Exhibit 99.2

Company Overview November 2022

Important Information and Where to Find it In connection with the proposed business combination, Western will file a registration statement on Form S - 4 with the SEC. The Form S - 4 will include a proxy statement/prospectus of Western. Additionally, Western will file other relevant materials with the SEC in connection with the business combination. Copies may be obtained free of charge at the SEC’s web site at www.sec.gov . Securities holders of Western are urged to read the Form S - 4 and the other relevant materials when they become available before making any voting decision with respect to the proposed business combination because they will contain important information about the business combination and the parties to the business combination. The information contained on, or that may be accessed through, the websites referenced in this presentation is not incorporated by reference into, and is not a part of, this presentation. Participants in the Solicitation Western and its directors and executive officers may be deemed participants in the solicitation of proxies from Western’s stockholders with respect to the proposed business combination . A list of the names of those directors and executive officers and a description of their interests in Western will be included in the Form S - 4 for the proposed business combination and be available at www . sec . gov . Additional information regarding the interests of such participants will be contained in the Form S - 4 for the proposed business combination when available . Information about Western’s directors and executive officers and their ownership of Western common stock is set forth in Western’s prospectus, dated January 11 , 2022 , as modified or supplemented by any Form 3 s or Form 4 s filed with the SEC since the date of the prospectus . Other information regarding the interests of the participants in the proxy solicitation will be included in the Form S - 4 pertaining to the proposed business combination when it becomes available . These documents can be obtained free of charge from the sources indicated above . Cycurion and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Western in connection with the proposed business combination . A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination will be included in the Form S - 4 for the proposed business combination . D i s cla i m er

Forward Looking Statements The information in this press release includes “forward - looking statements” within the meaning of “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward - looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “shall,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” “forecast,” “intend,” “plan,” “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Examples of forward - looking statements include, among others, statements made in this Presentation regarding the proposed transactions contemplated by the business combination agreement, including the potential benefits of the transaction, integration plans, expected synergies and revenue opportunities; anticipated future financial and operating performance and results, including estimates for growth; the expected management and governance of the combined enterprise; and the expected timing of the closing of the transaction. Forward - looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on Western’s and Cycurion’s managements’ current beliefs, expectations and assumptions. Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the parties’ control. Actual results and outcomes may differ materially from those indicated in the forward - looking statements. Therefore, you should not rely on any of these forward - looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward - looking statements include, among others, the following: (1) the occurrence of any event, change, or other circumstances that could give rise to the termination of the business combination agreement; (2) the outcome of any legal proceedings that may be instituted against Western and Cycurion following the announcement of the business combination agreement and the transactions contemplated therein; (3) the inability to complete the proposed business combination for reasons that could include failure to obtain approval of the stockholders of Western and Cycurion, certain regulatory approvals, or satisfaction of other conditions to closing in the business combination agreement; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the transactions contemplated by the business combination agreement or could otherwise cause the transaction to fail to close; (5) the impact of COVID - 19 pandemic on Cycurion’s business and/or the ability of the parties to complete the proposed business combination; (6) the inability to obtain or maintain the listing of Western’s shares of Common Stock on Nasdaq following the closing of the transactions contemplated by the business combination agreement; (7) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and its consummation; (8) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of Cycurion to grow and to manage its growth profitably, and retain its key employees; (9) costs related to the proposed business combination; (10) changes in applicable laws or regulations; (11) the possibility that Western or Cycurion may be adversely affected by other economic, business, and/or competitive factors; (12) risks relating to the uncertainty of the projected financial information with respect to Cycurion; (13) risks related to the organic and inorganic growth of Cycurion’s business; (14) the amount of redemption requests made by Western’s stockholders; and (15) other risks and uncertainties indicated from time to time set forth in the final prospectus of Western for its initial public offering dated January 11, 2022 filed with the SEC under “Risk Factors” therein, and in Western’s other filings with the SEC. Western cautions that the foregoing list of factors is not exclusive. Western and Cycurion caution readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Western and Cycurion do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its their expectations or any change in events, conditions, or circumstances on which any such statement is based. D i s cla i m er

