Third Quarter Earnings Supplemental November 5, 2024

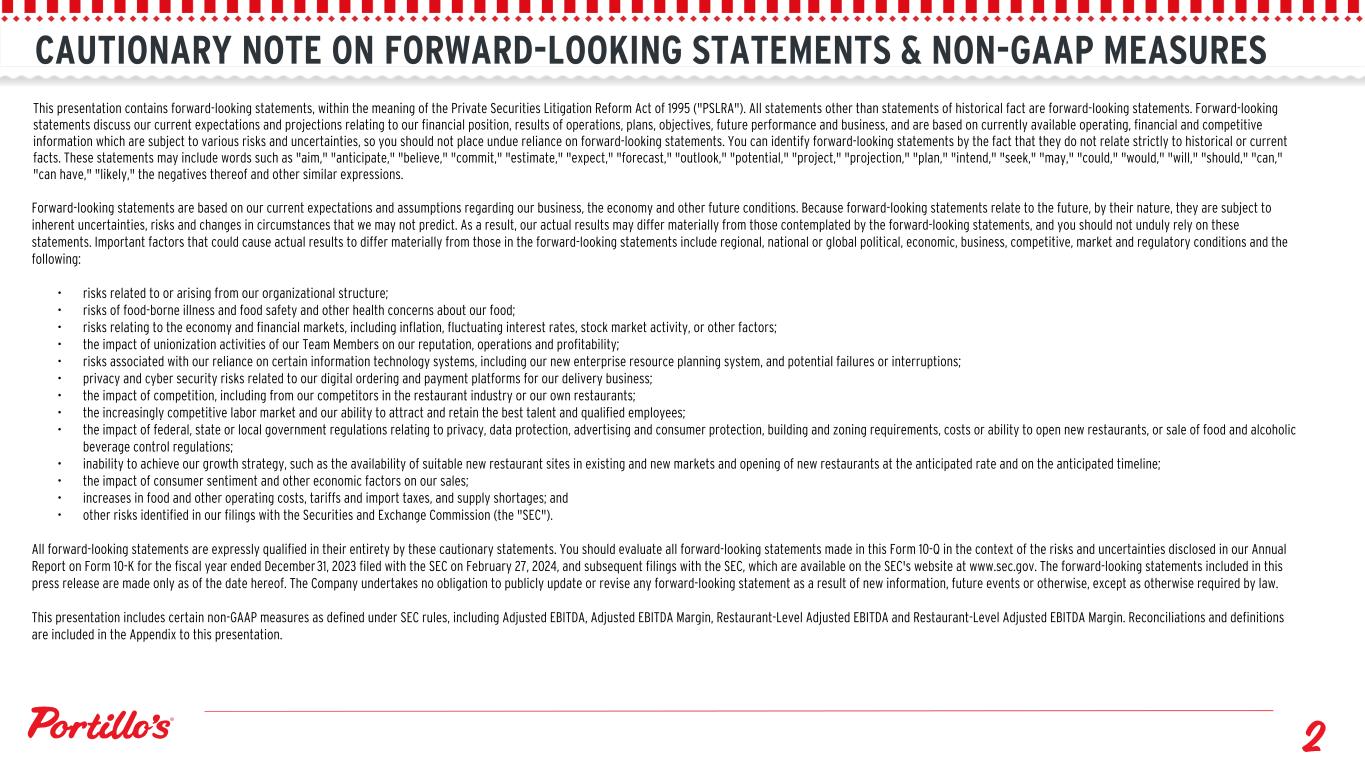

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS & NON-GAAP MEASURES This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). All statements other than statements of historical fact are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business, and are based on currently available operating, financial and competitive information which are subject to various risks and uncertainties, so you should not place undue reliance on forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "commit," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that we may not predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements, and you should not unduly rely on these statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following: • risks related to or arising from our organizational structure; • risks of food-borne illness and food safety and other health concerns about our food; • risks relating to the economy and financial markets, including inflation, fluctuating interest rates, stock market activity, or other factors; • the impact of unionization activities of our Team Members on our reputation, operations and profitability; • risks associated with our reliance on certain information technology systems, including our new enterprise resource planning system, and potential failures or interruptions; • privacy and cyber security risks related to our digital ordering and payment platforms for our delivery business; • the impact of competition, including from our competitors in the restaurant industry or our own restaurants; • the increasingly competitive labor market and our ability to attract and retain the best talent and qualified employees; • the impact of federal, state or local government regulations relating to privacy, data protection, advertising and consumer protection, building and zoning requirements, costs or ability to open new restaurants, or sale of food and alcoholic beverage control regulations; • inability to achieve our growth strategy, such as the availability of suitable new restaurant sites in existing and new markets and opening of new restaurants at the anticipated rate and on the anticipated timeline; • the impact of consumer sentiment and other economic factors on our sales; • increases in food and other operating costs, tariffs and import taxes, and supply shortages; and • other risks identified in our filings with the Securities and Exchange Commission (the "SEC"). All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this Form 10-Q in the context of the risks and uncertainties disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 27, 2024, and subsequent filings with the SEC, which are available on the SEC's website at www.sec.gov. The forward-looking statements included in this press release are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. This presentation includes certain non-GAAP measures as defined under SEC rules, including Adjusted EBITDA, Adjusted EBITDA Margin, Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin. Reconciliations and definitions are included in the Appendix to this presentation.

Q3 2024 PERFORMANCE REVENUE $178.3 million Q3 Total revenue CHANGE IN SAME RESTAURANT SALES (1) PROFITABILITY $16.0 million Q3 Operating Income 6.9% Q3 Total Revenue Growth (2) See appendix for a reconciliation to the most directly comparable GAAP financial measure. (3) A geometric comparable sales measure is used to determine the compounding effect of an earlier period's year over year comparable sales percentage on the subsequent period's year over year comparable sales percentage. $27.9 million Q3 Adjusted EBITDA(2) $41.9 million Q3 Restaurant-Level Adjusted EBITDA(2) $8.8 million Q3 Net Income (1) Same restaurant sales include restaurants open for a minimum of 24 months and excludes a restaurant that is owned by C&O Chicago, LLC ("C&O") of which Portillo's owns 50% of the equity. For the quarter ended September 29, 2024, same- restaurant sales compares the 13 weeks from July 1, 2024 through September 29, 2024 to the 13 weeks from July 3, 2023 through October 1, 2023.

Q3 YTD 2024 PERFORMANCE REVENUE $525.9 million Q3 YTD Total Revenue SAME RESTAURANT SALES CHANGE (1) PROFITABILITY $44.2 million Q3 YTD Operating Income 6.9% Q3 YTD Total Revenue Growth (2) See appendix for a reconciliation to the most directly comparable GAAP financial measure. $79.6 million Q3 YTD Adjusted EBITDA(2) $122.9 million Q3 YTD Restaurant-Level Adjusted EBITDA(2) $22.6 million Q3 YTD Net Income (1) Same restaurant sales include restaurants open for a minimum of 24 months and excludes a restaurant that is owned by C&O Chicago, LLC ("C&O") of which Portillo's owns 50% of the equity. For the three quarters ended September 29, 2024, same- restaurant sales compares the 39 weeks from January 1, 2024 through September 29, 2024 to the 39 weeks from January 2, 2023 through October 1, 2023.

2024 DEVELOPMENT UPDATE 10+ units in 2024Sunbelt = ~80% of Pipeline Denton, TX Denton, TX Surprise, AZ Q1 2024 Q2 2024 Q3 2024 Q4 2024 Currently Under Construction Surprise, AZ Livonia, MI & Mansfield, TX Richmond, TX + 5 Opened YTD Q3 2024 LATEST OPENING (Post Q3) Livonia, MI Willowbrook, TX Grapevine, TX Stafford, TX Katy, TXWaterford Lakes, FL Mansfield, TX New ~6,300 Square Foot Format Mansfield, TX Orland Park, IL New ~6,200 Square Foot Format Richmond, TX New ~6,300 Square Foot Format New ~6,200 Square Foot Format

STRATEGIC PILLARS

FINANCIAL PROFILE $41 $55 $59 2022 2023 LTM Q3 2024 $133 $165 $169 22.6% 24.3% 23.6% 2022 2023 LTM Q3 2024 $17 $25 $32 2022 2023 LTM Q3 2024 $85 $102 $106 14.5% 15.0% 14.8% 2022 2023 LTM Q3 2024 $587 $680 $714 2022 2023 LTM Q3 2024 5.4% 5.7% 0.5% 2022 2023 LTM Q3 2024 TOTAL REVENUE OPERATING INCOME NET INCOME SAME RESTAURANT SALES (1) RESTAURANT-LEVEL ADJ. EBITDA (Margin) (2) ADJ. EBITDA (Margin) (2) ($ in millions) ($ in millions) ($ in millions) ($ in millions) ($ in millions) (1) Same restaurant sales include restaurants open for a minimum of 24 months and excludes a restaurant that is owned by C&O Chicago, LLC ("C&O") of which Portillo's owns 50% of the equity. For more information on our same restaurant sales for Fiscal 2023, refer to our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. (2) See appendix for a reconciliation to the most comparable GAAP financial measure. Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2023 consisted of 53 weeks and fiscal 2022 and fiscal 2021 consisted of 52 weeks. The 53rd week in fiscal 2023 included Christmas Day, resulting in six operating days. LTM Q3 2024 represents the last twelve months ending September 29, 2024.

