UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of March 2022

Commission File Number: 001-41035

CI&T Inc

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

R. Dr. Ricardo Benetton Martins, 1,000

Pólis de Tecnologia-Prédio 23B,

Campinas-State of São Paulo

13086-902 - Brazil

+55 19 21024500

(Address of principal executive office))

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

CI&T Inc

TABLE OF CONTENTS

New York - March 09, 2022 /Business Wire/ - CI&T (NYSE: CINT, “Company”), a global digital specialist, today announces its unaudited results for the fourth quarter of 2021 (4Q21) and audited results for the year ended December 31, 2021 (2021), in accordance with International Standards on Auditing (ISAs). 4Q21 and 2021 financial results are presented in accordance with International Financial Reporting Standards (IFRS). For comparison purposes, we refer to the results for the fourth quarter of 2020 (4Q20) and for the year ended December 31, 2020 (2020).

4Q21 Operating and Financial Highlights

● Net revenue reached R$456.8 million, a 72% growth compared to 4Q20.

● Net revenue growth in constant currency was 69% over 4Q20.

● Net profit was R$43.8 million, 49% higher than 4Q20.

● Adjusted EBITDA was R$101.8 million, with an adjusted EBITDA margin of 22.3%.

● Adjusted net profit totaled R$47.7 million, 62% higher than the same quarter of 2020.

2021 Operating and Financial Highlights

● Net revenue was R$1,444.4 million in 2021, up 51.0% year-over-year.

● Pro forma net revenue of R$1,617.4 million, 39.4% higher than in 2020.

● Pro forma net profit for the year was R$129.0 million, up 13% compared to 2020.

● Pro forma adjusted EBITDA was R$380.5 million, with an adjusted EBITDA margin of 23.5%.

● Pro forma adjusted net profit totaled R$160.1 million, equivalent to a pro forma adjusted net margin of 9.9%

● CI&T generated R$214.4 million in cash from operating activities, 37% higher compared to the amount of R$156.9 million recorded in 2020, and 66% cash-conversion from adjusted EBITDA.

● CI&T ended the year with 5,564 employees, a net addition of 2,345 employees in 2021.

● The number of clients with annual revenue above R$1 million grew from 58 in 2020 to 94 in 2021, a net addition of 36 new clients, and the net revenue retention rate (NRR) was 128% in 2021.

A word from our CEO

We are delighted to end 2021 with robust results, outperforming our growth guidance for the quarter and year in our first year-end as a public Company. Our net revenue grew 51% in 2021 year over year, with a solid adjusted EBITDA margin of 22.4%. This growth was boosted by higher demand from existing clients, the addition of new clients to our portfolio combined with our selective M&A strategy. We added 36 new clients with annual revenue above R$1 million, totaling 94 in 2021. Our top 10 client concentration reduced from 67% of our net revenue in 2020 to 54% in 2021. We are also providing strong growth guidance for 2022. What a great year, and I'm very proud of what we've done as CI&Ters, as a team.

It is worth looking back to understand how we will move forward: founded in 1995, CI&T has 27 years of consecutive growth and profitability. From 2006, the emblematic year we launched CI&T in the USA, to 2016, we had an organic CAGR of 30% in revenue. From 2016 on, we introduced three new growth forces: [1] a domain-driven Digital Strategy as a core component of our offering; [2] our Growth Unit business architecture, fostering a scalable entrepreneur organizational model; and [3] a programmatic approach for M&A as an enduring new capability focused on a flow of selective and strategic acquisitions. As a result of those moves, we are accelerating our annual growth pace: 41% in 2020, 51% in 2021, and guiding at least 56% in 2022. To operate at this new pace, we are constantly increasing our investments in hiring, training, and leadership development while keeping solid margins and cash conversion rates.

Now let's move our eyes forward. And yes, there are clouds in the sky: the global economy is yet to recover from a devastating pandemic, and we have a new set of geopolitical threads on the table. In parallel, "software continues to eat the world", enabling unprecedented and radical changes in society, values, and consumer behaviors. Digital is the answer to reconnect companies to a new breed of consumers. The result is a secular demand for digital services in the corporate world and an extraordinary opportunity for a decade of high growth for CI&T.

As CEO, my primary mission is to harmonize the interlinked needs of our stakeholders: we will increase our transformational impact through digital for our clients. And we will continue to do that by fostering meaningful and fast carriers in a psychologically safe environment where people can fulfill their personal purpose and ambitions. Our talent density enables a long-term value creation journey for our shareholders by way of high growth and profitability. And for our communities is about solving complex human problems, fostering diversity and inclusion, and ESG in a broader perspective, concretely contributing to making a better world. It's the equation of building a company that makes sense through the lens of the future and not the past.

With these foundations, we are confident we are on the right track. Here is my special gratitude to all CI&Ters that provide this incredible environment of joy and accomplishment at CI&T. A warm thank you to all our clients, partners, investors, and stakeholders that believe in our audacious ambitions as a company.

Through hardships to the stars!

And stay safe.

Cesar Gon

Comments on the 4Q21 and 2021 financial performances

Net Revenue

Revenue (in BRL thousand) | 4Q21 | 4Q20 | Var. 4Q21 x 4Q20 | 2021 | 2020 | Var. 2021 x 2020 |

Net Revenue | 456,794 | 265,367 | 72.1% | 1,444,380 | 956,519 | 51.0% |

In 4Q21, net revenue was R$456.8 million, an increase of 72.1% compared to 4Q20, of which 40% was organic growth. Net revenue in constant currency grew 69% in the comparable period. This performance was attributed to our expansion of current contracts, combined with the addition in the quarter of 19 new clients with revenue above R$1.0 million in the last twelve months, from 75 to 94 clients.

In 2021, CI&T’s net revenue was R$1,444.4 million, an increase of 51.0% year-over-year. Net revenue growth in constant currency was 47.0% and the net revenue retention rate was 128% in 2021, demonstrating the recurrency and resilience of our business.

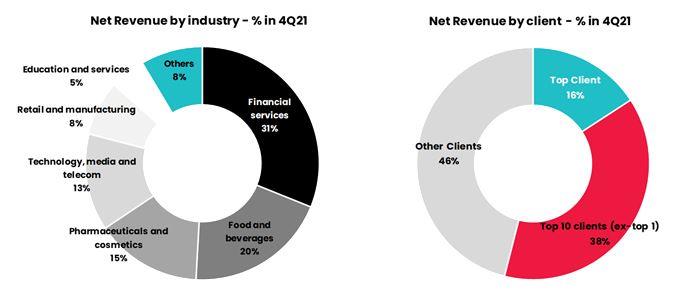

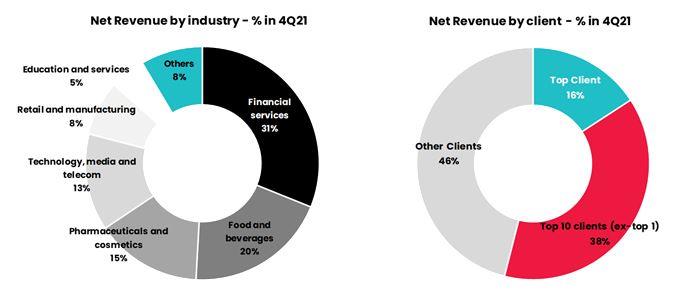

We reduced our top one and top 10 client concentration from 21% and 72% in 4Q20, respectively, to 16% and 54% in 4Q21, and we diversified our revenue breakdown by industry verticals. While all segments presented significant growth, Technology, Media and Telecom (TMT) and Retail and Manufacturing were the verticals that grew faster in terms of revenue from 4Q21 compared to 4Q20.

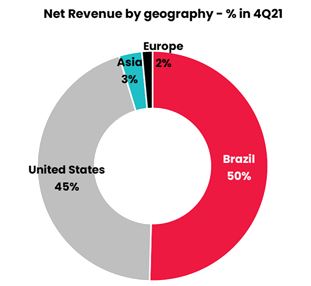

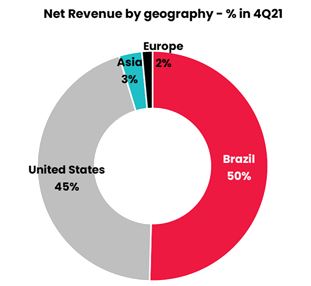

In terms of geography, Brazil and the U.S. continue to be our most relevant markets. The U.S. operation recorded the fastest growth rate of 50% organically in 4Q21 compared to 4Q20.

