Table of Contents

Filed pursuant to Rule 424(b)(3)

SEC file No. 333-264294

PROSPECTUS

PROPERTYGURU GROUP LIMITED

PRIMARY OFFERING OF

15,795,035 ORDINARY SHARES

SECONDARY OFFERING OF

149,193,490 ORDINARY SHARES

12,960,000 WARRANTS TO PURCHASE ORDINARY SHARES, AND

12,960,000 ORDINARY SHARES UNDERLYING WARRANTS

This prospectus relates to the issuance from time to time by PropertyGuru Group Limited, a Cayman Islands exempted company with limited liability, or “we”, “us”, “our”, the “Company”, of up to 12,960,000 of our ordinary shares, par value $0.0001 per share (“ordinary shares”), which are issuable upon the exercise of 12,960,000 of our warrants offered hereby issued to certain of the Selling Securityholders (as defined below) and up to 2,835,035 ordinary shares upon the exercise of share options and vesting of restricted stock units held by certain of our directors and executive officers.

This prospectus also relates to the offer and sale, from time to time, by the selling shareholders named herein (the “Selling Securityholders”), or their pledgees, donees, transferees, or other successors in interest, of: (i) up to 162,153,490 of our ordinary shares issued to the Selling Securityholders, as described below (which includes up to 12,960,000 ordinary shares issuable upon the exercise of 12,960,000 of our warrants offered hereby issued to certain of the Selling Securityholders, as described below); and (ii) up to 12,960,000 of our warrants issued to certain of the Selling Securityholders, as described below.

On March 17, 2022 (the “Closing Date”), we consummated the transactions contemplated by that certain Business Combination Agreement, dated as of July 23, 2021 (the “Business Combination Agreement”), by and among the Company, Bridgetown 2 Holdings Limited, a Cayman Islands exempted company limited by shares (“Bridgetown 2”), B2 PubCo Amalgamation Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly-owned subsidiary of the Company (“Amalgamation Sub”) and PropertyGuru Pte. Ltd., a Singapore private company limited by shares (“PropertyGuru”). As contemplated by the Business Combination Agreement, (i) Bridgetown 2 merged with and into the Company (the “Merger”), with the Company being the surviving entity; and (ii) following the Merger, Amalgamation Sub and PropertyGuru amalgamated and continued as one company, with PropertyGuru being the surviving entity and becoming a wholly-owned subsidiary of the Company (the “Amalgamation”, and together with the Merger and the other transactions contemplated by the Business Combination Agreement, collectively the “Business Combination”).

The securities for offer and sale covered by this prospectus include (i) 13,193,068 ordinary shares issued to certain investors in private placements originally issued at a purchase price of $10.00 per share pursuant to the PIPE Subscription Agreements (as defined herein) consummated in connection with the Business Combination; (ii) 133,165,387 ordinary shares issued to certain shareholders in connection with the Business Combination; (iii) 2,835,035 ordinary shares issuable by us upon the exercise of share options and vesting of restricted stock units held by certain of our directors and executive officers;; and (iv) 12,960,000 warrants issued to Bridgetown 2 LLC (the “Sponsor”) in connection with the Business Combination pursuant to the Business Combination Agreement and the Amended and Restated Assignment, Assumption and Amendment Agreement (as defined herein), the exercise of which will result in the issuance of 12,960,000 ordinary shares at a price of $11.50 per ordinary share. In addition, this prospectus relates to the offer and sale of up to 12,960,000 ordinary shares issuable by us upon exercise of 12,960,000 warrants offered hereby.

The 133,165,387 ordinary shares issued by us to certain shareholders in connection with the Business Combination consist of: (i) 43,475,124 ordinary shares issued by us to the KKR Investor in exchange for the cancelation of an aggregate 1,204,234 PropertyGuru Shares originally issued at a weighted average purchase price of S$268.61 per share (which translates to a weighted average purchase price of $5.47 per ordinary share), (ii) 48,497,728 ordinary shares issued by us to the TPG Investor Entities in exchange for the cancelation of an aggregate 1,343,357 PropertyGuru Shares originally issued at a weighted average purchase price of S$192.93 per share (which translates to a weighted average purchase price of $3.93 per ordinary share), (iii) 22,990,226 ordinary shares issued by us to REA in exchange for the cancelation of an aggregate 636,815 PropertyGuru Shares originally issued at a purchase price of S$311.7074818 per share in connection with the Company’s acquisition of the Project Panama Entities from iProperty (which translates to a weighted average purchase price of $6.34 per ordinary share), (iv) 7,475,000 ordinary shares to the Sponsor, its directors and certain other advisors and/or affiliates of the Sponsor to whom the Sponsor has transferred shares to, in exchange for the cancelation of an aggregate 7,475,000 Bridgetown 2 Class B Ordinary Shares originally issued at an aggregate purchase price of $25,000, (v) 3,650,000 ordinary shares issued by us to FWD Life Insurance Public Company Limited in exchange for the cancelation of an aggregate 3,650,000 Bridgetown 2 Class A Ordinary Shares originally issued at the purchase price of $10.00 per share, (vi) 3,250,000 ordinary shares originally issued by us to FWD Life Insurance Company Limited in exchange for the cancelation of an aggregate 3,250,000 Bridgetown 2 Class A Ordinary Shares originally issued at the purchase price of $10.00 per share and (vii) 3,827,309 ordinary shares issued by us to certain of our directors and executive officers in exchange for the cancelation of an aggregate 106,014 previously issued PropertyGuru Shares. The 12,960,000 warrants held by the Sponsor were issued in exchange for the cancelation of 12,960,000 private placement warrants that were originally issued at a price of $0.50 per warrant. For information about the price that the Selling Securityholders paid to acquire these ordinary shares and warrants, please see “Risk Factors—Risks Related to Ownership of Securities in the Company—Certain existing shareholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in our Company may not experience a similar rate of return.”

The ordinary shares being registered for resale by the Selling Securityholders in this prospectus (including ordinary shares underlying warrants, options and RSUs) constitute 91.1% of our ordinary shares issued and outstanding together with the ordinary shares underlying warrants, share options and restricted stock units held by the Selling Securityholders as of December 31, 2022. Although certain of our shareholders are subject to restrictions regarding the transfer of their securities, these shares may be sold after the expiration of the applicable lock up periods. The market price of our ordinary shares could decline if the Selling Securityholders sell a significant portion of our ordinary shares or are perceived by the market as intending to sell them. Despite such a decline in the public trading price of our ordinary shares, the Selling Securityholders may still experience a positive rate of return on the securities that they sell pursuant to this prospectus to the extent that such sales are made at prices that exceed the prices at which such securities were purchased. Certain of the securities being registered for sale pursuant to this prospectus were purchased by the corresponding Selling Securityholders at prices below the current market price of our ordinary shares, as described above. Accordingly, such Selling Securityholders may have an incentive to sell their securities. See “Risk Factors—Risks Related to Ownership of Securities in the Company—The securities being offered in this prospectus represent a substantial percentage of our outstanding ordinary shares, and the sales of such securities could cause the market price of our ordinary shares to decline significantly, even if our business is doing well.”

The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will not receive any proceeds from the sale of any securities by the Selling Securityholders, except with respect to amounts received by us upon exercise of warrants by holders thereof to the extent that such warrants are exercised for cash, which amount of aggregate proceeds, assuming the exercise of all warrants, could be up to $149,040,000.00. There is no assurance that our warrants will be in the money prior to their expiration or that the holders of the warrants will elect to exercise any or all of such warrants. We believe the likelihood that warrant holders will exercise their warrants, and therefore any cash proceeds that we may receive in relation to the exercise of the warrants overlying shares being offered for sale in this prospectus, will be dependent on the trading price of our ordinary shares. If the market price for our ordinary shares is less than the exercise price of $11.50 per ordinary share for our warrants, we believe warrant holders will be unlikely to exercise their warrants. See “Use of Proceeds.” We will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section entitled “Plan of Distribution.”

