Earnings Conference Call First Quarter 2023 May 4, 2023

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements. The factors that could cause actual results to differ materially from the forward-looking statements made by Constellation Energy Corporation and Constellation Energy Generation, LLC, (Registrants) include those factors discussed herein, as well as the items discussed in (1) the Registrants’ 2022 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 19, Commitments and Contingencies; (2) the Registrants’ First Quarter 2023 Quarterly Report on Form 10-Q (to be filed on May 4, 2023) in (a) Part II, ITEM 1A. Risk Factors, (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part I, ITEM 1. Financial Statements: Note 12, Commitments and Contingencies; and (d) other factors discussed in filings with the SEC by the Registrants. Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this presentation. Neither Registrant undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. Cautionary Statements Regarding Forward-Looking Information 2

The Registrants report their financial results in accordance with accounting principles generally accepted in the United States (GAAP). Constellation supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including: • Adjusted EBITDA represents earnings before interest, income taxes, depreciation and amortization, and excludes certain costs, expenses, gains and losses and other specified items, including mark-to-market adjustments from economic hedging activities and fair value adjustments related to gas imbalances and equity investments, decommissioning related activity, asset impairments, certain amounts associated with plant retirements and divestitures, pension and other post-employment benefits (OPEB) non-service credits, separation related costs and other items as set forth in the Appendix. Includes nuclear fuel amortization expense. • Adjusted cash flows from operations primarily includes net cash flows from operating activities and Collection of Deferred Purchase Price (DPP) related to the revolving accounts receivable arrangement, which is presented in cash flows from investing activities under GAAP • Free cash flows before growth (FCFbg) is adjusted cash flows from operations less capital expenditures under GAAP for maintenance and nuclear fuel, non- recurring capital expenditures related to separation and Enterprise Resource Program (ERP) system implementation, changes in collateral, net merger and acquisitions, and equity investments and other items as set forth in the Appendix • Adjusted operating revenues excludes the mark-to-market impact of economic hedging activities due to the volatility and unpredictability of the future changes in commodity prices • Adjusted purchased power and fuel excludes the mark-to-market impact of economic hedging activities and fair value adjustments related to gas imbalances due to the volatility and unpredictability of the future changes in commodity prices • Total gross margin is defined as adjusted operating revenues less adjusted purchased power and fuel expense, excluding revenue related to decommissioning, gross receipts tax, production tax credits (PTCs), variable interest entities, and net of direct cost of sales for certain end-user businesses • Adjusted operating and maintenance (O&M) excludes direct cost of sales for certain end-user businesses, Asset Retirement Obligation (ARO) accretion expense from unregulated units and decommissioning costs that do not affect profit and loss, the impact from operating and maintenance expense related to variable interest entities at Constellation, and other items as set forth in the reconciliation in the Appendix Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be available, as management is unable to project all of these items for future periods Non-GAAP Financial Measures 3

This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Constellation’s baseline operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentations of similarly titled financial measures. Constellation has provided these non-GAAP financial measures as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Non-GAAP financial measures are identified by the phrase “non-GAAP” or an asterisk (*). Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in the appendices and attachments to this presentation, except for the reconciliation for total gross margin*, which appears on slide 25 of this presentation. Non-GAAP Financial Measures Continued 4

Constellation is Uniquely Positioned to Create Value for Shareholders 5 • Best-in-class nuclear operations • Largest producer of carbon-free, clean electricity • Largest provider of electricity to C&I customers Unmatched, Premium Assets in the U.S. • Downside commodity price risk protected by U.S. government, while preserving ability to capture commodity price upside • Production Tax Credit (PTC) grows with inflation • Supports growth opportunities that will help decarbonize the U.S. including nuclear uprates, clean hydrogen and wind repowering • Extends horizon of our clean, carbon-free nuclear fleet to 80 years Beneficiary of Inflation Reduction Act • Strong free cash flow generation allows for: – Robust organic growth at compelling double-digit unlevered returns – Growth from M&A – Share repurchases – Dividend growth Growing Value for Shareholders

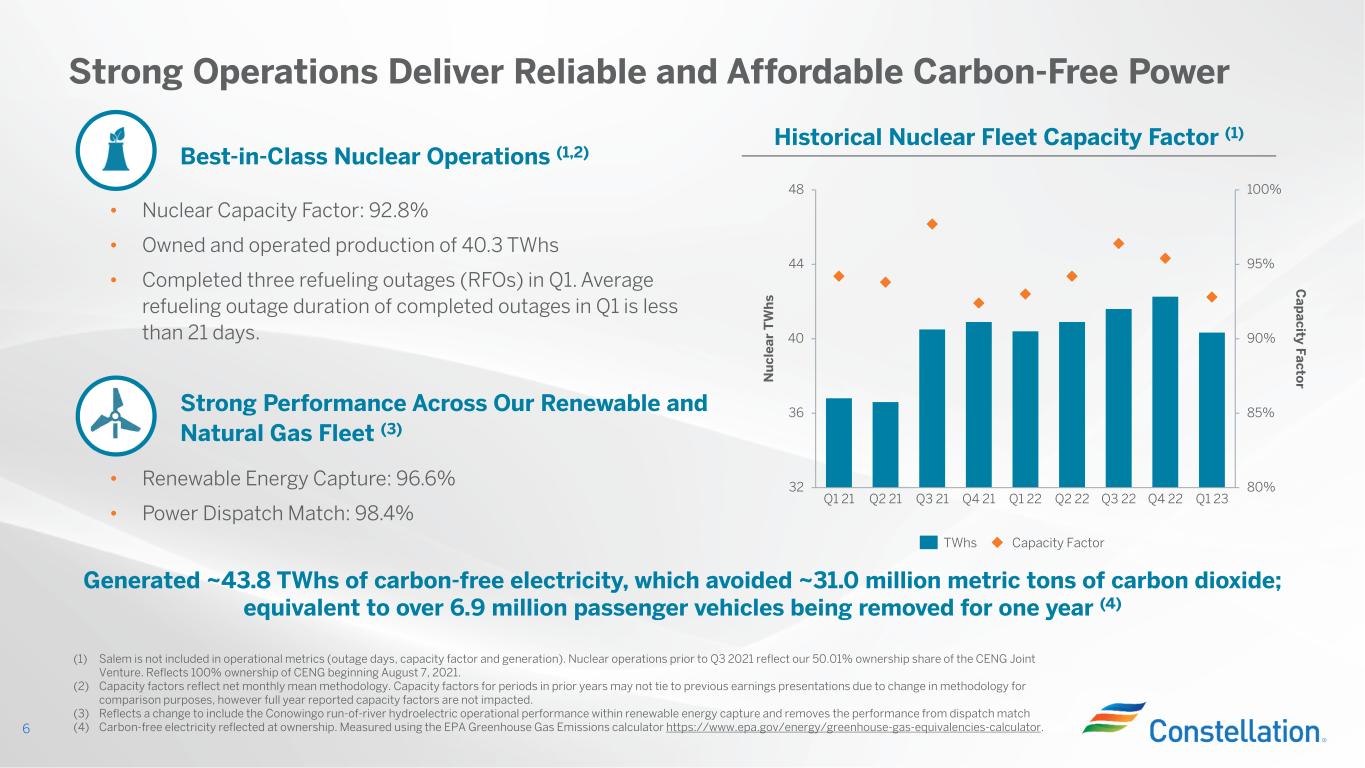

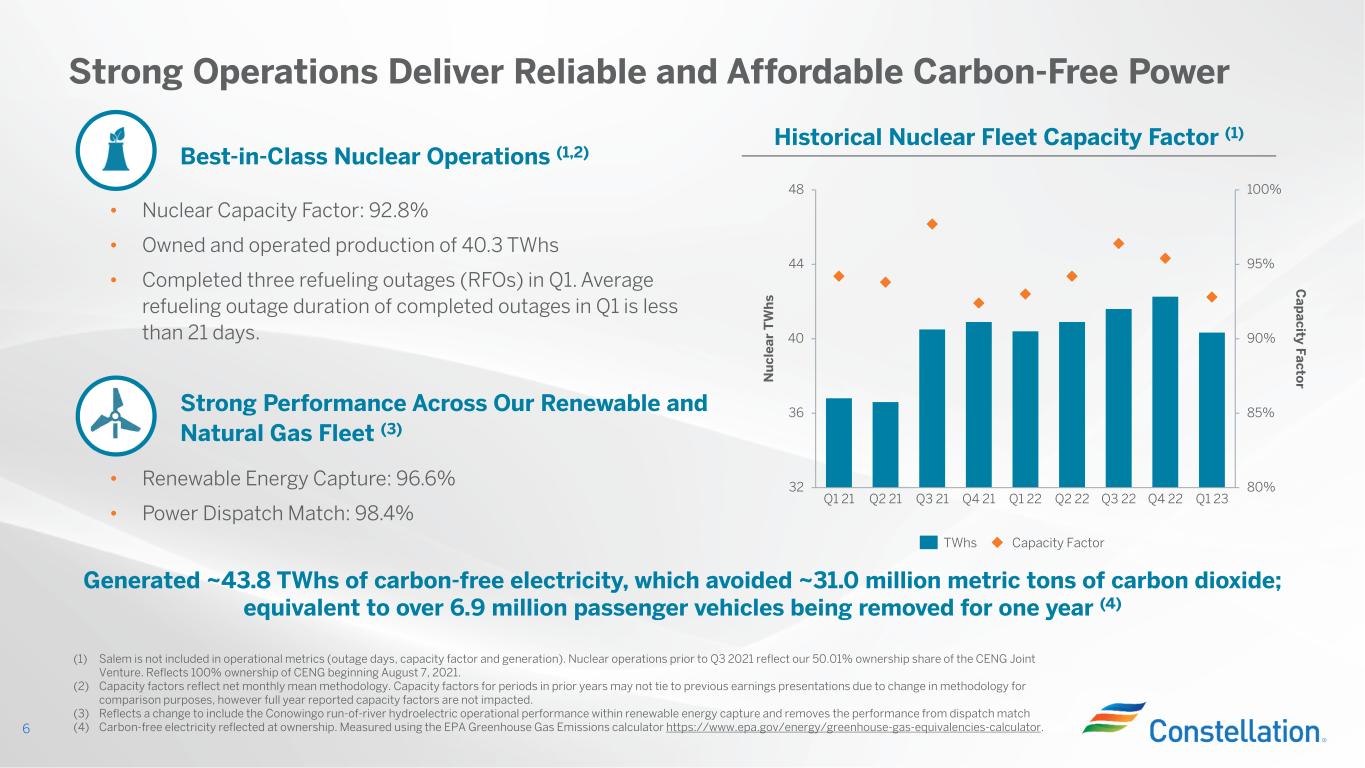

Best-in-Class Nuclear Operations (1,2) • Nuclear Capacity Factor: 92.8% • Owned and operated production of 40.3 TWhs • Completed three refueling outages (RFOs) in Q1. Average refueling outage duration of completed outages in Q1 is less than 21 days. 6 Strong Operations Deliver Reliable and Affordable Carbon-Free Power (1) Salem is not included in operational metrics (outage days, capacity factor and generation). Nuclear operations prior to Q3 2021 reflect our 50.01% ownership share of the CENG Joint Venture. Reflects 100% ownership of CENG beginning August 7, 2021. (2) Capacity factors reflect net monthly mean methodology. Capacity factors for periods in prior years may not tie to previous earnings presentations due to change in methodology for comparison purposes, however full year reported capacity factors are not impacted. (3) Reflects a change to include the Conowingo run-of-river hydroelectric operational performance within renewable energy capture and removes the performance from dispatch match (4) Carbon-free electricity reflected at ownership. Measured using the EPA Greenhouse Gas Emissions calculator https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator. 80% 85% 90% 95% 100% 32 36 40 44 48 Q4 21 Q2 22Q1 22Q3 21 Q4 22 N u cl ea r T W h s Q2 21 C ap acity F acto r Q1 21 Q3 22 Q1 23 TWhs Capacity Factor Generated ~43.8 TWhs of carbon-free electricity, which avoided ~31.0 million metric tons of carbon dioxide; equivalent to over 6.9 million passenger vehicles being removed for one year (4) Strong Performance Across Our Renewable and Natural Gas Fleet (3) • Renewable Energy Capture: 96.6% • Power Dispatch Match: 98.4% Historical Nuclear Fleet Capacity Factor (1)

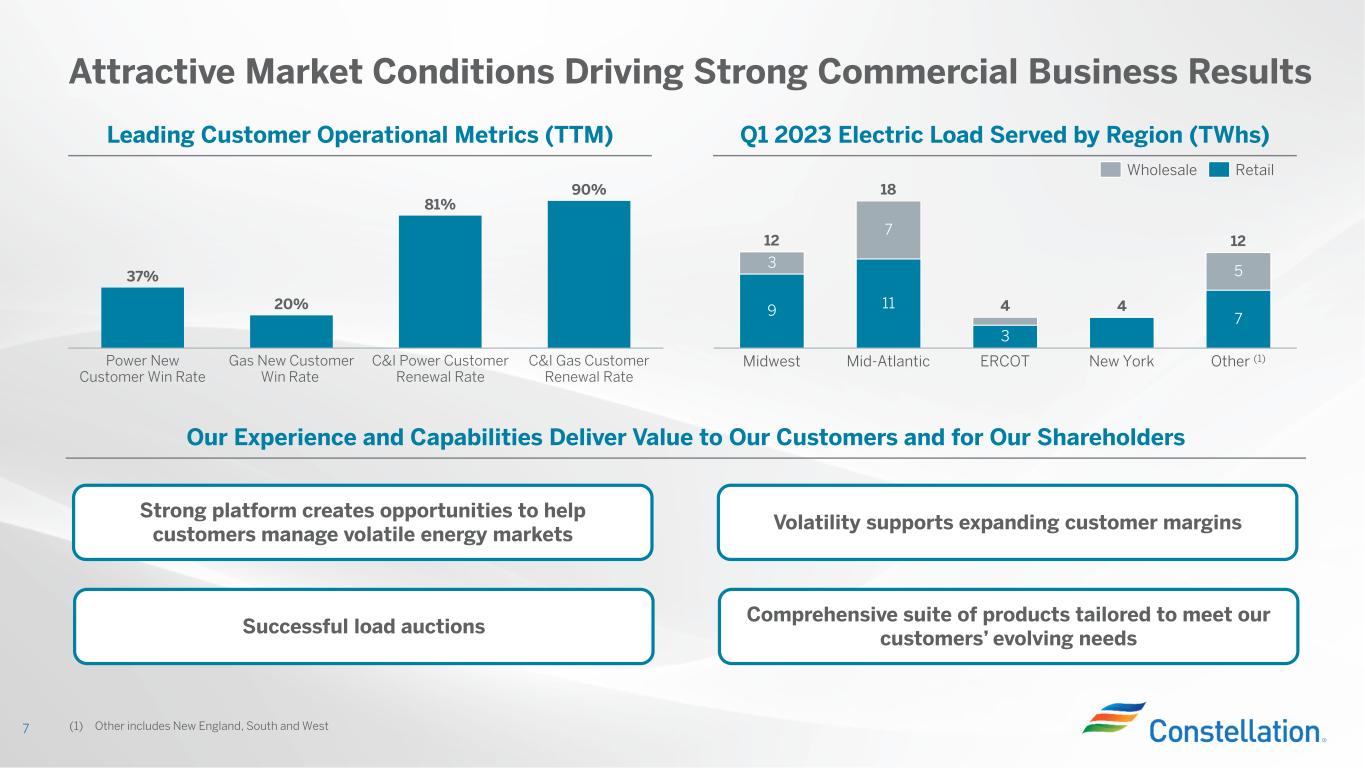

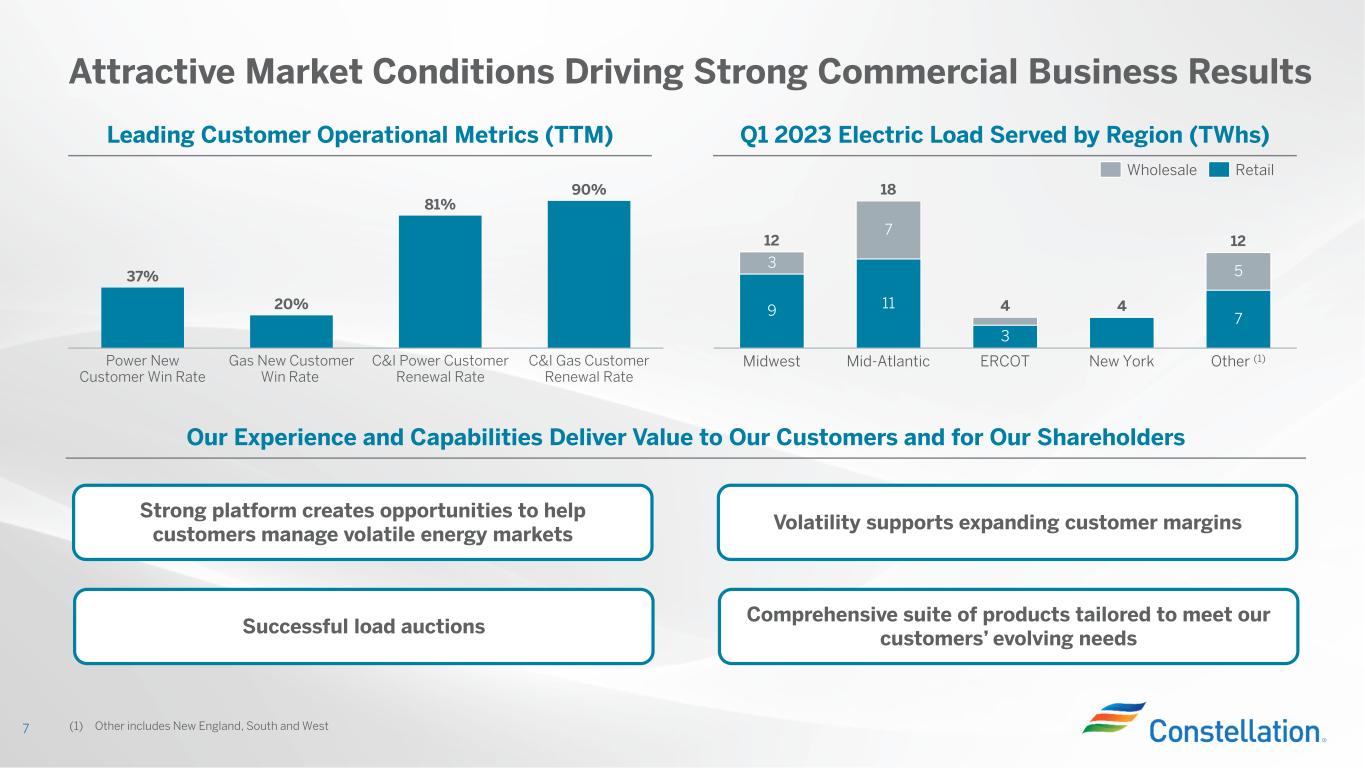

Attractive Market Conditions Driving Strong Commercial Business Results 7 (1) Other includes New England, South and West Leading Customer Operational Metrics (TTM) Q1 2023 Electric Load Served by Region (TWhs) 9 11 3 4 7 3 7 5 Midwest Other (1) 18 Mid-Atlantic 12 4 ERCOT New York 12 Wholesale Retail 37% 20% 81% 90% Power New Customer Win Rate Gas New Customer Win Rate C&I Power Customer Renewal Rate C&I Gas Customer Renewal Rate Our Experience and Capabilities Deliver Value to Our Customers and for Our Shareholders Strong platform creates opportunities to help customers manage volatile energy markets Successful load auctions Volatility supports expanding customer margins Comprehensive suite of products tailored to meet our customers’ evolving needs

