our significant accounting policies are described in Note 2 of the notes to the audited consolidated financial statements included in our 2020 Annual Report. Since the date of those financial statements, there have been no changes to our significant accounting policies.

6 Leases We account for leases in accordance with Accounting Standards Codification Topic 842, Leases (“ASC 842”). We determine if an arrangement is a lease at contract inception. A lease exists when a contract conveys to us the right to control the use of identified property, plant, or equipment for a period of time in exchange for consideration. The definition of a lease embodies two conditions: (1) there is an identified asset in the contract that is land or a depreciable asset (i.e., property, plant, and equipment), and (2) we have the right to control the use of the identified asset. Operating leases where we are the lessee are included in Right of use (“ROU”) assets and Accrued and other current liabilities and Other long-term liabilities on our Consolidated Balance Sheets. The lease liabilities are initially and subsequently measured at the present value of the unpaid lease payments at the lease commencement date. Key estimates and judgments include how we determined (1) the discount rate we use to discount the unpaid lease payments to present value, (2) lease term and (3) lease payments. ASC 842 requires a lessee to discount its unpaid lease payments using the interest rate implicit in the lease or, if that rate cannot be readily determined, its incremental borrowing rate. Because our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at the lease commencement date in determining the present value of lease payments. Our incremental borrowing rate for a lease is the rate of interest we would have to pay on a collateralized basis to borrow an amount equal to the lease payments under similar terms. The lease term for all of our leases includes the noncancellable period of the lease. Lease payments included in the measurement of the lease asset or liability are comprised of our fixed payments. The ROU asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments made at or before the lease commencement date less any lease incentives received. For operating leases, the ROU asset is subsequently measured throughout the lease term at the carrying amount of the lease liability, plus (minus) any prepaid (accrued) lease payments, less the unamortized balance of lease incentives received. Lease expense for lease payments is recognized on a straight-line basis over the lease term. We monitor for events or changes in circumstances that require a reassessment of a lease. If a reassessment results in the remeasurement of a lease liability, a corresponding adjustment is made to the carrying amount of the corresponding ROU asset unless doing so would reduce the carrying amount of the ROU asset to an amount less than zero. In that case, the amount of the adjustment that would result in a negative ROU asset balance is recorded in profit or loss. We have elected not to recognize ROU assets and lease liabilities for all short-term leases that have a lease term of 12 months or less. We recognize the lease payments associated with our short-term leases as an expense on a straight- line basis over the lease term. Variable lease payments associated with these leases are recognized and presented in the same manner as for all of our other leases. Cash, cash equivalents and marketable securities We consider all short-term highly liquid investments with an original maturity at the date of purchase of three months or less to be cash equivalents. Cash and cash equivalents consist of account balances at banks and money market accounts, respectively. We occasionally invest our excess cash balances in marketable debt securities of highly rated financial institutions. We seek to diversify our investments and limit the amount of investment concentrations for individual institutions, maturities and investment types. We classify marketable debt securities as available-for-sale and, accordingly, record such securities at fair value. We classify these securities as current assets as these investments are

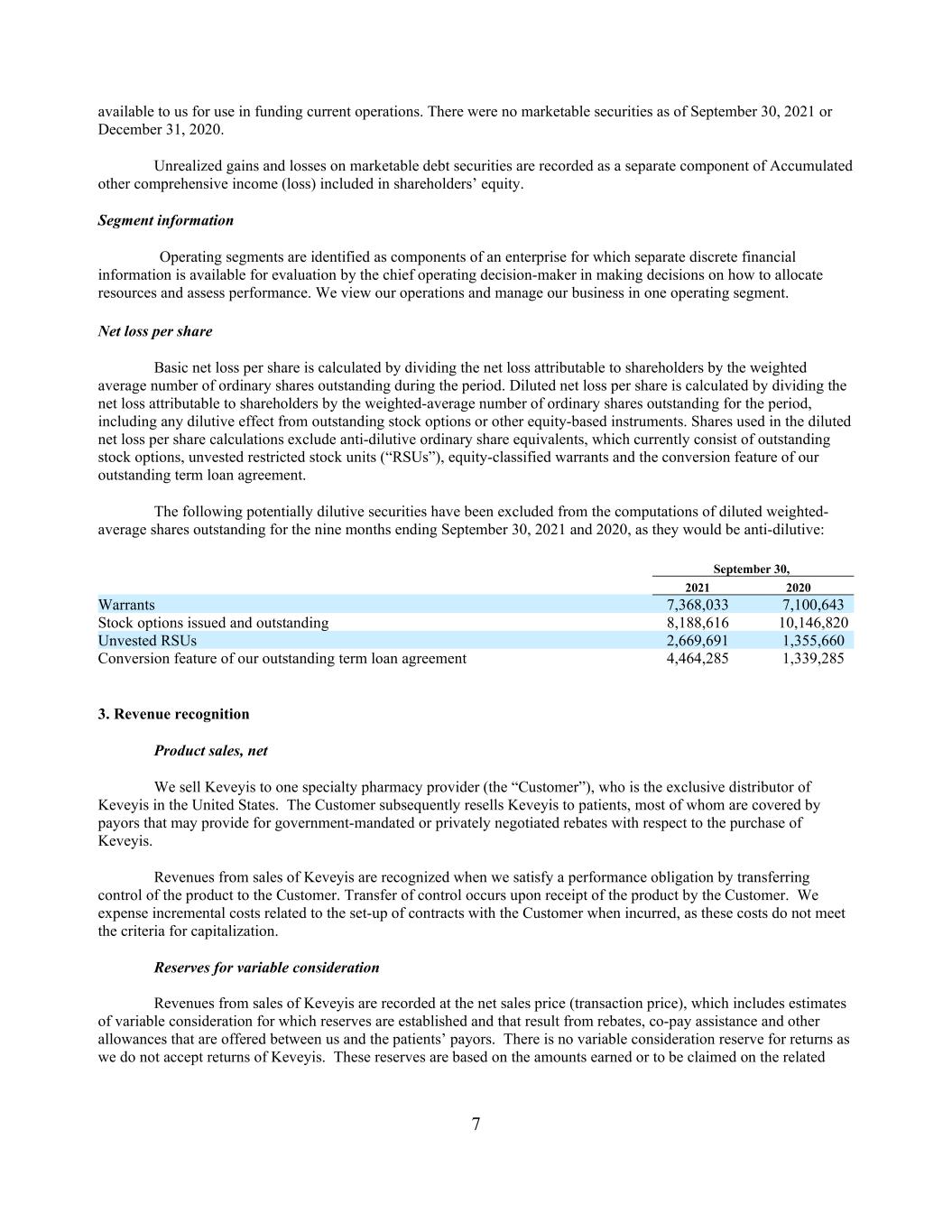

7 available to us for use in funding current operations. There were no marketable securities as of September 30, 2021 or December 31, 2020. Unrealized gains and losses on marketable debt securities are recorded as a separate component of Accumulated other comprehensive income (loss) included in shareholders’ equity. Segment information Operating segments are identified as components of an enterprise for which separate discrete financial information is available for evaluation by the chief operating decision-maker in making decisions on how to allocate resources and assess performance. We view our operations and manage our business in one operating segment. Net loss per share Basic net loss per share is calculated by dividing the net loss attributable to shareholders by the weighted average number of ordinary shares outstanding during the period. Diluted net loss per share is calculated by dividing the net loss attributable to shareholders by the weighted-average number of ordinary shares outstanding for the period, including any dilutive effect from outstanding stock options or other equity-based instruments. Shares used in the diluted net loss per share calculations exclude anti-dilutive ordinary share equivalents, which currently consist of outstanding stock options, unvested restricted stock units (“RSUs”), equity-classified warrants and the conversion feature of our outstanding term loan agreement. The following potentially dilutive securities have been excluded from the computations of diluted weighted- average shares outstanding for the nine months ending September 30, 2021 and 2020, as they would be anti-dilutive: September 30, 2021 2020 Warrants 7,368,033 7,100,643 Stock options issued and outstanding 8,188,616 10,146,820 Unvested RSUs 2,669,691 1,355,660 Conversion feature of our outstanding term loan agreement 4,464,285 1,339,285 3. Revenue recognition Product sales, net We sell Keveyis to one specialty pharmacy provider (the “Customer”), who is the exclusive distributor of Keveyis in the United States. The Customer subsequently resells Keveyis to patients, most of whom are covered by payors that may provide for government-mandated or privately negotiated rebates with respect to the purchase of Keveyis. Revenues from sales of Keveyis are recognized when we satisfy a performance obligation by transferring control of the product to the Customer. Transfer of control occurs upon receipt of the product by the Customer. We expense incremental costs related to the set-up of contracts with the Customer when incurred, as these costs do not meet the criteria for capitalization. Reserves for variable consideration Revenues from sales of Keveyis are recorded at the net sales price (transaction price), which includes estimates of variable consideration for which reserves are established and that result from rebates, co-pay assistance and other allowances that are offered between us and the patients’ payors. There is no variable consideration reserve for returns as we do not accept returns of Keveyis. These reserves are based on the amounts earned or to be claimed on the related

8 sales and are classified as reductions of accounts receivable (if the amount is payable to the Customer) or a current liability (if the amount is payable to a party other than the Customer). Where appropriate, these estimates may take into consideration a range of possible outcomes that are probability-weighted for relevant factors such as our historical experience, current contractual and statutory requirements, specific known market events and trends, industry data and forecasted buying and payment patterns of the Customer. Overall, these reserves reflect our best estimates of the amount of consideration to which we are entitled based on the terms of the contract. The amount of variable consideration that is included in the transaction price may be constrained and is included in the net sales price only to the extent that it is probable that a significant reversal in the amount of the cumulative revenue recognized will not occur in a future period. Actual amounts of consideration ultimately received may differ from our estimates. We reassess our estimates on an ongoing basis. If actual results in the future vary from our estimates, we will adjust our estimates. Any such adjustments would affect net product revenue and earnings in the period such variances become known. Trade Discount: We provide the Customer with a discount that is explicitly stated in our contract and is recorded as a reduction of revenue in the period the related product revenue is recognized. In addition, we receive sales order management, data and distribution services from the Customer. To the extent the services received are distinct from our sale of Keveyis to the Customer, these payments are classified in selling, general and administrative expenses in our consolidated statement of operations and comprehensive loss. Funded Co-pay Assistance Program: We contract with a third-party to manage the co-pay assistance program intended to provide financial assistance to qualified insured patients. The calculation of the accrual for co-pay assistance is based on an estimate of claims and the cost per claim that we expect to receive associated with Keveyis that has been recognized as revenue, but remains in the distribution channel inventories at the end of each reporting period. These payments are consideration payable to the Customer and the related reserve is recorded in the same period the related revenue is recognized, resulting in a reduction of product revenue and the establishment of a current liability which is included in accrued expenses on the consolidated balance sheet. Government Rebates: We are subject to discount obligations under state Medicaid programs and Medicare. We estimate our Medicaid and Medicare rebates for the estimated patient mix. These reserves are recorded in the same period the related revenue is recognized, resulting in a reduction of product revenue and the establishment of a current liability, which is included in accrued expenses on the consolidated balance sheet. For Medicaid, accruals are based on estimates of future Medicaid beneficiary utilization applied to the Medicaid unit rebate formula established by the Center for Medicaid and Medicare Services. Manufacturers of pharmaceutical products are responsible for 70% of the patient’s cost of branded prescription drugs related to the Medicare Part D Coverage Gap. In order to estimate the cost to us of this Medicare coverage gap responsibility, we estimate the number of patients in the prescription drug coverage gap for whom we will owe an additional liability under the Medicare Part D program. Our liability for these rebates consists of estimates of claims for the current quarter and estimated future claims that will be made for Keveyis transactions that have been recognized as revenue but remain in the Customer’s inventory at the end of each reporting period. Temporary Supply and Patient Assistance Programs: We provide free Keveyis to uninsured patients who satisfy pre-established criteria for either the Temporary Supply Program or the Patient Assistance Program. Patients who meet the Temporary Supply Program eligibility criteria may receive a temporary supply of free Keveyis for no more than 60 days while there is a determination of the patient’s third-party insurance, prescription drug benefit or other third-party coverage for Keveyis. The Patient Assistance Program provides free Keveyis for up to 12 months to uninsured patients who satisfy pre-established criteria for financial need. We do not recognize any revenue related to these free products and the associated costs are classified in selling, general and administrative expenses in our consolidated statements of operations and comprehensive loss.

