UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☒ | Definitive Proxy Statement. |

| ☐ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to § 240.14a-12. |

Sweater Cashmere Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

An Important Message from Your Fund’s President

Dear Shareholder:

I am asking for your vote to approve a new sub-advisory contract on behalf of the Sweater Cashmere Fund (the “Fund”). A special meeting of Fund shareholders will be held on September 5, 2024 in Boulder, Colorado to consider this matter, described below. You may conveniently vote by:

| · | Calling the toll-free number listed on your proxy card; | |

| · | Visiting the website listed on your proxy card; or | |

| · | Mailing the enclosed proxy card—be sure to sign and date the card before mailing it in the enclosed postage-paid envelope. |

Of course, you are also welcome to attend the special shareholder meeting on September 5, 2024 and vote your shares in person.

You—and all Fund shareholders—are being asked to approve a new sub-advisory agreement between the Fund’s adviser, Sweater Industries LLC (the “Adviser”), and Forma Cashmere LLC (the “Forma”), the proposed subadviser to the Fund (the “Sub-Advisory Agreement”). As discussed in more detail in the enclosed proxy statement, the Fund’s Board of the Trustees has determined that it would be in the best interest of the Fund and its shareholders to retain Forma as the Fund’s subadviser pursuant to the Sub-Advisory Agreement. In order to retain a subadviser for the Fund, the Board of Trustees has approved the proposed Sub-Advisory Agreement between the Adviser and Forma, which permits the Adviser to delegate its investment advisory duties to Forma, subject to oversight by the Adviser.

Detailed information regarding this proposal may be found in the enclosed proxy statement.

The Fund’s Board of Trustees unanimously recommend that you vote “FOR” the approval of the new Sub-Advisory Agreement with Forma.

I appreciate your participation and prompt response and thank you for your continued support.

Sincerely,

Jesse K Randall

President of Sweater Cashmere Fund

Important information to help you understand and vote on the proposal:

The following questions and answers provide an overview of the proposal on which you are being asked to vote. The accompanying Proxy Statement contains more information about the proposal, and we encourage you to read it in its entirety. Your vote is important.

| Q. | Why has a special meeting been called? |

| A. | The Investment Company Act of 1940, as amended (the “1940 Act”), which regulates investment companies such as Sweater Cashmere Fund (the “Fund”), requires any investment advisory agreement pursuant to which an adviser will serve as investment adviser to an investment company to be approved by (1) the board of trustees of the investment company and (2) shareholders of the investment company. |

The Fund’s Board of the Trustees has determined that it would be in the best interest of the Fund and its shareholders to retain Forma Cashmere LLC (the “Forma”) to serve as the Fund’s subadviser. In order to retain Forma as subadviser for the Fund, the Board of Trustees has approved the proposed sub-advisory agreement between the Fund’s investment adviser, Sweater Industries LLC (the “Adviser”), and Forma, which permits the Adviser to delegate its investment advisory duties to Forma, subject to oversight by the Adviser (the “Sub-Advisory Agreement”).

We are therefore asking shareholders to approve the proposed Sub-Advisory Agreement. The Fund’s Board of Trustees has unanimously approved the Sub-Advisory Agreement.

It is important to note that the management fee rate that the Fund pays will remain the same.

| Q. | What is this document and why did you send it to me? |

| A. | We are sending this mailing to you for your use in deciding whether to approve the proposed Sub-Advisory Agreement between the Adviser and Forma pursuant to which Forma will be retained to provide sub-advisory services to the Fund, subject to oversight by the Adviser. Under the terms of the Sub-Advisory Agreement, Forma will be paid by the Adviser out of the management fee it receives from the Fund. Accordingly, approval of the Sub-Advisory Agreement will not change the management fee rate paid by the Fund. |

This mailing includes a Notice of Special Meeting of Shareholders, a Proxy Statement, and your Proxy Card.

| Q. | Why am I being asked to vote on a proposed Sub-Advisory Agreement? |

| A. | In order for the proposed Sub-Advisory Agreement to be effective, and for Forma to serve as subadviser to the Fund, the Sub-Advisory Agreement must be approved by (1) the Board of Trustees of the Fund and (2) shareholders of the Fund. |

The Fund’s Board of Trustees has already approved the Sub-Advisory Agreement. Accordingly, we are now asking shareholders to approve the Sub-Advisory Agreement.

| Q. | How will the proposed Sub-Advisory Agreement, if approved by shareholders, affect the Fund. |

| A. | Sweater Industries LLC (the Adviser) currently serves as investment manager to the Fund pursuant to the terms of its investment management agreement with the Fund (the “Investment Management Agreement”) that was approved by the Fund’s Board of Trustees and sole shareholder in February 2022 prior to the Fund’s launch. The Investment Management Agreement permits the Adviser to delegate its investment management responsibilities to a sub-adviser. As discussed elsewhere, the Adviser is proposing to delegate its investment advisory responsibilities to Forma pursuant to the terms of the Sub-Advisory Agreement, subject to oversight by the Adviser. |

The Fund’s investment objectives, strategies, and policies will not change as a result of the new Sub-Advisory Agreement.

However, it is anticipated that, if the Sub-Advisory Agreement is approved, Elia Infascelli, Ari Schottenstein, and Mary Owen, Managing Partners at Forma, will serve as the Fund’s sole portfolio managers.

| Q. | Will approval of the proposed Sub-Advisory Agreement change the fees or expenses paid by the Fund? |

| A. | No. Approval of the proposed Sub-Advisory Agreement will not affect the Fund’s management fee rate. |

| Q. | Will Sweater Industries LLC continue to serve as the Fund’s investment adviser if the Sub-Advisory Agreement is approved? |

| A. | Yes. Sweater Industries LLC (the Adviser) will continue to serve as investment adviser to the Fund pursuant to the terms of its Investment Management with the Fund, regardless of whether the proposed Sub-Advisory Agreement is approved. |

| Q. | What will happen if shareholders do not approve the proposed Sub-Advisory Agreement? |

| A. | If the proposed Sub-Advisory Agreement is not approved by Fund shareholders, then the Sub-Advisory Agreement will not become effective, Forma will not be engaged as the Fund’s subadviser, and Forma will not provide sub-advisory services to the Fund. The Adviser will continue as investment adviser to the Fund, regardless of whether or not the Sub-Advisory Agreement is approved. |

| Q. | Who is Forma Cashmere LLC? |

| A. | Forma Cashmere LLC (Forma) is a newly-formed investment adviser that is an affiliate of, and shares its management team with, Forma Capital, LLC (“Forma Capital”), a venture capital firm focused on providing capital, creating brand awareness, finding growth opportunities through sales and marketing partnerships, and deploying capital and influence in consumer brands. Forma is led by its Managing Partners, Elia Infascelli, Ari Schottenstein, and Mary Owen. |

2

| · | Elia Infascelli. Elia is a Managing Partner of Forma. He is also the Founder and Managing Partner of Forma Capital, specializing in investments in sports and health consumer brands. Formerly, he co-founded Parallel Brands and served as Global CEO at Wanda Media's Propaganda Entertainment. Elia began his career at Endeavor, representing notable figures in entertainment and build their owned businesses. He holds a bachelor's degree from Institut Paul Bocuse and lives in Los Angeles with his family. |

| · | Mary Owen. Mary is a Managing Partner of Format. Mary is also a Founder and Managing Partner of Forma Capital. In addition, she chairs the Ralph C. Wilson, Jr. Foundation, serves on the boards of Hall of Fame Resort and Entertainment Company and KB Partners, and has a background in NFL team management and venture capital. Mary holds degrees from the University of Virginia and Walsh College and is involved in various educational and charitable organizations. |

| · | Ari Schottenstein. Ari is a Managing Partner of Forma and a Managing Partner of Forma Capital. Formerly, he was a Partner at Zukin Partners LLC, specializing in investment banking and strategic engagements. He focuses on M&A transactions and advisory services across media, tech, fintech, and healthcare sectors. Previously, Ari was involved in predictive analytics and software strategy, integrating IBM products. |

Forma is principally owned by Elia Infascelli, Mary Owen, Ari Schottenstein, Bruce Popko, and Josh Feine.

| Q. | How does the Fund’s Board of Trustees recommend that I vote? |

| A. | The Fund’s Board of Trustees unanimously recommends that you vote FOR the approval of the Sub-Advisory Agreement. The reasons for the Board of Trustees’ recommendation are discussed in more detail in the enclosed Proxy Statement under the heading “Evaluation by the Board of Trustees.” |

| Q. | When and where will the shareholder meeting be held? |

| A. | The shareholder meeting will be held at the offices of the Fund and the Adviser, located at 2000 Central Ave., Boulder, Colorado 80301, on September 5, 2024 at 11:00 a.m. Mountain Time. |

| Q. | Will the Fund pay for the proxy solicitation and related legal costs? |

| A. | Yes, the Fund will bear the expenses of this proxy solicitation. |

The Adviser has contractually agreed to waive its management fee and/or reimburse Fund expenses to the extent necessary so that the Fund’s total annual operating expenses (excluding any taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) do not exceed 5.90% of the Fund’s average daily net assets. The Adviser may recoup amounts of its Management Fee waived and Fund expenses paid or reimbursed in certain circumstances. This contractual expense limitation will remain in effect through August 15, 2025, unless the Board approves its earlier modification or termination. Proxy solicitation expenses will be subject to the Adviser’s expense cap agreement with the Fund.