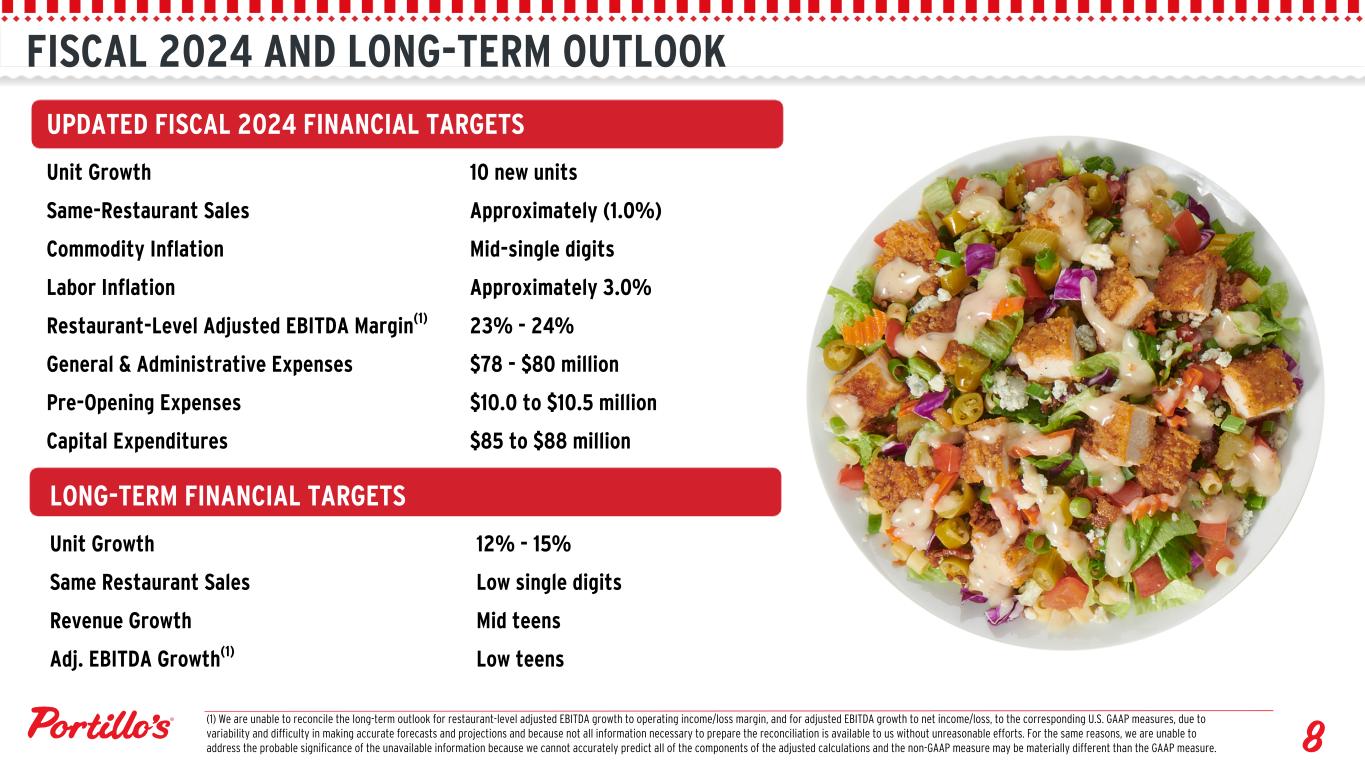

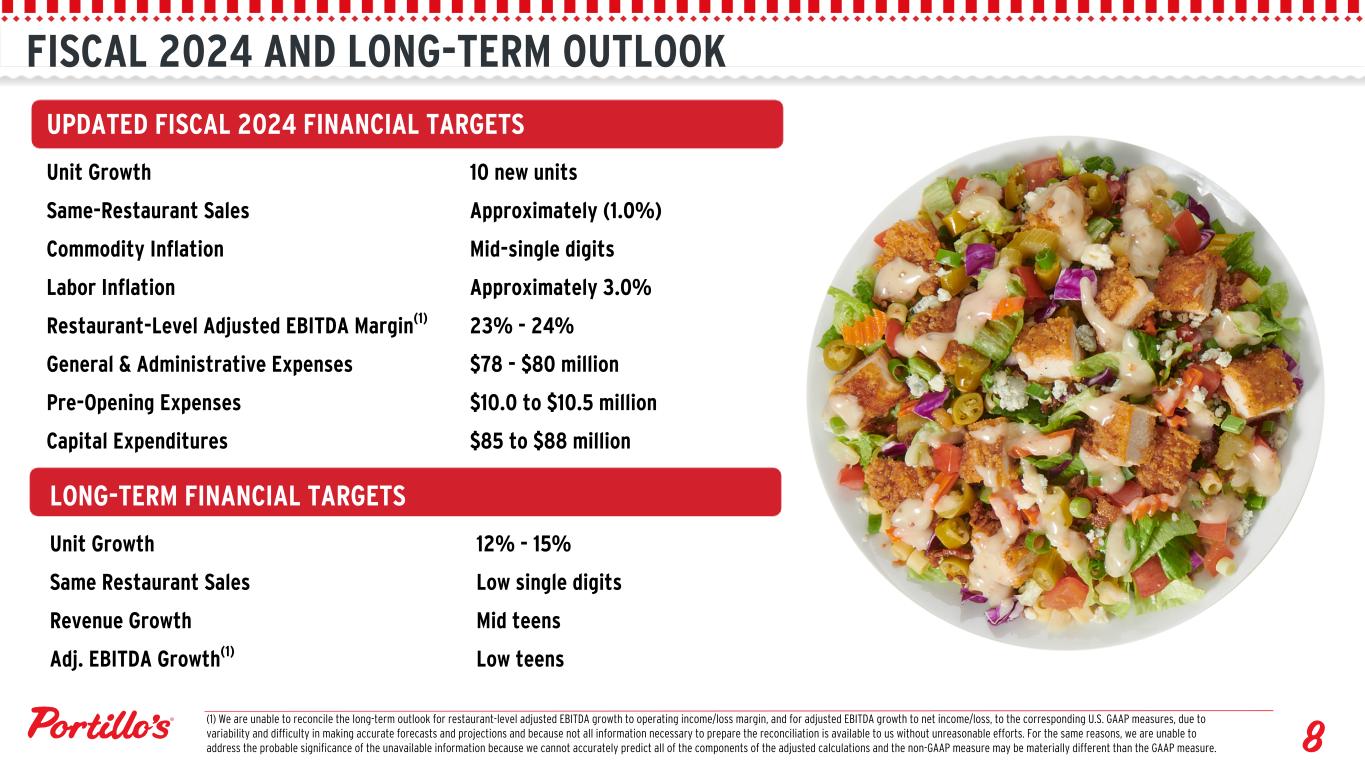

FISCAL 2024 AND LONG-TERM OUTLOOK (1) We are unable to reconcile the long-term outlook for Adjusted EBITDA growth to net income (loss), the corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure. UPDATED FISCAL 2024 FINANCIAL TARGETS Unit Growth 10 new units Same-Restaurant Sales Approximately (1.0%) Commodity Inflation Mid-single digits Labor Inflation Approximately 3.0% Restaurant-Level Adjusted EBITDA Margin(1) 23% - 24% General & Administrative Expenses $78 - $80 million Pre-Opening Expenses $10.0 to $10.5 million Capital Expenditures $85 to $88 million LONG-TERM FINANCIAL TARGETS Unit Growth 12% - 15% Same Restaurant Sales Low single digits Revenue Growth Mid teens Adj. EBITDA Growth(1) Low teens (1) We are unable to reconcile the long-term outlook for restaurant-level adjusted EBITDA growth to operating income/loss margin, and for adjusted EBITDA growth to net income/loss, to the corresponding U.S. GAAP measures, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure.