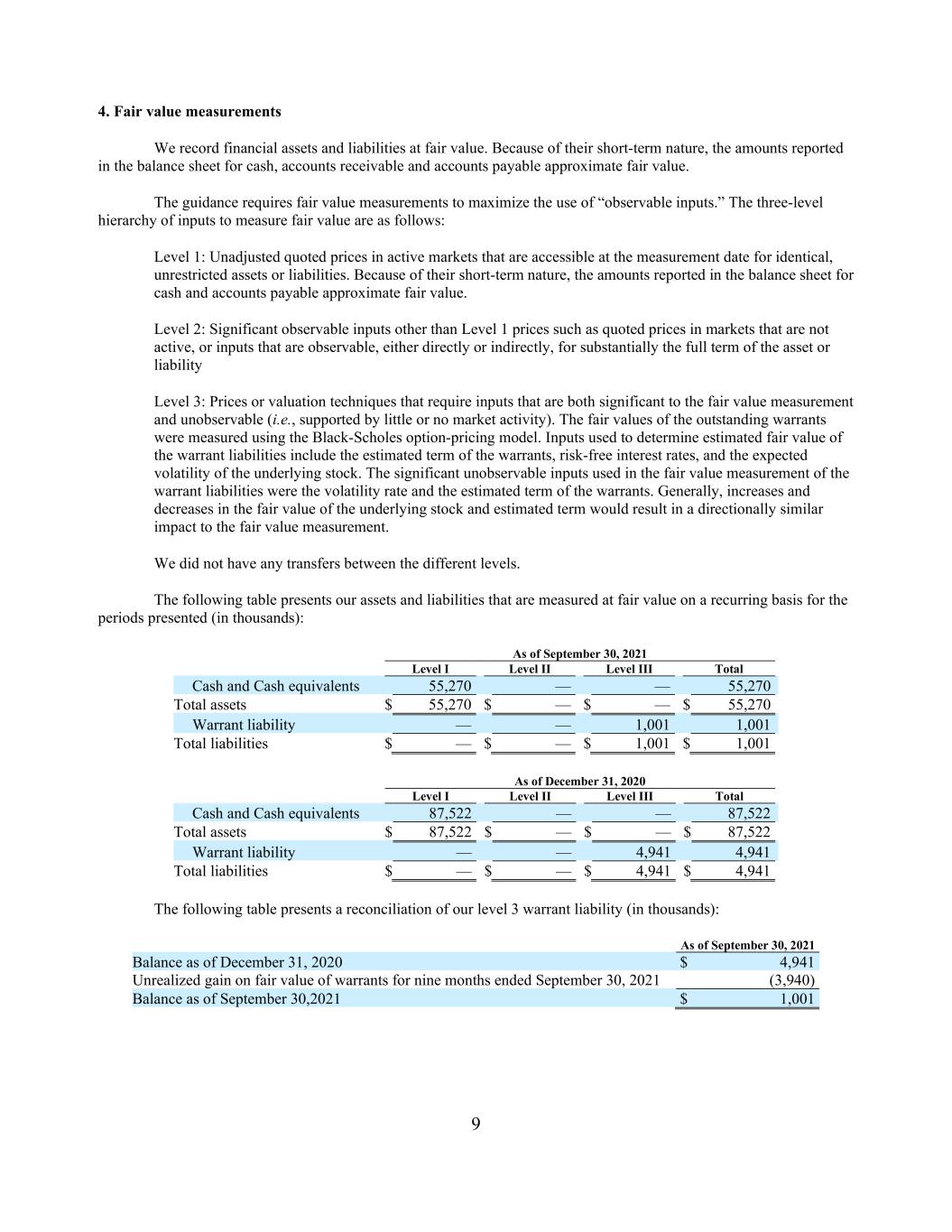

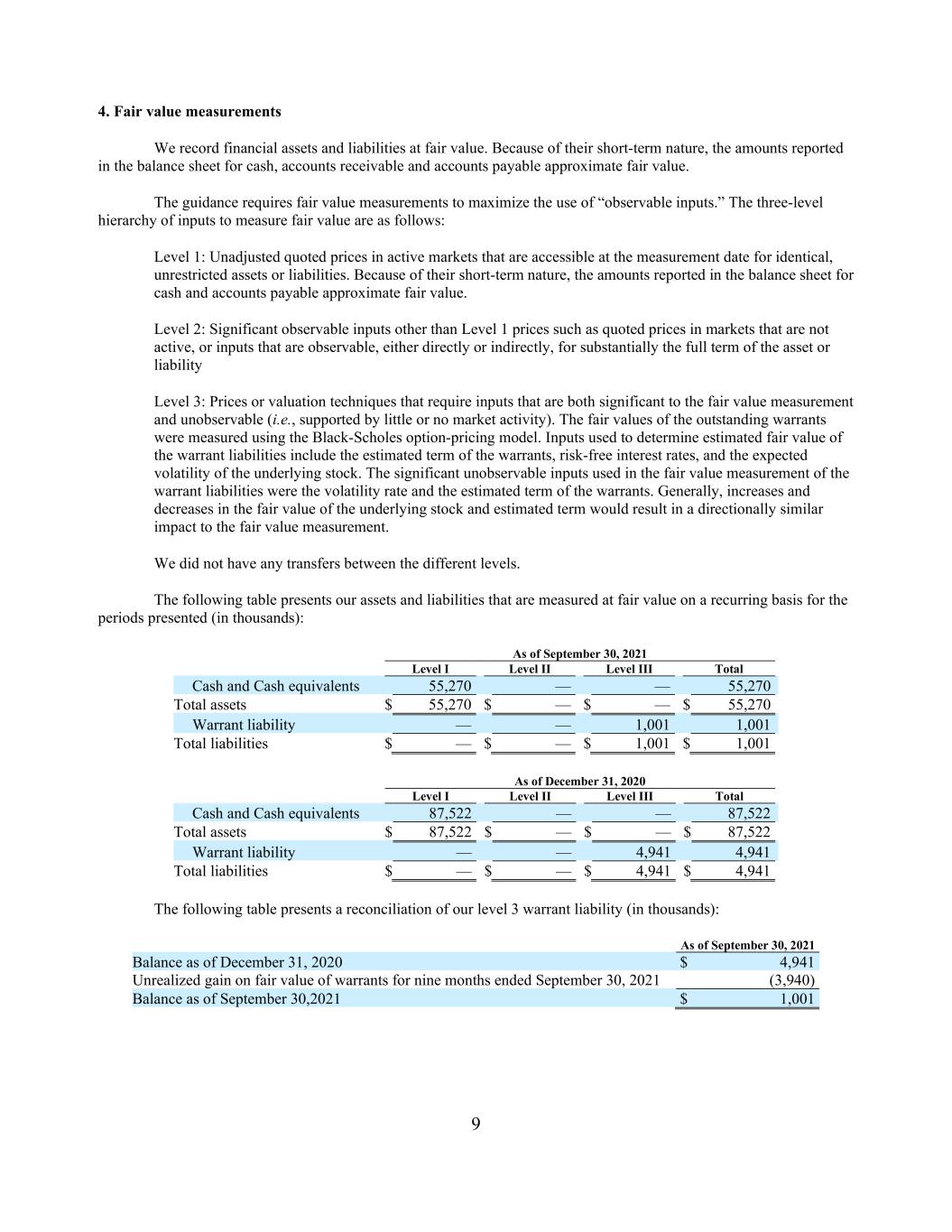

9 4. Fair value measurements We record financial assets and liabilities at fair value. Because of their short-term nature, the amounts reported in the balance sheet for cash, accounts receivable and accounts payable approximate fair value. The guidance requires fair value measurements to maximize the use of “observable inputs.” The three-level hierarchy of inputs to measure fair value are as follows: Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Because of their short-term nature, the amounts reported in the balance sheet for cash and accounts payable approximate fair value. Level 2: Significant observable inputs other than Level 1 prices such as quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). The fair values of the outstanding warrants were measured using the Black-Scholes option-pricing model. Inputs used to determine estimated fair value of the warrant liabilities include the estimated term of the warrants, risk-free interest rates, and the expected volatility of the underlying stock. The significant unobservable inputs used in the fair value measurement of the warrant liabilities were the volatility rate and the estimated term of the warrants. Generally, increases and decreases in the fair value of the underlying stock and estimated term would result in a directionally similar impact to the fair value measurement. We did not have any transfers between the different levels. The following table presents our assets and liabilities that are measured at fair value on a recurring basis for the periods presented (in thousands): As of September 30, 2021 Level I Level II Level III Total Cash and Cash equivalents 55,270 — — 55,270 Total assets $ 55,270 $ — $ — $ 55,270 Warrant liability — — 1,001 1,001 Total liabilities $ — $ — $ 1,001 $ 1,001 As of December 31, 2020 Level I Level II Level III Total Cash and Cash equivalents 87,522 — — 87,522 Total assets $ 87,522 $ — $ — $ 87,522 Warrant liability — — 4,941 4,941 Total liabilities $ — $ — $ 4,941 $ 4,941 The following table presents a reconciliation of our level 3 warrant liability (in thousands): As of September 30, 2021 Balance as of December 31, 2020 $ 4,941 Unrealized gain on fair value of warrants for nine months ended September 30, 2021 (3,940) Balance as of September 30,2021 $ 1,001