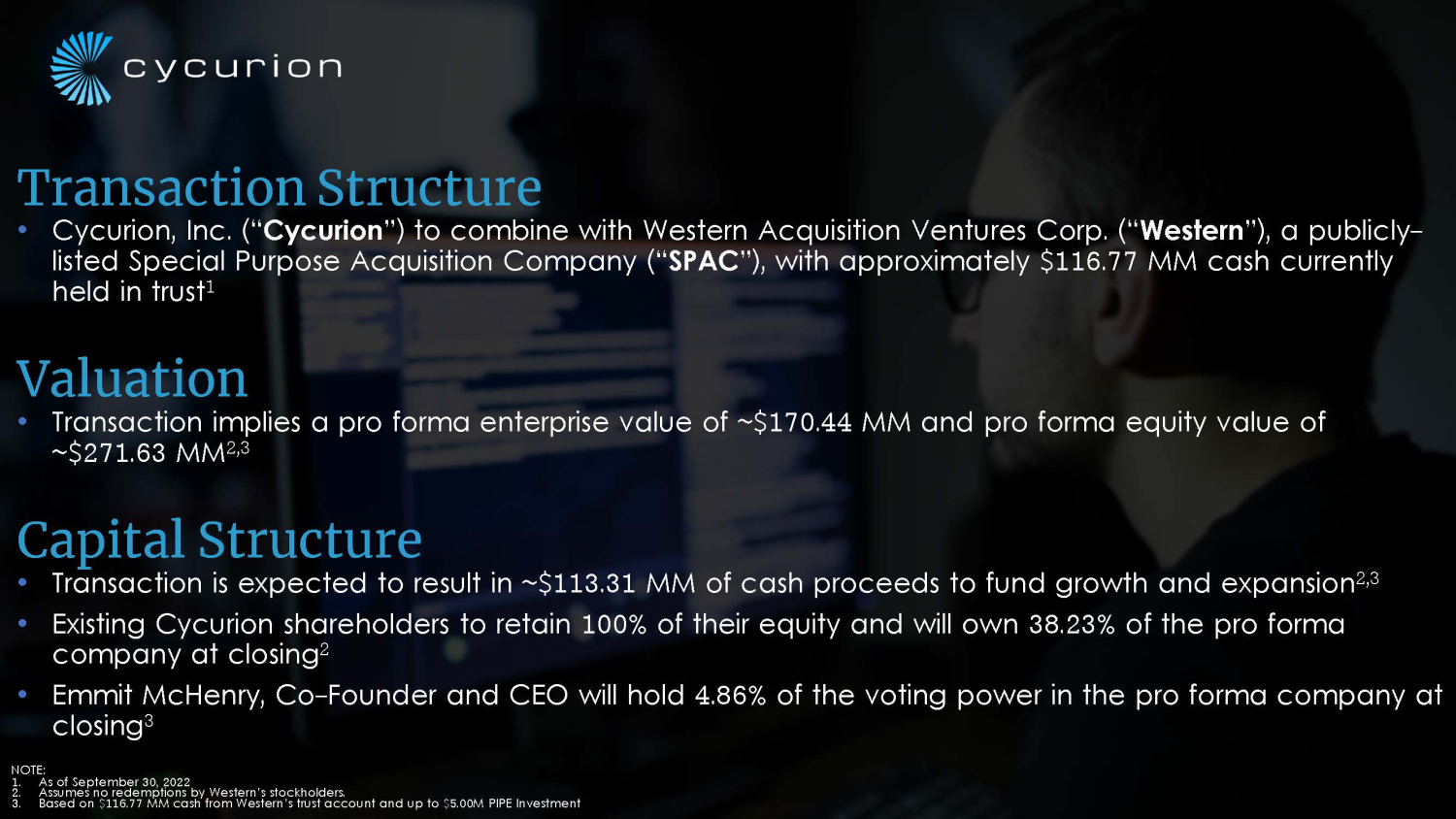

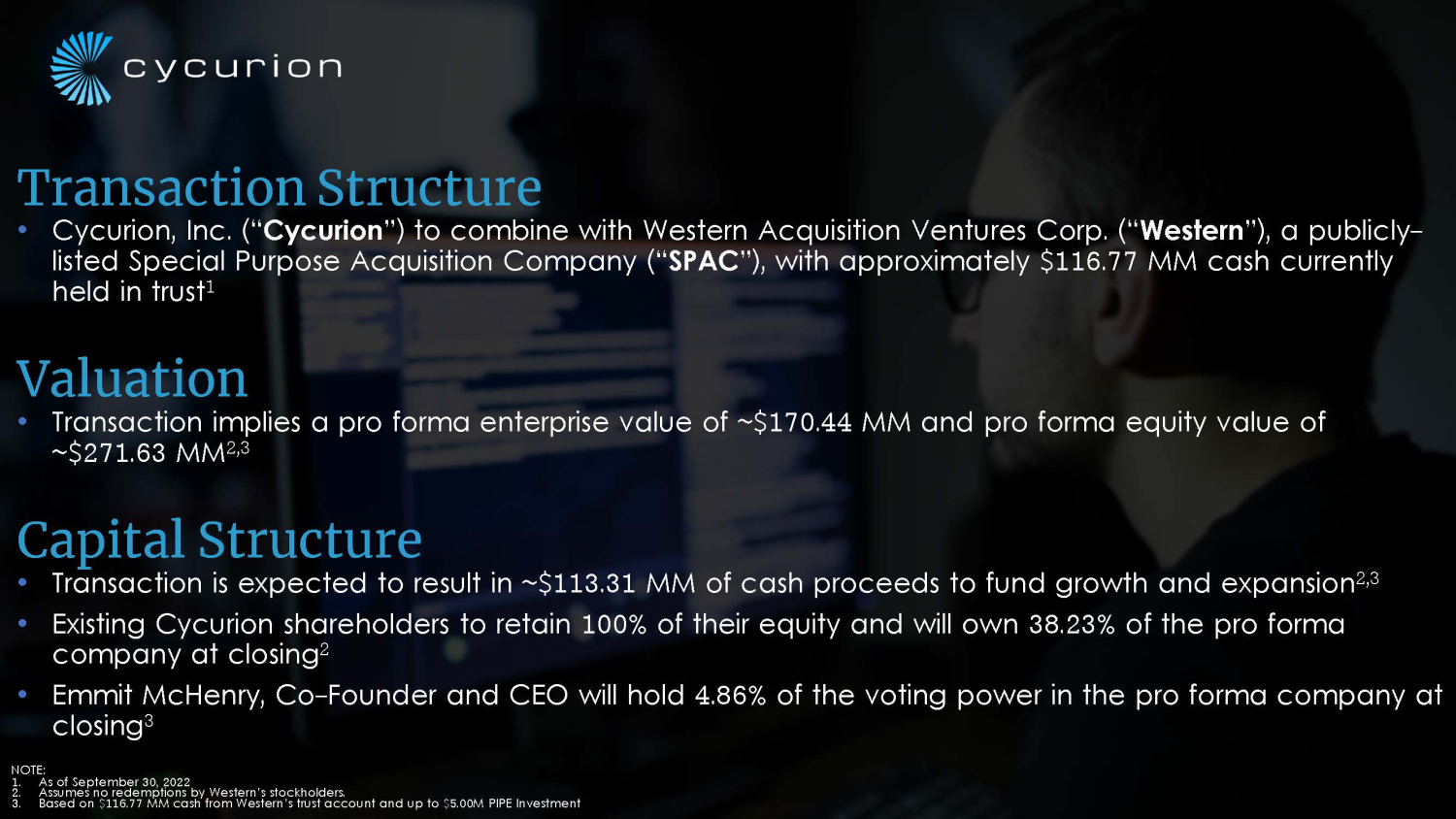

Transaction Structure • Cycurion, Inc. (“ Cycurion ”) to combine with Western Acquisition Ventures Corp. (“ Western ”), a publicly - listed Special Purpose Acquisition Company (“ SPAC ”), with approximately $116.77 MM cash currently held in trust 1 Valuation • Transaction implies a pro forma enterprise value of ~$170.44 MM and pro forma equity value of ~$271.63 MM 2,3 Capital Structure • Transaction is expected to result in ~$113.31 MM of cash proceeds to fund growth and expansion 2,3 • Existing Cycurion shareholders to retain 100% of their equity and will own 38.23% of the pro forma company at closing 2 • Emmit McHenry, Co - Founder and CEO will hold 4.86% of the voting power in the pro forma company at closing 3 NOTE: 1. As of September 30, 2022 2. Assumes no redemptions by Western’s stockholders. 3. Based on $116.77 MM cash from Western’s trust account and up to $5.00M PIPE Investment

