UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x Preliminary Proxy Statement |

| ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ Definitive Proxy Statement |

| ¨ Definitive Additional Materials |

| ¨ Soliciting Material under §240 14a-12 |

REDWOOD ENHANCED INCOME CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials. |

| o | Fee computed on table exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

REDWOOD ENHANCED INCOME CORP.

250 West 55th Street, 26th Floor, New York, NY 10019

NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 30, 2022

To The Stockholders Of Redwood Enhanced Income Corp.:

Notice Is Hereby Given that a Special Meeting of Stockholders of Redwood Enhanced Income Corp., a Maryland corporation (the “Company”), will be held on September 30, 2022 at 10:00 am local time at the Company’s principal executive office, 250 W55th Street, New York, New York 10019 for the following purposes:

| | (1) To approve an amended and restated investment advisory agreement between the Company and Redwood Capital Management, LLC. |

| | (2) To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The board of directors has fixed the close of business on September 12, 2022 as the record date for the determination of stockholders entitled to notice of and to vote at this Special Meeting and at any adjournment or postponement thereof.

| | By Order of the Board of Directors |

| | |

| | /s/ ADAM BENSLEY |

| | Adam Bensley |

| | Secretary |

New York, New York

September 19, 2022

All stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A FedEx overnight return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain from the record holder a proxy issued in your name.

REDWOOD ENHANCED INCOME CORP.

250 West 55th Street, 26th Floor, New York, NY 10019

PROXY STATEMENT

FOR SPECIAL MEETING OF STOCKHOLDERS

SEPTEMBER 30, 2022

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the board of directors of Redwood Enhanced Income Corp., a Maryland corporation (the “Company” or the “Fund”), for use at the Special Meeting of Stockholders to be held on September 30, 2022, at 10:00 am local time (the “Special Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Special Meeting. The Special Meeting will be held at the Company’s principal executive office, 250 W55th Street, New York, New York 10019. The Company intends to mail this proxy statement and accompanying proxy card on or about September 19, 2022 to all stockholders entitled to vote at the Special Meeting.

Solicitation

Redwood Capital Management, LLC (the “Adviser”) will be responsible for the cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s common stock beneficially owned by others to forward to such beneficial owners. The Company or the Adviser may reimburse persons representing beneficial owners of the Company’s common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company and the Adviser. No additional compensation will be paid to directors, officers or other regular employees for such services.

Voting Rights and Outstanding Shares

Only holders of record of the Company’s common stock at the close of business on September 12, 2022 will be entitled to notice of and to vote at the Special Meeting. At the close of business on September 12, 2022 the Company had outstanding and entitled to vote 8,304,341.32 shares of common stock.

Each holder of record of the Company’s common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Special Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted towards a quorum but are not considered votes “in favor” of Proposal 1, nor will they be counted for any purpose in determining whether any other matter properly brought before the meeting is approved. Therefore, with respect to the approval of the amended and restated investment advisory agreement with the Adviser (Proposal 1), abstentions and broker non-votes will count as votes against the approval of the proposal.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s principal executive office, 250 West 55th Street, 26th Floor, New York, NY 10019, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person.

Attendance at the meeting will not, by itself, revoke a proxy. However, no proxy is valid after eleven months from its date, unless otherwise provided in the proxy.

A copy of the Company’s most recent quarterly report on Form 10-Q and/or this proxy statement is available without charge upon written request to the Secretary at the principal executive offices of the Company. You may also request a copy free of charge from the Secretary by calling our offices at 212.970.1400.

PROPOSAL 1

APPROVAL OF AMENDED AND RESTATED INVESTMENT ADVISORY AGREEMENT

Stockholders of the Company are being asked to approve an amended and restated investment advisory agreement (the “Proposed Agreement”) between the Company and the Adviser. The Proposed Agreement provides for a quarterly base management fee, in arrears, equal to 0.375% (i.e., 1.50% annually) of the Company’s Weighted Average Net Asset Value for the quarter; provided that the quarterly base management fee will be decreased to 0.25% (i.e., 1.00% annually) of the value of the Company’s Weighted Average Net Asset Value during any extension of the period in which the Company may complete the listing of shares of the Company's common stock on a national securities exchange or a merger or other transaction in which investors receive cash or shares of a publicly-listed issuer (a “Liquidity Event”). “Weighted Average Net Asset Value” means, at the time of any calculation, the weighted average shares outstanding multiplied by the average of the beginning net asset value per share and ending net asset value per share (prior to management and incentive fees) of a period of time. Previously, the base management fee was calculated based on the value of the Company's net assets excluding cash and cash equivalents at the end of the two most recently completed calendar quarters. The Proposed Agreement makes no other changes to the calculation of the base management fee or the incentive fee or the services to be provided. For additional information concerning the fees under the Proposed Agreement, see “The Proposed Agreement — Advisory and Incentive Fees.”

The same individuals who manage the Company’s portfolio would continue to manage the portfolio under the Proposed Agreement and, the administrative services would be continued to be provided by our administrator, Redwood Capital Management, LLC (the “Administrator”) pursuant to a separate administration agreement (the “Administration Agreement”).

The Proposed Agreement is attached as Appendix A to this Proxy Statement. At a meeting of the board of directors of the Company held on , 2022, the board of directors unanimously voted to approve the Proposed Agreement with the Adviser.

The affirmative vote of a “majority,” as defined in the Investment Company Act, of the outstanding shares of the Company is required to approve Proposal 1. Under the Investment Company Act, the vote of holders of a “majority” means the vote of the holders of the lesser of (a) 67% or more of the outstanding shares of the Company present at the meeting or represented by proxy if the holders of more than 50% of the outstanding shares of the Company are present or represented by proxy, or (b) more than 50% of the Company’s outstanding shares.

Current Advisory Arrangement

Currently, the Company has an Investment Advisory Agreement (the “Existing Agreement”) with the Adviser, pursuant to which the Adviser, subject to the overall supervision of our Board of Directors, manages the day-to-day operations of the Company and provides investment advisory services to the Company. The Existing Agreement was approved by the Company’s sole initial shareholder and became effective on March 31, 2022. Under the Existing Agreement, the Company pays the Adviser (1) a base management fee equal to 1.50% of the value of the Company’s net assets excluding cash and cash equivalents and (2) an incentive fee based on the Company’s performance.

Under the Existing Agreement, the Adviser (1) determines the composition of the Company’s portfolio, the nature and timing of the changes to the Company’s portfolio and the manner of implementing such changes; (2) identifies, evaluates and negotiates the structure of the investments the Company makes; (3) executes, closes, services and monitors the investments the Company makes; (4) determines the securities and other assets that the Company purchases, retains or sells; (5) performs due diligence on prospective portfolio companies and their sponsors; and (6) provides the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its assets.

Subject to the payment of certain organization and offering expenses by the Adviser, the Company bears all other direct or indirect costs and expenses of its organization, operations and transactions, including operating costs, Company-level tax returns, legal and other customary investment related expenses. For the quarter ended June 30, 2022, the Company paid total base management fees of $251,223 to the Adviser under the Existing Agreement.

If the Company’s stockholders approve Proposal 1, the Proposed Agreement will go into effect on September 30, 2022. The Existing Agreement will terminate effective upon the effective date of the Proposed Agreement.

