Exhibit 99.1

2023 INTERIM REPORT

TABLE OF CONTENTS

This Interim Report contains forward-looking statements and estimates with respect to the anticipated future performance of MDxHealth SA and its wholly-owned subsidiaries (hereinafter “MDxHealth” or the “Company”) and the market in which it operates. Such statements and estimates are based on assumptions and assessments of known and unknown risks, uncertainties and other factors, which were deemed reasonable but may not prove to be correct. Actual events are difficult to predict, may depend upon factors that are beyond the company’s control, and may turn out to be materially different. Important factors that could cause actual results, conditions and events to differ materially from those indicated in the forward-looking statements include, among others, the following: uncertainties associated with the coronavirus (COVID-19) pandemic, including its possible effects on our operations, and the demand for the Company’s products; the Company’s ability to successfully and profitably market its products; the acceptance of its products and services by healthcare providers; the willingness of health insurance companies and other payers to cover its products and services and adequately reimburse us for such products and services; and the amount and nature of competition for its products and services. MDxHealth expressly disclaims any obligation to update any such forward-looking statements in this Interim Report to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based unless required by law or regulation. This Interim Report does not constitute an offer or invitation for the sale or purchase of securities or assets of MDxHealth in any jurisdiction. No securities of MDxHealth may be offered or sold within the United States without registration under the U.S. Securities Act of 1933, as amended, or in compliance with an exemption therefrom, and in accordance with any applicable U.S. securities laws.

I. INTERIM MANAGEMENT REPORT

Highlights

Key non-audited financials, as of June 30, 2023

Key unaudited consolidated figures for the six months ended June 30, 2023 (thousands of U.S. dollars, except per share data):

| | | Jan-June

2023 | | | Jan-June

2022 | | | Change | | | %

Change | |

| Revenue | | | 31,445 | | | | 13,009 | | | | 18,436 | | | | 142 | % |

| Gross Profit | | | 18,705 | | | | 5,772 | | | | 12,933 | | | | 224 | % |

| Operating expenses | | | (35,165 | ) | | | (22,795 | ) | | | (12,370 | ) | | | 54 | % |

| Operating loss | | | (16,460 | ) | | | (17,023 | ) | | | 563 | | | | (3 | )% |

| Net loss | | | (22,335 | ) | | | (18,104 | ) | | | (4,231 | ) | | | 23 | % |

| Basic and diluted loss per share | | | (0.08 | ) | | | (0.12 | ) | | | 0.04 | | | | (33 | )% |

Total revenue for the first half of 2023 was $31.4 million, an increase of 142% as compared to total revenue of $13.0 million for the first half of 2022. Excluding the GPS revenues, total revenues for the first half were $17.4 million, an increase of 34% compared to the first half of 2022. H1-2023 revenues of $31.4 million were comprised of $14.0 million from GPS, $12.4 million from Confirm mdx, $3.7 million from Resolve mdx, with the remaining revenues from Select mdx and other.

Gross profit for H1-2023 was $18.7 million as compared to $5.8 million for H1-2022. Gross margins were 59.5% for H1-2023 as compared to 44.4% for H1-2022, representing a gross margin improvement of 1,510 basis points, primarily related to our product mix and the addition of GPS to our product menu.

Operating expenses for the first half of 2023 were $35.2 million, up 54% from $22.8 million for H1-2022, primarily related to the additional field sales personnel associated with the GPS business.

Operating loss for H1-2023 was $16.5 million, a decrease of 3% over H1-2022, helped by our increased revenues and improved gross margin.

Net loss for H1-2023 of $22.3 million increased by $4.2 million versus $18.1 million for the prior year period, primarily due to an increase in financial expenses, of which $3.9 million was non-cash and relates to the fair value adjustment of the GPS contingent consideration, and the remainder was primarily related to an increase in interest expense from our debt facility.

Justification to continue using the accounting rules on the basis of going concern

The Company has experienced net losses and significant cash used in operating activities since its inception in 2003, and as of, and for the period ended, June 30, 2023, had an accumulated deficit of $310.7 million, a net loss of $22.3 million, and net cash used in operating activities of $9.9 million. Management expects the Company to continue to incur net losses and have significant cash outflows for at least the next twelve months.

While these conditions, among others, could raise doubt about its ability to continue as a going concern, these consolidated financial statements have been prepared assuming that the Company will continue as a going concern. This basis of accounting contemplates the recovery of its assets and the satisfaction of liabilities in the normal course of business. A successful transition to attaining profitable operations is dependent upon achieving a level of positive cash flows adequate to support the Company’s cost structure.

As of June 30, 2023, the Company had cash and cash equivalents of $39.5 million. Taking into account the above financial situation and on the basis of the most recent business plan, the Company believes that it has sufficient cash to be able to continue its operations for at least the next twelve months from the date of issuance of these financial statements, and accordingly has prepared the consolidated financial statements assuming that it will continue as a going concern. This assessment is based on forecasts and projections within management’s most recent business plan, including recent developments related to the Exact Sciences earnout (as detailed in Note 15 “Subsequent events”), as well as the Company’s expected ability to realize cost reductions should these forecasts and projections not be met.

Principal risks related to the business activities

The principal risks related to MDxHealth’s business activities have been outlined in the 2022 Annual Report, which is available on the Company’s website at www.mdxhealth.com/investors/financials.

Declaration of responsible persons

The Board of Directors of MDxHealth SA, represented by all its members, declares that, as far as it is aware, the financial statements in this Interim Report, made up according to the applicable standards for financial statements, give a true and fair view of the equity, financial position and the results of the Company and its consolidated subsidiaries. The Board of Directors of MDxHealth SA, represented by all its members, further declares that this Interim Report gives a true and fair view on the information that has to be contained herein. The condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard (IAS) 34 (Interim Financial Reporting) as issued by the International Accounting Standards Board, or IASB, and as adopted by the EU.

