UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended March 31, 2024

Worthy Property Bonds, Inc.

(Exact name of registrant as specified in its charter)

| Commission file number: | | 024-11279 |

| | | |

| Florida | | 86-3192320 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

11175 Cicero Dr. Suite 100 Alpharetta, GA | | 30022 |

| (Address of principal executive office) | | (Zip Code) |

(678) 646-6791

(Registrant’s telephone number, including area code)

Worthy Property Bonds

(Title of each class of securities issued pursuant to Regulation A)

PART II

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward looking statements that are subject to various risk and uncertainties and that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements that reflect historical facts. Many of these statements are contained under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements are generally identifiable by use of forward-looking terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this annual report. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this annual report, whether as a result of new information, future events or otherwise.

You should thoroughly read this annual report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Risk Factors appearing elsewhere in this annual report. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this annual report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

Overview

Worthy Property Bonds, Inc., (the “Company,” “we,” “us,” “our,” or “ours”) was incorporated under the laws of the State of Florida on April 9, 2021. Our wholly owned subsidiary Worthy Lending V, LLC (“Worthy Lending V”) was organized as a limited liability company in Delaware. We are a wholly owned subsidiary of Worthy Financial, Inc. (“WFI”) which owns a fintech platform and mobile app (the “Worthy App”) and also owns its proprietary website (collectively the “Worthy Fintech Platform”). On April 9, 2021, we issued 100 shares of our $0.001 per share par value common stock to WFI in exchange for $5,000. WFI is the sole shareholder of the Company’s common stock.

On June 23, 2021, the Company filed a public offering pursuant to Regulation A (the “Offering”) of $75 million aggregate principal amount of Worthy Property Bonds (the “Worthy Property Bonds”) under the Company’s qualified Offering Statement (File No. 024-11563). On October 31, 2022, the Offering was qualified by the SEC. From October 31, 2022 through March 31, 2024, the Company sold approximately $62 million aggregate principal amount of Worthy Property Bonds.

Our principal executive offices are located at 11175 Cicero Dr., Suite 200, Alpharetta, GA 30022, and our telephone number is (678) 646-6791. Our fiscal year end is March 31st. The information which appears on our websites, or is accessible through our websites, at www.worthybonds.com and www.worthypropertybonds.com are not part of, and is not incorporated by reference into, this Annual Report on Form 1-K.

We are an early stage company, which, through our wholly owned subsidiary Worthy Lending V, we are implementing our business model. Our business model is centered primarily around purchasing or otherwise acquiring mortgages and other liens on and interests in real estate. We anticipate that (i) at least 55% of our assets will consist of “mortgages and other liens on and interests in real estate” (“Qualifying Interests”), (ii) at least an additional 25% of our assets will consist of “real estate-type interests” (subject to proportionate reduction if greater than 55% of our assets are Qualifying Interests), and (iii) not more than 20% of our total assets consist of assets that have no relationship to real estate provided the amount and nature of such activities do not cause us to lose our exemption from regulations as an investment company pursuant to the Investment Company Act of 1940, or the “40 Act.” Qualifying Interests are assets that represent an actual interest in real estate or are loans or liens “fully secured by real estate” but exclude securities in other issuers engaged in the real estate business. Real estate-type interests include certain mortgage-related instruments including loans where 55% of the fair market value of the loan is secured by real property at the time the issuer acquired the loan and agency partial-pool certificates. We will sell Worthy Property Bonds in this offering to provide the capital for these activities

The Company generated net losses of approximately $1,677,000 and had cash used in operations of approximately $77,000 for the year ended March 31, 2024. The net losses incurred from inception have resulted in an accumulated deficit of approximately $3,094,000 at March 31, 2024. These conditions raise substantial doubt about the Company’s ability to continue as a going concern for a period of twelve months from the issuance date of this report. During the fiscal year ended March 31, 2022, the Company began to incur operating expenses, however, the Company filed a Form 1-A Regulation A Offering Statement, which, was declared effective, in fiscal year ended March 31, 2023, which allowed the Company to raise funds through the sale of its Worthy Property Bonds. Also during the fiscal year ended March 31, 2023, the Company began making loans and collecting interest income.

No assurances can be given that the Company will achieve success, without seeking additional financing. There also can be no assurances that the Form 1-A will result in enough additional financing or that any additional financing if required, can be obtained, or obtained on reasonable terms acceptable to the Company. These consolidated financial statements do not include adjustments related to the recoverability and classifications of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

History and Recent Developments – The Worthy Group of Companies

We are a wholly owned subsidiary of WFI. WFI was organized in 2016 to create a “Worthy Community” in an effort to help members achieve financial wellness. WFI was initially targeting the millennials who are surpassing the baby boomers as the nation’s largest living generation and to develop the Worthy Fintech Platform. WFI’s management believes that the millennial demographic in large part has a basic distrust of old guard financial institutions, is burdened by student loans and other debt, changes employment frequently and is unable to save money and/or fund a retirement program. At the same time there is a rapidly growing trend in on-line peer financing.

WFI formed Worthy Peer Capital, Inc. (“Worthy Peer I”) in 2016. Following the qualification by the SEC of its offering statement on Form 1-A under SEC File No. 024-10766, in January 2018 Worthy Peer I began offering its Worthy Bonds in a Regulation A exempt offering. Following the qualification, from January 2018 through March 17, 2020, Worthy Peer I sold approximately $50,000,000 aggregate principal amount of renewable bonds to 12,285 investors.

In March 2018, WFI launched the Fintech Platform and Worthy App, a free mobile app which provides tools to help people easily invest including through “spare change” round ups. Round ups monetize debit card purchases, checking account linked credit card purchases and other checking account transactions by “rounding up” each purchase to the next higher dollar until the “round up” reaches $10.00 at which time the user can purchase a $10.00 Worthy Bond.

In August 2018, Worthy Peer I formed Worthy Lending, LLC, a Delaware limited liability company, or “Worthy Lending I,” as a wholly owned subsidiary. Worthy Lending I provided loan and investment origination and processing services for Worthy Peer I. In September 2018 Worthy Peer I began deploying the capital it had raised through sales of its Worthy Bonds in accordance with its business model. On March 17, 2020, Worthy Peer I completed the offering. From January 2018 through March 17, 2020, Worthy Peer I sold approximately $50 million aggregate principal amount of Worthy Bonds to 12,285 investors.

In October 2019, WFI began an internal reorganization to more efficiently utilize personnel at both WFI and Worthy Peer I, including Worthy Lending I. Under this structure, Worthy Management, Inc., or “Worthy Management,” a wholly owned subsidiary of WFI, organized in October 2019, provides certain management services to us which are described in detail elsewhere in this Annual Report on Form 1-K.

In October 2019, WFI formed Worthy Peer Capital II, Inc. (“Worthy Peer II”) and its wholly-owned subsidiary Worthy Lending II, LLC (“Worthy Lending II”). In March 2020, Worthy Peer II commenced a public offering pursuant to Regulation A of $50,000,000 aggregate principal amount of renewable bonds under a qualified Offering Statement (File No. 024-11150). Worthy Peer II began deploying the capital it had raised through sales of its renewable bonds in accordance with its business model. On October 1, 2020, Worthy Peer II completed its offering. From March 17, 2020 through October 1, 2020, Worthy Peer II sold approximately $50,000,000 aggregate principal amount of renewable worthy bonds to 17,823 investors.

