Issuer Free Writing Prospectus

Relating to S-3 Registration Statement

Filed Pursuant to Rule 433

Registration No. 333-136787

September 15, 2006

AEP Texas Central Transition Funding II LLC

Issuer

Up to $1,739,700,000*

Senior Secured Transition Bonds, Series A

Transaction Summary

AEP Texas Central Transition Funding Company II LLC (the “Issuer”) is issuing up to $1,739,700,000* of Senior Secured Transition Bonds, Series A in five tranches (the “Bonds”). The Bonds are senior secured obligations of the Issuer supported by Transition Property which includes the right to a special, irrevocable non-bypassable charge (“Transition Charge”) paid by all retail electric customers in the service territory of AEP Texas Central Company (“TCC”) based on their consumption of electricity as discussed below. The Public Utility Commission of Texas (the “PUCT”) requires and guarantees that Transition Charges be adjusted annually, and semi-annually as necessary, to ensure the expected recovery of amounts sufficient to timely provide all scheduled payments of principal and interest on the Bonds (the “True-up Mechanism”). Through the True-up Mechanism, all retail electric customers cross share in the liabilities of all other retail electric customers for the payment of Transition Charges.

A special statute, the Texas Electric Utility Restructuring Act, enacted in June 1999, (the “Restructuring Act”) authorizes the PUCT to issue irrevocable financing orders supporting the issuance of transition bonds. One of the purposes of the Restructuring Act was to lower the cost to consumers of the transition to a competitive retail electricity market in Texas. The PUCT issued an irrevocable financing order to TCC on June 21, 2006 (the “Financing Order”). Pursuant to the Financing Order, TCC established the Issuer as a bankruptcy remote special purpose subsidiary company to issue the Bonds.

In the Financing Order, the PUCT authorized a Transition Charge to be imposed on all retail electric customers, which includes all individuals, corporations, other business entities, the State of Texas and other federal, state and local governmental entities, who purchase electricity in TCC’s service territory (approximately 729,000 customers as of December 31, 2005) to pay principal and interest on the Bonds and other administrative expenses of the offering. TCC as servicer will collect Transition Charges on behalf of the Issuer and remit the Transition Charges daily to the Indenture Trustee.

The PUCT guarantees that it will take specific actions pursuant to the irrevocable Financing Order as expressly authorized by the Restructuring Act to ensure that Transition Charge revenues are sufficient to pay on a timely basis scheduled principal and interest on the Bonds. The PUCT’s obligations are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the PUCT, which is a United States public sector entity.

The Bonds are not a liability of TCC or any of its affiliates (other than the Issuer). The Bonds are not a debt or general obligation of the State of Texas, the PUCT or any other governmental agency or instrumentality, and are not a charge on the full faith and credit or taxing power of the State of Texas or any other governmental agency or instrumentality. However, the State of Texas and other governmental entities, as retail electric customers, will be obligated to pay Transition Charges securing the Bonds. Only in their capacity as retail electric customers, will the State of Texas or any political subdivision, agency, authority or instrumentality of the State of Texas, or any other entity, be obligated to provide funds for the payment of the Bonds.

This Preliminary Term Sheet has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any Bonds in any jurisdiction where such offer or sale is prohibited. Please read the important information and qualifications on the last page of this Preliminary Term Sheet.

Saber Partners, LLC

Financial Advisor to the Public Utility Commission of Texas

| | | | |

Credit Suisse | | JPMorgan | | RBS Greenwich Capital |

| | |

Bear Stearns & Co. Inc. | | First Albany Capital | | Loop Capital Markets, LLC |

| | |

ABN AMRO Incorporated | | M.R. Beal & Company Siebert Brandford Shank & Co., LLC | | Ramirez & Co., Inc. |

* Preliminary; subject to change

Up to $1,739,700,000*

AEP Texas Central Transition Funding II LLC

Senior Secured Transition Bonds, Series A

Summary of Terms

Anticipated Fixed-Rate Bond Offering*

| | | | | | | | | | |

| Tranche1 | | Expected Average Life (Years) | | Size ($) | | Scheduled Maturity2 | | Scheduled Sinking Fund Payments Begin | | No. of Scheduled Semi-annual Sinking Fund Payments |

