UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | | | | | | | |

| (Mark One) | | |

| ☐ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2021 |

| OR |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☐ | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-41313

Brookfield Business Corporation

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

250 Vesey Street, 15th Floor

New York, NY 10281

United States

(Address of principal executive offices)

A.J. Silber

250 Vesey Street, 15th Floor

New York, NY 10281

United States

Tel: (212) 417-7000

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Class A Exchangeable Subordinate Voting Shares | BBUC | New York Stock Exchange, Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

73,008,085 Class A Exchangeable Subordinate Voting Shares as of March 18, 2022

NaN Class B Multiple Voting Share as of March 18, 2022

25,934,120 Class C Non-Voting Shares as of March 18, 2022

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of “accelerated filer”, “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý | | Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | | | | | | | |

o U.S. GAAP | | ý International Financial Reporting Standards as issued by the International Accounting Standards Board | | o Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Table of Contents

| | | | | |

| Brookfield Business Corporation | i |

| | | | | |

| ii | Brookfield Business Corporation |

INTRODUCTION AND USE OF CERTAIN TERMS

We have prepared this Form 20-F using a number of conventions, which you should consider when reading the information contained herein. Unless otherwise indicated or the context otherwise requires, in this Form 20-F all financial information is presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

In this Form 20-F, unless the context suggests otherwise, references to “we”, “us”, “our” and “our company” mean Brookfield Business Corporation together with all of its subsidiaries. References to “Brookfield Business Partners” means the partnership collectively with Holding LP, the Holding Entities and the operating businesses (but excluding our company). References to “our group” mean, collectively, our company and Brookfield Business Partners. Unless the context suggests otherwise, in this Form 20-F references to:

•“articles” means the notice of articles and articles of our company;

•“assets under management” mean assets managed by us or by Brookfield on behalf of our third-party investors, as well as our own assets, and also include capital commitments that have not yet been drawn. Our calculation of assets under management may differ from that employed by other asset managers and, as a result, this measure may not be comparable to similar measures presented by other asset managers;

•“backlog” represents an estimate of revenues to be recognized in future financial periods from contracts currently secured. Backlog is not indicative of future revenues, as we cannot guarantee that the revenues projected in our backlog will be realized or that it will exceed cost and generate profit. Projects may remain in our backlog for an extended period of time. Furthermore, variations in projects may occur with respect to contracts included in our backlog that could reduce the dollar amount of our backlog and the revenues and profits that we eventually realize;

•“BBUC” means Brookfield Business Corporation;

•“BCBCA” means the Business Corporations Act (British Columbia);

•“BRK Ambiental” means BRK Ambiental Participações S.A.;

•“Brookfield” means Brookfield Asset Management and any subsidiary of Brookfield Asset Management, other than us;

•“Brookfield Accounts” means Brookfield-sponsored vehicles, consortiums and/or partnerships (including private funds, joint ventures and similar arrangements);

•“Brookfield Asset Management” means Brookfield Asset Management Inc.;

•“Brookfield Brazil” means Brookfield Brasil Asset Management Investmentos Ltda.;

•“Brookfield Business Partners” means the partnership collectively with Holding LP, the Holding Entities, and any other direct or indirect subsidiary of a Holding Entity (but excluding our company);

•“Brookfield Personnel” means the partners, members, shareholders, directors, officers and employees of Brookfield;

•“Business” means the initial services and industrial operations acquired by our company immediately prior to the special distribution, consisting of Healthscope, Multiplex, BRK Ambiental and a portion of its indirect interest in Westinghouse;

•“CDS” means Clearing and Depository Services Inc.;

•“class B shares” means the class B multiple voting shares in the capital of our company and “class B share” means any one of them;

•class C shares” means the class C non-voting shares in the capital of our company and “class C share” means any one of them;

•“CODM” means Chief Operating Decision Maker;

•“company” means Brookfield Business Corporation;

•“consortium” means our company and the various institutional clients of Brookfield Asset Management;

•“CRA” means the Canada Revenue Agency;

•“distribution date” means March 15, 2022;

| | | | | |

| Brookfield Business Corporation | 1 |

•“DTC” means the Depository Trust Company;

•“ESG” means environmental, social and governance;

•“exchangeable shares” means the class A exchangeable subordinate voting shares of BBUC;

•“general partner of the partnership” means Brookfield Business Partners Limited, a wholly-owned subsidiary of Brookfield Asset Management;

•“Healthscope” means Healthscope Pty Limited;