APPENDIX

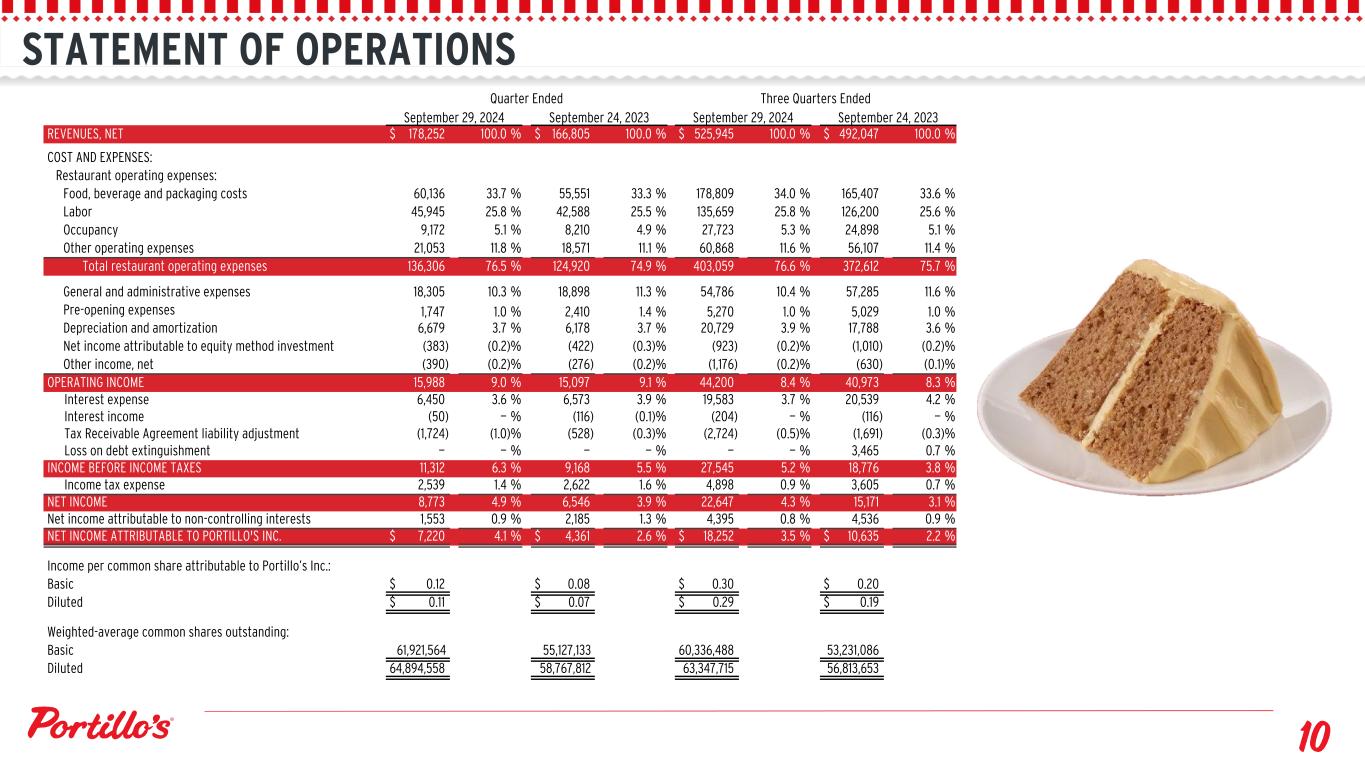

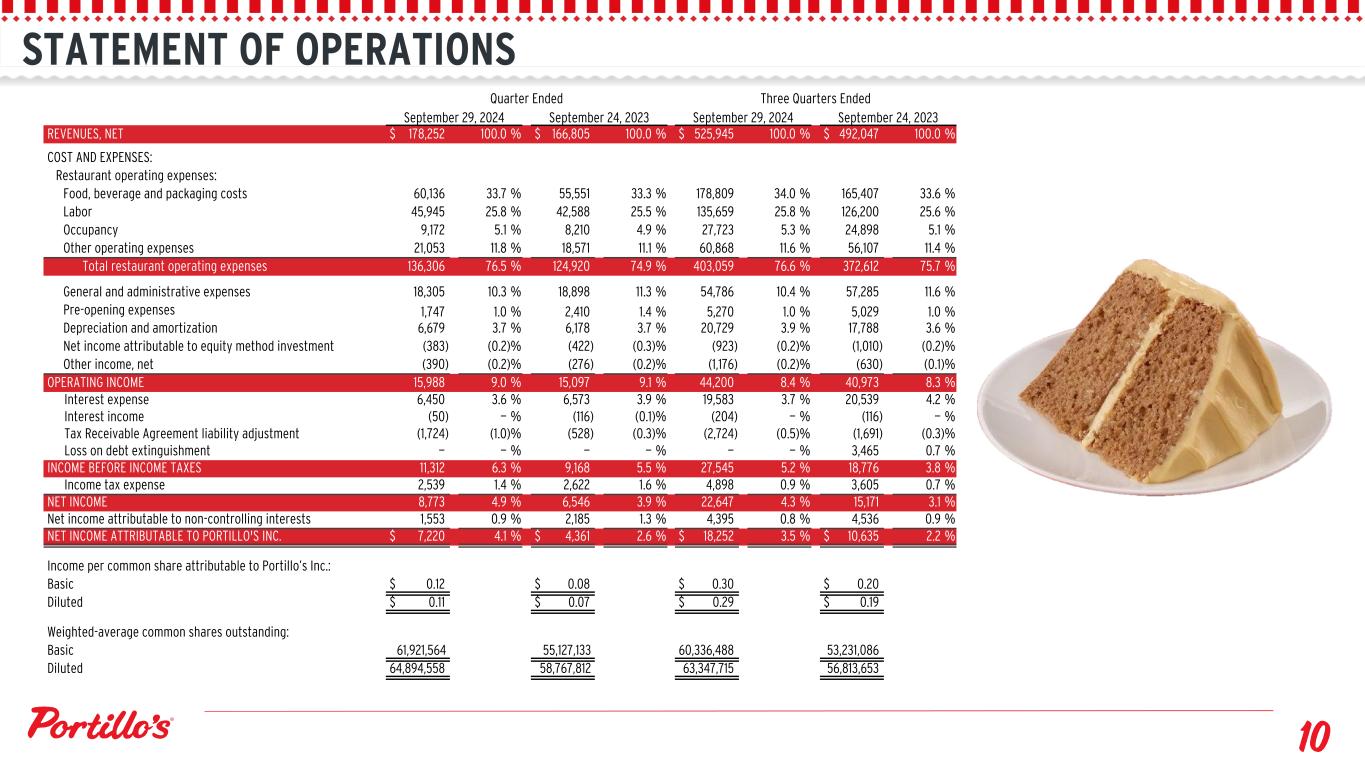

STATEMENT OF OPERATIONS Quarter Ended Three Quarters Ended September 29, 2024 September 24, 2023 September 29, 2024 September 24, 2023 REVENUES, NET $ 178,252 100.0 % $ 166,805 100.0 % $ 525,945 100.0 % $ 492,047 100.0 % COST AND EXPENSES: Restaurant operating expenses: Food, beverage and packaging costs 60,136 33.7 % 55,551 33.3 % 178,809 34.0 % 165,407 33.6 % Labor 45,945 25.8 % 42,588 25.5 % 135,659 25.8 % 126,200 25.6 % Occupancy 9,172 5.1 % 8,210 4.9 % 27,723 5.3 % 24,898 5.1 % Other operating expenses 21,053 11.8 % 18,571 11.1 % 60,868 11.6 % 56,107 11.4 % Total restaurant operating expenses 136,306 76.5 % 124,920 74.9 % 403,059 76.6 % 372,612 75.7 % General and administrative expenses 18,305 10.3 % 18,898 11.3 % 54,786 10.4 % 57,285 11.6 % Pre-opening expenses 1,747 1.0 % 2,410 1.4 % 5,270 1.0 % 5,029 1.0 % Depreciation and amortization 6,679 3.7 % 6,178 3.7 % 20,729 3.9 % 17,788 3.6 % Net income attributable to equity method investment (383) (0.2) % (422) (0.3) % (923) (0.2) % (1,010) (0.2) % Other income, net (390) (0.2) % (276) (0.2) % (1,176) (0.2) % (630) (0.1) % OPERATING INCOME 15,988 9.0 % 15,097 9.1 % 44,200 8.4 % 40,973 8.3 % Interest expense 6,450 3.6 % 6,573 3.9 % 19,583 3.7 % 20,539 4.2 % Interest income (50) — % (116) (0.1) % (204) — % (116) — % Tax Receivable Agreement liability adjustment (1,724) (1.0) % (528) (0.3) % (2,724) (0.5) % (1,691) (0.3) % Loss on debt extinguishment — — % — — % — — % 3,465 0.7 % INCOME BEFORE INCOME TAXES 11,312 6.3 % 9,168 5.5 % 27,545 5.2 % 18,776 3.8 % Income tax expense 2,539 1.4 % 2,622 1.6 % 4,898 0.9 % 3,605 0.7 % NET INCOME 8,773 4.9 % 6,546 3.9 % 22,647 4.3 % 15,171 3.1 % Net income attributable to non-controlling interests 1,553 0.9 % 2,185 1.3 % 4,395 0.8 % 4,536 0.9 % NET INCOME ATTRIBUTABLE TO PORTILLO'S INC. $ 7,220 4.1 % $ 4,361 2.6 % $ 18,252 3.5 % $ 10,635 2.2 % Income per common share attributable to Portillo’s Inc.: Basic $ 0.12 $ 0.08 $ 0.30 $ 0.20 Diluted $ 0.11 $ 0.07 $ 0.29 $ 0.19 Weighted-average common shares outstanding: Basic 61,921,564 55,127,133 60,336,488 53,231,086 Diluted 64,894,558 58,767,812 63,347,715 56,813,653

REVENUE SUMMARY - Q3 2024 Quarter Ended September 29, 2024 September 24, 2023 $ Change % Change Same-restaurant sales (70 restaurants) (1) (3) $150,854 $152,212 (1,358) (0.9) % Same-restaurant sales comparable week shift impact (2) — 1,001 (1,001) nm Restaurants not yet in comparable base opened in fiscal 2024 (4 restaurants) (3) 5,370 — 5,370 nm Restaurants not yet in comparable base opened in fiscal 2023 (12 restaurants) (3) 17,311 8,988 8,323 92.6 % Restaurants not yet in comparable base opened in fiscal 2022 (1 restaurant) (3) 2,049 2,094 (45) (2.1) % Other (4) 2,668 2,510 158 6.3 % Revenues, net $ 178,252 $ 166,805 $ 11,447 6.9 % (1) We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2024 consists of 52 weeks and fiscal 2023 consisted of 53 weeks. In order to compare like-for-like periods for the quarter ended September 29, 2024, same-restaurant sales compares the 13 weeks from July 1, 2024 through September 29, 2024 to the 13 weeks from July 3, 2023 through October 1, 2023. (2) Represents the impact from shifting comparable weeks for all periods in fiscal 2023 to compare like-for-like periods. For the quarter ended September 24, 2023, same- restaurant sales includes sales from the 13 weeks from July 3, 2023 through October 1, 2023 rather than the 13 weeks from June 26, 2023 through September 24, 2023. (3) Total restaurants indicated are as of September 29, 2024. Excludes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. (4) Includes revenue from direct shipping sales and non-traditional locations. *nm - not meaningful TAKEAWAYS Schererville in Fiscal 2022 class will enter comp base in December 2024. The 8 'Class of 2023' restaurants are annualizing at $6.7M in their first year. The 12 restaurants in the fiscal 2023 row include 4 'Class of 2022' restaurants.