A1 | | 2.0 | | Up to $212,000,000 | | Jan ’10 | | Jul ’07 | | 6 |

A2 | | 5.0 | | Up to $339,000,000 | | Jul ’13 | | Jan ’10 | | 8 |

A3 | | 7.6 | | Up to $250,000,000 | | Jul ’15 | | Jul ’13 | | 5 |

A4 | | 10.0 | | Up to $439,000,000 | | Jan ’18 | | Jul ’15 | | 6 |

A5 | | 12.7 | | Up to $499,700,000 | | Jul ’20 | | Jan ’18 | | 6 |

| | |

Issuer and Capital Structure | | AEP Texas Central Transition Funding II LLC, a special purpose bankruptcy-remote limited liability company wholly-owned by TCC. The Issuer has no commercial operations and was formed solely to purchase and own the Transition Property (defined in “Credit/Security”), to issue one or more series of transition bonds and to perform activities incidental thereto. The Issuer is responsible to the PUCT. In addition to the Transition Property, the Issuer is capitalized with an upfront cash deposit of 0.5% of the Bonds’ principal amount issued (held in the capital subaccount) and has created an excess funds subaccount to retain, until the next payment date, any amounts collected and remaining after all payments on the Bonds have been made. |

| |

Securities Offered | | Senior secured sinking fund fixed-rate bonds, as listed above, scheduled to pay principal semi-annually and sequentially in accordance with the sinking fund schedule. See “Sinking Fund Schedule.” |

| |

Expected Ratings | | Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively. |

| |

Payment Dates and Interest Accrual | | Semi-annually, January 1 and July 1. Interest will be calculated at a fixed rate on a 30/360 basis. The first scheduled payment date is July 1, 2007. Interest is due on each payment date and principal is due upon the final maturity date for each tranche. |

1 Each tranche pays sequentially.

2 The final maturity (i.e., the date by which the principal must be repaid to prevent a default) of each tranche of the Bonds is two years after the scheduled maturity date for Tranches A1 through A4 and one year after the scheduled maturity date for Tranche A5.

* Preliminary; subject to change.

SM

Page 2 of 13

| | |

Optional Redemption | | None. Non-call life. |

| |

Average Life | | Stable. Prepayment is not permitted; there is no prepayment risk. Extension is possible but the risk is statistically insignificant. |

| |

Credit/Security | | Pursuant to the Financing Order, the irrevocable right to impose, collect and receive a non-bypassable electricity consumption-based Transition Charge (the “Transition Property”) from all retail electric customers (approximately 729,000 customers as of December 31, 2005), including all individuals, corporations, other business entities, the State of Texas and other federal, state and local governmental entities, who purchase electricity in TCC’s service territory. The law and the PUCT require that Transition Charges be set and adjusted to collect amounts sufficient to pay principal and interest on a timely basis. See also “Issuer and Capital Structure” and “PUCT Guaranteed True-up Mechanism for Payment of Scheduled Principal and Interest.” |

| |

Transition Property/Cross Sharing of Liabilities | | The Transition Property securing the Bonds is not a pool of receivables. It consists of all the rights of TCC and the Issuer under the Restructuring Act and the Financing Order, including the irrevocable right to impose, collect and receive non-bypassable Transition Charges and the right to implement the True-up Mechanism. Transition Property is a present property right created by the Restructuring Act and the Financing Order and protected by the State Pledge described below. Through the True-up Mechanism, all retail electric customers cross share in the liabilities of all other retail electric customers for the payment of Transition Charges. |

| |

Non-bypassable Transition Charges | | The PUCT guaranteed right from the government of the State of Texas to collect Transition Charges from all existing and future retail electric customers located within TCC’s service territory, subject to certain limitations specified in the Restructuring Act and the Financing Order, even if those customers elect to purchase electricity from another supplier or choose to operate new on-site generation or if the utility goes out of business and its service area is acquired by another utility or is municipalized. |

| |

PUCT Guaranteed True-up Mechanism for Payment of Scheduled Principal and Interest | | The Restructuring Act and the irrevocable Financing Order together guarantee that Transition Charges on all retail electric customers will be adjusted annually, and semi-annually as necessary, to ensure the expected recovery of amounts sufficient to provide timely payment of scheduled principal and interest on the Bonds. The PUCT guarantees that it will take specific actions pursuant to the irrevocable Financing Order as expressly authorized by the Restructuring Act to ensure that Transition Charge revenues are sufficient to pay on a timely basis scheduled principal and interest on the Bonds. There is no “cap” on the level of Transition Charges that may be imposed on retail electric customers, including the State of Texas and other governmental entities, to pay on a timely basis scheduled principal and interest on the Bonds. |

| |

Obligations of the State of Texas and the PUCT | | The Financing Order provides that the True-up Mechanism and all other obligations of the State of Texas and the PUCT set forth in the Financing Order are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the State of Texas and the PUCT. |