Cost of Services Provided

Gross Profit (in BRL thousand) | 4Q21 | 4Q20 | Var. 4Q21 x 4Q20 | 2021 | 2020 | Var. 2021 x 2020 |

Net Revenue | 456,794 | 265,367 | 72.1% | 1,444,380 | 956,519 | 51.0% |

Cost of Services | (294,746) | (166,294) | 77.2% | (935,732) | (600,866) | 55.7% |

Gross Profit | 162,048 | 99,073 | 63.6% | 508,648 | 355,653 | 43.0% |

Adjustments | | | | | | |

Depreciation and amortization (cost of services provided) | 8,764 | 5,995 | 46.2% | 31,884 | 24,085 | 32.4% |

Stock Options | 1,582 | 76 | 1981.6% | 1,930 | 139 | 1288.5% |

Adjusted Gross Profit | 172,394 | 105,144 | 64.0% | 542,462 | 379,877 | 42.8% |

Adjusted Gross Profit Margin | 37.7% | 39.6% | -1.9p.p | 37.6% | 39.7% | -2.2p.p |

In 4Q21, the cost of services provided totaled R$294.7 million, an increase of 77.2% compared to 4Q20, and the gross profit was R$162.0 million. Eliminating the depreciation and amortization and stock option expenses, the adjusted gross profit in 4Q21 was R$172.4 million, with an adjusted gross profit margin of 37.7%.

In 2021, the cost of services provided was R$935.7 million, an increase of 55.7% compared to 2020, and the gross profit reached R$508.6 million. Adjusted gross profit totaled R$542.5 million, with an adjusted gross profit margin of 37.6%, compared to 39.7% in 2020. The decline in gross profit margins is explained mainly by employee promotions and compensation adjustments that were postponed during the first year of the pandemic, aligned with current market conditions and our continuous investments in our people to foster a higher pace of growth.

SG&A and Other Expenses

SG&A expenses (in BRL thousand) | 4Q21 | 4Q20 | Var. 4Q21 x 4Q20 | 2021 | 2020 | Var. 2021 x 2020 |

Selling | (27,752) | (25,815) | 7.5% | (89,654) | (65,093) | 37.7% |

General and administrative | (58,685) | (22,861) | 156.7% | (151,681) | (81,161) | 86.9% |

SG&A expenses | (86,437) | (48,676) | 77.6% | (241,335) | (146,254) | 65.0% |

Other income (expenses) net(1) | 1,716 | (538) | - | (22,210) | (959) | 2216.0% |

Impairment loss on trade receivables and contract assets | 1,533 | (191) | - | (497) | (196) | 153.6% |

SG&A and other operating expenses | (83,188) | (49,405) | 68.4% | (264,042) | (147,409) | 79.1% |

(1)Include Research and technological innovation expenses

Selling, General and Administrative (SG&A) expenses grew 77.6% in 4Q21 compared to 4Q20, mainly due to (i) an increase in people expenses, associated with new hires and the strengthening of the Human Resources, Finance, Administrative and Legal teams, (ii) IPO, M&A and accounting advisory services and related expenses and (iii) higher depreciation and amortization expenses due to the recognition of intangible assets related to the acquisition of Dextra. These incremental expenses are mainly related to M&A activities and to the IPO, which occurred in November 2021. In 2021, SG&A expenses grew 65.0% in relation to 2020, due to the same reasons explained above.

Other net expenses in 2021 totaled R$22.2 million, due to the impairment of intangible assets in the amount of R$21.9 million recorded in 3Q21, a non-cash and one-off effect that are not related to Dextra core ongoing services and shall not impact CI&T nor Dextra operations going forward.

EBITDA and Adjusted EBITDA

Ebitda (in BRL thousand) | 4Q21 | 4Q20 | Var. 4Q21 x 4Q20 | 2021 | 2020 | Var. 2021 x 2020 |

Net profit for the period | 43,828 | 29,401 | 49.1% | 125,957 | 127,654 | -1.3% |

(+) Net financial expense | 8,130 | 1,417 | 473.7% | 34,232 | 15,453 | 121.5% |

(+) Income tax expense | 26,902 | 18,850 | 42.7% | 84,417 | 65,137 | 29.6% |

(+)Depreciation and amortizationnet | 18,251 | 7,429 | 145.7% | 48,354 | 29,882 | 61.8% |

| EBITDA | 97,111 | 57,097 | 70.1% | 292,960 | 238,126 | 23.0% |

| EBITDA Margin | 21.3% | 21.5% | -0.3p.p | 20.3% | 24.9% | -4.6p.p |

| Adjustments |

|

|

|

|

|

|

| Stock Options | 1,838 | 201 | 814.4% | 2,531 | 934 | 171.0% |

Consulting expenses (1) | 3,821 | 108 | 3438.0% | 9,177 | 428 | 2044.2% |

| Government grants | (1,063) | (253) | 320.2% | (2,481) | (1,571) | 57.9% |

| Impairment | 77 | 0 | 0.0% | 21,895 | 0 | - |

| Adjusted EBITDA | 101,784 | 57,153 | 78.1% | 324,082 | 237,917 | 36.2% |

| Adjusted EBITDA Margin | 22.3% | 21.5% | 0.7p.p | 22.4% | 24.9% | -2.4p.p |

(1)Include R$18 thousand from indemnity expenses in 4Q20 and 2020

In 4Q21, EBITDA was R$97.1 million, 70.1% higher than 4Q20. Adjusted EBITDA in the quarter was R$101.8 million, an increase of 78.1% compared to 4Q20. Adjusted EBITDA margin was 22.3% in 4Q21, slightly above the adjusted EBITDA margin of 21.5% reported in 4Q20.

The reported EBITDA in 2021 was R$293.0 million, an increase of 23% in relation to 2020. Adjusted EBITDA was R$324.1 million, 36.2% higher than in 2020. Adjusted EBITDA margin was 22.4% in 2021, below the level of 24.9% reported in 2020 when the result benefited from lower costs and expenses during the first year of the pandemic.

Net Financial Expenses

Net financial expenses was R$8.1 million in 4Q21, compared to R$1.4 million in 4Q20, mainly due to new debt in the amount of R$650 million incurred by the Company in July to finance the Dextra acquisition, which will mature in 2026. In 2021, net financial expenses totaled R$34.2 million, an increase in relation to the R$15.4 million expense in 2020. Interest on loans increased from R$10.3 million in 2020 to R$R$29.7 million in 2021 due to the increase in the gross debt position, as explained above, combined with the increase in interest rates (CDI) during the year. Income from financial investments grew from R$2.6 million in 2020 to R$4.3 million in 2021.

Depreciation and Amortization

Depreciation and amortization expenses totaled R$18.3 million in 4Q21, an increase of R$10.8 million compared to 4Q20. In 2021, depreciation and amortization expenses reached R$48.3 million, compared to R$29.9 million in 2020, mainly due to the recognition of intangible assets related to the acquisition of Dextra in 2021 in the amount of R$148.5 million from customer relationships, non-compete agreement and brands.

In addition, the Company recognized R$595.7 million in goodwill from the acquisition of Dextra, which is expected to be deductible for tax purposes, considering the merger of Dextra and CI&T that occurred on December 2021.

Net Profit and Adjusted Net Profit

Net Profit (in BRL thousand) | 4Q21 | 4Q20 | Var. 4Q21 x 4Q20 | 2021 | 2020 | Var. 2021 x 2020 |

Net profit(loss) for the period | 43,828 | 29,401 | 49.1% | 125,957 | 127,654 | -1.3% |

Adjustments | | | | | | |

Consulting expenses (1) | 3,821 | 108 | 3438.0% | 9,177 | 428 | 2044.2% |

Impairment | 77 | 0 | 0.0% | 21,895 | 0 | - |

Adjusted Net Profit | 47,726 | 29,509 | 61.7% | 157,029 | 128,082 | 22.6% |

Adjusted Net Profit Margin | 10.4% | 11.1% | -0.7p.p | 10.9% | 13.4% | -2.5p.p |

(1)Include R$18 thousand from indemnity expenses in 4Q20 and 2020

In 4Q21, net profit was R$43.8 million, 49.1% higher than 4Q20. Adjusted net profit reached R$47.7 million, an increase of 61.7% compared to 4Q20. The adjusted net profit margin reduced slightly from 11.1% in 4Q20 to 10.4% in 4Q21, mainly due to higher depreciation and amortization and financial expenses, as explained above.