II. INTERIM CONDENSED UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS OF MDXHEALTH SA

For the six months ended June 30, 2023

1. CONDENSED UNAUDITED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

Thousands of $ (except per share data)

Condensed unaudited consolidated statement of profit or loss

| | | Note | | | Jan-June

2023 | | | Jan-June

2022 | |

| Services | | | 5 | | | $ | 31,345 | | | $ | 12,975 | |

| Royalties and other revenues | | | 5 | | | | 100 | | | | 34 | |

| Revenues | | | | | | | 31,445 | | | | 13,009 | |

| Cost of goods & services sold | | | | | | | (12,740 | ) | | | (7,237 | ) |

| Gross Profit | | | | | | | 18,705 | | | | 5,772 | |

| Research and development expenses | | | 6 | | | | (4,560 | ) | | | (3,585 | ) |

| Selling and marketing expenses | | | 6 | | | | (19,029 | ) | | | (9,848 | ) |

| General and administrative expenses | | | 6 | | | | (10,910 | ) | | | (9,636 | ) |

| Other operating income, net | | | | | | | (666 | ) | | | 274 | |

| Operating loss | | | | | | | (16,460 | ) | | | (17,023 | ) |

| Financial expenses, net: | | | 10 | | | | | | | | | |

| Contingent consideration fair value adjustments | | | | | | | (3,882 | ) | | | (197 | ) |

| Other financial expenses, net | | | | | | | (1,993 | ) | | | (883 | ) |

| Loss before income tax | | | | | | | (22,335 | ) | | | (18,103 | ) |

| Income tax | | | | | | | - | | | | (1 | ) |

| Loss for the period | | | | | | | (22,335 | ) | | | (18,104 | ) |

| | | | | | | | | | | | | |

| Loss for the period attributable to the parent | | | | | | $ | (22,335 | ) | | $ | (18,104 | ) |

| | | | | | | | | | | | | |

| Loss per share attributable to parent | | | | | | | | | | | | |

| Basic and diluted | | | | | | | (0.08 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | |

| Condensed unaudited consolidated statement of other comprehensive income | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Loss for the period | | | | | | $ | (22,335 | ) | | $ | (18,104 | ) |

| Other comprehensive income | | | | | | | | | | | | |

| Items that will be reclassified to profit or loss: | | | | | | | | | | | | |

| Exchange differences arising from translation of foreign operations | | | | | | | (199 | ) | | | 588 | |

| Total other comprehensive income | | | | | | | (199 | ) | | | 588 | |

| Total comprehensive loss for the period (net of tax) | | | | | | $ | (22,534 | ) | | $ | (17,516 | ) |

2. CONDENSED UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| Thousands of $ | | | | | | | | | |

| | | | | | | | | | |

| | | Note | | | as of

June 30,

2023 | | | as of

December 31,

2022 | |

| ASSETS | | | | | | | | | | | | |

| Goodwill | | | | | | $ | 35,926 | | | $ | 35,926 | |

| Intangible assets | | | 7 | | | | 44,907 | | | | 46,166 | |

| Property, plant and equipment | | | 8 | | | | 5,247 | | | | 3,791 | |

| Right-of-use assets | | | | | | | 4,733 | | | | 4,103 | |

| Non-current assets | | | | | | | 90,813 | | | | 89,986 | |

| Inventories | | | | | | | 2,674 | | | | 2,327 | |

| Trade receivables | | | 11 | | | | 8,098 | | | | 9,357 | |

| Prepaid expenses and other current assets | | | | | | | 1,488 | | | | 1,962 | |

| Cash and cash equivalents | | | | | | | 39,472 | | | | 15,503 | |

| Current assets | | | | | | | 51,732 | | | | 29,149 | |

| Total assets | | | | | | $ | 142,545 | | | $ | 119,135 | |

| | | | | | | | | | |

| EQUITY | | | | | | | | | |

| Share capital | | | | | | $ | 173,053 | | | $ | 133,454 | |

| Issuance premium | | | | | | | 153,177 | | | | 153,177 | |

| Accumulated deficit | | | | | | | (310,681 | ) | | | (288,346 | ) |

| Share-based compensation | | | | | | | 11,752 | | | | 11,474 | |

| Translation reserve | | | | | | | (643 | ) | | | (444 | ) |

| Total equity | | | 14 | | | $ | 26,658 | | | $ | 9,315 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Loans and borrowings | | | 9 | | | $ | 35,177 | | | $ | 34,914 | |

| Lease liabilities | | | 9 | | | | 3,445 | | | | 3,091 | |

| Other non-current financial liabilities | | | 9 | | | | 35,899 | | | | 53,537 | |

| Non-current liabilities | | | | | | | 74,521 | | | | 91,542 | |

| Loans and borrowings | | | 9 | | | | 640 | | | | 616 | |

| Lease liabilities | | | 9 | | | | 1,327 | | | | 1,172 | |

| Trade payables | | | | | | | 10,681 | | | | 10,178 | |

| Other current liabilities | | | | | | | 4,609 | | | | 3,985 | |

| Other current financial liabilities | | | 9 | | | | 24,109 | | | | 2,327 | |

| Current liabilities | | | | | | | 41,366 | | | | 18,278 | |

| Total liabilities | | | | | | | 115,887 | | | | 109,820 | |

| Total equity and liabilities | | | | | | $ | 142,545 | | | $ | 119,135 | |

3. CONDENSED UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to owners of MDxHealth SA

Thousands of $, except number of shares | | Number of

shares | | | Share

capital and

issuance

premium | | | Accumulated

Deficit | | | Share-based

compensation | | | Translation

reserves | | | Total

equity | |

| | | | | | Note 14 | | | | | | Note 13 | | | | | | | |

| Balance at January 1, 2022 | | | 155,969,226 | | | $ | 281,631 | | | $ | (244,302 | ) | | $ | 10,607 | | | $ | (1,037 | ) | | $ | 46,899 | |

| Loss for the period | | | | | | | | | | | (18,104 | ) | | | | | | | | | | | (18,104 | ) |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | 588 | | | | 588 | |

| Total comprehensive income for the period | | | | | | | | | | | (18,104 | ) | | | | | | | 588 | | | | (17,516 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based compensation | | | | | | | | | | | | | | | 379 | | | | | | | | 379 | |

| Balance at June 30, 2022 | | | 155,969,226 | | | $ | 281,631 | | | $ | (262,406 | ) | | $ | 10,986 | | | $ | (449 | ) | | $ | 29,762 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2023 | | | 162,880,936 | | | $ | 286,631 | | | $ | (288,346 | ) | | $ | 11,474 | | | $ | (444 | ) | | $ | 9,315 | |

| Loss for the period | | | | | | | | | | | (22,335 | ) | | | | | | | | | | | (22,335 | ) |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | (199 | ) | | | (199 | ) |

| Total comprehensive income for the period | | | | | | | | | | | (22,335 | ) | | | | | | | (199 | ) | | | (22,534 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of shares, net of transaction costs | | | 107,500,000 | | | | 39,599 | | | | | | | | | | | | | | | | 39,599 | |

| Share-based compensation | | | | | | | | | | | | | | | 278 | | | | | | | | 278 | |

| Balance at June 30, 2023 | | | 270,380,936 | | | $ | 326,230 | | | $ | (310,681 | ) | | $ | 11,752 | | | $ | (643 | ) | | $ | 26,658 | |