SM

Page 3 of 13

| | |

State Pledge | | The State of Texas has made a direct pledge in the Restructuring Act for the benefit and protection of Bondholders that it will not take or permit any action that would impair the value of the Transition Property or reduce, alter or impair the Transition Charges until the Bonds are fully repaid or discharged, other than specified true-up adjustments to correct any overcollections or undercollections. The State Pledge provides rights enforceable by Bondholders. No voter initiative or referendum process exists in Texas, unlike in some other states. |

| |

Credit Risk | | The broad-based nature of the True-up Mechanism and the State Pledge, along with other elements of the Bonds, will serve to effectively eliminate, for all practical purposes and circumstances, any credit risk associated with the Bonds (i.e., that sufficient funds will be available and paid to discharge all principal and interest obligations when due). (See also the Financing Order, Finding of Fact No. 100.) |

| |

Tax Treatment | | Fully taxable; treated as debt for U.S. federal income tax purposes. |

| |

Type of Offering | | SEC registered. |

| |

ERISA Eligible | | Yes, as described in the base prospectus. |

| |

20% International Risk Weighting | | If held by financial institutions subject to regulation in countries (other than the United States) that have adopted the 1988 International Convergence of Capital Measurement and Capital Standards of the Basel Committee on Banking Supervision (as amended, the “Basel Accord”), the Bonds may attract the same counterparty risk weighting as “claims on” or “claims guaranteed by” non-central government bodies within the United States, which are accorded a 20% risk weighting. The United Kingdom’s Financial Services Authority has issued “individual guidance” letters to one or more investors that an investment in Texas transition bonds issued under the Restructuring Act can be accorded a 20% counterparty risk weighting which is similar to the risk weighting assigned to U. S. Agency corporate securities (FNMA, FHLMC, etc.). There is no assurance that the Bonds will attract a 20% risk weighting treatment under any national law, regulation, multi-national directive or policy implementing the Basel Accord. Investors should consult their regulators before making any investment. |

| |

__________________________ | | ______________________________________________________________________________ |

| |

OTHER CONSIDERATIONS | | |

| |

Enhanced Continuing Disclosure and Dedicated Web Site (Surveillance) | | A dedicated web site will be established for the Bonds. In addition, the indenture under which the Bonds will be issued requires all of the periodic reports that TCC as sponsor for the Issuer files with the Securities and Exchange Commission (the “SEC”), the principal transaction documents and other information concerning the Transition Charges and security relating to the Bonds to be posted on the website associated with the Issuer’s parent, currently located atwww.aep.com. Furthermore, even if it would otherwise be permitted to suspend such filings, so long as any Bonds are outstanding, the Issuer or TCC on its behalf will continue filing periodic reports under the Securities Exchange Act of 1934 and the rules, regulations or orders of the SEC. Consequently, information will continue to be publicly available and accessible to bondholders through the SEC or through the dedicated web site. |

SM

Page 4 of 13

| | |

Relationship to the Series 2002-1 Bonds | | In February 2002, AEP Texas Central Transition Funding LLC (“TCC Funding I”), a special purpose, wholly owned subsidiary of TCC, issued $797,334,897 of Series 2002-1 transition bonds (the “Series 2002-1 Bonds”) in accordance with a financing order issued by the PUCT on March 27, 2000. TCC currently acts as servicer with respect to the Series 2002-1 Bonds. TCC Funding I will have no obligations under the Bonds, and the Issuer will have no obligations under the Series 2002-1 Bonds. The security pledged to secure the Bonds will be separate from the security that is securing the series 2002-1 Bonds or that would secure any other series of transition bonds. The outstanding series 2002-1 bonds are currently rated Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively. |

