UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2022

Commission File Number: 001-34476

GETNET ADQUIRÊNCIA E SERVIÇOS PARA MEIOS DE PAGAMENTO S.A.

(Exact name of registrant as specified in its charter)

GETNET MERCHANT ACQUISITION AND PAYMENT SERVICES, INC.

(Translation of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of incorporation)

Avenida Presidente Juscelino Kubitschek, 2041, suite 121, Block A

Condomínio WTORRE JK, Vila Nova Conceição

São Paulo, São Paulo, 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

GETNET ADQUIRÊNCIA E SERVIÇOS PARA MEIOS DE PAGAMENTO S.A.

TABLE OF CONTENTS

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Financial Statements for the

Year Ended December 2021

and Report of Independent

Registered Public Accounting Firm

| 1 |

About Getnet

Getnet Adquirência e Serviços para Meios de Pagamento S.A. (“Getnet” or “Getnet S.A.”) is a technology company, focused on business solutions, founded in 2003, being the third acquirer in Brazil when it comes to greater market share. We ended 2021 with approximately 887,600 customers (including micro-entrepreneurs, large corporate customers and Small and Medium-Sized Enterprises - SMEs). We operate with the one stop shop concept, that offers our commercial establishments clients a complete range of physical and digital solutions for their businesses, from payment solutions to business process management.

We closed the year 2021 with a team made up of more than 1,300 employees, responsible for the results that will be presented below.

Corporate Result

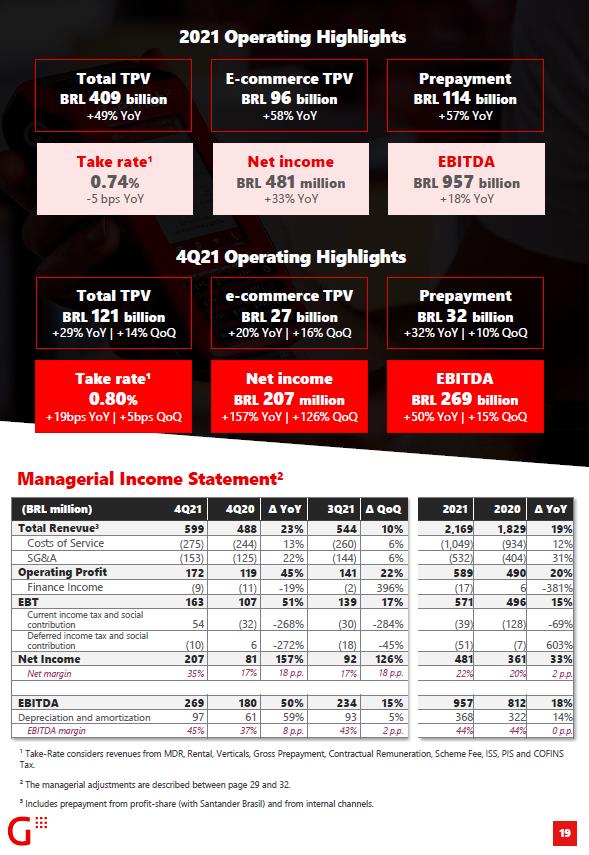

Our revenue from services increased by 23.0%, from R$2,320.5 million in the year ended December 31, 2020 to R$2,853.1 million in the year ended December 31, 2021. The increase in our services revenue in the year ended 2021 mainly reflected:

- a 46.5% increase in acquiring revenue and contractual remuneration, from R$1,095.2 million in 2020 to R$1,604.4 million in 2021. This increase was due to (i) a 49% increase in our total TPV, which resulted in a 14.6% increase in our MDR revenue; and (ii) contractual remuneration income derived from our commercial partnership with Banco Santander (Brasil) S.A. ("Banco Santander"), started in the first half of 2021, which detailed in “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Major Related Party Transactions— commercial partnership with Banco Santander”. Although the commercial partnership started on April 15, 2021, we receive revenue from the commercial partnership as if it had been in effect since January 1, 2021;

- a 37.1% increase in our processing services and capture revenue, from R$149.6 million for the year ended December 31, 2020 to R$205.1 million for the year ended December 31, 2021, primarily due to an increase in the volume of e-commerce transactions (such as products sold through our marketplace and subacquirer services) processed in the year ended December 31, 2021 compared to the year ended December 31, 2020;

- a 51.0% decrease in Point of Sales - POS sales revenue, from R$59.0 million in the year ended December 31, 2020 to R$28.9 million in the year ended December 31, 2021, mainly due to a decrease in the number of our customers using these products as a result of a strategic decision to lease more POS devices instead of selling them;

- an 8.0% decrease in other income, from R$37.0 million for the year ended December 31, 2020 to R$34.0 million for the year ended December 31, 2021 primarily due to a decrease in revenue from prepaid cards;

- a 2.0% increase in our profit share revenue, from R$623.5 million for the year ended December 31, 2020 to R$635.8 million for the year ended December 31, 2021, primarily due to a 47% increase in the volume of transactions processed in the year ended December 31, 2021 compared to the year ended December 31, 2020, partially offset by the increase in funding costs due to the increase in the Basic Interest Rate - SELIC; and

- a 3.2% decrease in our POS rental revenue from R$571.3 million for the year ended December 31, 2020 to R$553.2 million for the year ended December 31, 2021, primarily due to a reduction in rental fees due to increased competition and changes in our pricing policy applicable to POS devices rented as part of a package of services, partially offset by an increase in the number of rental customers.

Costs of services increased by 23.3%, from R$1,426.2 million in the year ended December 31, 2020 to R$1,758.9 million in the year ended December 31, 2021, mainly due to:

- a 55.0% increase in fees and commissions, mainly due to the increase in the volume of transactions and the increase in the level of fees and commissions charged by operators of payment arrangements;

- a 38.0% decrease in POS sales costs and other fees due to a reduction in POS sales, which was partially offset by payments under our commercial partnership with Banco Santander in 2021;

- 14.0% increase in depreciation and amortization expenses, mainly due to the increase in the number of POS; and

- a 10.0% increase in personnel, technology, system and other costs, primarily due to a contractual adjustment of approximately 28% in the costs of our call center service and an increase in the cost to maintaining POS devices.

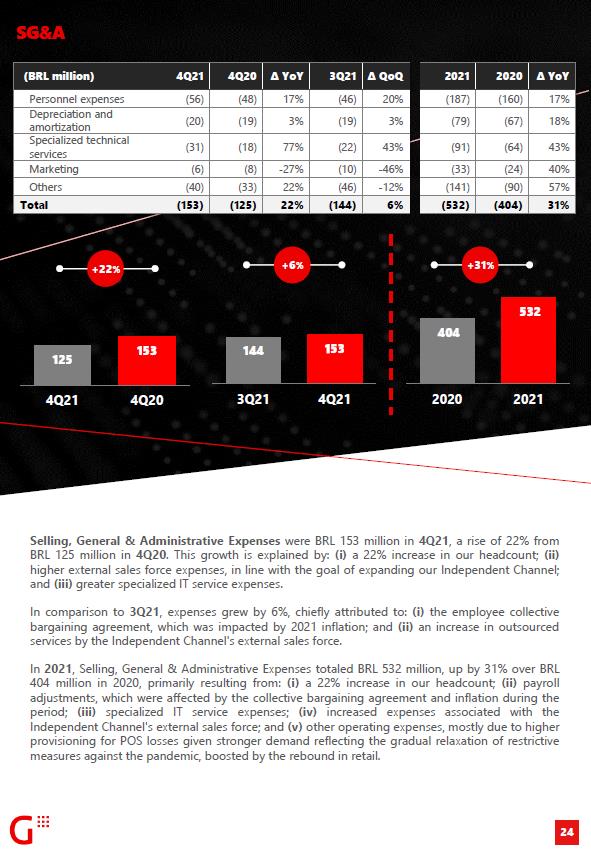

Selling, General and Administrative expenses increased by 27.0%, from R$348.5 million in the year ended December 31, 2020 to R$444.3 million in the year ended December 31, 2021, mainly due to (i) an increase in payroll costs due to an increase in the number of employees, and (ii) expenses incurred with external expert advisors hired to assist us in our listing on Nasdaq.

Our Other expenses, net increased by 71.3%, from R$55.8 million for the year ended December 31, 2020 to R$95.5 million for the year ended December 31, 2021, mainly due to (i) an increase in our provisions for customer losses as a result of increased default rates in our customer base due to the macroeconomic effects of the COVID-19 pandemic, (ii) an increase in provisions for losses on fixed assets due to the increase in the number of of our POS devices, (iii) an increase in provisions for losses on intangibles related to certain projects for which development is in progress and which may not materialize, and (iv) the write-off of fixed and intangible assets in the normal course of business. business (e.g. loss or destruction of POS devices).