3

| Q. | Who is eligible to vote? |

| A. | Shareholders of record of the Fund at the close of business on July 25, 2024 (the “Record Date”) are entitled to be present and to vote at the special meeting of shareholders (the “Meeting”) or any adjournment thereof. Shareholders of record of the Fund at the close of business on the Record Date will be entitled to cast one vote for each full share and a fractional vote for each fractional share they hold on each proposal presented at the Meeting. |

| Q. | What vote is required? |

| A. | Approval of the Sub-Advisory Agreement requires the affirmative vote of the lesser, as of the Record Date, of (i) more than 50% of the shares of the Fund entitled to vote or (ii) 67% of the shares of the Fund present (in person or by proxy) at the Meeting if more than 50% of the shares of the Fund entitled to vote are present at the Meeting in person or represented by proxy. |

| Q. | Do I have to attend the shareholder meeting in order to vote my shares? |

| A. | No. You can simply mail in the enclosed proxy card, or vote your shares by telephone or internet by following the instructions in the enclosed Proxy Statement. |

| Q. | How do I vote my shares? |

| A. | You may vote your shares by mail, telephone, or internet by following the instructions in the enclosed proxy card. You may also vote your shares in person by attending the Meeting on September 5, 2024, at 11:00 a.m. Mountain Time, at the offices of the Fund and the Adviser, 2000 Central Ave., Boulder, Colorado 80301. |

| Q. | Whom should I contact for additional information or if I have any questions about the enclosed Proxy Statement? |

| A. | Please contact our proxy solicitor, Broadridge Financial Solutions, toll free at 1-800-690-6903 should you have any questions about the enclosed proxy statement. |

Important Notes: If you simply sign, date, and return the enclosed proxy card but do not indicate a specific vote, your shares will be voted FOR the proposal. If any other business comes before the Meeting, your shares will be voted at the discretion of the persons designated on the proxy card. Abstentions will be treated as votes AGAINST the proposal.

Shareholders who execute proxies may revoke them at any time before they are voted by (1) filing with the Fund a written notice of revocation, (2) timely voting a proxy bearing a later date, or (3) attending the Meeting and voting in person.

Please complete, sign and return the enclosed proxy card in the enclosed envelope. You may also vote your proxy by internet or telephone in accordance with the instructions set forth in the enclosed proxy card. No postage is required for proxy cards mailed in the United States.

4

SWEATER CASHMERE FUND

For proxy information, please call 1-800-690-6903

For information about your account, please call 1-888-577-7987

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on September 5, 2024

Notice is hereby given that a Special Meeting of shareholders (the “Meeting”) of shareholders of Sweater Cashmere Fund (the “Fund”) will be held at 11:00 a.m. Mountain Time, on September 5, 2024, at the offices of the Fund and the Adviser at 2000 Central Ave., Boulder, Colorado 80301, to vote on a proposal (the “Proposal”) to approve a new sub-advisory agreement between Sweater Industries LLC (the “Adviser”), the investment adviser to the Fund, and Forma Cashmere LLC (“Forma”), pursuant to which the Adviser would delegate its investment advisory duties with respect to the Fund to Forma, subject to oversight by the Adviser, and to transact such other business (if any) as may properly come before the Meeting.

Please take some time to read the enclosed Proxy Statement, which discusses the Proposal in more detail. If you were a shareholder of the Fund as of the close of business on July 25, 2024, you may vote on the Proposal at the Meeting or at any adjournment of the Meeting.

You are welcome to attend the Meeting in person .. If you cannot attend the Meeting in person to cast your vote, please vote by mail, telephone, or internet. Just follow the instructions in the enclosed Proxy Statement. If you have any questions about voting your shares, please call 1-800-690-6903.

It is important that you vote. The Fund’s Board of Trustees unanimously recommends that you vote FOR the Proposal.

By Order of the Board of Trustees

Emma Clark, Secretary

August 7, 2024

YOUR VOTE IS IMPORTANT

To assure your representation at the Meeting, please complete the enclosed proxy card and return it promptly in the accompanying envelope, vote online, or call the number listed on your proxy card, whether or not you expect to be present at the Meeting. If you attend the Meeting, you may revoke your proxy and vote your shares in person.

Sweater Cashmere Fund

2000 Central Ave.

Boulder, Colorado 80301

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To Be Held on September 5, 2024

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Sweater Cashmere Fund (the “Fund”), for use at the Special Meeting of Shareholders of the Fund (the “Meeting”) to be held at 11:00 a.m. Mountain Time, on September 5, 2024, at the offices of the Fund and the Adviser, 2000 Central Ave., Boulder, Colorado 80301, and at any adjournments thereof. The Meeting has been called by the Board to vote on a proposal to approve a new sub-advisory agreement on behalf of the Fund between Sweater Industries LLC (the “Adviser”), the investment adviser to the Fund, and Forma Cashmere LLC (“Forma”), pursuant to which the Adviser would delegate its investment advisory duties with respect to the Fund to Forma, subject to oversight by the Adviser, and to transact such other business (if any) as may properly come before the Meeting and any adjournments or postponements thereof.

The Board has fixed the close of business on July 25, 2024 as the record date (the “Record Date”) for the determination of shareholders of the Fund entitled to notice of, and to vote at, the Meeting and any adjournments thereof. Shareholders on the Record Date will be entitled to one vote for each full share and a proportional fraction of a vote for each fractional share held on each matter to which they are entitled to vote and that is to be voted on at the Meeting by shareholders of the Fund.

Additional information about the Fund is available in the Fund’s most recent prospectus, statement of additional information and annual and semiannual reports to shareholders. Copies of these documents are available without charge upon request by sending a written request to Sweater Industries LLC, 2000 Central Ave., Boulder, Colorado 80301, by calling (888) 577-7987, or by visiting www.sweaterventures.com/cashmerefund. The Fund’s most recent annual and semiannual reports have previously been mailed to shareholders.

The Notice of Meeting, Proxy Statement, and accompanying proxy card are first being mailed to shareholders on or about August 7, 2024. The Notice of Meeting, the Proxy Statement, and the proxy card are also available at www.proxyvote.com. The solicitation of proxies will occur principally by the internet (including through the Sweater App) or mail, but proxies may also be solicited by phone or other means. The cost of preparing, printing and mailing the enclosed proxy card(s) and this Proxy Statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by internet, phone, mail or other means, will be paid by the Fund.

2

THE PROPOSAL

Approval of a New Sub-Advisory Agreement on Behalf of the Fund

The Trustees unanimously recommend the approval of the proposed sub-advisory agreement on behalf of the Fund (the “Sub-Advisory Agreement”) between Sweater Industries LLC (the “Adviser”), the investment adviser to the Fund, and Forma Cashmere LLC (“Forma”), pursuant to which the Adviser would delegate its investment advisory duties with respect to the Fund to Forma, with Forma acting as subadviser to the Fund, subject to oversight by the Adviser. The form of the proposed Sub-Advisory Agreement is attached hereto as Exhibit A.

