Filed Pursuant to Rule 424(b)(4)

Registration No. 333-280772

2,273,000 American Depositary Shares

YXT.COM GROUP HOLDING LIMITED

Representing 6,819,000 Class A Ordinary Shares

This is an initial public offering of American depositary shares, or ADSs, representing Class A ordinary shares of YXT.COM GROUP HOLDING LIMITED. We are offering a total of 2,273,000 ADSs, each representing three of our Class A ordinary shares, par value US$0.0001 per share. The underwriters may also purchase up to 340,950 ADSs representing 1,022,850 Class A ordinary shares within 30 days from the date of this prospectus to cover over-allotments, if any.

Prior to this offering, there has been no public market for the ADSs. The initial public offering price is US$11.00. We have been approved for listing the ADSs representing our Class A ordinary shares on the Nasdaq Stock Market (the “Nasdaq”) under the symbol “YXT.”

Image Frame Investment (HK) Limited, our existing shareholder, has subscribed for, and has been allocated by the underwriters, an aggregate of 454,545 ADSs at the initial public offering price and on the same terms as the other ADSs being offered, representing approximately 20.0% of the ADSs being offered in this offering, assuming the underwriters do not exercise their option to purchase additional ADSs. The underwriters will receive the same underwriting discounts and commissions on any ADSs purchased by such shareholder as they will on any other ADSs sold to the public in this offering. See “Underwriting.”

Following the completion of this offering, our issued and outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Mr. Xiaoyan Lu, our director, founder and chairman of the board will beneficially own 9,757,585 Class A ordinary shares and all of our issued Class B ordinary shares and will collectively be able to exercise 69.4% of the total voting power of our issued and outstanding share capital immediately following the completion of this offering, after taking into account the anti-dilution adjustments based on the initial public offering price of US$11.00 per ADS, and assuming the underwriters do not exercise their option to purchase additional ADSs. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes. Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof, while Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Upon any sale, transfer, assignment or disposition of any Class B ordinary share by a holder thereof to any non-affiliate to such holder, each of such Class B ordinary share will be automatically and immediately converted into one Class A ordinary share. See “Description of Share Capital.” As a result, Mr. Xiaoyan Lu has the ability to control the outcome of matters submitted to the shareholders for approval. Immediately following the completion of this offering, we will be a “controlled company” within the meaning of the Nasdaq rules. See “Principal Shareholders.”