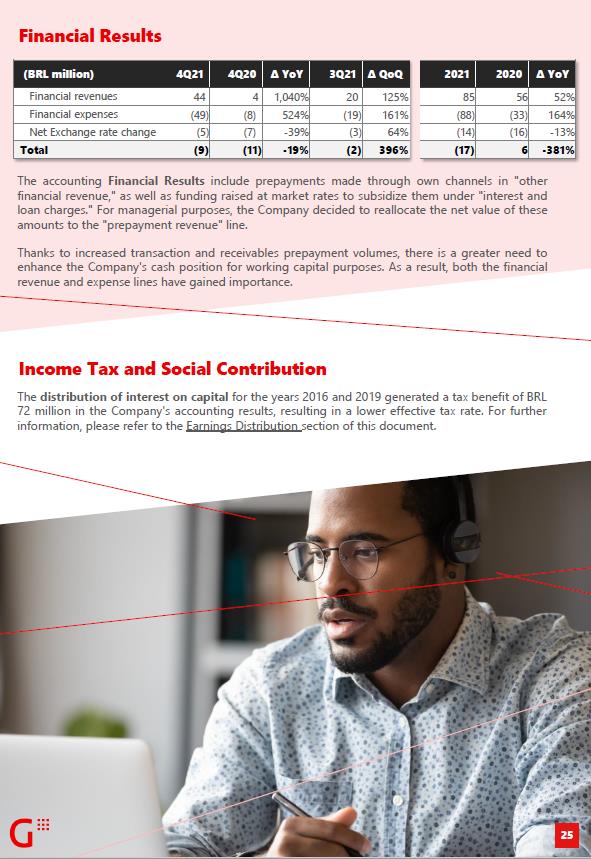

Our Finance income, net increased by 37.7%, from an income of R$ 6.2 million in the year ended December 31, 2020 to a financial income of R$ 8.5 million in the year ended December 31, 2021, mainly because:

- increase in the debt balance of our financial investments due to the growth of our operations which generated an increase in income from financial investments; and

- the inclusion of financial income from prepayments made through our own channels (distinct Banco Santander), which was partially offset by raising funds to finance these operations. In 2021, we began to provide receivables prepayments directly, rather than through Banco Santander. We raised additional funds in the year ended December 31, 2021 compared to the year ended December 31, 2020 to finance these receivables prepayment operations.

Current income tax and social contribution decreased by 71.4%, from R$128.0 million in the year ended December 31, 2020 to R$36.6 million in the year ended December 31, 2021, mainly due to a benefit tax of R$101.3 million generated by the payment of interest on own capital to be paid in 2022, but which were approved in December 2021.

We recorded deferred income tax and social contribution as an expense of R$7.2 million for the year ended December 31, 2020 compared to an expense of R$50.5 million for the year ended December 31, 2021. primarily due to (i) an increase in profit before income taxes of R$66.8 million, from R$496.2 million in the year ended December 31, 2020 to R$563.2 million in the year ended December 31, 2021, and (ii) a deferred tax expense in the amount of R$101.3 million in connection with the payment of interest on own capital that will be paid in 2022, but which was approved on December 21, 2021.

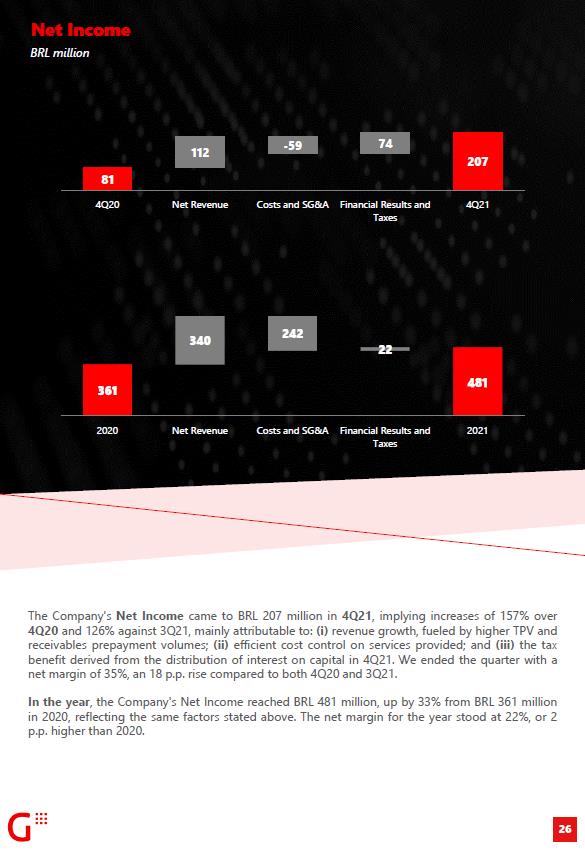

Our net income for the period increased by 31.9%, from R$361.0 million in the year ended December 31, 2020 to R$476.0 million in the year ended December 31, 2021, mainly due to:

- a 23.0% increase in our revenue from services for the year ended December 31, 2021 compared to the year ended 31 December 2020, as detailed above under “—Revenue from services”;

- Measures we take to control our costs and expenses, including with respect to logistics and POS installation. Although our cost of services and our expenses increased in the year ended December 31, 2021 compared to the year ended December 31, 2020, these measures have allowed us to keep the increases in our costs and expenses below the increase in our revenue services; and

- tax benefit of R$ 101.3 million generated by the payment of interest on own capital approved in December 2021.

Message from the Administration

2021 was yet another challenging year for the country. In the first months of the year, the second wave of COVID-19 contamination began, which lasted mainly throughout the second half of the year, recording the highest numbers of infected and lethality since the beginning of the pandemic. However, in the same period, the vaccination campaign gained traction and the country ended the year with more than 143 million Brazilians with a complete vaccination cycle, representing 80% of the adult population, according to the Ministry of Health. to restrictive measures against the pandemic, boosting the economic recovery with the reopening of shops.

As for the impacts of the pandemic, Getnet's management created continuous measures for the resumption of the Company, ensuring business continuity and ensuring safety for its more than 1,300 employees.

During the second half of 2021, the reduction of social distancing measures directly impacted Getnet's operations, as the resumption of economic activities is fundamental for the payments market, which is closely related to the consumption of Brazilian families. The Company began to observe a recovery in volumes, mainly in the segments of large companies, which managed to recover quickly, while small companies are showing a more modest and gradual recovery. Our e-commerce segment is currently one of the main levers for our volume and market share growth, something that continued with a positive performance this year.

We observe that the receivables market has been increasing its representation in small and medium businesses in recent years. Therefore, we remain optimistic about the growth and development potential of the Brazilian payments market.

Likewise, on June 7, 2021, Resolution 4,734 and Circular 3,952 published by the Central Bank of Brazil (“BACEN”) came into force, which brought new rules for the registration of receivables in order to create facilities for customers to acquire credit. All information on card operations will pass through a receivables center, which will record data from commercial establishments. Thus, credit lenders are able to seek greater visibility on their customers or potential, thus offering an increase in the supply of credit to the market as a whole.

Another element that changed economic factors this year was the increase in the SELIC rate, which started from 2% in january, to close the year at 9.25%, according to data from the BACEN, which directly influences Getnet, through our products financial instruments, such as the anticipation rate, which is directly linked to the SELIC. This measure was adopted to contain the advance of inflation, which closed the year 2021 at 10.06%, well above the 4.52% recorded in 2020.

Acquisition of Eyemobile Tecnologia Ltda.

On August 3, 2021, Getnet completed the acquisition of Eyemobile, headquartered in Florianópolis (SC) and focused on developing solutions and technologies for small and medium businesses. With the transaction, the Company aims to strengthen its offer for the segment, reinforcing its technological expertise in interfaces and applications for managing sales and mobile payments. Eyemobile offers management technologies for entrepreneurs who start their sales over the internet and provides applications integrated with operating systems such as Android, iOS and browsers in payment machines with internet connection.

Spin-off of Getnet S.A.

On August 10, 2021, Banco Santander informed its shareholders and the market in general that Getnet was registered as a publicly-held company (category A) by the CVM. Previously, on August 5, 2021, B3 SA - Brasil, Bolsa, Balcão granted the listing request of Getnet and the admission to trading of the shares and Units issued by Getnet, which had the spin-off approved by the BACEN, pursuant to CMN Resolution No. 4,122/12. Furthermore, on November 16, 2020 and February 2, 2021, Banco Santander had also informed its shareholders and the market in general that the Executive Board of Directors of Banco Santander, at a meeting held on February 25, 2021, approved the proposal to separate the interests held by Banco Santander in its wholly-owned subsidiary Getnet, through a partial spin-off of Banco Santander, to be resolved by the shareholders of Banco Santander at an extraordinary shareholders' meeting. On February 25, 2021, the Fiscal Council of Banco Santander issued a favorable opinion on the spin-off proposal.

Leadership

In January 2022, the Company's Board of Directors elected of Mr. Cassio Schmitt as the company's new Chief Executive Officer (CEO), taking his new position in April 2022. Mr. Schmitt is Brazilian, holds a degree in economics from the Federal University of Rio Grande do Sul, a master's degree in corporate economics from Fundação Getúlio Vargas, and an MBA from the Sloan School of Business, Massachusetts Institute of Technology. He has extensive experience in the financial market, having worked at Unibanco, among other institutions. In 2004 he joined Banco Santander, having worked in different positions, such as Project Finance, Risks, Credit Recovery. His last role at Santander was that of director responsible for the Companies, Governments and Institutional Retail Sector.

In December 2021, Mr. Pedro Carlos Araújo Coutinho announced that he will leave the position of CEO of the Company on 03.31.2022, after more than 7 years acting as CEO of Getnet, having played a relevant role in several strategic operations that contributed to the Getnet's growth.