Q1 2023 Adjusted EBITDA* Financial Results 8 Quarter Results Exceeded Plan • Strong wholesale and retail performance with margin expansion • Successful optimization of the portfolio to capture benefits from volatility • Estimate of net performance benefit from Winter Storm Elliott increased from $109 million (at Q4) to $148 million driven by additional clarity and invoicing from PJM $658 Q1 2023 2023 Guidance $3,300 $2,900 $3,100 ($M) Expect to be in top half of Adjusted EBITDA* guidance range of $2,900M - $3,300M

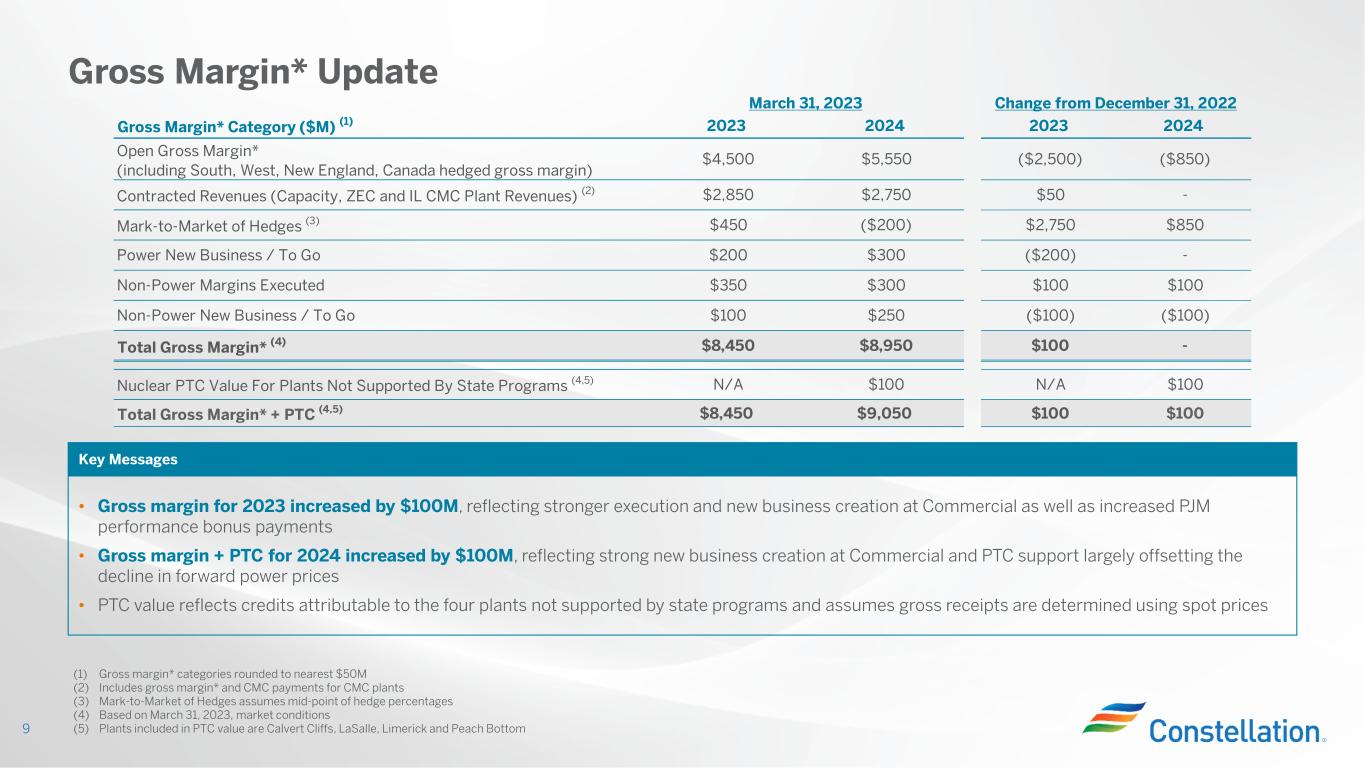

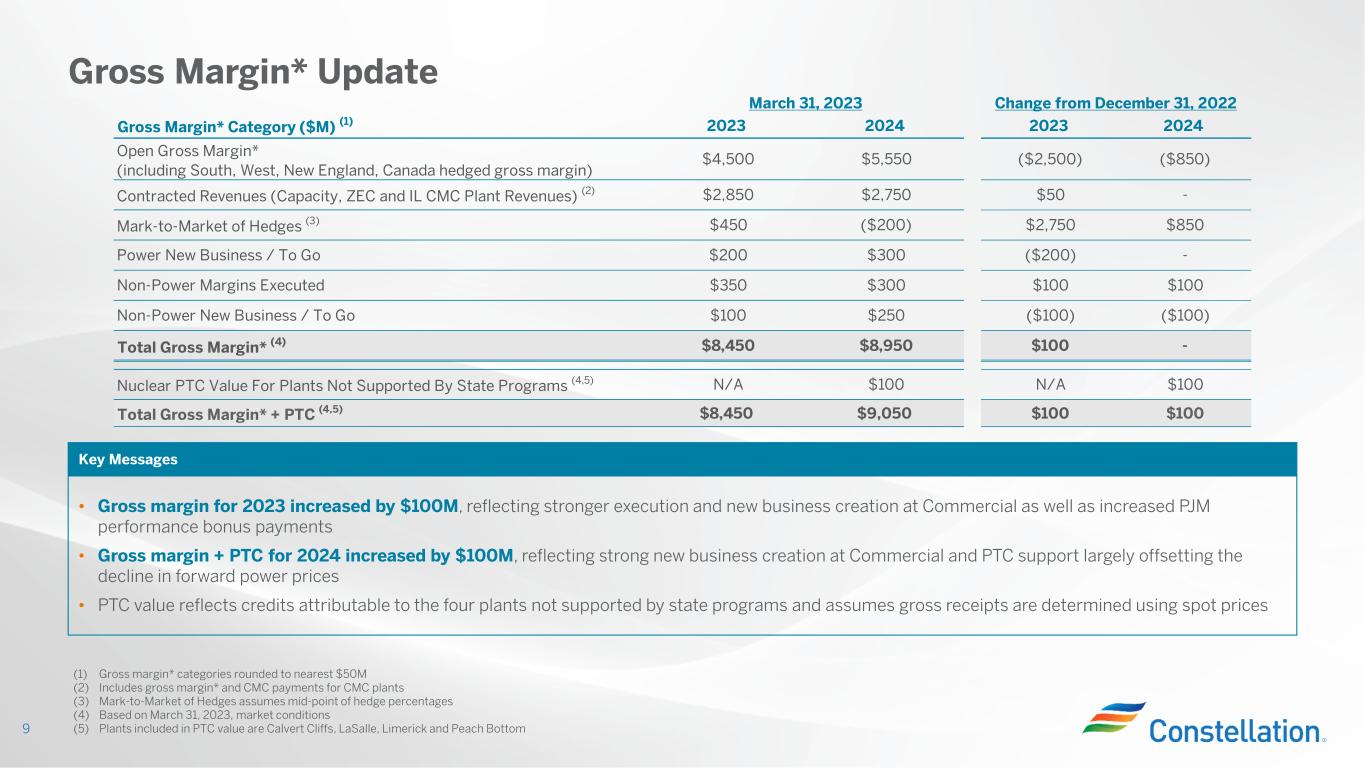

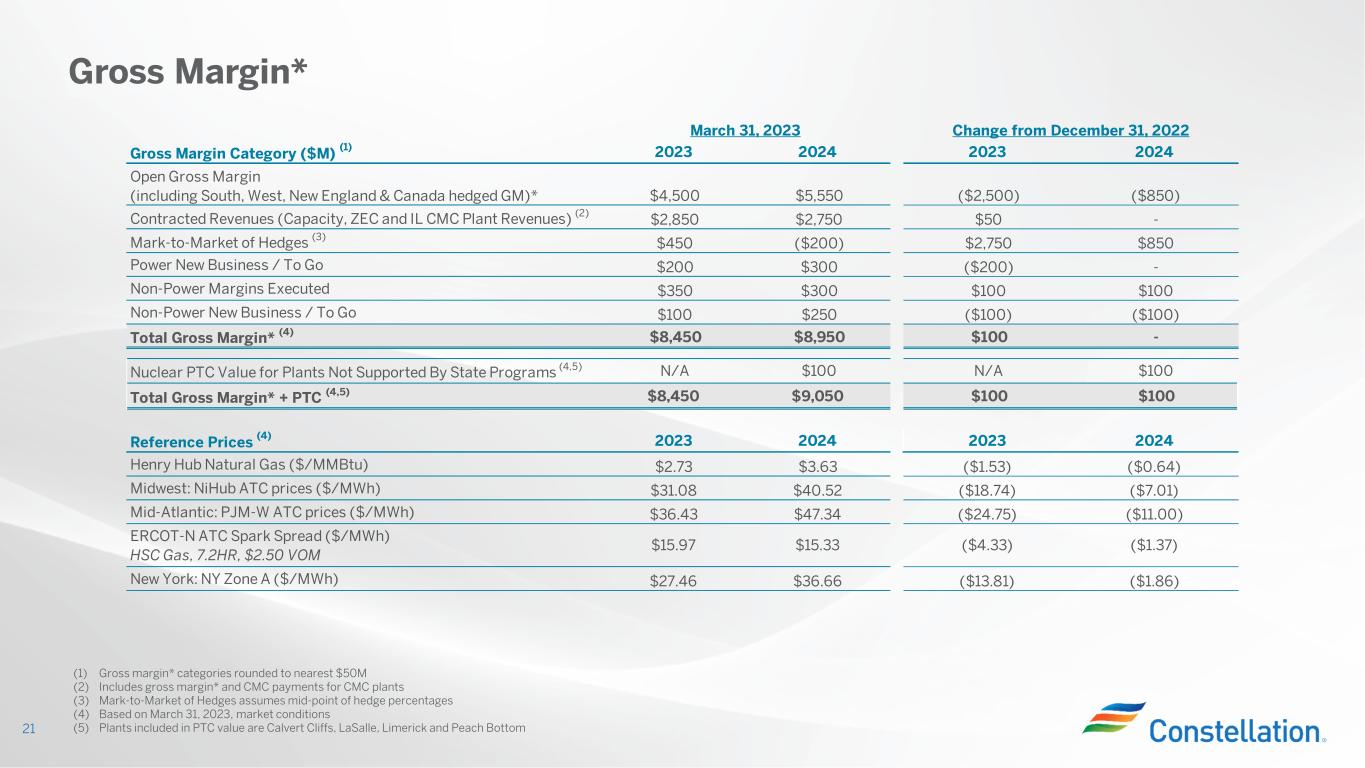

Gross Margin* Category ($M) (1) 2023 2024 2023 2024 Open Gross Margin* (including South, West, New England, Canada hedged gross margin) $4,500 $5,550 ($2,500) ($850) Contracted Revenues (Capacity, ZEC and IL CMC Plant Revenues) (2) $2,850 $2,750 $50 - Mark-to-Market of Hedges (3) $450 ($200) $2,750 $850 Power New Business / To Go $200 $300 ($200) - Non-Power Margins Executed $350 $300 $100 $100 Non-Power New Business / To Go $100 $250 ($100) ($100) Total Gross Margin* (4) $8,450 $8,950 $100 - Nuclear PTC Value For Plants Not Supported By State Programs (4,5) N/A $100 N/A $100 Total Gross Margin* + PTC (4,5) $8,450 $9,050 $100 $100 March 31, 2023 Change from December 31, 2022 Gross Margin* Update 9 (1) Gross margin* categories rounded to nearest $50M (2) Includes gross margin* and CMC payments for CMC plants (3) Mark-to-Market of Hedges assumes mid-point of hedge percentages (4) Based on March 31, 2023, market conditions (5) Plants included in PTC value are Calvert Cliffs, LaSalle, Limerick and Peach Bottom Key Messages • Gross margin for 2023 increased by $100M, reflecting stronger execution and new business creation at Commercial as well as increased PJM performance bonus payments • Gross margin + PTC for 2024 increased by $100M, reflecting strong new business creation at Commercial and PTC support largely offsetting the decline in forward power prices • PTC value reflects credits attributable to the four plants not supported by state programs and assumes gross receipts are determined using spot prices

