UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23724

Total Fund Solution

(Exact name of Registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Stephen E. Baird, President

Total Fund Solution

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 6th Fl

Milwaukee, WI 53202

(Name and address of agent for service)

(855) 625-7333

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2024

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| | |

| Cromwell CenterSquare Real Estate Fund | |

| Investor Class | MRESX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell CenterSquare Real Estate Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $54 | 1.10% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $115,570,078 |

Number of Holdings | 47 |

Portfolio Turnover | 15% |

Visit https://thecromwellfunds.com/funds/centersquare-real-estate for more recent performance information.

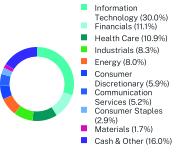

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *

| |

Top 10 Issuers | (%) |

American Tower Corp. | 9.2% |

Equinix, Inc. | 7.4% |

Prologis, Inc. | 7.2% |

Welltower, Inc. | 4.9% |

UDR, Inc. | 4.2% |

Ventas, Inc. | 3.8% |

Extra Space Storage, Inc. | 3.8% |

Digital Realty Trust, Inc. | 3.7% |

Invitation Homes, Inc. | 3.1% |

Equity Residential | 3.0% |

| * | Percentages are stated as a percentage of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell CenterSquare Real Estate Fund | PAGE 1 | TSR-SAR-89156Y407 |

28.613.412.611.69.06.15.84.42.75.8

| | |

| Cromwell CenterSquare Real Estate Fund | |

| Institutional Class | MRASX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell CenterSquare Real Estate Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $51 | 1.03% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $115,570,078 |

Number of Holdings | 47 |

Portfolio Turnover | 15% |

Visit https://thecromwellfunds.com/funds/centersquare-real-estate for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *

| |

Top 10 Issuers | (%) |

American Tower Corp. | 9.2% |

Equinix, Inc. | 7.4% |

Prologis, Inc. | 7.2% |

Welltower, Inc. | 4.9% |

UDR, Inc. | 4.2% |

Ventas, Inc. | 3.8% |

Extra Space Storage, Inc. | 3.8% |

Digital Realty Trust, Inc. | 3.7% |

Invitation Homes, Inc. | 3.1% |

Equity Residential | 3.0% |

| * | Percentages are stated as a percentage of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell CenterSquare Real Estate Fund | PAGE 1 | TSR-SAR-89156Y506 |

28.613.412.611.69.06.15.84.42.75.8

| | |

| Cromwell Long Short Fund | |

| Investor Class | MFADX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Long Short Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $115 | 2.28% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $99,116,724 |

Number of Holdings | 120 |

Portfolio Turnover | 91% |

Visit https://thecromwellfunds.com/funds/long-short for more recent performance information.

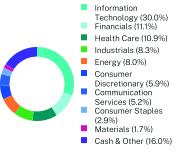

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**,†

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

NVIDIA Corp. | 6.8% |

Alphabet, Inc. | 3.7% |

Apple, Inc. | 3.5% |

JPMorgan Chase & Co. | 2.6% |

Costco Wholesale Corp. | 2.6% |

Amazon.com, Inc. | 2.6% |

Visa, Inc. | 2.4% |

ConocoPhillips | 2.4% |

Lam Research Corp. | 1.9% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| † | Net exposure, includes securities sold short. |

HOW HAS THE FUND CHANGED?

Effective May 31, 2024, the Cromwell Marketfield L/S Fund changed its name to the Cromwell Long Short Fund (the “Fund”).

| Cromwell Long Short Fund | PAGE 1 | TSR_SAR_89156Y100 |

Changes to Fund’s Investment Adviser or Sub-Adviser:

Effective May 31, 2024, Mutual of America Capital Management, LLC replaced Marketfield Asset Management LLC as a sub-adviser to the Fund.

Changes to the Fund’s Principal Investment Strategy:

Prior to May 31, 2024, under normal market conditions, the Fund’s long positions may range from approximately 60% to 95% of its net assets and its short positions may range from approximately 10% to 50% of its net assets. Effective May 31, 2024, under normal market conditions, the sub-adviser expects to maintain the Fund’s long positions in a range between 80% to 100% of net assets, and its short positions at approximately 20% of net assets, which may range between 10% to 30%.

Changes to Shareholder Fees (fees paid directly from your investment):

Effective May 31, 2024, with the change in sub-adviser to the Fund and associated change in principal investment strategy in regards to the volume and types of securities anticipated to be held short by the Fund the short sale expenses incured by the Fund are anticipated to be materially lower. Short sale expenses were reduced to 0.18% from the 0.58% the Fund incurred in 2023 in the Fund’s prospectus.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

Effective May 31, 2024, Joseph R. Gaffoglio, Thaddeus Pollock and Jamie A. Zendel of Mutual of America Capital Management, LLC became portfolio managers for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Long Short Fund | PAGE 2 | TSR_SAR_89156Y100 |

30.011.110.98.38.05.95.22.91.716.0

| | |

| Cromwell Long Short Fund | |

| Institutional Class | MFLDX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Long Short Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $102 | 2.02% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $99,116,724 |

Number of Holdings | 120 |

Portfolio Turnover | 91% |

Visit https://thecromwellfunds.com/funds/long-short for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**,†

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

NVIDIA Corp. | 6.8% |

Alphabet, Inc. | 3.7% |

Apple, Inc. | 3.5% |

JPMorgan Chase & Co. | 2.6% |

Costco Wholesale Corp. | 2.6% |

Amazon.com, Inc. | 2.6% |

Visa, Inc. | 2.4% |

ConocoPhillips | 2.4% |

Lam Research Corp. | 1.9% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| † | Net exposure, includes securities sold short. |

HOW HAS THE FUND CHANGED?

Effective May 31, 2024, the Cromwell Marketfield L/S Fund changed its name to the Cromwell Long Short Fund (the “Fund”).

| Cromwell Long Short Fund | PAGE 1 | TSR_SAR_89156Y308 |

Changes to Fund’s Investment Adviser or Sub-Adviser:

Effective May 31, 2024, Mutual of America Capital Management, LLC replaced Marketfield Asset Management LLC as a sub-adviser to the Fund.

Changes to the Fund’s Principal Investment Strategy:

Prior to May 31, 2024, under normal market conditions, the Fund’s long positions may range from approximately 60% to 95% of its net assets and its short positions may range from approximately 10% to 50% of its net assets. Effective May 31, 2024, under normal market conditions, the sub-adviser expects to maintain the Fund’s long positions in a range between 80% to 100% of net assets, and its short positions at approximately 20% of net assets, which may range between 10% to 30%.

Changes to Shareholder Fees (fees paid directly from your investment):

Effective May 31, 2024, with the change in sub-adviser to the Fund and associated change in principal investment strategy in regards to the volume and types of securities anticipated to be held short by the Fund the short sale expenses incured by the Fund are anticipated to be materially lower. Short sale expenses were reduced to 0.18% from the 0.58% the Fund incurred in 2023 in the Fund’s prospectus.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

Effective May 31, 2024, Joseph R. Gaffoglio, Thaddeus Pollock and Jamie A. Zendel of Mutual of America Capital Management, LLC became portfolio managers for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Long Short Fund | PAGE 2 | TSR_SAR_89156Y308 |

30.011.110.98.38.05.95.22.91.716.0

| | |

| Cromwell Foresight Global Sustainable Infrastructure Fund | |

| Institutional Class | CFGIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Foresight Global Sustainable Infrastructure Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $51 | 1.05% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $44,789,135 |

Number of Holdings | 26 |

Portfolio Turnover | 12% |

Visit https://www.thecromwellfunds.com/funds/foresight-global-sustainable-infrastructure for more recent performance information.