Our ordinary shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “PGRU.” On March 14, 2023, the last reported sale price of our ordinary shares as reported on NYSE was $4.49 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated March 21, 2023

Table of Contents

EXPLANATORY NOTES

This Post-Effective Amendment No. 2 to the Registration Statement on Form F-1 (File No. 333-264294) (as amended, the “Registration Statement”) is being filed:

The information included in this Post-Effective Amendment No. 2 updates the Registration Statement and the prospectus contained therein. No additional securities are being registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

Table of Contents

TABLE OF CONTENTS

| Page |

i | |

ii | |

vii | |

viii | |

x | |

xi | |

1 | |

5 | |

7 | |

39 | |

40 | |

41 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 42 |

57 | |

77 | |

93 | |

107 | |

111 | |

113 | |

117 | |

123 | |

125 | |

128 | |

Enforceability of Civil Liabilities Under U.S. Securities Laws | 129 |

130 | |

131 | |

132 | |

F-1 |

You should rely only on the information contained in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 filed with the Securities Exchange Commission, or the SEC. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the ordinary shares and warrants issued by us, the securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus supplement or post-effective amendment to the registration statement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement or

post-effective amendment to the registration statement, you should rely on the information contained in that particular prospectus supplement or post-effective amendment to the registration statement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find More Information.” You should rely only on information contained in this prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

We and the Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by us and/or the Selling Securityholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

Unless otherwise stated or the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to the business of PropertyGuru Group Limited and its subsidiaries, which prior to the Business Combination was the business of PropertyGuru Pte. Ltd. and its subsidiaries.

i

Table of Contents

FREQUENTLY USED TERMS

Key Business Terms

Unless otherwise stated or unless the context otherwise requires in this document:

“ACRA” means the Singapore Accounting and Corporate Regulatory Authority;

“agents” are real estate agents or individuals that sell, assist with the purchase of, and rent out properties for property seekers, consumers or clients (as applicable) in order to generate sales commissions from sales and property management fees from letting and management activities;

“AI” means artificial intelligence;

“AllProperty Media” means AllProperty Media Co., Ltd., a subsidiary of PropertyGuru;

“Amalgamation” means the amalgamation in accordance with Section 215A of the Companies Act (Chapter 50) of Singapore between Amalgamation Sub and PropertyGuru, with PropertyGuru being the surviving company and a wholly-owned subsidiary of the Company;

“Amalgamation Effective Time” means the effective date of the Amalgamation as may be agreed by Amalgamation Sub, the Company, Bridgetown 2 and PropertyGuru in writing and specified in writing in the Amalgamation Proposal (as defined in the Business Combination Agreement) and as set out in the notice of amalgamation issued by ACRA in respect of the Amalgamation;

“Amalgamation Sub” means B2 PubCo Amalgamation Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly-owned subsidiary of the Company;

“Amended and Restated Assignment, Assumption and Amendment Agreement” means the amendment and restatement, dated December 1, 2021, by and among Bridgetown 2, the Sponsor, the Company and Continental, to that Assignment, Assumption and Amendment Agreement, which removed Continental as a party to the Assignment, Assumption and Amendment Agreement;

“Amended Articles” means the amended and restated memorandum and articles of association of the Company adopted by special resolution dated July 23, 2021 and effective on March 16, 2022;

“API” means application programming interface;

“Assignment, Assumption and Amendment Agreement” means the amendment, dated July 23, 2021, to that certain warrant agreement, dated January 25, 2021, by and among Bridgetown 2, the Company, the Sponsor and Continental pursuant to which, among other things, Bridgetown 2 assigned all of its right, title and interest in the Existing Warrant Agreement to the Company effective upon the Merger Closing. The Assignment, Assumption and Amendment Agreement was amended and restated on December 1, 2021;

“Bridgetown 2” means Bridgetown 2 Holdings Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands;

“Bridgetown 2 Class A Ordinary Shares” means the Class A ordinary shares of Bridgetown 2, having a par value of $0.0001 each;

“Bridgetown 2 Class B Ordinary Shares” means the Class B ordinary shares of Bridgetown 2, having a par value of $0.0001 each;

“Bridgetown 2 Shares” means, collectively, the Bridgetown 2 Class A Ordinary Shares and Bridgetown 2 Class B Ordinary Shares;

“Business Combination” means the Merger, the Amalgamation and the other transactions contemplated by the Business Combination Agreement;

“Business Combination Agreement” means the business combination agreement, dated July 23, 2021 (as may be amended, supplemented, or otherwise modified from time to time), by and among the Company, Bridgetown 2, Amalgamation Sub and PropertyGuru;

ii

Table of Contents

“Business Combination Transactions” means, collectively, the Merger, the Amalgamation and each of the other transactions contemplated by the Business Combination Agreement, the Confidentiality Agreement, the PIPE Subscription Agreements, the Sponsor Support Agreement, the PropertyGuru Shareholder Support Agreement, the Registration Rights Agreement, the Amended and Restated Assignment, Assumption and Amendment Agreement, the Novation, Assumption and Amendment Agreement, the Plan of Merger, the Amalgamation Proposal, the Amended Articles and any other related agreements, documents or certificates entered into or delivered pursuant thereto;

“Cayman Companies Act” means the Companies Act (as amended) of the Cayman Islands;

“Closing” means the closing of the Amalgamation;

“Closing Date” means the date of the Closing;

“Company” means PropertyGuru Group Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands, or as the context requires, PropertyGuru Group Limited and its subsidiaries and consolidated affiliated entities;

“Continental” means Continental Stock Transfer & Trust Company;

“customers” means the agents, developers, valuers, banks and other enterprise clients from which PropertyGuru generates revenue through sales of digital classifieds, property development advertising products and services and data services, as well as homeowners and tenants who engage home services providers through our Sendhelper business, which we acquired in October 2022;

“DDProperty Media” means DDProperty Media Ltd., a subsidiary of PropertyGuru;

“depth products” means optional premium features and add-ons offered to agents and integrated into PropertyGuru’s platforms such as display rankings or enhanced listings;

“developers” are property developers or individuals that develop houses, buildings, and land with the intention of selling them for a profit;

“Do Thi” means Do Thi Media Service Company Limited, a subsidiary of PropertyGuru;

“Exchange Ratio” means the quotient obtained by dividing $361.01890 by $10.00;

“Existing Warrant Agreement” means the warrant agreement, dated January 25, 2021, by and between Bridgetown 2 and Continental;

“Fintech” means financial technology;

“IASB” means the International Accounting Standards Board;

“IFRS” means the International Financial Reporting Standards, as issued by the IASB;

“iProperty” means iProperty Group Asia Pte. Ltd.;

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012;

“KKR” means Kohlberg Kravis Roberts & Co. L.P. and its affiliates;

“KKR Investor” means Epsilon Asia Holdings II Pte. Ltd., an affiliate of KKR;

“Malaysian Ringgit” and “MYR” means Malaysian Ringgit, the legal currency of Malaysia;

“Merger” means the merger between Bridgetown 2 and the Company, with the Company being the surviving company;

“Merger Closing” means the closing of the Merger;