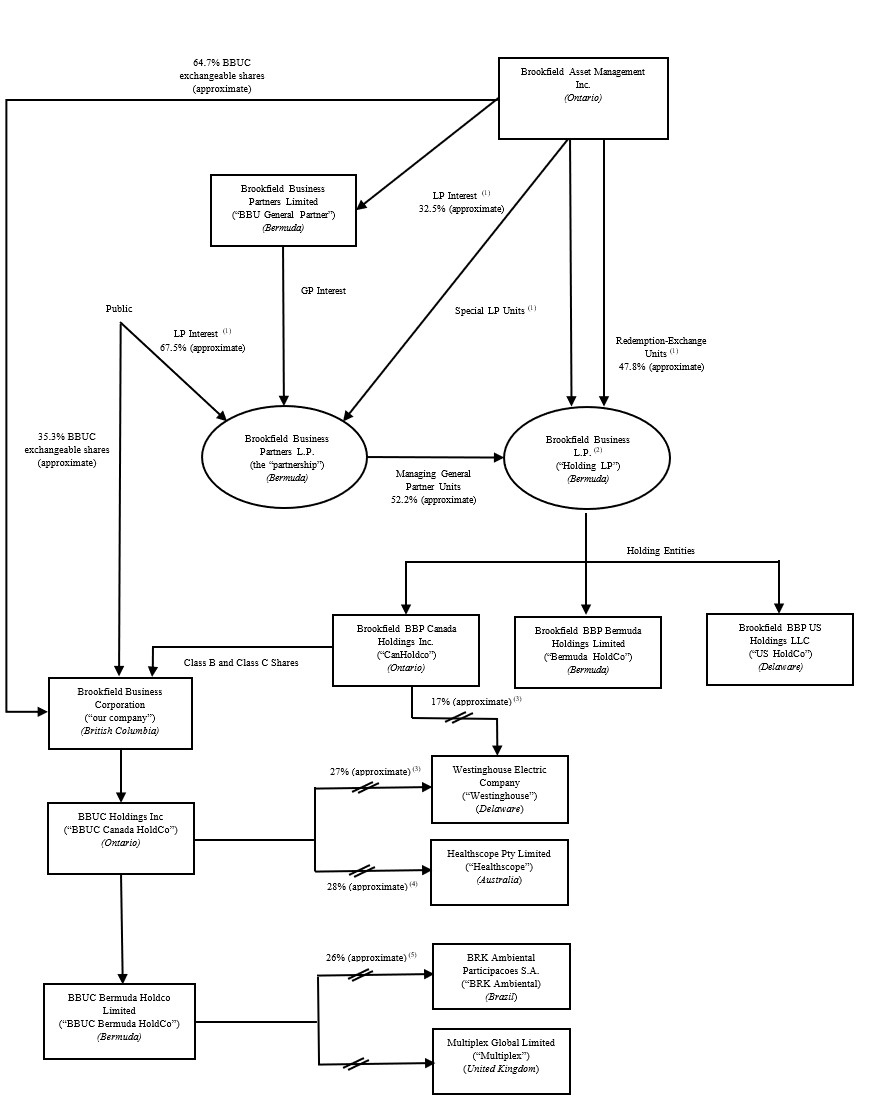

•“Holding Entities” means the primary holding subsidiaries of the Holding LP, from time to time, through which it indirectly holds all of our interests in our operating businesses, including Brookfield BBP Canada Holdings Inc., Brookfield BBP US Holdings LLC and Brookfield BBP Bermuda Holdings Limited;

•“Holding LP” means Brookfield Business L.P.;

•“Holding LP Limited Partnership Agreement” means the amended and restated limited partnership agreement of the Holding LP;

•“IASB” means the International Accounting Standards Board;

•“IBOR” means interbank offered rate;

•“IFRIC 23” means IFRIC 23, Uncertainty over Income Tax Treatments;

•“IFRS” means the International Financial Reporting Standards as issued by the IASB;

•“IFRS 3” means IFRS 3, Business combinations;

•“IFRS 8” means IFRS 8, Operating segments;

•“IFRS 16” means IFRS 16, Leases;

•“IFRS 17” means IFRS 17, Insurance contracts;

•“incentive distribution” means the distribution payable to holders of Special LP Units as described under “Related Party Transactions-Incentive Distributions”;

•“LIBOR” means the London Interbank offered rate;

•“Licensing Agreement” means the licensing agreement which the partnership and the Holding LP have entered into;

•“Managing General Partner Units” means the general partner interests in the Holding LP having the rights and obligations specified in the Holding LP Limited Partnership Agreement;

•“Master Services Agreement” means the master services agreement among the Service Recipients, the Service Providers, and certain other subsidiaries of Brookfield Asset Management who are parties thereto;

•“MD&A” means the management’s discussion and analysis of financial conditions and results of operations;

•“MI 61-101” means Multilateral Instrument 61-101-Protection of Minority Security Holders in Special Transactions;

•“Multiplex” means Multiplex Global Limited;

•“NI 51-102” means National Instrument 51-102-Continuous Disclosure Obligations;

•“Non-Resident Subsidiaries” means the subsidiaries of Holding LP that are corporations and that are not resident or deemed to be resident in Canada for purposes of the Tax Act;

•“Non-U.S. Holder” means a beneficial owner of one or more exchangeable shares, other than a U.S. Holder or an entity classified as a partnership or other fiscally transparent entity for U.S. federal tax purposes;

•“NRC” means the U.S. Nuclear Regulatory Commission;

•“NYSE” means New York Stock Exchange;

•“Oaktree” means Oaktree Capital Group, LLC together with its affiliates;

| | | | | |

| 2 | Brookfield Business Corporation |

•“Oaktree Accounts” means Oaktree-managed funds and accounts;

•“OEM” means original equipment manufacturer;

•“operating businesses” means the businesses in which the Holding Entities hold interests and that directly or indirectly hold our operations and assets other than entities in which the Holding Entities hold interests for investment purposes only of less than 5% of the equity securities;

•“our operations” means the business services and industrial operations we own;

•“PAA” means Price-Anderson Act;

•“partnership” means Brookfield Business Partners L.P., except as the context otherwise requires;

•“partnership limited partnership agreement” means the amended and restated limited partnership agreement of the partnership;

•“PRI” means Principles for Responsible Investment;

•“Redemption-Exchange Mechanism” means the mechanism by which Brookfield may request redemption of its Redemption-Exchange Units in whole or in part in exchange for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for units of our company;

•“Redemption-Exchange Units” means the non-voting limited partnership interests in the Holding LP that are redeemable for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for units of our company, pursuant to the Redemption-Exchange Mechanism;

•“Relationship Agreement” means the relationship agreement dated June 1, 2016 by and among Brookfield, the partnership, Holding LP, the Holding Entities and the Service Providers as amended in connection with the special distribution;

•“Rights Agreement” means the right agreement dated as of March 15, 2022, by and between Brookfield Asset Management Inc. and Wilmington Trust, National Association;

•“RFR” means risk-free interest rate;

•“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended;

•“SEC” means the U.S. Securities and Exchange Commission;

•“Service Providers” means the affiliates of Brookfield that provide services to us pursuant to our Master Services Agreement, which are expected to be Brookfield Asset Management (Barbados) Inc., Brookfield Asset Management Private Institutional Capital Adviser (Private Equity), L.P., Brookfield Canadian Business Advisor L.P., Brookfield BBP Canadian GP L.P. and Brookfield Global Business Advisors Limited, which are wholly-owned subsidiaries of Brookfield Asset Management, and unless the context otherwise requires, any other affiliate of Brookfield that is appointed by Brookfield Global Business Advisor Limited from time to time to act as a Service Provider pursuant to our Master Services Agreement or to whom the Service Providers have subcontracted for the provision of such services;

•“Service Recipients” means our company, the partnership, the Holding LP, the Holding Entities and, at the option of the Holding Entities, any wholly-owned subsidiary of a Holding Entity excluding any operating business;

•“SOFR” means secured overnight financing rate;

•“SONIA” means Sterling Overnight Index Average;

•“shareholder” means a holder of exchangeable shares;

•“special distribution” means the special distribution of exchangeable shares on March 15, 2022 by the partnership to holders of units of record as of March 7, 2022, as further described in Item 4.A., “History and Development of Our Company”;

•“Special LP Units” means special limited partnership units of the Holding LP;

•“Tax Act” means the Income Tax Act (Canada), together with the regulation thereunder;

•“TCFD” means the Task Force on Climate-related Financial Disclosures;

| | | | | |

| Brookfield Business Corporation | 3 |

•“TSX” means the Toronto Stock Exchange;

•“unitholders” means the holders of the partnership’s units;

•“units” or “LP Units” means the non-voting publicly traded limited partnership units of the partnership;

•“U.S. Holder” means a beneficial owner of one or more of our exchangeable shares that is for U.S. federal tax purposes (i) an individual citizen or resident of the United States; (ii) a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust (a) that is subject to the primary supervision of a court within the United States and all substantial decisions of which one or more U.S. persons have the authority to control or (b) that has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person; and

•“Westinghouse” means Westinghouse Electric Company.

