0001868995 cint:RemoteScenarioMember cint:InterestRateIncreaseLiborRiskMember cint:LoansAndBorrowingsMember 2021-01-01 2021-12-31

As filed with the Securities and Exchange Commission on April 22, 2022

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number: 001-41035

CI&T Inc

(Exact Name of Registrant as specified in its charter)

| The Cayman Islands | |

| (Jurisdiction of incorporation or organization) | |

R. Dr. Ricardo Benetton Martins,

1,000 Pólis de Tecnologia - Prédio 23B,

Campinas – State of São Paulo

13086-902- Brazil

+55 19 21024500

(Address of principal executive offices)

Stanley Rodrigues, Chief Financial Officer

+55 19 21024500

R. Dr. Ricardo Benetton Martins,

1,000 Pólis de Tecnologia - Prédio 23B

Campinas - State of São Paulo

13086-902- Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | Name of Each Exchange on Which Registered |

Class A common shares, par value US$0.00005 per share | CINT | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of outstanding shares of each class of stock of CI&T Inc as of December 31, 2021 was:

15,000,000 Class A common shares, each with par value of US$0.00005

117,197,896 Class B common shares, each with par value of US$0.00005

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☐ Accelerated Filer ☐ Non-accelerated Filer ☒ Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Unless otherwise indicated or the context otherwise requires, all references in this report to “CI&T” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to CI&T Inc, together with its subsidiaries.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to the Brazilian Central Bank (Banco Central do Brasil). References in the report to “real,” “reais” or “R$” refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollar,” “U.S. dollars” or “US$” refer to U.S. dollars, the official currency of the United States.

All references to “IFRS” are to International Financial Reporting Standards, as issued by the IASB.

Financial Statements

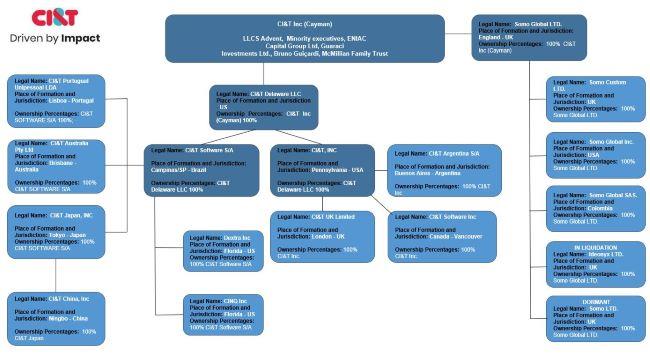

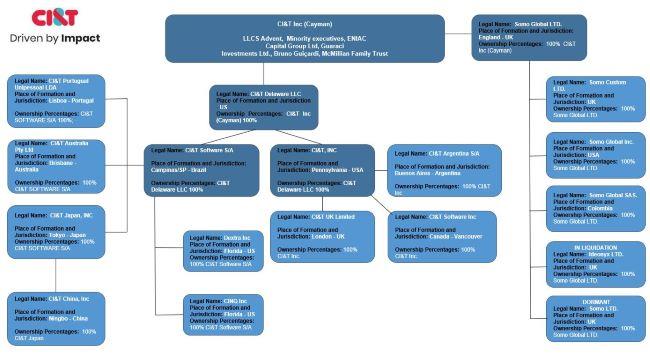

We are a Cayman Islands exempted company, incorporated with an indefinite term and limited liability on June 7, 2021 for purposes of carrying out our initial public offering. Until the contribution of shares of CI&T Software S.A., or CI&T Brazil, to us prior to the consummation of the initial public offering, we had not commenced operations and had only nominal assets and liabilities and no material contingent liabilities or commitments. On October 4, 2021, we established, as a sole member, our subsidiary CI&T Delaware LLC, or CI&T Delaware. On November 8, 2021, all CI&T Brazil’s shares were contributed to CI&T Delaware and, subsequently the CI&T Delaware’s shares were transferred to CI&T Inc. Until this corporate reorganization, CI&T Brazil, an operating company, was the ultimate holding of our group, and it consolidated the results of all companies until that date. We accounted for the restructuring as a business combination of entities under common control, and the pre-combination carrying amounts of CI&T Brazil are included in the CI&T’s consolidated financial statements with no fair value uplift. Thus, our consolidated financial statements reflect:

(i) The historical operating results and financial position of CI&T Brazil prior to the restructuring;

(ii) Our consolidated results following the restructuring;

(iii) The assets and liabilities of CI&T Brazil and its then subsidiaries at their historical cost;

(iv) The number of ordinary shares issued by CI&T, as a result of the restructuring is reflected retroactively to January 1, 2020, for purposes of calculating earnings per share;

(v) CI&T Brazil shares were contributed in CI&T Delaware at its book value as at November 8, 2021;

(vi) As the remaining equity reserves of CI&T Brazil are no longer applicable, they were added to our initial capital reserve balance.

We maintain our books and records in Brazilian reais, the functional currency of our operations in Brazil and the presentation currency for our financial statements. Our annual consolidated financial statements were prepared in accordance with IFRS, as issued by the IASB. Unless otherwise noted, the financial information presented herein has been derived from our audited consolidated financial statements as of December 31, 2021 and 2020 and for the three years ended December 31, 2021, 2020 and 2019, together with the accompanying notes thereto. All references herein to “our financial statements” and “our audited consolidated financial statements” are to our consolidated financial statements included elsewhere in this annual report.

This financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

Financial Information in U.S. dollars

Solely for the convenience of the reader, we have translated some of the real amounts included in this report from reais into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$5.5805 to US$1.00, the commercial selling rate for U.S. dollars as of December 31, 2021, as reported by the Brazilian Central Bank.

Special Note Regarding Non-IFRS Financial Measures

This report presents our Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Profit, Adjusted Net Profit Margin, Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency, which are non-IFRS financial measures used by management in the evaluation of our performance. A non-IFRS financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure.

We calculate Adjusted Gross Profit as Gross Profit, adjusted to exclude costs and expenses which are not under the responsibility of the project managers (depreciation and amortization costs and stock options payments). We calculate Adjusted Gross Profit Margin by dividing Adjusted Gross Profit by the Net Revenue of the same period.

We calculate Adjusted EBITDA as Net Profit, adjusted to include net finance costs, income tax expense, depreciation and amortization and further adjusted to exclude (i) stock option and indemnity payments related to the cancellation of the share-based compensation plan, (ii) consulting expenses, related to corporate reorganization, our IPO and mergers and acquisitions, (iii) government grants for tax reimbursements in the China subsidiary and (iv) impairment of Dextra intangible asset. We calculate Adjusted EBITDA Margin by dividing Adjusted EBITDA by the Net Revenue of the same period.