“MyProperty Data” means MyProperty Data Sdn Bhd., a subsidiary of PropertyGuru;

iii

Table of Contents

“Novation, Assumption and Amendment Agreement” means the novation, assumption and amendment agreement, dated July 23, 2021, to that certain instrument by way of deed poll executed by PropertyGuru on October 12, 2018 (the “PropertyGuru Warrant Instrument”), to be effective upon the closing of the Business Combination, pursuant to which, among other things, the Company assumed all of PropertyGuru’s obligations and responsibilities pursuant to or in connection with the PropertyGuru Warrant Instrument;

“NYSE” means the New York Stock Exchange;

“ordinary shares” means the ordinary shares of the Company, having a par value of $0.0001 each;

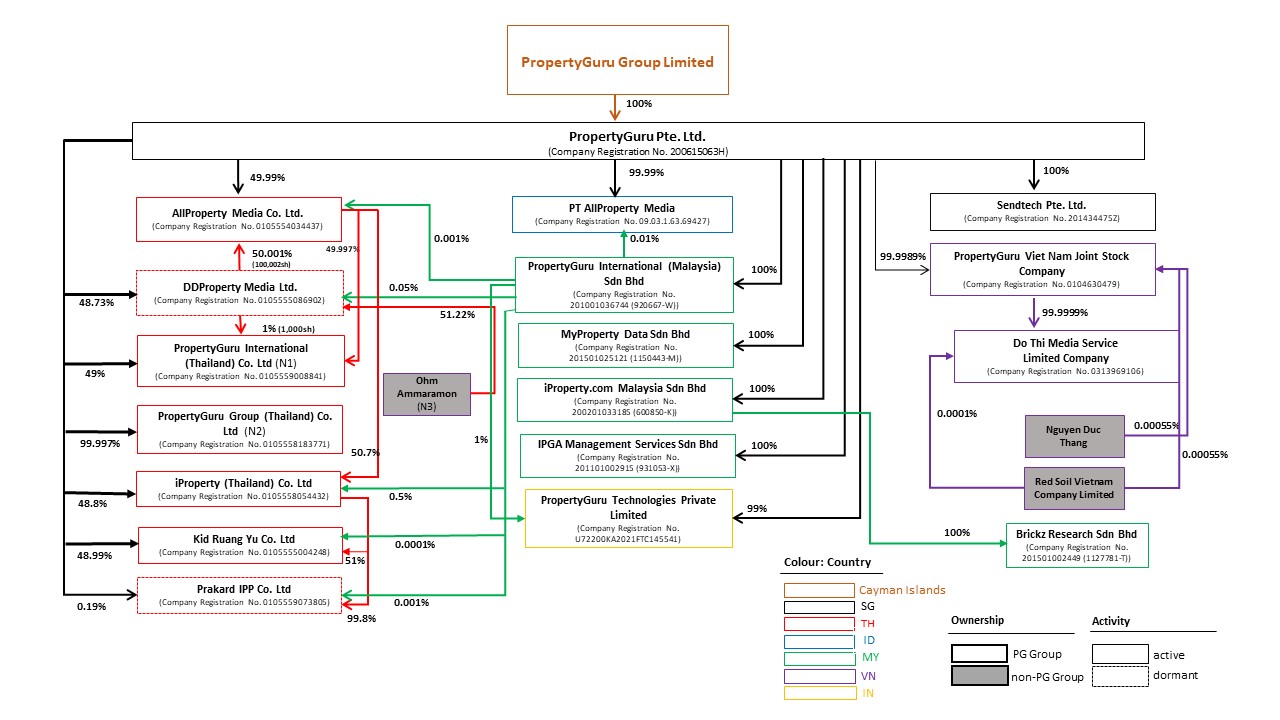

“Project Panama Entities” means iProperty’s (a subsidiary of REA Group) operating entities in Malaysia and Thailand, consisting of iProperty.com Malaysia Sdn. Bhd., Brickz Research Sdn. Bhd., IPGA Management Services Sdn. Bhd., iProperty (Thailand) Co., Ltd., Prakard IPP Co., Ltd. and Kid Ruang Yu Co., Ltd, whose shares were wholly acquired by PropertyGuru on August 3, 2021;

“PDPA” means the Personal Data Protection Act 2012 of Singapore;

“PG Vietnam” means PropertyGuru Viet Nam Joint Stock Company, a subsidiary of PropertyGuru;

“PGI Thailand” means PropertyGuru International (Thailand) Co., Ltd., a subsidiary of PropertyGuru;

“PIPE Investment” or “PIPE Financing” means the commitment by the PIPE Investors to subscribe for and purchase, in the aggregate, 13,193,068 ordinary shares for $10 per share, or an aggregate purchase price equal to $131,930,680, which includes REA’s $20.0 million subscription in the PIPE Investment and an additional $31.9 million equity investment in the Company by REA relating to REA’s existing call option to acquire additional shares in PropertyGuru, pursuant to the PIPE Subscription Agreements;

“PIPE Investors” means the third-party investors who entered into PIPE Subscription Agreements, and Red Square Singapore Limited, pursuant to the joinder agreement dated March 10, 2022, by and among the Company, Bridgetown 2, an individual and Red Square Singapore Limited;

“PIPE Subscription Agreements” means the share subscription agreements, dated July 23, 2021, by and among the Company, Bridgetown 2 and the PIPE Investors pursuant to which the PIPE Investors have committed to subscribe for and purchase, in the aggregate, 13,193,068 ordinary shares for $10 per share, or an aggregate purchase price equal to $131,930,680, which includes REA’s $20.0 million subscription in the PIPE Investment and an additional $31.9 million equity investment in the Company by REA relating to REA’s existing call option to acquire additional shares in PropertyGuru. For the avoidance of doubt, the PIPE Subscription Agreements include the REA Subscription Agreement;

“Priority Markets” means Singapore, Vietnam, Malaysia, Thailand and Indonesia;

“PropertyGuru” means PropertyGuru Pte. Ltd., a Singapore private company limited by shares, or as the context requires, PropertyGuru Pte. Ltd. and its subsidiaries and consolidated affiliated entities;

“PropertyGuru Shares” means the outstanding ordinary shares of PropertyGuru

“PropertyGuru Shareholder Support Agreement” means the voting support and lock-up agreement, dated July 23, 2021, by and among Bridgetown 2, the Company, PropertyGuru and certain of the shareholders of PropertyGuru, pursuant to which (i) certain PropertyGuru shareholders who hold an aggregate of at least 75% of the outstanding PropertyGuru voting shares have agreed, among other things: (a) to appear for purposes of constituting a quorum at any meeting of the shareholders of PropertyGuru called to seek approval of the transactions contemplated by the Business Combination Agreement and the other transaction proposals; (b) to vote in favor of the Business Combination Transactions; (c) to vote against any proposals that would materially impede the Business Combination Transactions; and (d) not to sell or transfer any of their shares prior to the closing of the Business Combination; (ii) certain shareholders of PropertyGuru have agreed to a lock-up of the ordinary shares in the Company they have received pursuant to the Amalgamation (subject to certain exceptions) for a period of 180 days following the closing of the Business Combination; and (iii) certain shareholders of PropertyGuru and the Company have agreed to enter into a shareholders agreement governing the rights and obligations of such shareholders with respect to the Company and ordinary shares in the Company which, among other things, include certain non-compete obligations, “drag-along” rights applicable to and as among such shareholders, “rights of first offer” rights and board appointment rights (the “Shareholders’ Agreement”);

“PropertyGuru Warrant Instrument” has the meaning assigned to such term in the definition of “Novation, Assumption and Amendment Agreement”;

iv

Table of Contents

“PropertyGuru Warrants” means the 112,000 warrants to purchase PropertyGuru Shares issued to KKR Investor in accordance with the PropertyGuru Warrant Instrument;

“PropTech” means property technology;

“REA” means REA Asia Holding Co. Pty Ltd;

“REA Group” means REA Group Ltd;

“REA Subscription Agreement” means the subscription agreement, dated July 23, 2021, by and among the Company, Bridgetown 2 and REA Asia Holding Co. Pty Ltd;

“REA Transitional Services Agreement” means the transitional services agreement, dated August 3, 2021, by and among realestate.com.au Pty Ltd and PropertyGuru.