4. CONDENSED UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

| Thousands of $ | | | | | | | | | |

| | | | | | | | | | |

| | | Note | | | Jan-June

2023 | | | Jan-June

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | | | | |

| Operating loss | | | | | | $ | (16,460 | ) | | $ | (17,023 | ) |

| Depreciation and amortization | | | | | | | 3,412 | | | | 1,576 | |

| Share-based compensation | | | | | | | 278 | | | | 379 | |

| Other non-cash transactions | | | | | | | 696 | | | | 10 | |

| Cash used in operations before working capital changes | | | | | | | (12,074 | ) | | | (15,058 | ) |

| | | | | | | | | | | | | |

| Changes in operating assets and liabilities | | | | | | | | | | | | |

| Increase in inventories | | | | | | | (347 | ) | | | (178 | ) |

| Increase in receivables | | | | | | | 1,733 | | | | (1,563 | ) |

| Increase in payables | | | | | | | 827 | | | | 1,708 | |

| Net cash outflow from operating activities | | | | | | | (9,861 | ) | | | (15,091 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | |

| Purchase of property, plant and equipment | | | | | | | (2,153 | ) | | | (925 | ) |

| Interest received | | | | | | | 317 | | | | 27 | |

| Acquisition and generation of intangible assets | | | | | | | (980 | ) | | | (451 | ) |

| Net cash outflow from investing activities | | | | | | | (2,816 | ) | | | (1,349 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

| Proceeds from issuance of shares, net of transaction costs | | | | | | | 39,599 | | | | - | |

| Payment of loan obligation | | | 9 | | | | (318 | ) | | | (439 | ) |

| Payment of lease liability | | | 9 | | | | (712 | ) | | | (663 | ) |

| Payment of interest | | | | | | | (1,731 | ) | | | (511 | ) |

| Net cash inflow from financing activities | | | | | | | 36,838 | | | | (1,613 | ) |

| | | | | | | | | | | | | |

| Net increase in cash and cash equivalents | | | | | | | 24,161 | | | | (18,053 | ) |

| | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of the period | | | | | | | 15,503 | | | | 58,498 | |

| Effect of exchange rates | | | | | | | (192 | ) | | | (420 | ) |

| Cash and cash equivalents at end of the period | | | | | | $ | 39,472 | | | $ | 40,025 | |

5. EXPLANATORY NOTES

Accounting policies

1. Basis of preparation

MDxHealth, SA together with its subsidiaries are herein referred to as “MDxHealth” or the “Company”. MDxHealth is a company domiciled in Belgium, with offices and labs in the United States and The Netherlands. The reporting and functional currency of the Company is the U.S. Dollar.

The condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard (IAS) 34 – Interim Financial Reporting, as issued by the International Accounting Standards Board, or IASB, and as adopted by the EU.

For translation of Euro amounts as of June 30, 2023 into U.S. dollars, the official exchange rate quoted as of June 30, 2023 by the European Central Bank of €1 to $1.087 was used.

These interim consolidated financial statements do not include all the information required for full annual financial statements and should be read in conjunction with the consolidated financial statements of the Company as of, and for the year ended, December 31, 2022.

The Company ended the period with $39.5 million in cash and cash equivalents as of June 30, 2023, and continued to incur losses. The Company is expecting continued losses and negative operating cash flows in the coming twelve months. Taking into account the above financial situation and on the basis of the most recent business plan, the Company believes that it has sufficient cash to be able to continue its operations for at least the next twelve months from the date of issuance of these condensed interim financial statements, and accordingly has prepared the consolidated condensed interim financial statements assuming that it will continue as a going concern. This assessment is based on forecasts and projections within management’s most recent business plan, including recent developments related to the Exact Sciences earnout (as detailed in Note 15 “Subsequent events”), as well as the Company’s expected ability to realize cost reductions should these forecasts and projections not be met.

2. Significant accounting policies, use of judgments and estimates

The Company applies the International Financial Reporting Standards (IFRS) as issued by the IASB and as adopted by the EU. The same accounting policies, presentation and methods of computation have been followed in these condensed financial statements as were applied in the preparation of the Company’s financial statements for the year ended December 31, 2022. No amendments to existing standards that became applicable as from January 1, 2023, have a material impact on the consolidated financial statements or accounting policies.

The preparation of the interim condensed financial statements in compliance with IAS 34 requires the use of certain critical accounting estimates. It also requires the Company’s management to exercise judgment in applying the Company’s accounting policies. The Company has applied the same accounting policies and there have been no material revisions to the nature and amount of estimates and judgments in its interim condensed financial statements.

As detailed in Note 2.7 of the Company’s 2022 yearend financial statements, a large portion of the Company’s revenues are derived from Medicare, which reimburses the Company for tests performed on its insured patients once a Local Coverage Determination or “LCD” has been established. On April 19, 2023, the Company announced that Select mdx for Prostate Cancer test has successfully completed a rigorous technical assessment process with the Molecular Diagnostics Services (MolDX) Program developed by Palmetto GBA and that Select mdx will be reimbursed throughout the U.S. for Medicare patients who meet coverage conditions under the foundational Local Coverage Determination (LCD) for Molecular Biomarkers to Risk-Stratify Patients at Increased Risk for Prostate Cancer.

As of June 30, 2023, no payments have been received from Noridian (the Company’s Medicare Administrative Contractor) and the Company is unable to reliably estimate the amount that will be paid, and as such, the Company considers this revenue as variable consideration and has not recognized Medicare revenues related to its Select mdx test for the period ended June 30, 2023.