NOTE: 1. Assumes no redemptions by the public shareholders of Western 2. Reflects the conversion of Cycurion’s outstanding convertible notes and/or preferred stock, which will convert into common stock of the combined company 3. As of September 30, 2022 4. Up to $5.00M PIPE Investment 5. Estimate of and Western’s aggregate investment banking, deferred underwriting, legal, SEC and stock exchange, printing and consulting fees and expenses 6. As of November 21, 2022 7. Inclusive of Cycurion’s cash balance as of November 21, 2022 (Source: Management Accounts) Transaction Overview Illustrative Sources (1) Pro Forma Valuation Cycurion Equity (2) $ 95.00 Share Price ($ / sh.) $ 10.00 SPAC Cash in Trust (3) 116.77 Pro Forma Shares Outstanding (1)(2) 27.16 PIPE Cash 5.00 Implied Equity Value 271.63 Total Sources $ 216.7 7 (+) Debt (6) 14.73 ( - ) Pro Forma Cash (7) 115.91 Uses (1) Enterprise Value 170.44 Cycurion Equity $95.00 34.97% Cycurion Shareholders 42.34% IPO Shareholders 10.72% PIPE and Bridge Investors 11.97% Western Sponsor Cash to Balance Sheet 113.31 Transaction Expenses (5) 8.45 Total Uses $ 216.7 7