| |

Parent/Servicer | | TCC is a State of Texas fully regulated electric transmission and distribution utility and is an operating subsidiary of American Electric Power Company, Inc., a New York corporation (“AEP”), a public utility holding company based in Columbus, Ohio. TCC is engaged in the transmission and distribution of electric energy in a 44,000 square-mile area located in Southern Texas that has a population of approximately 5 million people. |

| |

PUCT Financial Advisor | | Saber Partners, LLC (“Saber”) (co-equal decision maker with the Issuer). Certain financial advisory services, including any activities that may be considered activities of a broker dealer, will be assigned to Saber Capital Partners, LLC, a wholly-owned subsidiary of Saber Partners, LLC. |

| |

Bookrunners | | Credit Suisse, JPMorgan and RBS Greenwich Capital |

| |

Underwriting Syndicate | | ABN AMRO Incorporated, Bear Stearns & Co. Inc., First Albany Capital, Loop Capital Markets, LLC, M.R. Beal & Company, Ramirez & Co., Inc. and Siebert Brandford Shank & Co., LLC |

__________________________ | | ______________________________________________________________________________ |

| |

SETTLEMENT | | |

| |

Indenture Trustee | | The Bank of New York |

| |

Expected Settlement | | October , 2006, settling flat. DTC, Clearstream and Euroclear. |

| |

Use of Proceeds | | Paid to TCC to reduce debt and equity only. In accordance with the Financing Order, the Issuer may not use the net proceeds from the sale of the Bonds for general corporate or commercial purposes. |

| |

More Information | | For a complete discussion of the proposed transaction, please read the base prospectus and the accompanying prospectus supplement when available. |

SM

Page 5 of 13

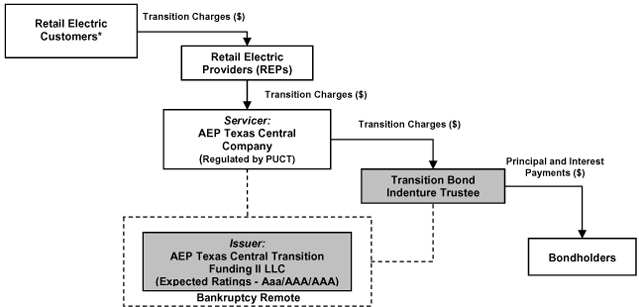

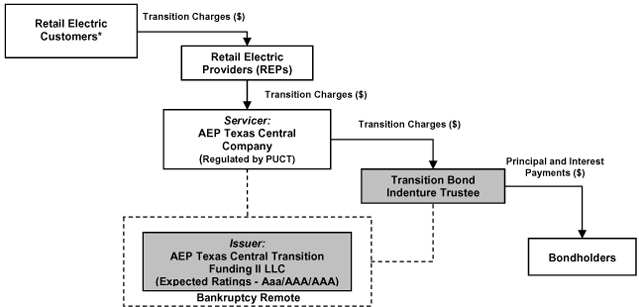

Parties to Transaction and Responsibilities

Flow of Funds to Bondholders

* | Includes all individuals, corporations, other business entities, the State of Texas and other federal, state and local governmental entities who purchase electricity in TCC’s service territory. As of December 31, 2005, TCC had approximately 729,000 retail customers. During the 12 months ended December 31, 2005, TCC’s total deliveries were approximately 23% industrial, 37% commercial and 39% residential, with the State of Texas and other federal, state and local governmental entities comprising approximately 6% of TCC’s total revenues. |

SM

Page 6 of 13

Key Questions and Answers on PUCT Guaranteed True-Up Mechanism

Q1: | Could the Financing Order be rescinded or altered or the PUCT fail to act to implement the True-up Mechanism? |

A: No. The Financing Order is irrevocable. The True-up Mechanism and all other obligations of the State of Texas and the PUCT set forth in the Financing Order are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the State of Texas and the PUCT.

Q2: | Could the Restructuring Act be repealed or altered in a manner that will impair the value of the security or prevent timely repayment of the Bonds? |

A: No. The Restructuring Act provides that the State of Texas cannot take or permit any action that impairs the value of the security or the timely repayment of the Bonds.