The Proposed Sub-Advisory Agreement

The proposed Sub-Advisory Agreement provides that Forma will, subject to the supervision of the Board and the Adviser, act as subadviser for, and manage on a discretionary basis the investment and reinvestment of the assets of the Fund. In connection therewith, and subject to the supervision of the Board and the Adviser, Forma will: (i) implement and supervise the investment program of the Fund and the composition of its portfolio; (ii) determine the timing and amount of commitments, investments and/or disposals to be made by the Fund, the securities and other investments to be purchased or sold by the Fund in connection therewith; (iii) arrange for the purchase of securities and other investments for the Fund and the sale or redemption of securities and other investments held in the portfolio of the Fund; all on behalf of the Fund and as described in the Fund’s most current effective registration statement on Form N-2 and as the same may thereafter be amended from time to time. The Sub-Advisory Agreement further requires Forma, in the performance of its duties, to in all material respects: (a) satisfy any applicable fiduciary duties it may have to the Fund; (b) monitor the Fund’s investments; (c) comply with the provisions of the Fund’s Declaration of Trust and By-laws, the stated investment objectives, policies and restrictions of the Fund as such objectives, policies and restrictions may subsequently be changed by the Board and communicated by the Fund or the Adviser to the Sub-Adviser in writing, and those requirements applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended; and (d) assist in the valuation of portfolio securities held by the Fund as reasonably requested by the Adviser or the Fund.

As compensation for its services under the Sub-Advisory Agreement, Forma will be entitled to receive a fee, based on the Average Daily Net Assets of the Fund (defined below), computed and paid monthly, payable by the Adviser, at the annual rates set forth below:

| Fund’s Average Daily Net Assets | Sub-Advisory Fee Payable to Forma |

| $1 - $50,000,000 | 1.55% |

| $50,000,001 - $100,000,000 | 1.65% |

| $100,000,000 - $250,000,000 | 1.75% |

| $250,000,000 - $500,000,000 | 1.84% |

| $500,000,000+ | 1.94% |

3

The Fund’s “Average Daily Net Assets” will be determined by taking an average of all of the determinations of such amount during such month at the close of business on each business day during such month while the Sub-Advisory Agreement is in effect.

The proposed Sub-Advisory Agreement provides that it will continue in force for an initial period of two years, and from year to year thereafter, but only so long as its continuance is approved at least annually by (i) the Board or (ii) a vote of a majority of the outstanding voting securities of the Fund, provided that in either event, continuance is also approved by a majority of the members of the Board who are not “interested persons” (as such term is defined in Section 2(a)(19) of the 1940 Act) of the Fund, the Adviser, or Forma (the “Independent Trustees”) by a vote cast in person at a meeting called for the purpose of voting such approval. The proposed Sub-Advisory Agreement automatically terminates on assignment and is terminable on 60 days’ notice by the Board or the Adviser. In addition, the proposed Sub-Advisory Agreement may be terminated by Forma on 60 days’ notice to the Fund or the Adviser.

The proposed Sub-Advisory Agreement provides that Forma will not be subject to any liability in connection with the performance of its services thereunder, except for liabilities resulting from Forma’s breach of fiduciary duty with respect to the receipt of compensation for services or losses resulting from the willful misfeasance, bad faith or gross negligence on its part in the performance of Forma’s duties or from reckless disregard by Forma of its duties under the Sub-Advisory Agreement. The proposed Sub-Advisory Agreement further provides for the Fund to indemnify Forma against any liabilities or expenses in may incur in connection with the performance of services to the Fund, with the exception of those liabilities or expenses incurred by reason of Forma’s willful misfeasance, bad faith, or gross negligence, or from reckless disregard by Forma of its duties to the Fund.

Subject to shareholder approval, the Adviser intends to enter into the proposed Sub-Advisory Agreement shortly after the Meeting. However, execution of the proposed Sub-Advisory Agreement will only occur after, Forma’s registration as an investment adviser with the Securities Exchange Commission has been completed. Forma is in the process of completing such investment adviser registration.

If the proposed Sub-Advisory Agreement with Forma is not approved by Fund shareholders, the Board will consider other options, which may include a new or modified request for shareholder approval of a new investment sub-advisory agreement. The Adviser intends to continue on as investment adviser to the Fund, regardless of whether the Sub-Advisory Agreement is approved by Shareholders.

The description in this Proxy Statement of the proposed Sub-Advisory Agreement is only a summary. A form of the proposed Sub-Advisory Agreement is attached to this Proxy Statement as Exhibit A. You should read the full proposed Sub-Advisory Agreement before determining how to vote your shares.

4

Information about Forma

Forma Cashmere LLC (Forma) is a newly-formed investment adviser located at 166 Geary St., STE 1500, #1577, San Francisco, California 94108. The names, addresses, and principal occupations of the executive officers of Forma as of the date of this Proxy Statement are set forth below:

| Name and Address* | Principal Occupation |

| Elia Infascelli | Managing Partner of Forma, Managing Partner of Forma Capital, LLC |

| Mary Owen | Managing Partner of Forma, Managing Partner of Forma Capital, LLC |

| Ari Schottenstein | Managing Partner of Forma, Managing Partner of Forma Capital, LLC |

* Each officer’s address is in care of Forma Cashmere LLC, 166 Geary St., STE 1500, #1577, San Francisco, California 94108.

Forma is an affiliate of Forma Capital, LLC (“Forma Capital”), a venture capital firm focused on providing capital, creating brand awareness, finding growth opportunities through sales and marketing partnerships, and deploying capital and influence in consumer brands. Forma is led by its Managing Partners, Elia Infascelli, Mary Owen, and Ari Schottenstein, and is principally owned Elia Infascelli, Mary Owen, Ari Schottenstein, Bruce Popko, and Josh Feine.

None of the Trustees or officers of the Fund is an officer, employer, or shareholder of Forma. None of the Trustees or officers of the Fund had any material direct or indirect interest in any transactions or proposed transactions with Forma during the past fiscal year.

Evaluation by the Board of Trustees

The Board, including all of the members of the Board who are not “interested persons” (as such term is defined in Section 2(a)(19) of the 1940 Act) of the Fund, the Adviser, or Forma (each, an “Independent Trustee” and, collectively, the “Independent Trustees”), met in person to discuss the proposed Sub-Advisory Agreement between the Adviser and Forma with respect to the Fund.

Pursuant to the 1940 Act, the Board is required to consider the initial approval of any investment advisory agreement with the Fund, including the Sub-Advisory Agreement. In connection with this process, the Board reviewed and discussed at a special in-person meeting materials relating to its consideration of the Sub-Advisory Agreement. The Board also considered all factors it believed relevant with respect to the Fund, including: (a) the nature, extent, and quality of services to be provided by Forma to the Fund; (b) the nature, estimated cost, and scope Forma’s proposed services under the Sub-Advisory Agreement; (c) conditions that might affect Forma’s ability to provide high quality services to the Fund; (d) the proposed fee to be paid to Forma by the Adviser under the Agreement; (e) estimated expenses to be incurred by Forma with respect to the Fund and estimated profitability of the Fund to Forma; (f) potential fall-out benefits to Forma with respect to its sub-management of the Fund; and (g) the extent to which Forma may realize economies of scale with respect to its sub-management of the Fund. The Board received materials related to these matters for review in advance of the Meeting.

In considering whether to approve the Sub-Advisory Agreement and in reviewing the related materials, the Board met with relevant personnel of the Adviser and Forma, and reviewed with them materials prepared by Forma and materials provided by legal counsel to the Fund. The Board also met, including in executive session, with legal counsel to the Fund and with the Fund’s Chief Compliance Officer. Fund legal counsel reviewed with the Board their duties and responsibilities with respect to considering the approval of the Sub-Advisory Agreement.

5

As part of their review, the Trustees examined Forma’s ability to provide high quality investment management services to the Fund. The Trustees considered the qualifications and experience of Forma’s personnel who would serve as the Fund’s portfolio managers, as well as the qualifications and experience of certain other key individuals at Forma who would provide services to the Fund. The Trustees also considered Forma’s investment philosophy and Forma’s representations regarding its intended research and decision-making processes, its ability to attract and retain capable research and advisory personnel and the costs associated with retaining such personnel, the capability of Forma’s senior management, and the level of skill required to provide sub-advisory services to the Fund. The Trustees also discussed with Forma’s representatives their experience in the venture capital space and how they would transition this to managing the Fund.