REVENUE SUMMARY - Q3 YTD 2024 Three Quarters Ended September 29, 2024 September 24, 2023 $ Change % Change Same-restaurant sales (70 restaurants) (1) (3) $443,666 $447,618 (3,952) (0.9) % Same-restaurant sales comparable week shift impact (2) — 1,830 (1,830) nm Restaurants not yet in comparable base opened in fiscal 2024 (4 restaurants) (3) 8,782 — 8,782 nm Restaurants not yet in comparable base opened in fiscal 2023 (12 restaurants) (3) 56,793 24,707 32,086 129.9 % Restaurants not yet in comparable base opened in fiscal 2022 (1 restaurant) (3) 8,341 9,049 (708) (7.8) % Other (4) 8,363 8,843 (480) (5.4) % Revenues, net $ 525,945 $ 492,047 $ 33,898 6.9 % (1) We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2024 consists of 52 weeks and fiscal 2023 consisted of 53 weeks. In order to compare like-for-like periods for the for the three quarters ended September 29, 2024, same-restaurant sales compares the 39 weeks from January 1, 2024 through September 29, 2024 to the 39 weeks from January 2, 2023 through October 1, 2023. (2) Represents the impact from shifting comparable weeks for all periods in fiscal 2023 to compare like-for-like periods. For the three quarters ended September 24, 2023, same-restaurant sales includes sales from the 39 weeks from January 2, 2023 through October 1, 2023 rather than the 39 weeks from December 26, 2022 through September 24, 2023. (3) Total restaurants indicated are as of September 29, 2024. Excludes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. (4) Includes revenue from direct shipping sales and non-traditional locations. *nm - not meaningful TAKEAWAYS Schererville in Fiscal 2022 class will enter comp base in December 2024. The 8 'Class of 2023' restaurants are annualizing at $6.7M in their first year. The 12 restaurants in the fiscal 2023 row include 4 'Class of 2022' restaurants.

