UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2022

Commission File Number: 001-34476

GETNET ADQUIRÊNCIA E SERVIÇOS PARA MEIOS DE PAGAMENTO S.A.

(Exact name of registrant as specified in its charter)

GETNET MERCHANT ACQUISITION AND PAYMENT SERVICES, INC.

(Translation of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of incorporation)

Avenida Presidente Juscelino Kubitschek, 2041, suite 121, Block A

Condomínio WTORRE JK, Vila Nova Conceição

São Paulo, São Paulo, 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

GETNET ADQUIRÊNCIA E SERVIÇOS PARA MEIOS DE PAGAMENTO S.A.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Interim Financial Statements as of September 30, 2022 and for the nine-month periods ended September 30, 2022 and September 30, 2021

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

sss

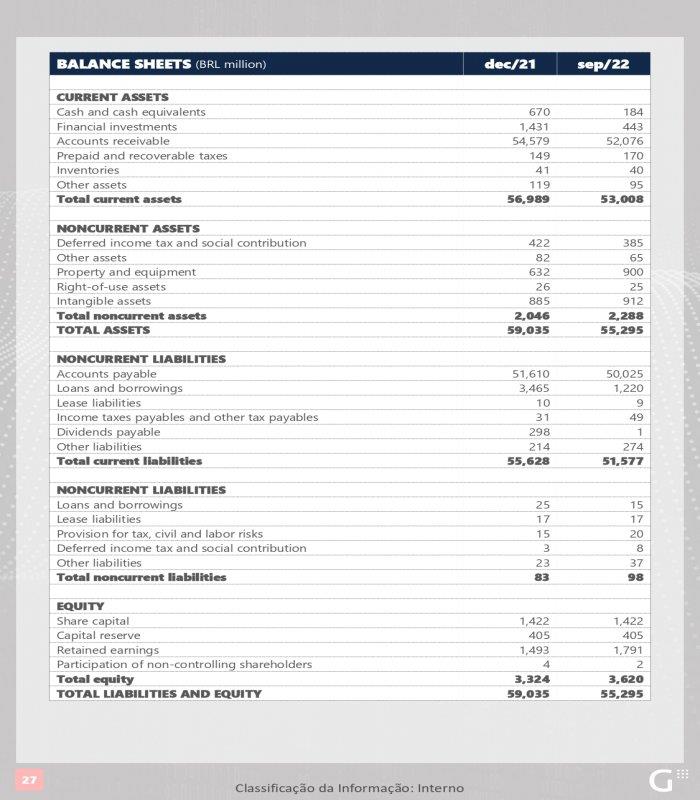

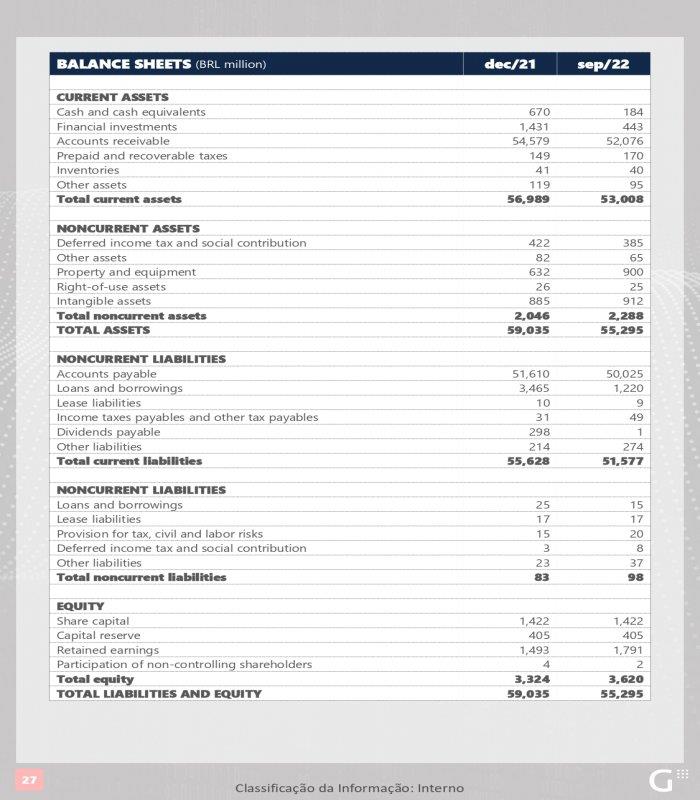

CURRENT ASSETS | Note | 2022 | 2021 |

Cash and cash equivalents | 5.1. a) | 183,545 | 670,441 |

Financial investments | 5.1. b) | 442,784 | 1,430,653 |

Accounts receivable | 5.1. c) | 52,076,312 | 54,578,684 |

Prepaid and recoverable taxes | | 170,013 | 149,235 |

Inventories | | 40,464 | 40,899 |

Other assets | | 94,523 | 118,935 |

Total current assets | | 53,007,641 | 56,988,847 |

NONCURRENT ASSETS | | | |

Deferred income tax and social contribution | 10.2 | 384,620 | 422,034 |

Other assets | | 65,186 | 81,556 |

Property and equipment | 8. | 900,308 | 631,598 |

Right-of-use assets | 6. | 25,354 | 25,703 |

Intangible assets | 7. | 912,301 | 885,083 |

Total noncurrent assets | | 2,287,769 | 2,045,974 |

TOTAL ASSETS | | 55,295,410 | 59,034,821 |

CURRENT LIABILITIES | | | |

Accounts payable | 5.2. a) | 50,025,189 | 51,610,405 |

Loans and borrowings | 5.2. b) | 1,219,921 | 3,464,649 |

Lease liabilities | 6. | 9,161 | 9,742 |

Income taxes payables and other tax payables | 10.3 | 48,654 | 30,976 |

Dividends payable | | 791 | 298,000 |

Other liabilities | | 273,666 | 214,132 |

Total current liabilities | | 51,577,382 | 55,627,904 |

NONCURRENT LIABILITIES | | | |

Loans and borrowings | 5.2. b) | 15,242 | 25,209 |

Lease liabilities | 6. | 17,415 | 16,573 |

Provision for tax, civil and labor risks | 9. | 20,438 | 15,013 |

Deferred income tax and social contribution | 10.2 | 8,269 | 3,345 |

Other liabilities | | 36,803 | 22,858 |

Total noncurrent liabilities | | 98,167 | 82,998 |

EQUITY | | | |

Share capital | | 1,422,496 | 1,422,496 |

Capital reserve | | 404,933 | 404,933 |

Accumulated other comprehensive income | | 37 | (242) |

Retained earnings | | 1,790,595 | 1,492,829 |

Participation of non-controlling shareholders | | 1,800 | 3,903 |

Total equity | | 3,619,861 | 3,323,919 |

TOTAL LIABILITIES AND EQUITY | | 55,295,410 | 59,034,821 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

For the nine months ended September 30

(In thousands of Brazilian reais - R$, unless otherwise stated)

sss

| Note | 2022 | 2021 |

Revenue from services | 14. a) | 2,522,420 | 2,023,388 |

Costs of services | 14. b) | (1,439,076) | (1,234,457) |

Gross profit | | 1,083,344 | 788,931 |

Selling, General and Administrative expenses | 15.a) | (507,246) | (304,639) |

Other expenses, net | 15.b) | (99,675) | (70,488) |

Operating profit | | 476,423 | 413,804 |

Finance income, net | 16. | 68,333 | (1,504) |

Profit before income taxes | | 544,756 | 412,300 |

Current income tax and social contribution | 10.1 | (115,509) | (95,071) |

Deferred income tax and social contribution | 10.1 | (37,381) | (40,766) |

Net income for the period | | 391,866 | 276,463 |

| | | |

Net income attributable to controlling shareholders | | 393,942 | 276,504 |

Loss attributable to non- controlling shareholders | | (2,076) | (41) |

| | | |

| | | |

Basic and diluted earnings per share for profit attributable to common shareholders (in R$) | 17 | 0.20 | 0.14 |

Basic and diluted earnings per share for profit attributable to preferred shareholders (in R$) | 17 | 0.22 | 0.16 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

For the nine months ended September 30

(In thousands of Brazilian reais - R$, unless otherwise stated)

| 2022 | 2021 |

Net income for the period | 391,866 | 276,463 |

Change in fair value of financial instruments classified as Fair Value Through Other Comprehensive Income | 423 | 426 |

Deferred income Tax | (144) | (145) |

Total comprehensive income for the period | 392,145 | 276,744 |

| | |

Total comprehensive income allocated to: | | |

Controlling shareholders | 394,221 | 276,785 |

Non-controlling interests | (2,076) | (41) |

Total comprehensive income for the period | 392,145 | 276,744 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