The Trustees reviewed the nature, estimated cost, and scope Forma’s proposed services under the Sub-Advisory Agreement. The Trustees considered that these services include adhering to the Fund’s investment restrictions, complying with regulatory obligations, performing due diligence on potential portfolio companies and funds, and negotiating to invest in proposed portfolio companies, subject to oversight by the Adviser. The Trustees discussed with the Adviser and with Forma the delegation by the Adviser of its day-to-day investment management responsibilities with respect to the Fund to Forma, and the Adviser’s responsibility to oversee Forma’s provision of investment management services to the Fund.

The Board noted that Forma’s senior management currently manage a private venture capital fund (advised by an affiliate of Forma), and considered certain performance information regarding this venture capital fund. The Board noted the differences between a private venture capital fund versus a registered closed-end fund such as the Fund, and thus did not rely on these comparisons to a significant extent.

The Trustees considered conditions that might affect Forma’s ability to provide high quality services to the Fund under the Sub-Advisory Agreement. This included information provided by Forma on its projected costs of advising the Fund and representations made by Forma to the Board regarding its capitalization and funding. Based on the foregoing, the Trustees concluded that Forma’s investment process, research capabilities and philosophy appeared to be well suited to the Fund, given the Fund’s investment objectives and policies. The Board also determined, based on representations provided by Forma, that Forma should be able to meet its reasonably foreseeable obligations under the Sub-Advisory Agreement.

The Trustees considered the proposed sub-management fee under the Agreement, including reviewing information provided by Forma comparing this with contractual management fees of certain peer group closed-end funds that also primarily make private investments. The Trustees also discussed with the Adviser and Forma the proposed sub-management fee under the Sub-Advisory Agreement. The Trustees also considered information provided by Forma regarding the fees it affiliated adviser charges to its private venture capital fund client. The Board did not rely on this comparison to a significant extent, however, noting the differences between a private venture capital fund versus a registered closed-end fund such as the Fund.

The Trustees considered information about the estimated expenses to be incurred by Forma with respect to the Fund and estimated profitability of the Fund to Forma over the initial term of the Sub-Advisory Agreement. The Trustees also evaluated the potential benefits of the sub-advisory relationship to Forma, in addition to the proposed sub-management fee under the Sub-Advisory Agreement. The Trustees considered Forma’s representations that it does not anticipate causing the Fund to enter into transactions that will generate “soft dollar” credits. The Trustees considered and discussed with Forma the proposed use of Fund assets for advertising purposes. Forma confirmed that no personnel of Forma or its affiliates would receive compensation from the Fund for assisting the Fund with its marketing efforts.

6

The Trustees also considered the extent to which economies of scale might be realized by Forma, and reviewed estimates provided by Forma. The Trustees determined that it does not appear that Forma will benefit from economies of scale acting as subadviser to the Fund to such an extent that additional breakpoints in the sub-management fee under the Sub-Advisory Agreement should be implemented at this time.

In its deliberations with respect to these matters, the full Board, including the Independent Trustees, was advised by counsel to the Fund. The Independent Trustees considered the Agreement in executive session, as well as in the presence of the full Board. The Trustees weighed the foregoing matters, as well as other information, in light of the advice given by the Fund’s counsel as to the law applicable to the review of investment advisory contracts. In arriving at a decision, the Board, including the Independent Trustees, did not identify any single matter as all-important or controlling, and the foregoing summary does not detail all of the matters considered. The Trustees may also have evaluated these matters differently, ascribing different weights to various matters.

Based on its review, the Board, including all of the Independent Trustees, determined, in the exercise of their business judgment, that the proposed management fee under the Sub-Advisory Agreement was reasonable in light of the nature and scope of services to be performed by Forma under the Sub-Advisory Agreement and the costs projected to be incurred by Forma in providing services to the Fund, and further determined that approval of the Sub-Advisory Agreement was in the best interests of the Fund and its shareholders.

The Board therefore recommended that approval of the Sub-Advisory Agreement be voted on by the Fund’s shareholders, and that the Fund’s Shareholders vote FOR the approval of the Sub-Advisory Agreement.

Required Vote

Shareholder approval of the proposed Sub-Advisory Agreement requires the affirmative vote of the lesser, as of the Record Date, of (a) more than 50% of the shares of the Fund entitled to vote or (b) 67% of the shares of the Fund present at the Meeting if more than 50% of the shares of the Fund entitled to vote are present at the Meeting in person or by proxy. All shares of the Fund vote together as a single class on the proposal to approve the proposed Sub-Advisory Agreement.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE PROPOSED SUB-ADVISORY AGREEMENT WITH FORMA.

7

Other Matters to Come Before the Meeting

The Board knows of no other matters to be presented at the Meeting other than the Proposal described above. If, however, any other matters properly come before the Meeting, such as to adjourn the meeting, proxies will be voted on these matters in accordance with the judgement of the persons named as proxies in the attached proxy card.

OPERATION OF THE FUND

The Fund is a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company that operates as an “interval fund.” The Fund’s principal executive offices are located at 12000 Central Ave., Boulder, Colorado 80301. The Board supervises the business activities of the Fund.

Like other registered closed-end interval funds, the Fund retains various organizations to perform specialized services. UMB Fund Services, Inc., located at 235 W Galena St, Milwaukee, Wisconsin 53212, provides the Fund with transfer agent, accounting, and administrative services. UMB Bank, N.A., located at 1010 Grand Blvd, Kansas City, Missouri 64106, serves as the Fund’s custodian.

PROXY VOTING AND SHAREHOLDER MEETING INFORMATION

Proxy Solicitation

If you properly authorize your proxy through the internet or telephonically, or by executing and returning the enclosed proxy card, and your proxy is not subsequently revoked, your vote will be cast at the Meeting. If you give instructions, your vote will be cast in accordance with your instructions. If you return your signed Proxy Card without instructions, your vote will be cast FOR the approval of the proposed Sub-Advisory Agreement between the Adviser and Forma (the “Proposal”). Your vote will be cast in the discretion of the proxy holders on any other matter that may properly come before the Meeting, including, but not limited to, proposing and/or voting on an adjournment of the Meeting in the event that a quorum is not obtained and/or sufficient votes in favor of the Proposal are not received.

Revocation of Proxies

If you execute and submit a proxy, you may revoke that proxy or change it at any time before it is exercised by: (a) submitting a duly executed proxy bearing a later date, (b) submitting a written notice to the President of the Fund revoking the proxy, or (c) by attending the Meeting and casting your vote in person.

Any written notice to revoke your proxy must be timely mailed to the President of the Fund at: Jesse K Randall, President, Sweater Cashmere Fund, 2000 Central Ave., Boulder, Colorado 80301

Quorum and Methods of Tabulation

The Fund offers a single class of shares of beneficial interest, which is the only class of shares currently authorized by the Fund. As of the close of business on the Record Date, 673,056.259 shares of the Fund were issued and outstanding.

The holders of a majority of the Fund’s shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at the Meeting. Abstentions will be treated as present for purposes of determining a quorum. A quorum is required to take action on the Proposal.

8

In the event that a quorum of shareholders of the Fund is not present at the Meeting or, even if such a quorum is so present, in the event that sufficient votes in favor of the Proposal are not received and tabulated prior to the time the Meeting is called to order, the Meeting may be adjourned by the vote of a majority of the shares represented at the Meeting, either in person or by proxy, and further solicitations may be made.

Fund shareholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting. Each shareholder is entitled to one vote per share held on the Record Date, and a proportional fractional vote for any fractional share held.

Effect of Abstentions

Abstentions will be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the Meeting, but they are not affirmative votes for the Proposal. Because approval of the Proposal requires the affirmative vote of a majority of the shares entitled to vote, abstentions will have the effect of a vote AGAINST the Proposal.

Shareholder Proposals and Future Meetings

The Fund has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the U.S. Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Fund’s Proxy Statement and proxy for a particular Meeting. Under these rules, proposals submitted for inclusion in the Fund’s proxy materials must be received by the Fund within a reasonable time before the solicitation is made. The fact that the Fund receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Any shareholder proposal should be sent to Jesse K Randall, President, Sweater Cashmere Fund, 2000 Central Ave., Boulder, Colorado 80301.