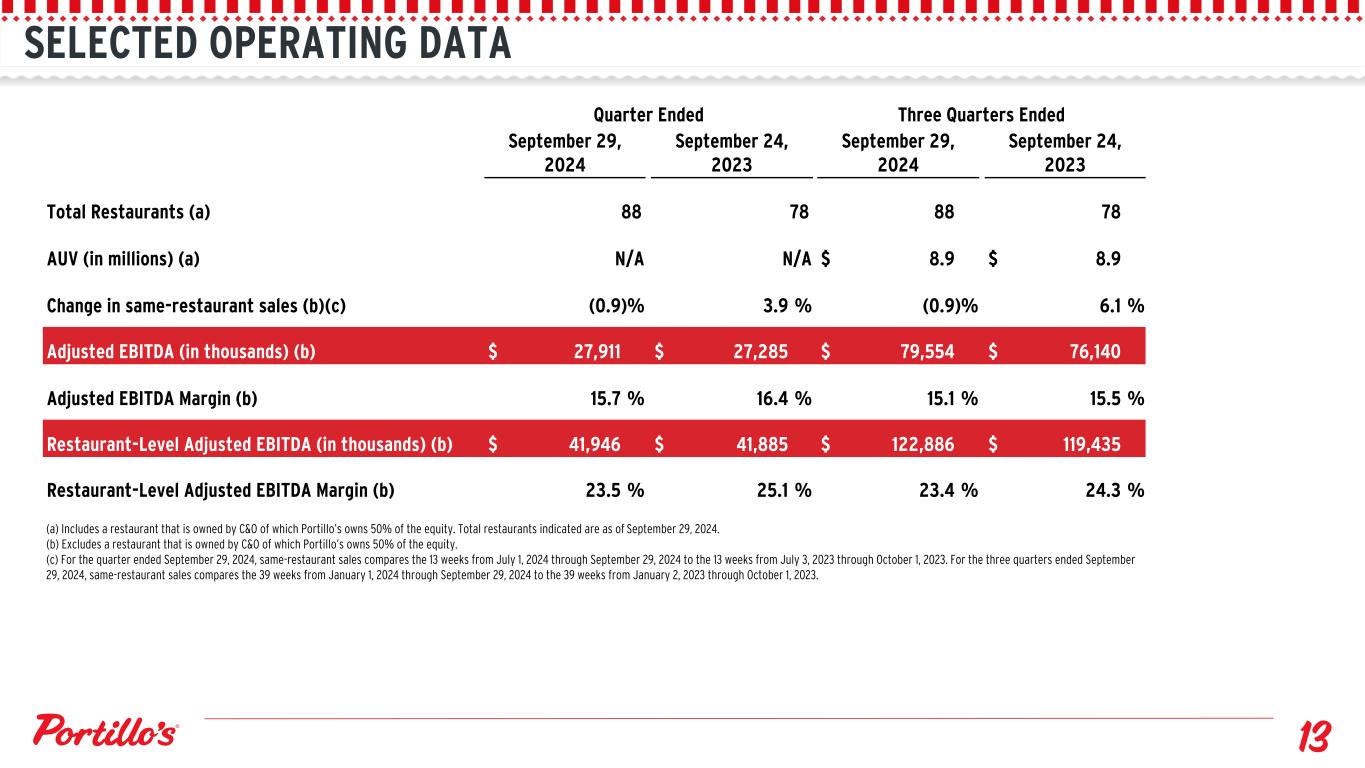

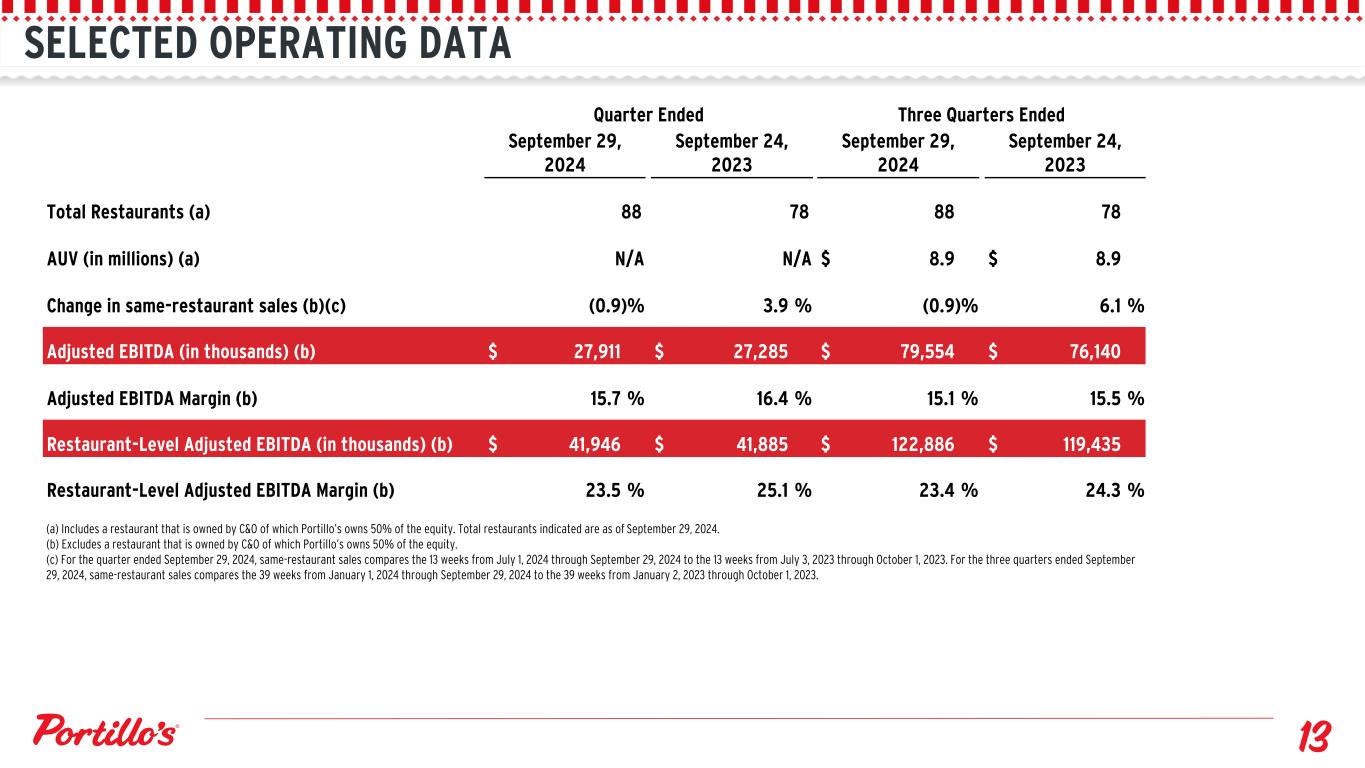

SELECTED OPERATING DATA (a) Includes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. Total restaurants indicated are as of September 29, 2024. (b) Excludes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. (c) For the quarter ended September 29, 2024, same-restaurant sales compares the 13 weeks from July 1, 2024 through September 29, 2024 to the 13 weeks from July 3, 2023 through October 1, 2023. For the three quarters ended September 29, 2024, same-restaurant sales compares the 39 weeks from January 1, 2024 through September 29, 2024 to the 39 weeks from January 2, 2023 through October 1, 2023. Quarter Ended Three Quarters Ended September 29, 2024 September 24, 2023 September 29, 2024 September 24, 2023 Total Restaurants (a) 88 78 88 78 AUV (in millions) (a) N/A N/A $ 8.9 $ 8.9 Change in same-restaurant sales (b)(c) (0.9) % 3.9 % (0.9) % 6.1 % Adjusted EBITDA (in thousands) (b) $ 27,911 $ 27,285 $ 79,554 $ 76,140 Adjusted EBITDA Margin (b) 15.7 % 16.4 % 15.1 % 15.5 % Restaurant-Level Adjusted EBITDA (in thousands) (b) $ 41,946 $ 41,885 $ 122,886 $ 119,435 Restaurant-Level Adjusted EBITDA Margin (b) 23.5 % 25.1 % 23.4 % 24.3 %

ADJUSTED EBITDA DEFINITIONS How These Measures Are Useful We believe that Adjusted EBITDA and Adjusted EBITDA Margin are important measures of operating performance because they eliminate the impact of expenses that do not relate to our core operating performance. Adjusted EBITDA and Adjusted EBITDA Margin are supplemental measures of operating performance and our calculations thereof may not be comparable to similar measures reported by other companies. Adjusted EBITDA and Adjusted EBITDA Margin have important limitations as analytical tools and should not be considered in isolation as substitutes for analysis of our results as reported under GAAP. Adjusted EBITDA and Adjusted EBITDA Margin Adjusted EBITDA represents net income (loss) before depreciation and amortization, interest expense, interest income and income taxes, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing core operating performance as identified in the reconciliation of net income (loss), the most directly comparable GAAP measure, to Adjusted EBITDA. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of revenues, net. We use Adjusted EBITDA and Adjusted EBITDA Margin (i) to evaluate our operating results and the effectiveness of our business strategies, (ii) internally as benchmarks to compare our performance to that of our competitors and (iii) as factors in evaluating management’s performance when determining incentive compensation. We are unable to reconcile the long-term outlook for Adjusted EBITDA to net income (loss), the corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure.