In March 2021, the Board of Directors elected Alberto de Souza Filho as Executive Vice President of Independent Channel. With more than 20 years of national and international career, with stints at Ambev, ZX Ventures and AB-Inbev, where he worked from 2017 to 2021 as Global Director at GHQ in New York. Graduated in Business Administration from Universidade Federal de Mato Grosso, with an MBA in Marketing from FIA (Fundação Instituto de Administração), Executive MBA from Insper and Innovation and Design Thinking from Columbia University.

In March 2021, the Board of Directors elected Luciano Decourt Ferrari as Vice President of Investor Relations. He joined Grupo Santander in 2003, having held various positions, including Investor Relations Deputy from 2013 to 2019 and Commercial Head at Santander Private Banking from 2019 to 2021. Luciano holds a degree in Economic Sciences from PUC-SP (Pontifical Catholic University of São Paulo), with a specialization in Financial Administration from INSPER (Instituto de Ensino e Pesquisa) and Certified Financial Planner from Planor (Brazilian Association of Financial Planning).

In August 2021, the Board of Directors elected André Parize Moraes as Executive Vice President of Finance. He joined Grupo Santander in 2016 and served as Executive Superintendent of Investor Relations at Banco Santander from 2016 to 2021. Previously, he worked at Banco Votorantim from 2008 to 2016, including as head of research, at E&Y from 2007 to 2008 and at Kroll Associates from 2005 to 2007. André holds a degree in business administration from Universidade Presbiteriana Mackenzie and an MBA in capital markets from Universidade de São Paulo - USP.

Board of Directors

On March 31, 2021, the company installed its board of directors, composed of six members, one of them an independent board member, in line with the company's objectives of adopting the best corporate governance practices.

Audit Committee

On October 4, 2021, Getnet's board of directors elected the members who will compose the Company's audit committee, which are:

João Guilherme de Andrade So Consiglio, independent board member, graduated in Economics from the Universidade de São Paulo - USP, with more than 25 years of experience in the financial market, as an economist and on Boards of Directors, working in several financial institutions throughout his career. He is currently a partner at Guilder Capital, a member of the Board of Directors of Unipar Carbocloro S.A., and member of the Board of Directors of You Inc. S.A.

Antonio Melchiades Baldisera, postgraduate in Accounting Management Control from Fundação Getúlio Vargas, with an MBA in Controlling, Auditing and Tax Management also from Fundação Getúlio Vargas, has extensive experience in the financial market working in several banks. He is currently a Consultant at AMB Consultoria Empresarial on Prevention and Treatment of Financial Fraud, Operational Security and Auditing.

Luis Carlos Nanini, graduated in accounting sciences, with several specialization courses in Brazil and abroad, including the Leadership Course at Harvard, with over 30 years of experience in providing independent audit services, also has significant experience in audit committees and fiscal councils of publicly traded Brazilian companies. He is currently a member and financial expert of our Audit Committee and a member of Eletrobrás' Statutory Audit and Risks Committee.

Renewal of working capital financing

In October 2021, Getnet renewed the working capital financing with Banco Santander in the amount of R$600 million.

Getnet listing on B3 and Nasdaq

On September 18, 2021, Getnet shares (GETT11, GETT3 and GETT4) began to be traded on B3, with October 15, 2021 being the cut-off date for holders of Banco Santander shares and on September 22, 2021, the ADRs (GET) were also listed on Nasdaq, with October 19, 2021 being the cut-off date for holders of Banco Santander ADSs, ending the Company's listing process, which began on 16 November 2020, after the decision of Banco Santander, the Company's controller until then.

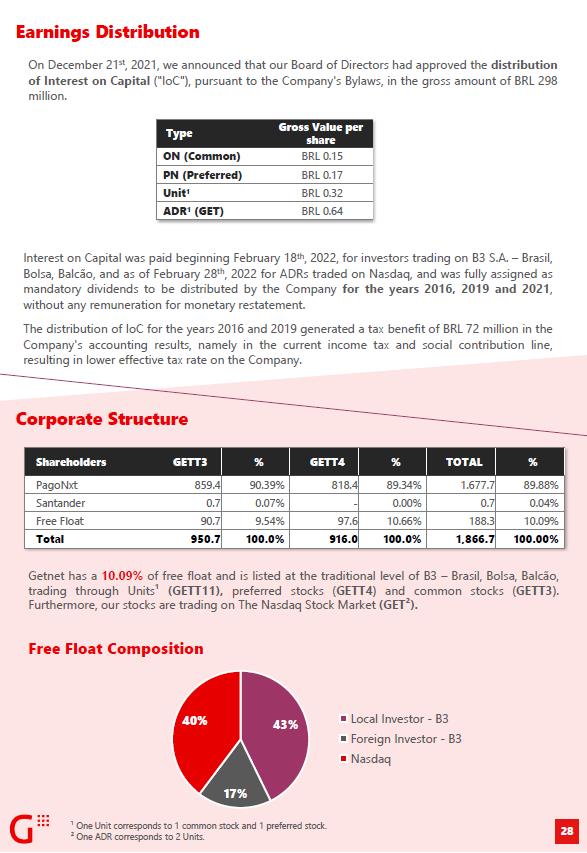

Dividends (interest on capital) payment

In December 2021, Getnet announced the distribution of interest on own capital in the gross amount of BRL 298 million for the years 2016, 2019 and 2021, paid as of of February 18, 2022.

Corporate Governance

Corporate Governance is one of the main pillars within Getnet's management guidelines. Since 2014, the Company has consistently implemented a series of measures to improve its governance, always in line with Grupo Santander's corporate frameworks and in line with the best practices of the IBGC and regulatory bodies.

We are part of an international financial group with a strong culture of Corporate Governance, committed to the ethical conduct of the business, its strategic development and longevity, in line with good market practices.

Our relationship with all employees, customers, suppliers, shareholders and partners is guided by our code of ethics, because here we believe in integrity, transparency, responsibility, diversity and respect, which represent the desired behavior, guaranteeing the practice of ethical and sustainable conduct. in compliance with legislation and regulatory bodies.

We also have the Getnet conduct guide, which is composed of the main certification and legal topics that govern our business and guide the conduct of our employees: ethics, information security, anti-corruption, money maundering prevention and data protection.

We adhere to the best national and international practices for the efficient management of business risks, reinforcing our risk culture and training and encouraging each employee to be a risk manager, always attentive to day-to-day activities.

Our Governance structure is made up of the Executive Board and its Executive Committee made up of the CEO and Executive Vice-Presidents, in the phase of strengthening Governance through the formalization of a Board of Directors and its Advisory Committees, all with their own regulations.

Maximizing the efficiency and long-term value creation of Getnet's Corporate Governance is translated, for example, through (i) adoption of an adequate decision-making and monitoring system through the committees, (ii) management of a secretary of Corporate Governance, (iii) practice of the code of ethical conduct, (iv) annual calendar of events and annual agenda of committees, (v) matrix of the committees' agenda, (vi) Corporate Governance platform, (vii) sustainable practices, ( viii) policies for stakeholder transactions and conflicts of interest, (ix) Compensation and Nomination Committee (CRN) and (x) diversity program.

Reinforcing our commitment to a solid Governance model and our relationship and commitment to all stakeholders, our business strategy is guided by the principles of Environmental, Social, & Governance - ESG.

We built an ESG strategy aimed at generating value with stakeholders, strengthening our purpose of "contributing to people and businesses to prosper" focused on the axes of support for small entrepreneurs, financial education, promotion of diversity, talent development, responsibility for our environmental impact and transition to a low carbon economy.

Among the highlights of this performance we have (i) initiatives to reduce and offset Greenhouse Gases - GHG emissions and we have neutralized the carbon of our operation since 2016, (ii) 100% of our supply chain is evaluated in socio-environmental aspects; (iii) 100% of strategic suppliers develop social projects with local communities; (iv) we are signatories of the UN Compact for Gender Equality; (v) the “Advance” podcast to support entrepreneurs in the pandemic was played over 160,000; (vi) we started the POS delivery pilot with an electric motorcycle with an expectation of a reduction of 26 tons of CO² and (vii) 5 consecutive years certified as one of the “Best Companies to Work For” by GPTW.

For 2022, we are committed to new leaps in the ESG theme, (i) including materiality issues as the Company's goal, (ii) publication of the first Sustainability Report, (iii) adherence to pacts and public commitments in favor of the development agenda sustainability and diversity principles, (iv) expand the scope of financial education initiatives and support for small entrepreneurs.

The administration.

Sao Paulo, March 9, 2022.