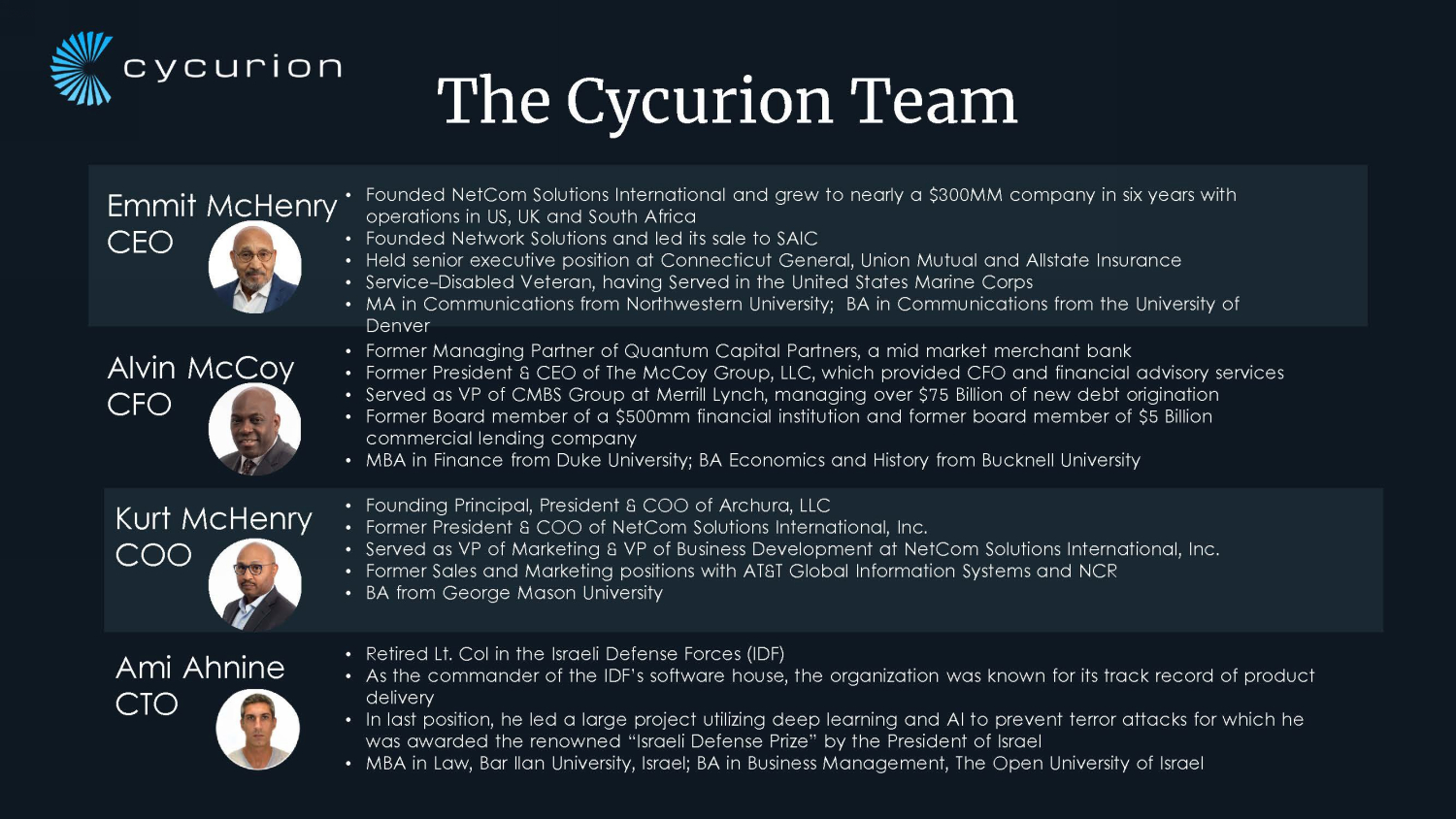

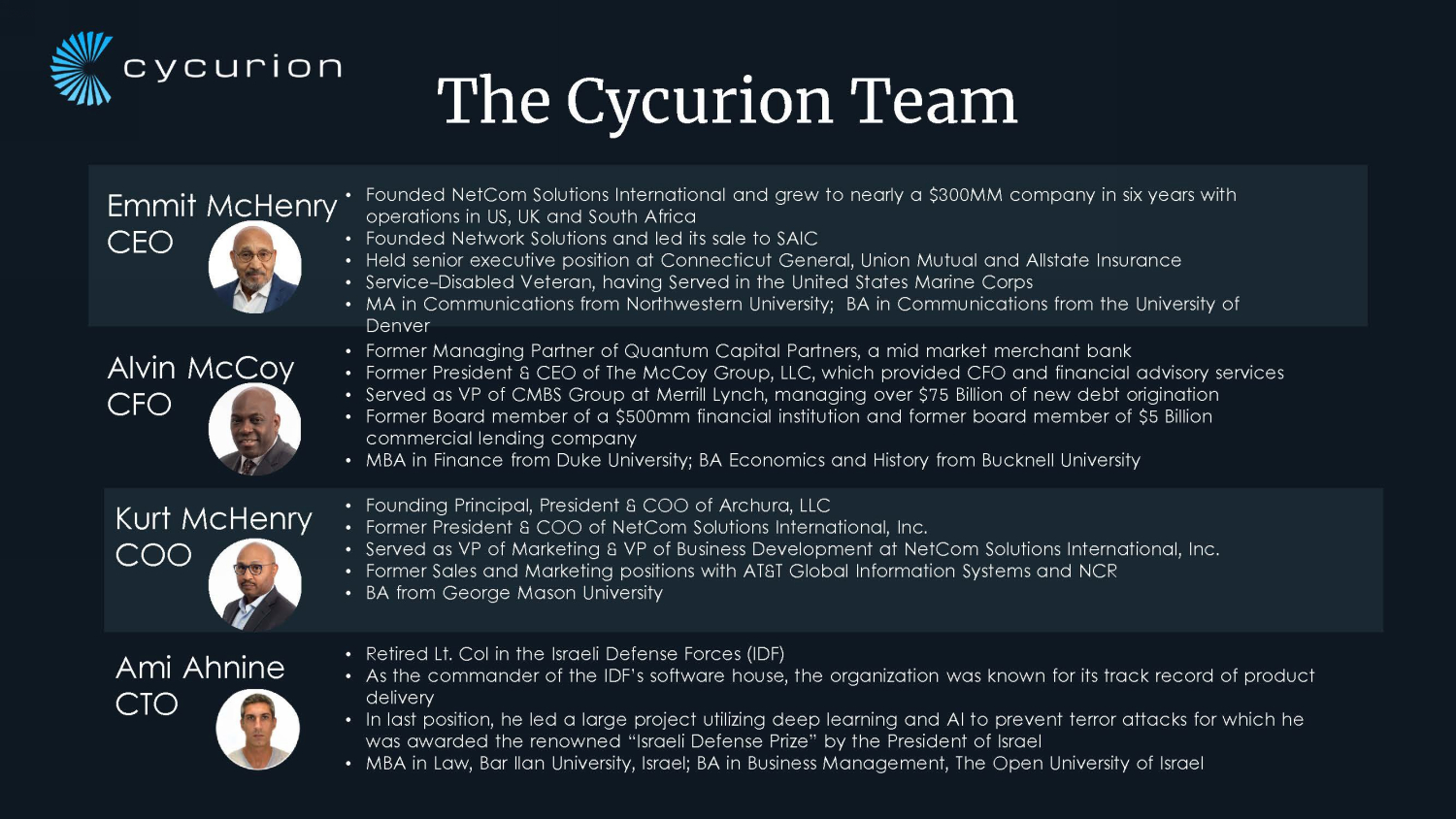

The Cycurion Team C E O Alvin McCoy CFO Emmit McHenry • Founded NetCom Solutions International and grew to nearly a $300MM company in six years with operations in US, UK and South Africa • Founded Network Solutions and led its sale to SAIC • Held senior executive position at Connecticut General, Union Mutual and Allstate Insurance • Service - Disabled Veteran, having Served in the United States Marine Corps • MA in Communications from Northwestern University; BA in Communications from the University of Denver Kurt McHenry COO • Former Managing Partner of Quantum Capital Partners, a mid market merchant bank • Former President & CEO of The McCoy Group, LLC, which provided CFO and financial advisory services • Served as VP of CMBS Group at Merrill Lynch, managing over $75 Billion of new debt origination • Former Board member of a $500mm financial institution and former board member of $5 Billion commercial lending company • MBA in Finance from Duke University; BA Economics and History from Bucknell University • Founding Principal, President & COO of Archura, LLC • Former President & COO of NetCom Solutions International, Inc. • Served as VP of Marketing & VP of Business Development at NetCom Solutions International, Inc. • Former Sales and Marketing positions with AT&T Global Information Systems and NCR • BA from George Mason University Ami Ahnine CTO • Retired Lt. Col in the Israeli Defense Forces (IDF) • As the commander of the IDF’s software house, the organization was known for its track record of product delivery • In last position, he led a large project utilizing deep learning and AI to prevent terror attacks for which he was awarded the renowned “Israeli Defense Prize” by the President of Israel • MBA in Law, Bar Ilan University, Israel; BA in Business Management, The Open University of Israel

• CEO of Range Ventures, LLC • BOD and CFO for XS Financial, Inc. (CSE: XSF) • Former CFO of KushCo Holdings Inc. (OTCQX:KSHB) • Former VP of Investment Strategist for Comerica Asset Management • Managing Partner, OKA Holdings, LLC • Chief Operating Officer, Techni - Tool Inc. • Former Investment Professional Arcis Equity Partners LLC • Former Merger Arbitrage & High Yield Credit Trader at Taconic • Former M&A Investment Professional at Credit Suisse Group AG Stephen Christoffersen, CFA, Chief Executive Officer Ade Okunubi, MBA, CFA, Director • CEO - RightsTrade, LLC • Former CFO - Johnson Management Group • Former CFO - PIXOMONDO STUDIOS Gmbh & Co • Former Co - President & COO - OddLot Entertainment LLC • Former President, COO, & CFO - First Look Studios William Lischak, CPA, MST, Chief Financial Officer • Founder, Chairman & President of the Cura Foundation • Former Chairman & CEO of NeoStem (NASDAQ: NBS) • Former Chairman of Mynd Analytics (NASDAQ: MYND) • Founder & President of the Cura Foundation • BOD of NYU Langone & BOT of Sanford Health • Current/previous BOD experience: SRNE, GXGX, SREV, SEEL & RMTI Robin L. Smith, MD, MBA, Director Adam K. Stern, Director • CEO of SternAegis Ventures • Head of Private Equity Banking at Aegis Capital • Former Senior Managing Director at Spencer Trask Ventures • Former Head of PE & MD at Josephthal & Co. • Current/previous BOD experience: DRIO, ONVO, MYNB & HYFM The Western Team