We calculate Adjusted Net Profit as Net Profit, adjusted to exclude (i) consulting expenses, related to the corporate reorganization, our IPO and mergers and acquisitions, and (ii) impairment of Dextra intangible assets. We calculate Adjusted Net Profit Margin by dividing it by Net Revenue for the same period.

We calculate Net Revenue at Constant Currency by translating revenue from entities reporting in foreign currencies into Brazilian reais using the comparable foreign currency exchange rates from the prior period. For example, the average rates in effect for the fiscal year ended December 31, 2020 were used to convert revenue for the fiscal year ended December 31, 2021, rather than the actual exchange rates in effect during the respective period.

We present Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Profit, Adjusted Net Profit Margin, Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency because management uses them in evaluating our performance and we believe these measures provide investors with a supplemental measure of the financial performance of our core operations that facilitates period-to-period comparisons on a consistent basis.

The non-IFRS financial measures described in this report are not a substitute for the IFRS measures of earnings. Additionally, our calculations of Adjusted Gross Profit, Adjusted EBITDA and Adjusted Net Profit may be different from the calculations used by other companies, including our competitors, and therefore, our measures may not be comparable to those of other companies. For a reconciliation of Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Profit, Adjusted Net Profit Margin, Net Revenue at Constant Currency and Net Revenue Increase at Constant Currency, each to its most directly comparable IFRS measure, see “Item 5. Operating and Financial Review and Prospects — Non-IFRS Measures.”

Market Share and Other Information

This report contains data related to economic conditions in the market in which we operate. The information contained in this report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Market data and certain industry forecast data used in this report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the United States Securities and Exchange Commission (“SEC”) website) and industry publications, including industry research reports we commissioned from International Data Corporation (“IDC”).

Industry publications, governmental publications and other market sources generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. While we are not aware of any misstatements regarding the market and industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed in the section entitled “Risk Factors.”

Except as disclosed in this report, none of the publications, reports or other published industry sources referred to in this report were commissioned by us or prepared at our request. Except as disclosed in this report, we have not sought or obtained the consent of any of these sources to include such market data in this report.

Rounding

We have made rounding adjustments to some of the figures included in this report for ease of presentation. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

FORWARD-LOOKING STATEMENTS

This annual report includes statements that constitute estimates and forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act, as amended, or Exchange Act. The words “believe,” “will,” “may,” “may have,” “would,” “estimate,” “continues,” “anticipates,” “intends,” “plans,” “expects,” “budget,” “scheduled,” “forecasts” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements refer only to the date when they were made, and we do not undertake any obligation to update or revise any estimate or forward-looking statement due to new information, future events or otherwise, except as required by law. Estimates and forward-looking statements involve risks and uncertainties and do not guarantee future performance, as actual results or developments may be substantially different from the expectations described in the forward-looking statements.

Forward-looking statement include, but are not limited to, statements about:

| ● | the impact of the ongoing war in Ukraine and economic sanctions imposed by Western economies over Russia, and their impact on global economy, which are highly uncertain and are difficult to predict; |

| ● | our ability to retain existing clients and attract new clients, including our ability to increase revenue from existing clients and diversify our revenue concentration; |

| ●

| our ability to maintain favorable pricing, productivity levels and utilization rates; |

| ● | our ability to adapt to technological change and innovate solutions for our clients; |

| ● | our ability to effectively manage our international operations, including our exposure to foreign currency exchange rate fluctuations; |

| ● | the effects of increased competition as well as innovations by new and existing competitors in our market; |

| ● | our ability to sustain our revenue growth rate in the future; |

| ●

| our ability to successfully identify acquisition targets, consummate acquisitions and successfully integrate acquired businesses and personnel, such as relating to our recent acquisitions of Dextra Investimentos S.A. and Somo Global Ltd.; |

| ● | our expectations of future operating results of financial performance; |

| ● | our ability to attract and retain highly-skilled IT professionals at cost-effective rates; |

| ●

| our ability to retain continued services of our senior development team or other key employees, |

| ● | our plans for growth and future operations, including our ability to manage our growth; |

● global economic conditions;

● uncertainty concerning the current economic, political, and social environment in Latin America, specifically in Brazil, and

● the impact of new strains of coronaviruses and the COVID-19 pandemic and measures taken in response thereto.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results and developments may be substantially different from the expectations described in the forward-looking statements for a number of reasons, many of which are not under our control, among them the activities of our competition, the future global economic situation, exchange rates, and operational and financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations on which we have based our estimates and forward-looking statements.

In light of the risks and uncertainties described above, the events referred to in the estimates and forward-looking statements included in this report may or may not occur, and our business performance and results of operation may differ materially from those expressed in our estimates and forward-looking statements, due to factors that include but are not limited to those mentioned above.

These forward-looking statements are made as of the date of this annual report, and we assume no obligation to update them or revise them to reflect new events or circumstances. There can be no assurance that the forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and senior management |

| Not applicable. |

|

|

| B. | |

| Not applicable. |

|

|

| C. | |

| Not applicable. |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

| A. | Offer statistics |

| Not applicable. |

|

|

| B. | Method and expected timetable |

| Not applicable. |

ITEM 3. KEY INFORMATION

Summary of Risk Factors

An investment in our Class A common shares is subject to a number of risks, including risks relating to our business and industry, risks relating to Brazil and risks relating to our Class A common shares. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Certain Risks Relating to Our Business and Industry

| ● | If any of our largest clients terminates, decreases the scope of, or fails to renew its business relationship or contract with us, our revenues, business and results of operations may be adversely affected. |

| ● | Our clients may terminate engagements before completion or choose not to enter into new engagements with us. |

| ●

| Geopolitical tensions and the outbreak of military hostilities, including the ongoing military conflict between Russia and Ukraine, and the economic sanctions imposed as a result of these conflicts may materially adversely affect us. |

| ● | The extent to which the COVID-19 pandemic and measures taken in response thereto impact our business, financial condition, results of operations and prospects will depend on future developments, which are highly uncertain and are difficult to predict. |

| ● | Degradation of the quality of the solutions we offer could diminish demand for our services or cause disruptions in our clients’ businesses, adversely affecting our ability to attract and retain clients, harming our business, results of operations and corporate reputation and subjecting us to liability. |

| ● | Our contracts could be unprofitable. |

| ● | Our business depends on a strong brand and corporate reputation. |

| ●

| We face intense competition. |

| ● | We must attract and retain highly-skilled IT professionals. Increases in our current levels of attrition may increase our operating costs and adversely affect our future business prospects. |