As of December 31

(In thousands of Brazilian reais - R$, unless otherwise stated)

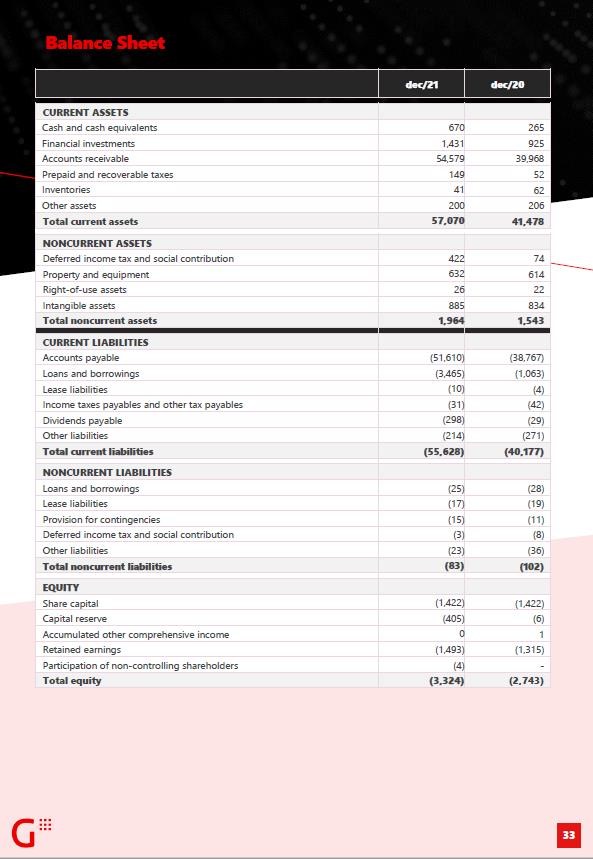

CURRENT ASSETS | Note | 2021 | 2020 |

Cash and cash equivalents | 5.1. a) | 670,441 | 265,096 |

Financial investments | 5.1. b) | 1,430,653 | 925,383 |

Accounts receivable | 5.1. c) | 54,578,684 | 39,968,233 |

Prepaid and recoverable taxes |

| 149,235 | 52,277 |

Inventories |

| 40,899 | 61,559 |

Other assets |

| 200,491 | 205,718 |

Total current assets |

| 57,070,403 | 41,478,266 |

NONCURRENT ASSETS |

|

|

|

Deferred income tax and social contribution | 10.2 | 422,034 | 73,859 |

Property and equipment | 8. | 631,598 | 613,861 |

Right-of-use assets | 6. | 25,703 | 21,905 |

Intangible assets | 7. | 885,083 | 833,807 |

Total noncurrent assets |

| 1,964,418 | 1,543,432 |

TOTAL ASSETS |

| 59,034,821 | 43,021,698 |

CURRENT LIABILITIES |

|

|

|

Accounts payable | 5.2. a) | 51,610,405 | 38,767,156 |

Loans and borrowings | 5.2. b) | 3,464,649 | 1,063,347 |

Lease liabilities | 6. | 9,742 | 4,265 |

Income taxes payables and other tax payables | 10.3 | 30,976 | 41,720 |

Dividends payable |

| 298,000 | 29,227 |

Other liabilities |

| 214,132 | 271,426 |

Total current liabilities |

| 55,627,904 | 40,177,141 |

NONCURRENT LIABILITIES |

|

|

|

Loans and borrowings | 5.2. b) | 25,209 | 27,810 |

Lease liabilities | 6. | 16,573 | 18,784 |

Provision for tax, civil and labor risks | 9. | 15,013 | 11,425 |

Deferred income tax and social contribution | 10.2 | 3,345 | 7,876 |

Other liabilities |

| 22,858 | 35,779 |

Total noncurrent liabilities |

| 82,998 | 101,674 |

EQUITY |

|

|

|

Share capital |

| 1,422,496 | 1,422,496 |

Capital reserve |

| 404,933 | 6,400 |

Accumulated other comprehensive income |

| (242) | (651) |

Retained earnings |

| 1,492,829 | 1,314,638 |

Participation of non-controlling shareholders |

| 3,903 | - |

Total equity |

| 3,323,919 | 2,742,883 |

TOTAL LIABILITIES AND EQUITY |

| 59,034,821 | 43,021,698 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Years ended December 31

(In thousands of Brazilian reais - R$, unless otherwise stated)

| Note | 2021 | 2020 | 2019 |

Revenue from services | 13. a) | 2,853,141 | 2,320,495 | 2,662,893 |

Costs of services | 13. b) | (1,758,858) | (1,426,192) | (1,086,511) |

Gross profit |

| 1,094,283 | 894,303 | 1,576,382 |

Selling, General and Administrative expenses | 14.a) | (444,281) | (348,540) | (440,668) |

Other expenses, net | 14.b) | (95,523) | (55,769) | (109,679) |

Operating profit |

| 554,479 | 489,994 | 1,026,035 |

Finance income, net | 15. | 8,529 | 6,193 | 73,826 |

Profit before income taxes |

| 563,008 | 496,187 | 1,099,861 |

Current income tax and social contribution | 10.1 | (36,551) | (127,984) | (330,012) |

Deferred income tax and social contribution | 10.1 | (50,533) | (7,190) | 24,183 |

Net income for the year |

| 475,924 | 361,013 | 794,032 |

Participation of non-controlling shareholders |

| 267 | - | - |

Net income attributable to controlling shareholders |

| 476,191 | 361,013 | 794,032 |

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share for profit attributable to common shareholders (in R$) | 16 | 0.24 | 0.19 | 0.43 |

Basic and diluted earnings per share for profit attributable to preferred shareholders (in R$) | 16 | 0.27 | NA | NA |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Years ended December 31

(In thousands of Brazilian reais - R$, unless otherwise stated)

| 2021 | 2020 | 2019 |

Net income for the year | 475,924 | 361,013 | 794,032 |

Change in fair value of financial instruments classified as Fair Value Through Other Comprehensive Income | 620 | (705) | 202 |

Deferred income Tax | (211) | 240 | (69) |

Total comprehensive income for the year | 476,333 | 360,548 | 794,165 |

|

|

|

|

Total comprehensive income allocated to: |

|

|

|

Controlling shareholders | 476,600 | 360,548 | 794,165 |

Non-controlling interests | (267) | - | - |

Total comprehensive income for the year | 476,333 | 360,548 | 794,165 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Years ended December 31

(In thousands of Brazilian reais - R$, unless otherwise stated)

|

|

|

| Retained earnings |

|

|

|

| ||

| Note | Share capital | Capital reserves | Legal reserve | Statutory reserve | Accumulated profit | Accumulated other comprehensive income | Equity attributable to controlling interest | Participation of non-controlling shareholders | Total consolidated equity |

Balance at December 31, 2018 |

| 1,189,503 | 6,400 | 82,351 | 1,278,721 | - | (319) | 2,556,656 | - | 2,556,656 |

Net income for the year |

| - | - | - | - | 794,032 | - | 794,032 | - | 794,032 |

Allocation: |

|

|

|

|

|

|

|

|

|

|

Legal reserve |

| - | - | 29,269 | - | (29,269) | - | - | - | - |

Dividends |

| - | - | - | - | (139,022) | - | (139,022) | - | (139,022) |

Reserve for dividend equalization |

| - | - | - | 414,146 | (414,146) | - | - | - | - |

Reserve for working capital strengthening |

| - | - | - | 211,595 | (211,595) | - | - | - | - |

Other comprehensive income |

| - | - | - | - | - | 133 | 133 | - | 133 |

Balance at December 31, 2019 |

| 1,189,503 | 6,400 | 111,620 | 1,904,462 | - | (186) | 3,211,799 | - | 3,211,799 |

Net income for the year |

| - | - | - | - | 361,013 | - | 361,013 | - | 361,013 |

Capital increase | 12. a) | 232,993 | - | - | (232,993) | - | - | - | - | - |

Allocation: |

|

|

|

|

|

|

|

|

|

|

Legal reserve | 12. b) | - | - | 14,498 | - | (14,498) | - | - | - | - |

Dividends | 12. c) | - | - | - | (760,361) | (69,103) | - | (829,464) | - | (829,464) |

Reserve for dividend equalization | 12. b) | - | - | - | 138,706 | (138,706) | - | - | - | - |

Reserve for working capital strengthening | 12. b) | - | - | - | 138,706 | (138,706) | - | - | - | - |

Other comprehensive income |

| - | - | - | - | - | (465) | (465) | - | (465) |

Balance at December 31, 2020 |

| 1,422,496 | 6,400 | 126,118 | 1,188,520 | - | (651) | 2,742,883 | - | 2,742,883 |

Net income for the year |

| - | - | - | - | 476,191 | - | 476,191 | (267) | 475,924 |

Non-controlling interests on acquisition of subsidiary |

| - | - | - | - | - | - | - | 4,170 | 4,170 |

Allocation: |

|

|

|

|

|

|

|

|

|

|

Legal reserve | 12. b) | - | - | 23,688 | - | (23,688) | - | - | - | - |

Dividends and Interest on capital | 12. c) | - | - | - | (211,175) | (86,825) | - | (298,000) | - | (298,000) |

Reserve for dividend equalization | 12. b) | - | - | - | 182,839 | (182,839) | - | - | - | - |

Reserve for working capital strengthening | 12. b) | - | - | - | 182,839 | (182,839) | - | - | - | - |

Tax credit – spin-off | 12. b) | - | 398,533 | - | - | - | - | 398,533 | - | 398,533 |

Other comprehensive income |

| - | - | - | - | - | 409 | 409 | - | 409 |

Balance at December 31, 2021 |

| 1,422,496 | 404,933 | 149,806 | 1,343,023 | - | (242) | 3,320,016 | 3,903 | 3,323,919 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Years ended December 31

(In thousands of Brazilian reais - R$, unless otherwise stated)