3. Business combinations

Acquisition of Genomic Prostate Score® (GPS) test from Exact Sciences

On August 2, 2022, the Company acquired the Genomic Prostate Score® (GPS) test from Genomic Health, Inc., a subsidiary of Exact Sciences Corporation (“Exact Sciences”) for up to $100 million, of which $30 million was paid at closing ($25 million in cash and $5 million settled through the delivery of 691,171 American Depositary Shares (“ADSs”) of the Company).

Following the closing, an additional aggregate earn-out amount of up to $70 million was to be paid by MDxHealth to Exact Sciences upon achievement of certain revenue milestones related to fiscal years 2023 through 2025. The liability recognized reflects a probability-weighted estimate at the current net present value at the date of acquisition, which is expected to become payable. Fair value adjustments to this contingent consideration liability are recognized in the statement of profit or loss.

As of June 30, 2023, the contingent consideration has been assessed at $57.6 million, of which $22.5 million has been recorded under “Other current financial liabilities” for the part that was estimated to become payable in the first half of 2024. The remaining $35.1 million has been recorded under “Other non-current financial liabilities” for part of liabilities expected to become payable in 2025 and 2026. As of December 31, 2022, the contingent consideration was assessed at $52.9 million and fully recorded under “Other non-current financial liabilities”.

Refer to Note 15, “Subsequent events” for information on the amended terms of the earnout that were agreed to with Exact Sciences in August 2023.

4. Significant events and transactions

Refer to Note 14 – Share capital, for further information on the Company’s offering of new ordinary shares in February – March 2023 resulting in gross proceeds of $43.0 million.

5. Segment information

The Company does not distinguish different business segments since most revenues are generated from clinical laboratory service testing, or the out-licensing of the Company’s patented DNA methylation platform and biomarkers. However, the Company does distinguish different geographical operating segments based on revenue since the revenues are generated both in the United States of America and in Europe.

Total product revenue and non-current assets are shown below as a percentage by geography:

Segment revenues

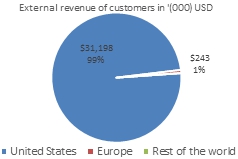

For the period ended June 30, 2023, the Company earned 100% of its revenue from external customers from its clinical laboratory testing services and out-licensing of intellectual property. For the period ended June 30, 2023, the clinical laboratory testing in the U.S. CLIA laboratory represented 99.2% of the Company’s revenue (first six months of 2022: 98.5%), while the out-licensing of intellectual property revenue and grant income in Europe represented less than 1% (first six months of 2022: less than 1%).

The amount of its revenue from external customers broken down by location from the customers is shown in the table below:

| Thousands of $ | | Jan-June 2023 | | | Jan-June 2022 | |

| United States of America | | $ | 31,198 | | | $ | 12,850 | |

| Europe | | | 243 | | | | 155 | |

| Rest of the world | | | 4 | | | | 4 | |

| Total segment revenue | | $ | 31,445 | | | $ | 13,009 | |

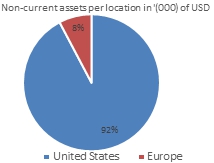

As of June 30, 2023, 92% of the non-current assets were located in the U.S. (June 30, 2022: 46%) and the remaining 8% were located in Europe (June 30, 2022: 54%). The increase in non-current assets located in the U.S. is mainly due to acquired intangible assets in the GPS business combination.

6. Operating expenses

Research & development expenses

Research and development expenses consist of costs incurred for the development and improvement of our products. These expenses consist primarily of labor costs (including salaries, bonuses, benefits, and stock-based compensation), reagents and supplies, clinical studies, outside services, patent expenses, depreciation of laboratory equipment, facility occupancy and information technology costs. Research and development expenses also include costs associated with assay improvements and automation workflow for our current suite of products. The Company recognizes its research and development expenses in the period in which they are incurred, except for those development expenses that qualify for capitalization. For the six months ended June 30, 2023, research and development expenses increased by $1.0 million, or 27%, over the same period last year, primarily due to the amortization expenses related to the acquired intellectual property (IP) and brand for the GPS business, as well as an increase in lab consumables.

Sales and marketing expenses

The Company’s sales and marketing expenses are expensed as incurred and include costs associated with its sales organization, including its direct clinical sales force and sales management, medical affairs, client services, marketing and managed care, as well as technical lab support and administration. These expenses consist primarily of labor costs (including salaries, bonuses, benefits, and stock-based compensation), customer education and promotional expenses, market analysis expenses, conference fees, travel expenses and allocated overhead costs. For the six months ended June 30, 2023, selling and marketing expenses increased by $9.2 million, or 93%, over the same period last year, primarily due to an increase in personnel costs and marketing expenses related to the GPS business as well as an increase in amortization expense related to customer lists as part of the GPS intangible asset.

General and administrative expenses

General and administrative expenses include costs for certain executives, accounting and finance, legal, revenue cycle management, information technology, human resources, and administrative functions. These expenses consist primarily of labor costs (including salaries, bonuses, benefits, and stock-based compensation), professional service fees such as consulting, accounting, legal, general corporate costs, and public-company costs associated with the Company’s listing, as well as allocated overhead costs (rent, utilities, insurance, etc.) For the six months ended June 30, 2023, general and administrative expenses increased by $1.3 million, or 13%, over the same period last year, primarily related to higher labor costs, insurance and professional fees.

7. Intangible assets

Thousands of $ | | Patents

and software

licenses | | | Internally

-developed

intangible

assets | | | Externally

acquired

intellectual

property | | | Customers

| | | Total | |

| Gross Value at January 1, 2023 | | $ | 5,134 | | | $ | 10,372 | | | $ | 41,375 | | | $ | 8,007 | | | $ | 64,888 | |

| Additions | | | | | | | 980 | | | | | | | | | | | | 980 | |

| Gross Value at June 30, 2023 | | | 5,134 | | | | 11,352 | | | | 41,375 | | | | 8,007 | | | | 65,868 | |

| | | | | | | | | | | | | | | | | | | | | |

Accumulated amortization and impairment at

January 1, 2023 | | | (5,134 | ) | | | (8,722 | ) | | | (4,353 | ) | | | (513 | ) | | | (18,722 | ) |

| Additions | | | | | | | (171 | ) | | | (1,452 | ) | | | (616 | ) | | | (2,239 | ) |

Accumulated amortization and impairment at

June 30, 2023 | | | (5,134 | ) | | | (8,893 | ) | | | (5,805 | ) | | | (1,129 | ) | | | (20,961 | ) |

| Net value at June 30, 2023 | | $ | - | | | $ | 2,459 | | | $ | 35,570 | | | $ | 6,878 | | | $ | 44,907 | |

Amortization of intangible assets is included in research & development expenses and in selling and marketing expenses in the statement of profit and loss.