Historical Performance and Market Data

This Form 20-F contains information relating to our business as well as historical performance and market data for Brookfield Asset Management and certain of its operating platforms. When considering this data, you should bear in mind that historical results and market data may not be indicative of the future results that you should expect from us.

Financial Information

The financial information contained in this Form 20-F is presented in United States dollars and, unless otherwise indicated, has been prepared in accordance with IFRS. All figures are unaudited unless otherwise indicated. In this Form 20-F, all references to “$” are to United States dollars, references to “£” are to British Pounds, references to “€” are to Euros and references to “C$” are to Canadian dollars.

| | | | | |

| 4 | Brookfield Business Corporation |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws, including the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of our group, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets”, “projects”, “forecasts”, “views”, “potential”, “likely”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause the actual results, performance or achievements of our group to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to:

•our limited operating history;

•the impact or unanticipated impact of general economic, political and market factors in the countries in which our group does business; including as a result of the ongoing novel coronavirus (SARS-CoV-2) pandemic and any SARS-CoV-2 variants (collectively, “COVID-19”);

•the behavior of financial markets, including fluctuations in interest and foreign exchange rates, global equity and capital markets and the availability of equity and debt financing and refinancing within these markets;

•strategic actions including dispositions;

•the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits;

•changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting assumptions and estimates);

•the effect of applying future accounting changes;

•the ability to appropriately manage human capital;

•business competition;

•operational and reputational risks;

•technological change;

•changes in government regulation and legislation within the countries in which our group operates;

•governmental investigations;

•litigation;

•changes in tax laws;

•ability to collect amounts owed;

•catastrophic events, such as earthquakes, hurricanes and pandemics/epidemics;

| | | | | |

| Brookfield Business Corporation | 5 |

•the redemption of exchangeable shares by the company at any time or upon notice from the holder of the class B shares;

•the possible impact of international conflicts and other developments including terrorist acts and cyber terrorism; and

•other risks and factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States.

In addition, our future results may be impacted by various government-mandated economic restrictions resulting from the ongoing COVID-19 pandemic and the related global reduction in commerce and travel and substantial volatility in stock markets worldwide, which may negatively impact our revenues, affect our ability to identify and complete future transactions, impact our liquidity position and result in a decrease of cash flows and impairment losses and/or revaluations on our investments and assets, and therefore we may be unable to achieve our expected returns. See Item 3.D., “Risk Factors - Risks Relating to our Operations Generally - Risks Relating to the COVID-19 Pandemic” in this Form 20-F.

Statements relating to “reserves” are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described herein can be profitably produced in the future. We qualify any and all of our forward-looking statements by these cautionary factors.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

Each exchangeable share has been structured with the intention of providing an economic return equivalent to one unit. We therefore expect that the market price of the exchangeable shares will be impacted by the market price of units and the combined business performance of our group as a whole. In addition to carefully considering the disclosure made in this Form 20-F, you should carefully consider the disclosure made by Brookfield Business Partners in its continuous disclosure filings. Copies of the partnership’s continuous disclosure filings will be available electronically on EDGAR on the SEC’s website at www.sec.gov or SEDAR at www.sedar.com.

These risk factors and others are discussed in detail in this Form 20-F, under the heading “Risk Factors”. New risk factors may arise from time to time and it is not possible to predict all of those risk factors or the extent to which any factor or combination of factors may cause actual results, performance or achievements of the partnership to be materially different from those contained in forward-looking statements or information. Given these risks and uncertainties, investors and other readers should not place undue reliance on forward-looking statements or information as a prediction of actual results. Although the forward-looking statements and information contained in this Form 20-F are based upon what we believe to be reasonable assumptions, we cannot assure investors that actual results will be consistent with these forward-looking statements and information, particularly in light of government mandated economic restrictions resulting from the COVID-19 pandemic in certain jurisdictions in which we operate. These forward-looking statements and information are made as of the date of this Form 20-F.

| | | | | |

| 6 | Brookfield Business Corporation |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A. [RESERVED]

3.B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

3.C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

3.D. RISK FACTORS

Your holding of exchangeable shares of our company involves substantial risks. The following summarizes some, but not all of the risks provided below. You should carefully consider the following risk factors in addition to the other information set forth in this Form 20-F. If any of the following risks were actually to occur, our business, financial condition and results of operations and the value of your exchangeable shares would likely suffer. Each exchangeable share has been structured with the intention of providing an economic return equivalent to one unit of the partnership. We therefore expect that the market price of our exchangeable shares will be significantly impacted by the market price of the units and the combined business performance of our group as a whole. In addition to carefully considering the risk factors contained in this Form 20-F and described below, you should carefully consider the risk factors applicable to Brookfield Business Partners’ business and an investment in units, described in the partnership’s annual report on Form 20-F.

Risks Relating to our Company

•Risks relating to the intended structural equivalence of the exchangeable shares with the units.

•Risks relating to our lack of separate operating history, including our ability to maintain effective internal controls.

•Risks related to our company’s status as a “foreign private issuer” under U.S. securities laws.

•Risks relating to our company’s future operations.

•Risks relating to our company’s completion of new acquisitions.

•Risks relating to the possibility of our company becoming an investment company under U.S. securities laws.

Risks Relating to the Exchangeable Shares

•Risks relating to our group’s ability to redeem our exchangeable shares at any time.

•Risks relating to the trading price of our exchangeable shares relative to the units.

•Risks relating to the liquidity and de-listing of our exchangeable shares.

•Risks relating to possible future dilution of units upon the exchange of our exchangeable shares.

•Risks relating to additional issuances of exchangeable shares and/or units, or other securities that have rights and privileges that are more favorable than the rights and privileges afforded to our shareholders.

•Risks relating to the possibility that any dividends received by the holders of our exchangeable shares may not be equal to the distributions paid on the units.

•Risks relating to foreign currency exchanges.

•Risks relating to differing laws in effect in Canada and Bermuda.

| | | | | |

| Brookfield Business Corporation | 7 |

Risks Relating to our Business Services Operations

•Risks relating to the healthcare services business and its dependence on revenues from private health insurance funds and its relationships with accredited medical practitioners.

•Risks relating to the healthcare services operations reliance on suppliers and skilled labor.

•Risks relating to indemnification for our healthcare services operations.

•Risks relating to operating costs and maintaining operations of the healthcare services operations.

•Risks relating to the cyclical nature of the construction market.

•Risks relating to the unpredictable award of new contracts in the construction market.

•Risks relating to reduced profits or losses under contracts if costs increase above estimates.

