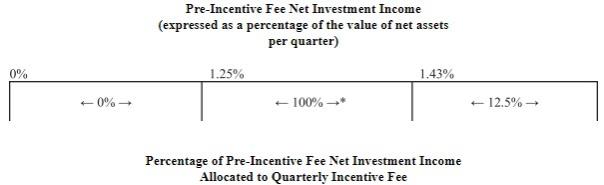

Examples of Quarterly Incentive Fee Calculations

The figures provided in the following examples are hypothetical, are presented for illustrative purposes only and are not indicative of actual expenses or returns.

Example 1: Income Related Portion of Incentive Fee(1):

Alternative 1 - Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.25%.

Hurdle Rate(2) = 1.25%.

Management Fee(3) = 0.3125%.

Other expenses (legal, accounting, custodian, transfer agent, etc.)(4) = 0.25%.

Pre-Incentive Fee Net Investment Income =

(investment income - (Management Fee + other expenses)) = 0.6875%.

Pre-Incentive Net Investment Income does not exceed Hurdle Rate, therefore there is no Investment Income Incentive Fee.

Alternative 2 - Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.90%.

Hurdle Rate(2) = 1.25%.

Management Fee(3) = 0.3125%.

Other expenses (legal, accounting, custodian, transfer agent, etc.)(4) = 0.25%.

Pre-Incentive Fee Net Investment Income =

(investment income - (Management Fee + other expenses)) = 1.3375%

Catch-Up = 1.3375% - 1.25% = 0.0875%

Incentive Fee = 100% x (1.3375% - 1.25%) = 0.0875%.

Alternative 3 - Assumptions

Investment income (including interest, dividends, fees, etc.) = 2.50%.

Hurdle Rate(2) = 1.25%.

Management Fee(3) = 0.3125%.

Other expenses (legal, accounting, custodian, transfer agent, etc.)(4) = 0.25%.

Pre-Incentive Fee Net Investment Income =

(investment income - (Management Fee + other expenses)) = 1.9375%.

Incentive Fee = 12.5% × Pre-Incentive Fee Net Investment Income, subject to “Catch-Up” (5).

Incentive Fee = (100% × “Catch-Up”) + (12.5% × (Pre-Incentive Fee Net Investment Income - 1.4286%)).

Catch-Up = 1.4286% - 1.25% = 0.1786%.

Incentive Fee = (100% × 0.1786%) + (12.5% × (1.9375% - 1.4286%))

= 0.1786% + (12.5% × 0.5089%)

= 0.1786% + 0.0636%

= 0.2422%.

Example 2: Capital Gains Portion of Incentive Fee:

Alternative 1 - Assumptions

| | • | | Year 1: $20 million investment made in Company A (“Investment A”), and $30 million investment made in Company B (“Investment B”). |

11