Certain Risks Relating to Our Growth Strategy

| ● | We may not be able to sustain our revenue growth rate in the future. |

| ● | We are focused on growing our client base internationally and may not be successful. |

| ●

| Potential future acquisitions could prove difficult to integrate, disrupt our business, dilute shareholder value and strain our resources. |

| ● | If we do not continue to innovate and remain at the forefront of emerging technologies and related market trends, we may lose clients and not remain competitive. |

Certain Risks Relating to Our Organizational Structure

| ● | Material weaknesses in our internal control over financial reporting have been identified and, if we fail to implement and maintain effective internal controls over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud. As we are an emerging growth company, our independent registered public accounting firm has not yet conducted an audit of our internal control over financial reporting in accordance with the provisions of the Sarbanes-Oxley Act of 2002. |

| ● | Requirements associated with being a public company in the United States will require significant company resources and management attention. |

| ●

| We are dependent on members of our senior management team and other key employees. |

| ● | We are exposed to fluctuations in foreign currency exchange rates and enter into derivatives transactions to manage our exposure to exchange rate risk.

|

| ● | Our holding company structure makes us dependent on the operations of our subsidiaries. |

Certain Compliance, Tax, Legal and Regulatory Risks

| ● | Changes in laws and regulations related to the internet or changes in the internet infrastructure itself may diminish the demand for our services, and could have a negative impact on our business. |

| ● | We and our clients may be subject to new and evolving privacy and data protection-related laws and regulations that impose obligations in connection with the collection, storage, use, processing, disclosure, protection, transmission, retention and disposal of personal, sensitive, regulated or confidential data. |

| ●

| Changes in tax laws, tax incentives, benefits or differing interpretations of tax laws may adversely affect our results of operations. |

Certain Risks Relating to Brazil

| ● | Exchange rate instability may have adverse effects on the Brazilian economy, us and the price of our Class A common shares. |

| ● | The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. This involvement as well as Brazil’s political and economic conditions could harm us and the price of our Class A common shares. |

| ●

| Risks related to the global economy may affect the perception of risks in other countries, particularly in the United States, Europe and emerging markets, adversely affecting the Brazilian economy and the market price of securities of issuers with principal operations in Brazil, including our Class A common shares. |

Certain Risks Relating to Our Class A Common Shares

| ● | An active trading market for our Class A common shares may not be sustainable. If an active trading market is not maintained, investors may not be able to resell their shares and our ability to raise capital in the future may be impaired. |

| ● | The dual class structure of our common stock has the effect of concentrating voting control with the Class B Shareholders; this will limit or preclude your ability to influence corporate matters. |

| ●

| Class A common shares eligible for future sale may cause the market price of our Class A common shares to drop significantly. |

| ● | We are a Cayman Islands exempted company with limited liability. The rights of our shareholders, including with respect to fiduciary duties and corporate opportunities, may be different from the rights of shareholders of companies incorporated under and governed by the laws of U.S. jurisdictions.

|

Certain Risks Relating to Our Business and Industry

If any of our largest clients terminates, decreases the scope of, or fails to renew its business relationship or contract with us, our revenues, business and results of operations may be adversely affected.

We generate a significant portion of our revenues from our ten largest clients. During the year ended December 31, 2021, our largest client based on revenues, accounted for 20% of our Net revenue, and our ten largest clients together accounted for 63% of our Net revenue. During the year ended December 31, 2020, our largest client based on revenues, accounted for 20% of our Net revenue, and our ten largest clients together accounted for 67% of our Net revenue.

Our ability to maintain close relationships with these and other major clients is essential to the growth and profitability of our business. The volume of work we perform for each client may vary from year to year, and as a result, a major client in one year may not provide the same level of revenues for us in any subsequent year. The technology services we provide to our clients, and the revenues associated with those services, may decline or vary as the type and quantity of technology services we provide changes over time. In addition, our reliance on any individual client for a significant portion of our revenues may give that client a certain degree of pricing leverage against us when negotiating contracts and terms of service.

Our clients may terminate engagements before completion or choose not to enter into new engagements with us.

A substantial part of our revenue is for software development and maintenance services and is typically generated from clients who also contributed to our revenue during the prior year. We constantly seek to obtain new engagements, as well as maintain relationships with existing clients, when our current engagements are successfully completed or are terminated. Notwithstanding our efforts, our contracts provide that our clients can terminate many of our master services agreements and work orders with or without cause, and, in the case of termination without cause, subject only to 30, 60 or 90 days’ prior notice.

Our clients may terminate or reduce their use of our services for any number of reasons, including if they are not satisfied with our services, the value proposition of our services or our ability to meet their needs and expectations. Even if we successfully deliver on contracted services and maintain close relationships with our clients, a number of factors outside of our control could cause the loss of or reduction in business or revenue from our existing clients. These factors include, among other things:

| ● | the business or financial condition of that client or the economy generally; |

| ● | a change in strategic priorities by our clients, resulting in a reduced level of spending on technology services; |

| ●

| changes in the personnel at our clients who are responsible for procurement of information technology (“IT”), services or with whom we primarily interact; |

| ● | a demand for price reductions by our clients;

|

| ● | mergers, acquisitions or significant corporate restructurings involving one of our clients; and |

| ● | a decision by that client to move work in-house or to one or several of our competitors. |

The ability of our clients to terminate their engagement with us at any time makes our future revenue uncertain. We may not be able to replace any client that chooses to terminate or not renew its contract with us, which could materially adversely affect our revenue and thus our results of operations. Furthermore, terminations in engagements may make it difficult to plan our project resource requirements. If a significant number of clients cease using or reduce their usage of our services, we may be required to spend significantly more on sales and marketing than we currently plan to spend in order to maintain or increase revenue from clients. Such additional sales and marketing expenditures could adversely affect our business, results of operations and financial condition.

In addition, while the restrictions imposed by the COVID-19 pandemic have prompted a shift to digital products and services that benefited our business in 2021 and 2020, there can be no assurance that once the COVID-19 pandemic is sufficiently controlled, this shift will continue and that we will continue to benefit from our clients’ increased spending on digital transformation efforts in response to the COVID-19 pandemic.