Q3: | Are there any circumstances, or any reason, in which the True-up Mechanism would not be applied to customer bills, e.g., economic recession, temporary power shortages, blackouts, bankruptcy of the parent company? |

A: No. Once the Bonds are issued, the provisions of the irrevocable Financing Order that relate to the Bonds (including the True-up Mechanism) are unconditional. If collections differ or are projected to differ from forecasted revenues, regardless of the reason,TCC is required semi-annually to submit to the PUCT an adjustment to the Transition Charges as necessary to ensure expected recovery of amounts sufficient to provide timely payment of principal and interest on the Bonds. The PUCT will confirm the mathematical accuracy of the submission and approve the imposition of the adjusted Transition Charges within 15 days. After this approval, the adjusted charges will immediately be reflected in the customer’s next bill. Any errors identified by the PUCT will be corrected in the next true-up adjustment.

Q4: | Can customers avoid paying Transition Charges if they switch electricity providers? |

A: No. The Restructuring Act provides that the Transition Charges are non-bypassable and, through the True-up Mechanism, all retail electric customers cross share in the liabilities of all other retail electric customers for the payment of Transition Charges. Non-bypassable means that these charges are collected from existing retail customers of a utility and future retail electric customers located within the utility’s historical certificated service area as it existed on May 1, 1999, subject to certain limitations specified in the Restructuring Act and the Financing Order. The Issuer is generally entitled to collect Transition Charges from the retail electric providers serving those customers even if those customers elect to purchase electricity from another supplier or choose to operate new on-site-generation equipment, or if the utility goes out of business and its service area is acquired by another utility or is municipalized.

SM

Page 7 of 13

Sinking Fund Schedule*

| | | | | | | | | | | | | | | | | |

Payment Date | | | | Tranche A-1 Balance | | Tranche A-2 Balance | | Tranche A-3 Balance | | Tranche A-4 Balance | | Tranche A-5 Balance |

Tranche Size | | | | $ | 212,000,000 | | $ | 339,000,000 | | $ | 250,000,000 | | $ | 439,000,000 | | $ | 499,700,000 |

7/1/2007 | | | | $ | 24,523,700 | | | | | | | | | | | | |

1/1/2008 | | | | $ | 44,344,586 | | | | | | | | | | | | |

7/1/2008 | | | | $ | 29,151,853 | | | | | | | | | | | | |

1/1/2009 | | | | $ | 49,575,816 | | | | | | | | | | | | |

7/1/2009 | | | | $ | 32,875,793 | | | | | | | | | | | | |

1/1/2010 | | | | $ | 31,528,253 | | $ | 22,104,241 | | | | | | | | | |

7/1/2010 | | | | | | | $ | 36,685,263 | | | | | | | | | |

1/1/2011 | | | | | | | $ | 57,955,076 | | | | | | | | | |

7/1/2011 | | | | | | | $ | 40,731,235 | | | | | | | | | |

1/1/2012 | | | | | | | $ | 62,515,432 | | | | | | | | | |

7/1/2012 | | | | | | | $ | 44,999,110 | | | | | | | | | |

1/1/2013 | | | | | | | $ | 67,308,993 | | | | | | | | | |

7/1/2013 | | | | | | | $ | 6,700,652 | | $ | 42,837,944 | | | | | | |

1/1/2014 | | | | | | | | | | $ | 72,443,299 | | | | | | |

7/1/2014 | | | | | | | | | | $ | 54,489,448 | | | | | | |

1/1/2015 | | | | | | | | | | $ | 78,007,703 | | | | | | |

7/1/2015 | | | | | | | | | | $ | 2,221,606 | | $ | 57,582,414 | | | |

1/1/2016 | | | | | | | | | | | | | $ | 83,972,932 | | | |

7/1/2016 | | | | | | | | | | | | | $ | 65,528,866 | | | |

1/1/2017 | | | | | | | | | | | | | $ | 90,349,841 | | | |

7/1/2017 | | | | | | | | | | | | | $ | 71,658,557 | | | |

1/1/2018 | | | | | | | | | | | | | $ | 69,907,391 | | $ | 27,252,161 |

7/1/2018 | | | | | | | | | | | | | | | | $ | 78,184,169 |

1/1/2019 | | | | | | | | | | | | | | | | $ | 104,419,418 |

7/1/2019 | | | | | | | | | | | | | | | | $ | 85,214,071 |

1/1/2020 | | | | | | | | | | | | | | | | $ | 112,158,589 |

7/1/2020 | | | | | | | | | | | | | | | | $ | 92,471,592 |

| | | | | | |

Total Payments | | | | $ | 212,000,000 | | $ | 339,000,000 | | $ | 250,000,000 | | $ | 439,000,000 | | $ | 499,700,000 |

* Preliminary; subject to change.