For the nine months ended September 30

(In thousands of Brazilian reais - R$, unless otherwise stated)

| | | | Retained earnings | | | | |

| Note | Share capital | Capital reserves | Legal reserve | Statutory reserve | Accumulated profit | Accumulated other comprehensive income | Equity attributable to controlling interest | Participation of non-controlling shareholders | Total consolidated equity |

Balance at December 31, 2020 | | 1,422,496 | 6,400 | 126,118 | 1,188,520 | - | (651) | 2,742,883 | - | 2,742,883 |

Net income for the period | | - | - | - | - | 276,504 | - | 276,504 | (41) | 276,463 |

Variation in the participation of non-controlling shareholders | | - | - | - | - | - | - | - | 4,170 | 4,170 |

Allocation: | | | | | | | | | | |

Legal reserve | 13.b | - | - | 13,695 | - | (13,695) | - | - | - | - |

Dividends and Interest on capital | 13.c | - | - | - | - | (44,550) | - | (44,550) | - | (44,550) |

Reserve for dividend equalization | 13.b | - | - | - | 67,044 | (67,044) | - | - | - | - |

Reserve for working capital strengthening | 13.b | - | - | - | 67,044 | (67,044) | - | - | - | - |

Tax credit – spin-off | 13.b | - | 398,533 | - | - | - | - | 398,533 | - | 398,533 |

Other comprehensive income | | - | - | - | - | - | 281 | 281 | - | 281 |

Balance at September 30, 2021 | | 1,422,496 | 404,933 | 139,813 | 1,322,608 | 84,171 | (370) | 3,373,651 | 4,129 | 3,377,780 |

| | | | Retained earnings | | | | |

| Note | Share capital | Capital reserves | Legal reserve | Statutory reserve | Accumulated profit | Accumulated other comprehensive income | Equity attributable to controlling interest | Participation of non-controlling shareholders | Total consolidated equity |

Balance at December 31, 2021 | | 1,422,496 | 404,933 | 149,806 | 1,343,023 | - | (242) | 3,320,016 | 3,903 | 3,323,919 |

Net income for the period | | - | - | - | - | 393,942 | - | 393,942 | (2,076) | 391,866 |

Allocation: | | | | | | | | | | |

Legal reserve | 13.b | - | - | 19,697 | - | (19,697) | - | - | - | - |

Dividends and Interest on capital | 13.c | - | - | - | (81,560) | (14,585) | - | (96,145) | - | (96,145) |

Reserve for dividend equalization | 13.b | - | - | - | 120,612 | (120,612) | - | - | - | |

Reserve for working capital strengthening | 13.b | - | - | - | 120,612 | (120,612) | - | - | - | |

Other comprehensive income | | - | - | - | - | - | 279 | 279 | - | 279 |

Others | | - | - | - | (31) | - | - | (31) | (27) | (58) |

Balance at September 30, 2022 | | 1,422,496 | 404,933 | 169,503 | 1,502,656 | 118,436 | 37 | 3,618,061 | 1,800 | 3,619,861 |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

For the nine months ended September 30

(In thousands of Brazilian reais - R$, unless otherwise stated)

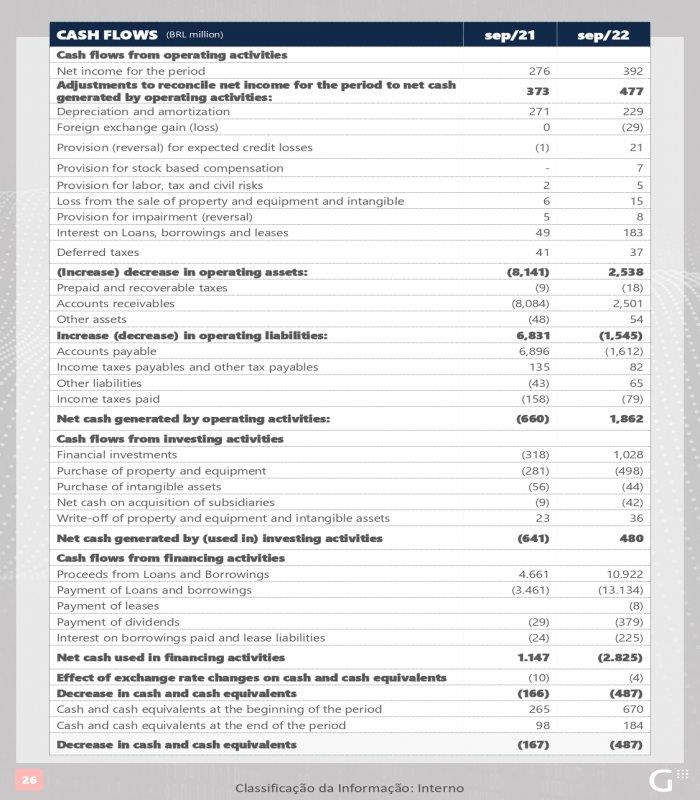

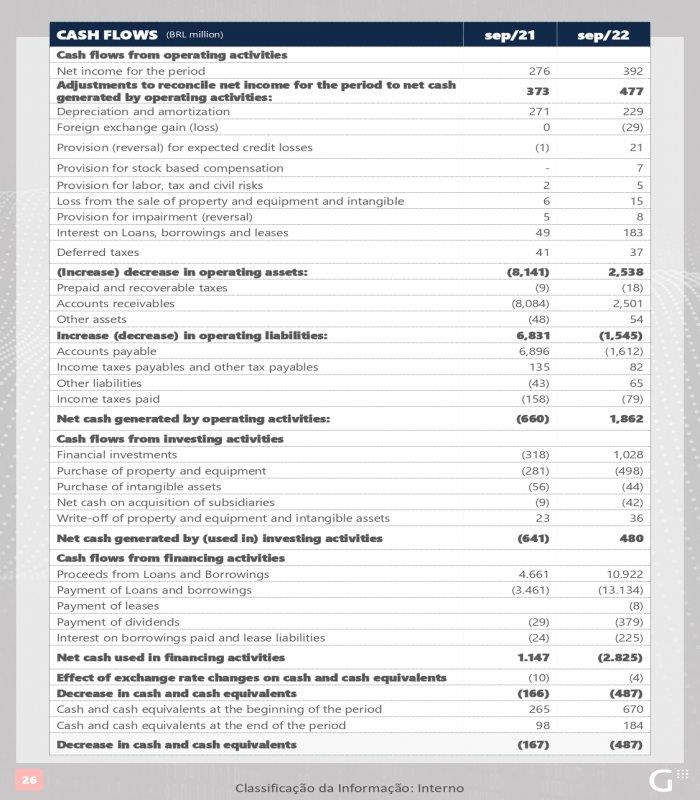

Cash flows from operating activities | | Note | 2022 | 2021 |

Net income for the period | | | 391,866 | 276,463 |

Adjustments to reconcile net income for the period to net cash generated by operating activities: | | | 477,328 | 373,173 |

Depreciation and amortization | | | 229,321 | 271,440 |

Foreign exchange gain | | | (28,991) | 272 |

Provision for expected credit losses | | 5.1 c) | 21,057 | (847) |

Provision for share-based payment | | 12 | 7,273 | - |

Provision for labor, tax and civil risks | | | 5,425 | 1,858 |

Loss from the sale of assets | | | 14,942 | 6,241 |

Provision for impairment | | 7 e 8 | 8,290 | 4,888 |

Interest on Loans, borrowings and leases | | 5.2 b) e 6 | 182,630 | 48,555 |

Deferred taxes | | 10.1 | 37,381 | 40,766 |

(Increase) decrease in operating assets: | | | 2,537,608 | (8,140,617) |

Prepaid and recoverable taxes | | | (17,957) | (9,062) |

Accounts receivables | | | 2,501,453 | (8,083,747) |

Other assets | | | 54,112 | (47,808) |

Increase (decrease) in operating liabilities: | | | (1,544,622) | 6,832,177 |

Accounts payable | | | (1,612,165) | 6,896,384 |

Income taxes payables and other tax payables | | | 82,119 | 135,128 |

Other liabilities | | | 64,923 | (41,180) |

Income taxes paid | | | (79,499) | (158,155) |

Net cash generated by (used in) operating activities: | | | 1,862,180 | (658,804) |

Cash flows from investing activities | | | | |

Financial investments | | | 1,028,230 | (318,353) |

Purchase of property and equipment | | 8 | (498,183) | (280,601) |

Purchase of intangible assets | | 7 | (44,197) | (56,370) |

Net cash on acquisition of subsidiaries | | | (42,481) | (9,260) |

Write-off of property and equipment and intangible assets | | 7 e 8 | 36,385 | 23,167 |

Net cash generated by (used in) investing activities | | | 479,754 | (641,417) |

Cash flows from financing activities | | | | |

Proceeds from Loans and Borrowings | | 5.2 b) | 10,921,515 | 4,660,907 |

Payment of Loans and borrowings | | 5.2 b) | (13,133,593) | (3,460,747) |

Payment of leases |

|

| (8,134) | (3,178) |

Payment of dividends and interest on equity | | | (379,313) | (29,227) |

Interest on borrowings paid and lease liabilities | | 5.2 b) | (225,451) | (24,319) |