The externally-acquired intangible asset includes technology acquired in the business combination with NovioGendix in 2015 and with the acquisition of the GPS test in August 2022. The estimated remaining amortization period amounts to 2.1 years for the NovioGendix IP and to 14.1 years for the GPS IP.

Customer relationships includes customers acquired in the GPS acquisition. The GPS Customer relationships are amortized over 6.5 years, the estimated remaining amortization period amounts to 5.5 years.

The internally-developed intangible assets relate to the capitalized development expenses for Confirm mdx and Select mdx over the past years as well as for the development of the GPS assay in-house and our Resolve mdx assay. The estimated remaining amortization period amounts to 0.7 years for Confirm mdx and Select mdx and 4.5 years for GPS and 3.8 years for Resolve mdx. As of June 30, 2023, the Company capitalized $2.1 million (2022: $0) in GPS and Resolve mdx development expenses.

8. Property, plant & equipment

As of June 30, 2023, the Company acquired $2.0 million of fixed assets which consisted of $1.1 million of laboratory equipment, $0.5 million of leasehold improvements, $0.2 million of IT equipment and $0.2 million of furniture. The primary purpose of these acquisitions was to add testing capacity for its new GPS and Resolve assays. As of June 30, 2022, the company acquired $0.9 million of fixed assets which consisted of $0.4 million of laboratory equipment, $0.4 million of leasehold improvements, and $0.1 million of IT equipment.

9. Loans, borrowings, lease obligations and other financial liabilities

| | | Loans and borrowings | | | Other financial liabilities | |

Thousands of $

Balance at the closing date of

| | June 30,

2023 | | | December 31,

2022 | | | June 30,

2022 | | | June 30,

2023 | | | December 31,

2022 | | | June 30,

2022 | |

| Beginning balance | | $ | 35,530 | | | $ | 12,092 | | | $ | 12,092 | | | $ | 55,864 | | | $ | 2,427 | | | $ | 2,427 | |

| Cash movements | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and borrowings repaid1 (Kreos / PPP) | | | (318 | ) | | | (10,805 | ) | | | (439 | ) | | | | | | | | | | | | |

| Loans and borrowings received (Innovatus) | | | | | | | 34,291 | | | | | | | | | | | | | | | | | |

| Non-cash movements | | | | | | | | | | | | | | | | | | | | | | | | |

| GPS contingent consideration | | | | | | | | | | | | | | | | | | | 50,483 | | | | | |

| Recognition of Innovatus embedded derivative convertible call option | | | | | | | (1,026 | ) | | | | | | | | | | | 1,026 | | | | | |

| Kreos effective interest rate adjustment and extinguishment costs | | | | | | | 1,328 | | | | 131 | | | | | | | | | | | | | |

| Innovatus - effective interest rate adjustment | | | 605 | | | | 660 | | | | | | | | | | | | | | | | 170 | |

| Foreign exchange rate impact / other | | | | | | | (1,010 | ) | | | (818 | ) | | | | | | | (35 | ) | | | | |

| Fair value changes through profit and loss | | | | | | | | | | | 85 | | | | 4,144 | | | | 1,963 | | | | (251 | ) |

| Balance at the closing date | | $ | 35,817 | | | $ | 35,530 | | | $ | 11,051 | | | $ | 60,008 | | | $ | 55,864 | | | $ | 2,346 | |

| 1 | The amount includes interest paid on loans and borrowings |

| | | Lease liabilities | |

Thousands of $

Balance at the closing date of | | June 30,

2023 | | | December 31,

2022 | | | June 30,

2022 | |

| Beginning balance | | $ | 4,263 | | | $ | 3,464 | | | $ | 3,464 | |

| Cash movements | | | | | | | | | | | | |

| Repayment of lease liabilities | | | (712 | ) | | | (1,358 | ) | | | (663 | ) |

| Non-cash movements | | | | | | | | | | | | |

| Interest accretion | | | 162 | | | | 314 | | | | 156 | |

| New leases1 | | | 1,059 | | | | 1,843 | | | | 367 | |

| Balance at the closing date | | $ | 4,772 | | | $ | 4,263 | | | $ | 3,324 | |

| 1 | Includes $43,000 lease transferred out to third party. |

Innovatus debt facility

On August 2, 2022, the Company entered into a $70 million loan and security agreement with Innovatus Life Sciences Lending Fund I, LP (“Innovatus”). At closing, an amount of $35 million was drawn, with an additional $35 million remaining available as a $20 million term B loan and a $15 million term C loan that can be drawn in 2024 and 2025 respectively, subject to certain conditions (including a condition that places a ceiling on the Company’s debt to market capitalization ratio, the satisfaction of which condition is beyond the direct control of the Company). The loans are secured by assets of the Company including intellectual property rights.

The loans accrue interest at a floating per annum rate equal to the sum of (a) the greater of (i) the prime rate published in The Wall Street Journal in the “Money Rates” section or (ii) 4.00%, plus (b) 4.25%, and require interest-only payments for the initial four years. As contractually agreed, and at the election of the Company, a portion of the interest is payable in-kind by adding an amount equal to 2.25% of the outstanding principal amount to the then outstanding principal balance on a monthly basis until August 2, 2025. The loans mature on August 2, 2027. The lenders have the right to convert, prior to August 2, 2025, up to 15% of the outstanding principal amount of the loans into ADSs of the Company at a price per ADS equal to $11.21. Amounts converted into ADSs of the Company will be reduced from the principal amount outstanding under the loan.

Notable fees payable to Innovatus consist of a facility fee equal to 1% of the total loan commitment, due on the funding date of the relevant loans, and an end-of-loan fee equal to 5% of the amount drawn, payable upon final repayment of the relevant loans.

Security has been granted over all assets (including IP rights) owned by the Company and MDxHealth, Inc. The loan agreement contains customary financial covenants and general affirmative and negative covenants, including limitations on our ability to transfer or dispose of assets, change our business, merge with or acquire other companies, incur additional indebtedness and liens, make investments, pay dividends and conduct transactions with affiliates.