The Proposed Agreement

Base Management Fee

The Proposed Agreement provides for a quarterly base management fee, in arrears, equal to 0.375% (i.e., 1.50% annually) of the Company’s Weighted Average Net Asset Value for the quarter; provided that the quarterly base management fee will be decreased to 0.25% (i.e., 1.00% annually) of the value of the Company’s Weighted Average Net Asset Value during any extension of the period in which the Company may complete a Liquidity Event. “Weighted Average Net Asset Value” means, at the time of any calculation, the weighted average shares outstanding multiplied by the average of the beginning net asset value per share and ending net asset value per share (prior to management and incentive fees) of a period of time. Previously, the base management fee was calculated based on the value of the Company's net assets excluding cash and cash equivalents at the end of the two most recently completed calendar quarters. The Proposed Agreement makes no other changes to the calculation of the base management fee or the incentive fee or the services to be provided.

Incentive Fee

The incentive fee payable under the Proposed Agreement is the same as in the Existing Agreement, and will have two parts, as follows:

One part is calculated and payable quarterly in arrears based on the Company’s Pre-Incentive Fee Net Investment Income for the immediately preceding calendar quarter. For this purpose, Pre-Incentive Fee Net Investment Income means interest income, dividend income and any other income, including any other fees (other than fees for providing managerial assistance) such as amendment, commitment, origination, prepayment penalties, structuring, diligence and consulting fees or other fees received from portfolio companies, accrued during the calendar quarter, minus the Company’s operating expenses for the quarter (including the base management fee, any expenses payable under the Administration Agreement, and any interest expense or amendment fees under any credit facility and distributions paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-Incentive Fee Net Investment Income includes, in the case of investments with a deferred interest feature (such as OID, PIK interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

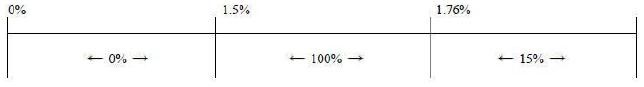

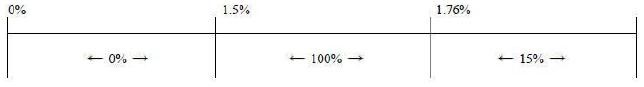

Pre-Incentive Fee Net Investment Income, expressed as a percentage of the value of the Company’s net assets at the end of the immediately preceding calendar quarter, is compared to a hurdle. The Company will pay the Adviser an incentive fee with respect to Pre-Incentive Fee Net Investment Income in each calendar quarter as follows:

(1) No incentive fee in any calendar quarter in which Pre-Incentive Fee Net Investment Income does not exceed the hurdle rate of one and a half percent (1.50%) per quarter (6.00% annualized);

(2) One hundred percent (100%) of Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate but is less than the percentage at which amounts payable to the Adviser pursuant to the income incentive fee equal fifteen percent (15%) of the Company’s Pre-Incentive Fee Net Investment Income as if a hurdle rate did not apply. This portion of the Pre-Incentive Fee Net Investment Income (which exceeds the hurdle rate but is less than 1.76%) is referred to as the “catch-up.” The “catch-up” is meant to provide the Adviser with 15% of the Company’s Pre-Incentive Fee Net Investment Income as if a hurdle rate did not apply; and

(3) Fifteen percent (15%) of the amount of Pre-Incentive Fee Net Investment Income, if any, that exceeds 1.76% in any calendar quarter (7.04% annualized).

These calculations will be pro-rated for any period of less than a full calendar quarter.

The following is a graphical representation of the calculation of the quarterly incentive fee based on Pre-Incentive Fee Net Investment Income:

Pre-Incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets)

Percentage of Pre-Incentive Fee Net Investment Income

allocated to income-related portion of incentive fee

The second part of the incentive fee will be determined and payable in arrears as of the end of each calendar year (or upon termination of the Proposed Agreement, as of the termination date) and will equal 15% of the Company’s realized capital gains, if any, on a cumulative basis from inception through the end of each calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees.

Under GAAP, the Company will be required to accrue a capital gains incentive fee based upon net realized capital gains and net unrealized capital appreciation and depreciation on investments held at the end of each period. In calculating the capital gains incentive fee accrual, the Company will consider the cumulative aggregate unrealized capital appreciation in the calculation, as a capital gains incentive fee would be payable if such unrealized capital appreciation were realized, even though such unrealized capital appreciation will not be permitted to be considered in calculating the fee actually payable under the Proposed Agreement. This accrual is calculated using the aggregate cumulative realized capital gains and losses and cumulative unrealized capital appreciation or depreciation. If such amount is positive at the end of a period, then the Company will record a capital gains incentive fee equal to 15% of such amount, less the aggregate amount of actual capital gains related incentive fees paid or accrued in all prior years. If such amount is negative, then there is either no accrual for such year or a reduction in prior accruals for changes in net unrealized capital appreciation and depreciation. There can be no assurance that such unrealized capital appreciation will be realized in the future.

Incentive Fee Cap

No incentive fee will be paid to the Adviser to the extent that, after such payment, the cumulative income-based incentive fees and capital gains-based incentive fees paid to date would be greater than fifteen percent (15%) of the Company’s Cumulative Pre-Incentive Fee Net Income since the date of its election to become a BDC (the “Incentive Fee Cap”). “Cumulative Pre-Incentive Fee Net Income” is equal to the sum of (a) Pre-Incentive Fee Net Investment Income for each period since the date of the Company’s election to become a BDC and (b) cumulative aggregate realized capital gains, cumulative aggregate realized capital losses, cumulative aggregate unrealized capital depreciation and cumulative aggregate unrealized capital appreciation, in each case, since the date of the Company’s election to become a BDC. If, for any relevant period, the Incentive Fee Cap calculation results in the Company paying less than the amount of the income-based incentive fee and the capital gains-based incentive fee as calculated above, then the difference between (a) such amount and (b) the Incentive Fee Cap will not be paid by the Company, and will not be received by the Adviser, either at the end of such relevant period or at the end of any future period.

Examples of Quarterly Incentive Fee Calculation

Assumptions

Hurdle(1) = 1.50%

Base management fee(2) = 0.375%

Other expenses (legal, accounting, custodian, transfer agent, etc.) = 0.1375%

Example 1: Income Related Portion of Incentive Fee (*):

Alternative 1:

Additional Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.25%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 0.7375%

Pre-Incentive Fee Net Investment Income does not exceed hurdle; therefore there is no incentive fee.

Alternative 2:

Additional Assumptions

Investment income (including interest, dividends, fees, etc.) = 2.75%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 2.2375%

Pre-Incentive Fee Net Investment Income exceeds hurdle; therefore there is an incentive fee.