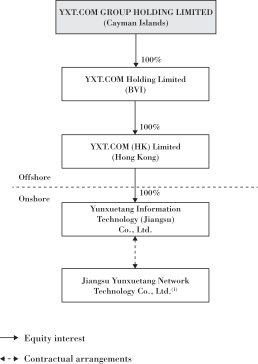

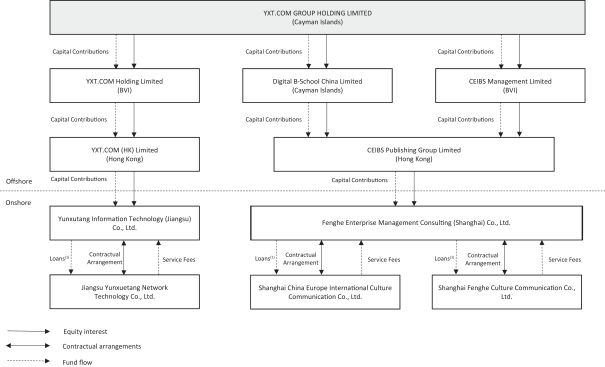

YXT.COM GROUP HOLDING LIMITED is a Cayman Islands holding company with no business operations. It conducts its operations in China through its PRC subsidiaries and consolidated variable interest entities, or the VIEs. However, we and our shareholders do not and are not legally permitted to have any equity interests in the VIEs as current PRC laws and regulations restrict foreign investment in companies that engage in certain services, such as the value-added telecommunication services. As a result, we operate businesses in China through certain contractual arrangements with the VIEs. This structure allows us to be considered the primary beneficiary of the VIEs for accounting purposes, which serves the purpose of consolidating the VIEs’ operating results in our financial statements under the U.S. GAAP. This structure also provides contractual exposure to foreign investment in such companies. As of the date of this prospectus, to the best knowledge of our company, our directors and management, our VIE agreements have not been tested in a court of law in the PRC. The VIEs are owned by certain nominee shareholders, not us. Most of the nominee shareholders are also shareholders of the Company. For a summary of such contractual arrangements, see “Our History and Corporate Structure—Contractual Arrangements with the VIEs and Their Shareholders.” Investors in the ADSs are purchasing equity securities of a Cayman Islands holding company rather than equity securities of our subsidiaries and the VIEs. Investors who are non-PRC residents may never directly hold equity interest in the VIEs under the current PRC laws and regulations. As used in this prospectus, “we,” “us,” “our company,” “our,” or “Yunxuetang” refers to YXT.COM GROUP HOLDING LIMITED and its subsidiaries, and, in the context of describing our consolidated financial information, business operations and operating data, our consolidated VIEs. We refer to Jiangsu Yunxuetang Network Technology Co., Ltd., Shanghai China Europe International Culture Communication Co., Ltd. and Shanghai Fenghe Culture Communication Co., Ltd. as the VIEs before January 15, 2024, and refer to Yunxuetang Network Technology Co., Ltd. as the VIE after January 15, 2024, in the context of describing their activities and contractual arrangements with us. This is because CEIBS PG has been deconsolidated from our consolidated financial statements from January 15, 2024 and the VIEs controlled by CEIBS PG have been deconsolidated as well. For details, see “Business—Legal Proceedings” and “Risk Factors—Risks Related to Our Business and Industry—From time to time, we may become defendants in legal proceedings for which we are unable to assess our exposure and which could become significant liabilities in the event of an adverse judgment.”

Our corporate structure involves unique risks to investors in the ADSs. In 2022 and 2023, all of our revenues were derived from the VIEs. As of December 31, 2022 and 2023, total assets of the VIEs, excluding amounts due from the group companies, equaled to 36.2% and 56.1% of our consolidated total assets as of the same dates, respectively. For details, see “Our Summary Consolidated Financial Data and Operating Data—VIE Consolidating Schedule (Unaudited).” If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to material penalties or be forced to relinquish our interests in those operations or otherwise significantly change our corporate structure. We and our investors face significant uncertainty about potential future actions by the PRC government that could affect the legality and enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect our ability to consolidate the financial results of the VIEs and the financial performance of our company as a whole. The ADSs representing our Class A ordinary shares may decline in value or become worthless, if we are unable to claim our contractual rights over the assets of the VIEs that conduct substantially all of our operations in China. See “Risk Factors—Risks Related to Our Corporate Structure” for detailed discussion.

As of December 31, 2023, YXT.COM GROUP HOLDING LIMITED had made cumulative capital contributions of US$245.0 million to our PRC subsidiaries through intermediate holding companies. Furthermore, funds equivalent to US$37.0 million were directly injected in the VIEs by certain shareholders issued by YXT.COM GROUP HOLDING LIMITED in the history. These funds have been used by the VIEs for their operations, and were accounted for as long-term investments of YXT.COM GROUP HOLDING LIMITED. Under relevant PRC laws and regulations, we are permitted to remit funds to the VIEs through loans rather than capital contributions. In 2022 and 2023, we made loans to the VIEs amounted to RMB20.0 million and nil, respectively. In 2022 and 2023, the VIEs repaid us at an amount of nil and RMB60.0 million, respectively. As of December 31, 2022 and 2023, the outstanding balance of the loans from us to the VIEs was RMB60.0 million and nil, respectively. In 2022 and 2023, the VIEs transferred RMB86.5 million and RMB137.4 million, respectively, to our PRC subsidiaries as service fees. YXT.COM GROUP HOLDING LIMITED has not previously declared or paid any cash dividend or dividend in kind, and has no plan to declare or pay any dividends in the near future on our shares or the ADSs representing our Class A ordinary shares. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Prospectus Summary—Holding Company Structure—Transfer of Funds and Other Assets.” As of the date of this prospectus, we do not have cash management policies and procedures in place that dictate how funds are transferred through our organization. Rather, the funds can be transferred in accordance with the applicable PRC laws and regulations without limitations, subject to satisfaction of applicable government registration and approval requirements. See “Prospectus Summary—Holding Company Structure—Restrictions on Foreign Exchange and the Ability to Transfer Cash Between Entities, Across Borders and to U.S. Investors.”