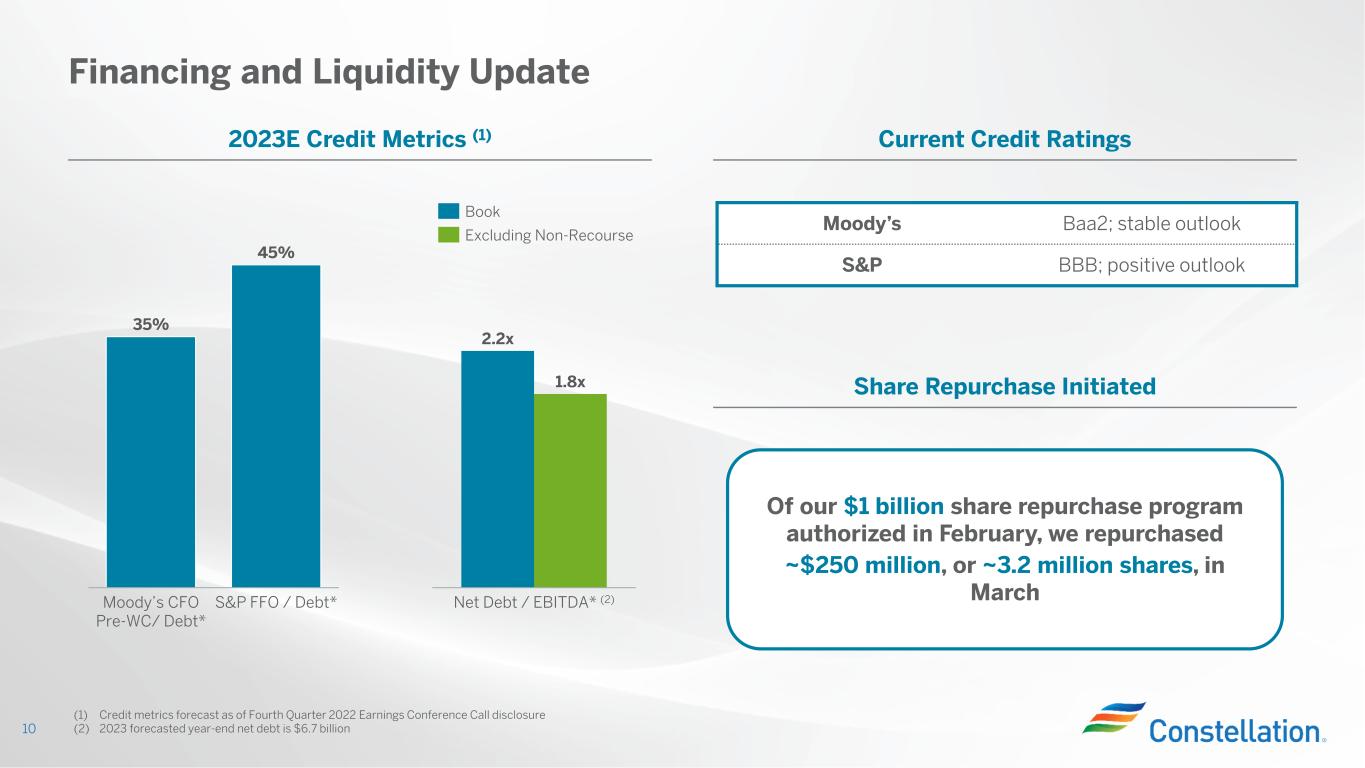

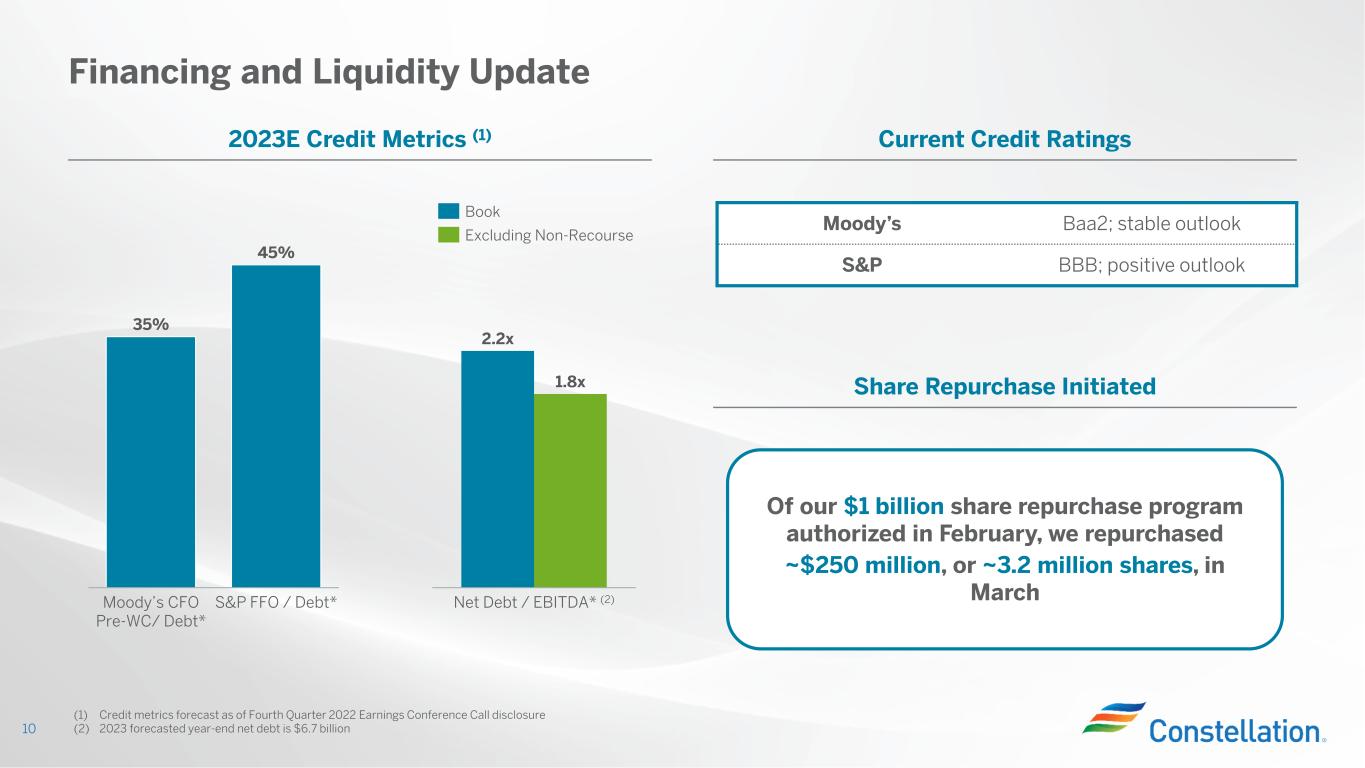

Financing and Liquidity Update 10 35% 45% Moody’s CFO Pre-WC/ Debt* S&P FFO / Debt* Net Debt / EBITDA* (2) 2.2x 1.8x Book Excluding Non-Recourse (1) Credit metrics forecast as of Fourth Quarter 2022 Earnings Conference Call disclosure (2) 2023 forecasted year-end net debt is $6.7 billion 2023E Credit Metrics (1) Current Credit Ratings Moody’s Baa2; stable outlook S&P BBB; positive outlook Share Repurchase Initiated Of our $1 billion share repurchase program authorized in February, we repurchased ~$250 million, or ~3.2 million shares, in March

Constellation’s Value Proposition 11

Additional Disclosures 12

E S G Environmental: • Clean Energy Leadership: Continue to be the cleanest supplier of power in the U.S. and maintain leadership through our climate commitment to own 100% carbon-free generation by 2040. • Investing in a Clean Energy Economy: Leverage our platform to impact customers through enabling new clean energy products and services and providing our customers with an accounting of their carbon emissions and ways to reduce their carbon footprint. • Protecting the Environment: Minimize the impacts of our operations on local air quality, water resources and biodiversity through robust environmental programs. Social: • DEI: Foster a culture of innovation and deliver strong performance by prioritizing a respectful workplace, ensuring a sense of belonging, providing opportunities for growth, attracting and retaining passionate and talented people, and integrating diversity as a business imperative and core value. • Supplier Diversity: Increase diverse supplier spend by expanding Constellation Diverse Business Empowerment strategy internally and externally with supplier diversity councils and other stakeholders. • Community Engagement: Act as a catalyst for positive change in our community, with a focus on employee giving and volunteerism and equity through STEM, scholarships, and workforce development opportunities. Governance: • Board & Executive Governance: Provide effective leadership and guidance to drive our sustainability efforts and deliver on our purpose to accelerate the transition to a carbon-free future. • Act with Integrity: Maintain a comprehensive ethics and compliance program that can adapt to the changing risks we face and guide us as we deliver on our purpose. Constellation’s ESG Strategy 13

Constellation’s Climate Commitment 14 100% 100% 100% Of our owned generation will be carbon-free by 2040 Reduction of our operations- driven emissions by 2040 (1) Of C&I customers provided with specific information about how to meet GHG reduction goals Clean Energy Supply: Clean Electricity Supply: We commit that our owned generation supply will be 100% carbon-free by 2040; with an interim goal of 95% carbon- free by 2030 subject to policy support and technology advancements. Operational Emissions Reduction Goal: We aspire to reduce operations driven emissions by 100% by 2040 subject to technology and policy advancement Interim target to reduce carbon emissions by 65% from 2020 levels by 2030 Constellation commits to reducing methane emissions 30% from 2020 levels by 2030, aligned with the Administration’s global methane pledge Supply Chain Engagement: Partner with our key energy suppliers on their GHG emissions and climate adaptation strategies Clean Customer Transformation: Provided 100% of C&I customers with customer-specific information on their GHG impact for facilities contracting for power and gas supply from Constellation including mitigation opportunities that include 24/7 clean electric use Commit to support reductions in customers’ gas emissions and a transition to low carbon fuels Technology Enablement and Commercialization: Commit to enable the future technologies and business models needed to drive the clean energy economy to improve the health and welfare of communities through venture investing and R&D. We will target 25% of these investments to minority and women led businesses and will require investment recipients to disclose how they engage in equitable employment and contracting practices, using performance as a factor when considering investments (1) Any emissions that cannot be technologically reduced by that time will be offset; includes all GHGs except methane which is addressed in a separate methane reduction goal

15 Q1 2023 Adjusted EBITDA* $42 $38 ($111) Q1 2022 Nuclear Outages ($104) Labor, Contracting and Materials Capacity Revenues ($47) Market and Portfolio Conditions PJM Performance Bonuses, Net ($26) Other Q1 2023 $866 $658 ($M)

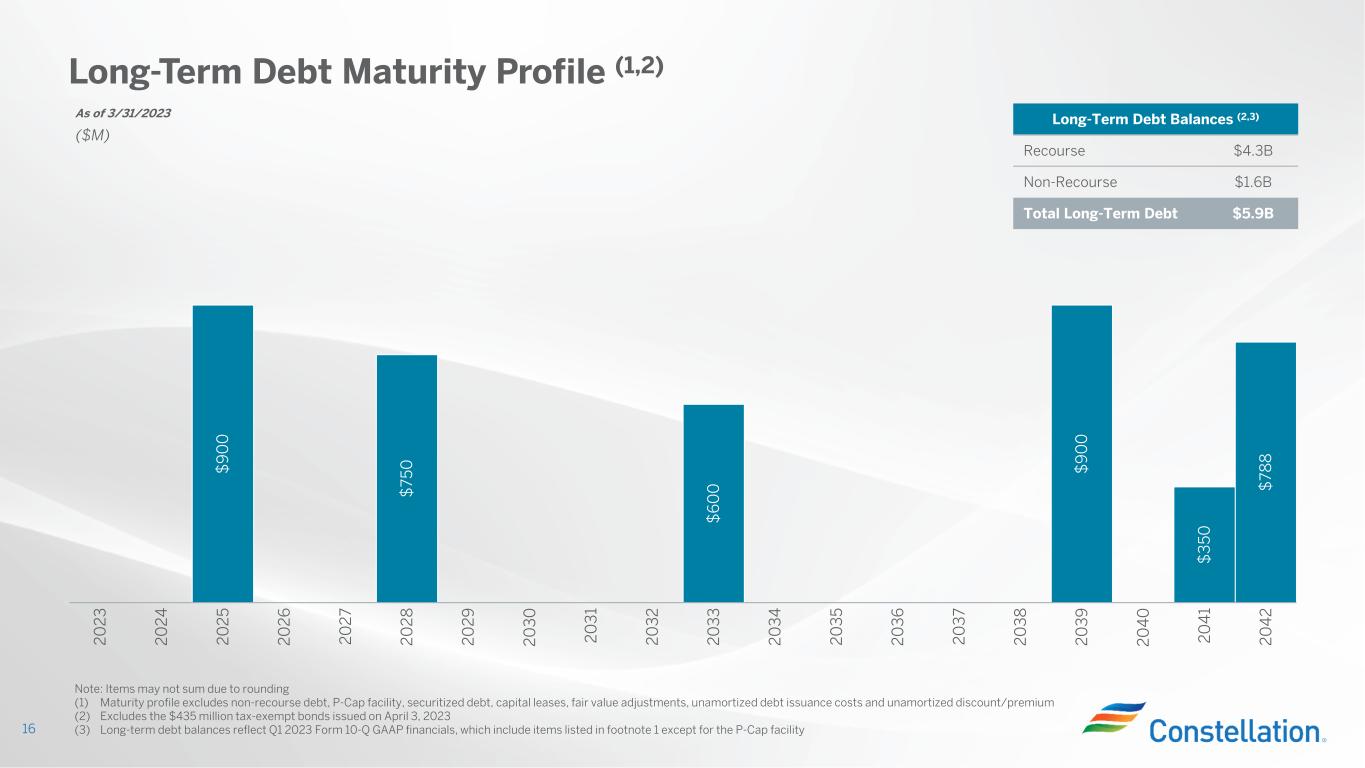

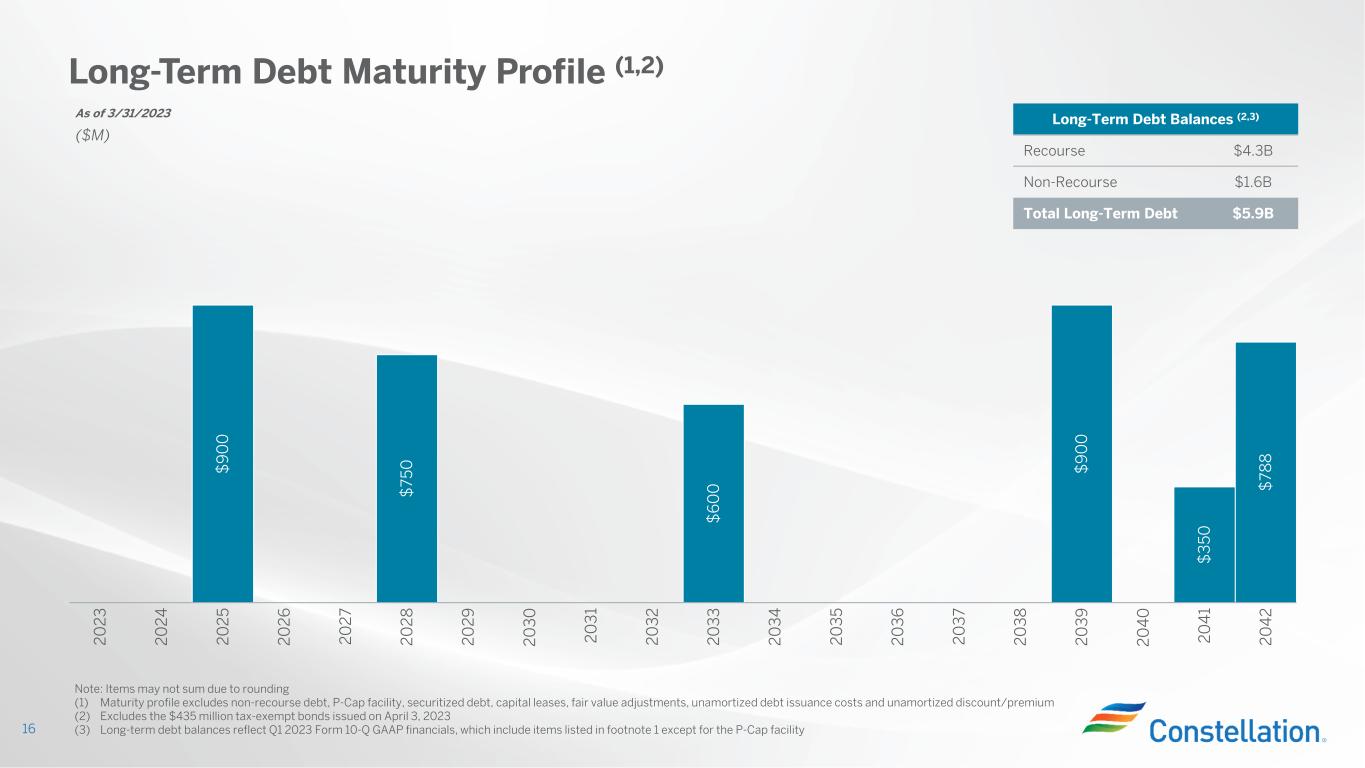

Long-Term Debt Maturity Profile (1,2) 16 Note: Items may not sum due to rounding (1) Maturity profile excludes non-recourse debt, P-Cap facility, securitized debt, capital leases, fair value adjustments, unamortized debt issuance costs and unamortized discount/premium (2) Excludes the $435 million tax-exempt bonds issued on April 3, 2023 (3) Long-term debt balances reflect Q1 2023 Form 10-Q GAAP financials, which include items listed in footnote 1 except for the P-Cap facility As of 3/31/2023 ($M) $ 9 0 0 $ 75 0 $ 6 0 0 $ 9 0 0 $ 3 5 0 $ 78 8 2 0 2 6 2 0 2 3 2 0 2 5 2 0 2 4 2 0 2 7 2 0 2 9 2 0 2 8 2 0 3 0 2 0 3 1 2 0 3 2 2 0 3 3 2 0 3 8 2 0 3 4 2 0 3 5 2 0 3 6 2 0 3 7 2 0 3 9 2 0 4 0 2 0 4 1 2 0 4 2 Long-Term Debt Balances (2,3) Recourse $4.3B Non-Recourse $1.6B Total Long-Term Debt $5.9B