Net cash (used in) generated by financing activities | | | (2,824,976) | 1,143,436 |

Effect of exchange rate changes on cash and cash equivalents | | | (3,854) | (10,047) |

Decrease in cash and cash equivalents | | | (486,896) | (166,832) |

Cash and cash equivalents at the beginning of the period | | 5.1 a) | 670,441 | 265,096 |

Cash and cash equivalents at the end of the period | | 5.1 a) | 183,545 | 98,264 |

Decrease in cash and cash equivalents | | | (486,896) | (166,832) |

The accompanying notes are an integral part of these consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagament

(In thousands of Brazilian reais - R$, unless otherwise stated)

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento ("Getnet" or "Company" or "Parent"), formerly controlled by Banco Santander (Brasil) S.A. ("Banco Santander"), on February 25, 2021 had its partial spin-off approved, becoming indirectly controlled by Banco Santander S.A. ("Banco Santander Spain"). After, on November 11, 2021, it became directly controlled by PagoNxt Merchant Solutions S.L., ("PagoNxt Spain"), company that is also part of Santander Business Group ("Santander Group"), from the partial spin-off of the former controlling shareholders' interests.

The change in the ownership interest is part of a corporate reorganization of the Santander Group and does not present any change in the final controlling shareholders or in the management structure of the Company.

Getnet, constituted in the form of a corporation, domiciled on Av. Pres. Juscelino Kubitschek, 2041 Vila Nova Conceição – São Paulo - SP, operates in the market of acquiring and services for means of payment, regulated by the National Monetary Council (“CMN”) and the Central Bank of Brazil (“BACEN”), and its operations are mainly aimed at:

- Merchant acquisition revenue related to the accreditation for retailer and service providers establishments to accept credit and debit cards;

- Processing services revenue related to the capture, transmission and processing of data and information using a network consisting of different types of equipment;

- POS rental revenue related to installing, uninstalling, monitoring, supplying, providing maintenance, and leasing equipment used in transaction capture networks, such as Point-of-Sales (“POS”) devices;

- Recharges sale revenue where it acts as a distributor of telecommunication operators for the commercialization of telephony and data recharge digital credits.

- Prepayment revenue that are recognized at the time of transfer of the respective prepayments by Santander Brazil (further details note 11);

- Other revenue from: i) the management of payments and receipts in the establishments accredited to Getnet’s network; ii) developing and selling or licensing software, iii) selling products or distributing services from entities that provide registry information; iv) providing technical, commercial, and logistic infrastructure services for the businesses related to the receipt of bills from dealers, banks, and other collection documents and issuing electronic currency pursuant to the regulations of the BACEN by providing the following services: (a) management of prepaid payment accounts; (b) provision of payment transactions based on electronic currency transferred to prepaid payment accounts; and, (c) conversion of funds into physical or book currency, with the possibility of enabling its acceptance through the settlement in any prepaid payment account it manages.

Getnet Sociedade de Crédito Direto S.A

On February 12, 2021, Getnet received the authorization from BACEN to operate as a Direct Credit Corporation (Sociedade de Crédito Direto – “SCD”), as defined by the BACEN Resolution 4,656/18, following the Getnet's business expansion to offer financial products such as loans directly to merchants during 2021.

SCDs' activity is focused on the granting of loans and financing, as well as on the acquisition of receivables, with financial resources from either equity or the Banco Nacional de Desenvolvimento Econômico e Social - BNDES. In addition, there is the assignment of credits without co-obligation to the Getnet Fundo de Investimento em Direitos Creditórios (“FIDC”) managed by BRL Trust in which Getnet group is not a shareholder.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

The spin-off of Getnet from Banco Santander (Brasil) S.A.

On February 25, 2021, Banco Santander (Brasil) S.A. (“Santander Brazil”) informed its shareholders and the market of the approval by its Board of Executive Directors of the proposed segregation of the equity interests held by Santander Brazil in its wholly-owned subsidiary Getnet, through a spin-off from Santander Brazil, deliberated by its shareholders at an extraordinary shareholders’ meeting. Additionally, at the same date, Santander Brazil’s Supervisory Board issued a favorable opinion on the proposed spin-off.

After the approval of the studies and proposal from the Board of Directors of Santander Brazil, on March 31, 2021, the shareholders of Santander Brazil and Getnet approved the spin-off. As a result, Getnet registered in its shareholders equity the portion of the net assets contributed from Santander Brazil spin-off, which correspond to the deferred tax asset registered in the amount of R$398,533 thousand. The operation became effective immediately upon the approval by the shareholders of both companies on March 31, 2021.

Approval of Getnet spin-off from Santander Brazil by BACEN

On July 14, 2021, through the published statement in the Official Gazette No. 131, Section 3 of the BACEN, the competent board approved the incorporation of Santander Brazil's assets portion related to its participation in Getnet. The delivery of Getnet shares and Units to Santander Brazil shareholders in Brazil, took place after the cut-off date for delivering the shares and Units on October 15, 2021, with the delivery of shares on October 18, 2021.

Transaction with Eyemobile Tecnologia S.A.

On August 3, 2021 after the satisfaction of the applicable preceding conditions, the Company closed the transaction relating to Getnet's acquisition of interest in Eyemobile Tecnologia Ltda. ("Eyemobile"), currently “Eyemobile Tecnologia S.A.”, with the subsequent corporate conversion of Eyemobile's and an increase in Eyemobile's capital, fully subscribed by Getnet (respectively “Transaction” and "Closing"). Eyemobile is a technology company that operates through the offer of software solutions focused on the payment market, points of sale (“POS”), cash front and events. After the closing, Getnet holds a 60% interest, acquired through a total of R$21.5 million paid in cash for the acquisition of: (i) equity interest of 44% (R$ 11.5 million) and capital increase (R$ 10.0 million) resulting in an increase in the level of ownership interest of 16%. In addition, Getnet may disburse an additional maximum amount of R$ 3.5 million conditioned to certain financial and operational achievements up to 18 months after the closing.

Brazilian Securities and Exchange Commission - CVM and Securities and Exchange Commission – SEC approval the grant registration as a securities issuer of the Getnet

On August 10, 2021, Getnet obtained the grant of issuer registration dealing with CVM Resolution n°. 80/22, in category "A" (permission to trade shares in the Brazilian stock exchange market), and on that date the approval of Getnet's registration of a publicly interest entity by CVM. On August 5, 2021, B3 S.A. - Brasil, Bolsa, Balcão granted Getnet's listing request and admission to the trading of shares and Units issued by Getnet. In Brazil, the cut-off date for delivering the shares was October 15, 2021, with delivery of shares on October 18, 2021, before CVM and B3. The listing process on the U.S. Securities and Exchange Commission (“SEC”) and the National Association of Securities Dealers Automated Quotations (“Nasdaq”) was concluded in October 2021 and the beginning of negotiations in the American market began on October 22, 2021.

On October 18, 2021 the Getnet shares (GETT11, GETT3 and GETT4) started to be traded at B3, and on October 22, 2021 the ADRs (GET) also started to be listed at Nasdaq, thus ending the spin-off process resolved at the Extraordinary Shareholders' Meeting held on March 31, 2021, since the Company's shares and Units were delivered to the shareholders of Santander Brazil.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

UN Global Compact

On January 24, 2022, the Company informed the market of its agreement to the UN Global Compact. The Global Compact is a voluntary Initiative of the United Nations that aims to mobilize business practices of the business community in the areas of human rights, labor, environment and anti-corruption.

Getnet's agreement endorses sustainability as a strategic and cultural pillar of the Company, integrating this initiative with the other fronts already in operation.

The Company since 2021 has focused on scaling ESG's actions from a perspective covering business, risk management, governance and fronts issues to engage stakeholders and generate value for customers and society. Getnet throughout 2021 made other public commitments such as the signing of the Women's Empowerment Principles, the UN's initiative for women's empowerment in companies, and the UN Free & Equal initiative, aimed at the LGBTQIA+ front.

New subsidiary - GNxt Serviços de Atendimento Ltda.

On April 1, 2022, Getnet made the capital contribution of R$20 million in GNxt Serviços de Atendimento Ltda. (“GNxt”), based in Campo Bom (RS), which is focused on call center and telemarketing services, including, credit recovery, customer retention, clarification of doubts, complaints solution, provision of information and support to active and receptive tele-service, intermediation of the sale of products and services to the company's customers by telephone, e-mail and other means of communication. GNxt supports the entire operation of Getnet as an intermediation of the sale of products and services to customers through telephone, e-mail and other means of communication, as well as in the management and execution of back office. The company entered into operation on July 1, 2022.