Geopolitical tensions and the outbreak of military hostilities, including the ongoing military conflict between Russia and Ukraine, and the economic sanctions imposed as a result of these conflicts may materially adversely affect us

Our business is subject to risks and uncertainties related to our global operations. U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the military conflict between Russia and Ukraine. Although the length and impact of the ongoing military conflict involving Russia and Ukraine and the economic sanctions imposed by the United States, the European Union and other countries are highly unpredictable, the conflict and resulting sanctions may significantly affect prices, disrupt supply chains, cause turmoil in the global financial system and lead to market disruptions, including significant volatility in credit and capital markets. These factors could materially affect our business and financial condition, along with our operating and development costs, and may impact the demand for our services and our ability to execute our growth plans. The war in Ukraine may also increase geopolitical tensions, with further effect on the world economy. Further escalation of the conflict in Ukraine or in other locations, and the related imposition of sanctions or other trade barriers, could disrupt the global markets in ways that cannot yet be anticipated and we cannot predict the impact on our business, financial position or results of operations.

The extent to which the COVID-19 pandemic and measures taken in response thereto impact our business, financial condition, results of operations and prospects will depend on future developments, which are highly uncertain and are difficult to predict.

The global impact of the COVID-19 outbreak and measures taken to reduce the spread of the virus have had an adverse effect on the global macroeconomic environment, and have significantly increased economic uncertainty and reduced economic activity. Governmental authorities around the world, including in Brazil, have taken measures to try to contain the spread of COVID-19, including by implementing travel bans and restrictions, quarantines, shelter-in-place or total lock-down orders and business limitations and shutdowns, but there can be no assurance that such steps will be effective or achieve their desired results in a timely fashion or at all. If the contagion does not subside or is not effectively addressed through vaccination efforts, or if new variants of COVID-19 emerge which prolong the spread of the virus, restrictions will likely remain in place, which may further suppress social and economic activity.

We have taken numerous actions to protect our employees and our business following the spread of COVID-19 (such as reinforcing our “work from anywhere” model and adopting other measures to manage the risks posed by COVID-19, including restricting employee travel, developing social distancing plans for our employees and canceling physical participation in meetings, events and conferences). We may take further actions if and when required by government authorities or as we determine are in the best interests of our employees, clients and business partners. There is no certainty that such measures will be sufficient to mitigate the risks posed by COVID-19. In addition, our management team has spent, and will likely continue to spend, significant time, attention, and resources monitoring the COVID-19 pandemic and associated global economic uncertainty and seeking to manage its effects on our business and workforce.

As of this time, the COVID-19 outbreak has not severely impacted the industry verticals to which we provided a significant portion of our services in the past two fiscal years (financial services, food and beverage, pharmaceuticals and cosmetics). In fact, our most significant clients, which are large enterprises that have been resilient in light of the effects of the COVID-19 pandemic, have in certain circumstances accelerated their demand for the implementation of digital transformation solutions over the next few years. As a result, the extent to which the COVID-19 outbreak impacts our business, financial condition, results of operations and prospects in the longer term will depend on future developments, which are highly uncertain and are difficult to predict, including, but not limited to, the duration, spread and severity of the outbreak, the actions taken to contain COVID-19 or treat its impact, how quickly and to what extent normal economic and operating conditions broadly resume, and the extent of the impact of these and other factors on our employees, suppliers, partners and clients. In addition, while the restrictions imposed by the COVID-19 pandemic have prompted a shift to digital products and services that benefited our business in 2021 and 2020, there can be no assurance that once the COVID-19 pandemic is sufficiently controlled, this shift will continue and that we will continue to benefit from our client’s increased spending on digital transformation efforts in response to the COVID-19 pandemic.

The continuation of the COVID-19 pandemic and related restrictions could limit our clients’ ability to continue to operate, obtain inventory, generate sales, invest in digital solutions or make timely payments to us. It could disrupt or delay the ability of employees to work because they become sick or are required to care for those who become sick, or for dependents for whom external care is not available. It could cause delays or disruptions in services provided by key suppliers and vendors, make us and our service providers more vulnerable to security breaches, denial of service attacks or other hacking or phishing attacks, or have other unpredictable effects.

To the extent there is a sustained general economic downturn and our solutions are perceived by clients and potential clients as costly, or too difficult to deploy or migrate to, our revenue may be disproportionately affected. Our revenue may also be disproportionately affected by delays or reductions in general information technology spending. Competitors may also respond to market conditions by lowering prices and attempting to lure away our clients. We cannot predict the timing, strength, or duration of any economic slowdown, instability, or recovery, generally or within any particular industry.

Once the COVID-19 pandemic is sufficiently controlled, we may also generally experience decreases or decreased growth rates in sales of digital transformation solutions to clients, as our prospective and existing clients may be less dependent on digital solutions, which would negatively affect our business, financial condition and operating results.

Degradation of the quality of the solutions we offer could diminish demand for our services or cause disruptions in our clients’ businesses, adversely affecting our ability to attract and retain clients, harming our business, results of operations and corporate reputation and subjecting us to liability.

Our clients expect a consistent level of quality in the provision of our solutions and services. Our clients use our products for important aspects of their businesses, and any errors, defects, security vulnerabilities, service interruptions or disruptions to our products and any other performance problems with our products could disrupt and cause damage to our clients’ businesses. Although we regularly update our products, they may contain undetected errors, failures, vulnerabilities and error, fault or flaw in our computer program or a hardware system (bugs) when first introduced or released. Real or perceived errors, failures or bugs in our products could result in negative publicity, loss of, or delay in, market acceptance of our solutions, loss of competitive position, lower client retention or claims by clients for losses sustained by them. In such events, we may be required, or may choose, for client relations or other reasons, to expend additional resources in order to help correct the problem, which may result in increased costs to us. Any failure to maintain the high quality of our products and services, or a market perception that we do not maintain a high quality service, could erode client trust and adversely affect our reputation, business, results of operations and financial condition.

Any defects or errors or failure to meet clients’ expectations in the performance of our contracts could result in claims for substantial damages against us. Our contracts generally limit our liability for damages that arise from negligent acts, error, mistakes or omissions in rendering services to our clients. However, there can be no assurance that these contractual provisions will be enforceable or adequate or will otherwise protect us from liability for damages in the event we are subject to any client claims. In addition, certain liabilities, such as claims of third parties for intellectual property infringement, breaches of data protection and security requirements, or breach of confidentiality obligations, for which we may be required to indemnify our clients, could be substantial. The successful assertion of one or more large claims against us in amounts greater than those covered by our current insurance policies could materially adversely affect our business, financial condition and results of operations. Even if such assertions against us are unsuccessful, a claim brought against us by any of our clients would likely be time-consuming and costly to defend and could seriously damage our reputation and brand, making it harder for us to sell our solutions and services. A client could also share information about bad experiences on social media or other publicly available sources, which could result in damage to our reputation and loss of future revenue. In addition, a failure or inability to meet a contractual requirement could seriously damage our corporate reputation and limit our ability to attract new business.