•Risks relating to performance guarantees and operating under various types of construction-related contracts.

•Risks relating to macroeconomic factors and climate change affecting our construction operations.

Risks Relating to our Infrastructure Services Operations

•Risks relating to the public perception of nuclear power.

•Risks related to nuclear power plants, the nuclear power industry and our nuclear technology services operations, including nuclear services regulation.

Risks Relating to our Industrials Operations

•Risks relating to our water, wastewater and industrial water treatment businesses in Brazil.

•Risks relating to the dependence on supplies of raw materials.

•Risks relating to the Brazilian government’s control over the Brazilian economy and Brazilian corporations.

Risks Relating to our Relationship with Brookfield and Brookfield Business Partners

•Risks relating to senior executives of Brookfield exercising influence over our company.

•Risks relating to our reliance on Brookfield’s ability to identify and present our company with acquisitions.

•Risks relating to our dependence on Brookfield and its personnel under our arrangements with Brookfield.

•Risks relating to Brookfield and Brookfield Business Partners’ control over a significant percentage of our outstanding securities.

•Risks relating to Brookfield’s lack of fiduciary duty to our shareholders or the partnership’s unitholders.

•Risks relating to our organizational, ownership and operational management structure potentially creating conflicts of interest.

Risks Related to Taxation

•Risks related to United States, Canadian and Bermuda taxation, and the effects thereof on our business.

| | | | | |

| 8 | Brookfield Business Corporation |

Risks Relating to our Operations Generally

•Risks relating to completion of new acquisitions and changes to the scale and scope of our group’s operations.

•Risks relating to identifying acquisition opportunities and acquiring distressed companies.

•Risks relating to the COVID-19 pandemic.

•Risks relating to Russia’s ongoing military conflict with Ukraine.

•Risks related to our group’s indebtedness and our group’s ability to distribute equity.

•Risks relating to our group’s access to the credit and capital markets and our group’s ability to raise capital.

•Risks relating to the structure of our group’s operations and our level of control over our group’s operations.

Risks Relating to our Company

Each exchangeable share has been structured with the intention of providing an economic return equivalent to one unit and therefore we expect that the market price of our exchangeable shares will be significantly impacted by the market price of the units and the combined business performance of our group as a whole.

Each exchangeable share has been structured with the intention of providing an economic return equivalent to one unit. Our company will target to pay dividends per exchangeable share that are identical to the distributions per unit, and each exchangeable share is exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company). See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares - Exchange by Holder - Adjustments to Reflect Certain Capital Events”. Our group currently intends to satisfy any exchange requests on the exchangeable shares through the delivery of units rather than cash. As a result, the business operations of Brookfield Business Partners, and the market price of the units, are expected to have a significant impact on the market price of the exchangeable shares, which could be disproportionate in circumstances where the business operations and results of our company on a standalone basis are not indicative of such market trends. Exchangeable shareholders will have no ability to control or influence the decisions or business of Brookfield Business Partners. You should therefore carefully consider the risk factors applicable to Brookfield Business Partners’ business and an investment in units, as described in the partnership’s Annual Report. For additional information regarding Brookfield Business Partners, see Item 7.B., “Related Party Transactions - Brookfield Business Partners”.

Our company is a newly formed corporation with limited separate operating history and the historical information included herein does not reflect the financial condition or operating results we would have achieved during the periods presented, and therefore may not be a reliable indicator of our future financial performance.

Our company was formed on June 21, 2021 and has only recently commenced its activities. Although our assets and operating businesses have been under Brookfield Business Partners’ control prior to the formation of our company, their combined results have not previously been reported on a stand-alone basis and any historical and pro forma financial statements may not be indicative of our future financial condition or operating results and will make it difficult to assess our ability to operate profitably and pay dividends to our shareholders.

The material assets of our company consist solely of interests in our operating subsidiaries.

Our company has no independent means of generating revenue. As a result, we depend on distributions and other payments from our operating businesses to provide our company with the funds necessary to meet our financial obligations. Our operating businesses are legally distinct from our company and some of them are or may become restricted in their ability to pay dividends and distributions or otherwise make funds available to our company pursuant to local law, regulatory requirements and their contractual agreements, including agreements governing their financing arrangements. Our operating businesses will generally be required to satisfy their own working capital requirements and service any debt obligations before making distributions to our company.

| | | | | |

| Brookfield Business Corporation | 9 |

Our company is a “foreign private issuer” under U.S. securities law. Therefore, we are exempt from requirements applicable to U.S. domestic registrants listed on the NYSE.

Although our company is subject to the periodic reporting requirements of the Exchange Act, the periodic disclosure required of foreign private issuers under the Exchange Act is different from periodic disclosure required of U.S. domestic registrants. Therefore, there may be less publicly available information about our company than is regularly published by or about other companies in the United States. Our company is exempt from certain other sections of the Exchange Act to which U.S. domestic issuers are subject, including the requirement to provide our shareholders with information statements or proxy statements that comply with the Exchange Act. In addition, insiders and large shareholders of our company are not obligated to file reports under Section 16 of the Exchange Act, and we are permitted to follow certain home country corporate governance practices (being Bermuda and British Columbia for the partnership and the company, respectively) instead of those otherwise required under the NYSE Listed Company Manual for domestic issuers. We currently follow the same corporate practices as would be applicable to U.S. domestic companies under the U.S. federal securities laws and NYSE corporate governance standards (being Bermuda and British Columbia for the partnership and the company, respectively); however, as our company is externally managed by the Service Providers pursuant to the Master Services Agreement and is a foreign private issuer, we will not have a compensation committee. However, we may in the future elect to follow our home country law for certain of our other corporate governance practices (being Bermuda and British Columbia for the partnership and our company, respectively), as permitted by the rules of the NYSE, in which case our shareholders would not be afforded the same protection as provided under NYSE corporate governance standards to U.S. domestic registrants. Following our home country governance practices as opposed to the requirements that would otherwise apply to a U.S. domestic company listed on the NYSE may provide less protection than is accorded to investors of U.S. domestic issuers.

Our company’s operations in the future may be different than our current business.

Our company’s current operations consist of interests in Healthscope, Westinghouse, Multiplex and BRK Ambiental, representing a portion of Brookfield Business Partners’ operations. Brookfield Business Partners currently has four operating segments: (i) business services, including residential mortgage insurance services, healthcare services, road fuel distribution and marketing, real estate and construction services, entertainment, financing services, and other businesses; (ii) infrastructure services, which includes services to the nuclear power generation industry and offshore oil production industry, and access, forming and shoring solutions and specialized services; (iii) industrials, which includes automotive batteries, graphite electrode and other manufacturing, water and wastewater services, natural gas production and well servicing, and a variety of other industrial operations; and (iv) corporate and other, which includes corporate cash and liquidity management, and activities related to the management of the partnership’s relationship with Brookfield. Brookfield Business Partners and our company may own interests in other operating subsidiaries in the future. The risks associated with the operations of Brookfield Business Partners, or our future operations, may differ from those associated with the Business.

