As filed with the U.S. Securities and Exchange Commission on August 30, 2024.

Registration No. 333-268759

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

POST-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1 POS AM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________

CARDIO DIAGNOSTICS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 6770 | | 87-0925574 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

311 West Superior Street, Suite 444

Chicago, IL 60654

Telephone: (855) 226-9991

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________________

Meeshanthini V. Dogan, Ph.D.

Chief Executive Officer

Cardio Diagnostics Holdings, Inc.

311 West Superior Street, Suite 444

Chicago, IL 60654

Telephone: (855) 226-9991

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________________

Copies to:

P. Rupert Russell, Esq.

Shartsis Friese LLP

425 Market Street, 11th Floor

San Francisco, CA 94105

(415) 421-6500

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 (this “Post-Effective Amendment No. 2”) to the Registration Statement on Form S-1 (File No. 333-268759) of Cardio Diagnostics Holdings, Inc. (the “Company,” “Cardio,” “we,” or “us”), originally declared effective by the Securities and Exchange Commission (“SEC”) on January 24, 2023, was subsequently amended by Post-Effective Amendment No. 1, which was declared effective by the SEC on April 28, 2023 (the “Existing Registration Statement”). This Post-Effective Amendment No. 2 is being filed to include in the Existing Registration Statement and the prospectus contained therein, information from the registrant’s Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on April 1, 2024 and its Quarterly Report on Form 10-Q for the period ended June 30, 2024, which was filed on August 12, 2024, and to update certain other information in the Existing Registration Statement.

This Post-Effective Amendment No. 2 contains an updated prospectus (the “Prospectus”) relating to the offer and sale of the securities registered by the Existing Registration Statement. No additional securities are being registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at the time of the initial filing of the Existing Registration Statement on December 12, 2022.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 30, 2024

PRELIMINARY PROSPECTUS

CARDIO DIAGNOSTICS HOLDINGS, INC.

Up to 11,783,256 Shares of Common Stock

Up to 3,486,686 Shares of Common Stock

Issuable Upon Exercise of Warrants

Up to 236,686 Warrants to Purchase Common Stock

This prospectus relates to the issuance by us of up to an aggregate of 3,486,686 shares of our common stock, $0.00001 par value per share (the “Common Stock”) consisting of (i) up to 236,686 shares of Common Stock that are issuable upon the exercise of 236,686 Sponsor Warrants (as defined below) originally issued to the Sponsor in a private placement in connection with the initial public offering (the “IPO”) of Mana Capital Acquisition Corp. (“Mana”), and (ii) up to 3,250,000 shares of Common Stock that are issuable upon the exercise of 3,250,000 Public Warrants originally issued in the IPO, and collectively with the Sponsor Warrants, the “Mana Warrants.” We will receive the proceeds from any exercise of any Warrants for cash.

This prospectus also relates to the resale by certain of the Selling Securityholders named in this Prospectus or their pledgees, donees, transferees, assignees, successors (the “Selling Securityholders”) of: (i) up to 11,783,256 shares of Common Stock including: (A) 3,493,296 Business Combination Shares (as defined below); (B) 944,428 Founder Shares (as defined below); (C) 1,754,219 shares of Common Stock issuable upon the exercise of Legacy Cardio Options (as defined below); and (D) 5,591,313 shares of Common Stock that may be issued upon exercise of outstanding warrants, including the following: (1) 3,250,000 Public Warrant shares; (2) 236,686 Sponsor Warrant shares; and (3) 2,104,627 Legacy Cardio Warrant shares; and (ii) up to 236,686 Sponsor Warrants. As used herein, the term “Warrants” includes all Public Warrants, Sponsor Warrants and Legacy Cardio Warrants, which were exchanged for warrants in the Company in connection with the Business Combination. We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the selling securityholders pursuant to this Prospectus.

On October 25, 2022, Mana consummated its previously announced business combination (the “Business Combination”) pursuant to that certain Merger Agreement (the “Merger Agreement”), dated as of May 27, 2022 and amended on September 15, 2022, by and among Mana, Mana Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Mana (“Merger Sub”), Cardio Diagnostics, Inc. (“Legacy Cardio”) and Meeshanthini Dogan, Ph.D., as representative of the Legacy Cardio Shareholders. As contemplated by the Merger Agreement, Merger Sub merged with and into Legacy Cardio, with Legacy Cardio surviving the Merger as a wholly owned subsidiary of Mana. As a result of the Merger, and upon the consummation of the Merger and the other transactions contemplated by the Merger Agreement, the securityholders of Legacy Cardio became securityholders of Mana and received shares of Common Stock (or securities convertible into or exchangeable for shares of Common Stock) at a deemed price of $10.00 per share, and Mana was renamed “Cardio Diagnostics Holdings, Inc.” (the “Company” or “we,” “us,” “our” or similar terms).

See “Selected Definitions” below for certain defined terms used in this Prospectus.

Subject to the terms of the applicable agreements, the Selling Securityholders may offer, sell or distribute all or a portion of their shares of Common Stock or Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the shares of Common Stock or Warrants in the section entitled “Plan of Distribution.” We will not receive any proceeds from the sale or other disposition of our Common Stock or Warrants by the Selling Securityholders.

Although unlikely given current stock prices, we would receive approximately $50.3 million if all of the 5,591,313 Warrants included in this Prospectus are exercised for cash, at exercise prices ranging between $3.90 and $11.50 per share, subject to adjustment as described herein, whether cash exercised by the Selling Securityholders or by public holders after the resale of the Warrants hereunder, and we would receive approximately $6.8 million in proceeds from the exercise of Options to the extent holder(s) thereof exercise such stock options for cash. To the extent we do receive proceeds from the cash exercise of the Warrants and Options, we will use such proceeds for working capital and other general corporate purposes. See the section of this Prospectus titled “Use of Proceeds.” Our stock price has been, and is expected to continue to be, volatile. As of August 26, 2024, all of the Warrants and Options are “out-of-the money,” which means that the trading price of the shares of our Common Stock underlying those securities is below the respective exercise prices (subject to adjustment as described herein). See table below. We would not expect warrantholders to exercise their Warrants or optionees to exercise their Options when the Warrants or Options are out of the money.