In 2021, net profit totaled R$125.9 million, 1.3% lower than in 2020. The adjusted net profit was R$157.0 million, 22.6% higher than in 2020. The adjusted net profit margin was 10.9% in 2021, a reduction of the level observed in 2020, explained mainly by the increase in the cost of service provided and higher expenses with depreciation and amortization and financial expenses.

Cash Flow from Operations

In 2021, CI&T generated R$214.4 million in cash from operating activities, 37% higher compared to the amount of R$156.9 million recorded in 2020. Deducting payment for income tax and interest on loans, borrowings and leasing, net cash from operating activities was R$132.4 million, an increase of R$31.4 million in relation to 2020.

Investments on acquisition of property, plant and equipment and intangible assets represented R$29.9 million in 2021 and R$21.4 million in 2020, and are mainly related to IT equipments for the growing number of employees.

Indebtedness

CI&T ended December 31, 2021 with a financial net cash position of R$145.8 million, composed of a gross debt position of R$788.7 million and R$934.5 million in cash, cash equivalents and financial investments, including the net proceeds of our IPO. Lease liabilities amounted to R$81.9 million at the end of the quarter. Currently, 34% of the total debt is USD denominated and 66% is denominated in Brazilian Reais, which is linked to the Brazilian interest rate, CDI.

Business Outlook

We expect our net revenue in the first quarter of 2022 to be at least R$485.0 million, a 64% growth compared to our net revenue of R$ 296.3 million in the first quarter of 2021.

For the full year of 2022, we expect our net revenue to be at least R$2,250 million or USD433 million, a 56% growth compared to our net revenue of R$1,444 million in 2021. In addition, we estimate our adjusted EBITDA to be at least 20% for the full year of 2022. This guidance for 2022 assumes an average exchange rate of 5.20 Brazilian Reais to the U.S. dollar for the full year.

These expectations are forward-looking statements and actual results may differ materially. See "Cautionary Statement on Forward-Looking Statements" below

Pro forma financial highlights, including the Dextra acquisition as if the acquisition had occurred on January 1, 2021

● Pro forma net revenue of R$1,617.4 million, 39.4% higher than in 2020.

● Pro forma net profit for the year was R$129.0 million

● Pro forma adjusted EBITDA was R$380.5 million, with an adjusted EBITDA margin of 23.5%.

● Pro forma adjusted net profit totaled R$160.1 million, equivalent to an adjusted net margin of 9.9%

Pro Forma Income Statement (in BRL thousand) | 2021 | 2020 | Var. 2021 x 2020 |

Net Revenue | 1,617,339 | 1,160,555 | 39.4% |

Costs of services provided | (1,038,939) | (717,701) | 44.8% |

Gross Profit | 578,400 | 442,854 | 30.6% |

SG&A | (277,293) | (210,678) | 31.6% |

Other income (expenses) net (1) | (23,499) | (1,047) | - |

Operating profit before financial income | 277,608 | 231,129 | 20.1% |

Net finance expense | (64,654) | (58,825) | 9.9% |

Profit before Income tax | 212,954 | 172,304 | 23.6% |

Income tax expense | (83,910) | (57,702) | 45.4% |

Net profit for the year | 129,044 | 114,602 | 12.6% |

(1) includes impairment loss on trade receivables and contract assets

Pro Forma Non-IFRS Financial Measures

Please refer to page the appendix for non-IFRS financial adjustments.

Pro Forma (in BRL thousand) | 2021 | 2020 | Var. 2021 x 2020 |

Adjusted Gross Profit | 617,334 | 471,584 | 30.9% |

EBITDA | 349,387 | 295,716 | 18.1% |

Adjusted EBITDA | 380,509 | 296,767 | 28.2% |

Adjusted EBITDA Margin | 23.5% | 25.6% | -2.0 |

Adjusted Net Profit | 160,116 | 116,290 | 37.7% |

Adjusted Net Profit Margin | 9.9% | 10.0% | -0.1 |

The unaudited pro forma condensed statements of profit or loss for the year ended December 31, 2021 is based on (a) the audited consolidated statements of profit or loss of CI&T Inc for the year ended December 31, 2021; and (b) the unaudited financial information of Dextra Tecnologia for the period from January 1, 2021 to August 9, 2021 and gives effect on a pro forma basis to the Dextra Acquisition as if it had been consummated on January 1, 2021.

The transaction accounting adjustments totaled a negative effect of R$28.8 million in the pro forma net income in 2021, and it relates to (a) amortization expense of intangible assets (customer relationship, brand and non-compete agreement), (b) estimated interest expenses on the new debt to finance the Dextra acquisition, and (c) expected income taxes based on the pro forma adjustments. Please refer to the table Pro Forma- Statement of profit and loss (Unaudited) below.

Conference Call and Webcast Information

Cesar Gon, Bruno Guicardi, Stanley Rodrigues and Eduardo Galvão will host a video conference call to discuss the 4Q21 and 2021 financial and operating results on March 10 at 8:00 a.m. Eastern Time / 10:00 a.m. BRT. The earnings call can be accessed at the Company’s Investor Relations website at https://investors.ciandt.com or at the following link:

http://investors.ciandt.com/investors-info/events-and-presentations/CIT-4Q21-Earnings-Call.

About CI&T

CI&T is a global digital specialist, a partner in end-to-end digital transformation for 100+ Large Enterprises & Fast Growth Clients. As digital natives, we bring a 27-year track record of accelerating business impact through complete and scalable digital solutions. With a global presence in 8 countries with a nearshore delivery model, CI&T is the Employer of Choice for more than 5,500 professionals in strategy, data science, design, and engineering, unlocking top-line growth, improving customer experience, and driving operational efficiency.

Basis of accounting and functional currency

CI&T maintains its books and records in Brazilian reais, the presentation currency for its audited consolidated financial statements, and the functional currency of our operations in Brazil. CI&T prepares its audited consolidated financial statements in accordance with IFRS, as issued by the IASB.

Non-IFRS Financial Measures

We regularly monitor certain financial and operating metrics to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions. These non-IFRS financial measures include Adjusted Gross Profit, Adjusted Gross Profit Margin, EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Profit for the period, Adjusted Net Profit Margin for the period, Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency, and should be considered in addition to results prepared in accordance with IFRS, but not as substitutes for IFRS results. In addition, our calculation of these non-IFRS financial measures may be different from the calculation used by other companies, and therefore comparability may be limited. These non-IFRS financial measures are provided as additional information to enhance investors’ overall understanding of the historical and current financial performance of our operations. Please refer to the previous pages for reconciliations and explanation of the reconciliation itens for Non-IFRS measures and see appendix below "Reconciliation of Non-IFRS measures Pro Forma, including the Dextra acquisition as if the acquisition had occurred on January 1, 2021" for reconciliations of our Non-IFRS measures to the nearest IFRS measure.

We monitor our net revenue at constant currency and net revenue increase at constant currency. As the impact of foreign currency exchange rates is highly volatile and difficult to predict, we believe Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency allow us to better understand the underlying business trends and performance of our ongoing operations on a period-over-period basis by eliminating the effect of fluctuations in the exchange rates we use in the translation of our Net revenue in foreign currencies into Brazilian reais. We calculate Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency by translating Net revenue from entities reporting in foreign currencies into Brazilian reais using the comparable foreign currency exchange rates from the prior period.

CI&T is not providing a quantitative reconciliation of forward-looking Non-IFRS Adjusted EBITDA to the most directly comparable IFRS measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort. These items include, but are not limited to, stock-based compensation expense, acquisition-related charges, the tax effect of non-IFRS adjustments and other items. These items are uncertain, depend on various factors, and could have a material impact on IFRS reported results for the guidance period.

In calculating Adjusted Gross Profit, we exclude cost components that are not related to the direct management of our services. For the periods herein, the adjustments applied were: (i) depreciation and amortization related to costs of services provided; and (ii) stock options compensation plan expenses.

In calculating Adjusted EBITDA, we exclude components that are not related to the direct management of our services. For the periods herein, the adjustments were: (i) consulting expenses related to corporate reorganization and initial public offering expenses, as well as mergers and acquisitions activity; (ii) government grants related to tax reimbursement in the Chinese subsidiary; (iii) stock options compensation plan expenses; and (iv) the impairment related to the discontinuation of certain investments made by Dextra on certain in progress intangible assets related to digital platforms following the closing of the Dextra acquisition. CI&T does not expect a continuing impact in its operations related to this impairment.