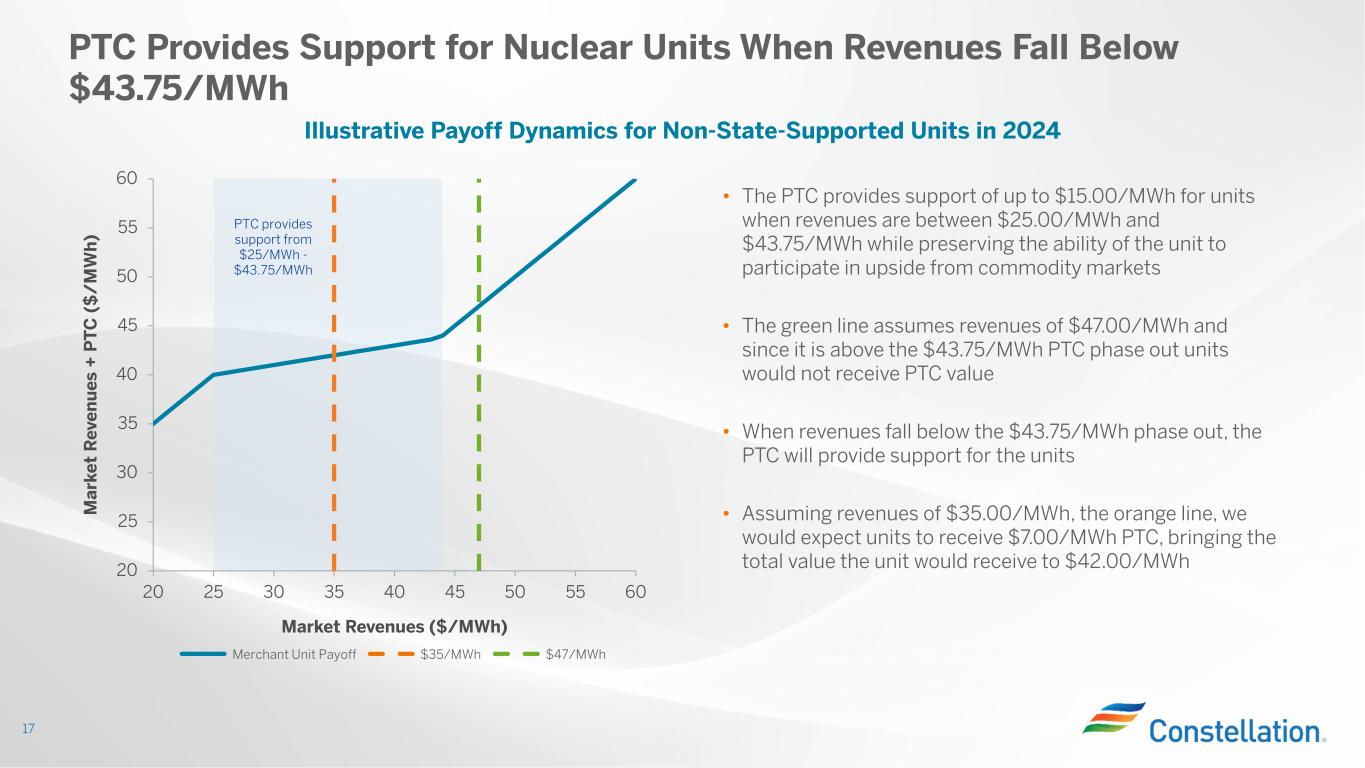

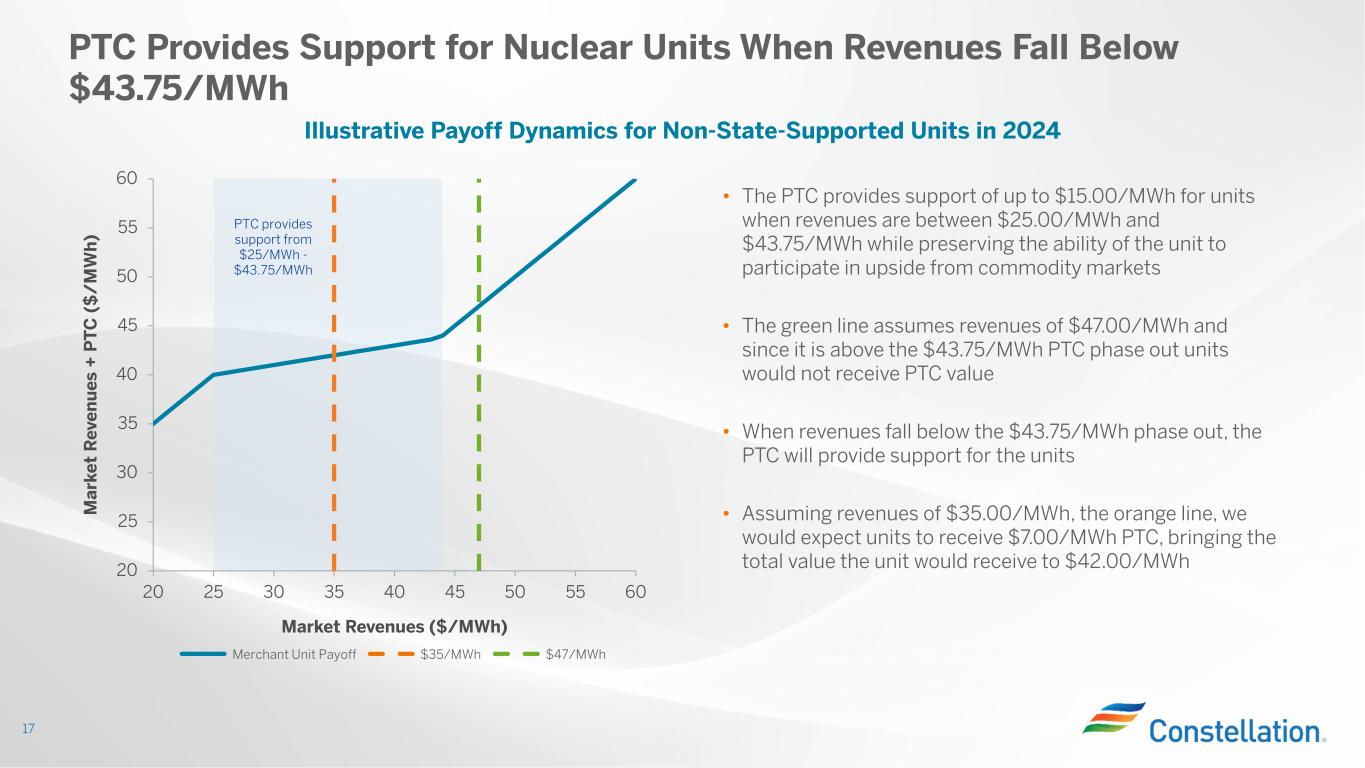

20 25 30 35 40 45 50 55 60 20 25 30 35 40 45 50 55 60 Market Revenues ($/MWh) M ar ke t R ev en u es + P T C ( $ / M W h ) 17 PTC Provides Support for Nuclear Units When Revenues Fall Below $43.75/MWh Illustrative Payoff Dynamics for Non-State-Supported Units in 2024 • The PTC provides support of up to $15.00/MWh for units when revenues are between $25.00/MWh and $43.75/MWh while preserving the ability of the unit to participate in upside from commodity markets • The green line assumes revenues of $47.00/MWh and since it is above the $43.75/MWh PTC phase out units would not receive PTC value • When revenues fall below the $43.75/MWh phase out, the PTC will provide support for the units • Assuming revenues of $35.00/MWh, the orange line, we would expect units to receive $7.00/MWh PTC, bringing the total value the unit would receive to $42.00/MWh $35/MWhMerchant Unit Payoff $47/MWh PTC provides support from $25/MWh - $43.75/MWh

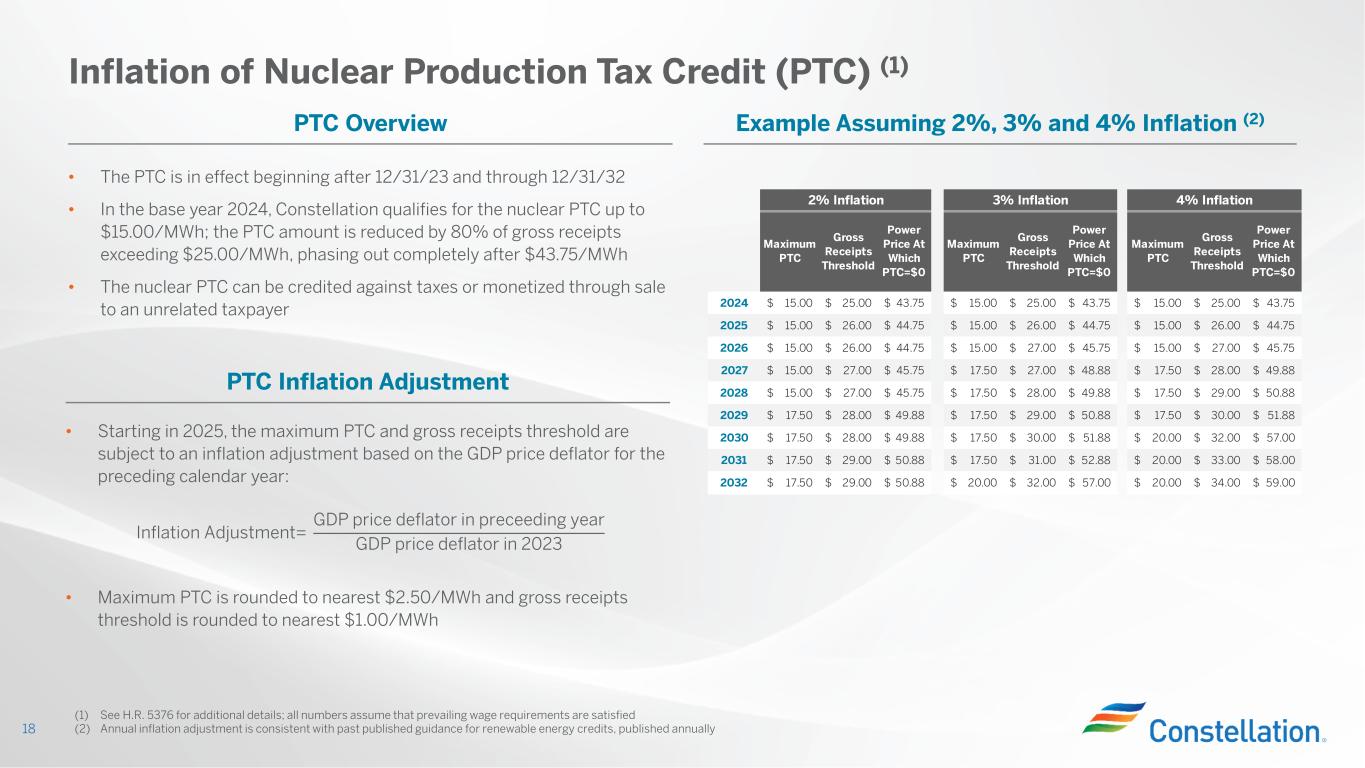

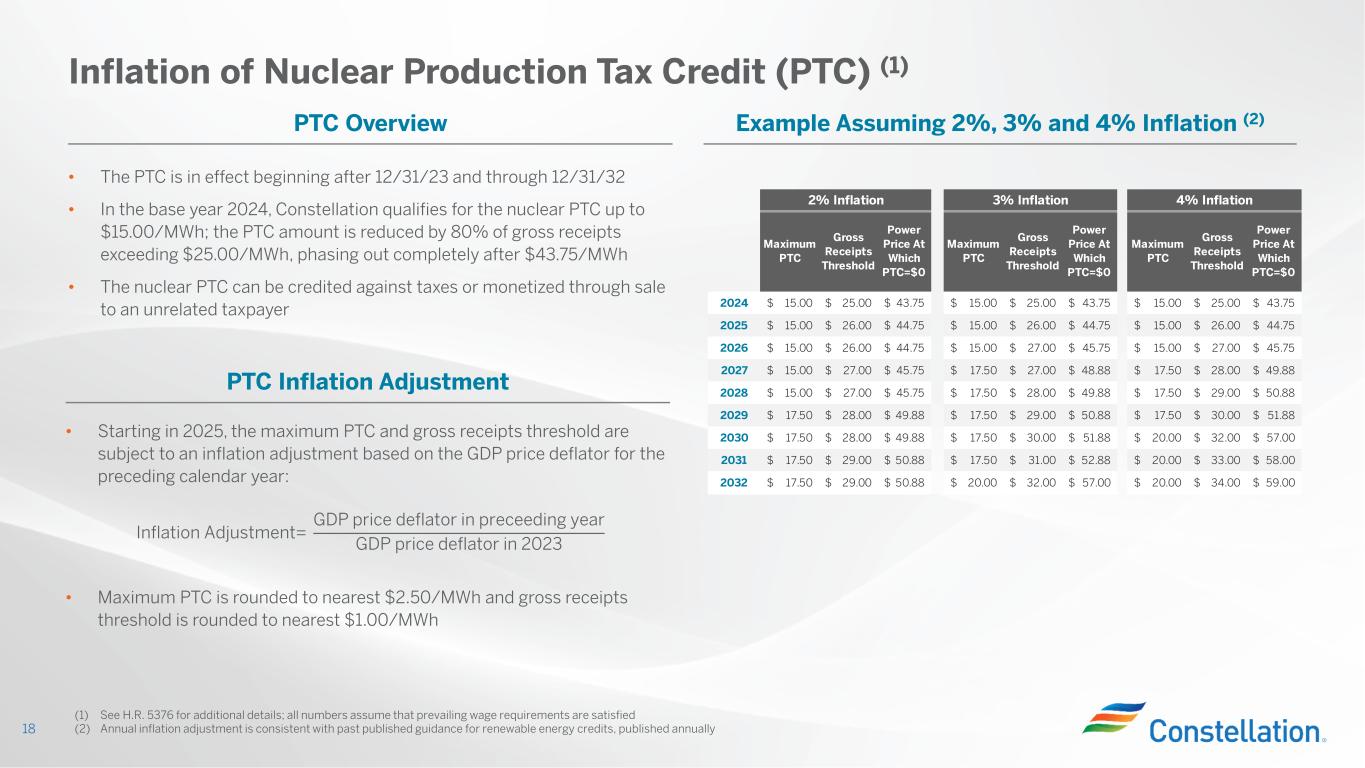

Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 2024 15.00$ 25.00$ 43.75$ 15.00$ 25.00$ 43.75$ 15.00$ 25.00$ 43.75$ 2025 15.00$ 26.00$ 44.75$ 15.00$ 26.00$ 44.75$ 15.00$ 26.00$ 44.75$ 2026 15.00$ 26.00$ 44.75$ 15.00$ 27.00$ 45.75$ 15.00$ 27.00$ 45.75$ 2027 15.00$ 27.00$ 45.75$ 17.50$ 27.00$ 48.88$ 17.50$ 28.00$ 49.88$ 2028 15.00$ 27.00$ 45.75$ 17.50$ 28.00$ 49.88$ 17.50$ 29.00$ 50.88$ 2029 17.50$ 28.00$ 49.88$ 17.50$ 29.00$ 50.88$ 17.50$ 30.00$ 51.88$ 2030 17.50$ 28.00$ 49.88$ 17.50$ 30.00$ 51.88$ 20.00$ 32.00$ 57.00$ 2031 17.50$ 29.00$ 50.88$ 17.50$ 31.00$ 52.88$ 20.00$ 33.00$ 58.00$ 2032 17.50$ 29.00$ 50.88$ 20.00$ 32.00$ 57.00$ 20.00$ 34.00$ 59.00$ 2% Inflation 3% Inflation 4% Inflation • Starting in 2025, the maximum PTC and gross receipts threshold are subject to an inflation adjustment based on the GDP price deflator for the preceding calendar year: • Maximum PTC is rounded to nearest $2.50/MWh and gross receipts threshold is rounded to nearest $1.00/MWh Inflation of Nuclear Production Tax Credit (PTC) (1) 18 (1) See H.R. 5376 for additional details; all numbers assume that prevailing wage requirements are satisfied (2) Annual inflation adjustment is consistent with past published guidance for renewable energy credits, published annually PTC Overview Example Assuming 2%, 3% and 4% Inflation (2) Inflation Adjustment= GDP price deflator in preceeding year GDP price deflator in 2023 PTC Inflation Adjustment • The PTC is in effect beginning after 12/31/23 and through 12/31/32 • In the base year 2024, Constellation qualifies for the nuclear PTC up to $15.00/MWh; the PTC amount is reduced by 80% of gross receipts exceeding $25.00/MWh, phasing out completely after $43.75/MWh • The nuclear PTC can be credited against taxes or monetized through sale to an unrelated taxpayer