The sale of shares by the Selling Securityholders, or the perception in the market that the Selling Securityholders of a large number of shares intend to sell shares, could increase the volatility of the market price of our Common Stock or result in a significant decline in the public trading price of our Common Stock. Even if our trading price continues to trade significantly below $10.00, which was the offering price for the units offered in Mana’s IPO, certain of the Selling Securityholders, including the Sponsor’s transferees and certain Legacy Cardio Stockholders, may still have an incentive to sell shares of our Common Stock. While the Sponsor’s transferees, other holders of the Founder Shares and certain Legacy Cardio Stockholders may experience a positive rate of return on their investment in our Common Stock, the public securityholders may not experience a similar rate of return on the securities they purchased due to differences in their purchase prices and the trading price.

| Selling Securityholder | | Number of

Offered

Securities | | | Original

Issuance Price

per Offered Security | |

| Mana Initial Stockholders | | | | | | | | |

| Founder Shares | | | 944,428 | | | $ | 0.0154 | |

| Sponsor Warrants | | | 236,686 | | | $ | 1.00 | |

| Shares Issuable upon Exercise of Sponsor Warrants | | | 236,686 | | | $ | 11.50 | |

| | | | | | | | | |

| Mana Public Warrant Holders | | | | | | | | |

| Shares Issuable upon Exercise of Public Warrants | | | 3,250,000 | (1) | | $ | 11.50 | |

| | | | | | | | | |

| Legacy Cardio Securityholders | | | | | | | | |

| Shares Issuable Upon Exercise of Legacy Cardio Private Placement Warrants (2021-2022)(2) | | | 1,254,861 | (3) | | $ | 3.90 | |

| Shares Issuable Upon Exercise of Legacy Cardio Private Placement Warrants (2022)(2) | | | 849,766 | (4) | | $ | 6.21 | |

| Shares Issued in the Business Combination to Legacy Cardio Officers, Directors and Their Affiliated Entities | | | 3,493,296 | | | $ | 10.00 | (5) |

| Shares Issuable Upon Exercise of Options of Legacy Cardio Officers and Directors Assumed in the Business Combination | | | 1,754,219 | | | $ | 3.90 | |

| | | | | | | | | |

__________

| (1) | Issued as a component of Units in Mana’s IPO, each Unit consisting of one share of Common Stock, one-half of one Public Warrant and one-seventh of one Right, which were sold in the IPO at $10.00 per Unit. The price at which existing paid for the Public Warrants, if purchased in the open market, depends on the trading price of the Public Warrants at the time of purchase. |

| (2) | Units sold by Legacy Cardio in its private placements consisted of one share of Legacy Common Stock and one-half of one warrant. These securities were exchanged in the Business Combination for shares of our Common Stock and Private Placement Warrants, based on the exchange ratio of 3.427259. |

| (3) | Includes 323,596 warrants issued to the placement agent as partial compensation in connection with the 2021-2022 Legacy Cardio Private Placement. |

| (4) | Includes 250,606 warrants issued to the placement agent as partial compensation in connection with the 2022 Legacy Cardio Private Placement. |

| (5) | Assumed value in the Business Combination. |

The Selling Securityholders may sell any, all or none of the securities, and we do not know when or in what amount the Selling Securityholders may sell their securities hereunder following the date of this Prospectus. The Selling Securityholders may sell the securities described in this Prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell their securities in the section titled “Plan of Distribution.”

We will not receive any of the proceeds from the sale of the securities by the Selling Securityholders, but we will receive the proceeds from the exercise for cash of the Warrants and the Legacy Cardio Options (or “Options”), which were exchanged for options under the 2022 Equity Incentive Plan (as defined below). We believe the likelihood that warrantholders and option holders will exercise their respective Warrants and Options, and therefore the amount of cash proceeds we would receive, is dependent upon the trading price of our Common Stock. If the trading price of our Common Stock is less than the exercise prices per share of the Warrants or the Options, we expect that holders of those securities will not elect to exercise. We expect to use the proceeds received from the cash exercise of the Warrants and Options, if any, for working capital and other general corporate purposes. See the section of this Prospectus titled “Use of Proceeds” appearing elsewhere in this Prospectus.

We will bear all costs, fees and expenses incurred in effecting the registration of these securities other than any underwriting discounts and commissions and expenses incurred by the Selling Securityholders, as described in more detail in the section titled “Use of Proceeds” appearing elsewhere in this Prospectus.

This Prospectus also covers any additional shares of Common Stock that may become issuable upon any anti-dilution adjustment pursuant to the terms of the Warrants by reason of stock splits, stock dividends, and other events described therein.

Our Common Stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “CDIO,” and the Public Warrants are listed on Nasdaq under the symbol “CDIOW.” On August 29, 2024, the last reported sales prices of our Common Stock and our Public Warrants, as reported on Nasdaq, were $0.3850 per share and $0.0341 per Public Warrant, respectively.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this Prospectus and for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning of page 7 of this Prospectus.

You should rely only on the information contained in this Prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is [·], 2024.

TABLE OF CONTENTS

i

You should rely only on the information provided in this Prospectus, as well as the information incorporated by reference into this Prospectus and any applicable prospectus supplement. Neither we nor the Selling Securityholders have authorized anyone to provide you with additional information or information different from that contained in this Prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Securityholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. You should not assume that the information in this Prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of any date other than the date of the applicable document. Since the date of this Prospectus and the documents incorporated by reference into this Prospectus, our business, financial condition, results of operations and prospects may have changed.

For investors outside of the United States: Neither we nor the Selling Securityholders, have done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this Prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this Prospectus outside the United States.

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this Prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this Prospectus. This Prospectus also relates to the issuance by us of the shares of Common Stock issuable upon the exercise of any Warrants. We will receive proceeds from any exercise of such Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this Prospectus or any applicable prospectus supplement. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also file a prospectus supplement or additional post-effective amendments to the Registration Statement of which this Prospectus forms a part that may contain material information relating to these offerings. Any prospectus supplement or post-effective amendment may also add, update or change information contained in this Prospectus with respect to that offering. If there is any inconsistency between the information in this Prospectus and any applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this Prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

As used in this Prospectus, unless otherwise indicated or the context otherwise requires, references to “we,” “us,” “our,” the “Company,” and “Cardio” refer to the consolidated operations of Cardio Diagnostics Holdings, Inc., a Delaware corporation, and its consolidated subsidiary following the Business Combination. References to “Mana” refer to the Company prior to the consummation of the Business Combination and references to “Legacy Cardio” refer to Cardio Diagnostics, Inc., prior to the consummation of the Business Combination., which entity is our wholly-owned subsidiary.

MARKET, RANKING AND OTHER INDUSTRY DATA

This Prospectus contains, and any additional post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this Prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this Prospectus, any post-effective amendment and the applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

Certain information contained in this Prospectus relates to or is based on our own internal estimates and research. While we believe our own internal research is reliable, such research has not been verified by any independent source. These estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Prospectus.

ii

TRADEMARKS

We own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business. In addition, our name, logos and website name and address are our trademarks or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this Prospectus are listed without the applicable ®, ™ and SM symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this Prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