In calculating Adjusted Net Profit, we exclude cost components that are not related to the direct management of our services. For the periods herein, the adjustments applied were: (i) consulting expenses related to corporate reorganization and initial public offering costs, as well as mergers and acquisitions activity; and (ii) the impairment related to the discontinuation of certain investments made by Dextra on certain in progress intangible assets related to digital platforms following the closing of the Dextra acquisition. CI&T does not expect a continuing impact in its operations related to this impairment. Net Revenue Retention Rate is calculated by dividing Net revenue, less Net revenue generated from new clients in a given year, over Net revenue from the previous year. Cash conversion rate is calculated by dividing cash generated from operating activities over adjusted EBITDA.

Cautionary Statement on Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, which include but are not limited to: the statements under "Business outlook," including expectations relating to revenues and other financial or business metrics; statements regarding relationships with clients; and any other statements of expectation or belief. The words “believe,” “will,” “may,” “may have,” “would,” “estimate,” “continues,” “anticipates,” “intends,” “plans,” “expects,” “budget,” "scheduled,” “forecasts” and similar words are intended to identify estimates and forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements represent our management's beliefs and assumptions only as of the date of this press release. You should read this press release with the understanding that our actual future results may be materially different from what we expect. These statements are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from results expressed or implied in this press release. Such risk factors include, but are not limited to, those related to: the current and future impact of the COVID-19 pandemic on our business and industry; the effects of competition on our business; uncertainty regarding the demand for and market utilization of our services; the ability to maintain or acquire new client relationships; general business and economic conditions; our ability to successfully integrate Dextra; and our ability to successfully execute our growth strategy and strategic plans. Additional information concerning these and other risks and uncertainties are contained in the "Risk Factors" section of CI&T's registration statement on Form F-1. Additional information will be made available in our annual reports on Form 20-F, and other filings and reports that CI&T may file from time to time with the SEC. Except as required by law, CI&T assumes no obligation and does not intend to update these forward-looking statements or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Contacts

Investor Relations Contact:

Eduardo Galvão

egalvao@ciandt.com

Media Relations Contact:

Zella Panossian

ciandt@illumepr.com

Consolidated Statement of profit and loss, including Dextra as of August 10, 2021

(in BRL thousand)

| Three months ended December 31, |

| | Full year ended December 31, |

|

| 2021 | |

| 2020 |

| | 2021 | |

| 2020 |

|

Net Revenue | 456,794 | |

| 265,367 |

| | 1,444,380 | |

| 956,519 |

|

Costs of services provided | (294,746 | ) |

| (166,294 | ) | | (935,732 | ) |

| (600,866 | ) |

Gross Profit | 162,048 | |

| 99,073 |

| | 508,648 | |

| 355,653 |

|

Selling expenses | (27,752 | ) |

| (25,815 | ) | | (89,654) | |

| (65,093 | ) |

General and administrative expenses | (58,685 | ) |

| (22,861 | ) | | (151,681 | ) |

| (81,161 | ) |

Research and technological innovation expenses | - | |

| (810 | ) | | (4 | ) |

| (3,462 | ) |

Impairment loss on trade receivables and contract assets | 1,533 | |

| (191 | ) | | (497 | ) |

| (196 | ) |

Other income (expenses) net | 1,716 | |

| 272 |

| | (22,206 | ) |

| 2,503 |

|

Operating profit before financial income and tax | 78,860 | |

| 49,668 |

| | 244,606 | |

| 208,244 |

|

Finance income | 26,395 | |

| 14,957 |

| | 69,816 | |

| 47,808 |

|

Finance cost | (34,525 | ) |

| (16,374 | ) | | (104,048 | ) |

| (63,261 | ) |

Net finance expense | (8,130 | ) |

| (1,417 | ) | | (34,232 | ) |

| (15,453 | ) |

Profit before Income tax | 70,730 | |

| 48,251 |

| | 210,374 | |

| 192,791 |

|

Income tax expense | | |

| |

| | | |

| |

|

Current | (32,008 | ) |

| (24,434 | ) | | (95,375 | ) |

| (66,912 | ) |

Deferred | 5,106 | |

| 5,584 |

| | 10,958 | |

| 1,775 |

|

Net profit for the year | 43,828 | |

| 29,401 |

| | 125,957 | |

| 127,654 |

|

Income attributable to: | | |

| |

| | | |

| |

|

Controlling shareholders | - | |

| - |

| | 125,957 | |

| 127,654 |

|

Non-controlling interests | - | |

| - |

| | - | |

| - |

|

Earnings per share | | |

| |

| | | |

| |

|

Earnings per share – basic (in R$) | - | |

| - |

| | 1.03 | |

| 1.06 |

|

Earnings per share – diluted (in R$) | - | |

| - |

| | 1.01 | |

| 1.04 |

|

Consolidated statements of financial position

(in BRL thousand)

Assets | December 31, 2021 | | December 31, 2020 | | Liabilities and equity | December 31, 2021 | | December 31, 2020 |

Cash and cash equivalents | 135,727 | | 162,827 | | Suppliers and other payables | 33,566 | | 15,312 |

Financial Investments | 798,786 | | - | | Loans and borrowings | 164,403 | | 75,377 |

Trade receivables | 340,519 | | 196,256 | | Lease liabilities | 21,214 | | 14,569 |

Contract assets | 134,388 | | 50,625 | | Salaries and welfare charges | 234,173 | | 141,794 |

Recoverable taxes | 7,785 | | 1,016 | | Accounts payable for business combination | 48,923 | | - |

Tax assets | 2,810 | | 2,117 | | Derivatives | 535 | | 5,392 |

Derivatives | 896 | | 8,837 | | Tax liabilities | 13,345 | | 6,078 |

Other assets | 29,994 | | 12,874 | | Other taxes payable | 5,423 | | 3,279 |

Total current assets | 1,450,905 | | 434,552 | | Dividends and interest on equity payable | - | | 30,677 |

| | | | | Contract liability | 13,722 | | 9,987 |

| | | | | Indemnity | - | | 628 |

Recoverable taxes | 3,046 | | 3,099 | | Other liabilities | 13,669 | | 7,899 |

Deferred tax | 31,989 | | 15,152 | | Total current liabilities | 548,973 | | 310,992 |

Judicial deposits | 3,079 | | 3,083 | | | | | |

Other assets | 2,974 | | 2,494 | | Loans and borrowings | 624,306 | | 13,853 |

Property, plant and equipment | 57,721 | | 38,771 | | Lease liabilities | 60,674 | | 60,659 |

Intangible assets | 738,803 | | 18,166 | | Provisions | 633 | | 161 |

Right-of-use assets | 73,827 | | 69,765 | | Accounts payable for business combination | 36,803 | | - |

Total non-current assets | 911,439 | | 150,530 | | Other liabilities | 1,660 | | 957 |

| | | | | | | | |

| | | | | Total non-current liabilities | 724,076 | | 75,630 |

| | | | | | | | |

| | | | | Equity | | | |

| | | | | Share capital | 36 | | 68,968 |

| | | | | Share premium | 915,947 | | - |

| | | | | Capital reserves | 10,105 | | 6,764 |

| | | | | Profit reserves | 125,957 | | 109,308 |

| | | | | Other comprehensive income | 37,250 | | 13,420 |

| | | | | Total equity | 1,089,295 | | 198,460 |

Total assets | 2,362,344 | | 585,082 | | Total equity and liabilities | 2,362,344 | | 585,082 |

Cash Flow Statement

(in BRL thousand)

| December 31, 2021 |

| | December 31, 2020 |

|

Cash flow from operating activities | |

| | |

|

Net profit for the year | 125,957 |

| | 127,654 |

|

Adjustments for: | |

| | |

|

Depreciation and amortization | 48,354 |

| | 29,882 |

|

Gain/loss on the sale of property, plant and equipment and intangible assets | 1,237 |

| | 689 |

|

Interest, monetary variation and exchange rate changes | 45,627 |

| | 7,789 |

|

Interest on accounts payable for business combinations | 3,091 |

| | - |

|

Interest on lease | 6,369 |

| | 5,023 |

|

Unrealized loss (gain) on financial instruments | 3,084 |

| | (2,512 | ) |

Income tax expenses | 84,417 |

| | 65,137 |

|

Impairment losses on trade receivables | 280 |

| | 414 |

|

Provision for (reversal of) impairment losses on trade receivables and contract assets | 217 |