In certain instances, we guarantee to clients that we will complete a project by a scheduled date or that we will maintain certain service levels. We are generally not subject to monetary penalties for failing to complete projects by the scheduled date, but may suffer reputational harm and loss of future business if we do not meet our contractual commitments. In addition, if the project experiences a performance problem, we may not be able to recover the additional costs we will incur, which could exceed revenue realized from a project.

Our contracts could be unprofitable.

Most of the services performed by our employees are usually charged at monthly rates that are agreed at the time at which we enter into the contracts. The rates and other pricing terms negotiated with our clients are highly dependent on our internal forecasts of our operating costs and predictions of increases in those costs influenced by marketplace factors, as well as the proposed scope of work. Typically, we do not have the ability to increase the rates established at the outset of a client service agreement, other than on an annual basis and often subject to caps. Independent of our right to increase our rates on an annual basis, client expectations regarding the anticipated cost of our services may limit our practical ability to increase our rates for ongoing work.

In addition a small proportion of the contracts are priced by project, which is highly dependent on our assumptions and forecasts about the costs we expect to incur to complete the related services, which are based on limited data and could turn out to be inaccurate. Any failure by us to accurately estimate the resources, including the skills and seniority of our employees, required to complete a fixed-price contract on time and on budget, or any unexpected increase in cost of our employees assigned to a client account, office space or materials could expose us to risks associated with cost overruns and could have a material adverse effect on our business, financial condition, results of operations and prospects. In addition, any unexpected changes in economic conditions that affect any of the foregoing assumptions and predictions could render contracts that would have been favorable to us when signed, subsequently unfavorable.

Our business depends on a strong brand and corporate reputation.

Since many of our specific client engagements involve highly tailored solutions, our corporate reputation is a significant factor in our clients’ and prospective clients’ determination of whether to engage us. We believe the CI&T brand name and our reputation are important corporate assets that help distinguish our services from those of our competitors and also contribute to our efforts to recruit and retain talented IT professionals. Successfully maintaining our brand will depend largely on the effectiveness of our marketing efforts, our ability to provide reliable and useful solutions to meet the needs of our clients at competitive prices, our ability to maintain our clients’ trust, our ability to continue to develop new functionalities and solutions, and our ability to successfully differentiate our solutions and services from competitive products and services. Additionally, our business partners’ performance may affect our brand and reputation if clients do not have a positive experience. Our efforts to build and maintain our brand have involved and will continue to involve significant expense and we anticipate that these expenditures will increase as our market becomes more competitive and as we expand into new markets. Brand promotion activities may not generate client awareness or yield increased revenue. Even if they do, any increased revenue may not offset the expenses we incurred in building our brand. We strive to establish and maintain our brand in part by obtaining, maintaining and protecting our trademark rights. However, if our trademark rights are not adequately obtained, maintained or protected, we may not be able to build name recognition in our markets of interest and our competitive position may be harmed. If we fail to successfully promote, protect and maintain our brand, we may fail to attract enough new clients or retain our existing clients to realize a sufficient return on our brand-building efforts, and our business could suffer.

Furthermore, our corporate reputation is susceptible to damage by actions or statements made by current or former employees or clients, competitors, vendors, and adversaries in legal proceedings, as well as members of the investment community and the media. There is a risk that negative information about our company, even if based on false rumors or misunderstandings, could adversely affect our business. In particular, damage to our reputation could be difficult and time-consuming to repair, could make potential or existing clients reluctant to select us for new engagements, resulting in a loss of business, and could adversely affect our employee recruitment and retention efforts. Damage to our reputation could also reduce the value and effectiveness of our CI&T brand name and could reduce investor confidence in us and our business, financial condition, results of operations and prospects may be materially adversely affected.

We face intense competition.

The market for technology and IT solutions and services is intensely competitive, highly fragmented and subject to rapid change and evolving industry standards and we expect competition to intensify. We believe that the principal competitive factors that we face are the ability to innovate; technical expertise and industry knowledge; end-to-end solution offerings; location of operation; price; reputation and track record for high-quality and on-time delivery of work; effective employee recruiting; training and retention; responsiveness to clients’ business needs; scale; and financial stability.

Our primary competitors include digital transformation and software engineering service providers, such as Endava plc, Globant S.A. and EPAM Systems, INC. Other competitors include traditional IT services companies, such as Accenture PLC, Capgemini SE, Cognizant Technology Solutions Corporation and Tata Consultancy Services Limited. To a lesser extent, other competitors include digital agencies and consulting companies, such as Ideo, McKinsey & Company, The Omnicom Group, Sapient Corporation and WPP plc. Many of our competitors have, and our potential competitors could have, substantial competitive advantages such as substantially greater financial, technical and marketing resources, greater name recognition, longer operating histories, greater client support resources, lower labor and development costs, and larger and more mature intellectual property portfolios. As a result, they may be able to compete more aggressively on pricing or devote greater resources to the development and promotion of technology and IT services. If successful, their development efforts could render our services less desirable to clients, resulting in the loss of clients or a reduction in the fees we could generate from our offerings. In addition, there are relatively few barriers to entry into our markets and we have faced, and expect to continue to face, competition from new market entrants. Further, there is a risk that our clients may elect to increase their internal resources to satisfy their services needs as opposed to relying on third-party service providers, such as us. The technology services industry may also undergo consolidation, which may result in increased competition in our target markets from larger firms that may have substantially greater financial, marketing or technical resources, may be able to respond more quickly to new technologies or processes and changes in client demands, and may be able to devote greater resources to the development, promotion and sale of their services than we can. Increased competition could also result in price reductions, reduced operating margins and loss of our market share.

Moreover, as we expand the scope and reach of our solutions, we may face additional competition. If one or more of our competitors were to merge or partner with other competitors, the change in the competitive landscape could also adversely affect our ability to compete effectively.

We cannot assure you that we will be able to compete successfully with existing or new competitors or that competitive pressures will not materially adversely affect our business, financial condition, results of operations and prospects.

We must attract and retain highly-skilled IT professionals. We may face a market shortage of personnel and increases in our current levels of attrition may increase our operating costs and adversely affect our future business prospects.