Under its Declaration of Trust, the Fund is not required to hold annual meetings of its shareholders to elect Trustees or for other purposes. It is not anticipated that the Fund will hold shareholders’ meetings unless required by law or its Declaration of Trust.

Other Matters to Come Before the Meeting

The Board knows of no other matters to be presented at the Meeting other than the Proposal described in this Proxy Statement. If other business should properly come before the Meeting, the persons named as proxies will vote thereon in accordance with their best judgment.

Expenses of the Solicitation

The Board is making this solicitation of proxies. For managing the Funds’ overall proxy campaign, Broadridge Financial Solutions (“Broadridge”) will receive a proxy management fee of $30,000 plus reimbursement for out-of-pocket expenses. Broadridge will also receive fees in connection with assembling, mailing, and transmitting the notice of meeting, proxy statement and related materials on behalf of the Fund, tabulating those votes that are received, and any solicitation of additional votes. While the fees received by Broadridge will vary based on the level of additional solicitation necessary to achieve quorum and shareholder approval, the fees paid to Broadridge are currently estimated to be approximately $35,600. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and any additional materials relating to the Meeting and the cost of soliciting proxies, including the fees paid to Broadridge, will be borne by the Fund. Certain officers, employees and agents of the Fund and the Adviser may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation.

9

Principal Shareholders

As of the Record Date, there were no record owners of more than 5% of the outstanding shares of the Fund. Shareholders owning more than 25% of the shares of a Fund may be presumed under securities laws to control the Fund and may be able to determine the outcome of the issues that are submitted to shareholders for vote.

As a group, the Trustees and officers of the Fund owned less than 1% of the outstanding shares of the Fund as of the Record Date.

Proxy Delivery

Call or write to the Fund if you are receiving multiple copies of the Proxy Statement now and wish to receive a single copy in the future. For such requests, call the Fund at (888) 577-7987, or write to the Fund at 2000 Central Ave., Boulder, Colorado 80301.

A copy of the Notice of Shareholder Meeting and the Proxy Statement (including copies of the proposed Sub-Advisory Agreement) are available at www.proxyvote.com.

Financial Information

The Fund will furnish to you, upon request and without charge to you, a copy of the Fund’s annual report for its most recent fiscal year, and a copy of its semiannual report for any subsequent semiannual period. You may direct these requests to the Fund at 2000 Central Ave., Boulder, Colorado 80301, by phone at (888) 577-7987, or by visiting www.sweaterventures.com/cashmerefund.

BY ORDER OF THE BOARD OF TRUSTEES

Jesse K Randall, President of the Fund and Trustee

Dated: August 7, 2024

PLEASE DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED REPLY ENVELOPE OR CALL THE NUMBER LISTED ON YOUR PROXY CARD.

10

Exhibit A

INVESTMENT SUB-ADVISORY AGREEMENT

Sweater Cashmere Fund

THIS INVESTMENT SUB-ADVISORY AGREEMENT (this “Agreement”), dated ________________, 2024, is between Sweater Industries LLC, a Delaware limited liability company (the “Adviser”) and a registered investment adviser with the Securities and Exchange Commission (“SEC”), and Forma Cashmere LLC, a Delaware limited liability company and a registered investment adviser with the SEC (the “Sub-Adviser”).

WHEREAS, the Adviser and the Sub-Adviser are each registered as investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”); and

WHEREAS, Sweater Cashmere Fund, a Delaware statutory trust (the “Fund”), is a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Fund has retained the Adviser to perform investment advisory services for the Fund under the terms of an investment advisory agreement, dated March 15, 2022, between the Adviser and the Fund (the “Management Agreement”), and

WHEREAS, the Management Agreement provides that the Adviser may retain one or more sub-advisers, subject to the approval of the Fund’s Board of Trustees (the “Board”) and, except as otherwise permitted under the terms of any applicable exemptive relief obtained from the SEC, or by rule or regulation, a majority of the outstanding voting securities of the Fund; and

WHEREAS, the Adviser, acting pursuant to the Management Agreement, wishes to retain the Sub-Adviser to provide sub-advisory services to the Fund, and the Sub-Adviser desires to provide such services in accordance with the terms of this Agreement; and

WHEREAS, the Trust’s Board has duly consented to and approved the appointment of the Sub-Adviser to provide sub-advisory services to the Fund in the manner and on the terms set out in this Agreement; and

WHEREAS, the Fund’s shareholders, in the manner required under the 1940 Act, have approved this Agreement and the Adviser’s retention of the Sub-Adviser to provide sub-advisory services to the Fund.

NOW, THEREFORE, in consideration of the promises and the mutual agreements herein contained, the parties hereto agree as follows:

| 1. | APPOINTMENT AND ACCEPTANCE. |

| (a) | Acceptance. The Adviser hereby appoints the Sub-Adviser to provide certain sub-investment advisory and related services to the Fund for the period and on the terms set forth in this Agreement. The Sub-Adviser accepts such appointment and agrees to furnish the services herein set forth for the compensation herein provided. |

| (b) | Independent Contractor. The Sub-Adviser shall, for all purposes herein provided, be deemed an independent contractor and, unless otherwise expressly provided or authorized, shall have no authority to act for nor represent the Fund or the Adviser in any way, nor otherwise be deemed an agent of the Fund or the Adviser. |

| (c) | The Sub-Adviser’s Representations. The Sub-Adviser represents, warrants and agrees that: |

| (i) | it has all requisite power and authority to enter into and perform its obligations under this Agreement; |

| (ii) | it has taken all necessary limited liability company action to authorize its execution, delivery and performance of this Agreement; |

| (iii) | neither it nor any “affiliated person” of it, as such term is defined in Section 2(a)(3) of the 1940 Act, is subject to any disqualification that would make it unable to serve as an investment adviser to a registered investment company under Section 9 of the 1940 Act; |

| (iv) | it is duly registered as an investment adviser under the Advisers Act; |

| (v) | except as otherwise specified herein, it will not delegate any obligation assumed pursuant to this Agreement to any third party (including any other sub-adviser) without first obtaining the written consent of the Fund and the Adviser; and |

| (vi) | the execution, delivery and performance of this Agreement do not, and will not, conflict with, or result in any violation or default under, any agreement to which the Sub-Adviser or any of its affiliates are a party. |

The Sub-Adviser further represents, warrants, and agrees that it shall, at all times during the term of this Agreement:

| (vii) | Use its best judgment and efforts in rendering the advice and services to the Fund as contemplated by this Agreement; |

| (viii) | Maintain all licenses and registrations necessary to perform its duties hereunder in good order; |

| (ix) | conform in all material respects to all applicable rules and regulations of the SEC, comply in all material respects with all policies and procedures adopted by the Board for the Fund and communicated to the Sub-Adviser in writing, and conduct its activities and operations under this Agreement in all material respects in accordance with any applicable law and regulations of any governmental authority pertaining to its investment advisory activities; and |

| (x) | Maintain errors and omissions insurance coverage in an amount not less than its current level of coverage and shall provide written notice to the Fund (x) of any material changes in its insurance policies or insurance coverage; or (y) if any materials claims will be made on its insurance policies. Furthermore, the Sub-Adviser shall, upon reasonable request, provide the Fund with any information it may reasonably require concerning the amount of or scope of such insurance. |

| (d) | The Adviser’s Representations. The Adviser represents, warrants and agrees that it has all requisite power and authority to enter into and perform its obligations under this Agreement, and has taken all necessary corporate action to authorize its execution, delivery and performance of this Agreement. The Adviser further represents, warrants and agrees that it has the authority under the Management Agreement to appoint the Sub-Adviser. |

2

| 2. | DELIVERY OF DOCUMENTS. |

| (a) | The Adviser has furnished to the Sub-Adviser copies of each of the following documents: |

| (i) | The Declaration of the Trust of the Fund as in effect on the date hereof; |

| (ii) | The By-laws of the Fund in effect on the date hereof; |

| (iii) | The resolutions of the Board approving the engagement of the Sub-Adviser as a sub-adviser to the Fund and approving the form of this Agreement; |

| (iv) | A certificate from an authorized Fund officer certifying that the Fund has received the necessary approval of Fund shareholders with respect to the Fund’s engagement of the Sub-Adviser as a sub-adviser to the Fund and the form of this Agreement; |

| (v) | The Management Agreement; |

| (vi) | The Code of Ethics of the Fund and the Fund’s other compliance policies and procedures as currently in effect; and |

| (vii) | Current copies of the Fund’s Prospectus and Statement of Additional Information. |