| | (218 | ) |

Write-off of intangible assets | 21,894 |

| | - |

|

Provision for labor risks | 472 |

| | (12 | ) |

Provision for indemnity | - |

| | (18 | ) |

Share-based plan | 2,531 |

| | 942 |

|

Exchange rate changes on indemnity | - |

| | (4,324 | ) |

Others | 98 |

| | 469 |

|

Variation in operating assets and liabilities | |

| | |

|

Trade receivables | (102,300 | ) | | (47,848 | ) |

Contract assets | (52,876 | ) | | (8,339 | ) |

Other taxes recoverable | (13,806 | ) | | 461 |

|

Tax assets | (91 | ) | | 507 |

|

Judicial deposits | 4 |

| | - |

|

Suppliers | 12,215 |

| | 6,746 |

|

Salaries and welfare charges | 63,083 |

| | 49,086 |

|

Tax liabilities | (17,364 | ) | | (12,275 | ) |

Other taxes payable | 1,698 |

| | (407 | ) |

Contract liabilities | 1,922 |

| | (7,138 | ) |

Payment of share-based indemnity | (628 | ) | | (43,354 | ) |

Other receivables and payables, net | (21,054 | ) | | (11,435 | ) |

Cash generated from operating activities | 214,431 |

| | 156,919 |

|

Income tax paid | (64,150 | ) | | (47,044 | ) |

Interest paid on loans and borrowings | (12,149 | ) | | (3,880 | ) |

Interest paid on lease | (5,753 | ) | | (5,023 | ) |

Net cash from operating activities | 132,379 |

| | 100,972 |

|

Cash flows from investment activities: | |

| | |

|

Acquisition of property, plant and equipment and intangible assets | (29,907 | ) | | (21,391 | ) |

Financial investment application | (784,915 | ) | | - |

|

Acquisition of subsidiary net of cash acquired | (692,722 | ) | | - |

|

Net cash used in investment activities | (1,507,544 | ) | | (21,391 | ) |

Cash flow from financing activities: | |

| | |

|

Share-based plan contributions | 1,282 |

| | - |

|

Issuance of common shares at initial public offering | 915,947 |

| | - |

|

Transaction cost of offering | (55,874 | ) | | - |

|

Dividends paid | (126,045 | ) | | (30,977 | ) |

Interest on equity, paid | (6,288 | ) | | (4,276 | ) |

Payment of lease liabilities | (17,656 | ) | | (15,500 | ) |

Proceeds from loans and borrowings | 740,596 |

| | 144,269 |

|

Payment of loans and borrowings | (75,196 | ) | | (88,107 | ) |

Net cash from financing activities | 1,376,766 |

| | 5,409 |

|

Net increase in cash and cash equivalents | 1,601 |

| | 84,990 |

|

Cash and cash equivalents as of January 1st | 162,827 |

| | 79,500 |

|

Exchange variation effect on cash and cash equivalents | (20,949 | ) | | (1,663 | ) |

Cash reduction due to spin-off effect | (7,752 | ) | | - |

|

Cash and cash equivalents as of December 31, 2021 | 135,727 |

| | 162,827 |

|

Pro Forma- Statement of profit and loss (Unaudited )

(in BRL thousand)

| CI&T |

|

| Dextra |

|

| Transaction Accounting Adjustments |

|

| CI&T Pro forma 2021 |

|

Net revenue | 1,444,380 |

|

| 172,959 |

|

| - |

|

| 1,617,339 |

|

Costs of services provided | (935,732 | ) |

| (103,207 | ) |

| - |

|

| (1,038,939 | ) |

Gross profit | 508,648 |

|

| 69,752 |

|

| - |

|

| 578,400 |

|

Selling expenses | (89,654 | ) |

| (1,021 | ) |

| - |

|

| (90,675 | ) |

General and administrative expenses | (151,681 | ) |

| (20,010 | ) |

| (14,927 | ) |

| (186,618 | ) |

Research and technological innovation expenses | (4 | ) |

| - |

|

| - |

|

| (4 | ) |

Impairment loss on trade receivables and contract assets | (497 | ) |

| 92 |

|

| - |

|

| (405 | ) |

Other income (expenses) net | (22,206 | ) |

| (884 | ) |

| - |

|

| (23,090 | ) |

Operating profit before financial income and tax | 244,606 |

|

| 47,929 |

|

| (14,927 | ) |

| 277,608 |

|

Finance income | 69,816 |

|

| 224 |

|

| - |

|

| 70,040 |

|

Finance cost | (104,048 | ) |

| (1,852 | ) |

| (28,794 | ) |

| (134,694 | ) |

Net finance costs | (34,232 | ) |

| (1,628 | ) |

| (28,794 | ) |

| (64,654 | ) |

Profit before Income tax | 210,374 |

|

| 46,301 |

|

| (43,721 | ) |

| 212,954 |

|

Income tax | (84,417 | ) |

| (14,358 | ) |

| 14,865 |

|

| (83,910 | ) |

Current | (95,375 | ) |

| (12,740 | ) |

| 14,865 |

|

| (93,250 | ) |

Deferred | 10,958 |

|

| (1,618 | ) |

| - |

|

| 9,341 |

|

Net profit for the period | 125,957 |

|

| 31,943 |

|

| (28,856 | ) |

| 129,044 |

|

Income attributable to: | |

|

| |

|

| |

|

| |

|

Controlling shareholders | 125,957 |

|

| 31,943 |

|

| (28,856 | ) |

| 129,044 |

|

Net profit for the period | 125,957 |

|

| 31,943 |

|

| (28,856 | ) |

| 129,044 |

|

Earnings per share | |

|

| |

|

| |

|

| |

|

Earnings per share – basic (in R$) | 1.030 |

|

| |

|

| |

|

| 1.060 |

|

Earnings per share – diluted (in R$) | 1.010 |

|

| |

|

| |

|

| 1.030 |

|

APPENDIX

Reconciliation of Non-IFRS measures - Pro Forma, including the Dextra acquisition as if the acquisition had occurred on January 1, 2021 (Unaudited)

(in BRL thousand)

| 2021 |

| | 2020 |

|

Pro forma Net Revenue | 1,617,339 |

| | 1,160,555 |

|

Pro forma Cost | (1,038,939 | ) | | (717,701 | ) |

Pro forma Gross Profit | 578,400 |

| | 442,854 |

|

Pro forma Selling, general, and administrative | (277,297 | ) | | (210,678 | ) |

Pro forma Impairment loss on trade receivables and contract assets | (405 | ) | | (258 | ) |

Pro forma Other income (expenses) net | (23,090 | ) | | (789 | ) |

Pro forma Operating profit before financial income | 277,608 |

| | 231,129 |

|

Pro forma Net finance expense | (64,654 | ) | | (58,825 | ) |

Pro forma Profit before Income tax | 212,954 |

| | 172,304 |

|

Pro forma Income Tax | (83,910 | ) | | (57,702 | ) |

Pro forma Net profit for the period | 129,044 |

| | 114,602 |

|

Reconciliation of Pro forma Adjusted Gross Profit | |

| | |

|

Pro forma Gross Profit | 578,400 |

| | 442,854 |

|

Adjustments | |

| | |

|

Depreciation and amortization (cost of services provided) | 37,004 |

| | 28,591 |

|

Stock Options | 1,930 |

| | 139 |

|

Adjusted Pro forma Gross Profit | 617,335 |

| | 471,584 |

|

Adjusted Pro forma Gross Profit Margin | 38.0 | % | | 40.6 | % |

Reconciliation of Pro forma EBITDA | |

| | |

|

Pro forma Net profit for the period | 129,044 |

| | 114,602 |

|

Adjustments | |

| | |

|

Net finance expense | 64,654 |

| | 58,825 |

|

Income tax expense | 83,910 |

| | 57,702 |

|

Depreciation and amortization | 71,779 |

| | 64,587 |

|

Pro forma EBITDA | 349,387 |

| | 295,716 |

|

Pro forma EBITDA Margin | 21.6 | % | | 25.5 | % |

Reconciliation of Adjusted Pro forma EBITDA | |

| | |

|

Pro forma Net profit for the period | 129,044 |

| | 114,602 |

|

Adjustments | |

| | |

|

Net finance expense | 64,654 |

| | 58,825 |

|

Income tax expense | 83,910 |

| | 57,702 |

|

Depreciation and amortization | 71,779 |

| | 64,587 |

|

Stock Options | 2,531 |

| | 934 |

|

Consultant Expenses | 9,177 |

| | 1,706 |

|

Government grants | (2,481 | ) | | (1,571 | ) |

Impairment | 21,895 |

| | 0 |

|

Indemnity | 0 |

| | (18 | ) |

Adjusted Pro forma EBITDA | 380,508 |

| | 296,767 |

|

Adjusted Pro forma EBITDA Margin | 23.5 | % | | 25.6 | % |

Reconciliation of Adjusted Pro forma Net Income | |

| | |

|

Pro forma Net profit for the period | 129,044 |

| | 114,602 |

|

Adjustments | |

| | |

|

Business Consultant Cost | 9,177 |

| | 1,706 |

|

Impairment | 21,895 |

| | 0 |

|

Indemnity | 0 |

| | (18) |

|

Adjusted Pro forma Net profit for the period | 160,116 |

| | 116,290 |

|

Adjusted Pro forma Net profit Margin for the period | 9.9 | % | | 10.0 | % |

NET REVENUE AT CONSTANT CURRENCY | Three months ended December 31, | | Full year ended December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

Net Revenue at Constant Currency | 448,375 | | 265,292 | | 1,408,679 | | 958,142 |

CI&T

Inc

Consolidated financial statements

December 31, 2021

KPMG Auditores Independentes Ltda.