The Innovatus debt facility has been accounted for as a hybrid financial instrument which includes a host financial liability as well as an embedded derivative financial instrument being an equity conversion call option at a fixed rate of up to 15% of the aggregate outstanding principal amount through August 2, 2025.

The embedded derivative is not considered to be closely related to the host financial liability given the differences in economics and risks, and as such both are accounted for separately:

| ● | The host financial liability is recognized at amortized cost applying the effective interest rate method; |

| ● | The embedded derivative convertible (American) call option is recognized at fair value using a binomial tree option pricing model whereby the fair value is based on the actual stock price and the estimated volatility of the Company’s ADS on Nasdaq since the Company’s IPO on November 4, 2021, and through the valuation date. The volatility measured at August 2, 2022, which was the closing date of the Innovatus debt facility, was 62.85% and at June 30, 2023 was 72.80%. Any changes to the fair value of the embedded derivative are recognized through the statement of profit or loss. |

Other financial liabilities

GPS Contingent consideration

As part of the acquisition of the GPS business from Exact Sciences in August 2022, an aggregate earn-out amount of up to $70 million was to be paid by MDxHealth to Exact Sciences upon achievement of certain revenue milestones related to fiscal years 2023 through 2025, with the maximum earn-out payable in relation to 2023 and 2024 not to exceed $30 million and $40 million, respectively. The liability recognized reflects a probability-weighted estimate at the current net present value which is expected to become payable. Future fair value adjustments to this contingent consideration will be recognized in the statement of profit or loss.

As of June 30, 2023, the contingent consideration has been assessed at $57.6 million, of which $22.5 million has been recorded under “Other current financial liabilities” and the remaining $35.1 million has been recorded under “Other non-current financial liabilities”. As of December 31, 2022, the contingent consideration had been assessed at $52.9 million and recorded under “Other non-current financial liabilities”.

Refer to Note 15, “Subsequent events” for information on the amended terms of the earnout that were agreed to with Exact Sciences in August 2023.

Innovatus embedded derivative convertible call option

The embedded derivative convertible (American) call option is recognized at fair value within the other non-current financial liabilities and amounted to $221,015 and $910,000 as of June 30, 2023, and December 31, 2022, respectively.

Kreos derivative financial instrument (“initial drawdown fee”)

In June 2023, Kreos provided notice to the Company of the cancelation of the convertible loan associated with the initial drawdown fee and requested repayment in cash.

As such, Kreos is entitled to a cash repayment of €945,000 ($1.0 million) which is equal to 150% of the initial drawdown fee of €630,000. The Company has paid €472,500 ($513,419) in July 2023, with the remaining €472,500 ($513,419) expected to be paid in 2023.

Accordingly, as of June 30, 2023, the fair value of the financial derivative related to the initial drawdown fee has been recorded at its fair value being equal to the actual aggregate payments to be made in 2023.

Other financial liabilities

Other financial liabilities include the contingent consideration related to the acquisition of NovioGendix in 2015 and amounted to $1.2 million as of June 30, 2023 and December 31, 2022, of which $550,000 and $526,000 was considered current as of June 30, 2023 and December 31, 2022, respectively. The contingent consideration is valued at fair value through the statement of profit or loss. The fair value of this contingent consideration is reviewed on a periodic basis. The fair value is based on risk-adjusted future cash flows of different scenarios discounted using an interest rate of 14.94% as of June 30, 2023.

10. Financial expenses, net

Thousands of $

Balance at the closing date of | | Jan-Jun 2023 | | | Jan-Jun 2022 | |

| Contingent consideration fair value adjustments: | | | | | | | | |

| GPS contingent consideration | | $ | (3,854 | ) | | $ | - | |

| NovioGendix contingent consideration | | | (28 | ) | | | (197 | ) |

| Total contingent consideration fair value adjustments | | | (3,882 | ) | | | (197 | ) |

| | | | | | | | | |

| Other financial expenses, net: | | | | | | | | |

| Interest income | | | 317 | | | | 27 | |

| Interest on Innovatus loan | | | (2,628 | ) | | | - | |

| Innovatus derivative instrument | | | 689 | | | | - | |

| Interest on Kreos loan | | | - | | | | (686 | ) |

| Kreos derivative instrument | | | (136 | ) | | | - | |

| Interest on other loans & leases | | | (169 | ) | | | (170 | ) |

| Other financial expenses | | | (66 | ) | | | (54 | ) |

| Total other financial expenses, net | | | (1,993 | ) | | | (883 | ) |

| Financial expenses, net | | $ | (5,875 | ) | | $ | (1,080 | ) |

Financial expenses for the period ended June 30, 2023, were primarily related to the fair value adjustment of $3.9 million for the GPS contingent consideration as well as interest charges of $2.6 million on the Innovatus loan, partially offset by the positive fair value adjustment of $0.7 million related to the Innovatus derivative instrument.

11. Financial instruments and fair value

The table shows the Company’s significant financial assets and liabilities. All financial assets and liabilities are carried at amortized cost with the exception of the contingent considerations in relation to acquisitions and derivative financial instruments reported at fair value through profit and loss.

All financial assets and liabilities are considered to have carrying amounts that do not materially differ from their fair value.

The carrying value and fair value of the financial instruments as of June 30, 2023 and December 31, 2022 can be presented as follows:

| Thousands of $ | | As of

June 30,

2023 | | | As of

December 31,

2022 | | | Hierarchy |

| Assets | | | | | | | | |

| At amortized cost | | | | | | | | |

| Trade receivables | | $ | 8,098 | | | $ | 9,357 | | | |

| Cash and cash equivalents | | | 39,472 | | | | 15,503 | | | |

| Total financial assets | | | 47,570 | | | | 24,860 | | | |

| | | | | | | | | | | |

| Liabilities | | | | | | | | | | |

| At fair value | | | | | | | | | | |

| Other financial liabilities | | | | | | | | | | |

| -GPS contingent consideration | | | 57,550 | | | | 52,881 | | | Level 3 |

| -NovioGendix contingent consideration | | | 1,210 | | | | 1,182 | | | Level 3 |

| -Innovatus derivative instrument | | | 221 | | | | 910 | | | Level 3 |

| -Kreos derivative instrument* | | | 1,027 | | | | 891 | | | Level 1/3 |

| Subtotal financial liabilities at fair value | | | 60,008 | | | | 55,864 | | | |

| | | | | | | | | | | |

| At amortized cost: | | | | | | | | | | |

| Loans and borrowings | | | 35,817 | | | | 35,530 | | | Level 2 |

| Lease liabilities | | | 4,772 | | | | 4,263 | | | |

| Trade payables | | | 10,681 | | | | 10,178 | | | |

| Subtotal financial liabilities at amortized cost | | | 51,270 | | | | 49,971 | | | |

| | | | | | | | | | | |

| Total financial liabilities | | $ | 111,278 | | | $ | 105,835 | | | |

| * | Fair-value hierarchy changed from level 3 to level 1 during the six months ended June 30, 2023 |