The Adviser shall furnish the Sub-Adviser from time to time with copies of all material Amendments of or material supplements to the foregoing, if any.

| (b) | The Sub-Adviser has furnished or will furnish the Fund with copies of each of the following documents: |

| (i) | the Sub-Adviser’s most recent registration statement on Form ADV; |

| (ii) | separate lists of persons whom the Sub-Adviser wishes to have authorized to give written and/or oral instructions to the custodian (the “Custodian”) and accounting agent of the Fund’s assets; |

| (iii) | the Code of Ethics of the Sub-Adviser as currently in effect; and |

| (iv) | complete and accurate copies of any compliance manuals, trading, commission and other reports, insurance policies, and such other management or operational documents as the Adviser may reasonably request in writing (on behalf of itself or the Board) in assessing the Sub-Adviser. |

The Sub-Adviser shall furnish the Fund from time to time with copies of all material amendments of or material supplements to the foregoing, if any. Additionally, the Sub-Adviser shall provide to the Fund such other documents relating to its services under this Agreement as the Adviser may reasonably request on a periodic basis. Such amendments or supplements shall be provided within 30 days of the time such materials became available to the Sub-Adviser.

3

| 3. | PROVISION OF INVESTMENT SUB-ADVISORY SERVICES |

Subject always to the supervision of the Board and the Adviser, the Sub-Adviser will act as sub-adviser for, and manage on a discretionary basis the investment and reinvestment of the assets of the Fund. In connection therewith, and subject to the supervision of the Board and the Adviser, the Sub-Adviser shall (i) implement and supervise the investment program of the Fund and the composition of its portfolio; (ii) determine the timing and amount of commitments, investments and/or disposals to be made by the Fund, the securities and other investments to be purchased or sold by the Fund in connection therewith; (iii) arrange, subject to the provisions of Section 4 hereof, for the purchase of securities and other investments for the Fund and the sale or redemption of securities and other investments held in the portfolio of the Fund; all on behalf of the Fund and as described in the Fund’s most current effective registration statement on Form N-2 and as the same may thereafter be amended from time to time. In the performance of its duties, the Sub-Adviser will in all material respects (a) satisfy any applicable fiduciary duties it may have to the Fund; (b) monitor the Fund’s investments; (c) comply with the provisions of the Fund’s Declaration of Trust and By-laws, as amended from time to time and communicated by the Fund or the Adviser to the Sub-Adviser in writing, the stated investment objectives, policies and restrictions of the Fund as such objectives, policies and restrictions may subsequently be changed by the Board and communicated by the Fund or the Adviser to the Sub-Adviser in writing, and those requirements applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended; and (d) assist in the valuation of portfolio securities held by the Fund as reasonably requested by the Adviser or the Fund.

| 4. | BROKERAGE COMMISSIONS. While not expected to be a primary part of the Fund’s investment strategy, to the extent applicable, and subject always to the supervision of the Board and the Adviser, the Sub-Adviser is authorized to select brokers and/or dealers to execute certain purchases and sales of portfolio securities for the Fund and, to the extent that public securities are involved, is directed to use its best efforts to obtain “best execution,” considering the Fund’s investment objectives, policies, and restrictions as stated in the Fund’s Prospectus and Statement of Additional Information, as the same may be amended, supplemented or restated from time to time, and resolutions of the Fund’s Board. The Sub-Adviser will promptly communicate to the Adviser and the Board such information relating to portfolio transactions as they may reasonably request. It is understood that the Sub-Adviser will not be deemed to have acted unlawfully, or to have breached a fiduciary duty to the Fund or be in breach of any obligation owing to the Fund under this Agreement, or otherwise, by reason of its having directed a securities transaction on behalf of the Fund to a broker-dealer in compliance with the provisions of Section 28(e) of the Securities Exchange Act of 1934, as amended, or as described from time to time by the Fund’s Prospectus and Statement of Additional. |

| 5. | PROXY VOTING AND RELATED MATTERS |

| (a) | The Adviser hereby delegates to the Sub-Adviser the Adviser’s discretionary authority to exercise voting and consent rights with respect to the securities and investments of the Fund, provided, however, that the Fund or the Adviser may require, upon request, that the Sub-Adviser vote proxies and related consents for the Fund in accordance with the Fund’s or the Adviser’s proxy voting policies. Absent specific instructions to the contrary provided to it by the Fund or the Adviser, and subject to its receipt of all necessary voting materials, the Sub-Adviser shall vote all proxies and similar consents with respect to investments of the Fund in accordance with the Adviser’s proxy voting policy. |

| (b) | The Sub-Adviser shall maintain and preserve a record, in an easily-accessible place for a period of not less than five years (or longer, if required by law), of the Sub-Adviser’s voting procedures, of the Sub-Adviser’s actual votes, and such other information required for the Fund to comply with any rules or regulations promulgated by the SEC. The Sub-Adviser shall supply updates of this record to the Adviser or any authorized representative of the Adviser, or to the Fund, on a quarterly basis (or more frequently, upon the request of the Adviser or the Fund). |

4

| 6. | ALLOCATION OF CHARGES AND EXPENSES |

| (a) | The Sub-Adviser will pay all of the ordinary and usual office overhead expenses of the Sub-Adviser and any of its affiliates (including rent) in connection with performance of the Sub-Adviser’s duties under this Agreement and the salaries or other compensation of the employees and other professionals of the Sub-Adviser or any of its affiliates. |

| (b) | The Sub-Adviser shall not be required to bear any expenses of the Fund other than those specified in Section 6(a) hereof and such other expenses specifically assumed by the Sub-Adviser in writing. Without limiting the generality of the foregoing, the Sub-Adviser shall not be required to pay, and shall be reimbursed promptly by the Fund if it pays, any third party charges and out-of-pocket costs and expenses that are related to the organization, operation or business of the Fund, including, without limitation, the following: (i) interest and taxes; (ii) brokerage commissions (if any) and other transaction expenses in connection with the Fund’s purchase and sale of assets; (iii) fees and expenses related to the offering of the Fund’s shares (including Fund marketing expenses), and the admission of investors in the Fund; (iv) fees and expenses related to the formation and operation of any subsidiaries of the Fund; (v) fees and expenses related to the investigation and evaluation of investment opportunities (whether or not consummated); (vi) fees and expense related to the acquisition, ownership, management, financing, hedging of interest rates on financings, or sale of portfolio investments; (vii) travel costs associated with investigating and evaluating investment opportunities (whether or not consummated) or making, monitoring, managing or disposing of portfolio investments; (viii) costs of borrowings of the Fund; (ix) costs of any third parties retained to provide services to the Fund; (x) premiums for fidelity and other insurance coverage requisite to the Fund’s operations; (xi) fees and expenses of the Fund’s “non-interested” trustees; (xii) legal, audit and Fund accounting expenses; (xiii) Custodian and transfer agent fees and expenses; (xiv) expenses incident to the repurchase of the Fund’s shares; (xv) fees and expenses related to the registration under federal and state securities laws of shares of the Fund for public sale; (xvi) expenses of printing and mailing prospectuses, reports, notices and proxy material to shareholders of the Fund; (xvii) all other expenses incidental to holding meetings of the Fund’s shareholders; and (xviii) such extraordinary non-recurring expenses as may arise, including litigation affecting the Fund and any obligation which the Fund may have to indemnify its officers and trustees with respect thereto. Any partner, director, officer or employee of the Sub-Adviser or its affiliates who may also serve as officers, trustees or employees of the Fund shall not receive any compensation directly from the Fund for their services, except to the extent the Board shall have specifically approved the payment by the Fund of all or a portion of such compensation. |

| (c) | The Sub-Adviser may, with the Board’s approval, agree to waive its fees and/or pay or reimburse the expenses of the Fund or otherwise subsidize the Fund to any level that the Sub-Adviser, or any such affiliate, may specify. Any such undertaking may be modified or discontinued at any time except to the extent the Sub-Adviser explicitly agrees in writing to maintain such undertaking for a specified period. |

| (d) | To the extent the Sub-Adviser or its affiliates incur any costs by assuming expenses that are an obligation of the Fund as set forth herein, the Fund shall promptly reimburse the Sub-Adviser for such costs and expenses, except to the extent the Sub-Adviser has otherwise explicitly agreed to bear such expenses. |