Av. Coronel Silva Teles, 977, 10º andar, Conjuntos 111 e 112 - Cambuí

Edifício Dahruj Tower

13024-001 - Campinas/SP - Brasil

Caixa Postal 737 - CEP: 13012-970 - Campinas/SP - Brasil

Telefone +55 (19) 3198-6000

kpmg.com.br

To the Management, Those Charged with Governance and Shareholders of

CI&T Inc.

Opinion

We have audited the consolidated financial statements of CI&T Inc. (“the Company”), which comprise the consolidated statement of financial position as at December 31, 2021, the consolidated statements of profit or loss, other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2021, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Company in accordance with the relevant ethical requirements included in the Accountant Professional Code of Ethics (“Código de Ética Profissional do Contador”) and in the professional standards issued by the Brazilian Federal Accounting Council (“Conselho Federal de Contabilidade”) and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current year. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Assessment of the initial fair value measurement of intangible assets acquired through the business combination of Dextra |

Note nº 9 to the consolidated financial statements |

Key audit matters | How the matter was addressed in our audit |

During the fiscal year 2021, the Company acquired control of Dextra Investimentos S.A. and its subsidiaries (“Dextra”). The acquisitions were completed in 2021, after approval by regulatory bodies and compliance with legal formalities. The acquisition is considered a business combination. The fair value of the acquired intangible assets was determined based on the estimated future cash flows to be generated from the acquired assets. The definition of useful life for the identified assets used to estimate the fair value of the acquired intangible assets involved a high degree of judgment and effort due to the significant measurement of methodology and uncertainty in the assumptions. Due to the relevance and high degree of judgment involved in the fair value measurement of intangible assets acquired, we consider this matter to be significant for our audit work. | We analyzed the acquisition was considered a business combination agreement and with the technical support of our specialists in corporate finance, we evaluated the reasonableness and consistency of the methodology used to measure the fair value attributed to the acquired assets, identified intangibles, as well as the assumption of useful life estimates used in the projection of cash flows compared with reference market values. The assessment of the disclosures made by the Company in the consolidated financial statements was also part of our procedures. Based on the evidence obtained through the procedures described above, we believe that the fair value measurement of intangible assets acquired, recognition and disclosure of the business combination is reasonable in the context of the financial statements taken as a whole.

|

Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS as issued by the IASB, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Company to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Company to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions taken to eliminate threats or safeguards applied.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Campinas, Brazil

March 9, 2022

KPMG Auditores Independentes

CRC 2SP014428/O-6

Marcio José dos Santos

CRC Accountant 1SP252906/O-0

Assets | Note |

| December 31, 2021 |

| | December 31, 2020 |

| | Liabilities and equity | Note |

| December 31, 2021 |

| | December 31, 2020 |

|

|

Cash and cash equivalents | 10.1 |

| 135,727 |

| | 162,827 |

| | Suppliers and other payables | |

| 33,566 |

| | 15,312 |

|

|

Financial investments | 10.2 |

| 798,786 |

| | - |

| | Loans and borrowings | 16 |

| 164,403 |

| | 75,377 |

|

|

Trade receivables | 11 |

| 340,519 |

| | 196,256 |

| | Lease liabilities | 15.b |

| 21,214 |

| | 14,569 |

|

|

Contract assets | 23 |

| 134,388 |

| | 50,625 |

| | Salaries and welfare charges | 17 |

| 234,173 |

| | 141,794 |

|

|

Recoverable taxes | |

| 7,785 |

| | 1,016 |

| | Accounts payable for business combination | 18 |

| 48,923 |

| | - |

|

|

Tax assets | |

| 2,810 |

| | 2,117 |

| | Derivatives | 28.1 |

| 535 |

| | 5,392 |

|

|

Derivatives | 28.1 |

| 896 |

| | 8,837 |

| | Tax liabilities | |

| 13,345 |

| | 6,078 |

|

|

Other assets | 12 |

| 29,994 |

| | 12,874 |

| | Other taxes payable | |

| 5,423 |

| | 3,279 |

|

|

| |

| |

| | |

| | Dividends and interest on equity payable | 22 |

| - |

| | 30,677 |

|

|

Total current assets | |

| 1,450,905 |

| | 434,552 |

| | Contract liability | |

| 13,722 |

| | 9,987 |

|

|

| |

| |

| | |

| | Indemnity | 21.c |

| - |

| | 628 |

|

|

| |

|

|

| |

|

| | Other liabilities | |

| 13,669 |

| | 7,899 |

|

|

Recoverable taxes |

|

| 3,046 |

| | 3,099 |

| | Total current liabilities | |

| 548,973 |

| | 310,992 |

|

|

Deferred tax | 26 |

| 31,989 |

| | 15,152 |

| | | |

| |

| | |

|

|

Judicial deposits | 19 |

| 3,079 |

| | 3,083 |

| | | |

| |

| | |

|

|

Other assets | 12 |

| 2,974 |

| | 2,494 |

| | Loans and borrowings | 16 |

| 624,306 |

| | 13,853 |

|

|

Property, plant and equipment | 13 |

| 57,721 |

| | 38,771 |

| | Lease liabilities | 15.b |

| 60,674 |

| | 60,659 |

|

|

Intangible assets | 14 |

| 738,803 |

| | 18,166 |

| | Provisions | 19 |

| 633 |

| | 161 |

|

|

Right-of-use assets | 15.a |

| 73,827 |

| | 69,765 |

| | Accounts payable for business combination | 18 |

| 36,803 |

| | - |

|

|

Total non-current assets | |

| 911,439 |

| | 150,530 |

| | Other liabilities | |

| 1,660 |

| | 957 |

|

|

| |

| |

| | |

| | Total non-current liabilities | |

| 724,076 |

| | 75,630 |

|

|

| |

| |

| | |

| | | |

| |

| | |

|

|

| |

| |

| | |

| | Equity | 22 |

| |

| | |

|

|

| |

| |

| | |

| | Share capital | |

| 36 |

| | 68,968 |

|

|

| |

| |

| | |

| | Share premium | |

| 915,947 |

| | - |

|

|

| |

| |

| | |

| | Capital reserves | |

| 10,105 |

| | 6,764 |

|

|

| |

| |

| | |

| | Profit reserves | |

| 125,957 |

| | 109,308 |

|

|

| |

| |

| | |

| | Other comprehensive income | |

| 37,250 |

| | 13,420 |

|

|

| |

| |

| | |

| | Total equity | |

| 1,089,295 |

| | 198,460 |

|

|

| |

| |

| | |

| | | |

| |

| | |

|

|

Total assets |

|

| 2,362,344 |

| | 585,082 |

| | Total equity and liabilities |

|

| 2,362,344 |

| | 585,082 |

|

|

The accompanying notes are an integral part of these consolidated financial statements

CI&T Inc.