In June 2020, WFI formed Worthy Community Bonds, Inc. and its wholly-owned subsidiary Worthy Lending III. On September 29, 2020, the Worthy Community Bonds commenced the Offering of $50,000,000 aggregate principal amount of Worthy Community Bonds and completed the Offering on February 26, 2021, selling approximately $50,000,000 aggregate principal amount to18,914 investors.

On June 30, 2020 we entered into a Management Services Agreement (the “Management Services Agreement”) with Worthy Management. Under the terms of the Management Services Agreement, Worthy Management agreed to provide to the Company certain management services, personnel and office facilities, including all equipment and supplies, that are reasonable, necessary or useful for the day-to-day operations of the business of the Company, subject to such written direction provided by the Company to Worthy Management. Pursuant to the Management Services Agreement, the Company agreed to reimburse Worthy Management for the costs incurred by Worthy Management in paying for the staff and office expenses for the Company under the Management Services Agreement. There is no interest rate or maturity associated with the obligations to reimburse Worthy Management under the Management Services Agreement.

On April 9, 2021, WFI formed Worthy Property Bonds, Inc. (“Worthy Property”) and its wholly-owned subsidiary Worthy Lending V, LLC (“Worthy Lending V”). On June 23, 2021, Worthy Property filed an Offering Statement on Form 1-A (File No. 024-11563), as amended, by Amendment No. 1 filed on August 26, 2021, Amendment No. 2 filed on October 21, 2021, Amendment No. 3 filed on December 17, 2021, and Amendment No. 4 filed on February 28, 2022 with the SEC for a public offering pursuant to Regulation A of up to (i) $74,880,000 of its bonds for cash and (ii) $120,000 of its bonds as rewards. On October 31, 2022, WPB completed the offering and sold approximately $62 million aggregate principal amount of bonds as of March 31, 2024. Effective May 28, 2024, the Company temporarily suspended bond sales pending approval of the Post-Qualification Amendment on file with the SEC.

In February of 2023, WFI formed Worthy Property Bonds 2, Inc. (WPB 2) and its wholly-owned subsidiary Worthy Lending VI, LLC. WPB 2 filed an Offering Statement on Form 1-A under SEC File No. 024-12206 on April 3, 2023. On April 10, 2023, the Company received a letter from the SEC advising the Company that they do not intend to review the offering statement and they will consider qualifying the offering statement at the Company’s request. On June 21, 2023, WPB completed the offering and sold approximately $23 million aggregate principal amount of bonds as of March 31, 2024. Effective June 20, 2024, the Company temporarily suspended bond sales pending approval of the Post-Qualification Amendment on file with the SEC.

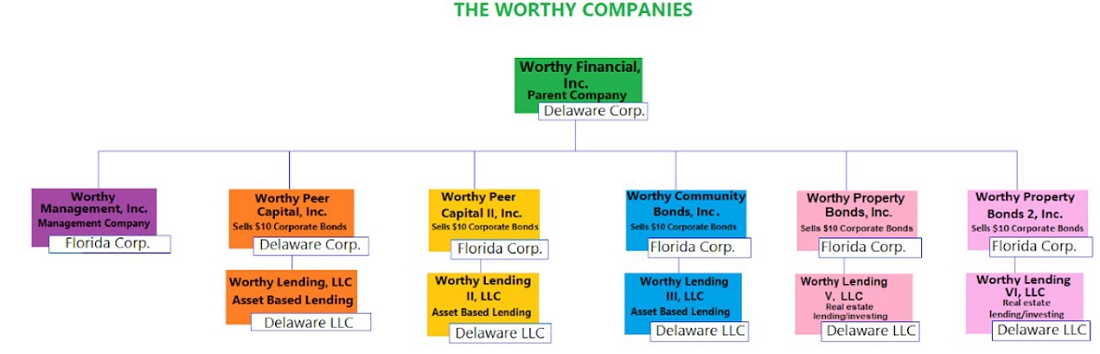

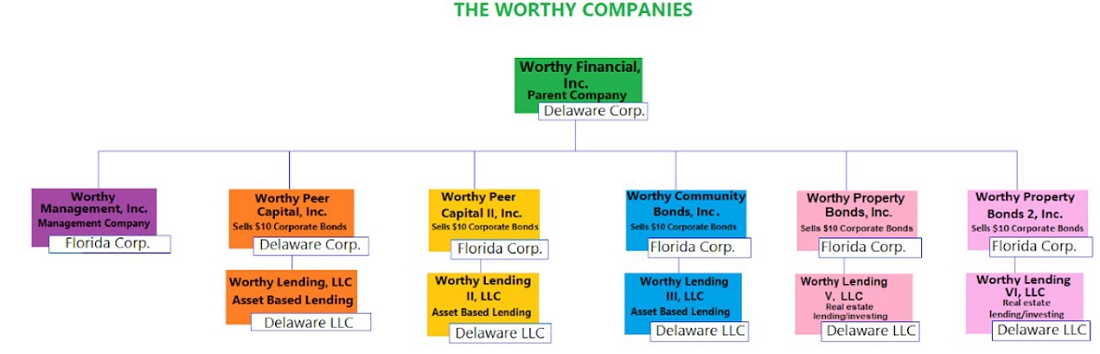

Organizational Structure

The following reflects the current organization structure of the Worthy Companies:

THE WORTHY COMPANIES

| | (1) | Worthy Financial, Inc. owns 100% of the issued and outstanding capital stock of Worthy Management, Inc., Worthy Peer Capital, Inc., Worthy Peer Capital II, Inc., Worthy Community Bonds, Inc., Worthy Property Bonds, Inc. and Worthy Property Bonds 2, Inc. |

| | (2) | Worthy Peer Capital, Inc., Worthy Peer Capital II, Inc., Worthy Community Bonds, Inc., Worthy Property Bonds, Inc. and Worthy Property Bonds 2, Inc. are each a party to a management services agreement with Worthy Management, Inc. |

| | (3) | Worthy Peer Capital, Inc., Worthy Peer Capital II, Inc., Worthy Community Bonds, Inc., Worthy Property Bonds, Inc. and Worthy Property Bonds 2, Inc. own 100% of the issued and outstanding membership interests of Worthy Lending, LLC, Worthy Lending II, LLC, Worthy Lending III, LLC, Worthy Lending V, LLC and Worthy Lending VI, LLC, respectively. |

Our Business Model

We are an early stage company, which, through our wholly owned subsidiary Worthy Lending V, we are implementing our business model. Our business model is centered primarily around purchasing or otherwise acquiring mortgages and other liens on and interests in real estate. We anticipate that (i) at least 55% of our assets will consist of “mortgages and other liens on and interests in real estate” (“Qualifying Interests”), (ii) at least an additional 25% of our assets will consist of “real estate-type interests” (subject to proportionate reduction if greater than 55% of our assets are Qualifying Interests), and (iii) not more than 20% of our total assets consist of assets that have no relationship to real estate provided the amount and nature of such activities do not cause us to lose our exemption from regulations as an investment company pursuant to the Investment Company Act of 1940, or the “40 Act.” Qualifying Interests are assets that represent an actual interest in real estate or are loans or liens “fully secured by real estate” but exclude securities in other issuers engaged in the real estate business. Real estate-type interests include certain mortgage-related instruments including loans where 55% of the fair market value of the loan is secured by real property at the time the issuer acquired the loan and agency partial-pool certificates. We will sell Worthy Property Bonds in this offering to provide the capital for these activities.