5

| 7. | COMPENSATION OF THE SUB-ADVISER. |

| (a) | For the services provided and the expenses assumed pursuant to this Agreement, the Adviser will pay to the Sub-Adviser a fee, based on the Average Daily Net Assets of the Fund, computed and paid monthly, at the annual rates set forth on Schedule A attached to this Agreement, as from time to time amended. The Fund’s “Average Daily Net Assets” shall be determined by taking an average of all of the determinations of such amount during such month at the close of business on each business day during such month while this Agreement is in. Such fee shall be payable for each month within 20 business days after the end of such month. |

| (b) | If the Sub-Adviser serves for less than the whole of a month, the foregoing compensation will be prorated. |

| (c) | The Sub-Adviser may agree to waive its fees and/or pay or reimburse the expenses of the Fund or otherwise subsidize the Fund to any level that the Sub-Adviser may specify. Any such undertaking may be modified or discontinued at any time except to the extent the Sub-Adviser explicitly agrees in writing to maintain such undertaking for a specified period. |

| (d) | All rights of compensation under this Agreement for services performed as of the termination date shall survive the termination of this Agreement. |

| 8. | FURTHER RESPONSIBILITIES AND OBLIGATIONS OF THE SUB-ADVISER. The Sub-Adviser further agrees that it: |

| (a) | will use the same degree of skill and care in providing services to the Fund as it uses in providing services to other accounts for which it has investment responsibilities; |

| (b) | will report to the Adviser and to the Board on a quarterly basis and will make appropriate persons available for the purpose of reviewing with representatives of the Adviser and the Board on a regular basis at such times as the Adviser or the Board may reasonably request in writing regarding the management of the Fund, including, without limitation, review of the general investment strategies of the Fund, the performance of the Fund’s investment portfolio in relation to relevant standard industry indices and general conditions affecting the marketplace, and will provide various other reports from time to time as reasonably requested by the Adviser or the Board; |

| (c) | will prepare and maintain such books and records with respect to the Fund’s securities and other transactions for the Fund’s investment portfolio as required for registered investment advisers performing such services under applicable law, the Fund’s compliance policies and procedures (as provided to the Sub-Adviser in writing) or as otherwise requested by the Adviser or the Board in writing, and will prepare and furnish the Adviser and the Board such periodic and special reports as the Adviser or the Board may request in writing from time to time. The Sub-Adviser further agrees that all records that it maintains for the Fund are the property of the Fund, and the Sub-Adviser will surrender promptly to the Fund any such records upon the request of the Adviser or the Board (provided, however, that the Sub-Adviser shall be permitted to retain copies thereof); and shall be permitted to retain originals (with copies to the Fund) to the extent required under Rule 204-2 of the Advisers Act or other applicable law; and |

| (d) | will monitor the pricing of portfolio securities, and events relating to the issuers of those securities and the markets in which the securities trade in the ordinary course of managing the portfolio securities of the Fund, and will notify the Adviser promptly of any issuer-specific or market events or other situations that occur (particularly those that may occur after the close of a foreign market in which the securities may primarily trade but before the time at which the Fund’s investments are priced on a given day) that may materially impact the pricing of one or more securities in Sub-Adviser’s portion of the portfolio. In addition, Sub-Adviser will at the Adviser’s request assist the Adviser in evaluating the impact that such an event may have on the net asset value of the Fund and in determining a recommended fair value of the affected security or securities. |

6

| 9. | OTHER ACTIVITIES. Nothing in this Agreement shall limit or restrict the right of any director, member, manager, officer, or employee of the Sub-Adviser or its affiliates to engage in any other business or to devote his or her time and attention in part to the management or other aspects of any other business, whether of a similar nature or a dissimilar nature, nor to limit or restrict the right of the Sub-Adviser or its affiliates to engage in any other business or to render services of any kind to any other person, corporation, firm, individual or association. The Sub-Adviser’s services to the Fund pursuant to this Agreement are not deemed to be exclusive and it is understood that the Sub-Adviser and its affiliates may render investment advice, management and other services to others. |

| 10. | LIMITATION OF LIABILITY AND INDEMNIFICATION OF THE SUB-ADVISER. |

| (a) | Except for losses resulting from the Sub-Adviser’s breach of fiduciary duty with respect to the receipt of compensation for services or losses resulting from the willful misfeasance, bad faith or gross negligence on its part in the performance of the Sub-Adviser’s duties or from reckless disregard by the Sub-Adviser of its duties under this Agreement, the Sub-Adviser will not be liable for any error of judgment or mistake of law or for any loss suffered by the Adviser or by the Fund in connection with the performance of this Agreement, including, without limitation, any loss incurred by the Adviser or the Fund as a result of any action taken or failure to act by the Sub-Adviser in good faith reliance upon (i) information, instructions or requests, whether oral or written, that the Sub-Adviser reasonably believes were made by a duly authorized person of the Adviser or the Fund; (ii) the written advice of counsel to the Fund or the Adviser; and (iii) any written instruction or certified copy of any resolution of the Board. |

| (b) | The Fund shall indemnify, to the fullest extent permitted by law, the Sub-Adviser, or any member, manager, officer or employee of the Sub-Adviser, and each and all of their affiliates, executors, heirs, assigns, successors or other legal representatives, against any liability or expense to which the person may be liable that arises in connection with the performance of services to the Fund, so long as the liability or expense is not incurred by reason of the person’s willful misfeasance, bad faith, or gross negligence, or from reckless disregard by such party of its duties to the Fund. The rights of indemnification provided under this Section shall not be construed so as to provide for indemnification of any aforementioned persons for any losses (including any liability under Federal securities laws which, under certain circumstances, impose liability even on persons that act in good faith) to the extent (but only to the extent) that such indemnification would be in violation of applicable law, but shall be construed so as to effectuate the applicable provisions of this Section to the fullest extent permitted by law. |

| (c) | This Section 10 shall survive the expiration or earlier termination of this Agreement. |

| 11. | PERMISSIBLE INTERESTS. Trustees, agents, and interest holders of the Fund and the Adviser are or may be interested in the Sub-Adviser (or any successor thereof) as members, managers, officers, or interest holders, or otherwise; members, managers, officers, agents, and interest holders of the Sub-Adviser are or may be interested in the Fund as trustees, interest holders or otherwise; and the Sub-Adviser (or any successor) is or may be interested in the Fund as an interest holder or otherwise. In addition, brokerage transactions for the Fund may be effected through affiliates of the Sub-Adviser if approved by the Fund’s Board, subject to the rules and regulations of the SEC. |

7

| 12. | DURATION AND TERMINATION. |

| (a) | This Agreement shall become effective on the date hereof and, unless sooner terminated as provided herein, shall continue in effect for a period of two (2) consecutive years from the effective date of this Agreement. Thereafter, if not terminated, this Agreement shall continue in effect with respect to the Fund for successive periods of 12 months, provided such continuance is specifically approved at least annually by both (a) the vote of a majority of the Fund’s Board or the vote of a majority of the outstanding voting securities of the Fund at the time outstanding and entitled to vote, and (b) by the vote of a majority of the Fund’s trustees who are not parties to this Agreement or interested persons of any party to this Agreement, cast in accordance with the requirements of the 1940 Act or any exemptive or other relief therefrom. |

| (b) | Notwithstanding the foregoing, this Agreement may be terminated at any time without the payment of any penalty by the Adviser or the Fund upon giving the Sub-Adviser 60 days’ written notice thereof (which notice may be waived by the Sub-Adviser), provided that such termination by the Fund shall be directed or approved by the vote of a majority of the trustees of the Fund in office at the time or by the vote of the holders of a majority of the outstanding voting securities of the Fund at the time outstanding and entitled to vote, or by the Adviser on 60 days’ written notice (which notice may be waived by the Fund). This Agreement will also immediately terminate in the event of its assignment. |

| (c) | The Sub-Adviser may terminate this Agreement at any time and without the payment of any penalty upon sixty (60) days’ written notice to the Fund and the Adviser. |

| (d) | As used in this Agreement, the terms “majority of the outstanding voting securities,” “interested person” and “assignment” shall have the same meanings of such terms in the 1940 Act and the rules and regulations thereunder; subject to such exemptions as may be granted by the SEC. |

| 13. | THE FUND AS A THIRD-PARTY BENEFICIARY. The parties hereto acknowledge and agree that the Fund is a third-party beneficiary as to the covenants, obligations, representations, and warranties undertaken by the Sub-Adviser under this Agreement and as to the rights and privileges to which the Adviser is entitled pursuant to this Agreement, and that the Fund is entitled to all of the rights and privileges associated with such third-party-beneficiary status. |

| 14. | NOTICE. Any notice under this Agreement shall be in writing to the other party at such address as the other party may designate from time to time for the receipt of such notice, and shall be deemed to be received on the earlier of the date actually received or on the fourth day after the postmark if such notice is mailed first class postage prepaid. |

| 15. | Amendment. No provision of this Agreement may be changed, waived, discharged or terminated orally, but only by an instrument in writing signed by the party against which enforcement of the change, waiver, discharge or termination is sought. Any amendment of this Agreement shall be subject to the requirements of the 1940 Act or any exemptive or other relief therefrom. |