We face various legal and operational risks and uncertainties as a company based in and primarily operating in China. Such legal and operational risks associated with being based in China could result in a material change in the operations of us and the VIEs, and/or the value of the securities we are registering for sale, or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. The PRC government has significant authority to exert influence on the ability of a China-based company, like us, to conduct its business, accept foreign investments or list on a U.S. stock exchange. For example, recently the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, strengthened supervision on overseas listings by China-based companies, including companies with a VIE structure, adopting new measures to extend the scope of cybersecurity reviews and data security protection, and expanding the efforts in anti-monopoly enforcement. The PRC government may also intervene with or influence our operations at any time by adopting new laws and regulations as the government deems appropriate to further regulatory, political and societal goals. Uncertainties with respect to the PRC legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in policies, laws and regulations with little advance notice in China, could adversely affect us. The PRC government has published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Furthermore, the PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and other capital markets activities and foreign investment in China-based companies like us. Any such action, once taken by the PRC government, could cause the value of such securities to significantly decline or in extreme cases, become worthless. You should carefully consider all of the information in this prospectus before making an investment in the ADSs. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. In particular, as we are a China-based company incorporated in the Cayman Islands, you should pay special attention to subsections headed “Risk Factors—Risks Related to Doing Business in China” and “Risk Factors—Risks Related to Our Corporate Structure.”

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020 and amended by the Consolidated Appropriations Act, 2023 enacted on December 29, 2022. The amended HFCAA states if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for two consecutive years, the SEC shall prohibit our shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. The Consolidated Appropriations Act, 2023 reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two years.

On December 15, 2022, the PCAOB released a statement confirming it has secured complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. Our auditor, PricewaterhouseCoopers Zhong Tian LLP, is an independent registered accounting firm based in mainland China. The PCAOB issued the 2022 HFCAA Determination Report, which vacated its previous 2021 determinations to the contrary. Accordingly, our auditor is no longer identified as one of the registered public accounting firms that the PCAOB is unable to inspect or investigate completely. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. Therefore, there is no guarantee that our auditor would not be identified again by the PCAOB in the future as a registered public accounting firm that the PCAOB is unable to inspect or investigate completely. In such event, we would again be subject to the trading prohibition under the HFCAA if we are identified as a commission identified issuer for two consecutive years.

The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. If the PCAOB again concludes that it is unable to inspect and investigate completely registered public accounting firms, and if we are identified as a “Commission-Identified Issuer” for two consecutive years after we file our annual report on Form 20-F after becoming a public company, we would be subject to the delisting and prohibition of trading requirements of the HFCAA. The delisting of the ADSs, or the threat of their being delisted, may cause the value of the ADSs to significantly decline or be worthless. Additionally, the inability of the PCAOB to conduct inspections of our auditors in the past deprives investors with the benefits of such inspections. For details, see “Risk Factors—Risks Related to Doing Business in China—The ADSs will be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, if in the future the PCAOB is unable to inspect and investigate completely auditors located in China. The delisting of and prohibition from trading the ADSs, or the threat of their being delisted and prohibited from trading, may cause the value of the ADSs to significantly decline or be worthless” on page 61 of this prospectus.

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), effective on March 31, 2023. As advised by Global Law Office, our PRC legal counsel, we are required to perform the filing procedures for this offering under the Trial Measures. We have submitted the relevant filing documents with the CSRC in connection with this offering, and the CSRC published the notification on our completion of the required filing procedures for this offering on February 7, 2024.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” under the U.S. federal securities laws and will be subject to reduced public company reporting requirements. Investing in the ADSs involves risks. See “Risk Factors” beginning on page 31 of this prospectus.

PRICE US$11.00 PER ADS

| | | | | | | | |

| | | Per ADS | | | Total | |

Public offering price | | | US$11.00 | | | | US$25,003,000 | |

Underwriting discounts and commissions(1) | | | US$0.66 | | | | US$1,500,180 | |

Proceeds, before expenses, to us | | | US$10.34 | | | | US$23,502,820 | |

| (1) | For a description of the compensation payable to the underwriters, see “Underwriting.” |

China International Capital Corporation Hong Kong Securities Limited has acted as our independent financial advisor in connection with this offering.

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on August 19, 2024.

The date of this prospectus is August 15, 2024.