SELECTED DEFINITIONS

Unless stated in this Prospectus or the context otherwise requires, references to:

| | · | “Business Combination” means the transactions contemplated by the Merger Agreement, including the Merger. |

| | · | “Business Combination Shares” means the shares of Common Stock issued in the Business Combination to Legacy Cardio officers, directors and their affiliates that are registered for resale on the registration statement of which this Prospectus is a part. |

| | · | “Charter” means our Certificate of Incorporation as currently amended. |

| | · | “Closing” means the closing of the Business Combination. |

| | · | “Closing Date” means October 25, 2022, the date on which the Closing occurred. |

| | · | “Code” means the Internal Revenue Code of 1986, as amended. |

| | · | “DGCL” means the General Corporation Law of the State of Delaware. |

| | · | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| | · | “Equity Incentive Plan” means the Cardio Diagnostics Holdings, Inc. 2022 Equity Incentive Plan, effective as of the Closing of the Business Combination. |

| | · | “Founder Shares” means the aggregate of 1,625,000 shares of Mana Common Stock purchased by the Sponsor in exchange for a capital contribution of $25,000, or approximately $0.0154 per share. |

| | · | “GAAP” means United States generally accepted accounting principles. |

| | · | “IPO” means Mana’s initial public offering of the sale of 6,500,000 Mana units, including 300,000 units issued upon partial exercise of the underwriter’s over-allotment option, at $10.00 per unit. |

| | · | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012. |

| | · | “Legacy Cardio Common Stock” means the Common Stock, par value $0.001 per share, of Legacy Cardio. |

| | · | “Legacy Cardio Incentive Plan” means the Cardio Diagnostics, Inc. 2022 Equity Incentive Plan. |

| | · | “Legacy Cardio Options” means the options granted by Legacy Cardio prior to the Business Combination, all of which were exchanged for options under the 2022 Equity Incentive Plan in connection with the Business Combination. |

| | · | “Legacy Cardio Stockholder” means each holder of Legacy Cardio capital stock or securities exercisable for or convertible into Legacy Cardio capital stock prior to the Closing. |

| | · | “Mana” means Mana Capital Acquisition Corp., a Delaware corporation (which, after the Closing is known as Cardio Diagnostics Holdings, Inc.). |

| | · | “Mana Common Stock” means the shares of Common Stock, par value $0.00001 per share, of Mana. |

iii

| | · | “Merger” means the merger of Merger Sub with and into Legacy Cardio. |

| | · | “Merger Agreement” means that Agreement and Plan of Merger, dated as of May 27, 2022, as amended on September 15, 2022, by and among Mana, Merger Sub, Legacy Cardio and Meeshanthini Dogan, as representative of the Legacy Cardio Stockholders. |

| | · | “Merger Sub” means Mana Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Mana prior to the consummation of the Business Combination. |

| | · | “Person” means any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind. |

| | · | “Private Placement Units” means the units purchased by Legacy Cardio investors in two private placements conducted prior to the Business Combination, each unit consisting of one share of Legacy Cardio Common Stock and one-half of one Legacy Cardio Warrant. |

| | · | “Private Placement Warrants” means the Legacy Cardio warrants included in the Private Placement Units, each of which is exercisable for one share of Common Stock, 931,265 of which are exercisable at $3.90 per share and 1,273,362 of which are exercisable at $6.21 per share, all of which are subject to adjustment, in accordance with their terms. |

| | · | “Public Warrants” means the Mana warrants included in the Mana units issued in the IPO, each of which is exercisable for one share of Common Stock at an exercise price of $11.50 per share, subject to adjustment, in accordance with its terms. |

| | · | “Sponsor” means Mana Capital, LLC, a Delaware limited liability company. |

| | · | “Subsidiary” means, with respect to a Person, a corporation or other entity of which more than 50% of the voting power of the equity securities or equity interests is owned, directly or indirectly, by such Person. |

| | · | “Transfer Agent” means Continental Stock Transfer & Trust Company. |

| | · | “Warrants” means the Public Warrants, the Sponsor Warrants and Private Placement Warrants. |

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains “forward-looking statements” regarding, among other things, our plans, strategies and prospects, both business and financial. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot provide assurance that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Investors should read statements that contain these words carefully because they:

| | · | discuss future expectations; |

| | · | contain projections of future results of operations or financial condition; or; |

| | · | state other “forward-looking” information. |

We believe it is important to communicate our expectations to our securityholders. However, there may be events in the future that management is not able to predict accurately or over which we have no control. The risk factors and cautionary language contained in this Prospectus provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in such forward-looking statements, including among other things:

| | · | the possibility that we may be adversely impacted by economic, business, and/or competitive factors; |

| | · | our limited operating history makes it difficult to evaluate our business and prospects; |

| | · | the success, cost and timing of our product development and commercialization activities, including the degree to which Epi+Gen CHD™, our initial clinical test, PrecisionCHD™, our second clinical test, or HeartRiskTM , our recently introduced software product, are accepted and adopted by patients, healthcare professionals and other participants in other key channels may not meet our current expectations; |

| | · | changes in applicable laws or regulations could negatively our current business plans; |

| | · | we may be unable to obtain and maintain regulatory clearance or approval for our tests, and any related restrictions and limitations of any cleared or approved product could negatively impact our financial condition; |

| | · | the pricing of our products and services and reimbursement for medical tests conducted using our products and services may not be sufficient to achieve our financial goals; |

| | · | we may be unable to successfully compete with other companies currently marketing or engaged in the development of products and services that could serve the same or similar functions as our products and services; |

| | · | the size and growth potential of the markets for our products and services, and our ability to serve those markets, either alone or in partnership with others may not meet our current expectations; |

| | · | we may be unable to maintain our existing or future licenses, or manufacturing, supply and distribution agreements; |

| | · | we may be unable to identify, in-license or acquire additional technology needed to develop new products or services; |

| | · | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing may not be accurate; |

v

| | · | we may be unable to raise needed financing in the future on acceptable terms, if at all; |

| | · | we may be unable to maintain our listing on The Nasdaq Stock Market; |

| | · | although highly uncertain, our operational and financial performance could be negatively impacted by the potential short and long-term impact of a re-emergence of COVID-19 variants or any other pandemic, epidemic or infectious disease outbreak, the extent of which will depend on future developments, including the duration and spread of the outbreak, the willingness of doctors and patients to use our tests during such times and the impact on our supply chain and the financial markets, all of which are highly uncertain and cannot be predicted; and |

| | · | there are other risks and uncertainties indicated in this Prospectus, including those under “Risk Factors” herein, and other filings that have been made or will be made with the SEC by us that could materially alter our current expectations. |

These forward-looking statements are based on information available as of the date of this Prospectus, and our management’s current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and you should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements of belief and similar statements reflect the beliefs and opinions of the Company on the relevant subject. These statements are based upon information available to us as of the date of this Prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

Before you invest in our securities, you should be aware that the occurrence of one or more of the events described in the “Risk Factors” section and elsewhere in this Prospectus may adversely affect us.

vi

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this Prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire Prospectus, including our consolidated financial statements and the related notes included in this Prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Company