The Worthy Property Bonds:

| | ● | are priced at $10.00 each; |

| | ● | represent a full and unconditional obligation of our company; |

| | ● | bear interest at 5% per annum (5.5% effective April 2023, 5.75% effective August 2023, 7% effective November 2023 through November 2024). For clarification purposes, we will pay interest on interest (compounded interest) and credit such interest to bondholders’ Worthy accounts; |

| | ● | are subject to repayment at any time at the demand of the holder; |

| | ● | are subject to redemption by us at any time; |

| | ● | are not payment dependent on any underlying real estate loans or investments; |

| | ● | are transferable; |

| | ● | are unsecured. |

For the year ended March 31, 2024, the Company generated revenues of $2,666,491, primarily from interest earned on loans receivable.

Our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report with respect to our audited consolidated financial statements for the year ended March 31, 2024.

Worthy Fintech Platform

WFI has developed technology solutions, including the Worthy App and the Worthy Website, which facilitates the purchase of Worthy Property Bonds in the Offering and provides information on accounts of the Worthy Bond investors. We refer to these as the “Worthy Fintech Platform.” We pay a license fee to WFI in the amount of $5 per registered user per year; and agreed that such amount would be subject to periodic review and modification.

Worthy App

The Worthy App is designed to support the target market for our bonds which we believe is approximately 74 million millennials, who spend more than $600 billion a year. The Worthy App seeks to provide an easy way for our target market to micro invest including monetizing their debit card purchases, checking account linked credit card purchases and other checking account transactions by “rounding up” each purchase to the next higher dollar until the “round up” reaches $10.00 at which time the user can purchase a $10.00 bond. The Worthy App is available via the web at worthybonds.com or for Apple iPhone users from the Apple Store and for Android phone users from Google Play.

Procedurally, Worthy App users download the application and simply link their bank account to the App. If engaging in the round-up feature, they connect their debit card or credit card to the App. Every time the user shops or completes any checking account transaction, the App automatically rounds up their purchase to the next dollar, tracks the spare change and during the Offering permitted the user to use it to invest in our Worthy Community Bonds. The user’s bank accounts are monitored, and the money is transferred via ACH once the round up amounts reach $10.00.

Users can also make one time or recurring purchases of bonds.

Worthy Website

The Worthy Website offers users the following features:

| | ● | Available online directly from us. Prior to the completion of the Offering, users could purchase Worthy Community Bonds directly from us through the Worthy Website; |

| | ● | No purchase fees charged. We did not charge purchasers any commission or fees to purchase Worthy Community Bonds through the Worthy Website in the Offering; |

| | ● | Invest as little as $10. Investors were able to build ownership in Worthy Community Bonds over time by making purchases as low as $10 in the Offering prior to its completion; |

| | ● | Flexible, secure payment options. Prior to the completion of the Offering, users could purchase Worthy Community Bonds electronically or by wire transfer; and |

| | ● | Manage your portfolio online. Users can view their bond purchases, redemptions, interest payments and other transaction history online, as well as receive tax information and other reports. |

Operations – Management Services Agreement with Worthy Management

On April 9, 2021 we entered into a Management Services Agreement (the “Management Services Agreement”) with Worthy Management. Worthy Management was established in October 2019 as part of the internal reorganization of the operations of our parent, WFI. This operational restructure was undertaken as a cost-sharing effort to more efficiently utilize personnel throughout the Worthy group of companies. As a result, our executive officers and the other personnel which provide services to us are all employed by Worthy Management.

Under the terms of the Management Services Agreement, Worthy Management agreed to provide to the Company certain management services, personnel and office facilities, including all equipment and supplies, which are reasonable, necessary or useful for the day-to-day operations of the business of the Company, subject to such written direction provided by the Company to Worthy Management.

Pursuant to the Management Services Agreement, the Company agreed to reimburse Worthy Management for the costs incurred by Worthy Management in paying for the staff and office expenses for the Company under the Management Services Agreement. There is no interest rate or maturity associated with the obligations to reimburse Worthy Management under the Management Services Agreement.

The reimbursement amount under the Management Services Agreement, will be equal to the costs incurred by Worthy Management in paying for the staff and office expenses under the Management Services Agreement for the Company and consists of a portion of the annual salaries and employee benefits of our executive officers and the other personnel employed by Worthy Management based upon the amount of time they devote to us, as well as a pro-rata allocation of office expenses. This monthly reimbursement amount is based on the costs incurred by Worthy Management in paying for the staff and office expenses for the Company under the Management Services Agreement.

There will be no management service or other fees under the Management Services Agreement.

The initial term of the Management Services Agreement will continue until the fifth anniversary of the effectiveness of such agreement and will automatically renew for successive one year terms. The Management Services Agreement can be terminated at any time upon 30 days’ prior written notice from one party to the other.

The Company has a receivable from Worthy Management of $9,077 at March 31, 2024.

License Fee

We entered into an agreement with WFI to pay a license fee to WFI in the amount of $5 per registered user per year. The license fees paid by the Company to WFI are not used to offset the reimbursements under the Management Services Agreement.

Our Loan Portfolio

Mortgage Loans Held for Investment

Commencing in November of 2022, the Company began investing in mortgage loans. Each loan is secured by a mortgage in the real estate, which is located in the state of Florida. Each loan has a maturity date of 2 years and mature between November of 2024 and March of 2026. These loans generally pay interest at rates between 10% and 13%, annually and are serviced by an outside, unrelated party.

A summary of the Company’s loan portfolio as of March 31, 2024, disaggregated by class of financing receivable, are as follows:

| | | Loans to Real Estate Developers Secured by First Mortgages | |

| | | | |

| Outstanding at March 31, 2024 | | | | |

| | | | | |

| Loans | | $ | 25,775,624 | |

| | | | | |

| Allowance for credit losses | | $ | (257,756 | ) |

| | | | | |

| Total Loans, net | | $ | 25,517,868 | |

A summary of the Company’s loan loss allowance as of March 31, 2024, are as follows:

| | | Balance at

March 31, 2023 | | | Write-off | | | Provision for

loan loss | | | Balance at

March 31, 2024 | |

| | | | | | | | | | | | | |

| Mortgage Receivable Allowance | | $ | 203,310 | | | $ | (127,000 | ) | | $ | 181,446 | | | $ | 257,756 | |

| | | | | | | | | | | | | | | | | |

| Interest Receivable Allowance | | $ | 2,070 | | | $ | (86,952 | ) | | $ | 87,394 | | | $ | 2,512 | |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 205,380 | | | $ | (213,952 | ) | | $ | 268,840 | | | $ | 260,268 | |

We had no loans past due or on non-accrual status at March 31, 2024 and 2023.