“Registration Rights Agreement” means the registration rights agreement, dated July 23, 2021, by and among Bridgetown 2, the Company, the Sponsor, the directors of Bridgetown 2 who hold Bridgetown 2 Shares, certain advisors of Bridgetown 2 to whom the Sponsor has transferred Bridgetown 2 Shares, certain shareholders of Bridgetown 2 affiliated with the Sponsor, and certain of the shareholders of PropertyGuru to be effective upon Closing pursuant to which, among other things, the Company agreed to undertake certain resale shelf registration obligations in accordance with the Securities Act and the Sponsor, certain Sponsor affiliated parties and certain shareholders of PropertyGuru party thereto have been granted certain demand and piggyback registration rights;

“RSU” means restricted stock units;

“SEC” means the U.S. Securities and Exchange Commission;

“Selling Securityholders” means the selling shareholders named in this prospectus who may, from time to time, offer to sell their ordinary shares and/or warrants;

“Shareholders’ Agreement” means the shareholders agreement, dated March 17, 2022, by and among the Company, each of the TPG Investor Entities, the KKR Investor, REA and REA Group Limited;

“Singapore Dollars” and “S$” means Singapore dollars, the legal currency of Singapore;

“Sponsor” means Bridgetown 2 LLC, a limited liability company incorporated under the laws of the Cayman Islands;

“Sponsor Support Agreement” means the voting support agreement, dated July 23, 2021, by and among Bridgetown 2, the Sponsor, the Company and PropertyGuru pursuant to which the Sponsor has agreed, among other things and subject to the terms and conditions set forth therein: (i) to vote in favor of the transactions contemplated in the Business Combination Agreement and the other transaction proposals, (ii) to appear at the Extraordinary General Meeting for purposes of constituting a quorum, (iii) to vote against any proposals that would materially impede the transactions contemplated in the Business Combination Agreement and the other transaction proposals, (iv) not to redeem any Bridgetown 2 Shares held by the Sponsor, (v) not to amend that certain letter agreement between Bridgetown 2, the Sponsor and certain other parties thereto, dated as of January 25, 2021, (vi) not to transfer any Bridgetown 2 Shares held by the Sponsor, subject to certain exceptions, (vii) to release Bridgetown 2, the Company, PropertyGuru and its subsidiaries from all claims in respect of or relating to the period prior to the Closing, subject to the exceptions set forth therein (with PropertyGuru agreeing to release the Sponsor and Bridgetown 2 on a reciprocal basis) and (viii) to a lock-up of its ordinary shares in the Company during the period of one year from the Closing, subject to certain exceptions;

“Thai PDPA” means Personal Data Protection Act 2022 of Thailand;

“TPG” means TPG Inc. and its affiliates;

“TPG Investor Entities” means TPG Asia VI SF Pte. Ltd. and TPG Asia VI Digs 1 L.P., each an affiliate of TPG; and

“U.S. Dollars” and “$” means United States dollars, the legal currency of the United States; and “U.S. GAAP” means United States generally accepted accounting principles.

v

Table of Contents

Key Performance Metrics and Non-IFRS Financial Measures

Unless otherwise stated or unless the context otherwise requires in this document:

“Adjusted EBITDA” is a non-IFRS financial measure defined as net loss for year/period adjusted for changes in fair value of preferred shares, warrant liability and embedded derivatives, finance costs, depreciation and amortization expense, tax expenses or credits, impairments when the impairment is the result of an isolated, non-recurring events, share grant and option expenses, loss on disposal of plant and equipment and intangible assets, currency translation loss, business acquisition transaction and integration costs, legal and professional expenses incurred for our initial public offering (“IPO”) through the Business Combination, share listing expenses and on-going costs of a listed entity;

“Adjusted EBITDA Margin” is a non-IFRS financial measure defined as Adjusted EBITDA as a percentage of revenue;

“ARPA” is defined as agent revenue for a period divided by the average number of agents in that period, which is calculated as the sum of the number of total agents at the end of each month in a period divided by the number of months in such period;

“Average revenue per listing” is defined as revenue for a period divided by the number of listings in such period;

“Engagement Market Share” is the average monthly engagement for websites owned by PropertyGuru as compared to average monthly engagement for a basket of peers calculated over the relevant period. Engagement is calculated as the number of visits to a website during a period multiplied by the amount of time spent per visit on that website for the same period, in each case based on data from SimilarWeb. Engagement Market Share is based on the prevailing SimilarWeb algorithm on the date the Company first filed or furnished such information to the SEC;

“Number of agents” in all Priority Markets except Vietnam is calculated for a period as the sum of the number of agents with a valid 12-month subscription package at the end of each month in a period divided by the number of months in such period. In Vietnam, number of agents is calculated as the number of agents who credit money into their account within the relevant period. When counting in aggregate across the PropertyGuru group, in markets where PropertyGuru operates more than one digital property marketplace, an agent with subscriptions to more than one portal is only counted once;

"Number of listings” in Vietnam is calculated as the sum of all listings created in each month over the relevant period (other than listings from promotional accounts). Number of listings is used to calculate average revenue per listing;

“Number of real estate listings” is calculated as the average number of listings created monthly during the period for Vietnam and the average number of monthly listings available in the period for other Priority Markets;

“property seekers” is the number of total visits to PropertyGuru’s websites over a period, based on Google Analytics data; and

“Renewal rate” is defined as the number of agents that successfully renew their annual package during a year/ period divided by the number of agents whose packages are up for renewal (at the end of their 12 month subscription) during that year/period.

vi

Table of Contents

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS MEASURES

PropertyGuru’s audited consolidated financial statements included in this prospectus have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and referred to in this prospectus as “IFRS.” We refer in various places within this prospectus to non-IFRS financial measures. The presentation of this non-IFRS information is not meant to be considered in isolation or as a substitute for PropertyGuru’s audited consolidated financial results prepared in accordance with IFRS.

vii

Table of Contents

FINANCIAL STATEMENT PRESENTATION

The Company

The Company was incorporated on July 14, 2021 for the purpose of effectuating the Business Combination. In connection with the Business Combination, upon Closing, (i) Bridgetown 2 merged with and into the Company (the “Merger”), with the Company being the surviving entity; and (ii) following the Merger, Amalgamation Sub and PropertyGuru amalgamated and continued as one company, with PropertyGuru being the surviving entity and becoming a wholly-owned subsidiary of the Company (the “Amalgamation”, and together with the Merger and the other transactions contemplated by the Business Combination Agreement, collectively the “Business Combination”).