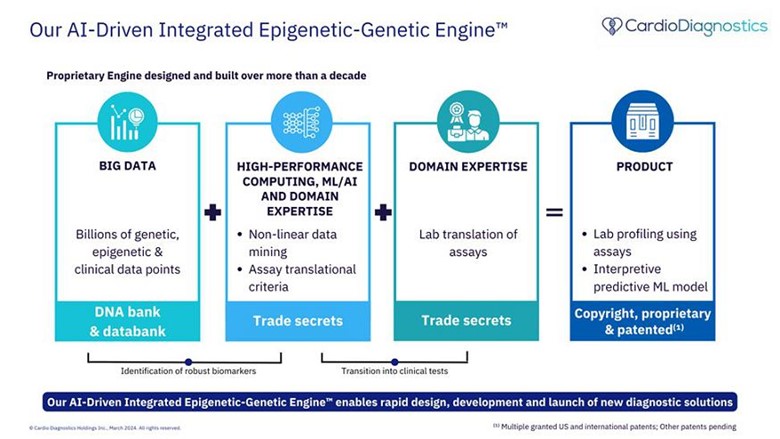

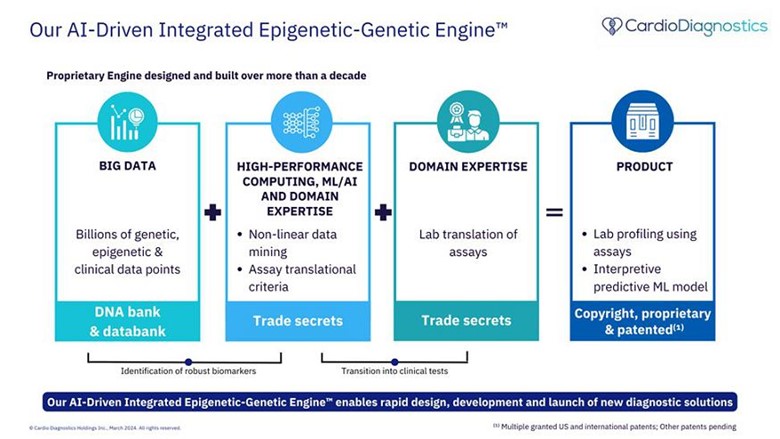

Cardio was formed to further develop and commercialize a series of products for major types of cardiovascular disease and associated co-morbidities, including coronary heart disease (“CHD”), stroke, heart failure and diabetes, by leveraging our Artificial Intelligence (“AI”)-driven Integrated Genetic-Epigenetic Engine™. As a company, we aspire to give every American adult insight into their unique risk for various cardiovascular diseases. Cardio aims to become one of the leading medical technology companies for enabling improved prevention, detection, treatment and management of cardiovascular disease and associated co-morbidities. Cardio is transforming the approach to cardiovascular medicine from reactive to proactive and hopes to accelerate the adoption of Precision Medicine for all. We believe that incorporating our solutions into routine clinical practice in and prevention efforts can help alter the trajectory that nearly one in two Americans is expected to develop some form of cardiovascular disease by 2035.

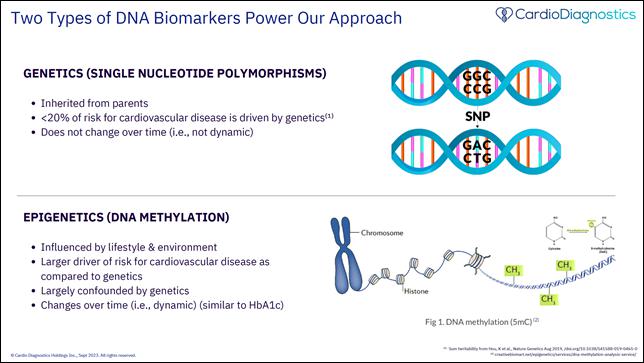

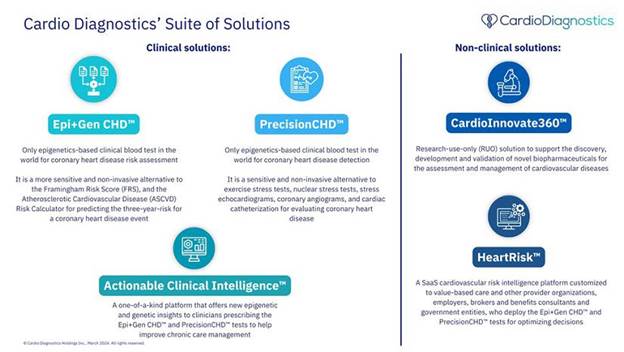

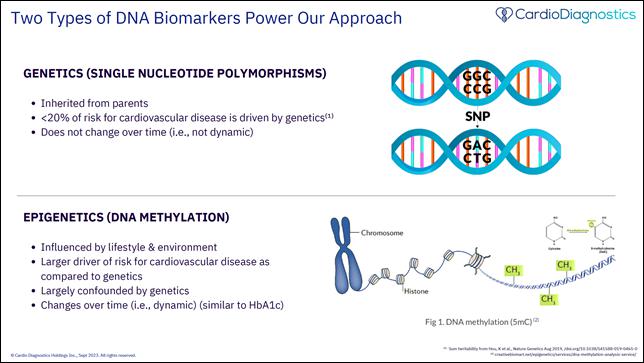

According to the CDC, epigenetics is the study of how a person’s behaviors and environment can cause changes that affect the way a person’s genes work. Unlike genetic changes, epigenetic changes are reversible and do not change one’s DNA sequence, but they can change how a person’s body reads a DNA sequence. We believe that we are the first company to develop and commercialize epigenetics-based clinical tests for cardiovascular disease that have clear value propositions for multiple stakeholders including (i) patients, (ii) clinicians, (iii) hospitals/health systems, (iv) employers and (v) payors.