Commercial Disclosures March 31, 2023 19

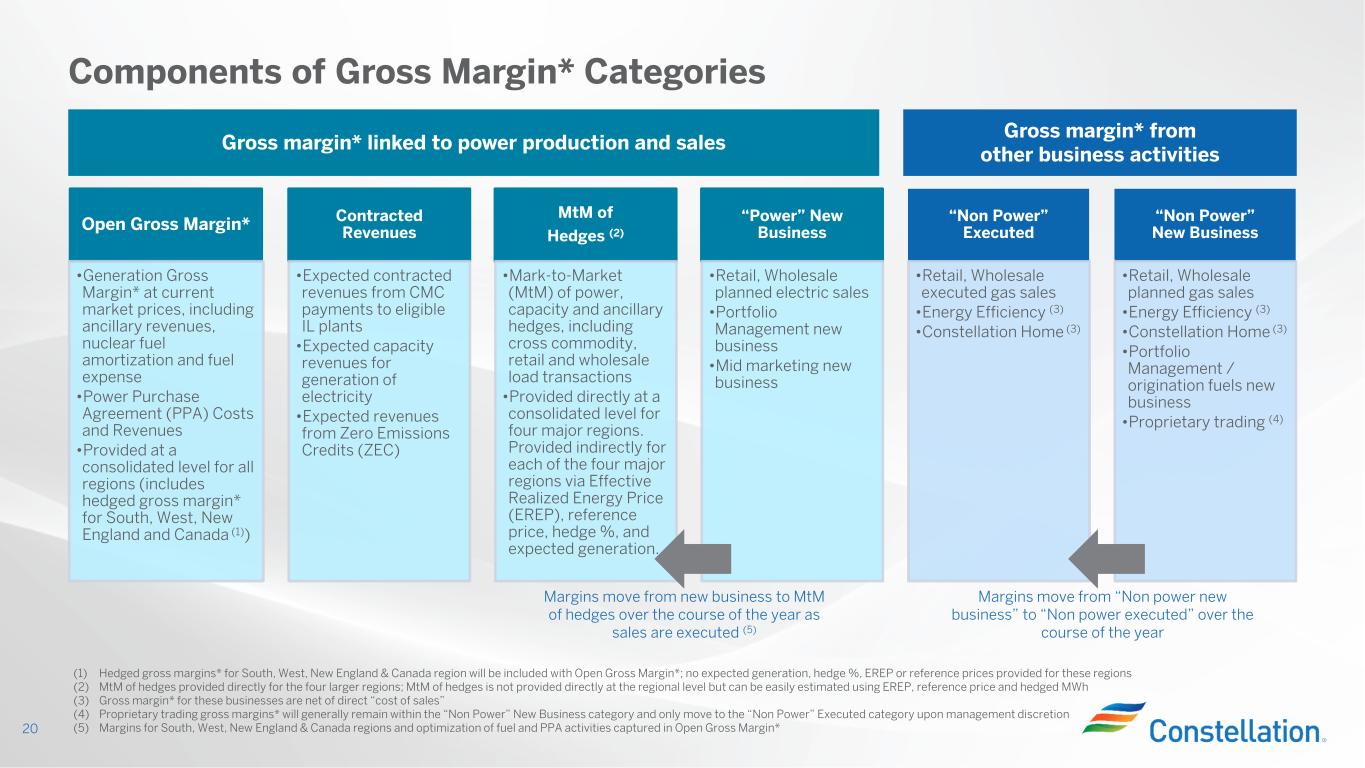

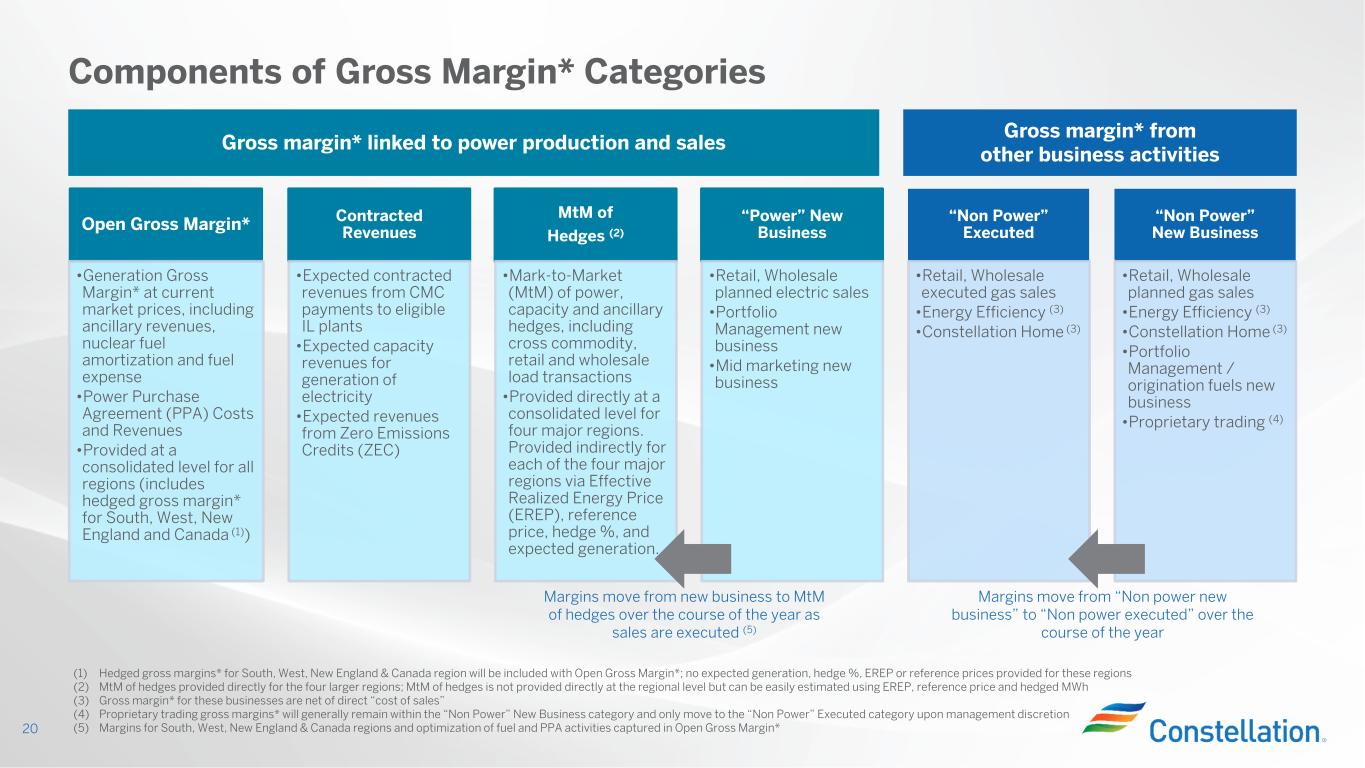

Open Gross Margin* •Generation Gross Margin* at current market prices, including ancillary revenues, nuclear fuel amortization and fuel expense •Power Purchase Agreement (PPA) Costs and Revenues •Provided at a consolidated level for all regions (includes hedged gross margin* for South, West, New England and Canada (1)) Contracted Revenues •Expected contracted revenues from CMC payments to eligible IL plants •Expected capacity revenues for generation of electricity •Expected revenues from Zero Emissions Credits (ZEC) MtM of Hedges (2) •Mark-to-Market (MtM) of power, capacity and ancillary hedges, including cross commodity, retail and wholesale load transactions •Provided directly at a consolidated level for four major regions. Provided indirectly for each of the four major regions via Effective Realized Energy Price (EREP), reference price, hedge %, and expected generation. “Power” New Business •Retail, Wholesale planned electric sales •Portfolio Management new business •Mid marketing new business “Non Power” Executed •Retail, Wholesale executed gas sales •Energy Efficiency (3) •Constellation Home (3) “Non Power” New Business •Retail, Wholesale planned gas sales •Energy Efficiency (3) •Constellation Home (3) •Portfolio Management / origination fuels new business •Proprietary trading (4) Components of Gross Margin* Categories 20 Margins move from new business to MtM of hedges over the course of the year as sales are executed (5) Margins move from “Non power new business” to “Non power executed” over the course of the year Gross margin* linked to power production and sales Gross margin* from other business activities (1) Hedged gross margins* for South, West, New England & Canada region will be included with Open Gross Margin*; no expected generation, hedge %, EREP or reference prices provided for these regions (2) MtM of hedges provided directly for the four larger regions; MtM of hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh (3) Gross margin* for these businesses are net of direct “cost of sales” (4) Proprietary trading gross margins* will generally remain within the “Non Power” New Business category and only move to the “Non Power” Executed category upon management discretion (5) Margins for South, West, New England & Canada regions and optimization of fuel and PPA activities captured in Open Gross Margin*

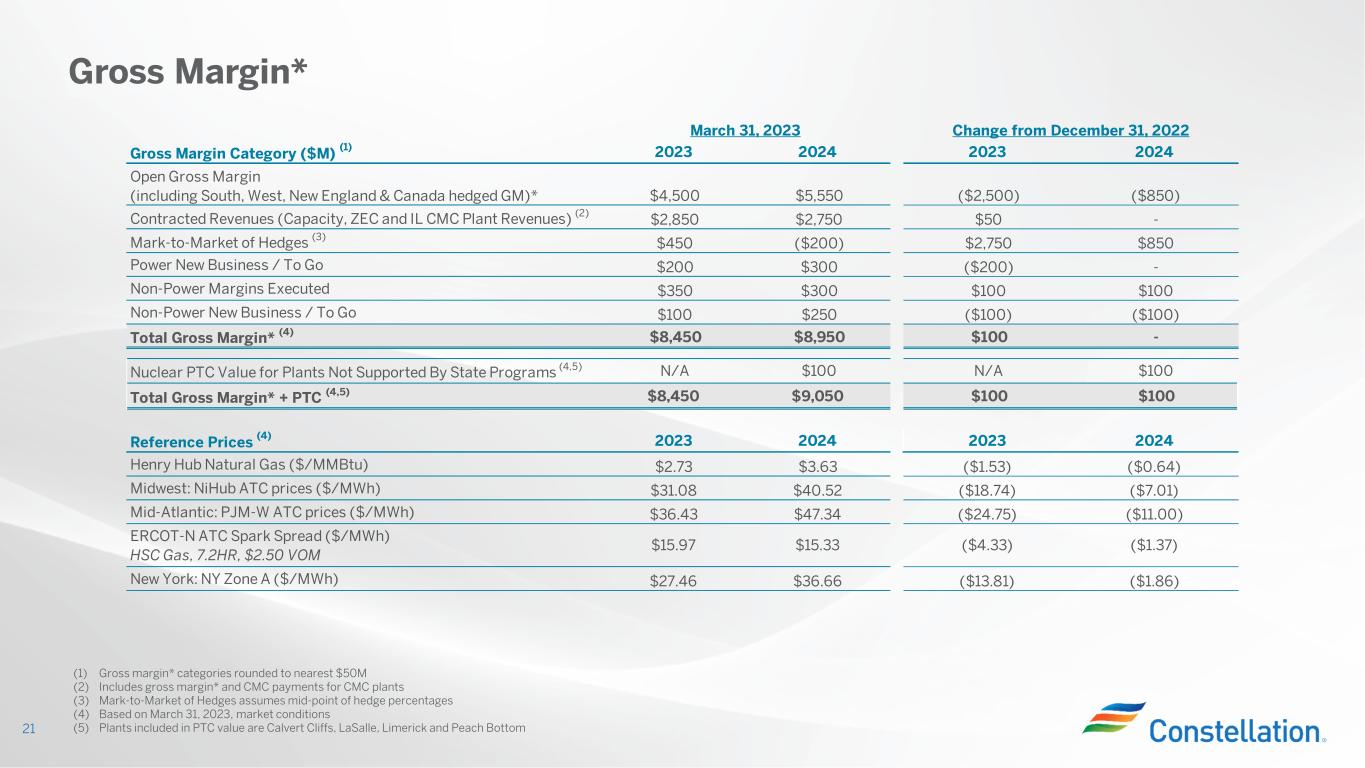

Gross Margin Category ($M) (1) 2023 2024 2023 2024 Open Gross Margin (including South, West, New England & Canada hedged GM)* $4,500 $5,550 ($2,500) ($850) Contracted Revenues (Capacity, ZEC and IL CMC Plant Revenues) (2) $2,850 $2,750 $50 - Mark-to-Market of Hedges (3) $450 ($200) $2,750 $850 Power New Business / To Go $200 $300 ($200) - Non-Power Margins Executed $350 $300 $100 $100 Non-Power New Business / To Go $100 $250 ($100) ($100) Total Gross Margin* (4) $8,450 $8,950 $100 - Nuclear PTC Value for Plants Not Supported By State Programs (4,5) N/A $100 N/A $100 Total Gross Margin* + PTC (4,5) $8,450 $9,050 $100 $100 Reference Prices (4) 2023 2024 2023 2024 Henry Hub Natural Gas ($/MMBtu) $2.73 $3.63 ($1.53) ($0.64) Midwest: NiHub ATC prices ($/MWh) $31.08 $40.52 ($18.74) ($7.01) Mid-Atlantic: PJM-W ATC prices ($/MWh) $36.43 $47.34 ($24.75) ($11.00) ERCOT-N ATC Spark Spread ($/MWh) HSC Gas, 7.2HR, $2.50 VOM $15.97 $15.33 ($4.33) ($1.37) New York: NY Zone A ($/MWh) $27.46 $36.66 ($13.81) ($1.86) March 31, 2023 Change from December 31, 2022 Gross Margin* 21 (1) Gross margin* categories rounded to nearest $50M (2) Includes gross margin* and CMC payments for CMC plants (3) Mark-to-Market of Hedges assumes mid-point of hedge percentages (4) Based on March 31, 2023, market conditions (5) Plants included in PTC value are Calvert Cliffs, LaSalle, Limerick and Peach Bottom