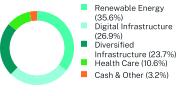

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *

| |

Top 10 Issuers | (%) |

Cellnex Telecom SA | 6.2% |

3i Infrastructure PLC | 5.3% |

Infratil Ltd. | 5.3% |

Boralex, Inc. | 5.3% |

Equinix, Inc. | 5.2% |

Brookfield Renewable Partners LP | 5.0% |

American Tower Corp. | 4.8% |

Innergex Renewable Energy, Inc. | 4.6% |

Transurban Group | 4.1% |

Northland Power, Inc. | 4.1% |

| |

Top 10 Countries | (%) |

United States | 30.8% |

Canada | 19.0% |

United Kingdom | 18.3% |

New Zealand | 7.3% |

Spain | 6.2% |

Jersey | 5.4% |

Australia | 4.1% |

Germany | 3.0% |

Ireland | 2.7% |

Cash & Other | 3.2% |

| * | Percentages are stated as a percentage of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

| Cromwell Foresight Global Sustainable Infrastructure Fund | PAGE 1 | TSR_SAR_89156Y878 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Foresight Global Sustainable Infrastructure Fund | PAGE 2 | TSR_SAR_89156Y878 |

35.626.923.710.63.2

| | |

| Cromwell Tran Sustainable Focus Fund | |

| Investor Class | LIMAX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Tran Sustainable Focus Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $57 | 1.10% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $31,423,804 |

Number of Holdings | 28 |

Portfolio Turnover | 26% |

Visit https://thecromwellfunds.com/funds/tran-sustainable-focus for more recent performance information.

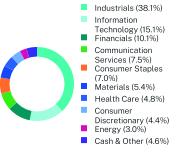

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**

| |

Top 10 Issuers | (%) |

Amazon.com, Inc. | 8.5% |

Microsoft Corp. | 8.1% |

Danaher Corp. | 6.2% |

NVIDIA Corp. | 6.0% |

AerCap Holdings NV | 5.0% |

Palo Alto Networks, Inc. | 4.9% |

Entegris, Inc. | 4.9% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 4.8% |

T-Mobile US, Inc. | 4.7% |

Meta Platforms, Inc. | 4.3% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

| Cromwell Tran Sustainable Focus Fund | PAGE 1 | TSR-SAR-89156Y803 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Tran Sustainable Focus Fund | PAGE 2 | TSR-SAR-89156Y803 |

38.712.711.510.69.69.37.63.93.9

| | |

| Cromwell Tran Sustainable Focus Fund | |

| Institutional Class | LIMIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Tran Sustainable Focus Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $44 | 0.85% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $31,423,804 |

Number of Holdings | 28 |

Portfolio Turnover | 26% |

Visit https://thecromwellfunds.com/funds/tran-sustainable-focus for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**

| |

Top 10 Issuers | (%) |

Amazon.com, Inc. | 8.5% |

Microsoft Corp. | 8.1% |

Danaher Corp. | 6.2% |

NVIDIA Corp. | 6.0% |

AerCap Holdings NV | 5.0% |

Palo Alto Networks, Inc. | 4.9% |

Entegris, Inc. | 4.9% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 4.8% |

T-Mobile US, Inc. | 4.7% |

Meta Platforms, Inc. | 4.3% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

| Cromwell Tran Sustainable Focus Fund | PAGE 1 | TSR-SAR-89156Y704 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Tran Sustainable Focus Fund | PAGE 2 | TSR-SAR-89156Y704 |

38.712.711.510.69.69.37.63.93.9

| | |

| Cromwell Greenspring Mid Cap Fund | |

| Institutional Class | GRSPX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Greenspring Mid Cap Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $53 | 1.03% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $121,769,602 |

Number of Holdings | 56 |

Portfolio Turnover | 7% |

Visit https://mail.thecromwellfunds.com/funds/greenspring-mid-cap-fund for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**

| |

Top 10 Issuers | (%) |

Republic Services, Inc. | 9.7% |

KBR, Inc. | 8.8% |

EMCOR Group, Inc. | 8.4% |

MYR Group, Inc. | 4.8% |

Johnson Controls International PLC | 3.9% |

Primo Water Corp. | 3.4% |

DuPont de Nemours, Inc. | 3.1% |

W.R. Berkley Corp. | 3.1% |

EOG Resources, Inc. | 2.6% |

Ziff Davis, Inc. | 2.6% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

| Cromwell Greenspring Mid Cap Fund | PAGE 1 | TSR-SAR-89156Y852 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Greenspring Mid Cap Fund | PAGE 2 | TSR-SAR-89156Y852 |

38.115.110.17.57.05.44.84.43.04.6

| | |

| Cromwell Sustainable Balanced Fund | |

| Institutional Class | CSBIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Cromwell Sustainable Balanced Fund for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.thecromwellfunds.com/resources/literature. You can also request this information by contacting us at 1-855-625-7333.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $57 | 1.10% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $11,008,989 |

Number of Holdings | 46 |

Portfolio Turnover | 21% |

Visit https://thecromwellfunds.com/funds/sustainable-balanced for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024) *,**

| |

Top 10 Issuers | (%) |

United States Treasury Note/Bond | 30.7% |

Microsoft Corp. | 4.3% |

Amazon.com, Inc. | 4.2% |

NVIDIA Corp. | 3.4% |

Danaher Corp. | 3.4% |

AerCap Holdings NV | 3.1% |

Ferguson PLC | 2.7% |

Meta Platforms, Inc. | 2.6% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 2.6% |

Ball Corp. | 2.6% |

| * | Percentages are stated as a percentage of net assets. |

| ** | The Global Industry Classification Standard (‘‘GICS®’’) was developed by and/or is the exclusive property of MSCI, Inc. (‘‘MSCI’’) and Standard & Poor’s Financial Services LLC (‘‘S&P’’). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thecromwellfunds.com/resources/literature

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Cromwell Investment Advisors, LLC documents not be householded, please contact Cromwell Investment Advisors, LLC at 1-855-625-7333, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Cromwell Investment Advisors, LLC or your financial intermediary.

| Cromwell Sustainable Balanced Fund | PAGE 1 | TSR_SAR_89156Y837 |

58.230.74.17.0

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

CROMWELL FUNDS

Core Financial Statements

June 30, 2024 (Unaudited)

TABLE OF CONTENTS

| | | | |

Schedules of Investments

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

Cromwell CenterSquare Real Estate Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

REAL ESTATE INVESTMENT

TRUSTS - 99.2%

|

Apartments - 12.6%

| | | | | | |

Camden Property Trust | | | 23,810 | | | $2,597,909 |

Equity Residential | | | 50,190 | | | 3,480,175 |

Invitation Homes, Inc. | | | 100,630 | | | 3,611,611 |

UDR, Inc. | | | 118,610 | | | 4,880,801 |

| | | | | | 14,570,496 |

Diversified - 28.6%(a)