The total cost of cybercrime attacks could reach $10.5 trillion by 2025, representing a CAGR of 15% over the next five years. Source: Cybersecurity Ventures • “As the world is increasing interconnected, everyone shares the responsibility of securing cyberspace.” - Newton Lee • “Cyberattacks are becoming an increasingly common weapon used to steal valuable information and destabilize our national security.” - Senator Marco Rubio • • • • “There two types of companies — those who have been hacked and those that will be.” - Robert Mueller “In the future, cyber threat will equal or even eclipse the terrorist threat.” - Robert Mueller “As cyber threats evolve, we need to evolve as well.” - Christopher A. Wray “The cyber threat is….one of the most serious economic and security challenges we face as a nation.” - President Barack Obama Cyber Attacks are Existential Threats

Cybersecurity products and services could reach $174 billion in 2024, representing a CAGR 8.1% for the period 2020 - 2024. Source: IDC • US is estimated to be the largest market, followed by China and the UK. Gartner projects the global cybersecurity spend to reach $207 billion by 2024. • Gartner predicts spending on Cloud Security solutions will grow 37% in 2022 and 33% in 2023, outpacing all other information security markets. • Ransomware attacks on governmental institutions increased by 47% in 2021. Cyberattacks on healthcare organizations increased 71% in 2021. Source: Check Point • President Biden proposed $11 billion in civilian cybersecurity funding for fiscal 2023. The DoD requested another $11.2 billion, bringing total government spending on cybersecurity to over $20 billion in 2023. • According to World Economic Forum (WEF), majority of cybercrime often goes undetected especially data breaches in organizations. Cybersecurity Total Addressable Market

In the age of Digital Transformation, the growing risk of cyber - piracy requires unique solutions to protect sensitive data and prevent data breaches for the privacy of patients, clients, partners, and organizations. Cycurion is committed to delivering cybersecurity solutions that protect our clients’ high value assets. Quick Facts • 45 Active Contracts • 2021 Year End Annual Revenue ~$16.9MM • 2021 Adj. EBITDA ~ $1.7MM • The Cycurion Security Platform: Cycurion has developed a multi - layered SaaS solution to protect clients’ digital assets while minimizing false positives. • Headquarters: McLean, Virginia • R&D: Tel Aviv, Israel • Staff: 80 • Skilled staff holding impressive list of industry certifications • DoD Cleared Facilities Company Snapshot