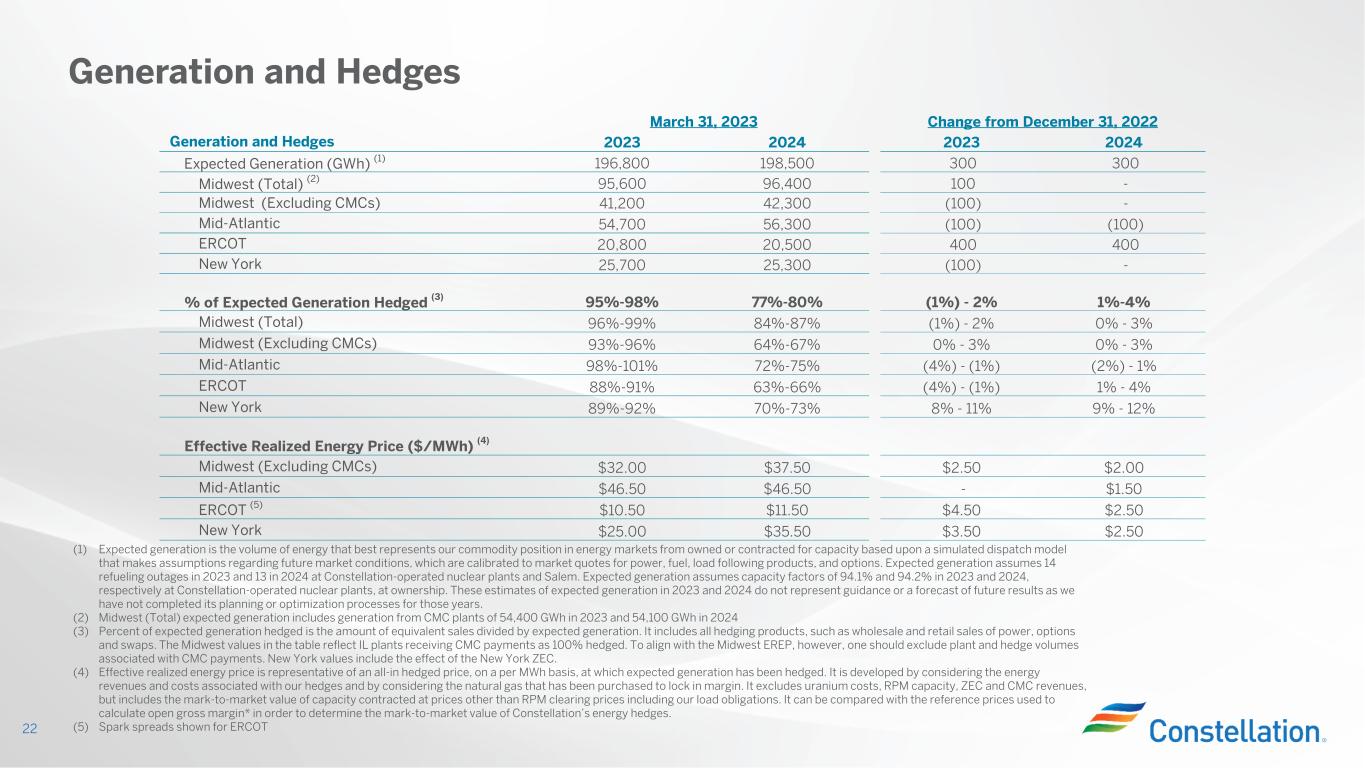

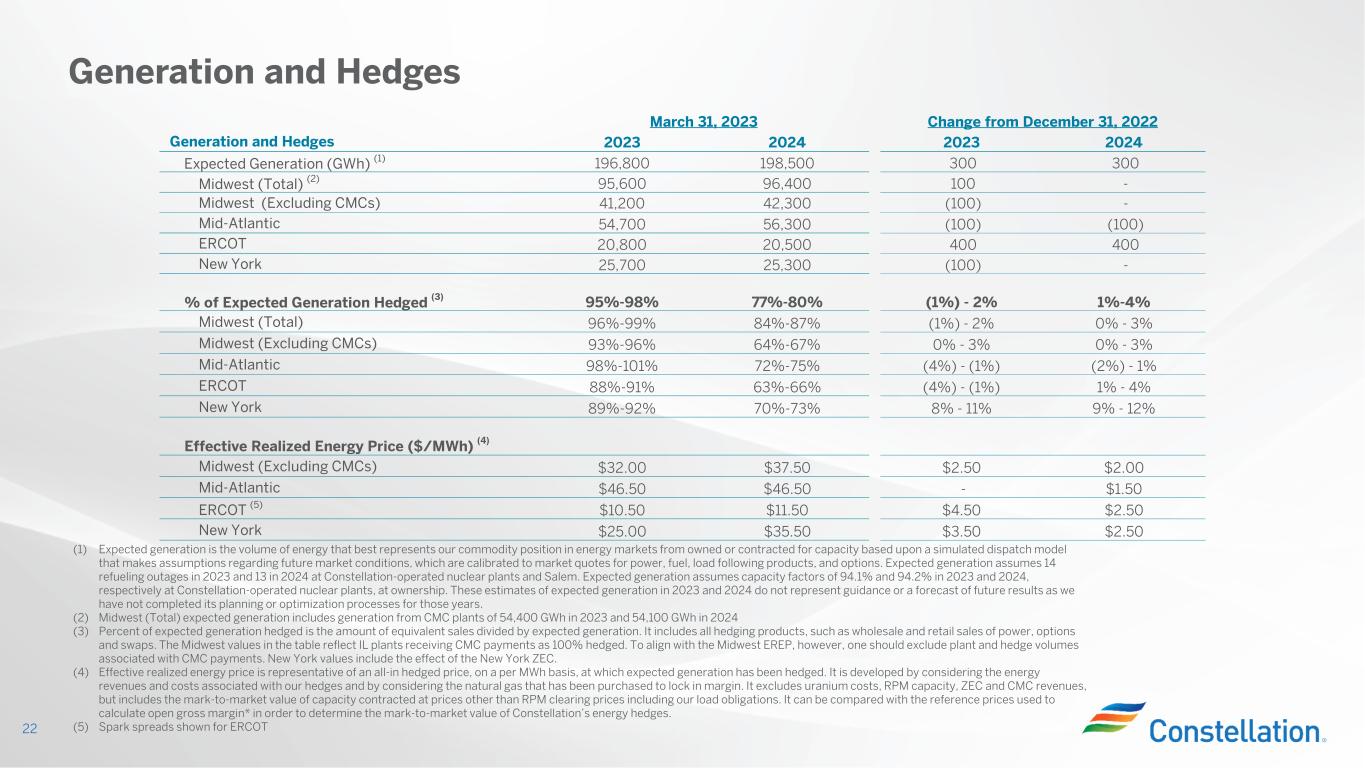

22 (1) Expected generation is the volume of energy that best represents our commodity position in energy markets from owned or contracted for capacity based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 14 refueling outages in 2023 and 13 in 2024 at Constellation-operated nuclear plants and Salem. Expected generation assumes capacity factors of 94.1% and 94.2% in 2023 and 2024, respectively at Constellation-operated nuclear plants, at ownership. These estimates of expected generation in 2023 and 2024 do not represent guidance or a forecast of future results as we have not completed its planning or optimization processes for those years. (2) Midwest (Total) expected generation includes generation from CMC plants of 54,400 GWh in 2023 and 54,100 GWh in 2024 (3) Percent of expected generation hedged is the amount of equivalent sales divided by expected generation. It includes all hedging products, such as wholesale and retail sales of power, options and swaps. The Midwest values in the table reflect IL plants receiving CMC payments as 100% hedged. To align with the Midwest EREP, however, one should exclude plant and hedge volumes associated with CMC payments. New York values include the effect of the New York ZEC. (4) Effective realized energy price is representative of an all-in hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs associated with our hedges and by considering the natural gas that has been purchased to lock in margin. It excludes uranium costs, RPM capacity, ZEC and CMC revenues, but includes the mark-to-market value of capacity contracted at prices other than RPM clearing prices including our load obligations. It can be compared with the reference prices used to calculate open gross margin* in order to determine the mark-to-market value of Constellation’s energy hedges. (5) Spark spreads shown for ERCOT Generation and Hedges Generation and Hedges 2023 2024 2023 2024 Expected Generation (GWh) (1) 196,800 198,500 300 300 Midwest (Total) (2) 95,600 96,400 100 - Midwest (Excluding CMCs) 41,200 42,300 (100) - Mid-Atlantic 54,700 56,300 (100) (100) ERCOT 20,800 20,500 400 400 New York 25,700 25,300 (100) - % of Expected Generation Hedged (3) 95%-98% 77%-80% (1%) - 2% 1%-4% Midwest (Total) 96%-99% 84%-87% (1%) - 2% 0% - 3% Midwest (Excluding CMCs) 93%-96% 64%-67% 0% - 3% 0% - 3% Mid-Atlantic 98%-101% 72%-75% (4%) - (1%) (2%) - 1% ERCOT 88%-91% 63%-66% (4%) - (1%) 1% - 4% New York 89%-92% 70%-73% 8% - 11% 9% - 12% Effective Realized Energy Price ($/MWh) (4) Midwest (Excluding CMCs) $32.00 $37.50 $2.50 $2.00 Mid-Atlantic $46.50 $46.50 - $1.50 ERCOT (5) $10.50 $11.50 $4.50 $2.50 New York $25.00 $35.50 $3.50 $2.50 March 31, 2023 Change from December 31, 2022

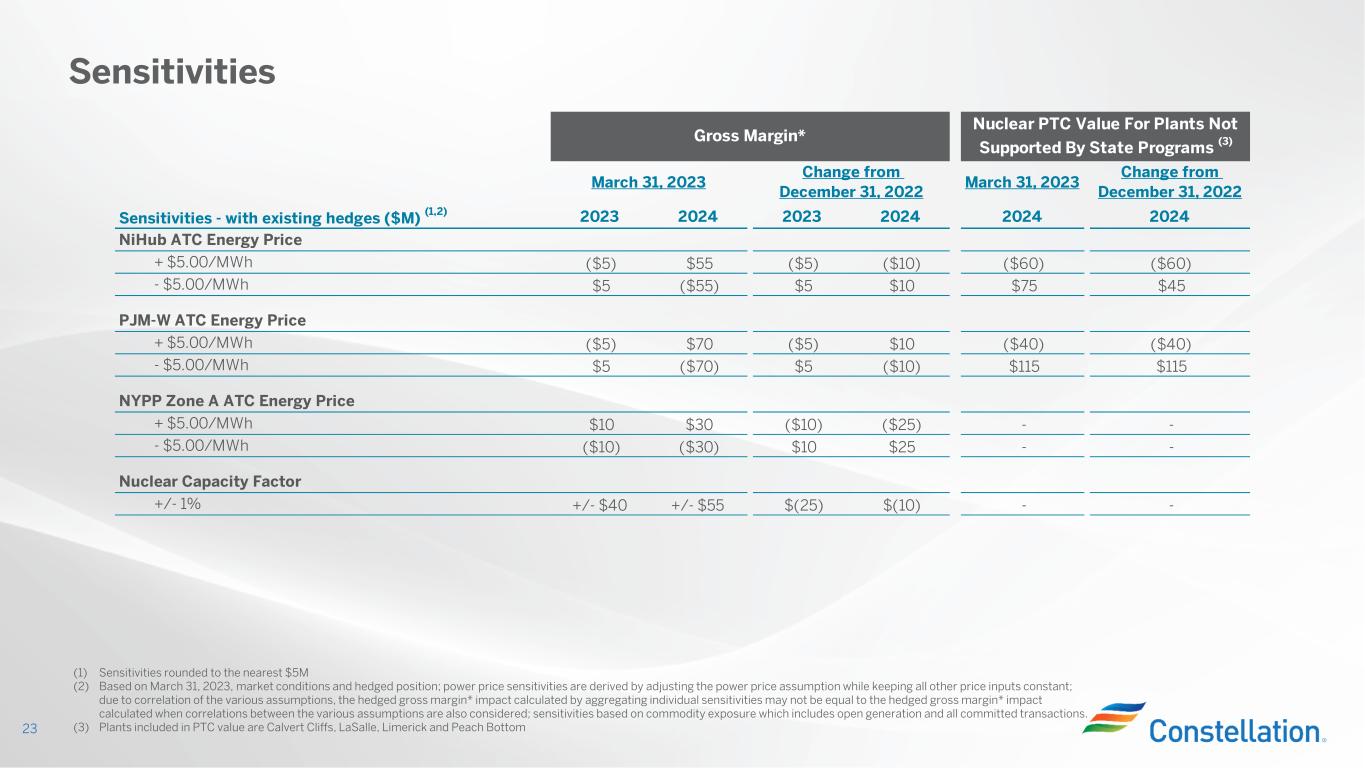

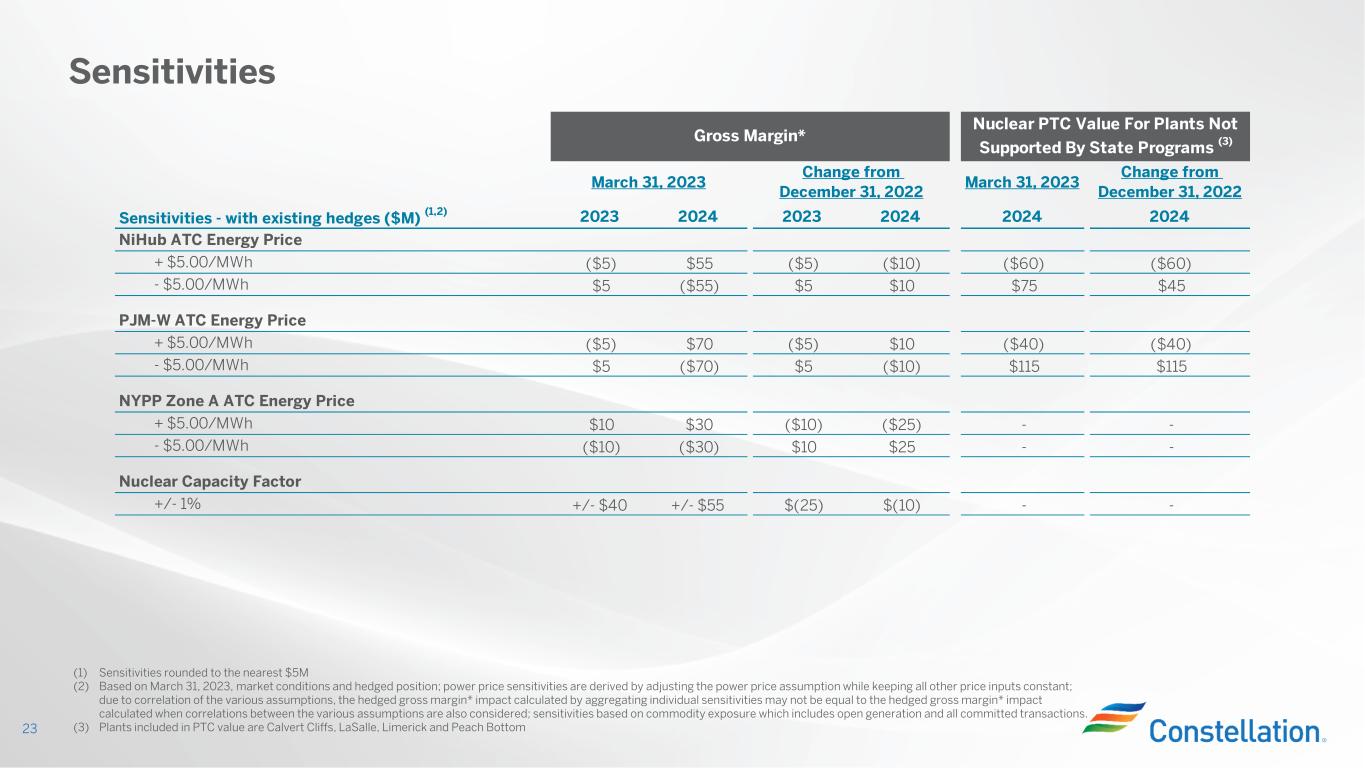

Sensitivities - with existing hedges ($M) (1,2) 2023 2024 2023 2024 2024 2024 NiHub ATC Energy Price + $5.00/MWh ($5) $55 ($5) ($10) ($60) ($60) - $5.00/MWh $5 ($55) $5 $10 $75 $45 PJM-W ATC Energy Price + $5.00/MWh ($5) $70 ($5) $10 ($40) ($40) - $5.00/MWh $5 ($70) $5 ($10) $115 $115 NYPP Zone A ATC Energy Price + $5.00/MWh $10 $30 ($10) ($25) - - - $5.00/MWh ($10) ($30) $10 $25 - - Nuclear Capacity Factor +/- 1% +/- $40 +/- $55 $(25) $(10) - - Nuclear PTC Value For Plants Not Supported By State Programs (3) March 31, 2023 Change from December 31, 2022 March 31, 2023 Change from December 31, 2022 Gross Margin* Sensitivities 23 (1) Sensitivities rounded to the nearest $5M (2) Based on March 31, 2023, market conditions and hedged position; power price sensitivities are derived by adjusting the power price assumption while keeping all other price inputs constant; due to correlation of the various assumptions, the hedged gross margin* impact calculated by aggregating individual sensitivities may not be equal to the hedged gross margin* impact calculated when correlations between the various assumptions are also considered; sensitivities based on commodity exposure which includes open generation and all committed transactions. (3) Plants included in PTC value are Calvert Cliffs, LaSalle, Limerick and Peach Bottom

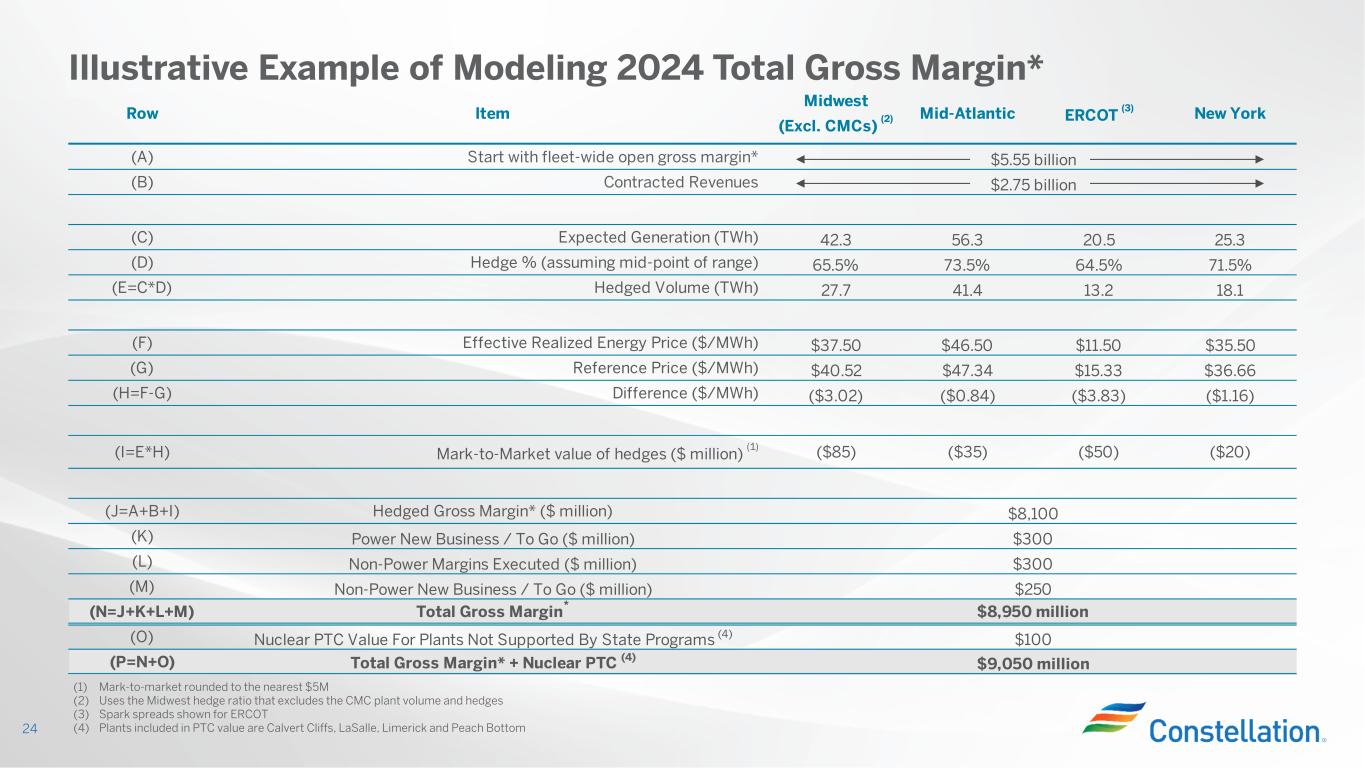

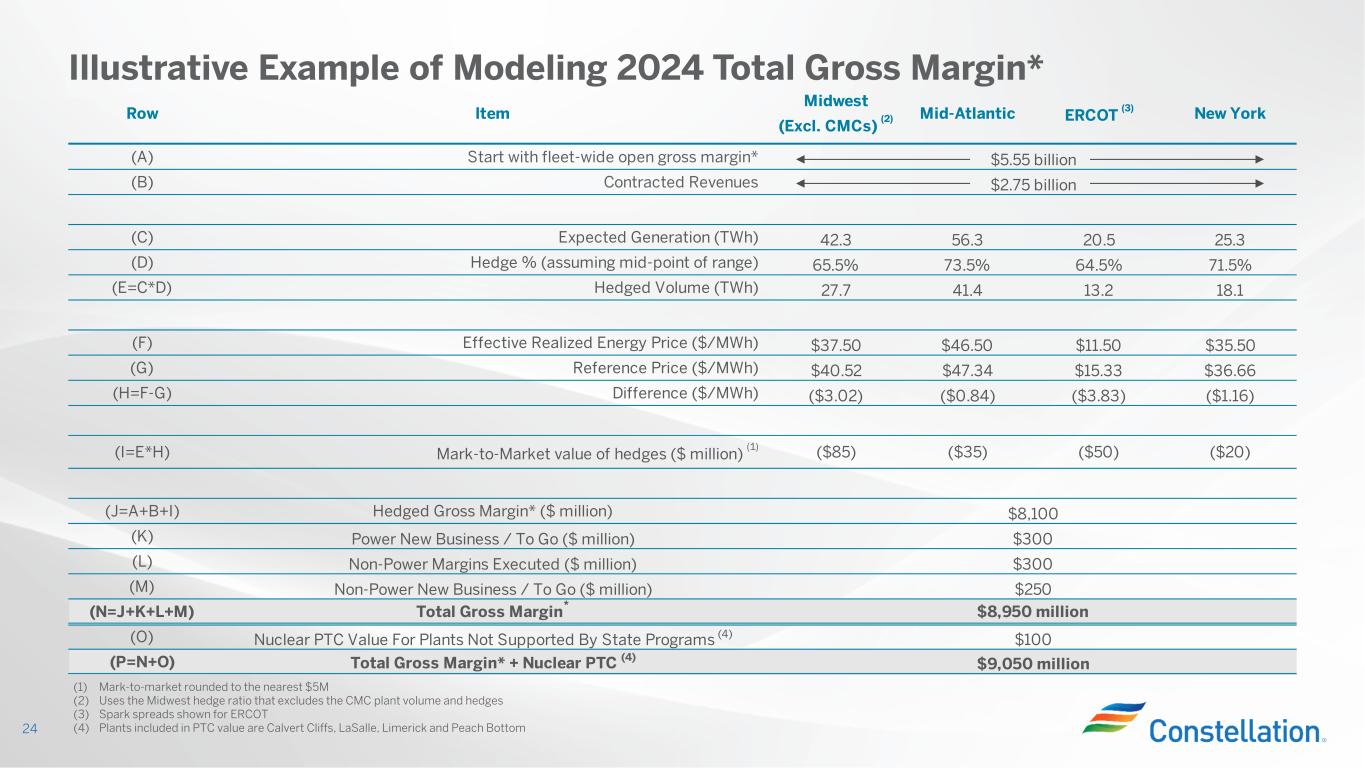

Illustrative Example of Modeling 2024 Total Gross Margin* 24 (1) Mark-to-market rounded to the nearest $5M (2) Uses the Midwest hedge ratio that excludes the CMC plant volume and hedges (3) Spark spreads shown for ERCOT (4) Plants included in PTC value are Calvert Cliffs, LaSalle, Limerick and Peach Bottom Row Item Midwest (Excl. CMCs) (2) Mid-Atlantic ERCOT (3) New York (A) Start with fleet-wide open gross margin* (B) Contracted Revenues (C) Expected Generation (TWh) 42.3 56.3 20.5 25.3 (D) Hedge % (assuming mid-point of range) 65.5% 73.5% 64.5% 71.5% (E=C*D) Hedged Volume (TWh) 27.7 41.4 13.2 18.1 (F) Effective Realized Energy Price ($/MWh) $37.50 $46.50 $11.50 $35.50 (G) Reference Price ($/MWh) $40.52 $47.34 $15.33 $36.66 (H=F-G) Difference ($/MWh) ($3.02) ($0.84) ($3.83) ($1.16) (I=E*H) Mark-to-Market value of hedges ($ million) (1) ($85) ($35) ($50) ($20) (J=A+B+I) Hedged Gross Margin* ($ million) (K) Power New Business / To Go ($ million) (L) Non-Power Margins Executed ($ million) (M) Non-Power New Business / To Go ($ million) (N=J+K+L+M) Total Gross Margin * (O) Nuclear PTC Value For Plants Not Supported By State Programs (4) (P=N+O) Total Gross Margin* + Nuclear PTC (4) $9,050 million $300 $250 $8,950 million $5.55 billion $8,100 $300 $2.75 billion $100