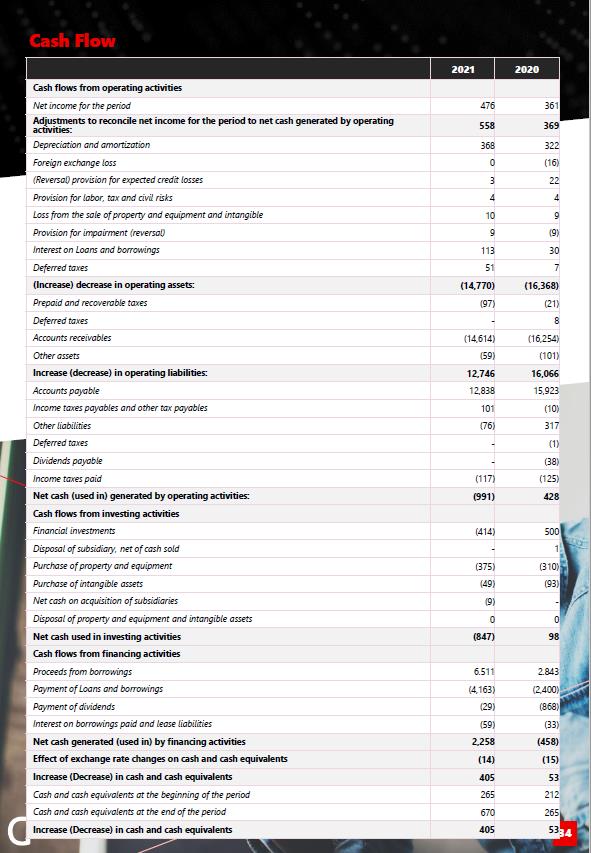

Cash flows from operating activities |

| Note | 2021 | 2020 | 2019 |

| ||||

Net income for the year |

|

| 475,924 | 361,013 | 794,032 |

| ||||

Adjustments to reconcile net income for the year to net cash generated by operating activities: |

|

| 557,719 | 369,080 | 375,068 |

| ||||

Depreciation and amortization |

|

| 368,438 | 322,232 | 277,895 |

| ||||

Foreign exchange gain (loss) |

|

| 93 | (16,467 | ) | 3,772 |

| |||

Provision for expected credit losses |

|

| 3,408 | 21,517 | 73,338 |

| ||||

Provision for labor, tax and civil risks |

|

| 3,588 | 3,924 | 1,397 |

| ||||

Loss from the sale of property and equipment and intangible |

|

| 9,766 | 9,250 | 11,424 |

| ||||

Provision for impairment (reversal) |

| 7 e 8 | 9,121 | (9,032 | ) | 18,420 |

| |||

Interest on Loans and borrowings |

| 5.2 b) e 6 | 112,772 | 30,466 | 13,005 |

| ||||

Deferred taxes |

| 10.1 | 50,533 | 7,190 | (24,183 | ) | ||||

(Increase) decrease in operating assets: |

|

| (14,770,215 | ) | (16,375,812 | ) | (1,321,197 | ) | ||

Prepaid and recoverable taxes |

|

| (96,958 | ) | (21,085 | ) | (11,364 | ) | ||

Accounts receivable |

|

| (14,613,859 | ) | (16,254,164 | ) | (1,305,344 | ) | ||

Other assets |

|

| (59,398 | ) | (100,563 | ) | (4,489 | ) | ||

Increase (decrease) in operating liabilities: |

|

| 12,745,552 | 16,073,741 | (1,586,134 | ) | ||||

Accounts payable |

|

| 12,837,734 | 15,922,589 | (1,701,899 | ) | ||||

Income taxes payables and other tax payables (1) |

|

| 101,227 | (2,684 | ) | (51,558 | ) | |||

Other liabilities |

|

| (76,499 | ) | 278,752 | 451,924 |

| |||

Income taxes paid |

|

| (116,910 | ) | (124,916 | ) | (284,601 | ) | ||

Net cash (used in) generated by operating activities: |

|

| (991,020 | ) | 428,022 | (1,738,231 | ) | |||

Cash flows from investing activities |

|

|

|

|

|

| ||||

Financial investments |

|

| (414,238 | ) | 499,696 | 375,473 |

| |||

Disposal of subsidiary, net of cash sold |

|

| - | 1,100 | 3,000 |

| ||||

|

|

|

|

|

|

| ||||

Purchase of property and equipment |

| 8 | (375,335 | ) | (310,167 | ) | (491,819 | ) | ||

Purchase of intangible assets |

| 7 | (48,637 | ) | (92,760 | ) | (142,087 | ) | ||

Payment for acquisition of subsidiary, net of cash acquired |

| 7 | (9,260 | ) | - | - |

| |||

Disposal of property and equipment and intangible assets |

| 7 e 8 | 252 | 464 | 1 |

| ||||

Net cash (used in) generated by investing activities |

|

| (847,218 | ) | 98,333 | (255,432 | ) | |||

Cash flows from financing activities |

|

|

|

|

|

| ||||

Proceeds from Loans and Borrowings |

| 5.2 b) | 6,510,906 | 2,842,742 | 599,160 |

| ||||

Payment of Loans and borrowings |

| 5.2 b) | (4,164,474 | ) | (2,399,622 | ) | (50,054 | ) | ||

Payment of dividends |

|

| (29,227 | ) | (867,746 | ) | (131,339 | ) | ||

Interest on borrowings paid and lease liabilities |

| 5.2 b) | (59,213 | ) | (33,060 | ) | (5,271 | ) | ||

Net cash generated (used in) by financing activities |

|

| 2,257,992 | (457,686 | ) | 412,496 |

| |||

Effect of exchange rate changes on cash and cash equivalents |

|

| (14,409 | ) | (15,275 | ) | (1,068 | ) | ||

Increase in cash and cash equivalents |

|

| 405,345 | 53,394 | (1,582,235 | ) | ||||

Cash and cash equivalents at the beginning of the year |

| 5.1 a) | 265,096 | 211,702 | 1,793,937 |

| ||||

Cash and cash equivalents at the end of the year |

| 5.1 a) | 670,441 | 265,096 | 211,702 |

| ||||

Increase in cash and cash equivalents |

|

| 405,345 | 53,394 | (1,582,235 | ) |

(1) For better presentation purposes the disclosure items of "Deferred income tax and social contribution" and "Deferred taxes and contributions payable" have been reallocated to the item "Income taxes payables and other tax payables" in the operating activities.

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

(In thousands of Brazilian reais - R$, unless otherwise stated)

1. General Information

Getnet Adquirência e Serviços para Meios de Pagamento S.A. ("Getnet" or "Company" or "Parent"), formerly controlled by Banco Santander (Brasil) S.A. ("Banco Santander"), on February 25, 2021 had its partial spin-off approved, becoming indirectly controlled by Banco Santander S.A. ("Banco Santander Spain"). After, on November 11, 2021, it became controlled by PagoNxt Merchant Solutions S.L., ("PagoNxt Spain"), company that is also part of Santander Business Group ("Santander Group"), from the partial spin-off of the former controlling shareholders' interests.

The change in the ownership interest is part of a corporate reorganization of the Santander Group and does not present any change in the final controlling shareholders or in the management structure of the Company.

Getnet, constituted in the form of a corporation, domiciled on Av. Pres. Juscelino Kubitschek, 2041 Vila Nova Conceição – São Paulo - SP, operates in the market of acquiring and services for means of payment, regulated by the National Monetary Council (“CMN”) and the Central Bank of Brazil (“BACEN”), and its operations are mainly aimed at:

- Merchant acquisition revenue related to the accreditation for retailer and service providers establishments to accept credit and debit cards;

- Processing services revenue related to the capture, transmission and processing of data and information using a network consisting of different types of equipment;

- POS rental revenue related to installing, uninstalling, monitoring, supplying, providing maintenance, and leasing equipment used in transaction capture networks, such as Point-of-Sales (“POS”) devices;

- Recharges sale revenue where it acts as a distributor of telecommunication operators for the commercialization of telephony and data recharge digital credits.

- Profit share revenue that are recognized at the time of transfer of the respective prepayments by Santander Brazil (further details note 11);

- Other revenue from: i) the management of payments and receipts in the establishments accredited to Getnet’s network; ii) developing and selling or licensing software, iii) selling products or distributing services from entities that provide registry information; iv) providing technical, commercial, and logistic infrastructure services for the businesses related to the receipt of bills from dealers, banks, and other collection documents and issuing electronic currency pursuant to the regulations of the BACEN by providing the following services: (a) management of prepaid payment accounts; (b) provision of payment transactions based on electronic currency transferred to prepaid payment accounts; and, (c) conversion of funds into physical or book currency, with the possibility of enabling its acceptance through the settlement in any prepaid payment account it manages.

The spin-off of Getnet from Banco Santander (Brasil) S.A.

On February 25, 2021, Banco Santander (Brasil) S.A. (“Santander Brazil”) informed its shareholders and the market of the approval by its Board of Executive Directors of the proposed segregation of the equity interests held by Santander Brazil in its wholly-owned subsidiary Getnet, through a spin-off from Santander Brazil, deliberated by its shareholders at an extraordinary shareholders’ meeting. Additionally, at the same date, Santander Brazil’s Supervisory Board issued a favorable opinion on the proposed spin-off.

After the approval of the studies and proposal from the Board of Directors of Santander Brazil, on March 31, 2021, the shareholders of Santander Brazil and Getnet approved the spin-off. As a result, Getnet registered in its shareholders equity the portion of the net assets contributed from Santander Brazil spin-off, which correspond to the deferred tax asset registered in the amount of R$398,533 thousand. The operation became effective immediately upon the approval by the shareholders of both companies on March 31, 2021.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

Approval of Getnet spin-off from Santander Brazil by BACEN

On July 14, 2021, through the published statement in the Official Gazette No. 131, Section 3 of the BACEN, the competent board approved the incorporation of Santander Brazil's assets portion related to its participation in Getnet. The delivery of Getnet shares and units to Santander Brazil shareholders in Brazil, took place after the cut-off date for delivering the shares and units on October 15, 2021, with the delivery of shares on October 18, 2021.