The completion of new acquisitions can have the effect of significantly increasing the scale and scope of our group’s operations, including operations in new geographic areas and industry sectors, and the Service Providers may have difficulty managing these additional operations. In addition, acquisitions involve risks to our business.

A key part of our group’s strategy involves seeking acquisition opportunities upon Brookfield’s recommendation and allocation of opportunities to our group. Acquisitions may increase the scale, scope and diversity of our operating businesses. We depend on the diligence and skill of Brookfield’s and our professionals to effectively manage our company and integrate acquired businesses with our existing operations. These individuals may have difficulty managing additional acquired businesses and may have other responsibilities within Brookfield’s asset management business. If any such acquired businesses are not effectively integrated and managed, our existing business, financial condition and results of operations may be adversely affected.

Future acquisitions will likely involve some or all of the following risks, which could materially and adversely affect our business, financial condition or results of operations: the difficulty of integrating the acquired operations and personnel into our current operations; potential disruption of our current operations; diversion of resources, including Brookfield’s time and attention; the difficulty of managing the growth of a larger organization; the risk of entering markets in which we have little experience; the risk of becoming involved in labor, commercial or regulatory disputes or litigation related to the new enterprise; risk of environmental or other liabilities associated with the acquired business; and the risk of a change of control resulting from an acquisition triggering rights of third parties or government agencies under contracts with, or authorizations held by the operating business being acquired. While it is our practice to conduct extensive due diligence investigations into businesses being acquired, it is possible that due diligence may fail to uncover all material risks in the business being acquired, or to identify a change of control trigger in a material contract or authorization, or that a contractual counterparty or government agency may take a different view on the interpretation of such a provision to that taken by our company, thereby resulting in a dispute.

| | | | | |

| 10 | Brookfield Business Corporation |

Our company is not, and does not intend to become, regulated as an investment company under the Investment Company Act of 1940, or the Investment Company Act (and similar legislation in other jurisdictions) and, if our company were deemed an “investment company” under the Investment Company Act, applicable restrictions could make it impractical for our company to operate as contemplated.

The Investment Company Act (and similar legislation in other jurisdictions) provides certain protections to investors and imposes certain restrictions on companies that are required to be regulated as investment companies. Among other things, such rules limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities and impose certain governance requirements. Our company has not been and does not intend to become regulated as an investment company and our company intends to conduct its activities so it will not be deemed to be an investment company under the Investment Company Act (and similar legislation in other jurisdictions). In order to ensure that we are not deemed to be an investment company, we may be required to materially restrict or limit the scope of our operations or plans. We will be limited in the types of acquisitions that we may make, and we may need to modify our organizational structure or dispose of assets which we would not otherwise dispose of. Moreover, if anything were to happen which would cause our company to be deemed an investment company under the Investment Company Act, it would be impractical for our company to operate as contemplated. Agreements and arrangements between and among our company and Brookfield would be impaired, the type and number of acquisitions that we would be able to make as a principal would be limited and our business, financial condition and results of operations would be materially adversely affected. Accordingly, we would be required to take extraordinary steps to address the situation, such as the amendment or termination of the Master Services Agreement, the restructuring of our company (including our operating subsidiaries), the amendment of our governing documents or the dissolution of our company, any of which could materially adversely affect the value of the exchangeable shares.

Our failure to maintain effective internal controls could have a material adverse effect on our business in the future and the price of the exchangeable shares.

As a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, and stock exchange rules promulgated in response to the Sarbanes-Oxley Act. A number of our current operating subsidiaries are, and potential future acquisitions will be, private companies and their systems of internal controls over financial reporting may be less developed as compared to public company requirements. In addition, the partnership routinely excludes recently acquired companies from its evaluation of internal controls. Any failure to maintain adequate internal controls over financial reporting or to implement required, new or improved controls, or difficulties encountered in their implementation, could cause material weaknesses or significant deficiencies in our internal controls over financial reporting and could result in errors or misstatements in our consolidated financial statements that could be material. If our company were to conclude that our internal controls over financial reporting were not effective, investors could lose confidence in our reported financial information and the price of our exchangeable shares could decline. Our failure to achieve and maintain effective internal controls could have a material adverse effect on our business, our ability to access capital markets and investors’ perception of our company. In addition, material weaknesses in our internal controls could require significant expense and management time to remediate.

| | | | | |

| Brookfield Business Corporation | 11 |

Risks Relating to the Exchangeable Shares

Our company may redeem the exchangeable shares at any time without the consent of the holders.

Our board of directors, in its sole discretion and for any reason, and without the consent of holders of exchangeable shares, may elect to redeem all of the then outstanding exchangeable shares at any time upon sixty (60) days’ prior written notice, including without limitation following the occurrence of any of the following redemption events: (i) the total number of exchangeable shares outstanding decreases by 50% or more over any twelve-month period; (ii) a person acquires 90% of the units in a take-over bid (as defined by applicable securities law); (iii) unitholders of the partnership approve an acquisition of the partnership by way of arrangement or amalgamation; (iv) unitholders of the partnership approve a restructuring or other reorganization of the partnership; (v) there is a sale of all or substantially all of the partnership assets; (vi) there is a change of law (whether by legislative, governmental or judicial action), administrative practice or interpretation, or a change in circumstances of our company and our shareholders, that may result in adverse tax consequences for our company or our shareholders; or (vii) our board of directors, in its sole discretion, concludes that the unitholders of the partnership or holders of exchangeable shares are adversely impacted by a fact, change or other circumstance relating to our company. For greater certainty, unitholders do not have the ability to vote on such redemption and the board’s decision to redeem all of the then outstanding exchangeable shares will be final. In addition, the holder of class B shares may deliver a notice to our company specifying a redemption date upon which our company shall redeem all of the then outstanding exchangeable shares, and upon sixty (60) days’ prior written notice from our company to holders of the exchangeable shares and without the consent of holders of exchangeable shares, our company shall be required to redeem all of the then outstanding exchangeable shares on such redemption date. In the event of such redemption, holders of exchangeable shares will no longer own a direct interest in our company and will become unitholders of the partnership or receive cash based on the value of a unit, even if such holders desired to remain holders of exchangeable shares. Such redemption could occur at a time when the trading price of the exchangeable shares is greater than the trading price of the units, in which case holders would receive units (or its cash equivalent) with a lower trading price. See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares - Redemption by Issuer”.