Incentive fee = 100% x “catch up” + the greater of 0% AND (15% × (Pre-Incentive Fee Net Investment Income – 1.76%)

= 100% x (1.76% – 1.50%) + 15% x (2.2375% – 1.76%)

= 100% x (.026%) + (15% x 0.4775%)

= 0.26% + 0.071625%

= 0.331625%

Alternative 3:

Additional Assumptions

Investment income (including interest, dividends, fees, etc.) = 3.75%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 3.2375%

Incentive fee = 100% x “catch up” + the greater of 0% AND (15% × (Pre-Incentive Fee Net Investment Income – 1.76%)

= 100% x (1.76% – 1.50%) + 15% x (3.2375% – 1.76%)

= 100% x (0.26%) + 15% x (1.4775%)

= 0.26% + 0.221625%

= 0.481625%

* The hypothetical amount of Pre-Incentive Fee Net Investment Income shown is based on a percentage of total net assets.

| (1) | Represents quarterly hurdle rate. |

| (2) | Represents one-quarter of 1.50% annualized base management fee. |

Example 2: Capital Gains Portion of Incentive Fee:

Alternative 1

Assumptions

Year 1: $20 million investment made in Company A (“Investment A”) and $30 million investment made in Company B (“Investment B”)

Year 2: Investment A is sold for $15 million and fair value of Investment B determined to be $29 million

Year 3: Fair value of Investment B determined to be $27 million

Year 4 Investment B sold for $25 million

The capital gain incentive fee, if any, would be:

Year 1: None

Year 2: None (Sales transaction resulted in a realized capital loss on Investment A)

Year 3: None

Year 4: None (Sales transaction resulted in a realized capital loss on Investment B)

Each quarterly incentive fee is subject to the Incentive Fee Cap. Below are the necessary adjustments to adhere to the Incentive Fee Cap.

Year 1: No adjustment.

Year 2: Investment A sold at a $5 million loss. Investment B has unrealized capital depreciation of $1 million. Therefore, the Adviser would not be paid on the $6 million of realized losses and unrealized capital depreciation, which would reduce the incentive fee by $900,000.

Year 3: Investment B has additional unrealized capital depreciation of $2 million. Therefore, the Adviser would not be paid on the $2 million of unrealized capital depreciation, which would reduce the incentive fee by $300,000.

Year 4: Investment B sold at a $5 million loss. Investment B was previously marked down by $3 million; therefore, the Company would realize a $5 million loss on Investment B and reverse the previous $3 million in unrealized capital depreciation. The net effect would be a realized loss of $2 million. The Adviser would not be paid on the $2 million loss, which would reduce the incentive fee by $300,000.

Alternative 2

Assumptions

Year 1: $20 million investment made in Company A (“Investment A”), $30 million investment made in Company B (“Investment B”) and $25 million investment made in Company C (“Investment C”)

Year 2: Fair value of Investment A determined to be $18 million, fair value of Investment B determined to be $25 million and fair value of Investment C determined to be $25 million

Year 3: Investment A sold for $18 million. Fair value of Investment B determined to be $24 million and fair value of Investment C determined to be $25 million

Year 4: Fair value of Investment B determined to be $22 million. Investment C sold for $24 million

Year 5: Investment B sold for $20 million

The Capital Gain Incentive Fee, if any, would be:

Year 1: None

Year 2: None

Year 3: None

Year 4: None

Year 5: None

Each quarterly incentive fee is subject to the Incentive Fee Cap. Below are the necessary adjustments to adhere to the Incentive Fee Cap.

Year 1: No adjustment.

Year 2: There is total unrealized capital depreciation of $7 million. The Adviser would not be paid on the $7 million unrealized capital depreciation, which would reduce the incentive fee by $1,050,000.

Year 3: Investment A sold at a $2 million loss. Investment A was previously marked down by $2 million; therefore, the Company would realize a $2 million loss on Investment A and reverse the previous $2 million in unrealized capital depreciation. Investment B has additional unrealized capital depreciation of $1 million. The net effect would be a loss of $1 million. The Adviser would not be paid on the $1 million loss, which would reduce the incentive fee by $150,000.

Year 4: Investment B has additional unrealized capital depreciation of $2 million. Investment C sold at a $1 million realized loss. The Adviser would not be paid on the $3 million of unrealized depreciation and realized losses, which would reduce the incentive fee by $450,000.

Year 5: Investment B sold at a $10 million loss. Investment B was previously marked down by $8 million; therefore, the Company would realize a $10 million loss on Investment B and reverse the previous $8 million in unrealized capital depreciation. The net effect would be a loss of $2 million. The Adviser would not be paid on the $2 million loss, which would reduce the incentive fee by $300,000.

Alternative 3

Assumptions

Year 1: $25 million investment made in Company A (“Investment A”) and $20 million investment made in Company B (“Investment B”)

Year 2: Investment A is sold for $30 million and FMV of Investment B determined to be $21 million

Year 3: FMV of Investment B determined to be $23 million

Year 4: Investment B sold for $23 million

The Capital Gain Incentive Fee, if any, would be:

Year 1: None

Year 2: $750,000 (15% multiplied $5 million realized capital gains on sale of Investment A)

Year 3: None

Year 4: $450,000 (15% multiplied by $8 million realized capital gains on sale of Investment A and Investment B less capital gain incentive fee paid in year 2)

Each quarterly incentive fee is subject to the Incentive Fee Cap. Below are the necessary adjustments to adhere to the Incentive Fee Cap.

Year 1: No adjustment.

Year 2: No adjustment.

Year 3: No adjustment.

Year 4: No adjustment.

Additional Expense Information

The following table is intended to assist you in understanding the fees and expenses that a shareholder would bear directly or indirectly under the Existing Agreement as compared to the Proposed Agreement. Some of the percentages indicated in the table below are estimates and may vary.

Stockholder Transaction Expenses for the three-month Period Ended June 30, 2022

| | | Existing

Agreement | | | Proposed

Agreement | |

| Expenses (as a percentage of offering price) | | | | | | | | |

| Sales load to dealer manager | | | — | % | | | — | % |

| Offering expenses | | | — | % | | | — | % |

| Distribution reinvestment plan expenses | | | — | % | | | — | % |

| Total shareholder transaction expenses | | | — | % | | | — | % |

| Annual expenses (as a percentage of net assets attributable to Shares) (1) | | | | | | | | |

| Management fees | | | 1.58 | % | | | 1.48 | % |

| Incentive fees (2) | | | — | % | | | — | % |

| Interest payments on borrowed funds (3) | | | 2.86 | % | | | 2.86 | % |

| Other expenses (4) | | | 1.88 | % | | | 1.88 | % |

| Total annual expenses | | | 6.31 | % | | | 6.22 | % |

| (1) | “Net assets attributable to Shares” equals weighted average net assets as of June 30, 2022. |

| (2) | The incentive fees payable to our Investment Adviser is based on actual amounts of the Incentive Fee incurred during the three months ended June 30, 2022, annualized for a full year, and the amount payable under our Investment Management Agreement, for the capital gains component as of June 30, 2022. No fees were incurred for the three months ended June 30, 2022. |

| (3) | Interest payments on borrowed funds represents an estimate of our annualized interest expense based on borrowings under the Revolving Credit Facility as of June 30, 2022. As of June 30, 2022, the weighted average interest rate on our total debt outstanding was 4.58%. We may borrow additional funds from time to time to make investments to the extent we determine that the economic situation is conducive to doing so. We may also issue additional debt securities or preferred stock, subject to our compliance with applicable requirements under the Investment Company Act. |

| (4) | Other expenses include accounting, legal, auditing fees, tax, independent director fees and expenses and certain other administration or operational expenses based on estimated amounts for the three month period ended June 30, 2022, calculated by annualizing the applicable expenses for the three months ended June 30, 2022. |

Example

The following example demonstrates the projected dollar amount of total expenses that would be incurred over various periods with respect to a hypothetical investment in Shares. In calculating the following expense amounts, the Company has assumed its annual operating expenses would remain at the percentage levels set forth in the table above. Interest payments on borrowed funds and Transaction expenses are not included in the following example. Further, it is assumed that no incentive fees on investment income will be earned since assumed return of 5% is below the hurdle rate of 6%.