As of March 31, 2024, future annual maturities of mortgage loans held for investment consists of the following:

| Period Ended March 31, | | Amount | |

| 2025 | | $ | 9,603,999 | |

| 2026 | | $ | 16,171,625 | |

| | | $ | 25,775,624 | |

As of March 31, 2024 there were 22 mortgage loans with a gross balance of $25,775,624, which are required to pay only interest until maturity when the principal is due.

As of March 31, 2023 there were 19 mortgage loans with a gross balance of $20,330,999 which are required to pay only interest until maturity when the principal is due.

Our real estate loans are generally sourced via originator/servicing partners. Upon introduction of a real estate loan opportunity, our underwriting department reviews the proposed transaction and assesses the collateral based on material submitted to us pursuant to our document request list. The underwriting process includes (but is not limited to) a review of i) third-party appraisals of the value of collateral, ii) title, insurance and borrower’s corporate entity documents (i.e. articles of incorporation/organization, operating/shareholder agreement, certificate of good standing, by-laws, officer’s certificate), iii) lien searches, and iv) background checks on the principal(s) of the borrower. We may also request any additional information or material that we deem appropriate to supplement the originator/servicing partner’s file. After completing its review of the loan file and the executed closing documents (including, among others, the promissory note, mortgage, assignment of mortgage and settlement statement) and prior to any commitment to the borrower or referring lender, the underwriting team makes a recommendation for approval to the Commitment Committee. The Commitment Committee also determines whether the loan qualifies under Investment Company Act exemptions.

Once a loan is funded, the portfolio management team monitors the ongoing performance of each loan, ensures that loan documentation is complete and on hand and attends to monthly billing and collection. A dialogue is maintained with the originator/servicing partner should any issues arise. Our underwriting staff has more than 45 years of combined experience in underwriting, loan servicing, real estate and property management.

Marketing and Strategy

Our Worthy Property Bonds are marketed through our website, on-line information sources, social networks, institutional (Colleges and universities, charities, trade associations and employers) and other marketing partner sources of introduction and referral.

Executive Offices

Our office is located at 11175 Cicero Dr., Suite 100 Alpharetta, GA 30022.Worthy Management also provides office space to us under the terms of the Management Services Agreement described above. As described therein, we reimburse Worthy Management for our portion of the total office expenses associated with this office space.

On August 1, 2019 Worthy Peer Capital, Inc. commenced a 5-year lease for its corporate headquarters located in Boca Raton, Florida. Monthly rent is $5,296 inclusive of sales tax and the lease contains an annual escalation clause of 4%. Worthy Management makes the monthly payments and allocates the cost ratable to its subsidiaries, including us.

Competition

We compete with other companies that lend to the small developer mortgage industry. We seek to, but may not be able to effectively compete with such competitors.

We believe we benefit from the following competitive strengths:

We are part of the Worthy Community. The Worthy App and websites (the “Worthy FinTech Platform”) are targeted primarily to the millennials who are part of the fastest growing segment of our population. We believe that they have a basic distrust of traditional banking institutions yet they have a need to accumulate assets for retirement or otherwise. The Worthy FinTech Platform provides for a savings and investing alternative for the millennials.

We focus on an underserved banking sector. Due to higher costs, we believe that banks cannot profitably serve the smaller sub-prime mortgage industry. We believe that this area is one of our competitive strengths because we believe that there are not many lenders who are servicing these borrowers which leaves more room for the Company to pursue opportunities in this sector. Additionally, we believe that this area is one of our competitive strengths because many other lenders are not interested in loans to smaller sub-prime developers who seek to finance their real estate to provide funds for short term development of their properties. However, despite our intentions, we may never be profitable in this sector.

No Public Market

Although under Regulation A the Worthy Property Bonds are not restricted, Worthy Property Bonds are still highly illiquid securities. No public market has developed nor is expected to develop for Worthy Property Bonds, and we do not intend to list Worthy Property Bonds on a national securities exchange or interdealer quotation system. You should be prepared to hold your Worthy Property Bonds as Worthy Property Bonds are expected to be highly illiquid investments.

Employees

We do not have any full-time employees. We are dependent upon the services provided under the Management Services Agreement with Worthy Management for our operations.

Legal Proceedings

From time to time, we may become party to various lawsuits, claims and other legal proceedings that arise in the ordinary course of our business. We are not currently a party, as plaintiff or defendant, nor are we aware of any threatened or pending legal proceedings, that we believe to be material or which, individually or in the aggregate, would be expected to have a material effect on our business, financial condition or results of operations if determined adversely to us.

On January 11, 2021, WFI received a subpoena from the SEC in connection with Peerbackers Advisory, LLC (“Peerbackers”), a company that was wholly owned by WFI that was previously registered with the SEC as an investment adviser and did not conduct any business, requesting certain information from Peerbackers, WFI and its operating subsidiaries. Peerbackers did not conduct any business, withdrew its SEC registration in July 2020 and was dissolved on January 16, 2021. WFI is fully cooperating with the SEC’s request.

Governmental Regulation

The sale of our bonds is subject to federal securities laws. The distribution of our bonds is also subject to the regulation by several states and we are registered as an issuer dealer in the State of Florida. The loans made by us are also subject to state usury laws. Changes in laws or regulations or the regulatory application or judicial interpretation of the laws and regulations applicable to us could adversely affect our ability to operate in the manner in which we intend to conduct business or make it more difficult or costly for us to participate in or otherwise make loans. A material failure to comply with any such laws or regulations could result in regulatory actions, lawsuits, and damage to our reputation, which could have a material adverse effect on our business and financial condition and our ability to participate in and perform our obligations to investors and other constituents.

The collection, processing, storage, use, and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements, or differing views of personal privacy rights. We receive, collect, process, transmit, store, and use a large volume of personally identifiable information and other sensitive data from borrowers and purchasers of the Worthy Bonds and services. There are federal, state, and foreign laws regarding privacy, recording telephone calls, and the storing, sharing, use, disclosure, and protection of personally identifiable information and sensitive data. Specifically, personally identifiable information is increasingly subject to legislation and regulations to protect the privacy of personal information that is collected, processed, and transmitted. Any violations of these laws and regulations may require us to change our business practices or operational structure, address legal claims, and sustain monetary penalties, or other harms to our business. The regulatory framework for privacy issues in the United States and internationally is constantly evolving and is likely to remain uncertain for the foreseeable future. The interpretation and application of such laws is often uncertain, and such laws may be interpreted and applied in a manner inconsistent with other binding laws or with our current policies and practices. If either we or our third-party service providers are unable to address any privacy concerns, even if unfounded, or to comply with applicable laws and regulations, it could result in additional costs and liability, damage our reputation, and harm our business.