Public delisting tender offer in Brazil and public delisting tender offer in the United States (“US”)

On May 19, 2022, the Company communicated to the market, through a material fact, PagoNxt's intention to make a public offer for delisting of registration in Brazil and in the United States (together "Offers") for the acquisition of the entirety:

| (i) | of common shares, preferred shares (together "Shares") and certificates of deposit of shares, each representing a common share and a preferred share ("Units"), traded in B3 S.A. – Brasil, Bolsa, Balcão ("B3"); and |

| (ii) | American Depositary Shares, each representing two Units ("ADSs"), traded on the Nasdaq Global Select Market ("NASDAQ"). |

All issued by the Company and in circulation, not held, directly or indirectly, by PagoNxt, with the purpose of:

| (i) | cancel Getnet's registration as a publicly held company (Class A) before the Brazilian Securities and Exchange Commission (CVM), pursuant to CVM Resolution No. 80 of March 29, 2022 and CVM Resolution No. 85 of March 31, 2021 ("CVM Resolution 85"); |

| (ii) | cancel Getnet's registration with the U.S. Securities and Exchange Commission (SEC);

|

| (iii) | to close the trading of shares and Units in the traditional segment of B3, pursuant to the B3 Issuer Manual; and |

| (iv) | to close the trading in the ADSs on the NASDAQ. |

The price to be offered by the Shares and Units will be R$2.36 per Common Share (GETT3), R$2.36 per Preferred Share (GETT4) and R$ 4.72 per Unit (GETT11), to be adjusted for potential dividends, interest on equity and/or bonuses that may be paid and/or splits, groupings and conversions that may occur between this date and the maturity dates of the Offerings (but excluding the payment of interest on equity announced on 4 May 2022, which will not be deducted from the price to be offered), and will be paid in national currency on the settlement dates of the Offers.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

The posting of the Offers and the Offers themselves are subject to the applicable conditions in these types of transactions, which will be duly disclosed in the Offer documents, including, but not limited to:

| i) | the registration of the Offer in Brazil before the CVM and the authorization for the holding of the special auction in the B3 trading session, an auction scheduled to take place in December 2022; |

| ii) | regulatory authorization to conduct the Offer in the United States by the SEC; |

| iii) | the confirmation that the price to be offered complies with the provisions of article 22(I) of CVM Resolution No. 85, being within or above the fair value range of the Company's Shares, verified verified in accordance with the appendage report established in the caput of Article 9 of CVM Resolution 85 ("Appraisal Report "); |

| iv) | the agreement of shareholders representing more than 2/3 (two thirds) of the Outstanding Shares, Units and ADSs, calculated considering only the shareholders participating in the Offers, taken together; |

| v)

| the absence of an adverse material change in the condition, results, operations or prospects at Getnet. |

The Company has chosen KPMG Auditores Independentes Ltda., as the specialized consultancy responsible for the preparation of the Appraisal Report, in the form of §1 of Article 9 of CVM Resolution No. 85, and pursuant to Article 19, item XXVI, of the bylaws.

On July 8, 2022, pursuant to article 6, paragraph one of the Company´s bylaws, an Extraordinary General Meeting of the Company was held which approved the termination of the Company´s registration as an issuer of securities conditioned on the conclusion and settlement, respectively, of a public delisting tender offer in Brazil and public delisting tender offer in the US (the “Offers”). The attending shareholders resolved to approve, by majority, with 899,636,094 affirmative votes, 61,930 dissenting votes e 15,024,389 votes not cast due to abstentions, under paragraph 1 of article 6 of the Company´s bylaws:

a) the termination of Getnet’s registration as a publicly held company (Category A) with the CVM;

b) the termination of Getnet’s registration with the SEC.

Both items (a) and (b) are conditioned on the conclusion and settlement, respectively, of the Offers by PagoNxt and to the meeting of the quorum necessary for the purposes of terminating the Company´s registration with the CVM in the context of the Brazilian offer, pursuant to CVM Resolution No. 85, of March 31, 2022.

In addition, on July 15, 2022, the Company disclosed a new material fact announcing to the market the disclosure a first version of the Appraisal Report, prepared by KPMG Auditores Independentes. The appraiser concluded that the economic value of Getnet as of March 31, 2022 was between R$3,960,000,000.00 (three billion, nine hundred and sixty million Brazilian reais) and R$4,350,000,000.00 (four billion, three hundred and fifty million Brazilian reais) or a price per unit (GETT11) in the range of R$ 4.24 (four Brazilian reais and twenty-four cents) to R$ 4.66 (four Brazilian reais and sixty-six cents), or in the range of R$ 2.12 (two Brazilian reais and twelve cents) to R$ 2.33 (two Brazilian reais and thirty-three cents) per common share (GETT3) or preferred share (GETT4), calculated based on the Discounted Cash Flow method.

In the appraiser’s opinion as stated on the appraisal report, the Discounted Cash Flow method is the most adequate method to value Getnet, considering: (i) the Company is an operational company; (ii) the discounted cash flow method takes into account the Company's business plan´s perspective, as made available by the Company's management to the appraiser, its future profitability, and the consequent cash generation for its shareholders; and (iii) the valuation obtained through this method also considers the implicit appraisal of Company´s intangible assets.

Approval of the financial statements

The consolidated financial statements were authorized for issue by the board of directors on November 7, 2022. The directors have the power to amend and reissue the consolidated financial statements.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

2. Basis of preparation

Accounting policy

The accounting policies below are applied in the preparation of the consolidated financial statements (“Group”):

Subsidiaries

Subsidiaries are all entities over which Getnet holds control, according to article 116 of Law 6,404/1976 ("Lei das Sociedades por Ações"). Subsidiaries are consolidated from the date on which control is transferred to Getnet. Consolidation is discontinued when control no longer exists.

Identifiable assets acquired and liabilities and contingent liabilities assumed in the acquisition of a subsidiary are initially measured at their fair values at the acquisition date.

All intragroup transactions, balances and unrealized gains are eliminated on consolidation. Unrealized losses are also eliminated, unless the transaction provides evidence of impairment of the transferred asset. The subsidiaries’ accounting policies are amended according to Getnet’s accounting policies, as applicable.

The interim financial statements have been prepared taking into consideration the historical cost model as the base value, except in the case of certain financial assets and liabilities that are measured at fair value.

The consolidated interim financial statements have been prepared and are presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The financial accounts are interim accounts following the rules of IAS 34 - Interim Financial Statements and show all relevant information specific to the interim accounts, and only them, as well as which are consistent with those used by management in its management.

2.1. Consolidation

The Company consolidates all entities over which it has the capacity to exercise control, i.e., when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to direct the investee’s relevant operations.

The subsidiaries included in consolidation are the following:

Subsidiary | Type | Equity interest % |

Auttar H.U.T. Processamento de Dados Ltda. (“Auttar”) | Subsidiary | 100% |

Getnet Sociedade de Crédito Direto S.A (“SCD”) | Subsidiary | 100% |

Eyemobile Tecnologia S.A. (“Eyemobile”) (1) | Subsidiary | 60% |

GNxt Serviços de Atendimento Ltda. (“GNxt”) (2) | Subsidiary | 100% |

Paytec Tecnologia em Pagamentos Ltda.; e Paytec Logística e Armazém Eireli (together “Paytec”) (3) | Subsidiary | 100% |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

| (1) | On May 12, 2021, Getnet entered into an investment agreement with the former controlling shareholders of Eyemobile Tecnologia Ltda. (Actually “Eyemobile Tecnologia S.A.”), establishing the terms of the negotiation of the purchase and sale of the shares representing Eyemobile's capital stock. The control acquisition was concluded on August 3, 2021, with the transformation of the corporate type of Eyemobile, from Ltda., to S.A., so that Getnet now holds 60% of Eyemobile's common shares for the amount of R$19,415, as described in note 7 a), corresponding to the equity value of the shares on the purchase date, plus the amount of the contribution of the shares paid up upon subscription. The Company's corporate purpose is to explore the development and licensing of customizable computer programs, the rental of office machines and equipment, and the specialized retail trade of computer equipment and supplies. |

| (2) | GNxt is a subsidiary of Getnet, constituted in the second quarter of 2022 with the contribution of R$20.000, as described in note 1 – New Subsidiary - GNxt Serviços de Atendimento Ltda. |

| (3) | On April 1, 2022, Getnet has acquired from Santander Brazil, 100% of the quotas representing the capital of the Paytec Tecnologia em Pagamentos Ltda., also indirectly controlling Paytec Logística e Armazém Eireli (together "Paytec"), for the amount of R$22,960 plus the assumption of Santander Brazil obligations to former Paytec shareholders, in the amount of R$15,736, totaling R$38,696. Paytec acts, among others, as a logistics operator with national coverage and focused on the payments market. More details in note 7 (a). |

2.2. Functional and presentation currency

Items included in the financial statements of each investee controlled by Getnet are measured using the currency of the main economic environment in which it operates (“functional currency”).