In accordance with the terms and subject to the conditions of the Business Combination Agreement, (i) each issued and outstanding PropertyGuru ordinary share was automatically cancelled and converted into such number of newly issued ordinary shares in the Company as determined in accordance with the Business Combination Agreement; (ii) each outstanding PropertyGuru restricted stock unit award was assumed by the Company and converted into the right to receive restricted stock units based on such number of newly issued ordinary shares in the Company as determined in accordance with the Business Combination Agreement; (iii) each outstanding PropertyGuru option was assumed by the Company and converted into an option in respect of such number of newly issued ordinary shares in the Company as determined in accordance with the Business Combination Agreement; (iv) each Company Warrant (as defined in the Business Combination Agreement) was assumed by

the Company and converted into a warrant to purchase such number of newly issued ordinary shares in the Company as determined in accordance with the Business Combination Agreement and pursuant to the Company Warrant Assumption Agreement (as defined in the Business Combination Agreement); (v) each issued and outstanding share of Amalgamation Sub was automatically converted into one Surviving Company Ordinary Share (as defined in the Business Combination Agreement) and accordingly, the Company shall be the holder of all Surviving Company Ordinary Shares; (vi) each issued and outstanding Bridgetown 2 Class A ordinary share and Class B ordinary share was cancelled and ceased to exist in exchange for one ordinary share in the Company; and (vii) each issued and outstanding Bridgetown 2 private placement warrant was assumed by the Company and converted into a warrant to purchase one ordinary share in the Company.

Prior to the Business Combination, the Company had no material assets and did not conduct any material activities other than those incidental to its formation and the matters contemplated by the Business Combination Agreement, such as the making of certain required securities law filings. Accordingly, the financial statements included in this prospectus for historical periods prior to consummation of the Business Combination reflect the assets, liabilities and operations of the Company’s predecessor, PropertyGuru. As it relates to the audited consolidated financial statements of the Company as of December 31, 2022 and for the year ended December 31, 2022 included elsewhere in this prospectus, the impact of the capital reorganization between the Company and PropertyGuru on historical earnings per share calculations has been retrospectively adjusted. As it relates to the consolidated financial statements of PropertyGuru as of December 31, 2021 and 2020 and for each of the three years in the period ended December 31, 2021 included elsewhere in this prospectus, the historical earnings per share calculations of PropertyGuru do not reflect any impact of the capital reorganization between the Company and PropertyGuru. Pro forma earnings-per-share for the Company for each of the years ended December 31, 2022, 2021 and 2020, after giving effect to the exchange ratio embedded in the Business Combination agreement (as it relates to the capital reorganization between the Company and PropertyGuru), is presented below:

| For the Year Ended December 31, | ||

| 2022 | 2021 | 2020 |

|

|

|

|

(Loss) per share for loss attributable to equity holders of the Company |

|

|

|

Basic loss per share (S$ per share) | (0.84) | (2.03) | (0.26) |

Diluted loss per share (S$ per share) | (0.84) | (2.03) | (0.37) |

The Business Combination is made up of the series of transactions provided for in the Business Combination Agreement as described elsewhere within this prospectus. The Business Combination will be accounted for as a capital reorganization. Under this method of accounting, Bridgetown 2 will be treated as the acquired company for financial reporting purposes. Accordingly, the Business Combination will be treated as the equivalent of PropertyGuru issuing shares at the Closing for the net assets of Bridgetown 2 as of the Closing Date, accompanied by a recapitalization. The net assets of Bridgetown 2 will be stated at historical cost, with no goodwill or other intangible assets recorded. The Business Combination, which is not within the scope of

IFRS 3—Business Combinations (“IFRS 3”) since Bridgetown 2 does not meet the definition of a business in accordance with IFRS 3, is accounted for within the scope of IFRS 2—Share-based payment (“IFRS 2”). Any excess of fair value of shares in the Company issued over the fair value of Bridgetown 2’s identifiable net assets acquired represents compensation for the service of a stock exchange listing for its shares and is expensed as incurred.

viii

Table of Contents

PropertyGuru

PropertyGuru’s audited consolidated financial statements as of December 31, 2022 and 2021 and for each of the years ended December 31, 2022, 2021 and 2020 and included in this prospectus have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and are reported in Singapore Dollars. IFRS differs from the generally accepted accounting principles in the United States (“U.S. GAAP”) in certain material respects and thus may not be comparable to financial information presented by U.S. companies.

PropertyGuru refers in various places in this prospectus to non-IFRS financial measures, Adjusted EBITDA and Adjusted EBITDA Margin which are more fully explained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Financial Measures and Key Performance Metrics.” The presentation of non-IFRS information is not meant to be considered in isolation or as a substitute for PropertyGuru’s audited consolidated financial results prepared in accordance with IFRS.

ix

Table of Contents

INDUSTRY AND MARKET DATA

This prospectus includes industry, market and competitive position data that have been derived from publicly available information, industry publications and other third-party sources, including estimated insights from SimilarWeb and Google Analytics, as well as from PropertyGuru’s own internal data and estimates.

Independent consultant reports, industry publications and other published sources generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

x

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, the markets in which we operate as well as any information concerning possible or assumed future results of our operations. Such forward-looking statements are based on available current market material and our management’s expectations, beliefs and forecasts concerning future events impacting us. Factors that may impact such forward-looking statements include:

xi

Table of Contents

The foregoing list of factors is not exhaustive. The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties may in the future be amplified by the COVID-19 pandemic and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We will not and do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

xii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before making an investment decision, you should read this entire prospectus carefully, especially “Risk Factors” and the financial statements and related notes thereto, and the other documents to which this prospectus refers. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

Unless otherwise stated or the context otherwise requires, all references in this subsection to the “Company”, “we,” “us” or “our” refer to the business of PropertyGuru Group Limited and its subsidiaries, which prior to the Business Combination was the business of PropertyGuru Pte. Ltd. and its subsidiaries.

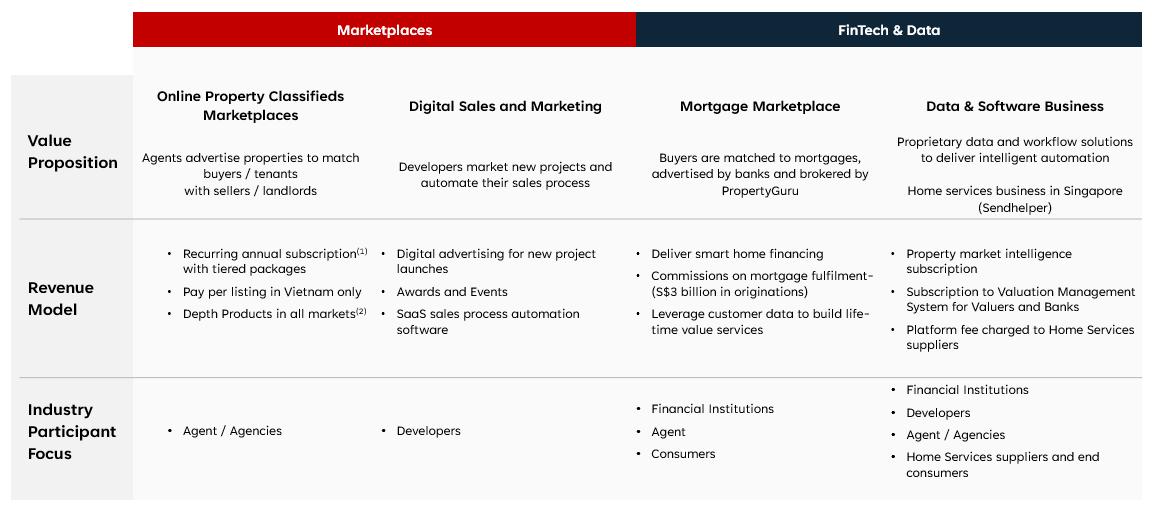

The Company

We are the leading PropTech company in Southeast Asia, with leading Engagement Market Shares in Singapore, Vietnam, Malaysia and Thailand, based on SimilarWeb data between July 2022 and December 2022. Our mission is to help people make confident property decisions through relevant content, actionable insights and world-class service. Our platforms provide: (1) online property listings to match buyers, sellers, tenants and landlords; (2) digital and marketing services for developers; (3) a digital mortgage marketplace and brokerage; (4) a data services business for enterprise clients including property agencies, developers, valuers and banks; (5) sales process and workflow automation software for developers; and (6) an online marketplace that connects homeowners and tenants with verified home service providers.