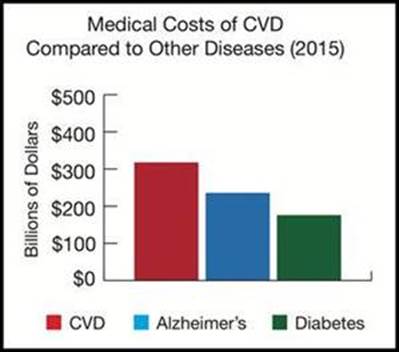

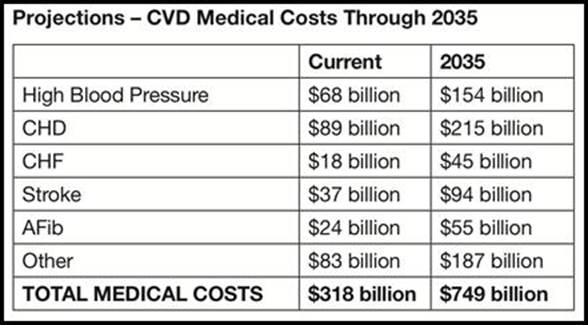

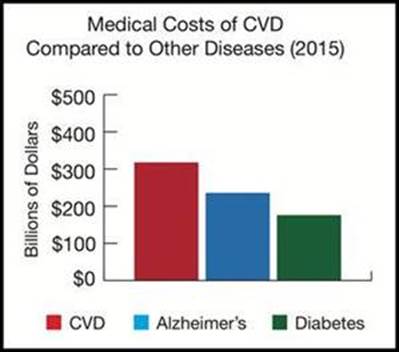

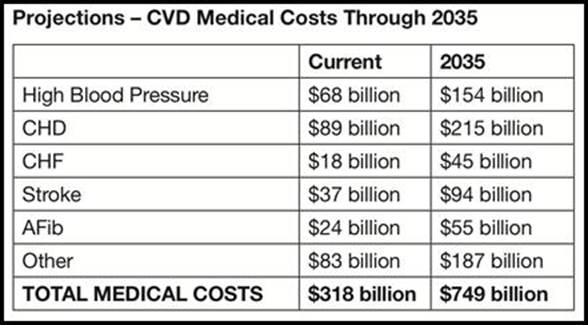

An estimated 80% of cardiovascular disease (“CVD”) is preventable, yet, it is responsible for one in every four deaths and remains the number one killer in the United States for both men and women. Coronary heart disease is the most common type of CVD and the major cause of heart attacks. The enormous number of unnecessary heart attacks and deaths associated with CHD is attributable to the failure of current primary prevention approaches in clinical practice to effectively detect, reduce and monitor risk for CHD prior to life altering and costly health complications. Several reasons for this failure include (i) the current in-person risk screening approach is incompatible with busy everyday life; (ii) even if the current risk screening tests are taken, they only identify 44% and 32% of men and women at high risk, respectively; and (iii) the lack of patient care plan personalization. We believe that a highly accessible, personalized and precise solution for CHD prevention is not currently available.

Furthermore, in the aftermath of the COVID-19 pandemic and the ongoing possibility of a potential re-emergence of COVID variants or other public crises, preventable illnesses such as CHD are expected to spike. Therefore, now more than ever, there is an urgent need for a highly sensitive, scalable, at-home risk screening tool that can help physicians better direct care and allow patients to receive the help they need sooner.

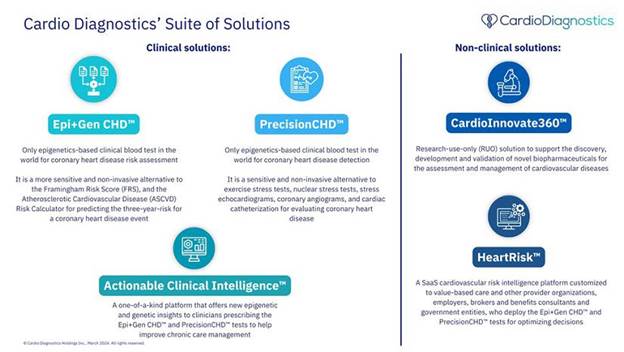

Our first test, Epi+Gen CHD™, which was introduced for market testing in 2021, is a three-year symptomatic CHD risk assessment clinical blood test targeting CHD events, including heart attacks. In June 2023, we announced the nationwide launch of our second product, PrecisionCHD™, an integrated epigenetic-genetic clinical blood test for the detection of coronary heart disease. The Epi+Gen CHD™ and PrecisionCHD™ tests are coupled to Actionable Clinical Intelligence (“ACI”), a platform that offers new epigenetic and genetic insights to clinicians to help improve chronic care management. In May 2023, we launched CardioInnovate360TM, a research-use-only (“RUO”) solution to support the discovery, development and validation of novel biopharmaceuticals for the assessment and management of cardiovascular diseases. In February 2024, we announced the launch of HeartRisk™, a cardiovascular risk intelligence platform. The Company earned only $950 and $17,065 in revenue for the years ended December 31, 2022 and 2023, respectively, and $1,725 and $23,798 in revenue for the six months ended June 30, 2023 and 2024, respectively. We are continuing to focus our efforts on establishing relationships with larger organizations and channel partners to increase adoption of our solutions. However, this process can take many months and up to as much as a year or more to finalize, depending on the sales channel. For example, hospitals routinely take a year or longer to make purchasing decisions. While these relationships take considerable time to establish, we believe that our strategy to pursue larger organizations can provide far greater revenue potential for our existing and future tests and other products. We have begun to see results from this recent shift in marketing focus: In October 2023, we announced that we have secured an Innovative Technology Contract from Vizient, Inc., the nation’s largest provider-driven healthcare performance improvement company, with a customer base encompassing over 60% of hospitals and 97% of academic medical centers in the United States. In November 2023, we announced that Family Medicine Specialists (“FMS”), a leading Illinois primary care provider with eight locations, is implementing our heart attack risk assessment test, Epi+Gen CHD™, covering at least 1,200 BlueCross BlueShield Medicare, Medicaid, HMO and PPO health plan and other health plan patients with CHD risk factors. In addition to providers and provider organizations, we are also expanding to offer our solutions through employers and benefit brokers. We have grown our provider and employer pipelines significantly with a major focus on advancing them to close. Beyond the U.S. market, we also have an arrangement with one of India’s leading healthcare and medical instrumentation companies to lay the pre-marketing groundwork via its extensive healthcare network to introduce our solutions in India. In addition to growing the adoption of our solutions, we have also secured Current Procedural Terminology (“CPT”) Proprietary Laboratory Analysis (“PLA”) codes from the American Medical Association for Epi+Gen CHD™ (0439U) and PrecisionCHD™ (0440U), which is a key step in securing payor coverage.

We believe that our Epi+Gen CHD™ and PrecisionCHD™ tests are categorized as laboratory-developed tests, or “LDTs.” The FDA has historically taken the position that it has the authority to regulate LDTs as in-vitro diagnostics (“IVDs”) under the Federal Food, Drug, and Cosmetic Act (“FDC Act”), although it has generally exercised enforcement discretion with regard to LDTs. current FDA enforcement discretion policy, an LDT does not require FDA premarket authorization, or other FDA clearance or approval. As such, we believe that under current FDA policies, the Epi+Gen CHD™ and PrecisionCHD™ tests do not require FDA premarket evaluation of our performance claims or marketing authorization, and such premarket authorization has not been obtained. However, in May 2024, the FDA published a final rule amending the definition of an IVD device to include IVDs manufactured by a clinical laboratory. The final rule also announced the FDA’s intention to phase out its general enforcement discretion policy. Unless the rule is overturned by a court or Congress, the medical device requirements for most LDTs will be phased in beginning in May 2025. If implemented, the new FDA regulations will substantially increase the time and expense to bring our tests to market and may have far reaching impacts on our operations and results of operations.

As a company in the early stages of its development, we continuously reevaluate our business, the market in which we operate and potential new opportunities. We may seek other alternatives within the healthcare field in order to grow our business and increase revenues. Such alternatives may include, but not be limited to, combinations or strategic partnerships with other laboratory companies or with medical practices such as hospitalists or behavioral health.

Corporate Information

Mana Capital Acquisition Corp. was formed on May 19, 2021 under the laws of the State of Delaware as a blank check company for the purpose of engaging in a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination, with one or more target businesses or entities. Legacy Cardio was formed in January 2017 as an Iowa limited liability company (Cardio Diagnostics, LLC) and was subsequently incorporated as a Delaware C-Corp (Cardio Diagnostics, Inc.) on September 6, 2019. Upon completion of the Business Combination on October 25, 2022, we changed our name to Cardio Diagnostics Holdings, Inc.