In the event that an exchangeable share held by a holder is redeemed by our company or exchanged by the holder, the holder will be considered to have disposed of such exchangeable share for Canadian income tax purposes. See Item 10.E., “Taxation - Certain Material Canadian Federal Income Tax Considerations” for more information.

Holders of exchangeable shares do not have a right to elect whether to receive cash or units upon a liquidation, exchange or redemption event. Rather, our group has the right to make such election in its sole discretion.

In the event that (i) there is a liquidation, dissolution or winding up of our company or the partnership, (ii) our company or the partnership exercises its right to redeem (or cause the redemption of) all of the then outstanding exchangeable shares, or (iii) a holder of exchangeable shares requests an exchange of exchangeable shares, holders of exchangeable shares shall be entitled to receive one unit per exchangeable share held (subject to adjustment to reflect certain capital events described in this Form 20-F and certain other payment obligations in the case of a liquidation, dissolution or winding up of our company or the partnership) or its cash equivalent. The form of payment will be determined at the election of our group so a holder will not know whether cash or units will be delivered in connection with any of the events described above. Our company and the partnership currently intend to satisfy any exchange requests on the exchangeable shares through the delivery of units rather than cash. See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares”.

Any holder requesting an exchange of their exchangeable shares for which our company or the partnership elects to provide units in satisfaction of the exchange amount may experience a delay in receiving such units, which may affect the value of the units the holder receives in an exchange.

Each exchangeable share is exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our group). See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares - Exchange by Holder”. In the event cash is used to satisfy an exchange request, the amount payable per exchangeable share will be equal to the NYSE closing price of one unit on the date that the request for exchange is received by the transfer agent. As a result, any decrease in the value of the units after that date will not affect the amount of cash received. However, any holder whose exchangeable shares are exchanged for units will not receive such units for up to ten (10) business days after the applicable request is received. During this period, the market price of units may decrease. Any such decrease would affect the value of the unit consideration to be received by the holder of exchangeable shares on the effective date of the exchange.

| | | | | |

| 12 | Brookfield Business Corporation |

The partnership is required to maintain an effective registration statement in the United States in order to exchange any exchangeable shares for units. If a registration statement with respect to the units issuable upon any exchange, redemption or acquisition of exchangeable shares (including in connection with any liquidation, dissolution or winding up of our company) is not current or is suspended for use by the SEC, no exchange or redemption of exchangeable shares for units may be effected during such period.

The exchangeable shares may not trade at the same price as the units.

Although each exchangeable share is structured with the intention of providing an economic return that is equivalent to one unit (subject to adjustment to reflect certain capital events), there can be no assurance that the market price of exchangeable shares is equal to the market price of units at any time. If our company redeems the exchangeable shares (which can be done without the consent of the holders) at a time when the trading price of the exchangeable shares is greater than the trading price of the units, holders will receive units (or its cash equivalent) with a lower trading price. Factors that could cause differences in such market prices may include:

•perception and/or recommendations by analysts, investors and/or other third parties that these securities should be priced differently;

•actual or perceived differences in distributions to holders of exchangeable shares versus holders of the units, including as a result of any legal prohibitions;

•business developments or financial performance or other events or conditions that may be specific to only Brookfield Business Partners or our company; and

•difficulty in the exchange mechanics between exchangeable shares and units, including any delays or difficulties experienced by the transfer agent in processing the exchange requests.

If a sufficient number of exchangeable shares are exchanged for units, then the exchangeable shares may be de-listed.

If a sufficient amount of exchangeable shares are exchanged for units following the special distribution, or our company exercises our redemption right at any time including if the total number of exchangeable shares decreases by 50% or more over any twelve-month period, our company may fail to meet the minimum listing requirements on the NYSE and the TSX, and the NYSE or the TSX may take steps to de-list the exchangeable shares. Though holders of exchangeable shares will still be entitled to exchange each such share at any time for one unit (subject to adjustment to reflect certain capital events described in this Form 20-F), or its cash equivalent (the form of payment to be determined at the election of our group), a de-listing of the exchangeable shares would have a significant adverse effect on the liquidity of the exchangeable shares, and holders thereof may not be able to exit their investments in the market on favorable terms.

The market price of the exchangeable shares and units may be volatile, and holders of exchangeable shares and/or units may lose a significant portion of their investment due to drops in the market price of exchangeable shares and/or units.

The market price of the exchangeable shares and the units may be volatile and holders of such securities may not be able to resell their securities at or above the implied price at which they acquired such securities due to fluctuations in the market price of such securities, including changes in market price caused by factors unrelated to our company or Brookfield Business Partners’ operating performance or prospects. Specific factors that may have a significant effect on the market price of the exchangeable shares and the units include:

•changes in stock market analyst recommendations or earnings estimates regarding the exchangeable shares or units, other companies and partnerships that are comparable to our company or Brookfield Business Partners or are in the industries that they serve;

•with respect to the exchangeable shares, changes in the market price of the units, and vice versa;

•actual or anticipated fluctuations in our company and partnership’s operating results or future prospects;

•reactions to public announcements by our company and Brookfield Business Partners;

•strategic actions taken by our company or Brookfield Business Partners;

•adverse conditions in the financial market or general U.S. or international economic conditions, including those resulting from pandemics, war, incidents of terrorism and responses to such events; and

•sales of such securities by our company, Brookfield Business Partners or significant stockholders.

| | | | | |

| Brookfield Business Corporation | 13 |

Exchanges of exchangeable shares for units may negatively affect the market price of the units, and additional issuances of exchangeable shares would be dilutive to the units.

Each exchangeable share is exchangeable by the holder thereof for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our group). See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchange by Holder - Adjustments to Reflect Certain Capital Events”. If our group elects to deliver units in satisfaction of any such exchange request, a significant number of additional units may be issued from time to time which could have a negative impact on the market price for units. Additionally, any exchangeable shares issued by our company in the future will be exchangeable for units, and, accordingly, any future exchanges satisfied by the delivery of units would dilute the percentage interest of existing holders of the units and may reduce the market price of the units.

We or the partnership may issue additional shares or units in the future, including in lieu of incurring indebtedness, which may dilute holders of our equity securities. We or the partnership may also issue securities that have rights and privileges that are more favorable than the rights and privileges accorded to our equity holders.

Subject to the terms of any of our securities then outstanding, we may issue additional securities, including exchangeable shares, class B shares, class C shares, preferred shares, options, rights and warrants for any purpose and for such consideration and on such terms and conditions as our board of directors may determine. Subject to the terms of any of our securities then outstanding, our board of directors is able to determine the class, designations, preferences, rights, powers and duties of any additional securities, including any rights to share in our profits, losses and dividends, any rights to receive our company’s assets upon our dissolution or liquidation and any redemption, conversion and exchange rights. Subject to the terms of any of our securities then outstanding, our board of directors may use such authority to issue such additional securities, which would dilute holders of such securities, or to issue securities with rights and privileges that are more favorable than those of our exchangeable shares.