The fair value of the financial instruments has been determined on the basis of the following methods and assumptions:

| ● | The carrying value of the cash and cash equivalents, the trade receivables, other current assets and the trade payables approximate their fair value due to their short-term character; |

| ● | The fair value of loans and borrowings applying the effective interest rate method approximates their carrying value (level 2). |

| o | Innovatus debt facility: the host financial liability was obtained with a variable interest rate based upon the Prime Rate (with a floor of 4% and a margin of 4.25%). |

| o | Paycheck Protection Program (PPP): applying a market rate would not result in a materially different fair value which carries an interest rate of 1% and was obtained as part of the U.S Coronavirus Aid, Relief, and Economic Security (CARES) Act. |

| ● | Leases are measured at the present value of the remaining lease payments, using a discount rate based on the incremental borrowing rate at the commencement date of these leases. Their fair value approximates their carrying value. |

| ● | The fair value of contingent consideration payable to NovioGendix (presented in the statement of financial position under “other non-current financial liabilities” and “other current financial liabilities”) and Exact Sciences is based on an estimated outcome of the conditional purchase price/contingent payments arising from contractual obligations (level 3). These are initially recognized as part of the purchase price and subsequently fair valued with changes recorded through other operating income in the statement of profit or loss. |

| o | NovioGendix: the Company used a discount rate of 14.94%. The effect of the fair value measurement is $28,000 in the condensed consolidated financial statements of which all is in operating expense. |

| o | GPS: The fair value of the contingent consideration payable to Exact Sciences is based on a probability-weighted average estimate based on multiple scenarios varying in timing and amount of earn-out payment. This probability-weighted estimate is then discounted to its net present value, taking into account the expected time when the earn-out would become payable in 2024, 2025 and 2026. Fair-value adjustments resulting in a financial charge of $3.9 million and a charge to other operating expenses of $0.8 million have been recorded as of June 30, 2023. The Company used a discount rate of 14.94%. As of June 30, 2023 an amount of $22.5 million is considered to be short term debt expected to become payable in May 2024. |

| ● | Following notice in June 2023 by Kreos of the cancelation of the derivative instrument and request for repayment in cash (which was partially settled in July 2023), the fair value of the liability was recorded at carrying value given the short-term nature of the liability. Accordingly, as of June 30, 2023, the fair-value hierarchy of the Kreos derivative financial instrument changed from level 3 to level 1. |

| ● | The fair value of the derivative financial liabilities related to the Innovatus derivative call option (as detailed in Note 7) was performed using a binomial pricing model which takes into account several factors including the expected evolution in price of an ADS and are considered as level 3 input. The fair value of the liability is estimated at $0.2 million as of June 30, 2023. |

Fair value hierarchy:

The Company uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation technique:

| ● | Level 1: quoted prices in active markets for identical assets and liabilities; |

| | | |

| ● | Level 2: other techniques for which all inputs have a significant effect on the recorded fair value are observable, either directly or indirectly; and |

| | | |

| ● | Level 3: techniques which use inputs that have a significant effect on the recorded fair value that are not based on observable market data. |

No financial assets or financial liabilities have been reclassified between the valuation categories during the year, other than the Kreos derivative financial instrument which changed from level 3 to level 1.

A reconciliation of cash and non-cash movements of level 3 financial liabilities is presented below:

| | | Financial Derivative

Instruments

(Kreos* and Innovatus) | | | Contingent consideration

(NovioGendix and GPS) | |

Thousands of $

Balance at the closing date of | | June 30,

2023 | | | December 31,

2022 | | | June 30,

2023 | | | December 31,

2022 | |

| Beginning balance | | $ | 1,801 | | | $ | 810 | | | $ | 54,063 | | | $ | 1,617 | |

| Cash movements | | | | | | | | | | | | | | | | |

| Innovatus embedded derivative convertible call option | | | | | | | 1,026 | | | | | | | | | |

| Non-cash movements | | | | | | | | | | | | | | | | |

| GPS Contingent Consideration | | | | | | | | | | | | | | | 50,483 | |

| Foreign exchange rate impact / other movements | | | | | | | (35 | ) | | | | | | | | |

| Fair value changes through profit and loss | | | (689 | ) | | | | | | | 4,697 | | | | 1,963 | |

| Change to level 1 fair value hierarchy | | | 136 | | | | | | | | | | | | | |

| Ending balance | | $ | 1,248 | | | $ | 1,801 | | | $ | 58,760 | | | $ | 54,063 | |

| * | Fair-value hierarchy changed from level 3 to level 1 during the first half of 2023 for Kreos derivative financial instrument |

12. Related party transactions

There were no transactions to key management other than remuneration, warrants, and bonus, all of which are detailed in the Company’s 2022 Annual Report. For the six months ended June 30, 2023, total remuneration for key management and Directors was $1.3 million, with 2.2 million warrants being granted.

There were no other related party transactions.

13. Warrant plans

On June 30, 2023, the shareholders approved the creation of 5,000,000 “2023 Share Options” of which 2,550,000 have been granted as of June 30, 2023.

As of June 30, 2023, the Company granted a total of 10,706,000 of the respectively “2019, 2021, and 2022 Share Options” to employees of the Company (respectively 2,983,500, 3,595,000, and 4,127,500 warrants).