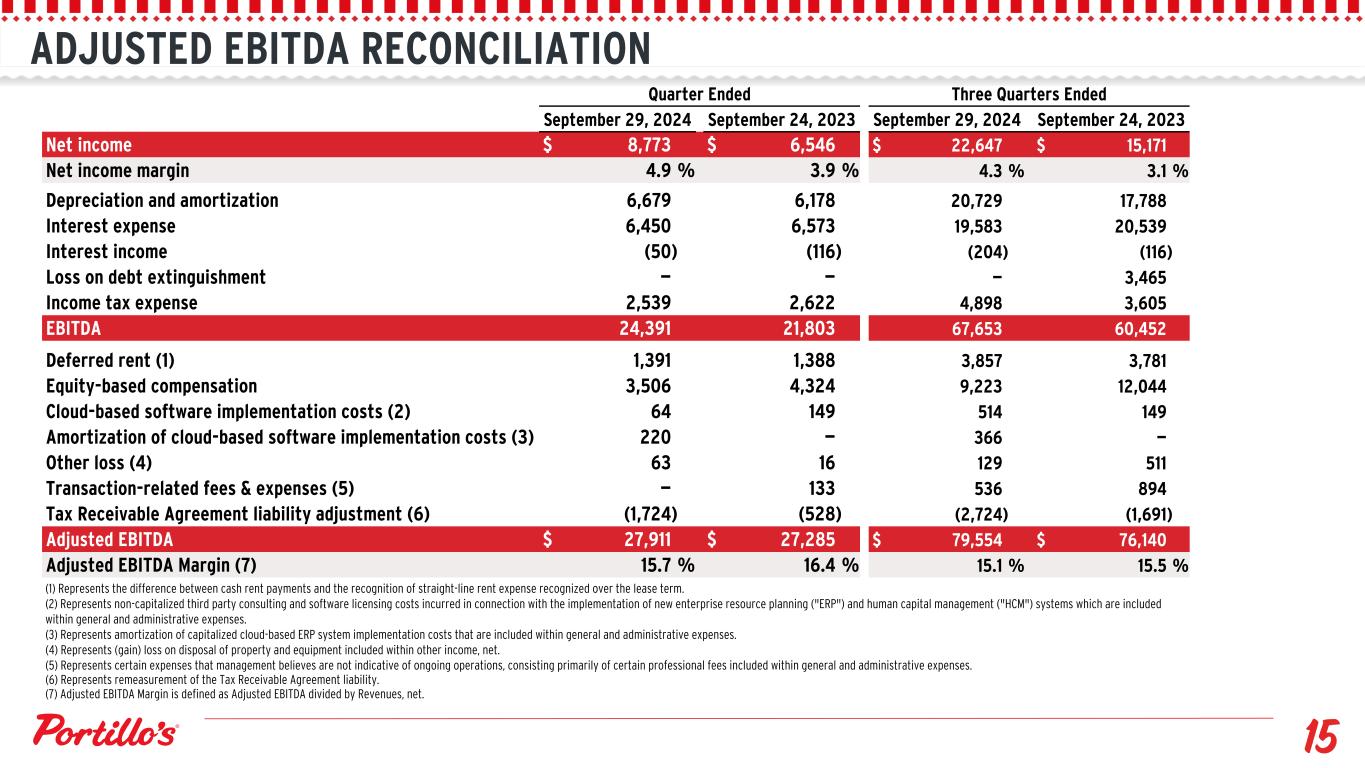

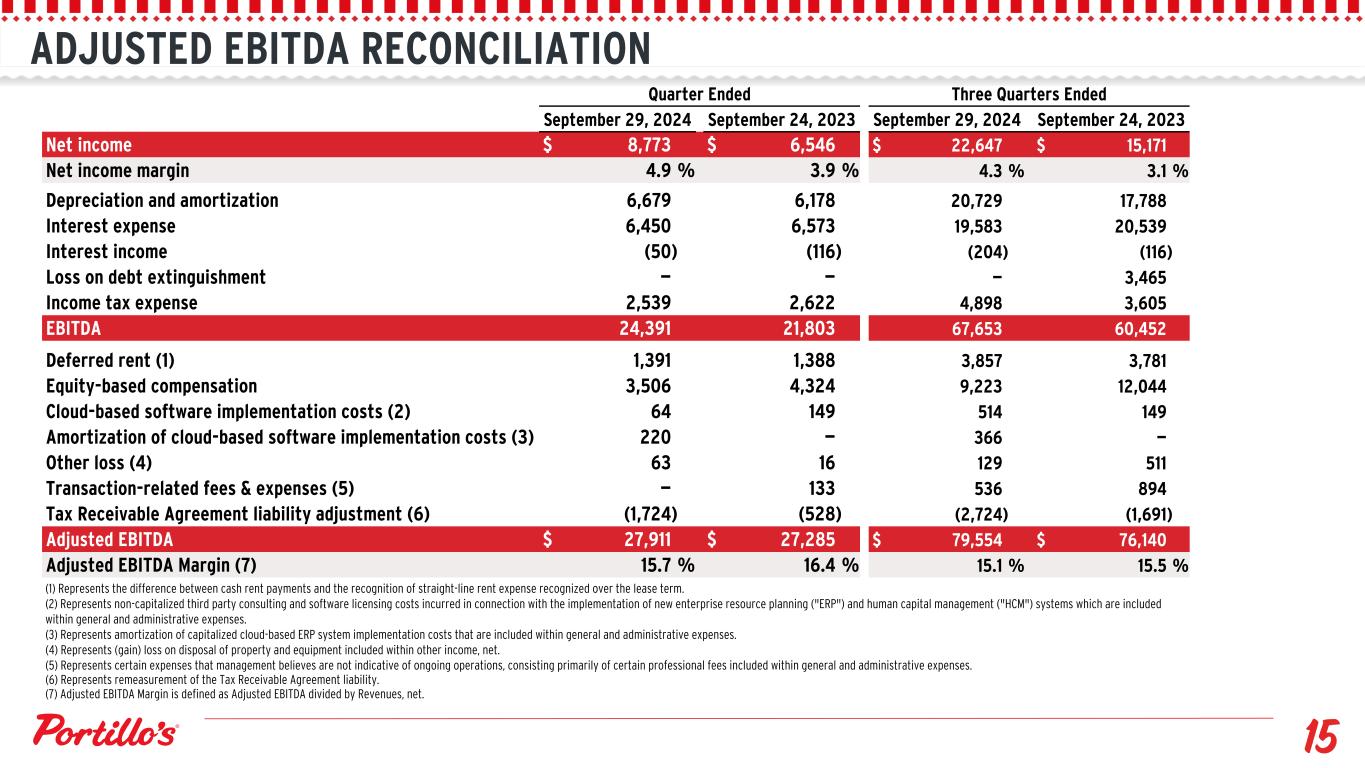

ADJUSTED EBITDA RECONCILIATION (1) Represents the difference between cash rent payments and the recognition of straight-line rent expense recognized over the lease term. (2) Represents non-capitalized third party consulting and software licensing costs incurred in connection with the implementation of new enterprise resource planning ("ERP") and human capital management ("HCM") systems which are included within general and administrative expenses. (3) Represents amortization of capitalized cloud-based ERP system implementation costs that are included within general and administrative expenses. (4) Represents (gain) loss on disposal of property and equipment included within other income, net. (5) Represents certain expenses that management believes are not indicative of ongoing operations, consisting primarily of certain professional fees included within general and administrative expenses. (6) Represents remeasurement of the Tax Receivable Agreement liability. (7) Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenues, net. Quarter Ended Three Quarters Ended September 29, 2024 September 24, 2023 September 29, 2024 September 24, 2023 Net income $ 8,773 $ 6,546 $ 22,647 $ 15,171 Net income margin 4.9 % 3.9 % 4.3 % 3.1 % Depreciation and amortization 6,679 6,178 20,729 17,788 Interest expense 6,450 6,573 19,583 20,539 Interest income (50) (116) (204) (116) Loss on debt extinguishment — — — 3,465 Income tax expense 2,539 2,622 4,898 3,605 EBITDA 24,391 21,803 67,653 60,452 Deferred rent (1) 1,391 1,388 3,857 3,781 Equity-based compensation 3,506 4,324 9,223 12,044 Cloud-based software implementation costs (2) 64 149 514 149 Amortization of cloud-based software implementation costs (3) 220 — 366 — Other loss (4) 63 16 129 511 Transaction-related fees & expenses (5) — 133 536 894 Tax Receivable Agreement liability adjustment (6) (1,724) (528) (2,724) (1,691) Adjusted EBITDA $ 27,911 $ 27,285 $ 79,554 $ 76,140 Adjusted EBITDA Margin (7) 15.7 % 16.4 % 15.1 % 15.5 %