Our corporate headquarters is located at 311 West Superior Street, Suite 444, Chicago IL 60654. Our telephone number is (855) 226-9991 and our website address is cardiodiagnosticsinc.com. The information contained on, or that can be accessed through, our website is not incorporated by reference in this Prospectus and does not form a part of this Prospectus. The reference to our website address does not constitute incorporation by reference of the information contained at or available through our website, and you should not consider it to be a part of the Registration Statement or the Prospectus contained therein.

Emerging Growth Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Securities Exchange Act of 1934, as amended the “Exchange Act”), are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of the IPO, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Common Stock held by non-affiliates equaled or exceeded $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our Common Stock held by non-affiliates equaled or exceeded $250 million as of the end of the prior June 30th, or (2) our annual revenues equaled or exceeded $100 million during such completed fiscal year and the market value of our Common Stock held by non-affiliates equaled or exceeded $700 million as of the prior June 30th.

Risk Factor Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our ability realize the anticipated benefits of the Business Combination, and may have an adverse effect on our business, cash flows, financial condition and results of operations. Such risks include, but are not limited to:

Risks Related to Our Business, Industry and Business Operations

| | · | We have a limited operating history that makes it impossible to reliably predict future growth and operating results. |

| | · | The audited consolidated financial statements as of and for the year ended December 31, 2023 and the unaudited consolidated financial statements as of and for the six months ended June 30, 2024 include disclosure indicating that our current liquidity position raises substantial doubt about our ability to continue as a going concern. |

| | · | We have an unproven business model, have not generated significant revenues and can provide no assurance of generating significant revenues or operating profit. |

| | · | The market for epigenetic tests is fairly new and unproven, and it may decline or experience limited growth, which would adversely affect our ability to fully realize the potential of our business plan. |

| | · | The estimates of market opportunity and forecasts of market growth included in this Prospectus may prove to be inaccurate, and even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all. |

| | · | If we are not able to enhance or introduce new products that achieve market acceptance and keep pace with technological developments, our business, results of operations and financial condition could be harmed. |

| | · | The success of our business depends on our ability to expand into new vertical markets and attract new customers in a cost-effective manner. |

| | · | Our growth strategy may not prove viable and expected growth and value may not be realized. |

| | · | Our future growth could be harmed if we lose the services of our key personnel. |

| | · | We may face intense competition, which could limit our ability to maintain or expand market share within our industry, and if we do not maintain or expand our market share, our business and operating results will be harmed. |

| | · | Our business depends on customers increasing their use of our existing and future products, and we may experience loss of customers or a decline in their use of our solutions. |

| | · | We rely on a limited number of suppliers, contract manufacturers, and logistics providers, and our tests are currently performed by a single contract high complexity Clinical Laboratory Improvement Amendments (“CLIA”) laboratory. |

| | · | We may be unable to scale our operations successfully. |

| | · | As we grow the size of our organization, we may experience difficulties in managing this growth. |

| | · | Our success depends upon our ability to adapt to a changing market and our continued development of additional tests, other products and services. |

| | · | Our Board of Directors may change our strategies, policies, and procedures without stockholder approval. |

| | · | We may need to seek alternative business opportunities and change the nature of our business. |

| | · | We may be subject to general litigation that may materially adversely affect us and our operations. |

| | · | Our management expects to continue to devote substantial time to maintaining and improving the internal controls over financial reporting and the requirements of being a public company which may, among other things, strain our resources, divert management’s attention and affect our ability to accurately report our financial results and prevent fraud. |

Risks Related to Our Intellectual Property

| | · | Certain of our core technology is licensed, and that license may be terminated if we were to breach our obligations under the license. |

| | · | Our license agreement with University of Iowa Research Foundation (“UIRF”) includes a non-exclusive license of “technical information” that potentially could grant unaffiliated third parties access to materials and information considered derivative work made by us, which could be used by such licensees to develop competitive products. |

Risks Related to Government Regulation

| | · | We conduct business in a heavily regulated industry, and if we fail to comply with these laws and government regulations, we could incur penalties or be required to make significant changes to our operations or experience adverse publicity, which could have a material adverse effect on our business, financial condition, and results of operations. |

| | · | In May 2024, the Food & Drug Administration (“FDA”) adopted new final regulations that could substantially alter the regulatory environment surrounding our tests, which we believe are categorized as laboratory developed tests (“LDTs”). Unless the rule is overturned by a court or Congress, we could incur substantial costs and delays associated with complying with requirements to obtain premarket approval, de novo authorization or clearance of LDTs. |

| | · | If our products do not receive adequate coverage and reimbursement from third-party payors, our ability to expand access to our tests beyond our initial sales channels will be limited and our overall commercial success will be limited. |

Risks Related to Our Common Stock

| | · | The price of our Common Stock likely will be volatile like the stocks of other early-stage companies. |

| | · | We may not be able to maintain our Nasdaq listing if we are unable to comply with the various listing requirements of The Nasdaq Stock Market (“Nasdaq”). We have received a deficiency letter from Nasdaq informing us that because the trading price of our Common Stock currently does not meet the minimum bid price required to maintain our listing on the Nasdaq Capital Market, our Common Stock could be delisted unless we are able to satisfy the minimum bid requirement within the cure period or, if granted, the extended cure period. |

| | · | Because a substantial number of our currently outstanding shares of Common Stock are registered for resale, we may have difficulty raising additional capital when and if needed. |

| | · | A significant number of shares of our Common Stock are subject to issuance upon exercise of outstanding warrants and options, which upon such exercise or conversion may result in dilution to our security holders. |

| | · | We have never paid dividends on our Common Stock, and we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. |

| | · | Sales of a substantial number of shares of our Common Stock in the public market by our existing stockholders could cause our stock price to decline. |

THE OFFERING

| Issuer | Cardio Diagnostics Holdings, Inc. |

| | |

| Issuance of Common Stock: | |

| | |

| Shares of Common Stock offered by us | Up to 3,486,686 shares of our Common Stock, consisting of (i) 3,250,000 shares of Common Stock issuable upon the exercise of the Public Warrants, and (ii) 236,686 shares of Common Stock issuable upon the exercise of the Sponsor Warrants. |

| | |

Shares of Common Stock outstanding

prior to the exercise of any Warrants and Options | 24,077,781 shares of Common Stock as of August 26, 2024 |

| | |

| Shares of Common Stock outstanding assuming the exercise of all Warrants and Options | 36,579,843 shares of Common Stock |

| | |

| Terms of the Public Warrants and Sponsor Warrants | |

| | |

Exercise price of the Public Warrants and

Sponsor Warrants | $11.50 per share for the Public Warrants and Sponsor Warrants, subject to adjustment for stock splits, reverse stock splits and other similar events of recapitalization. |

| | |

| Expiration of the Warrants | The Public Warrants and Sponsor Warrants expire five years from the Closing of the Business Combination (October 25, 2027), unless earlier redeemed. |