During 2023, the Company granted a total of 675,000 of the respectively “2019, 2021 and 2022 Share Options” to employees of the Company (respectively 10,000, zero, and 665,000 warrants). The warrants have been granted free of charge. Each warrant entitles its holder to subscribe to one common share of the Company at a subscription price determined by the board of directors, within the limits decided upon at the time of their issuance.

The warrants issued generally have a term of ten years as of issuance. Upon expiration of their term, the warrants become null and void. In general, the warrants vest in cumulative tranches of 25% per year, provided that the beneficiary has been employed for at least one year.

The fair value of each warrant is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions:

| ● | The dividend return is estimated by reference to the historical dividend payment of the Company; currently, this is estimated to be zero as no dividends have been paid since inception |

| ● | The expected volatility was determined using the Euronext average volatility of the stock over the last two years at the date of grant |

| ● | Risk-free interest rate from Euronext is based on the interest rate applicable for the 10-year Belgian government bond at the grant date |

The model inputs for warrants granted during the period ended June 30, 2023 included:

| Grant date | | 25 March,

2023 | | | 27 April,

2023 | | | May 3,

2023 | | | June 22,

2023 | | | June 30,

2023 | |

| Plan | | | 2022 Share Options | | | | 2022 Share Options | | | | 2022 Share Options | | | | 2019 Share Options | | | | 2023 Share Options | |

| Number of Shares | | | 305,000 | | | | 250,000 | | | | 110,000 | | | | 10,000 | | | | 2,550,000 | |

| Exercise price | | € | 0.32 | | | € | 0.32 | | | € | 0.33 | | | € | 0.36 | | | € | 0.29 | |

| Expiry date | | | 31/03/2032 | | | | 31/03/2032 | | | | 31/03/2032 | | | | 31/03/2033 | | | | 31/03/2033 | |

| Share price at grant date | | € | 0.27 | | | € | 0.35 | | | € | 0.34 | | | € | 0.31 | | | € | 0.31 | |

| Expected price volatility | | | 71.42 | % | | | 73.60 | % | | | 73.64 | % | | | 72.54 | % | | | 72.62 | % |

| Risk-free interest rate | | | 2.75 | % | | | 3.10 | % | | | 2.92 | % | | | 3.11 | % | | | 3.09 | % |

The total fair value of the granted warrant is estimated at $465,000 following the underlying assumptions of the model. This amount represents the full fair value of the warrants granted that will vest over time.

14. Share capital

In March 2023, the Company completed a registered public offering of 10.75 million American Depositary Shares (“ADSs”) (each representing 10 ordinary shares of the Company without nominal value) at a price to the public of $4 per ADS for total gross proceeds of $43.0 million before deducting commissions and offering expenses of $3.4 million.

In the context of the aforementioned capital increase, the number of issued and outstanding shares has increased from 162,880,936 to 270,380,936 ordinary shares, through the issuance of a total of 107,500,000 new shares.

15. Subsequent events

On August 23, 2023, MDxHealth and Exact Sciences Corporation amended their existing Oncotype DX GPS prostate cancer business asset purchase agreement, deferring the Company’s initial earnout payment by 3 years, from 2024 to 2027, in consideration for an amendment fee of $250,000 in cash and 250,000 of the Company’s ADSs, a 5-year subscription right (warrant) to acquire up to 1,000,000 of the Company’s ADSs at an exercise price of $5.265 per ADS (representing a 50% premium to the market price of the ADSs as of August 18, 2023), and an increase in the potential aggregate earnout amount from $70 million to $82.5 million. The Company agreed to convene a general shareholders’ meeting to approve the subscription right. Under the terms of the amended asset purchase agreement, MDxHealth has agreed to make earn-out payments to Exact Sciences in each of fiscal years 2025, 2026 and 2027, based upon certain revenues related to fiscal years 2024, 2025 and 2023, respectively. At the option of MDxHealth, the earn-out amounts can be settled in cash or through the issuance of additional ADSs of the Company (valued in function of a volume weighted average trading price of the Company’s shares at the end of the relevant earnout period) to Exact Sciences, provided that the aggregate number of shares representing the ADSs held by Exact Sciences shall not exceed more than 7.5% (increased from 5% in the initial agreement) of the outstanding shares of the Company.

16. Statutory auditor’s report to the Board of Directors of MDxHealth SA on the review of consolidated interim financial information for the six-month period ended 30 June 2023

Introduction

We have reviewed the accompanying interim consolidated statement of financial position of MDxHealth SA as of 30 June 2023 and the related interim consolidated statements of comprehensive income, cash flows and changes in equity for the six-month period then ended, as well as the explanatory notes. The Board of Directors is responsible for the preparation and presentation of this consolidated interim financial information in accordance with IAS 34 “Interim Financial Reporting”, as adopted by the European Union. Our responsibility is to express a conclusion on this consolidated interim financial information based on our review.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”. A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the accompanying consolidated interim financial information is not prepared, in all material respects, in accordance with IAS 34 “Interim Financial Reporting”, as adopted by the European Union.

Zaventem, 23 August 2023

BDO Bedrijfsrevisoren BV / BDO Réviseurs d’Entreprises SRL

Statutory auditor

Represented by Bert Kegels

III. CORPORATE INFORMATION

Registered office

MDxHealth SA has the legal form of a public limited liability company (société anonyme - SA / naamloze vennootschap - NV) organized and existing under the laws of Belgium. The company’s registered office is located at CAP Business Center, Rue d’Abhooz 31, B-4040 Herstal, Belgium.

The company is registered with the Registry of Legal Persons (registre des personnes morales - RPM / rechtspersonenregister – RPR) under company number RPM/RPR 0479.292.440 (Liège).

Listings

Euronext Brussels: MDXH

NASDAQ: MDXH

Financial calendar

November 8, 2023 – Q3 business update

Financial year

The financial year starts on 1 January and ends on 31 December.

Statutory auditor

BDO Bedrijfsrevisoren / Réviseurs d’entreprises BV/SRL

Da Vincilaan 9

1935 Zaventem

Belgium

Availability of the Interim Report

This document is available to the public free of charge and upon request:

MDxHealth SA - Investor Relations

CAP Business Center - Rue d’Abhooz, 31 – 4040 Herstal - Belgium

Tel: +32 4 257 70 21

E-mail: ir@mdxhealth.com

For informational purposes, an electronic version of the Interim Report 2022 is available on the website of mdxhealth at www.mdxhealth.com/investors/financials

19