Brazilian Securities and Exchange Commission - CVM and Securities and Exchange Commission – SEC approval the grant registration of the Getnet

On August 10, 2021, Getnet obtained the grant of issuer registration dealing with CVM Instruction n°. 480/09, in category "A" (permission to trade shares in the Brazilian stock exchange market), and on that date the approval of Getnet's registration of a publicly interest entity by CVM. On August 5, 2021, B3 S.A. - Brasil, Bolsa, Balcão granted Getnet's listing request and admission to the trading of shares and Units issued by Getnet. In Brazil, the cut-off date for delivering the shares was October 15, 2021, with delivery of shares on October 18, 2021, before CVM and B3. The listing process on the U.S. Securities and Exchange Commission (“SEC”) and the National Association of Securities Dealers Automated Quotations (“Nasdaq”) was concluded in October 2021 and the beginning of negotiations in the American market began on October 22, 2021.

On October 18, 2021 the Getnet shares (GETT11, GETT3 and GETT4) started to be traded at B3, and on October 22, 2021 the ADRs (GET) also started to be listed at Nasdaq, thus ending the spin-off process resolved at the Extraordinary Shareholders' Meeting held on March 31, 2021, since the Company's shares and units were delivered to the shareholders of Santander Brazil.

New subsidiary - Getnet Sociedade de Crédito Direto S.A

On February 12, 2021, Getnet received the authorization from BACEN to operate as a Direct Credit Corporation (Sociedade de Crédito Direto – “SCD”), as defined by the BACEN Resolution 4,656/18, following the expansion of our business to offer financial products such as loans directly to merchants during 2021.

Seeking to provide greater legal certainty to this “new Brazilian credit market", the applicable regulation requires SCDs to select their clients based on consistent, verifiable and transparent criteria, including relevant aspects of credit risk assessment. The SCDs are authorized to provide ancillary credit services, limited to an exhaustive list set forth in the regulation, encompassing: (i) credit analysis for third parties; (ii) collection of debts owed by third parties; (iii) acting as insurance representative in distribution of insurance related to credit transactions; and (iv) issuance of electronic currency. Notwithstanding, SCDs are prohibited from having equity interest in financial institutions, and restricted from raising funds from the public, except for the issuance of its own shares.

Transaction with Eyemobile Tecnologia Ltda.

On August 3, 2021 after the satisfaction of the applicable preceding conditions, the Company closed the transaction relating to Getnet's acquisition of interest in Eyemobile Tecnologia Ltda. ("Eyemobile"), with the subsequent corporate conversion of Eyemobile's and an increase in Eyemobile's capital, fully subscribed by Getnet (respectively “Transaction” and "Closing"). Eyemobile is a technology company that operates through the offer of software solutions focused on the payment market, points of sale (“POS”), cash front and events. After the closing, Getnet holds a 60% interest, acquired through a total of R$21.5 million paid in cash for the acquisition of: (i) equity interest of 44% (R$ 11.5 million) and capital increase (R$ 10.0 million) resulting in an increase in the level of ownership interest of 16%. In addition, Getnet may disburse an additional maximum amount of R$ 3.5 million conditioned to certain financial and operational achievements up to 18 months after the closing.

Approval of the financial statements

The consolidated financial statements were authorized for issue by the board of directors on March 09, 2022. The directors have the power to amend and reissue the consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

2. Basis of preparation

The consolidated financial statements have been prepared taking into consideration the historical cost model as the base value, except in the case of certain financial assets and liabilities that are measured at fair value.

The preparation of consolidated financial statements requires the use of certain critical accounting estimates. It also requires Getnet’s management to exercise judgment in the process of applying the adopted accounting policies. Those areas involving a higher degree of judgment and complexity, as well as those where assumptions and estimates are significant to the consolidated financial statements, are disclosed in notes.

The consolidated financial statements have been prepared and are presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

(a) Other information

c.1) Adoption of new standards and interpretations

The following standard changes were adopted for the first time for the year beginning January 1, 2021:

• Amendments to IFRS 9, IAS 39, IFRS 7 “Financial Instruments”, IFRS 4 “Insurance Contracts” and IFRS 16 “Leases”:

The changes provided for in Phase 2 of the interbank offered rates (“IBOR)” reform address issues that may affect the Financial Statements during the reform of a benchmark interest rate, including the effects of changes in contractual cash flows or hedging relationships arising from the substitution of a rate for a alternative reference rate (replacement issues). The effective date of application of this change was January 1, 2021. Therefore, the implementations above had no significant impact on these Financial Statements.

Rules and interpretations that will come into effect after December 31, 2021

The IASB has disclosed some amendments to certain accounting standards that are not yet effective, and the Company and its subsidiaries have not early adopted for the preparation of these consolidated financial statements.

Amendments to IFRS 10 Consolidated Financial Statements and IAS 28 Sale or Contribution of Assets between an Investor and its Associate or Joint Venture

The amendments to IFRS 10 and IAS 28 deal with situations where there is a sale or contribution of assets between an investor and its associate or joint venture. Specifically, the amendments state that gains or losses resulting from the loss of control of a subsidiary that does not contain a business in a transaction with an associate or a joint venture that is accounted for using the equity method, are recognized in the parent’s profit or loss only to the extent of the unrelated investors’ interests in that associate or joint venture. Similarly, gains and losses resulting from the remeasurement of investments retained in any former subsidiary (that has become an associate or a joint venture that is accounted for using the equity method) to fair value are recognized in the former parent’s profit or loss only to the extent of the unrelated investors interests in the new associate or joint venture.

The effective date of the amendments has not been set by the IASB yet; however, early adoption of the changes is allowed. Getnet is assessing the possible impacts of adopting this standard.

Amendments to IAS 1 Classification of Liabilities as Current or Non-current

The amendments to IAS 1 affect only the presentation of liabilities as current or non-current in the statement of financial position and not the amount or timing of recognition of any asset, liability, income or expenses, or the information disclosed about those items.

The amendments clarify that the classification of liabilities as current or non-current is based on rights that are in existence at the end of the reporting period, specify that classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of a liability, explain that rights are in existence if covenants are complied with at the end of the reporting period, and introduce a definition of settlement to make clear that settlement refers to the transfer to the counterparty of cash, equity instruments, other assets or services.

The amendments are effective retrospectively for annual periods beginning on or after January 1, 2023, with early adoption permitted. Getnet is assessing the possible impacts of adopting this standard.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

Amendments to IFRS 3 Business Combinations - Reference to the Conceptual Framework

The amendments update IFRS 3 so that it refers to the 2018 Conceptual Framework instead of the 1989 Framework. They also add to IFRS 3 requirement that, for obligations within the scope of IAS 37, an acquirer applies IAS 37 to determine whether at the acquisition date a present obligation exists as a result of past events. For a levy that would be within the scope of IFRIC 21 Levies, the acquirer applies IFRIC 21 to determine whether the obligating event that gives rise to a liability to pay the levy has occurred by the acquisition date.

Finally, the amendments add an explicit statement that an acquirer does not recognize contingent assets acquired in a business combination.

The amendments are effective for business combinations for which the date of acquisition is on or after the beginning of the first annual period beginning on or after January 1, 2022. Early application is permitted if an entity also applies all other updated references (published together with the updated Conceptual Framework) at the same time or earlier. Getnet is assessing the possible impacts of adopting this standard.

Amendments to IAS 16 Property, Plant and Equipment—Proceeds before Intended Use

The amendments prohibit deducting from the cost of an item of property, plant and equipment any proceeds from selling items produced before that asset is available for use, i.e. proceeds while bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Consequently, an entity recognizes such sales proceeds and related costs in profit or loss. The entity measures the cost of those items in accordance with IAS 2 Inventories.

The amendments also clarify the meaning of ‘testing whether an asset is functioning properly’.<0} IAS 16 now specifies this as assessing whether the technical and physical performance of the asset is such that it is capable of being used in the production or supply of goods or services, for rental to others, or for administrative purposes.<0}

If not presented separately in the comprehensive income statement, the financial statements should disclose the amounts of the resources and costs included in the income corresponding to the items produced that are not a product of the entity's ordinary activities, and whose item in the comprehensive income statement includes these resources and costs.

The amendments are applied retrospectively, but only to items of property, plant and equipment that are brought to the location and condition necessary for them to be capable of operating in the manner intended by management on or after the beginning of the earliest annual period presented in the financial statements in which the entity first applies the amendments.

The entity shall recognize the cumulative effect of initially applying the amendments as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at the beginning of that earliest annual period presented.

The amendments are effective for annual periods beginning on or after January 1, 2022, with early application permitted. Getnet is assessing the possible impacts of adopting this standard.

Amendments to IAS 37 Onerous contracts—cost of fulfilling a contract

The amendments specify that the ‘cost of fulfilling’ a contract comprises the ‘costs that relate directly to the contract’. Costs that relate directly to a contract consist of both the incremental costs of fulfilling that contract (examples would be direct labor or materials) and an allocation of other costs that relate directly to fulfilling contracts (an example would be the allocation of the depreciation charge for an item of property, plant and equipment used in fulfilling the contract).