Existing Agreement

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return from investment income: | | $ | 36 | | | $ | 110 | | | $ | 186 | | | $ | 386 | |

Proposed Agreement

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return from investment income: | | $ | 35 | | | $ | 107 | | | $ | 182 | | | $ | 377 | |

The foregoing table is to assist you in understanding the various costs and expenses that an investor in our common stock will bear directly or indirectly. While the examples above assume, as required by the SEC, a 5% annual return, the Company’s performance will vary and may result in a return greater or less than 5%. Assuming a 5% annual return, and considering the Company’s performance will vary, the incentive fees under the Existing Agreement and the Proposed Agreement may not be earned or payable and are not included in the example. This illustration assumes that the Company will not realize any capital gains computed net of all realized capital losses and gross unrealized capital depreciation in any of the indicated time periods. If the Company achieves sufficient returns on its investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, the Company’s expenses would be higher. The example assumes reinvestment of all distributions at NAV. In addition, while the example assumes reinvestment of all dividends and distributions at NAV, under certain circumstances, reinvestment of dividends and other distributions under our dividend reinvestment plan may occur at a price per share that differs from NAV.

Assuming, however, that the incentive fee on capital gains under the Proposed Agreement is earned and payable and the subordinated incentive fee on income is not earned and payable, the following example demonstrates the projected dollar amount of total expenses that would be incurred over various periods with respect to a hypothetical investment in Shares.

Existing Agreement

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return from investment income solely from realized capital gains | | $ | 38 | | | $ | 117 | | | $ | 197 | | | $ | 408 | |

Proposed Agreement

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return from investment income solely from realized capital gains | | $ | 37 | | | $ | 114 | | | $ | 193 | | | $ | 401 | |

The above examples and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses (including the cost of debt, if any, and other expenses) may be greater or less than those shown.

Effect of the Proposed Agreement on Base Management Fees

During the three-month period ended June 30, 2022, the Company recorded approximately $251,223 in base management fees payable to the Adviser. As of September 9, 2022, all of these base management fees were payable to the Adviser.

Were the base management fees for the three-month period ended June 30, 2022 calculated under the terms of the Proposed Agreement, the amount of base management fees payable by the Company to the Adviser for such period would have decreased from approximately $251,223 to approximately $236,037, which represents a decrease of approximately 6.0%.

Below is a presentation of the effect of the Proposed Agreement on a pro forma basis for the three-month period ended June 30, 2022:

| | | Base

Management Fee | | | Subordinated

Incentive

Fee on Income | | | Capital Gains

Incentive Fees | | | Total | |

| Existing Agreement | | $ | 251,223 | | | $ | 0 | | | $ | 0 | | | $ | 251,223 | |

| Proposed Agreement | | $ | 236,037 | | | $ | 0 | | | $ | 0 | | | $ | 236,037 | |

| Difference | | | Decrease of approximately 6.0% | | | | No change | | | | No change | | | | Decrease of approximately 6.0% | |

Portfolio Managers. The following individuals will continue to be primarily responsible for the day-to-day management of the Company’s portfolio under the Proposed Agreement:

Ruben Kliksberg. Ruben Kliksberg is currently Chief Executive Officer and Chief Investment Officer of the Adviser. Mr. Kliksberg joined the Adviser in 2005. He became Deputy Portfolio Manager of the Redwood Master Fund, Ltd and the Redwood Drawdown Funds in 2013. He became Co-Chief Executive Officer of the Adviser, and Co-Portfolio Manager of the Redwood Master Fund, Ltd and the Redwood Drawdown Funds, in 2017. From 2000 until 2002, Mr. Kliksberg worked as an analyst at the Investment Banking Technology Group of Credit Suisse, where he was an advisor on mergers and acquisitions and corporate finance transactions. From 1999 until 2000, Mr. Kliksberg worked for the International Finance Corporation of the World Bank, making private direct debt and equity investments in companies in emerging markets. Mr. Kliksberg graduated cum laude from Georgetown University in 1999. He received an M.B.A. with High Distinction Honors (Baker Scholar) from Harvard Business School, and a Masters in Public Administration from the Harvard Kennedy School of Government in 2005.

Sean Sauler. Sean Sauler is currently Deputy Chief Executive Officer and Co-Chief Investment Officer of the Adviser. Mr. Sauler joined the Adviser in 2006, became Deputy Portfolio Manager of the Redwood Opportunity Fund, Ltd in 2016 and became the Deputy Chief Executive Officer of the Adviser in April 2020. From 2004 to 2006, Mr. Sauler was an analyst in the Restructuring and Distressed Finance Group at Credit Suisse, where he was involved in rescue financings and corporate advisory work. Mr. Sauler graduated cum laude with a B.S. degree from the Wharton School, University of Pennsylvania in 2004.

Expenses

The Company expects that its primary operating expenses will include the payment of management and incentive fees to the Adviser under the Proposed Agreement, the Company’s allocable portion of overhead under the Administration Agreement and other operating costs as detailed below. The Company will bear all other direct or indirect costs and expenses of its operations and transactions, including:

| | ● | organizational and offering costs in excess of $1.0 million; |

| | ● | the cost of calculating the Company’s net asset value, including the cost of any third-party valuation services and software; |

| | ● | fees payable to third parties relating to, or associated with, making investments, including fees and expenses associated with performing due diligence and reviews of prospective investments or complementary businesses, whether or not the investment is consummated; |

| | ● | expenses incurred by the Adviser in performing due diligence and reviews of investments; |

| | ● | research expenses incurred by the Adviser (including subscription fees and other costs and expenses related to Bloomberg Professional Services); |

| | ● | amounts incurred by the Adviser in connection with or incidental to acquiring or licensing software and obtaining research; |

| | ● | distributions on the Company’s common stock; |

| | ● | expenses related to leverage, if any, incurred to finance the Company’s investments, including rating agency fees, interest, preferred stock dividends, obtaining lines of credit, loan commitments and letters of credit for the account of the Company and its related entities; |

| | ● | transfer agent and custodial fees and expenses; |

| | ● | fees and expenses associated with marketing efforts; |

| | ● | federal and state registration fees and any stock exchange listing fees; |

| | ● | fees and expenses associated with independent audits and outside legal costs; |

| | ● | federal, state, local and foreign taxes (including real estate, stamp or other transfer taxes), including costs in connection with any tax audit, investigation or review, or any settlement thereof; |

| | ● | complying with FATCA and/or any foreign account reporting regimes and certain regulations and other administrative guidance thereunder, including the Common Reporting Standard issued by the Organisation for Economic Cooperation and Development, or similar legislation, regulations or guidance enacted in any other jurisdiction, which seeks to implement tax reporting and/or withholding tax regimes as well as any intergovernmental agreements and other laws of other jurisdictions with similar effect; |