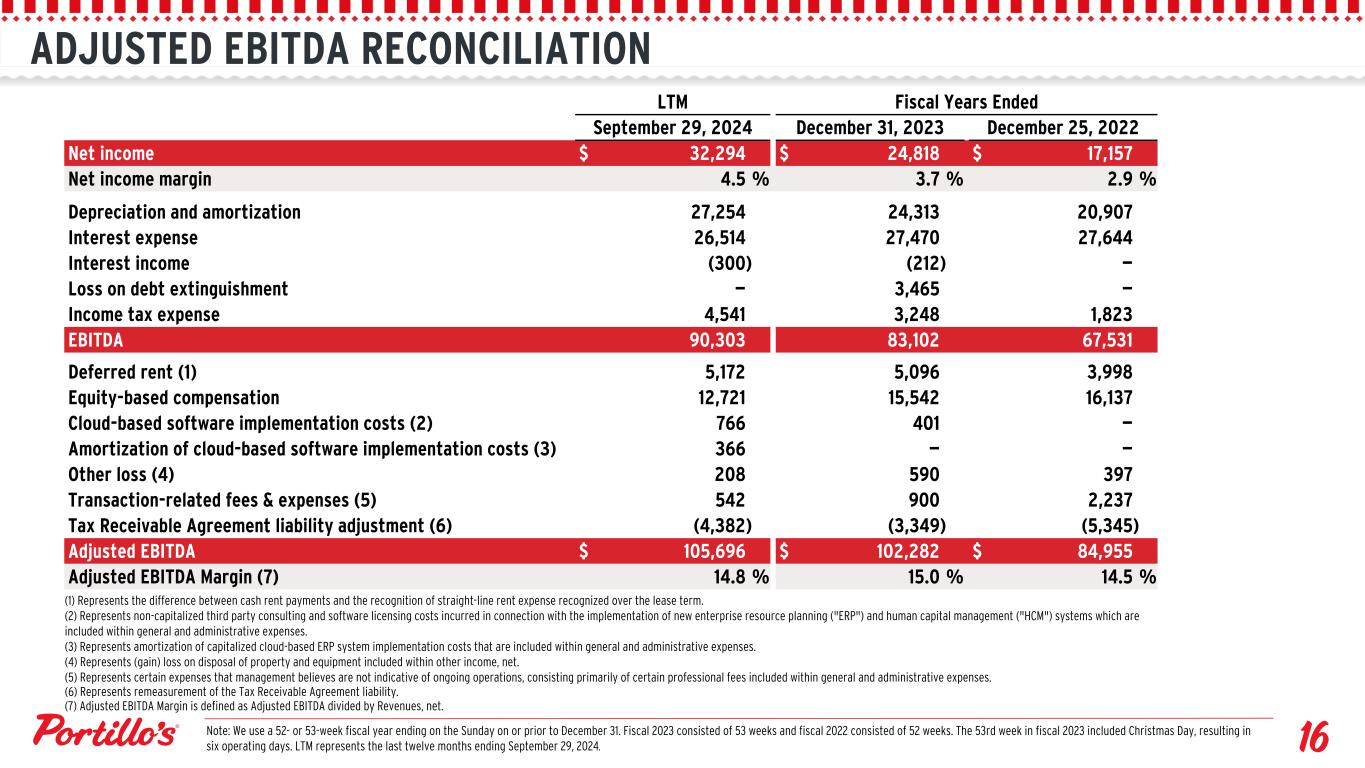

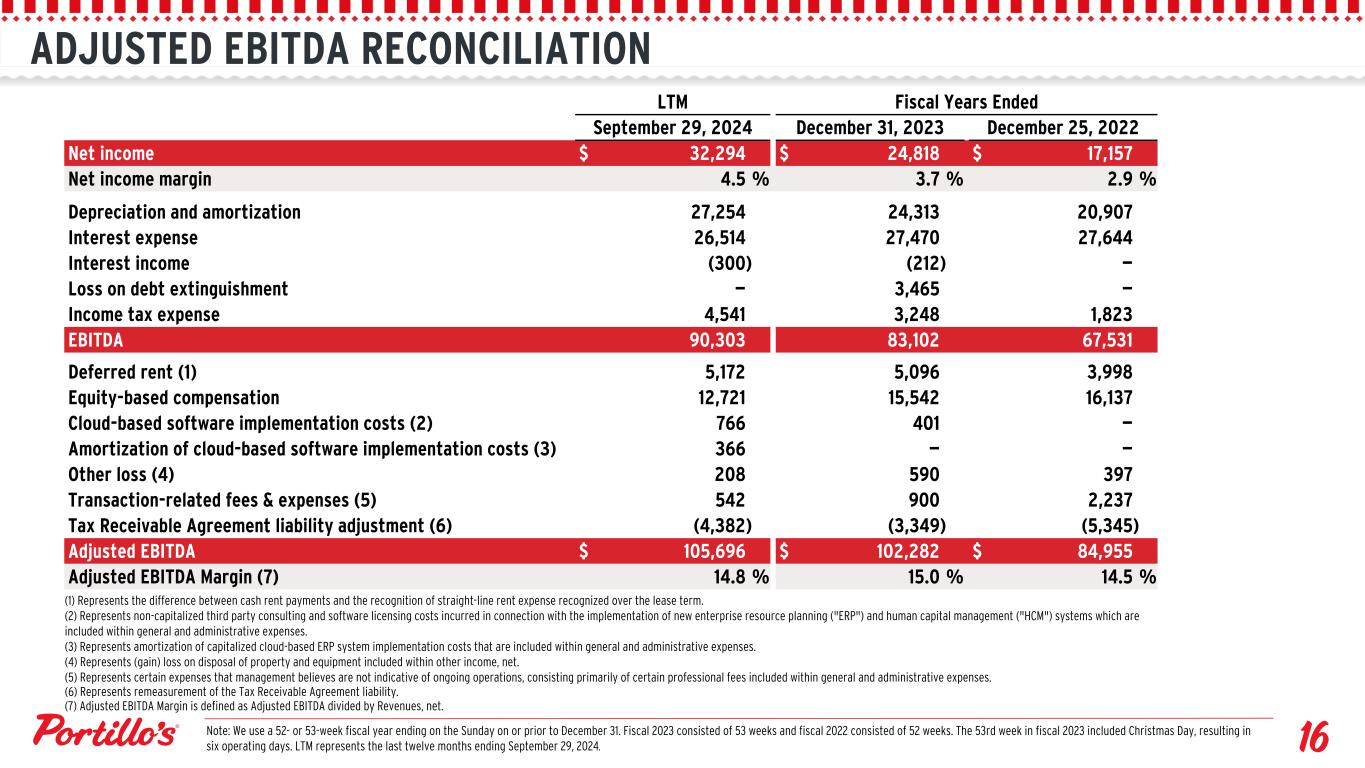

LTM Fiscal Years Ended September 29, 2024 December 31, 2023 December 25, 2022 Net income $ 32,294 $ 24,818 $ 17,157 Net income margin 4.5 % 3.7 % 2.9 % Depreciation and amortization 27,254 24,313 20,907 Interest expense 26,514 27,470 27,644 Interest income (300) (212) — Loss on debt extinguishment — 3,465 — Income tax expense 4,541 3,248 1,823 EBITDA 90,303 83,102 67,531 Deferred rent (1) 5,172 5,096 3,998 Equity-based compensation 12,721 15,542 16,137 Cloud-based software implementation costs (2) 766 401 — Amortization of cloud-based software implementation costs (3) 366 — — Other loss (4) 208 590 397 Transaction-related fees & expenses (5) 542 900 2,237 Tax Receivable Agreement liability adjustment (6) (4,382) (3,349) (5,345) Adjusted EBITDA $ 105,696 $ 102,282 $ 84,955 Adjusted EBITDA Margin (7) 14.8 % 15.0 % 14.5 % ADJUSTED EBITDA RECONCILIATION Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2023 consisted of 53 weeks and fiscal 2022 consisted of 52 weeks. The 53rd week in fiscal 2023 included Christmas Day, resulting in six operating days. LTM represents the last twelve months ending September 29, 2024. (1) Represents the difference between cash rent payments and the recognition of straight-line rent expense recognized over the lease term. (2) Represents non-capitalized third party consulting and software licensing costs incurred in connection with the implementation of new enterprise resource planning ("ERP") and human capital management ("HCM") systems which are included within general and administrative expenses. (3) Represents amortization of capitalized cloud-based ERP system implementation costs that are included within general and administrative expenses. (4) Represents (gain) loss on disposal of property and equipment included within other income, net. (5) Represents certain expenses that management believes are not indicative of ongoing operations, consisting primarily of certain professional fees included within general and administrative expenses. (6) Represents remeasurement of the Tax Receivable Agreement liability. (7) Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenues, net.

RESTAURANT-LEVEL ADJUSTED EBITDA DEFINITIONS Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin Restaurant-Level Adjusted EBITDA is defined as revenue, less restaurant operating expenses, which include food, beverage and packaging costs, labor expenses, occupancy expenses and other operating expenses. Restaurant-Level Adjusted EBITDA excludes corporate level expenses, pre-opening expenses and depreciation and amortization on restaurant property and equipment. Restaurant-Level Adjusted EBITDA Margin represents Restaurant-Level Adjusted EBITDA as a percentage of revenues, net. How These Measures Are Useful We believe that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are important measures to evaluate the performance and profitability of our restaurants, individually and in the aggregate. Restaurant- Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin have limitations as analytical tools and should not be considered as a substitute for analysis of our results as reported under GAAP. Limitations of the Usefulness of This Measure Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are not required by, nor presented in accordance with GAAP. Rather, Restaurant- Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are supplemental measures of operating performance of our restaurants. You should be aware that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are not indicative of overall results for the Company, and Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. In addition, our calculations thereof may not be comparable to similar measures reported by other companies.

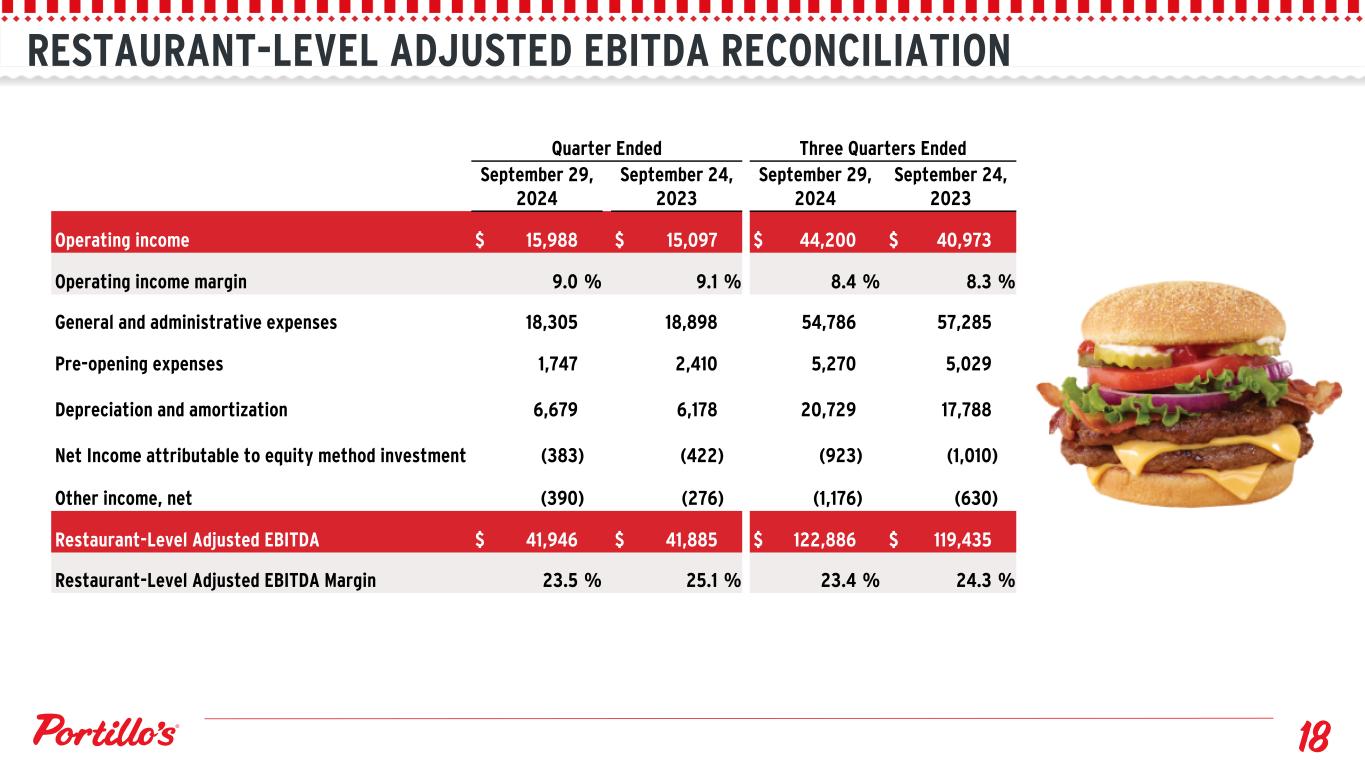

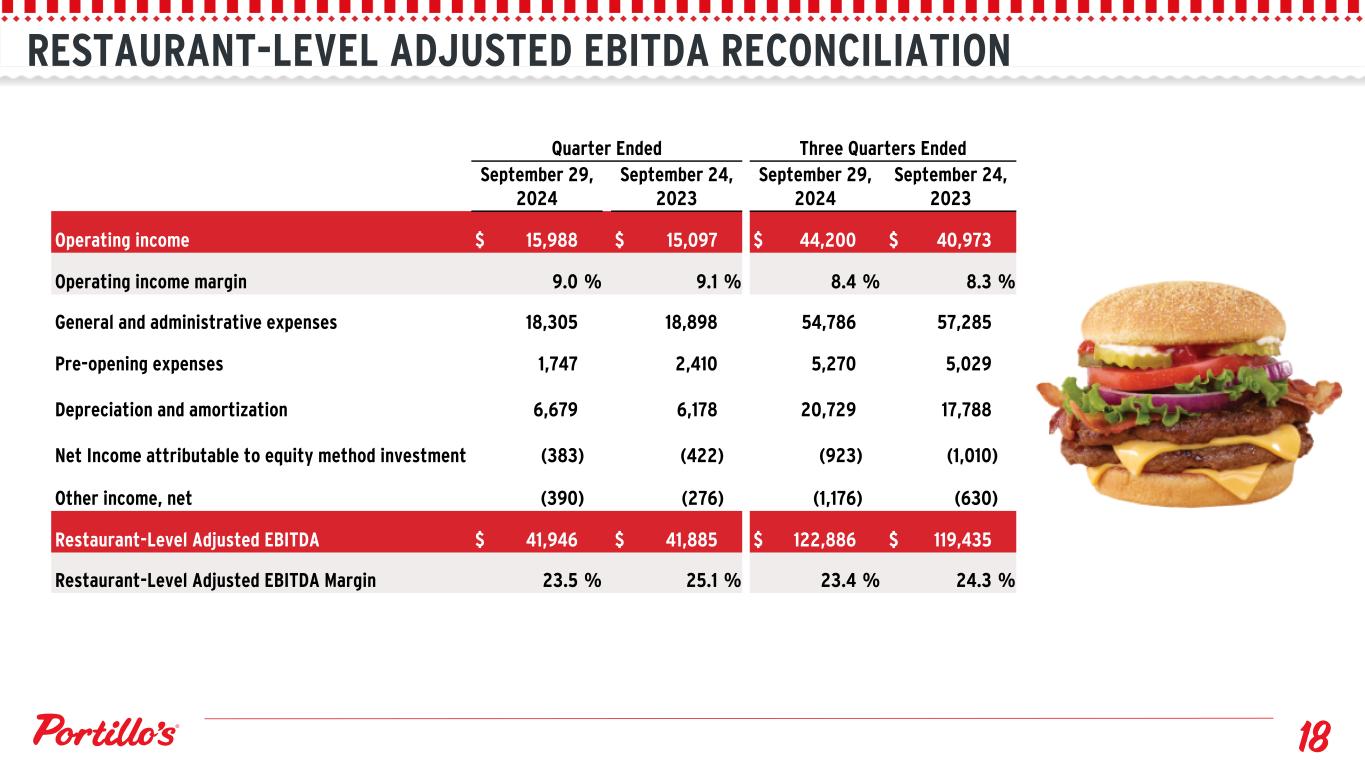

RESTAURANT-LEVEL ADJUSTED EBITDA RECONCILIATION Quarter Ended Three Quarters Ended September 29, 2024 September 24, 2023 September 29, 2024 September 24, 2023 Operating income $ 15,988 $ 15,097 $ 44,200 $ 40,973 Operating income margin 9.0 % 9.1 % 8.4 % 8.3 % General and administrative expenses 18,305 18,898 54,786 57,285 Pre-opening expenses 1,747 2,410 5,270 5,029 Depreciation and amortization 6,679 6,178 20,729 17,788 Net Income attributable to equity method investment (383) (422) (923) (1,010) Other income, net (390) (276) (1,176) (630) Restaurant-Level Adjusted EBITDA $ 41,946 $ 41,885 $ 122,886 $ 119,435 Restaurant-Level Adjusted EBITDA Margin 23.5 % 25.1 % 23.4 % 24.3 %