The consolidated interim financial statements are presented in Brazilian reais (R$), which is Getnet’s functional and presentation currency.

2.3. Estimates and critical accounting judgments

The preparation of individual and consolidated financial information requires the use of certain critical accounting estimates and the exercise of judgment by management in the process of applying accounting policies. Those areas that require higher level of judgment and have greater complexity, as well as areas in which assumptions and estimates are significant for individual and consolidated financial information, are disclosed in detail in the respective notes and summarized below:

Accounting estimate | Note |

Impairment analysis of intangible assets with indeterminate useful life | 7. a) |

Useful life of tangible assets – Point of sale (POS) | 8 |

Provision for tax, civil and labor risks | 9 |

Share-based payment | 12 |

A business segment is an identifiable component of the entity that is intended to provide an individual product or service or a group of related products or services, and which is subject to risks and benefits that are distinguishable from other business segments.

Operating segment reporting is presented in a manner consistent with the internal reporting provided to the chief operating decision maker, in the case of Getnet, the Chief Executive Officer (“CEO”), in which he reviews items of the Consolidated Statement of Income and other comprehensive income. The CEO takes into consideration the entire Company as a single operating and reportable segment by monitoring operations, making decisions about resource allocation, financial and strategic planning, and performance evaluation based on a single operating segment. The CEO formally reviews financial data material for the Company and its subsidiaries.

The Company's revenue, profit or loss, and assets for this reportable segment can be determined by reference to the Consolidated Statement of Income, the Consolidated Statement of Cash Flows, and the Consolidated Balance Sheet.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Getnet’s shareholders and management consider risk management an essential tool for strategic decision making, including for maximizing efficiency in the use of capital in Getnet‘s operations.

Getnet established its policies, systems and internal control to ensure a continual mitigation of possible risks and/or the realization of losses arising from exposure to credit, liquidity, market, and operational risks.

a)Credit risk: Credit risk is the risk that a financial loss due to a counterparty failing to fulfill its obligations under a financial instrument or accounts receivable, leading to a financial loss for the Company. The Company is exposed to credit risk from its operating activities, mainly related to accounts receivable and also cash and cash equivalents and derivative financial instruments. c. In merchant acquisition transactions, the card issuers are required to pay Getnet the amounts arising on to the transactions carried out by the cardholders so that the payment of such amounts to the accredited merchants can be made; therefore, Getnet is exposed to the credit risk of the card issuers and the greatest exposure to credit risk is correlated to the transactions recorded in the Other customer receivables lines presented in note 5.1 c). For the management of loss risks arising from accounts receivable, Getnet applies a simplified approach in calculating expected credit losses (“ECLs”), therefore, the Company instead recognizes a loss allowance based on lifetime ECLs, provision matrix and days past due at each reporting date.

b)Liquidity risk: The liquidity risk management policy aims at ensuring that the risks that affect the implementation of Getnet’s strategies and goals are continuously assessed. Getnet manages the liquidity risk by setting the necessary tools for its management in normal or crisis scenarios. The frequent monitoring aims at mitigating possible maturity mismatches by allowing corrective actions, if necessary. Getnet’s approach to liquidity management is to ensure that it always has enough funds to discharge its obligations on due date, under normal and stress conditions, in order to avoid unacceptable losses or losses resulting in undue exposure of Getnet’s reputation. The cash flow forecasting is performed by the treasury department which monitors rolling forecasts of the Company’s liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient headroom on its undrawn committed borrowing facilities at all times in order to the Company does not breach covenants (where applicable). The liquidity risk management is performed to : (i) measuring liquidity risk, the Company has tools to control the cash flow forecasting to ensure that Getnet has sufficient cash to meet operational needs; (ii) daily monitoring the cash needs, segregated into liquidity buffer and free movement cash, ensuring that they are consistent with the policies and minimum amounts decided by the management; (iii) limits and liquidity risk alerts, monitored monthly by the management and by the controller where the available amounts and the projection of possible gaps over a 90-day horizon are measured; (iv) contingency plan test is conducted every six months, whereby previously approved credit agreements with other financial institutions are contracted for possible emergency cover.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

c)Interest rate risk: This risk arises from the possible losses of Getnet’s asset values due to fluctuations in sovereign interest rates. Getnet is exposed to interest rate risk due to short-term settlements of accounts receivable, mismatch between transaction settlements and the transfers from the credit card companies, and possible difficulty to raise funds. In addition to the financial risk generated by a possible decrease in the spreads due to a possible increase in borrowing costs. The Company manages the interest rate risk by maintaining a diversification of borrowing at fixed and variable rates.

d)Exchange rate risk: Corresponds to the possibility of loss of value due to exchange rate fluctuations from transactions or recognized assets or liabilities denominated in a currency different from the Getnet’s functional currency. The exposure to foreign exchange rate risk by Getnet arises substantially from receivables from international card issuers, cash and cash and equivalents in foreign exchange. Getnet has operating expenses that are settled in U.S. Dollars, mainly from purchasing equipment which are indexed to U.S. Dollars and resold in Brazilian reais and costs of hiring IT suppliers paid in U.S. Dollars. Due to the low volume of transactions subject to exchange rate fluctuation. At September 30, 2022 and 2021, Getnet is not materially exposed to the foreign exchange rate risk due the short-term and low amount outstanding at the end of each month.

e)Capital management: The current Liquidity and Market Risk Management Policy, Getnet follows the BACEN Resolution Nº 4,557, issued on February 23, 2017, which provides for Risk Management and Capital Management Structure, making efficient use of capital as an indispensable component of the business decision-making process, and its management is a factor of competitive differentiation. With integrated risk management, this practice supports the Company's projected growth, besides increasing its profitability, and has the following drivers (i) efficient use of capital, through allocation in businesses considering risk versus return; (ii) optimization of capital allocated in business and products of greater profitability; (iii) integrated risk management ensuring the position of soundness in the market, by adopting the best management practices and risk mitigation.

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

The Company’s classifies financial instruments into the following categories:

| September 30, 2022 | | December 31, 2021 |

| Amortized cost | Fair value through other comprehensive income | Total | | Amortized cost | Fair value through other comprehensive income | Total |

Financial assets | | | | | | | |

Current/Non-current | | | | | | | |

Cash and cash equivalents | 183,545 | - | 183,545 | | 670,441 | - | 670,441 |

Financial investments | 317,895 | 124,889 | 442,784 | | 875,240 | 555,413 | 1,430,653 |

Accounts receivable | 52,076,312 | - | 52,076,312 | | 54,578,684 | - | 54,578,684 |

Other assets | 159,709 | - | 159,709 | | 200,491 | - | 200,491 |

Total financial assets | 52,737,461 | 124,889 | 52,862,350 | | 56,324,856 | 555,413 | 56,880,269 |

| | | | | | | |

Financial liabilities | | | | | | | |

Current/Non-current | | | | | | | |

Accounts payable | 50,025,189 | - | 50,025,189 | | 51,610,405 | - | 51,610,405 |

Loans and borrowings | 1,235,163 | - | 1,235,163 | | 3,489,858 | - | 3,489,858 |

Lease liabilities | 26,576 | - | 26,576 | | 26,315 | - | 26,315 |

Other liabilities | 310,469 | - | 310,469 | | 236,990 | - | 236,990 |

Total financial liabilities | 51,597,397 | - | 51,597,397 | | 55,363,568 | - | 55,363,568 |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

5.1 Financial assets

Financial assets are classified into the following categories: (i) amortized cost; (ii) fair value through other comprehensive income; and (iii) fair value through profit or loss. The basis for classification depends on the Company’s business financial assets management model and the contractual cash flow characteristics of the financial asset. The classifications of the financial assets are detailed below:

Amortized cost

Held within the business model in order to collect to collect contractual cash flows; these cash flows represent solely payments of principal and interest and are, therefore, initially recognized at fair value and subsequently measured at amortized cost using the effective interest rate method, less provisions for reduction to recoverable amount.

Interest income from these financial assets is recognized in finance income. Any gains or losses due to the write-off of the asset are recognized directly in the profit or loss, together with foreign exchange gains and losses. Impairment losses are presented separately in the Consolidated Statement of Income.

Fair value through other comprehensive income (FVOCI)

A financial asset is measured at fair value through comprehensive income if it meets the concept of principal and interest only payments and is held within the business model whose objective is to both, collecting contractual cash flows and selling the financial assets.

Changes in carrying amount are recognized in other comprehensive income, except for the recognition of impairment gains or losses, interest income, and foreign exchange gains and losses, which are recognized in the profit or loss. When the financial asset is derecognized, the cumulative gains or losses that had been previously recognized in other comprehensive income are reclassified from equity to profit or loss. Interest income from these financial assets is recognized in finance income using the effective interest method.