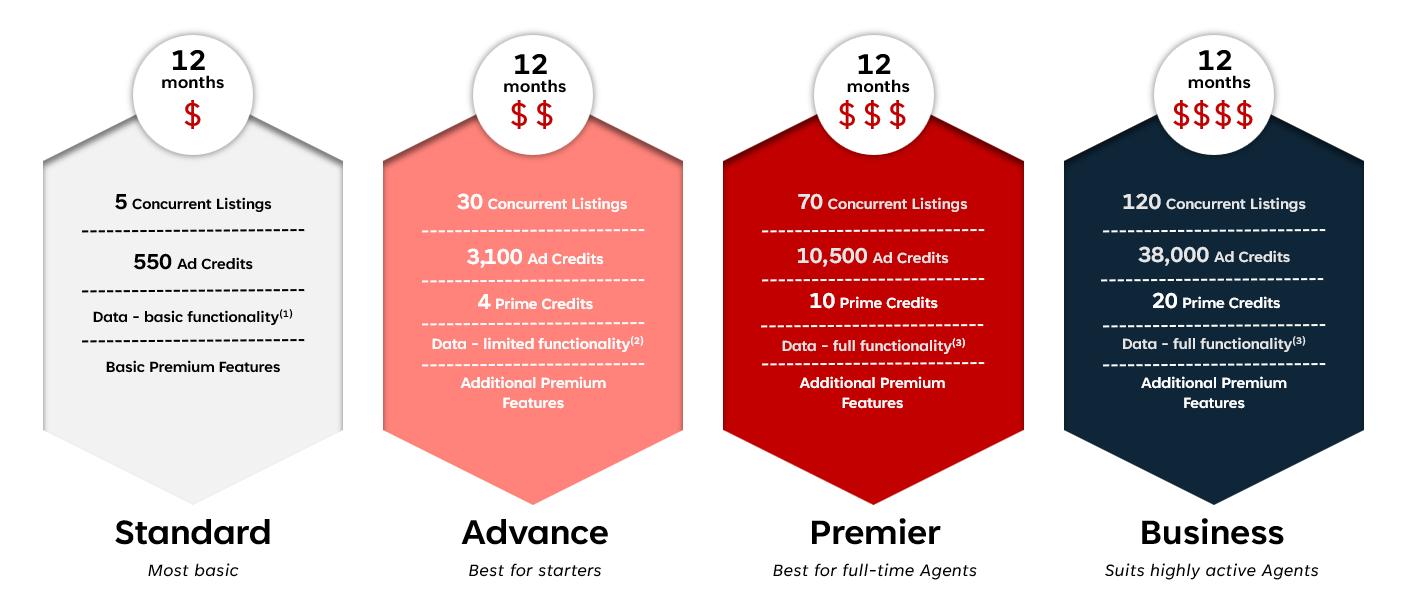

We built our presence in Southeast Asia through organic growth and strategic acquisitions to enhance our revenue growth and diversify our offerings. Our organic growth has been driven by our focus on expanding our marketplace through innovation, and developing new products and solutions that help us stay ahead of the evolving needs of our markets. These innovations include PropertyGuru Lens, an app that allows users to search for property in the real world through their smart phone camera, and PropertyGuru StoryTeller, an immersive content experience to help Singapore real estate developers market and sell their offerings virtually. We also integrate various premium products into our platforms to allow agents to further differentiate and enhance their listings, such as Turbo, which provides increased listing exposure through listing placement at the top of the search, larger photos and additional content. In 2022,we launched a premium form of credit, “Prime Credits”, that allows agents in Singapore and Malaysia to book, reserve and extend “Featured Agent” slots, which provide agents with exposure in a particular development or area, and agents in Singapore to use the “Promoted Listings” tool, which enhances visibility of property listings to property seekers searching for properties with similar criteria. As a step toward driving greater trust and transparency in our marketplace business, we launched “Agent Ratings and Reviews” in 2022, which allows property seekers to provide star-ratings and written reviews of agents’ service quality, knowledge and expertise, marketing skills, and negotiation..

Our strategic acquisitions have sought to extend the depth and reach of our products and services. In 2015, we acquired our SaaS-based sales automation solution, PropertyGuru FastKey, which is used by developers to enable end-to-end project management from launch to sales conversion. Since the end of 2019, we have made transformative investments in technology, products and markets that we believe will further strengthen our market leadership and accelerate our growth through the recovery from the COVID-19 pandemic. In December 2020, we acquired MyProperty Data Sdn Bhd (“MyProperty Data”), a Malaysia-focused data analytics platform. In August 2021, through our acquisition of the Project Panama Entities, we acquired iProperty’s (a subsidiary of REA Group) Malaysia and Thailand digital property marketplace businesses, iProperty.com.my and thinkofliving.com, to solidify our leadership in those markets, as well as Brickz.my, an online data platform that adds data analytics capabilities in Malaysia. In October 2022, we acquired Sendhelper, a Singapore home services technology company. The acquisition represents our entry into the home services industry and is in line with our growth strategy of expanding into adjacencies while investing in our core marketplaces business towards creation of a digital property ecosystem for all our stakeholders in Southeast Asia. With the addition of Sendhelper, we aim to become a one-stop destination for property seekers to not only find, finance and own their dream home but also manage and maintain it.

In December 2022, we launched our enterprise solutions brand, PropertyGuru For Business, which includes a unified service and proprietary data solutions, event solutions and marketing services to guide enterprise clients such as property developers, agencies, banks, valuers, city planners and policy makers. PropertyGuru For Business works with property stakeholders to improve systems in markets where it operates by championing and enabling digitalization so that all property stakeholders can leverage deeper insights to make more confident decisions in a more transparent property ecosystem.

Our headquarters are in Singapore. As of December 31, 2022, our platform connects more than 41 million property seekers monthly, based on Google Analytics data between July 2022 and December 2022, to more than 63,000 agents in our digital property marketplace of more than 3.2 million real estate listings.

Corporate Information

1

Table of Contents

PropertyGuru Group Limited, or the “Company”, is an exempted company with limited liability incorporated under the laws of Cayman Islands on July 14, 2021. The Company was formed for the sole purpose of effectuating the Business Combination contemplated by the Business Combination Agreement, which was consummated on March 17, 2022.

Prior to the Business Combination, the Company had no material assets and did not conduct any material activities other than those incidental to its formation and the matters contemplated by the Business Combination Agreement, such as the making of certain required securities law filings.

The mailing address of the Company’s principal executive office is Paya Lebar Quarter, 1 Paya Lebar Link,

#12-01/04, Singapore 408533, and our telephone number is +65 6238 5971. Our principal website address is www.propertygurugroup.com. We do not incorporate the information contained on, or accessible through, our websites into this prospectus, and you should not consider it a part of this prospectus.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging growth company may take advantage of specified exemptions from various requirements that are otherwise applicable generally to U.S. public companies. These provisions include:

We currently prepare our financial statements in accordance with IFRS as issued by the IASB, which do not have separate provisions for publicly traded and private companies. However, in the event we convert to U.S. GAAP in the future while we are still an emerging growth company, we may be able to take advantage of the benefits of Section 107 of the JOBS Act, which provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. We may choose to take advantage of some but not all of these reduced reporting burdens.

We will remain an emerging growth company until the earliest of:

In addition, we report under the Exchange Act as a “foreign private issuer.” As a foreign private issuer, we may take advantage of certain provisions under the rules that allow us to follow Cayman Islands law for certain corporate governance matters. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

2

Table of Contents

Foreign private issuers, like emerging growth companies, also are exempt from certain more stringent executive compensation disclosure rules. Thus, if we remain a foreign private issuer, even if we no longer qualify as an emerging growth company, we will continue to be exempt from the more stringent compensation disclosures required of public companies that are neither an emerging growth company nor a foreign private issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

Summary of Risk Factors

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, but are not limited to, the following:

3

Table of Contents

4

Table of Contents

SUMMARY TERMS OF THE OFFERING

The summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains a more detailed description of the ordinary shares and warrants of the Company.

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” of this prospectus.

Ordinary shares offered by us |

|

| 15,795,035 ordinary shares |

Ordinary shares offered by the Selling Securityholders |

|

| up to 162,153,490 ordinary shares of the Company, par value $0.0001 per share, comprising: |

|

|

| • up to 13,193,068 ordinary shares issued to the PIPE Investors; |

|

|

| • up to 133,165,387 ordinary shares issued to certain shareholders in connection with the Business Combination; |

|

|

| • up to 2,835,035 ordinary shares issuable by us upon the exercise of share options and vesting of restricted stock units held by certain of our directors and executive officers; and |

|

|

| • up to 12,960,000 ordinary shares issuable upon the exercise of up to 12,960,000 warrants offered hereby. |

Warrants offered by the Selling Securityholders |

|

| up to 12,960,000 warrants of the Company, the exercise of which will result in the issuance of 12,960,000 ordinary shares at a price of $11.50 per ordinary share. |

|

|

| There is no assurance that our warrants will be in the money prior to their expiration or that the holders of the warrants will elect to exercise any or all of such warrants. We believe the likelihood that warrant holders will exercise their warrants, and therefore any cash proceeds that we may receive in relation to the exercise of the warrants overlying shares being offered for sale in this prospectus, will be dependent on the trading price of our ordinary shares. If the market price for our ordinary shares is less than the exercise price of $11.50 per ordinary share for our warrants, we believe warrant holders will be unlikely to exercise their warrants. |

Ordinary shares issued and outstanding prior to the exercise of the warrants |

|

| 162,129,826 ordinary shares based on ordinary shares issued and outstanding as of December 31, 2022. |

Warrants issued and outstanding |

|

| 12,960,000 warrants, the exercise of which will result in the issuance of 12,960,000 ordinary shares. |

Use of proceeds |

|

| All of the ordinary shares and warrants of the Company offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective amounts. We will not receive any of the proceeds from these sales. |

|

|

| However, we will receive up to an aggregate of $149,040,000.00 from the exercise of warrants being offered for sale in this prospectus, assuming the exercise of 12,960,000 warrants for cash at an exercise price of $11.50 per ordinary share. |

Lock-up restrictions |

|

| Certain of our shareholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Securities Eligible for Future Sales—Lock-Up Agreements.” |

Dividend policy |

|

| The Company has never declared or paid any cash dividends. The Company’s board of directors will consider whether or not to institute a dividend policy. It is presently intended that the Company will retain its earnings for use in business operations and, accordingly, it is not anticipated that the Company’s board of directors will declare dividends in the foreseeable future. The Company has not identified a paying agent. See “Dividend Policy.” |

Risk factors |

|

| Investing in the ordinary shares and warrants of the Company involves a high degree or risk. See “Risk Factors” and other information |

5

Table of Contents

|

|

| included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the ordinary shares and warrants of the Company. |

Market for our ordinary shares |

|

| Our ordinary shares are listed on the NYSE under the symbol “PGRU”. |

Except where otherwise stated, the number of ordinary shares that will be outstanding immediately after this offering is based on 162,129,826 ordinary shares issued and outstanding prior to the exercise of the warrants as of December 31, 2022 and excludes:

6

Table of Contents

RISK FACTORS

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our ordinary shares could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Global economic conditions have been and continue to be challenging and have had, and may continue to have, an adverse effect on financial markets, the health of the real estate industry in our Priority Markets and the economy in general.

The current global economic slowdown, the possibility of continued turbulence or uncertainty in global financial markets and economies, and fiscal policy in our Priority Markets has had, and continues to have, and may increasingly have a negative impact on property seekers, our customers, demand for our existing and new products and services, profitability, access to credit and our ability to operate our business.

Our financial performance is influenced by the overall condition of the real estate markets in the Priority Markets in which we operate. Each of these real estate markets are affected by various macroeconomic factors outside our control (which by their nature are cyclical and subject to change). These factors include inflation, interest rates, the general market outlook for economic growth, unemployment and consumer confidence. These factors are also affected by government policy and regulations that may change.

In many countries globally, including our Priority Markets, there are concerns over rising inflation and potential economic recessions, including due to the impacts of the COVID-19, such as the global supply chain disruptions, government stimulus packages and rising costs of commodities, and geopolitical conflicts. Inflation has risen significantly in recent years, which in turn led to an increase in interest rates in 2022, which has impacted mortgage affordability. To the extent inflation and interest rates remain elevated, these pressures may negatively impact property demand and demand for our products and services. In addition, global and industry-wide supply chain disruptions caused by the COVID-19 pandemic have resulted in shortages in labor, materials and services. Such shortages have resulted in inflationary cost increases for labor, materials and services and could continue to cause costs to increase, as well as a scarcity of certain products and raw materials, all of which could significantly impact our customers and weaken global economies. Inflationary pressures have increased our operating costs in 2022 and the effects of inflation may have an adverse impact on our costs, margins and profitability in the future. We cannot predict any future trends in the rate of inflation, and to the extent we are unable to recover higher costs through higher prices for our products and offerings, a significant increase in inflation, could negatively impact our business, financial condition and results of operation.

Our marketplaces business generates revenue from property developers from advertising activities to promote sales of residences in new property developments (which we refer to as “primary listings” to distinguish them from “secondary” sales of already existing residential properties). Given the longer lead times required to develop and market new property developments, these primary listings may prove more volatile than secondary listings, as economic uncertainty (over a longer period) may have a greater adverse impact on the rate and extent of new property development activity and could result in fewer primary listings. In addition, most agents in our Priority Markets are effectively self-employed individuals who are largely commission remunerated and may leave the industry when market conditions deteriorate sufficiently. Accordingly, a property downturn could cause a decline in the number of agents and developers, reduce demand for our products and services or reduce our ability to increase prices in light of subdued market conditions. For example, in Singapore, our agent customers reduced their discretionary spending in 2020 due to the COVID-19 pandemic. In Vietnam, our agent customers reduced their discretionary spending in the fourth quarter of 2022 following actions by the State Bank of Vietnam to control credit growth, including controlling loans for real estate, which suppressed the real estate market in Vietnam. This negatively impacted the number of real estate listings on our platform and in turn impacted our revenue in Vietnam, where we operate a pay-as-you-go model and effective monetization depends on our ability to sustain the number of listings that agents post to our platform. The cyclical nature of the real estate market also has an effect, where the real estate market in each country or major city tends to rise and fall in line with economic prosperity and sentiment in that country or major city tends to rise and fall in line with economic prosperity and sentiment in that country or city (noting Priority Markets generally operate independently of one another). These macroeconomic factors, along with regulatory and political changes, also contribute to the availability of credit to purchasers, which is a main driver of housing price accretion and capability to transact.

Government and regulatory policies could also have a significant impact on real estate or credit markets and, in turn, our revenues. For example, governmental actions in Vietnam in 2022 significantly limited both consumers’ and developers’ access to credit, which has suppressed the real estate market in Vietnam and reduced demand for our platform, products and services in Vietnam in the fourth quarter of 2022. For further information, see “— Our business is subject to legal and regulatory risks and changes in regulatory requirements and governmental policy that could have an adverse impact on our business and prospects.”

7

Table of Contents

In addition, our ability to fund our liquidity requirements and operate our business depends on our cash flows from operations and, in future, potentially our ability to access capital markets and borrow on credit facilities. Our access to and the availability of financing on acceptable terms may be adversely impacted by global economic conditions. For more information, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Changing economic conditions may also have an effect on foreign exchange rates, which in turn may affect our business. For further information, see “— Fluctuations in foreign currency exchange rates will affect our financial results, which we report in Singapore Dollars.”

We cannot predict the timing or duration of an economic slowdown or the timing or strength of a subsequent economic recovery generally or in the real estate industry. If macroeconomic conditions worsen or the current global economic conditions continue for a prolonged period of time, we are not able to predict the impact that such conditions will have on credit markets, the real estate industries in our Priority Markets and our results of operations.

Changes in the structure of the real estate markets in which we operate could also adversely impact our business. For example, a reduction in the customary rate of commissions earned by real estate agents from property sales could reduce agents’ capacity to pay for our products and services and could prevent us from increasing prices or even require us to reduce our subscription fees or the prices of our discretionary credits, which could have an adverse effect on our business and financial performance. This risk would be more pronounced in Vietnam where our business derives most of its revenue from agent discretionary revenue given our pay-as-you-go model in the country. Similarly, if larger agencies, rather than individual agents, become comparatively more important as a source of revenue, this could increase customer pricing power, could prevent us from increasing prices or put pressure on our existing pricing and could develop into us competing with such agencies’ own websites or platforms. The occurrence of any of these factors could adversely affect our business, financial condition and results of operations.

We have a history of losses, and we may not achieve or maintain profitability in the future.

We have a history of losses, including net losses of S$129.2 million, S$187.4 million and S$14.4 million for the years ended December 31, 2022, 2021 and 2020, respectively. We expect to continue to make investments in developing and expanding our business, including but not limited to in technology, recruitment and training, marketing, and for the purpose of pursuing strategic opportunities. We may incur substantial costs and expenses from our growth efforts before we receive any incremental revenues in respect of any acquisitions or investments in growth. We may find that these efforts are more expensive than we originally anticipate, or that these investments do not result in an increase in revenue to offset these expenses, which would further increase our losses. Additionally, we may continue to incur significant losses in the future for a number of reasons, including but not limited to:

8

Table of Contents

Inflationary pressures increased our operating costs in 2022 and the effects of inflation may have an adverse impact on our costs, margins and profitability in the future. Our initiatives to alleviate inflationary pressures, such as alternative supply arrangements and changes to our hiring policies, including hiring employees in locations with lower ongoing wage costs, may not be successful or sufficient. In addition, in light of rising operating costs, we also implemented cost control actions in 2022 by managing discretionary costs, delaying hiring and reducing our sales and marketing expenses. Furthermore, there can be no assurance that we will be willing or able to recover any increased costs by increasing the prices of our products and services.

If we fail to manage our losses or to grow our revenue sufficiently to keep pace with our investments and other expenses, our business will be harmed. If our existing businesses or any future acquisitions underperform, this may result in impairments to the carrying values of assets on the balance sheet including but not limited to goodwill and intangible assets. These impairments may adversely impact our financial condition and results of operations and the confidence of shareholders, lenders, customers and our employees. Impairments may also be generated due to changes in the assessment methodology of the carrying value of assets or changes to the inputs that form part of these assessments. These changes are not predictable and many of them may be outside of our control. In addition, as a public company, we will also incur significant legal, accounting, insurance, compliance and other expenses that we did not incur as a private company.

Our business is dependent on our ability to attract new, and retain existing, customers and consumers to our platform in a cost-effective manner.

Currently, we generate revenue primarily through sales of digital classifieds and property development advertising products and services (including software-as-a-service) to real estate agents and developers, which we refer to as customers. Our ability to attract and retain customers, and ultimately to generate advertising revenue, depends on a number of factors, including but not limited to:

Online real estate advertising in our Priority Markets other than Singapore is still in the early stages of offline-to-online migration compared to developed markets, with print and other offline channels currently the dominant media for property advertising in our Priority Markets. Growth in advertising expenditure may be slower or less than anticipated, which could have a negative impact on our prospects.

We may not succeed in capturing a greater share of our customers’ advertising expenditure if we are unable to convince them of the effectiveness or superiority of our products compared to alternatives, including but not limited to traditional offline advertising media. Property developers, in particular, continue to allocate significant advertising expenditure for the sales of residences in their new property developments to print media, including but not limited to large display advertisements in newspapers, and other media such as billboards. This is significant because property advertising in our Priority Markets predominantly involves these primary transactions (i.e., new developments advertised by property developers or their marketing agents). We also compete for a share of advertisers’ overall marketing budgets with other PropTech companies in our Priority Markets.

If we are unable to attract new customers in a cost-effective manner or if existing customers reduce or end their subscription or advertising spending with us, our business, financial condition and results of operations could be adversely affected.

We do not have long-term contracts with most of our customers, and most of our customers may terminate their contracts on short notice.

Our agent subscription agreements generally have a duration of 12 months and we do not have long-term contracts with most of our other customers. Our customers could choose to modify or discontinue their relationships with us with little or no advance notice. In addition, as existing subscription agreements or other contracts expire, we may not be successful in renewing these subscription agreements or other contracts, securing new customers or increasing or maintaining the amount of revenue we derive from a given subscription agreement or other contract over time for a number of reasons, including, among others, the following:

9

Table of Contents

Our decision to launch new product or service offerings and increase the prices of our products and services may not achieve the desired results.

The industry for residential real estate transaction services, technology, information marketplaces and advertising is dynamic, and the expectations and behaviors of customers and consumers shift constantly and rapidly. As part of our operating strategy, we have increased, and plan in the future to continue to change, the nature and number of products, including depth products, that we offer to our customers and, with that, the prices we charge our customers for the services and products we offer. Changes or additions to our products and services may not attract or engage our customers, and may reduce confidence in our products and services, negatively impact the quality of our brands, negatively impact our relationships with partners or other industry participants, expose us to increased market or legal risks, subject us to new laws and regulations or otherwise harm our business. Our customers may not accept new products and services (which would adversely affect our average revenue per agent (“ARPA”)), or such price increases may not be absorbed by the market, or our price increases may result in the loss of customers or the loss of some of our customers’ business. We may not successfully anticipate or keep pace with industry changes, and we may invest considerable financial, personnel and other resources to pursue strategies that do not ultimately prove effective such that our results of operations and financial condition may be harmed. If we are not able to raise our prices or encourage our customers to upgrade their subscription packages or invest in depth products to further differentiate their listings, or if we lose some of our customers or some of our customers’ business as a result of price increases, or if the bargaining power of our customer base increases and the subscription prices and other fees we are able to charge real estate developer or agent customers decline, our business, financial condition and results of operations could be adversely affected.

If our customers do not make valuable contributions to our platform or fail to meet consumers’ expectations, we may experience a decline in the number of consumers accessing our platform and consumer engagement, which could adversely affect our business, financial condition and results of operations.