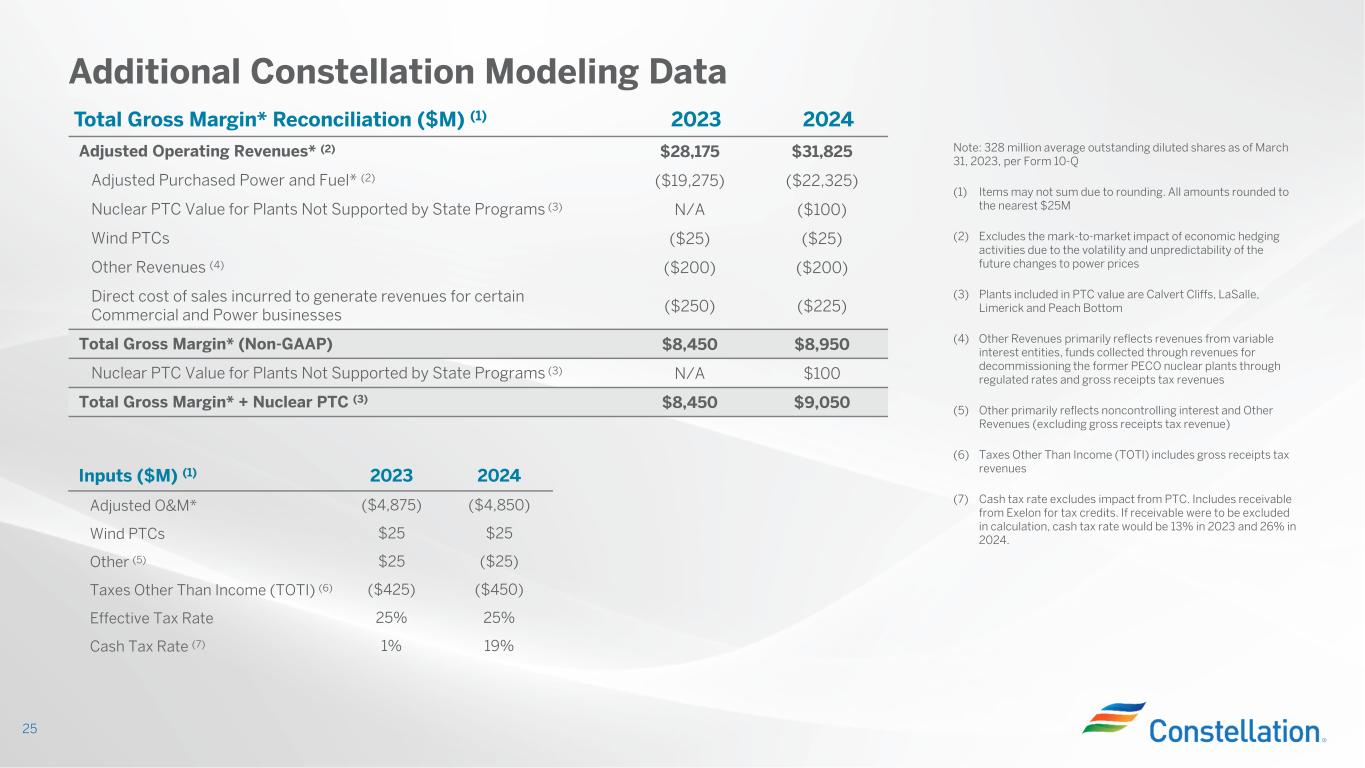

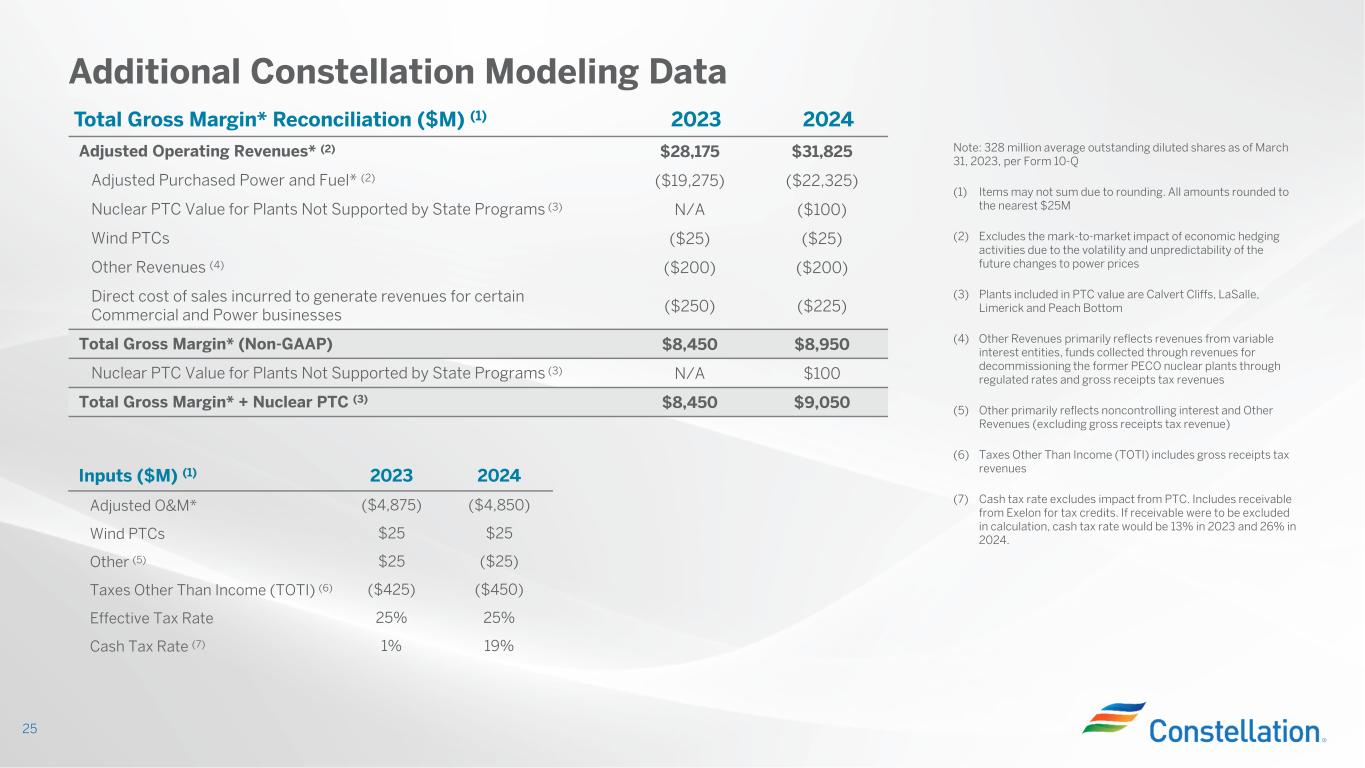

Additional Constellation Modeling Data 25 Total Gross Margin* Reconciliation ($M) (1) 2023 2024 Adjusted Operating Revenues* (2) $28,175 $31,825 Adjusted Purchased Power and Fuel* (2) ($19,275) ($22,325) Nuclear PTC Value for Plants Not Supported by State Programs (3) N/A ($100) Wind PTCs ($25) ($25) Other Revenues (4) ($200) ($200) Direct cost of sales incurred to generate revenues for certain Commercial and Power businesses ($250) ($225) Total Gross Margin* (Non-GAAP) $8,450 $8,950 Nuclear PTC Value for Plants Not Supported by State Programs (3) N/A $100 Total Gross Margin* + Nuclear PTC (3) $8,450 $9,050 Note: 328 million average outstanding diluted shares as of March 31, 2023, per Form 10-Q (1) Items may not sum due to rounding. All amounts rounded to the nearest $25M (2) Excludes the mark-to-market impact of economic hedging activities due to the volatility and unpredictability of the future changes to power prices (3) Plants included in PTC value are Calvert Cliffs, LaSalle, Limerick and Peach Bottom (4) Other Revenues primarily reflects revenues from variable interest entities, funds collected through revenues for decommissioning the former PECO nuclear plants through regulated rates and gross receipts tax revenues (5) Other primarily reflects noncontrolling interest and Other Revenues (excluding gross receipts tax revenue) (6) Taxes Other Than Income (TOTI) includes gross receipts tax revenues (7) Cash tax rate excludes impact from PTC. Includes receivable from Exelon for tax credits. If receivable were to be excluded in calculation, cash tax rate would be 13% in 2023 and 26% in 2024. Inputs ($M) (1) 2023 2024 Adjusted O&M* ($4,875) ($4,850) Wind PTCs $25 $25 Other (5) $25 ($25) Taxes Other Than Income (TOTI) (6) ($425) ($450) Effective Tax Rate 25% 25% Cash Tax Rate (7) 1% 19%

Appendix Reconciliation of Non-GAAP Measures 26

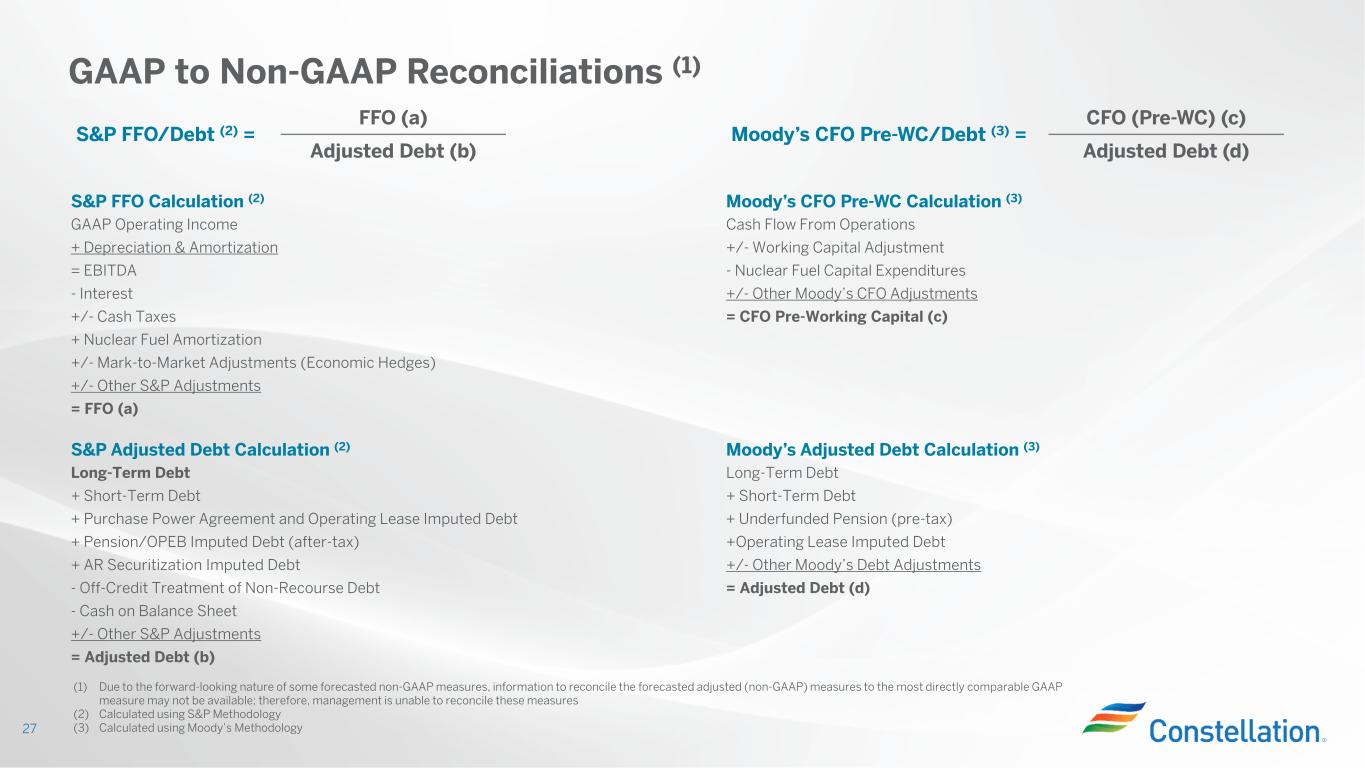

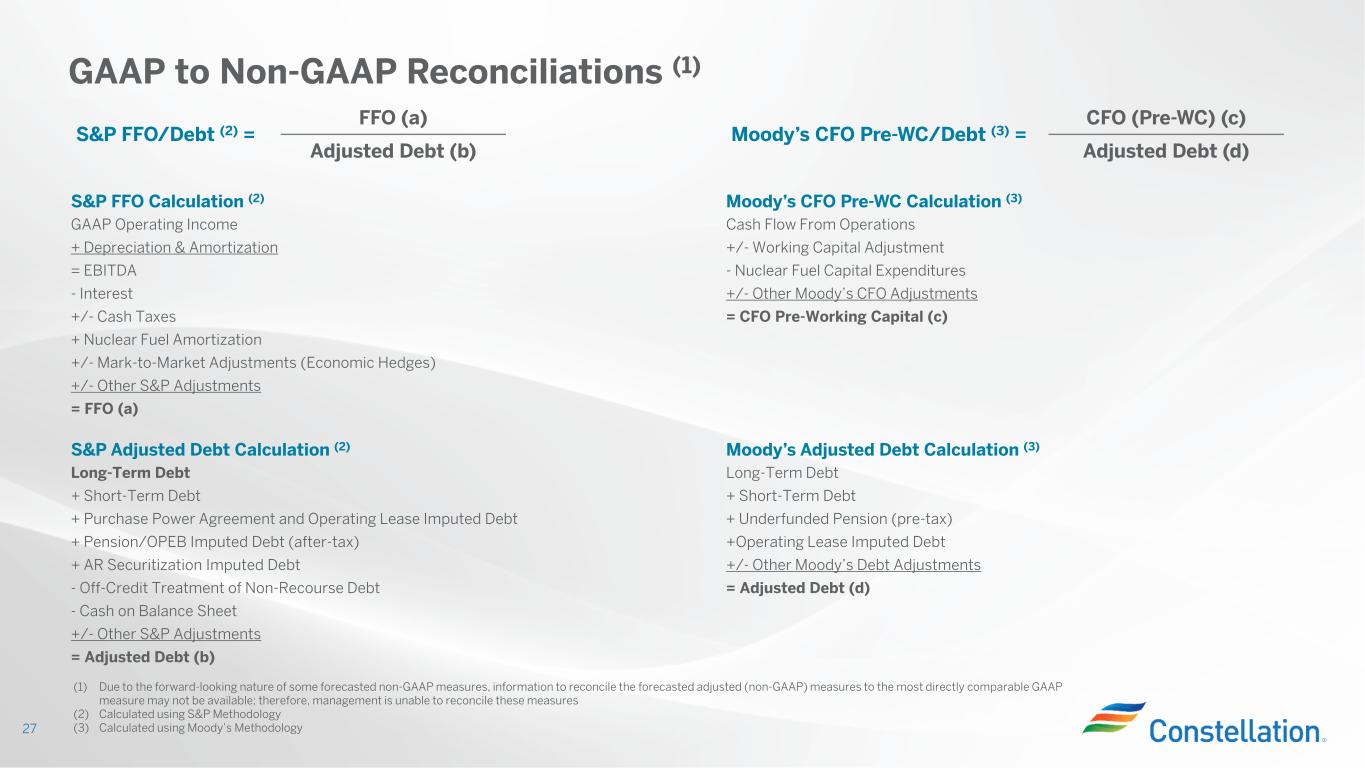

S&P FFO/Debt (2) = FFO (a) Moody’s CFO Pre-WC/Debt (3) = CFO (Pre-WC) (c) Adjusted Debt (b) Adjusted Debt (d) S&P FFO Calculation (2) Moody’s CFO Pre-WC Calculation (3) GAAP Operating Income Cash Flow From Operations + Depreciation & Amortization +/- Working Capital Adjustment = EBITDA - Nuclear Fuel Capital Expenditures - Interest +/- Other Moody’s CFO Adjustments +/- Cash Taxes = CFO Pre-Working Capital (c) + Nuclear Fuel Amortization +/- Mark-to-Market Adjustments (Economic Hedges) +/- Other S&P Adjustments = FFO (a) S&P Adjusted Debt Calculation (2) Moody’s Adjusted Debt Calculation (3) Long-Term Debt Long-Term Debt + Short-Term Debt + Short-Term Debt + Purchase Power Agreement and Operating Lease Imputed Debt + Underfunded Pension (pre-tax) + Pension/OPEB Imputed Debt (after-tax) +Operating Lease Imputed Debt + AR Securitization Imputed Debt +/- Other Moody’s Debt Adjustments - Off-Credit Treatment of Non-Recourse Debt = Adjusted Debt (d) - Cash on Balance Sheet +/- Other S&P Adjustments = Adjusted Debt (b) GAAP to Non-GAAP Reconciliations (1) 27 (1) Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be available; therefore, management is unable to reconcile these measures (2) Calculated using S&P Methodology (3) Calculated using Moody’s Methodology