The amendments apply to contracts for which the entity has not yet fulfilled all its obligations at the beginning of the annual period in which the entity first applies the amendments. Comparatives are not restated. Instead, the entity shall recognize the cumulative effect of initially applying the amendments as an adjustment to the opening balance of retained earnings or other component of equity, as appropriate, at the date of initial application.

The amendments are effective for annual periods beginning on or after January 1, 2022, with early application permitted. Getnet is assessing the possible impacts of adopting this standard.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

IFRS 17 Insurance Contracts

In May 2017, the IASB issued the IFRS for insurance contracts that aims to replace IFRS 4. The implementation date of IFRS 17 is January 1, 2023. This standard is intended to demonstrate greater transparency and information useful in financial statements, one of the main changes being the recognition of earnings as the measure of delivery of insurance services, in order to assess the performance of insurers over time. Getnet is evaluating the possible impacts when adopting the standard.

IAS 12 Income Taxes

The amendments to IAS 12 Income Taxes require companies to recognise deferred tax on transactions that, on initial recognition, give rise to equal amounts of taxable and deductible temporary differences. They will typically apply to transactions such as leases of lessees and decommissioning obligations and will require the recognition of additional deferred tax assets and liabilities. The amendments to IAS 12 are effective as of January 1, 2023.

IAS 8 Accounting Policies, changes in accounting estimates and errors

Changes in accounting estimates and errors, which use a consistent definition of materiality for the purpose of making material judgements and deciding on the information to be included in the financial statements. The amendments to IAS 1 are effective as of January 1, 2023.

Annual Improvements to IFRS Standards 2018 - 2020 - to be adopted beginning January 1, 2022

IFRS 9 Financial Instruments

The amendment clarifies that in applying the ‘10 percent’ test to assess whether to derecognize a financial liability, an entity includes only fees paid or received between the entity (the borrower) and the lender, including fees paid or received by either the entity or the lender on the other’s behalf.

The amendment is applied prospectively to modifications and exchanges that occur on or after the date the entity first applies the amendment.

The amendment is effective for annual periods beginning on or after January 1, 2022, with early application permitted. Getnet is assessing the possible impacts of adopting this standard.

According to management’s opinion, there are no other standards or interpretations issued and not yet adopted that could have a material impact on the profit or loss for the year or the equity disclosed by the Company and its subsidiaries.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

2.1. Consolidation

The Company consolidates all entities over which it has the capacity to exercise control, i.e., when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to direct the investee’s relevant operations.

The subsidiaries included in consolidation are the following:

Subsidiary | Type | Equity interest % |

Auttar H.U.T. Processamento de Dados Ltda. (“Auttar”) | Subsidiary | 100% |

Getnet Sociedade de Crédito Direto S.A (“SCD”) | Subsidiary | 100% |

Eyemobile Tecnologia S.A. (“Eyemobile”) (1) | Subsidiary | 60% |

(1) On May 12, 2021, Getnet Adquirência e Serviços para Meios de Pagamentos S.A. entered into an investment and other agreements with Eyemobile, as consenting intervening party, establishing the terms of the negotiation for the purchase and sale of the shares representing Eyemobile's capital stock. The control acquisition was concluded on August 3, 2021, so that Getnet now holds 60% of Eyemobile's voting shares for the amount of R$19,415, corresponding to the equity value of the shares on the purchase date, plus the amount of the contribution of the shares paid up upon subscription. The Company's corporate purpose is to explore the development and licensing of customizable computer programs, the rental of office machines and equipment, and the specialized retail trade of computer equipment and supplies.

| Accounting policy |

The accounting policies below are applied in the preparation of the consolidated financial statements:

Subsidiaries

Subsidiaries are all entities over which Getnet holds control. Subsidiaries are consolidated from the date on which control is transferred to Getnet. Consolidation is discontinued when control no longer exists.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

Identifiable assets acquired and liabilities and contingent liabilities assumed in the acquisition of a subsidiary are initially measured at their fair values at the acquisition date.

All intragroup transactions, balances and unrealized gains are eliminated on consolidation. Unrealized losses are also eliminated, unless the transaction provides evidence of impairment of the transferred asset. The subsidiaries’ accounting policies are amended according to Getnet’s accounting policies, as applicable.

2.2. Functional and presentation currency

Items included in the financial statements of each investee controlled by Getnet are measured using the currency of the main economic environment in which it operates (“functional currency”).

The consolidated financial statements are presented in Brazilian reais (R$), which is Getnet’s functional and presentation currency.

3. Segment Reporting

A business segment is an identifiable component of the entity that is intended to provide an individual product or service or a group of related products or services, and which is subject to risks and benefits that are distinguishable from other business segments.

Operating segment reporting is presented in a manner consistent with the internal reporting provided to the chief operating decision maker, in the case of Getnet, the Chief Executive Officer (“CEO”), in which he reviews items of the Consolidated Statement of Income and other comprehensive income. The CEO takes into consideration the entire Company as a single operating and reportable segment by monitoring operations, making decisions about resource allocation, financial and strategic planning, and performance evaluation based on a single operating segment. The CEO formally reviews financial data material for the Company and its subsidiaries.

The Company's revenue, profit or loss, and assets for this reportable segment can be determined by reference to the Consolidated Statement of Income, the Consolidated Statement of Comprehensive Income, and the Consolidated Balance Sheet.

4. Risk Management

Getnet’s shareholders and management consider risk management an essential tool for strategic decision making, including for maximizing efficiency in the use of capital in Getnet‘s operations.

Getnet established its policies, systems and internal control to ensure a continual mitigation of possible risks and/or the realization of losses arising from exposure to credit, liquidity, market, and operational risks.

a)Credit risk: Credit risk is the risk that a financial loss due to a counterparty failing to fulfill its obligations under a financial instrument or accounts receivable, leading to a financial loss for the Company. The Company is exposed to credit risk from its operating activities, mainly related to accounts receivable and also cash and cash equivalents and derivative financial instruments. c. In merchant acquisition transactions, the card issuers are required to pay Getnet the amounts arising on to the transactions carried out by the cardholders so that the payment of such amounts to the accredited merchants can be made; therefore, Getnet is exposed to the credit risk of the card issuers and the greatest exposure to credit risk is correlated to the transactions recorded in the Other customer receivables lines presented in note 5.1 c). For the management of loss risks arising from accounts receivable, Getnet applies a simplified approach in calculating expected credit losses (“ECLs”), therefore, the Company instead recognizes a loss allowance based on lifetime ECLs, provision matrix and days past due at each reporting date.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

b)Liquidity risk: The liquidity risk management policy aims at ensuring that the risks that affect the implementation of Getnet’s strategies and goals are continuously assessed. Getnet manages the liquidity risk by setting the necessary tools for its management in normal or crisis scenarios. The frequent monitoring aims at mitigating possible maturity mismatches by allowing corrective actions, if necessary. Getnet’s approach to liquidity management is to ensure that it always has enough funds to discharge its obligations on due date, under normal and stress conditions, in order to avoid unacceptable losses or losses resulting in undue exposure of Getnet’s reputation. The cash flow forecasting is performed by the treasury department which monitors rolling forecasts of the Company’s liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient headroom on its undrawn committed borrowing facilities at all times in order to the Company does not breach covenants (where applicable). The liquidity risk management is performed to : (i) measuring liquidity risk, the Company has tools to control the cash flow forecasting to ensure that Getnet has sufficient cash to meet operational needs; (ii) daily monitoring the cash needs, segregated into liquidity buffer and free movement cash, ensuring that they are consistent with the policies and minimum amounts decided by the management; (iii) limits and liquidity risk alerts, monitored monthly by the management and by the controller where the available amounts and the projection of possible gaps over a 90-day horizon are measured; (iv) contingency plan test is conducted every six months, whereby previously approved credit agreements with other financial institutions are contracted for possible emergency cover.

c)Interest rate risk: This risk arises from the possible losses of Getnet’s asset values due to fluctuations in sovereign interest rates. Getnet is exposed to interest rate risk due to short-term settlements of accounts receivable, mismatch between transaction settlements and the transfers from the credit card companies, and possible difficulty to raise funds. In addition to the financial risk generated by a possible decrease in the spreads due to a possible increase in borrowing costs. The Company manages the interest rate risk by maintaining a diversification of borrowing at fixed and variable rates.

d)Exchange rate risk: Corresponds to the possibility of loss of value due to exchange rate fluctuations from transactions or recognized assets or liabilities denominated in a currency different from the Getnet’s functional currency. The exposure to foreign exchange rate risk by Getnet arises substantially from receivables from international card issuers, cash and cash and equivalents in foreign exchange. Getnet has operating expenses that are settled in U.S. Dollars, mainly from purchasing equipment which are indexed to U.S. Dollars and resold in Brazilian reais and costs of hiring IT suppliers paid in U.S. Dollars. Due to the low volume of transactions subject to exchange rate fluctuation. At December 31, 2021 and 2020, Getnet is not materially exposed to the foreign exchange rate risk due the short-term and low amount outstanding at the end of each month.