Fair value through profit or loss (FVPL)

Assets are measured at fair value through profit or loss when they do not meet the criteria to be classified at amortized cost or at fair value through other comprehensive income or when on initial recognition was designated to eliminate or reduce an accounting mismatch. Any exchange gains or losses are recognized in the Consolidate Statement of Income.

Derecognition of financial assets

The Company derecognizes financial assets when the contractual rights to the cash flows from investing activities expire or when it transfers the investments and substantially all the risks and rewards of ownership to another entity.

Expected credit losses

Getnet assesses, on a prospective basis at each reporting date, the expected credit losses on financial assets carried at amortized cost and at fair value through other comprehensive income.

The impairment assessment methodology applied depends on whether there is a significant increase in credit risk and the loss is estimated as the difference between all contractual cash flows that are due to the Company in accordance with the contract and all the cash flows that the Company expects to receive, discounted at an approximation of the original effective interest rate. Expected cash flows will include cash flows from the sale of collaterals held or other credit enhancements that are integral to the contractual terms.

ECLs are based on the difference between the contractual cash flows due in accordance with the contract and all the cash flows that Getnet expects to receive, discounted at an approximation of the original effective interest rate. Getnet applies a simplified approach in calculating ECLs, therefore, Getnet instead recognizes a loss allowance based on lifetime ECLs, provision matrix and days past due at each reporting date.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

For accounts receivable, Getnet applies the simplified approach as permitted by IFRS 9 by recognizing lifetime expected credit losses from the initial recognition of the receivables.

Estimates and critical accounting judgments

Financial assets measured at amortized cost are tested for impairment at the end of each annual reporting period. The carrying amounts of these assets are adjusted by the loss allowance as a contra entry to the Consolidated Statement of Income. The reversal of previously recognized losses is recognized in the Consolidated Statement of Income in the period in which the impairment decreases and can be objectively related to a recovery event. The amount recorded in the Consolidated Statement of Income in the line item ‘Other expenses, net’ is disclosed in table ‘Movements in the provision for expected credit losses’ in the note 5.1(c).

(a) Cash and cash equivalents

| 09/30/2022 | 12/31/2021 |

Cash | 2,949 | 229 |

Short-term bank deposits | 143,851 | 646,304 |

Foreign currency cash and investments abroad(1) | 36,745 | 23,908 |

Total | 183,545 | 670,441 |

(1) Refers to highly liquid financial investments in U.S. Dollars.

(b) Financial investments

| 09/30/2022 | 12/31/2021 |

Brazilian treasury bonds (1) | 124,889 | 555,413 |

Short-term investment (2) | 317,895 | 875,240 |

Total | 442,784 | 1,430,653 |

(1) Consists of investments in Brazilian Treasury Bonds ("LFTs") with an interest rate of 101.02% of the Basic Interest Rate (SELIC –13.75% and 9.25% for the period ended September 30, 2022 and December 2021, respectively), invested to comply with certain requirements for authorized payment institutions as set forth by the BACEN regulation. This financial asset was classified at fair value through other comprehensive income.

(2) Refer to the amounts invested in the SBAC Investment Fund, remunerated at DI rate (the Brazilian interbank deposit rate), where Getnet holds participation Units. The underlying assets of the fund comprises substantially in public securities and repo with high liquidity (Level 1 – Further details note 5.3).

(c) Accounts receivable

| 09/30/2022 | 12/31/2021 |

Accounts receivable from card issuers | 51,728,777 | 54,131,057 |

Other accounts receivable from clients | 430,324 | 509,359 |

Provision for expected credit losses | (82,789) | (61,732) |

Total | 52,076,312 | 54,578,684 |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Movements in the provision for expected credit losses

| 09/30/2022 | 09/30/2021 |

Opening balance | 61,732 | 58,324 |

Additions | 79,221 | 23,902 |

Reversals | (58,164) | (24,749) |

Closing balance | 82,789 | 57,477 |

5.2 Financial liabilities

On initial recognition, financial liabilities are classified as (i) financial liabilities at fair value through profit or loss; or (ii) financial liabilities at amortized cost, as appropriate.

Amortized cost

Initially measured at fair value, net of transaction costs, and subsequently measured at amortized cost using the effective interest method, with interest expense recognized on a in profit or loss.

Gains and losses from these financial liabilities are recognized in the Consolidated Statement of Income.

a) Accounts payable

| 09/30/2022 | 12/31/2021 |

Payment transactions (1) | 49,532,561 | 50,980,629 |

Other financial liabilities (2) | 492,628 | 629,776 |

Total | 50,025,189 | 51,610,405 |

(1) Refers mainly to payment transactions with Santander Brazil (related party) in the amount of R$ 18,937 on September 30, 2022 and R$ 18,858 on December 31, 2021 (further details note 11) and commercial establishments.

(2) Amounts to be paid as an interchange fee and amounts that are under analysis for approval of settlement.

b) Loans and borrowings

| 09/30/2022 | 12/31/2021 |

Financial liabilities at amortized cost(1) | 1,235,163 | 3,489,858 |

Total | 1,235,163 | 3,489,858 |

(1) Includes Brazilian real-denominated transactions with credit institutions resulting from loan and financing credit facilities and on lending in Brazil (BNDES/ FINAME).

The types of operations and rates used are listed below:

| Rate | Maturity | 09/30/2022 | 12/31/2021 |

Working capital financing (1) | 105.37% of the CDI(2) | 10/22 | 1,205,518 | 3,451,641 |

DELL financing | 0.729% p.m. + 2% | 02/25 | 22,971 | 29,175 |

IBM financing | CDI + 2% | 05/24 | 6,674 | 9,042 |

Total | | | 1,235,163 | 3,489,858 |

(1) Related mainly to Santander Brazil transaction. See note 11 for further details.

(2) CDI rate means the Brazilian interbank deposit (Certificado de Depósito Interbancário) rate, which is an average of interbank overnight rates in Brazil.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Movements in loans and borrowings in the period

Balance at December 31, 2020 | 1,091,157 |

Additions | 4,660,907 |

Principal payments | (3,460,747) |

Accrued interest | 47,264 |

Interest paid | (24,319) |

Incorporation of Eyemobile (1) | 767 |

Balance at September 30, 2021 | 2,315,029 |

| |

Balance at December 31, 2021 | 3,489,858 |

Additions | 10,921,515 |

Principal payments | (13,133,593) |

Accrued interest | 180,849 |

Interest paid | (225,451) |

Incorporation of Paytec (1) | 1,985 |

Balance at September 30, 2022 | 1,235,163 |

(1) Consolidated opening balances referring to the acquisition of Eyemobile and Paytec.

Debt breakdown (by maturity)

| September 30, 2022 | December 31, 2021 |

| Up to 3 months | 3-12 months | Over 12 months | Total | Up to 3 months | 3-12 months | Over 12 months | Total |

Loans and borrowings from domestic financial institutions | 1,208,607 | 11,314 | 15,242 | 1,235,163 | 3,454,903 | 9,813 | 25,142 | 3,489,858 |

As of September 30, 2022 the Company had no covenants in its loan agreements.

5.3 Fair value estimation

Fair value is the price that would be received to sell an asset or paid to transfer a liability in the major or most advantageous market, in an orderly transaction between market participants at the measurement date. A three-level hierarchy is used to measure and disclose fair value, as shown below:

- Level 1—Prices quoted (unadjusted) in active markets for identical assets or liabilities. For investments in investment funds, the price of the fund unit share is an appropriate indicator of fair value and falls into this fair value hierarchy category. For the financial investments, fair value is determined based on the interbank deposit interest rate (DI), released to the market through official agencies (Cetip, BACEN, etc.), and from the fund unit value published by CVM, respectively.

- Level 2—Inputs, other than quoted prices included in Level 1, that are observable in the market for assets or liabilities, either directly (such as prices) or indirectly (derived from prices). This category includes (i) accounts receivable; (ii) loans and borrowings; and (iii) other assets and other liabilities. For loans and borrowings, fair value was determined using the expected payment of principal and interest until maturity at the contractual rates.

- Level 3—Inputs on assets or liabilities that are not based on observable data adopted by the market (i.e., unobservable inputs). The valuation technique for the fair values of the other financial instruments classified as Level 3 is the discounted cash flow method. Getnet does not have assets or liabilities measured at Level 3 fair value.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Getnet classifies the fair value measurement using a hierarchy that reflects the model used in the measurement process, segregating the financial instruments into levels 1, 2 or 3.