COVID-19

While the extent to which COVID-19 impacts the Company’s future results will depend on future developments, the pandemic and associated economic impacts could result in a material impact to the Company’s future financial condition, results of operations and cash flows.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the JOBS Act, which permits us to elect not to be subject to certain disclosure and other requirements that otherwise would have been applicable to us had we not been an “emerging growth company.” These provisions include:

| | ● | reduced disclosure about our executive compensation arrangements; |

| | ● | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| | ● | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time as we are no longer an “emerging growth company.” We will qualify as an “emerging growth company” until the earliest of:

| | ● | the last day of our fiscal year following the fifth anniversary of the date of completion of our Offering; |

| | ● | the last day of our fiscal year in which we have annual gross revenue of $1.0 billion or more; |

| | ● | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or |

| | ● | the last day of the fiscal year in which we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” |

Under this definition, we are and could remain an “emerging growth company” until as late as October, 2026.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

RISK FACTORS

Investing in our securities involves risks. In addition to the other information contained in this annual report, you should carefully consider the following risks. The occurrence of any of the following risks might cause you to lose all or a part of your investment. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Statement Regarding Forward-Looking Statements” for more information regarding forward-looking statements.

Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations:

| | ● | We are an early-stage startup with a limited operating history, and we may never become profitable; |

| | ● | Absent any additional financing or advances from our parent company, other than the sale of the Worthy Property Bonds, we may be unable to meet our operating expenses; |

| | ● | In addition to the sale of the Worthy Property Bonds, we are dependent on advances from our parent company in order to meet our operating expenses and our parent company is under no obligation to advance us any funds; |

| | ● | We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful; |

| | ● | The amount of repayments that bond holders demand at a given time may exceed the amount of funds we have available to make such payments which may result in a delay in repayment or loss of investment to the bond holders; |

| | ● | Public health epidemics or outbreaks (such as the novel strain of coronavirus (COVID-19)) could adversely impact our business; |

| | ● | We operate in a highly regulated industry, and our business may be negatively impacted by changes in the regulatory environment; |

| | ● | Our business may be negatively impacted by worsening economic conditions and fluctuations in the credit market; |

| | ● | Competition in our industry is intense; |

| | ● | Holders of Worthy Property Bonds are exposed to the credit risk of our company; |

| | ● | There has been no public market for Worthy Property Bonds and none is expected to develop; and |

| | ● | We could be materially and adversely affected if we are deemed to be an investment company under the Investment Company Act. |

Risks Related to our Industry

The lending industry is highly regulated. Changes in regulations or in the way regulations are applied to our business could adversely affect our business.

Changes in laws or regulations or the regulatory application or judicial interpretation of the laws and regulations applicable to us could adversely affect our ability to operate in the manner in which we intend to conduct business or make it more difficult or costly for us to participate in or otherwise make loans. A material failure to comply with any such laws or regulations could result in regulatory actions, lawsuits, and damage to our reputation, which could have a material adverse effect on our business and financial condition and our ability to participate in and perform our obligations to investors and other constituents.

The initiation of a proceeding relating to one or more allegations or findings of any violation of such laws could result in modifications in our methods of doing business that could impair our ability to collect payments on our loans or to acquire additional loans or could result in the requirement that we pay damages and/or cancel the balance or other amounts owing under loans associated with such violation. We cannot assure you that such claims will not be asserted against us in the future.

Worsening economic conditions may result in decreased demand for loans, cause borrowers’ default rates to increase, and harm our operating results.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets, historically have created a difficult environment for companies in the lending industry. Many factors, including factors that are beyond our control, may have a detrimental impact on our operating performance. These factors include general economic conditions, unemployment levels, energy costs and interest rates, as well as events such as natural disasters, acts of war, terrorism, pandemic like the recent coronavirus (COVID-19) and catastrophes.

We primarily lend to sub-prime real estate borrowers. Accordingly, our borrowers have historically been, and may in the future remain, more likely to be affected or more severely affected than large enterprises by adverse economic conditions. These conditions may result in a decline in the demand for loans by potential borrowers or higher default rates by borrowers.

There can be no assurance that economic conditions will remain favorable for our business or that demand for real estate mortgage loans or default rates by borrowers will remain at current levels. Reduced demand for loans would negatively impact our growth and revenue, while increased default rates by borrowers may inhibit our access to capital and negatively impact our profitability. Further, if an insufficient number of qualified borrowers apply for loans, our growth and revenue would be negatively impacted.

Our management team has limited experience in mortgage loan underwriting.

Our management team has limited experience in mortgage loan underwriting. If the method adopted by the Company for evaluating real estate property related to a potential real estate loan and for establishing interest rates for the corresponding real estate loan proves flawed, investors may not receive the expected yield on the Worthy Property Bonds.

We have limited experience in managing real estate investments or developing real estate projects.

If the borrower is unable to repay its obligations under a loan from us, we may foreclose on the real estate property. Although we will seek out purchasers for the property, we or experienced third parties engaged by us may have to take an active role in the management of the real estate or the project. Prospective investors should consider that the members of our management have limited experience in managing real estate or developing real estate projects. No assurances can be given that we or third parties engaged by us can manage real estate or operate real estate projects profitably.

Competition for employees is intense, and we may not be able to attract and retain the highly skilled employees whom we need to support our business.

Competition for highly skilled personnel, especially data analytics personnel, is extremely intense, and we could face difficulty identifying and hiring qualified individuals in many areas of our business. We may not be able to hire and retain such personnel. Many of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment. In addition, we intend to invest significant time and expense in training our employees, which increases their value to competitors who may seek to recruit them. If we fail to retain our employees, we could incur significant expenses in hiring and training their replacements and the quality of our services and our ability to serve borrowers could diminish, resulting in a material adverse effect on our business. We currently have no full time employees. However, management and staffing are presently provided by Worthy Management, Inc., a wholly owned subsidiary of our parent company.

We operate in a competitive market which may intensify, and competition may limit our ability to implement our business model and have a material adverse effect on our business, financial condition, and results of operations.

We operate in a competitive market which may intensify, and competition may limit our ability to implement our business model and have a material adverse effect on our business, financial condition, and results of operations. Our competitors may be able to have a lower cost for their services which would lead to borrowers choosing such other competitors over the Company. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of loans and investments, offer more attractive pricing or other terms and establish more relationships than us.

Risks Related to Our Company

We are an early-stage startup with a limited operating history, and we may never become profitable.

We do not expect to be profitable for the foreseeable future. If we are unable to obtain or maintain profitability, we will not be able to attract investment, compete, or maintain operations.

Our management has raised substantial doubt about our ability to continue as a going concern and our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report with respect to our audited consolidated financial statements for the year ended March 31, 2024.

We are an early-stage startup with a limited operating history, and we may never become profitable. Our management has raised substantial doubt about our ability to continue as a going concern and our independent registered public accounting firm has included an explanatory paragraph in their opinion on our audited consolidated financial statements for the year ended March 31, 2024 and 2023, that states that there is a substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming that we will continue as a going concern. There is substantial doubt about our ability to continue as a going concern. No assurances can be given that we will generate sufficient revenue or obtain necessary financing to continue as a going concern. No assurances can be given that we will achieve success in selling the Worthy Property Bonds.

We are dependent on advances from our parent company and the funds to be raised in the offering in order to be able to implement our business plan.

Until sufficient proceeds have been received by us from the sale of Worthy Property Bonds in the offering we will rely on advances from our parent as to which we have no assurances. WFI is not obligated to provide advances to us and there are no assurances that we will be successful in raising proceeds in this offering. If we do not raise sufficient funds in the offering or if our parent declines to make advances to us, we will not be able to implement our business plan, or may have to cease operations altogether.

If we do not raise sufficient funds in the offering or if our parent company declines to make advances to us we won’t be able to implement our business plan.

We have generated limited revenues and we are dependent on the proceeds from the offering to provide funds to implement our business model. Given the uncertainty of the amount of Worthy Property Bonds that we will sell makes it difficult to predict our planned operations. Until sufficient proceeds have been received by us from the sale of Worthy Property Bonds we will rely on advances from our parent as to which we have no assurances. WFI is not obligated to provide advances to us and there are no assurances that we will be successful in raising proceeds in this offering. If we do not raise sufficient funds in this offering or if our parent company declines to make advances to us we won’t be able to implement our business plan.

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have a limited operating history in an evolving industry that may not develop as expected. Assessing our business and future prospects is challenging in light of the risks and difficulties we may encounter. These risks and difficulties include our ability to:

| | ● | increase the number and total volume of loans and other credit products extended to borrowers; |

| | ● | improve the terms on which loans are made to borrowers as our business becomes more efficient; |

| | ● | increase the effectiveness of our direct marketing and lead generation through referral sources; |

| | ● | favorably compete with other companies that are currently in, or may in the future enter, the business of lending to sub-prime real estate borrowers; |

| | ● | successfully navigate economic conditions and fluctuations in the credit market; and |

| | ● | effectively manage the growth of our business. |

We may not be able to successfully address these risks and difficulties, which could harm our business and cause our operating results to suffer.

The amount of repayments that bond holders demand at a given time may exceed the amount of funds we have available to make such payments which may result in a delay in repayment or loss of investment to the bond holders.

We will use our commercially reasonable efforts to maintain sufficient cash and cash equivalents on hand to honor repayment demands of bond holders. Pursuant to the terms of our Worthy Property Bonds Investor Agreement and Worthy Property Bonds, investors may require us to repay the amount of their Worthy Property Bonds on 5 days’ notice, provided, however, if the requested amount of repayment is greater than $50,000 such repayment must be made by us within 30 days of the request. Any failure to make repayments on the foregoing terms is an event of default under the Worthy Property Bonds. Under the Worthy Property Bonds Investor Agreement any claims brought by an investor against us following such a payment event of default may be subject to binding arbitration (subject to certain opt-out provisions) or small claims court. See “Description of the Worthy Property Bonds - Worthy Property Bonds – Arbitration.”

We anticipate setting aside a minimum of 20% of Worthy Property Bonds sales in cash and cash equivalents. However, in the event there are more demands for repayment to meet than our cash and cash equivalents on hand, we may be required to (i) liquidate some of our loan portfolio and investments (which loans and investments qualify under the exemption provided by Section 3(c)(5)(C) of the Investment Company Act of 1940), (ii) seek commercial banks and non-bank lending sources, such as insurance companies, private equity funds and private lending organizations, for the provision of credit facilities, including, but not limited to, lines of credit, pursuant to which funds would be advanced to us, or (iii) seek capital contributions from our parent company, WFI. In the event that the above sources of funds to honor repayments cannot be realized within the time frame of the repayment requests of bond holders, bond holders might have to wait for repayment until the above sources are realized. If the above sources do not generate enough funds to honor bond holders’ requests for repayment, there is a risk that the bond holders may lose some or all of their investment in the Worthy Property Bonds.

On August 22, 2022, Worthy Peer Capital, Inc., our sister company and wholly owned subsidiary of our parent company WFI, advised all bondholders that due to a number of domestic and global economic factors, some of its loans to small businesses, including loans to manufacturers, wholesalers, and retailers secured by inventory, accounts receivable and/or equipment and purchase order financing, have defaulted in their payment obligations. While the Worthy Peer Capital, Inc.’s portfolio of real estate loans continues to perform well, the foregoing defaults in small business loans has caused current illiquidity of Worthy Peer Capital, Inc.’s overall loan portfolio. As a result, Worthy Peer Capital, Inc. temporarily delayed the redemption of outstanding bonds while continuing to accrue the 5% interest (5.5% effective April 1, 2023). $8,885,663 of Worthy Peer Capital Bonds are presently subject to the suspension of redemptions. Prior to the suspension in redemptions Worthy Peer Capital, Inc. had redeemed $41,114,337 of Worthy Peer Capital Bonds. Collectively, Worthy Peer Capital, Inc. and sister companies Worthy Peer Capital II, Inc., and Worthy Community Bonds, Inc., have redeemed approximately $98,846,130 of Worthy Bonds to date. Worthy Peer Capital, Inc. continues to pursue outstanding loan collections and will redeem outstanding bonds with accrued interest as loan collections and other asset liquidation permits and will do so automatically in the order of bond maturity and redemption requests. To the extent that Worthy Peer Capital, Inc.’s asset liquidity does not provide sufficient funds for full bond redemption, it is the intention of WFI, the parent company of Worthy Peer Capital, Inc., to provide capital contributions to Worthy Peer Capital, Inc. from a pending transaction.

On July 26, 2023, Worthy Peer Capital II, Inc. advised all bondholders that due to a number of domestic and global economic factors, some of its loans to small businesses, including loans to manufacturers, wholesalers, and retailers secured by inventory, accounts receivable and/or equipment and purchase order financing, have defaulted in their payment obligations. While Worthy Peer Capital II, Inc.’s portfolio of real estate loans performed well, the foregoing defaults in small business loans has caused current illiquidity of Worthy Peer Capital II, Inc.’s overall loan portfolio. As a result, Worthy Peer Capital II, Inc. paused the redemption of outstanding bonds while continuing to accrue interest. Worthy Peer Capital II, Inc. continues to pursue outstanding loan collections and will redeem outstanding bonds with accrued interest as loan collections and other asset liquidation permits and will do so automatically in the order of bond maturity and redemption requests. To the extent that Worthy Peer Capital II, Inc.’s asset liquidity does not provide sufficient funds for full bond redemption, it is the intention of WFI, the parent company of Worthy Peer Capital II, Inc., to provide capital contributions to Worthy Peer Capital II, Inc. from a pending transaction.

If the information provided by borrowers is incorrect or fraudulent, we may misjudge a customer’s qualification to receive a loan, and our operating results may be harmed.

Although a significant part of our loan participation or loan decisions is based on appraisals of the real estate underlying the loans, our decisions are based partly on information provided to us by loan applicants. To the extent that these applicants provide information to us in a manner that we are unable to verify, we may not be able to accurately assess the associated risk. In addition, data provided by third-party sources is a significant component of our underwriting process, and this data may contain inaccuracies. Inaccurate analysis of credit data that could result from false loan application information could harm our reputation, business, and operating results.