e)Capital management: The current Liquidity and Market Risk Management Policy, Getnet follows the BACEN Resolution Nº 4,557, issued on February 23, 2017, which provides for Risk Management and Capital Management Structure, making efficient use of capital as an indispensable component of the business decision-making process, and its management is a factor of competitive differentiation. With integrated risk management, this practice supports the Company's projected growth, besides increasing its profitability, and has the following drivers (i) efficient use of capital, through allocation in businesses considering risk versus return; (ii) optimization of capital allocated in business and products of greater profitability; (iii) integrated risk management ensuring the position of soundness in the market, by adopting the best management practices and risk mitigation.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

5. Financial Instruments

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

The Company’s classifies financial instruments into the following categories:

| December 31, 2021 |

| December 31, 2020 | ||||

| Amortized cost | Fair value through other comprehensive income | Total |

| Amortized cost | Fair value through other comprehensive income | Total |

Financial assets |

|

|

|

|

|

|

|

Current |

|

|

|

|

|

|

|

Cash and cash equivalents | 670,441 | - | 670,441 |

| 265,096 | - | 265,096 |

Financial investments | 875,240 | 555,413 | 1,430,653 |

| 393,783 | 531,600 | 925,383 |

Accounts receivable | 54,578,684 | - | 54,578,684 |

| 39,968,233 | - | 39,968,233 |

Other assets | 200,491 | - | 200,491 |

| 205,718 | - | 205,718 |

Total financial assets | 56,324,856 | 555,413 | 56,880,269 |

| 40,832,830 | 531,600 | 41,364,430 |

|

|

|

|

|

|

|

|

Financial liabilities |

|

|

|

|

|

|

|

Current/Non-current |

|

|

|

|

|

|

|

Accounts payable | 51,610,405 | - | 51,610,405 |

| 38,767,156 | - | 38,767,156 |

Loans and borrowings | 3,489,858 | - | 3,489,858 |

| 1,091,157 | - | 1,091,157 |

Lease liabilities | 26,315 | - | 26,315 |

| 23,049 | - | 23,049 |

Other liabilities | 236,990 | - | 236,990 |

| 307,205 | - | 307,205 |

Total financial liabilities | 55,363,568 | - | 55,363,568 |

| 40,188,567 | - | 40,188,567 |

5.1 Financial assets

(a) Cash and cash equivalents

| 12/31/2021 | 12/31/2020 |

Cash | 229 | 41 |

Short-term bank deposits | 646,304 | 255,407 |

Foreign currency cash and investments abroad(1) | 23,908 | 9,648 |

Total | 670,441 | 265,096 |

(1) Refers to highly liquid financial investments in U.S. Dollars.

(b) Financial investments

| 12/31/2021 | 12/31/2020 |

Brazilian treasury bonds (1) | 555,413 | 531,600 |

Short-term investment (2) | 875,240 | 393,783 |

Total | 1,430,653 | 925,383 |

(1) Consists of investments in Brazilian Treasury Bonds ("LFTs") with an interest rate of 99.04% of the Basic Interest Rate (SELIC –9.25% and 2.0% for the year ended December 31, 2021 and December 2020, respectively), invested to comply with certain requirements for authorized payment institutions as set forth by the BACEN regulation. This financial asset was classified at fair value through other comprehensive income.

(2) Refer to the amounts invested in the SBAC Investment Fund, remunerated at DI rate (the Brazilian interbank deposit rate), where Getnet holds participation units. The underlying assets of the fund comprises substantially in public securities and repo with high liquidity (Level 1 – Further details note 5.3).

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

(c) Accounts receivable

| 12/31/2021 | 12/31/2020 |

Accounts receivable from card issuers | 54,131,057 | 39,610,114 |

Other accounts receivable from clients | 509,359 | 416,443 |

Provision for expected credit losses | (61,732) | (58,324) |

Total | 54,578,684 | 39,968,233 |

Movements in the provision for expected credit losses

| 12/31/2021 | 12/31/2020 | 12/31/2019 |

Opening balance | 58,324 | 66,564 | 75,109 |

Additions | 67,351 | 69,789 | 83,293 |

Reversals | (63,943) | (78,029) | (91,838) |

Closing balance | 61,732 | 58,324 | 66,564 |

Accounting policy

Financial assets are classified into the following categories: (i) amortized cost; (ii) fair value through other comprehensive income; and (iii) fair value through profit or loss. The basis for classification depends on the Company’s business financial assets management model and the contractual cash flow characteristics of the financial asset. The classifications of the financial assets are detailed below:

Amortized cost

Held within the business model in order to collect to collect contractual cash flows; these cash flows represent solely payments of principal and interest and are, therefore, initially recognized at fair value and subsequently measured at amortized cost using the effective interest rate method, less provisions for reduction to recoverable amount.

Interest income from these financial assets is recognized in finance income. Any gains or losses due to the write-off of the asset are recognized directly in the profit or loss, together with foreign exchange gains and losses. Impairment losses are presented separately in the Consolidated Statement of Income.

Fair value through other comprehensive income (FVOCI)

A financial asset is measured at fair value through comprehensive income if it meets the concept of principal and interest only payments and is held within the business model whose objective is to both, collecting contractual cash flows and selling the financial assets.

Changes in carrying amount are recognized in other comprehensive income, except for the recognition of impairment gains or losses, interest income, and foreign exchange gains and losses, which are recognized in the profit or loss. When the financial asset is derecognized, the cumulative gains or losses that had been previously recognized in other comprehensive income are reclassified from equity to profit or loss. Interest income from these financial assets is recognized in finance income using the effective interest method.

Fair value through profit or loss (FVPL)

Assets are measured at fair value through profit or loss when they do not meet the criteria to be classified at amortized cost or at fair value through other comprehensive income or when on initial recognition was designated to eliminate or reduce an accounting mismatch. Any exchange gains or losses are recognized in the Consolidate Statement of Income.

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

Derecognition of financial assets

The Company derecognizes financial assets when the contractual rights to the cash flows from investing activities expire or when it transfers the investments and substantially all the risks and rewards of ownership to another entity.

Expected credit losses

Getnet assesses, on a prospective basis at each reporting date, the expected credit losses on financial assets carried at amortized cost and at fair value through other comprehensive income.

The impairment assessment methodology applied depends on whether there is a significant increase in credit risk and the loss is estimated as the difference between all contractual cash flows that are due to the Company in accordance with the contract and all the cash flows that the Company expects to receive, discounted at an approximation of the original effective interest rate. Expected cash flows will include cash flows from the sale of collaterals held or other credit enhancements that are integral to the contractual terms.

The Company recognizes an allowance for ECLs for all financial assets not measured at FVPL. ECLs are based on the difference between the contractual cash flows due in accordance with the contract and all the cash flows that Getnet expects to receive, discounted at an approximation of the original effective interest rate. Getnet applies a simplified approach in calculating ECLs, therefore, Getnet instead recognizes a loss allowance based on lifetime ECLs, provision matrix and days past due at each reporting date.

For accounts receivable, Getnet applies the simplified approach as permitted by IFRS 9 by recognizing lifetime expected credit losses from the initial recognition of the receivables.

Estimates and critical accounting judgments

Financial assets measured at amortized cost and fair value through other comprehensive income are tested for impairment at the end of each annual reporting period. The carrying amounts of these assets are adjusted by the loss allowance as a contra entry to the Consolidated Statement of Income. The reversal of previously recognized losses is recognized in the Consolidated Statement of Income in the year in which the impairment decreases and can be objectively related to a recovery event. The amount recorded in the Consolidated Statement of Income in the line item ‘Other expenses, net’ is disclosed in table ‘Movements in the provision for expected credit losses’ in the note 5.1(c).

5.2 Financial liabilities

a) Accounts payable

| 12/31/2021 | 12/31/2020 |

Payment transactions (1) | 50,980,629 | 38,241,934 |

Other financial liabilities (2) | 629,776 | 525,222 |

Total | 51,610,405 | 38,767,156 |

(1) Refers mainly to payment transactions with Santander Brazil (related party) in the amount of R$ 18,858,043 on December 31, 2021 and R$ 17,474,617 on December 31, 2020 (further details note 11) and commercial establishments.

(2) Amounts to be paid as an interchange fee and amounts that are under analysis for approval of settlement.

b) Loans and borrowings

| 12/31/2021 | 12/31/2020 |

Financial liabilities at amortized cost(1) | 3,489,858 | 1,091,157 |

Total | 3,489,858 | 1,091,157 |

Getnet Adquirência e Serviços para Meios de Pagamento S.A.

Notes to the Consolidated Financial Statement

(In thousands of Brazilian reais - R$, unless otherwise stated)

(1) Includes Brazilian real-denominated transactions with credit institutions resulting from loan and financing credit facilities and on lending in Brazil (BNDES/ FINAME).

The increase in loan obligations for the year was due to the raising of working capital to support the Company's operational activities, which had the strategy of expanding the offer of receivables anticipation products.

The types of operations and rates used are listed below:

| Rate | Maturity | 12/31/2021 | 12/31/2020 |

Working capital financing (1) | 110.63% of the CDI(2) | 02/22 | 2,993,507 | 1,051,358 |

Working capital financing | 9.16% of the CDI(2) | 01/22 | 457,416 | - |

BNDES/ FINAME | 3.75% p.y + Long Term Interest Rate | - | - | 2,957 |

Other financing | 11.11% - 11.15% p.y. | 05/24 - 02/25 | 38,935 | 36,842 |

Total |

|

| 3,489,858 | 1,091,157 |

(1) Related to Santander Brazil transaction. See note 11 for further details.