| | | | | | |

American Tower Corp. | | | 54,830 | | | 10,657,855 |

Broadstone Net Lease, Inc. | | | 47,050 | | | 746,683 |

Digital Realty Trust, Inc. | | | 27,800 | | | 4,226,990 |

Equinix, Inc. | | | 11,338 | | | 8,578,331 |

Lamar Advertising Co. - Class A | | | 13,660 | | | 1,632,780 |

SBA Communications Corp. | | | 17,707 | | | 3,475,884 |

VICI Properties, Inc. | | | 77,829 | | | 2,229,023 |

Weyerhaeuser Co. | | | 55,179 | | | 1,566,532 |

| | | | | | 33,114,078 |

Health Care - 13.4%

| | | | | | |

American Healthcare

REIT, Inc | | | 55,499 | | | 810,840 |

CareTrust REIT, Inc. | | | 33,195 | | | 833,194 |

Healthpeak Properties, Inc. | | | 125,290 | | | 2,455,684 |

Omega Healthcare Investors, Inc. | | | 40,570 | | | 1,389,523 |

Ventas, Inc. | | | 86,750 | | | 4,446,805 |

Welltower, Inc. | | | 53,770 | | | 5,605,523 |

| | | | | | 15,541,569 |

Hotels - 2.5%

| | | | | | |

DiamondRock Hospitality Co | | | 80,840 | | | 683,098 |

Host Hotels & Resorts, Inc. | | | 80,980 | | | 1,456,020 |

Ryman Hospitality Properties, Inc. | | | 3,440 | | | 343,518 |

Xenia Hotels & Resorts, Inc. | | | 26,590 | | | 381,035 |

| | | | | | 2,863,672 |

Manufactured Homes - 2.5%

| | | | | | |

Sun Communities, Inc. | | | 24,039 | | | 2,892,853 |

Office Property - 4.4%

| | | | | | |

Alexandria Real Estate

Equities, Inc. | | | 7,590 | | | 887,802 |

BXP, Inc. | | | 21,769 | | | 1,340,100 |

Cousins Properties, Inc. | | | 51,280 | | | 1,187,132 |

Douglas Emmett, Inc. | | | 50,762 | | | 675,642 |

Kilroy Realty Corp. | | | 17,470 | | | 544,540 |

Vornado Realty Trust | | | 15,070 | | | 396,190 |

| | | | | | 5,031,406 |

Regional Malls - 2.7%

| | | | | | |

Simon Property Group, Inc. | | | 19,741 | | | 2,996,684 |

The Macerich Co. | | | 11,520 | | | 177,869 |

| | | | | | 3,174,553 |

| | | | | | | |

| | | | | | | |

Shopping Centers - 5.8%

| | | | | | |

Brixmor Property Group, Inc. | | | 71,410 | | | $1,648,857 |

Kimco Realty Corp. | | | 166,570 | | | 3,241,452 |

Retail Opportunity Investments

Corp. | | | 96,620 | | | 1,200,987 |

Urban Edge Properties | | | 30,302 | | | 559,678 |

| | | | | | 6,650,974 |

Single Tenant - 6.1%

| | | | | | |

Agree Realty Corp. | | | 40,770 | | | 2,525,294 |

NNN REIT, Inc. | | | 47,710 | | | 2,032,446 |

Realty Income Corp. | | | 46,294 | | | 2,445,249 |

| | | | | | 7,002,989 |

Storage - 9.0%

| | | | | | |

CubeSmart | | | 14,400 | | | 650,448 |

Extra Space Storage, Inc. | | | 28,191 | | | 4,381,163 |

Iron Mountain, Inc. | | | 30,420 | | | 2,726,240 |

Public Storage | | | 9,150 | | | 2,631,998 |

| | | | | | 10,389,849 |

Warehouse/Industrial - 11.6%

| | | | | | |

Americold Realty Trust, Inc. | | | 15,150 | | | 386,931 |

EastGroup Properties, Inc. | | | 2,640 | | | 449,064 |

First Industrial Realty Trust, Inc. | | | 48,923 | | | 2,324,332 |

Prologis, Inc. | | | 73,620 | | | 8,268,262 |

Rexford Industrial Realty, Inc. | | | 44,269 | | | 1,973,955 |

| | | | | | 13,402,544 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $99,811,302) | | | | | | 114,634,983 |

TOTAL INVESTMENTS - 99.2%

(Cost $99,811,302) | | | | | | 114,634,983 |

Other Assets in Excess of

Liabilities - 0.8% | | | | | | 935,095 |

TOTAL NET ASSETS - 100.0% | | | | | | $115,570,078 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Long Short Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 95.0%

|

Banks - 3.1%

| | | | | | |

Citigroup, Inc. | | | 6,933 | | | $439,968 |

JPMorgan Chase & Co. | | | 12,981 | | | 2,625,537 |

| | | | | | 3,065,505 |

Biotechnology - 4.1%

|

AbbVie, Inc. | | | 6,040 | | | 1,035,981 |

Gilead Sciences, Inc. | | | 7,830 | | | 537,216 |

Halozyme Therapeutics, Inc.(a) | | | 20,040 | | | 1,049,294 |

Regeneron Pharmaceuticals, Inc.(a) | | | 484 | | | 508,699 |

Vertex Pharmaceuticals, Inc.(a) | | | 2,091 | | | 980,094 |

| | | | | | 4,111,284 |

Broadline Retail - 2.6%

|

Amazon.com, Inc.(a)(b) | | | 13,178 | | | 2,546,648 |

Building Products - 2.3%

|

Builders FirstSource, Inc.(a) | | | 5,085 | | | 703,815 |

Carlisle Cos., Inc. | | | 1,224 | | | 495,977 |

Trane Technologies PLC | | | 3,142 | | | 1,033,498 |

| | | | | | 2,233,290 |

Capital Markets - 3.2%

|

Ameriprise Financial, Inc. | | | 2,323 | | | 992,362 |

Houlihan Lokey, Inc. | | | 3,844 | | | 518,402 |

LPL Financial Holdings, Inc. | | | 3,567 | | | 996,263 |

Morgan Stanley | | | 6,602 | | | 641,649 |

| | | | | | 3,148,676 |

Chemicals - 1.2%

|

Ecolab, Inc. | | | 2,029 | | | 482,902 |

The Sherwin-Williams Co. | | | 2,464 | | | 735,331 |

| | | | | | 1,218,233 |

Construction & Engineering - 0.7%

|

EMCOR Group, Inc. | | | 1,955 | | | 713,731 |

Consumer Staples Distribution & Retail - 2.6%

|

Costco Wholesale Corp. | | | 3,058 | | | 2,599,269 |

Containers & Packaging - 0.5%

|

Crown Holdings, Inc. | | | 6,062 | | | 450,952 |

Diversified Telecommunication Services - 1.6%

|

AT&T, Inc. | | | 41,259 | | | 788,460 |

Verizon Communications, Inc. | | | 18,226 | | | 751,640 |

| | | | | | 1,540,100 |

Electric Utilities - 0.5%

|

NRG Energy, Inc. | | | 6,107 | | | 475,491 |

Electronic Equipment, Instruments & Components - 1.7%

|

Amphenol Corp. - Class A | | | 7,220 | | | 486,412 |

Vontier Corp. | | | 31,996 | | | 1,222,247 |

| | | | | | 1,708,659 |

Entertainment - 0.5%

|

Electronic Arts, Inc. | | | 3,632 | | | 506,047 |

| | | | | | | |

| | | | | | | |

Financial Services - 3.9%

|

Mastercard, Inc. - Class A | | | 3,369 | | | $ 1,486,268 |

Visa, Inc. - Class A | | | 9,204 | | | 2,415,774 |

| | | | | | 3,902,042 |

Ground Transportation - 2.0%

|

Old Dominion Freight Line, Inc. | | | 2,956 | | | 522,030 |

Union Pacific Corp. | | | 6,443 | | | 1,457,793 |

| | | | | | 1,979,823 |

Health Care Equipment & Supplies - 1.8%

|

Intuitive Surgical, Inc.(a) | | | 4,075 | | | 1,812,764 |

Health Care Providers & Services - 3.5%

|

McKesson Corp. | | | 1,110 | | | 648,285 |

The Cigna Group | | | 3,744 | | | 1,237,654 |

UnitedHealth Group, Inc. | | | 3,058 | | | 1,557,317 |

| | | | | | 3,443,256 |

Hotels, Restaurants & Leisure - 1.5%

|

Booking Holdings, Inc. | | | 187 | | | 740,801 |

Hilton Worldwide Holdings, Inc. | | | 3,425 | | | 747,335 |

| | | | | | 1,488,136 |

Household Durables - 1.0%

|

DR Horton, Inc. | | | 3,479 | | | 490,295 |

Toll Brothers, Inc. | | | 4,177 | | | 481,107 |

| | | | | | 971,402 |

Household Products - 1.3%

|

Colgate-Palmolive Co. | | | 13,285 | | | 1,289,176 |

Insurance - 2.5%

|

Arch Capital Group Ltd.(a) | | | 10,036 | | | 1,012,532 |

Everest Group Ltd. | | | 1,331 | | | 507,138 |

Reinsurance Group of America, Inc. | | | 2,409 | | | 494,495 |

The Hartford Financial Services Group, Inc. | | | 5,006 | | | 503,303 |

| | | | | | 2,517,468 |

Interactive Media & Services - 3.7%

|

Alphabet, Inc. - Class A(b) | | | 20,119 | | | 3,664,676 |

Machinery - 3.8%

|

Caterpillar, Inc. | | | 3,046 | | | 1,014,622 |

Crane Co. | | | 5,305 | | | 769,119 |

Deere & Co. | | | 3,971 | | | 1,483,685 |

Parker-Hannifin Corp. | | | 967 | | | 489,118 |

| | | | | | 3,756,544 |

Metals & Mining - 0.5%

|

Barrick Gold Corp. | | | 30,332 | | | 505,938 |

GMK Norilskiy Nickel PAO - ADR(a)(c) | | | 105,916 | | | 0 |

| | | | | | 505,938 |

Oil, Gas & Consumable Fuels - 8.5%

|

Chevron Corp. | | | 10,433 | | | 1,631,930 |

ConocoPhillips | | | 20,628 | | | 2,359,431 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Long Short Fund