| | |

| Redemption | We may call the outstanding Public Warrants and Sponsor Warrants for redemption, in whole and not in part at any time while such warrants are exercisable, upon not less than 30 days’ prior written notice of redemption to each warrant holder, if, and only if, the reported last sale price of the shares of Common Stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations), for any 20 trading days within a 30-day trading period ending on the third business day prior to the notice of redemption to warrant holders (the “Force-Call Provision”), and if, and only if, there is a current registration statement in effect with respect to the shares of Common Stock underlying such warrants at the time of redemption and for the entire 30-day trading period referred to above and continuing each day thereafter until the date of redemption. The redemption price equals $0.01 per warrant. |

| | |

| Use of proceeds | We will receive up to an aggregate of approximately $50.3 million from the exercise of the Warrants included in this Prospectus, assuming the exercise in full of all of the Warrants for cash, which we currently do not believe is likely to occur. We expect to use the net proceeds from the exercise of the Warrants, if any, for general corporate purposes. We believe the likelihood that warrantholders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, will be highly dependent upon the trading price of our Common Stock, the last reported sales price for which was $0.3850 per share on August 29, 2024. If the trading price for our Common Stock is less than $11.50 per share (as adjusted), we believe holders of our Public Warrants and Sponsor Warrants will be unlikely to exercise their Warrants. Similarly, if the trading price for our Common Stock is less than $6.21 with respect to certain Legacy Cardio Private Warrants and $3.90 with respect to the balance of Legacy Cardio Private Warrants, it is unlikely that these warrants will be exercised. See “Use of Proceeds.” As of the date of this Prospectus, the Public Warrants, Sponsors Warrants and the Private Placement Warrants are out-of-the-money. |

| | |

Resale of Common Stock and Warrants:

| Shares of Common Stock offered by the Selling Securityholders | Up to 11,783,256 shares of Common Stock, consisting of (i) 944,428 Founder Shares, (ii) 236,686 shares of Common Stock issuable upon the exercise of the Sponsor Warrants; (iii) 2,104,627 shares of Common Stock issuable upon exercise of Private Placement Warrants; and (iv) 5,247,515 shares of Common Stock issued or issuable to certain Company directors, officers and affiliates, including up to 1,754,219 shares issuable upon exercise of outstanding options held by such affiliates that are included in a registration statement on Form S-8 that we filed on March 22, 2023 covering our 2022 Equity Incentive Plan. |

| | |

| Warrants offered by the Selling Securityholders | 236,686 Sponsor Warrants, exercisable at $11.50 per share, subject to adjustment. |

| | |

| Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the shares of Common Stock and Warrants registered for resale under this Prospectus. |

| | |

| Use of proceeds | We will not receive any proceeds from the sale of the securities offered by the Selling Securityholders pursuant to this Prospectus, except with respect to amounts received by us upon exercise of the Warrants offered hereby (to the extent such Warrants are exercised for cash). We intend to use any such proceeds for general corporate purposes. |

| | |

| Nasdaq Stock Market symbols | Our Common Stock and Public Warrants are listed on the Nasdaq Capital Market under the symbols “CDIO” and “CDIOW,” respectively. |

| Risk factors | See the section entitled “Risk Factors” beginning on page 7 and other information included in this Prospectus for a discussion of factors you should consider before investing in our securities. |

| | |

Unless otherwise noted, the number of our shares of Common Stock outstanding is based on 24,077,781 shares of Common Stock outstanding as of August 26, 2024, and excludes:

| | • | | 3,796,725 shares of our Common Stock issuable upon the exercise of options, exercisable at prices between $0.55 and $3.90 per share, subject to adjustment for stock splits, reverse stock splits and other similar events of recapitalization; |

| | • | | 8,528,766 shares of our Common Stock issuable upon the exercise of outstanding Warrants, exercisable at prices ranging from $1.78 and $11.50 per share, subject to adjustment for stock splits, reverse stock splits and other similar events of recapitalization; and |

| | • | | 176,571 shares of our Common Stock reserved for future issuance under our 2022 Equity Incentive Plan. |

Unless the context otherwise requires, all numbers in this Prospectus assume no exercise of any options and warrants.

RISK FACTORS

Investing in our securities involves risks. You should carefully consider the risks and uncertainties described below and the other information in this Prospectus before making an investment in our Common Stock. Our business, financial condition, results of operations, or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our Common Stock could decline and you could lose all or part of your investment. This Prospectus also contains forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including those set forth below.

Risks Related to Our Limited Operating History and Early Stage of Growth

We are a medical diagnostic testing company with a limited operating history and have not yet generated significant revenue from product sales. We have incurred operating losses since our inception and may never achieve or maintain profitability.

We generated only nominal revenue in 2022 and 2023, including $950 in revenue generated in 2022 and $17,065 in revenue generated in 2023. Our net losses totaled $4,660,985 and $8,376,834 for the years ended December 31, 2022 and 2023, respectively, and we had an accumulated deficit of $14,368,380 at December 31, 2023. Revenue, net loss and accumulated deficit as of and at June 30, 2024 totaled $23,798, $5,451,579 and $19,819,959, respectively. We expect losses to continue as a result of our ongoing activities to increase the adoption of our products, to gain market recognition and acceptance of our products, to expand our marketing channels, to prepare our newly-acquired laboratory for operation and otherwise position ourselves to grow our revenue opportunities, all of which will require hiring additional employees as well as other significant expenses. We are unable to predict when we will become profitable, and it is possible that we may never become profitable. We may encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses, which we expect to increase substantially, especially if new FDA regulations of LTDs go into effect in May 2025, and on our ability to generate revenue. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. If additional capital is not available when required, if at all, or is not available on acceptable terms, we could be forced to modify or abandon our current business plan.

Although our financial statements have been prepared on a going concern basis, we must raise additional capital to fund our operations in order to continue as a going concern.

Prager Metis, our independent registered public accounting firm, included an explanatory paragraph in their April 1, 2024 opinion that accompanies our audited consolidated financial statements as of and for the year ended December 31, 2023 (the “2023 Audited Financial Statements”), indicating that our current liquidity position raises substantial doubt about our ability to continue as a going concern. The unaudited consolidated financial statements as of and for the six months ended June 30, 2024 (the “June 30, 2024 Unaudited Financial Statements”) also include similar going concern disclosure. If we are unable to improve our liquidity position, we may not be able to continue as a going concern. The 2023 Audited Financial Statements and the June 30, 2024 Unaudited Financial Statements do not include any adjustments that might result if we are unable to continue as a going concern and, therefore, be required to realize our assets and discharge our liabilities other than in the normal course of business which could cause investors to suffer the loss of all or a substantial portion of their investment. We anticipate that our principal sources of liquidity will only be sufficient to fund our activities over the next 12 months. In order to have sufficient cash to fund our operations beyond the next 12 months, we will need to raise additional equity over the next 12 months, including our ongoing at-the-market offering, in order to continue as a going concern. We cannot provide any assurance that we will be successful in doing so.