SM

Page 8 of 13

PUCT Guaranteed True-up Mechanism for Payment of Scheduled Principal and Interest

The Restructuring Act and the irrevocable Financing Order together guarantee that the Transition Charges will be reviewed and adjusted at least annually, and semi-annually as necessary, to ensure the expected recovery from all retail electric customers of amounts sufficient to timely provide all payments of principal and interest and other required amounts and charges in connection with the Bonds. Transition Property is not a pool of receivables and all retail electric customers cross share in the liabilities for all other retail electric customers for the payment of Transition Charges.

The following describes the mechanics for implementing the True-up Mechanism on all retail electric customers based on their consumption of electricity. (See also “Key Questions and Answers on PUCT Guaranteed True-up Mechanism” on page 7.)

MANDATORY ANNUAL TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

| | |

STEP 1: | | Each year, TCC computes the total dollar requirement for the Bonds for the coming year, which includes scheduled principal and interest payments and all other permitted costs of the transaction, adjusted to correct any prior undercollection or overcollection. |

| |

STEP 2: | | TCC allocates this total dollar requirement among specific customer classes. |

| |

STEP 3: | | TCC forecasts consumption by each customer class. |

| |

STEP 4: | | TCC divides the total dollar requirement for each customer class by the forecasted consumption to determine the Transition Charge for that customer class. |

| |

STEP 5: | | TCC must make a true-up filing with the PUCT, specifying such adjustments to the Transition Charges as may be necessary, regardless of the reason for the difference between forecasted and required collections. The PUCT will approve the adjustment within 15 days and adjustments to the Transition Charges are immediately reflected in customer bills. |

MANDATORY INTERIM TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

TCC must seek an interim true-up once every six months (or quarterly in the fourteenth and fifteenth years):

(i) to correct any undercollection of Transition Charges, regardless of cause, in order to ensure timely payment of the Bonds based on rating agency and bondholder considerations, including a mandatory interim true-up in connection with each semi-annual payment date if the Servicer forecasts that collections of Transition Charges during the next semi-annual payment period will be insufficient to make all scheduled payments of principal, interest and other amounts in respect of the Bonds and to replenish the capital subaccount for the Bonds to its required level; or

(ii) if an interim true-up is needed to meet any rating agency requirement that the Bonds be paid in full at scheduled maturity.

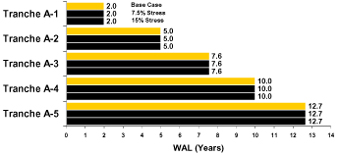

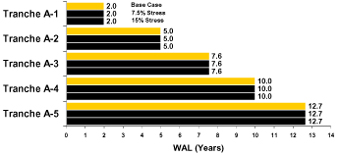

STABLE AVERAGE LIFE

Severe stress cases on electricity consumption result in no measurable changes in the weighted average lives of each tranche.

| | |

Weighted Average Life by Tranche (Base and Stress Case Scenarios)

| | For the purposes of preparing the chart shown on the left, the following assumptions, among others, have been made: (i) the forecast error stays constant over the life of the Bonds and is equal to an overestimate of electricity consumption of 7.5% (2.1 standard deviations from mean) or 15% (5.0 standard deviations from mean) and (ii) the Servicer makes timely and accurate filings to true-up the Transition Charges semi-annually. There can be no assurance that the weighted average lives of the Bonds will be as shown. |

SM

Page 9 of 13

Glossary

| | |

“Transition Charges” | | Transition Charges are statutorily-created, non-bypassable, consumption-based per kilowatt hour, per kilowatt or per kilovolt-Amperes charges. Transition Charges are irrevocable and payable, through retail electric providers, by all retail electric customers, including the State of Texas and other governmental entities, as long as they continue to use electricity at any facilities located within TCC’s service territory even if such electricity is self-generated using new on-site generation, subject to limited exceptions. There is no “cap” on the level of Transition Charges that may be imposed on future retail electric customers, including the State of Texas and other governmental entities, to timely pay scheduled principal and interest on the Bonds. Through the True-up Mechanism, all retail electric customers cross share in the liabilities for all other retail electric customers for the payment of Transition Charges. |