The table below presents a comparison by class between book value and fair value of the financial instruments:

| September 30, 2022 |

| Book value |

| Fair value |

| Level 1 | Level 2 | Total | | Level 1 | Level 2 | Total |

Financial assets | | | | | | | |

Current/Non-current | | | | | | | |

Cash and cash equivalents | 183,545 | - | 183,545 | | 183,545 | - | 183,545 |

Financial investments | 442,784 | - | 442,784 | | 442,784 | - | 442,784 |

Accounts receivable | - | 52,076,312 | 52,076,312 | | - | 52,076,312 | 52,076,312 |

Other assets | - | 159,709 | 159,709 | | - | 159,709 | 159,709 |

Total financial assets | 626,329 | 52,236,021 | 52,862,350 | | 626,329 | 52,236,021 | 52,862,350 |

| | | | | | | |

Financial liabilities | | | | | | | |

Current/Non-current | | | | | | | |

Accounts payable | - | 50,025,189 | 50,025,189 | | - | 50,025,189 | 50,025,189 |

Loans and borrowings | - | 1,235,163 | 1,235,163 | | - | 1,235,163 | 1,235,163 |

Lease liabilities | - | 26,576 | 26,576 | | - | 26,576 | 26,576 |

Other liabilities | - | 310,469 | 310,469 | | - | 310,469 | 310,469 |

Total financial liabilities | - | 51,597,397 | 51,597,397 | | - | 51,597,397 | 51,597,397 |

| December 31, 2021 |

| Book value |

| Fair value

|

| Level 1 | Level 2 | Total | | Level 1 | Level 2 | Total |

Financial assets | | | | | | | |

Current/Non-current | | | | | | | |

Cash and cash equivalents | 670,441 | - | 670,441 | | 670,441 | - | 670,441 |

Financial investments | 1,430,653 | - | 1,430,653 | | 1,430,653 | - | 1,430,653 |

Accounts receivable | - | 54,578,684 | 54,578,684 | | - | 54,578,684 | 54,578,684 |

Other assets | - | 200,491 | 200,491 | | - | 200,491 | 200,491 |

Total financial assets | 2,101,094 | 54,779,175 | 56,880,269 | | 2,101,094 | 54,779,175 | 56,880,269 |

| | | | | | | |

Financial liabilities | | | | | | | |

Current/Non-current | | | | | | | |

Accounts payable | - | 51,610,405 | 51,610,405 | | - | 51,610,405 | 51,610,405 |

Loans and borrowings | - | 3,489,858 | 3,489,858 | | - | 3,489,858 | 3,489,858 |

Lease liabilities | - | 26,315 | 26,315 | | - | 26,315 | 26,315 |

Other liabilities | - | 236,990 | 236,990 | | - | 236,990 | 236,990 |

Total financial liabilities | - | 55,363,568 | 55,363,568 | | - | 55,363,568 | 55,363,568 |

(1) The carrying values of Other assets are measured at amortized cost, less the provision for impairment and adjustment to present value, when applicable.

(2) The carrying values of Other liabilities are measured at amortized cost. These amounts refer mainly to payables to suppliers.

The fair value of the financial assets and the liabilities are substantially similar to their book value.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

5.4 Sensitivity analysis

Sensitivity analysis to foreign currency

The sensitivity analysis includes outstanding monetary items and foreign currency-denominated transaction (U.S. Dollars), such as loans and borrowings, and adjusts their translation at the end of each period by the exchange rates, taking into account the changes shown above.

Sensitivity analysis to changes in interest rates

The yield on short-term investments and the interest from loans are mainly affected by changes in the interbank deposit interest rate (DI) and SELIC.

The following analysis estimates the potential value of the financial instruments in hypothetical stress scenarios of the main market risk factors (fixed interest rate and foreign currency risk: exposure subject to exchange fluctuations) that impact each position. This analysis was performed according to topics presented in footnote 4 d).

Sensitivity analysis of changes in foreign exchange rates

| September 30, 2022 | September 30, 2021 |

Assets | | |

Cash and cash equivalents | 36,746 | 2,567 |

Accounts receivable | 13,497 | 18,641 |

Liabilities | | |

Accounts payable | (59) | (59) |

Net exposure | 50,184 | 21,149 |

| September 30, 2022 |

| Probable scenario | | Possible scenario | | Remote scenario |

| +/-10% | | +/-25% | | +/-50% |

Net effect on profit or loss | 5,018 | | 12,546 | | 25,092 |

| | | | | |

| September 30, 2021 |

| Probable scenario | | Possible scenario | | Remote scenario |

| +/-10% | | +/-25% | | +/-50% |

Net effect on profit or loss | 2,115 | | 5,287 | | 10,575 |

Translation rates in the period ended: | USD:BRL |

09/30/2022 | 5.4066 |

09/30/2021 | 5.4394 |

Analysis rates in the periods ending in: | SELIC |

09/30/2022 | 13.75% |

09/30/2021 | 6.25% |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Sensitivity analysis of changes in interest rates

| September 30, 2022 | September 30, 2021 |

Assets | | |

Financial investments | 442,785 | 1,330,094 |

Accounts receivable and other assets | 204,495 | 89,983 |

Liabilities | | |

Loans and borrowings | (1,204,603) | (2,273,278) |

Net exposure | (557,323) | (853,201) |

| | September 30, 2022 | |

| Probable scenario | Possible scenario | Remote scenario |

| +/-10% | +/-25% | +/-50% |

Net effect on profit or loss | (7,663) | (19,158) | (38,316) |

| | | |

| | September 30, 2021 | |

| Probable scenario | Possible scenario | Remote scenario |

| +/-10% | +/-25% | +/-50% |

Net effect on profit or loss | (5,333) | (13,331) | (26,663) |

Probable Scenario: taking into account a 10% deterioration in the associated risk variables.

Possible Scenario: taking into account a 25% deterioration in the associated risk variables.

Remote Scenario: taking into account a 50% deterioration in the associated risk variables.

6. Leases

Accounting policy

The Group leases several floors of office buildings for its administrative departments. Leases are recognized as a right-of-use asset and a corresponding lease liability on the date the leased asset becomes available for use by the Group.

Each lease payment is allocated between principal and finance costs. Finance costs are recognized in the Consolidated Statement of Income over the lease term. The right-of-use asset is depreciated over the lease term on a straight-line basis.

Assets and liabilities arising from a lease are initially measured at present value.

Lease liabilities include the net present value of the following lease payments:

- Fixed lease payments (including in-substance fixed payments), less any lease incentives receivable.

- Variable lease payments that depend on an index or rate.

- Amounts expected to be payable by the Group, under the residual value guarantees.

- The exercise price of purchase options, if the Group is reasonably certain to exercise the options.

- Payments of penalties for terminating the lease, if the lease term reflects the exercise of an option to terminate the lease.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Lease payments are discounted using Group’s incremental borrowing rate, which is the rate the Group would have to pay on a loan to obtain the funds necessary to acquire an asset of similar value, in a similar economic environment, under equivalent terms and conditions.

Right-of-use assets are measured at cost, according to the following items:

- The initial measurement amount of the lease liability.

- Any lease payments made on or before the commencement date, less any lease incentives received.

- Any initial direct costs.

- Restoration costs.

The Group’s property leases include extension options. These terms are used to maximize operational flexibility in terms of contract management. Payments associated with short-term property leases are recognized on the straight-line basis as an expense in profit or loss. Short-term leases are leases with term of 12 months or less and which the Group has no intention or history of contract renewal.

There is no identifiable implicit discount rate to be applied to the Group’s lease contracts; therefore, the Group’s incremental borrowing rate is used to calculate the present value of lease liabilities at initial contract recognition.

The Group’s incremental borrowing rate is the interest rate the Group would have to pay to borrow the funds necessary to obtain to acquire an asset similar to the leased asset, for a similar term, and with similar collateral, i.e., funds necessary to obtain to obtain an asset with similar value of the right-of-use asset, in a similar economic environment.

The rate-setting process preferably uses readily observable inputs, based on which the lessee must make the necessary adjustments to arrive at its incremental borrowing rate.

IFRS 16 allows the incremental rate to be determined for a group of contracts, since this option is associated with the validation that the grouped contracts have similar features.

The Group has made use the aforementioned practical expedient of determining groupings for its leases within the same scoped, as it believes that the effects of its application do not differ materially from the application to individual leases.

The Group’s criteria regarding the incremental interest rate were:

- Risk-free rate: benchmark rate of the market where the Company operates.

- Credit spread: the spread of the most recent borrowings and the same currency was used.

Determining the lease term

To determine the lease term, management takes into account all facts and circumstances that create an economic incentive to exercise an extension option or not to exercise a termination option. Extension options (or periods after termination options) are included in the lease term only when there is reasonable certainty that the lease will be extended (or will not be terminated).