Schedule of Investments

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Oil, Gas & Consumable Fuels - (Continued)

|

Devon Energy Corp. | | | 31,963 | | | $1,515,046 |

EOG Resources, Inc. | | | 9,283 | | | 1,168,451 |

Marathon Petroleum Corp. | | | 9,987 | | | 1,732,545 |

| | | | | | 8,407,403 |

Pharmaceuticals - 2.7%

|

Johnson & Johnson | | | 10,231 | | | 1,495,363 |

Merck & Co., Inc. | | | 9,554 | | | 1,182,785 |

| | | | | | 2,678,148 |

Semiconductors & Semiconductor

Equipment - 10.6%

|

Lam Research Corp. | | | 1,772 | | | 1,886,914 |

NVIDIA Corp.(b) | | | 54,471 | | | 6,729,347 |

NXP Semiconductors NV | | | 3,516 | | | 946,121 |

QUALCOMM, Inc. | | | 4,620 | | | 920,212 |

| | | | | | 10,482,594 |

Software - 13.2%

|

Adobe, Inc.(a) | | | 2,500 | | | 1,388,850 |

Cadence Design Systems, Inc.(a) | | | 4,202 | | | 1,293,165 |

Check Point Software Technologies Ltd.(a) | | | 6,298 | | | 1,039,170 |

Fortinet, Inc.(a) | | | 12,313 | | | 742,105 |

Intuit, Inc. | | | 2,000 | | | 1,314,420 |

Microsoft Corp. | | | 16,359 | | | 7,311,655 |

| | | | | | 13,089,365 |

Specialty Retail - 1.9%

|

AutoZone, Inc.(a) | | | 245 | | | 726,205 |

The Home Depot, Inc. | | | 3,484 | | | 1,199,332 |

| | | | | | 1,925,537 |

Technology Hardware, Storage &

Peripherals - 5.0%

|

Apple, Inc. | | | 16,435 | | | 3,461,540 |

Dell Technologies, Inc. - Class C | | | 3,502 | | | 482,961 |

NetApp, Inc. | | | 7,933 | | | 1,021,770 |

| | | | | | 4,966,271 |

Textiles, Apparel & Luxury Goods - 0.7%

|

Ralph Lauren Corp. | | | 4,074 | | | 713,194 |

| | | | | | | |

| | | | | | | |

Tobacco - 1.0%

|

Philip Morris International, Inc. | | | 9,596 | | | $972,363 |

Trading Companies & Distributors - 0.8%

|

Applied Industrial Technologies,

Inc. | | | 4,059 | | | 787,446 |

Wireless Telecommunication Services - 0.5%

|

T-Mobile US, Inc. | | | 2,776 | | | 489,076 |

TOTAL COMMON STOCKS

(Cost $86,294,198) | | | | | | 94,160,507 |

EXCHANGE TRADED FUNDS - 0.0%(d)

|

VanEck Russia ETF(c) | | | 81,903 | | | 0 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $1,778,634) | | | | | | 0 |

TOTAL INVESTMENTS - 95.0%

(Cost $88,072,832) | | | | | | 94,160,507 |

Securities Sold Short - (11.1)% | | | | | | (11,006,069) |

Other Assets in Excess of

Liabilities - 16.1% | | | | | | 15,962,286 |

TOTAL NET ASSETS - 100.0% | | | | | | $99,116,724 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

NV - Naamloze Vennootschap

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of June 30, 2024 is $7,268,011.

|

(c)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of June 30, 2024.

|

(d)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Long Short Fund

Schedule of Securities Sold Short

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - (10.5)%

|

Aerospace & Defense - (0.3)%

|

Hexcel Corp. | | | (4,151) | | | $ (259,230) |

Beverages - (0.2)%

|

Monster Beverage Corp.(a) | | | (4,966) | | | (248,052) |

Biotechnology - (0.2)%

|

Moderna, Inc.(a) | | | (1,853) | | | (220,044) |

Building Products - (0.2)%

|

Fortune Brands Innovations, Inc. | | | (3,815) | | | (247,746) |

Capital Markets - (0.8)%

|

FactSet Research Systems, Inc. | | | (622) | | | (253,944) |

MarketAxess Holdings, Inc. | | | (1,300) | | | (260,689) |

Nasdaq, Inc. | | | (4,304) | | | (259,359) |

| | | | | | (773,992) |

Chemicals - (0.5)%

|

Albemarle Corp. | | | (2,231) | | | (213,105) |

PPG Industries, Inc. | | | (1,953) | | | (245,863) |

| | | | | | (458,968) |

Consumer Staples Distribution & Retail - (0.9)%

|

Dollar General Corp. | | | (1,854) | | | (245,154) |

Dollar Tree, Inc.(a) | | | (2,296) | | | (245,144) |

Maplebear, Inc.(a) | | | (7,768) | | | (249,663) |

Walgreens Boots Alliance, Inc. | | | (15,880) | | | (192,069) |

| | | | | | (932,030) |

Distributors - (0.3)%

|

LKQ Corp. | | | (6,059) | | | (251,994) |

Electrical Equipment - (0.2)%

|

Bloom Energy Corp. - Class A(a) | | | (18,990) | | | (232,438) |

Electronic Equipment, Instruments &

Components - (0.3)%

|

Zebra Technologies Corp. - Class A(a) | | | (841) | | | (259,810) |

Energy Equipment & Services - (0.3)%

|

NOV, Inc. | | | (14,249) | | | (270,873) |

Entertainment - (0.8)%

|

Live Nation Entertainment,

Inc.(a) | | | (2,804) | | | (262,847) |

ROBLOX Corp. - Class A(a) | | | (7,120) | | | (264,935) |

Warner Music Group Corp. - Class A | | | (8,264) | | | (253,292) |

| | | | | | (781,074) |

Financial Services - (0.8)%

|

Affirm Holdings, Inc.(a) | | | (10,744) | | | (324,576) |

Shift4 Payments, Inc. - Class A(a) | | | (3,504) | | | (257,018) |

StoneCo Ltd. - Class A(a) | | | (20,838) | | | (249,848) |

| | | | | | (831,442) |

| | | | | | | |

| | | | | | | |

Food Products - (0.5)%

|

Campbell Soup Co. | | | (5,900) | | | $ (266,621) |

The J.M. Smucker Co. | | | (2,243) | | | (244,577) |

| | | | | | (511,198) |

Ground Transportation - (0.3)%

|

Lyft, Inc. - Class A(a) | | | (18,154) | | | (255,971) |

Health Care Equipment & Supplies - (0.2)%

|

Integer Holdings Corp.(a) | | | (2,082) | | | (241,075) |

Health Care Providers & Services - (0.3)%

|

Acadia Healthcare Co., Inc.(a) | | | (3,939) | | | (266,040) |

Hotels, Restaurants & Leisure - (0.5)%

|

Las Vegas Sands Corp. | | | (5,762) | | | (254,969) |

Norwegian Cruise Line Holdings Ltd.(a) | | | (14,456) | | | (271,628) |

| | | | | | (526,597) |

Household Durables - (0.3)%

|

Whirlpool Corp. | | | (2,784) | | | (284,525) |

Household Products - (0.3)%

|

The Clorox Co. | | | (1,920) | | | (262,022) |

Life Sciences Tools & Services - (0.2)%

|

Avantor, Inc.(a) | | | (11,226) | | | (237,991) |

Media - (0.3)%

|

Liberty Broadband Corp. -

Class C(a) | | | (5,383) | | | (295,096) |

Oil, Gas & Consumable Fuels - (0.3)%

|

ONEOK, Inc. | | | (3,183) | | | (259,574) |

Passenger Airlines - (0.2)%

|

United Airlines Holdings,

Inc.(a) | | | (4,754) | | | (231,330) |

Pharmaceuticals - (0.2)%

|

Catalent, Inc.(a) | | | (4,427) | | | (248,930) |

Semiconductors & Semiconductor

Equipment - (0.3)%

|

Intel Corp. | | | (8,478) | | | (262,564) |

Specialty Retail - (0.8)%

|

Five Below, Inc.(a) | | | (2,114) | | | (230,363) |

Floor & Decor Holdings, Inc. - Class A(a) | | | (2,176) | | | (216,316) |

Lithia Motors, Inc. | | | (1,379) | | | (348,128) |

| | | | | | (794,807) |

TOTAL COMMON STOCKS (Proceeds $10,595,654) | | | | | | (10,445,413) |

REAL ESTATE INVESTMENT TRUSTS - (0.6)%

|

Industrial Real Estate Investment Trusts - (0.3)%

|

Americold Realty Trust, Inc. | | | (9,646) | | | (246,359) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Long Short Fund