For the years ended on December 31, 2021 and 2020

(In thousands of Brazilian Reais – R$)

| Note |

| December 31, 2021 |

| | December 31, 2020 |

|

|

Net revenue | 23 |

| 1,444,380 |

| | 956,519 |

|

|

Costs of services provided | 24 |

| (935,732 | ) | | (600,866 | ) |

|

Gross profit | |

| 508,648 |

| | 355,653 |

|

|

Selling expenses | 24 |

| (89,654 | ) | | (65,093 | ) |

|

General and administrative expenses | 24 |

| (151,681 | ) | | (81,161 | ) |

|

Research and technological innovation expenses | 24 |

| (4 | ) | | (3,462 | ) |

|

Impairment loss on trade receivables and contract assets | 24 |

| (497 | ) | | (196 | ) |

|

Other income (expenses) net | 24 |

| (22,206 | ) | | 2,503 |

|

|

| |

| (264,042 | ) | | (147,409 | ) |

|

Operating profit before financial income and tax | |

| 244,606 |

| | 208,244 |

|

|

Finance income | 25 |

| 69,816 |

| | 47,808 |

|

|

Finance cost | 25 |

| (104,048 | ) | | (63,261 | ) |

|

Net finance costs | |

| (34,232 | ) | | (15,453 | ) |

|

Profit before income tax | |

| 210,374 |

| | 192,791 |

|

|

Income tax expense | |

| |

| | |

|

|

Current | 26 |

| (95,375 | ) | | (66,912 | ) |

|

Deferred | 26 |

| 10,958 |

| | 1,775 |

|

|

Net profit for the year | |

| 125,957 |

| | 127,654 |

|

|

Income attributable to: | |

| |

| | |

|

|

Controlling shareholders | |

| 125,957 |

| | 127,654 |

|

|

Net profit for the year | |

| 125,957 |

| | 127,654 |

|

|

Earnings per share | |

| |

| | |

|

|

Earnings per share – basic (in R$) | 27 |

| 1.03 |

| | 1.06 |

|

|

Earnings per share – diluted (in R$) | 27 |

| 1.01 |

| | 1.04 |

|

|

The accompanying notes are an integral part of these consolidated financial statements.

CI&T Inc.

Consolidated statement of other comprehensive income

For the years ended on December 31, 2021 and 2020

(In thousands of Brazilian Reais – R$)

| Note |

| December 31, 2021 |

| | December 31, 2020 |

|

|

Net profit for the year | |

| 125,957 |

| | 127,654 |

|

|

Other comprehensive income (OCI): | |

| |

| | |

|

|

Items that are or may be reclassified subsequently to profit or loss | |

| |

| | |

|

|

Exchange variation in foreign investments | 22.d |

| 23,830 |

| | 9,620 |

|

|

Total comprehensive income for the year | |

| 149,787 |

| | 137,274 |

|

|

Total comprehensive income attributed to | |

| |

| | |

|

|

Owners of the Company | |

| 149,787 |

| | 137,274 |

|

|

Total comprehensive income for the year | |

| 149,787 |

| | 137,274 |

|

|

The accompanying notes are an integral part of these consolidated financial statements.

| |

| |

| | |

| | |

| | Profit reserves |

| | |

| | |

| | |

| |

| Notes |

| Share capital |

| | Share premium |

| | Capital reserve |

| | Legal reserve |

| | Retained earnings reserve |

| | Retained earnings |

| | Other comprehensive income |

| | Total equity |

| |

Balance as of January 1, 2020 | |

| 68,968 |

| | - |

| | 4,112 |

| | 8,846 |

| | 23,979 |

| | - |

| | 3,800 |

| | 109,705 |

| |

Net profit for the year | |

| - |

| | - |

| | - |

| | - |

| | - |

| | 127,654 |

| | - |

| | 127,654 |

| |

Additional dividends related to 2019 approved at Extraordinary general meeting (EGM) held as of July 30, 2020 | 22.e |

| - |

| | - |

| | - |

| | - |

| | (16,263 | ) | | - |

| | - |

| | (16,263 | ) | |

Other comprehensive income for the year | 22.d |

| - |

| | - |

| | - |

| | - |

| | - |

| | - |

| | 9,620 |

| | 9,620 |

| |

Share-based compensation | 21.e |

| - |

| | - |

| | 2,652 |

| | - |

| | - |

| | - |

| | - |

| | 2,652 |

| |

Tax effect on the compensation of the share-based plan | 26 |

| - |

| | - |

| | - |

| | - |

| | 45 |

| | - |

| | - |

| | 45 |

| |

Interest on shareholders´ equity | 22.e |

| - |

| | - |

| | - |

| | - |

| | - |

| | (4,276 | ) | | - |

| | (4,276 | ) | |

Legal reserve | |

| - |

| | - |

| | - |

| | 4,947 |

| | - |

| | (4,947 | ) | | - |

| | - |

| |

Minimum mandatory dividends | |

| - |

| | - |

| | - |

| | - |

| | - |

| | (30,677 | ) | | - |

| | (30,677 | ) | |

Constitution of retained earnings reserve | |

| - |

| | - |

| | - |

| | - |

| | 87,754 |

| | (87,754 | ) | | - |

| | - |

| |

Balances as of December 31, 2020 | |

| 68,968 |

| | - |

| | 6,764 |

| | 13,793 |

| | 95,515 |

| | - |

| | 13,420 |

| | 198,460 |

| |

Net profit for the year | |

| - |

| | - |

| | - |

| | - |

| | - |

| | 125,957 |

| | - |

| | 125,957 |

| |

Spin-off of the CI&T IOT | 1.a/22.a. |

| (9,426 | ) | | - |

| | 597 |

| | - |

| | - |

| | - |

| | - |

| | (8,829 | ) | |

Merger of Hoshin investment | 1.a |

| - |

| | - |

| | 108 |

| | - |

| | - |

| | - |

| | - |

| | 108 |

| |

Additional dividends of 2020 | 22.e |

| - |

| | - |

| | - |

| | - |

| | (95,368 | ) | | - |

| | - |

| | (95,368 | ) | |

Shares exercised of executive officers | 21.d |

| 28,697 |

| | - |

| | (28,697 | ) | | - |

| | - |

| | - |

| | - |

| | - |

| |

Share-based compensation | 21.e |

| - |

| | - |

| | 2,498 |

| | - |

| | - |

| | - |

| | - |

| | 2,498 |

| |

Tax effect on the compensation of the share-based plan | 26 |

| - |

| | - |

| | - |

| | - |

| | (147 | ) | | - |

| | - |

| | (147 | ) | |

Interest on shareholders’ equity | 22.e |

| - |

| | - |

| | - |

| | - |

| | (6,288 | ) | | - |

| | - |

| | (6,288 | ) | |

Other comprehensive income for the year | 22.d |

| - |

| | - |

| | - |

| | - |

| | - |

| | - |

| | 23,830 |

| | 23,830 |

| |

Corporate restructuring | |

| (88,206 | ) | | - |

| | 95,711 |

| | (13,793 | ) | | 6,288 |

| | - |

| | - |

| | - |

| |

Shareholders’ contribution and distributions to shareholders | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

Capital contribution | 22.a |

| 3 |

| | - |

| | - |

| | - |

| | - |

| | - |

| | - |

| | 3 |

| |

Initial public offering proceeds, gross | 22.b |

| - |

| | 915,947 |

| | - |

| | - |

| | - |

| | - |

| | - |

| | 915,947 |

| |

Initial public offering costs, net of taxes | 22.c |

| - |

| | - |

| | (66,876 | ) | | - |

| | - |

| | - |

| | - |

| | (66,876 | ) | |

Constitution of retained earnings reserve | |

| - |

| | - |

| | - |

| | - |

| | 125,957 |

| | (125,957 | ) | | - |

| | - |

| |

Balances as of December 31, 2021 | |

| 36 |

| | 915,947 |

| | 10,105 |

| | - |

| | 125,957 |

| | - |

| | 37,250 |

| | 1,089,295 |

| |

The accompanying notes are an integral part of these consolidated financial statements.

Consolidated statement of cash flows

For the years ended on December 31, 2021 and 2020

(In thousands of Brazilian Reais – R$)

| Notes |

| December 31, 2021 |

| | December 31, 2020 |

|

Cash flow from operating activities | |

| |

| | |

|

Net profit for the year | |

| 125,957 |

| | 127,654 |

|

Adjustments for: | |

| |

| | |

|

Depreciation and amortization | 13, 14 |

| 48,354 |

| | 29,882 |

|

Loss on the sale of property, plant and equipment and intangible assets | 13, 14 |