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

(a) Balances recognized in the balance sheet

The balance sheet discloses the following lease-related balances:

Right-of-use-asset | |

December 31, 2020 | 21,905 |

Additions and contractual changes | (8,576) |

Depreciation | (2,614) |

September 30, 2021 | 10,715 |

| |

December 31, 2021 | 25,703 |

Additions and contractual changes | 2,337 |

Incorporation of Paytec(1) | 4,278 |

Depreciation | (6,964) |

September 30, 2022 | 25,354 |

Lease liabilities | |

December 31, 2020 | 23,049 |

Additions and contractual changes | (10,418) |

Payments | (3,178) |

Interest | 1,291 |

September 30, 2021 | 10,744 |

| |

December 31, 2021 | 26,315 |

Additions and contractual changes | 2,337 |

Incorporation of Paytec(1) | 4,278 |

Payments | (8,134) |

Interest | 1,780 |

September 30, 2022 | 26,576 |

(1) Consolidated opening balances referring to the acquisition of Paytec.

(b) Expenses recognized in the consolidated statement of income

September 30, 2021 | |

Depreciation | 2,614 |

Interest expense | 1,291 |

Total | 3,905 |

| |

September 30, 2022 | |

Depreciation | 6,964 |

Interest expense | 1,780 |

Total | 8,744 |

Payments of short-term leases

In September 30, 2022 and September 30, 2021 there were no short-term contract expenses.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

7. Intangible Assets

Accounting policy

Intangible assets represent identifiable non-monetary assets (separable from other assets), without physical substance, arising from business combinations, in-house developed software, or use licenses with finite or indefinite useful lives. Only assets whose cost can be reliably estimated and which the consolidated entities consider to be probable that they will generate future economic benefits are recognized.

Intangible assets are initially recognized at purchase or production cost and are subsequently measured less any accumulated amortization and any impairment losses.

Other intangible assets are considered to have indefinite useful lives when, based on a review of all relevant factors, it is concluded that there is no foreseeable limit to the period over which an asset is expected to generate cash inflows for the Company.

Intangible assets with indefinite useful lives are not amortized, but rather at the end of each annual period, the entity reviews the remaining useful lives of the assets in order to determine whether they continue to be indefinite and, if this is not the case, the change should be accounted for as a change in accounting estimate. Goodwill impairment assessment is performed annually or more frequently if events or changes in circumstances indicate possible impairment.

Intangible assets with finite useful lives are amortized over those useful lives using methods similar to those used to depreciate property and equipment. Amortization expenses are recognized in line item ‘Depreciation and amortization’ in the Consolidated Statement of Income.

At the end of each year, Getnet assesses whether there is indication that its intangible assets might be impaired, i.e., whether the carrying amount of an asset exceeds its probable realizable value. If an impairment loss is identified, the recoverable amount is written down until it reaches the asset’s realizable value.

Assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognized when the asset's carrying amount exceeds its recoverable amount, which is the higher of an asset's fair value less costs of disposal or its value in use.

Goodwill on acquisitions

When an investment in a subsidiary is acquired, any difference between the investment cost and the investor’s share of the net fair value of the investee’s identifiable assets, liabilities, and contingent liabilities (subsidiary or associate) is accounted for in accordance with IFRS 3.

Goodwill is recognized only when the amount of the consideration transferred for an investee exceeds its fair value at the acquisition date, and therefore represents a payment made by the acquirer in anticipation of future economic benefits from assets of the acquiree that cannot be individually identified and separately recognized.

The net fair value adjustments to an investee’s identifiable assets, liabilities and contingent liabilities based on their carrying amounts are individually allocated to the identifiable assets acquired and liabilities assumed based on their respective fair values at the acquisition date.

Assets that have an indefinite useful life, such as goodwill, are not subject to amortization and are tested annually to identify any impairment. Impairment reviews of goodwill are performed annually or more frequently if events or changes in circumstances indicate possible impairment. At September 30, 2022 and December 31, 2021, Getnet has not identified the need to make any adjustments for impairment.

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

Internally generated intangible asset

Expenditure on research activities is recognized as an expense for the period when incurred. The expenses with projects that are not activated are recognized in the line of Selling, General and Administrative expenses.

When an internally generated intangible asset can be recognized, development expenditure is capitalized in intangible asset in the balance sheet, and amortized in the line item ‘Cost of services’ for POS software and in the line item ‘Selling, General and Administrative expenses’ for other intangible assets, in the ‘Consolidated Statement of Income’.

Systems in development

Getnet capitalizes expenses that are directly related to the internal development of software for their own operations, provided that the aspects required for recognition are met. The main expenses are related to internal labor for the development of the systems used by Getnet. Research expenditure is recorded as expenses when incurred. These projects evolve through an assessment of the IT and Accounting areas in order to verify their adherence to IAS 38 and whether they should be classified as Intangible Assets or Expenses. For further details refer to note 15 – (technology and systems).

The provision for impairment of intangible assets is recognized according to the probable losses identified between the activated software and the systems in development. Getnet monitors the performance of the systems taking into consideration technological and market aspects related to the continuity of the operation.

Estimates and critical accounting judgments

The goodwill recorded is subject to impairment testing at least once a year, or more frequently if there is any indication of impairment.

The adoption of these estimates involves the probability of occurrence of future events and the change of any of these factors could have a different result. The cash flow estimate is based on an appraisal prepared internally by an independent specialized firm, annually or whenever there are indications that the asset might be impaired, which is reviewed and approved by management.

Getnet uses an estimated useful life to calculate and record the amortization applied to its intangible assets.

The amortization of software and software licenses is defined based on the effective period of the license contracted. The amortization of internally developed software is defined based on the period over which the software will generate future economic benefits for Getnet.

The Company performed the Impairment test during second half of 2021. The Company test whether goodwill suffered any impairment on an annual basis at December 31 and, when circumstances indicate that the value may be impaired. At the period ended on September 30, 2022, the Company concluded there was no evidence of impairment that would lead to the need to update the performed in 2021 before its regular performance.

| 09/30/2022 | 12/31/2021 |

Goodwill Getnet Tecnologia | 669,831 | 669,831 |

Goodwill Eyemobile | 9,041 | 18,659 |

Goodwill Paytec | 11,136 | - |

Other intangible assets | 222,293 | 196,593 |

Total | 912,301 | 885,083 |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)

a)Goodwill

Getnet Tecnologia – Refers to the acquisition of Getnet Tecnologia em Captura e Processamento de Transações H.U.A Ltda (“Getnet Tecnologia”). in 2014, which was subsequently legally merged with Getnet. Getnet Tecnologia was a subsidiary merchant acquisition and processing services company of Santander Brazil, which passed its merchant acquisition business to Getnet after the acquisition.

Eyemobile – As described in note 2, the amount paid for the acquisition of 60% of Eyemobile was R$ 19,415. In addition to this amount, an amount of R$ 5,500 was recorded as contingent consideration, a total consideration of R$ 24,915 as defined in IFRS 3. The fair value of net assets acquired from Eyemobile on the acquisition date was R$ 15,874, which generated a goodwill of R$ 9,041, as shown below:

| | Transaction date 08/03/2021 |

CURRENT ASSETS | | Book value | Added value | Fair value |

Cash and cash equivalents | | 10,368 | - | 10,368 |

Accounts receivable | | 300 | - | 300 |

Other assets | | 275 | - | 275 |

Total current assets | | 10,943 | - | 10,943 |

| | | | |

NONCURRENT ASSETS | | | | |

Property and equipment | | 181 | - | 181 |

Intangible assets (1) | | 605 | 14,574 | 15,179 |

Total noncurrent assets | | 786 | 14,574 | 15,360 |

Total assets (1) | | 11,729 | 14,574 | 26,303 |

| | | | |

CURRENT LIABILITIES | | | | |

Accounts payable | | 15 | - | 15 |

Loans and borrowings | | 83 | - | 83 |

Income taxes payables and other tax payables | | 54 | - | 54 |

Tax installment | | 53 | - | 53 |

Other liabilities | | 305 | - | 305 |

Total current liabilities | | 510 | - | 510 |

| | | | |

NONCURRENT LIABILITIES | | | | |

Loans and borrowings | | 700 | - | 700 |

Tax installment | | 93 | - | 93 |

Total noncurrent liabilities | | 793 | - | 793 |

Total assumed liabilities (2) | | 1,303 | - | 1,303 |

Total identifiable asset, net (1 - 2) | | 10,426 | 14,574 | 25,000 |

Total equity acquired (60%) | | 6,255 |

Asset capital gain | | 14,574 |

Deferred income tax on capital gain(2) | | (4,955) |

Goodwill generated in the transaction | | 9,041 |

Total net compensation | | 24,915 |

| | |

Value paid in cash | | 9,415 |

Paid-in capital | | 10,000 |

Contingent consideration (3) | | 5,500 |

Total transaction | | 24,915 |

Getnet Adquirência e Serviços para Meios de Pagamento S.A. – Instituição de Pagamento

Notes to the Unaudited Consolidated Financial Statements

(In thousands of Brazilian reais - R$, unless otherwise stated)