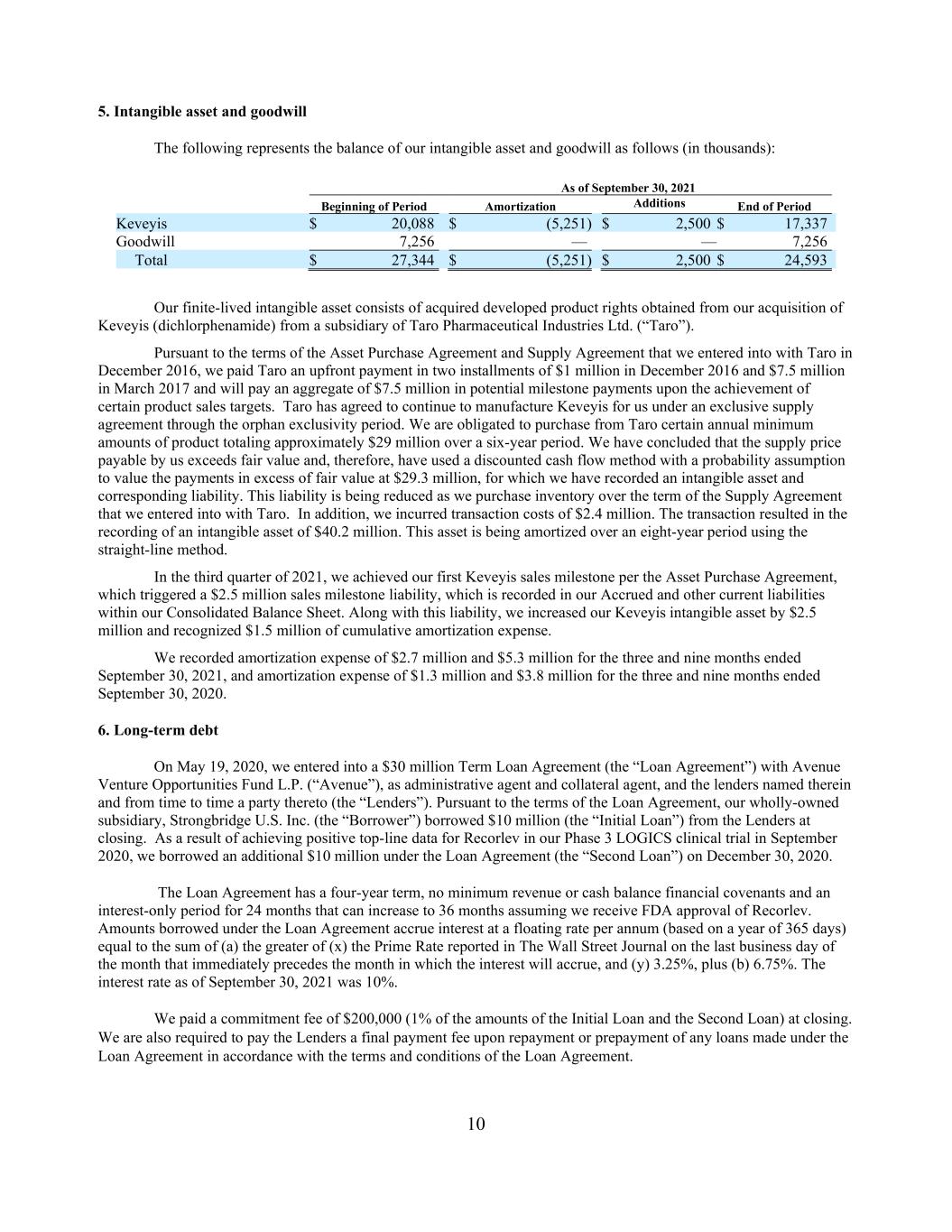

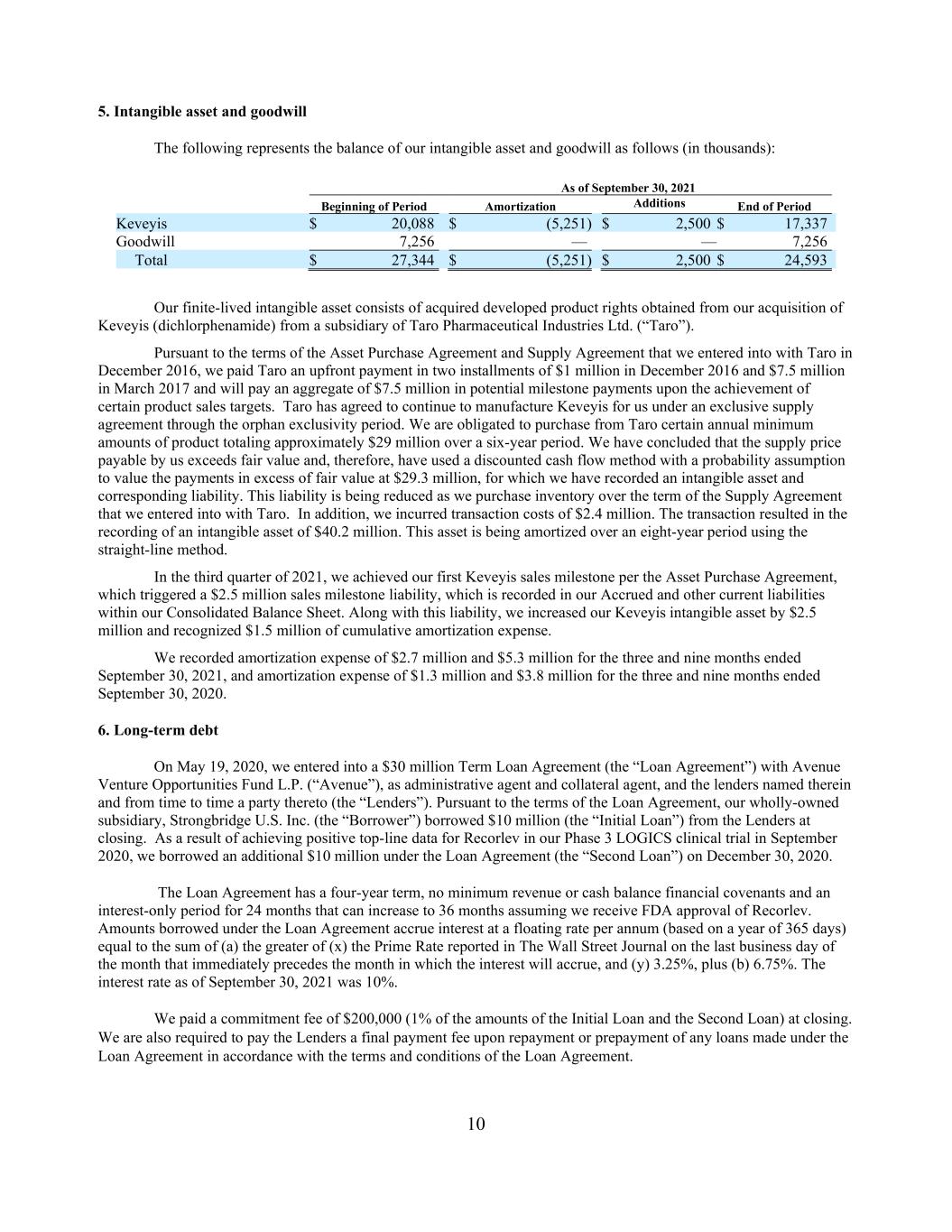

10 5. Intangible asset and goodwill The following represents the balance of our intangible asset and goodwill as follows (in thousands): As of September 30, 2021 Beginning of Period Amortization Additions End of Period Keveyis $ 20,088 $ (5,251) $ 2,500 $ 17,337 Goodwill 7,256 — — 7,256 Total $ 27,344 $ (5,251) $ 2,500 $ 24,593 Our finite-lived intangible asset consists of acquired developed product rights obtained from our acquisition of Keveyis (dichlorphenamide) from a subsidiary of Taro Pharmaceutical Industries Ltd. (“Taro”). Pursuant to the terms of the Asset Purchase Agreement and Supply Agreement that we entered into with Taro in December 2016, we paid Taro an upfront payment in two installments of $1 million in December 2016 and $7.5 million in March 2017 and will pay an aggregate of $7.5 million in potential milestone payments upon the achievement of certain product sales targets. Taro has agreed to continue to manufacture Keveyis for us under an exclusive supply agreement through the orphan exclusivity period. We are obligated to purchase from Taro certain annual minimum amounts of product totaling approximately $29 million over a six-year period. We have concluded that the supply price payable by us exceeds fair value and, therefore, have used a discounted cash flow method with a probability assumption to value the payments in excess of fair value at $29.3 million, for which we have recorded an intangible asset and corresponding liability. This liability is being reduced as we purchase inventory over the term of the Supply Agreement that we entered into with Taro. In addition, we incurred transaction costs of $2.4 million. The transaction resulted in the recording of an intangible asset of $40.2 million. This asset is being amortized over an eight-year period using the straight-line method. In the third quarter of 2021, we achieved our first Keveyis sales milestone per the Asset Purchase Agreement, which triggered a $2.5 million sales milestone liability, which is recorded in our Accrued and other current liabilities within our Consolidated Balance Sheet. Along with this liability, we increased our Keveyis intangible asset by $2.5 million and recognized $1.5 million of cumulative amortization expense. We recorded amortization expense of $2.7 million and $5.3 million for the three and nine months ended September 30, 2021, and amortization expense of $1.3 million and $3.8 million for the three and nine months ended September 30, 2020. 6. Long-term debt On May 19, 2020, we entered into a $30 million Term Loan Agreement (the “Loan Agreement”) with Avenue Venture Opportunities Fund L.P. (“Avenue”), as administrative agent and collateral agent, and the lenders named therein and from time to time a party thereto (the “Lenders”). Pursuant to the terms of the Loan Agreement, our wholly-owned subsidiary, Strongbridge U.S. Inc. (the “Borrower”) borrowed $10 million (the “Initial Loan”) from the Lenders at closing. As a result of achieving positive top-line data for Recorlev in our Phase 3 LOGICS clinical trial in September 2020, we borrowed an additional $10 million under the Loan Agreement (the “Second Loan”) on December 30, 2020. The Loan Agreement has a four-year term, no minimum revenue or cash balance financial covenants and an interest-only period for 24 months that can increase to 36 months assuming we receive FDA approval of Recorlev. Amounts borrowed under the Loan Agreement accrue interest at a floating rate per annum (based on a year of 365 days) equal to the sum of (a) the greater of (x) the Prime Rate reported in The Wall Street Journal on the last business day of the month that immediately precedes the month in which the interest will accrue, and (y) 3.25%, plus (b) 6.75%. The interest rate as of September 30, 2021 was 10%. We paid a commitment fee of $200,000 (1% of the amounts of the Initial Loan and the Second Loan) at closing. We are also required to pay the Lenders a final payment fee upon repayment or prepayment of any loans made under the Loan Agreement in accordance with the terms and conditions of the Loan Agreement.