| | ● | Independent Directors’ fees and expenses; |

| | ● | brokerage fees and commissions; |

| | ● | fidelity bond, directors and officers, errors and omissions liability insurance and other insurance premiums; |

| | ● | the costs of any reports, proxy statements or other notices to the Company’s stockholders, including printing costs; |

| ● | costs of holding stockholder meetings; |

| | ● | litigation, indemnification and other non-recurring or extraordinary expenses; |

| | ● | any governmental inquiry, investigation or proceeding to which the Company and/or an investment is a related party or is otherwise involved, including judgments, fines, other awards and settlements paid in connection therewith; |

| | ● | other direct costs and expenses of administration and operation, such as printing, mailing, long distance telephone and staff; |

| | ● | costs associated with the Company’s reporting and compliance obligations, including under the 1940 Act and applicable federal and state securities laws (including reporting under Sections 13 and 16 under the Exchange Act and anti-money laundering compliance); |

| | ● | dues, fees and charges of any trade association of which the Company is a member; |

| | ● | costs associated with the formation, management, governance, operation, restructuring, maintenance (including any amendments to constituent documents), winding up, dissolution or liquidation of entities; |

| | ● | fees, costs and expenses incurred in connection with or incidental to co-investments or joint ventures (whether or not consummated) that are not borne by co-investors or joint venture partners; |

| | ● | The allocated costs incurred by the Administrator, in providing managerial assistance to those portfolio companies that request it; and |

| | ● | all other expenses incurred by either the Administrator or the Company in connection with administering the Company's business, including payments under the Administration Agreement that will be based upon the Company's allocable portion of overhead, and other expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including the fees of the Sub-Administrator, rent, technology systems (including subscription fees and other costs and expenses related to Bloomberg Professional Services and the Adviser's third-party Order Management System), insurance and the Company's allocable portion of the cost of compensation and related expenses of its Chief Compliance Officer and Chief Financial Officer and their respective staffs. |

The allocation of expenses by the Adviser between it, the Company and any client and among clients represents a conflict of interest for the Adviser. To address this conflict, the Adviser has adopted and implemented policies and procedures for the allocation of expenses. See "Item 1A. Risk Factors—Company Operations—The Adviser has obligations to its other clients" in the Company’s most recent Registration Statement on Form 10.

The Adviser has agreed to limit, indefinitely, the amount of Specified Expenses (defined below) borne by the Company to an amount not to exceed 0.25% per annum of the greater of (i) the Company's aggregate capital commitments ("Capital Commitments") and (ii) the Company's net assets, at the time of determination (the "Expense Cap"). Specified Expenses include the following expenses incurred by the Company in its ordinary course of business: (i) third-party fund administration and fund accounting; (ii) printing and mailing expenses; (iii) professional fees, consisting of legal, compliance, tax and audit fees; (iv) treasury and compliance function expenses, including the salary of any internal Redwood resources reimbursed by the Company; (iv) research expenses relating to Bloomberg, expert network services, and investment research subscriptions, (v) Independent Director fees and expenses; (vi) premiums for director and officer and errors and omissions insurance; and (vii) valuation of Company investments. For the avoidance of doubt, Specified Expenses will not include any other expenses of the Company incurred in connection with its operations, including but not limited to, (i) any advisory fees payable by the Company under an effective advisory agreement, (ii) investment expenses (such as fees and expenses of outside legal counsel or third-party consultants, due diligence-related fees and other costs, expenses and liabilities with respect to consummated and unconsummated investments), (iii) taxes paid, (iv) interest expenses and fees on borrowing, (v) fees incurred in connection with the establishment of borrowing or other leverage arrangements, (vi) brokerage commissions, expenses related to litigation and potential litigation, and extraordinary expenses not incurred in the ordinary course of the Company's business, including such expenses as approved by the Board of Directors, including a majority of the Independent Directors. The Expense Cap will be based on the greater of (i) the Company's aggregate Capital Commitments, without reduction for contributed capital or Capital Commitments no longer available to be called by the Company and (ii) the Company's net assets, in each case as calculated at the end of a calendar year. In any year, to the extent that Specified Expenses exceed the Expense Cap of such prior year end, the Adviser will promptly waive fees or reimburse the Company for expenses necessary to eliminate such excess. For the Company's first year of operations, the Specified Expenses will be annualized and to the extent such annualized Specified Expenses exceed the Expense Cap for such period on an annualized basis, the Adviser will promptly waive fees or reimburse the Company for expenses necessary to eliminate such excess. Such waivers are not subject to future reimbursement by the Company.

Duration and termination. Unless terminated earlier as described below, the Proposed Agreement will continue in effect for an initial term of two years from its effective date. Thereafter, it will remain in effect if approved annually by the Board of Directors, or by the affirmative vote of the holders of a majority of the Company's outstanding voting securities, including, in either case, approval by a majority of the Independent Directors. The Proposed Agreement may not be assigned by either party without the consent of the other party. The Proposed Agreement may be terminated by either party without penalty upon 60 days' written notice to the other.

Indemnification. The Proposed Agreement and the Administration Agreement provide that, absent willful misfeasance, bad faith or gross negligence in the performance of their duties or by reason of the reckless disregard of their duties and obligations, the Adviser and the Administrator and their officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with them (the "Indemnified Parties") are entitled to indemnification from the Company for any damages, liabilities, costs and expenses (including reasonable attorneys' fees and amounts reasonably paid in settlement) arising from the rendering of the Adviser's and the Administrator's services under the Proposed Agreement or Administration Agreement or otherwise as investment adviser or administrator of the Company. Under the Proposed Agreement, the Indemnified Parties shall not be indemnified for any losses, liabilities or expenses arising from or out of an alleged violation of federal or state securities laws by such party unless one or more of the following conditions are met: (A) there has been a successful adjudication on the merits of each count involving alleged material securities law violations as to the Indemnified Party; (B) such claims have been dismissed with prejudice on the merits by a court of competent jurisdiction as to the Indemnified Party; or (C) a court of competent jurisdiction approves a settlement of the claims against the Indemnified Party and finds that indemnification of the settlement and the related costs should be made, and the court considering the request for indemnification has been advised of the position of the SEC and of the published position of any state securities regulatory authority in which the Company's securities were offered or sold as to indemnification for violations of securities laws.

Managerial Assistance and Servicing fees. In order to count portfolio securities as qualifying assets for the purpose of the 70% test, the BDC must either control the issuer of the securities or must offer to make available to the issuer of the securities (other than small and solvent companies described above) significant managerial assistance; except that, where the BDC purchases such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available significant managerial assistance means, among other things, any arrangement whereby the BDC, through its directors, officers or employees, offers to provide, and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company. The Administrator may provide such significant managerial assistance on the Company's behalf to portfolio companies that request such assistance. The Company may receive fees for these services.

Considerations of the Board of Directors

Our board of directors approved this proxy statement on , 2022. In its consideration of the Proposed Agreement, the board of directors focused on information it had received relating to, among other things: the reasonableness of the advisory fee (including the incentive fee), the experience of the Adviser’s personnel, the potential for additional attractive investments resulting from synergies with other funds to be managed by the Adviser and the advantage of terminating the Company’s equity incentive plan in favor of the incentive fee arrangement. The board of directors considered the investment advisory and incentive fees under the Proposed Agreement (the “Proposed Fees”) and information on fees charged by other investment advisers for comparable services, and determined that the Proposed Fees were reasonable in relation to the services to be provided by the Adviser.