Schedule of Securities Sold Short

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - (Continued)

|

Office Real Estate Investment Trusts - (0.3)%

|

Vornado Realty Trust | | | (11,955) | | | $(314,297) |

TOTAL REAL ESTATE INVESTMENT TRUSTS (Proceeds $1,126,471) | | | | | | (560,656) |

TOTAL SECURITIES SOLD SHORT - (11.1)%

(Proceeds $11,722,125) | | | | | | $(11,006,069) |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(a)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Foresight Global Sustainable Infrastructure Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 66.9%

|

Digital Infrastructure - 11.3%

| | | | | | |

Cellnex Telecom SA(a) | | | 85,871 | | | $2,795,005 |

Chorus Ltd. | | | 189,544 | | | 888,186 |

Cordiant Digital

Infrastructure Ltd.(a) | | | 1,450,527 | | | 1,393,539 |

| | | | | | 5,076,730 |

Diversified Infrastructure - 20.0%

|

3i Infrastructure PLC | | | 591,245 | | | 2,394,804 |

Infratil Ltd. | | | 349,963 | | | 2,389,483 |

International Public

Partnerships Ltd. | | | 686,885 | | | 1,107,374 |

Sequoia Economic Infrastructure Income Fund Ltd. | | | 1,205,632 | | | 1,217,974 |

Transurban Group | | | 223,533 | | | 1,845,681 |

| | | | | | 8,955,316 |

Renewable Energy - 35.6%(b)

| | | | | | |

Boralex, Inc. - Class A | | | 97,089 | | | 2,377,646 |

Brookfield Renewable

Partners LP | | | 91,229 | | | 2,256,807 |

Clearway Energy, Inc. - Class C | | | 66,057 | | | 1,630,947 |

Encavis AG(c) | | | 72,448 | | | 1,327,754 |

Greencoat Renewables PLC | | | 1,291,461 | | | 1,204,494 |

Greencoat UK Wind PLC/Funds | | | 605,796 | | | 1,010,834 |

Innergex Renewable Energy, Inc. | | | 275,665 | | | 2,060,915 |

Northland Power, Inc. | | | 106,561 | | | 1,831,633 |

Octopus Renewables Infrastructure Trust PLC | | | 867,459 | | | 789,313 |

Renewables Infrastructure

Group Ltd. | | | 1,184,822 | | | 1,428,017 |

| | | | | | 15,918,360 |

TOTAL COMMON STOCKS

(Cost $33,093,288) | | | | | | 29,950,406 |

REAL ESTATE INVESTMENT TRUSTS - 29.9%

|

Digital Infrastructure - 15.6%

| | | | | | |

American Tower Corp. | | | 11,159 | | | 2,169,086 |

Crown Castle, Inc. | | | 11,849 | | | 1,157,647 |

Digital Realty Trust, Inc. | | | 8,577 | | | 1,304,133 |

Equinix, Inc. | | | 3,106 | | | 2,350,000 |

| | | | | | 6,980,866 |

Diversified Infrastructure - 3.7%

|

Easterly Government

Properties, Inc. | | | 136,011 | | | 1,682,456 |

| | | | | | | |

| | | | | | | |

Health Care - 10.6%

| | | | | | |

Assura PLC | | | 2,438,952 | | | $1,236,263 |

Healthcare Realty Trust, Inc. | | | 106,552 | | | 1,755,977 |

Healthpeak Properties, Inc. | | | 88,903 | | | 1,742,499 |

| | | | | | 4,734,739 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $14,283,467) | | | | | | 13,398,061 |

TOTAL INVESTMENTS - 96.8%

(Cost $47,376,755) | | | | | | 43,348,467 |

Other Assets in Excess of

Liabilities - 3.2% | | | | | | 1,440,668 |

TOTAL NET ASSETS - 100.0% | | | | | | $44,789,135 |

| | | | | | | |

Percentages are stated as a percent of net assets.

AG - Aktiengesellschaft

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $4,188,544 or 9.4% of the Fund’s net assets.

|

(b)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

|

(c)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Tran Sustainable Focus Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 103.9%

|

Broadline Retail - 8.5%

|

Amazon.com, Inc.(a) | | | 13,877 | | | $2,681,730 |

Capital Markets - 3.6%

|

The Charles Schwab Corp. | | | 15,184 | | | 1,118,909 |

Chemicals - 3.0%

|

The Sherwin-Williams Co. | | | 3,133 | | | 934,981 |

Construction Materials - 3.5%

|

Martin Marietta Materials, Inc. | | | 2,001 | | | 1,084,142 |

Containers & Packaging - 3.2%

|

Ball Corp. | | | 16,615 | | | 997,232 |

Financial Services - 2.0%

|

PayPal Holdings, Inc.(a) | | | 10,635 | | | 617,149 |

Health Care Providers & Services - 4.0%

|

AMN Healthcare Services, Inc.(a) | | | 10,892 | | | 557,997 |

UnitedHealth Group, Inc. | | | 1,386 | | | 705,835 |

| | | | | | 1,263,832 |

Hotels, Restaurants & Leisure - 2.0%

|

Expedia Group, Inc.(a) | | | 5,100 | | | 642,549 |

Household Durables - 1.0%

|

DR Horton, Inc. | | | 2,169 | | | 305,677 |

Independent Power and Renewable Electricity

Producers - 3.9%

|

Talen Energy Corp.(a) | | | 11,022 | | | 1,223,662 |

Insurance - 2.1%

|

The Progressive Corp. | | | 3,207 | | | 666,126 |

Interactive Media & Services - 5.8%

|

Alphabet, Inc. - Class A | | | 2,549 | | | 464,300 |

Meta Platforms, Inc. - Class A | | | 2,700 | | | 1,361,394 |

| | | | | | 1,825,694 |

IT Services - 1.9%

|

Accenture PLC - Class A | | | 1,987 | | | 602,876 |

Life Sciences Tools & Services - 8.7%

|

Danaher Corp. | | | 7,834 | | | 1,957,325 |

IQVIA Holdings, Inc.(a) | | | 3,669 | | | 775,773 |

| | | | | | 2,733,098 |

| | | | | | | |

| | | | | | | |

Semiconductors & Semiconductor Equipment - 15.6%

|

Entegris, Inc. | | | 11,278 | | | $1,527,041 |

NVIDIA Corp. | | | 15,170 | | | 1,874,102 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 8,711 | | | 1,514,059 |

| | | | | | 4,915,202 |

Software - 21.1%

|

Gitlab, Inc. - Class A(a) | | | 12,467 | | | 619,859 |

Intuit, Inc. | | | 1,633 | | | 1,073,224 |

Microsoft Corp. | | | 5,730 | | | 2,561,024 |

Palo Alto Networks, Inc.(a) | | | 4,519 | | | 1,531,986 |

Salesforce, Inc. | | | 3,330 | | | 856,143 |

| | | | | | 6,642,236 |

Trading Companies & Distributors - 9.3%

|

AerCap Holdings NV | | | 16,973 | | | 1,581,883 |

Ferguson PLC | | | 6,901 | | | 1,336,379 |

| | | | | | 2,918,262 |

Wireless Telecommunication Services - 4.7%

|

T-Mobile US, Inc. | | | 8,464 | | | 1,491,188 |

TOTAL COMMON STOCKS

(Cost $23,242,738) | | | | | | 32,664,545 |

TOTAL INVESTMENTS - 103.9%

(Cost $23,242,738) | | | | | | 32,664,545 |

Liabilities in Excess of Other

Assets - (3.9)% | | | | | | (1,240,741) |

TOTAL NET ASSETS - 100.0% | | | | | | $ 31,423,804 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