We believe our long-term value as a company will be greater if we focus on growth, which may negatively impact our results of operations in the near term.

We believe our long-term value as a company will be greater if we focus on longer-term growth over short-term results. As a result, our results of operations may be negatively impacted in the near term relative to a strategy focused on maximizing short-term profitability. Significant expenditures on marketing efforts, potential acquisitions and other expansion efforts may not ultimately grow our business or lead to expected long-term results.

Our business and the markets in which we operate are new and rapidly evolving, which makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

Our business and the markets in which we operate are new and rapidly evolving, which make it difficult to evaluate and assess the success of our business to date, our future prospects and the risks and challenges that we may encounter. These risks and challenges include our ability to:

| | · | attract new customers for our tests through patient awareness, sales and marketing campaigns, as well as through key channel partners; |

| | · | gain market acceptance of our current and future tests, other products and services with key constituencies and maintain and expand such relationships; |

| | · | comply with existing and new laws and regulations applicable to our business and in our industry; |

| | · | anticipate and respond to changes in payor reimbursement rates and the markets in which we operate; |

| | · | react to challenges from existing and new competitors; |

| | · | maintain and enhance our reputation and brand; |

| | · | effectively manage our growth and business operations, including new geographies; |

| | · | accurately forecast our revenue and budget for, and manage, our expenses, including capital expenditures; and |

| | · | hire and retain talented individuals at all levels of our organization; |

| | | |

If we fail to understand fully or adequately address the challenges that we are currently encountering or that we may encounter in the future, including those challenges described here, elsewhere in this “Risk Factors” section and in future filings we may make with the SEC, our business, financial condition and results of operations could be adversely affected. If the risks and uncertainties that we plan for when operating our business are incorrect or change, or if we fail to manage these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

We were established in 2017, and we are continuing to grow our marketing and management capabilities. Consequently, predictions about our future success or viability may not be as accurate as they could be if we had a longer operating history. The evolving nature of the medical diagnostics industry increases these uncertainties. If our growth strategy is not successful, we may not be able to continue to grow our revenue or operations. Our limited operating history, evolving business and growth make it difficult to evaluate our future prospects and the risks and challenges we may encounter.

In addition, as a business with a limited operating history, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown challenges. We are not be successful at commercialization, sales and marketing and, as a result, our business may be adversely affected.

Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our results of operations and key metrics discussed elsewhere in this Prospectus may vary significantly in the future and period-to-period comparisons of our operating results and key metrics may not provide a full picture of our performance. Accordingly, the results of any one quarter or year should not be relied upon as an indication of future performance. Our quarterly financial results and metrics may fluctuate as a result of a variety of factors, many of which are outside of our control, and as a result they may not fully reflect the underlying performance of our business. These quarterly fluctuations may negatively affect the value of our securities. Factors that may cause these fluctuations include, without limitation:

| | • | the level of demand for our tests, other products and services, which may vary significantly from period to period; |

| | • | our ability to attract new customers, whether patients or strategic channel partners or other customers; |

| | • | the timing of recognition of revenues; |

| | • | the amount and timing of operating expenses; |

| | • | general economic, industry and market conditions, both domestically and internationally, including any economic downturns and adverse impacts resulting from the COVID-19 pandemic and/or the military conflict between Russia and Ukraine; |

| | • | the timing of our billing and collections; |

| | • | adoption rates by participants in our key channels; |

| | • | increases or decreases in the number of patients, providers and organizations that use our tests or pricing changes upon any signing and renewals of agreements with healthcare sub-vertical channel partners; |

| | • | changes in our pricing policies or those of our competitors; |

| | • | the timing and success of new offerings by us or our competitors or any other change in the competitive dynamics of our industry, including consolidation among competitors, practitioners, clinics or outsourcing facilities; |

| | • | extraordinary expenses such as litigation or other dispute-related expenses or settlement payments; |

| | • | sales tax and other tax determinations by authorities in the jurisdictions in which we conduct business; |

| | • | the impact of new accounting pronouncements and the adoption thereof; |

| | • | fluctuations in stock-based compensation expenses; |

| | • | expenses in connection with mergers, acquisitions or other strategic transactions; |

| | • | changes in regulatory and licensing requirements; |

| | • | the amount and timing of expenses related to our expansion to markets outside the United States; and |

| | • | the timing of expenses related to the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill or intangibles from acquired companies. |

| | | |

Further, in any future period, our revenue growth could slow or our revenues could decline for a number of reasons, including slowing demand for our tests, other products and services, increasing competition, a decrease in the growth of our overall market, or our failure, for any reason, to continue to capitalize on growth opportunities. In addition, our growth rate may slow in the future as our market penetration rates increase. As a result, our revenues, operating results and cash flows may fluctuate significantly on a quarterly basis and revenue growth rates may not be sustainable and may decline in the future, and we may not be able to achieve or sustain profitability in future periods, which could harm our business and cause the market price of our Common Stock to decline.

We expect to need to raise additional capital to fund our existing operations or develop and commercialize new tests or other products or expand our operations.

We expect to spend significant amounts to expand our existing operations, including expansion into new geographies, to make additional key hires, to expand our sales channels and constituencies and to develop new tests, other products and services. If we are unable to raise additional capital, we may need to delay the timing of, or scale back, certain aspects of our business plan and operations. The estimate and our expectation regarding the sufficiency of funds to continue our business plan and operations are based on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we currently expect. Until such time, if ever, as we can generate sufficient revenues, we may finance our cash needs through a combination of equity offerings and debt financings or other sources. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

Our present and future funding requirements will depend on many factors, including:

| | • | our ability to achieve revenue growth; |

| | • | our ability to effectively manage our expenses and burn; |

| | • | the cost of expanding our operations, including our geographic scope, and our offerings, including our marketing efforts; |

| | • | our rate of progress in launching, commercializing and establishing adoption of our tests, other products and services; and |

| | • | the effect of competing technological and market developments. |

| | | |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a securityholder. In addition, debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our technologies, intellectual property, or future revenue streams or grant licenses on terms that may not be favorable to us. Furthermore, any capital raising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to advance development activities. If we need additional capital and cannot raise it on acceptable terms, or at all, we may not be able to, among other things:

| | • | invest in our business and continue to grow our brand and expand our customer and patient bases; |

| | • | hire and retain employees, including scientists and medical professionals, operations personnel, financial and accounting staff, and sales and marketing staff; |

| | • | respond to competitive pressures or unanticipated working capital requirements; or |

| | • | pursue opportunities for acquisitions of, investments in, or strategic alliances and joint ventures with complementary businesses. |

| | | |

We may invest in or acquire other businesses, and our business may suffer if we are unable to successfully integrate an acquired business into our company or otherwise manage the growth associated with multiple acquisitions.

From time to time, we may acquire, make investments in, or enter into strategic alliances and joint ventures with, complementary businesses. These transactions may involve significant risks and uncertainties, including:

In the case of an acquisition: