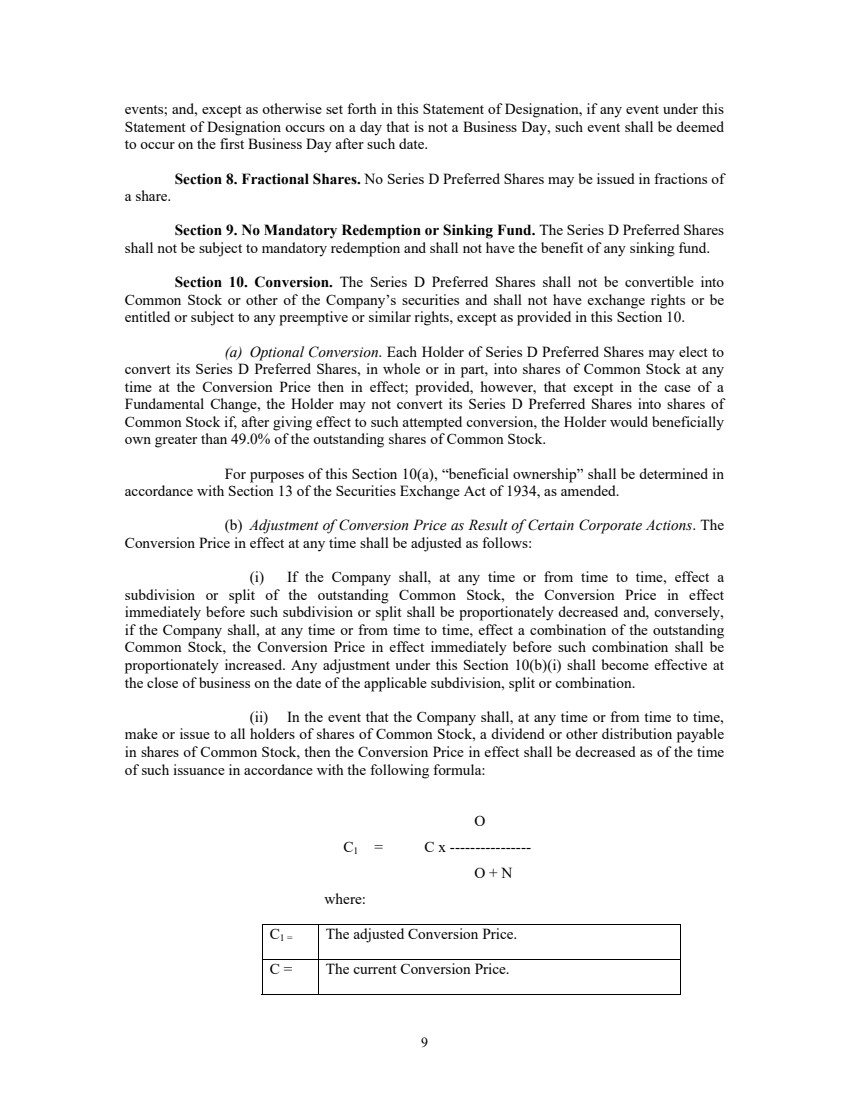

| 7 plan or arrangement approved by the Board of Directors; (B) in respect of a conversion of the Series D Preferred Shares in accordance herewith; (C) pursuant to a stock split, stock dividend, reorganization or recapitalization applicable to all of the shares of Common Stock of the Company; or (D) pursuant to a transaction that the Initial Holder agrees shall be deemed to be an issuance of Excluded Shares. “Fair Market Value” means the 30-Trading Day trailing VWAP of the Common Stock (as adjusted to take into account any offering expenses, such as underwriting discounts and expenses (but not including discounts to the VWAP), that are customary for the type of offering being conducted by the Company) “Fundamental Change” means the occurrence of a liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary, or a sale of all or substantially all of the assets, property or business of the Company individually or in a series of transactions, or a change of control of the Company. “Holder” means the Person in whose name the Series D Preferred Shares is registered on the stock register of the Company maintained by the Registrar and Transfer Agent. “Initial Holder” means Diana Shipping Inc. and/or its Affiliates. “Junior Stock” has the meaning set forth in Section 6(a) of this Statement of Designation. “Liquidation Event” means the occurrence of a liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary, or a sale of all or substantially all of the assets, property or business of the Company individually or in a series of transactions, or a change of control of the Company. A consolidation or merger of the Company with or into any other Person, individually or in a series of transactions, shall not be deemed a Liquidation Event. “Liquidation Preference” has the meaning set forth in Section 4(a) of this Statement of Designation. “Officer’s Certificate” means a certificate signed by the Company’s Chief Executive Officer or the Chief Financial Officer or another duly authorized officer. “Original Issue Date” means the first date on which the first Series D Preferred Share is issued and outstanding. “Original Issue Price” means $1,000.00 per share for each Series D Preferred Share (as adjusted for any stock dividends, stock splits, combinations, recapitalizations, reclassifications or other similar events with respect to the Series D Preferred Shares). “Parity Stock” has the meaning set forth in Section 6(b) of this Statement of Designation. “Paying Agent” means Computershare Inc., acting in its capacity as paying agent for the Series D Preferred Shares, and its respective successors and assigns or any other payment agent appointed by the Company. “Person” means a legal person, including any individual, Company, estate, partnership, joint venture, association, joint-stock company, limited liability company, trust or entity. |