Government Commercial Key Clients and Partners

Our Vision is to be the leading provider of cybersecurity solutions and services Managed IT Services Managed Security Solutions Cycurion Cybersecurity Platform Consulting and Advisory Services Our Mission is to protect our clients’ digital assets by partnering the right tools and data with the right resources and competencies Business Description

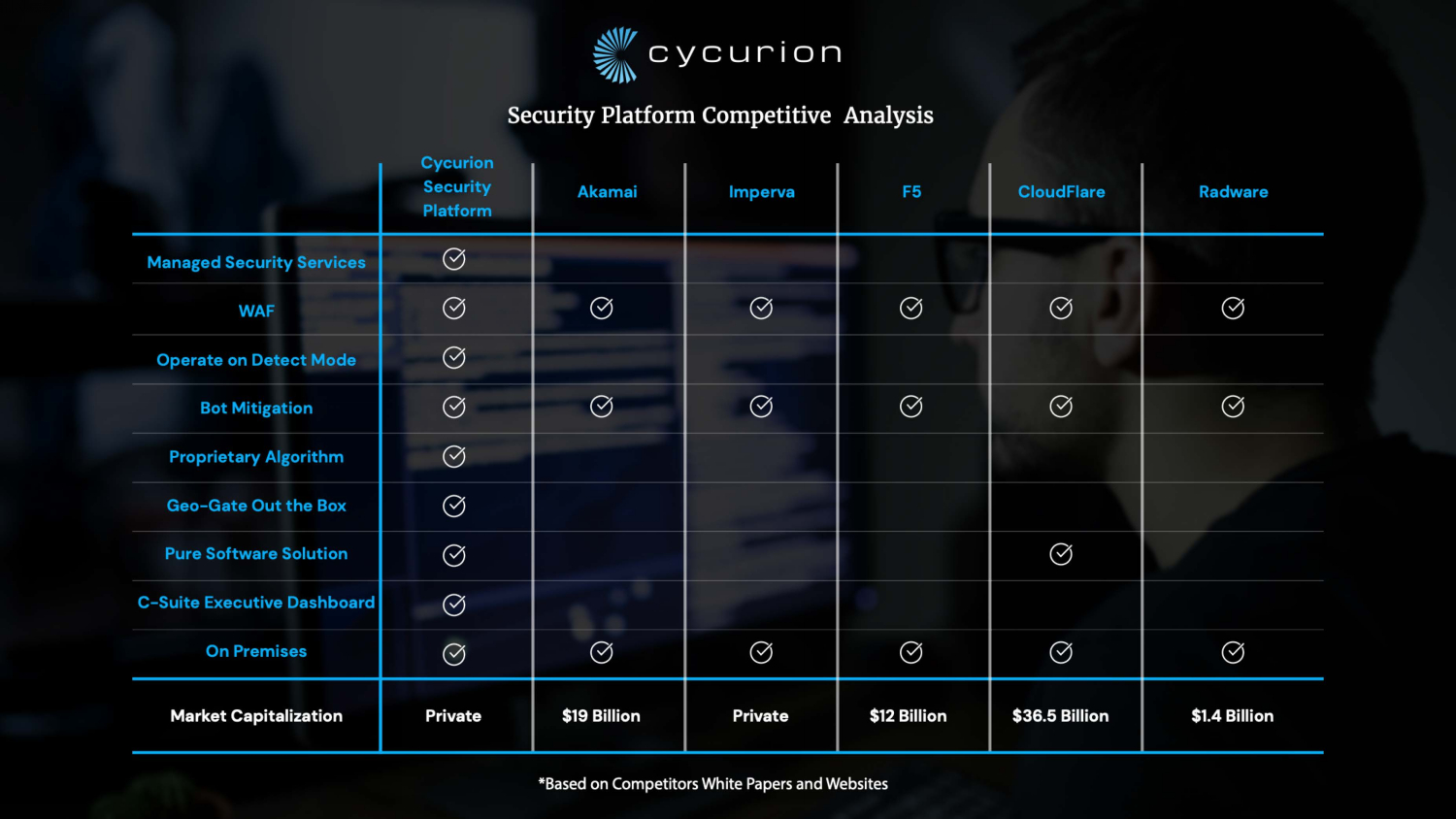

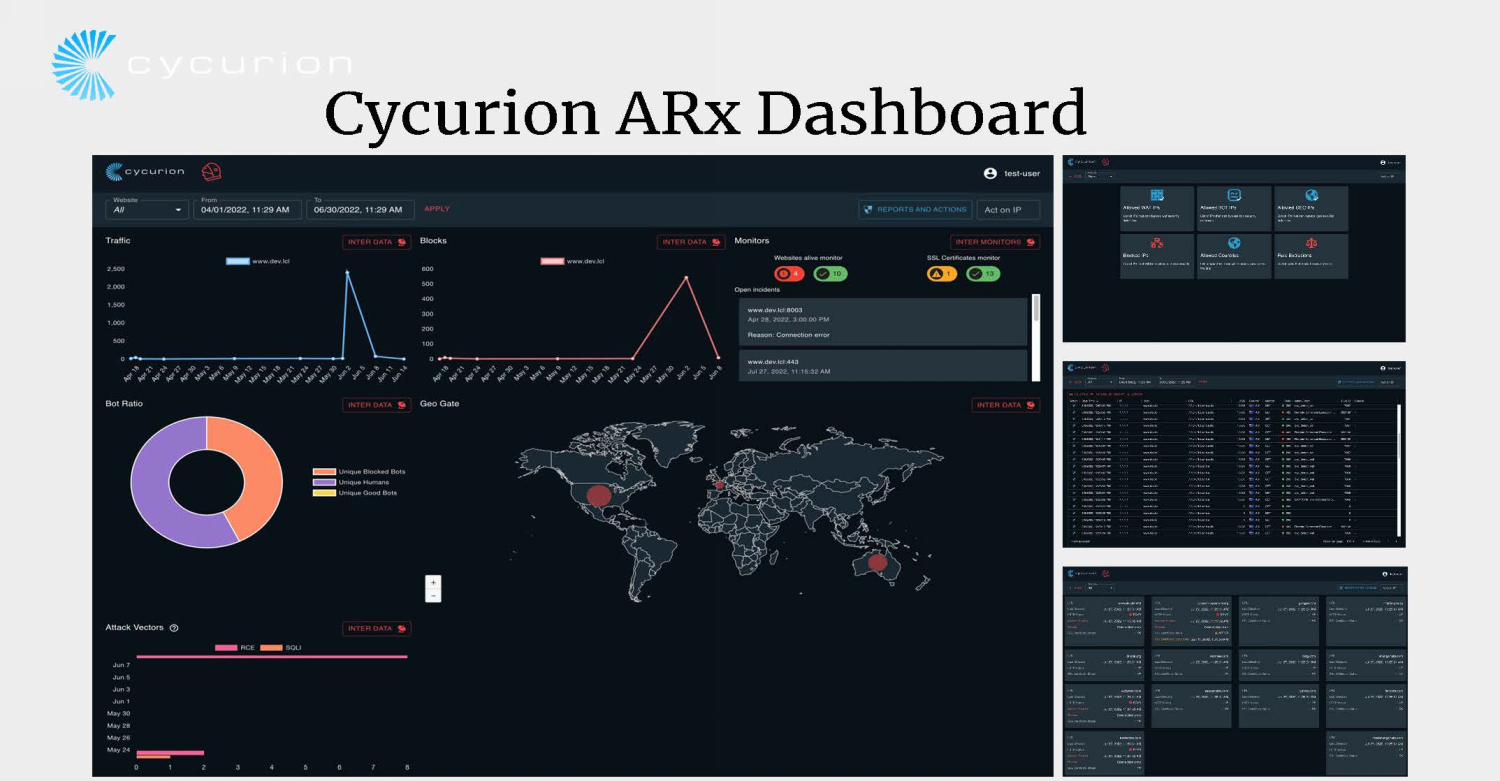

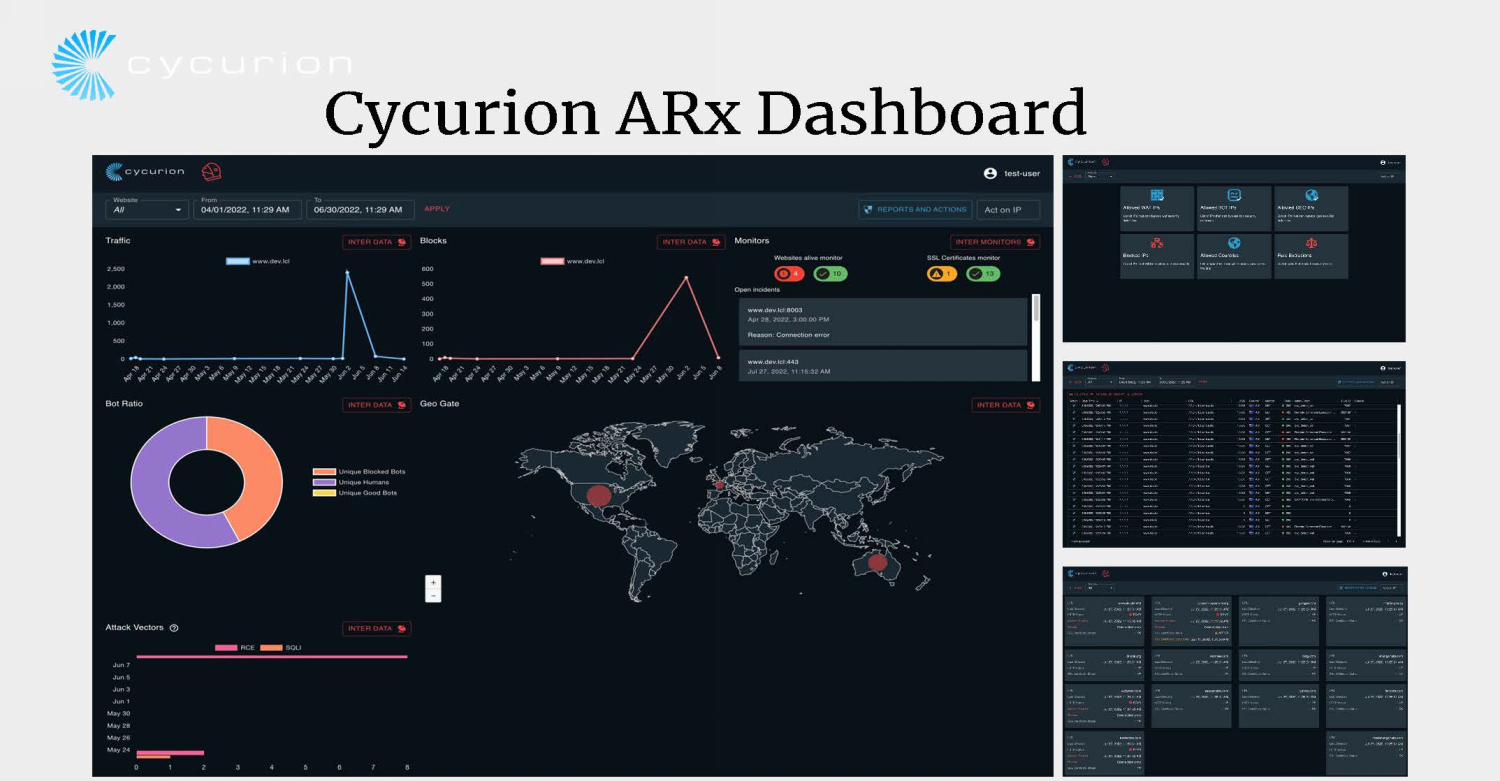

Services and Solutions Managed IT Services □ Project Management and IV&V □ Microsoft 365 Support □ Voice and Data Infrastructure Engineering and Management □ IT Help Desk Support □ HW/SW License Management □ Systems Engineering and Administration □ Application D ev el op m e n t □ Staff Augmentation Managed Security Services □ SOC as a Service □ Managed Detection and Response □ Incident Response and Forensics □ Threat and Vulnerability Management □ 24 by 7 Security Monitoring □ Dark Web Monitoring □ Cloud Security □ Firewall Management □ Cybersecurity Awareness and Training □ Virtual CISO Support Cycurion AR x Security Platform □ C - Suite Dashboard □ Web Application Firewall □ Geo - Gating □ Intelligent Bot - Mitigation □ Integration with Cycurion SOC as a Service □ Consulting and Advisory Services □ Managed Security Services Consulting and Advisory Services □ Enterprise Risk Management □ Security Architecture and Engineering □ Penetration Testing □ Digital Forensics and Incident Response □ Threat Hunting □ Staff Augmentation

The Technology Layer 1: Geo - Gating Layer 3: Bot Mitigation Talent Seasoned and certified cybersecurity professionals focused on protecting our clients’ digital assets. Techniques Well - versed in the leading cybersecurity frameworks, allowing us to deliver services efficiently. Tools Experience with