8

| 16. | SEVERABILITY. If any provision of this Agreement shall be held or made invalid by a court decision, statute, rule or otherwise, the remainder of this Agreement shall not be affected thereby. |

| 17. | GOVERNING LAW. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware for contracts to be performed entirely therein without reference to choice of law principles thereof and in accordance with the applicable provisions of the 1940 Act. |

| 18. | CHANGE OF CONTROL. The Adviser shall notify the Sub-Adviser in writing at least sixty (60) days in advance of any change of control of the Adviser, as defined in the 1940 Act. The Sub-Adviser shall notify the Adviser and the Fund at least sixty (60) days in advance of any change of control of the Sub-Adviser, as defined in the 1940 Act. |

[Signature Page Follows]

9

IN WITNESS WHEREOF, the parties hereto have caused the foregoing instrument to be duly executed as of the day and the year first above written.

| Forma cashmere LLC | ||

| By: | ||

| Name: | ||

| Title: | ||

| Sweater Industries LLC | ||

| By: | ||

| Name: | ||

| Title: | ||

[Signature Page to Sub-Advisory Agreement]

Schedule A

Sub-Advisory Fee:

| Fund’s Average Daily Net Assets | Portion of total Management Fee to Sub-Adviser |

| $1 - $50,000,000 | 1.55% |

| $50,000,001 - $100,000,000 | 1.65% |

| $100,000,000 - $250,000,000 | 1.75% |

| $250,000,000 - $500,000,000 | 1.84% |

| $500,000,000+ | 1.94% |

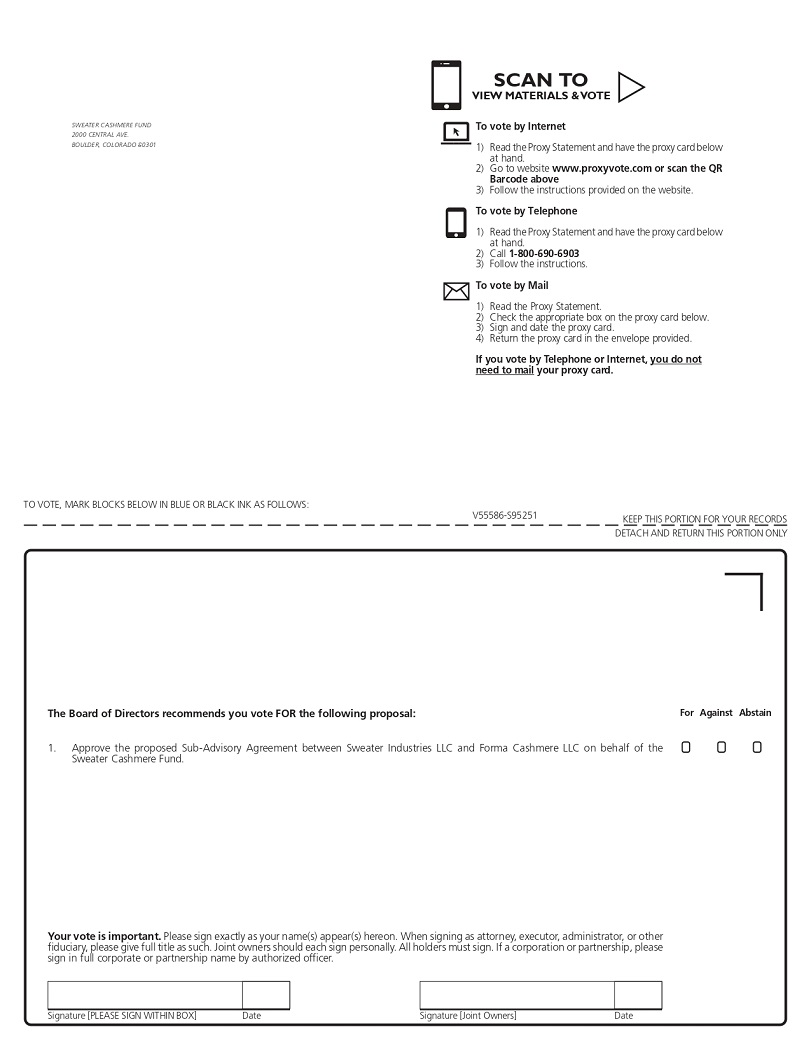

SCAN TO VIEW MATERIALS & VOTE SWEATER CASHMERE FUND 2000 CENTRAL AVE. BOULDER, COLORADO 80301 To vote by Internet 1) Read the Proxy Statement and have the proxy card below at hand. 2) Go to website www.proxyvote.com or scan the QR Barcode above 3) Follow the instructions provided on the website. To vote by Telephone 1) Read the Proxy Statement and have the proxy card below at hand. 2) Call 1-800-690-6903 3) Follow the instructions. To vote by Mail 1) Read the Proxy Statement. 2) Check the appropriate box on the proxy card below. 3) Sign and date the proxy card. 4) Return the proxy card in the envelope provided. If you vote by Telephone or Internet, you do not need to mail your proxy card. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: V55586-S95251 KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY The Board of Directors recommends you vote FOR the following proposal: For Against Abstain 1. Approve the proposed Sub-Advisory Agreement between Sweater Industries LLC and Forma Cashmere LLC on behalf of the Sweater Cashmere Fund. Your vote is important. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature [Joint Owners] Date

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com. V55587-S95251 SWEATER CASHMERE FUND PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS ON SEPTEMBER 5, 2024 This proxy is solicited by the Board of Trustees of the Sweater Cashmere Fund (the “Fund”) for use at a Special Meeting to be held at 11:00 a.m. Mountain Time, on September 5, 2024, at the offices of the Fund at 2000 Central Ave., Boulder, Colorado 80301. The proposal to be voted upon on behalf of the Fund (set forth on the reverse side of this proxy card) has been approved by the Board of Trustees and recommended for approval by shareholders. The undersigned shareholder of the Sweater Cashmere Fund hereby appoints Jesse Randall and Emma Clark, and each of them separately, with full power of substitution to each, as proxies of the undersigned, to represent the undersigned, and to vote, as designated on the reverse side of this proxy card, at the above stated Special Meeting and at any and all adjourned or postponed sessions thereof, all shares of the Fund that the undersigned is entitled to vote at the Special Meeting, and at any and all adjourned or postponed sessions thereof, on the proposal listed on the reverse side of this proxy card and in their discretion on any other matter which may properly come before the Special Meeting, and at any and all adjourned or postponed sessions thereof. In a case where the undersigned fails to designate a choice on the proposal listed on the reverse side of this proxy card, the proxies will vote “FOR” the proposal at the Special meeting, and at any and all adjourned or special sessions thereof. Unless revoked by you, your duly executed proxy card will remain in effect for any and all adjourned or postponed sessions of the meeting. If a new record date is fixed for the meeting, your duly executed proxy card, unless revoked, will remain in effect as to the number of shares you hold on the new record date. PLEASE VOTE, SIGN, AND DATE THE PROXY CARD AND RETURN IT IN THE ENCLOSED POSTAGE-PAID ENVELOPE