In recommending that the Company continue to use the Adviser as its investment adviser, the Company’s board of directors considered the fact that the advisory team of the Adviser are expected to be in all material respects, for at least the next year, the same as the current team responsible for managing and administering the Company and the fact that our investment objectives are consistent with the investment selection process employed by the Adviser. In connection with its final deliberations, the board of directors reviewed and discussed additional materials provided by the Adviser in response to the Board’s request, including information regarding the services to be performed; the prior experience of the Adviser’s personnel in connection with the types of investments we propose to make, including such personnel’s extensive network of contacts; the size of the Adviser’s staff; anticipated changes in the Adviser’s current personnel; the compensation of such personnel; the Adviser’s ability to provide managerial assistance to portfolio companies; the written plan for allocating investment opportunities among the Adviser’s current and future clients; the Adviser’s operations; and the Adviser’s organizational capability and financial condition as evidenced by the Adviser’s level of service to us. The board of directors also relied upon comparisons of the services to be rendered and the amounts to be paid under the Proposed Agreement with those under other investment advisory contracts such as the Adviser’s private funds and BDCs identified by the Adviser as being in the Company’s peer group. When evaluating comparisons, the board of directors considered, among other things:

| • | the Adviser’s strong performance, as evidenced by the historical performance of the Adviser’s private funds following similar investment strategies; |

| • | the high quality and extensive level of the advisory and other services that we expect the Adviser to continue to provide to us; and |

| • | the difficulty of obtaining similar services from other third party service providers. |

The board of directors acknowledged that the fees to be received by the Adviser under the Proposed Agreement are expected to exceed the Adviser’s costs of providing services to the Company. However, the board did not attempt to quantify the Adviser’s level of profits (including those based on fees received from the Company’s portfolio companies) because of its satisfaction with the Adviser’s performance advising the Company. The Proposed Agreement does not provide for any reduction in fees in the event that the Adviser experiences any economies of scale in its provision of management services to the Company. Based on the information reviewed by, and the ensuing discussions of, the Company’s board of directors, the board, including a majority of the non-interested directors, concluded that the investment advisory fee rates, including the incentive fee rates, were reasonable in relation to the services to be provided by the Adviser. Based on its review and discussion, the board believes the Proposed Agreement as being in the best interests of the Company’s stockholders and by unanimous written consent has directed that the Proposed Agreement be submitted to stockholders for approval with the board’s recommendation that stockholders of the Company vote to approve the Proposed Agreement.

Information About the Adviser

The Adviser is an investment management firm focused on investing in credit and other opportunities in stressed and distressed companies. The Adviser was founded in 2000, and is wholly owned by Redwood Capital Management Holdings, LP, a Delaware limited partnership. An entity controlled by Ruben Kliksberg, the Chief Executive Officer and Chief Investment Officer of the Adviser, serves as the general partner of Redwood Capital Management Holdings, LP. Entities controlled by Mr. Kliksberg are the principal owners of the Adviser and its affiliates and accordingly Mr. Kliksberg has ultimate decision-making authority with respect to the Adviser. The Adviser has been registered with the SEC since March 2012, and has its principal place of business at 250 West 55th Street, 26th Floor, New York, NY 10019.

Sean Sauler is the Deputy-CEO and Co-Chief Investment Officer of the Adviser.

Mr. Kliksberg and Mr. Sauler serve as the Company's Co-Chairmen, Co-Presidents and Co-Portfolio Managers. They have worked at the Adviser for 17 years and 16 years, respectively.

Recommendation of the Board of Directors

The Board recommends that stockholders vote FOR Proposal 1.

ADDITIONAL INFORMATION

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the ownership of the Company’s common stock as of September 12, 2022 by: (i) all executive officers and directors of the Company as a group; and (ii) all those known by the Company to be beneficial owners of more than five percent of its common stock. Except as otherwise noted, the address of the individuals below is c/o Redwood Enhanced Income Corp., 250 West 55th Street, 26th Floor, New York, NY 10019.

| Name and Address1 | | Shares Owned | | | Percentage | |

| Independent Directors | | | | | | | | |

| Jeanne L. Manischewitz | | | — | | | | — | |

| Boris Onefater | | | — | | | | — | |

| Jennifer Rosenthal | | | — | | | | — | |

| | | | | | | | | |

| Interested Directors | | | | | | | | |

| Ruben Kliksberg | | | 298,898.21 | 2,3 | | | 3.6 | %2,3 |

| Sean Sauler | | | 98,521.63 | 4 | | | 1.19 | %4 |

| | | | | | | | | |

| Executive Officers (who are not Interested Directors) | | | | | | | | |

| Toni Healey | | | — | | | | — | |

| Adam Bensley | | | — | | | | — | |

| | | | | | | | | |

| All officers and directors as a group (7 persons) | | | 397,419.84 | | | | 4.79 | % |

| | | | | | | | | |

| Five Percent Holders | | | | | | | | |

| Cliffwater Corporate Lending Fund | | | 1,471,256.31 | 5 | | | 17.72 | %5 |

| Cliffwater Enhanced Lending Fund | | | 1,023,543.76 | 6 | | | 12.33 | %6 |

| Texas County and District Retirement System | | | 3,940,865.10 | 7 | | | 47.46 | %7 |

| (1) | The address for each of our officers and directors is c/o Redwood Enhanced Income Corp., 250 West 55th Street, 26th Floor, New York, NY 10019. |

| (2) | The Adviser holds 3,333.33 shares of the Company. Mr. Kliksberg holds all voting interests of the Adviser and, accordingly, controls the Adviser's shares of the Company. |

| (3) | RDK Family Investments LLC holds 295,564.88 shares of the Company. Mr. Kliksberg is a control person of RDK Family Investments LLC and, accordingly, has beneficial ownership over such shares. |

| (4) | MishSaulHamesh LLC holds 98,521.63 shares of the Company. Mr. Sauler is a control person of MishSaulHamesh LLC and, accordingly, has beneficial ownership over such shares. |

| (5) | The address of the principal business office of Cliffwater Corporate Lending Fund is c/o UMB Fund Services Inc., 235 W. Galena St., Milwaukee, WI 53212. |

| (6) | The address of the principal business office of Cliffwater Enhanced Lending Fund is 235 W. Galena St., Milwaukee, WI 53212. |

| (7) | The address of the principal business office of Texas County and District Retirement System is 901 Mopac Expressway, South Barton Oaks Plaza IV Suite 500, Austin TX 78746. |

Stockholder Proposals and Stockholder Communications with the Board of Directors

Stockholders who wish to submit a stockholder proposal for inclusion in the Company’s proxy statement and form of proxy for the Company’s first annual meeting of stockholders pursuant to Rule 14a-8 of the SEC must do so a reasonable time before the Company begins to print and send its proxy materials in connection with such meeting. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must deliver notice to the Secretary at the principal executive offices of the Company not earlier than the 150th day prior to the date of such annual meeting and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to the date of such annual meeting, as originally convened, or the tenth day following the day on which public announcement of the date of such meeting is first made. Stockholders are also advised to review the Company’s Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are stockholders of the Company are “householding” the Company’s proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker, direct your written request to the Secretary of our Company, Adam Bensley, at the address set forth on the cover page of this proxy statement or 212.970.1419. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

OTHER MATTERS

The board of directors knows of no other matters that will be presented for consideration at Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| | By Order of the Board of Directors |

| | |

| | /s/ ADAM BENSLEY |

| | Adam Bensley |

| | Secretary |

September 9, 2022

APPENDIX A

AMENDED AND RESTATED

INVESTMENT ADVISORY aGREEMENT

by and BETWEEN

REDWOOD ENHANCED INCOME CORP.