| |

“Security” | | All assets held by the Indenture Trustee for the benefit of the holders of the Bonds. The Issuer’s principal asset securing the Bonds is the Transition Property. The Transition Property is not a receivable, and the principal credit supporting the Bonds is not a pool of receivables. It is the irrevocable right to impose, collect and receive non-bypassable Transition Charges and is a present property right created by the Restructuring Act and the Financing Order and expressly protected by the state’s pledge not to take or permit any action that would impair its value. |

| |

“Principal Payments” | | Principal will be paid sequentially. No tranches will receive principal payments until all tranches with earlier expected maturity dates have been paid in full unless there is an acceleration of the Bonds following an event of default in which case principal will be paid to all tranches on a pro-rata basis. Please see “Sinking Fund Schedule.” |

| |

“Sinking Fund” | | The amortization method providing for sequential payments of scheduled principal of each tranche. Please see “Sinking Fund Schedule.” |

| |

Issuer Responsible to the State and PUCT | | The Issuer is responsible to the State and the PUCT. Specifically, (i) the Issuer’s organizational documents and transaction documents prohibit the Issuer from engaging in any activities other than acquiring transition property, issuing transition bonds, and performing other activities as specifically authorized by the Financing Order, (ii) the Issuer must respond to representatives of the PUCT throughout the process of offering transition bonds, with the Financing Order directing the PUCT’s financial advisor to advise the PUCT of any proposal that does not comply in any material respect with the criteria established in the Financing Order; and (iii) all required true-up adjustments must be filed by the Servicer on the Issuer’s behalf. In addition, the servicing agreement and indenture require certain reports to be submitted to the PUCT by or on behalf of the Issuer. |

| |

“Legal Structure” | | The Restructuring Act provides, among other things, that the Transition Property is a present property right created pursuant to such Act and the Financing Order. The Financing Order includes affirmative findings to the effect that (i) the Financing Order is final and not subject to PUCT rehearing, (ii) the Issuer’s right to collect Transition Charges is a property right against which bondholders will have a perfected lien upon execution and delivery of a security agreement and the filing of notice with the Secretary of State, and (iii) the State of Texas has pledged not to take or permit any action that would impair the value of the Transition Property, or, reduce, alter or impair the Transition Charges to be imposed, collected and remitted to bondholders, except for the periodic true-up, until the Bonds have been paid in full. The Financing Order is final and is no longer subject to further appeal or review by the PUCT or the courts. |

| |

“Ratings” | | A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. No person is obligated to maintain the rating on any Bond, and, accordingly, there can be no assurance that the ratings assigned to any tranche of the Bonds upon initial issuance will not be revised or withdrawn by a rating agency at any time thereafter. |

SM

Page 10 of 13

The Issuer has filed a registration statement (including a prospectus) (Registration No. 333-136787) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website atwww.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free at 1-800-221-1037 (Credit Suisse), 1-866-669-7629 (JPMorgan) or 1-866-884-2071 (RBS Greenwich Capital).

This Preliminary Term Sheet is not required to contain all information that is required to be included in the base prospectus and the prospectus supplement that will be prepared for the securities offering to which this Preliminary Term Sheet relates. This Preliminary Term Sheet is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

The information in this Preliminary Term Sheet is preliminary, and may be superseded by an additional term sheet provided to you prior to the time you enter into a contract of sale. This Preliminary Term Sheet is being delivered to you solely to provide you with information about the offering of the securities referred to herein. The securities are being offered when, as and if issued. In particular, you are advised that these securities, and the transition charges securing them, are subject to modification or revision (including, among other things, the possibility that one or more tranches of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the securities and the underlying transaction having the characteristics described in these materials.

A contract of sale will come into being no sooner than the date on which the relevant tranche has been priced and we have confirmed the allocation of securities to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. You may withdraw your offer to purchase securities at any time prior to our acceptance of your offer.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

SM

Page 11 of 13

OFFERING RESTRICTIONS IN CERTAIN JURISDICTIONS

NOTICE TO RESIDENTS OF SINGAPORE

The Bonds may be offered pursuant to (i) a private placement, (ii) Sections 274 and/or 275 of the SFA (as defined below) or (iii) an exemption under Division 5A of the Companies Act.