NV - Naamloze Vennootschap

PLC - Public Limited Company

(a)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Greenspring Mid Cap Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 95.4%

|

Aerospace & Defense - 0.1%

|

Cadre Holdings, Inc. | | | 3,419 | | | $ 114,742 |

Air Freight & Logistics - 0.7%

|

United Parcel Service,

Inc. - Class B | | | 6,445 | | | 881,998 |

Banks - 5.1%

|

OceanFirst Financial Corp. | | | 30,012 | | | 476,891 |

Primis Financial Corp. | | | 258,169 | | | 2,705,611 |

Shore Bancshares, Inc. | | | 124,014 | | | 1,419,960 |

WSFS Financial Corp. | | | 32,805 | | | 1,541,835 |

| | | | | | 6,144,297 |

Beverages - 3.5%

|

Keurig Dr Pepper, Inc. | | | 3,050 | | | 101,870 |

Primo Water Corp. | | | 189,582 | | | 4,144,263 |

| | | | | | 4,246,133 |

Broadline Retail - 0.7%

|

Amazon.com, Inc.(a) | | | 4,020 | | | 776,865 |

Building Products - 4.8%

|

Advanced Drainage Systems, Inc. | | | 7,316 | | | 1,173,413 |

Johnson Controls International

PLC | | | 70,795 | | | 4,705,744 |

| | | | | | 5,879,157 |

Chemicals - 5.4%

|

DuPont de Nemours, Inc. | | | 47,262 | | | 3,804,118 |

Minerals Technologies, Inc. | | | 27,728 | | | 2,305,861 |

The Sherwin-Williams Co. | | | 1,629 | | | 486,142 |

| | | | | | 6,596,121 |

Commercial Services & Supplies - 9.7%

|

Republic Services, Inc. | | | 60,783 | | | 11,812,568 |

Construction & Engineering - 13.3%

|

EMCOR Group, Inc. | | | 28,138 | | | 10,272,621 |

MYR Group, Inc.(a) | | | 43,482 | | | 5,900,942 |

| | | | | | 16,173,563 |

Consumer Staples Distribution & Retail - 1.1%

|

US Foods Holding Corp.(a) | | | 24,486 | | | 1,297,268 |

Electric Utilities - 1.1%

|

NextEra Energy, Inc. | | | 19,279 | | | 1,365,146 |

Electrical Equipment - 4.6%

|

Emerson Electric Co. | | | 14,405 | | | 1,586,855 |

NEXTracker, Inc. - Class A(a) | | | 33,094 | | | 1,551,447 |

nVent Electric PLC | | | 20,000 | | | 1,532,200 |

Shoals Technologies Group,

Inc. - Class A(a) | | | 137,915 | | | 860,589 |

| | | | | | 5,531,091 |

Electronic Equipment, Instruments & Components - 1.5%

|

Flex Ltd.(a) | | | 61,989 | | | 1,828,056 |

| | | | | | | |

| | | | | | | |

Financial Services - 1.0%

|

Cannae Holdings, Inc. | | | 30,599 | | | $ 555,066 |

Visa, Inc. - Class A | | | 2,422 | | | 635,702 |

| | | | | | 1,190,768 |

Food Products - 0.9%

|

Darling Ingredients, Inc.(a) | | | 29,221 | | | 1,073,872 |

Health Care Equipment & Supplies - 4.5%

|

Abbott Laboratories | | | 9,105 | | | 946,100 |

Hologic, Inc.(a) | | | 2,174 | | | 161,419 |

Medtronic PLC | | | 28,597 | | | 2,250,870 |

STERIS PLC | | | 598 | | | 131,285 |

Teleflex, Inc. | | | 1,899 | | | 399,417 |

Zimmer Biomet Holdings, Inc. | | | 14,107 | | | 1,531,033 |

| | | | | | 5,420,124 |

Hotels, Restaurants & Leisure - 2.1%

|

Wyndham Hotels & Resorts, Inc. | | | 34,688 | | | 2,566,912 |

Insurance - 4.1%

|

Chubb Ltd. | | | 4,938 | | | 1,259,585 |

W.R. Berkley Corp. | | | 47,610 | | | 3,741,194 |

| | | | | | 5,000,779 |

Interactive Media & Services - 5.0%

|

Alphabet, Inc. - Class C | | | 16,240 | | | 2,978,741 |

Ziff Davis, Inc.(a) | | | 57,042 | | | 3,140,162 |

| | | | | | 6,118,903 |

IT Services - 2.3%

|

Akamai Technologies, Inc.(a) | | | 12,931 | | | 1,164,824 |

Amdocs Ltd. | | | 20,718 | | | 1,635,065 |

| | | | | | 2,799,889 |

Oil, Gas & Consumable Fuels - 2.9%

|

EOG Resources, Inc. | | | 25,226 | | | 3,175,197 |

Phillips 66 | | | 2,813 | | | 397,111 |

| | | | | | 3,572,308 |

Personal Care Products - 1.5%

|

Kenvue, Inc. | | | 102,927 | | | 1,871,213 |

Pharmaceuticals - 0.4%

|

Johnson & Johnson | | | 3,289 | | | 480,720 |

Professional Services - 12.6%

|

Alight, Inc. - Class A(a) | | | 358,217 | | | 2,643,641 |

Dun & Bradstreet Holdings, Inc. | | | 208,520 | | | 1,930,895 |

KBR, Inc. | | | 167,691 | | | 10,755,701 |

| | | | | | 15,330,237 |

Software - 1.0%

|

Blackbaud, Inc.(a) | | | 16,583 | | | 1,263,127 |

Technology Hardware, Storage & Peripherals - 0.3%

|

Pure Storage, Inc. - Class A(a) | | | 6,195 | | | 397,781 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Greenspring Mid Cap Fund

Schedule of Investments

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Textiles, Apparel & Luxury Goods - 1.6%

|

Levi Strauss & Co. - Class A | | | 103,241 | | | $1,990,487 |

Trading Companies & Distributors - 1.2%

|

Rush Enterprises, Inc. - Class A | | | 17,839 | | | 746,919 |

Rush Enterprises, Inc. - Class B | | | 17,328 | | | 679,951 |

| | | | | | 1,426,870 |

Wireless Telecommunication Services - 2.4%

|

T-Mobile US, Inc. | | | 16,777 | | | 2,955,772 |

TOTAL COMMON STOCKS

(Cost $58,104,118) | | | | | | 116,106,767 |

REAL ESTATE INVESTMENT TRUSTS - 1.3%

|

Residential Real Estate Investment Trusts - 1.3%

|

American Homes 4 Rent - Class A | | | 43,695 | | | 1,623,706 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $1,177,639) | | | | | | 1,623,706 |

EXCHANGE TRADED FUNDS - 1.1%

|

Invesco Solar ETF | | | 33,518 | | | 1,347,759 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $1,120,903) | | | | | | 1,347,759 |

PREFERRED STOCKS - 0.0%(b)

|

Oil, Gas & Consumable Fuels - 0.0%(b)

|

GasLog Partners LP Series A, 8.63% to 06/15/2027 then 3 mo. LIBOR US + 6.31%, Perpetual(c) | | | 884 | | | 22,144 |

TOTAL PREFERRED STOCKS

(Cost $11,376) | | | | | | 22,144 |

TOTAL INVESTMENTS - 97.8%

(Cost $60,414,036) | | | | | | 119,100,376 |

Other Assets in Excess of

Liabilities - 2.2% | | | | | | $2,669,226 |

TOTAL NET ASSETS - 100.0% | | | | | | $121,769,602 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

LIBOR - London Interbank Offered Rate

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| Represents less than 0.05% of net assets. |

(c)

| Securities referencing LIBOR are expected to transition to an alternative reference rate by the security’s next scheduled coupon reset date. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Sustainable Balanced Fund