AND

Redwood Capital Management, LLC

This Amended and Restated Investment Advisory Agreement made this 30th day of September, 2022 (this "Agreement"), by and between REDWOOD ENHANCED INCOME CORP., a Maryland corporation (the "Company"), and REDWOOD CAPITAL MANAGEMENT, LLC, a Delaware limited liability company (the "Adviser").

WHEREAS, the Company is a newly organized, non-diversified closed-end management investment company that intends to elect to be treated as a business development company under the Investment Company Act of 1940, as amended (the "Investment Company Act");

WHEREAS, the Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the "Advisers Act");

WHEREAS, the Company desires to retain the Adviser to furnish investment advisory and management services to the Company on the terms and conditions hereinafter set forth, and the Adviser wishes to be retained to provide such services;

WHEREAS, the Company and the Adviser desire to amend and restate that certain Investment Advisory Agreement dated March 31, 2022 in its entirety.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the parties hereby agree as follows:

1. Duties of the Adviser.

(a) The Company hereby retains the Adviser to act as the investment adviser to the Company and to manage the investment and reinvestment of the assets of the Company, subject to the supervision of the board of directors of the Company (the "Board of Directors"), for the period and upon the terms herein set forth, (i) in accordance with the investment objective, policies and restrictions that are set forth in the Company's filings with the Securities and Exchange Commission, as the same may be amended from time to time, (ii) in accordance with the Investment Company Act, the Advisers Act and all other applicable federal and state law and (iii) in accordance with the Company's charter and bylaws, each as amended or restated from time to time. Without limiting the generality of the foregoing, the Adviser shall, during the term and subject to the provisions of this Agreement, (i) determine the composition of the portfolio of the Company, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identify, evaluate and negotiate the structure of the investments made by the Company; (iii) execute, close, service and monitor the Company's investments; (iv) determine the securities and other assets that the Company will purchase, retain or sell; (v) perform due diligence on prospective portfolio companies and their sponsors; and (vi) provide the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its assets. The Adviser shall have the power and authority on behalf of the Company to effectuate its investment decisions for the Company, including the execution and delivery of all documents relating to the Company's investments and the placing of orders for other purchase or sale transactions on behalf of the Company.

In the event that the Company determines to acquire debt financing or to refinance existing debt financing, the Adviser shall arrange for such financing on the Company's behalf, subject to the oversight and approval of the Board of Directors.

If it is necessary or convenient for the Adviser to make investments on behalf of the Company through a subsidiary or special purpose vehicle or to otherwise form such subsidiary or special purpose vehicle, the Adviser shall have authority to create or arrange for the creation of such subsidiary or special purpose vehicle and to make such investments through such subsidiary or special purpose vehicle in accordance with the Investment Company Act.

(b) The Adviser hereby accepts such retention as investment adviser and agrees during the term hereof to render the services described herein for the amounts of compensation provided herein.

(c) Subject to the requirements of the Investment Company Act, the Adviser is hereby authorized, but not required, to enter into one or more sub-advisory agreements with other investment advisers (each, a "Sub-Adviser") pursuant to which the Adviser may obtain the services of the Sub-Adviser(s) to assist the Adviser in fulfilling its responsibilities hereunder. Specifically, the Adviser may retain a Sub-Adviser to recommend specific securities or other investments based upon the Company's investment objective and policies, and work, along with the Adviser, in structuring, negotiating, arranging or effecting the acquisition or disposition of such investments and monitoring investments on behalf of the Company, subject in all cases to the oversight of the Adviser and the Company. The Adviser, and not the Company, shall be responsible for any compensation payable to any Sub-Adviser. Any sub-advisory agreement entered into by the Adviser shall be in accordance with the requirements of the Investment Company Act, the Advisers Act and other applicable federal and state law.

(d) For all purposes herein provided, the Adviser shall be deemed to be an independent contractor and, except as expressly provided or authorized herein, shall have no authority to act for or represent the Company in any way or otherwise be deemed an agent of the Company.

(e) The Adviser shall keep and preserve, in the manner and for the period that would be applicable to investment companies registered under the Investment Company Act, any books and records relevant to the provision of its investment advisory services to the Company, shall specifically maintain all books and records with respect to the Company's portfolio transactions and shall render to the Board of Directors such periodic and special reports as the Board of Directors may reasonably request. The Adviser agrees that all records that it maintains for the Company are the property of the Company and shall surrender promptly to the Company any such records upon the Company's request, provided that the Adviser may retain a copy of such records.

2. The Company's Responsibilities and Expenses Payable by the Company. All investment professionals of the Adviser and their respective staffs, when and to the extent engaged in providing investment advisory and management services hereunder, and the compensation and routine overhead expenses of such personnel allocable to such services, shall be provided and paid for by the Adviser and not by the Company.