If the Bonds are offered pursuant to a private placement, residents should note the following:

This Preliminary Term Sheet is confidential. It is addressed solely to and is for the exclusive use of the person named below. Any offer or invitation in respect of Bonds is capable of acceptance only by such person and is not transferable. This Preliminary Term Sheet may not be distributed or given to any person other than the person named below and should be returned if such person decides not to purchase any Bonds. This Preliminary Term Sheet should not be reproduced, in whole or in part.

Name:

Number:

This Preliminary Term Sheet has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this Preliminary Term Sheet and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of Bonds may not be circulated or distributed, nor may Bonds be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than under circumstances in which such offer, sale or invitation does not constitute an offer or sale, or invitation for subscription or purchase, of Bonds to the public in Singapore.

If the Bonds are offered pursuant to Sections 274 and/or 275 of the SFA, residents should note the following:

This Preliminary Term Sheet has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this Preliminary Term Sheet and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of Bonds may not be circulated or distributed, nor may Bonds be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to an institutional investor specified in Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”), (ii) to a sophisticated investor, and in accordance with the conditions, specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

If the Bonds are offered pursuant to an exemption under Division 5A of the Companies Act, residents should note the following:

The prospectus relating to the Bonds (“Prospectus”) will, prior to any sale of securities pursuant to the provisions of Section 106D of the Companies Act (CAP.50), be lodged, pursuant to said Section 106D, with the registrar of Companies in Singapore, which will take no responsibility for its contents. However, neither this Preliminary Term Sheet nor the Prospectus has been and nor will they be registered as a prospectus with the registrar of Companies in Singapore. Accordingly, the Bonds may not be offered, and neither this Preliminary Term Sheet nor any other offering document or material relating to the Bonds may be circulated or distributed, directly or indirectly, to the public or any member of the public in Singapore other than to institutional investors or other persons of the kind specified in Section 106C and Section 106D of the Companies Act or any other applicable exemption invoked under Division 5A of Part IV of the Companies Act. The first sale of securities acquired under a Section 106C or Section 106D exemption is subject to the provisions of Section 106E of the Companies Act.

NOTICE TO RESIDENTS OF THE PEOPLE’S REPUBLIC OF CHINA

The Bonds have not been and will not be registered under the Securities Law of the People’s Republic of China (as the same may be amended from time to time) and are not to be offered or sold to persons within the People’s Republic of China (excluding the Hong Kong and Macau Special Administrative Regions) unless permitted by the laws of the People’s Republic of China.

SM

Page 12 of 13

NOTICE TO RESIDENTS OF JAPAN

The Bonds have not been and will not be registered under the Securities and Exchange Law of Japan (the “SEL”), and the Bonds may not be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (including Japanese corporations) or to others for re-offering or resale, directly or indirectly, in Japan or to any resident of Japan, except that the offer and sale of the Bonds in Japan may be made only through private placement sale in Japan in accordance with an exemption available under the SEL and with all other applicable laws and regulations of Japan. In this paragraph, “a resident/residents of Japan” shall have the meaning as defined under the Foreign Exchange and Trade Law of Japan.

NOTICE TO RESIDENTS OF HONG KONG

Each Underwriter has represented and agreed that:

| | • | | it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Bonds other than (a) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and |

| | • | | it has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Bonds, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Bonds which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and Futures Ordinance and any rules made under that Ordinance. |

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each a “Relevant Member State “), each Underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date “) it has not made and will not make an offer of the Bonds to the public in that Relevant Member State prior to the publication of a Prospectus in relation to the Bonds, which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date, make an offer of the Bonds to the public in that Relevant Member State at any time: (a) to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities; (b) to any legal entity which has two or more of (i) an average of at least 250 employees during the last financial year; (ii) a total balance sheet of more than EUR43,000,000 and (iii) an annual net turnover of more than EUR50,000,000, as shown in its last annual or consolidated accounts; or (c) in any other circumstances which do not require the publication by the Issuer of a Prospectus pursuant to Article 3 of the Prospectus Directive. For the purposes of this provision, the expression an “offer of the Bonds to the public “ in relation to any Bonds in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the Bonds to be offered so as to enable an investor to decide to purchase or subscribe the Bonds, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State.

SM

Page 13 of 13