Schedule of Investments

as of June 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 58.2%

| | | | | | |

Broadline Retail - 4.1%

| | | | |

Amazon.com, Inc.(a) | | | 2,371 | | | $458,196 |

Capital Markets - 1.8%

| | | | |

The Charles Schwab Corp. | | | 2,693 | | | 198,447 |

Chemicals - 2.0%

| | | | |

The Sherwin-Williams Co. | | | 742 | | | 221,435 |

Construction Materials - 2.1%

| | | | |

Martin Marietta Materials, Inc. | | | 421 | | | 228,098 |

Containers & Packaging - 2.5%

|

Ball Corp. | | | 4,682 | | | 281,014 |

Financial Services - 1.1%

| | | | |

PayPal Holdings, Inc.(a) | | | 2,058 | | | 119,426 |

Health Care Providers & Services - 2.2%

|

AMN Healthcare Services, Inc.(a) | | | 2,082 | | | 106,661 |

UnitedHealth Group, Inc. | | | 258 | | | 131,389 |

| | | | | | 238,050 |

Hotels, Restaurants & Leisure - 1.1%

|

Expedia Group, Inc.(a) | | | 948 | | | 119,438 |

Household Durables - 0.5%

| | | | |

DR Horton, Inc. | | | 405 | | | 57,077 |

Independent Power and Renewable

Electricity Producers - 2.2%

|

Talen Energy Corp.(a) | | | 2,169 | | | 240,802 |

Insurance - 1.2%

| | | | |

The Progressive Corp. | | | 621 | | | 128,988 |

Interactive Media & Services - 3.4%

|

Alphabet, Inc. - Class A | | | 484 | | | 88,160 |

Meta Platforms, Inc. - Class A | | | 562 | | | 283,372 |

| | | | | | 371,532 |

IT Services - 1.0%

| | | | |

Accenture PLC - Class A | | | 369 | | | 111,958 |

Life Sciences Tools & Services - 5.2%

|

Danaher Corp. | | | 1,495 | | | 373,526 |

IQVIA Holdings, Inc.(a) | | | 946 | | | 200,022 |

| | | | | | 573,548 |

Semiconductors & Semiconductor Equipment - 8.0%

|

Entegris, Inc. | | | 1,639 | | | 221,921 |

NVIDIA Corp. | | | 3,030 | | | 374,326 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 1,627 | | | 282,789 |

| | | | | | 879,036 |

Software - 11.5%

| | | | |

Gitlab, Inc. - Class A(a) | | | 2,848 | | | 141,603 |

| | | | | | | |

| | | | | | | |

Intuit, Inc. | | | 329 | | | $ 216,222 |

Microsoft Corp. | | | 1,063 | | | 475,108 |

Palo Alto Networks, Inc.(a) | | | 790 | | | 267,818 |

Salesforce, Inc. | | | 633 | | | 162,744 |

| | | | | | 1,263,495 |

Trading Companies & Distributors - 5.8%

|

AerCap Holdings NV | | | 3,680 | | | 342,976 |

Ferguson PLC | | | 1,538 | | | 297,834 |

| | | | | | 640,810 |

Wireless Telecommunication Services - 2.5%

|

T-Mobile US, Inc. | | | 1,570 | | | 276,602 |

TOTAL COMMON STOCKS

(Cost $5,943,062) | | | | | | 6,407,952 |

| | | | | | | |

| | | | | | | |

U.S. TREASURY SECURITIES - 30.7%

|

United States Treasury Note/Bond

|

4.63%, 06/30/2026 | | | $500,000 | | | 499,111 |

4.25%, 03/15/2027 | | | 600,000 | | | 595,266 |

4.25%, 02/28/2029 | | | 1,150,000 | | | 1,145,036 |

4.00%, 02/15/2034 | | | 600,000 | | | 582,516 |

4.38%, 05/15/2034 | | | 50,000 | | | 50,019 |

4.25%, 02/15/2054 | | | 530,000 | | | 504,784 |

TOTAL U.S. TREASURY SECURITIES

(Cost $3,411,711) | | | | | | 3,376,732 |

CORPORATE BONDS - 4.1%

|

Banks - 0.9%

|

Bank of America Corp., 3.85% to 03/08/2032 then 5 yr. CMT Rate + 2.00%, 03/08/2037 | | | 50,000 | | | 43,841 |

Morgan Stanley, 5.83% to 04/19/2034 then SOFR + 1.58%,

04/19/2035 | | | 50,000 | | | 51,273 |

| | | | | | 95,114 |

Biotechnology - 0.4%

|

Amgen, Inc.,

4.20%, 03/01/2033 | | | 50,000 | | | 46,345 |

Computers - 0.5%

|

Booz Allen Hamilton, Inc.,

5.95%, 08/04/2033 | | | 50,000 | | | 51,634 |

Environmental Control - 0.4%

|

Veralto Corp.,

5.45%, 09/18/2033 (b) | | | 50,000 | | | 49,929 |

Healthcare-Services - 0.6%

|

Elevance Health, Inc.,

5.65%, 06/15/2054 | | | 20,000 | | | 19,799 |

Humana, Inc.,

5.38%, 04/15/2031 | | | 50,000 | | | 49,751 |

| | | | | | 69,550 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Cromwell Sustainable Balanced Fund

Schedule of Investments

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Lodging - 0.4%

|

Marriott International, Inc., 2.75%, 10/15/2033 | | | $ 50,000 | | | $40,389 |

Real Estate Investment Trusts - 0.5%

|

Brixmor Operating Partnership LP,

5.75%, 02/15/2035 | | | 25,000 | | | 24,967 |

Equinix Europe 2 Financing

Corp. LLC,

5.50%, 06/15/2034 | | | 20,000 | | | 19,975 |

Host Hotels & Resorts LP,

5.70%, 07/01/2034 | | | 10,000 | | | 9,834 |

| | | | | | 54,776 |

Software - 0.4%

|

Fiserv, Inc.,

5.60%, 03/02/2033 | | | 50,000 | | | 50,439 |

TOTAL CORPORATE BONDS

(Cost $458,033) | | | | | | 458,176 |

TOTAL INVESTMENTS - 93.0%

(Cost $9,812,806) | | | | | | 10,242,860 |

Other Assets in Excess of

Liabilities - 7.0% | | | | | | 766,129 |

TOTAL NET ASSETS - 100.0% | | | | | | $11,008,989 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard ("GICS®") was developed by and/or is the exclusive property of MSCI, Inc. ("MSCI") and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

CMT - Constant Maturity Treasury Rate

NV - Naamloze Vennootschap

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

(a)

| Non-income producing security. |

(b)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $49,929 or 0.4% of the Fund’s net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets and Liabilities

as of June 30, 2024 (Unaudited)

| | | | | | | | | | |

ASSETS

| | | | | | | | | |

Investments in securities, at value* | | | $114,634,983 | | | $94,160,507 | | | $43,348,467 |

Foreign currency, at value*** | | | — | | | — | | | 24,214 |

Cash & cash equivalents | | | 801,927 | | | 4,145,676 | | | 1,435,796 |

Dividends & interest receivable | | | 398,662 | | | 277,787 | | | 241,568 |

Receivable for capital shares sold | | | 5,724 | | | 205 | | | — |

Broker interest receivable | | | — | | | 44,258 | | | — |

Deposits at brokers(1) | | | — | | | 11,696,249 | | | — |

Receivable for investment securities sold | | | 247,434 | | | — | | | — |

Prepaid expenses & other assets | | | 18,176 | | | 21,208 | | | 6,986 |

Total Assets | | | 116,106,906 | | | 110,345,890 | | | 45,057,031 |

LIABILITIES

| | | | | | | | | |

Payable for capital shares redeemed | | | 20,836 | | | 67,233 | | | — |

Securities sold short, at value** | | | — | | | 11,006,069 | | | — |

Payable for investment securities purchased | | | 375,870 | | | — | | | 189,953 |

Payable to investment adviser | | | 48,832 | | | 83,750 | | | 23,370 |

Payable for fund administration & accounting fees | | | 9,259 | | | 18,783 | | | 7,128 |

Payable for compliance fees | | | 874 | | | 874 | | | 874 |

Payable for custody fees | | | 4,274 | | | 2,472 | | | 2,539 |

Payable for transfer agent fees & expenses | | | 48,229 | | | 25,408 | | | 2,020 |