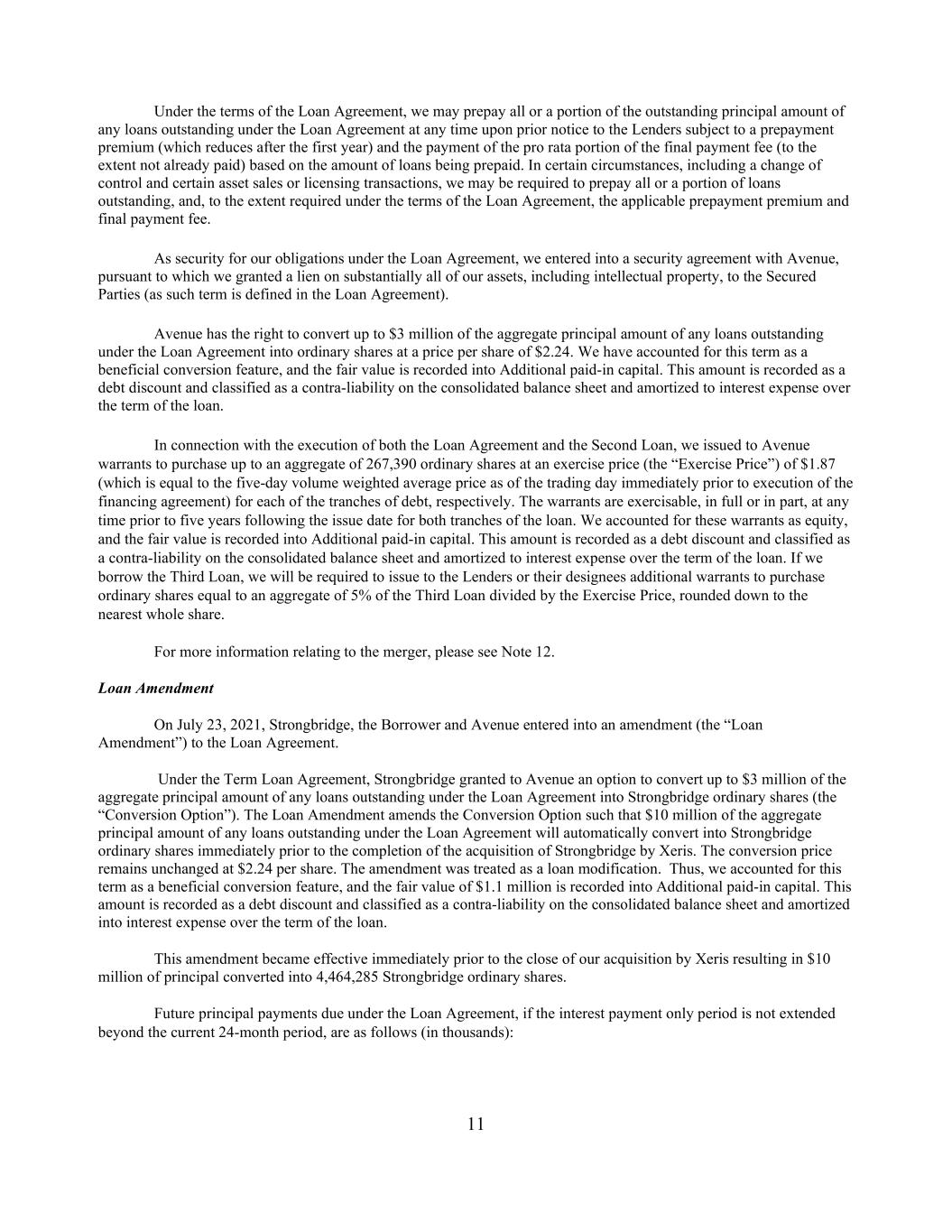

11 Under the terms of the Loan Agreement, we may prepay all or a portion of the outstanding principal amount of any loans outstanding under the Loan Agreement at any time upon prior notice to the Lenders subject to a prepayment premium (which reduces after the first year) and the payment of the pro rata portion of the final payment fee (to the extent not already paid) based on the amount of loans being prepaid. In certain circumstances, including a change of control and certain asset sales or licensing transactions, we may be required to prepay all or a portion of loans outstanding, and, to the extent required under the terms of the Loan Agreement, the applicable prepayment premium and final payment fee. As security for our obligations under the Loan Agreement, we entered into a security agreement with Avenue, pursuant to which we granted a lien on substantially all of our assets, including intellectual property, to the Secured Parties (as such term is defined in the Loan Agreement). Avenue has the right to convert up to $3 million of the aggregate principal amount of any loans outstanding under the Loan Agreement into ordinary shares at a price per share of $2.24. We have accounted for this term as a beneficial conversion feature, and the fair value is recorded into Additional paid-in capital. This amount is recorded as a debt discount and classified as a contra-liability on the consolidated balance sheet and amortized to interest expense over the term of the loan. In connection with the execution of both the Loan Agreement and the Second Loan, we issued to Avenue warrants to purchase up to an aggregate of 267,390 ordinary shares at an exercise price (the “Exercise Price”) of $1.87 (which is equal to the five-day volume weighted average price as of the trading day immediately prior to execution of the financing agreement) for each of the tranches of debt, respectively. The warrants are exercisable, in full or in part, at any time prior to five years following the issue date for both tranches of the loan. We accounted for these warrants as equity, and the fair value is recorded into Additional paid-in capital. This amount is recorded as a debt discount and classified as a contra-liability on the consolidated balance sheet and amortized to interest expense over the term of the loan. If we borrow the Third Loan, we will be required to issue to the Lenders or their designees additional warrants to purchase ordinary shares equal to an aggregate of 5% of the Third Loan divided by the Exercise Price, rounded down to the nearest whole share. For more information relating to the merger, please see Note 12. Loan Amendment On July 23, 2021, Strongbridge, the Borrower and Avenue entered into an amendment (the “Loan Amendment”) to the Loan Agreement. Under the Term Loan Agreement, Strongbridge granted to Avenue an option to convert up to $3 million of the aggregate principal amount of any loans outstanding under the Loan Agreement into Strongbridge ordinary shares (the “Conversion Option”). The Loan Amendment amends the Conversion Option such that $10 million of the aggregate principal amount of any loans outstanding under the Loan Agreement will automatically convert into Strongbridge ordinary shares immediately prior to the completion of the acquisition of Strongbridge by Xeris. The conversion price remains unchanged at $2.24 per share. The amendment was treated as a loan modification. Thus, we accounted for this term as a beneficial conversion feature, and the fair value of $1.1 million is recorded into Additional paid-in capital. This amount is recorded as a debt discount and classified as a contra-liability on the consolidated balance sheet and amortized into interest expense over the term of the loan. This amendment became effective immediately prior to the close of our acquisition by Xeris resulting in $10 million of principal converted into 4,464,285 Strongbridge ordinary shares. Future principal payments due under the Loan Agreement, if the interest payment only period is not extended beyond the current 24-month period, are as follows (in thousands):