Our risk management efforts may not be effective.

We could incur substantial losses, and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, liquidity risk, and other market-related risk, as well as operational risks related to our business, assets, and liabilities. To the extent our models used to assess the creditworthiness of potential borrowers do not adequately identify potential risks, the risk profile of such borrowers could be higher than anticipated. Our risk management policies, procedures, and techniques may not be sufficient to identify all of the risks we are exposed to, mitigate the risks that we have identified, or identify concentrations of risk or additional risks to which we may become subject in the future.

We will rely on various referral sources and other borrower lead generation sources, including lending platforms.

Unlike banks and other larger competitors with significant resources, we intend to rely on our smaller-scale marketing efforts, affinity groups, partners, and loan referral services to acquire borrowers. We do not have exclusive rights to referral services, and we cannot control which small developer loans or the volume of small developer loans we are sent. In addition, our competitors may enter into exclusive or reciprocal arrangements with their own referral services, which might significantly reduce the number of small developer mortgage borrowers we are referred. Any significant reduction in small developer mortgage borrower referrals could have an adverse impact on our loan volume, which will have a correspondingly adverse impact on our operations and our company.

We are subject to a number of conflicts of interest arising out of our relationship with WFI and its subsidiaries which may not be resolved in our favor.

We are subject to a number of conflicts of interest arising out of our relationship with WFI and its subsidiaries, including the following:

| | ● | WFI is our parent company and our sole shareholder. WFI is also the sole shareholder of Worthy Management, Worthy Peer Capital, Inc., Worthy Peer Capital II, Inc., Worthy Community Bonds, Inc., and Worthy Property Bonds 2, Inc. Accordingly, its executive officers and directors have fiduciary obligations to a number of entities. This potential conflict of interest poses a risk that the executive officers and directors may exercise their fiduciary duties in favor of affiliated entities rather than us even though they have fiduciary duties to us; |

| | | |

| | ● | Certain of our executive officers and directors are also executive officers and directors of Worthy Peer Capital, Inc., Worthy Peer Capital II, Inc., Worthy Community Bonds, Inc., Worthy Property Bonds 2, Inc. and Worthy Management and they do not devote all of their time and efforts to our company. This potential conflict of interest poses a risk that those executive officers and directors may devote an insufficient amount of time and effort to operating our company because they are too busy devoting their time and effort to the operations of our affiliates; and |

| | | |

| | ● | The terms of the Management Services Agreement with Worthy Management were not negotiated on an arms-length basis and the amounts to be reimbursed thereunder will be equal to the costs incurred by Worthy Management in paying for the staff and office expenses for the Company under the Management Services Agreement, will be determined by our executive officers and directors who are also executive officers and directors of Worthy Management notwithstanding that they are executive officers and directors of both our Company and Worthy Management. This potential conflict of interest poses a risk that the amount to be reimbursed by our company under the Management Services Agreement may be determined by the executive officers and directors to be higher in the absence of an arms-length arrangement at the expense of our company. |

There are no assurances that any conflicts which may arise will be resolved in our favor, which could adversely affect our operations. In addition, as a bondholder you have no right to vote upon or receive notice of any corporate actions we may undertake which you might otherwise have if you owned equity in our company.

A significant disruption in our computer systems or a cybersecurity breach could adversely affect our operations.

We rely extensively on our computer systems to manage our loan origination and other processes. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber security breaches, vandalism, severe weather conditions, catastrophic events and human error, and our disaster recovery planning cannot account for all eventualities. If our systems are damaged, fail to function properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to perform critical functions, which could adversely affect our business and results of operations. Any compromise of our security could also result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

Our ability to protect the confidential information of our borrowers and investors may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions.

We process certain sensitive data from our borrowers and investors. While we have taken steps to protect confidential information that we receive or have access to, our security measures could be breached. Any accidental or willful security breaches or other unauthorized access to our systems could cause confidential borrower and investor information to be stolen and used for criminal purposes. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, our relationships with borrowers and investors could be severely damaged, and we could incur significant liability.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause borrowers and investors to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, would harm our reputation, we could lose borrowers and investors and our business and operations could be adversely affected.

Any significant disruption in service on our platform or in our computer systems, including events beyond our control, could prevent us from processing or posting payments on loans, reduce the attractiveness of our marketplace and result in a loss of borrowers or investors.

In the event of a system outage and physical data loss, our ability to perform our servicing obligations, process applications or make loans available would be materially and adversely affected. The satisfactory performance, reliability and availability of our technology are critical to our operations, customer service, reputation and our ability to attract new and retain existing borrowers and investors.

Any interruptions or delays in our service, whether as a result of third-party error, our error, natural disasters or security breaches, whether accidental or willful, could harm our relationships with our borrowers and investors and our reputation. Additionally, in the event of damage or interruption, our insurance policies may not adequately compensate us for any losses that we may incur. Our disaster recovery plan has not been tested under actual disaster conditions, and we may not have sufficient capacity to recover all data and services in the event of an outage. These factors could prevent us from processing or posting payments on the loans, damage our brand and reputation, divert our employees’ attention, reduce our revenue, subject us to liability and cause borrowers and investors to abandon our marketplace, any of which could adversely affect our business, financial condition and results of operations.

We contract with third parties to provide services related to our online web lending and marketing, as well as systems that automate the servicing of our loan portfolios. While there are material cybersecurity risks associated with these services, we require that our vendors provide industry-leading encryption, strong access control policies, Statement on Standards for Attestation Engagements (SSAE) 16 audited data centers, systematic methods for testing risks and uncovering vulnerabilities, and industry compliance audits to ensure data and assets are protected. To date, we have not experienced any cyber incidents that were material, either individually or in the aggregate.

If our estimates of loan receivable losses are not adequate to absorb actual losses, our provision for loan receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for loans receivable losses. To estimate the appropriate level of allowance for loan receivable losses, we consider known and relevant internal and external factors that affect loan receivable collectability, including the total amount of loan receivables outstanding, historical loan receivable charge-offs, our current collection patterns, and economic trends. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general economic uncertainty may affect our allowance for loan receivable losses, our provision may be inadequate. Our allowance for loan receivable losses is an estimate, and if actual loan receivable losses are materially greater than our allowance for loan receivable losses, our financial position, liquidity, and results of operations could be adversely affected.

We will face increasing competition of other small developer real estate lenders and, if we do not compete effectively, our operating results could be harmed.

We compete with other companies that make small developer real estate loans. If we are not able to compete effectively with our competitors, our operating results could be harmed.

Many of our competitors have significantly more resources and greater brand recognition than we do and may be able to attract borrowers more effectively than we do.

When new competitors seek to enter one of our markets, or when existing market participants seek to increase their market share, they sometimes undercut the pricing and/or credit terms prevalent in that market, which could adversely affect our market share or ability to explore new market opportunities. Our pricing and credit terms could deteriorate if we act to meet these competitive challenges. Further, to the extent that the fees we pay to our strategic partners and borrower referral sources are not competitive with those paid by our competitors, whether on new loans or renewals or both, these partners and sources may choose to direct their business elsewhere. All of the foregoing could adversely affect our business, results of operations, financial condition, and future growth.