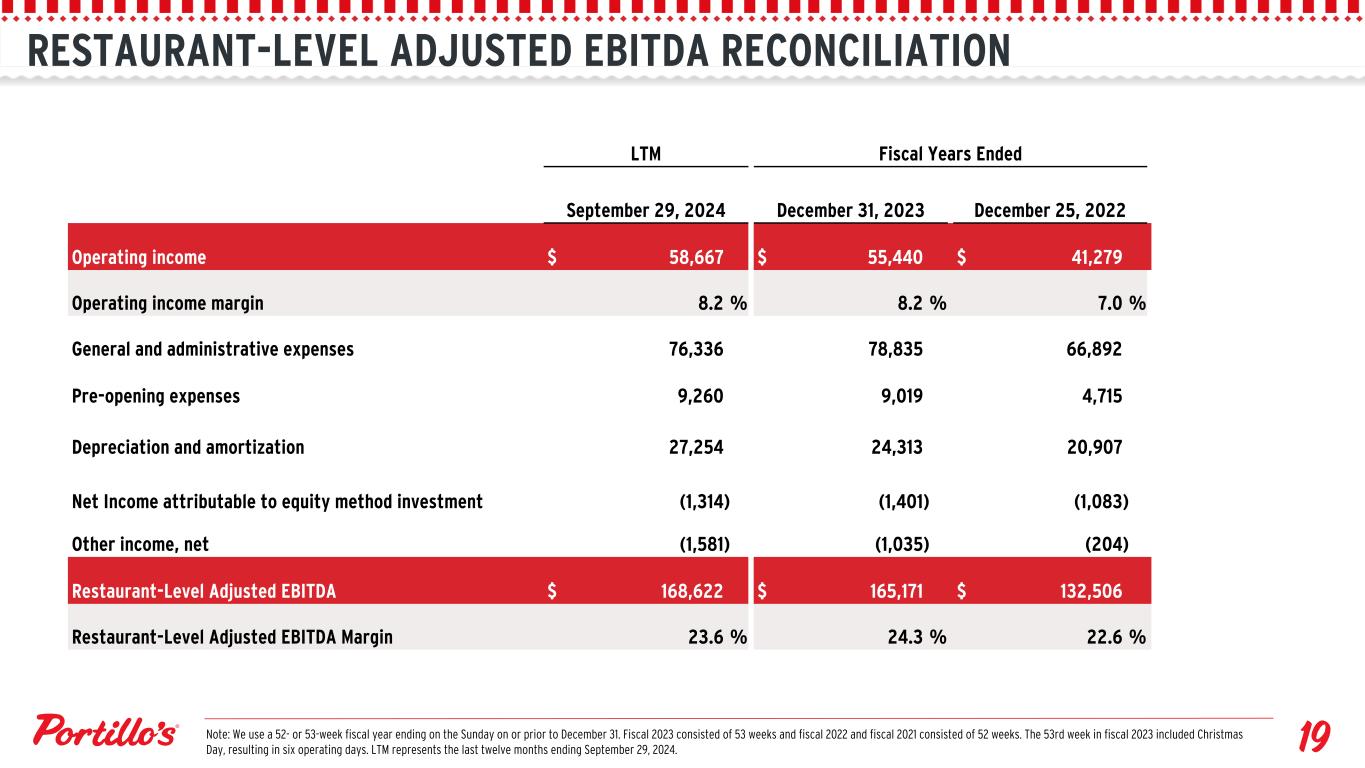

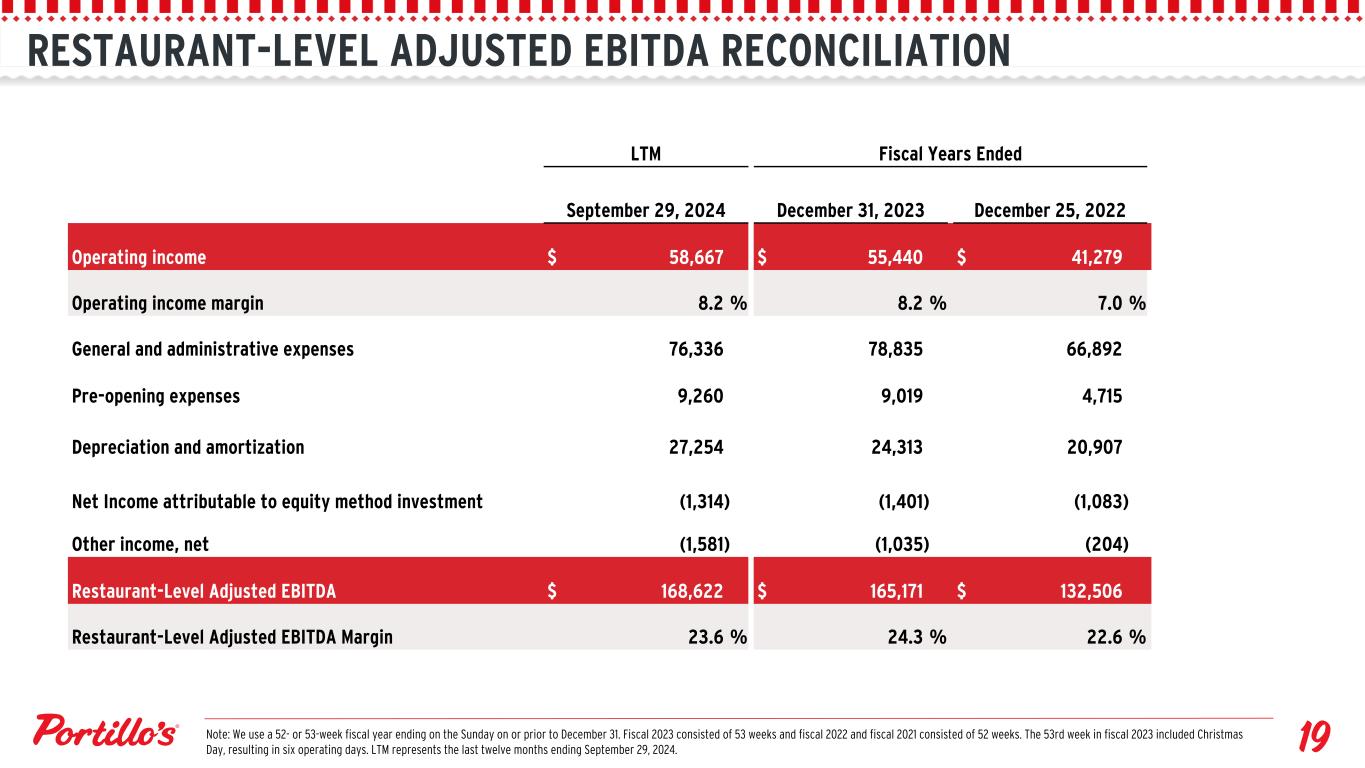

RESTAURANT-LEVEL ADJUSTED EBITDA RECONCILIATION LTM Fiscal Years Ended September 29, 2024 December 31, 2023 December 25, 2022 Operating income $ 58,667 $ 55,440 $ 41,279 Operating income margin 8.2 % 8.2 % 7.0 % General and administrative expenses 76,336 78,835 66,892 Pre-opening expenses 9,260 9,019 4,715 Depreciation and amortization 27,254 24,313 20,907 Net Income attributable to equity method investment (1,314) (1,401) (1,083) Other income, net (1,581) (1,035) (204) Restaurant-Level Adjusted EBITDA $ 168,622 $ 165,171 $ 132,506 Restaurant-Level Adjusted EBITDA Margin 23.6 % 24.3 % 22.6 % Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2023 consisted of 53 weeks and fiscal 2022 and fiscal 2021 consisted of 52 weeks. The 53rd week in fiscal 2023 included Christmas Day, resulting in six operating days. LTM represents the last twelve months ending September 29, 2024.

CONTACT INFORMATION Investor Contact: investors@portillos.com Media Contact: ICR, Inc. portillosPR@icrinc.com