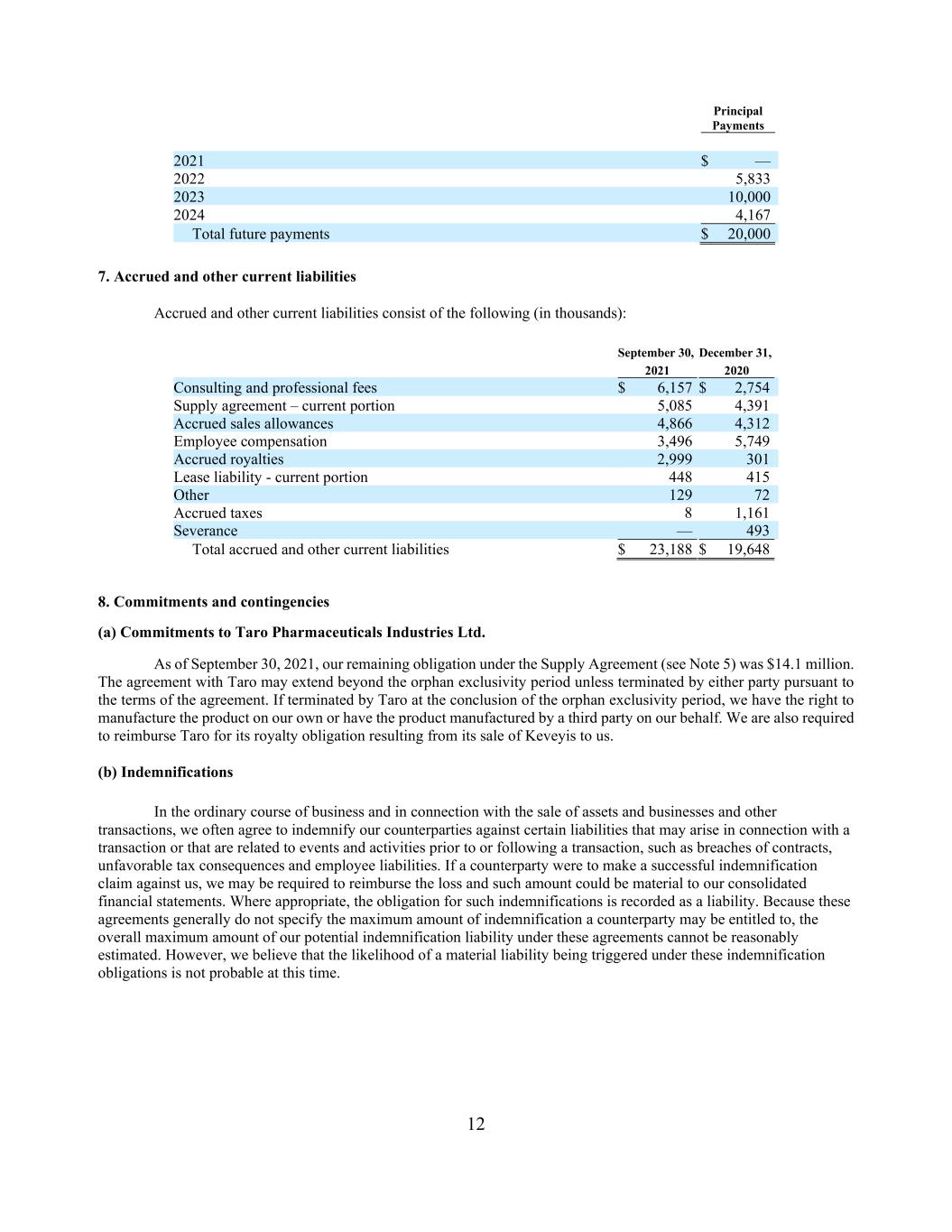

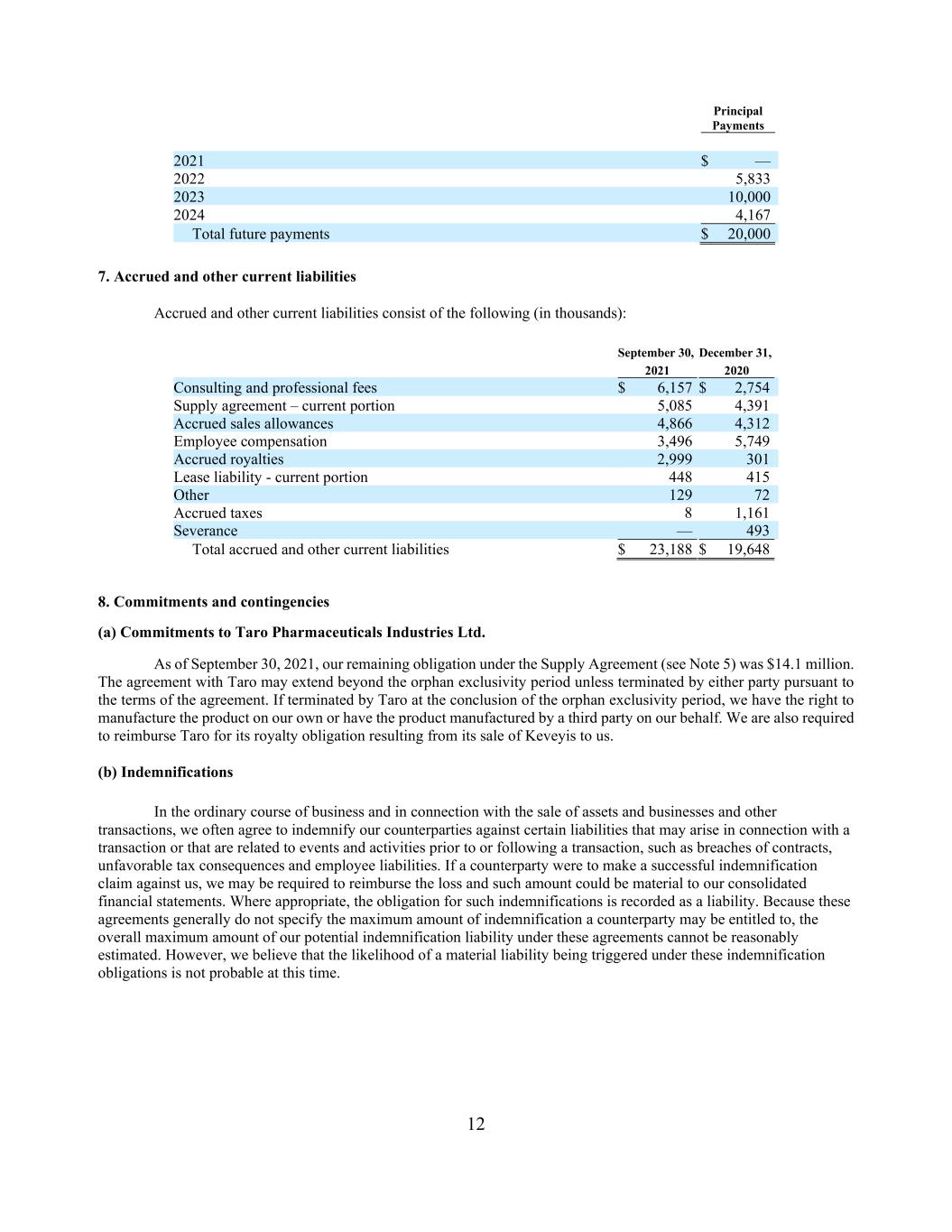

12 Principal Payments 2021 $ — 2022 5,833 2023 10,000 2024 4,167 Total future payments $ 20,000 7. Accrued and other current liabilities Accrued and other current liabilities consist of the following (in thousands): September 30, December 31, 2021 2020 Consulting and professional fees $ 6,157 $ 2,754 Supply agreement – current portion 5,085 4,391 Accrued sales allowances 4,866 4,312 Employee compensation 3,496 5,749 Accrued royalties 2,999 301 Lease liability - current portion 448 415 Other 129 72 Accrued taxes 8 1,161 Severance — 493 Total accrued and other current liabilities $ 23,188 $ 19,648 8. Commitments and contingencies (a) Commitments to Taro Pharmaceuticals Industries Ltd. As of September 30, 2021, our remaining obligation under the Supply Agreement (see Note 5) was $14.1 million. The agreement with Taro may extend beyond the orphan exclusivity period unless terminated by either party pursuant to the terms of the agreement. If terminated by Taro at the conclusion of the orphan exclusivity period, we have the right to manufacture the product on our own or have the product manufactured by a third party on our behalf. We are also required to reimburse Taro for its royalty obligation resulting from its sale of Keveyis to us. (b) Indemnifications In the ordinary course of business and in connection with the sale of assets and businesses and other transactions, we often agree to indemnify our counterparties against certain liabilities that may arise in connection with a transaction or that are related to events and activities prior to or following a transaction, such as breaches of contracts, unfavorable tax consequences and employee liabilities. If a counterparty were to make a successful indemnification claim against us, we may be required to reimburse the loss and such amount could be material to our consolidated financial statements. Where appropriate, the obligation for such indemnifications is recorded as a liability. Because these agreements generally do not specify the maximum amount of indemnification a counterparty may be entitled to, the overall maximum amount of our potential indemnification liability under these agreements cannot be reasonably estimated. However, we believe that the likelihood of a material liability being triggered under these indemnification obligations is not probable at this time.

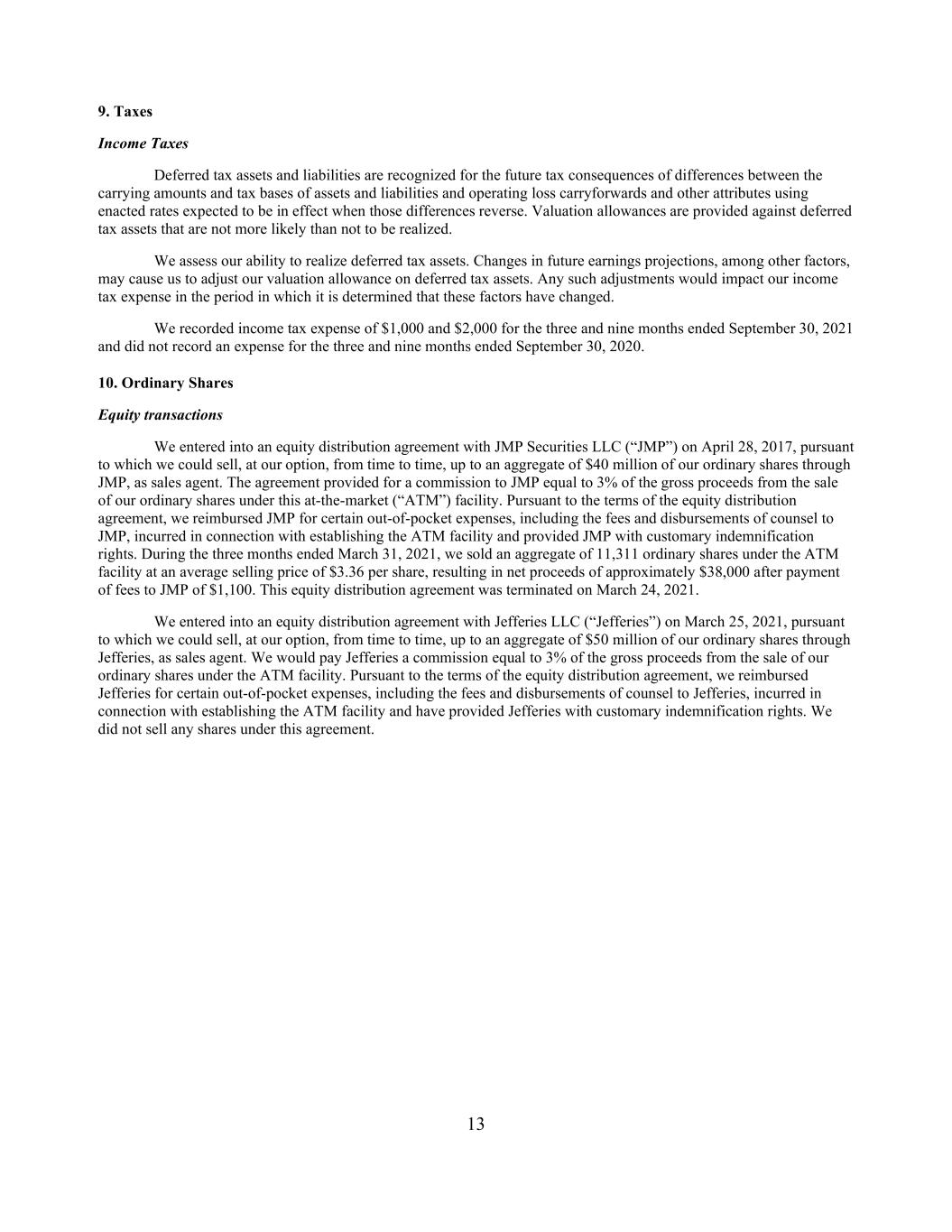

13 9. Taxes Income Taxes Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the carrying amounts and tax bases of assets and liabilities and operating loss carryforwards and other attributes using enacted rates expected to be in effect when those differences reverse. Valuation allowances are provided against deferred tax assets that are not more likely than not to be realized. We assess our ability to realize deferred tax assets. Changes in future earnings projections, among other factors, may cause us to adjust our valuation allowance on deferred tax assets. Any such adjustments would impact our income tax expense in the period in which it is determined that these factors have changed. We recorded income tax expense of $1,000 and $2,000 for the three and nine months ended September 30, 2021 and did not record an expense for the three and nine months ended September 30, 2020. 10. Ordinary Shares Equity transactions We entered into an equity distribution agreement with JMP Securities LLC (“JMP”) on April 28, 2017, pursuant to which we could sell, at our option, from time to time, up to an aggregate of $40 million of our ordinary shares through JMP, as sales agent. The agreement provided for a commission to JMP equal to 3% of the gross proceeds from the sale of our ordinary shares under this at-the-market (“ATM”) facility. Pursuant to the terms of the equity distribution agreement, we reimbursed JMP for certain out-of-pocket expenses, including the fees and disbursements of counsel to JMP, incurred in connection with establishing the ATM facility and provided JMP with customary indemnification rights. During the three months ended March 31, 2021, we sold an aggregate of 11,311 ordinary shares under the ATM facility at an average selling price of $3.36 per share, resulting in net proceeds of approximately $38,000 after payment of fees to JMP of $1,100. This equity distribution agreement was terminated on March 24, 2021. We entered into an equity distribution agreement with Jefferies LLC (“Jefferies”) on March 25, 2021, pursuant to which we could sell, at our option, from time to time, up to an aggregate of $50 million of our ordinary shares through Jefferies, as sales agent. We would pay Jefferies a commission equal to 3% of the gross proceeds from the sale of our ordinary shares under the ATM facility. Pursuant to the terms of the equity distribution agreement, we reimbursed Jefferies for certain out-of-pocket expenses, including the fees and disbursements of counsel to Jefferies, incurred in connection with establishing the ATM facility and have provided Jefferies with customary indemnification rights. We did not sell any shares under this agreement.

