embecta Second Quarter 2022 Earnings Conference Call May 13, 2022

2 Forward-Looking Statements Safe Harbor Statement Regarding Forward-Looking Statements This presentation contains express or implied "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward-looking statements concern our current expectations regarding our future results from operations, performance, financial condition, goals, strategies, plans and achievements. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors, and you should not rely upon them except as statements of our present intentions and of our present expectations, which may or may not occur. When we use words such as "believes," "expects," "anticipates," "estimates," "plans," "intends", “pursue”, “will” or similar expressions, we are making forward-looking statements. For example, embecta is using forward-looking statements when it discusses its fiscal 2022 financial guidance, opportunities for growth and its capabilities as an independent company and strategic priorities, including its ability to optimize its product portfolio and achieve more efficient resource and capital allocation. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) competitive factors that could adversely affect embecta’s operations, (ii) any events that adversely affect the sale or profitability of embecta’s products or the revenue delivered from sales to its customers, (iii) any failure by BD to perform of its obligations under the various separation agreements entered into in connection with the separation and distribution; (iv) increases in operating costs, including fluctuations in the cost and availability of raw materials or components used in its products, the ability to maintain favorable supplier arrangements and relationships, and the potential adverse effects of any disruption in the availability of such items; (v) changes in reimbursement practices of governments or private payers or other cost containment measures; (vi) the adverse financial impact resulting from unfavorable changes in foreign currency exchange rates, as well as regional, national and foreign economic factors, including inflation, deflation, and fluctuations in interest rates; (vii) the impact of changes in U.S. federal laws and policy that could affect fiscal and tax policies, healthcare and international trade, including import and export regulation and international trade agreements; (viii) any impact of the COVID-19 pandemic, including disruptions in its operations and supply chains; (ix) new or changing laws and regulations, or changes in enforcement practices, including laws relating to healthcare, environmental protection, trade, monetary and fiscal policies, taxation and licensing and regulatory requirements for products; (x) the expected benefits of the separation from BD; (xi) risks associated with embecta’s indebtedness; (xii) the risk that embecta’s separation from BD will be more difficult or costly than expected; and (xiii) the other risks described in our periodic reports filed with the Securities and Exchange Commission (“SEC”), including under the caption “Risk Factors” in our Information Statement dated February 11, 2022, filed with the SEC on February 11, 2022 as Exhibit 99.1 to our Current Report on Form 8-K. Except as required by law, we undertake no obligation to update any forward-looking statements appearing in this presentation.

3 Conference Call Logistics The release, accompanying slides, and replay webcast are available online in the investors section of embecta’s website, at www.embecta.com An audio replay of the call will be available beginning at 11:00am ET on May 13, 2022, either on the embecta website or by telephone. The replay can be accessed by dialing 855-859-2056 (U.S.) or 404-537-3406 (International). The access code is 5596984. The webcast will be archived on the investor website for one year.

4 Today’s Speakers Dev Kurdikar Chief Executive Officer Jake Elguicze Chief Financial Officer

5 Mission To develop and provide solutions that make life better for people living with diabetes Vision A life unlimited by diabetes Advance every day together Spin from BD completed and independent company as of April 1, 2022

6 Trusted leader in the global marketplace: The largest producer of diabetes injection devices with a ~100-year history of reliability and quality Best-in-class products and brand: Trusted brand leadership across our broad portfolio for People With Diabetes (PWD) in all geographies Unmatched manufacturing, distribution and sales capabilities: Produce ~7.6B units and distribute to 100+ countries and ~30M PWD embecta’s Enduring Strengths Trusted leader with best-in-class products and unmatched capabilities

7 An expanding category Pure-play diabetes company with leadership in insulin delivery Diabetes: chronic condition, large and growing market opportunity Strong, trusted core business Established brand loyalty over ~100 years Unmatched global manufacturing infrastructure and know-how Geographically diverse sales and distribution network Immediate benefits of the spin Compelling financial profile that supports an “invest for growth” strategy Attract talent; proven leadership and highly motivated workforce Streamlined operating model: more nimble, innovative, and customer-focused Opportunities for growth Deliver organic growth R&D pipeline with potential to enter infusion segment M&A and partnership opportunities embecta’s Strong Position Our stable core provides the foundation for new growth opportunities

8 Executive Summary of Q2 and 1H 2022 Results Successfully executed the planned spinoff from BD on April 1, 2022, giving embecta the strategic, operational, and financial independence, and opportunity to optimize its product portfolio and achieve more efficient resource and capital allocation to address the significant unmet need for chronic diabetes care Executing on transition service agreements with BD while building up embecta’s internal organization, systems and processes Advanced the development of a type 2 closed loop insulin delivery system utilizing embecta’s proprietary patch pump, which carries Breakthrough Device Designation from the U.S. Food & Drug Administration Ongoing efforts to mitigate global supply chain challenges and minimize customer and patient impact Continued to manage through COVID-19 disruptions in certain markets that impacted operations Despite these efforts, inflationary pressures on raw materials, shipping costs and delays, COVID-19 disruptions, and foreign currency fluctuations impacting results

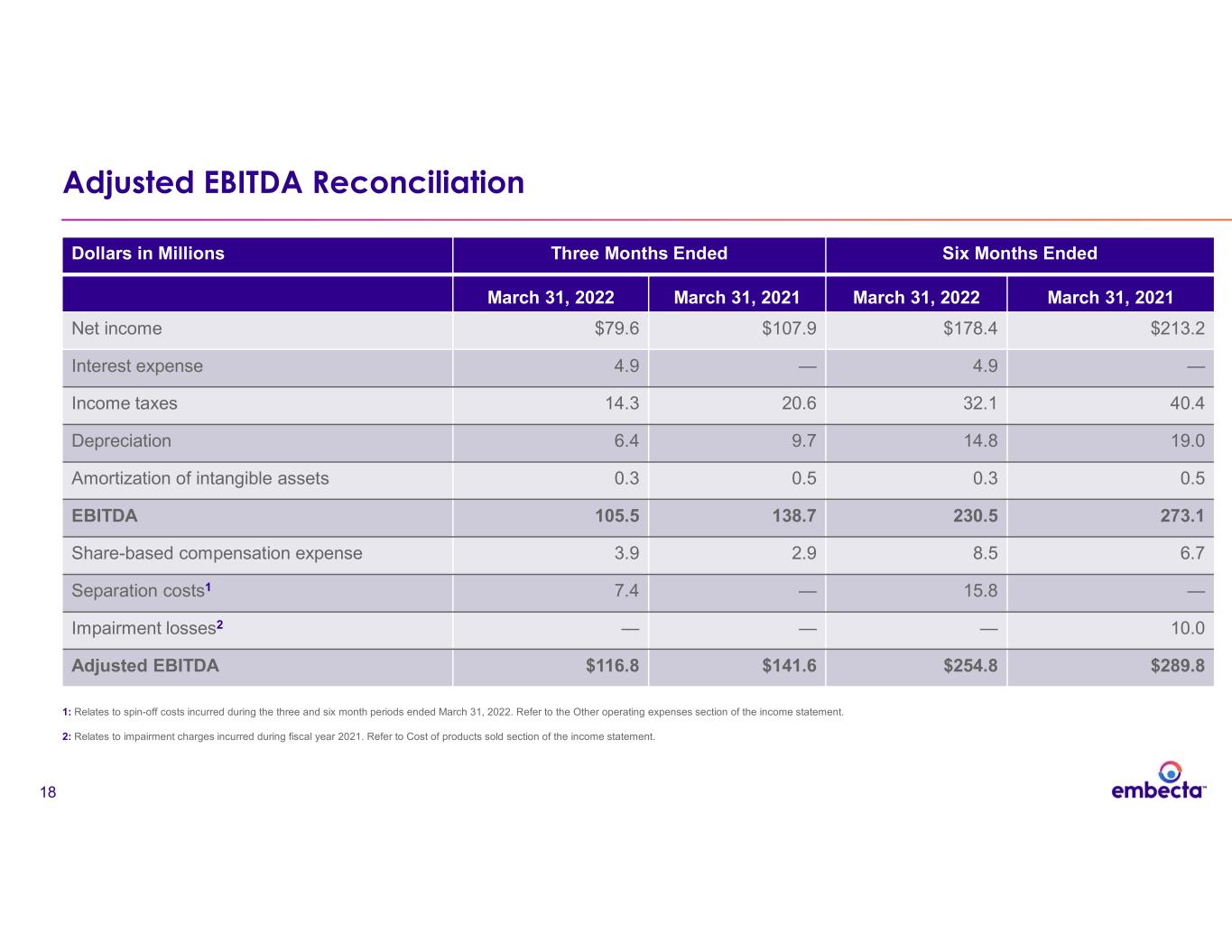

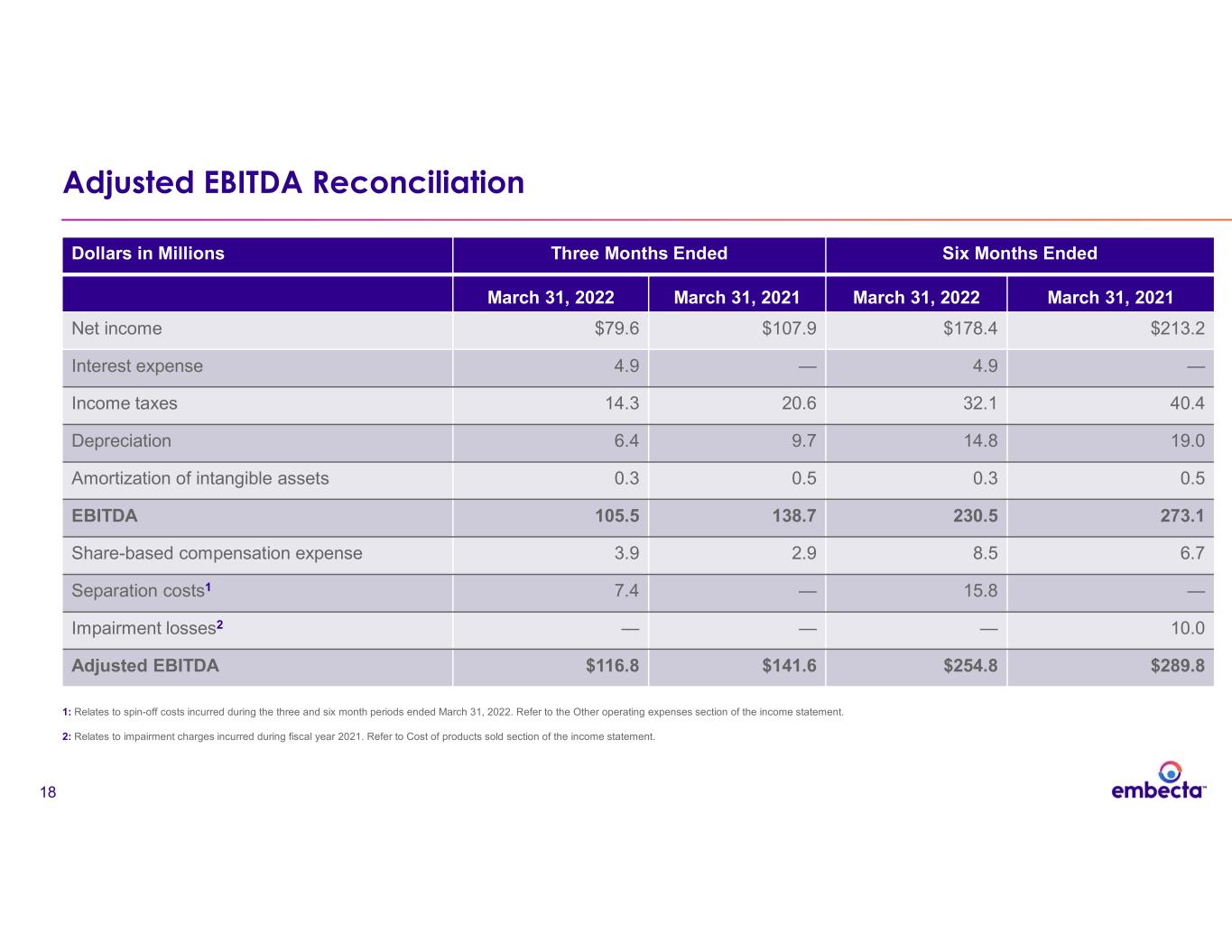

9 Revenue • Q2’22 revenue of $274.5 million, down 3.4% vs. prior year period on an as-reported basis; down 1.3% on a constant currency basis • March ‘22 year-to-date revenue of $563.8 million, down 1.0% vs. prior year period on an as-reported basis; up 0.2% on a constant currency basis Gross Profit • Q2’22 gross profit and margin of $191.2 million and 69.7%, respectively; up 60 basis points vs. prior year period • March ’22 year-to-date gross profit and margin of $395.1 million and 70.1%, respectively; up 200 basis points vs. prior year period Net Income • Q2’22 net income of $79.6 million; compared to $107.9 million in the prior year period • March ’22 year-to-date net income of $178.4 million; compared to $213.2 million in the prior year period Adjusted EBITDA • Q2’22 adjusted EBITDA and margin of $116.8 million and 42.6%, respectively; compared to $141.6 million and 49.8% in the prior year period • March ’22 year-to-date adjusted EBITDA and margin of $254.8 million and 45.2%, respectively; compared to $289.8 million and 50.9% in the prior year period Q2 and Year-to-Date 2022 vs. 2021 Financial Results Note: The second quarter and first half of fiscal year 2022 and 2021 results described above are based on carve-out accounting principles, derived from the unaudited interim condensed consolidated financial statements and accounting records of BD. These condensed combined financial statements reflect the historical results of operations, financial position and cash flows of BD’s Diabetes Care Business as they were historically managed in conformity with U.S. generally accepted accounting principles (“GAAP”). In addition, these condensed combined financial statements include general corporate expenses of BD and shared segment expenses for certain support functions that are provided on a centralized basis within BD and which were not historically allocated to the BD Diabetes Care Business. Nonetheless, these financial statements do not include all the actual expenses that would have been incurred had embecta been a standalone public company during the periods presented.

10 2H’22 Financial Guidance Assumptions 2H’22 financial projections include: • Contract manufacturing agreement impacts (e.g. impact of cannula supply agreement; embecta to BD revenue) • Holdrege lease and factoring agreement expense • Transition Service Agreement expense • Estimated public company stand-up expenses • Moderate impact of COVID-19, geo-political concerns, inflationary pressures (raw materials, transportation), and supply chain disruptions F/X • EUR/USD assumed to be ~1.07 • USD/YEN assumed to be ~127 • USD/CNY assumed to be ~6.60

11 2H’22 Financial Guidance Revenue • 2H’22 total revenue of ~$555 million • Decrease of ~7.0% on an as-reported basis • Decrease of ~3.5% on a constant currency basis • 2H’22 contract manufacturing revenue of ~$15 million Non-GAAP Gross Margin • 2H’22 non-GAAP gross margin1 in the “low-60%s” • 2H’22 contract manufacturing revenue expected to generate gross margin in the “high single-digit” percent area Transition Services Agreement • 2H’22 transition services agreement expense of ~$35 million Adjusted EBITDA Margin • 2H’22 adjusted EBITDA margin1 in the “low-30%s” 1: We are unable to present a quantitative reconciliation of our expected non-GAAP gross margin, expected adjusted EBITDA and our expected adjusted EBITDA margin as we are unable to predict with reasonable certainty and without unreasonable effort the impact and timing of certain one-time items. The financial impact of these one-time items is uncertain and is dependent on various factors, including timing, and could be material to our Combined Statements of Income.

12 Our core provides basis for growth: Broadly defensible core business: We have strong organizational capabilities: A Strong embecta From Day 1 Steady core provides basis for growth We launch with a healthy balance sheet and steady tailwinds Our IP position, manufacturing strengths, and cannula agreement provide competitive advantage Our unique opportunities attract top talent, enabled by agile decision-making processes, incentives, and culture

13 Our Business Provides a Financial Foundation for Growth Business model and a healthy balance sheet provide a strong core Stable, recurring, geographically- diversified revenue base Vast majority of PWD administer insulin using injection devices Healthy margin profile Brand recognition, long history of reliable supply, scale and efficient operations allow for differentiation in the marketplace Strong cash flow generation History of generating positive cash flow from operations Modest leverage at spin Considerably below net leverage covenant in credit agreement Starting cash balance Allows for capitalizing on opportunities to invest for growth

14 Expand and penetrate through the core: We have opportunities to drive growth in the core portfolio and serve unmet needs Stronger R&D: We can enter the T2D market with our patch pump, while continuing to drive injection innovation M&A potential: We will seek partnerships and acquisitions where embecta can add value through our commercial capabilities and manufacturing expertise Strategic Investments to Accelerate our Long-term Growth Profile Including commercial investments, next-gen products, and M&A

Thank you

16 Appendix

17 Q2 and Year-to-Date 2022 vs. 2021 Segment Revenue Three Months Ended % Increase / Decrease March 31, 2022 March 31, 2021 As-Reported Revenue Growth Currency Impact Constant Currency Revenue Growth U.S. 139.8 148.4 (5.8%) 0.0% (5.8%) International 134.7 135.8 (0.8%) (4.4%) 3.6% Total 274.5 284.2 (3.4%) (2.1%) (1.3%) Six Months Ended % Increase / Decrease March 31, 2022 March 31, 2021 As-Reported Revenue Growth Currency Impact Constant Currency Revenue Growth U.S. 290.7 297.9 (2.4%) 0.0% (2.4%) International 273.1 271.6 0.6% (2.5%) 3.1% Total 563.8 569.5 (1.0%) (1.2%) 0.2%

18 Adjusted EBITDA Reconciliation Dollars in Millions Three Months Ended Six Months Ended March 31, 2022 March 31, 2021 March 31, 2022 March 31, 2021 Net income $79.6 $107.9 $178.4 $213.2 Interest expense 4.9 — 4.9 — Income taxes 14.3 20.6 32.1 40.4 Depreciation 6.4 9.7 14.8 19.0 Amortization of intangible assets 0.3 0.5 0.3 0.5 EBITDA 105.5 138.7 230.5 273.1 Share-based compensation expense 3.9 2.9 8.5 6.7 Separation costs1 7.4 — 15.8 — Impairment losses2 — — — 10.0 Adjusted EBITDA $116.8 $141.6 $254.8 $289.8 1: Relates to spin-off costs incurred during the three and six month periods ended March 31, 2022. Refer to the Other operating expenses section of the income statement. 2: Relates to impairment charges incurred during fiscal year 2021. Refer to Cost of products sold section of the income statement.