Accrued distribution and/or shareholder service fees | | | — | | | 9,333 | | | — |

Payable for trustee fees | | | 7,684 | | | — | | | 4,362 |

Dividends & interest on short positions | | | — | | | 3,015 | | | — |

Payable for audit fees | | | 6,941 | | | 6,891 | | | 8,492 |

Other accrued expenses & liabilities | | | 14,029 | | | 5,338 | | | 29,158 |

Total Liabilities | | | 536,828 | | | 11,229,166 | | | 267,896 |

NET ASSETS | | | $115,570,078 | | | $99,116,724 | | | $44,789,135 |

Net Assets Consist of:

| | | | | | | | | |

Paid-in capital | | | $111,876,444 | | | $420,639,330 | | | $51,250,260 |

Total distributable earnings/(accumulated deficit) | | | 3,693,634 | | | (321,522,606) | | | (6,461,125) |

Net assets | | | $115,570,078 | | | $99,116,724 | | | $44,789,135 |

Investor Class:

| | | | | | | | | |

Net assets | | | $50,056,099 | | | $44,021,937 | | | $— |

Shares issued and outstanding(2) | | | 4,741,474 | | | 1,979,459 | | | — |

Net asset value | | | $10.56 | | | $22.24 | | | $— |

Institutional Class:

| | | | | | | | | |

Net assets | | | $65,513,979 | | | $55,094,787 | | | $44,789,135 |

Shares issued and outstanding(2) | | | 6,210,189 | | | 2,426,025 | | | 2,570,357 |

Net asset value | | | $10.55 | | | $22.71 | | | $17.43 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets and Liabilities

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | | |

* Cost of securities | | | $99,811,302 | | | $88,072,832 | | | $47,376,755 |

**Proceeds received on securities sold short | | | — | | | 11,722,125 | | | — |

*** Cost of foreign currency | | | — | | | — | | | 24,230 |

| | | | | | | | | | |

(1)

| Serves as collateral for securities sold short.

|

(2)

| Unlimited number of shares authorized with no par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets and Liabilities

as of June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | | |

ASSETS

| | | | | | | | | |

Investments in securities, at value* | | | $32,664,545 | | | $119,100,376 | | | $10,242,860 |

Cash & cash equivalents | | | 331,465 | | | 2,659,014 | | | 1,223,946 |

Due from investment adviser | | | — | | | — | | | 6,552 |

Dividends & interest receivable | | | 13,426 | | | 103,808 | | | 54,332 |

Receivable for capital shares sold | | | — | | | 1,790 | | | — |

Receivable for investment securities sold | | | — | | | 25,355 | | | — |

Prepaid expenses & other assets | | | 13,307 | | | 13,602 | | | 26,406 |

Total Assets | | | 33,022,743 | | | 121,903,945 | | | 11,554,096 |

LIABILITIES

| | | | | | | | | |

Payable for capital shares redeemed | | | 1,547,318 | | | 9,660 | | | — |

Payable for investment securities purchased | | | — | | | — | | | 499,243 |

Payable to investment adviser | | | 6,413 | | | 74,340 | | | — |

Payable for fund administration & accounting fees | | | 10,497 | | | 7,361 | | | 23,034 |

Payable for compliance fees | | | 874 | | | 874 | | | 894 |

Payable for custody fees | | | 564 | | | 4,063 | | | 498 |

Payable for transfer agent fees & expenses | | | 8,721 | | | 6,936 | | | 6,196 |

Accrued distribution and/or shareholder service fees | | | 3,734 | | | — | | | — |

Payable for trustee fees | | | 4,033 | | | 7,951 | | | 4,197 |

Payable for audit fees | | | 7,128 | | | 6,847 | | | 7,090 |

Other accrued expenses & liabilities | | | 9,657 | | | 16,311 | | | 3,955 |

Total Liabilities | | | 1,598,939 | | | 134,343 | | | 545,107 |

NET ASSETS | | | $31,423,804 | | | $121,769,602 | | | $11,008,989 |

Net Assets Consists of:

| | | | | | | | | |

Paid-in capital | | | $21,093,661 | | | $58,007,895 | | | $10,555,663 |

Total distributable earnings/(accumulated deficit) | | | 10,330,143 | | | 63,761,707 | | | 453,326 |

Net assets | | | $31,423,804 | | | $121,769,602 | | | $11,008,989 |

Investor Class:

| | | | | | | | | |

Net assets | | | $16,783,259 | | | $— | | | $— |

Shares issued and outstanding(1) | | | 2,529,084 | | | — | | | — |

Net asset value | | | $6.64 | | | $— | | | $— |

Institutional Class:

| | | | | | | | | |

Net assets | | | $14,640,545 | | | $121,769,602 | | | $11,008,989 |

Shares issued and outstanding(1) | | | 1,983,606 | | | 4,884,155 | | | 515,691 |

Net asset value | | | $7.38 | | | $24.93 | | | $21.35 |

* Cost of securities | | | $23,242,738 | | | $60,414,036 | | | $9,812,806 |

| | | | | | | | | | |

(1)

| Unlimited number of shares authorized with no par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Operations

For the period ended June 30, 2024 (Unaudited)

| | | | | | | | | | |

INVESTMENT INCOME:

|

Dividend income | | | $2,203,954 | | | $994,085 | | | $926,380 |

Less: Foreign taxes witheld | | | (1,758) | | | (23,328) | | | (62,323) |

Broker interest income | | | — | | | 820,905 | | | — |

Interest income | | | 13,992 | | | 290,917 | | | 14,998 |

Total Investment Income | | | 2,216,188 | | | 2,082,579 | | | 879,055 |

|

EXPENSES:

|

Investment advisory fees (See Note 4) | | | 350,309 | | | 879,942 | | | 184,203 |

Dividend expense | | | — | | | 300,226 | | | — |

Transfer agent fees & expenses (See Note 4) | | | 23,606 | | | 97,980 | | | 9,953 |

Fund administration & accounting fees (See Note 4) | | | 39,240 | | | 49,933 | | | 29,787 |

Federal & state registration fees | | | 19,625 | | | 25,311 | | | 4,103 |

Trustee fees | | | 15,697 | | | 16,962 | | | 9,518 |

Audit fees | | | 7,193 | | | 7,193 | | | 8,582 |

Custody fees (See Note 4) | | | 7,044 | | | 5,537 | | | 9,691 |

Other expenses | | | 5,270 | | | 5,797 | | | 2,071 |

Legal fees | | | 22,595 | | | 25,792 | | | 8,097 |

Interest expense | | | — | | | — | | | 581 |

Insurance expense | | | 740 | | | 27 | | | 784 |

Postage & printing fees | | | 10,211 | | | 10,529 | | | 2,067 |

Compliance fees (See Note 4) | | | 6,807 | | | 6,807 | | | 6,807 |

Tax expense | | | 7,414 | | | — | | | — |

Distribution and/or shareholder service fees (See Note 5)

|

Investor Class | | | 53,787 | | | 59,723 | | | — |

Institutional Class | | | 44,174 | | | — | | | — |

Total Expenses Before Reimbursement/Recoupment | | | 613,712 | | | 1,491,759 | | | 276,244 |

Adviser recoupment (See Note 4) | | | 5,630 | | | — | | | — |

Reimbursement from adviser (See Note 4) | | | — | | | (157,588) | | | (48,119) |

Total Net Expenses | | | 619,342 | | | 1,334,171 | | | 228,125 |

Net Investment Income (loss) | | | 1,596,846 | | | 748,408 | | | 650,930 |

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS

|

Net realized gain (loss) on:

|

Investments | | | (2,331,066) | | | 43,685,787 | | | (928,157) |

Securities sold short | | | — | | | (12,927,797) | | | — |

Foreign currency transactions | | | — | | | (59,296) | | | (14,967) |

| | | (2,331,066) | | | 30,698,694 | | | (943,124) |

Net change in unrealized appreciation(depreciation) on:

|

Investments | | | (1,832,885) | | | (37,304,318) | | | (1,637,686) |

Securities sold short | | | — | | | 9,613,878 | | | — |

Foreign currency translations | | | — | | | (5,209) | | | (44,293) |