best - in - class cybersecurity tools, enabling us to enhance the security posture of our clients’ enterprises. Unparalleled threat detection accuracy Impenetrable multilayered protection Built on Proprietary IP Multi - layered SaaS Protection has Arrived. Minimizes false positives Layer 2: Web Application Firewall (WAF) The People Subject Matter Experts The Cycurion Security Platform

Cycurion ARx Dashboard

• Customer Cost Savings • Reduce False Positive Alerts • Reduction of Monitoring Staff • Reduction of Technology Cost • Real - time Integrated Management and C - Suite Dashboard • Product can be placed in front of or behind existing security products • The Cycurion Advantage • Experienced Leadership Team • Revolutionary SaaS IP • Strong Strategic Partnerships Value Proposition

• Build Capacity to Generate Organic Growth and Profit • Add C - Suite Executive Talent to Team • Build Internal Sales and Marketing Team • Increase Capacity of Security Operations Team • Increase Resources allocated to R&D and Product Development • Growth through Acquisitions • Target Commercial MSSP • Government Prime Contractors • Key Enterprise Accounts • Strategic/Complimentary Solutions • Partner with strategic channel partners in the Healthcare, Telecommunications and Financial Services sectors • Create Channel Partner Program • Target specific markets • In initial discussions with enterprise partners • Increase Direct Sales Resource • Cross sell platform to existing customers • Increased Revenue • Increased Margins • Prioritizing Recurring Revenue Business • Expand Existing Customer Base • Target Markets • Government (Federal, State and Local) • Higher Education • Finance • Healthcare • Small and Midsized Businesses Growth Strategy

Appendix