In order to sustain our growth, we must attract and retain a large number of highly-skilled and talented IT professionals. Our business is people-driven and, accordingly, our success depends upon our ability to attract, develop, motivate, retain and effectively utilize highly-skilled IT professionals in our delivery. We believe that there is significant competition for technology professionals in the geographic regions in which we operate and that such competition is likely to continue for the foreseeable future. Increased hiring by technology companies and increasing worldwide competition for skilled technology professionals may lead to a shortage in the availability of suitable qualified personnel. Our ability to properly staff projects, maintain and renew existing engagements and win new business depends, in large part, on our ability to recruit, train and retain IT professionals.

In addition, the technology industry generally experiences a significant rate of turnover of its workforce. There is a limited pool of individuals who have the skills and training needed to help us grow our company. We compete for such talented individuals not only with other companies in our industry but also with companies in other industries, such as software services, engineering services, financial services and technology generally, among others. High attrition rates of IT personnel would increase our hiring and training costs and could have an adverse effect on our ability to complete existing contracts in a timely manner, meet client objectives and expand our business. Failure to hire, train and retain IT professionals in sufficient numbers could have a material adverse effect on our business, financial condition, results of operations and prospects.

Potential clients may be reluctant to switch to a new provider of digital solutions.

As we expand our offerings into new solutions, our potential clients may be concerned about disadvantages associated with switching providers, such as a loss of accustomed functionality, increased costs and business disruption. For prospective clients, switching from one vendor of solutions similar to those provided by us (or from an internally developed system) to a new vendor may be a significant undertaking. As a result, certain potential clients may resist changing vendors. There can be no assurance that our investments to overcome potential clients’ reluctance to change vendors will be successful, which may adversely affect our business, financial condition, results of operations and prospects.

We must maintain adequate resource utilization rates and productivity levels.

Our profitability and the cost of providing our services are affected by our utilization rates of our employees in the locations in which we operate. If we are not able to maintain appropriate utilization rates for our employees involved in delivery of our services, our profit margin and our profitability may suffer. Our utilization rates are affected by a number of factors, including:

| ● | our ability to promptly transition our employees from completed projects to new assignments and to hire and integrate new employees; |

| ● | our ability to forecast demand for our services and thereby maintain an appropriate number of employees in each of the locations in which we operate; |

| ●

| our ability to deploy employees with appropriate skills and seniority to projects; |

| ● | our ability to manage the attrition of our employees; and |

| ● | our need to devote time and resources to training, professional development and other activities that cannot be billed to our clients. |

Our revenue could also suffer if we misjudge demand patterns and do not recruit sufficient personnel to satisfy our future demand. Employee shortages could prevent us from completing our contractual commitments in a timely manner and cause us to lose contracts or clients. Further, to the extent that we lack sufficient personnel with lower levels of seniority and daily or hourly rates, we may be required to deploy more senior employees with higher rates on projects without the ability to pass such higher rates along to our clients, which could adversely affect our profit margin and profitability.

Our profitability could suffer if we are not able to maintain favorable pricing.

Our profitability and operating results are dependent on the rates we are able to charge for our services.

Our rates are affected by a number of factors, including:

● our clients’ perception of our ability to add value through our services;

● our competitors’ pricing policies;

● bid practices of clients and their use of third-party advisors;

● the ability of large clients to exert pricing pressure;

● employee wage levels and increases in compensation costs;

● employee utilization levels;

● our ability to charge premium prices when justified by market demand or the type of service; and

● general economic conditions, including inflation rates.

Pricing pressures and increased competition generally could result in reduced revenue, reduced margins, increased losses or the failure of our solutions to achieve or maintain widespread market acceptance. If we are not able to maintain favorable pricing for our services, our profitability could suffer, and our business, financial condition, results of operations and prospects may be materially adversely affected.

We have experienced, and may in the future experience, a long selling cycle with respect to certain projects that require significant investment of human resources and time by both our clients and us.

The length of our selling cycle for clients, from initial evaluation to contract execution, is generally 1 to 12 months for large enterprise clients and 1 to 6 months for small and mid-market clients, but can vary substantially. The timing of our sales with our clients is difficult to predict because of the length and unpredictability of the selling cycle for these clients. Mid-market and large enterprise clients, particularly those in highly regulated industries and those requiring highly customized solutions, may have an even further lengthy selling cycle for the evaluation and implementation of our products and services. If these clients maintain work-from-home arrangements for a significant period of time as a result of the COVID-19 pandemic or otherwise, it may cause a lengthening of these selling cycles.

Before committing to use our services, potential clients may require us to expend substantial time and resources educating them on the value of our services and our ability to meet their requirements. Therefore, our selling cycle is subject to many risks and delays over which we have little or no control, including our clients’ decision to choose alternatives to our services (such as other technology and IT service providers or in-house resources) and the timing of our clients’ budget cycles, approval and integration processes. If our sales cycle unexpectedly lengthens for one or more projects, it would negatively affect the timing of our revenue and hinder our revenue growth. For certain clients, we may begin work and incur costs prior to executing the contract. A delay in our ability to obtain a signed agreement or other persuasive evidence of an arrangement, or to complete certain contract requirements in a particular quarter, could reduce our revenue in that quarter or render us entirely unable to collect payment for work already performed.

Implementing our services also involves a significant commitment of resources over an extended period of time from both our clients and us. Our clients may experience delays in obtaining internal approvals or delays associated with technology, thereby further delaying the implementation process. Our current and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to close sales with potential clients to which we have devoted significant time and resources. Any significant failure to generate revenue or delays in recognizing revenue after incurring costs related to our sales or services process could materially adversely affect our business.

Our cash flows and results of operations may be adversely affected if we are unable to collect on billed and unbilled receivables from clients.

Our business depends on our ability to successfully receive payment from our clients of the amounts they owe us for work performed. We evaluate the financial condition of our clients, usually bill and collect on relatively short cycles and maintain provisions for expected losses against receivables. Actual losses on client balances could differ from those that we currently anticipate and, as a result, we may need to adjust our provisions. We may not accurately assess the creditworthiness of our clients. Macroeconomic conditions, such as a potential credit crisis in the global financial system, could also result in financial difficulties for our clients, including limited access to the credit markets, insolvency or bankruptcy. Such conditions could cause clients to delay payment, request modifications of their payment terms, or default on their payment obligations to us, all of which could increase our receivables balance and our provision for doubtful debts. Timely collection of fees for client services also depends on our ability to complete our contractual commitments on schedule and subsequently bill for and collect our contractual service fees. If we are unable to meet our contractual obligations, we might experience delays in the collection of or be unable to collect our client balances, which would adversely affect our results of operations and could adversely affect our cash flows. In addition, if we experience an increase in the time required to complete our services, bill and collect for our services, our cash flows could be adversely affected, which in turn could adversely affect our ability to make necessary investments and, therefore, our results of operations.