Similarly, under the partnership’s limited partnership agreement, the partnership’s general partner may issue additional partnership securities, including units, preferred units, options, rights, warrants and appreciation rights relating to partnership securities for any purpose and for such consideration and on such terms and conditions as the board of the partnership’s general partner may determine. Subject to the terms of any of the partnership securities then outstanding, the board of the partnership’s general partner is able to determine the class, designations, preferences, rights, powers and duties of any additional partnership securities, including any rights to share in the partnership’s profits, losses and dividends, any rights to receive the partnership’s assets upon its dissolution or liquidation and any redemption, conversion and exchange rights. Subject to the terms of any of the partnership securities then outstanding, the board of the partnership’s general partner may use such authority to issue such additional partnership securities, which would dilute holders of such securities, or to issue securities with rights and privileges that are more favorable than those of the units.

The sale or issuance of a substantial number of our exchangeable shares, the units or other equity securities of our company or the partnership in the public markets, or the perception that such sales or issuances could occur, could depress the market price of our exchangeable shares and impair our ability to raise capital through the sale of additional exchangeable shares. We cannot predict the effect that future sales or issuances of our exchangeable shares, units or other equity securities would have on the market price of our exchangeable shares. Subject to the terms of any of our securities then outstanding, holders of exchangeable shares will not have any pre-emptive right or any right to consent to or otherwise approve the issuance of any securities or the terms on which any such securities may be issued.

| | | | | |

| 14 | Brookfield Business Corporation |

Our company cannot assure you that it will be able to pay dividends equal to the levels currently paid by the partnership and holders of exchangeable shares may not receive dividends equal to the distributions paid on the units and, accordingly, may not receive the intended economic equivalence of those securities.

The exchangeable shares are intended to provide an economic return per exchangeable share equivalent to one unit (subject to adjustment to reflect certain capital events). See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares - Exchange by Holder - Adjustments to Reflect Certain Capital Events”. However, dividends are at the discretion of our board and unforeseen circumstances (including legal prohibitions) may prevent the same dividends from being paid on each security. Accordingly, there can be no assurance that dividends and distributions will be identical for each exchangeable share and unit, respectively, in the future, which may impact the market price of these securities. Dividends on our exchangeable shares may not equal the levels currently paid by the partnership for various reasons, including, but not limited to, the following:

•our company may not have enough unrestricted funds to pay such dividends due to changes in our company’s cash requirements, capital spending plans, cash flow or financial position;

•decisions on whether, when and in which amounts to make any future dividends will be dependent on then-existing conditions, including our company’s financial conditions, earnings, legal requirements, including limitations under British Columbia law, restrictions on our company’s borrowing agreements that limit our ability to pay dividends and other factors we deem relevant; and

•our company may desire to retain cash to improve our credit profile or for other reasons.

Non-U.S. shareholders are subject to foreign currency risk associated with our company’s dividends.

A significant number of our shareholders reside in countries where the U.S. dollar is not the functional currency. Our dividends are denominated in U.S. dollars but are settled in the local currency of the shareholder receiving the dividend. For each non-U.S. shareholder, the value received in the local currency from the dividend will be determined based on the exchange rate between the U.S. dollar and the applicable local currency at the time of payment. As such, if the U.S. dollar depreciates significantly against the local currency of the non-U.S. shareholder, the value received by such shareholder in its local currency is adversely affected.

Our articles and the partnership’s limited partnership agreement provide that the federal district courts of the United States of America are the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the U.S. Securities Act. This choice of forum provision could limit the ability of shareholders of our company and unitholders of the partnership to obtain a favorable judicial forum for disputes with directors, officers or employees.

Our articles provide, and the partnership’s limited partnership agreement provide, that, unless our company or the partnership consent in writing to the selection of an alternative forum, the federal district courts of the United States of America shall, to the fullest extent permitted by law, be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the U.S. Securities Act. In the absence of these provisions, under the U.S. Securities Act, U.S. federal and state courts have been found to have concurrent jurisdiction over suits brought to enforce duties or liabilities created by the U.S. Securities Act. This choice of forum provision does not apply to suits brought to enforce duties or liabilities created by the Exchange Act, which already provides that such federal district courts have exclusive jurisdictions over such suits. Additionally, investors cannot waive the company and the partnership’s compliance with federal securities laws of the United States and the rules and regulations thereunder.

| | | | | |

| Brookfield Business Corporation | 15 |

The choice of forum provision contained in the company’s articles and the partnership’s limited partnership agreement may limit a company shareholder’s or limited partnership unitholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with the company, the partnership or their directors, officers or other employees, which may discourage such lawsuits against the company, the partnership and their directors, officers and other employees. However, the enforceability of similar choice of forum provisions in other companies’ governing documents has been challenged in recent legal proceedings, and it is possible that a court in the relevant jurisdictions with respect to the company and the partnership could find the choice of forum provision contained in the company’s articles and the partnership’s limited partnership agreement to be inapplicable or unenforceable. While the Delaware Supreme Court ruled in March 2020 that U.S. federal forum selection provisions purporting to require claims under the U.S. Securities Act be brought in a U.S. federal court are “facially valid” under Delaware law, there can be no assurance that the courts in Canada (including in the Province of British Columbia) and Bermuda, and other courts within the United States, reach a similar determination regarding the choice of forum provision contained in the company’s articles and the partnership’s limited partnership agreement. If the relevant court were to find the choice of forum provision contained in the company’s articles or the partnership’s limited partnership agreement to be inapplicable or unenforceable in an action, the company and the partnership may incur additional costs associated with resolving such action in other jurisdictions, which could materially adversely affect their business, financial condition and operating results.

The exchangeable shares are not units and will not be treated as units for purposes of the application of applicable Canadian or U.S. rules relating to takeover bids, issuer bids and tender offers.

Units and exchangeable shares are not securities of the same class. As a result, holders of exchangeable shares will not be entitled to participate in an offer or bid made to acquire units, and holders of units will not be entitled to participate in an offer or bid made to acquire exchangeable shares. In the event of a takeover bid for units, a holder of exchangeable shares who would like to participate would be required to tender his or her exchangeable shares for exchange, in order to receive a unit, or the cash equivalent, at the election of our group, pursuant to the exchange right. If an issuer tender offer or issuer bid is made for the units at a price in excess of the market price of the units and a comparable offer is not made for the exchangeable shares, then the conversion factor for the exchangeable shares may be adjusted. See Item 10.B., “Memorandum and Articles of Association - Adjustments to Reflect Certain Capital Events” for more information on the circumstances in which adjustments may be made to the conversion factor.