Except as provided herein or in another agreement between the Company and the Adviser, the Company shall bear all other costs and expenses of its operations and transactions, including those relating to: (a) the Company's organization and offering costs in excess of $1.0 million; (b) the Base Management Fee (as defined below) and any Incentive Fee (as defined below); (c) calculating the Company's net asset value, including the cost of any third-party valuation services and software; (d) the cost of effecting sales and repurchases of shares of the Company's common stock and other securities (except to the extent covered by clause (a) above); (e) fees payable to third parties relating to, or associated with, making investments, including fees and expenses associated with performing due diligence and reviews of prospective investments or complementary businesses, whether or not the investment is consummated; (f) expenses incurred by the Adviser in performing due diligence and reviews of investments; (g) research expenses incurred by the Adviser (including subscription fees and other costs and expenses related to Bloomberg Professional Services); (h) amounts incurred by the Adviser in connection with or incidental to acquiring or licensing software and obtaining research; (i) distributions on the Company's common stock; (j) expenses related to leverage, if any, incurred to finance the Company's investments, including rating agency fees, interest, preferred stock dividends, obtaining lines of credit, loan commitments and letters of credit for the account of the Company and its related entities; (k) transfer agent and custodial fees and expenses; (l) bank service fees; (m) fees and expenses associated with marketing efforts; (n) federal and state registration fees and any stock exchange listing fees; (o) fees and expenses associated with independent audits and outside legal costs; (p) federal, state, local and foreign taxes (including real estate, stamp or other transfer taxes), including costs in connection with any tax audit, investigation or review, or any settlement thereof; (q) complying with Sections 1471 through 1474 of the Code (generally referred to as "FATCA") and/or any foreign account reporting regimes and certain regulations and other administrative guidance thereunder, including the Common Reporting Standard issued by the Organisation for Economic Cooperation and Development, or similar legislation, regulations or guidance enacted in any other jurisdiction, which seeks to implement tax reporting and/or withholding tax regimes as well as any intergovernmental agreements and other laws of other jurisdictions with similar effect; (r) fees and expenses of directors who are not "interested persons" (as defined in Section 2(a)(19) of the Investment Company Act) of the Company or the Adviser; (s) brokerage fees and commissions; (t) fidelity bond, directors and officers, errors and omissions liability insurance and other insurance premiums; (u) the costs of any reports, proxy statements or other notices to the Company's stockholders, including printing costs; (v) costs of holding stockholder meetings; (w) litigation, indemnification and other non-recurring or extraordinary expenses; (x) any governmental inquiry, investigation or proceeding to which the Company and/or an investment is a related party or is otherwise involved, including judgments, fines, other awards and settlements paid in connection therewith; (y) other direct costs and expenses of administration and operation, such as printing, mailing, long distance telephone and staff; (z) costs associated with the Company's reporting and compliance obligations, including under the Investment Company Act and applicable federal and state securities laws (including reporting under Sections 13 and 16 under the Securities Exchange Act of 1934, as amended, and anti-money laundering compliance); (aa) dues, fees and charges of any trade association of which the Company is a member; (bb) costs associated with the formation, management, governance, operation, restructuring, maintenance (including any amendments to constituent documents), winding up, dissolution or liquidation of entities; (cc) fees, costs and expenses incurred in connection with or incidental to co-investments or joint ventures (whether or not consummated) that are not borne by co-investors or joint venture partners; (dd) the allocated costs incurred by the Adviser in its capacity as administrator (the "Administrator") in providing managerial assistance to those portfolio companies that request it; and (ee) all other expenses incurred by either the Administrator or the Company in connection with administering the Company's business, including payments under the administration agreement dated as of March 18, 2022 (as amended from time to time, the "Administration Agreement") that will be based upon the Company's allocable portion of overhead, and other expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including the fees of any sub-administrator, rent, technology systems (including subscription fees and other costs and expenses related to Bloomberg Professional Services and the Adviser's third-party Order Management System), insurance and the Company's allocable portion of the cost of compensation and related expenses of its chief compliance officer and chief financial officer and their respective staffs.

3. Compensation of the Adviser. The Company agrees to pay, and the Adviser agrees to accept, as compensation for the investment advisory and management services provided by the Adviser hereunder, a base management fee (the "Base Management Fee") and an incentive fee (the "Incentive Fee"), each as hereinafter set forth. The Company shall make any payments due hereunder to the Adviser or to the Adviser's designee as the Adviser may otherwise direct. To the extent permitted by applicable law, the Adviser may elect, or the Company may adopt a deferred compensation plan pursuant to which the Adviser may elect, to defer all or a portion of its fees hereunder for a specified period of time.

(a) The Base Management Fee shall be calculated at a quarterly rate equal to 0.375% (i.e., 1.50% annually) of the Company’s Weighted Average Net Asset Value for the quarter; provided that the quarterly base management fee will be decreased to 0.25% (i.e., 1.00% annually) of the value of the Company’s Weighted Average Net Asset Value during any extension of the period in which the Company may complete a listing of shares of the Company’s common stock on a national securities exchange or a merger or other transaction in which investors receive cash or shares of a publicly-listed issuer. “Weighted Average Net Asset Value” means, at the time of any calculation, the weighted average shares outstanding multiplied by the average of the beginning net asset value per share and ending net asset value per share (prior to management and incentive fees) of a period of time.

(b) The Incentive Fee shall consist of two parts, as follows:

| | (i) | One part of the Incentive Fee (the "Income Incentive Fee") will be calculated and payable quarterly in arrears based on the Pre-Incentive Fee Net Investment Income for the immediately preceding calendar quarter. For this purpose, Pre-Incentive Fee Net Investment Income means interest income, dividend income and any other income, including any other fees (other than fees for providing managerial assistance, such as amendment, commitment, origination, prepayment penalties, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies, accrued during the calendar quarter, minus the Company's operating expenses for the quarter (including the Base Management Fee, any expenses payable under the Administration Agreement and any interest expense or amendment fees under any credit facility and distributions paid on any issued and outstanding preferred stock, but excluding the Incentive Fee). Pre-Incentive Fee Net Investment Income includes, in the case of investments with a deferred interest feature (such as original issue discount, payment-in-kind interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. |

Pre-Incentive Fee Net Investment Income, expressed as a percentage of the value of the Company's net assets at the end of the immediately preceding calendar quarter, will be compared to a hurdle. The Company will pay the Adviser an Income Incentive Fee with respect to each calendar quarter as follows:

| | · | no Income Incentive Fee for any calendar quarter in which Pre-Incentive Fee Net Investment Income does not exceed the hurdle rate of one and a half percent (1.50%) per quarter (6.00% annualized); |

| | | |

| | · | one hundred percent (100%) of Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate but is less than the percentage at which amounts payable to the Adviser pursuant to the income incentive fee equal fifteen percent (15%) of the Company's Pre-Incentive Fee Net Investment Income as if a hurdle rate did not apply. This portion of the Pre-Incentive Fee Net Investment Income (which exceeds the hurdle rate but is less than 1.76%) is referred to as the "catch-up." The "catch-up" is meant to provide the Adviser with 15% of the Company's Pre-Incentive Fee Net Investment Income as if a hurdle rate did not apply; and |

| | · | fifteen percent (15%) of the amount of the Company's Pre-Incentive Fee Net Investment Income, if any, that exceeds 1.76% in any calendar quarter (7.04% annualized). |

These calculations will be pro rated for any period of less than a full calendar quarter and will be adjusted for share issuances or repurchases during the relevant quarter, if applicable.

| | (ii) | The second part of the Incentive Fee (the "Capital Gains Fee") will be determined and payable in arrears as of the end of each calendar year (or upon termination of this Agreement as set forth below) and will equal 15% of the Company's cumulative aggregate realized capital gains from the date of this Agreement through the end of that calendar year, computed net of the Company's cumulative realized capital losses and the Company's cumulative unrealized capital depreciation through the end of such year, less the aggregate amount of any previously paid Capital Gains Fees. In the event that this Agreement shall terminate as of a date that is not a calendar year end, the termination date shall be treated as though it were a calendar year end for purposes of calculating and paying a Capital Gains Fee. |

The Company shall accrue the Capital Gains Fee if, on a cumulative basis, the sum of net realized gains/(losses) plus net unrealized appreciation/ (depreciation) is positive.

4. Covenants of the Adviser. The Adviser hereby covenants that it is registered as an investment adviser under the Advisers Act. The Adviser hereby agrees that its activities shall at all times be in compliance in all material respects with all applicable federal and state laws governing its operations and investments.

5. Excess Brokerage Commissions. The Adviser is hereby authorized, to the fullest extent now or hereafter permitted by law, to cause the Company to pay a member of a national securities exchange, broker or dealer an amount of commission for effecting a securities transaction in excess of the amount of commission another member of such exchange, broker or dealer would have charged for effecting such transaction if the Adviser determines, in good faith and taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm's risk and skill in positioning blocks of securities, that the amount of such commission is reasonable in relation to the value of the brokerage and/or research services provided by such member, broker or dealer, viewed in terms of either that particular transaction or its overall responsibilities with respect to the Company's portfolio, and constitutes the best net result for the Company.