If we fail to offer high-quality client support, our business and reputation could suffer.

Our clients rely on our personnel for support related to their solutions. High-quality support is important for the renewal and expansion of our agreements with existing clients. The importance of high-quality support will increase as we expand our business and pursue new clients, particularly mid-market and large enterprise clients. If we do not help our clients quickly resolve issues and provide effective ongoing support, our ability to sell new solutions to existing and new clients could suffer and our reputation with existing or potential clients could be harmed.

Our revenue is dependent on a limited number of industry verticals, and any decrease in demand for technology services in these sectors or our failure to effectively penetrate new sectors could adversely affect our revenue, business, financial condition, results of operations and prospects.

Historically, we have focused on developing industry expertise and deep client relationships in a limited number of industry verticals. As a result, a substantial portion of our revenue has been generated by clients operating in the financial services, food and beverages and pharmaceutical and cosmetics industry vertical. Net revenue from the financial services, food and beverages and pharmaceutical and cosmetics industry vertical represented 34%, 24% and 14% of total Net revenue for the year ended December 31, 2021 respectively, and 34%, 26% and 14% of total Net revenue for the fiscal year ended December 31, 2020, respectively. Our business growth largely depends on continued demand for our services from clients in these sectors, and any slowdown or reversal of the trend to spend on technology services in these sectors could result in a decrease in the demand for our services and materially adversely affect our revenue, business, financial condition, results of operations and prospects.

Other developments in the industries in which we operate may also lead to a decline in the demand for our services, and we may not be able to successfully anticipate and prepare for any such changes. For example, consolidation or acquisitions, particularly involving our clients, may adversely affect our business. Our clients and potential clients may experience rapid changes in their prospects, substantial price competition and pressure on their profitability. This, in turn, may result in increasing pressure on us from clients and potential clients to lower our prices, which could adversely affect our revenue, business, financial condition, results of operations and prospects.

If we are unable to comply with our contractual security obligations or are required to indemnify our clients for data breaches or any significant failure related to their equipment or systems, we may face reputational damage and lose clients and revenue.

The services we provide are often critical to our clients’ businesses. Certain of our client contracts require us to comply with security obligations, which could include maintaining network security and backup data, ensuring our network is virus-free, maintaining business continuity planning procedures, and verifying the integrity of employees that work with our clients by conducting background checks. Any failure in a client’s or third-party service provider’s system, whether or not a result of or related to the services we provide, or breach of security relating to the services we provide to the client could damage our reputation or result in a claim for substantial damages against us. Our liability for breaches of data security requirements or breaches or incidents affecting our clients’ equipment or systems, for which we may be required to indemnify our clients, may be extensive and could result in reputational damage or a loss of clients and revenue.

Breaches of, or significant disruptions to, our information technology systems and solutions and those of our third-party service providers and subprocessors and unauthorized access to or misuse of the information and data we collect, transmit, use, store and otherwise process may cause us to lose current or future clients and our reputation and business may be harmed.

We have access to or are required to collect, transmit, use, store and otherwise process confidential client and consumer data. We also use third-party service providers (including cloud infrastructure and data center providers) and subprocessors to help us deliver services to clients and their end-consumers. These service providers and subprocessors may also collect, transmit, use, store and otherwise process personal information, credit card information and/or other confidential information of our employees, clients and our clients’ end-consumers. Despite our efforts with respect to security measures, this information, and the information technology systems that are used to store and otherwise process such information, including those information technology systems of our service providers and subprocessors, may be vulnerable to cyberattacks and other security threats or disruptions, including unauthorized access or intrusion, breaches, damage or other interruptions, including as a result of third-party action, criminal conduct, physical or electronic break-ins, telecommunications or network failures or interruptions, malicious or inadvertent acts of employee or contractors, nation state malfeasance, computer viruses, malware, denial-of-service attacks, phishing, hackers, system error, software bugs or defects, fraud, process failure or otherwise. While we strive to maintain reasonable preventative and data security controls, it is not possible to prevent all security threats to our systems and data and those of our third-party service providers, over which we exert less control. In addition, cybersecurity threats and techniques used to obtain unauthorized access, disable or degrade service or sabotage systems continue to increase, evolve in nature and become more sophisticated. Further, as a result of the COVID-19 pandemic, we may face increased security risks due to our increased reliance on internet technology and the number of our employees who are working remotely, which may create additional opportunities for cybercriminals to exploit vulnerabilities. If any person circumvents our network security, accidentally exposes our data or code, or misappropriates data or code that belongs to us, our clients or our clients’ end users, or cause our systems to malfunction, we could face numerous risks, including risk related to breach of contract, diversion of management resources, increased costs relating to mitigation and remediation of such problems, regulatory actions, penalties and fines, litigation and future costs related to information security.

We may incorporate third-party open source software in our solutions, and any defects or security vulnerabilities in the open source software or our failure to comply with the terms of the underlying open source software licenses could adversely impact our clients, negatively affect our business, subject us to litigation, and create potential liability.

Certain of our solutions and software that is delivered to our clients incorporate software components that are licensed to us by third parties under various “open source” licenses, including the GNU General Public License, the GNU Lesser General Public License, the BSD License, the Apache License and others, and we may also rely on licensed software for the provision of our services. Despite our efforts to comply with such licenses, we or our clients may be subject to claims from third parties that our use or our clients’ use of certain open source software infringes the claimants’ intellectual property rights. We are generally required to indemnify our clients against such claims. In addition, use of open source software may entail greater risks than use of third-party commercial software, as open source licensors generally do not provide warranties or other contractual protections regarding infringement claims or the quality of the code. To the extent that our solutions and software depend upon the successful operation of open source software, any undetected errors or defects in this open source software could prevent the deployment or impair the functionality of our solutions and software, delay the introduction of new solutions, result in a failure of our software, and injure our reputation. For example, undetected errors or defects in open source software could render it vulnerable to breaches or security attacks, and, in conjunction, make our systems more vulnerable to data breaches.

Certain open source licenses require that users who distribute or convey the open source software subject to such licenses make available the source code of any modifications or derivative works based on such open source software. Although we monitor our use of open source software in an effort both to comply with the terms of the applicable open source licenses and to avoid subjecting our solutions and software to restrictions we do not intend, the terms of many open source licenses have not been interpreted by courts in relevant jurisdictions, and therefore the potential impact of such licenses on our business is not fully known or predictable. There is a risk that these licenses could be construed in a way that could impose unanticipated conditions or restrictions on our ability to market certain of our software solutions or our clients’ ability to use the software that we develop for them and operate their businesses as they intend. The terms of certain open source licenses may require us or our clients to release the source code of the software we develop for our clients that is combined with or linked to open source software, and to make such software available under the applicable open source licenses. In the event that portions of our solutions or client deliverables are determined to be subject to an open source license, we or our clients could be required to publicly release the affected portions of source code, pay damages for breach of contract, re- engineer all, or a portion of, the applicable software, discontinue sales of one or more of our solutions in the event re-engineering cannot be accomplished on a timely basis or take other remedial action that may divert resources away from our development efforts. Disclosing could allow our competitors or our clients’ competitors to create similar products with lower development effort and time and ultimately could result in a loss of sales for us or our clients. Any of these events could create liability for us to our clients, increase our costs and damage our reputation, which could have a material adverse effect on our revenue, business, financial condition, results of operations and prospects.

We may not receive sufficient intellectual property rights from our employees and independent contractors to comply with our obligations to our clients and we may not be able to prevent unauthorized use of our intellectual property. We may also be subject to claims by third parties asserting that we, companies we have acquired, our employees or our independent contractors have misappropriated their intellectual property, or claiming ownership of what we regard as our own intellectual property.

Our client contracts generally require, and our clients typically expect, that we will assign to them all intellectual property rights associated with the deliverables that we create in connection with our engagements. In order to assign these rights to our clients, we must ensure that our employees and independent contractors validly assign to us all intellectual property rights that they have in such deliverables. Our employment and independent contractor agreements include terms regarding the assignment of inventions. These agreements provide that the employee or independent contractor assign to us all of the intellectual property rights of the employee and/or independent contractor to such deliverables, but there can be no assurance that we will be able to enforce our rights under such agreements. Given that we operate in a variety of jurisdictions with different and evolving legal regimes, we face increased uncertainty regarding whether such agreements will be found to be valid and enforceable by competent courts and whether we will be able to avail ourselves of the remedies provided for by applicable law, see “Risk Factors — Certain Compliance, Tax, Legal and Regulatory Risks — Our business, financial condition and results of operations may be adversely affected by the various conflicting and/or onerous legal and regulatory requirements imposed on us by the countries where we operate.”

Our success also depends in part on certain methodologies, practices, tools and technical expertise we utilize in designing, developing, implementing, protecting, enforcing and maintaining our proprietary and intellectual property rights. In order to protect our proprietary and intellectual property rights, we rely upon a combination of technical measures, license agreements, nondisclosure and other contractual arrangements as well as trade secret, copyright, trademark laws and other similar laws. We consider trade secrets and confidential know-how to be important to our business. However, trade secrets and confidential know-how are difficult to maintain as confidential. We attempt to protect this type of information and our proprietary and intellectual property rights generally by requiring our employees, consultants, contractors and advisors to enter into confidentiality agreements with us. We also seek to preserve the integrity and confidentiality of our technology, data, trade secrets and know-how by maintaining physical security of our premises and physical and electronic security of our information technology systems. Despite our efforts to protect our confidential information, intellectual property, and technology, unauthorized third parties may gain access to our confidential proprietary information, develop and market solutions similar to ours, or use trademarks similar to ours, any of which could materially harm our business and results of operations. Moreover, policing our intellectual property rights is expensive, time consuming and unpredictable. If a competitor lawfully obtained or independently developed any of our trade secrets, we would have no right to prevent such competitor from using that technology or information to compete with us, which could harm our competitive position. Further, if the steps taken to maintain our trade secrets are deemed inadequate, we may have insufficient recourse against third parties for misappropriating the trade secret. To the extent that we seek to enforce our rights, we could be subject to defenses, counterclaims, claims that our intellectual property rights are invalid, unenforceable, or licensed to the party against whom we are pursuing a claim. If we are not successful in defending or enforcing such claims in litigation, we could lose valuable intellectual property rights or we may be subject to damages that could, in turn, harm our results of operations. Even if we are successful in defending or enforcing our claims, litigation could result in substantial costs and diversion of resources and could negatively affect our business, reputation, results of operations and financial condition. If we are unable to protect our technology and to adequately maintain and protect our intellectual property rights, we may find ourselves at a competitive disadvantage to others who need not incur the additional expense, time and effort required to create the innovative solutions that have enabled us to be successful to date.

We may be subject to claims by third parties asserting that we, our clients, companies we have acquired, our employees or our independent contractors have infringed, misappropriated or violated their intellectual property, or claiming ownership of what we regard as our own intellectual property.

We may be subject to claims by third parties that we, our clients, companies we have acquired, our employees, or our independent contractors have misappropriated their intellectual property. For example, many of our employees were previously employed at our competitors or potential competitors. Some of these employees executed proprietary rights, non-disclosure and non-competition agreements in connection with such previous employment. Although we try to ensure that our employees do not use the proprietary information of others in their work for us, we may be subject to claims that we or these employees have used or disclosed confidential information or intellectual property, including trade secrets or other proprietary information, of any such employee’s former employer. Litigation may be necessary to defend against these claims. In addition, we are subject to additional risks related to intellectual property infringement as a result of our recent acquisitions and any future acquisitions we may complete. For instance, the developers of the technology that we have acquired or may acquire may not have appropriately created, maintained, protected or enforced their intellectual property rights in such technology. Indemnification and other rights we have under acquisition documents may be limited in term and scope and may therefore provide us with little or no protection from these risks.

Further, we have in the past, and may in the future be subject to legal proceedings and claims in the ordinary course of our business, including claims of alleged infringement, violation or misappropriation of intellectual property rights of third parties by us or our clients in connection with their use of our solutions or the software we develop for them.

Although we take steps to avoid infringement, misappropriation or violation by us or our clients of the intellectual property rights of third-parties, any such claims, whether or not meritorious, could result in costly litigation and divert the efforts of our management and personnel. Should we be found liable for infringement or misappropriation, we may lose valuable intellectual property rights or personnel or we may be required to enter into royalty arrangements (including licensing agreements, which may not be available on reasonable terms, or at all) or to pay damages or result in us being unable to use certain intellectual property. Any of these events could seriously harm our business, results of operations and financial condition.

If our current insurance coverage is or becomes insufficient to protect against losses incurred, our business, financial condition, results of operations and prospects may be adversely affected.