The Rights Agreement will terminate on the fifth anniversary of the distribution date.

The Rights Agreement will terminate on the fifth anniversary of the distribution date, unless otherwise terminated earlier pursuant to its terms. After such date, holders of exchangeable shares will no longer have the benefit of the protections provided for by the Rights Agreement and will be reliant solely on the rights provided for in our company’s articles. In the event that our company or the partnership fails to satisfy a request for exchange after the expiry of the Rights Agreement, a tendering holder will not be entitled to rely on the secondary exchange rights. See Item 10.B., “Memorandum and Articles of Association - Description of Our Share Capital - Exchangeable Shares - Exchange by Holder” and Item 7.B., “Related Party Transactions - Relationship with Brookfield - Rights Agreement”.

U.S. investors in our exchangeable shares may find it difficult or impossible to enforce service of process and enforcement of judgments against our company and our board of directors and the Service Providers.

The company was established under the laws of the Province of British Columbia, and most of our subsidiaries are organized in jurisdictions outside of the United States. In addition, our executive officers are located outside of the United States. Certain of our directors and officers and the Service Providers reside outside of the United States. A substantial portion of our assets are, and the assets of our directors and officers and the Service Providers may be located outside of the United States. It may not be possible for investors to effect service of process within the United States upon our directors and officers and the Service Providers. It may also not be possible to enforce against our company, or our directors and officers and the Service Providers, judgments obtained in U.S. courts predicated upon the civil liability provisions of applicable securities law in the United States.

| | | | | |

| 16 | Brookfield Business Corporation |

Risks Relating to our Business Services Operations

The majority of the revenues from our healthcare services operations are derived from private health insurance funds.

The profitability of our healthcare services operations is influenced by its ability to reach ongoing commercial agreements with private health insurance funds. A failure to reach a satisfactory commercial agreement with any key private health insurance fund has the potential to negatively impact the financial and operational performance of our healthcare services operations. Additionally, a deterioration in the economic climate, changes to economic incentives, annual increases in private health insurance premiums and other factors may affect the participation rate or the level of private health insurance coverage of members in private health insurance funds. This has the potential to reduce demand for our healthcare services operations, resulting in decreased revenues. If the profitability of private health insurance funds deteriorates, there is a risk of increased pricing pressures on private hospital operators such as our healthcare services operations. Healthscope continues to incur additional costs in the current environment related to increased health and safety measures associated with the global pandemic. We can provide no assurance regarding the impact of these costs on our future results.

Our healthcare services operations are reliant on relationships with accredited medical practitioners.

Accredited medical practitioners prefer to work at hospitals which, amongst other things, provide high quality facilities, equipment and nursing staff, exceptional clinical safety outcomes and which are conveniently located. Accredited medical practitioners could cease to practice or stop referring patients to our facilities if the hospitals become a less attractive place to work. Our healthcare services operations are subject to rising costs, particularly labor costs associated with attracting and retaining key personnel. Nursing labor is the most significant cost in our hospital operations. Any increase in cost or tightening of supply of accredited medical practitioners or nursing labor is likely to adversely impact the financial and operational performance of our healthcare services operations.

Our healthcare services operations are reliant on suppliers and skilled labor and have been impacted by COVID-19.

The ability of our healthcare services operations to compete and grow is dependent on it having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts and components. No assurances can be given that the healthcare services operations will be successful in maintaining its supply of skilled labor, equipment, parts and components. COVID-19 and the measures taken in place to address COVID-19, including temporary lockdowns, have and continue to have an impact on our healthcare services operations’ ability to effectively manage skilled labor and facility staffing. In addition, our healthcare services operations have been impacted by the reduction in demand for elective surgeries as a result of the pandemic. We can provide no assurance that our healthcare services operations will have adequate staffing and resume full activity levels to the extent and timeframe we have anticipated.

If we do not have adequate indemnification for our healthcare services, it could adversely affect our healthcare services operations and financial condition.

Current or former patients may commence or threaten litigation for medical negligence against our healthcare services operations. Subject to indemnity insurance arrangements, future medical malpractice litigation, or threatened litigation, could have an adverse impact on the financial performance and position and future prospects of our healthcare services operations. Insurance coverage is maintained by our healthcare services operations consistent with industry practice, including public liability and medical malpractice. However, no assurance can be given that such insurance will be available in the future on commercially reasonable terms or that any coverage will be adequate and available to cover all or any future claims.

Certain risks are inherent in the private hospital and healthcare provider industry.

Changes in the operating costs (including costs for maintenance, insurance, and those related to the onset and ongoing nature of COVID-19), inability to obtain permits required to conduct hospital business operations, changes in health care laws and governmental regulations, and various other factors may significantly impact the ability of our healthcare services operations to generate revenues. Certain significant expenditures, including fees related to health and safety measures, legal fees, borrowing costs, maintenance costs, insurance costs and related charges must be made to operate our healthcare services operations.

Our construction operations are vulnerable to the cyclical nature of the construction market.

The demand for our construction operations is dependent upon the existence of projects with engineering, procurement, construction and management needs. For example, a substantial portion of the revenues from our construction operations derives from residential, commercial and office projects in Australia and the U.K. Capital expenditures by our clients may be influenced by factors such as prevailing economic conditions and expectations about economic trends, technological advances, consumer confidence, domestic and international political, military, regulatory and economic conditions and other similar factors.

| | | | | |

| Brookfield Business Corporation | 17 |

Our revenues and earnings from our construction operations are largely dependent on the award of new contracts which we do not directly control.

A substantial portion of the revenues and earnings of our construction operations is generated from large-scale project awards. The timing of project awards is unpredictable and outside of our control. Awards often involve complex and lengthy negotiations and competitive bidding processes. These processes can be impacted by a wide variety of factors including a client’s decision to not proceed with the development of a project, governmental approvals, financing contingencies and overall market and economic conditions. We may not win contracts that we have bid upon due to price, a client’s perception of our ability to perform and/or perceived technology advantages held by others. Many of our competitors may be inclined to take greater or unusual risks or agree to terms and conditions in a contract that we might not deem acceptable. Because a significant portion of our construction operations’ revenues is generated from large projects, the results of our construction operations can fluctuate quarterly and annually depending on whether and when large project awards occur and the commencement and progress of work under large contracts already awarded. As a result, we are subject to the risk of losing new awards to competitors or the risk that revenues may not be derived from awarded projects as quickly as anticipated.

Our construction operations may experience reduced profits or losses under contracts if costs increase above estimates.

Generally, our construction operations are performed under contracts that include cost and schedule estimates in relation to our services. Inaccuracies in these estimates may lead to cost overruns that may not be paid by our clients, thereby resulting in reduced profits or in losses.