Derek J Penn Director Leela J Gray Director • Independent Trustee Charles Schwab Corporation - Board of Trustees Mutual Funds and ETFs • Former Managing Director - Head of Equity Sales and Trading BNY Mellon// Pershing Capital Markets • Former Head of Equity Trading Fidelity Investments, Head Trader Lehman Brothers, Merrill Lynch and Morgan Stanley • Fuqua School of Business, Duke University Board of Trustees (Emeritus after 14 years as regular trustee) • MBA in Finance from Duke University; BA Chemistry and English from Duke University • Retired Brigadier General US Army Cyber Command • Board Member Empower Rideshare, and Monterey Capital Acquisition Corporation • Thirty - year career, Twenty - Three years active duty and seven years in the reserves • NACD Directorship Certification; Project Management Professional (PMP); and Top Secret Clearance • MS in Strategic Studies, US Army War College; MA in Journalism Ball State University; and BA in Mass Communication, Elon University Henry V Stoever Director • President & CEO of the Associations of Governing Boards of Universities and Colleges • Former Chief Marketing Officer National Association of Corporate Directors (NACD) • Former Senior VP StudentLoans.com; VP Marketing CoStar Group; Senior Director Marketing Sprint - Nextel Corporation; • Caption in US Marine Corp, received Navy Commendation Medal with Combat “V” for device during Operation Desert Storm • MBA in Marketing and Strategy, Northwestern University; BS Economics US Naval Academy Gerry Czarnecki Director • Chairman & CEO of the Deltennium Group • Former Director State Farm Insurance - Fifteen (15) Years • Director Jack Cooper Enterprises, DirectView Holdings, RFD & Associates • National Association of Corporate Directors Board Leadership Fellow • CERT Certificate in Cybersecurity Oversight from Carnegie Mellon University, • MA in Economics from Michigan State University; BS in Economics from Temple University Cycurion Board of Directors