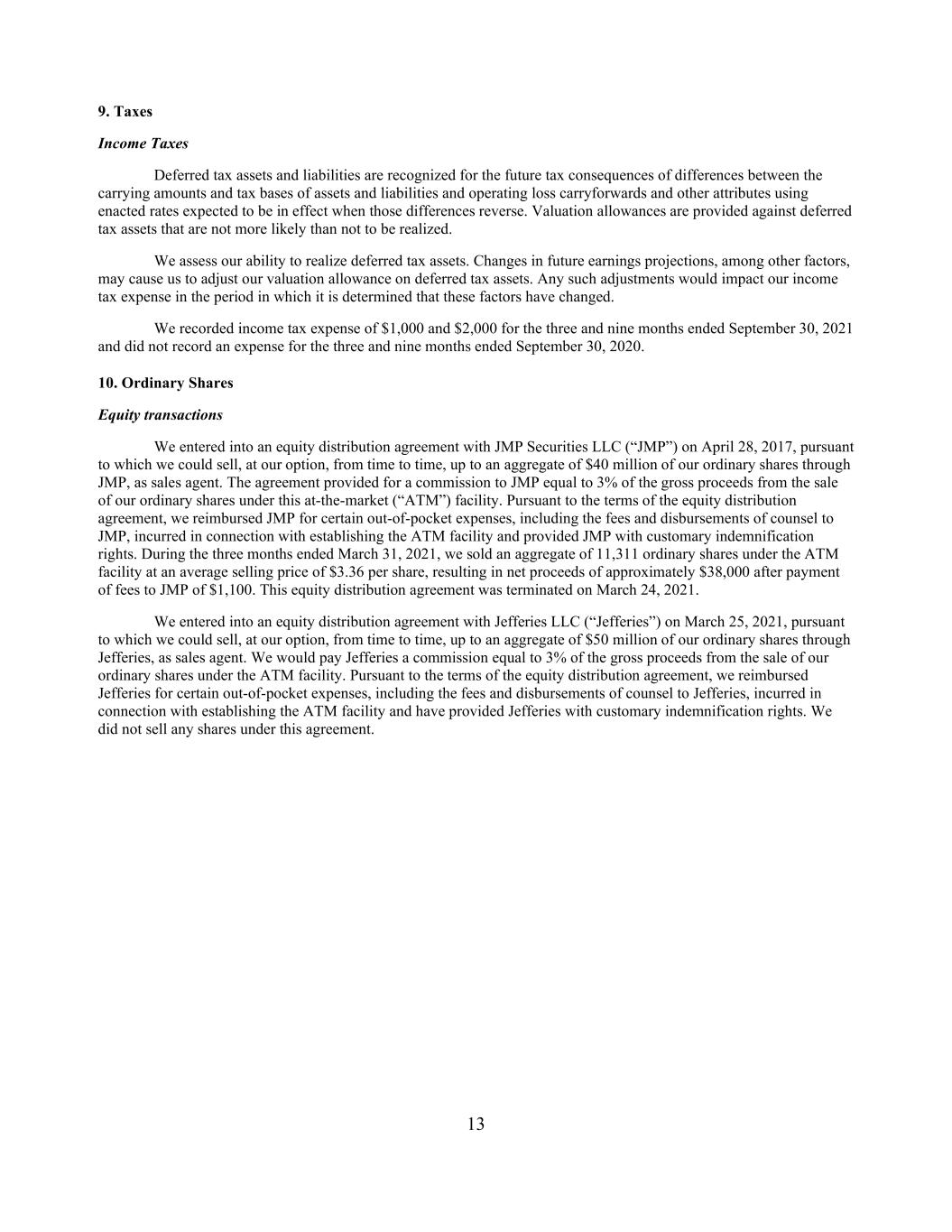

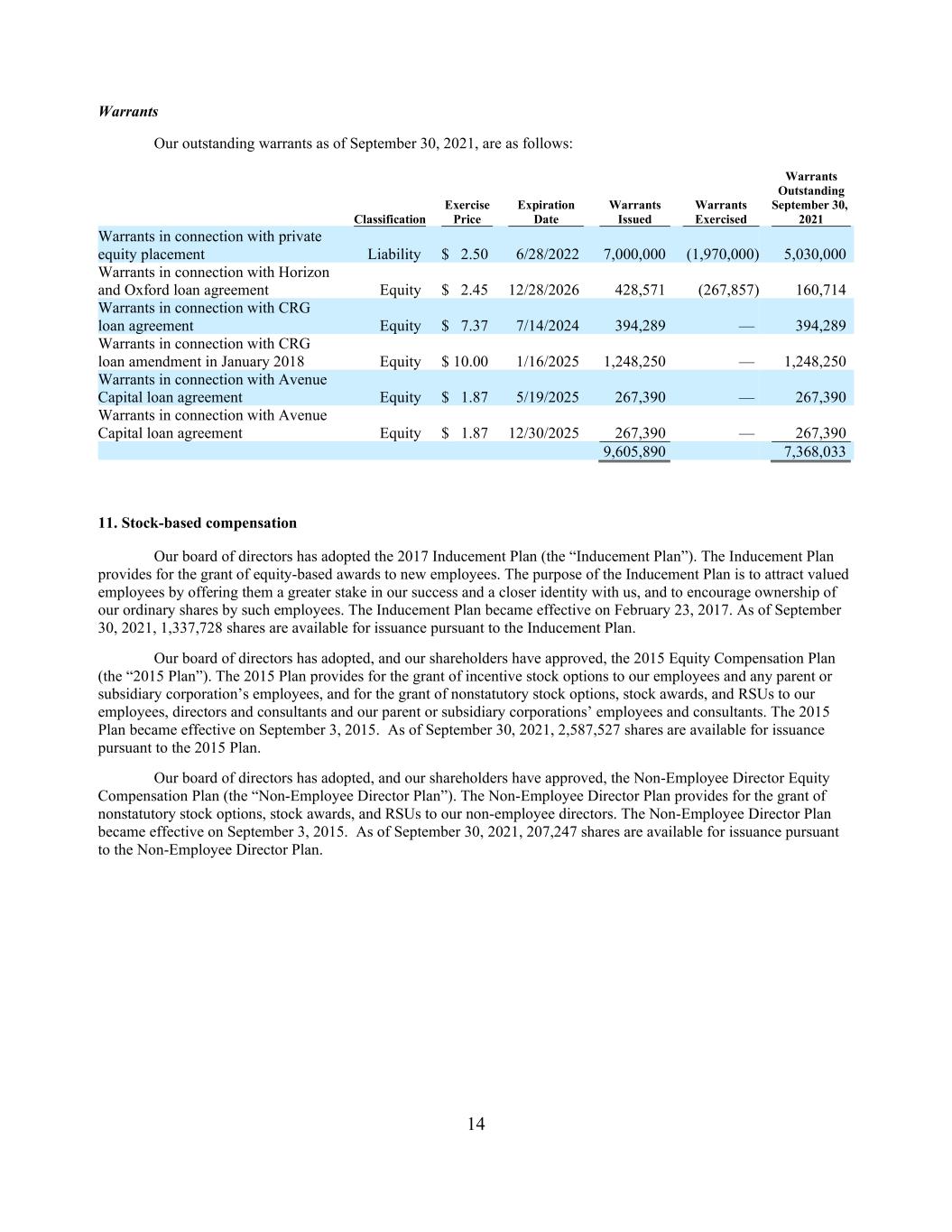

14 Warrants Our outstanding warrants as of September 30, 2021, are as follows: Warrants Outstanding Exercise Expiration Warrants Warrants September 30, Classification Price Date Issued Exercised 2021 Warrants in connection with private equity placement Liability $ 2.50 6/28/2022 7,000,000 (1,970,000) 5,030,000 Warrants in connection with Horizon and Oxford loan agreement Equity $ 2.45 12/28/2026 428,571 (267,857) 160,714 Warrants in connection with CRG loan agreement Equity $ 7.37 7/14/2024 394,289 — 394,289 Warrants in connection with CRG loan amendment in January 2018 Equity $ 10.00 1/16/2025 1,248,250 — 1,248,250 Warrants in connection with Avenue Capital loan agreement Equity $ 1.87 5/19/2025 267,390 — 267,390 Warrants in connection with Avenue Capital loan agreement Equity $ 1.87 12/30/2025 267,390 — 267,390 9,605,890 7,368,033 11. Stock-based compensation Our board of directors has adopted the 2017 Inducement Plan (the “Inducement Plan”). The Inducement Plan provides for the grant of equity-based awards to new employees. The purpose of the Inducement Plan is to attract valued employees by offering them a greater stake in our success and a closer identity with us, and to encourage ownership of our ordinary shares by such employees. The Inducement Plan became effective on February 23, 2017. As of September 30, 2021, 1,337,728 shares are available for issuance pursuant to the Inducement Plan. Our board of directors has adopted, and our shareholders have approved, the 2015 Equity Compensation Plan (the “2015 Plan”). The 2015 Plan provides for the grant of incentive stock options to our employees and any parent or subsidiary corporation’s employees, and for the grant of nonstatutory stock options, stock awards, and RSUs to our employees, directors and consultants and our parent or subsidiary corporations’ employees and consultants. The 2015 Plan became effective on September 3, 2015. As of September 30, 2021, 2,587,527 shares are available for issuance pursuant to the 2015 Plan. Our board of directors has adopted, and our shareholders have approved, the Non-Employee Director Equity Compensation Plan (the “Non-Employee Director Plan”). The Non-Employee Director Plan provides for the grant of nonstatutory stock options, stock awards, and RSUs to our non-employee directors. The Non-Employee Director Plan became effective on September 3, 2015. As of September 30, 2021, 207,247 shares are available for issuance pursuant to the Non-Employee Director Plan.