| 1,237 |

| | 689 |

|

Interest, monetary variation and exchange rate changes | 16 |

| 45,627 |

| | 7,789 |

|

Interest on accounts payable for business combinations | |

| 3,091 |

| | - |

|

Interest on lease | 16 |

| 6,369 |

| | 5,023 |

|

Unrealized loss (gain) on financial instruments | |

| 3,084 |

| | (2,512 | ) |

Income tax expenses | 26 |

| 84,417 |

| | 65,137 |

|

Impairment losses on trade receivables | 11 |

| 280 |

| | 414 |

|

Provision for (reversal of) impairment losses on contract assets | 23 |

| 217 |

| | (218 | ) |

Write-off of intangible assets | 14 |

| 21,894 |

| | - |

|

Provision for labor risks | |

| 472 |

| | (12 | ) |

Provision for indemnity | |

| - |

| | (18 | ) |

Share-based plan | 21.e |

| 2,531 |

| | 942 |

|

Exchange rate changes on indemnity | |

| - |

| | (4,324 | ) |

Others | |

| 98 |

| | 469 |

|

Variation in operating assets and liabilities | |

| |

| | |

|

Trade receivables | 11 |

| (102,300 | ) | | (47,848 | ) |

Contract assets | 23 |

| (52,876 | ) | | (8,339 | ) |

Other taxes recoverable | |

| (13,806 | ) | | 461 |

|

Tax assets | |

| (91 | ) | | 507 |

|

Judicial deposits | 19 |

| 4 |

| | - |

|

Suppliers | |

| 12,215 |

| | 6,746 |

|

Salaries and welfare charges | 17 |

| 63,083 |

| | 49,086 |

|

Tax liabilities | |

| (17,364 | ) | | (12,275 | ) |

Other taxes payable | |

| 1,698 |

| | (407 | ) |

Contract liabilities | |

| 1,922 |

| | (7,138 | ) |

Payment of share-based indemnity | 21 |

| (628 | ) | | (43,354 | ) |

Other receivables and payables, net | |

| (21,054 | ) | | (11,435 | ) |

Cash generated from operating activities | |

| 214,431 |

| | 156,919 |

|

Income tax paid | 26 |

| (64,150 | ) | | (47,044 | ) |

Interest paid on loans and borrowings | 16 |

| (12,149 | ) | | (3,880 | ) |

Interest paid on lease | 16 |

| (5,753 | ) | | (5,023 | ) |

Net cash from operating activities | |

| 132,379 |

| | 100,972 |

|

Cash flows from investment activities | |

| |

| | |

|

Acquisition of property, plant and equipment and intangible assets | 13, 14 |

| (29,907 | ) | | (21,391 | ) |

Financial investment application | |

| (784,915 | ) | | - |

|

Acquisition of subsidiary net of cash acquired | 9, 9.c |

| (692,722 | ) | | - |

|

Net cash used in investment activities | |

| (1,507,544 | ) | | (21,391 | ) |

Cash flow from financing activities | |

| |

| | |

|

Share-based plan contributions | 21 |

| 1,282 |

| | - |

|

Issuance of common shares at initial public offering | 1 |

| 915,947 |

| | - |

|

Transaction cost of offering | 1 |

| (55,874 | ) | | - |

|

Dividends paid | 22.e |

| (126,045 | ) | | (30,977 | ) |

Interest on equity, paid | 22.e |

| (6,288 | ) | | (4,276 | ) |

Payment of lease liabilities | 15.b |

| (17,656 | ) | | (15,500 | ) |

Proceeds from loans and borrowings | 16 |

| 740,596 |

| | 144,269 |

|

Payment of loans and borrowings | 16 |

| (75,196 | ) | | (88,107 | ) |

Net cash from financing activities | |

| 1,376,766 |

| | 5,409 |

|

Net increase in cash and cash equivalents | |

| 1,601 |

| | 84,990 |

|

Cash and cash equivalents as of January 1st | |

| 162,827 |

| | 79,500 |

|

Exchange variation effect on cash and cash equivalents | |

| (20,949 | ) | | (1,663 | ) |

Cash reduction due to spin-off effect | 1 |

| (7,752 | ) | | - |

|

Cash and cash equivalents as of December 31, 2021 | |

| 135,727 |

| | 162,827 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CI&T Inc.

Consolidated financial statements

December 31, 2021

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

1 Operational context

CI&T Inc (“CI&T” or “Company”), previously named CI&T Cayman, is a publicly held company incorporated in the Cayman Islands on June 2021, headquartered at Rua Dr. Ricardo Benetton Martins, 1000, Pólis de Tecnologia, in the City of Campinas, State of São Paulo, Brazil. As a holding company, it is mainly engaged in the investment, as a partner or shareholder, in other companies, consortia or joint ventures in Brazil and other countries where most of the Company’s operations are located. The Company’s subsidiaries are mainly engaged in the development of customizable software through implementation of software solutions, including Machine Learning, Artificial Intelligence (AI), Analytics, Cloud and Mobility technologies.

These consolidated financial statements comprise the Company and its subsidiaries (collectively referred to as the “Group”).

Unless otherwise indicated or if the context otherwise requires, all references in these consolidated financial statements to “CI&T Brazil” refer to CI&T Software S.A., one of the Company’s subsidiaries.

On November 10, 2021 the Company completed its initial public offering (“IPO”) and CI&T Inc offered 15,000,000 Class A common shares, of which 11,111,111 were offered by CI&T Inc and 3,888,889 were offered by certain selling shareholders. The IPO price per Class A common share was US$15.00. On November 15, 2021, the IPO was concluded with the total offering of US$225,000, of which the Group received net proceeds of R$ 860,993 (US$156,667), after deducting the underwriting discounts and commissions. The Company incurred incremental costs directly attributable to the public offering in the amount of R$ 66,876, net of taxes. The Group Class A common shares are traded on the New York Stock Exchange, or NYSE, under the symbol “CINT”.

- Corporate restructuring

- Mergers in 2021 – in connection with CI&T Brazil

On April 30, 2021, the Extraordinary Shareholders’ Meeting of CI&T Brazil approved the reverse merger of Hoshin Empreendimentos S.A. (“Hoshin”) into CI&T Brazil. The purpose of this merger is to simplify the corporate structure of Hoshin and CI&T Brazil, and to reduce the operational, administrative, and financial expenses of both. The transaction was recorded at book value in the amount of R$108.

- Spin-off in 2021 – in connection with CI&T Brazil

The Extraordinary Shareholders’ Meeting of CI&T Brazil, held on April 30, 2021 approved the partial spin-off of the interest in subsidiary CI&T IOT Comércio de Hardware e Software Ltda. (“CI&T IOT”). The valuation of the spin-off portion was carried out at book value based on the statement of financial position of CI&T IOT as of March 31, 2021.

- Reorganization transactions in 2021 – in connection with CI&T Inc

CI&T Inc. was incorporated as an exempted, limited liability company in Cayman Islands to become the holding entity of CI&T Software S.A. (CI&T Brazil) in connection with the initial public offering. Prior to the IPO, CI&T Inc had not begun operations, had nominal assets and liabilities, and no material contingent liabilities or commitments. As a holding company, it is mainly engaged in the investment in other companies, consortia or joint ventures, as a partner or shareholder, in Brazil and other countries where most of the Company’s operations are located.

CI&T Inc.

Consolidated financial statements

December 31, 2021

On October 04, 2021, CI&T established, as a sole member, the subsidiary CI&T Delaware LLC (“CI&T Delaware”). The main office is located at 251 Little Falls Drive, Wilmington, Delaware, 19808. On November 8, 2021, all CI&T Brazil’s shares were contributed to CI&T Delaware and, subsequently the CI&T Delaware’s shares were transferred to CI&T Inc. Until this corporate reorganization, CI&T Brazil, an operating company, was the ultimate holding of the Group, and it consolidated the results of all companies until that date.

The Group accounted for the restructuring as a business combination of entities under common control, and the pre-combination carrying amounts of CI&T Brazil are included in the CI&T’s consolidated financial statements with no fair value uplift. Thus, these consolidated financial statements reflect:

| (i) | The historical operating results and financial position of CI&T Brazil prior the restructuring; |

| (ii) | The consolidated results of the Group following the restructuring; |

| (iii) | The assets and liabilities of CI&T Brazil and its then subsidiaries at their historical cost; |

| (iv) | The number of ordinary shares issued by CI&T, as a result of the restructuring is reflected retroactively to January 1, 2020, for purposes of calculating earnings per share; |

| (v) | CI&T Brazil shares were contributed in CI&T Delaware at its book value as at November 8, 2021; |

| (vi) | As the remaining equity reserves of CI&T Brazil are no longer applicable to CI&T, they were added to the initial capital reserve balance (see note 22.c). |

CI&T Inc.

Consolidated financial statements

December 31, 2021

2 List of direct and indirect subsidiaries

Information on the Company’s direct and indirect subsidiaries is presented below:

| | | December 31,2021 | | December 31,2020 |

Subsidiaries | Country of Origin | | Direct | Indirect | | Direct | Indirect |

CI&T Delaware LLC (a) | United States | | 100% | - | | - | - |

CI&T Software S.A. | Brazil | | - | 100% | | - | - |

CI&T, Inc. (“CI&T US”) | United States | | - | 100% | | 100% | - |

CI&T Software Inc. (“CI&T Canada”) | Canada | | - | 100% | | - | 100% |