The collection, processing, storage, use, and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements, or differing views of personal privacy rights.

We receive, collect, process, transmit, store, and use a large volume of personally identifiable information and other sensitive data from borrowers and purchasers of the Worthy Property Bonds and services. There are federal, state, and foreign laws regarding privacy, recording telephone calls, and the storing, sharing, use, disclosure, and protection of personally identifiable information and sensitive data. Specifically, personally identifiable information is increasingly subject to legislation and regulations to protect the privacy of personal information that is collected, processed, and transmitted. Any violations of these laws and regulations may require us to change our business practices or operational structure, address legal claims, and sustain monetary penalties, or other harms to our business.

The regulatory framework for privacy issues in the United States and internationally is constantly evolving and is likely to remain uncertain for the foreseeable future. The interpretation and application of such laws is often uncertain, and such laws may be interpreted and applied in a manner inconsistent with other binding laws or with our current policies and practices. If either we or our third-party service providers are unable to address any privacy concerns, even if unfounded, or to comply with applicable laws and regulations, it could result in additional costs and liability, damage our reputation, and harm our business.

We are reliant on the efforts of Dara Albright, Richard Alterman, Sally Outlaw and Alan Jacobs.

We rely on our management team and need additional key personnel to grow our business, and the loss of key employees or inability to hire key personnel could harm our business. We believe our success has depended, and continues to depend, on the efforts and talents of our executive officers and directors, Dara Albright, Richard Alterman, Sally Outlaw and Alan Jacobs. Our key personnel have expertise that could not be easily replaced if we were to lose any or all of their services.

Compliance with Regulation A and reporting to the SEC could be costly.

Compliance with Regulation A could be costly and requires legal and accounting expertise. After qualifying this Form 1-A, we will be required to file an annual report on Form 1-K, a semiannual report on Form 1-SA, and current reports on Form 1-U.

Our legal and financial staff may need to be increased in order to comply with Regulation A. Compliance with Regulation A will also require greater expenditures on outside counsel, outside auditors, and financial printers in order to remain in compliance. Failure to remain in compliance with Regulation A may subject us to sanctions, penalties, and reputational damage and would adversely affect our results of operations.

The Company may be subject to fines and penalties for failure to timely file reports and amendments with the SEC, including annual reports, semi-annual reports, current reports and post-qualification amendments.

The SEC requires Regulation A issuers to file certain reports and amendments after an offering has been qualified to sell to investors. Specifically, issuers are required to file annual and semi-annual reports and current reports reflecting certain changes and events that are material to investors. Further, Post-Qualification Amendments must be filed for ongoing offerings at least every 12 months after the qualification date to include the financial statements that would be required by Form 1–A as of such date; or to reflect any facts or events arising after the qualification date of the offering statement (or the most recent Post-Qualification Amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the offering statement. The Company believes that it has filed all required annual, semi-annual and current reports. However, the Company has filed a Post-Qualification Amendment to Form 1-A after 12 months from its qualification date. Effective May 28, 2024, the Company temporarily suspended bond sales pending approval of the Post-Qualification Amendment on file with the SEC. As such, the Company may be subject to fines, penalties or other enforcement actions which may negatively impact the financial status of the Company after closing, and your investments.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. Therefore, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies,” and our investors could receive less information than they might expect to receive from exchange traded public companies.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year. Therefore, our investors could receive less information than they might expect to receive from exchange traded public companies.

Our limited operating history makes it difficult for you to evaluate this investment.

We are a recently formed entity with a limited operating history and may not be able to successfully operate our business or achieve our investment objectives. We may not be able to conduct our business as described in our plan of operation.

We are subject to the risk of fluctuating interest rates, which could harm our planned business operations.

We expect to generate net income from the difference between the interest rates we charge borrowers or otherwise make from our permissible investments, including loan origination fees paid by borrowers, and the interest we will pay to the holders of Worthy Property Bonds. Due to fluctuations in interest rates, we may not be able to charge borrower’s an interest rate sufficient for us to generate income, which could harm our planned business operations.

Any Bond Rewards you receive as a result of the Bond Rewards Program could have adverse tax consequences to you.

There is some uncertainty about the appropriate treatment of these Bond Rewards for income purposes. You may be subject to tax on the value of your Bond Rewards. If you receive Worthy Property Bonds under the Bond Rewards Program, upon receipt you will generally realize taxable income equal to the fair market value of the Worthy Property Bonds. Your participation in the Bond Rewards Program may increase the complexity of your tax filings and may cause you to be ineligible to file Internal Revenue Service Form 1040-EZ, if you would otherwise be eligible to file such form.

Risks Related to Being Deemed an Investment Company under the Investment Company Act

We could be materially and adversely affected if we are deemed to be an investment company under the Investment Company Act.

We rely on the exception from the Investment Company Act set forth in Section 3(c)(5)(C) of the Investment Company Act, which excludes from the definition of investment company “any person who is not engaged in the business of issuing redeemable securities, face-amount certificates of the installment type or periodic payment plan certificates, and who is primarily engaged in one or more of the following businesses… (C) purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” The SEC Staff generally requires that, for the exception provided by Section 3(c)(5)(C) to be available, at least 55% of an entity’s assets be comprised of mortgages and other liens on and interests in real estate, also known as “qualifying interests,” and at least another 25% of the entity’s assets must be comprised of additional qualifying interests or real estate-type interests (with no more than 20% of the entity’s assets comprised of miscellaneous assets). We intend to acquire assets with the proceeds of this offering in satisfaction of such SEC requirements to fall within the exception provided by Section 3(c)(5)(C). Notwithstanding, it is possible that the staff of the SEC could disagree with any of our determinations. If the staff of the SEC were to disagree with our analysis under the Investment Company Act, we would need to adjust our investment strategy. Any such adjustment in our strategy could have a material adverse effect on us. If we are deemed to be an investment company, we may be required to register as an investment company if we are unable to dispose of the disqualifying assets, which could have a material adverse effect on us.

Registration under the Investment Company Act would require us to comply with a variety of substantive requirements that impose, among other things:

| | ● | limitations on capital structure; |

| | | |

| | ● | restrictions on specified investments; |

| | | |

| | ● | restrictions on leverage or senior securities; |

| | | |

| | ● | restrictions on unsecured borrowings; |

| | | |

| | ● | prohibitions on transactions with affiliates; and |

| | | |

| | ● | compliance with reporting, record keeping, voting, proxy disclosure and other rules and regulations that would significantly increase our operating expenses. |

If we were required to register as an investment company but failed to do so, we could be prohibited from engaging in our business, and criminal and civil actions could be brought against us. Registration with the SEC as an investment company would be costly, would subject us to a host of complex regulations and would divert attention from the conduct of our business, which could materially and adversely affect us. In addition, we would no longer be eligible to offer our securities under Regulation A of the Securities Act if we were required to register as an investment company.