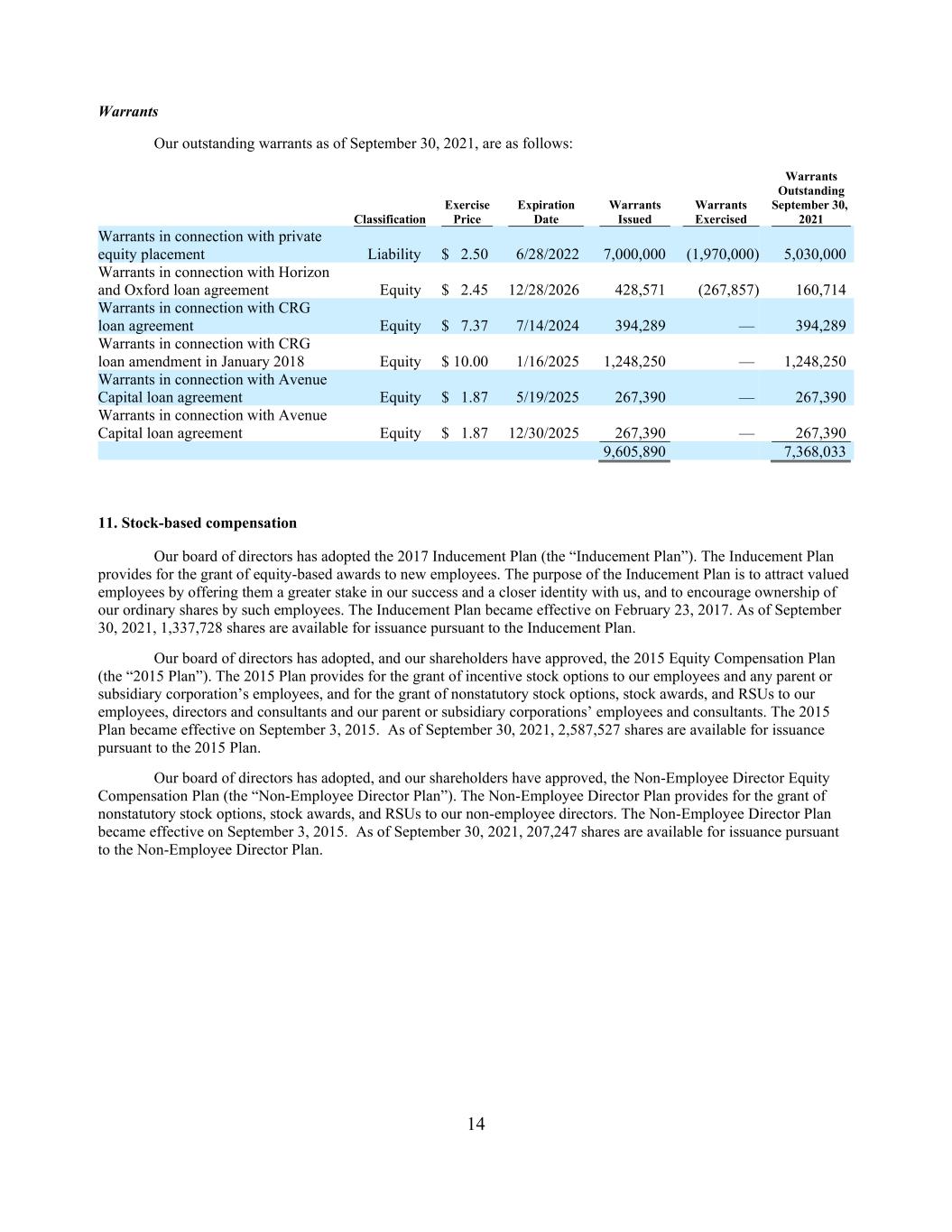

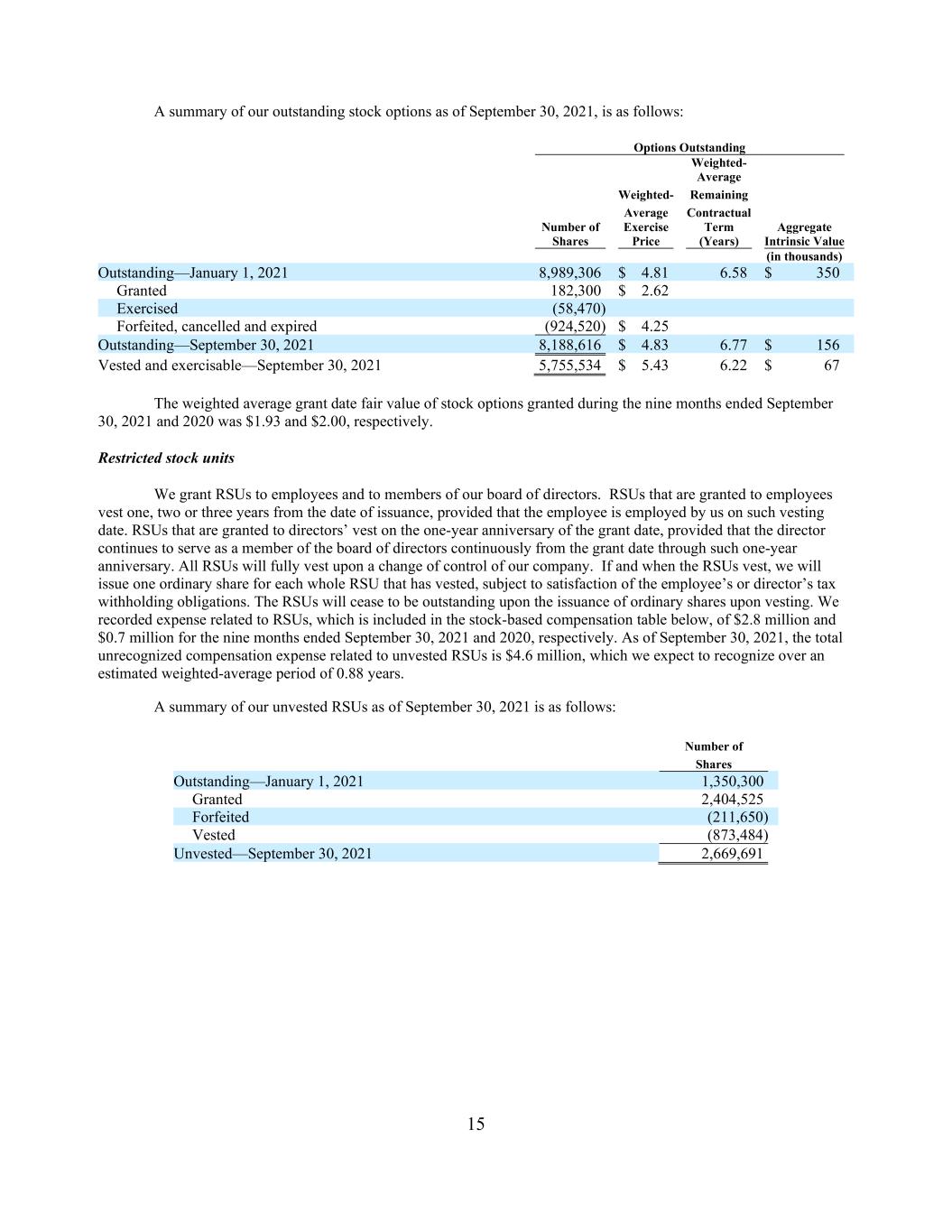

15 A summary of our outstanding stock options as of September 30, 2021, is as follows: Options Outstanding Weighted- Average Weighted- Remaining Average Contractual Number of Exercise Term Aggregate Shares Price (Years) Intrinsic Value (in thousands) Outstanding—January 1, 2021 8,989,306 $ 4.81 6.58 $ 350 Granted 182,300 $ 2.62 Exercised (58,470) Forfeited, cancelled and expired (924,520) $ 4.25 Outstanding—September 30, 2021 8,188,616 $ 4.83 6.77 $ 156 Vested and exercisable—September 30, 2021 5,755,534 $ 5.43 6.22 $ 67 The weighted average grant date fair value of stock options granted during the nine months ended September 30, 2021 and 2020 was $1.93 and $2.00, respectively. Restricted stock units We grant RSUs to employees and to members of our board of directors. RSUs that are granted to employees vest one, two or three years from the date of issuance, provided that the employee is employed by us on such vesting date. RSUs that are granted to directors’ vest on the one-year anniversary of the grant date, provided that the director continues to serve as a member of the board of directors continuously from the grant date through such one-year anniversary. All RSUs will fully vest upon a change of control of our company. If and when the RSUs vest, we will issue one ordinary share for each whole RSU that has vested, subject to satisfaction of the employee’s or director’s tax withholding obligations. The RSUs will cease to be outstanding upon the issuance of ordinary shares upon vesting. We recorded expense related to RSUs, which is included in the stock-based compensation table below, of $2.8 million and $0.7 million for the nine months ended September 30, 2021 and 2020, respectively. As of September 30, 2021, the total unrecognized compensation expense related to unvested RSUs is $4.6 million, which we expect to recognize over an estimated weighted-average period of 0.88 years. A summary of our unvested RSUs as of September 30, 2021 is as follows: Number of Shares Outstanding—January 1, 2021 1,350,300 Granted 2,404,525 Forfeited (211,650) Vested (873,484) Unvested—September 30, 2021 2,669,691