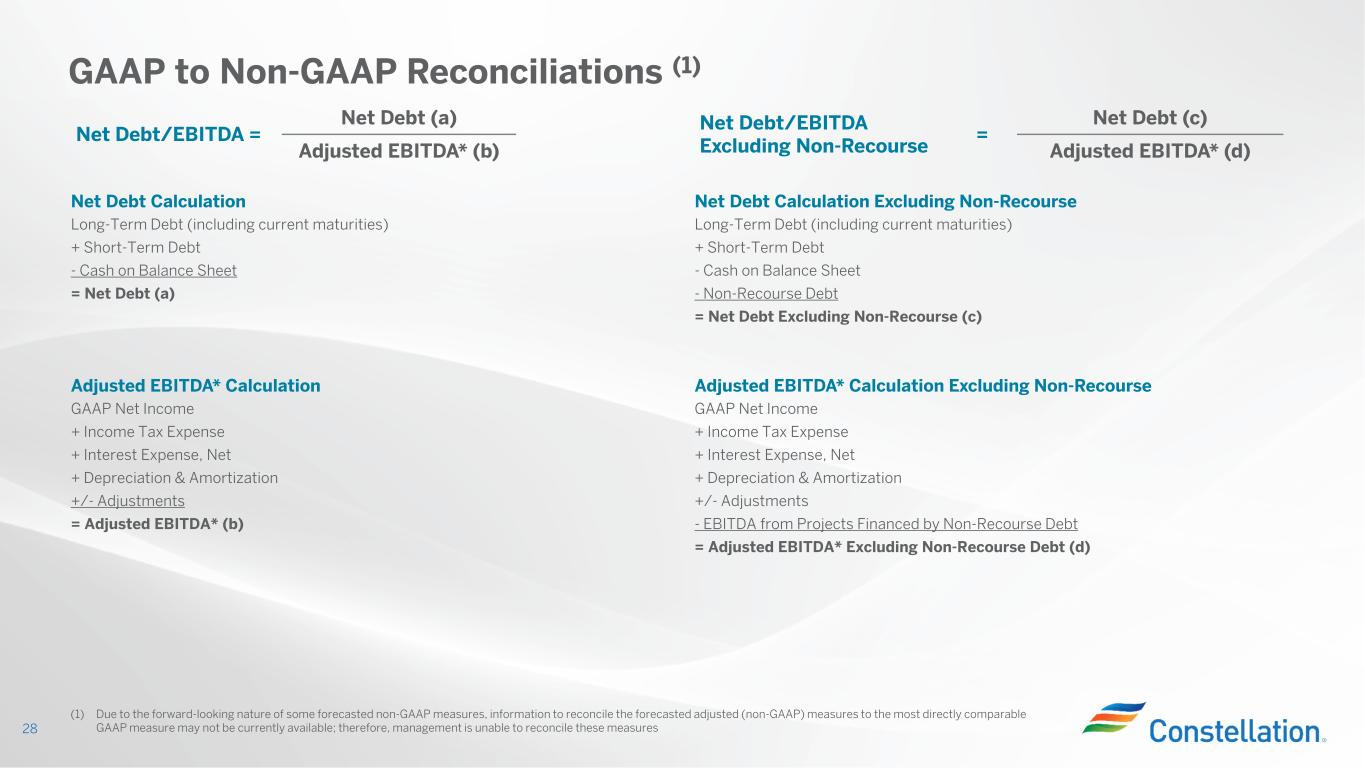

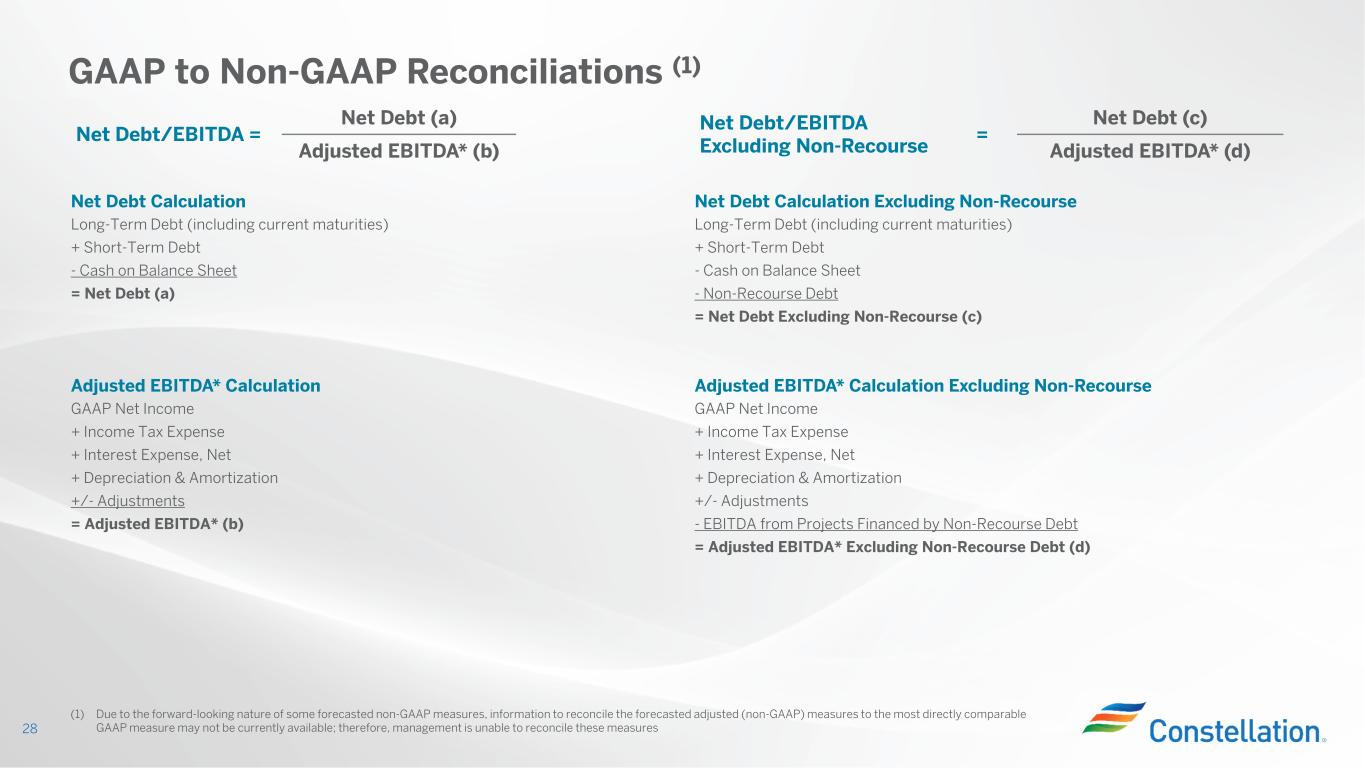

Net Debt/EBITDA = Net Debt (a) Net Debt/EBITDA Excluding Non-Recourse = Net Debt (c) Adjusted EBITDA* (b) Adjusted EBITDA* (d) Net Debt Calculation Net Debt Calculation Excluding Non-Recourse Long-Term Debt (including current maturities) Long-Term Debt (including current maturities) + Short-Term Debt + Short-Term Debt - Cash on Balance Sheet - Cash on Balance Sheet = Net Debt (a) - Non-Recourse Debt = Net Debt Excluding Non-Recourse (c) Adjusted EBITDA* Calculation Adjusted EBITDA* Calculation Excluding Non-Recourse GAAP Net Income GAAP Net Income + Income Tax Expense + Income Tax Expense + Interest Expense, Net + Interest Expense, Net + Depreciation & Amortization + Depreciation & Amortization +/- Adjustments +/- Adjustments = Adjusted EBITDA* (b) - EBITDA from Projects Financed by Non-Recourse Debt = Adjusted EBITDA* Excluding Non-Recourse Debt (d) GAAP to Non-GAAP Reconciliations (1) 28 (1) Due to the forward-looking nature of some forecasted non-GAAP measures, information to reconcile the forecasted adjusted (non-GAAP) measures to the most directly comparable GAAP measure may not be currently available; therefore, management is unable to reconcile these measures

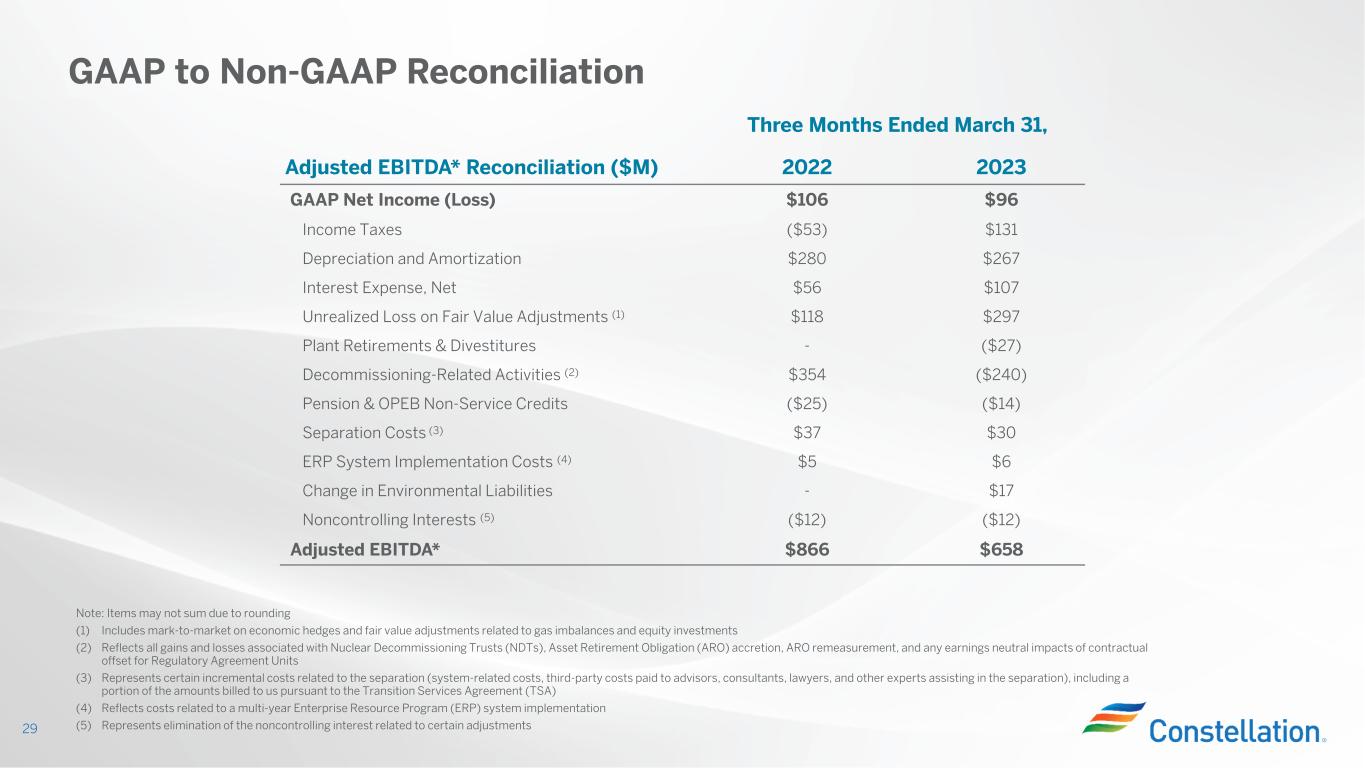

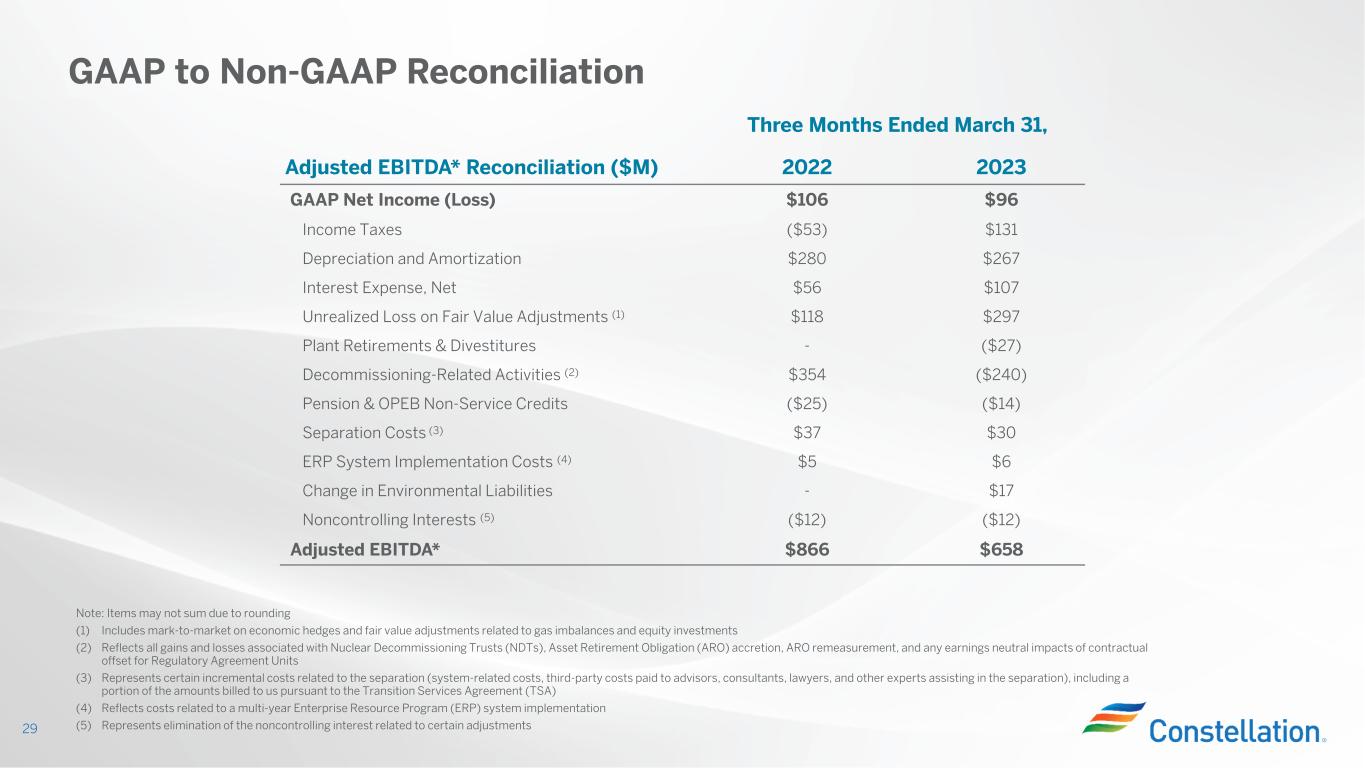

Three Months Ended March 31, Adjusted EBITDA* Reconciliation ($M) 2022 2023 GAAP Net Income (Loss) $106 $96 Income Taxes ($53) $131 Depreciation and Amortization $280 $267 Interest Expense, Net $56 $107 Unrealized Loss on Fair Value Adjustments (1) $118 $297 Plant Retirements & Divestitures - ($27) Decommissioning-Related Activities (2) $354 ($240) Pension & OPEB Non-Service Credits ($25) ($14) Separation Costs (3) $37 $30 ERP System Implementation Costs (4) $5 $6 Change in Environmental Liabilities - $17 Noncontrolling Interests (5) ($12) ($12) Adjusted EBITDA* $866 $658 GAAP to Non-GAAP Reconciliation 29 Note: Items may not sum due to rounding (1) Includes mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments (2) Reflects all gains and losses associated with Nuclear Decommissioning Trusts (NDTs), Asset Retirement Obligation (ARO) accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units (3) Represents certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the Transition Services Agreement (TSA) (4) Reflects costs related to a multi-year Enterprise Resource Program (ERP) system implementation (5) Represents elimination of the noncontrolling interest related to certain adjustments

Contact Information InvestorRelations@constellation.com (833) 447-2783 Links Events and Presentations ESG Resources Reports & SEC Filings