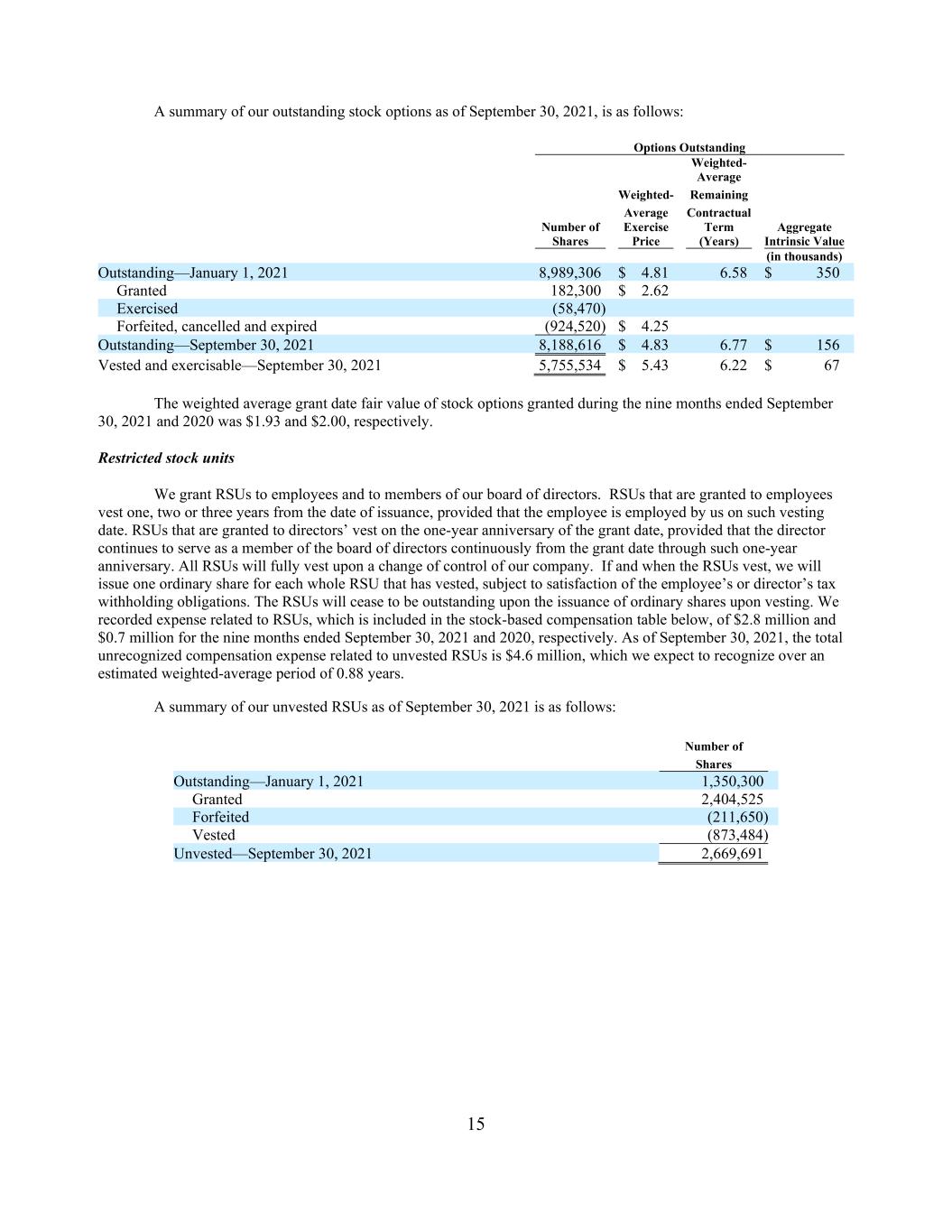

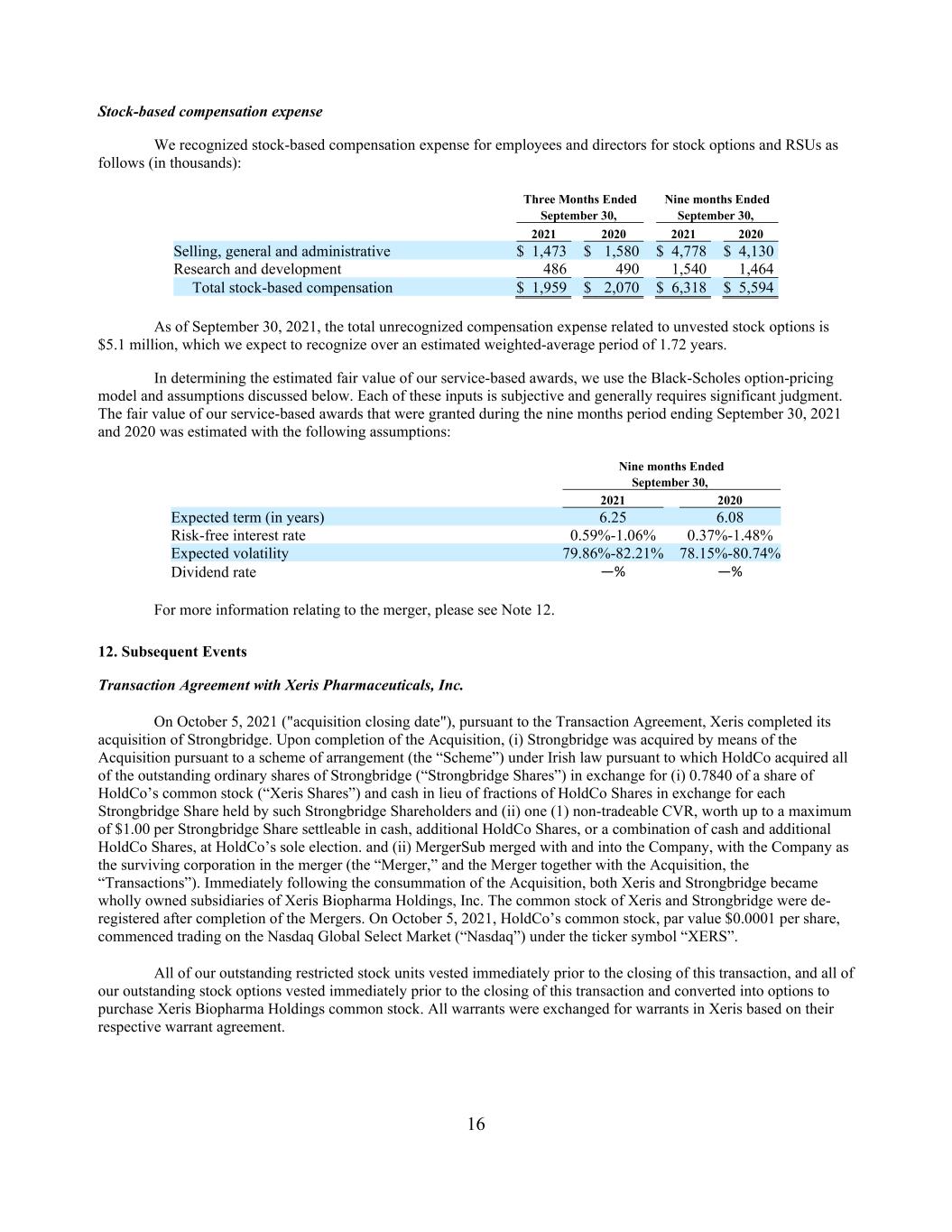

16 Stock-based compensation expense We recognized stock-based compensation expense for employees and directors for stock options and RSUs as follows (in thousands): Three Months Ended Nine months Ended September 30, September 30, 2021 2020 2021 2020 Selling, general and administrative $ 1,473 $ 1,580 $ 4,778 $ 4,130 Research and development 486 490 1,540 1,464 Total stock-based compensation $ 1,959 $ 2,070 $ 6,318 $ 5,594 As of September 30, 2021, the total unrecognized compensation expense related to unvested stock options is $5.1 million, which we expect to recognize over an estimated weighted-average period of 1.72 years. In determining the estimated fair value of our service-based awards, we use the Black-Scholes option-pricing model and assumptions discussed below. Each of these inputs is subjective and generally requires significant judgment. The fair value of our service-based awards that were granted during the nine months period ending September 30, 2021 and 2020 was estimated with the following assumptions: Nine months Ended September 30, 2021 2020 Expected term (in years) 6.25 6.08 Risk-free interest rate 0.59%-1.06% 0.37%-1.48% Expected volatility 79.86%-82.21% 78.15%-80.74% Dividend rate —% —% For more information relating to the merger, please see Note 12. 12. Subsequent Events Transaction Agreement with Xeris Pharmaceuticals, Inc. On October 5, 2021 ("acquisition closing date"), pursuant to the Transaction Agreement, Xeris completed its acquisition of Strongbridge. Upon completion of the Acquisition, (i) Strongbridge was acquired by means of the Acquisition pursuant to a scheme of arrangement (the “Scheme”) under Irish law pursuant to which HoldCo acquired all of the outstanding ordinary shares of Strongbridge (“Strongbridge Shares”) in exchange for (i) 0.7840 of a share of HoldCo’s common stock (“Xeris Shares”) and cash in lieu of fractions of HoldCo Shares in exchange for each Strongbridge Share held by such Strongbridge Shareholders and (ii) one (1) non-tradeable CVR, worth up to a maximum of $1.00 per Strongbridge Share settleable in cash, additional HoldCo Shares, or a combination of cash and additional HoldCo Shares, at HoldCo’s sole election. and (ii) MergerSub merged with and into the Company, with the Company as the surviving corporation in the merger (the “Merger,” and the Merger together with the Acquisition, the “Transactions”). Immediately following the consummation of the Acquisition, both Xeris and Strongbridge became wholly owned subsidiaries of Xeris Biopharma Holdings, Inc. The common stock of Xeris and Strongbridge were de- registered after completion of the Mergers. On October 5, 2021, HoldCo’s common stock, par value $0.0001 per share, commenced trading on the Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “XERS”. All of our outstanding restricted stock units vested immediately prior to the closing of this transaction, and all of our outstanding stock options vested immediately prior to the closing of this transaction and converted into options to purchase Xeris Biopharma Holdings common stock. All warrants were exchanged for warrants in Xeris based on their respective warrant agreement.

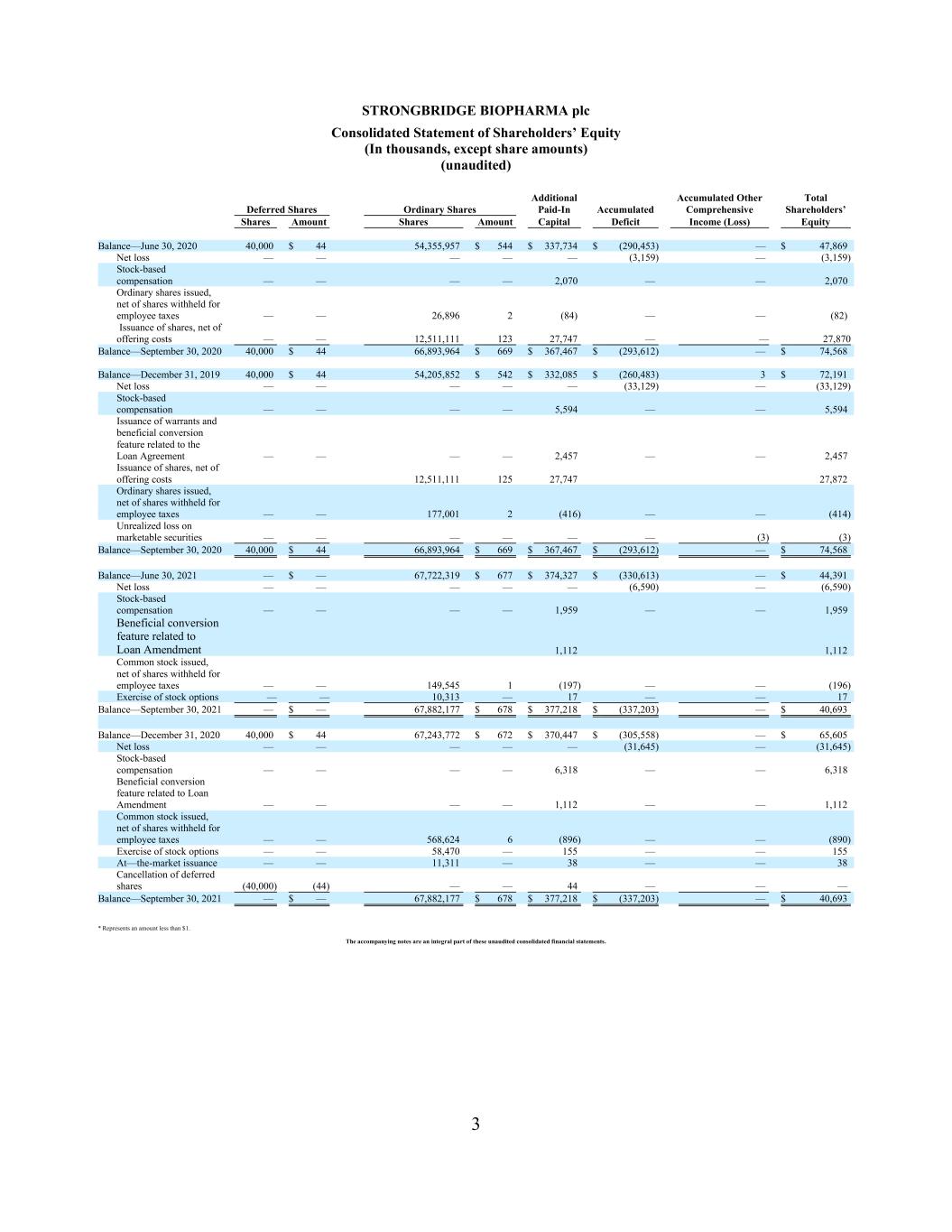

17 Additionally, as part of our loan amendment, $10 million of loan principal was converted into 4,464,285 Strongbridge ordinary shares immediately prior to the completion of the acquisition of Strongbridge by Xeris Pharmaceuticals, Inc, at a conversion price of $2.24 per share. The remaining amount of the loan was extinguished, resulting in a $2.0 million early extinguishment loss. The subsequent events have been evaluated through January 28, 2022, which is the date these consolidated financial statements were issued.